15.1 – Getting started with the DCF Analysis

We discussed “The Net Present Value (NPV)” in the previous chapter. NPV plays a vital role in the DCF valuation model. Having understood this concept, we now need to understand a few other related topics to the DCF valuation model. In fact, we will learn more about these concepts by implementing the DCF model on Amara Raja Batteries Limited (ARBL). With this, we will conclude the 3rd stage of Equity Research, i.e. ‘The Valuation’.

In the previous chapter, to evaluate the pizza machine’s price, we looked at the future cash flows from the pizza machine and discounted them back to get the present value. We added all the present value of future cash flows to get the NPV. Towards the end of the previous chapter, we also toyed with the idea –What will happen if the company’s stock replaces the pizza machine? In that case, we just need an estimate of the future cash flows from the company, and we will be able to price the company’s stock.

But what cash flow are we talking about? And how do we forecast the future cash flow for a company?

15.1 – The Free Cash Flow (FCF)

We need to consider the cash flow for the DCF Analysis is called the “Free Cash flow (FCF)” of the company. The free cash flow is basically the excess operating cash that the company generates after accounting for capital expenditures such as buying land, building and equipment. This is the cash that shareholders enjoy after accounting for the capital expenditures. The mark of a healthy business eventually depends on how much free cash it can generate.

Thus, free cash is the amount of cash the company is left with after paying all its expenses, including investments.

When the company has free cash flows, it indicates the company is healthy. Hence investors often look out for such companies whose share prices are undervalued but who have high or rising free cash flow, as they believe over time, the disparity will disappear as the share price will soon increase.

Thus the Free cash flow helps us know if the company has generated earnings in a year or not. Hence as an investor to assess the company’s true financial health, look at the free cash flow besides the earnings.

FCF for any company can be calculated easily by looking at the cash flow statement. The formula is –

FCF = Cash from Operating Activities – Capital Expenditures

Let us calculate the FCF for the last 3 financial years for ARBL –

| Particular | 2011 -12 | 2012 -13 | 2013 -14 |

|---|---|---|---|

| Cash from Operating Activities (after income tax) | Rs.296.28 Cars | Rs.335.46 | Rs.278.7 |

| Capital Expenditures | Rs.86.58 | Rs.72.47 | Rs.330.3 |

| Free Cash Flow (FCF) | Rs.209.7 | Rs.262.99 | (Rs.51.6) |

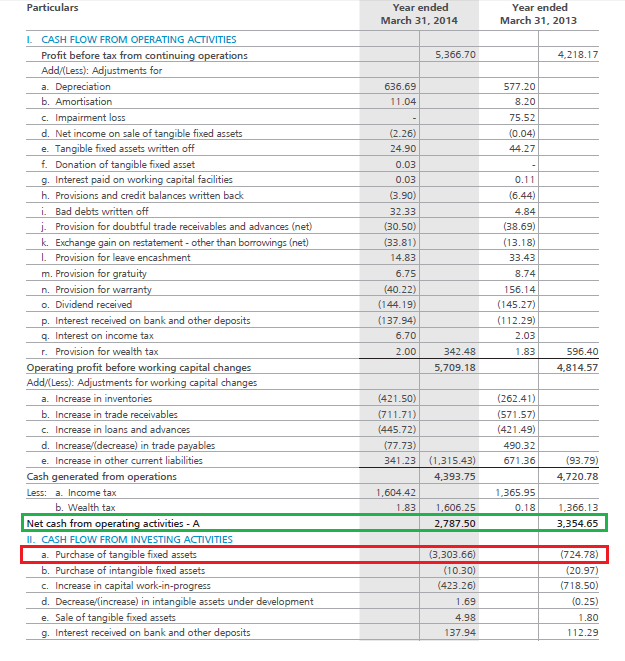

Here is the snapshot of ARBL’s FY14 annual report from where you can calculate the free cash flow –

Please note, the Net cash from operating activities is computed after adjusting for income tax. The net cash from operating activities is highlighted in green, and the capital expenditure is highlighted in red.

You may now have a fair point in your mind – When the idea is to calculate the future free cash flow, why are we calculating the historical free cash flow? The reason is simple while working on the DCF model; we need to predict the future free cash flow. The best way to predict the future free cash flow is by estimating the historical average free cash flow and then sequentially growing the free cash flow by a certain rate… This is a standard practice in the industry.

Now, by how much do we grow, the free cash flow is the next big question? Well, the growth rate you would assume should be as conservative as possible. I personally like to estimate the FCF for at least 10 years. I do this by growing the cash flow at a certain rate for the first 5 years, and then I factor in a lower rate for the next five years. If you are getting a little confused here, I will encourage you to go through the following step by step calculation for better clarity.

Step 1 – Estimate the average free cash flow.

As the first step, I estimate the average cash flow for the last 3 years for ARBL –

= 209.7 + 262.99 + (51.6) / 3

=Rs.140.36 Crs

The reason for taking the average cash flow for the last 3 years is to ensure we are averaging out extreme cash flows and accounting for the business’s cyclical nature. For example, in ARBL, the latest year cash flow is negative at Rs.51.6 Crs. Clearly, this is not a true representation of ARBL’s cash flow; hence, for this reason, it is always advisable to take the average free cash flow figures.

Step 2 – Identify the growth rate.

Select a rate which you think is reasonable. This is the rate at which the average cash flow will grow going forward. I usually prefer to grow the FCF in 2 stages. The first stage deals with the first 5 years, and the 2nd stage deals with the last 5 years. Specifically, concerning ARBL, I prefer to use 18% for the first 5 years and around 10% for the next five years. If the company under consideration is a mature company that has grown to a certain size (as in a large-cap company), I would prefer to use a growth rate of 15% and 10%, respectively. The idea here is to be as conservative as possible.

Step 3 – Estimate the future cash flows.

We know the average cash flow for 2013 -14 is Rs.140.26 Crs. At 18% growth, the cash flow for the year 2014 – 2015 is estimated to be –

= 140.36 * (1+18%)

= Rs. 165.62 Crs.

The free cash flow for the year 2015 – 2016 is estimated to be –

165.62 * (1 + 18%)

= Rs. 195.43 Crs.

So on and so forth. Here is a table that gives the detailed calculation…

An estimate of future cash flow –

| Sl No | Year | Growth rate assumed | Future Cash flow (INR Crs) |

|---|---|---|---|

| 01 | 2014 – 15 | 18% | 165.62 |

| 02 | 2015 – 16 | 18% | 195.43 |

| 03 | 2016 – 17 | 18% | 230.61 |

| 04 | 2017 – 18 | 18% | 272.12 |

| 05 | 2018 – 19 | 18% | 321.10 |

| 06 | 2019 – 20 | 10% | 353.21 |

| 07 | 2020 – 21 | 10% | 388.53 |

| 08 | 2021 – 22 | 10% | 427.38 |

| 09 | 2022 – 23 | 10% | 470.11 |

| 10 | 2023 – 24 | 10% | 517.12 |

With this, we now have a fair estimate of the future free cash flow. How reliable are these numbers, you may ask? After all, predicting the free cash flow implies predicting the sales, expenses, business cycles, and literally every aspect of the business. Well, the estimate of the future cash flow is just that; it is an estimate. The trick here is to be as conservative as possible while assuming the free cash flow growth rate. We have assumed 18% and 10% growth rate for the future; these are fairly conservative growth rate numbers for a well managed and growing company.

15.2 – The Terminal Value

We have tried to predict the future free cash flow for upto 10 years. But what would happen to the company after the 10th year? Would it cease to exist? Well, it would not. A company is expected to be a ‘going concern’ which continues to exist forever. This also means that as long as the company exists, some amount of free cash is generated. However, as companies mature, the rate at which free cash is generated starts to diminish.

The rate at which the free cash flow grows beyond 10 years (2024 onwards) is called the “Terminal Growth Rate”. Usually, the terminal growth rate is considered to be less than 5%. I personally like to set this rate between 3-4%, and never beyond that.

The “Terminal Value” is the sum of all the future free cash flow beyond the 10th year, also called the terminal year. To calculate the terminal value, we just have to take the cash flow of the 10th year and grow it at the terminal growth rate. However, the formula to do this is different as we are calculating the value literally to infinity.

Terminal Value = FCF * (1 + Terminal Growth Rate) / (Discount Rate – Terminal growth rate)

Do note, the FCF used in the terminal value calculation is that of the 10th year. Let us calculate the terminal value for ARBL considering a discount rate of 9% and terminal growth rate of 3.5% :

= 517.12 *(1+ 3.5%) / (9% – 3.5%)

= Rs.9731.25 Crs

15.3 – The Net Present Value (NPV)

We know the future free cash flow for the next 10 years, and we also know the terminal value (which is the future free cash flow of ARBL beyond the 10th year and upto infinity). We now need to find out the value of these cash flows in today’s terms. As you may recall, this is the present value calculation. Once we find out the present value, we will add these present values to estimate the net present value (NPV) of ARBL.

We will assume the discount rate at 9%.

For example, in 2015 – 16 (2 years from now), ARBL is expected to receive Rs.195.29 Crs. At a 9% discount rate, the present value would be –

= 195.29 / (1+9%)^2

= Rs.164.37 Crs

So here is how the present value of the future cash flows stack up –

| Sl No | Year | Growth rate | Future Cash flow (INR Crs) | Present Value (INR Crs) |

|---|---|---|---|---|

| 1 | 2014 – 15 | 18% | 165.62 | 151.94 |

| 2 | 2015 – 16 | 18% | 195.29 | 164.37 |

| 3 | 2016 – 17 | 18% | 230.45 | 177.94 |

| 4 | 2017 – 18 | 18% | 271.93 | 192.72 |

| 5 | 2018 – 19 | 18% | 320.88 | 208.63 |

| 6 | 2019 – 20 | 10% | 352.96 | 210.54 |

| 7 | 2020 – 21 | 10% | 388.26 | 212.48 |

| 8 | 2021 – 22 | 10% | 427.09 | 214.43 |

| 9 | 2022 – 23 | 10% | 470.11 | 216.55 |

| 10 | 2023 – 24 | 10% | 517.12 | 218.54 |

| Net Present Value (NPV) of future free cash flows | Rs.1968.14 Crs | |||

Along with this, we also need to calculate the net present value for the terminal value. To calculate this, we simply discount the terminal value by discount rate –

= 9731.25 / (1+9%)^10

= Rs.4110.69 Crs

Therefore, the sum of the present values of the cash flows is = NPV of future free cash flows + PV of terminal value

= 1968.14 + 4110.69

= Rs.6078.83 Crs

This means standing today and looking into the future; I expect ARBL to generate a totally free cash flow of Rs.6078.83 Crs, all of which would belong to the shareholders of ARBL.

15.4 – The Share Price

We are now at the very last step of the DCF analysis. We will now calculate the share price of ARBL based on the firm’s future free cash flow.

We now know the total free cash flow that ARBL is likely to generate. We also know the number of shares outstanding in the markets. Dividing the total free cash flow by the total number of shares would give us the per-share price of ARBL.

However, before doing that, we need to calculate the value of ‘Net Debt’ from its balance sheet. Net debt is the current year total debt minus current year cash & cash balance.

Net Debt = Current Year Total Debt – Cash & Cash Balance.

For ARBL, this would be (based on the FY14 Balance sheet) –

Net Debt = 75.94 – 294.5

= (Rs.218.6 Crs)

A negative sign indicates that the company has more cash than debt. This naturally has to be added to the total present value of free cash flows.

= Rs.6078.83 Crs – (Rs. 218.6 Crs)

= Rs.6297.43 Crs

Dividing the above number by the total number of shares should give us the company’s share price, also called the intrinsic value of the company.

Share Price = Total Present Value of Free Cash flow / Total Number of shares.

We know from ARBL’s annual report the total number of outstanding shares is 17.081 Crs. Hence the intrinsic value or the per-share value is –

= Rs.6297.43 Crs / 17.081 Crs

~ Rs.368 per share!

This, in fact, is the final output of the DCF model.

15.5 – Modeling Error & the intrinsic value band

The DCF model though quite scientific, is built on a bunch of assumptions. Making assumptions, especially in finance, takes on an art form. You get better at it as you progress through and gain more experience. Hence, we should assume (yet another assumption ) that we have made a few errors while making the intrinsic value calculation for all practical purposes. Hence, we should accommodate for modelling errors.

A leeway for the modelling error simply allows us to be flexible with calculating the per-share value. I personally prefer to add + 10% as an upper band and – 10% as the lower band for what I perceive as the stock’s intrinsic value.

Applying that on our calculation –

Lower intrinsic value = 368 * (1- 10%) = Rs. 331

Upper intrinsic value = Rs.405

Hence, instead of assuming Rs.368 as the stock’s fair value, I would now assume that the stock is fairly valued between 331 and 405. This would be the intrinsic value band.

Now keeping this value in perspective, we check the market value of the stock. Based on its current market price, we conclude the following –

- If the stock price is below the lower intrinsic value band, we consider the stock to be undervalued. Hence one should look at buying the stock.

- If the stock price is within the intrinsic value band, then the stock is considered fairly valued. While no fresh buy is advisable, one can continue to hold on to the stock if not adding more to the existing positions.

- If the stock price is above the higher intrinsic value band, the stock is considered overvalued. The investor can either book profits at these levels or continue to stay put. But should certainly not buy at these levels.

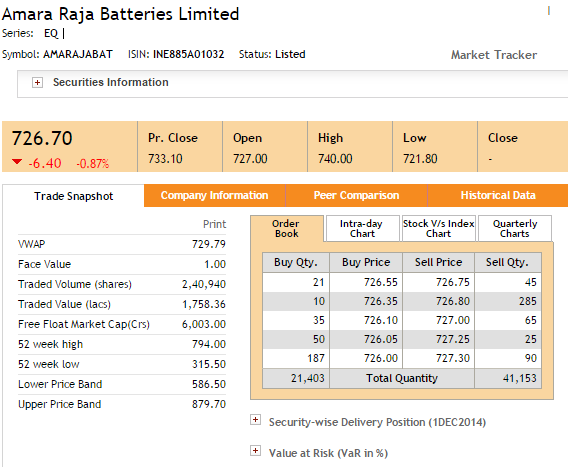

Keeping these guidelines, we could check for Amara Raja Batteries Limited’s stock price as of today (2nd Dec 2014). Here is a snapshot from the NSE’s website –

The stock is trading at Rs.726.70 per share! Way higher than the upper limit of the intrinsic value band. Clearly, buying the stock at these levels implies one is buying at extremely high valuations.

15.6 –Spotting buying opportunities

Long term investment and activities surrounding long term investing are like a slow-moving locomotive train. Active trading, on the other hand, is like the fast bullet train. When long term value opportunity is created, the opportunity lingers in the market for a while. It does not really disappear in a hurry. For instance, we now know that Amara Raja Batteries Limited is overvalued at the current market price. It is trading way higher than the upper limit of the intrinsic value band. But the scene was totally different a year ago. Recall based on FY 2013- 2014, ARBL’s intrinsic value band is between Rs. 331 and Rs.405.

Here is the chart of ARBL –

The blue highlight clearly shows that the stock was comfortable trading within the band for almost 5 months! You could have bought the stock anytime during the year. After buying, all you had to do was stay put for the returns to roll!

In fact, this is the reason why they say – Bear markets create value. The whole of last year (2013), the markets were bearish, creating valuable buying opportunities in quality stocks.

15.7 – Conclusion

Over the last 3 chapters, we have looked at different aspects of equity research. As you may have realized, equity research is simply the process of inspecting the company from three different perspectives (stages).

In stage 1, we looked at the qualitative aspects of the company. At this stage, we figured out who, what, when, how, and why of the company. I consider this an extremely crucial stage of equity research. If something is not really convincing here, I do not proceed further. Remember, markets are an ocean of opportunities, so do not force yourself to commit to an opportunity that does not give you the right vibe.

I proceed to stage 2 only after I am 100% convinced with my findings in stage 1. Stage 2 is basically the application of the standard checklist, where we evaluate the company’s performance. The checklist that we have discussed is just my version of what I think is a fairly good checklist. I would encourage you to build your own checklist, but make sure you have a reasonable logic while including each checklist item.

Assuming the company clears both stage 1 and 2 of equity research, I proceed to equity research stage 3. In stage 3, we evaluate the stock’s intrinsic value and compare it with the market value. If the stock is trading cheaper than the intrinsic value, then it is considered a good buy. Else it is not.

When all the 3 stages align to your satisfaction, you certainly would have the conviction to own the stock. Once you buy, stay put, ignore the daily volatility (that is, in fact, the virtue of capital markets) and let the markets take its own course.

Please note, I have included a DCF Model on ARBL, which I have built on excel. You could download this and use it as a calculator for other companies as well.

Key takeaways from this chapter

- The free cash flow (FCF) for the company is calculated by deducting the capital expenditures from the net cash from operating activates.

- The free cash flow tracks the money left over for the investors.

- The latest year FCF is used to forecast the future year’s cash flow.

- The growth rate at which the FCF is grown has to be conservative.

- The terminal growth rate is when the company’s cash flow is supposed to grow beyond the terminal year.

- The terminal value is the value of the company’s cash flow from the terminal year upto infinity.

- The future cash flow, including the terminal value, has to be discounted back to today’s value.

- The sum of all the discounted cash flows (including the terminal value) is the total net present value of cash flows.

- From the total net present value of cash flows, the net debt has to be adjusted. Dividing this by the total number of shares gives us the per-share value of the company.

- One needs to accommodate for modelling errors by including a 10% band around the share price.

- By including a 10% leeway, we create an intrinsic value band.

- Stock trading below the range is considered a good buy, while the stock price above the intrinsic value band is considered expensive.

- Wealth is created by long term ownership of undervalued stocks.

- Thus, the DCF analysis helps the investors identify whether the company’s current share price is justified.

Hi Karthik,

How do you think about intrinsic value for Banks / NBFCs when “free cash flow” is conceptually different? I slightly understand how fcf for a bank is tricky to infer. The major portion of equity itself is necessary to be reinvested into the business for growth (which is like the capex deducted from actual cash collected in a manufacturing firm). The true free distributable cash is hence is a very low value. And if you calculate intrinsic value with a guesstimate of such freely distributable cash it is a very low number. Just confused about this whole concept and wanted to understand how experienced investors reconcile this.

Thanks

Hi Karthik,

Thanks for all this material. Extremely helpful and easy to read.

How can we reliably forecast free cash flow for a company like Titan, where operating cash flows are highly volatile due to fluctuating working capital and CAPEX cycles? Unlike retained earnings, which often grow at a relatively stable rate, free cash flow appears unpredictable and does not follow a consistent pattern. How do analysts build a DCF model and calculate intrinsic value of the company in such cases?

One more question – Warren Buffer says he calculated intrinsic value but it was always a mental math, never really calculated by putting pen to paper. He says the oppertunity ought to scream at you that you\’ve got this huge margin of safety. Wanted to understand your thoughts on how he went about this.

Well, when Warren Buffet says he does mental valuation models, that basically years of investing experience backing that mental calculation 🙂

Volatile is fine, but not negative.

Hi Sir,

1. Can the discount rate used here (9%) be relaced by WACC?

2. For calculating the terminal value here, you have used power 10 (I assume for the 10th year) \”9731.25 / (1+9%)^10\”, shouldn\’t it be 11 since we have already calculated the NPV for the 10th year.

Thank you

1) Yes

2) Hmm, I think it does. Need to double check 🙂

Hello Sir, I am not able to download the DCF model on ARBL given at the end of this chapter. Could you please look into it?

Can you please try downloading from another browser?

That worked thanks

Happy learning!

Thank you for publishing this learning material, Karthik and Zerodha team!

For fundamentals analysis and DCF calculation – what\’s the best way to do it for the new potentially growing companies? I think the modeling described here works for companies that are mature (or on that path already). Appreciate any input on that.

Hmm, that would be tricky. One way is to look at relative valuation and compare it to peers locally and outside the country as well.

Sir capital expenditure is considered as purchase of tangible assets as you highlighted that in the diagram but when i am going through the Monte carlo annual report there they have included something more with tangible assets so how can i came up with actual numbers?

in monte carlo report: \”Purchase of property, plant and equipment and Intangible

assets (including capital advances, creditors for capital goods,

Capital work-in-progress and Intangible assets under develop

ment )\”

Can you help me to identify actual capital expenditure?

One more question What if the stock price is less than the intrinsic value of the stock but the Index P/E is 21 or more than that should i buy the stock at that time or should i wait as you earlier said do not invest when Index P/E is Somewhat in this range.

Thats your call as an analysts. But such an exercise suggests that the market is mispricing the value 🙂

Intangibles can also be included in CAPEX, maybe they are working on some branding exercise?

hello Karthik,

First of all a big thank you for the treasure of knowledge provided here. I was just using the dcf model in excel which you provided and discovered that a change in net debt value had no effect on the final share price. Is this an issue with the excel sheet or is this the actual case??

Thanks Loven. Debt values should have an impact, let me check.

Hello kartik sir aditya here , sir why is onyl tnagible assets considered in the capital expenditure like the one highlighted in red

Capital Expenditure refers to money spent by a business to acquire, upgrade, or maintain physical assets like property, machine, hence 🙂

Hi, just wanted to have a comment on the current share value of ARBL which is Rs.964 with a highest peak of Rs.1775 .

The stock value never came close to our predicted value in 2014; in fact, it has been increasing.

Did you calculate an updated stock value band?

Would you say there were some wrong assumptions in the method used?

Nayan, Ideally one needs to have a dedicated model and and the bands get updated as and when new information emerges. New information via quaterly results and annual reports.

Hi Karthik

Thank you so much for the content provided. Has helped learn a lot. I have a doubt regarding FCF, while calculating the same the Capex will include purchase of intangible fixed assets as well right?

Thanks in advance

Like goodwill you mean? That would be one time cash outflow basically.

Like IPs or Patent

DIDN\’T UNDERSTAND HOW TO SPOT BUYING OPPERTUNITIES. CAN YOU PLEASE EXPLAIN

Here you go, please check this module – https://zerodha.com/varsity/module/technical-analysis/

For calculating net debt of Amara raja, we are deducting the current cash balance from the Current Year Total Debt

Net Debt = 75.94 – 294.5

= (Rs.218.6 Crs)

in other words we are deducting the Current Year Total Debt from our cash balance and adding this cash balance to the future cash value

But while calculating the future cash value we have started of of our calculation with current cash balance, this the future cash balance already includes the current cash balance.

Won’t this method allow including our current cash balance twice.

Net Debt = Total Debt – Cash & Cash Equivalents

In your example:

Net Debt = 75.94 – 294.5 = (Rs. 218.6 Cr)

This indicates the company has a net cash position, meaning cash exceeds debt.

Now, regarding the future cash flows: if we\’re starting our DCF or valuation with the current cash balance already included in the initial value, and then also adding net debt at the end (which includes subtracting cash again), there’s indeed a risk of double-counting the current cash.

To avoid this, there are generally two correct approaches:

1. Start with Enterprise Value (calculated using future cash flows and exclude current cash), and then:

Equity Value = Enterprise Value – Net Debt

2. Start with total future cash including current cash, and do not separately add the current cash again.

So yes — if we include the current cash in the future cash flow projection and also adjust for it via net debt, it gets counted twice, which would inflate the valuation.

The key is to stay consistent.

Hi Karthik,

Nicely explained the things. I have few questions.

1. In step 3 you have mentioned that the average cash flow for 2013-14 is 140.36. So you have taken a 3 year horizon and hence, the average cash flow is 140.36.

2. If I have the data from 2020-2024 and want to calculate the valuation then what should be my approach.

3. I want to do the valuation analysis of First Cry Ltd. What process should I follow.

The same approach, but different time series data. Thats it 🙂

I am getting stuck at various points. Could you suggest me from where I can get the help.

Please post your queries here, will try and resolve here itself.

what things should be forecasted for valuation analysis. Also, what should be the growth rate, terminal rate and discount rate in case of a company like firstcry.

I\’ve explained all this and more here – https://zerodha.com/varsity/module/financial-modelling/

Hello Karthik,

There are numerous DCF calculators available online. Can rely on, or should we perform our own calculations? What do you suggest?

You can use these calculators if you know its from a trusted source.

Quoting the above line, \”as companies mature, the rate at which free cash is generated starts to diminish.\” There are many mature companies with large market capitalizations. If I were to invest in some of these companies today, what growth rate should I consider: a \”terminal growth rate\” of 3%-4% or a normal rate of 18% and 10%?

It has to be in the region of inflation numbers, so maybe 3-5%.

Why did\’nt you include capital work in progress(cwip)while calculating free cash flow??

But that capital is committed right?

You have subtracted the debt from the total cash flow i.e.

(Net Debt = Current Year Total Debt – Cash & Cash Balance)

1.) Don\’t you think, at the initiation of calculation, while estimating the average cash flow we should deduct the debt.

2.) I think the assets can also be calculated in this method.

3.) I am not able to download the excel sheet in the attachment with all the formulas.

Thanks for teaching us!

1) We do factor in the debt right?

2) Not sure about this, can you elaborate?

3) Can you try downloading from a different browser?

Sir the value of total debt you use in calculating net debt is only including long term borrowing not short term. I think this is mistake.

The idea is to figure long term debt only.

I didn\’t understand that why the FCF till infinity will cap at Rs.9731.25 Crs. If you are considering a terminal growth rate of 3.5% I think it should keep compounding and not saturating to zero.

Abhiveer, this is a good question. I\’m not sure about this, but mostly this will have something to do with the mathematical derivation, but then there has to be a business explanation as well. I\’ll try and find out.

Thank you, Karthik Rangappa and zerodha. I learnt a lot from your modules in my journey to financial freedom.

Karthik Rangappa sir, At the end of this chapter you have provided a link to download excel sheet to calculate DCF model for other companies. But, it\’s not working, can you please provide a new link or make it to work.

Thank you for your hard work.

Thanks Jaswanth. Can you please try downloading this from a different browser?

What should we do if the FCF comes out to be negative

You cannot apply DCF in such cases.

Thank you so much for brief lessons. I can not download DCF Model on ARBL excel. Could you please send it on my email address?

Thanks Amol. Can you please try downloading from another browser? That usually works.

I found many research papers have taken cash flow as PAT + Adjustment of on cash items such as Depreciation etc.

I think it is more accurate than Cash flow from operating activities as PAT is the final output after paying all items including interest . Further if we adjust noncash item to it , it reflects true cash flow position . Can we take it for cash flow measurement ? What is your views on this?

Sure, like I\’ve mentioned most of the things in DCF and financial modelling is art, so feel free to use inputs that you think makes sense.

Hi Karthik,

Thank You so much for sharing such an invaluable content. For some reason, I was unable to download the Excel shared to calculate DCF. It would be great if you could help us with it.

Thanks,

Mayank

Thanks Mayank. Can you please try downloading from another browser? Thanks.

Net Debt = Total liabilities – Cash and cash equivalents.

can i take cash and cash equivalents as Cash + Reserves?

if i take only cash and cash equivalents then my net debt comes as positive for Cipla

and if i take reserves then it comes as negative?

Pls help me here.

No, dont include reserves in this.

I\’m Waiting For This Module And Thanks For Give My All Questions Answers ☺️.

Good luck, and happy learning 🙂

Hello Again 🤗🤠 Sir As You Say I clicked On Link And Start Learning About Modelling But In Second Chapter You Already cleared about BFSI sector Is Not Including Or Avoid So What Can I Do For Banking Sector Because I Like To In Invest In Bank But Now How Can I Value?

Ah, for that you should do relative valuations. We will soon include that in Varsity 🙂

Hello Sir I Have One More Question I Can Take Net Debt As A Total Liabilities And Cash And Cash Balance As A Total Assets.

Nope. Net Debt = Total liabilities – Cash and cash equivalents.

Hello Sir🤗I Have A Small Request Can You Please Built DCF Model For 10 Years FCF. So I Can Calculate intrinsic Value Of Share More Accurately.

I Request Please Built It For Me If Possible It\’s My Humble Request.

Have you checked this – https://zerodha.com/varsity/module/financial-modelling/

Hello Kartik Sir,

Very happy with the quality of content you provide!

I\’ve the following question:

how would the FCF calculation will work( how would the formula look like to be precise) if the Company\’s cashflows are negative till date.

Thankyou,

Awaitng for you reply!

Thanks Siddharth, glad youb liked the quality of our content. FCF or for that matter DCF itself does not work when the cashflow is negative. You will have to use other modes of valuation, like relative valuation.

hey, not been able to download the dcf model file attached. is the link still working?

Yes, but can you check with another browser?

I think we shoud first calculate intrinsic value. If the stock price is not in fair value band, we can ignore knowing the company ratios and business in detail. It can save time. Will that be right approach ?

There is no right or wrong approch, if you think this works, then sure, please develop the framework.

Sir,

Regarding FCF, how we should calculate this? Should we need to look the cash flow statement for this? Do we require to note the \”Net cash flow from operative activities\” minus the \”Capital expenditure\”? Does the capital expenditure only signifies the tangible assets only and not intangible?

I would request if you could kindly be a little more elaborate.

Yes, have explained in detail in the Financial Modelling module – https://zerodha.com/varsity/module/financial-modelling/

Hi Karthik just wondering why you used only long term borrowings as total debt in the calculation for net debt.

Because the current liabilities is expected to be paid off within the current financial year.

I am unable to download DCF Model on ARBL provided in the above link –> http://zerodha.com/varsity/wp-content/uploads/2014/12/Module-3_Chapter-15_DCF-Model.xlsx

Thanks a lot, the posted content was really helpful and very well explained 🙂

Seems to be working fine, can you try downloading from another browser?

Sir ji after 10 years Amara Raja is trading around 1400 it means it took 10 years to double the money invested in it now this is not good even banks double in 10 years with all these good financials it did not perform that well investing in stock has to be some thing more than just number wisdom !

Of course, applies to stock market in general. But going by data and making rational data based decision is the next best think you can do.

Sorry.

Was able to download from the other link that you had shared.

Thank You

Ah, ok. Sure. Good luck 🙂

Not able to download the excel file.

Please try downloading from another browser.

Net Debt = 75.94 – 294.5

In this equation, you have considered only Long term borrowings. However Net debt is a summation of Current and Non Current liabilities. Which is 776.7.

Thats right, checking this though.

Please ignore this. I read previous comments and tried using different browser and it worked. Thank you

Ah, ok 🙂

Hello Karthik

I was trying to download the DCF model excel file through the hyperlink but it seems that the hyperlink is not working. I don\’t know if it\’s only for me or for everyone. Could you please check it?

I just did and it worked for me. Can you try downloading from another browser?

Hi,

Could you please share the excel for DCF, i am unable to get it through the above given link.

You can check that here – https://zerodha.com/varsity/module/financial-modelling/

Hi Karthik Sir,

Firstly, I would like to express my sincere gratitude for your dedication and commitment to teaching. Your efforts and teaching style have greatly contributed to my learning experience, and I truly appreciate the time and effort you invest in ensuring that we understand the material thoroughly. Thank you for your continued support and guidance.

I have calculate the share price of Asian paint using your excel sheet. Could you please verify it?

Net cash flow from operation activity 3683(FY21),986(FY22), 4193(FY23) and Capital Expenditure 282(FY21), 551(FY22), 1486(FY23).

Average cash flow is = 2194.3

First 5 year growth 18%

Last 5 year growth 10%

TGR 5%

DR 9%

TV 212229.9

Total Dept – 59

No of share 95.92

Share Price is 1283

Lower band 1154

Upper band 1411

Glad you liked the content, Madhav 🙂

About the calculation, I cant really comment. This would require me to do the math myself 🙂

Thank you, sir, for replying.

Could you please tell me how you calculate capital expenditures? For calculating the DCF model

For the financial year 2013–14, it was Rs. 330.3.

Rahul, the easiest way is to look at what the management guidelines is for the capex. They usually state that number explicitly.

Hello sir

Thanks for sharing this module.

DCF Model on ARBL, which you have built on Excel. I am not able to download. Could you please share the link again?

Rahul, can you try and use a different module to download the excel?

The DCF model excel link is not working sir

Try downloading from another browser?

Hi Karthik, I have doubt in section 15.4-Share price, during calculating net debt , for the current year total debt entry you have considered it as 75.94 crs viz long term debt as per ARBL\’s report. My question is why isnt short term debt of 8cr not added into current year\’s total debt. Thanks to Zerodha and you for teaching me everything a B-school educates.

Abhinay, thanks for that. Total debt should include both, can you please double check the numbers, I think I\’ve included it 🙂

link to excel not working

Please use another browser to download the excel.

Hi Karthik,

Why is increase in CWIP of Rs.423 crore not considered while calculating capex? Isn\’t CWIP included in capex?

I was analyzing the cash flow statement of IOCL for FY2022-23. Even there, the Expenditure on Construction Work in Progress was not considered while calculating capex for DCF valuation? What\’s the reason for the same?

Regards,

Sreyansh.

Have explained this in detail here – https://zerodha.com/varsity/module/financial-modelling/

Net Debt = Current Year Total Debt – Cash & Cash Balance.

But while giving certificate exam on varsity app the correct ans is :

Long term debt+short term debt – cash and cash equivalent.

As long term debt suggest, it will last more than 1yr so it won\’t make in current year.

You should consider today debt, Ashay.

working from another browser sir, thanks!

excel sheet link is not working sir

Can you please try downloading the excel sheet from another browser?

Thank you for making me understand FCF. How FCF will get affected after fixed or financial assets sale? Also, there will be intrinsic brand value associated to \’intrinsic stock value\’. Why only cash from operational activity is considered? can you please explain?

Cash from operations is what the business is supposed to generate, all other sources of cash generated is short term and does not really add any long term value to the business, including financial asset sale.

Hi Karthik Rangappa,

The Excel sheet link is not valid, couldn\’t able to download the sheet. Kindly change the link.

Ashok, can you try downloading from another browser?

Hi, I read that the Reverse DCF Model is a bit more accurate than the DCF model which has drawbacks related to the randomness associated with Discount rate and future cash flow growth % values.

Can we expect Zerodha Varsity tutorials for reverse DCF as well?

Yes, we can do that 🙂

Hi karthik,

From where I can get the current discount rate? any website or link.

How frequently it changes?

You can check the RBI webiste, they have rates updated on the portal.

To calculate the net present value for the terminal value we have used the time period of 10 years (= 9731.25 / (1+9%)^10 = Rs.4110.69 Crs) this has resulted in inflated present value for the terminal value. As the terminal value is the FCF after infinite time period i guess it will make sense if we use value greater than 10.

Yes, thats right, but always makes sense to assume conservative numbers.

Karthik sir, while calculating intrinsic value in case of ARBL you have taken non-current borrowings and only cash and cash equivalents why you have not taken short term borrowings and short term receivables in calculation?

Becuase short term liabilities are expected to be cleared anytime during the year and will not stay on the balance sheet like the non current borrowings.

Sure sir…

Sir for example we have q1 and q2 results for 23-24 fy ..so can we take avg fcf of these two quaters to calculate intrinsic value of share?

You can see how these numbers match for the previous year, same quarter and try if you can project a trend. This maybe be better I feel.

KARTHIK SIR ,

SIR I CHECKED AS PER 22-23 BALANCE SHEET NON CURRENT BORROWING IS OF 2159 CRORES AND CASH AND CASH EQUAILENT IS OF 1.23 CRORES AND EQUIRTY CAPITAL IS 148.91 CRORES ….PLS GUIDE ME ABOUT THIS SIR

MY SECOND QUESTION IS WE CALCULATE AVG FREE CASH FLOW OF THREE YEARS FOR INTRINSIC VALUE CALCUALTION….SUPPOSE I HAVE TO RAISE OR DECREASE STAKE IN ANY COMPANY HOW CAN I USE THE QUATERLY CASH FLOW TO KNOW THE INTRINSIC VALUE OF THAT COMPANY….SO THAT I CAN INCREASE OR DECREASE MY STAKE…

Kindly dont use caps while typing 🙂

So once you build a EQ research module, you will have to constant update it with numbers you get from company, thats how you can keep your model sharp.

KARTHIK SIR,

I HAVE CHECKED TWICE AND I HAVE ASSUMED 10% GROWTH RATE FOR 5 YRS 5% FOR NEXT 5 YRS….STILL THE VALUE IS 1520/-

SIR PLS LET ME KNOW IF I CAN SHARE YOU THE FIGURES AND SHEET…IT WILL BE VERY CONVINENT AND I LL GAIN CONFIDENCE IF MY CALCULATIONS ARE CORRECT….

Not just the growth rate in cash flows, Nitin. What about other parameters? Things like cost of debt, equity etc?

HII KARTHIK

I JUST CALCULATED INTRINSIC VALUE OF CPCL AND AS PER SHEET ITS COMING 4407/ AND CURRENTLY SHARE PRICE IS 680/- ….I DOUBT IF I M SOMEWHERE WRONG IN CALCULATION…HOW CAN I SHARE YOU THE DCF CALCULATION OF CPCL9CHENNAI PETROLEUM CORPORATION LIMITED)…PLZ LET ME KNOW

I dont have the caluclation, Nitin. But Please do double check the assumptions, you can get such valuation numbers when the assumptions are aggressive. Maybe you need to trim down your assumption.

I have some questions.

1. I guess you have mentioned in one of the comments that you keep your estimate very conservative, like not more than 20% FCF growth. But what if the company consistently produces more like 35 or 40% FCF growth like say Divis Lab. Would you still keep at 20% for first 5 years? (I tried to do that and it skews the value)

2. What about companies that do not show consistent FCF growth or say like lower 5% CAGR? In that case would you say DCF is not a good method to analyse in such conditions?

3. I guess you have mentioned that we can consider selling the stock if it crosses the intrinsic value band. But as far as I have come across many books from great Investors, they have repeatedly suggested not to sell just based on high valuation alone until the fundamentals are intact. May I know your personal view on this?

4. You had suggested before that one should not hold stocks if it goes below certain point or else our portfolio would bleed. I came across your interview with smallcase recorded 4 years back and I guess you had told something like, you would like to see your stock value go down during tough times. So did anything change in your way of approach in these last 4 years. Just want to know so that I can learn from You.

(I read a lot Sir. But I can only ask these questions to you and you are really helping me a lot. Thanks)

1) You can start with a higher % value and taper it down as you move through the years.

2) If the cashflow is -ve, then DCF may not work well. You need to switch to relative valuations or something like that.

3) You can always trail your sell limit – as in when the stock trends up, keep increasing your stop loss threshold. In that way you keep locking in higher profits.

4) Not really, I still hold that thought.

Happy learning 🙂

Sir,

You have mentioned: FCF= Cash from operating activities – Capital expenditure.

You have taken the both the values from Cash Flow statement. While, \”Cash from operating activities\” is quite straight forward, please help with below for \”Capital Expenditure\”calculation:

(i) What are the line items that could be considered while calculating \”Capital Expenditure\”?

(ii) Like \”Purchse of tangible fixed assets\” is considered for ARBL, should it be diferent for different sectors? If yes, please help how to realize the which line item to consider?

(ii) Should we have to look for line items under \”Cash flow from investing activities\” for \”Capital Expenditure\” calculation?

1) Any long term capital used for expanding the business – investing in buildings, plants, machinery etc can be considered as CAPEX

2) Yes, it will be, and you will understand this only when you read about sectors. Check this – https://zerodha.com/varsity/module/sector-analysis/

3) You will get a better picture from the balance sheet.

This excel link does not work, please share it again.

Try downloading this from another browser?

Also, white considering total current debt what should I consider exactly from the balance sheet. For example:

Current Liabilities:

(a) Financial Liabilities:

(i) Lease liabilities

(ii) Trade payables

-total outstanding dues of micro enterprises and small enterprises

-total outstanding dues of creditors other than micro enterprises and small enterprises

(iii) Other financial liabilities

(b) Other current liabilities

(c) Provisions

(d) Current tax liabilities (net)

Out of these which one should be considered???

Please do check the links of banking chapter that I\’ve provided in your previous comment.

How to use this method to evaluate NBFC, or gold financing companies or Banks?

I\’d suggest you use the methods discussed under the banking chapters here – https://zerodha.com/varsity/module/sector-analysis/

Thanks 🙂

Hi Karthik,

I have the following queries. It would be great if you could help me by clarifying the same:

On what assumptions have we taken 18% and 10% as our future and discount rates?

While calculating net debt, why haven\’t we considered short-term borrowings under the current year\’s total debt?

Additionally, the entire calculation is based on historical + FCF. What if the company has had major capex spending and hasn\’t generated FCF for the past 2-3 years? This could be the case with companies that are expanding. In such situations, can we look at BV (Book Value) instead of intrinsic value to understand the valuation?

I\’m not able to download the Excel calculator. Could you please check if there is any error?

Also, I am extremely thankful to you and your entire team for these modules. I am really impressed with the detailed explanation of each module. This has surely helped me immensely.

Thanks and Regards,

Saurav

I think you may find all your answers here 🙂 – https://zerodha.com/varsity/module/financial-modelling/

In the Excel sheet the inflation rate is 3.5% but if you look at today\’s scenario last 10 years average inflation rate in India is around 5%. Can you suggest how to make modifications for the inflation rate as it can bring a lot of change in the intrinsic value?

Since its excel, you can change this to whatever number you think is relavent for today.

It has been around 10 years since the calculations were done by you using the dcf method, so can we keep the rates as 18% 10% 3.5% 9% in the Excel sheet or they need to be compulsorily changed from time to time?

You can change that as per the latest economic conditions 🙂

How to use dcf method for banks as they generate a negative cash flow?

You cannot use DCF for banks, Digvendra. But do check chapter 8 & 9 here – https://zerodha.com/varsity/module/sector-analysis/ , it will give you a sense of how to analyse banking as a sector.

Karthik Sir,

Not able to download the excel sheet , could you please check.

Thank you

Can you try downloading from another browser?

Thank you Sir for the quick response….the modules are very helpful in understanding many concepts in the Stock Market

Happy learning, Shwetha 🙂

Thank you Sir for the valuable information on DCF Model.

The Last Part of Net Debt and Cash and Cash Balance is a little confusing and information from the annual report/balance sheet of the mentioned example of Amara Raja BAtteries is not tallying..

Could you please guide me on the same.

Shwetha, actually we have dealt with it in complete detail here – https://zerodha.com/varsity/module/financial-modelling/

Sir the download link isn\’t working. Please

Do you want to try downloading another browser?

The FCF years are wrong, I think. 2011-12 has the FCF of 2012, sir.

Let me recheck, thanks.

Got it Sir.

\”We deduct the present-day debt from the enterprise value and add the present-day cash to give equity holders the free cash flow.\”

I guess this line says it all. So if the net debt value is positive, it means more debt than cash and hence need to be subtracted from the total PV of FCF. If net debt is negative, it means more cash than debt and hence need to be added back to the sum. Hope I\’m right.

Absolutely 🙂

1. I understand sir. But I\’m trying to understand whether the final formula is

Total Present Value of Free Cash flow + Net debt (Or) Total Present Value of Free Cash flow – Net Debt

2. What to do in case of positive Net debt value? Add or subtract. Thanks Sir.

Sathish – can you check this? Have discussed this in detail here – https://zerodha.com/varsity/chapter/fcff-fcfe/

\” This naturally has to be added to the total present value of free cash flows.

= Rs.6078.83 Crs – (Rs. 218.6 Crs)

= Rs.6297.43 Crs\”

The line says we should add but in the formula the figure gets subtracted. Is it because of the negative sign? If so should we add the number in case net debt value is a positive number? Thanks.

Its -ve of -ve, so its added back 🙂

Hi Karthik, why are we only considering the +ve cash flow difference for calculating share price? What about the assets like land, employees, etc? Why aren\’t these included in share price calculation?

DCF does not work if the cash flow is -ve, Siddharth.

Sir,

can you please share the link to download DCF model as it is not working

Checking this.

Hello, you have taken 10 years from 2014 when you were calculating terminal year and taken the values of 2024 to grow at 5% (let say). But today, as in 2023 I follow your model, then the calculations will become very different and stock price too. Can you please explain.

Yes, thats right. With such equity models, you need to update the model as and when new information comes in, which in that case is quarterly. So if you are updating the model, then the model will stay relevant so does your output. Have spoken more about it here – https://zerodha.com/varsity/module/financial-modelling/

I can\’t download dcf model

Try using a different browser, Punit.

Hi Karthik,

So for a matured companies like Infy, TCS etc which has already grown over 20yrs , how should we evaluate the value. Is it only the terminal value calculation to br done for these companies or both growth rate and terminal value?

Thats right, but for such companies, ensure you have conservative growth numbers as expecting them to grow at a higher rate may not be practical.

Hi, why is CWIP not considered when calculating free cash flow? As CWIP is also an item of capital expenditure. Shouldn\’t the formula be free cash flow = cash flow from operations – (fixed asset + capital work in progress)? As we can see in the cash flow statement of ARBL fy13-14 there is a cash outflow of 42.3 Cr under line item CWIP.

Thank you for responding in advance.

One way to think about it CWIP is that its a budget of sorts, may increase/decrease based on execution. So best to consider just fixed assets

Hi kartik Rangappa Sir,

can you please explain the concept of net debt on page 162, I didn\’t get it.

And why do we need to add it to the sum of the present values of the cash flows?

Net debt tells you how much money the company has once all the debt is paid off. It gives you a sense of how the company is positioned wrt to leverage. We add net debt to PV to get true value of the company by assuming that all the debt is paid off.

Thanks a lot sir. Finally found out that the reason for error.

When input \” 517.12 *(1+ 3.5%) / (9% – 3.5%)\” the answer was 6162.56

Instead if I input \”517.12*(1+3.5%)/ (9-3.5)%\” the answer is right(9731.25). The way I input the % sign was all I need to change.

No error if I do it directly in excel sheet though.

Ah ok. Good luck 🙂

\”Terminal Value = FCF * (1 + Terminal Growth Rate) / (Discount Rate – Terminal growth rate)

Do note, the FCF used in the terminal value calculation is that of the 10th year. Let us calculate the terminal value for ARBL considering a discount rate of 9% and terminal growth rate of 3.5% :

= 517.12 *(1+ 3.5%) / (9% – 3.5%)

= Rs.9731.25 Crs\”

Sir if I calculate the above numbers, I get 6162.56. I tried with changing brackets in scientific calculator as well. Could you tell me where the error was in my calculation?

Sathish, here are the steps –

517.12*(1+3.5%)

=535.2192

535.2192/5.5%

=9731.25

Quite straight forward, not sure where you are going wrong.

I have 3 questions.

1. Why is the discount rate 9%. Can I keep the same discount rate for all stock calculations?

2. I calculated the net present value of Free cash Flow from the last table. It seems that there is a slight difference for only those last 5 entries of future cash flows with 10% growth rate and not the one with 18%. Any reason?

3. What is your personal opinion on PEG ratio? Is DCF better than PEG?

1) Discount rate is what prevails in the economy. Yes, you can keep the same discount rate for all stocks.

2) Hmm, very hard to point out the reason without looking at the entire calculation. I\’d suggest you review each step carefully once.

3) I\’d go with DCF.

Sir,

Could you kindly share the excel to calculate DCF for other companies as well?

Please check this module, Anirban – https://zerodha.com/varsity/module/financial-modelling/

When I tried calculating DCF for some of the stocks I got confused with the cash balance and Net Debt value. Even the growth % for 5 years can it be taken as current 3yr CAGR Growth (Revenue)?

If you can send some more examples from current year it will be helpful for me. I am non financial background. But reading this course is helping me understand investments and Finance.

Yes, you can break the 5 years into 2 parts and assign two growth rates (for 3 yrs and then for 2 yrs). I\’ll try and figure more example 🙂

Thanks Karthik.

Happy learning, Manish.

Hi Karthik,

As per the question asked by Saratharni D \”Can there be a huge difference in intrinsic values calculated using different methods, where one gives Rs1400 and another Rs550\” and you told that it\’s possible as no two methods lead to same result. In that case which one to assume correct as we will make buying decision based on it

Manish, sorry, for some reason I saw 1400 and 1550 and not 550. Such a huge difference should not be there. If there is a difference, then you need to re-evaluate the models to see if the assumptions are ok. But anyway, as fas as picking one model – I\’d suggest you pick the one basis the conviction you have on the model. For example, if I feel my DCF model is robust, then I\’ll go with the DCF over relative valuation.

Thanks for your reply. Kindly clarify this one point. Can there be a huge difference in intrinsic values calculated using different methods, where one gives Rs1400 and another Rs550? In my opinion No. If you say Yes, then to what extend we can rely on it?

There could be, no two methods that will lead you to the same result. If fact the same methods by two different analysts will lead you to different results.

Calculated the intrinsic value of Metropolis Healthcare (CMP was Rs.1301 as on 28Jan23) by following what is explained here. I got Rs.1756.47 as intrinsic value. But as per the TicketTape, accessed through Kite app, the intrinsic value is higher than CMP. I used the ARBL sample template you provided here and used the corresponding numbers of Metropolis.

Can you please help me figure out the error?

Its possible that different ppl get different intrinsic values. This is because the assumptions are different. The accurateness of the intrinsic value really depends on how well your assumptions are. The more conservative the better in my opinion.

Yeah it was negitive As for the latest year 2022 their capital expenditure is 148cr higher than their net cashflow from operating activities

Ok. So that explains right? Do check the module on financial modeling.

Hi Karthik,

How to do intrinsic value calculation incase 3 yr average free cash flow is in negitive.

Regards

That wont be possible, Manish. While you can\’t use DCF, you can use the comparable or relative valuation method.

Hi Karthik, looking forward to your response. Thank you.

Sorry, I must have missed this query. Can you repost the same please?

Calculated the intrinsic value of a particular share of a company (say ABC Ltd, CMP is Rs.1200) by following what is explained here. I got a value, say Rs.1500 as intrinsic value. But the TicketTape, accessed through Kite app, shows the intrinsic value as Rs.850. I used the ARBL sample template you provided here and used the corresponding numbers of ABC Ltd.

Can you please help me figure out the error?

Thank u sir for ur so much effort for making us aware of these finance terms, always grateful to you…

Because of varsity im a lifetime zerodhas customer

Happy learning, Bharath 🙂

How can i know the current risk free rate (discount rate) to consider ?

You can check RBI\’s website for the 91 of 180-day t bill rates.

Hi Karthik,

I am very impressed with the content and happy to be the part of this learning. Just now did my first FA (Stage 1 to 3). Now feeling bit confident that before putting money in companies, I know how to evaluate. Thanks for all this.

One query – In \”15.6 –Spotting buying opportunities\” you mentioned that Amaraja batteries is currently trading at price much higher than it\’s upper intrinsic value.So suggestion is not to purchase here – I understand but what if it\’s \”investible grade attributes\” are still intact ? should we wait for price to come down (It may not come down if it\’s investible grade attribute is quite good)?

Regards,

Manish

Thats right, Manish. If the attributes remain intact, then you can wait to buy at a better price, which gives you a better margin of safety.

Hi Karthik,

What\’s assumption behind taking the discount rate at 9% ?

Basically, the risk-free rate prevailing in the economy at that point.

Hello Karthik!

Thank you so much for your wonderful lessons. It is really helpful.

I am facing challenge in understanding the estimated FCF as i can see that currently for year 2021-22 the actual figures are totally different.

the concern here is that the estimated future cash flow we calculated here is nowhere closer to the actual figures.

In fact the actual figures are negative.

Not sure if i understood this topic correctly.

Gaurav, so if the FCF is -ve, there is no way DCF will work.

Hi Karthik,

How do we approach calculating the Average Free Cash Flows when Operating Cash for a con for last 3 years are negative? In this scenario, will the Avg free cash flows arrived at be of any use to calculate the future cash flows?

thanks

Aditya

For example KOEL :- The Operating cash from 2020 to 2022 has bene nagative.

Its not possible, Aditya. DCF works well when the cash flow is +ve.

how to calculate constant currency revenue growth of IT company

You will have to fix a Dollar value to Rupee and assume its constant.

Hi Karthik,

\”This also means that as long as the company exists, some amount of free cash is generated. However, as companies mature, the rate at which free cash is generated starts to diminish.\” what does it mean. Does it mean that DCF not applicable for already matured companies as they are already there for a long time (more than 10 yrs) so we can\’t take 15% and 10% growth rate for first 5 and second 5 years respectively and only Terminal Growth Rate is applicable ?

It does exist, but the rate at which the FCF generates is lesser and you can apply DCF as long as there is a +ve rate of cashflow.

unable to down load dcf calculator

Try downloading from another browser.

I have downloaded it from another browser..

Thank you so much Karthik Sir for helping us.

Sure, good luck 🙂

Hello Sir,

This \”download\” link for excel is not working. Plz help..

Thanks!

Navdip, please try downloading from another browser.

Hi Karthik, I am unable to download the excel sheet. Please help..

Can you please try downloading from another browser?

I can not download DCF model on ARBL. Can you send me on my e-mail address

You can also check this – https://zerodha.com/varsity/module/financial-modelling/

Hi,

Truly loved the content and the simplicity with which you have explained it.

\”The link to excel sheet is no longer available. Could you please repost the same\”

Thanks

Thanks so much. Can you try downloading from another browser?

hello sir

How can we value business if it has low cash flows or negative cashflows.

You cannot use DCF to value companies in such cases. You will have to shift to other valuation techniques, such as the relative valuation.

very Thanks for your reply sir.Zerodha varsity is a school of knowledge to laymen.And you are teacher to thousands of students majorly india like me.

Happy learning, Srikanth!

hello sir

Shall we take FCF growth rate as 10 year indian g-sec rate+Country equity risk premium with respective to weighted average of particular company . For whatever time we are doing(using DCF 10 years later).

Yes, that would be even better 🙂

I think there are 3rd party sites that give you the country risk premium.

Hi Kartik, first of all the modules are extraordinary-Easy to understand, fun to read and apply! Thanks for the great effort you and the team have put in for these modules!

I had a query regarding calculation Free Cash Flows. Companies in their Cash Flow Statements use different names for Capital Expenditures-

Case in point-

1. IOCL has the head- i) Purchase of Property, Plant & Equipment and Intangible Assets – With intangible assets part of the head

2. Bajaj Auto has two heads- i) Capital expenditure on development of technical know-how and ii) Purchase of property, plant and equipment (including advances)

So which particular heads should be considered for Capex? Also should intangible assets be removed when the are part of PPE head?

Thanks Sreenath.

You can exclude intangible assets and include others as a part of CAPEX.

Hello can\’t download the excel file for DCF analysis

Working on it.

I have one question , I am quite new in Finance and I am trying to understand the valuation of capital intensive companies wherein cash flows from operations is not that much but debt is high every year and it turns average free cash flow comes out to be negative. What is your take on it . How we have to deal for calculating the FV.. Can you please help by taking any example and show the valuation for such company and your thoughts.. Also , are there any online courses by instructors on it ?

You need to project CAPEX and see if the company will do in the future. Have discussed it here – https://zerodha.com/varsity/chapter/asset-schedule/

Hello Karthik Sir,

Hope you\’re fine and doing well?

Then, I have a doubt.

When you say,

Share Price = Total Present Value of Free Cash flow / Total Number of shares.

Which metric exactly should we take that is closest to the total number of shares?

Free float shares?

Or should it include shares held by Promoters, DII\’s and FII\’s.?

Regards.

You need to consider the total outstanding shares in the market. I\’d suggest you read this module for a full charity https://zerodha.com/varsity/module/financial-modelling/

Sir the download button is not working.

Thank you so much for such a quick reply sir I really appreciate your efforts to spread financial knowledge for free. I almost feel little guilty for getting all this knowledge for free.

So can you tell me what model applies on banks on NBFC?

I guess that\’s why net cash from operating activates for HDFC bank was negative(because it gives out loans and that comes under OA). I really had a very hard time subtracting that negative with negative value(capex, which of course will be negative.)

So negative cash from operating activities for a manufacturing companies should never be negative am I right Sir?

Mohit, you dont have to feel guilty and all; just feel free to ask 🙂

For banks and NBFC, you can use a modified DCF model, but its just that I\’ve never used it myself so I may not be the best person to explain it 🙂

CF from OA can be -ve, it implies the company\’s operations are not profitable. You need to watch out for such businesses.

Hello Karthik Sir, thank you so much for these modules i have few doubts regarding DCF calculations.

I am calculating Iv for HDFC bank but while calculating net debt I couldn\’t find any line item with long term debt it just has a single line item of borrowing also I want to ask why we do not consider short term debt as well?

2. Also while calculating FCF why we do not consider capex on other assets like purchase of intangible assets etc.

3. Why data is variable on ticker websites and in annual reports?

Mohit, debt plays a very different role for banks and NBFCs. Traditional DCF models will not work.

2) We do consider, right? Check this for a more detailed explanation – https://zerodha.com/varsity/chapter/fcff-fcfe/

3) Ah, I\’m not sure about this.

Hi Karthick,

Thanks for the DCF model.

1. For ARBL, since we are now in the Year 2022, if i want to use this model for the future 10 years, what should be my FCF for 1st 5 years and the next 5 yrs? Shall i assume with 10% for 10 years until 2032?

Krish, do check this module – https://zerodha.com/varsity/module/financial-modelling/ , I\’m discussing these things in detail.

Download button on this page is not working. It\’s clickable but doesn\’t download anything. Can you please check ?

Checking on this.

Hi Karthik,

Unable to download DCF primer excel sheet.

Krish, can you please check from an alternate browser?

Hi Unable to download the calculator

Can you please try another browser?

How to determine the growth rate at which we should increase free cash flows….can we assume the growth rate to be the growth rate at which the industry is growing or the revenue of the business has been growing historically?

I\’ve just started discussing growth rates and free cash flow in this module -https://zerodha.com/varsity/module/financial-modelling/ please keep track of it.

Hi, Mr karthick really sorry the mistake was mine I have made a mistake in this calculation. I have another question don\’t mistake me for asking silly questions am a beginner so I have some question which may looks silly for you really sorry for that, but i really learning many stuffs from this article really thank for zerodha and for you for supporting us.

Cash flow from investing activities – purchase of tangible fixed assets you have shown in this article

I just want to calculate tcs FCF but there\’s

# Purchase of investments*

# Payment including advances for acquiring right-of-use assets

# Payment for purchase of property, plant and equipment

Which one of this 3 we take it as capital expenditure.

*this think 3rd one might be the right one please clarify

Thank you

No problem at all. Please take a look at this chapter, I\’ve just started explaining FCFF and FCFE in detail – https://zerodha.com/varsity/chapter/fcff-fcfe/

Hi Kartik

for below query

for Intrinsic value calculation, do we need to look at consolidated PNL, Balance sheet, Cash Flow, or standalone

I suppose it should be standalone as the Number of shares that are traded is only on a standalone basis, not on a consolidated basis

Please clarify if I am wrong

u answered-Yes, it\’s the risk-free rate + a slight premium.

My question is how do u take a slight premium, is it like 1% or 2%?

Its consolidated statememts.

Premium is based on market trends. In a bullish market, it can be as much as 5%.

Hi Mr karthik if any of the average free cash flow is in negative then how to calculate it ?? We can consider this stock or we can avoid it kindly advice it. Thank you

Tcs (FCF)

2019-20 – 3776

2020-21 – 6433

2021- 22 – -2305

I don\’t think TCS has a -ve free cash flow to the firm. Can you please check the calculations again?

Hi Kartik

for Intrinsic value calculation, do we need to look at consolidated PNL, Balance sheet, Cash Flow, or standalone

I suppose it should be standalone as the Number of shares that are traded is only on a standalone basis, not on a consolidated basis

Please clarify if I am wrong

You need to look at the consolidated basis, Sarvesh. I\’ve tried to explain that here – https://zerodha.com/varsity/chapter/historical-data/

Hi Kartik

the 9% discount rate that u took in the terminal value calculation

have u taken a risk-free rate or like FD rates which were prevailing at that particular time (i mean while writing this chapter )

Yes, its the risk free rate + a slight premium.

For FCF calculation why did we just subtracted the Capex amount and not the debt and the finance cost on the debt?….Like practically we should take the net cash from all activities right because that\’s what is in the bank and will be available to the shareholders.

Tejas, check this – https://zerodha.com/varsity/chapter/fcff-fcfe/

Hi Karthik,

While studying DCF analysis, many doubts are coming. Please clarify two main doubts:

1. Step-2 \”Identify Growth Rate\”: Instead of assuming the rates, why we can not predict based on the past growth rates?

2. 10th year is the terminal year is noted, but while calculating it, we can not use the same for differently aged companies. How to deal with the companies of various ages?

Thank you,

Sanjay

Sanjay, I\’d suggest you read this module, especially towards the end. I\’ve just started discussing DCF in detail – https://zerodha.com/varsity/module/financial-modelling/

Sir, how could we get an inference using DCF from a company with a negative cash flow , for instance Manappuram finance

DCF wont help there, Bepin.

Hi Kartik

For calculating the present value of terminal value, why did u take a number of years as 10

Below is a statement that I am talking about

\”

to calculate the net present value for the terminal value. To calculate this, we simply discount the terminal value by the discount rate –

= 9731.25 / (1+9%)^10 ( Here is why u took it as 10?)

= Rs.4110.69 Crs

\”

Because we are moving 10 years forward and figuring out how the cashflow is likely to be at that point. Btw, keep track of the financial modeling module, we will cover DCF in detail.

Hi Kartik

Why discount rate in terminal value calculation is considered as 9%, any specific reason for this?

Or do we need to consider existing risk-free rates in markets like Fixed deposit rates or T bill rates?

Sarvesh, it was the basis of the rates which prevailed in the economy at that time. YOu need to review it from time to time.

I am not able to download the excel DCF model

Please try another browser.

Hey,

The link for downloading the excel sheet is broken I guess. it would be great if you could fix it.

Thanks for putting up a great module.

Ayush, please do check with another browser?

Hi Karthik,

First of all, thank you so much for your work, it is of tremendous value, it has been my companion in my learning journey.

My concern is that I am not able to download the excel file attached in this lesson, I click on it and nothing happens, can you please check the link? It will be really helpful if you can fix this please.

Hey Praful, glad you liked the content. Someone else had a similar issue with downloading, but he/she switched to a different browser and it worked.

Thanks for the insightful and lucid article!

I cannot download the Excel file for some reason. Can you please have a look at it?

Thanks,

Arun

Can you please check in a different browser?

Dear Mr.KR,

The quality of your content is outstanding, to put it mildly. Pl keep-up the good work!

I\’m afraid I could not find the DCF model in xl in this section.

Can you kindly share the same?

With warm regards

Jai ganesh

Thanks, Jai. I\’ll be sharing an elaborate DCF model in this module – https://zerodha.com/varsity/module/financial-modelling/

Sir What is the difference between DCF way of calculating intrinsic value and Ben Graham intrinsic formula? and which one should we preferred better and how to calculate the Margin of Safety. Please help

Both of their own set of advantages and disadvantages. I\’d prefer DCF.

Hello karthik,

I know I shouldn’t be asking for help on assignments, but since I was studying fundamental analysis on varisty and had this course so I wanted to get the doubt cleared.

So basically, given the input the question has given and as the stock price & no of shares is missing here, there is no way I can calculate the P/E in this question right? Only market cap and all the data I previously told is given by them

Hey Hardik, thats ok 🙂

No, you need stock price for sure which is missing.

Hello karthik,

Thank you for your response, I understand so basically, the 9% rate here is not the risk free rate right but WACC?

also karthik I’m currently doing an online course where there is an assignment, where the ask is to calculate the P/E multiple, however the data inputs they have given are market cap, Firm value, cash & eq, total debt, revenue, net income, EBITDA, EBIT, capex, and dividend. How can I calculate the PE ratio from this as stock price, no of shares are missing.

I don\’t know if I should be helping you with your assignments. Anyway, to get the number of shares you need share capital and the face value of the stock, since P/E = Price/Earnings and earnings = PAT/No of shares. Btw, you also need the stock price.

Hello karthik,

Thank you for Your reply.

In the first comment of the this comment thread, you have told somebody that 9% used here is the weighted average cost of capital (WACC). So I’m a little confused here? Is it WACC or risk free rate in the economy? The same 9% is used for discounting the terminal value also, so that’s also the risk free rate or WACC?

And lastly can you explain what WACC is please?

Looking forward to hearing from you soon.

Hey I\’m sorry, I got a bit confused with what you were asking. Yes, 9% is the rate at which the company gets its funding of both Debt and Equity. As you can imagine, it can change from company to company. I\’d suggest you keep track of the financial modelling module, I will be discussing this in more detail.

Hello Karthik, hope you are doing well.

Is the discount rate of 9% that you have used here the risk free rate in the economy? Is that why you’ve used it to discount the values back to the PV?

If not, can you please tell me what is this value of 9% and how was it computed?

Looking forward to hearing from you soon.

Best regards,

Hardik phagotra

Thats right Hardik. But the rates have now changed, so use as per the recent economic activity.

What discount rate should in take in the year 2022?

Keshav, please keep track of the financial modeling module. Will be updating the same.

Download link not working. Solve the issue ASAP. Need the excel.

free cash flow to equity = Cash from Operating Activities – Capital Expenditures + Net borrowings

should we omit net borrowings?

Not really.

Hi. The link for download is not working. Can you send me the excel on [email protected]?

Sir

In the DCF model, can the DISCOUNT RATE be treated as rate of inflation ?

Nope, not really.

Really enjoyed reading the module, but I\’m unable to download the DCF excel sheet.

Thanks, Karan. Let me check.

Thanks Karthik for your quick reply.

Can you please clarify whether \”gross block\” and \”cost/deemed cost\”(mentioned in the recent plant,propety and equipments notes in the financial statements) are same?

Note, they are different.

Hi Karthik,

For calculating the capEX, when we take the difference between the previous year and this year cost/deemed cost(2,243.22-1,807.56),it comes around 435.66.

But in the \”Cash flows from investing activities\”, \”Purchase of property, plant and equipment\” is mentioned as 386.61.If that difference can be taken as capEx,will that affect the calculation of buying price as capEx is involved in the buying price calculation.

If this difference cannot be taken as capEx,please guide me how to calculate the capEx.

PFB the financial statement snippet of the same

Note 3: Property, plant and equipment and capital work in progress (contd.)

—————————————————————————–

(A) Cost or deemed cost

———————————————–

Balance at March 31, 1,480.99

Additions – 339.44

Disposals/adjustments (12.87)

Balance at March 31, 2017 1,807.56

Additions 443.27

Disposals/adjustments (7.61)

Balance at March 31, 2018 2,243.22

(B) Accumulated depreciation and impairment

——————————————————–

Balance at March 31, 2016 133.04

Eliminated on disposal/adjustment of assets (2.52)

Depreciation expense 190.02

Balance at March 31, 2017 320.54

Eliminated on disposal of assets (4.59)

Depreciation expense 229.08

Balance at March 31, 2018 545.03

(C) Carrying amount

——————————————————