4.1 – Overview of the financial statements

You can think about the financial statements from two different angles:

- From the maker’s perspective

- From the user’s perspective

A maker prepares financial statements. He is typically a person with an accounting background. His job involves preparing ledger entries, matching bills and receipts, tallying the inflows versus the outflows, auditing etc. The final objective is to prepare transparent financial statements that best represent the company’s true financial position. To prepare such a financial statement, certain skills are required. Usually, these skills are developed through the rigour of a Chartered Accountant’s training program.

On the other hand, the user just needs to be in a position to understand what the maker has prepared. He is just the user of the financial statements. He need not really know the details of the journal entries or the audit procedure. His main concern is to read what is being stated and use it to make his decisions.

To put this in context, think about Google. Most of us do not understand Google’s complex search engine algorithm that runs in the backend. However, we all know how to use Google effectively. Such is the distinction between the maker and the user of financial statements.

A common misconception amongst the market participants is that they believe the fundamental analyst needs to be thorough with financial statement preparation concepts. While knowing this certainly helps, it is not really required. To be a fundamental analyst, one needs to be the user and not the financial statement maker.

There are three main financial statements that a company showcases to represent its performance.

- The Profit and Loss statement

- The Balance Sheet

- The Cash flow statement

Over the next few chapters, we will understand each of these statements from the user’s perspective.

4.2 – The Profit and Loss statement

The Profit and Loss statement is also popularly referred to as the P&L statement, Income Statement, Statement of Operations, and Statement of Earnings. The Profit and Loss statement shows what has transpired during a time period. The P&L statement reports information on:

- The revenue of the company for the given period (yearly or quarterly)

- The expenses incurred to generate the revenues

- Tax and depreciation

- The earnings per share number

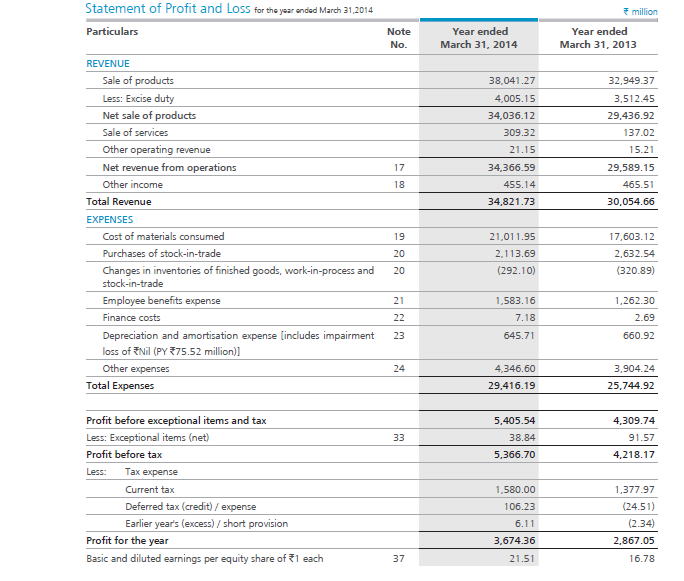

From my experience, the financial statements are best understood by looking at the actual statement and figuring out the information. Hence, here is the P&L statement of Amara Raja Batteries Limited (ARBL). Let us understand every line item.

4.3 – The Top Line of the company (Revenue)

You may have heard analysts talk about the top line of a company. When they do so, they are referring to the revenue side of the P&L statement. The revenue side is the first set of numbers the company presents in the P&L.

Before we start understanding the revenue side, let us notice a few things mentioned on the header of the P&L statement:

The header clearly states:

- The statement of P&L for the year ending March 31, 2014, hence this is an annual statement and not a quarterly statement. Also, since it is as of March 31st 2014, it is evident that the statement is for the Financial Year 2013 – 2014 or it can be referred to as the FY14 numbers.

- All currency is denominated in Rupee Million. Note – 1 Million Rupees is equal to Ten Lakh Rupees. It is upto the company’s discretion to decide which unit they would prefer to express their numbers in

- The particulars show all the main headings of the statement. Any associated note to the particulars is present in the note section (also called the schedule). An associated number is assigned to the note (Note Number)

- By default, when companies report the numbers in the financial statement, they present the current year number on the left-most column and the previous year number to the right. In this case, the numbers are for FY14 (latest) and FY13 (previous)

The first line item on the revenue side is called the Sale of Products.

Since we know, we are dealing with a batteries company. Clearly, the sale of products means the Rupee value of all the battery sales the company has sold during FY14. The sales stand at Rs.38,041,270,000/- or about Rs.3,804 Crore. The company sold batteries worth Rs.3,294 Cr in the previous financial year, i.e. FY13.

Please note, I will restate all the numbers in Rupee Crore as I believe this is more intuitive to understand.

The next line item is the excise duty. This is the amount (Rs.400 Crs) the company would pay to the government; hence, the revenue must be adjusted.

The revenue adjusted after the excise duty is the net sales of the company. The net sales of ARBL are Rs.3403 Crs for FY14. The same was Rs.2943 Crs for FY13.

Apart from the sale of products, the company also draws revenue from services. This could probably be in the form of annual battery maintenance. The revenue from the sale of services stands at Rs.30.9Crs for FY14.

The company also includes “other operating revenues” at Rs.2.1crs.This could be revenues through the sale of products or services that is incidental to the company’s core operations.

Finally, the revenue from Sale of products + Sale of services + Other operating revenues sums up to give the company’s total operating revenue. This is reported at Rs.3436 Crs for FY14 and Rs.2959Crs for FY13. Interesting, there is a note; numbered 17 associated with “Net Revenue from Operations” will help us inspect this aspect further.

Do recall, in the previous chapter we had discussed notes and schedules of the financial statement.

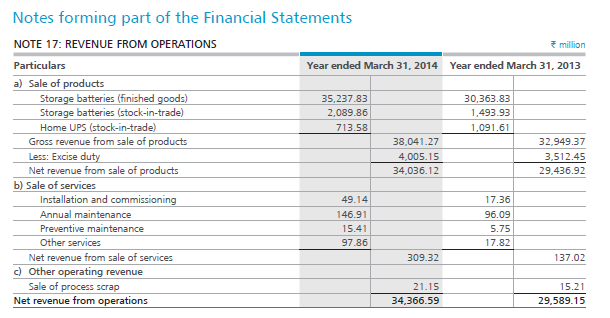

The following snapshot gives the details of note 17.

The notes clearly give a more detailed analysis of the split-up of revenues from operations (does not include other income details). As you can see under the particulars, section ‘a’ talks about the split up under sales of products.

- Sale of storage batteries in the form of finished goods for the year FY14 is Rs.3523 Crs versus Rs.3036 Crs in FY13.

- Sale of Storage batteries (stock in trade) is Rs.208 Crs in FY14 versus 149 Crs. Stock in trade refers to finished goods of previous financial year being sold in this financial year.

- Sale of home UPS (stock in goods) is at Rs.71 Crs in FY14 versus Rs.109 Crs FY13

- Net sales from sales of products adjusted for excise duty amounts to Rs.3403 Crs, matching the number reported in the P&L statement.

- Likewise, you can notice the split up for revenue from services. The revenue number of Rs.30.9 tallies with the number reported in the P&L statement

- In the note, the company says the “Sale of Process Scrap” generated revenue of Rs.2.1 Cr. Note that the sale of process scrap is incidental to the operations of the company, hence reported as ‘Other operating revenue”.

- Adding up all the revenue streams of the company, i.e. Rs.3403 Crs+ Rs.30.9 Crs +Rs.2.1 Crs gets us the Net revenue from operations = Rs.3436 Crs.

- You can also find similar split up for FY13

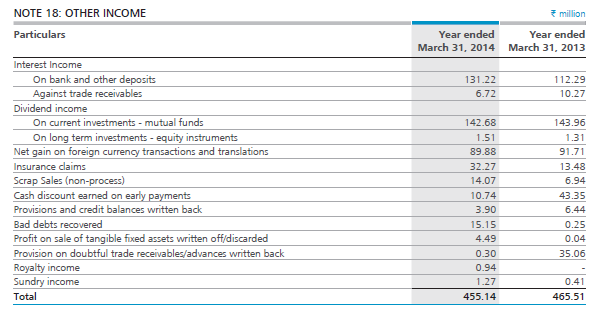

If you notice the P&L statement, apart from net revenue from operations, ARBL also reports ‘Other Income’ of Rs.45.5 Crs. Note number 18 reproduced below explains what the other income is all about.

As we can see, the other income includes income that is not related to the company’s main business. It includes interest on bank deposits, dividends, insurance claims, royalty income etc. Usually the other income forms (and it should) a small portion of the total income. A large ‘other income’ usually draws a red flag, demanding a further investigation.

So adding up revenue from operations (Rs.3436 Crs) and other income (Rs.45 Crs), we have the total revenue for FY14 at Rs.3482Crs.

Key takeaways from this chapter

- The financial statement provides information and conveys the financial position of the company.

- A complete set of financial statements include the Profit & Loss Account, Balance Sheet and Cash Flow Statement.

- A fundamental Analyst is a financial statement user, and he needs to know what the maker of the financial statements states.

- The profit and loss statement gives the profitability of the company for the year under consideration.

- The P&L statement is an estimate, as the company can revise the numbers at a later point. Also, by default, companies publish data for the current year and the previous year, side by side.

- The revenue side of the P&L is also called the top line of the company.

- Revenue from operations is the main source of revenue for the company.

- Other operating income includes revenue incidental to the business.

- The other income includes revenue from non-operating sources.

- The sum of revenue from (operations less of duty) and other operating income gives the “net revenue from operations”.

GILLETTE#

Qty. 9

Realised +5,545.50 (+7.03%)

Buy avg. 8,768.83

Sell avg. 9,385.00

Buy value

78,919.50

Sell value

84,465.00

What is mean by # symbol in profit and loss statement

Ah, not sure. Isit denoting the number?

Hi karthik

I was reading the AR of a company which read as follow:

“During the year under review, the Company has

completed its Buy Back Offer of 4,50,000 (Four Lakhs

Fifty Thousand) fully paid up equity shares of Rs. 5/-

each representing 0.98% of the total paid up equity

share capital at a price of Rs. 550/- (Rupees Five

Hundred and Fifty) per share for an aggregate amount

of Rs. 24,75,00,000/- (Rupees Twenty Four Crore

Seventy Five Lakhs).

Post buy back, the paid up equity share capital of the

Company decreased from Rs. 22,88,88,000/- (Rupees

Twenty Two Crore Eighty Eight Lakhs Eighty Eight

Thousand) consisting of 4,57,77,600 (Four Crore Fifty

Seven Lakhs Seventy Seven Thousand Six Hundred)

Equity Shares of Rs. 5/- (Rupees Five) each to Rs.

22,66,38,000/- (Rupees Twenty Two Crore Sixty Six

Lakhs Thirty Eight Thousand) consisting of 4,53,27,600

12/03/2025, 23:53 Understanding the P&L Statement (Part 1) – Varsity by Zerodha

https://zerodha.com/varsity/chapter/understanding-pl-statement-part1/?comments=all#comments 21/54

(Four Crore Fifty Three Lakhs Twenty Seven Thousand

Six Hundred) Equity Shares of Rs. 5/- each.

can you please explain me the post buy back numbers. first of all what is post buy back in itself?

Once you buy back the shares, the share capital changes. The number represents the change post buy back.

Sir

You have answered the below question . But didn\’t understand the valuation u r taking about. Please let me understand with example it

suppose a company lists its 40% share in the stock market. and from initial round of selling the company get the fund of say 1 crore. but now what? as now these 40% share belongs to the trader and trading is done between the traders.. so if say the price of the stock get high, how does the company profit from this because these trading is happening between the traders so the money goes from one trader to another.. so how can a company profit from there stocks getting higher?

Reply

The company benefits only at the time of listing. If after listing the stock price increases, then the networth of shareholders increases which includes the promoters.

Hi Sir,

When are you planning for Financial modelling course?

Regards

Neeraj Kumar Agarwal

Check this – https://zerodha.com/varsity/module/financial-modelling/

Hi Karthik,

Thanks for the wonderful content.

I want to understand, the Excise duty was removed directly from the top of the line

Then why don\’t they remove GST and other taxations (whatever others are) from the top of the line ?

Why do they differentiates ?

Thanks

Not sure if you can remove GST. I need to figure this as well 🙂

Hi Karthik, could you pls explain why excise duty is not considered and calculated like Tax for Amara Raja?

Hi Kartik, I have a little doubt in the following line:

\”The revenue adjusted after the excise duty is the net sales of the company. The net sales of ARBL are Rs.3403 Crs for FY14. The same was Rs.2943 Crs for FY13\”.

Why is \’excise duty\’ included in the Revenue section of P&L statement, although company has to pay it?

Ah Mehraj, this was pre GST, now its no longer there and you can ignore it.

Thanks for your reply !

Sure. Good luck!

At the time of issue itself. If my earnings are x and I have no restrictions on what face value I can issue shares at if I issue shares lower in qty and higher in FV my EPS will be better? Is this a wrong way to think about this ?

Deciding face value is an integral part of company formation. A company is most likely sticking to Rs.10 as face value. But yes, what you are suggesting works.

If I Increase the face value of the share and decrease the number of shares my EPS will increase . How is this concept factored in to save the sacredness of the EPS numbers. Like anyone can just issue lesser number of shares with higher face values and get 10x better EPS ?

How will you increase the face value?

cash discount on early payment, the image says that its a revenue but isn\’t it just a decreased expense, why even mention it under other income

Perhaps its savings, which gets treated as income?

Hi,

In the above P&L Statement In the current scenario will the GST component replace the excise duty component?

Yeah, excise duty is not longer a part of P&L I guess?

What is the maening of P&L Pct.

P&L = Profit & Loss. You mean to ask that or something else?

There is no mention of Home UPS (finished goods) in the revenue statement. Does this mean the sales of the HOME UPS were less than the stock carried forward in the next financial year?

I guess that was a new addition in the compnay\’s portfolio and was not there at the time of writing the chpater.

NVM, found the asnwer in other comments

Okay. Happy learning!

Why is it said the P&L statement is an estimate?

Becuase your actual Profit or loss depends on the exact price and the applicable statutory charges.

Sir, in the section of other incomes pertaining to insurance claims and sale of fixed assets amounting to Rs 3.7 crore highlights loopholes in or violation of the standard operational practices. I can say this from my operational experience in manufacturing industry. Thus, it should be as minimum as possible especially in manufacturing industry.

Hi Karthik. Could you please give an example of stock in trade and purchase of stock in trade? According to the content, stock in trade means finished goods that were produced last year and sold in the current year. In which line item will the cost incurred to produce the goods i.e. stock in trade goods be recorded on the expense side? Is it the purchase of stock in trade? Few of the websites are showing stock in trade as goods which are purchased for resale.

Hmm, maybe check out Amar raja batteries or Exide batteries for this? See the line item and the associated notes. The explanation will be clear 🙂

What happens if the company tries to not show the authenticate financial results?

what if they manipulate the investors?

What would be the consequences to the company?

In the past have you heard anything like this?

And sorry for being so skeptical !! I\’m asking this because of my curiosity..

These are corporate governance issues, always has a bad ending 🙂

How much portion the other income need to be to get a green flag??

No standard number, but I look for it if its more than 5-8% of revenues.

1. One lesson I have learnt from my limited time in the markets is that, the price starts to react before margin erosion happens or EPS shrinks. Even I remember Mr.Rakesh Jhunjhunwala saying in one of his interviews that he sells when the EPS starts to peak. I would like to know about how you would personally approach this, and how to approximately find that the margins or EPS is more or less peaking? Your answer would be really useful in analyzing companies with volatile margins.

2. Could you direct me to some good source which gives an idea about raw material prices?(Tijori is good but is a paid service to have full access)

Thanks Sir.

1) One easy way to figure of any of these ratios or margins peaking is by looking at historical trends and also comparing with the industry. Sometimes you can even take cues from global equivalents

2) Cant think of any apart from Tijori 🙂

OK got it👍

Thanks sir

Sure, Niraj. Happy learning 🙂

That l got borrowing is total debt of company.

But how to understand the company paying it\’s debt or not.

So look at how much debt the company has in year one and how much debt the company has in year 2, if the debt has increased, then the company has taken on more debt, else the debt has reduced.

As I look in balance sheet for debt of a company. I look at borrowing of company. Now how to understand is company paying it\’s debt or not.

What proced from borrowing and repayment of borrowing explain in cash financing activity?

What is difference between borrowing in balance sheet and cash fin activity?

Sorry sir but these one concept I not able to understand in AR.

Niraj, you can compare the debt level from the previous year to the current year. An increase in debt means the debt has increased; otherwise, no. Borrowing is a balance sheet activity reflects everywhere else.

Exactly in which column.

As in? What are you looking for? Can you share some context, please?

Sir where to see real debt of company.

Balance sheet.

Sir, plz suggest any link for right financial reports of company.

Check the company\’s annual report in the website.

Karthik, you are a gem. Awesome material!! Keep imparting your knowledge through these materials. Extremely helpful

Happy learning, Kishan!

How much % Generally the Other Income should be of Total Income from Operations

As low as possible. You need the company to be earning revenue from operations and not via other sources.

wonderful explanation ! best I have read as a non financial guy. very crisp and to the point with good egamples too

Glad you liked the content, Venkat. Happy learning 🙂

Doesn\’t the sale of scrap attract GST? Similarly the services provided should also attract Service tax. Why isn\’t there clarity on thihese aspects in P/L statement?

In the older format, there were duties. While the concept largely remains the same, will try and update to reflect the current changes.

What is Realized P&L Pct. means?

It means Realized P&L Percentage.

What is Unrealized P&L Pct?

It is Unrealized P&L Percentage.

Hope it helps someone who is looking for it the same way I did…..

Yeah, I guess pct is short form for percentage.

KArthik, I\’m loving it, learning is so much fun suddenly, thank you for all your efforts and keep us posted with new updates. 🙂

I\’m glad. Happy learning 🙂

I have query please help me. If a company buys fixed assets(definitely costs big amount), then there will be an expense. Either in the form of decreasing surplus or increase in debt. What if none the two happens? Even if the expense is shown in depreciation, then there must be an increase in depreciation. What does it mean if none of the things happen???

Depreciation will increase, otherwise how will you account for 🙂

Sir

Can yo explain me why i look through the consolidated financial statements. Why not standalone financial statements.

I have done that in the chapter itself, Vishal.

Thanks a lot Sir for your reply.

Can we blindly trust Nifty50 or Nifty100 companies ?

Or there is a possibility of discrepancies there also ?

Regards

Ishwar

Nope, you cant blindly trust these companies. You need to put in the efforts to learn more 🙂

Good Afternoon Sir,

I have portfolio of 25 companies. Should i goto AR of all the companies ? generally i look at the data of company at tickertape premium section and decides. I mostly look whether tickertape gives green signal or red signal. is that enough or i should do more research ?

Ishwar, it is a good practice to know your investment companies well. The good part is that you only have to go through the AR once to get a full understanding of business, subsequent readings AR readings will be faster.

In Note 18: Other Income, there are certain terminologies for example: Provision and cash balance written-off. Where can I get the meaning of these terminologies? Because simple Google search didn\’t help. Can you please help me here?

These can be specific to the company. Please check the associated notes for details.

Kindly delete my first comment including this. It had some grammatical mistakes and there was no means to edit it so posted it twice.

Thanks

Dear Mr. Karthik,

Your article is really helpful and I have been reading article as well as each and every comment so as to make sure I don’t lose any critical information.

Just came up with one of the comment posted by user kjgaurav On April 24, 2015 at 6:05 am on which I too agree with him.

The statement “The sum of revenue from operations (net of duty), other operating income, and other incomes gives the ‘Net Revenue from Operations’” should be corrected since it creates confusion & contradiction wherein other income is included for considering Net Revenue from Operations.

Although you might have mean to say that other income is actually other operational income but you might simply write it “The sum of revenue from operations (less of duty) and other operating income gives the ‘Net Revenue from Operations’”.

This is what I felt so.It is upto to you to amend it as per your knowledge to avoid new readers confusion.

Lastly, thanks for your beautiful article and still actively replying each and every comments. Hats off to your efforts. 🙂

Dear Mr. Karthik,

Your article is really helpful and I have reading article as well as each and every comment as well so as to make sure I don\’t lose any critical information.

Just come up with one of the comment posted by user kjgaurav On April 24, 2015 at 6:05 am which I too agree with him.

The statement \”The sum of revenue from operations (net of duty), other operating income, and other incomes gives the ‘Net Revenue from Operations’\” should be corrected since I creates confusion & contradiction wherein other income is included in assuming Net Revenue from Operations.

Although you might have mean to say that other income is actually other operational income but you might simple write it \”The sum of revenue from operations (less of duty) and other operating income gives the ‘Net Revenue from Operations’\”.

I feel so you amend as per your knowledge to avoid new readers confusion.

Lastly, thanks for your beautiful article and still actively replying each and every comments. Hats off to your efforts. 🙂

Thanks so much for pointing this out, Dinesh. I\’ll try and correct this to avoid confusion.

I just can\’t stop appreciating you before writing any comment.

Thanks, Anupam, hope you continue learning on Varsity 🙂

I am asking this question because hdfc bank results are 18% better than last year in terms of profit & all other things look good.

But stock has given only 5% return after the last result & today after the result it went down by 1.53%.

I know that it is matter of only one day & we do fundamental analysis for long term, but if results are good and today was first trading session after the results then why market responded bearish ?

Because everyone expects HDFC to deliver good results, Anupam. Its already factored in the stock price of HDFC.

Thank you sir for this awesome module.

I don\’t know how many times i will thank you throughout this course. Maybe the number of times i will write some comment.

My question is that suppose a fundamentally strong company shows profit increase of 20% year on year. And after the last results it has already surged 30%.

Can we expect the price to drop in short term.

Thanks, Anupam. No need to thank so many times 🙂

Price drop – depends on many factors. In a bull market, it may not happen, but can happen in a bear market.

Hi

What stand for \”Pct.\” in below. It is a column name in \”P&L Statement for Equity\”.

\”Realized P&L Pct.\”

Please let me know.

Thanks

Anuj Kumar Jain

Anuj, I\’m not sure what Pct means. Can you please share more context?

Interest amount(Finance cost) is 0.7Cr but here it is written 7Cr.

Must be a typo, let me check again.

Thank you for your immediate reply

Sure, happy learning Kauseelan!

Hi Karthik,

Your articles are excellent and helping novices to on-board investing. Thanks a lot.

What is the logic behind determination of face value of share?

Is there any criteria?

No logic as far as I know. Usually Rs.10/- works all the time 🙂

Why the Excise part is not shown in Expenses as it does not give any profitability to revenue?

Its deducted from the top line itself.

what item in other income will be considered a red flag? What\’s the min value other income should be to avoid red flags?

Always look at it in proportion to the revenue income.

But, why it should be lower?

Can u pls explain?

Sorry, I lost context. What are u referring to?

Sir, Some example for such screening tools and sites

Noted, will try and do that.

Respected sir,

I have a quite simple question at this point of time …right you are teaching us to read the financial statements but how will we identify companies that are worth giving our time ….in simpler words how to short list companies worth further analysis …how do we select companies !?

YOu can use a screening tool for this, I guess some websites provide you with a feature using which you can filter for companies that offer good financial metrics.

how possible??? loss is greater than its revenue

Thats possible, you borrow to fund your expenses.

Srei Infra company\’s annual p&l report in which Sales revenue = 3700 cr and Loss = 7000cr.

how loss is grater than its sale.?

Its possible right?

Hi Team, just a suggestion and request.

Can you please add a button or ribbon to toggle between the section, like next section, previous sections and so on. This make is easier to proceed and go back quickly. Thanks

Noted.

What are the modules of PNL

Modules as in?

Hi Zeroda Team,

From the take away points, the fifth point below is not clear. Can you please kindly justify it? How can a company can change the Financial numbers after audited and Published?

The P&L statement is an estimate, as the company can revise the numbers at a later point. Also, by default, companies publish data for the current year and the previous year, side by side.

Thats right. But companies can restate numbers (not major changes). For example, provision for tax can be X for this year, but that could be + or – and restated the next year. Can happen for any line item in the Financial statement.

What proportion of the total income as other income would you suggest acceptable to consider a company performing well?

Hmm, there are no set rules here, but I\’d personally like to see it less than 10%.

In the key takeaway section..point 10 is telling that net operating revenue = revenue from operations + other operating revenue + other income….but in note 17 it is showing net operating revenue = revenue from operations + other operating revenue….kindly guide which one is correct

This one: net operating revenue = revenue from operations + other operating revenue

Heyy,

Thanks for your time ,its very well explained all of it .

Thank you

but I went through Asian paints cash flow statement , 2015\’s net increase in cash is different to what is shown in the next year on 2016\’s cash flow statement as 2015(previous year)

Asian paints seems like well established company, but what does that indicate about the company?

Koushik, is the difference large? If its slight difference, then its ok since companies usually restate the numbers. If its a large difference, then do check the associated notes for a detailed explanation.

hi kartik,

I would like to know what is face value?

Thats the nominal value of the share assigned at the time of share creation.

To start with, its an outstanding course for people like us who just started. I have few doubt. I understand COGS ( Cost of Goods Sold) includes all direct for manufacturing. In Expense Side, Change in inventories of finished good, is the expense company has to bear last year, which was not included in last year Income statement because the inventories were not sold. However, this year when the inventories were sold, it is added as an expense in Income statement. Why are we not including this expense in COGS calculation? Moreover, Salary and Wages of employees, who are involved with production of materiels ( e.g. Battery here in this case) are also not included. Why are they not part of direct cost?

Reference Annual Report : https://www.amararajabatteries.com/Files/AnnualGeneralMeetingFiles/2013/Annual-Report-2013-14.pdf

Salaries of Wages of employees : 1361.32

Changes in inventories of finished goods, work-in-process and

stock-in-trade : 292.10

Saurav, Wages etc is mentioned as employee benefit if I remember right. I prefer to consider the entire expense section as the direct expenses.

valuable lessons

I am just shocked to see , you are replying to each queries. I soon would be here for answers to my questions. Btw Zerodha varsity is the best collection.

Happy to do that, Alok 🙂

dear sir,

there is a doubt.

\”key take aways from this chapter\” point number 10.

it is stated that net sale of products + other operating revenue + \”OTHER INCOME\” adds up to give \”NET REVENUE FROM OPERATIONS\” .

does other income other income come under net revenue from operations ?

when i look into the p&l statement other income does not come under net revenue from operations.

getting a bit confused.

Ah no, we will have to ignore the other income bit to get the perspective on revenue from operations.

Hi Karthik, Unable to post comments from personal computer. I did this one using mobile. What can I do?

What is the issue, Satish?

Hi Karthik, As you mentioned we just need to know how to read AR rather than knowing accounting procedure. But there are time rarely when there is a change in auditing guidelines and it has larger impact on different AR components. To name a few liabilities have been impacted by new Ind AS 116 ‘Leases’. This will impact the most financial ratios but there is no major change in reality in liabilities. What should we do in these times. I think learning a bit about accounting techniques might help.

Of course, it does. All incremental learning helps Naga. The more you learn, the better in terms of edge you\’d develop for yourself.

Why Excise Duty is deducted under Revenue Head? I think it should be considered under Tax Head. Please correct me if wrong.

Excise Duty is no longer applicable I think. But anyway, manufacturing companies earlier had to deduct exercise from the final output and then sell.

sir, two parameters required to calculate the EPS of a company?

Yes, the earnings of the company and the share price of the company.

In one of the above comments you said:

\”There are couple of things to watch out for when the results come out –

1) Are the results better than expectation or worst or did it meet expectations?

2) If the results are better, can it sustain for the coming quarters?

3) If it can sustain, what are the headwinds? Does the company have a realistic approach to deal with it?

4) Guidance for the future quarters

The stock price is a function of all this and more…and not just the quarterly results.\”

Who\’s expectations and what expectations were you talking about?

Your expectation of what the companies results are going to be.

DEAR SIR ,

I went through fundamentals on youtube and stilling reading pages on varsity , i know am asking ready made food , i think working individual needs more energy than group , at 58 th minute , a template of bs, pl, cf, dcf is been shown

https://www.youtube.com/watch?v=fTIOzRPOXsk

it would be helpful for me , as i do follow peter lynch graphs and fundamental analysis , i would miss much if i do on own excel .

i do belive knowledge is only asset of human and you do super job ,zerodha is surely future of indian financial educator .

thank you lot for response .

[email protected]

I understand, thanks for the feedback, Kailsha.

HI KARTHIK SIR

PLEASE GIVE EXCEL SHEET FORMAT OF ALL FUNDAMENTAL ANALYSIS PUT ON YOUTUBE .

THANK YOU

Unfortunately, we don\’t have any such excel, Kailash.

Thankyou sir,i have got the answer,

for PAT Margin I simply used Profit for the Year.

and to calculate EPS,I used \”Profit Attributable to Shareholders\”.

Thankyou Again sir

Cool. All the best Sunny!

Hi sir,Sometimes it becomes difficult to find out to clearly finding the Profit After Tax for PAT Calculation.

Like in case of TCS they first mention\” PAT\”, then they mention \”TOTAL COMPREHENSIVE INCOME FOR THE YEAR\”,it causes difficulty to which value to take for profit.

and also which value to take to calculate EPS in this case.

Sunny, in such cases, I\’d suggest you read through the associated notes to figure what they mean by the total comprehensive income for the year. Since its not a common P&L line item, they would have given an explanation in the associated notes.

Hello sir, very amazingly explained and thanks for helping us understand FA in such lucid way.

Also I would like to understand why has company given \”Home UPS(stock in trade)\” but nothing about \”Home UPS(finished goods)\” in the schedule 17. Did the company stopped manufacturing them after 2013 or did they included that also in the \”Storage battery(finished goods)\” and if so then why didn\’t they include the same in \”Storage Battery(Stock in Trade)\”.

Thank you

This you will gain have to check the AR, in the management discussion and analysis section, Ajit. They would have specified here.

Thanks Karthik!! In this lockdown, I have decided to enhance my knowledge of fundamental analysis so I will keep bothering you with my stupid questions 🙂

Please feel free to do that.

Hi Karthik,

First of all, thanks a lot for making this complicated things in a simple term and I have become a great fan of yours. My question is that why do we dig so deeper in the financial statements when it\’s already available in different sources. I mean based on financial statements of any company, different sources have their ratios already calculated like ROCE, EPS, PE ratios then what difference does it make to calculate at your own? The ratios must be same for every source since the source data (Annual reports) and methodology are same. Please advise.

Databases have their own formats, hence its best to take this from AR. Also, as an investor, it is best if you can crunch these yourself, helps you ask and answer many questions during this process, which is really important for you as an investor.

Hi Karthik,

I am reviewing Kotak\’s FY19 P&L Statement.

In schedules they have mentioned other income. Is it ok to update other income in schedule as I assumed schedule is for detailed note on incomes and stating other doesn\’t give much info.

Also, what should we conclude on this?

Regards,

Pratibha

Thats ok, as long as they have provided information.

Hello Karthik

Thanks for your writing to make us understand the terms so easily , really owe you a ton

i was struggling since 2008 to understand the things related to stock and bought some book and use to watch CNBC but nothing helped , and finally i gave with in a year , and in between i tried to explore again but couldnot crack it , But your expalnation are getting me the things now

some said it rite , everything has it own time and comes with its own time

i wish i had googled your blog in 2014 itself , my bad luck

i have one doubt ,

Net Operating Revenue = Net Revenue from sales + Sale of services + Other Operating revenue

and

Total Revenue = Net Operating revenue + Other income

Please correct me with the equation for Net Operating revenue and Total Revenue ??

Better late than never 🙂

Yes, that\’s right about Net and total revenue.

Sir if Assets = Liabilities in balance sheet

Then share holders equity must always be zero

The difference if any is the net worth.

Hi Karthik,

Thanks for providing us such a nice material on fundamental analysis.

One Doubt: In key Takeaways from this chapter \”Last Point:10\” :The sum of revenue from operations (net of duty), other operating income, and \”other incomes\” gives the ‘Net Revenue from Operations’.

Here \”other incomes\” should be excluded since it doesn\’t contribute to Net Revenue from Operations, As you mentioned in this chapter(second last para) that \”other incomes\” is not related to the main business of the company.

Even in P/L statement \”Net Revenue From Operations\” is 34,366.59 and \”Other Income\” separately written on the last is : 455.14 .

Or It should quote as \”Total Revenue\” if \”other income\” is not excluded.

The idea is to isolate the other income and see what the true earning potential of the company is.

Hi Karthik,

Today i placed intradat sell order for dcmshriram at 280 price. It got sold. Quantity is 180. But i could not buy it as there were no sellers. Now when will the order will be completed. Will it be Trading 2 days with higher market price?

Unfortunately, this is a short delivery case, check this – https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/what-is-short-delivery-and-what-are-its-consequences?ref_query=short%20delivery

So does this mean that as long as the actual value is reasonably close to the quoted value, it is considered acceptable?

Yup, it is. Else, you will have to inspect the reasons for a large change. The company will explain this with an associated note.

Sir is this true I have read it in quora article by Abid Hassan of sensibull.

If we think we can read the balance sheet of companies and find out something which all the banks and hedge funds have missed, and make some great investments on fundamental analysis, we are on an acid trip. Reading balance sheets is not simple. A lot of details are lost in creative accounting (mal)practices. Only an extremely trained eye with deep experience and insider knowledge can do that.

Lol, no. I actually disagree with him on this. Reading company financials is quite easy. This entire module is dedicated towards that effort 🙂

Hello Karthik,

I am confused by the following two statements:

\”The P&L statement is an estimate, as the company can revise the numbers at a later point.\”

\”Since the annual report is published by the company, whatever is mentioned in the AR is assumed to be official. Hence, any misrepresentation of facts in the annual report can be held against the company. To give you a perspective, AR contains the auditor’s certificates (signed, dated, and sealed) certifying the sanctity of the financial data included in the annual report.\”

How can the annual report be official if the P&L statement can be modified at a later point in time?

Ah, by estimate I mean that the actual number can be in and around the quoted number. For example, if the company states a revenue of Rs.100/-, the actual number can be 100 or anywhere between 98-102.

Dear Karthik,

Thanks so much for the material. They are very helpful. I had a question

– Assuming all other things equal, how does inflation affect the revenue of the company? For example, if the inflation rate is 7%, then naturally the price of the products sold also increases 7% and hence the revenue increases proportionally. So when reading these numbers should we account for inflation?

Yes, inflation has an effect on everything, including corporate earnings.

Hi Karthik Sir,

IIn Case of Amarraja batteries, they have different business under the brand name AMARA RAJA BATTERIES. This annual report , whether it includes revenue from all businesses or only main company. How to know about it? If only the Main Company, then what about other unlisted Companies?

Yes, hence you need to check the consolidated annual report.

Dear Zerodha Team,

I need to understand what is categoty \”Other credits & debits\” and why are charges debited into this ?

THis is additional debit post brokerage charges. Do clarify ?

Bhavik, check this – https://support.zerodha.com/category/q-backoffice/reports/articles/other-debits-credits-console and here is the list of complete charges from Zerodha – https://zerodha.com/charges#tab-equities

yes i want to how to calculate the trading positions, on daily basis

How do calculate profit/loss on daily basis,can anyone provide equation like the profit an loss statement in zerodha, i need to keep track of my profit and loss separate spread sheet

On a daily basis? Are you talking about trading positions?

I\’ll say again your simple explanation of complex things like these for non-commerce background person like me is a lifesaver.

If you could enlighten me more, I would like to know what it is you visualize in your mind/brain when reading a P&L statement.

I mean how do you see it (visual picture) in your mind in what geometrical shapes/symbols/charts/something else, as I would like to know how professionals like you read this in few seconds, so there must be some visualizing process. Plz give me your approach.

Regards,

Kcrest

I\’ve not really thought about it, interesting question though 🙂

Nice information karthik,

but I have one doubt while reading a Balance sheet, Cashflow statement, P&L statement you use Calculator… like accounting equation (I think)

or just see numbers, and check in mind that the given numbers are correct.

please reply, whenever possible.

thank you for sharing your experience 🙂

Glad you liked the content, Rajesh!

Most of the times, it is just about reading through the numbers and checking if things are fine. If numbers don\’t add up or if something seems off, then maybe it calls for a further inspection. But yeah, most often you take things at face value.

Should we do this analysis on standalone financial statements or consolidated? Please reply…thnx. the information you hv provided is very useful , learned alot…love you Zerodha

Always on consolidated 🙂

Hi Karthik,

You have wrote that the sum of revenue from operations (net of duty), other operating income, and *other incomes* gives the ‘Net Revenue from Operations’ in the key takeaways from the chapter part.

How come \’other income\’ is included in \’net revenue from operations\’?

Other income should be removed from total revenues to arrive at the operating income.

OK

Hi Karthik,

Today i wanted to sell shares of Lindie India at 580 but after 2.00pm there were no buyers after price reached 583. I planned for intraday. Now my question is if i would have sold at 580 and as i cannot buy it as there are no sellers, what would have happened to my positions? will it be bought at 583 at closing time?

This would have led to a short delivery of shares, check this – https://zerodha.com/z-connect/queries/stock-and-fo-queries/consequences-of-short-delivery-nse-bse

Hi karthik,

Thanks for the simplest version of FA.

Just want to understand \”5.

The P&L statement is an estimate, as the company can revise the numbers at a later point.

Yes, P&L is supposed to be an estimate of the revenue and the expense the company incurs during the year. But these are supposed to very very close to the actual figures. At times, there could be minor adjustments, based on which the numbers can be restated. Please note, the restated numbers should not be widely off the mark.

So items recorded in p&l should be based on entries recorded in bank and invoices generated, that\’s my understanding so how it should different. Would appreciate if you can give some examples.

Yes, I completely agree. However, the difference can arise through provisions/deferred taxes, and other current items. I\’d suggest you check the Annual Reports of ARBL for the same period used in this chapter.

Ok. Got it. Thanks karthikey.

You mentioned about financial modelling module. When we can expect that.

Hopefully by next year, Parmar.

Hi Karthik,

You mentioned \”Finally the revenue from Sale of products + Sale of services + Other operating revenues sums up to give the total operating revenue \”.

Total Operating Revenue = Sale of products + Sale of services + Other operating revenues

= 3804 + 30.9 + 2.1

= 3837 Crs

Total Operating Revenue = Net sale of products + Sale of services + Other operating revenues

= 3403 + 30.9 + 2.1

= 3436 Crs

From figures looks 2nd equation is correct.

Do we need to consider \”Net sale of products\” instead of \”Sale of products\” while calculating Total Operating revenue?

Net is after considering the duties, which by the way is no longer valid with the introduction of GST.

Okay sir, means you need to find out different valuation metrics for the companies in different Industry.

Thank you so much Sir.

Yes, Palak. Good luck and happy trading.

Okay sir. Thankyou

So, if we want to calculate the financial ratios for the py, we should use restated numbers?

Secondly, which method is most likely suitable to value the stock. By P/E OR BY P/book value?

Thank you for helping and educating youth.

Palak, there is no single metric which is considered sacred for valuing stocks. It always is a combination of all these ratios. It also makes sense to compare these across the peers.

I am observing in my companies.

company BSE limited

In annual report 2017- 18

march 31,2018 march 31,2017

Revenue 47,698 37,365

In annual report 2016-2017

march 31,2017 march 31,2018

Revenue 33,104 26,098

So why 2017 figures are changed ?

Most likely, the previous year\’s number gets restated in the current year. This is a common practice.

Hello sir,

I have one query.

Why is revenue different in two statements? means

In financial report 2018, the company showing PY figures is different from financial report 2017?

Regards

PY figures? I guess the company has restated the numbers in 2018. Can you please check?

Hey Karthik!

Could you please share a snapshot of excel, in which you do all these calculations.

Thanks.

The idea was to put that up as a financial modeling module. Hopefully, I can do that sometime soon.

Hi karthik

I was reading the AR of a company which read as follow:

\”During the year under review, the Company has

completed its Buy Back Offer of 4,50,000 (Four Lakhs

Fifty Thousand) fully paid up equity shares of Rs. 5/-

each representing 0.98% of the total paid up equity

share capital at a price of Rs. 550/- (Rupees Five

Hundred and Fifty) per share for an aggregate amount

of Rs. 24,75,00,000/- (Rupees Twenty Four Crore

Seventy Five Lakhs).

Post buy back, the paid up equity share capital of the

Company decreased from Rs. 22,88,88,000/- (Rupees

Twenty Two Crore Eighty Eight Lakhs Eighty Eight

Thousand) consisting of 4,57,77,600 (Four Crore Fifty

Seven Lakhs Seventy Seven Thousand Six Hundred)

Equity Shares of Rs. 5/- (Rupees Five) each to Rs.

22,66,38,000/- (Rupees Twenty Two Crore Sixty Six

Lakhs Thirty Eight Thousand) consisting of 4,53,27,600

(Four Crore Fifty Three Lakhs Twenty Seven Thousand

Six Hundred) Equity Shares of Rs. 5/- each.

All these words are uncomprehensible to me.

Sorry for such a subjective and lengthy statement.

Can you kindly teach me what does all this mean?

Tarun, this is quite simple. Go back and read one line at a time after reading my reply –

1) The company in focus has bought back its own shares from the open market. For example, if it had 100 shares in all in the open market and it decides to buy back 25 shares, then the outstanding shares in the market will be 75

2) The values mentioned in the above text are is valuation i.e share price * the number of shares.

3) Once a company buys back shares, the number of shares outstanding reduces.

thank you for the simplification but I didnt get the part where it mentions that

\”equity shares of Rs. 5/-

each representing 0.98% of the total paid up equity

share capital at a price of Rs. 550/- \” are bought

does it mean the face value of the Share is Rs. 5 and they bought it back at Rs.550 each?

That means out of the 100% shares only 0.98% of shares were bought back, whose face value was 5 and buyback price was 550.

Thanks for clarifying the doubt Karthik. your articles and teachings are saviors

Happy learning, Tarun 🙂

Respected Sir,

I just want to thank you for such wonderful content, trust me the explanation you give is comparable to what Experience Professor will taught of reputed business school. Hats off to you !

Thanks !

Thanks for the kind words 🙂

Happy learning!

I have a doubt here \”When the Revenue goes up From previous yr the growth can come from either Volume Growth or Price increase or both\” Right. My question is Where can I get the Break up Numbers of the Revenue Growth to figure out is the Growth coming From Vol increase or Price Increase.

Rajdeep, companies publish this data in the annual report itself. I\’d suggest you check under the notes associated with the revenue section. Thanks.

Hi sir

If company sell it\’s property or machinery

this income also calculated in net profit ?

It will come under Revenue under other income.

Hi sir

Reverse situation.

If company buy property or machinery then its impact on net profit ?

Then the fixed income component will go up, cash can come down, or borrowing will increase.

Hi sir

Means buy property is not calculated in expense ??

Its an asset.

Sir in 10th point of Key takeaways from this chapter…

i think \”other income\” should not be included in \”Net Revenue from Operations\”

am i right??

Yup, because it is not an operational income.

Thanks for the explanation. I am carrying out DCF valuation for a company, but I am unable to find a format which segregates COGS and Operating expenses and provides details of EBITDA EBIT EBT and so on. Annual reports give the format explained here. is there any way to identify this format? or we will have to prepare the p/l and b/s from scratch to carry on financial modeling?

Tushar, remove the finance cost, depreciation, and amortization from the expense part to identify operating expenses. You can deduct the operating expenses from operating income to figure out Operating profits or EBITDA.

Dear Karthik,

Thanks for a valuable information.

Please let me know, when will ZERODHA be listed in market.

I am eagerly waiting for investing in ZERODHA.

Touch wood ZERODHA has bright furture because of good management like you.

Thanks.

Hiren, thanks for the kind words 🙂

Its good wishes from people like you that keep us going!

Hai sir,

I am learning lot of information about fundamental analysis by varsity.sir i want to detailed report on revenue from operations and expenses .how to get the details of it.pls help me sir.

Thankyou

YOu need to check the notes associated with the P&L. You will have a detailed overview.

Thanks for your reply sir.but I didn\’t forget the details.so how to check the details pls gives me any examples .sorry for the trouble sir.thank you

Joseph, next to the revenue in P&L, you will find a note number associated. Look at that number and scroll down to the schedule sheet and there you will get a detailed breakdown into the revenue.

Karthik sir I got the details.muchmore thanks for your support sir.

Good luck, Joseph!

Hai karthik really superb stuff!!! Can inask on e doubt??? All AR will publish these sub divisions as para??

Yes, they usually associate a note and the explanation is given following the financial statements.

Kartik – your presentation of the content and example explanations are awesome, i mean it, i have become a fan of your style. Thanks a lot educating us, keep it up….

Happy learning, Surjeet 🙂

Appreciate the hard work !!! 🙂

I used to ask people what is Stock and …. . but now i learn and learning everything from zerodha.

Thanks for clear content !!!

Happy to note that, Arun. Good luck 🙂

All your modules are quite helpful for a beginner like me. Thanks a ton sir.

Good luck and happy learning 🙂

Dear Karthik,

Amazing Job in preparing the whole content. Its very simple effective and practical , I am glued to read more and more 🙂

Happy to note that, Shilpa!

Good luck and happy learning 🙂

Dear sir, taxes are levied on PBT amount or total revenue generated ?

It is on the taxable amount as represented by PBT.

Hi Sir,

What do u mean by saying \”From my experience, the financial statements are best understood by looking at the actual statement and figuring out the information.\”What is that \”actual statement\” mean?

Don\’t form opinion on a stock based of financial highlights, excerpts, etc. Better if you dig deep and read the actual statement released by the company. You can find this in the company\’s website under Investor Information

Hi kartik,

I really appreciate your efforts in creating such a easy to understand course on the markets. I have one quick question, when you say

large \’other income\’ raises a red flag , how do you define large in terms of numbers like 1 % or 2% because every AR has some \’other income\’ values.

TIA

Measure the other income as a percentage of Operating income. If it is 10% or more, then we have a reason to be cautious.

Is operating income same as Net revenue from operations ?

Yes.

Hi karthik

Thanks for sharing such a profound information to us.i really learnt alot,really grateful to u for making efforts to educate us. I just have one question.

I want to buy the stocks by analyzing their past performance( upto10 year) that means I want to look at the stock price only after I have figured out what the stock is worth of. So how do I choose stock from thousand of stocks without getting influenced by price?

Thanks

You will have to develop a broader investment theme, Aashish. This theme will define the sector and kind of companies. For example, you can choose to invest in Data consumption as a theme – obvious themes may include, companies in telecom, cables, hardware, and broadband services. So you will now have to start filtering out companies which fit your criteria.

Thanks karthik

I was unaware of this theme concept.But if I choose specific theme,won\’t it effect on my diversification?

Not really, as long as you restrict the number of stocks from the same theme.

Hi Karthik,

When you say \’The P&L statement is an estimate, as the company can revise the numbers at a later point\’, what does this mean?

Does the revision in figures happen at a later date due to errors committed while preparing the statements or some other reason?

and what is its impact on our investment decision?

Yes, usually the revision (if any) is made to correct omissions. The restated numbers should not be too different from the actual numbers.

what is mean by excise duty?

Tax charged on manufacturing goods.

sir why we dont post plant and machinery on profit and loss a/c debit side because purchase of that asset is our expenditure please ans.

They are balance sheet items.

nice explanation…keeping it simple is a masterstroke ….

Good luck and happy learning, Amit.

Recently I hv. registered in zerodha. the varsity is awesome. n very useful . Thank U sir. n pl. keep it up , see the company\’ s goodwill increase only by doing service like this. people will automatically come to zerodha n we will also recommend zerodha to our friends. I hv. searched yr. peer companies before signing up . U look very reasonable.

thanx

Thanks for the kind words, Sivakumar. Happy learning!

Karthik,

For http://www.ratestar.in I see you have given some rating, How can I list all the rated stocks

No, I\’ve not really rated any stocks at rate star. Do you see my name there? If yes, can you please share the link here?

I mean, Not you, some rating from Zerodha, I see out of 99 stocks, for example coal india is rated as 46/99, infosys at 30/99.

You can visit ratestar and visit any of these stocks and you will see rating there. I want the complete list of that.

No, Zerodha does not rate stock across any platform.

Thank you for taking the time in educating us. Very well written and easy to understand. My question is how do I transfer all the data from the APR into excel and how do I create a template for analysing the data. Do you have any suggestions on how to create a template through which I can analyze and track the past and present Financial performance of a company.

Anurag, there is no option but to do the old fashioned \’data entry\’ work here. The problem is there are no \’free\’ online resources which give out the right data. The rest of the things you are talking about is core to financial modelling. We will discuss this when we take up the same.

Good luck.

Hi Karthik,

Expense and revenue numbers of 2013 in the annual report 0f 2013(AMARAJABAT) do not match with expense and revenue numbers of 2013 in the annual report 0f 2014. Is it some mistake made by auditors or an amendment?

They usually get adjusted and restated – the difference are not much I guess.

Oh yes. The difference is not much but the adjustments are pervasive throughout the financial statements. Same is the case for Exide Ind annual reports. I hope its normal.

Thanks

Yup, this does happen once in a way.

Hi Karthik sir

when the products sales are 3804 then what is the mean again that income \”The company also includes “other operating revenues” at Rs.2.1crs.This could be revenues through the sale of products or services that is incidental to the core operations of the company.\”

Thanks

You may want to check the notes for detailed explanation.

What is the mean of note numbers here 18, 19, 20, 20 ?

Thanks

Notes contain detailed description of a line item. For example if \’Finance Cost\’ in P&L has a note 18 associated to it, then when you refer note 18 you will get all the information associated with the Finance Cost – like which bank has given them loan, at what rate etc.

Got it Thanks for giving valuable advise

Welcome!

The modules are really good, I am going through almost all of them. Previously I detested financial statements and maybe feared them. But now I am enjoying the same and looking forward for learning more and more.

Can you give an example of financial fraud, why I am asking so is, I don\’t think we need to be concerned about frauds since these are audited and if the company is really doing fraud it won\’t be detectable so easily. Like is case of Satyam why nobody was able to detect them, so many people might be reading there ARs.

I agree, but few simple checks and asking yourself few basic questions why reading AR helps. For example Satyam had debt on their books, one may have asked why the company has debt while their peers dint. Usually questions like this leads you to identifying such frauds. However I must tell you, this is easier said than done!

Hi

This is an incredible place to be. I haven\’t received this kind of clarity in concepts and detailed explanation from anywhere else. You are doing awesome work to educate non-finance guys like me. Thank you so much for sharing this priceless information with us. Keep up the good work and dedication. Wish you all the best in life, investing and business.

Thank you for the kind words Jeswin 🙂

suppose a company lists its 40% share in the stock market. and from initial round of selling the company get the fund of say 1 crore. but now what? as now these 40% share belongs to the trader and trading is done between the traders.. so if say the price of the stock get high, how does the company profit from this because these trading is happening between the traders so the money goes from one trader to another.. so how can a company profit from there stocks getting higher?

Once the stock gets listed, the stock price dictates the valuation for all shareholders. Higher the stock price, higher the valuation, and higher the net wroth of shareholders including the promoters.

hi karthik, ril\’s q3 was beating street estimates but the day before result stock started to crack,corrected sharply from 1080 to 1040 and after the result beaten down to 1000 range may be due nifty management,call writing and expiry pressure then after reaching 1015 post expiry its downward journey resumed now it is near 960 and i believe it may reach 940 and 920 soon as nifty is also weak and its weight age on nifty where as tata steel\’s loss mounted q3 loss – 2000 cr instead of street expectation of – 1000 cr but stock rallied more than 15 points post results, why ril\’s good result over looked and ts rallied ,how can we trust fundamental analysis and do operators exist in Indian stock market?

There are couple of things to watch out for when the results come out –

1) Are the results better than expectation or worst or did it meet expectations?

2) If the results are better, can it sustain for the coming quarters?

3) If it can sustain, what are the headwinds? Does the company have a realistic approach to deal with it?

4) Guidance for the future quarters

The stock price is a function of all this and more…and not just the quarterly results.

Waste. Even a child knows

Well, maybe not worth your time!

Priya, what\’s your child name? Is it Rakesh or Buffett? Or a new combined entity: Warren Jhunjhunwala?

Priya, if you cannot appreciate really good things then better dont post negative comments. People at Zerodha are far more knowledgeable than you and they are really doing a marvellous job. Thanks to Zerodha for such a good content.

Thanks for the kind words and support, Akash 🙂

Such an unwarranted comment.

Thanks for all your hard work and efforts Karthik! 🙂

Happy learning!

Another thing, pl efer to the attached snip.

1.What are atock adjustments & their impact?

2.I also see misc expenses much more than employee costs! I wish to know the details of misc expenses (no notes are available on moneycontrol P&Ls)

3. What are preoperative exp capitalised?

Ajay – I would suggest you do not look at moneycontrol. Its always better to look at the Annual Reports directly…you get more information with lot of clarity.

Stock adjustments are mainly to do with adjusting previous year inventory carried forward to current year. Some companies treat this a top line, hence added on the revenue side.

Hi Karthik,

Thanks a lot for sharing information in a lucid manner.

However, I would like to know the source from where you have taken the P&L for ARBL. Because I can\’t find the same line items on ex. moneycontrol as I see in your snapshots.

Took it directly from the companies Annual Report.

I tried to see the price of ARBL on NSE but could not get. Then I searched for \’Amara Raja Batteries Limited\’ and got it with symbol \’AMARAJABAT\’. Is the symbol changed from ARBL to AMARAJABAT or am I going wrong somewhere?

The symbol has always been AMARAJABAT, but in the module for some reason I have used ARBL…sorry if this created any confusion.

Thank you for the clarification Karthik…. Material is great and really helpful. It has improved my understanding.. Thank you zerodha team for all your efforts….

Super happy to know that 🙂

In Key takeaways- the 10th point – \’Net Revenue from Operations\’ should not include other Income, and i think should be corrected. Please let me know if I am wrong.

It is \’Other Operating Income\’ not \’Other income\’ . It is an Operational Income and not the Income from other sources. I think it is correct.

Other income is due to non operational activity – like rental income or dividends from investment….all income from operational activity is termed as \’Revenue from Operations\’.

Respected sir,

As i can see from the snapshots provided for the other expenses column as given in note 18 of this financial statement, i can see that the other income for the current financial year (fy14) is less by 10 crore with regard to the previous financial year:. What are we to understand by this difference?

Other income is income mainly from dividends, rental, and interest…all of which are non operational incomes. So lesser the value of other income better it is.

Can u explain stock in trade concept

Durgesh – Check the comments in this chapter http://zerodha.com/varsity/chapter/understanding-pl-statement-part2/

Can u explain stock in trade concept ….

Sir,

How can we justify the statement ,if it is manipulated or on higher side

You just need to cross check the numbers across the 3 financial statements. Also, once you develop some experience with regard to reading the statements, you will get a hang of identifying financial frauds.

Karthik,

Again thanks for the wonderful explanation :).

You said \” Usually the other income forms (and it should) a small portion of the total income. A large ‘other income’ usually draws a red flag and it would demand a further investigation\” .Why should the \”larger other income\” be viewed seriously?

That is because a well managed company should generate revenues through core operations and not really through \’Other\’ sources. Hence it always makes sense to check the schedule of other income.

Any public listed company needs to clearly state the intent of the business and most of the figures or majority of the revenue should be from that intent. In case of AMRON it should be related to batteries. Any \”other\” head becomes catch all bucket and any wrong doing of the company to generate revenue or the wrong doings of the promotors can easily be hidden in that bucket. Most importantly, \”other\” head will not explain the nature of the business company did to generate that revenue and that in itself should raise red flag. Anything that you do not understand from a company, the company should be avoided. Hence, \”other income\” should be as low as possible.

Absolutely!

Also, Other income includes income from rent, interest, dividends. So always make sure to check the schedule of other income.