4.1 – A quick recap

With the Tata Consultancy Services (TCS) example in the previous chapter, we got a working knowledge of how Futures trading works. The futures trade example required us to go long on TCS futures as the expectation was that the TCS stock price would increase in due course. Further, we decided to square off the contract the very next day for a profit. However, if you recall, right at the beginning of the example, we posed a fundamental question; let me rephrase and repost the same for your ready reference.

A rational to go long on TCS was built – the thought was that TCS stock price had overreacted to the management’s statement. I expected the stock price to increase in due course of time. A directional view was established, and hence a futures trade was initiated. The question was – anyway, the expectation is that the stock price will go higher, why should one bother about buying futures and why not the stock in the spot market?

In fact, buying futures requires one to enter a digital agreement with the counterparty. Besides, a futures agreement is time-bound, meaning the directional view has to pan out within the specified time period. If it does not pan out within the specified time (as in the expiry), one has to suffer a loss. Contrast this (futures buying) with just buying stock and letting it reside in your DEMAT account. There is no obligation of an agreement or the pressure of time. So why does one really need futures? What makes it so attractive? Why not just buy the stock and stay oblivious to the stock price and the time?

The answers to all these questions lie in the financial leverage inherent in financial derivatives, including futures. As they say, Leverage is a true financial innovation; if used in the right context and spirit, leverage can create wealth. Without much ado, let us explore this angle of futures trading.

4.2 – Leverage in perspective

Leverage is something we use at some point or the other in our lives. We don’t think about it in the way it is supposed to be thought about. We miss seeing through the numbers and therefore never really appreciate the essence of leverage.

Here is a classic example of leverage – many of you may relate to this one.

A friend of mine is a real estate trader; he likes to buy apartments, sites, and buildings, hold them for a while, and then sell them for a later stage. He believes this is better than trading inequities, and I beg to differ – I could go on and on debating this, but maybe some other time.

Anyway, here is a summary of a recent real estate transaction he carried out. In November 2013, Prestige Builders (popular builders in Bangalore) identified land in South Bangalore. They announced a new project – A luxurious apartment complex with state of the art amenities. My friend jumped in and booked a 2 bedroom, hall, and kitchen apartment, expected to come up on the 9th floor for a sum of Rs.10,000,000/-. The project is expected to be completed by mid-2018. Since the apartment was just notified, and no work had started, the potential buyers were only required to pay 10% of the actual buy value. This is pretty much the norm when it comes to buying brand new apartments. The remaining 90% was scheduled to be paid as the construction progressed.

So back in Nov 2013, for an initial cash outlay of Rs.10,00,000/- (10% of 10,000,000/-), my friend was entitled to buy a property worth Rs.10,000,000/-. In fact, the property was so hot; all the 120 apartments were sold out like hot cakes just within 2 months of Prestige Builder announcing the brand new project.

Fast forward to Dec 2014, and my friend had a potential buyer for his apartment. Being a real estate trader, my friend jumped into the opportunity. A quick survey revealed that the area’s property value had appreciated by at least 25% (well, that’s how crazy real estate is in Bangalore). So my friend’s 9th-floor apartment was now valued at Rs.12,500,000/-. My friend and the potential buyer struck a deal and settled on the sale at Rs.12,500,000/-.

Here is a table summarizing the transaction –

| Particulars | Details |

|---|---|

| Initial Value of Apartment | Rs. 10,000,000/- |

| Date of Purchase | November 2013 |

| Initial Cash outlay @ 10% of the apartment value | Rs.10,00,000/- |

| Balance Payment to Builder | Rs.90,00,000/- |

| Appreciation in apartment value | 25% |

| Value of the apartment in Dec 2014 | Rs.12,500,000/- |

| New buyer agrees to pay the balance payment | Rs.90,00,000/- to the builder |

| My friend gets paid | 12,500,000 – 9000000 = Rs.35,00,000/- |

| My friend’s profit on the transaction | Rs.35,00,000/- minus Rs.10,00,000/- = Rs.25,00,000/- |

| Return on investment | 25,00,000 / 10,00,000 = 250% |

Clearly, few things stand out in this transaction.

- My friend was able to participate in a large transaction by paying only 10% of the transaction value.

- To enter into the transaction, my friend had to pay 10% of the actual value (call it the contract value)

- The initial value he pays (10 lakhs) can be considered a token advance, or in terms of ‘Futures Agreement,’ it would be the initial margin deposit.

- A small change in the asset value impacts the return massively.

- This is quite obvious – a 25% increase in asset value resulted in a 250% return on investment.

- A transaction of this type is called a “Leveraged Transaction.”

Do make sure you understand this example thoroughly because this is very similar to a futures trade, as all futures transactions are leveraged. Do keep this example in perspective as we will now move back to the TCS trade.

4.3 – The Leverage

While we looked at the futures trade’s overall structure in the previous chapter, let us now re-work the TCS example with some specific details. For the sake of simplicity, the trade details are as follows: we will assume the opportunity to buy TCS occurs on the 15th of Dec at Rs.2362/- per share. Further, we will assume the opportunity to square off this position occurs on 23rd Dec 2014 at Rs.2519/-. Also, we will assume there is no difference between the spot and futures price.

| Particulars | Details |

|---|---|

| Underlying | TCS Limited |

| Directional View | Bullish |

| Action | Buy |

| Capital available for the trade | Rs.100,000/- |

| Trade Type | Short term |

| Remarks | The expectation is that the stock price will increase over the next few days |

| By Date | 15th Dec 2014 |

| Approximate buy Price | Rs.2362/- per share |

| Sell Date | 23rd Dec 2014 |

| Approximate Sell Price | Rs.2519/- per share |

So with a bullish view on TCS stock price and Rs.100,000/ in hand, we have to decide between the two options at our disposal – Option 1 – Buy TCS stock in the spot market or Option 2 – Buy TCS futures from the Derivatives market. Let us evaluate each option to understand the respective dynamics.

Option 1 – Buy TCS Stock in the spot market

Buying TCS in the spot market requires us to check for the price at which the stock is trading and calculate the number of stocks we can afford to buy (with the capital at our disposal). After buying the stock in the spot market, we have to wait for at least two working days (T+2) to get credited to our DEMAT account. Once the stocks reside in the DEMAT account, we just have to wait for the right opportunity to sell them.

Few salient features of buying the stock in the spot market (delivery based buying) –

- Once we buy the stock (for delivery to DEMAT), we have to wait for at least 2 working days before deciding to sell it. This means even if the very next day, if a good opportunity to sell comes up, we cannot really sell the stock.

- We can buy the stock to the extent of the capital at our disposal. Meaning if our disposable cash is Rs.100,000/- we can only buy to the extent of Rs.100,000/- not beyond this.

- There is no pressure of time – as long as one has the time and patience, one can wait for a really long time before deciding to sell

Specifically, with Rs.100,000/- at our disposal, on 15th Dec 2014, we can buy –

= 100,000 / 2362

~ 42 shares

Now, on 23rd Dec 2014, when TCS is trading at Rs.2519/- we can square off the position for a profit –

= 42 * 2519

= Rs.105,798/-

So Rs.100,000/- invested in TCS on 14th Dec 2014 has now turned into Rs.105,798/- on 23rd Dec 2014, generating Rs.5,798/- in profits. Interesting, let us check the return generated by this trade –

= [5798/100,000] * 100

= 5.79 %

A 5.79% return over 9 days is quite impressive. In fact, a 9-day return of 5.79% when annualized yields about 235%. This is phenomenal!

But how does this contrast with option 2?

Option 2 – Buy TCS Stock in the futures market

Recall in futures market variables are predetermined. For instance, the minimum number of shares (lot size) that needs to be bought in TCS is 125 or in multiples of 125. The lot size multiplied by the futures price gives us the ‘contract value’. We know the futures price is Rs.2362/- per share; hence the contract value is –

= 125 * 2362

= Rs.295,250/-

Does that mean to participate in the futures market, I need Rs.295,250/- in total cash? Not really; Rs. 295,250/- is the contract value; however, to participate in the futures market, one just needs to deposit a margin amount which is a certain % of the contract value. In the case of TCS futures, we need about 14% margin. At 14% margin (14% of Rs.295,250/-), Rs.41,335/- is all we need to enter into a futures agreement. At this stage, you may get the following questions in your mind –

- What about the balance money? i.e Rs.253,915/- ( Rs.295,250/ minus Rs.41,335/-)

- Well, that money is never really paid out.

- What do I mean by ‘never really paid out’?

- We will understand this in greater clarity when we take up the chapter on “Settlement – mark 2 markets.”

- Is 14% fixed for all stocks?

- No, it varies from stock to stock.

So, keeping these few points in perspective, let us explore the futures trade further. The cash available in hand is Rs.100,000/-. However, the cash requirement in terms of margin amount is just Rs. Rs.41,335/-.

This means instead of 1 lot, maybe we can buy 2 lots of TCS futures. With 2 lots of TCS futures, the number of shares would be 250 (125 * 2) – at the cost of Rs.82,670/- as the margin requirement. After committing Rs.82,670/- as margin amount for 2 lots, we would still be left with Rs.17,330/- in cash. But we cannot really do anything with this money; hence it is best left untouched.

Now here is how the TCS futures equation stacks up –

Lot Size – 125

No of lots – 2

Futures Buy price – Rs. 2362/-

Futures Contract Value at the time of buying = Lot size *number of lots* Futures Buy Price

= 125 * 2 * Rs. 2362/-

= Rs. 590,500/-

Margin Amount – Rs.82,670/-

Futures Sell price = Rs.2519/-

Futures Contract Value at the time of selling = 125 * 2 * 2519

= Rs.629,750/-

This translates to a profit of Rs. 39,250/-!

Can you see the difference? A move from 2361 to 2519 generated a profit of Rs.5,798/- in the spot market, but the same move generated Rs’ profit. 39,250/-. Let us see how juicy this looks in terms of % return.

Remember our investment for the futures trade is Rs.82,670/-, hence the return has to be calculated keeping this as the base –

[39,250 / 82,670]*100

Well, this translates to a whopping 47% over 9 days! Contrast that with 5.79% in the spot market. For the sake of annualizing, this translates to an annual return of 1925 % …. With this, hopefully, I should have convinced you why short term traders prefer transactions in the Futures market as opposed to spot market transactions.

Futures offer something more than a plain vanilla spot market transaction. Thanks to the existence of ‘Margins’, you require a much lesser amount to enter into a relatively large transaction. If your directional view is right, your profits can be huge.

We can take positions much bigger than the capital available; this is called “Leverage”. Leverage is a double-edged sword. If used in the right spirit and knowledge, leverage can create wealth; if not, it can destroy wealth.

Before we proceed further, let us just summarize the contrast between the spot and futures market in the following table –

| Particular | Spot Market | Futures Markets |

|---|---|---|

| Capital Available | Rs.100,000/- | Rs.100,000/- |

| By Date | 15th Dec 2014 | 15th Dec 2014 |

| Buy Price | Rs.2362 per share | Rs.2362 per share |

| Qty | 100,000 / 2362 = 42 shares | Depends on Lot size |

| Lot Size | Not Applicable | 125 |

| Margin | Not Applicable | 14% |

| Contract value per lot | Not Applicable | 125 * 2362 = 295,250/- |

| Margin Deposit per lot | Not Applicable | 14% * 295,250 = 41,335/- |

| How many lots can be bought | Not Applicable | 100,000/41,335= 2.4 or 2 Lots |

| Margin Deposit | Not Applicable | 41,335 * 2 = 82,670/- |

| No of shares bought | 42 (as calculated above) | 125 * 2 = 250 |

| Buy Value (Contract Value) | 42 * 2362 = 100,000/- | 2 * 125 * 2362 = 590,500/- |

| Sell Date | 23rd Dec 2014 | 23rd Dec 2014 |

| No of days trade was live | 9 days | 9 days |

| Sell Price | Rs.2519/- per share | Rs.2519/- per share |

| Sell Value | 42 * 2519 = 105,798 | 250 * 2519 = 629,750/- |

| Profit earned | 105798 – 100000 = Rs.5798/- | 629750 – 590500 = Rs.39,250/- |

| Absolute Return for 9 days | 5798 / 100,000 = 5.79 % | 39250 / 82670 = 47% |

| % Return annualized | 235% | 1925% |

All through, we have discussed rewards of transacting in futures, but what about the risk involved? What if the directional view does not pan out as expected? To understand both the sides of a futures trade, we need to understand how much money we stand to make (or lose) based on the underlying movement. This is called the “Futures Payoff”.

4.4 – Leverage Calculation

Usually, when we talk about leverage, the common questions one gets asked is – “How many times leverage are you exposed to?” The higher the leverage, the higher is the risk, and the higher is the profit potential.

Calculating leverage is quite easy –

Leverage = [Contract Value/Margin]. Hence for TCS trade the leverage is

= [295,250/41,335]

= 7.14, which is read as 7.14 times or simply as a ratio – 1: 7.14.

This means every Rs.1/- in the trading account can buy upto Rs.7.14/- worth of TCS. This is a very manageable ratio. However, if the leverage increases, then the risk also increases. Allow me to explain.

At 7.14 times leverage, TCS has to fall by 14% for one to lose all the margin amount; this can be calculated as –

1 / Leverage

= 1/ 7.14

= 14%

Now for a moment, assume the margin requirement was just Rs.7000/- instead of Rs.41,335/-. In this case, the leverage would be –

= 295,250 / 7000

= 42.17 times

This is clearly is a very high leverage ratio. One will lose all his capital if TCS falls by –

1/41.17

= 2.3%.

So, the higher the leverage, the higher is the risk. When leverage is high, only a small move in the underlying is required to wipe out the margin deposit.

Alternatively, at roughly 42 times leverage, you just need a 2.3% move in the underlying to double your money.☺

I personally don’t like to over-leverage. I stick to trades where the leverage is about 1:10 or about 1:12, not beyond this.

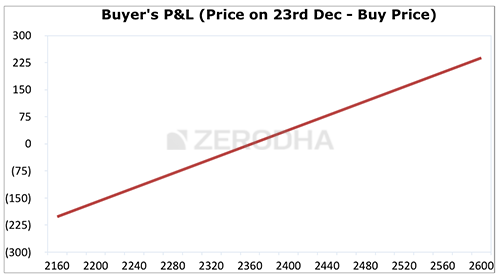

4.5 – The Futures payoff

Imagine this – when I bought TCS futures, the expectation was that TCS stock price would go higher, and therefore, I would financially benefit from the futures transaction. But what if instead of going up, TCS stock price went down? I would obviously make a loss. Think about it after initiating a futures trade. At every price point, I would either stand to make a profit or loss. The payoff structure of a futures transaction simply highlights the extent to which I either make a profit or loss at various possible price points.

To understand the payoff structure better, let us build one for the TCS trade. Remember it is a long trade initiated at Rs.2362/- on 16th of Dec. After initiating the trade, by 23rd Dec, the price of TCS can go anywhere. Like I mentioned, at every price point, I will either make a profit or a loss. Hence while building the structure’s pay, I will assume various possible price point situations that can pan out by 23rd Dec, and I will analyze the P&L situation at each of these possibilities. In fact, the table below does the same –

| Possible Price on 23rd Dec | Buyer P&L (Price on 23rd Dec – Buy Price) |

|---|---|

| 2160 | (202) |

| 2180 | (182) |

| 2200 | (162) |

| 2220 | (142) |

| 2240 | (122) |

| 2260 | (102) |

| 2280 | (82) |

| 2300 | (62) |

| 2320 | (42) |

| 2340 | (22) |

| 2360 | (2) |

| 2380 | 18 |

| 2400 | 38 |

| 2420 | 58 |

| 2440 | 78 |

| 2460 | 98 |

| 2480 | 118 |

| 2500 | 138 |

| 2520 | 158 |

| 2540 | 178 |

| 2560 | 198 |

| 2580 | 218 |

| 2600 | 238 |

This is the way you need to read this table – considering you are a buyer at Rs.2362/-, what would be the P&L by 23rd Dec assuming TCS is trading is Rs.2160/-. As the table suggests, you would make a loss of Rs.202/-per share (2362 – 2160).

Likewise, what would be your P&L if TCS is trading at 2600? Well, as the table suggest, you would make a profit of Rs.238/- per share (2600 – 2362). So on and so forth.

In fact, if you recollect from the previous chapter, we stated that if the buyer is making Rs. X/- as profit, then the seller is suffering a loss to the extent of Rs. X/-. So assuming 23rd Dec TCS is Trading at 2600, the buyer makes a profit of Rs.238/- per share, and the seller would be making a loss of Rs.238/- per share, provided that the seller has shorted the share at Rs.2362/-.

Another way to look at this is that the money is being transferred from the seller’s pocket to the buyer’s pocket. It is just a transfer of money and not a creation of money!

There is a difference between the transfer of money and creation of money. Money is generated when the value is created. For example, you have bought TCS shares from a long term perspective, TCS as a business does well, profits and margins improve. Obviously, you as a shareholder will benefit from under-appreciation in the share price. This is money creation or wealth generation. If you contrast this with Futures, money is not being created but moving from one pocket to another.

Precisely for this reasons, Futures (rather financial derivatives in general) is called a “Zero Sum Game”.

Further, let us now plot a graph of the possible price on 23rd December versus the buyers P&L. This is also called the “Payoff Structure”.

As you can see, any price above the buy price (2362) results in a profit and any price below the buy price results in a loss. Since the trade involved purchasing 2 lots of futures (250 shares), a 1 point positive movement (from 2362 to 2363) results in a gain of Rs.250. Likewise, a 1 point negative movement (from 2362 to 2361) results in a loss of Rs.250. Clearly, there is a sense of proportionality here. The proportionality comes from the fact that the money made by the buyer is the loss suffered by the seller (provided they have bought/short the same price), and vice versa.

Most importantly, because the P&L is a smooth straight line, it is said that the futures are a “Linear Payoff Instrument”.

Key takeaways from this chapter

- Leverage plays a key role in futures trading.

- Margins allow us to deposit a small amount of money and take exposure to a large value transaction.

- Margins charged is usually a % of the contract value.

- Spot market transactions are not leveraged; we can transact to the extent of our capital.

- Under leverage, a small change in the underlying results in a massive impact on the P&L

- The profits made by the buyer is equivalent to the loss made by the seller and vice versa.

- The higher the leverage, the higher is the risk and, therefore, the higher the chance of making money.

- Futures Instrument simply allows one to transfer money from one pocket to another. Hence it is called a “Zero Sum Game.”

- The payoff structure of a futures instrument is linear.

Hi Karthik Sir,

Actually I have learnt about the options first and then came to futures. I have some doubts which i have mentioned one by one.

1. The margins you have mentioned of 41335/-, is same as the premium for the options we use to buy or sell. Right?

2. Sir even if we buy 1 lot of futures with 41335/- then should we need to maintain a margin with the broker seperately like maintaining for the Short call and short put options with the broker?

3. Here in the futures, the delta of the option will remain 1 right? because 1 point increase will result in Rs.1 increase (250 in the TCS example case).

4. Will the retailers have the similar type of strategies like spreads in the futures also?

5. the 14% of the margin amount of the total value is predetermined in the contract Right? If so then the margin will vary from stock to stock. Then TCS will give a normal Leveraged futures contract of 14% (so risk is ok) and other stock will give leverage of 25% (where risk will be high).

Sir Please correct me if I am wrong.

1) Yes, margins are similar.

2) Yes, margin is applicable for both buying and selling of futures

3) Yes, delta of futures is 1 constant

4) Yes, thats right. Most traders have similar strategies

5) Yes, margins are dependent of the contract value, hence there could be variations in margins.

In rollover we have one benifit that is buying price.

How is that a benefit?

once the margin become zero due to one downward in spot price the trade will countinue till expiry or it get closed automatically on same day?

Without the required margins, the position gets closed out.

What happens if the loss due to price change in stock price is higher than the margin amount?

Then the amount will be recovered from you by the broker. But chances of this happening is unlikely.

IT HAS BEEN EXPLAIMED IN A VERY SIMPLE WAY.

Glad you liked it. Happy learning 🙂

Very nicely explained Sir.Thanks a lot.

Thanks!

Hi Karthik,

Just wanted to know why gold guinea futures contract required me to pay 58000 rupees ( whole contract value ) while requiring a margin of 5000 rupees , the concept of leverage seems more blurred now

Please explain me this

Thanks for your knowledgeable information to understand the leverages properly.

Happy learning, Ramesh!

I don\’t think this is a zero sum game – it is a negative sum game. You have all the transaction costs, the cost of the tech/data/education to really have a chance to make money on any given trade.

Yeah true, these are the other costs involved.

Hello Sir, One very critical doubt about futures.

I believe if someone has gained some profit, then someone also has to loss the same amount of money(like here 39,250 was that amount). So in the TCS futures example please explain how and by taking what position the other person is booking loss.

Thanks in advance.

If you are long and make a profit, then it implies the trader who is short on the same instrument is making a loss. Vice versa if you are short.

Here it is said that in spot market there is no lot size but that is opposite of what I observe.whenver I try to buy in spot market there also that have lot size minimum number of stock to buy. Can you clarify.

Ayush, there is no lot size when it comes to spot market. You can buy to whatever extent you want, even 1 share 🙂

Hi Sir,

Thank you so much for such a great content.

So total profit of the buyer at the end of DEC 23rd will be

114(Sum of P/L of buyer) x 250(2 lots) = 28500 right?

Yes, thats right.

A question; what is the benefit of new buyer buying apartment from your friend? I mean couldnt he simply get the apartment directly from builder!

Assumption is that nothing else for sale.

Excellent content. Thanks to the Team.

Happy learning!

A 5.79% return over 9 days is quite impressive. In fact, a 9-day return of 5.79% when annualized yields about 235%. This is phenomenal!

Hi,

Pls consider this example for INTRADAY trading with leverage :

Total funds in Demat : 30,000

Cost per share : 558

No of shares bought: 150 ( leveraging 53000 ) – Total Cost : 83700

If I sell this share during an intraday session at suppose : 560

Trade Value – 84000.

What would be my profit value selling at ₹560 per share if calculated on leverage ?.

Eager for your response

It would be Buy value (8400) minus sell value (83700) = 300 or

Sell price (560) minus buy price (558) multiplied by number of shares i.e. 2*150 = 300.

Sir in the option 1 section, you\’ve written it takes T+2 days for the stock to reflect in your DEMAT account and it also takes 2 days to sell (basically you cannot sell it before 2 days of buying the stock)….hasn\’t this situation changed? SEBI has initiated the T+1 system, please correct me if I\’m wrong.

Yes, we have updated this in Module 1. Settlement is T+1 now.

it is so wonderful to learn with zerodha varsity. Thanks to all the team members. Karthik sir, i am putting some formulas as i have understood. please correct me where i am wrong. Thanks for your valuable time and thanks again such a good study material.

Leverage is in terms of times or ratio and not percentage

Margin can be in terms of percentage or value

Leverage = contract size value/ margin value

Margin value = contract value / Leverage

Margin % = Margin value / Contract value x 100

Margin % = 100/Leverage

Leverage = 100/Margin % (if margin is in terms of percentage)

Hence, Leverage = 100/(Margin value x 100/contract value)

Hence, Leverage = contract value / Margin value

% Margin loss = % loss of contract x Leverage

% Margin loss = % loss of contract x 100/margin%

1. if % loss of contract = 100/leverage then whole margin will wipe out

2. if % loss of contract = margin % then whole margin will wipe out

similarly we can calculate % margin profit

Thanks

So margin value is given by the exchange and brokers, you cant really calculate that. So you need to keep that in perspective. For P&L, you need to consider what profit or loss you\’ve made and divide that over the margin you\’ve deposited.

\”Another way to look at this is that the money is being transferred from the seller’s pocket to the buyer’s pocket. It is just a transfer of money and not a creation of money!

There is a difference between the transfer of money and creation of money. Money is generated when the value is created. For example, you have bought TCS shares from a long term perspective, TCS as a business does well, profits and margins improve. Obviously, you as a shareholder will benefit from under-appreciation in the share price. This is money creation or wealth generation. If you contrast this with Futures, money is not being created but moving from one pocket to another.\”

THIS IS THE STATEMENT FROM ABOVE CHAPTER. Futures is a money movement. VEry nicely explained. Thanks a lot for such a wonderful explaination. Futures is a fight between two mindsets- equivalent to playing a chess or any game with an opponent.

Thanks and I\’m really glad you liked the content, Dr.Agarwal. Happy learning 🙂

Hello,

As I am new, I may have understood something wrong. Kindly clarify a doubt for me. Here, you assumed the futures price is 2362. But I thought that was the spot price and the future price is ~2374. Am I missing something?

Spot and future prices are different right?

SECTION 4.4

Stock has to fall by x %age for one to lose all the margin amount; this can be calculated as –

1 / Leverage

So it works out, margin %age one has to deposit for a contract is the same %age a stock has to fall for one to lose all the margin amount.

Nice Karthik, thanks bro for detailed chapters

Happy learning, Deepak!

Can i sell a future contract on the same day if i have bought it on that day on overnight basis ?

Yes, you can.

Can we square off oru position easily while trading in futures?

Yes, you can as long as there is liquidity in market.

cant find a better explanation about leverage than this.

Happy learning, Anto!

Wow. That\’s an amazing insight. Thanks for the response Karthik.

So I am safe to play around with the trade as long as the price of derivative doesn\’t fall beyond 10% incase of 10X margin right ? But it will eventually settle on expiry date at whatever is the spot price.

Let me know if my thinking is correct below:

In the case of perpetuals(in crypto), there is no expiry. So does it mean for relatively stable bluechip assets where price fluctuations are not drastic, can I hold and trade as much as time I can ?

Leverages like 10x can wipe out the accounts quickly if the risk is not managed well 🙂

Also, it depends on how you define drastic. Technically, you can keep rolling over and hold the futures as well tp perpetuity.

Hey Anand – Great tutorials here. I have a noob query here.

Irrespective of the underlying stock price , will the price fluctuation always remains in tune with the amount of leverage ?

For example, \”if I take a leverage of say 10X on any given futures, will it ALWAYS take 10% fall in the price of futures to get my margin money to zero\” ?

Yup, thats right.

Very good simple explanation

Happy learning 🙂

lucid explanation. easy to understand. thanks.

Happy learning 🙂

Its a great great explanation Karthik.

I have one question here, If I buy 1 lot of TCS and paying 41335(margin amount) and contract value is 295250 and holding this position till expiry or carry forward for next month so any interest have to pay on contract amount or any of the amount.

There is no interest Abhishek. But remember, the contract will expire on the last Thursday of the month and you cant hold beyond that.

Hi, Can you please explain how 1/leverage gives us the percentage drop for entire margin to be wiped out? Rest all the part is crisp and clear. thanks!

When you do 1/leverage, you get the percentage representing the min movement required to double your money or lose the entire capital. 1/leverage is just the math.

So when should one consider buying stocks instead of futures?

When you don\’t want to use leverage.

Futures are daily settled in India? Futures on stocks are cash settled?

Yes, that is called mark to market, Anil. Stock futures are physically settled upon expiry.

Hi Karthik, quick question, it\’s been giving me a hard time understanding –

Let\’s say we do intraday in futures of a stock and we are long. Is the price that appear on the chart and the tradable price the same? I have this question because futures is a derived price and the chart shows that. But if we want to trade in that, we need to look at the market depth, so will the market depth also have prices that is close to what is been shown on the chart. Will there be a situation where I am long and the futures price (as per the chart) has gone up but the market depth prices (bid/offer) has not changed much? I hope my question is clear, might be a weird question but nobody to ask this to other than you Mr Karthik.

Yes Pradeep, for example, if you are trading Infy futures, then look at Infy futures chart. The chart displays the last traded price. Bid and ask is just on the dept and wont impact the chart.

Hello, Karthick I can understand your teaching It\’s in a very simple way. By the way, my age is 22 I would like to take some risks till my age of 30. So, my question to you is How can we relate this future Market to real estate. Bot are different.

Both are different, Ram. But I used the concept to explain leverage 🙂

Leverage is a double-edged sword. If used in the right spirit and knowledge, leverage can create wealth; if not, it can destroy wealth. – Beautiful lines.

Happy learning 🙂

Isnt the leverage only 3.57 times in the TCS eg i.e. 295,250/82670, as we have bought 2 lots?

Its not the number of lots. Its the amount you pay for a lot versus the contract size.

sir as per my understanding: leverage is optional …if we take leverage 1) in case of loss it deducts money from margin money. 2)if in case only take a trade on margin money in case of loss it gets to deduct from margin money itself…..am I right sir?

No. In futures and options, leverage is not optional. It is inherent to the instrument.

is it compulsory to take leverage? for futures

Yes, if you don\’t wish then you can transact in Equity without any leverage.

Sir u mentioned that \” if tcs falls by 14% , then we will loose all the margin amount\”. Does this mean that suppose if i bought tcs today and the expiry is suppose 25 days from now and If tcs falls by 14% say tomorrow, then will the margin amount be debited from my account or will it simply show a loss of the margin amount? I mean will the contract remain or not?

Thats right. Remember, there is a mark to market for options and daily P&L gets adjusted.

Could you please explain more about the \”zero-sum game\”?

In derivatives, money just transfers hands from one party to another. No new wealth is created as such. Hence its called a zero-sum game.

ANOTHER QUERY WHAT IF LOSSES EXCEEDS OUR MARGIN DEPOSITED AMOUNT ?

Unlikely, but if yes, delayed payment charges will be applicable in that case.

sir how can there be same buy price in spot market and future market in case of tcs example ?

The futures price is pretty close to the spot price, Yash. May not be the exact same price.

Hiii there , I want to trade in future in indices, so I have a few querries regarding , the risk I want to ask the risk of the trade is equal to the moment of the stock ( which is against your direction) * lot size … Or is there any this else which is needed to be noticed , thaanks!

There are several risks Animesh – price moving against your trade, volatility increasing, liquidity risk.

Hi Karthik,

I started late in stock market because of lack of exposure initially and was in search of good structured training course to understand basic terminology, jargons. I found training sessions designed by your team simple, structured that helped me immensely. I hope that thousands of retail investors will benefit from such training courses.

Thanks

Piyush

Thanks for the kind words and I\’m glad that you found the content easy to follow and understand 🙂

Happy learning!

Hi Karthik. Thanks for an excellent explanation…I want to know, after entering into a futures contract, if at the time of contract expiry date I\’m in profit (or loss) then what exactly happens? In case of profit, do I need to pay the remaining contract value & get the shares in my Demat account? or do I get only the profit portion amount transferred in my account?

Please do check this chapter, Jay – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement/

What is the difference between obtaining leverage through pledging of holdings and the leverage in margin trading in equity intraday? I mean if we do intraday in equity cash segment we can get leverage by pledging our holdings and also by maintaining the required margin, so what is the difference between them? And what exactly happens if my losses go beyond the required margin and my fund shows a huge negative balance in case of volatility and my broker was unable to square off the position? In this case when will my position get square off? Will it get square off after market closes? And what consequences will i have to face? And what consequences do my broker face?

Ankush, they both are different forms of leverage, but the end of the day it\’s still leverage. If losses goes beyond margins, the broker will cut your position and make good for losses.

Excellently simplified.

Happy learning 🙂

Thanks for the reply. Keep up the good work of educating and transforming people into traders.

Happy learning 🙂

Earlier, while trading in F&O segment, we were given huge leverage. Some of the brokers were giving 50 times leverage or even more. But while trading in the Equity segment, we will not get this much leverage. This was the top lucrative reason for traders seeking to trade in F&O segment. But now, after SEBI\’s new margin rules, the leverage has been restricted to 5 times in Equity as well as F&O segment. That\’s why I said F&O has lost its edge over Equities trading from a leverage perspective. Don\’t you think ? Also, with high leverage comes high reward ( and high risk too ). Now that the high leverage is cut down, what would be the top factors that would still pull traders towards trading in F&O. Your views pls.

5 times leverage is still good enough for active traders. Like you mentioned, high leverage comes with a very high risk, something that\’s not worth taking for bulk majority of traders.

Mr.Karthik, thank you for educating the readers through these topics. So, with the new margin rules in force, Equity F&O trading has lost its edge over Equities trading (from a leverage perspective). Is that right ? Kindly clarify.

Not really, with the new margin policy, the leverage has been reduced to just 5x, but leverage still exists.

Really made easy to understand with the help of examples. Kudos to you sir!! Thank you.

Happy learning, Swapnil.

I didn\’t understand the formula 1/leverage. How did we arrive at this formula and conclusion that if 1/leverage is 14% then it means if TCS stocks fall by 14% we will lose our margin amount. How ?

Reduce the stock price by 14%, and multiply the new stock price by lot size, which gives you the loss. Which will be equal to the margin you\’ve put for the trade.

Hello Karthik

Is there a way I could do dummy trades(paper trades) to learn futures and options.

Thanks also for varsity i lacked knowledge in many areas this has helped me hugely please keep up the good work!

Regards

Bharath

Dummy trades or paper trades may not help. Instead, I\’d suggest you try the USD INR futures, to try out trades and experience it, margins are lower and so is the risk.

Hello Sir. I\’m a CA final student. Your varsity teachings have helped me a lot for my CA final SFM preparation. Thanks a lot!

Hi Karthik. Can you please tell me that what will happen if the price goes really down and i lose all my margin and then the price goes up. Wil I be in the trade???

BTW great content…

Aman, the broker would have closed your position in case of short margin. Unfortunately, there is nothing much that can be done in such situations.

Hi Karthik! Post 1 Sep 2021, since new SEBI rules are applicable, do futures still have the benefit of margin or are margins completely eliminated now? If so, then returns would be the same whether we buy equity or futures right? Only benefit in case of buying futures is that you can sell it the next day itself. Please correct me if I\’m wrong. Thanks!

Margins still exist, it is just that the leverage on these instruments is restricted to 5 times across all brokers.

Sir can you explain how margin percentage calculated. In the case of TCS it was 14%. How can we calculate for others.

That\’s based on the SPAN methodology, which is known to the exchanges.

Hello Sir,

I have a doubt about the following section. As far i see, i need not wait for T+2 days to sell a stock after buying ..right? Buying on T+2 days is applicable for only T2T category stocks..isn\’t it?

Option 1 – Buy TCS Stock in the spot market

Buying TCS in the spot market requires us to check for the price at which the stock is trading and calculate the number of stocks we can afford to buy (with the capital at our disposal). After buying the stock in the spot market, we have to wait for at least two working days (T+2) to get credited to our DEMAT account. Once the stocks reside in the DEMAT account, we just have to wait for the right opportunity to sell them.

Thats right Murali. But since TCS does not really belong to the T2T category, you can buy and sell at share even before the T+2 settlement. This is called the Buy today, sell tomorrow transaction.

Thankyou for this wonderful initiative. I came across this resource totally by chance yet this has the best explanation in stock market! I m reading this in 2021 and I guess nothing has changed

These are core concepts, Sara. This will remain the same no matter when you read 🙂

Hello sir,

as you explained that (What about the balance money? i.e Rs.253,915/- ( Rs.295,250/ minus Rs.41,335/-)

Well, that money is never really paid out.)

what if the trade is moving in our favor and we want to benefit from it by exercising the full contract value(as the profit that we earned is for only fraction of percentage of total contract value)

how will it be settled in the trading account if we want to do that?

Futures has market to market settlement, Abhishek. I\’ve explained that later in the module.

What if the losses are so great that the margin amount is not enough? Is the margin amount the maximum loss you can have in a futures trade ?

Thats possible too. In such cases the the broker will have to recover from you by invoicing you.

With the Sebi new margin rule, we will not be able to use leverage. ? correct me if I am wrong. &

and also how will it effect the market. ?

Leverage is there but restricted to 5 times, Chandan.

I dont understand/agree that ideally delivery based stock buying is wealth generation (in sense of stock market procedure). Assuming neither new investors are coming up nor existing investors are bringing more money from salary/bank deposits/clients, equity investment is too just zero sum game like FnO in stock market operation sense. (Of course buying low and selling high will make investor feel appreciation of wealth which is in fact just transfer of collective pooled money from.others to him).

Investment just feels as wealth creations because new money is continuously poured in market, otherwise it\’s also a zero sum game. After IPO, it just works on demand and supply mechanism.

Please someone clarify.

Not really. How would you factor in business growth and improvement in margins?

Can the following scenario pan out:

Bid price of scrip A is trending at Rs. 80 and below. Mr. X with very deep pockets shorts A by selling 2 million shares (presume 2% of outstanding) at limit price of Rs. 70, just for the fun of it. To enjoy the ensuing chaos.

1. If between 80 to 70, there are 4 million orders, and till 75 there are two million orders, then after execution of his shorting order, where will LTV be set at?

2. Two million buy orders will be executed by priority on best price basis, i.e. even if someone bid 76, will he get price of 70?

3. There must be other sellers besides him who may have offered/ asked their prices, now, will the software match prices and execute those orders or will it go with best price criteria?

No Deepak, such vast price differences wont occur since there are things like execution range etc in place.

Sir

On an unrelated note, where can I find the list of all the buyers who bought a particular stock on a particular day? With a view to gauge the involvement of big players.

Today, Bank of Maharashtra shares rose 13%. And it rose 10-11% within 7 minutes at one time. This, to me, seems indication of big player participation.

Secondly, I could not find any rationale, logic or cause for such sudden spike. I know trends, the essence of short term movement, may not have any fundamental logic and may be, and more often than not are, driven by sentiments and trader psychology. Still such sudden movements can\’t be predicted any mathematical formulation. It was something out of the blue. I just couldn\’t find what it was. What was the cause? Could you venture a reasoned guess what it was?

As an aside, I really do admire your unflinchingly sincerity. You must be in a job that you love. Many haven\’t been that fortunate.

One more question below pls.

That list is not available, Deepak. The reason for the price move could be for any reason. Speculation is the biggest reason 🙂

Yup, I love doing this and I\’m glad I get to do it 🙂

you a kannadiga bro?

Howdu bro. Pakka Kannada boy.

Hi sir

Let\’s suppose the future price of bank nifty is 35649 and market lot is 25 which makes the contract value as

35649*25= 891225

Now basis on the margin calculator the total margin ( spam+exposure) = 351129

Now to calculate the leverage i.e contract value/ margin

891225/351129= 2.538

1/2.538*100= 39.4%

Is this means that i\’ll not be loosing a money until and unless bank nifty falls till 39% ?

No no, that\’s the leverage. Please re-read this topic again.

2nd question :

\”and the seller would be making a loss of Rs.238/- per share, provided that the seller has shorted the share at Rs.2362/-\”

Why would the seller of future will short short the share? Two txn in same direction?

Besides, if shorting is allowed only intra day, how will he be able to practically do it?

Am I making any sense here?

Its not, Deepak. The context is to explain that the buyer and seller have equal P&L but opposite..as in buyer makes a profit of 10, the seller makes a loss of -10.

Sir,

Let\’s say, for argument\’s sake, TCS share were to fall by 42% at expiry, however unlikely it may be. Broker will demand triple the margin money? Or is there a mechanism to avoid such scenarios? What if I don\’t have money to honor the transaction? What recourses are there?

Your position will be squared off if you don\’t have the necessary margins, Deepak.

Hi…

If I\’m paying only 14% margin, how can take the profit amount Rs.39250 fully ?? Out of the total profit only 14% would be my share.

No, your profit or loss is entitled completely to you.

Hello Sir,

Lets say I have a current bullish view on Infy.

I am not sure when exactly my target will get achieved by I think sometime in a few days-few weeks,

So should I buy a Future and protect it with an ATM put option or should I buy an ATM call option.

Both has the nearly identical pay-out graph, buying an ATM is requires little more premium and does not require margin compared to the Synthetic Call position? Time decay would affect both option contracts appropriately but the protection put for future reduces hence it can cause problems for me. The pro of the synthetic call is that I don\’t have to pick a strike price so I don\’t have to worry about when my target gets achieved.

For an index, I have an choice to pick weekly or monthly option contracts.

Which strike price should one choose for protecting the future?

Assuming there is a lot of time to expiry, and that you are outrightly bullish, then you can maybe buy a slightly OTM Call option. You can buy futures as well, but that the only issue is that you will have to deal with the daily mark to market. You can protect the Fut with a slightly OTM PUT.

Hi,

Will it be right if I say that Futures Trading is nothing but an Intraday share Trading where the quantity is in lot and the day is an extended period till the expirty date?

Well yes, except for intraday bit 🙂

hello sir if we use leverage then we have to pay the levrage after profit????

Pay the leverage means?

SIR, IF I USED THE LEVERAGE IN EQUITY STOCK AND I HAVE DID A PROFIT SO I HAVE TO PAY ALL THE LEVERAGE……..AND WHAT IF I DID LOSS.

Sorry, dint really get that. Can you please share more context? Thanks.

First of all thanks Karthik for your lucid explanation of all concepts.

My query is – if an underlying has low volatility, the margin requirement will be lesser. Since margin required is a smaller percentage of contract value, leverage will be higher for taking a trade in a low volatility stock. But since leverage is high it will be a riskier trade.

Now isn\’t it counterintuitive that taking a futures trade in an underlying with LOW VOLATILITY have HIGHER RISK ?

If it\’s low volatility, then the chances of it moving drastically against your position is low. So that\’s an important thing to note 🙂

Sir,

This is regarding term ‘Short Covering’ when underlying is index (Nifty or BankNifty).

We know that value of Nifty is calculated from 50 Top MCap companies’ Spot Price. Then by trading Nifty Futures or Options, how can it impact value of Nifty to go up?

Hope my question is clear to you.

Thanks in advance

Its tough, but if the futures go up, then for short period it may influence stock buying which in turn pushes the index up, this is not sustainable though.

Don\’t mislead people by showing them only the rosy side of the story .At least tell them in detail how much they will lose if the share price falls. \”Never use leverage on volatile stocks guys you will lose all your money they will only show the positive side if the story\”. I have been in stock market for less than 2 months and still know the disadvantages of leverage and you are teaching people about leverage and still cant mention any of its downside.

Please take the trouble of reading the entire module.

What if the loss exceeds the margin? how will it be paid out then

The position will be cut by the broker in case of insufficient margins.

Can future options be taken as normal trade and get the share in demat account if decided for the same and paid out the full price at or before expiry

Yes, happens on a physical delivery basis.

Great…

Thanks Karthik

Good luck!

Hi Karthik,

How to find margin of any specific future. As margin is base for leverage calculation and leverage is base for which future to trade in…

TIA

Abhijeet

You can check the margins here – https://zerodha.com/margin-calculator/SPAN/

Sir,

Does brokerage includes the interest charged on leverage provided or any other specific payment would deduct during fix time intervals?

Specially for MIS orders.

No, the brokerage does not include that. Btw, there is no additional cost for providing leverage.

No, if any other charges, it will be levied separately and shown to you in your ledger.

you took spot price and future price here in TCS\’s example same , ideally this may not be case

Why not?

As all explanations was really great .My question is Does Zerodha Charge For Leverage that we take for intraday…. If we r in profit we book the profit n if in loss we book the loss right?….

All the leverage traded value has to be return which is huge amount after taking Leverage….

And 1 more question is Can we do buy or sell same stock in intraday daily…. Is it allowed?

No, there is no separate charge for leverage. Yes, you can daily trade stocks, but ensure you know what you are doing, else the risk of capital is quite high.

Hi Karthik,

First off, Hats Off to Zerodha on its phenomenal journey since its inception. I came across Varsity about 2-3 years back and it is has been a wonderful learning experience so far.

A fundamental query on margin trades, I may have missed it incase discussed in the comments.

To engage in a futures trade, one has to pay only the margin amount. Why is the balance amount of the contract value never paid out?

Thanks in advance,

Varun

Because Futures is a leveraged product. However, if you do hold the futures closer (stocks) to expiry, then you will be required to deposit full contract value as margins.

How are the gains in futures treated for income tax purposes.

Please do check the module on Markets and Taxation.

Do one has to wait to sell future contact as done in share T+2 days

Sorry, I did not see to understand your query. You can sell a Futures contract instantly, no need to wait.

Hi

A bit late to the party here. In the calculation for leverage ratio above, which margin value is being used? viz NRML/MIS/CO?…all are different and would throw up significantly different results, can you plz clarify?

Also, you\’ve mentioned an overleveraged position as being > 10-12. Is this with NRML margin option or MIS/CO?

Thanks!

Depends on which product you are using. Use NRML margin if you wish to carry forward the trade, MIS if it is an intraday trade. Btw, all margins will be normalized with the new peak margin, check this – https://zerodha.com/z-connect/zerodha/bulletin-latest-at-zerodha/peak-margin-intraday-leverages-2nd-order-effects-dec-1st-2020

Suppose I have 1 lakh in demat account.If I buy 1000 shares of infy in MIS EQ…. Actual Buy value will be more right?…. So in this case company gives us Leverage….

Suppose if we r in loss, only the loss money wl be deducted right?….

And Suppose if we r in Profit? We get back amt invested n the profits after 2 days?….here only brokerage wl be deducted with tax n wat charges we wl get then?….

or have to give actual money of 1000 shares ka more than 10lakh has to be paid…. no right?…. if we r in profit? What company actually gets ?

That\’s right, Tufel. Brokerage is applicable on this though.

Which segments do you prefer for yourself and recommend others to trade in? Cash, Futures or Options? (Assuming the investor has in depth knowledge of all segments)

I\’d prefer you swing trade with cash.

Sir.I want intraday trading by leverage amount about 10lakh.then i get 1000/profit.then what charges taken by broker house

Please do check this Vikas – https://zerodha.com/charges

What are charges taken by zerodha on leverage amount for intraday

Please check this – https://zerodha.com/charge

Beautiful representation and easy to understand

Happy learning!

Question 1: Can we short sell Futures like we used to short sell stocks?

Question 2: You mentioned that we can sell stocks only after having them on our deemat account, buy I saw that we can sell stocks on T+1 day before taking the delivery. Have the rules changed? And can you explain the current changes in rules of margin given by SEBI?

I would like to here your debate with your friend regarding which is better, equity or real estate. 😄

By the way, you out performed on this Karthik sir, thank you!

1) Yes, you can

2) No, this was always the case. These trades are called \’Buy today, sell t\’row\’or the BTST trades

Equity for me 🙂

Hi sir..

personally don’t like to over leverage, I stick to trades where the leverage is about 1 :10 or about 1:12, not beyond this.

Sir could you please explain this with example, how you would leverage

Anyway, the leverage bit is changing in India, so this won\’t matter going forward, check this – https://zerodha.com/z-connect/zerodha/bulletin-latest-at-zerodha/peak-margin-intraday-leverages-2nd-order-effects-dec-1st-2020

I know this is nit picky but this paragraph needs the word \’to\’ added to it after the word \’Thanks\’. I\’m Just making an already amazing article even more amazing 🙂

Futures offer something more than a plain vanilla spot market transaction. Thanks \’to\’ the existence of ‘Margins’ you require a much lesser amount to enter into a relatively large transaction. If you’re directional view is right, your profits can be really large.

Leverage = [Contract Value/Margin]. Hence for TCS trade the leverage is

= [295,250/41,335]

= 7.14, which is read as 7.14 times or simply as a ratio – 1: 7.14.

sir here the ratio should have been 7.14:1 (i.e. to say that for every 1 rs invested we can buy 7.14rs of TCS futures) according to my understanding of maths.

may be am wrong; would be great if you could relook at it and help me understand where exactly the catch is.

thanks in advance!

Ah yes, Aarti. Means to say that every 1 Rupee of your own can be leveraged 7.14 times.

Firstly sir, i would like to take a moment to wish you a very happy new year! Hope you have a successful year ahead and keep adding many more such enriching modules to Varsity;)

Secondly, I had a doubt in the following concept:

\”Now for a moment assume the margin requirement was just Rs.7000/- instead of Rs.41,335/-. In this case, the leverage would be

= 295,250 / 7000

= 42.17 times\”

Now, my doubt is that technically the leverage is Rs 295250-7000=Rs288250 so then why are we not taking 288250/7000=41.17times leverage. Because what is really happening is this: 41.17×7000+7000=295250. so then the leverage clearly becomes 41.17times the margin and not 42.17times.

Your thoughts on this sir?

Thanks in advance!

Thanks for the kind words, Aarti. Wishing you the same!

The standard practises when talking about leverage is to use the contract value in the numerator. Also, 41 or 42 or 43 times does not really matter, as long as you get a sense of how large the leverage is 🙂

Hi Karthik & Team,

As usual explanation is top notch and to the point with perfect analogy. Some questions regarding P&L for futures.

Suppose we purchased 1 LOT of TCS considering bullish or bearish directional view, so LOT purchased today – 15 Nov and Expiry is 30 Nov.

1. I\’m not planning to square off position till expiry then will profit and loss settle on daily basis?

2. What if loss is greater than Margin amount blocked by broker?

3. My understanding is that Margin amount is one time, post that even though we incur losses should we have to keep funds in our account? What if we don\’t keep? Will it be squared off and how will broker recover the amount if some person incurred heavy losses.

There are many question heads, please answer separately 🙂

Glad you liked the content, Shashank.

1) Yes, this is called the M2M process, more on that here – https://zerodha.com/varsity/chapter/margin-m2m/

2) As the loss approaches the margin blocked the

3) Margins are dynamic, keeps varying based on the movement in the underlying. Yes, it will be squared off if the losses are higher than the margin blocked.

Great to learn in such amazing and easy way sir. Thanx alot

Are u on any social media platforms?

I\’m on Twitter – @karthikrangappa

You\’re one of the greatest Mr. Karthik sir. I could understand how hard your research is, because you deliver your knowledge is very simple and easy to understand. Tell me where you are, i need an autograph from you sir 😁

Haha, thanks for the kind words 🙂

Don\’t think I\’m autograph worthy lol 🙂

Hello Kartik Sir,

All I want to say is that all the modules on the varsity app, written by you are absolute gold. The way it was been explained can be understood by anyone. Thank you for that

I have one more question. The Children\’s books which zerodha is providing will be useful for which age bracket of children?

Thanks for the kind words, Tanmay. The children\’s book is good for kids above 7 years.

Hello Karthik,

Great Explanation. Thank you. One question btw. I understood that the underlying is never transacted when the futures is squared off. What is the purpose of futures\’ concept existence apart from facilitating traders to make/loose money ?

Hi Karthik, I started learning Futures. My doubt is I could see from Kite,

Spot: INFY 1200 shares, CO/BO Margin = ₹76,796.28

MIS Margin = ₹1,27,993.80

Futures: INFY OCT FUT * 1200, CO/BO Margin = ₹57,569.11

MIS Margin = ₹1,01,623.50

For intraday trading, there is not much difference in Spot and Futures in-terms of leverage, right. If yes, shall I choose to do spot trading itself. Or do we have any other benefits in Futures. Thanks.

There is a 30% difference right? But yeah, if its intraday, you can use Spot itself.

If I long on a position, keeping a bullish view, and someone short a position, keeping the bearish view. But on the second day of buying my prediction is going true and the price of futures is going up, but the other party settles the trade. Then what will happen even though I don\’t want the settle.

The party squaring off will sell it another buyer, and you contract will exist in the system.

\”The proportionality comes from the fact that the money made by the buyer is the loss suffered by the seller (provided they have bought/short the same price), and vice versa.\”

You\’ve mentioned this thing in the bracket a multiple times; just need some more clarity on this as I\’m a beginner. I mean my doubt is if I buy at a certain price from the seller, doesn\’t the seller has to sell it necessarily at the same price?

A trade occurs only when the buyer and seller agree to a price right?

Sir / Madam,

I am new trading, I doing F & O – Banking related, Example – BANKNIFTY

Q 1: what is CE or PE. Option or Future, Example – BANKNIFTY 10th SEP 23000 CE, BANKNIFTY 10th SEP 23000 PE,

Q 2: zerodha giving levorage or margin for options. If yes, interest charged by zerodha to me yearly.

Q3: If zerodha not giving levorage or margin then whether I pay first and then buy CE and PE Option. Yes/No

Thanks in advance

1) I\’d suggest you read the module on options for this – https://zerodha.com/varsity/module/option-theory/

2) No interest charges

3) Yes, to buy you need to have the amount required for premium.

In 4.3 LEVERAGE –

1. You mentioned no leverage for spot market but in 2020 we have MIS option which facilitate leverage for intraday Trading. eg:upto 12x for DR Reddy\’s share.

2. And also we can trade with in a day without waiting for T+2days.

So, is futures an extension like MIS for intraday?

And Is it only the Leverage the difference between spot and futures trade?

Can you share the context where I\’ve mentioned no leverage?

Sir ,I wud like to know zerodha feature in this scenario as this trade I have done in fyers. Today when banknifty futures is trading at 22290 ,I sold 50 qty (CO Market order) sepetmber contract with stop loss at 22340 i.e 50 pts .When bank nifty futures is trading at 22130 ,I tried to change my stop loss to 22190 to block 100 pts as profit .But the fyers did not allow me to do so. This happende to me twice in fyers. Fyers support told max s.l I can chnage to the initial sell price i.e in my case is 22290. If I trade in zerodha (I have an account) whether this problem will be there ? What are the options to train stop loss smoothly.

This should not happen with us as the SL is based on LTP, Vinay.

The person/team created this content,hatsoff to them. Easy to understand and well explained with example\’s. Great Job

Happy learning, Toby!

Dear Sir,

I am a very begginer in stock market, please tell me from where I can learn to get profit from it at affordable price.

Queries:

1. Is leverage only work in futures not in Intraday

2. What is Margin and where and how can it be used.

1) Both futures and intraday

2) Margin is the initial deposit for the trade. Suggest you read through this chapter.

Excellent job, I\’m loving Varsity and indebted to the simplicity in which you explained. Just a minor points that some things like BTST point mentioned in the comment has not been updated yet. And overall there a very minor grammatical errors. If you could ask for a proof read, it would be great.

Thank you for Varsity!!!

Thanks, Samar. Will take a look at this 🙂

By simple Math -Now, I am getting 235%, sir

I confused myself with the CAGR formula,

Thanks for the clarification,Sir

Good luck!

Hello Sir,

Can you Explain me, How was the Annualaized Return % (235 %) calculated for a Absolute Return (9 days) which has a value 5.79% ?

While i tried to do it through the formula i am getting a totally different result (880%).

Simple math – if for 9 days its 5.79%, how much is it for 365 days?

Thanks like always Karthik!!

Hi Karthik,

Hope you are safe and doing good!!

I need your opinion of the characteristics which a trader needs to have in order to become a successful trader. I guess that it doesn\’t need much fundamental knowledge since the trade is done from short-term perspective. Just having a directional view would make all the difference. So what are the skills I can learn to get directional insights about any underlying asset and any other thing which could help me to be a better trader? Please advise.

Not sure but I think you are more in fundamental (long-term investing) than future trading and if so, then please share the reason for this preference. Thanks a lot!!

I was trading quite a bit, both futures and options Pradeep. Now the company policy mandates us not to trade 🙂

Apart from being knowledgable, things that immensely help are attributes such as – resilience to events, patience, and discipline. In my view, these are highly underrated factors.

So if I want to trade future with 2X leverage in zerodha what is the step by step process … sorry I couldn’t find the relevant article ie why posting it here .. i will be grateful if you could direct me the process

The leverage is kind of baked into the contract. So for example, margins to trade 1 lot of Nifty is Rs.1.5L. The contract size of Nifty futures is roughly 8.25L. In other words you get to trade something worth 8.25L for only 1.5L, which means to say there is a leverage of 5.5 times.

Hi

When an investor says he has 2X Leverage or 3X leverage what does that mean

You have Rs.100, your broker allows you to but for Rs.300, its 2x leverage. At Rs.400, its 3x leverage.

How will the new leverage regulations impact F&O trading? Please elaborate with some examples

No impact on F&O. This is wrt to Equity intraday.

I think all sections have been lucidly explained. Zerodha is doing a great service by bringing financial literacy to the masses.

Happy learning 🙂

Sir how do I calculate profit nd loss taking leverage into accoun while doing papertrade?? Zeroda has recently removed the leverage calculator so it will be helpful if u tell us the math!!!

And sir does leverage multiply the profit/loss or the investment ???

Leverage allows you to trade for amount far greater than you have as capital. Hence your P&L gets magnified. For example, I have 1000 with me, the stock is trading at 100, I can buy 10 shares without leverage. If I get leverages, I can buy for say for 1500, hence 15 shares.

P&L math is simple – the difference between buying and sell price, multiply with quantity.

Ticket no 20200716224044

I have now got the response that

Buy average for F&O positions is calculated on a pure FIFO (First In First Out) basis. For example, let’s consider the following trades:

Date Symbol Trade Type Quantity Rate

06/08/2018 NIFTY18AUGFUT

Buy 75 11000

07/08/2018 NIFTY18AUGFUT

Buy 75 11100

07/08/2018

NIFTY18AUGFUT

Sell 75 11050

In the above case, the buy trade executed on 07/08/2018 will be the open quantity at the end of the day hence, the average price of the open quantity on 08/08/2018 will be Rs. 11100. Irrespective of the product type used (NRML/MIS) for the trades on 07/08/2018, this logic does not change.

If this is the case then, what is the difference between MIS and NRML option, If we choose NRML we can carry the position overnight

However during the day if we want to take advantage of the price fluctuations for the same futures and use MIS, it adversely affects our overnight position

I have learnt it that horrible way and loosing money

Can you please advise or write a nice example on varsity highlighting this calculations and FAQs/do\’s and donts for futures MIS and NRML orders

I have a real example from yesterday.

If Zerodha can call me, i can show the discrepancy

It would be great if you can arrange for a call back as the support call center disconnects after being on wait for 15 minutes and for the ticket i dont see a response yet

If you have raised a ticket, please do share the ticket number. Thanks.

Cannot get through support call

It goes on wait forever

no luck with the support ticket as well

I think there is a genuine problem with use-case i mentioned

It has happened to me again yesterday

I would like to demo this issue with Zerodha and get it sorted.

Might help others as well

Getting this checked.

I dont think this works, i have faced an issue/discrepancy in the past, i can provide the details via email

Can we discuss this further ? Infact i lost 40k due to this

I have provided my email in the comment, please feel free to ping me

Request you to please call our support for this.

I have an short sell open NRML position in Aurp futures, purchased on July 1st currently in am in negative profit due to price movement.

Question

While i have NRML position for AURO and wait for the price to drop for me to gain

Can i initiate a MIS position on the same futures AURO ?

Can you please explain with an example

Yes, you can.

Hi,

I would like to know if we can expect full fledged knowledge series on FnO like Hedging, Adjustments, Strategies etc..

Awaiting reply.

Regards,

Dilip

We have a ton of content here already, Dililp. Is there anything, in particular, you are looking for?

Thanks for the article explaining the leveraged gains and losses in detail.

1. Would request a change in the article though – to bring out the risks in leveraged trades better . And critically important for investor education.

The exact sections i would like to refer to are Sections 4.4 and 4.5 . The losses table in Section 4.5 are harder to understand than the gains table at 4.4 . To be precise – Section 4.5 deals with the results (losses) expressed in \”loss per share\” , whereas in section 4.4 the results (gains) are displayed in percentage terms. Reason being that the retail trader, like me, would like to know his the extent of loss as well as the loss percentage for a directional bet gone wrong. what happens when the spot price drops 5% or 10% in a futures contract (using the same example in 4.4 ) Can i loose more than just the margin money ? (yes as per your reply to other comments).

2. are both losses and gains unlimited in either direction ?

Amit, thanks for the suggestion. I will try and see what best I can do about this. Yes, in a futures contract both are theoretically unlimited.

Sir, you said that if one buys a stock he has to wait 2 days to take the delivery and in order to sell whenever its the right time. Also that he cannot sell the stocks anytime before. But when I place CNC orders and the stock happen to make a big jump the next day or the day after, I can easily square off my position and exit. Why is it so?

That\’s right, this is called a BTST trade. Do check this – https://zerodha.com/z-connect/queries/stock-and-fo-queries/btstatst-buyacquire-today-sell-tomorrow

Very good articles! Thank you! In subsection 4.4 I think it should be 1/42.17 = 2.3%…There is a typo (41.17).

Ah, thanks for pointing that out, Prasad.

Still have a little doubt about margin.

Lets say I have 5000rs as fund balance. And I want to Short Axis bank which is currently at 400 rs. Margin calculator shows I can buy 12 shares as CNC and 62 as MIS (5x Multiplier). When I try to buy it in the app as MIS, It shows 400 x 12 taking 4800 as margin.

How do I buy 5x as shown in the calcluator?

YEs, that\’s could be the margin, but the number of shares can be 62. Please go with the calculator.

can you please explain the difference between money creation and transfer with examples…?

Have explained that in this module at various points, Akash 🙂

hey Karthik,

1) How does Zerodha finance the remaining amount of our future contract (we only pay some percentage of the amount we should pay as margin)? Like someone has to pay right? Do banks pay the remaining? And do we have to pay any interest?

2) And what happens if my future margin(SPAN + Exposure) gets exhausted overnight? Say something huge happened to the underlying investment instrument? Of course, I\’ll get a margin call. But will I have to pay anything extra, even if I don\’t want to continue my position?

1) The client is obligated to pay the broker dues, failing which a legal case can ensue

2) Yes, as long as you have an open position you are obligated

Hello Sir!

First off thanks for these brilliant lessons. Really make it easy to understand these concepts.

One doubt I had was regarding your mention about Futures being a “Zero Sum Game”. As you said in the spot market one can hold shares for a long time and benefit off of the performance of the company. But the performance of the company is what causes someone else to buy the trade at a higher value which explains the higher cost of the share. In both the cases, some other party has to buy at a higher value to increase the price of the trade be it futures or spot market.

Then how are they different? Isn’t derivatives just a virtual wrapper over the existing spot market?

Sorry if this question feels repetitive but did not want to have any doubt in my fundamentals about the markets.

Thanks in advance 🙂

What differentiates is the fact that if the company tends to do well, even the guy who has bought at higher levels can create wealth. When I say \’create wealth\’, I\’m talking about new wealth being generated. In derivatives, money from one person\’s pocket moves to another. No new wealth is created. Hence the zero-sum tag.

Were do we find the expiry for Comodities.

For futures its the last thursday of every month.Is it the same for Comodity,Crude oil?

For each commodity, expiry is different, not fixed like equity.

Sir

I have following query:

In the above TCS Futures example, suppose the BUYER of TCS Futures does the deal at Rs. 2362 but the SELLER of TCS Futures as SHORTED the TCS Futures at say Rs. 2800. In this case, even if TCS stock price goes up say to Rs. 2600, both the BUYER of TCS Futures and SELLER of TCS Futures are making profit. Who is making loss in this case?

Not sure if I understand your query completely, but here is the thing, in a futures mkts the buyer\’s loss is the seller\’s profit and vice versa.

Hello,

If i have money 20000+ in my account, in there i have sold 1 lot Zinc mini @155 on date 3/10/2020 hold for next 3 days and next day (3/11/2020) Silvermic bought 1 lot @ 46480 Position. but 1st day (3/10/2020) charge 193 @ as Net obligation. on next day (3/11/2020) 983 rs charged for Net obligation.

Can you please explain how it was charged.

Veeresh, I\’d suggest you speak to our customer helpdesk for this. They will explain all the charges for you.

When you say \”Once we buy the stock (for delivery to DEMAT) we have to wait for at least 2 working days before we can decide to sell it. \”. So we can\’t sell on next day..??

Technically you can buy today and sell tomorrow (BTST)…however, ensure the stock is eligible for BTST trades.

Hello Karthik,

Thanks for writing good article. I have couple of questions.

1). As we buy in equity we become as % involved in particular company. So what about when we buy Futures.. ?

2). As in equity its transferred to DMAT account.. what\’s in Future contact?

3). Can we sell equity in next trading day.. as of today in Feb 2020.

1) Equity shares exist for long, but futures contract has an expiry. So no ownership when you buy futures

2) Held in the trading account

3) Yes, you can do buy today sell t\’row trades.

Hi Karthik,

Lucid explanation as always. Kudos to you for making this an exciting journey (I have also read Stock Market Basics, TA & FA on Varsity).

PS: Varsity app is really useful. It was really helpful as our understanding about the concepts could be measured by taking quizzes. But it has only four chapters. Can you please update the app on iOS? It would be awesome to read concepts on the go instead of opening a browser on the phone. Thanks

Thanks for the kind words 🙂

The app is available on iOS, the same version as the andriod. We are making a few changes though.

Hello sir

What if i buy two lots worth margin of 40,000 each, and the total shares bought amount to about 5 lakhs.

If the share price rises i benefit even if i dont have 5 lakh rupees.( As i had to pay the margin amount ). But what if the price falls? Will i incur loss on the initial amt of 5 lakhs? And if yes. Isnt futures too risky??

Yes, the futures P&L works linearly. All leveraged products are risky 🙂

Hey! Amazingly written. I\’ve a query

Let\’s say for example I\’ve a bought a KOTAKBANK NOV 1600 CE NFO (NRML) on 8th Nov 2019 Lot Size [email protected]

If KOTAKBANK hits beyond 1600 on expiry date which will be 28th Nov 2019. If I hold this NRML on expiry date and KOTAKBANK closes at 1650 what will be my profits? and if in case contract expires what will be my loss? I will be losing premium amount which I paid?

Also, do I have to deposit full amount for eg 1650 (Kotak Share Price in Spot Market) @ 800 = 13,20,000 when the contract matures. Also, is there a limit like I\’ve to buy the actual lot after T+7 days

Sorry for so many questions 🙂 I\’m new here. Thank you for your help once again 🙂

At 1650, the long 1600CE will be profitable by Rs.50. There is no loss here 🙂

There is physical settlement now, check this on how a long call option will be settled – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

Hlw sir,

I am new in this field.

I have some queries.