6.1 – The balance sheet equation

While the P&L statement gives us information about the company’s profitability, the balance sheet gives us information about the assets, liabilities, and shareholders equity. The P&L statement, as you understood, discusses the profitability for the financial year under consideration. Hence it is good to say that the P&L statement is standalone. However, the balance sheet is prepared on a flow basis, meaning, it has financial information about the company right from the time it was incorporated. Thus while the P&L talks about how the company performed in a particular financial year; the balance sheet, on the other hand, discusses how the company has evolved financially over the years.

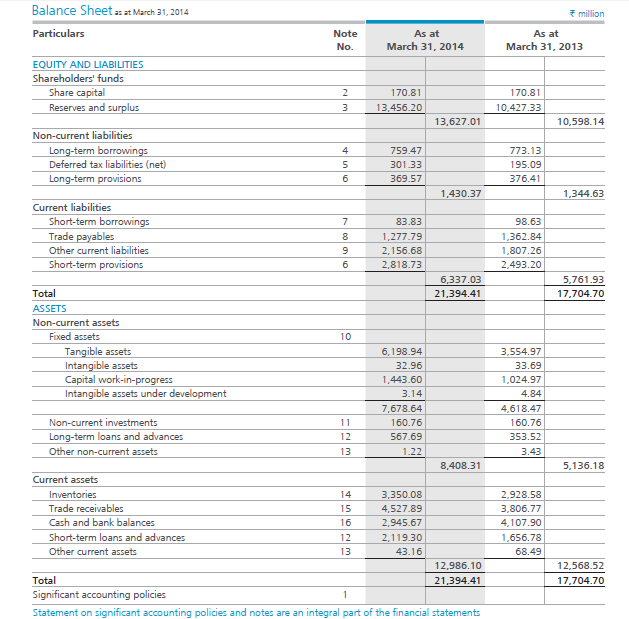

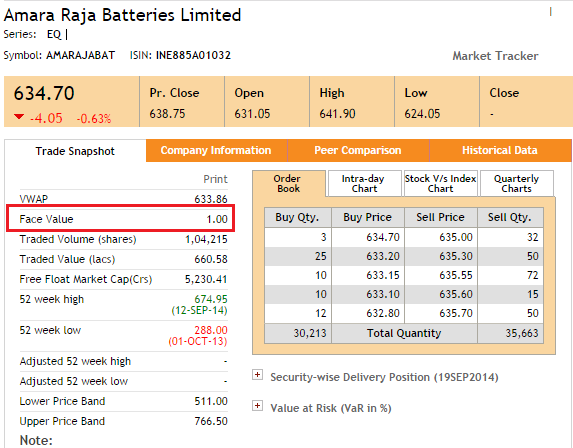

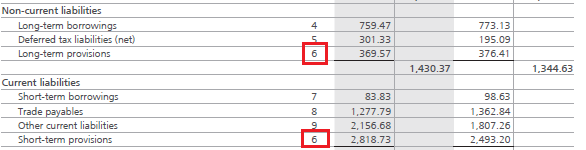

Have a look at the balance sheet of Amara Raja Batteries Limited (ARBL):

As you can see, the balance sheet contains details about the assets, liabilities, and equity.

We had discussed assets in the previous chapter. Assets, both tangible and intangible, are owned by the company. An asset is a resource controlled by the company and is expected to have an economic value in the future. Typical examples of assets include plants, machinery, cash, brands, patents etc. Assets are of two types, current and non-current, we will discuss these later in the chapter.

Liability, on the other hand, represents the company’s obligation. The company takes up the obligation because it believes these obligations will provide economic value in the long run. Liability in simple words is the loan that the company has taken, and it is obligated to repay. Typical examples of obligation include short term borrowing, long term borrowing, payments due etc. Liabilities are of two types, namely current and non-current. We will discuss the kinds of liabilities later on in the chapter.

In any typical balance sheet, the company’s total assets should be equal to the company’s total liabilities. Hence,

Assets = Liabilities

The equation above is called the balance sheet equation or the accounting equation. In fact, this equation depicts the balance sheet’s key property, i.e. the balance sheet, should always be balanced. In other words, the Assets of the company should be equal to the Liabilities of the company. This is because everything that a company owns (Assets) has to be purchased either from either the owner’s capital or liabilities.

Owners Capital is the difference between the Assets and Liabilities. It is also called the ‘Shareholders Equity’ or the ‘Net worth’. Representing this in the form of an equation :

Shareholders equity = Assets – Liabilities

6.2 –A quick note on shareholders’ funds

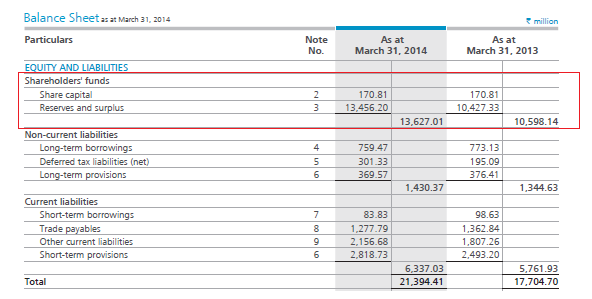

As we know, the balance sheet has two main sections, i.e. the assets and the liabilities. The liabilities, as you know, represent the obligation of the company. The shareholders’ fund, which is integral to the balance sheet’s liabilities side, is highlighted in the snapshot below. Many people find this term a little confusing.

On the one hand, if you think about it, we are discussing liabilities that represent the company’s obligation. On the other hand, we discuss the shareholders’ fund, which represents the shareholders’ wealth. This is quite counter-intuitive, isn’t it? How can liabilities and shareholders’ funds appear on the ‘Liabilities’ side of the balance sheet? After all the shareholder’s funds represent the funds belonging to its shareholders’ which in the true sense is an asset and not really a liability.

To make sense of this, you should change how you look at a company’s financial statement. Think about the entire company as an individual, whose sole job is to run its core operation and create wealth for its shareholders’. By thinking this way, you are in fact separating the shareholders’ (which also includes its promoters) and the company. With this new perspective, now think about the financial statement. You will appreciate that the financial statements are a statement published by the company (which is an entity on its own) to communicate to the world about its financial well being.

This also means the shareholders’ funds do not belong to the company as it rightfully belongs to its shareholders’. Hence from the company’s perspective, the shareholders’ funds are an obligation payable to shareholders’. Hence this is shown on the liabilities side of the balance sheet.

6.3 –The liability side of the balance sheet

The liabilities side of the balance sheet details all the liabilities of the company. Within liabilities, there are three sub-sections – shareholders’ fund, non-current liabilities, and current liabilities. The first section is the shareholders’ funds.

To understand share capital, think about a fictional company issuing shares for the first time. Imagine, Company ABC issues 1000 shares, with each share having a face value of Rs.10 each. In this case, the share capital would be Rs.10 x 1000 = Rs.10,000/- (Face value X number of shares).

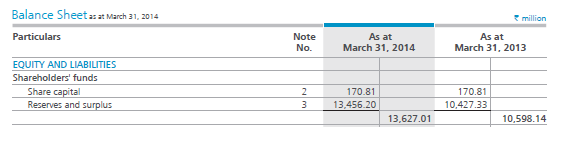

In the case of ARBL, the share capital is Rs.17.081 Crs (as published in the Balance Sheet), and the Face Value is Rs.1/-. I got the FV value from the NSE’s website:

I can use the FV and share capital value to calculate the number of shares outstanding. We know:

Share Capital = FV * Number of shares

Therefore,

Number of shares = Share Capital / FV

Hence in case of ARBL,

Number of shares = 17,08,10,000 / 1

= 17,08,10,000 shares

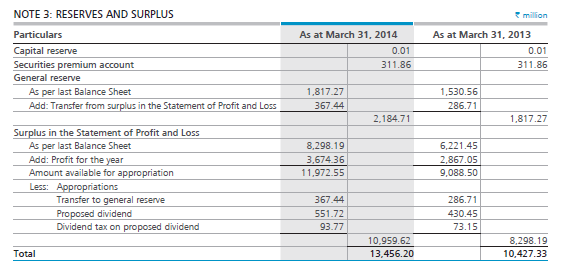

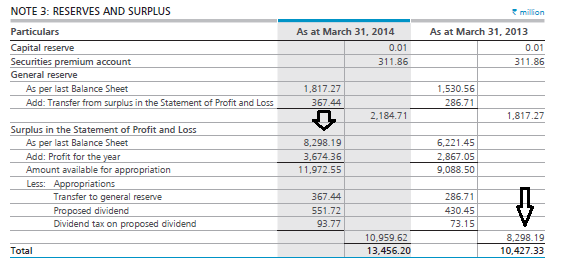

The next line item on the Balance Sheet’s liability side is the ‘Reserves and Surplus’. Reserves are usually money earmarked by the company for specific purposes. The surplus is where all the profits of the company reside. The reserves and surplus for ARBL stand at Rs.1,345.6 Crs. The reserves and surplus have an associated note, numbered 3. Let us look into the same.

As you can notice from the note, the company has earmarked funds across three kinds of reserves:

- Capital reserves – Usually earmarked for long term projects. Clearly, ARBL does not have much amount here. This amount belongs to the shareholders, but cannot be distributed to them.

- Securities premium reserve/account – This is where the premium over and above the shares’ face/par value sits. ARBL has an Rs.31.18 Crs under this reserve

- General reserve – This is where all the company’s accumulated profits, which is not yet distributed to the shareholder, reside. The company can use the money here as a buffer. As you can see, ARBL has Rs.218.4 Crs in general reserves.

The next section deals with the surplus. As mentioned earlier, the surplus holds the profits made during the year. Couple of interesting things to note:

-

- As per the last year (FY13) balance sheet, the surplus was Rs.829.8Crs. This is what is stated as the opening line under a surplus. See the image below:

- The current year (FY14) profit of Rs.367.4 Crs is added to previous years closing balance of surplus. Few things to take note here:

- Notice how the bottom line of P&L is interacting with the balance sheet. This highlights a significant fact – all three financial statements are closely related.

- Notice how the previous year balance sheet number is added up to this year’s number. This highlights that the balance sheet is prepared on a flow basis, adding the carrying forward numbers year on year.

- Previous year’s balance plus this year’s profit adds up to Rs.1197.2 Crs. The company can choose to apportion this money for various purposes.

- The first thing a company does is transfer some money from the surplus to general reserves so that it will come handy for future use. They have transferred close to Rs.36.7 Crs for this purpose.

- After transferring to general reserves, they have distributed Rs.55.1 Crs as dividends over which they have to pay Rs.9.3 Crs as dividend distribution taxes.

- After making the necessary apportions the company has Rs.1095.9 Crs as surplus as closing balance. This, as you may have guessed, will be the opening balance for next year’s (FY15) surplus account.

- Total Reserves and Surplus = Capital reserve + securities premium reserve + general reserves + surplus for the year. This stands at Rs.1345.6 Crs for the FY 14 against Rs.1042.7 Crs for the FY13

The total shareholders’ fund is a sum of share capital and reserves & surplus. Since this amount on the balance sheet’s liability side represents the money belonging to shareholders’, this is called the ‘shareholders funds’.

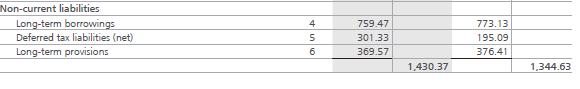

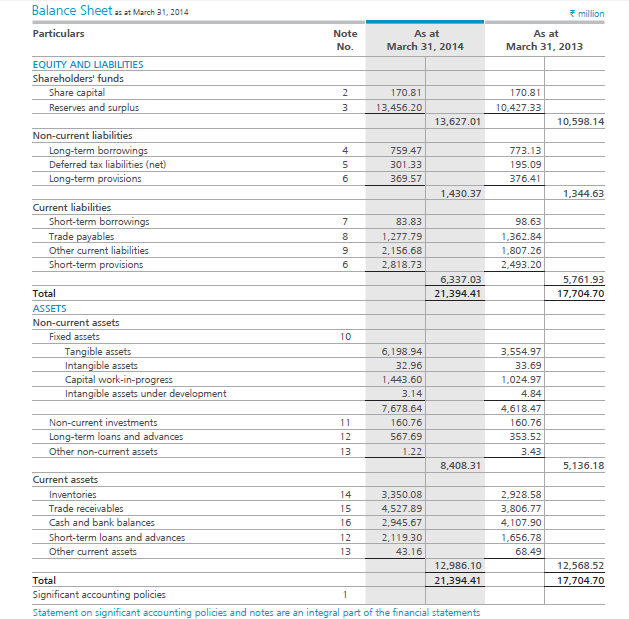

6.4 – Non-Current Liabilities

Non-current liabilities represent the long term obligations, which the company intends to settle/ pay off not within 365 days/ 12 months of the balance sheet date. These obligations stay on the books for a few years. Non-current liabilities are generally settled after 12 months after the reporting period.

Here is the snapshot of the non-current liabilities of Amara Raja batteries Ltd.

The company has three types of non-current liabilities; let us inspect each one of them.

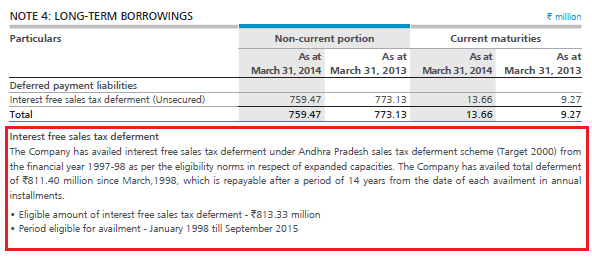

The long term borrowing (associated with note 4) is the first line item within the non-current liabilities. Long term borrowing is one of the most important line items in the entire balance sheet as it represents the amount of money that the company has borrowed through various sources. Long term borrowing is also one of the key inputs while calculating some of the financial ratios. Subsequently, in this module, we will look into the financial ratios.

Let us look into the note associated with ‘Long term borrowings’:

From the note, it is quite clear that the ‘Long term borrowings’ is in the form of ‘interest-free sales tax deferment’. To understand what interest-free sales tax deferment really means, the company has explained the note below (I have highlighted the same in a red box). It appears to be some tax incentive from the state government. The company plans to settle this amount over a period of 14 years.

You will find that there are many companies which do not have long term borrowings (debt). While it is good to know that the company has no debt, you must also question why there is no debt? Is it because the banks are refusing to lend to the company? Or is it because the company is not taking initiatives to expand its business operations. Of course, we will deal with the analysis part of the balance sheet later in the module.

Do recollect; we looked at ‘Finance Cost’ as a line item when we looked at the P&L statement. If the debt of the company is high, then the finance cost will also be high.

The next line item within the non-current liability is ‘Deferred Tax Liability’. The deferred tax liability is basically a provision for future tax payments. The company foresees a situation where it may have to pay additional taxes in the future; hence they set aside some funds for this purpose. Why do you think the company would put itself in a situation where it has to pay more taxes for the current year at some point in the future?

This happens because of the difference in the way depreciation is treated as per the Company’s act and Income tax. We will not get into this aspect as we will digress from our objective of becoming users of financial statements. But do remember, deferred tax liability arises due to the treatment of depreciation.

The last line item within the non-current liability is the ‘Long term provisions’. Long term provisions are usually money set aside for employee benefits such as gratuity; leave encashment, provident funds etc.

6.5 – Current liabilities

Current liabilities are a company’s obligations which are expected to be settled within 365 days (less than 1 year). The term ‘Current’ is used to indicate that the obligation will be settled soon, within a year. Going by that ‘non-current’ clearly means obligations that extend beyond 365 days.

Think about this way – if you buy a mobile phone on EMI (via a credit card) you obviously plan to repay your credit card company within a few months. This becomes your ‘current liability’. However, if you buy an apartment by seeking a 15 year home loan from a housing finance company, it becomes your ‘non-current liability’.

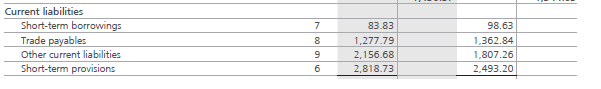

Here is the snapshot of ARBL’s current liabilities:

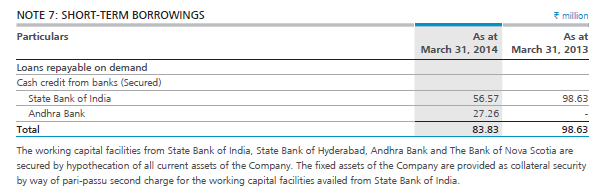

As you can see, there are 4 line items within the current liabilities. The first one is the short term borrowings. As the name suggests, these are short term obligations of the company usually undertaken by the company to meet day to day cash requirements (also called working capital requirements). Here is the extract of note 7, which details what short term borrowings mean:

Clearly, as you can see, these are short-term loans available from the State bank of India and Andhra Bank towards meeting the working capital requirements. It is interesting to note that the short term borrowing is also kept at a low level, at just Rs.8.3Crs.

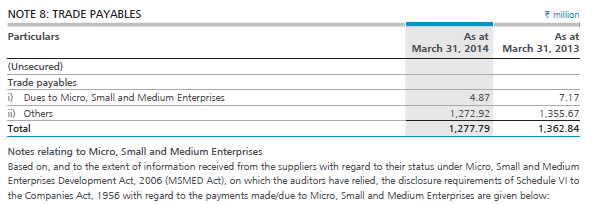

The next line item is Trade Payable (also called account payable) at Rs.127.7 Crs. These are obligations payable to vendors who supply to the company. The vendors could be raw material suppliers, utility companies providing services, stationery companies etc. Have a look at note 8 which gives the details:

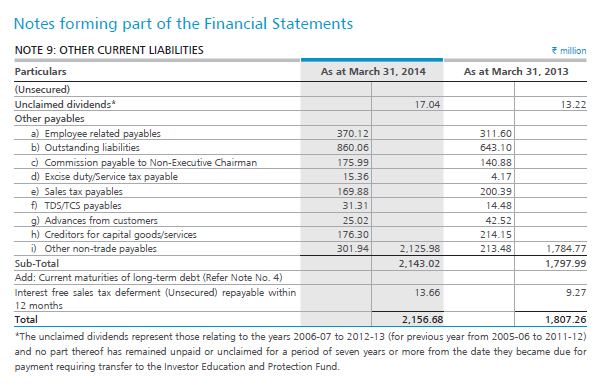

The next line item says ‘Other current liabilities’ which stands at Rs.215.6 Crs. Usually ‘Other current Liabilities’ are obligations associated with the statutory requirements and obligations that are not directly related to the company’s operations. Here is note 9 associated with ‘Other current liabilities’:

The last line item in current liabilities is the ‘Short term provisions’ which stands at Rs.281.8 Crs. Short term provisions are quite similar to long term provisions, which deals with setting aside funds for employee benefits such as gratuity, leave encashment, provident funds etc. Interestingly the note associated with ‘Short term Provisions’ and the ‘Long term provisions’ is the same. Have a look at the following:

Since note 6 is detailing both long and short term provisions, it runs into several pages; hence, for this reason, I will not represent an extract of it. Those who are curious to look into the same can refer to pages 80, 81, 82 and 83 in the FY14 Annual report for Amara Raja Batteries Limited.

However, from the user of a financial statement perspective, all you need to know is that these line items (short and long term provisions) deal with the employee and related benefits. Please note, one should always look at the associated note to run through the details.

We have now looked through half of the balance sheet, which is broadly classified as the Balance sheet’s Liabilities side. Let us relook at the balance sheet once again to get a perspective:

Clearly,

Total Liability = Shareholders’ Funds + Non Current Liabilities + Current Liabilities

= 1362.7 + 143.03 + 633.7

Total Liability = Rs.2139.4 Cars

Key takeaways from this chapter

- A Balance sheet also called the Statement of Financial Position is prepared on a flow basis that depicts the company’s financial position at any given point in time. It is a statement which shows what the company owns ( assets) and what the company owes (liabilities)

- A business will generally need a balance sheet when it seeks investors, applies for loans, submits taxes etc.

- Balance sheet equation is Assets = Liabilities + Shareholders’ Equity.

- Liabilities are obligations or debts of a business from past transactions, and Share capital is the number of shares * face value.

- Reserves are the funds earmarked for a specific purpose, which the company intends to use in future.

- The surplus is where the profits of the company reside. This is one of the points where the balance sheet and the P&L interact. Dividends are paid out of the surplus.

- Shareholders’ equity = Share capital + Reserves + Surplus. Equity is the claim of the owners on the assets of the company. It represents the assets that remain after deducting the liabilities if you rearrange the Balance Sheet equation, Equity = Assets – Liabilities.

- Non-current liabilities or the long-term liabilities are expected to be settled in not less than 365 days or 12 months of the balance sheet date.

- Deferred tax liabilities arise due to the discrepancy in the way the depreciation is treated. Deferred tax liabilities are amounts of income taxes payable in the future concerning taxable differences as per accounting books and tax books.

- Current liabilities are the company’s obligations to settle within 365 days /12 months of the balance sheet date.

- In most cases, both long and short term provisions are liabilities dealing with employee-related matters

- Total Liability = Shareholders’ Funds + Non-Current Liabilities + Current Liabilities. . Thus, total liabilities represent the total amount of money the company owes to others

I\’m truly grateful for your valuable contribution to the varsity.

How has the experience been integrating AI into the Zerodha Varsity.

Thanks Pradeep. There is no AI for now, but its an active conversation 🙂

hello kartik sir aditya here , could u please tell me the difference between General reserves and Surplus

General reserves is a portion of profits that a company voluntarily sets aside for future use or contingencies.It can be used for expansion, absorbing future losses, or issuing bonus shares.Surplus, on the other hand is the remaining balance of retained earnings after transferring any amount to reserves like the general reserve.

Namaste Sir,

In, quarterly(q) results…. How to add reserves in Balance sheet… from Profit And Loss…

532140 Mohite Industries Ltd – in Sep 2024 – Reserves 94cr

q3 December result link:

https://www.bseindia.com/xml-data/corpfiling/AttachHis/d9e3d106-77d5-40c0-9eb5-385a1cc99a79.pdf

or You may count from q1 to q2 to q3

Please, reply..

Thanks

I dont seem to understand your query fully, but the PAT from P&L flows into the reserves in balance sheet.

sir, if any company does capex and it funds the project with internal accruals then does the amount used will be deducted from general reserves and will amount will be subtracted from reserves sections?

Yes, reserves will go down, assets will increase, balance sheet will remain balanced.

where does reserves and surplus sits, is it deposited in bank?

Reserves & Surplus should be matched against the assets of the company. Few examples –

1) For an investment company – Reserves can be in Investment and highest yielding bank Deposit Highest

2) A construction Company will have land and building as asset than just a bank balance

3) Cash Rich company will have more Cash & Cash Equivalent

So this answer depends on the company you are evaluating.

Sir, why some companies have negative reserves in balance sheet?? I have seen this in loss making companies like Ola etc. Then they suddenly become positive with no such Hugh loan. I am really confused. I will be very thankful if you solve this query. 🙏

Well, they could have gone through some debt restructuring. Do check their Annual returns for information.

Ok Sir, but what could be the reason for negative reserves?

Ashish, negative reserves, hmm..technically, yes, the reserves of a company can go negative, but this usually manifests in financial statements as negative retained earnings (also called accumulated losses), rather than negative reserves per se.

Thanks Respected Sir for clearing my query. I am sorry if I bother you with such basic questions. 🙇🙏

Not at all, happy to help 🙂

Still not clear

For e.g If a company shows 100 Cr PAT during the FY, out of which 30 Crore is not yet received by the company. Then how much proceeds will park in Reserve. The entire 100 Cr or 70 Cr (Cash received during the year) or something else. Lets say company don\’t distribute any dividend.

2. From where can we find the exact amount transfer to Reserve i.e. from Cash flow statement or P&L statement.

It will be 70. The exact amount is in the Balance seet, under liabilities.

Sir,

Does all the profits move to reserve and surplus irrespective of the cash inflow, if not distributed in dividend. For e.g. if 50% of the profit is still receivable, how much of the profit will add to R&S. please elaborate clearly

Its seems that Reserve and Surplus is a virtual if all the profits are added without considering total cash inflow, as all the profits announced by the company in P&L may not be received by the company. lots of confusion

Regards

PAT flows into the Reserves, and dividends are given out from Reserves. If cash is in receivables, then its still not converted to cash. R&S is not virtual, it is like any other balance sheet item 🙂

Sir, what is the significance of the face value, how is it calculated.

It is a notional value assigned to the share at the tie of forming the company. All corporate actions are basis this.

If a fundamental principle of balance sheets is that ‘Assets’ must always equal ‘Liabilities’, then ‘Shareholder’s equity’ cannot equal ‘Assets’ minus ‘Liabilities’:

These two equations can’t be simultaneously true:

Assets = Liabilities

Shareholders Equity = Assets – Liabilities

Because ‘Assets’ minus ‘Liabilities’ equals to 0. So that part makes no sense to me unfortunately.

Thanks for pointing this mark, will update this to Assets = Liabilities + Shareholder Eq.

Whom are the dividends paid to? 5.51 cr. company share holders?

Dividends are paid to the shareholders of the company.

if assets are equal to liabilties,then shareholders\’s equity must be zero right?Curious to know after seeing the formula…

If its not zero, then it is the networth of the company 🙂

If the P&L shows calculation in thousands then how to read the figures take Yes Bank 2023-2024 statement to explain it please.

Sorry, I\’m unable to understand your query. Can you please elaborate?

im very new to finance. just 14. so this doubt might be really stupid, if assets equal to liabilities then shouldn\’t Shareholders equity always be zero?

Shareholder Equity is part of the liabilities, and not necessarily zero 🙂

Hi sir,can you please explain more with small example, i did not get.

Reserves is cash + stock, which can goto zero. Networth is what you own minus what you owe. If you owe more than what you own, networth can become negative.

Hi Karthik sir, can you please explain how reservers become negative, i know that when company continously making losses then reserves become negative.

but my question is if comany makes losses then the company to compensate the losses it uses reserves money, it can use the reserves money untill the reserves money become 0 then how it become negative. if they borrowings to compensate the losses then it should be shown liability of borrowings and not be shown in reserves negative right.

eg: if A comapany has reserves around 100rs and it made loss of 150 rs for that year then it uses complete reserves 100rs to compensate the loss and reserves become 0, there are no reserves to cover loss of 50rs then how reserves become negative. if it should borrow money 50rs from bank then it should be in liability of borrowing right.

can you please explain this some scenario to understand

Pavan, reserves goes to zero, but the networth becomes -ve.

sir how to calculate for this in crore

example :

RS in ‘000

Net cash flow from / (used in) operating activities 424,764,563 (how many crores)

Divide this number by 1 Crore i.e 100,00,000 and you will get the answer.

Hi Karthik

First of all this is such a well written Doc so thank you so much. I am usually someone who is very curious and its very for me to get stuck if I don\’t understand the concepts in entirety but Varsity covers everything.

From Financial analysis to fundamental this seems to be my first doubt :

– In the snapshot you updated to fetch 1Rs FV of the share , the share price of the company is Rs 634 . If share capital = FV * No of Shares . The remaining premium/incrementality in the share value from 1 Rs to 634 should reflect under Securities premium account correct?

– The total amount if you multiply 17,00,00,000 shares from 634 comes out to be more than 10,000 Cr but that doesn\’t get reflected anywhere

Glad you liked the content, Kanav. The premium resides in the security premium reserve, but this is at the time of going public. The share price that you see is driven by market valuation.

The market cap captures that right?

why reserve and surplus is on liability side ?after all it is the money that is kept by company.

They are a liability from the company\’s perspective as the funds belongs to the shareholders and not to the company.

I guess this is the same link you referred to in your previous reply sir. I\’m also referring to the same link only. I couldn\’t find anything in relation to contingent liabilities. I gave this a read fully.

Sorry, then can you post a comment in the chapter, my colleague Vineet will get back to you.

I guess, You have already pointed out to this chapter before for a similar question. I did check that time. And also I gave this chapter a full read now as well. Its very well written. But unfortunately, there are no details in relation to contingent liabilities.

Usually high contingent liabilities are seen as a red flag. But in case of big banks, contingent liabilities as a percentage of total networth is multiple times high. I couldn\’t understand, how is this normal. Tried my part on researching. No clear answer.

The nuances to understand bank balance sheet is slightly different, for that reason we have a dedicated chapter here – https://zerodha.com/varsity/chapter/banking-part-1/

If you dont find your answers there, please do post a query.

Both HDFC bank and ICICI bank has extremely high contingent liabilities. Is it like the normal case for banks. I don\’t understand as to how to interpret this? Could you give your opinion. Thanks.

We have a two part chapter on Banking, I\’d suggest you check this, it has all the details and more 🙂

https://zerodha.com/varsity/chapter/banking-part-1/

Thank you, sir.

Good luck!

Sir I have a doubt in the long-term borrowing line heading. Mostly these will be term loans. Term loans are expressed in EMI (Principle + Interest) Component. Since we would have already deducted the interest component for 12 months in the P&L account for that said period, then will the remaining total debt, after deducting the 12 months interest be expressed as long-term borrowings. Is my understanding correct?

and my second question is on the Securities premium reserve / account . is that premium amount during the issue of shares or it is the premium above the current market capitalisation. (Difference between Current market capitalisation and face value of the shares outstanding)

So most companies issue bonds or borrow in a bond like structure, hence EMI wont be relevant.

Yes,security premium is during the IPO time.

Sir in some company we see that reserve is negative what is reason behind these

That is because the company is not being profitable 🙂

Why is reserves & surplus considered liabilities not assets?

From a company\’s perspective, it is a liability as the R&S belongs to the shareholders of the company.

Issecurity premium is shown in reserve and surplus

Yes, thats right.

I understand what is authorised capital

In module-1 origin of business

But my question is? from above

Authorised shares = 80 crores shares

Issued shares = 41,24,29,900 shares

Retained authorised shares

(not issued to anyone)= 332,429,900 shares

Why retained authorised shares are not carried in \”SHARE CAPITAL\” segment in balance sheet.where issued share capital is carried on \”SHARE CAPITAL\” .

Thank you

Share capital is issued capital and fully subscribed. We will be making a video on this shortly.

Hi, karthik sir.

Could you please clarify the below , Iam confused regarding \”EQUITY SHARE CAPITAL\”

(in crores)

Particulars 31 march2021

Authorised capital 83

83,00,00,000(as 31st

march-2021) equity

Shares of rs 1/- each –

fully paid.

Issued,subcribed &fully 41.2429

Paid-up shares

41,24,29,000 (41,24,29,000-

as 31st March 2021equity 41.2429 Shares of rs 1/-

each fully paid

Which part is confusing, Shaik?

Hi Karthik, One small correction. At the end of this blog, that is before the \”Key takeaways from this chapter\” section the total liabilities has written as \”Rs.2139.4 Cars\”. Do change the cars to crores. Thanks for putting lot of effort to write these amazing blogs😊

Thanks Ashok. Will do that 🙂

1. I am seeing that the contingent liabilities are higher for banks, even for HDFC bank. Is it normal if contingent liabilities are higher in case of banks? Should I ignore this?

2. Assume your selected stock made a huge rally. You have always stressed on the importance of exiting based on both fundamentals and technicals. But you might have come across stocks where the fundamentals despite being strong enough are getting broken down after making a huge rally. This might also be due to poor growth expectation or some insider news that retail investors will never know. Assuming there is no information even if you dig further, I would like to know, how you would approach such a situation. Save your profits and exit or wait?

Thanks sir. Currently reading the sector analysis module and is very helpful.

1) Its on the higher side. By the way, we will soon publish a chapter on understanding banks as a sector, maybe that will help

2) One of the best things to do in such situations is to ride the profit. You can use the technique of trailing stop loss 🙂

Hello Sir,

As mentioned above the Assets and Liabilities for a given company is always equal. The same is seen in the balance sheet. Then how is Shareholder\’s equity (Assets – Liabilities) calculated? Is it we need to consider the difference between current assets and liabilities?

Thank you.

The difference is the net worth of the company, Dhiraj.

sir you wrote shareholders= assests- liabilities. But the correct one is Asset= liability+shareholders. what do you say sir. Iam I wrong if so please correct me. Thankyou

Its the same if you rearrange the equation 🙂

Sir, if assets = liabilities, then Owner\’s capital will be zero according to the equation OC=assets-liabilities.

So does this make sense? if yes, can you please explain it sir?

Thank you

Assets should be equal to liabilities, the difference if any, is the net worth of the company 🙂

Yes sir. Finally found it. It was hiding inside the annual report notes. Its strange that I have to wait for 1 year to know the updated details rather than a quarterly update in balance sheets. Thanks a lot!

Can we look forward for a future update on Varsity modules regarding analyzing banks/ NBFCs and forensic analysis?

The balance sheet is updated half-yearly. About banks and NBFC, yeah, will do that soon 🙂

Sir, I\’m currently analyzing a fintech company, the balance sheet of which doesn\’t have current/ Non current assets or liabilities. Instead I see only financial and non financial liabilities/ Assets. I even checked the latest annual report. No further details. I want to calculate \’capital employed = Total assets – current liabilities\’. So want to know current liabilities. How do I proceed? Thanks.

Sathish, can you inspect the notes associated with the border line items? It must be stated in the notes.

sir when can we expect a detailed write up for understanding balance sheet pnl financials of banks and nbfc

Anupam, thats been on cards for a while now, will try and do that.

Sir, if assets and liabilities are always equal, then their difference should be zero correct ?

Then how come shareholder equity is asset minus liabilities.

I know I am wrong here but please help me understand the specifics and the context.

The difference between the assets and liabilities is the net worth of the company, Samarth.

Karthik sir, The ARBL Example is relates back to 2014, Now the Companies have updated with Indian Accounting Standards(Ind As) whose accounting concepts which is far Differential from Accounting Standards (AS). I\’m asking from curiosity when the Example(ARBL With Financials of 31.03.22) would get updated. Thanks.

Raghu, the objective was to showcase the techniques used to evaluate a company and do FA. But that said, yes, I agree formats have changed. I\’ll see if I can do something about this.

I have several questions based on your explanation using ARBL example:

1- Are reserves real cash or just account entries?

2- If companies apportion surplus funds for just dividend payment or tax on the same, what about other requirements for day to day operations such as changes in working capital requirements?

3- Where does cash or cash equivalents or investments on the asset side come from if not from reserves?

4-What do companies do with their general reserves if they don\’t have any use for them? Do they invest them in liquid or long term funds or just keep them in the bank? Or again is it just an accounting entry?

5- You said general reserves are used for buffer? Buffer for what? Isn\’t that the purpose of keeping surplus funds in the reserves?

5- Similarly what do companies with their surplus fund while they are not being utilized?

6- Is there a book or link you can recommend where I can get into more details on utilization of reserves in the balance sheet and how the interact with cash flow statements? For example for some companies their cash flow statements show significant investments in mutual funds, bonds or other companies which are more than just the PAT-dividend. So I\’m assuming that some of that investment represents reserves on the balance sheet but I\’m not sure.

1) Real cash

2) Surplus can be used for anything

3) They are investments made earlier now treated as assets

4) Its a statutory requirement (need to double-check as well)

5) They can make investments in liquid funds or GSec

6) You can pick up any BEcom finance book to understand how B/S works

OK sir 👍

In finance activity there are two column one is proceed from borrowing and other is repayment of borrowing.

what these column show in finance activity?

These are borrowing funds and repayment, pretty much as the name indicates, Niraj.

Sir l just want to know what proceed form borrowing and repayment of borrowing explain us in cash finance activity.

So there is no cash finance activity as such. From a cash flow perspective, there is operations, finance, and investing activity. Not sure which one you are referring to.

Means borrowing shown in balance sheet is total borrowing of company.

But proceed from borrowing in cash fin activity means money used from total borrowing.

Means borrowing shown in balance sheet is fixed.

And proceed from borrowing shown in cash fin activity is money use from total borrowing.

I\’d sugges you read through till cash flow statements to understand how these statements interact. We have videos as well.

What is difference between borrowing shown in balance sheet and borrowing shown in finance cash flow.

Borrowing remains the same, Niraj. Treatment is different.

Why is Shareholders equity not 0 if assets = liablitiies?

This seems confusing

The difference between assets and liabilities = Shareholders\’ equity. If its 0, then there is no shareholder\’s wealth.

Hi Kartik.

Could you please explain, Securities premium reserve from customer perspective. I can buy a share fropm open market then why would I have the need to get a share on face value + premium? Face value. + Premium can be cheaper than current value of share in open market and therefore can I not just buy on face value + premium? That seems wrong.

Therefore confused on Securities premium reserve. Any clarification?

Security premium reserves are on the balance sheet of the company. Suppose a company issues an IPO and the cut-off price is 100, but the face value is 10. Here, 90 is termed as a premium, which goes into the Reserves & Surplus section (under the header of security premium reserve) of the company.

There is a typo here in this line I think : \”It is interesting to note that the short term borrowing is also kept at a low level, at just Rs.8.3Crs\”. The actual figures are 83.83 Crores.

Ah, let me recheck this.

Hello sir

thanks for the wonderful understandable material

i wanted to understand the share capital here ,

here the share capital = No of share * FV

But when company issues share ,it issues with a issuing price

So where does difference in the money gets accounted ? the difference between (issuing pirce – FV)

It goes to the security premium reserves.

Some of the companies like TVS motors shreecement TTK prestige keep a very low equity but high on debt?

What is the advantage except EPS?

They may need debt financing for their capex cycles. You need to read the AR to figure why they have such a structure.

\”In any typical balance sheet, the company’s total assets should be equal to the company’s total liabilities. Hence,

Assets = Liabilities\”

Can you please explain why this needs to be the case?

Thank you

That\’s the balance sheet equation, Shashank. Found a good explanation for you here – https://accountingo.org/financial/accounting-equation/why-always-balanced/

Sir what\’s the difference between retained earnings and surplus

Both go into the balance sheet under reserves, Chilesh. Not much difference.

How come provident funds come under Long term provisions? We have already considered it in expense part of P & L statement and profit is evaluated after considering it. Then why again to put it in liabilities?

If its mentioned in BS, then maybe you should check the notes once for an explanation from company\’s perspective?

Please answer tejas question. I have almost same doubt

Vignesh, can you please repost the question? Looks like I missed it.

Hello sir.First of all I am really glad and thankful for proving all this information.I tried to apply this some companies like SBI bank, and Kotak Mahindra bank and I was so confused.I was fraustated that maybe I did not focus properly reading but then I read first part of balance again and tried to apply again but then I realised that total format of banks is different then I applied this to other companies like divis labs.then I worked so please explain how to Read FINACIAL STATEMENTS OF BANKS…thank you sir

Are other current liabilities the one which is not related to the core operation?

Nope, they are. Check the associated notes for more details.

Hi, How can a company spend the securities premium reserve? The stock price of the company changes daily and it is traded on daily basis. Suppose the price of the company falls by 50% and the company has already spent more than 50%, how will they account for that extra money spent. Please clarify, I am quite confused.

Security premium reserves is created at the time of IPO issue. It does not change on a day-to-day basis.

Sir, Please elaborate about additional paid in capital. Having that on balance sheet is good ?

Roshan, additional paid-up capital is when the company issues new shares. Usually, at a price higher than the face value. This is similar to the securities premium reserve in the balance sheet.

Thanks

1. Sorry sir I didn\’t followed

2. Ok sir will check

Sure, good luck!

Good morning sir,

What is

1. Additional paid in capital ? . What it is signify ?. It\’s good or bad

2. What is goodwill ? What it is signify ?. It\’s good or bad

Thanks.

1) It happens when the company decides to raise more capital

2) Guess I\’ve explained this in the chapter itself, can you please check again?

When there is increase in share value of a company in share market, how is that treated in balance sheet and against which item on the asset side or liability side is it balanced in balance sheet?

The increase in share price does not have any implication on the company\’s balance sheet.

Sir,

How can find total debt of the company and which part do we need to see for this in financial statements?

Please check the balance sheet of the company, you will long the long and short-term debt mentioned on the liabilities side.

Hi Karthik,

I am looking into a stock of a travel agent.Here,in the non-current liabilities, only contract liability is mentioned,should this be considered as \”long term borrowing\”.Please clarify

Before considering that as long-term borrowings, please get into the associated notes and read the nature of this liability. If its long term in nature, then yes, you can consider this as a long-term liability.

Hi Karthik, Commission to the Non Executive Chairman is included in the Balance sheet under \”Other current liabilities\” and also under ‘Other expenses’ in the P&L Statement (Note 24 of https://zerodha.com/varsity/chapter/understanding-pl-statement-part2/). And the amount mentioned is the same.. Is this redundant to be recorded under both the sections? Please elaborate. Thanks in advance.

Ah, it is usually a P&L line item, gets clubbed under expenses. Let me check this again, not sure about the Balance sheet part.

Sir, can u please explain what is the purpose of (Securities premium reserve/account) a little more !

Check this Sarves, I\’ve explained the securities premium reserves – https://zerodha.com/varsity/chapter/reserves-schedule-part-1/

Hello,

I didn\’t quite understand why the \’Reserves and Surplus\’ come under Liabilities? Since these are accumulated from profits over last and current year, shouldn\’t this be treated as assets?

Thanks

The R&S funds belong to the shareholders of the company, hence from the company\’s perspective, this is a liability to the company.

Thanks Karthik. Can\’t thank enough for what Zerodha is doing for the community. I look forward to seeing this platform grow even bigger. I\’m trying to add in my responses wherever I can. I wish I could be a part of Varsity writing team.

I hope so too, Pradeep. Every comment enriches the platform 🙂

Answer to Garry Kevin – When an asset (say land, building etc.) increases in value subsequent to its purchase (say after one year the value increases), then that increase is called a revaluation gain which will be recognized in the P/L statement. And as Karthik perfectly pointed out how the P/L interacts with the balance sheet, we see how it balances.

Note – Assets are shown at their carrying value in the balance sheets. Carrying value means original cost minus accumulated depreciation. There is another concept called the \’fair value\’ which is basically the market price of the asset. When the company revalues its assets based on the fair value, the value of the assets will increase/decrease, thus creating a revaluation gain/loss accordingly.

Thanks for pitching in that bit, Pradeep 🙂

The reason why the amount in general reserve is not shown under cash/cash equivalents is because general reserve is basically the profits that get added as reserves to meet future needs (e.g company expansion etc). Since these are essentially profits it is treated as an equity component and belongs to the shareholders. Cash and cash equivalents involves cash generated by the business through its operations as well as investments. For example, sale of goods will result in cash inflow and thus will add on to the existing cash balance. Try going through the cash flow statement to see how the year-end cash balance is arrived at. It will show how business activities (operating, financing and investing) generate cash.

A company buys land using shareholder\’s equity. The value of the land increases.

How does the balance sheet balance ?

Will reflect in the fixed assets of the balance sheet.

If reserve and surplus belongs to shareholders can it be distributed among shareholders as dividend.

Yes, dividends come from the R&S amount.

What is FVTOCI reserve? If it decreases, what could be the possible reason behind it?

Not sure, Rashmi. Need to check this.

Hi, can you please help us understand the Balance sheets of insurance companies?

I\’ve never looked at one, but I guess it\’s fairly straightforward, and follows the same pattern as discussed here.

Good Morning Sir,

How does the Face value of the company (Rs. 1, 5, or 10) is calculated during the IPO, and how does it differ from book value. Kindly clarify. Thanks!

The face value is a nominal value created at the time of taking forming a company. But the book value is dependent on the profitability of the company.

Hi,

How can one know about the agreements(details like maturity period and more) related to the preference shares that a company has issued? (I mean, what kind of a preference share it has issued, like, say, convertible and redeemable and etc.)

– For the above question, I have received answer saying that the details will be be represented in the balance sheet with the corresponding note number but unfortunately I cannot find any details. So any ideas about it ???

Do check the annual report, usually, companies have a dedicated section on the share holding pattern which will have all the info.

is there any specific purpose of reserves and surples? I think they both are used to same purpose for future use right?

Thats right.

Okay. Thanks a lot!

On Note 7 & 8 in the beginning there is mention of \”(Secured)\” & (\”Unsecured\”). What does it mean?

Secured debt is a credit against collateral, unsecured is issued without any security.

How many equation are there for solving reserve and surplus in debt to equity ratios.

Debt to equity is just one ratio, no equations as such.

Securities over premium is defined unclear. It would be clear, if you had mentioned that the premium over the face value when the shares issued.

Can you elaborate more on Securities and Premium account ?

I\’ll do that in the current module on Financial Modelling.

Hello Sir,

How and when exactly would a company report this?

Lets say a company like INfy or TCS takes a 5-10 cr loan. Do they report this or only when the sum is very substantial?

5-10Cr is nothing for a large company. But if its a substantial amount, companies will report it.

Hello Sir,

When companies take out loans, do they mention the reason they take out a loan? I would only find out about this in the annual report/balance sheet.

What if a company takes out a substantial loan in October or November, I would only know about this till next June/July correct?

Yes, companies usually report this in advance.

I am reading this for the first time about financial statement and absolutely loved your words. I will eager to read more on such topics.

Happy reading and learning 🙂

Hello Sir,

Unsecure loans is not guaranteed which means a company could default on those loans correct?

Interest coverage ratio shows the ability to service its interest loans, what about its ability to pay of these loans?

Lets say another huge covid lockdown happens and business get shut down. What does the company do to pay these interest and potentially loans?

That\’s right, but usually, that is the last options for the company. The ability to repay depends on the revenue growth. About lockdown, that\’s why ensuring companies with good reserves is important.

Hello Sir,

When I look at a companies balance sheet and see Long term (Secure + Unsecure) debt and short term secure and unsecure debt do I need to be worried?

Should a company have unsecure debt?

Also as long as the debt of a company is substantially less than its general reserve I can always assume that the company can pay of its debt correct? What are red flags I need to see if a company has high debt?

These are common practises, Samay. Nothing to worry about. Look at the interest coverage ratio, which should give you a perspective.

Hi sir,

A company maintains a general reserve for situations for emergency situations. Does it keep this reserve in a liquid/over night fund to earn interest or just keep it in a saving account?

What about a surplus? Surplus is used to give out dividends, what else can be done with it? Rather just move the surplus to the general reserves?

These are all maintained in cash equivalent form, usually in liquid funds.

Sir I am so confused, the day before yesterday reliance industry announced its new project batteries , and JIO NEXT phone . Its a positive sentiment for the company so I assumed yesterday reliance was going to perform good in market but I am so confused ,because it does not perform well yesterday even with a positive sentiment. why sir ?

Is it because of , they announced about spending such a large capital amount on new project is this is the reason sir ? even though that\’s good for companies future right ? then why it didn\’t perform so well yesterday sir? can you explain me.

There is no harm in announcing, how much will that translate to earnings is the question.

sir one doubt , where to know about companies revenue model ,how the companies like amazon run across the country what is business model , the company structures ,where can I get these kind of total information about a companies sir to prepare case studies .I searched a lot but know where to get these information so details. can you tell me sir ? any websites u know or some other things!

Its usually mentioned in the annual report itself. Look for it with the notes associated with the revenue.

Sir,

Many thanks for your analysis.

In a B/S of a co. there is a huge increase in the Deferred Tax Liability in the current F.Y from the previous one but, they are not showing any profit in their P/L A/C. is it not fishy?

Not really. Deferred tax liability is basically like provisioning for taxes for the previous year, which can arise out of the way depreciation is treated.

What happens when a company repays the debt ,it would create a imbalance, having asset more and liability less right?

No, debt reduces on the liability side, and so would the reserves/cash from asset side.

Hello Sir,

HDFC bank is trading at 1492. Its face value is 1. So its premium is 1491?

What exactly does the company do with this money?

This money does nothing to the company. It creates wealth for shareholders.

Hello Sir,

From the surplus, after transfer money to the reserve fund + dividend and dividend tax the company still has 1000 cr as a surplus.

What exactly does it do with this excess surplus? Leave it in a yearly FD or something like that?

Yeah, the company can use it to invest in FDs, liquid funds etc.

Dear Sir,

What does this mean?

Securities premium reserve/account – This is where the premium over and above the shares’ face/par value sits. ARBL has an Rs.31.18 Crs under this reserve

Please give an example?

If a 10 Rupee Face value share is trading at 100, then the security premium is 90.

My question basically is that when we buy physical asset using say debt we can equate them on the balance sheet equation but

If we consider employees as liabilities, what should we put on the asset side of the equation.

Yes, you can.

Assets = liabilities + share Equity

I want to open a Xerox centre

Case 1. Debt 700 and 300 share. Equity, I buy an automated Xerox machine which needs no employee to operate, so

Assets = liabilities + share Equity

1000 700 300

Case 2. Debt 700 and 300 share Equity,I buy xerox machine(not automated) for 700 and 300 goes to employee expense

Assets = liabilities + share Equity

700 700 300

In this case where will the 300 expense on the employee head will be on the balance sheet equation.

You buy a Xerox, that adds to the assets, right? Also how did you buy the machine? It is an expense, right?

very well written and explained…..Thank you so much

Happy reading, Navnith.

Dear sir,

The content you upload is very lucid. It helps a lot. Thank you for uploading such great modules.

I have one questions.

If a company takes a loan from a bank for a long term then the installments that the company has to pay in next year from the balance sheet considered current liability or non-current liability?

Non-current liabilities.

Hi Karthik,

This work is wonderful and neatly explained. Appreciate the efforts taken.

I have one question, I have seen some balance sheets where Non current trade receivables are also mentioned. So when calculating Avg. trade receivables, shall one take the total of receivables and then avg. them with previous year receivables?

Thanks!

Yes, you need to consider just the current one since the end objective is to figure the number of days for receivables.

what is authorized share capital and what impact it creates.

Hava shared the details in the chapter itself.

If Assets = Liabilities , then In How Book Value Determine = Assets – Liabilities

Asset = Equity+ Liabilities

Asset – Equity = Shareholders funds from which book value is derived.

Oh man this was so much, i am gonna sleep now and read again later

Good luck and don\’t give up 🙂

Sir,

My self from civil engineering background trying to understand this module, I have a doubt, mentioned below!

Total current liabilities of FY14 is 6337.03 current means they have to pay with in year! But in profit and loss statement current liabilities were not shown in expense side! Then how this liabilities will be paid off!

Current liabilities is a balance sheet item, won\’t reflect in the P&L statement.

Sir!

You should have been my accounts teacher in school!!

kudos to you for having done such a great job. <3

Happy learning 🙂

\”This is where the premium over and above the shares’ face/par value sits.\”

I don\’t understand this sentence. Can you please explain with an example?

The ARBL case is the example 🙂

Hello Sir,

Would you invest in any banking/financial/nbfc stock??

On what basis would you invest in them, just curious?

I would, based on price action.

Hello Sir,

You have not mentioned how to analyze a banking/nbfc/finserv/insurance company\’s balance sheet and ratios.

Ideally these are the best companies to have in ones portfolio.

How does one go about picking which one to purchase as I am extremely confused about their balance sheet.

I was not too comfortable explaining these hence excluded the same. Hopefully soon.

Dear Sir,

When is the next module on financial model coming out?

Hopefully this month the first chapter should be up.

Hi Karthik,

If assets=Liabilities (always) in Balance sheet,can you explain what is the use of calculating \”Shareholders equity\”.Anyway,when both assets and Liabilities are same,the answer(\”Shareholders equity\”) will always be Zero only.

Hmm not really, shareholders equity gives a perspective of what the net worth is, btw, shareholders equity is a part of liabilities.

Dear Sir,

What other parameters would I require?

Could you explain or give an example?

The next module is on Financial modelling, it will have all this and more 🙂

Hi Sir,

For example a company has a market cap of 7000 cr.

It has reserves of 5000 cr and short term borrowing of 1000 cr.

What exactly can I infer from this information??

How do i compare market cap with reserves/borrowing etc?

Or do i need to compare Book value?

Please do explain?

You need to see several other parameters to make sense of this (including book value), but on the onset, it looks like an undervalued company.

How to calculate sale growth and profit growth in percentage

= (This year sales number / previous year\’s sales number )-1

This will give you the percentage change.

A doubt regarding current liabilities part of balance sheet.

Let us take that the balance sheet is for FY 19-20, prepared as on march 31st 2020.

So according to this, if current liabilities is some 50Cr, does this mean that this much amount of money was already utilised in the financial year before March 31st 2020, to settle the liabilities OR that this much amount is GOING to be utilised within March 31st of 2021 to settle the liabilities?

Please clarify

Rakesh, the balance sheet is always a reflection of what has happened, it is not forward-looking.

As I understand, some money from profit is kept as \”surplus & reserved\”. What is the complementary effect on assets to keep the balance sheet equation balanced?

For example, if the company needs to add a surplus of 50 Rs, to keep the balance the company needs to increase the asset by 50 rs? Please clarify.

Cash reserves go up right?

What is a good and bad balance sheet

?

Please do read this and the next chapter, you\’ll know 🙂

Sir since reserves and surplus come under liability which forms shareholders equity and since shareholders equity = assets – liabilities so if shareholders equity is negative so isnt it a good thing?

-ve is not a good thing, Krishna.

hi Karthik, I have been learning a lot through Varsity so far. Thank you for sharing your knowledge. I have a question, might sound simple but if assets = liabilities then how come shareholder\’s funds be a number greater than zero? assets = liabilities + shareholders\’ funds .. so shareholders\’ funds = assets – liabilities but assets == liabilities lol .. how come this makes sense? TIA

Assets – Liabilities = Net worth 🙂

thanks a lot sir

hello sir, just wanna know if it is true that some companies lie on the P&L Statement…….. and if yes how to know the truth

Yes, there have been such instances in the past. Very difficult to see through this. YOu need to be fully glued into the sector to know if the sales and operation numbers match up.

Why sales tax deferment is shown under non-current borrowings instead of deferred tax liability ?

Different tax heads right?

When calculating share capital why are we multiplying with face value ?

Shouldn\’t we multiply with LTP since in reality we can get this much value from a share ?

Thank you for your hard work.

I guess you are confusing this with the market cap of the company.

PSU shares had strong balance sheet low debt level there price is still bearish why

Markets also look at the growth right?

Why is the company\’s profit added to the shareholder funds? Ideally, the company pays only dividends to its shareholders, so how does it owe the rest of the profit to the shareholders?

why is Long term provisions on the liability side.from where do they get this money.how the balance sheet is actually balanced after adding this.i mean how this is cancelled out on asset side.

Hmm, aren\’t the provisions a liability when you look at it from a company\’s stand point?

Hello Karthik,

It really is interesting to go through your content on any topics in Varsity. You make it look so easy with your explanations and working example.

Question

Regarding \’Securities Premium account\’ – It is clear with all the above explanations and questions from other members in the forum that it is the amount gained over and above FV of the share during IPO listing.

Post-IPO, the share price fluctuates daily and we may have a new share price at the end of FY when it is time to prepare an updated balance sheet.

Do \’Securities premium account\’ value changes if the last closing price of share at the end of FY is different from its IPO price?

Kailash, this is something I\’m not 100% sure. But I do believe that the the 30 day average value of the securties from time of reporting the AR is taken into consideration. Need to double check this.

Thanks Karthik.:-)

Hi karthik,

I am really enjoying fundamental modules.Appreciate your hard work to teach us in a laymen terms. 🙂

I have some following queries please help me with those.

1) What does it indicates company having (current+non-current liabilities > Shareholders\’ funds ). Is it good sign to invest or not?

2) Why does company takes liabilities if they have more reserves or surplus? Why should not they fulfill their working capital or long term need through reserves or surplus?

3) Lets say two companies A & B from same sector having following details

In the initial years,

For company A : Authorized capital = 10 (FV) * 10000 (#Share) =1 lac

For company B : Authorized capital = 10 (FV) * 100000 (#Share) =10 lac

Lets say after 5 years ,

For company A : Market capital = 30 (market price) * 10000 (#Share) =3 lac

For company B : market capital = 15(market Price) * 100000 (#Share) =15 lac

then

For company A : capital growth = (3 lac/ 1 lac )*100=200%

For company B : capital growth = (15 lac/ 10 lac )*100=50%

so here looking at capital growth can we say that company A is worth investing than company B despite company B having Mkt Cap > company A?

Sorry for the asking too much questions but was little confused about above quires? Thanks

1) Shareholders funds is always a part of the liabilities. In case this component is larger than the rest of the liabilities, it just implies that the company has a high reserves or the equity base is large

2) Sometimes it makes sense to leverage, especially when cost of funds is cheap. Depends on the company and the sector

3) No, this depends on the investment strategy. If you are chasing growth then A makes sense and if stability is what you need, then maybe B.

Here in reverse

arbl had 8k cr surplus from previour year of which they moved 300+ cr to reserve. then while totaling it is made 8K+300 . is that correct . we are adding the same amount in reserve and surplus which in reality exists only in one place . consider as having two boxes . one box has surplus from previous year 8k and from it you parked 3k into reserve for this year. so you basically have only 5k in the name of surplus . can you clarify me on this doubt

Take the difference in the surplus for two years and you will get the number. You can match it with this year\’s number from P&L and it should ideally match.

Thank you so much for the course you have put out. I am finding them to be very useful and engaging. I have a question on the Share Capital. Share capital is FV multiplied by no. of Shares. But why is it FV? Why should it not be the IPO price at which the public had bought the shares?

I am actually not at all clear about FV and its significance. Please clarify.

Face value because it is the nominal share price. Face value is also used for all corporate actions.

Hi Karthik,

How exactly is General Reserve different from the Company\’s Cash holdings? I mean a company can use either of them for expansion?

Good question Aditya, I\’m not 100% sure here, but if I were to take a guess, to remove cash from Gen reserves, company needs board approval. Besides, these are fund for the long term and strategic investments. Cash, on the other hand, is current. The company can use it to even plus working capital deficits.

Dear Karthik

Thanks for the response.

In that case , the entire post dividend earning which comes down to 1095 Cr should have been transfered to General Reserve instead of only 36.7 Cr for ARBL.

Kindly correct me if am wrong.

And also what is the use of this Generl Reserve since we already have capital reserve for long term projects.

Yes, that is if the dividends were not paid. Since it was paid, what goes to reserves is the retained earnings post dividend.

Dear Karhtik

I have a doubt.

1) In the Reserve we have the general reserve head.Does this consist of the fund after deducting the divident +divident taxes from the cumulative profit .I mean in Surplus whatever remaining fund is available after deducting the divident +divident taxes from total cuulative profit gets directly transfered to general reserve.

2)Do u feel divident is an expense for the company.In that wayit should also get accouted in P&L account like Interest and Deprciation.

Please suggest.

l

1) Yes, the reserves consist of all earnings post dividends

2) No, depreciation is an accounting entry, but the dividend is a real cash treatment. Also, it is not an expense, it is distributed from the profits made by the company.

Hello sir, had two queries

1) From which reserves does the company pay out for dividends, buybacks or while issuing bonus shares

2) What are revaluation reserves?

1) Dividends are paid from earnings. Rest from general reserves

2) Business revaluation reserves are reassessment of assets. I need to double-check this as well:)

why are reserves and surplus a liability to a company .It is the money of the company itself and why capital reserves belongs to the shareholders and they also cannot be distributed to them.

Shareholder fund = shareholder equity = Net worth of the company

am i right if not please correct

Yes, that is correct.

Hi Karthik! Are \’employee benefits expense\’ (salaries & wages, contribution to provident and other funds, staff welfare funds) included in the Balance Sheet? If yes, where are they mentioned? If not, why not?

Thanks!

No, that is an expense and is included in the P&L statement, under the expenses section.

Yeah, got it.

Thanks

Good luck!

Hi Karthik,

Excellent Work.

So, I was trying to calculate the number of shares for Relaxo Footwear for FY2019. Here, https://www.relaxofootwear.com/pdf/Annual-Report-final-2018-2019.pdf. On-Page 72, for calculation number of shares I\’m taking Share capital which is 12.40 cr and Face value is Rs 1(from NSE website).

No of Shares = Share Cap/Face Value.

But my No of shares value does not match with any other market source available plus due to this my P/E ratio is not right, not even close. I strongly feel I\’m missing something in calculating No of shares.

Please let me know your perspective in this matter.

Thanks

No of Share = (Share Cap * 10^7)/ Face Value. 10^7 is basically to convert share capital into Crores.

Hi Karthik,

Hats off to you and your team for an excellent elaboration on the topic, I found it extremely useful.

I have a query in Note 9 – Other Current Liabilities. Why is \”Advance from customer\” categorized under liabilities? Ideally, it is receivable received in advance. Can you help me understand it?

Regards,

Krishna AG

Advance is before providing the service/product since it is still dependent on delivery, the company treats it as a liability. If delivered and money is expected, it is receivable.

As you mentioned if a company uses only the money pooled during IPO then what use or benefit the company has in rewarding its secondary shareholders? i mean breaking the FV of 10 to FV 1 so that Market cap will increase and liquidity in trades will be happen? why they give bonus and all? pls explain

Bonus and split are all non-cash dividends, which will help the investors in the longer run, Arjun. Do read the first module where we have discussed this in greater detail.

Sir,

then how can 17.08crs (which includes everthing as you said) be available in the secondary market?

I checked on moneycontrol website, 17.08crs shares are available in the market.

Only those shares should be available which were alloted during IPO (just as you said).

I hope i have conveyed my doubted.

Sorry, for being slow learner.

Actually, the annual report contains a section called a Shareholding pattern, do check that. You will get to see the exact split.

Sir, so you mean, this company allotted all the shares during IPO?

Not all, how much ever was earmarked for IPO.

sir,

17.08 crs shares, these are the shares outstanding in the market. What about shares held by promoters, VC or may be PE?

It includes everything.

Who pays the premium amount and can this money be used by the company for any purpose?

Nope, the money they get is during the IPO only.

Q1.) How is the premium on face value of a share calculated in the securities premium account?

Q2.) If the short and long term borrowings are not mentioned in the BS, then is the company debt free? (couldnt find it in bata\’s AR)

Q3.) In case of \’increse or decrease\’ can negative symbols be used?

1) Its driven by the markets

2) Yup

3) Yup but it also depends on the context

Hello.Can a company use its reserves and surplus to acquire other companies?

They can utilize it.

How do you calculate book value of debt. These are the items I have (would it just be secured and unsecured loans?):

Secured Loans

Unsecured Loans

Deferred Tax Assets/Liabilities

Other Long-Term Liabilities

Long Term Provisions

Total Non-Current Liabilities

Trade Payables

Other Current Liabilities

Short-Term Borrowings

Short-Terms Provisions

Total Current Liabilities

Book value of debt is simply the current outstanding loan of the company right? Which is essentially the long term debt on the books.

Sir, can you please elaborate ? In shareholders equity, Share capital is athe amount which we get when multiply face value by number of outstanding shares, right ? The other part that constitutes Shareholders equity is Reserves and surplus.. so, where exactly is owners investment amount residing ? For eg, if a persons starts a company by investing 1000 crores and at a later stage he lists his company and raises 500 crores through ipo, where will the initial 1000 crores ve shown ? ( 500 crores will be shown as sum of share capital and securities premium account, right ? )

Yes, thats right about share capital. So if I start a company today by investing Rs.100, then the share capital of the company will be 100. Assuming 10 is the face value, then I as the owner will have 10 shares.

Where is the investment made by the person eho started the company shown in liabalities side of balance sheet ?

Shareholders equity is that.

Will you please tell me which balance sheet should I analyse for fundamental analysis standalone or consolidate????

Hello Karthik sir,

I\’m one of the beginners to stock investing and this is one of the easiest and simplest article which anyone can understand. I have recommended it to my friends as well. Great job for publishing this article for us !

Hey, thank you so much for letting us know 🙂

Happy learning.

[…] You can check the calculation of shareholder’s equity from the example of Uttam Sugar Mills given below. Alternatively you can Click here to know more about shareholder’s equity […]

what is Securities Premium Reserve

Its a balance sheet reserve, the premium over and above the face value of the share gets accounted for here.

Is there any relation between shareholders funds and current market price of a share?

No relation as such.

sir

if a company X came up with an IPO of its subsidary ,will the shareholders of company X get the share of subsidary ?if not why?

Depends on the shareholding structure of the parent company.

Or after trasferring some amount to reserves, Company reinvested the money into plants etc..

Yes, this is possible.

Hi Karthik,

Regarding Surplus 1095.9 Cr, Does it mean Company has 1095.9Cr money in it\’s bank account ??

Thanks in Advance

Hey Karthik,

I was reading through the comments section of this article and I came across a question from Chakradhar in 2017, stated as-

*\”2.Securities premium reserve / account – Is this the amount earned by share holders through equity

example:

the company had 100 shares;

face value 1;

each shareholder has a single share;

Now the current share value is 10 rupees

so shareholders have earned an amount of 1000 – 100 = 900

Am I right?\”

You replied

\’\’Yes\”

So while I was reading this question I got another question that \”If the securities premium reserve is where the premium over the face value sits, then the value of the securities premium should only increase when a company files for any IPO or it dilutes its equity\”

Please correct me.

Thanks in advance.

Thats right, Ram. The premium is generated only when the company\’s shares get listed.

Hi sir

in Cox n king annual report R&S ASSOCIATED NOTE not any specificention whether it\’s liquid for or other.

Can I send a screen shot of it?

Thats alright, maybe you should check the associated note of R&S to figure this out.

Hi sir

Can we see this in associated notes or anywhere else?

It is available in the annual report itself.

Hi sir

As u said earlier in one reply to me company have reserve & Surplus in cash form.

Recently I read in news some company like cox n king have R&S 3773 Cr

Reliance infra 13912 Cr

Dhfl. 10087 Cr

Above company r default in repay .

How it\’s happen ?

You need to see how the cash in R&S is locked up, maybe it is not liquid.

in other long term liabilities there is a head stating about provision for lease obligation.

can you please elaborate this part, how one can understand about this liability increasing? and what is the contra journal entry for the same?

Provisioning is basically a term used in the context where a company is earmarking a certain amount of money for its future use. In this case, as the company states, they have a lease obligation coming up, for which they have provisioned. If any liability is increasing, then the asset should increase too. The exact journal entry can be figured by looking at the balance sheet.

congratulations to the entire team of zerodha for working hard regarding creating all modules in an easy and understandable l manner..i have a question regarding reserves and surplus data of ARBL 2018 Annual report..

in that report that have mentioned the reserves and surplus data by other equity..also by going through the note surplus data is completely missing ..can you please explain why they haven\’t balance provided their surplus data in balance sheet?

Glad you liked it, Jayanth!

Have you checked associated notes? R&S is an important aspect of the balance sheet, the company will have to share that data.

Can you please tell one more screener to see stock?

Madhan, my current favorites are Tijori and Screener.

Can you give the link for Tijori

This one – https://www.tijorifinance.com/

I think it like rare screener somthing

Hi karthick

Can you please tell two screener to see stock ratio , balance sheet ….?

Madhan, have you checked out screener.in?

Ok ok

I think you have informed one more in somewhere in your modules

What is it ?

As in?

Thank you sir

Welcome!

Sir what is the meaning of \”healthy margin\” ?

Say a double-digit margin like 20-22%?

Sir in a company baLance sheet reseve is given but surplus detail is not given in notes nor mention on balance sheet.

Then what should we do in that case.

Maybe there is nothing is the surplus, Shishir. Can you check for previous years BS to get a sense?

Maybe there is nothing is the surplus..

how it can possible, sir?

reserves are where all the accumulated profits of the company resides as you mentioned.if there is nothing in surplus then what does it mean?

is it good or bad?

ARBL has a healthy surplus 🙂

You should look at the associated notes for the details.

Hi Karthik,

I am a beginner in Fundamental Analysis, but your modules are well written and easy to understand for a beginner like me. But, when I come across the Comments section, there are so many technical/ accounting jargons used, which I am unable to understand. Please advise if these jargons and understanding of these Comments are a prerequisite for doing Fundamental Analysis.

Also, please advise from where to find the Short Term and Long Term Liability as I was going through the Exide Annual Report 2017-18

All the jargons that you need to know are explained in the relevant chapter, Pratibha. So don\’t worry about it.

The liabilities are a part of the balance sheet.

Thanks for the reply.. I actually meant Short term and long term borrowings, instead of liabilities. I am not able to locate these in the Balance sheet.

Ah, the formats have changed, Pratibha. It just gets reported as liabilities now.

Then I hope it should be Current and Non-Current liabilities, please correct me if I am wrong.

Yes, current is short term, non-current is long term liabilities.

Good explanation in a easy and simple way, THANKS….

Cheers!

Hallow Mr. Karthik,

When a company issues bonus shares to the existing shareholders, are the funds from surplus used towards shares issued and balance sheet is altered to maintain \” Liabilities = Assets\”. Please clarify.

Thats right, the balance sheet is just readjusted on the liabilities side. In fact, the same is true with splits as well.

Hello Karthik Sir,

I am very thankful to Zerodha and specially to you for teaching us these so nicely. You are passing on these valuable information for free and that\’s really sweet and kind of you.

Regards,

Ravi

Happy reading, Ravi! Keep going 🙂

\”Think about the entire company as an individual, whose sole job is run its core operation and to create wealth to its shareholders\” – Superb explanation!

Thanks, Raj 🙂

Hi, I don\’t understand the Balance sheet Equation. If Assets= Liabilities, then wouldn\’t the Net worth formula be equal to 0.