12.1 – Open Interest and its calculation

Before we conclude this module on “Futures Trading”, we must address one of the questions that is often asked- “What is Open Interest (OI)?”, “How is it different from Volumes?”, and “How can we benefit from the Volumes and Open interest data?” Let me attempt to answer these questions and more in this chapter. After reading this, you will be able to interpret OI data in conjunction with the Volumes to make better decisions while trading. Also, I would suggest you refresh your understanding on Volumes from here.

Open Interest (OI) is a number that tells you how many futures (or Options) contracts are currently outstanding (open) in the market. Remember that there are always 2 sides to a trade – a buyer and a seller. Let us say the seller sells 1 contract to the buyer. The buyer is said to be long on the contract and the seller is said to be short on the same contract. The open interest in this case is said to be 1.

Let me illustrate OI with an example. Assume the market consists of 5 traders who trade NIFTY futures. We will name them Arjun, Neha, Varun, John, and Vikram. Let us go through their day to day trading activity and observe how open interest varies. Please note, you need to exercise some patience while understanding the flow of events below, else you can quite easily get frustrated!

Lets get started.

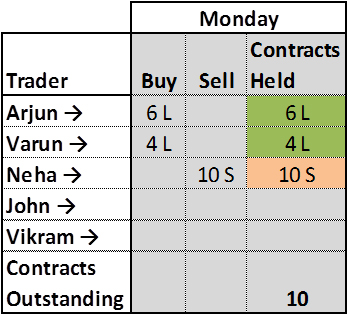

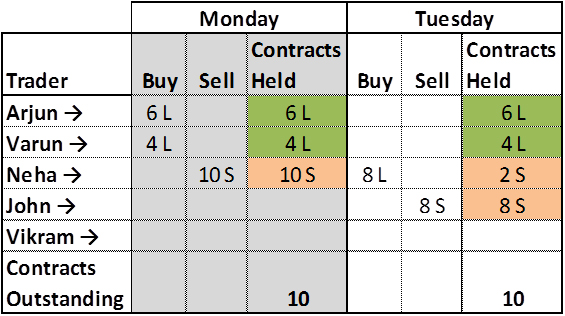

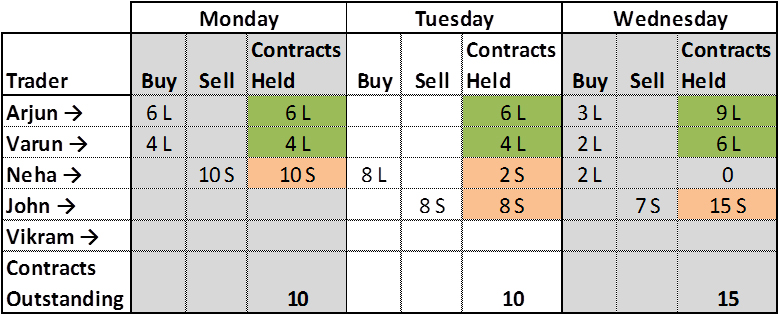

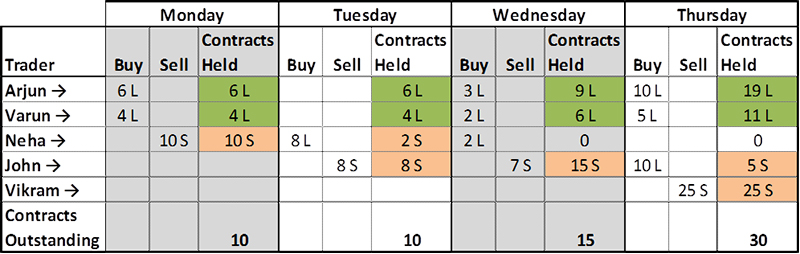

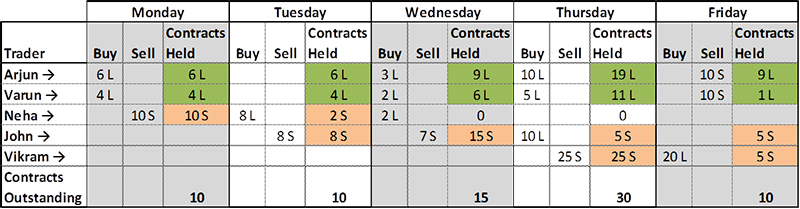

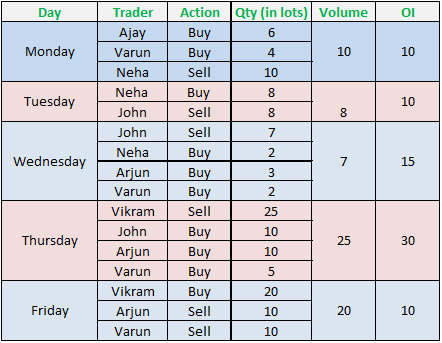

Monday: Arjun buys 6 futures contracts and Varun buys 4 futures contracts, while Neha sells all of those 10 contracts. After this transaction, there are 10 contracts in total with 10 on the long side (6 + 4) and another 10 on the short side; hence the open interest is 10. This is summarized in the table below.

Tuesday: Neha wants to get rid of 8 contracts out of the 10 contracts she holds, which she does. John comes into the market and takes on the 8 shorts contracts from her. You must realize that this transaction did not create any new contracts in the market. It was a simple transfer from one person to another. Hence the OI will still stand at 10. Tuesday’s transaction is summarized in the table below.

Wednesday: To the existing 8 short contracts, John wants to add 7 more short positions, while at the same time both Arjun and Varun decide to increase their long position. Hence John sold 3 contracts to Arjun and 2 contracts to Varun. Note, these are 5 new contracts created. Neha decides to close out her open positions. By going long on 2 contracts, she effectively transferred 2 of her short contracts to John and hence Neha holds no more contracts. The table now looks like this:

By the end of Wednesday, there are 15 long (9+6) and 15 short positions in the market, hence OI stands at 15!

Thursday: A big guy named Vikram comes to the market and sells 25 contracts. John decides to liquidate 10 contracts, and hence buys 10 contracts from Vikram, effectively transferring his 10 contracts to Vikram. Arjun adds 10 more contracts from Vikram and finally Varun decides to buy the remaining 5 contracts from Vikram. In summary, 15 new contracts got added to the system. OI would now stands at 30.

Friday: Vikram decides to square off 20 of the 25 contracts he had sold previously. So he buys 10 contracts each from Arjun and Varun. This means, 20 contracts in system got squared off, hence OI reduces by 20 contracts. The new OI is 30-20 = 10. The final summary is listed in the table below.

So on and so forth; I hope the above discussion is giving you a fair sense of what Open Interest (OI) is all about. The OI information just indicates how many open positions are there in the market. Here is something you should have noticed by now. In the ‘contracts held’ column, if you assign a +ve sign to a long position and a –ve sign to a short position and add up the long and short positions, it always equates to zero. In other words, wealth is transferred from buyers and sellers (or vice versa) and no new wealth is created (like if you hold a stock and stock price appreciates, then everyone makes money). For this reason, derivatives are often termed as a zero-sum game!

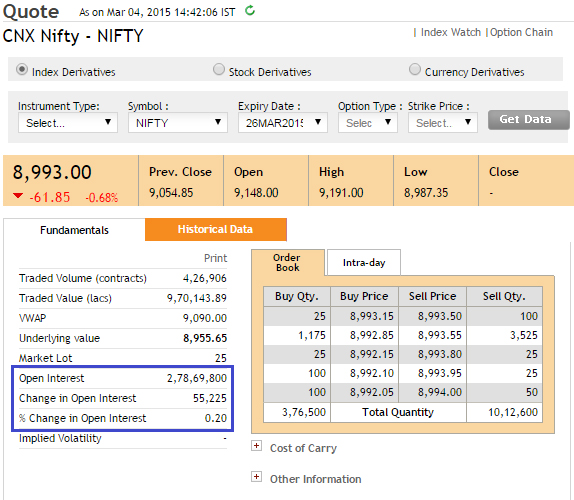

Have a look at the following snapshot –

As of 4th March 2015, OI on Nifty futures is roughly 2.78 Crores. It means that there are 2.78 crore Long Nifty positions and 2.78 crore Short Nifty positions. Also, about 55,255 (or 0.2% over 2.78Crs) new contracts have been added today. OI is very useful in understanding how liquid the market is. Bigger the open interest, more liquid the market is. And hence it will be easier to enter or exit trades at competitive bid / ask rates.

12.2 – OI and Volume interpretation

Open interest information tells us how many contracts are open and live in the market. Volume on the other hand tells us how many trades were executed on the given day. For every 1 buy and 1 sell, volume adds up to 1. For instance, on a given day, 400 contracts were bought and 400 were sold, then the volume for the day is 400 and not 800. Clearly volumes and open interest are two different; buy seemingly similar set of information. The volume counter starts from zero at the start of the day and increments as and when new trades occur. Hence the volume data always increases on an intra-day basis. However, OI is not discrete like volumes, OI stacks up or reduces based on the entry and exit of traders. In fact for the example we have just discussed, let us summarize the OI and volume information.

Notice how OI and volume change on a daily basis. Today’s volume has no implication on tomorrow’s volume. However, it is not true for OI. From a stand-alone perspective both OI and volume numbers are pretty useless. However traders generally associate these numbers with prices to draw an inference about the market.

The following tables summarizes the trader’s perspective with respect to changes in volume and prices –

| Price | Volume | Trader’s Perception |

|---|---|---|

| Increase | Increase | Bullish |

| Decrease | Decrease | Bearish trend could probably end, expect reversal |

| Decrease | Increase | Bearish |

| Increase | Decrease | Bullish trend could probably end, expect reversal |

Unlike volumes, the change in Open interest does not really convey any directional view on markets. However it does give a sense of strength between bullish and bearish positions. The following tables summarizes the trader’s perspective with respect to changes in the OI and prices –

| Price | OI | Trader’s Perception |

|---|---|---|

| Increase | Increase | More trades on the long side |

| Decrease | Decrease | Longs are covering their position, also called long unwinding |

| Decrease | Increase | More trades on the short side |

| Increase | Decrease | Shorts are covering their position, also called short covering |

Do note, if there is an abnormally high OI backed by a rapid increase or decrease in prices then be cautious. This situation simply means that there is a lot of euphoria and leverage being built up in the market. In situations like this, even a small trigger could lead to a lot of panic in the market.

And with this, I would like to conclude this module on Futures Trading. I hope you enjoyed reading through this module as much as I enjoyed writing it!

On wards to Option Theory now!

Key takeaways from this chapter

- Open Interest (OI) is a number that tells you how many contracts are currently outstanding (open) in the market

- OI increases when new contracts are added. OI decreases when contracts are squared off

- OI does not change when there is transfer of contracts from one party to another

- Unlike volumes, OI is continuous data

- On a stand along basis OI and Volume information does not convey information, hence it makes sense to always pair it with the price to understand the impact of their respective variation

- Abnormally high OI indicates high leverage, beware of such situations.

Updated : 24th Aug 2016 – If you use intra day OI information as a critical input for your trading strategy, then you should read this before you trade.

This chapter explains Open Interest in a very clear and practical way. The step-by-step examples make it easy to understand how OI changes with new positions, exits, and transfers. The comparison between OI, volume, and price is especially useful for traders to judge market strength, liquidity, and possible trend behavior instead of relying on numbers alone.

Thanks Omesh. Glad you found the explanation useful. There has been some changes to how OI is interpreted recently, you should check the video here – https://youtu.be/I4EoHTw3SG0?si=ryPAdpujKkJZUng3

Date Expiry Date LTP SetPrice No.Contract turnover OI changeOI underlyingvalue

01-Oct-25 30-Dec-25 5676 5676 34 288.38 3750 3750 5606

03-Oct-25 30-Dec-25 5731 5731 44 377.95 7500 3750 5657

06-Oct-25 30-Dec-25 5764 5771.5 16 137.89 8100 600 5694.5

consider this is first 3 days of a Stock FO contract lot size 150.

I am not really sure how its possible for a stock fut to have 34 contract and OI 3750 on first day .

on the first day it should start from 0 correct ?can you please explain here . whats happening

Not really, there could be rollovers right?

Open Interest Calculation method is changed by SEBI.

SEBI vide circular NCL/CMPT/70194 issued on September 15, 2025.

How to calculate increase / decrease in Open Interest as per new formula suggested.

But the interpretation of OI still would remain the same, Pravin.

Calculation changes has made Open Interest calculation difficult during live mkt.

I feel if there is simple tool to auto generate the OI at combined stock level it will be great help.

If you have any tool which gives combined OI information based on new formula suggested by SEBI then please send.

Maybe check with Sesnibull for this?

Price: Decrease OI: Increase Inference: More trades on the short side

This inference is for a Stock or Futures Contract.

Largely yes, you can use for options too.

Hello Karthik,

When we say , for example, when price increases and OI increases , we say there is long buildup. The \”price increases \” we are referring to , is it increase in premium of particular option strike or the price of the underlying stock itself ?

No, it means the number of positions is increasing.

very well explained. I must say this thing is not available on internet

Happy learning!

Hello,

In your article, you have provided a link with information regarding Intraday OI information . This was the case back in 2016. Please let know if this is true even today ?

\” Updated : 24th Aug 2016 – If you use intra day OI information as a critical input for your trading strategy, then you should read this before you trade.\”

Thanks,

Gourish

Yes, it does. By the way, please keep a track of the sessions happening here – https://varsitylive.zerodha.com/home , we will do one options analysis and OI interpretation.

Thanks Karthik.

Happy learning!

Hii karthik sir,

Good evening.

I\’ve a doubt, since option sellers are considered as more powerful as compared to buyers. So, any change in OI is basically bought by the action of option writers.

In that scenario, If price & OI, both, are increasing, it means more Puts are being sold and if Price & OI, both, decreases then PE sellers are exiting their positions, similar for Call writers.

Am I right ?

Yes. So OI is indicative of both players. Only if both players participate OI changes. We often associate price with OI to draw up a narrative.

Hi Kartik,

Was going through the F&O FII data. Usually when a general index/stock call OI is interpreted, if there is high call OI on a certain strike, it is said that that price is the \”resistance\” and that sellers don\’t expect the price to breach that easily (usually, right?).

But when it comes to interpreting FII call OI, if its increasing, how do we say that FII are \”buying\”/long option and not selling at that price? It could be either right? Or is there specific data from NSE which says that they have actually BOUGHT calls instead of selling them?

Correct me if I\’m wrong. Thanks

Yes, usually resistance points attracts OI. But just because OI is there does not mean there is resistance. To interpret what is happening, you need to look at the price and volume.

So, if I put a short request of 500 options (sell order of 500 options) and the buyers buy only 400 of them, I suppose the open interest would be only 400 and not 500, right?

Thats right, OI will be only to the extent of whatever position is open.

sir mujhe ye Janna hai ki nifty ya kisi index ke mai max Kitne lots buy kar skta hu please sir reply mai apko follow karta hu please sir reply

Mohit, you can buy as many lots as possible. No restriction.

Hi sir As you said above Nse illustration your open interest interpretation As of 4th March 2015, OI on Nifty futures is roughly 2.78 Crores. It means that there are 2.78 crore Long Nifty positions and 2.78 crore Short Nifty positions. The old NSE website is clearly showing open interest in crore or lakh but our new NSE website open interest of indices and stock are given in open interest(contracts) – 26 or 50 or some numbers. so how to understand that exactly how to get open interest in crore or lakh in new NSE website

I\’d suggest you check the Sensibull option chain for this, OI is given in a much better way 🙂

What will be the difference in trading far month contract, i mean standing in july, if i trade in september contract, in the place of july contract, i will get the same profit/loss. i mean if i underlying asset change by 1 point, july contract will change 1 point and september also change by 1 point.

Now the question is why dont people trade with the far month contact, like i got the view that gold will touch 7200(g) from 7000, and i know that it will happen within a week or two. But if my assumption failed i incur a loss within 30 july, but if i trade in sep, i have the time till 30sep.

The liquidity is higher in current month contract Jeesu, which means you can buy and sell these contracts easily without having to deal with impact cost.

Oh if my understanding is right sellers will book losses and close their position and enter into option selling again at higher price with an assumption that they will get profits latter. but when the sellers book losses and close there position they are not forcing the buyers to close their positions right ?

if sellers once book losses and don\’t want to enter selling position again at higher value then how come the OI means Buyers= sellers?

There are always new sellers coming in, you dont have to thing of sellers as a whole. At any point there will be a batch of buyers and sellers in the market.

Hi Karthik,

Assume one day there was some good news and 100 buyers entered the market and market started going up and money started flowing from 100 sellers . So those sellers panicked and started booking losses and closing there contract, will buyers also be forced to close those contract(the 100 buyers don\’t want to close there contract as they are in profitable position) ? Assume there are only 100 buyers and 100 sellers.

But sellers will be happy to sell at higher and higher prices right?

when the very first time person A long 1 contract and person B sell a contract. open interest would be 0, 1 or 2?

That would be 1 contract.

If i combine hedging,OI and FII data then how i know FII is bullish or bearish? How i know FII is hedging or take a neked position?

Thats impossible to figure out 🙂

As per previous chapters the contracts ends on only at expiry. So how OI is down in the example? If some one sell his long position another one is buy that position.

Yes, the OI keeps changing as and when the positions are added and squared off in the market.

Thank you sir mr.karthik rangappa

Happy learning!

Greetings,

I fail to understand 1 thing, from what I know all long or short positions need to be squared off on the day of expiry, so in your example where you showed that at the end the OI was 10, can the OI be anything else than 0 and if so what does this indicate?

Thats right, all open positions are closed upon expiry. Hence OI becomes zero for all contracts upon expiry.

Hi Karthik,

Symbol Date Expiry Open High Low Close LTP Settle Price No. of contracts Turnover * in ₹ Lakhs Open Int Change in OI

NIFTY 20-Feb-24 28-Mar-24 22307 22372.75 22225.4 22359.15 22370 22359.15 14034 156547.42 1436550 77650

NIFTY 21-Feb-24 28-Mar-24 22397.95 22409 22175 22211.8 22185 22211.8 26912 300149.87 1705400 268850

NIFTY 22-Feb-24 28-Mar-24 22218.5 22410 22093.6 22383.2 22410 22383.2 45705 508152.16 2543200 837800

second row volume of 26912 but change in OI is 268850, my understanding is that volume is number of contracts eith bought/sold. oi is number contract yet open in the market. from 1436550 oi, if only 26912 contracts are traded how did oi increase by over 2L. can you please make me understand this

OI is cumulative…so today\’s OI = Y\’day OI plus change in today\’s OI. However, volume is reset to zero at the end of the day and it starts fresh the next day.

Good day, everyone. I observed an interesting scenario in the Nifty market today. Despite higher call open interest (OI) than put OI at the 22100 level, the futures price was holding above 22150. Strikes at 22k and 22050 exhibited more puts than calls. However, the spot price remained below 22100. When the spot price surged above 22100, there was a significant shift in the 22100 OI. How should we interpret this data? Does it yield better insights when analyzing spot or futures? Theoretically, it aligns with futures analysis, but practical observations might suggest otherwise. What\’s the most effective approach to interpret OI data?

Its just that at the start of the market, people continued with the bearishness of March 13th, hence more PUTS. As the markets held and put up some gains, the calls were in favor.

I am zerodha account holder.

Why some times in Option Chain , Change in OI column shows negative values.

Possible it happens when the OI decreases with respect to the previous day.

Hi sir,

I think if on a given day, 400 contracts were bought and 400 were sold, then the volume for the day is 800 and not 400 as you said here.

800, if you try and count it twice. But best to look at volumes only at the transacted level.

I Like introduction part of share and future market,

it very beneficial to me rest topic i feel only making fool to traders and generate breakage income of broker.

Happy learning 🙂

Well written article, lucid explanation with playable examples. If possible, pl guide where OI data are accessible and how can these be made handy for instant use. Thanks for taking pains in writing.

Thanks, Umed. Glad you liked the content. Maybe you can check Sensibull for the OI data.

More confused

You can ask your queries here, will be happy to answer and clear your confusion.

Hi sir,

I have a doubt – when a buyer sell its contract,before the expiry date of the contract, then in the real market this contract will close or rollover to any other ?

It will cease to exist upon the expiry of the contract.

Srikant ji

You rarely disappoint but you complicate a simple thing here you go in circles trying to complicate it as much as you can

If CE of nifty is 10000 for a particular strike what it denotes.

Very Very disappointed had to go through numerous videos to get it right.

If adani ent at 2500 price has 60,000 OI what to conclude ?

Rgds

Mukesh

Not sure whom this message is intend for 🙂

Thanks Karthik sir for your appreciation. it means a lot to me.

Happy learning!

Very very thanks to all the team of Zerodha varsity for providing such an excellent study material. Great job by you all. nice compilation, very nice examples, good study material, proper flow of topics and their details. You have created my interest in studying and understanding share market. Its wonderful to learn from Zerodha varsity.

This topic was so difficult to understand. Thanks for making it so simple and explainable with such a good excel chart. I would like to share the example which i used, to understand this topic.Lets take an example of playing cards. there are two types of cards B (buy) and S (sell) representing a contract and any number of players representing the traders. pick B and S both cards as a pair at a time from cards stock. the frequency with which cards are picked up from cards stock will be represented as volume(one number given for one B and S pair). these B and S cards will be shared by any two players, one each. the moment player makes the pair in his hands (B and S), he drops the pair from his hands and keep that pair cards aside (squared off contracts). so the remaining cards in the hands of players (that will be divided by two for a pair)will be Open Interest. I hope i am not making any mistake here in this example. Thanks again to zerodha team. Thanks to Karthik Sir.

Thanks for the kind words! I\’m glad you liked the content on Varsity.

Your analogy is roughly right. Its in the right direction and also very creative 🙂

Hi, Rangappa,

I have installed your kite app in my i pad. I find it difficult to plot cpr in trading view. Does this app provide this facility?

I\’d suggest you speak to the support desk once for this. They will probably help you with this over phone.

Query related to margin:

I want to Short option of current expiry (weekly/monthly). Of price 5-8rs quantity 1020 (68 lot).

With minimum margin with help of hedge/future.

Request to suggest a way to reduce margin.

Margins are stipulated by the exchanges, no one can change these margins.But you can reduce risk and margin by having counter positions.

Why is NRML order restricted in Currency trading to limited number of lots, even if I\’m doing any debit/ credit strategy.

As the no lots are limited. I cannot use my complete capital. This is very annoying.

How can I get to increase no of lots for my currency trading (Option Strategies) so that I could deploy my capital?

Broker’s have overall OI limits that they can have with the exchange, once we get close to these limits, we limit client wise open positions. Read more.

https://support.zerodha.com/category/trading-and-markets/margins/margin-leverage-and-product-and-order-types/articles/why-am-i-unable-to-place-fresh-nrml-orders-in-some-currency-contracts

So, OI only give the number of contracts but not the contract value right? Coz each contact will consist of various lots?

Price increase and OI increase indicates Trader’s Perception More trades on long side, but actually equal no of trades are created on short side also. Shall I assume market movers view only considered ( As higher probability of being them right).

Market perception is developed when we associate price movement with OI.

can you guide me on stock options where to put stop loss. for ex lets say i buy an SBI 500CE at 11.2 then what should be the criteria to put stop loss ?should this based on option chart or spot chart?

Ravi, do check this once – https://www.youtube.com/watch?v=1kQjXFL4Mfc&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=10

The explanation of what is OI is really confusing in this document. I saw another writeup on OI which is very clear.

Sure, does not matter where you read from, as long as you understand the concept 🙂

Happy learning.

in OI data if Price Decreses and Volume Decreses then \”Bearish trend could probably end, expect reversal\”

Explain above sentense in Simple Words please

Pratham, we have explained that in the chapter itself. Can you give it a quick read?

Hi Karthik, I have a question as I am still confused about OI data. As explained above, OI is no of open contracts. How is the same shown in the option chain. Correct me if I am wrong. This is what I understand till now.

As the option chain shows two OI for a Strike Price (41000) one at Call Option and other at Put Option.

Suppose, OI for 41000 CE is 15.4L and the same for 41000 PE is 14.0L. This means that the open contracts for 41000 CE is 15.4L whereas the open contracts for 41000 PE is 14.0L; and this has nothing to do with Long Position / Short Position etc., as the same is just a number which can be interpreted in conjunction with other numbers.

Thanks & regards.

Thats right. OI just tells you the number of open positions and nothing really about the directional bias.

Dear Mr. Rangappa,

Thank your for the valuable insight on OI. if i have understood correctly, does long unwinding mean that the trend is turning bearish and short covering mean the trend is turning bullish.

Yes, traders unwind long positions when the feel the trend changes.

What is COI by NT ?

And how to calculate it ?

Where did you find this?

Ok oi is all opened contact

Volume is count lot size/ quantity

I\’m confused becouse there shere data

10,000 volume but there lot ya quantity basied say

Volume like show in stock 100k thi 1 Lakh there shers , in stock

But in derivatives lik nifty and future stock ther what depend to say it quality ya lot side

What there pres in lot ya quantity

I\’m undstand of stock it ok volume is in 1 share

But option I\’m don\’t understand it\’s lot ya single equity

Its the same for both options and futures. Lot size only.

Thank You Sir , Got it

Watched the video , great help

Sure, happy learning 🙂

Ok Sir

Regarding Options generally we are speaking , if OI interest increases with price , then it is bullish

My doubt is which Open Interest is considered , CALL Open Interest or PUT Open interest ? Please advise

Price OI Trader’s Perception

Increase Increase More trades on the long side

Decrease Decrease Longs are covering their position, also called long unwinding

Decrease Increase More trades on the short side

Increase Decrease Shorts are covering their position, also called short covering

To make this analysis, you need to look at the ATM option of both CE and PE. Here is a video that will help you put this in perspective – https://www.youtube.com/watch?v=bCRw8YN-4QY&list=PLX2SHiKfualE4o4joBMXM_YHGBKnZSQbs

Sir , We are generally talking ,

If Price increases and Open interest increases it is long build up

If Price Increases and Open interest decreases it is Short Covering

If Price Decreases and Open Interest increases it is Short build up

If Price Decreases and Open Interest decreases it is long Unwinding

We have CALL Open Interest and PUT open Interest in NSE option Chain , actually which Open Interest is considered here ??

Everywhere it generally mentioning as Open Interest ,

Please help me

This is with respect to futures open interest 🙂

What does this means?

Long call OI is increased by 38%

short call OI is increased by 97%

Long put OI is increased by 33% and

Short put OI is increased by 24%

Does it mean 38% increase in long call OI included in 97% increase in short call?

It just means that the number of open positions in the market has either increased or decreased wrt to the previous day.

i have two questions,

1) in the chapter 12- open interest , price vs volume vs traders prediction and price vs OI vs traders predictions , do i have to check volume and OI data on PUT side or CALL side in the option chain data with sensibull.

2) Does this option chain OI or volume is also applicable for future contract (i mean this data is inclusive of future contract) or it is only for option contract, if so then where i can get the OI and volume information for future contract.

1) YOu can check strike-specific call and put OI. I think Sensibull gives this info

2) OI is applicable, there is no option chain of sorts for futures.

Karthik,

Quick question :- If i wanted to trade 480 lots ( 480*50) of Nifty which is 24,000. Should i look for volume or OI during the day ?

Thank you !

Regards,

Raj

Yes, better if you do. But Nifty is fairly liquid enough to absorb 500 lots.

@Karthik

No right ? without creating/changing volume is it possible to change the OI ?

No right ? so volume should be greater than equal to change in OI but not less than

Please provide in detail. Thanks

OI is on a cumulative basis, and gets carried across all trading sessions up until the expiry of the contract. Volume is not. Also, I need to double-check once on how the exchange is reporting volumes, someone mentioned there is a change, not sure though. Maybe you can as well and update here if you get info.

Hi

If you see the volume & OI at 12.10 and 12.11 on 11th Oct 2022, for ICICI Oct Future is as below.

At 12.10 Vol = 35750, OI = 83.3m

At 12.11 Vol = 78375, OI = 82.6m

So how is it possible to reduce the open interest by 833L – 826L = 7L with just 35750 volume.

Please let us know.

Volume and OI are two different things right?

Hi Karthik, one question I really need help with – In the first situation, Neha sells 10 contracts to Arjun and Varun. So the OI is 10. But I\’m wondering from where did Neha get those 10 contracts to sell. I mean from where do those 10 contracts actually initiate?

The exchanges introduce these contracts, Pradeep. Th easiest way to think about this like how a car manufacturer makes a brand-new car and out it up for display. Neha buys the car and immediately sell it to Arjun. The number of cars on road = 1.

Dont take the example in literal sense, its just to help you get the concept 🙂

In option chain of NSE on 28th sept

Oi is well explained.From this we understand that total nos of L and S will be equal. But I have noticed in the option Rain sep 205 PE the total no OI in L is 66 and in S is 9 on close of 27/09/2022. Will you please explain how this is possible and in my opinion both must be of same number.

Where did you see the long and short OI?

How can I got master in oi and become a perfect trader on option please help me for brightfull future .if u help then advance :-happy teacher day 🙏

Thanks, Tarun. We have a ton of content here. Please go through it and let us know if you have any queries.

Sir. Thanks a lot for the good work you are doing here. It helps a lot.

One request… can you please tell me from where can I get the Futures OI Contracts data.

You can check the market depth page of any futures contract you are interested in to get the OI info.

Dear Sir,

Kindly explain OI in value term\’s

I have a question on OI

If Call OI is in \”+\” sign, Is it \”buying Calls\” or \”Selling Calls\”

Example : @17450 Call side it is showing as Total Contract of 12,90,00,000 and underneath to this showing as negetive (2,99,050) and put side showing it total contract as 30,66,300 underneath to this showing as positive 23,17,250.

Siva, +ve indicates that the OI for today has increased compared to y\’day and -ve OI indicates that the OI has decreased wrt to y\’day. There is no buying call OI and selling call OI concept. 1 OI reflects 1 buy and 1 sell.

Sir position square off and position sell is same?

Square off is when you close out on an open position. For example, if you have a long trade, to square off you need to sell.

hai sir

volume vs no of contracts, which is the most important thing to see before to initiate future trade.

Both are equally important. But the main decision to buy or sell should come from either FA or TA.

Hi Karthik,

When an option, say CE, expires OTM without a buyer, you mention it will be settled by exchange. But where is exchange getting the money for settling it without a buyer in place?

It will be from the seller who would have sold that to you, remember if you have a open position not squared off, that means there is a seller who has an open position too.

How can I get data for Order FLow Analysis ?

Check this – https://zerodha.com/varsity/chapter/supplementary-note-the-20-market-depth/

How can we get data during live trading on:

No of new contracts bought or sold by buyers and Sellers?

No of Contracts which has been squared off ?

e.g. when for a particular strike price if OI is decreasing it implies traders are squaring off their positions. Then, how many of them were sellers and how many of them were buyers, from where we can get this data?

Do check Sensibull\’s platform for this, Anupam.

Thank you for the article. I am still new to F&O. Trying to learn how NSE option chain can help to buy or sell PE or CE and at what price. I have a question: Today 4/28/2022 Thursday weekly and monthly expiry day. I saw option data (Banknifty)and understood PCR is 0.69. It was kindly of similar thing last Thursday too. During last week and this week market was negative till Wednesday. Being high OI and PCR around 0.6 I was thinking people who were short would be covering their positions on Thursday and the index banknifty should be positive throughout. That was the case last week however today Banknifty there was gap up opening however later it was in negative and suddenly after midday it started moving positive and ended in green. Is my understanding correct did market ended in green because of short covering due to expiry combination of High OI and Low PCR. Reply would be greatly appreciated.

If it was any other day\’I\’d have debated but since it was an expiry day, then yes, short-covering rallies and long unwinding falls are common. I\’ve seen this happen across many expiries now 🙂

What is the relation between Volume and Open Interest in case of Options and Futures?

If OI is Increasing then volume should increase or decrease and

If OI is Decreasing then volume should increase or decrease

Have explained this in the chapter itself 🙂

OI and volume are two different things.

What signals do we get or what interpretation can be made when

1. Price Increases, Open Interest Increases while Volume Decrease

2. Price Decrease, Open Interest decrease and volume decrease

Hi sir,

Can you explain change in open interest.

Thats what I\’ve tried to explain in this chapter 🙂

Hi Karthik,

Please explain me what happens on weekly expiry day? Because I saw some open interest in nifty option chain in NSE site on a particular expiry day even after market closed. Ideally, on expiry day everyone should close their contracts and that should make the OI to 0. But I did not see that was happening. Am I missing anything here or is there any reason for that?

Thanks!!

Thats because NSE would not have updated the OI change in real-time. But yes, the OI for all contracts goto to 0 post expiry.

What is the meaning of munus (-) before change in open interest.. eg (-47.21%) or -5436.

It means OI has decreased compared to the previous day.

Whether OI indicates total number of effective contracts for a particular expiry month/week. In the given example total number contracts reduced to 10 on Friday from 30 on Thursday. How it is possible before expiry?

Its the total number of open contracts at any given point. The same can increase or decrease any time.

Sir, what is difference between transfer and square-off

cant u/s this 🙂

They are similar in this context. For example, you are long on a trade, when you square off, you are essentially transferring your position to someone else in the market.

Hello, I usually gauge PCR ratio by taking only 1000- 2000 points away from strike (1000/2000 points upside and 1000/200 lower side) depending on the volatility we are facing because market making more than 2000 points move is very short term I believe 99% not possible. In this current high volatile scenario, march 3rd PCR showing 0.7 ( which might make me believe market bottomed out) but 31st march PCR is 2.8 which is too bearish. So how do I interpret this scenario?

Sathvik, you can use PCR as a contrarian indicator as well. Do check the PCR chapter.

Hi Sir,

Total how many Contracts will be available for a single asset.Is this fixed.Like for a company there will be fixed no of shares fixed.Similarly how many contracts will be available based on asset.And who will decide this number.

This is decided by the exchanges, Hari.

Dear Karthik,

Also throw some light on Long unwinding and Short covering – These terms are not coined in the article.

When traders go long, to close their position, it is called long unwinding wherein the traders have to sell the futures. When traders are short, to close the position they have to buy back, and thas is called short covering.

Dear Karthik,

Thanks for the wonderful insights you have been providing.

Can you please clarify this below statement on OI. I got confued a bit.

\”Tuesday: Neha wants to get rid of 8 contracts out of the 10 contracts she holds, which she does\” – On Monday Neha only took a short position of 10 contracts and so she does not own any contracts – Then how on Tuesday, she can get rid of the 8 contracts ? Please throw some light on it.

Thanks

The 10 short were fresh positions which were carried to Tuesday. 8 out of the 10 were closed on Tuesday.

Thanks for making this whole varsity platform… a really helpful and amazing way to learn in-depth concepts of the market.

Loving it.

Happy learning, Ritvik!

Good

So what or how does OI really help as being a part of one\’s trading strategy 🙂?

YOu can look at OI and see where all the action is and take a call basis that. Its just empirical though 🙂

Hello Karthik,

Where can I find the data in regards to change in volumes or OI based on time frames. Let\’s say for 1 hour time frame, what could be the change of volumes or OI from the previous hour.

Thank you.

You can look at the volume indicator, but I don\’t think they give change of OI/Volume data. It gives you the overall number.

Pl guide, which indicator should i use to see Open interest?

No indicator as such. You can keep track of OI itself.

In above example on Wednesday when John sell 7 contracts, Arun buy 3, Varun buy 2 and Neha close her 2 short positions. Now let say market falls and John decides to book profit and at the same time Arun and Varun decides to book losses. So for 5 contracts John will book profit and for the same 5 contract Arun and Varun will book loss. But for the remaining 2 contracts John has to book profit but who will bear the loss. As per the example till Wednesday only 4 persons were in market so how this will be settled.

can it considered short buildup or long build up? like what inference can be drawn from such a scenario? recently i came across continuous strikes of which oi has increased but the price change is 0%.

OI alone does not give much information. You need to combine OI, price, and volume information to get an idea of where the market is heading.

hello karthik,

please explain what does it mean when the oi of a strike has changed but the price has not changed?

It just means the number of open contracts has changed, does not really mean the price should change.

Thanks for your response

Please let me know which one you do follow to select strike from Option chain…OI or Candlestick ..i will also follow same way.

Candlestick.

Hi Karthik,

I have some queries regards the Trend and apply a strategy

How we can identify the trend whether it is Bullish or Bearish or Netural to apply the Strategy, I have read Module 5 and Module 6 from this Zerodha varsity .

Some one says learn Candlestick Chart price action or Option Interest analysis from Option chain and etc .As I am completely new to Market and started Backtest and will continue for a upcoming 3 to 4 months. Please help me on this.

I was quite confusing on this.is it enough to learn the Option Greeks and Option Chain to anlyse the trend and take a decision. I didn\’t know anything apart from the Options.

Thanks

That\’s right, one of the good ways to identify trends is by looking at the candlestick pattern. YOu can overlay a simple moving average as well to figure how the market is moving. I\’d suggest you get comfortable with this before you move to options.

Hello Sir,

In below case, Neha short 10 contracts and out of those 10, she wants to sell 8.

But how will she purchased from John as john doesn\’t have any contracts to sell. Please advise.

—–

Tuesday: Neha wants to get rid of 8 contracts out of the 10 contracts she holds, which she does. John comes into the market and takes on the 8 shorts contracts from her. You must realize that this transaction did not create any new contracts in the market. It was a simple transfer from one person to another. Hence the OI will still stand at 10.

Madan, I guess the same query was asked by someone else in the comments. Can you please check for the explanation?

for eg. if bajfinance 7000 ce has 1,00,000 open contracts, and change in oi is 1,50,000 .

is this data bullish or bearish?

I am confused between that if ce has more open contacts so that data will be considered bullish or bearish

In 12.2 – OI and Volume interpretation, second tabulation about price and Volume show a two options of volume decreasing whereas just above the first tabulation, you\’ve mentioned that \”Hence the volume data always increases on an intra-day basis\”.

Isn\’t it contradictory.

Pankaj, think about it. Volume is 100 at 9:20 AM, as the day progresses and more trades come in, then the intraday volume will only become higher right?

Where is it better to trade intra day in stocks or stock futures ?

Which one is more liquid ?

I\’d suggest stocks because the list of liquid stocks is I guess higher than the list of liquid futures. Besides you have an option to choose no leverage with stocks.

Sir, whether NSE don\’t make it available deliberately,

can we have it from other sources?

Not sure, Roshan. Need to dig around.

Dear Sir,

Where do i get participant wise open interest data separately for Nifty, BankNifty, FinNifty?

I dont think combined data of Index Future (Long)/ Short is useful

Regards

Roshan

Dont think OI is available at the participant level.

Hi Karthik,

Thanks for taking time out and making such informative sessions & replying to the queries/doubts. I have one doubt i.e. what is the difference between Volume and Change in open Interest ?

Thanks

Volume is the number of transaction per day. So volume starts from 0 at the beginning of the day and increases as more trading picks up. Its reset back to zero at the end of the day. OI is the number of open position on any given day (during the expiry).

Hello Sir,

I hope you and your family are doing well.

1) Regarding OI,

If price decreases and OI increases of Call options wouldn\’t that mean Call writers are actively writing options?

If price increases and OI increases of put options wouldn\’t that mean Put writers are actively writing options?

2)

Is it easier to look at option chain from a buyers perspective or sellers perspective??

3) Can you use option interest as support + resistances. Like nifty has a large amount of OI at 16000CE which could mean lots of call writers have initiated positions there. Hence it acts like a resistance?

1) Price decrease and OI increases it implies that there are more open positions building up. So the price decline could be a short term retracement

Similarly for Put OI increase and price increases, could be a short term price pull back.

2) You need to look at it from the market participants perspective, as an indicator of activity

3) To some extent yes, gives you a sense of where the market activity lies and the probable areas which can act as S&R.

By the way, you need to be aware that OI, price, and volumes analysis are all suggestive, not necessary that the market will obey these factors at play.

If derivatives are zero sum game then how come OI tells us about the Traders perception in terms of number of trades on the long/short side because even if OI increases the number of long trades will equal number of short trades

OI is an indicator of the open position, not really the way funds move.

Hello Sir,

I hope you are doing well.

I have just subscribed to sensibull right now.

When I look at the Nifty option chain, the OI is shown in Lakh. For example 17 June Exp OI is 27.6 L for 15800 CE while 20.3 L for 15800 PE.

Are these 27.6 L contracts or 27.6 L shares? Do I need to divide by 75 to get the number of contracts??

I am very confused about this.

These are shares. But do contact Sensibull once to get clarity from them.

To get a clearer insight into the concept, could you please add a chapter to explain the interplay of volume and OI with respect to price change.

Clearly, volume and OI data doesn\’t convey much except maybe indication to liquidity. But in and of themselves, volume and OI don\’t give any conclusive cue. Increase in volume can lead to increase (when new positions are being created) as well as decrease (when old ones are being closed) in OI.

A chapter with illustrative examples will crystalize the understanding.

Sure Deepak. But I thought I\’ve already done that in this chapter 🙂

Hello Sir,

1) In the module you have written that an decrease in price along with decrease in OI results in Long unwinding.

For puts a decrease in price is beneficial. So a decrease in price did happen which in turn increased the atm puts price however its OI decreased. So how would long unwinding happen?

2)How did Delta influence the option premium positively? The spot fell so delta should also decrease the option price. assuming volatility to be constant.

Sapna, as I\’ve stated in the chapter, OI interpretation is empirical. Likely to happen, but there is no guarantee that it will happen, especially in a context where there are multiple factors affecting the option premiums.

So long unwinding means, that traders who held long positions squared off their positions and the number of long contracts open is lower in the market. This will have no impact on how puts move.

Fall in underlying is good for puts. I hope this explanation helps. Do let me know, else I\’ll try and put this in a better way. Thanks.

Hello Sir,

To follow up with my previous question.

In the module you have written that an decrease in price along with decrease in OI results in Long unwinding.

For puts a decrease in price is beneficial. So a decrease in price did happen which in turn increased the atm puts price however its OI decreased. So how would long unwinding happen?

Secondly,

Nifty CE options from 16250 onwards all showed an increase in price despite the spot and VIX falling. Why must this be the case?

Over here the volatility as well as the spot price was decreasing. Shouldn\’t the price reduce instead of increasing??

VIX or volatility is just one factor that influences the premium. There are other factors as well which has an impact on the premium. Delta for example, and the demand supply situation as well.

Hi Karthik

why CALL side OI buildup generally leads to price decrease and PUT side OI buildup generally leads to price increase….???

Maybe because of excess option selling?

Hello Sir,

On 09/06/21

Nifty closed at 15635

1) Nifty 15600 and 15650 PE options had a ~15% decrease in OI despite PE option prices increasing. How can One interpret this?

2) Nifty CE options from 16250 onwards all showed an increase in price despite the spot and VIX falling. Why must this be the case?

1) Increase in price and decrease in PE OI means, traders are closing their open positions in PE

2) While volatility decreased, the delta pulled the prices higher.

Hello Sir,

In your last part you gave a table of OI increase with respect to price.

Is this the price of option strike price/future price with respect to OI or the spot price with respect to OI?

This is the price of the underlying in the spot market.

Dear Sir,

I trust you are well.

I don\’t understand the last part of this chapter

\’If there is an abnormally high OI backed by a rapid increase or decrease in prices then be cautious. This situation simply means that there is a lot of euphoria and leverage being built up in the market. In situations like this, even a small trigger could lead to a lot of panic in the market.\’

Can you explain with an example or something

Think about it as a pressure cooker situation. A small trigger can release the accumulated pressure. In market terms this could be a crash of rapid increase in prices.

Your thoughts on MWPL and OI interaction. Especially when it goes into ban due to price rise/ fall and how it would then impact the cash market volumes ! Needless to say margining norms would also be an important variable in the outcome.

These are common activities occurrence in the market, Rajesh. It does not have any direct impact on the spot market.

I was looking at the bhavcopy on the day of expiry @ https://www1.nseindia.com/products/content/all_daily_reports.htm

There\’s one thing I could not understand. For Index futures (let\’s say NIFTY) the bhavcopy of monthly expiry day will show some Open Interest even in after the series has expired. While ideally it should go to zero, right?

It should, not sure if they update this.

Hi Karthik and team

Few fundamental doubts on Futures –

1. You said that after expiry, a new month’s contract is launched. Presumably this is done by exchange. Now for stocks we know there is a total limit to the free floating stocks in market at any time. Is there any such limit for F&Os ? For e.g say on 1st June 2021, RELIANCE AUG FUT are created by exchanges. Is there a limit on total number of contracts which can be traded ?

2. I am also not clear on the OI example given above. How are the transactions called out under Tuesday any different from transactions of Monday ? On Monday, Arjun and Varun purchased 6 and 4 contracts , while Neha sold 10 so OI became 10. Why wasn’t the Tuesday transaction between Neha and John treated in same way to make OI 18 ?

2.

1) There are restrictions in terms of member wide positions, check this – https://www1.nseindia.com/products/content/derivatives/equities/position_limits.htm

2) I guess someone else had the exact same query, have replied in the comments above. Request you to please check that.

Dear Karthik

As per my knowledge, OI data only reveals immediate support and resistance level.

We have to interpret OI data from the viewpoint of Option Sellers.

Now i want to ask you that, Does OI data clarifies the immediate trend in the market ??

How to place trade based on OI data analysis??

OI does not really indicate S&R in my opinion. Yes, OI is more of a trend indicator. Please check the chapter for more info.

Hi Karthik,

I am always confused by this Open interest.

Suppose Infy price decreases today by 2 percent and at the end of day, open interrest for June future increases. Why does it says , that it is bearish signal?

I mean it can be that , more people are now expecting that it is a good chance to buy the futures since the price will bounce back as may be it is due to downtrend trend of market and not stock specific?

Thanks

Nagendra

Thats right, the interpretation of OI + price and even volume is all empirical. These are expectations of the likely behaviour of prices, no guarantees.

SIR IWANT TO KNOW OI FIGURES

BUYERS,SHORT SELL

SEND ME PROVIDE DATA TO CHECK

Dear Karthik Sir,

Kindly tell me whether Am I right or Wrong in below mentioned chart

Price Volume OI Trader’s Perception

Increase Increase Increase Bullish & More trades on the long side

Increase Decrease Decrease Weak & Short covering

Decrease Increase Increase Bearish, More trades on the short side

Decrease Decrease Decrease Weak & Long unwinding

Increase Increase Decrease Short Covering with Loss

Increase Decrease Increase Case not possible

Decrease Increase Decrease Long Unwinding With Loss

Decrease Decrease Increase Case not Possible

Yes, Lokesh. This is the same that we have discussed in the chapter as well.

Brokers nse aur sebi sab mile hue hai nifty me kabhi bhi koi bada position mat banaiye ye teen teen patti khel rahe hai public ka paisa khaane ka dhandha hai inka

ओपन इंट्रेस्ट जो भी हो मगर क्लाएंट का सौदा एक्षिक्युट् करवाने के बाद मतलब एक लोट खरीद ने के बाद दूसरा लोट आप नहीं ले सकते। आज मैंने १७३ में एक लोट ख़रीदा तब आर्डर एक्षिक्युट् हो गया दुपहर १:३०बजे दलाल ने लिख दिया की सेबी के गाईड लाइन्स के अनुसार आप ये लोट नहीं खरीद सकते मतलब आप १२र् में नहीं खरीद सकते।3 बजे भाव 19 आया मैंने लॉस 3 पॉइंट निचे बुक कर लिया सब ओर्डर के स्क्रीन शॉट मेरे पास है।सेबी का नाम बताकर आप नीचे के भाव पर माल खरीद नहीं सकते मतलब लॉस बुक कर सकते हैं।मेरे साथ फ्रॉड किया गया है ।

Hi Sir,

First of all huge thanks to you for writing Varsity. Huge fan and I have learned a lot from you. So thanks.

I have a question regarding open Interest.

All that I have read, I have formed the opinion that open interest is nothing but the total number of outstanding contracts in the market. Now you said \”an increase in Open interest indicates bullish trends\” but if Open Interest is increasing, does is not mean that the sellers of the same contract is also increasing(because No. of sellers = No. of buyers). Hence an increase or decrease in open interest only indicates liquidity of a script and nothing else?

Thats right, Piyush. OI is simply an indicator of all the open position in the market. Yes, on its own OI does not convey much information hence the need to associate it with both price and volume.

Sir, once the current month expires and next month become current, we have only few data point to analyze OI. How can we connect expired months OI data with current month

Its the general trend that you observe and not the actual numbers itself, so it should not really matter.

Do we have OI charts on zerodha?

Yes, please check this – https://zerodha.com/z-connect/tradezerodha/kite/open-interest-on-kite-charts-and-more

Sir,

To trade in Nifty future, is it enough to analyze the OI data of current month\’s Nifty future? OR do I need to look for next month\’s and far month\’s OI also to get the idea of Nifty direction tomorrow.

Apart from this whether nifty option chain analysis would also be required?

The current month is good enough, Roshan.

Dear Sir,

Where can I find historical data of the option chain?

Warm Regards,

Ashish.

Not sure if this is available, but do check with Sensibull once.

Bank Nifty is below 35500. But the option chain of 35500 PE due for expiry on 08 april 2021 has stikr price as 0 with its open interest as 0 but depth can be seen as 5000. Today is 08 mar

Where are you seeing this, Naresh? As in which platform?

I m very confused that which basis I do trade.. when I trade with price action then it say to difficult that where it take support or resist and as well as OI. Pls give any suggestions and direction to trade in option.

Sunil, I\’d suggest you stick to the regular price action theory to trade. In my opinion, its one of the better techniques to trade.

I want to ask a question, that suppose nifty 14900 Put price is going up and its OI is also going up. But should we see it from seller perspective, that they are thinking nifty will not close below 14900 mark, so they are selling 14900 put options.

Think about it, the price of PUT goes up, so does OI, that means more ppl are buying PUTS (else price wont increase), which implies that traders are berish.

Hello Sir,

How do companies know that from 9:15-9:30 there is short covering/long buildup etc. and so on and so forth.

Aren\’t transactions all secret and not disclosed? For example HDFC pro terminal tells you the market snapshot for F/O every 15 mins whether it is long buildup/short buildup, short covering, long unwinding.

How is this possible?

Jone, these are interpretations drawn based on combining the price and OI data.

Dear Sir,

Thank you for your prompt reply.

How do I interpret the cost of carry? Is it the same as the future pricing as you have mentioned??

How do I know about MWPL?

Can you provide and example?

Josnson, please do check this on MWPL – https://www1.nseindia.com/products/content/derivatives/equities/position_limits.htm

Cost of carry, you can think of it as futures pricing.

Hello Sir,

Can you explain cost of carry and how do we go about it?

Also can you also explain MWPL and the basis of this? Can MWPL ban happen during intra day?

Do F/O stocks have circuit limits like cash/equity?

Think of the cost of carry as the financing cost which gets backed into Futures pricing. MWPL is a rule by the exchanges which talks about how the maximum position a trading member/client can take on. Yes, ban can happen intraday as well. No, there are no circuit limits for F&O.

i need a open interest book

Hi Karthik,

I have often observed that on various business news channels, before the trading day starts, news anchors provide nifty range levels, S&R levels etc with good precision based on the homework they do using previous day bhav copies. Could you please throw some light on what and how do they do these calculations? What exactly they use as data and how?

Best Regards.

PS: Thank you for the wonderful initiative and being regularly active to answer our queries since so many years now 🙂

Pravek, most of them just end up applying the classic support and resistance theory. Check this – https://zerodha.com/varsity/chapter/support-resistance/

I am not clear after searching through many websites, about what is the unit of open interest. the unit of volume is number of shares. but the unit of open interest is number of contracts, now, what is the term \”contract\” meaning here. is it the number of lots, the number of orders, the number of shares or something else? thanx in advance!

Its the number of contracts. 1 contract = 1 lot.

Any update on the OI function update?

Please tell me how to determine maximum number contracts available in nifty future in any expiry.

I\’m not sure how to go about that, Sarvesh.

Hi Karthikji,

I am trading option selling with hedging. For hedging a position I may have to buy a far off call or put option for adjustment of the trade. In such cases I find that Zerodha will not allow traders to buy PE/CE and restricts traders to trade within the allowed range. This has curtailed my selection of strike price for buying, affecting my trades adversly. I thought of moving to custodian – Orbis Financial to avoid this problem. But with that move I will be losing the benefit of investing in stocks. I am in dilemma. Is there any possibility of allowing all the strikes in future or revision of this decision by concerned?

While all other brokers do not have such restrictions as in zerodha or \’trading within a range\’, all other features of Zerodha are EXCELLENT which is the lone reason holding me back into Zerodha. I solicit ur helphul comment and advise. Thank You.

Suresh, unfortunately, this is an issue. Can you please create a ticket? I\’m sure my colleagues will suggest a possible solution to this. Do let me know if this is not sorted. Thanks. https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/articles/trade-all-strikes

If we taken a 1 call or put position, after that if there is no OI until expiry. what will happen to invested money…

Upon expiry, the contract will be settled.

Hi,

May I assume that option writers control(all times or some times) the Stock prices or index levels by any chance bcz as they pump huge money at different Stike prices…Please clarify.

Thq

Rajasekhar

To a large extent yes, but not always. There are times when option writers lose a ton of money.

Hi Karthik ..

Please clarify the below ones…

1. BHARTI AIRTEL Spot price on 8th Jan\’21 was Rs540. Below are the put strikes and oi.

As i understand put side oi\’s are act as support points and we have 9.49L contracts exist at Rs540 strike but what are the oi\’s of 550, 560, 570 strikes. ? How to understand them? And how do we use them?

PUTS

480.00-810,738

490.00-625,638

500.00-1,823,235

510.00-888,480

520.00-1,384,548

530.00-992,136

540.00-949,563

550.00-962,520

560.00-283,203

570.00-79,593

580.00-66,636

2. Is OI data show CE & PE sell(write) Contracts? but not Call buy put buy contracts?

3. Is the oi data suitable for day-trading on stocks?

Thq

Rajasekhar

1) If the contracts exist, then traders trade and create an OI.

2) OI does not differentiate between buy and sell

3) You can use it for both intraday and overnight

I got stuck in Tuesday when Neha buys 8L from John. Not able to understand this.

Is it necessary to consider OI to trade in Futures or can I ignore this?

It may not be necessary to know how OI is calculated, as long as you know how to use it 🙂

Sir plz let me know all scenarios related to price and oi on put side .

Also I wud like to know what happens when on both side the OK and price are decreasing at the same time,what wud be inferred from it

What scenarios are you looking at, Nash?

I got confused in the price and OI table. Didn\’t get it clearly.

Cool, I hope all clear now 🙂

Thanks..I checked..the OI of older website matches the option chain on the older website…however for some reason..the new website shows a different option chain with different OI..( god knows why the two types of option chains on old and new website )

There is a footnote on new website that says OI is in number of contracts..whereas the old website is not clear on the same..

I tried to match the old and new with a lot of PnC but failed😅

I cannot understand why the two different data

I\’m really not sure either 🙂

Hi..i observed the same thing today also…just wanted to confirm are there two websites of NSE??

https://www.nseindia.com/ &

https://www1.nseindia.com/

they both are showing contradictory data…thanks

Both belong to NSE 🙂

Do check the time period, one of them maybe updated while the other may not be (for whatever reason).

Ok..thanks..but is the EOD Bhav copy net of intraday trades..like the OI that may have been created during the day which is settled at eod..is that excluded in Bhav copy?

That would not matter right, what matters is the EOD OI. Intraday will anyway change throughout.

Yes…its live for 10th…Im looking at put as a whole, not individual strikes..what i cannot understand is that the option chain has total put OI of just 4 lac contracts …whereas the data from NSE show a much higher OI ..why is that?

Live data from what I know is not very accurate, Alok. Its best to get this from the EOD Bhav copy.

Hi Karthik, I tried analyzing OI data for options today for 26Nov Expiry. The 9th Nov Bhav copy is showing total put OI as 2.8 cr contracts whereas the participant wise total OI for put is around 17 lacs…and whereas 10th Nov option chain is showing Put OI of only 4 lacs…can you please help me understand the why the difference in the OI ??

Are you taking this data live for 10th? I\’d suggest you take the bhav copy data. Also, are you looking at individual strikes or entire put OI?

Thank you sir.

Very well explained sir.Thank you so much

Good luck, Deepika!

Thank you sir. At any particular time in the market total number of sellers are equal to total number of buyers,irrespective of the direction of market.Then why it is said,bulls are dominant or bears are dominant and so on and we used to take position on that basis.Is price the main determining factor or something else?

True. The dominance depends on who is leading the price and who is a price taker. Suppose in a bullish market, bulls will expect higher and higher prices, and the market pays for it, hence price trends. Likewise in the bear market.

Thank you sir.Sir quantity of trade should be equal in both the directior to maintain equilibrium in OI.

Can u pls share more context?

Thank you sir.When there is price action

(Suppose up trend),shorts cover their position.Simultaneously someone is selling or reverse is also happening in the market.Then why we used to say price up,OI up ,more traders on long side.

Depends on the quantity of the trade right?

Query related to open interest.

Thanks sir for giving the vast knowledge especially on the future and options. Sir I want to know when price decreases and OI decreases resulting in covering of long position.But when the longs are covered,do the short positions are not automatically created.

No, these are positions getting closed or squared off. No new positions are created.

Any plan for adding change in OI (Increase or Decrease) on daily basis in zerodha kite for Future stock

Hi,

on expiry date end of the day, all the contracts should be closed and OI should be zero. Is that correct?

But I observed that, on the expiry date after trading hours also, still OI exists. what does that mean?

For example:- 24th Sept is Expiry date. After trading hours on 24th Sept also, ITC SEPT FUT has OI as 30 million. Can you explain it?

Yes, that\’s correct. The OI will be rest to zero, post markets since all trades would be settled.

If Neha sold all 10 contracts, \”while Neha sells all of those 10 contracts\”; how can Neha want to get rid of 8 contracts out of the 10 contracts she holds in the second instance.

You can choose to sell each contract individually right? So that\’s exactly what Neha has opted to do. Sell 8 out of 10.

If stock OTM put sold @50/- and on expiry day price become Re.2/-but, contract can\’t closed due to illiquidity whether I shall receive the difference of premium (50-2)=48/- ?

In such a case the option will expire worthlessly and hence you get to retain the entire premium of Rs.50.

I am a CA student and this entire module has been very helpful and one of the best available material on the net on futures.The practical connections were also very helpful in understanding the concept.Thanks for this

Happy reading!

Hi,

If OI interest reflect the lot size or lot size *contract quantity?

Lot size * Qty.

We can easily see open interest but how to know whether open interest contracts increase or decrease for particularly strike rate on ciurrent date.

YOu can see the change in OI for this, Sunil.

Hi,

I referred to your link below, where I read your response to Q3 and Q4. In that article, you mention that if OI on Nifty 5,600 calls went up significantly, then it implies a bearish trend/ resistance at 5,600.

https://zerodha.com/z-connect/queries/stock-and-fo-queries/open-interest-maxpain-put-call-ratiopcr

However, in this article, you mention that OI increase does not necessarily mean a bearish trend. Rather, it depends upon the movement in the price (assumed as premium in case of Options). So, if the price (premium) has increased with increase in OI for call option, it rather implies a bullish trend.

Your views in the two articles published by yourself are contradictory. Or, perhaps, I have failed to understand them properly. Pls can you clarify.

Thanks

Gaurav, dont associated the option premium with OI, that will not help. When you look at OI, you need to also look at the price movement in the underlying, without which the analysis would be incomplete. Increase in OI + Increase in price = Bullish. Increase in OI + decrease in price = bearish.

Thanks for replying Karthik. I\’m talking specifically in case of expiry only; and this month expiry to be specific 🙂

If OI increases with increase in volume and price, would that not cause max pain to the call sellers in the expiry? If in spite of increase in underlying and OI, the PCR increases with every day, i.e. there are still lots of call writing in that scrip, shouldn\’t it give an indication that the scrip might show some resistance at those levels?

P.S. I\’m not trying to confuse or mix PCR, Max pain, OI or the logics.. I\’m just trying to find a correlation between all the indicators 🙂

Thanks

Aditya, these 3 concepts i.e. OI, Max Pain, and PCR, these are all very empirical concepts. They are best looked up in silos. No point trying to correlate these theories because there is no underlying science which connects them. Look at the individually, know what they are trying to convey and at best add this is a supplementary study for your analysis.

Hi Karthik,

Thanks for always being regular and prompt with your replies. Really appreciate that.

My query is- generally, what can we say about the stock if there is high OI, especially a high PCR (>+0.5)? If people are rushing to get call options, should we interpret it as people are bullish about the share? Or using the Max Pain theory and PCR, it is the option sellers who are luring people to buy the calls, since we assume sellers are mostly big institutions and their logic is more sound than buyers?

I find the scenario a bit complicated and contradictory. What do you fell?

Yes, in general, if the OI increases along with the increase in volume and price then the expectation is that the stock has turned bullish. Hmm, max pain gives you a perspective of where the expiry is likely, dont use it beyond that 🙂

Sir, what is the equation, relation among these? Kindly let me know.Thank you.

Price increasing- oi decreasing -volume(+/-)-change in oi=?

Price increasing-oi increasing -volume(+/-)- change oi=?

Price decreasing-oi increasing-volume(+/-)-change in oi=?

Price decreasing-oi decreasing-volume(+/-)-change in oi=?

Monu, we have discussed this in the chapter itself right?

hi karthik you told there r two side one buyer and a seller , let us say the selller sells one contract to the buyer ,now the buyer is said to be long and seller said to be short then my question is that why pcr is different it should be same

What matters in PCR is the number of contracts.

Sir,

In NIFTY Option chain, Is 1 Contract is 1Lot (75 Units of Nifty units) ?

Please clarify.

Regards

Jose

Thats right.

Sir

How new contracts are being created and by whom?

I mean retail traders can buy or sell the existing contracts….right?

It is the job of the exchanges to create new contracts.

Thanks a lot for your reply.

But Sir I am not able to comprehend.

How can there be more longs or more shorts if for every trade on long side there is a short seller on other side.

I know I may be asking silly question but please have patience with me.

This question is bothering me from long time. I have read so many books but no clarity.

I need detailed information with example. Can I get your personal mail/ number.

Mine is [email protected]/9136491005

I will be very grateful if you make me understand this concept.

The number of longs and shorts does not matter. For example, let\’s say 10 traders short 1 lot each and 1 trader goes long on 10 lots. This means there are 10 short traders and 1 long trader.

Hello Sir,

I have a doubt .

You have written that future buying and selling is a zero sum game, meaning same number of longs and shorts on opposite side.

But in summary table you have written that if price decrease and open interest increase, then there are more trades on short side.

To me both statement are contradictory.

Can you please make me understand.

Thanks and regards

They are written in two different contexts. Zero-sum is more from a long term perspective, while OI thing is a short term/expiry phenomenon.

Hi Karthik ji … please accept my appreciation and BIG thank You!!! …you are replying everyone\’s query and helping them and guiding, almost without fail ! this is really really very helpful for learners!

We are very much thank full to you 🙂 Great Job ! keep it up ! 🙂

Thanks Atul, happy reading 🙂

Hi Karthik,

I have opened the NSE at 23:07 PM today on 16 July 2020 – the option expiry, i can still see OI on call side of 5,960 Contracts and on put side of 49,492 for the strike price of 10,600 on NIFTY. Why So ? Because ‘after’ the option expiry, everything should be settled/squared-off, and hence OI should come to zero.

Reply –

You can find it in bhav copy as well. Download bhav copy and check open interest of every Thursday option expiry after its expiry, you will not find it to be 0.

Sorry, I meant to say that it will be 0 🙂

why are OI increasing when price is increasing wont the short seller want to close the contracts thus reducing the OI. one party wants to go long in increasing trend but the other part will want to short. what will happen if price is increasing and more people want to go long at the same time less people want to go shirt how will OI be created then.

The thumb rule is that more open position are created, more OI will increase. New positions have to be created. Only then will OI increase.

Hi Karthik,

I have opened the NSE at 23:07 PM today on 16 July 2020 – the option expiry, i can still see OI on call side of 5,960 Contracts and on put side of 49,492 for the strike price of 10,600 on NIFTY. Why So ? Because \’after\’ the option expiry, everything should be settled/squared-off, and hence OI should come to zero.

Can you try looking at it today? I guess that they have not updated the data real-time.

Sir please guide me can I buy banknifty current month and also short same banknifty next month F&O at the same time

Yes, you can. These are two different expires.

HI Karthik,

I have a small doubt in option chain open interest,

1. Yesterday I was tracking Mothersumi CE 117.50 current expiry which was trading at 1.15 Rs but today i cant see anything in the option chain only in that particular strike.

The field those are blanks are Change in OI, volume, IV, LTP and net change but it has a community OI of 63000 (7000 Lot size)

Why is this appearing completely blank, if we might have initiated a position all things remaining equal atleast Theta might have eroded the premium by a meager amount, hence thought of clarifying with you

https://www1.nseindia.com/live_market/dynaContent/live_watch/option_chain/optionKeys.jsp?symbolCode=1385&symbol=MOTHERSUMI&symbol=MOTHERSUMI&instrument=-&date=-&segmentLink=17&symbolCount=2&segmentLink=17

Not sure by the time you see it may change

That means that there is no trading activity in the strike. The contract is illiquid.

Rollover: \’It is to square-off the current position & buying a similar position for next month contract\’. Now, to understand this further – a scenario when it has to be rolled-over then why it has to be done on the day of expiry and why not after a few days:

1. Is it necessary to BUY at the same time as squaring-off to gain any cost-benefit?

2. Can it also be bought it at a later stage (maybe after 2-3 days) when it would be presumed that price would fall within those 2-3 days?

3. Is there any cost-benefit in both stages?

4. In short, what is the difference of buying on the expiry day AND at a later stage except for underlying price?

1) No cost-benefit, it is about the continuity of position

2) Yes, but it is not really called a \’roll-over\’

3) Nope

4) No difference since there is no cost-benefit. Rollover is just about the continuity of holding the position.

Sir, whenever I read these modules for revision I just feel like you are talking to me(which is the quality of great authors)….people may have diff things in life but having a great guru is absolute bliss….I feel that I have gotten a great guru after reading your modules…somehow I landed up at zerodha varsity without going into a pit of other scrap sources….utmost respect from the bottom of my heart sir for writing these modules….have recommended to lots of my friends:-)

Hey Mahesh, thank you so much for the kind words. You made my weekend 🙂

Thanks for your reply sir….it means a lot to me….sir I have completed FA from zerodha written by you….but I want to learn more about valuation….can you please recommend some books?

I\’d suggest you look at the \’Little book on Valuations\’, by Ashwath Dhamodaran.

Sir,read the complete futures and options…thanks for the great knowledge sharing

Sir,iam interested in long term investment then is there a necessity to learn futures and options…just want to know your opinion or just TA and FA sufficient?….plz Ans in a straight forwrd way sir…ur big fan:)

For long term investment, you need to look at FA Mahesh. A bit of TA helps as well. You don\’t really need to know Futures and Options.

Hello,

Please help me in the understanding of below and how to interpret:

– During the morning till 15:20 pm, the future basis difference was -0.30 to -0.50 points between future price and underlying price. Future was trading at a discount… What does it mean?

– However, after 15:21pm, the difference came into positive n became +.30 points till the closing time.

Is any link available to read about this to understand?

1) It means the futures contract was trading at a discount to spot price. Meaning, if the spot price of Infy was 809 and its futures were trading at 806, then the futures is said to be trading at a discount of 3 points