1.1 – Overview

The Futures market is an integral part of the Financial Derivatives world. ‘Derivatives’, as they are called, is a security whose value is derived from another financial entity referred to as an ‘Underlying Asset’. The underlying asset can be anything a stock, bond, commodity or currency. The financial derivatives have been around for a long time now. The earliest reference to the application of derivatives in India dates back to 320 BC in ‘Kautilya’s Arthashastra’. It is believed that in the ancient Arthashastra (study of Economics) script, Kautilya described the pricing mechanism of the standing crops ready to be harvested at some point in the future. Apparently, he used this method to pay the farmers much in advance, thereby structuring a true ‘forwards contract’.

Given the similarities between the forwards and the futures market, I think the best possible way to introduce the futures market is by first understanding the ‘Forwards market’. The Understanding of Forwards Market would lay a strong foundation for learning the Futures Market.

The forwards’ contract is the simplest form of derivative. Consider the forwards’ contract as the older avatar of the futures contract. Both the futures and the forward contracts share a common transactional structure, except that the futures contracts have become the trader’s default choice over the years. The forward contracts are still in use but are limited to a few participants, such as the industries and banks. The focus of this chapter is to help you understand the structure of a typical forwards transaction, after which we will break it down into its elements and understand its advantages and disadvantages.

1.2 – A simple Forwards example

The Forward market was primarily started to protect the interest of the farmers from adverse price movements. In a forward market, the buyer and seller agree to exchange the goods for cash. The exchange happens at a specific price on a specific future date. The goods’ price is fixed by both the parties on the day they agree. Similarly, the date and time of the goods to be delivered is also fixed. The agreement happens face to face with no intervention from a third party. This is called “Over the Counter or OTC” agreement. Forward contracts are traded only in the OTC (Over the Counter) market, where individuals/ institutions trade through negotiations on a one to one basis.

Consider this example; there are two parties involved here.

One is a jeweller whose job is to design and manufacture jewellery. Let us call him ‘ABC Jewelers’. The other is a gold importer whose job is to sell gold at a wholesale price to jewellers. Let us call him’ XYZ Gold Dealers’.

On 9th Dec 2014, ABC agreed with XYZ to buy 15 kilograms of gold at a certain purity (say 999 purity) in three months (9th March 2015). They fix the price of gold at the current market price, which is Rs.2450/- per gram or Rs.24,50,000/- per kilogram. Hence as per this agreement, on 9th March 2015, ABC is expected to pay XYZ a sum of Rs.3.675 Crs (24,50,000/Kg*15) in return for the 15 kgs of Gold.

This is a very straightforward and typical business agreement that is prevalent in the market. An agreement of this sort is called a ‘Forwards Contract’ or a ‘Forwards Agreement’.

Do note; the agreement is executed on 9th Dec 2014, irrespective of the price of gold 3 months later, i.e. 9th March 2015, both ABC and XYZ are obligated to honour the agreement. Before we proceed further, let us understand each party’s thought process and understand what compelled them to enter this agreement.

Why do think ABC entered into this agreement? Well, ABC believes the price of gold would go up over the next 3 months; hence they would want to lock in today’s market price for the gold. Clearly, ABC wants to insulate itself from an adverse increase in gold prices.

In a forwards contract, the party agreeing to buy the asset at some point in the future is called the “Buyer of the Forwards Contract”; in this case, it is ABC Jewelers.

Likewise, XYZ believes the price of gold would go down over the next 3 months, and hence they want to cash in on the high price of gold available in the market today. In a forwards contract, the party agreeing to sell the asset at some point in the future is called the “Seller of the Forwards Contract”, in this case, it is XYZ Gold Dealers.

Both the parties have an opposing view on gold; hence they see this agreement to be in line with their future expectation.

1.3 – 3 possible scenarios

While both these parties have their own view on gold, only three possible scenarios could pan out at the end of 3 months. Let us understand these scenarios and how they could impact both the parties.

Scenario 1 – The price of gold goes higher.

Assume on 9th March 2015, the price of gold (999 purity) is trading at Rs.2700/- per gram. Clearly, ABC Jeweler’s view on the gold price has come true. At the time of the agreement, the deal was valued at Rs 3.67 Crs, but now, with the increase in Gold prices, the deal is valued at Rs.4.05 Crs. As per the agreement, ABC Jewelers is entitled to buy Gold (999 purity) from XYZ Gold Dealers at a price they had previously agreed upon, i.e. Rs.2450/- per gram.

The increase in Gold price impacts both the parties in the following way –

| Party | Action | Financial Impact |

|---|---|---|

| ABC Jewelers | Buys gold from XYZ Gold Dealers @ Rs.2450/- per gram | ABC saves Rs.38 Lakhs ( 4.05 Crs – 3.67 Crs) by this agreement |

| XYZ Gold Dealers | Obligated to sell Gold to ABC @ Rs.2450/- per gram | Incurs a financial loss of Rs.38 Lakhs. |

Hence, XYZ Gold Dealers will have to buy Gold from the open market at Rs.2700/- per gram and sell it to ABC Jewelers at the rate of Rs.2450/- per gram, thereby facing a loss in this transaction.

Scenario 2 – The price of gold goes down.

Assume on 9th March 2015, the price of gold (999 purity) is trading at Rs.2050/- per gram. Under such circumstances, XYZ Gold Dealers view on the gold price has come true. At the time of the agreement, the deal was valued at Rs 3.67 Cr, but now, with the decrease in gold prices, the deal is valued at Rs.3.075 Cr. However, according to the agreement, ABC Jewelers is obligated to buy Gold (999 purity) from XYZ Gold Dealers at a price they had previously agreed upon, i.e. Rs.2450/- per gram.

This decrease in the gold price would impact both the parties in the following way –

| Party | Action | Financial Impact |

|---|---|---|

| ABC Jewelers | Is obligated to buy gold from XYZ Gold Dealers @ Rs.2450/- per gram | ABC loses Rs.59.5 Lakhs ( 3.67 Crs – 3.075 Crs) under this agreement |

| XYZ Gold Dealers | Entitled to sell Gold to ABC @ Rs.2450/- per gram | XYZ enjoys a profit of Rs.59.5 Lakhs. |

Even though Gold is available at a much cheaper rate in the open market, ABC Jewelers is forced to buy gold at a higher rate from XYZ Gold Dealers hence incurring a loss.

Scenario 3 – The price of Gold stays the same.

If on 9th March 2015, the price is the same as on 9th Dec 2014, then neither ABC nor XYZ would benefit from the agreement.

1.4 – 3 possible scenarios in one graph

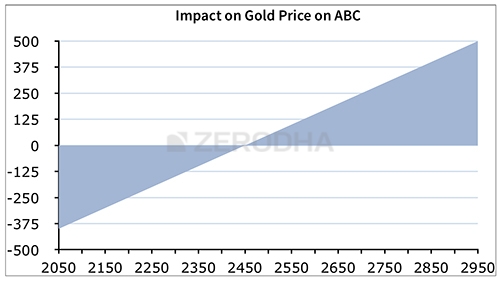

Here is a visual representation of the impact of gold prices on ABC Jewelers –

As you can see from the chart above, at Rs.2450/- per gram, there is no financial impact for ABC. However, as per the graph above, we can notice that ABC’s financials are significantly impacted by a directional movement in the gold prices. Higher the price of gold (above Rs.2450/-), higher is ABC’s savings or the potential profit. Likewise, as and when the gold price lowers (below Rs.2450/-), ABC is obligated to buy gold at a higher rate from XYZ, thereby incurring a loss.

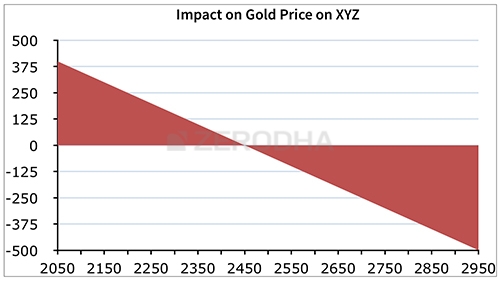

Similar observations can be made with XYZ –

At Rs.2450/- per gram, there is no financial impact on XYZ. However, as per the graph above, XYZ’s financials are significantly impacted by a directional movement in the gold prices. As and when the price of gold increases (above Rs.2450/-), XYZ is forced to sell gold at a lower rate, thereby incurring a loss. However, as and when the price of gold decreases (below Rs.2450/-), XYZ would enjoy the benefit of selling gold at a higher rate, at a time when gold is available at a lower rate in the market, thereby making a profit.

1.5– A quick note on settlement

Assume that on 9th March 2015, the price of Gold is Rs.2700/- per gram. Clearly, as we have just understood, at Rs.2700/- per gram, ABC Jewelers stands to benefit from the agreement. At the time of the agreement (9th Dec 2014), 15 Kgs gold was worth Rs. 3.67Crs, as of 9th March 2015, 15 kgs Gold is valued at Rs.4.05 Crs. Assuming at the end of 3 months, i.e. 9th March 2015, both the parties honour the contract, here are two options available to them for settling the agreement –

- Physical Settlement – – The buyer of a forward contract pays the full purchase price, and the seller delivers the actual asset. XYZ buys 15 Kgs of gold from the open market by paying Rs.4.05Crs and would deliver the same to ABC on the receipt of Rs.3.67 Crs. This is called a physical settlement

- Cash Settlement – In a cash settlement, there is no actual delivery or receipt of security. In cash settlement, the buyer and the seller will exchange the cash difference. As per the agreement, XYZ is obligated to sell Gold at Rs.2450/- per gram to ABC. In other words, ABC pays Rs.3.67 Crs in return for the 15 Kgs of Gold which is worth Rs.4.05Cr in the open market. However, instead of making this transaction, i.e. ABC paying Rs.3.67 Crs in return for the gold worth Rs.4.05Crs, the two parties can agree to exchange only the cash differential. In this case, it would be Rs.4.05 Crs – Rs.3.67 Crs = Rs.38 Lakhs. Hence XYZ would pay Rs.38 lakhs to ABC and settle the deal. This is called a cash settlement

We will understand a lot more about the settlement at a much later stage. Still, at this stage, you need to be aware that there are basically two basic types of settlement options available in a Forwards Contract – physical and cash.

1.6 – What about the risk?

While we are clear about the structure (terms and conditions) of the agreement and the impact of the price variation on either party, what about the risk involved? Do note, the risk is not just with price movements, there are other major drawbacks in a forward contract, and they are–

- Liquidity Risk – In our example, we have conveniently assumed that ABC finds a party XYZ who has an exact opposite view with a certain view on gold. Hence they easily strike a deal. In the real world, this is not so easy. In a real-life situation, the parties would approach an investment bank and discuss their intention. The investment bank would scout the market to find a party who has an opposite view. Of course, the investment bank does this for a fee.

- Default Risk/ / Counterparty risk – Consider this, assume the gold prices have reached Rs.2700/- at the end of 3 months. ABC would feel proud of the financial decision they had taken 3 months ago. They are expecting XYZ to pay up. But what if XYZ defaults?

- Regulatory Risk – The Forwards contract agreement is executed by mutual consent of the parties involved, and there is no regulatory authority governing the agreement. In the absence of a regulatory authority, a sense of lawlessness creeps in, which in turn increases the incentive to default.

- Rigidity – Both ABC and XZY entered into this agreement on 9th Dec 2014 with a certain gold view. However, what would happen if their view would strongly change when they are halfway through the agreement? The rigidity of the forward agreement is such that they cannot foreclose the agreement halfway through.

The forward contracts have a few disadvantages, and hence future contracts were designed to reduce the risks of the forward agreements.

In India, the Futures Market is a part of a highly vibrant Financial Derivatives Market. During the course of this module, we will learn more about the Futures and methods to trade this instrument efficiently!

So, let’s hit the road!

Key takeaways from this chapter

- The forwards’ contract lays down the basic foundation for a futures contract.

- A Forward is an OTC derivative, which is not traded on an exchange.

- Forward contracts are private agreements whose terms vary from one contract to the other.

- The structure of a forwards contract is fairly simple.

- In a forward agreement, the party agreeing to buy the asset is called the “Buyer of the Forwards Contract.”

- In a forward agreement, the party agreeing to sell the asset is called the “Seller of the Forwards Contract.”

- A variation in the price would impact both the buyer and the seller of the forwards’ contract.

- Settlement takes place in two ways in a forward contract – Physical and Cash settlement.

- A futures contract reduces the risk of a forward contract.

- The core of a forward and futures contract is the same.

Karthik,

I want to understand how short covering in nifty futures makes underlying nifty index move.How it happens?whether arbitrage has a role to play in it.

Short covering is a term to express the fact that the traders with short position are closing their open positions. When they close their open positions they simply need to buy back the futures. This means there would be a surge to buy back shares, which would lead to a short rally in the market. As far as i can imagine, short covering has nothing to do with arbitrage.

Hi Karthik,

Short Covering:

People are expecting market may fall

Futures – short shares of ABC – Intention go down (opened the position)

Buy shares of ABC – Intention go up (so closed the position to make the profit)

People are expecting short/small rally may come to upside for some time, but the main trend is down.

Please correct if I am wrong about the short covering.

Thanks,

Siva.

True, short covering is when there is fear of increase in prices hence short sellers cover their positions in a panic to save themselves from booking a loss….by virtue of which the prices starts to increase. This is because when short sellers cover their positions, the need to buy back shares.

Hello sir

Can you tell me that I m trading in mcx and yesterday my unrealised profit was -4400, now is this amount deducted from my total account value or not for the next day trading starts, my all trades are normal to mis.

Yes, commodities are futures for which mark to market is applicable and the money will be deducted from your trading account.

Thank you for explaining things very well with examples!!!

Most welcome!

sir

why there is no pdf available after module 2 .please provide us

We are working on converting the content to e-book format. It takes a lot of time, request you to please bear with us in the meanwhile. Thanks.

not a problem sir , thanks for that this site is very useful for us

🙂

There is an annoying share prompt on the screen that refuses to go even if one shares the page.

Kindly remove as it is preventing smooth reading especially on mobile devices.

Got rid of it, thanks for pointing it Sunil.