9.1 – The Bullion Twins

To begin with, I need to apologise for the delay in putting up this chapter. Perhaps this is the longest ‘in-between chapter’ break I’ve taken from the time I have started writing for Varsity. I’ve been working on another high priority project which required my time and attention, hence the delay.

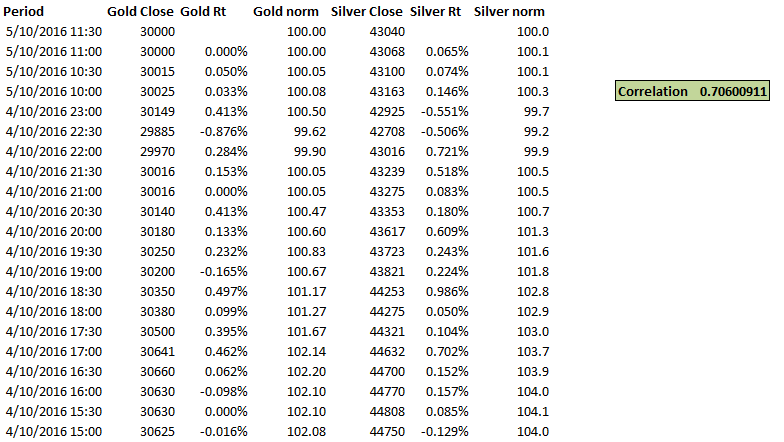

Anyway, let us get straight to work and discuss Silver. Precious metals such as Gold, Silver, and Platinum are collectively referred to as ‘Bullion’. There is a common perception that the market price of gold and silver makes similar moves. If this is true, then it gives rise to many trading opportunities such a ‘pair trading’. We will discuss pair trading in detail, perhaps in a different module altogether. However, let us go ahead and investigate if Gold and Silver move in tandem. I did run a correlation check on Gold and Silver using 30 minutes intraday data for the last 3 months (note this is over a 1000 data points) and here are the results –

The correlation on an intraday basis is 0.7, which is quite remarkable. I’m guessing the correlation at the end of day basis would be even better. So what does this mean? Well, the correlation suggests that the two metals make similar moves on an intraday basis. If you recall, we discussed the concept of correlation in detail in the USD INR chapter. I’d suggest you read up section 5.3 of chapter 5 if you haven’t already done so.

If the intraday correlation is as tight as 0.7, then we can think about exploring trading ideas of going long on gold and short on silver or vice versa. This will be a kind of hedged strategy as you are long and short (on similar assets) at the same time. The idea here is just to let you know that building such a trading strategy is a possibility; please don’t jump in and set up a trade just with this information. J

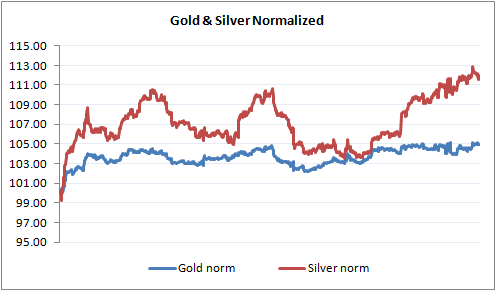

There are lots of other things to take care of when you initiate such trades; more on pair trading at a later point. Meanwhile, have a look at the intraday graph of both gold and silver; I’ve normalized it to start at 100 so that the graphs are more comparable –

If you were to look at the graph and take a call on how closely the two metals move, then chances are you would disregard any correlation between them J, but the actual numbers paint a completely different picture!

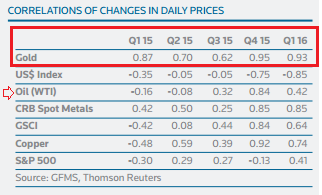

Anyway, as I mentioned earlier, I’ve used intraday data here to develop both the correlation and the graph. Longer-term data will portray more meaningful information. In fact, I dug up the correlation data between silver and gold from a recent survey by Thomson Reuters, and here is what they suggest –

The correlations are broken down every quarter (clearly a longer-term approach here) and as you can see the correlation between Gold and Silver is on average is about 0.8, which is why traders prefer to call this pair the ‘Bullion Twins’.

The tight EOD correlation implies that traders and investors consider both gold and silver as safe havens in times of economic crisis. This further implies that any global geopolitical tensions tend to drive the price of not just gold, but silver as well.

Also, please do note the correlation of Silver with Oil, it is quite erratic and gives a sense on unreliability here.

9.2 – The Silver Basics

Silver has applications in industrial fabrication, photography, fashion, electrical, and electronics industries. Hence, there is always a demand for silver. In fact, the recent survey from ‘‘The Silver Institute’ in the United States suggests that the global silver demand stands at 1170.5 million ounces. Historically, the demand for silver has grown at roughly 2.5% year on year. Out of the total global demand, the bulk of it comes from industrial fabrication and manufacturing. This directly suggests that the price of silver is influenced by the growth of manufacturing and industrial economies such as China and, to some extent, India.

On the supply side, global mining production along with scarp and sovereign sales stands at 1040.6 million ounces, clearly indicating that silver as a commodity is under slight deficit. The supply has not really improved over the years; in fact, the data suggest that supply growth has just been about 1.4%.

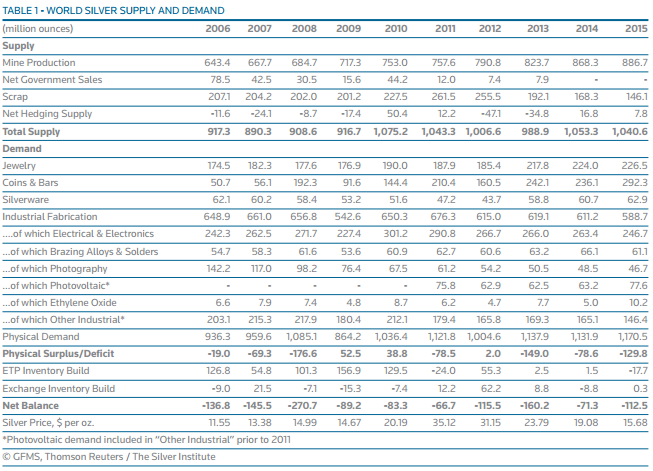

Here is the table which gives you the complete demand-supply scenario in silver –

You can read the complete survey report.

Given how the supply and demand scenario plays out, there is a lot of scopes to trade silver as a commodity. This leads us back to the most important question – who decides the rate of silver? Well, silver rates are fixed the same way as that of gold, in London, by a pool of participating banks. To know how gold/silver rates are fixed, I’d recommend you read this.

9.3 – The Silver contracts

There are four variants of silver contracts that are available for you to trade on MCX. They differ mainly in terms of the contract value, and therefore the margin required. These contracts are as follows –

| Contracts | Price Quote | Lot Size | Tick Size | P&L/tick | Expiry | Delivery Units |

|---|---|---|---|---|---|---|

| Silver | 1 kilogram | 30 kgs | Rs.1/tick | Rs.30/tick | 5th day of the expiry month | 30 kgs |

| Silver Mini | 1 kilogram | 5 kgs | Rs.1/tick | Rs.5/tick | Last day of the expiry month | 30 kgs |

| Silver Micro | 1 kilogram | 1 kg | Rs.1/tick | Rs.1/tick | Last day of the expiry month | 30 kgs |

| Silver 1000 | 1 kilogram | 1 kg | Rs.1/tick | Rs.1/tick | Last day of the expiry month | 1 kg |

Of all the four contracts, the ‘Silver’ 30 kg contract and ‘Silver Mini’ are most actively traded on MCX; we shall discuss both these contracts detail. Let us begin with the main Silver contract.

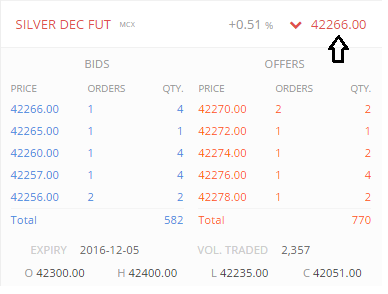

The price quotation for the Silver contract is 1 kilogram. This means when you check the price of Silver on MCX or your trading terminal, the price that you see is for 1 kg of silver. This price includes the import duties, taxes, and all the other applicable duties. Have a look at the screenshot below (taken from Kite) –

The current price of Silver December Future is Rs.42,266/-, note this is quoted on a per kg basis. Since the contract is for 30 kgs (lot size), the contract value will be –

= 30 * 42,266

= Rs.12,67,980/-

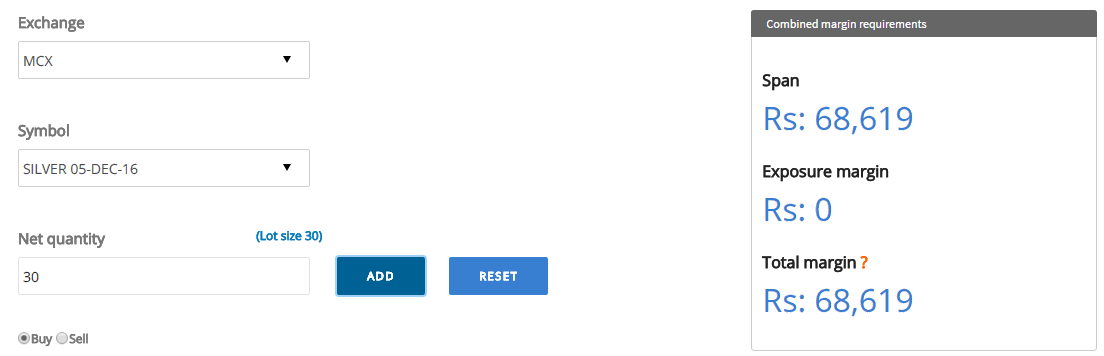

The margins on Silver is roughly 5%, in fact here is the snapshot of the margin required to trade these contracts –

This works out to –

= 68619/1267980

= 5.41%

The P&L per tick can be calculated using the following formula –

P&L per tick = (Lot Size / Quotation) * Tick Size

= (30 kgs /1 kg) * Rs.1/-

= Rs. 30/-

So for every tick on Silver, you either make Rs.30/- or lose Rs.30/-.

As far as the contracts expiries are concerned, here are the set of contracts that are available to trade as of now (as of Oct 2016), note all contracts expire on the 5th of the contract month –

- December 2016

- March 2017

- May 2017

- July 2017

- September 2017

When the December 2016 contract expires, the December 2017 contract gets introduced to the market. You must be aware by now that the most liquid contract to trade would be the one which has the closest expiry date. For example, we were now in Oct 2016, and if I were to trade Silver, I’d choose the December 2016 contract.

Do recall, settlement in equities is always in cash and not physical. However, when it comes to commodities, the settlement is physical and therefore ‘delivery’ is compulsory. This means if you hold 10 lots of Silver and you opt for delivery, then you will get delivery on 30 kg of Silver. To get the delivery of the commodity, one has to express his intention to do so. This has to be done any time before 4 days to expiry. So given that the expiry is on 5th, one has to express his intent to take delivery anytime on or before the 4th (1st, 2nd, 3rd, 4th).

If you are trading with Zerodha, note that we do not allow you to get into the physical delivery of commodities. So you will be forced to close the position before 1st of the expiry month. In fact, I personally prefer to close the positions early on and not really get into the physical delivery of commodities just because of the logistics involved.

Another important point to note here – while the delivery is mandatory for Silver (30 kgs) contract, delivery is not mandatory for the Silver Mini and Silver Micro contracts. This means to say that you can let the Silver Mini/Micro contract expire and settle for cash (or opt for delivery). However, you do not have the option to cash settle the Silver 30 kg contract.

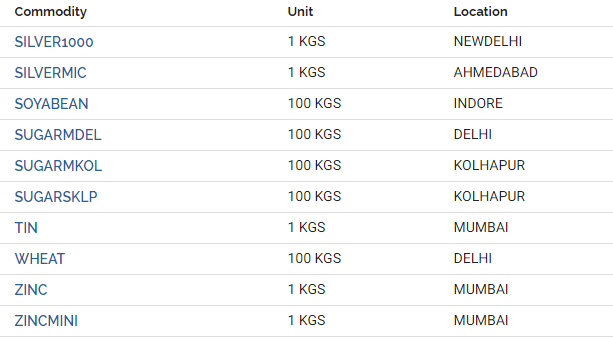

Finally, here is something else you should know. Have a look at this snapshot below –

The table above maps a commodity with a location; for example, Silver Micro is mapped to Ahmedabad. Ever wondered what this really means?

We all know that upon expiry, the price of the underlying in the spot market and its futures price converge to a single price point. Now in case of equities, the underlying and its futures are traded on the same platform, i.e. NSE (and now BSE as well). So, for example, Infosys Spot in NSE will converge with Infosys Futures on NSE. However, in the case of commodities, there are many different spot markets. For example, Pepper and Rubber are prominently traded in Kochi. Gold is traded in both Mumbai and Ahmedabad and so on. Given this, upon expiry, the futures of Gold should merge with which spot price? Should it be the one in Mumbai or the one in Ahmedabad? For this exact reason, MCX has mapped each commodity with a spot market, and upon expiry, the futures price will converge with the price of the designated spot market.

9.4 – The other Silver contracts

If you are comfortable with the contract details of Silver mentioned above, then it is fairly easy to understand the other silver contracts that are traded on MCX. They vary mainly in terms of the lot size and therefore the margin requirement.

I’ll skip working out the math, but instead, put up the margin numbers and the delivery option directly for you. The delivery option helps you decided whether you would like to take delivery of the contract or simply cash settle.

| Contract | Margin Required | Margin as a % | Delivery options |

|---|---|---|---|

| Silver Mini | Rs.13,158/- | 6.27% | Cash/Physical |

| Silver Micro | Rs.2,618/- | 5.1% | Cash/Physical |

| Silver 1000 | Rs.2,711/- | 6.2% | Physical only |

As you can see, the margins required are much lesser (quite naturally) compared to the big silver contract.

As far as trading is concerned, similar to Gold, the Silver Fundamentals are quite complex – tracking them on a day to day basis may not really be possible and in fact, is not really required. Most traders I know trade commodities based on technical analysis. I personally think this a much better way to go about active commodity trading.

Apart from technical analysis, one can even choose to trade based on quantitative techniques such as ‘Pair Trading’. As stated earlier in this chapter, we’ll discuss this technique in a separate module altogether.

Key takeaways from this chapter

- Gold and Silver are correlated both on an intraday basis and on an end of day basis.

- Gold and Silver make a good pair for trading based on the ‘Pair trading technique’.

- Silver does not have a great correlation with crude oil.

- There are 4 variants of silver traded on MCX.

- The main Silver contract has a lot size of 30 kgs and requires a margin close to Rs.75,000/-.

- The average margin requirement for silver is roughly between 5-6% of the contract value.

- Technical analysis works quite well on Silver.

Jab lg khan ch kb z j kb gf cio

Hello Karthikji, what did you use to backtest?

Also tangential but do you still trade commodities/options/stocks?

You can backtest using Streak.tech. No one in Zerodha is allowed to trade, its a company policy. We can only make long term investments 🙂

Can I get physical delivery of silver for MCX Feb Contract through Kite?

No, not possible to get physical delivery of commodities via Kite.

I can\’t find silver mini Dec fut mcx in kite app

Please call the support desk for this, Rajiv.

Is their any link or site wherein we can see spot price of silver.

Hmm, no on Kite Shekhar. Spot silver is not traded actually.

I have a few kilograms of physical Silver, and I am planning to sell it and want to invest virtually. So, which is the better option? Dealing with Futures contracts, silver ETFs, or anything that mimics silver price returns.

Not sure why you\’d want to do that, but between the two, I\’d opt for Silver ETFs.

I want to invest and than pledge for trading margin. So making some planning. Either buy SILVER ETFs and pledge or buy equity or Eq. MFs and pledge. In equity pledge, I may hold few SILVER Micro lots which will be like holding the silver. I am active trader in the market so.

Which may be good plan from above? Kindly give some enlightenment. Yes, from trading part, it\’ll be system based with low risk.

I cant suggest one for you Ravi. Really depends on your capital, you risk appetite, your risk tolerance, and your timelines. Basically this is a very individualistic call.

I\’m not sure if Silver can be pledged, please do check once before you buy. But as a concept, yes, you can pledge and use margins for trade.

dont sell wait some time . my analaysis is gold will some correct and silver will increae furthure.

Good luck!

Hello Karthik Sir,

Hope you doing Great Thank you for Varsity. MY questions is in Sliver and Gold how settlement happen for pair trade like, in case of In the money / out of money scenarios for options.

1) IF Sliver Future ( @ 90000 INR) – Long

2) Sliver90000CE – SHORT

what happen at settlement if both are of same month.

You should get a margin benefit. I\’d suggest you check once with the support desk for this. Thanks.

I want to take/give silver 1kg. Please describe what kind of expenses are lying on it as well as legal papers.May I get delivery/transported to/from my desired address?

Ah, we dont support physical delivery of Silver and other commodities. I wont be able to help you with the numbers for this.

Thank You!

Happy learning, Anu.

I want to understand this statement given by you:

\”MCX has mapped each commodity with a spot market, and upon expiry, the futures price will converge with the price of the designated spot market.\”

1. For silver what is the designated spot market here ?

2. For eg. The silver spot price is 92000 and the silver mini future price is 91000.

And im on my last date of contract expiry so final settlement will be based on the spot price (92k) or the last price of the silver mini future(91k) ?

Naveen, you can actually check this on their factsheet – https://www.mcxindia.com/products/bullion/silver

Is the margin still approximately 5% for Silver?

You can always check this here – https://zerodha.com/margin-calculator/Commodity/

If you hold 10 lots of Silver contracts , then physical delivery will be 30kg or 300kg?

Its the lot size (unit) * the number of lots you hold.

As always, you excel at breaking down complex topics.

I wanted to know, from where can we download historical (intraday and Daily) data for commodities?

Also is there any split,bonuses or dividends in commodities contracts??

Dhaval, thanks. Are you looking at spot data? I\’m not sure is that is available. Maybe you should check tradinview once.

Hi, just wanted to know the correlation between silverbees(etf), silver futures in mcx, When I invested in silver bees, mcx price was much lower, however currently, silver futures in mcx currently trade 3-4% more than silverbees, couldn’t understand the divergence between the prices. As difference between the prices of both the product has cost me 6-7%.

The difference is related to parity and I also believe there is a stamp duty angle to this.

Lets say i buy silver micro from mcx zerodha. How long can i hold the same in demate account?

Its not held it Demat, its in your trading account. You can hold it till the expiry of the contract.

hi Karthik, how can i buy silver for positional trade for 6-12 months without having to worry about roll over etc. is there any way? please share best possible way with minimum roll-over executions. thank you

Ah, there is no spot market for silver Dipak. Your only option is to buy it physically.

I am holding Silvermic feb future. I received a message that i should exit before 22 Feb 9 Pm to avoid physical delivery. however Zerodha is not permitting to place NRML order. How to exit the position?

Tanuj, I\’d suggest you speak to the support desk on this, they will guide you on it.

Can silver spot trading be done on Zerodha kite

No, thats not possible.

I am trying to buy 1 lot of SilverM Nov 23 Fut.

The margin value is 40k, I have added 45k in my Kite app and have set the limit but it\’s not being bought even the price come down from the set value.

Please let me know how to buy

I\’d suggest you speak to the support desk for this, Vinit.

Res sir,

Why silverM price is premium vs silverbees(Nippon) some time and silverM price is discount vs silver bees(Nippon)?

These variations in bid-ask is due to demand supply situation as well.

How do I roll forward a silver micro current month contact to next expiry period? Should I exit current and buy a new lot? for example i have Nov expiry solver micro however want to roll forward to Dec expiry, how should I approach this.

Do check this – https://www.youtube.com/watch?v=FqRB7NGnOtA

Hey sir as I am holding silver mic nov future and buyed 4 lots at 72400 average price it\’s in loss of around 13 k so will it will have decay into it or I can hold till 30 nov or I have to shift to next future

This really depends on what you expect in terms of directional movement. But as a good trading practice, always have a stop loss and stick to it.

Hi Karthik sir,

I\’m begginner to commodity. now after backtesting a strategy I\’m trading with 1 lot silverMic. I have shorted silvermic, but why in Zeordha there is no GTT or OCO option not availble for SilverMic buyback. is this feature not available for commodity in Zerodha?

Yathish, can you please call the support desk for this?

Sir

Can we buy sold & silver from paytm? Is it safe?

No idea, Sajjan.

Sir

How to buy Gold & silver in cash rather than futures?

There is no cash market for commodities, Sajjan.

What about option how do option expire in case of Silver and what is methodology of settlement. Unlike in equity can we do covered call sort of strategy in Silver.

Shekhar, we will put up a post on all expires soon. Please do follow Varsity on Insta or Twitter 🙂

Covered call, nope, not possible.

How much fund required in commodity margin to hold silvermic future

Please check the margin data on the order window itself.

Can we do intrday tarding in silver micro futures like we do in equity? Is there anything different that i should consider while doing intrday in silver micro futures ?

Yes, you can. The way futures work is the same for both EQ and commodities.

Currently for silvermicro, i can buy near month contract (Feb 2023) and next to near month contract (Apr 2023), at what date zerodha will allow me to buy far month contract i.e. \”June 2023\”?

I didn\’t understand the term devolvement into futures of shorted silverm calls. What would it have been, if i allowed it to get into that? Would it have shorted the future and cash settled at the end of the day? Thanks

Your option position is converted to a futures position. But when the devolvement happens, you need to ensure future margins are available.

Are silver contracts not available every month.. eg i don\’t see a Dec 23 contract on silverMini.. next available contract is feb23.. is that how it is? And why was i asked to close my nov22 short calls yesterday (21-11-2022), while the expiry is still 9 days away

I think only quarterly contracts are available in big bullion during US summer daylight savings and bi-monthly otherwise. Positions are squared off to avoid physical delivery, and this happens when the tender period starts. I\’d suggest you speak to customer care regarding your position.

Can I settle the contract before expiry date?

No, but you can square off the trade anytime before expiry.

Sir why silvermic can\’t buy in limit price order ,

How to see silver mega yearly chart in zerodha ..

In Silver money , for long trade , the amount is deducted on daily basis in case we r in loss in zerodha. Where as it never happens in other platforms. Why so. Other will pay back the amount when we reach profitable amount but not in zerodha. May I now the reason?

I think you are confused with different product types. What we offer in Silver Futures, which is traded on MCX. Settlement of futures is the same across all brokers.

Is there any book/hard copy available in Market of there all 13 module?

Kindly Ans

No, its not available.

Silver M future contracts are cash settled or physically settled upon expiry in zerodha?

I tried to purchase Silver M in the last week of the month and got a nudge from zerodha warning me about taking physical delivery for the contract.

Can you please clarify this?

Thank you.

There is a physical settlement for this, but best to close before expiry. Only Crude and Natural Gas are cash-settled.

Sir can retail traders trade in commodities like Sugar or any other commodity that is on NCDEX rather than MCX and are they fairly liquid?

Not sure about NCDEX. Don\’t think there is any liquidity there.

Commodity trading mein future me hitrading kyo karte hain aur future ka expiry kya hota hai silver mein buy karke kab tak sell kar sakta hu kotex security app me kon kon se box, ya option par tik karna padega

Is it possible to invest (delivery trade) for a non-definite period of time?

Like buying a share of a company & holding it in the demat account for years. Can this be done in case of gold or silver commodity?

Not possible with commodities as they are all futures and have an expiry date to the contract.

hello,

if the lot size of silver micro is 1kg, how can its delivery be 30kg?

The price quote is for 1Kg, delivery quantity is 30Kgs. Its like saying 1kg of onion is x amount, here the price quote is for 1 kg and you can buy whatever quantity based on that. But in Silver, lot size is 30kgs, so you can transact in multiples of the lot size.

Thank you very much sir for this amazing module too.

By the way, The title picture in this chapter reminds me the character of \”Dholu-Bholu\” in Chota Bheem. 😄

Lol, it does actually 🙂

Dear sir,

I am trading in silver micro futures. Can i take physical delivery of the same ?

We don\’t have an option for physical delivery.

I am interested to buy \”Silver\” for long time – cash delivery. I see gold etf trading in cash. Can anyone guide if any such product for Silver available at Zerodha? Thanks

There are no silver ETFs Nanda.

Hi Nitin,

Can i get physical delivery for Silver Mic August Contract and if yes pls. explain how ??

Pls. also suggest if I can rollover Silver Mic August Contract with a rollover fee, if yes pls. explain how??

No, physical delivery is not possible Jitendra.

Can we Incorporate & see US spot Gold & Silver in Zerodha charts ?? if so which one to chooce.

Thna

Naga

Not possible, we can show feeds of whats traded on the exchanges i.e. NSE and BSE only.

As on today why SilverM September is not visible on Zerodha while SilverM August and SilverM November are visible?

Mini contracts are discontinued I guess, Sukesh.

How can I buy silver and hold in demat account? I see National spot exchange offers eSilver. But I want to buy and hold in my zerodha demat account.

Not possible, Aparna. Silver is traded only in futures form.

Can we place amo order of silverm

Please let me know by which date do I have to close my silver mini and gold mini contracts if I don’t want physical delivery

Silver M August

Gold M Sept

Please let me know by which date do I have to close my silver mini and gold mini contracts if I don’t want physical delivery

Silver MAugust

Gold M Sept

I would suggest you call the support desk about this, they will help you with the details.

If i buy silver micrco nov futures at 73k

And in a month price moves to 80k

Can i hold position till november expiry

Or do i need to rollover on each monthly expiry?

What are the other charges if i enter into this agreement as mentioned above ?

You can hold till Nov expiry. Btw, I think these contracts no longer exist, please double check.

Sir what do you mean by tick size

And

P&L per tick you would lose or make money

Tick size is the minimum price movement in the underlying asset.

When will be trade open for silverMic Aug fut 2021?

Good endeavour. Nice explanation.

Happy learning, Ravi!

Hi,

Why the contract for SilverMini or Micro is not available for all months.. like I can not find SilverMic for Sep and Nov, but it available for Aug n Oct.

These mini contracts are discontinued by MCX I suppose.

Hi Karthik,

Want to understand that suppose i have actual physical silver bricks with me as on today and I want to sell them in the market with any jeweller lets say. Which price should i consider for selling them?

Is the prevailing spot price of Sept 20 MCX future will be used for it?

You can look at the MCX price and get a sense of what the reference rate is. Then it depends on how well you negotiate 🙂

Can I buy silver in equity format? If yes, how to buy through MCX. (I need to hold silver for some time)

Please suggest.

No, not possible.

HOW SUDDENLY GAP UP OPENING BY ALMOST 2800 POINTS HAPPENED IN SILVER ON MONDAY 27 JUL? WILL IT REVERT SOON? I AM NEW TO COMMODITY TRADING. I HOLD ACCOUNT IN ZERODHA.. CAN I TRADE COMMODITY AND F& O ON ZERODHA..

This is common, happens due to regular demand and supply situation.

Where can I find option Chain for commodities in kite , since it\’s not available like stock option Chain in the underlying stock itself

You will have to check this on MCX website. There are no volumes for these contracts.

could we buy e silver and keep it in our demat a/c ?

No, there is no such product available.

Can i do swing trading in zerodha.. like buy silver today and sell after 4-5 days or even time what i want 1 month or one year.. as stocks

Yes, you can swing trade Silver. Swing trade by definition is to hold the position anytime between a day to 1-2 weeks. Not more than that.

where can I get past daily levels in detail for SilverM?

You can look at the continuous charts for this – https://tradingqna.com/t/what-are-continuous-futures-charts-that-i-see-on-kite/17317

Oh, Thank you.

Welcome!

Yes. Silver 1000 is mentioned on this page

https://i.imgur.com/FdjxhoW.jpg

The contract is discontinued by MCX.

Hi Karthik

1. Silver Mini – you have mentioned above (in the table) that lot size if 5 kgs but under delivery, you have mentioned 30 kgs….is that a typo? if not a typo, shall i safely go with the assumption that the lot size if still 5 kgs?…and i exchange revises this, is there a way to check the latest lot size

2. for hedging a silver mini future with a silver call….I am assuming that 1 silver call (which is default for 30 kgs) will equal = 30/lot size of silver mini number of silver futures to balance the quantity…is this right?

1) Could be, please check the specs on MCX website

2) Yes, you will have to balance the quantities.

What is the point having two contracts \”Silver 1000\” and \”Silver Micro\” with a same contract value?

The only difference in the table is the Delivery Units. But who cares? Let\’s keep the only with the small delivery unit and remove the other one to increase liquidity?

Where did you find Silver 1000? MCX?

thanks,

you might be thinking that i have been asking silly questions. This is because 4i am 14 yrs old.Thankyou for sparing time and replying to all my questions

Ah, not really. No questions are silly. I\’m glad you are taking interest in markets at such an early age!

hi

when the gold and silver prices are fixed at that time it is midnight in india is the same price fixed in london is prevailed in india

India too has a polling technique, works similar to gold fixing in London. Also, when its morning in London, its midday here.

hey kartik you mentioned delivery quantity in 9.3 section as 300 kg, I think it is 30 kg can you clarify

Yes, its 30Kgs, not 300 kgs. Thanks for pointing 🙂

Hi,

Can you pls advise :

1. what is the lot size for both, Silver Future and Silver Future mini?

2. is there any way to invest in silver except through F&O?

3. for hedging through options, is there provision to hedge a silver mini future through equal sized call option?

4. any comments on liquidity in both near and far month contracts?

Regards

1) Explained in this chapter itself

2) No

3) No

4) Dont think they are very liquid.

Hi,

Could you help me figure what gold and silver contracts should I buy if i want to keep them for medium-long term ( 2-3 years) ? Most of the gold and silver contracts seem illiquid in the further months.

Thanks for your time !

You can buy the Sovereign Gold bonds, this is probably the best way to invest in gold. Check this – https://zerodha.com/gold/

Not sure about silver though.

Hi Sir,

1) Similar to Silver mini, can other Gold contracts (like Gold mini, guinea, petal) be cash settled?

2) Can we trade options on commodities like Gold and Silver?

1) Need to take this up with the exchanges

2) Yes, but I don\’t think there is liquidity here

I thought you didn\’t know about the rothschild Family and illuminati…why would you miss them on the currency chapter…when the whole banking system is invented by them?

Perhaps a new module on that family 🙂

Hi

The article describes the contract expiry as below-

As far as the contracts expiries are concerned, here are the set of contracts that are available to trade as of now (as of Oct 2016), note all contracts expire on the 5th of the contract month –

December 2016

March 2017

May 2017

July 2017

September 2017

When the December 2016 contract expires, the December 2017 contract gets introduced to the market. You must be aware by now that the most liquid contract to trade would be the one which has the closest expiry date. For example, we are now in Oct 2016 and if I were to trade Silver, I’d choose the December 2016 contract.

Now the question is, if we are now in Oct.16 and choose March\’17 contract to trade, what will be the advantages and disadvantages of doing so ?

The only thing to note is the lack of liquidity, Shriram.

Can i load the spot price of commodities on kite or pi? if not, which blog/ website will be able to flash the spot prices of silver in terms of $, ₹ or pounds or euros.

Thank you karthik sir

No spot prices, Sundar. The problem is that there is no consolidated market for spot price, its a scattered market, depends on the commodity.

Hey Kartik,

A small clarification.

For ex, I gain 50 points on one lot of SilverMini (46400 to 46450) and margin required is 6946. My profit will be Rs 250 (ie, 50 x 5 )

Return is 250/6946 = 3.5%

Is this correct ?

There are two ways you can measure the ROI here….as a percentage of margins, which is what you\’ve calculated or as a % of the entire contract value. Both are correct, you can choose one over the other based on your risk management techniques.

Hi karthik

for commodities like gold, silver and crude oil it is good to analyze international market, i guess in mcx this commodities depend on international market, so analyze with whole TA in international market is a good option or not ? and i guess patterns reflects (candlesticks) in international market are more trusted as compare to our Indian market. so its good to depend 60% on international market and 40% in Indian market ?

Thank you karthik again. for your great availability on varsity and since 2014 you constantly answer all the questions that asked every day by readers. i think it is a great service that provide by zerodha and of course you.

Hey Rajesh, thanks for the kind words.

Yes, tracking and analyzing the international markets for these commodities helps. I\’d do the same.

What is the validity and expiry of gold and silver futures?as well as plz mention the expiry day?

It depends on the contract, at any given point there are at least 6 contracts available for you to trade. It is just that the liquidity is not good enough.

Hi,

Can you tell me that if we buy silver, can we sell it anytime before the expiry, or silver under MCX is only available for intraday Trading?

Yes, you can hold for few days and sell it.

hai sir I did run a correlation check on Gold and Silver using 30 minutes intraday data for the last 3 months (note this is over a 1000 data points) . sir my question was 1) where can i download this data 30 minutes

2) we need to take spot value data in zerodha no mcx spot value data sir,

sir will you pls help me in this point , 30 minutes candle closing price taking more data points and time in excel sir.

1) I\’d personally prefer the EOD chart here as opposed to the 30 mins chart.

2) Spot data is not available

When is the last trading day of Silver May 2019 future contract. In the depth buy and sell Expiry date is mentioned 3rd May 2019

30th April in this case. Check this – https://support.zerodha.com/category/trading-and-markets/trading-faqs/articles/mcx-expiry-settlement and this – https://docs.google.com/spreadsheets/d/1AdXr4voOKs2RpxftI_eJ78J7j-fBremMGiOOnf0I9jc/edit#gid=0

When is last trading day of Silver March 2019 futures contract

2nd March I guess.

Thanks for the quick reply Karthik.

As you said the domestic has its own supply and demand, so a trade can be taken basis on some pattern/technical analysis in futures??

Yes, you can. But do pay attention to the spot price.

Hey Karthik, your blogs are awesome as usual !

I have a question, on kite we have derivatives chart not spot, So I am using Investing.com to track Silver\’s spot chart and if I am not wrong derivatives follows spot, not the other way around.

The query is, when sometimes we have some pattern building on our futures chart & that patterns breaks successfully, but we do not see the same pattern break confirmation on the spot chart, so what should we do in that case ??

For Eg. today Silver broke its long term daily channel & fell around 200 points, but that same daily pattern is yet to be broken in spot chart, hence I didn\’t take the trade.

So just because a long term pattern has been broken in future\’s chart, can we take the trade? or should we wait for spot to break the same pattern ??

You can see today\’s Silver future\’s chart on kite & see it broke a long term upward trend line(trend line started from 30-11-18), it broke today on our future & price fell some 200 points, but the same trend line in spot chart is yet to hit the trend line.

Hope I am making some sense.

Your help would be appreciated.

Thanks!

Saify, I get your point. Yes, the spot dictates the future price, but the correlation with these international commodities is not perfect like in equities, such that the tick by tick behavior are similar. This is because the domestic commodities have their own price dynamics and demand-supply situation. Having said that, a large impact on the spot will map on the futures as well.

hi sir,

can u teach how u run these correlations ? on which platform? between to commodities or between any asset classes. I do correlation by the eye by comparing charts but in that method, I can only spot assets which are strongly correlated .but the way u do it one can spot correlation that is hard to do by doing charts

All you need to do is have the time series data of the closing prices of the stock or two commodities you are tracking and use the excel function \’=correl()\’.

It is possible to buy far month contract. Iam trying to buy silverm Feb contract 2019 in site but it is rejected. It is showing blocked for mcx_fo block type all.

No, that contract is not available.

Hello sir

Is there any place where I can get intraday candlestick pattern chart of silver(MCX) of 2016 and 2017?Please help me by providing some links,thanks in adavnce

Sindhura, you can check on Kite, the continuous futures data is available from 2010.

Hi Karthik,

Can you please tell me where I can get a candlestick chart with years of data for silver or any other commodity for that matter traded on MCX?? Because the commodity futures chart just shows the data from the start of the contract… I just want to know if I can find the underlying commodity price like Nifty index…

You can get continuous data on Kite. Look for it in the settings or call the support desk for this.

Thank you Karthik… Will look into that.

Good luck, Shreyas!

Hi,

If we want to invest in Gold or Silver can we do it with Commodity account? or what are the ways to do so. Currently I am having one Gold mutual fund but no able to find same with Silver. So if I want to buy Gold and Silver and not trade them and keep them in my Dmat account as long as I wish what should I do? Please guide me.

Regards,

Mohsin

If you want to trade these commodities, then you will have to trade the futures via your Commodity trading account. No need of a DEMAT as these are derivative contracts.

Hi Karthik,

Thanks for your reply. I do not want to trade in commodities what I need is as we buy and hold stocks in our account so that we can keep them as long as we want and sell later whenever we desire, can we do the same with Gold or Silver using zerodha?

As I informed earlier that I have started a mutual fund for Gold. I want to accumulate Silver. Please guide.

Regards,

Mohsin

You can do that with Gold ETFs, but for Silver, I\’m not sure if there is a way out. We don\’t have silver ETFs in India.

The best way to invest in gold is through exchange traded funds (ETFs). Unfortunately, we do not have Silver ETFs in India. However, the most popular ways you could invest in the white metal are as follows:

Silver Bars/Coins

The most traditional way to invest in silver are buying silver bars and silver coins. The advantage of investing in silver bars/coins is its tangibility (you can see, feel, and touch) and its affordable price. Unlike gold, where you have to invest in thousands, silver coins can be bought with a few hundred rupees.

But holding physical silver has its own disadvantages. Like storage problems, safety issues, and transaction costs.

Silver Jewelry

Silver is also known as poor man\’s gold. Silver jewelry has the same benefits as the silver bars or coins. That is, it is tangible. But making and transaction charges (which is usually 15 to 30%) is a big disadvantage here. And of course, silver jewelry also possess other risks associated with silver bar and coins.

E-Silver

You can also invest in silver through electronic form. Just like you invest in shares, you can invest in silver in demat form through the National Spot Exchange Limited (NSEL). You just need to open an account with one of the NSEL\’s Depository Participants. And there\’s also an option to take physical delivery if you\’re so inclined.

Commodity Futures

Silver is also available for trading in the futures market at the multi-commodity exchange (MCX). Trading in silver futures is highly risky due to the leverage components. So you can consider this option only if you have a high risk appetite.

Foreign ETFs

Since there are no silver ETFs available in India, another roundabout way is investing in silver ETFs in the US market through international trading accounts. This is a perfectly legal way to invest in the commodity, but there are certain regulations that you will have to compile with before taking this route.

There are also certain level of risk attached to this route. The foreign currency fluctuations is the biggest one. You will also have to take care of the taxation issues. Also, the brokerage and transaction costs are much higher. Certainly, this option isn\’t for everyone.

Above are some of the most popular ways to invest in silver. Now the best options among these may vary from person to person. For something that works best for you

Great tips. Thanks for sharing!

At what price settlement will take place in commodity after expiry. If I don\’t square off say crude buy position and let it go to expiry.

Will it settle at last trading price ?

or Is there any method which exchange follow ?

Closing Price is the weighted average price of all trades done during the last 30 minutes of a trading day. This will be the settlement price.

Commodities have physical and cash settlement(differs for each contract). Crude Oil is cash-settled at the settlement price

If a trader calculate weighted avg. around last 30 minute. Is there any arbitrage opportunity in cash settlement commodity ?

Possible, have you seen the \’predictive close\’ feature on Pi?

I use kite only

Is there any correlation between silver and base metal like copper? .. Our commodity market is too much volatile after 6 o\’clock to 9 o\’clock mostly in silver and gold.. Is safe to trade in that time?

I cannot comment on the safety part. This really depends on how you trade. I cant think of a correlation from their characteristics perspective, but maybe the numbers could paint a different picture. I\’d suggest you run a correlation test between the two.

Thanks for providing quality material

delivery of the contract or simply cash settle! will you elaborate it what it means? I am still confusing …

Hoping for reply

Thanks

Delivery of contract (or physical settlement) is when you deliver actual shares/commodities upon expiry. Cash is when you pay the difference in your buy and sale price.

Hi Karthik, Just to clarify my understanding,

The MCX Silver MINI Contract specification states following at:

https://www.mcxindia.com/docs/default-source/default-document-library/silver-mini-november-2017-contract-onwards.pdf

Trading Unit : 5kg

Maximum Order size: 600kg

Am I correct in calculating:

1. That the maximum lots that can be pruchased in a single(1) order is 120 ?

2. Is there a limit by MCX, that an order above certain amount, for individual traders, would be rejected ? e.g. An order for Silver MINI would easily cross an amount of 1 crores, for lot quantity of even 100. would it be rejected based on the amount ? Or per contract spec. 120 lots per order would be allowed ?

3. Would a similar calculation be applicable for other commodities in MCX based on their contract specifications ?

Thanks,

Mayank

1) Not sure what the position wide limit is on Silver, you need to check that.

2) If it exceeds client wise position limit, then it will get rejected

3) Yes

Hi Nitin. I understand how gold is priced in India since our demands are met by import. But is silver priced in the same fashion? Since the supply of silver is low globally compared to the demand and we export quite a bit of silver every year with the imports falling drastically.

I guess, we follow the international market pricing for silver.

Alright. Thank you.

Hi

If I trade silver M , I will not be forced to close my position

I can hold position till expiry. Right?

Its always better to close the commodities position before expiry to avoid settlement obligation.

I mean on 5 of expiry month I can close my position, since in this not compulsory of taking physical delivery, we can do cash settlement also

Yes, you can.

Hi,

Are you going to teach Pair Trading technique in trading strategies and system module?

It is certainly in the agenda.

Glad to hear that. Will be waiting for it. Meanwhile can you recommend any good source to learn pair trading. I have almost completed learning basics of it, but not getting some clarification for certain points. If at all your recommendation links might work for me.

I do plan to cover that sometime soon. But I\’ve heard the quant insti program on pair trading is decent. But its a paid program, not free.

Sir……….what is tha 5th day of expiri of month. ? End what is tha last day of expirei month?

End what is tha ……case/fhycial

Its 5 days prior to expiry.

where do i get spot price graph for commodities??? it seems not enabled in zerodha….mcx website doesn\’t have any graphs too

MCX is only futures.

Is kite enough for Silver Intraday?

Yes, absolutely!

When i search for silver micro it comes and shows the price of silver. Then when i click on buy option it showa the same price. But i think it should have shown 1950 or something like that for 1 lot.i will be highly obliges if you answer my question..

The option is available only for the main contract and not the micro/mini contracts.

Hi,

Thanks for this chapter.

Since gold and silver move in same direction.

Can I buy gold if a buy signal emerge in silver and same as can I buy silver if a buy signal emerge in gold

Sir will it Good to do??

You can, in fact many traders adopt this strategy.

can u throw some light on what affects other metal prices like aluminium, nickel, copper etc.

Of course, will cover them as we go ahead. Taking on Crude next.

Hi Nithin, Just like in EQ in NSE, one can download a historic excel file showing underlying price, futures price, OI etc. for EQ or INDEX.. On the same lines is there a link available which allows us to do the same thing for silver or gold etc. in order to see historic spot and futures prices in excel together with OI etc. Thanks in advance

You can now do this with Zerodha Pi. I\’d suggest you write to [email protected] to understand how this can be done.

Thanks Nithin. At the moment the Commodities part is not enabled on my account in Zerodha.

I\’d suggest you speak to our Sales team to get it activated.