4.1 – The contract

We make an extremely critical assumption at this stage – we will assume you are familiar with how Future and Options contracts work.

Technical Analysis plays an important role in setting up short term currency trades, so we’ll assume you know Technical Analysis as well.

If you are not familiar with these topics, then I’d strongly suggest you read through these modules before proceeding further. The currency and commodities market is largely a Futures market; hence a working knowledge of these derivative instruments is the key.

Now, assuming you understand these concepts fairly well, let us begin by slicing and dicing the USD INR futures contract. The contract specification of the USD INR futures gives us insights on trade logistics.

Here are the salient features of the USD INR pair –

| Particular | Details | Remark |

|---|---|---|

| Lot Size | $1,000 | Inequity derivatives, the lot is number of shares, but here it’s a dollar amount |

| Underlying | The rate of Indian Rupee against 1 USD | |

| Tick Size | 0.25 Paise or in Rupee terms INR 0.0025 | |

| Trading Hours | Monday to Friday between 9:00 AM to 5:00 PM | |

| Expiry Cycle | Upto 11 weekly expires and 12 monthly expiries | Note, equity derivatives have an expiry upto 3 months. |

| Last trading day |

All weekly expiry contracts will expire on the Friday of the expiring week |

All contracts other than weekly, will expire Two working days prior to the last business day of the expiry month at 12:30 pm |

| Final Settlement day | Last working day of the month | |

| Quantity Freeze Limit | 10,001 or greater | |

| Margin | SPAN + Exposure | Usually, SPAN is about 2%, and exposure is around 0.5%. Hence roughly about 2.5% is the overall margin requirement. |

| Settlement Price | RBI Reference rate on the day of Final settlement | The closing price of spot |

To give you a sense of how this works, let’s take an example –

This is the 15-minute chart of the USD INR pair, as you can see the encircled candle has formed a bearish Marubuzo. One can initiate a short trade based on this, keeping the high of the Marubuzo as the stoploss.

Note that I’m not trying to justify a trade here, my objective is to showcase how the USD INR contract works.

The trade details are as below –

Date: 1st July 2016

Position – Short

Entry – 67.6900

SL – 67.7500

Number of lots to short – 10

1 lot of USD INR = $ 1000

The contract value of 1 lot of USD INR = Lot size * price

=1000 * 67.7000

=67,700

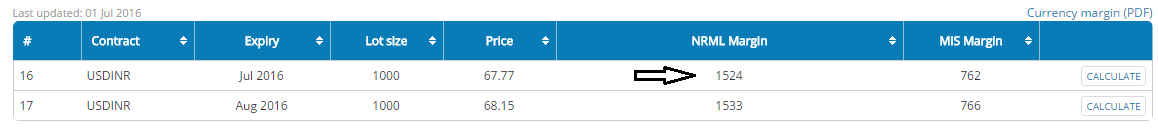

The margin required for this can be fetched from Zerodha’s margin calculator; here is the snapshot of the same.

As you can see, the margin required to initiate a fresh position in USD INR is about Rs.1,524/-. Therefore on a contract size of 67700, this works out to –

1525/67700

= 2.251%

Out of this, I’m guessing about 1.5% would be SAPN margin requirement (read as the minimum margin required as per exchange) and the rest as exposure margin.

Further, the idea is to short 10 lots, hence total margin required is –

10 * 1525

= 15,250/-

A point to note here – when trading equity futures, one has to earmark anywhere between 15% and 65% of the contract value as margins, this obviously varies from stock to stock. In contrast to equities, the margin charged in currencies is way lower. This should give you a sense of how leveraged currency trading really is.

On the other hand, currency sticks to a tight trading range compared to equities—hence higher leverage.

4.2 – The contract logistics

Notice how the currency futures are quoted – they go upto the 4th decimal digit. There is a reason for this – when it comes to currency futures, a number as small as this – 0.0025 is considered big.

When RBI states the reference rate, they quote upto the 4th decimal. Even a minor difference at the 4th decimal can alter the foreign reserves by a large degree. In fact, it is a norm world over to quote the currency to 4th decimal – in case of USD INR, this is 0.0025. This is called the tick size or in currency parlance, a ‘pip’. A pip/tick is the minimum number of points by which a currency can move.

So when the USD INR moved from 67.9000 to 67.9025, it is said that the currency has moved up by a pip.

How much money would you make per pip in the USD INR pair? Well, this should be easy to figure out –

Lot Size * pip (tick size)

= 1000 * 0.0025

= 2.5

This means to say, for every pip or every tick movement you make Rs.2.5/-.

Going back to the short trade, here is how the Marubuzo panned out –

After initiating the short, the currency pair declined 67.6000. If I choose to close this position, he is how much I would make –

Entry = 67.6900

CMP = 67.6000

Total number of points = 67.6900 – 67.6000 = 0.0900

Position – Short

This could be a bit tricky, do pay attention. A pip as you know is the minimum number of points the currency can move. To know how many pips a currency had moved when it moved by 0.09 paise, we divide the total number of points moved by the pip size.

Number of pips = 0.0900/0.0025

= 36

As you can see the trade managed to capture 36 pips, let us now calculate how much money one would make –

Lot size * number of lots * number of pips * tick size

We know, Number of pips * tick size is as good as the total number of points caught with this trade. Therefore we can restate the above formula –

Lot Size * Number of lots * total number of points

= 1000 * 10 * 0.0900

= 900

Remember this is an intraday trade. What if you were to carry this forward to expiry? Well, we can carry this forward as long as we maintain the adequate margin requirements. The July contract will stay in series 2 days before the last working day of the month.

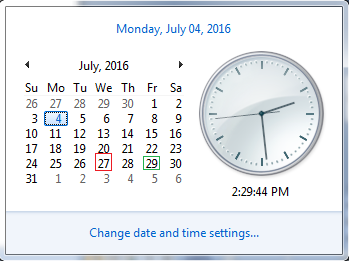

Here is the calendar –

So 29th July happens to be the last working day of the month. Hence 27th July will be the expiry of this series. In fact, you can hold the contract only till 12:30 PM on 27th July.

Of course, you can always look at the contract to see the exact date of the expiry.

Another question at this stage – at what price will the settlement happen?

The settlement will happen at the RBI reference rate set for 27th July, and it is important to note that the P&L will be settled in INR.

So for example, if I hold this position till 12:30 PM on 27th July and let it expiry, assume the price is 67.4000, then I’d stand to make –

= 1000 * 0.29 * 10

=2900/-

And this money will be credited to my trading account on 28th July 2016. Needless to say, as long as you hold the contract, your position will be marked to market (M2M). This is similar to the way it works for equity futures.

Hopefully, this example should give you a sense of how the logistics for the currency futures work.

Let us quickly run through the USDINR options contract.

4.3 – USD INR options contract

Let us have a look at how the USDINR option contract is structured. You may be interested to know that the option contract is made available only for the USD INR pair. Hopefully, in the future, we could see option contracts on other currency pairs as well. While most of the parameters are similar to the futures contract, there are few features specific to option contracts.

Option expiry style – European

Premium – Quoted in INR

Contract cycle – While the future contracts are available for 12 months forward, the options contracts are available just 3 months forward. This is similar to equity derivatives. So, since we are in July, contracts are available for July, August, and September.

Strikes available – 12 In the Money, 12 Out of the Money, and 1 Near the money option. So this is roughly 25 strikes available for you to pick and choose from. Of course, more options are added based on how the market behaves. Strikes are available at every 0.25 paisa intervals.

Settlement – Settled in INR based on the settlement price (RBI reference rate on expiry date).

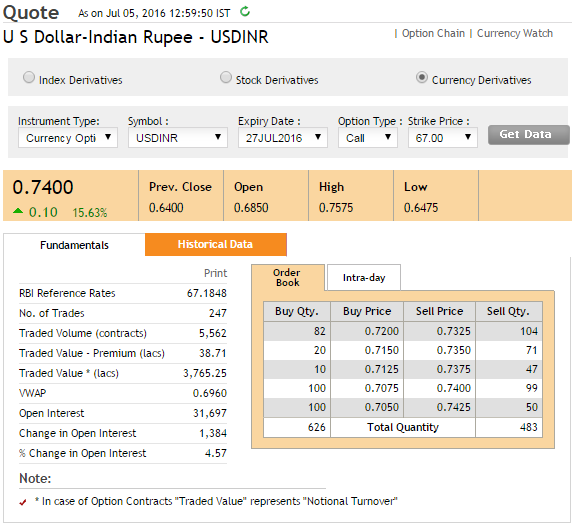

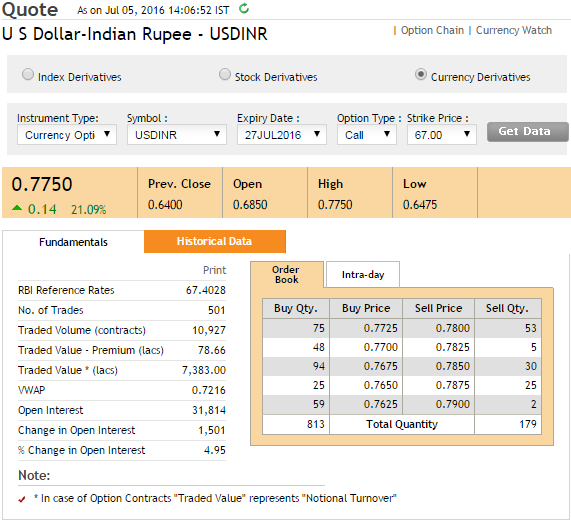

Let’s have a look at the USD INR option contract and figure out the logistics. Have a look at the following image –

From the option quote, we know the following –

Option type – Call option

Strike – 67.0000

Spot price (see RBI reference rate) – 67.1848

Expiry Date – 27th July 2016

Position – Long

Premium – 0.7400 (quoted in INR)

We know the lot size is $1000, although the lot size has not been mentioned in the quote above. Usually, this information is made available in the quote for equity derivatives. So if you are seeing this for the first time, be aware that the lot size is $1000.

Now, if you were to buy this option, what would be the premium outlay? Well, this is fairly easy to calculate –

Premium to be paid = lot size * premium

= 1000 * 0.7400

= 740

The option contract works similar to the equity derivative contracts. Here is another snapshot I captured –

As you can see, the premium has shot up, and I can choose to close my trade right away. If I did, here is how much I would make –

= 1000 * 0.7750

=775

This translated to a profit of 775 – 740 = 35 per lot.

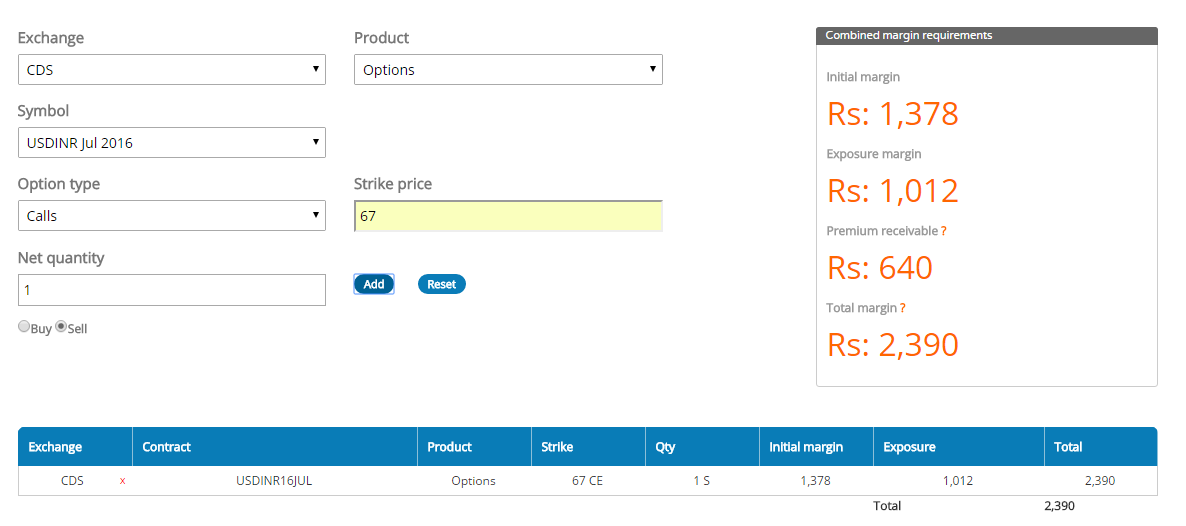

What if you were to sell/write this option instead? Well, you know that option selling requires you to deposit margins. You can use Zerodha’s F&O Margin calculator to get an estimate on the margin required.

Have a look at the snapshot below; I’ve used the calculator to identify the margin required to write (short) this option –

As you can see, the margin required is Rs.2,390/-.

I hope this chapter has given you a basic sense of how the USD INR contracts are designed. In the next chapter, we will try and discuss some quantitative aspects of the USD INR pair and perhaps look at the contract specification of other currency pairs.

Key takeaways from this chapter

- The contract specification specs out the logistics of the USD INR derivative.

- The lot size is fixed to $1,000, but this can be changed by the exchange anytime.

- Expiry of the USD INR contract is 2 days before the last working day of the month. The contract can be held/traded till 12:30 PM.

- Margins applicable = SPAN + Exposure, usually the margins add upto 2.25 – 2.5%.

- Currency pairs are quoted upto the 4th decimal place.

- A pip is the minimum price moment allowed in a currency.

- Currency options are European in nature.

- The premium quoted in currency options is in INR.

- Strikes are available at every 25 paisa price difference.

- Margins are blocked when you intend to write currency options.

Hi, Can you Create module on covered call strategy in gold mini and silver mini ?

Coincidentally working on a video module on Gold and Silver. Lets see if this can go in as well.

sir if my entry 87.4000 exit 87.4500 bought buy side lots 11 i have taken how much profit i have got percentage and number please mention

It will be 0.05 times the lot size 🙂

Thanks for the lesson.

You say above…

\”As you can see, the premium has shot up, and I can choose to close my trade right away. If I did, here is how much I would make –

= 1000 * 0.7750

=775

This translated to a profit of 775 – 740 = 35 per lot.\”

I get an impression you make money in the movement of premium – intra day or interday. But in your answer to couple of queries, you have compared the USD:INR movment and determined the profit multiple. I am bit confused. Pl throw some light. thanks.

Basically the USDINR or any other asset\’s movement determines the price of the premium, basis which you can choose to close the position or hold 🙂

Hi i was studying advance financial management for CA Final exams when i came to know about varsity. Thank you so much for this kind of content because it helped me so much to understand about derivatives and what not. But i am stuck in this concept of future contract in forex market.I know it is slightly out of topic here because it is more about hedging but it will be very helpful for me to understand. Because i really love understanding thing by reading

than listening. So there is very limited content on this online. And your way of teaching is really good.So if possible please post someting on this topic.

Thanks Muskan. What exactly are you looking for? I can try and point you to the right resource.

Hi Karthik,

I love the content and the diverse topics it covers. Just had a doubt, in the kite web, does the quantity mentioned in the USDINR Futures contract translate to ? is it 1 or 1000$ ?

I do not see a lot size as we do in equity or index futures. Please explain. Many thanks.

Thanks for the kind words. Thats right, $1000 is the lot size in USDINR contract.

What is the actual leverage that we trade at when trading USDINR futures

I have a question? can we trade on the bases of education given by varsity or still we have to join some classes?

You can get started and see how it goes. Once you start trading, you will know where are the gaps in your understanding of things and you can focus on learning just that aspect. Also, as far as I know, most of the knowledge required to for markets is already available online for free, you dont really have to pay anyone for this 🙂

Hi,

What happened if i write one option and it expire. Like Stock is there delivery settlement or it just settle based on loss and amount is deducted ?

Regards

If the stock option is out of money, then the option will expire worthless and you need not have to worry about physical delivery.

I appreciate your way of explaining about currency trading, Sir, i like know if i trade only in Future buy and future sell of USDINR, instead of call option,as i am not well acquainted

in currency trading, how i can watch the market trend, is any site is there?

Thanks

Then you can stick just to futures only, Sabita, until you get comfortable with options 🙂

Sir, for example I brought 1 lot of USDINR trading at 70 and I sell at 70.30, how much will be the profit on that 1 lot with 0.30 ups.

You make 0.3 times lot size.

What are the timings to trade in currency derivatives?

Is it same as equity markets?

Its open till 5PM.

How much maximum quantity zerodha allows in USD For trade is it 1200 or 14990 lots in total

Are you referring to freeze quantity? If yes, it is 10,000. Check this – https://www1.nseindia.com/content/circulars/cd11222.htm

Hi Karthik, what is really the underlying for currency options? Is the spot fx Or the futures? I\’m confused because on Sensibull the ticker shows futures rate and the slider (within strategy builder feature) shows the spot rate. If it is spot, then what exactly is the spot in this case?

There is no spot market, Pradeep. The currency options market follows the futures market, and the futures market is driven by the reference rate declared by RBI.

Thanks man 👍

Hi karthik

How doe\’s \”vega\”[Greeks] is calculated for currency options is there a specific index like \”india vix\” \’were we can track market volatility and when will weekly options expire.

Yes, you can keep track of ViX for volatility. Do keep an eye on our Youtube channel, will be uploading a video on this topic today.

Hi Karthik – two questions

1. For trading USD/INR, which chart should we see? The one on tradingview is not so fluid, the candles look small and illiquid. should we use the USD/INR futures chart offered by Zerodha\’s tradingview? Having a good chart is important for intraday trades

2. Currency options have multiple expiry, so it would always make sense to trade the near week or near month expiries right?

1) Its the same. But maybe you can check ChartIQ once to see if it works better for you.

2) Yeah, stick to near term options for better liquidity

Sir in USDINR can i sell first and hold for long term ?

How long can i hold USDINR ?

Please answer me

Yes, USD INR is a futures contracts which you can short and hold overnight.

can i place after market order to exit the holding position?

Yes, you can place an AMO order, but the execution will happen only when the markets are open.

why there is no gtt order in currency futures and options

Because of risk management policy.

Is there any issue regarding liquidity in currency trading ?

No, why do you ask?

Details

How to see usdinr spot chart(not futures chart on zerodha)

Spot charts are not there, Pranit.

Is the expiry day settlement for option sellers 0.0025 or 0 ?

It will be 0, assuming the option has expired OTM.

In nse currency weekly options usdinr expiry on every Friday. Is there any specific time ?

Can you add how and when weekly option expiry’s ?

Expiry is around 12 noon.

Thanks Karthick.

For the point 2, is the settlement price based on the 12.30 PM close of reference rate or 5 PM close ?

because i saw the trading closing time was 5 PM other than expiry days ?

One more question, Will the friday expiries close at 12.30 PM only right ?

Today (27-Apr-22, 12 PM), Incase if i sell 1000 quantity of 76.75 at 0.025 (it will be 2500 rs premium) which is going to expire in 30 mins at 12.30 PM today, and assume USDINR price closed below 76.75

1. Will i get this 2500 rs ?

2. Hope spot price is based on 12.30 PM today ?

3. When will i get my margin back ?

Thanks.

1) Yes

2) Its based on settlement price

3) After the position is closed

I have taken long position for JPYINR for April contract at 63.96….and I have 5

to 7k with me with me as Available cash….and now if i hold April contract…then will it be okk?

Sarvesh, I\’m not tracking margins. Not sure if the margins suffice.

If I buy April\’s future contract in March and hold it till April….then will it be okay?

Yes, you can do that. But ensure you have enough margins to accommodate for the M2M fluctions.

Hi ,

1

If OTM options valued 0.0025 is sold on expiry, so would I also get that premium amount of 0.0025×1 lot = 2.5 rs in my profit after expiry?

2

Do we have to sell the option on expiry day EOD i.e 5 pm or they automatically settled?

3

In currency ,ITM options are cash settled and OTM option become worthless, am I right?

4

\”If current USDINR rate is 75.26 so the 75.25 PE would be OTM and would be zero\” , is this correct or not?

1) Yes, but it will result in a loss considering brokerage itself is Rs.20, plus all the statutory charges.

2) If you hold to expiry, it will get settled

3) Yes

4) Yes

Don\’t they do that in Octa fx?

Its not legal.

Sir is Futures and Options the only way to trade in Forex? , can\’t we just buy and sell normally ?

Nope, this is the only way.

sir, how is the settlement on expiry day for usdinr. please explain. thanks

Hi Sir, do we have to squeare off before expiry or can leave it on expiry day. is this cash settled like options. please reply. thanks

You can hold to expiry or square off before. Its cash settled.

Hi Karthik, could you please help clarify how lower margin means higher leverage?

Lower margins means you pay a lower amount to gain exposure to a large contract, hence high leverage.

How to track strike price and exchange rate is there any chart ?

You can always look at the option chain for this.

Sir, could you suggest what the best time usd/inr can make a move, I mean I could see that usd/inr generally move at 10\’o clok and sometimes at 3\’o clok. And again after markets are closed i.e at around 7:30 when American markets are open. I would like to ask why it\’s not make a move when London market are open say around 1-2 pm

I think post noon is the best bet, if you are looking for movement. But generally, this instrument does not move much.

Where can I find the daily reference rate for usdinr set by RBI?

You can try this link – https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

Now I have taken July features and today is expiry is it possible to switch to August month

Yes, close today\’s position and initiate the same position in August expiry.

Hi,

May I know as to why the margin requirements in Currency Options Selling is so much lesser than say index/stock options? Is there any specific reason for this? Also are currency options strike price dervied from the futures price?

It\’s because the volatility of current options is a lot lesser.

How does the option pricing premiums are calculated for USD INR contracts. Does Black & Scholes calculator helps here sir.

There is a variation of B&S called the Black 76 pricing model which is used here. The only difference is that instead of spot price, futures price is considered as the underlying.

I placed AMO BUY Order for USDINR In Normal ,CNC but It was made sell Order in market price,why it happened ? And In zerodha there is option to place AMO ORDER FOR USDINR or Not, Please reply

Yes, but buy cant be changed to sell. Please call the support for clarification.

Why huge time value? I have taken the trade on 29th April of weekly expiry. One day before the expiry.. Which expired on 30th of April..

Oh, sorry, for some reason I read it as may series. Not sure, Ruben.

Thanx 4 ur rply..

I have another one question, on April 29th I have sell 74.25 PE USDINR option whose expiry was on 30th April. I have taken it on the basis of May FUT becoz on 28th April \’April FUT\’ expired.

At the expiry time at 12:30 PM, May FUT traded at 74.52 but 74.25 PE option premium was .2100..

Why huge premium being the strike price was on OTM??

Am I right by choosing the strike price on the basis of May FUT?

That there is a huge time value to this right?

Sir,

Today (5/7/21) at 12:30 PM at the time of Weekly Expiry, USDINR May FUT price was trading 73.88 and USDINR 73.75 PE option premium was 0.0225..

My question is if at the time of expiry PE/CE strike price is on OTM then it expires worthless and premium become zero.. In this case strike price was on OTM but premium was not zero..

Why it happened?

Please check the settlement price, the price for all OTM options will goto 0.

One question

Lot size is $1000 then one pip or ,0025 shall be = 1000*.0025. And also * $ to ₹ conversation ie

1000*.0025.72= 175/-

Why conversation of $ to inr is not considered.

Because these are Rupee denominated contracts, Hans. All settlements happen in INR, so no required.

Very Good and simple explanation. Thank You.

Hi,

My question is with regard to settlement in Option Trading :

USD INR Futures Price 73.83 (31-03-21——10:22 AM)

Expiry – 31-03-2021

Strike Price 73.5 PE

Assuming at 12:30 it expires at 73.75 and option goes worthless

Assuming At 1:30 RBI Ref Rate comes out to be 73.25 based on spot rates .

So will I get profit 1000 * 0.25 = 250

Thats right, your P&L is dependent on the settlement price.

Is the currency segment is included in the new leverage rules? or there will be the same leverage as Zerodha is used to give?

Yes, it is.

Can u plz explain about how to calculate capital?Based on which I can decide no.of lots for trading.

Which capital, Prem?

i cant find USDINR indices in kite. where we can find the underlying value price?

Are you sure? It is available. Are you searching for it properly?

What is the intraday square off timing for currency trading like USDINR? I mean equity market closes at 03:30, can I continue my USDINR intraday trade even after 03:30?

Yes, till 5 PM.

Hello Karthik,

Thanks for providing these good information for free..

However i need some information on the below trade executed in the zerodha platform.

This trade was taken on 24th Nov.

I had sold the 20Nov 74 CE USD INR Pair 5 lots and it has made 387 rs loss, i am not able to the close the position now it says 1628 Security has matured, and also it has hit the lower circuit,

could you please guide me on the next steps.

Pradeep, that is probably because the expiry has happened and the contract no longer exists.

Apart from hedging or doing only intraday, do you there are other solutions?

Unfortunately no, Jay.

In commodity markets like the MCX, trading hours ( 9 am to 11:30 pm approx.) are similar to the market hours. So you do have opportunities to exit.

In USD INR the trading hours (in India) are (9 am to 5pm) whereas the market hours are say (from 7 am to midnight, maybe more as forex is 24/7). This means that you cannot exit once the trading hours are closed (at 5pm). The period from 5pm to midnight is when the USA markets open, this makes overnight USDINR positions riskier than commodities.

I agree with you the order can\’t go through, but things would be better the USDINR trading hours would match the market hours (say from 7 am to midnight). That way the overnight risk is reduced, and it would be similar to commodities.

In the current scenario, hedging is probably the only way out.

True. If you remember the April Crude episode, our markets were closed, but Crude continued to slide. But anyway this is a dead end situation unless exchanges keep the segment open.

You are correct that the stop loss won\’t get triggered. This is actually the problem.

In cases like NIFTY index, stocks etc. you can get out during the market hours when your stop loss is hit. This is because market hours and trading hours are the same.

This is not the case with currencies, after the Indian trading hour closes at 5:30 PM the rest of the world continues to trade. FOREX is 24/7

For example

Buy USD INR at 74.0000 at 4:30 PM on Tuesday

Stop loss .1000, thus get out price is 73.9000

Due to some panic in the USA markets, USDINR becomes 73.4000. This will reflect in the Indian markets next day (Wednesday). When I sell I will be selling at 73.4000 instead of 73.9000.

If USDINR futures in India was 24/7 I could have sold at 73.9000 before it reaches 73.4000. Unfortunately that is not the case .Now I end up with a bigger loss by selling on Wednesday.

I hope you understand my problem. I want the stop loss to get triggered. Leaving the position overnight might result in a bigger loss than that I was prepared to take.

The only solution I can think of is to do only intraday trades, and avoid positional trades.

What do you think?

Jay, but how will that even work when the markets are closed? There is no way that the order can go through. This is how it works in the commodities market as well. At best you can keep your overnight positions hedged and remove the hedge at market open.

The Indian market closes at 5 pm, and the USA market begins much later after that.

Suppose something unexpected happens in the USA market against your position and hits your stop loss, what do you do?

You will have to wait till next day 9 am (Indian time) to exit.By this time your position would have got worse, how to handle this problem?

Thanks,

Jay

The SL won\’t be triggered anyway since the market is closed.

Rbi reference rate is price for settlement but price of Rbi will be as per 12.30 pm or 5 pm for expiry?

12:30PM if I\’m not wrong.

Is the maximum risk being limited to span margin or could it incur higher losses , is currency trading price movements regulated ?

Could be higher if there is a rapid movement in the stock.

I have a demart account of zerodha. Can i trade the currency & how it\’s possible ?

Yes, you can. Btw, you don\’t need a DEMAT account to trade currency.

Thank you very much karthik. Varsity is the foundation for me to enter into stock market, i cannot describe my thanks to you and zerodha team in words. You guys are the best.

Happy reading and it is a pleasure to be of help 🙂

Hi karthik,I’m a big fan

Could you please tell me if the forex and commodity market is also included in the new leverage rules?

No, Bharath. Only Equities.

Hello Katrhik Sir,

I Am Holding USDINR 18 SEP 2020 Contract Does it Expires on 18 SEP 2020 at 12:30 P.M or Ii will Expire before Two days prior to it. .

Thank you.

It will expire on the day of expiry specified.

So what will be the outcome if

1) The option contract u buy shoots up n becomes ITM n u let it expire?

2) U buy any option contract n it expires in OTM?

Can u please clarify these 2 scenario, thanks in advance!

1) You will be settled based on the intrinsic value of the option

2) You will lose the premium money you paid

Sir

In the table it ia mentioned that settlement price is the RBI reference rate on the final settlement day i.e last working day.

But in the example the settlement price is mentioned as RBI reference rate on 27th july instead of 29th july as said in table.

Please confirm

Need to check. By the way, Last working day = expiry day I mean.

Sir, Can i trade forex on any time of the day? Or the time of trade is fixed

No, you can trade whats available on NSE.

There is something wrong in 60 day Challenge Profit update.

For example One of my 60 day Challenge for currency has started on 24th July. Till 7th August my actual profit is 24.06 K, however in 60 day challenge, its showing as 11.06 K.

I\’m not sure about this, you\’ll have to speak to the support for this.

Ok. Thank you.

Thank you.

But in Zerodha Margin Calculator, Margin requirement for weekly expiry can not be calculated. Only Monthly expiry can be.

Thats right, the monthly and weekly margins are similar, they don\’t vary much.

Is there any way we can we can put the screen shot of these Analysis Pages here in this blog. That will give you correct picture of what we see when we analyse the multi legs baskets in Sensibull Option Chain.

You can try to upload this on G drive and sharing the link.

No.

This was in the Sensibull Option chain Analyzing Summery. After selecting the legs.

Sure, but please do double check once with the margin calculator on Zerodha as well.

Thank you.

But if I want to place a multi legged order say Long Put Calendar & Long Call Calendar, is there any place where I can see my Capital requirement for all the 4 legs in place.

If I place the order through Sensibull option chain than the capital requirement that I see in the Summery (on analyzing the basket order) is not correct.

For example just now, I was seeing basket order:

Sell – Nifty11000 put -6th August expiry – 1 lot

Buy – Nifty11000 put – 27th August Expiry – 1 lot

Capital requirement was showing as Rs.14.20K which is not correct.

May I have your comment on this.

Did you check this on Zerodha Margin calculator?

when can we expect the following

Currency option chain and

Nifty weekly options details in Zerodha Marging Calculator

Are you all working on this front.

This is on the list of things. Hopefully soon. Btw, you can now see the margin in the order placement window itself.

Sir suppose I sell put for USDINR at 68 strike price and it becomes in at rs 65 on expiry.Then can I take delivery of USD like equity?????

No, CDS is cash settled in INR.

Ok Sir, will wait for confirmation. Please provide your thoughts on below also

1) for scalping on USDINR futures, which exchange is more liquid. NSE or BSE?

2) on zerodha calculator observed that charges collected by BSE is way far too less compared to NSE. please let me know if I noticed it right

3) what is the approx. maximum number of lots I can use per trade in NSE so that the trade goes through without much waiting assuming the target price is hit.

4) what is the approx. maximum number of lots I can use per trade in BSE so that the trade goes through without much waiting assuming the target price is hit.

Max is 10K USD per order.

1) NSE

2) Yes, BSE charges are lower

3) 1 lot

4) 10K (again, need to confirm)

Karthik Sir,

The knowledge you are sharing here is amazing for beginners like us.

in general what is the average number of lots a retailer can execute successfully on a USDINR futures , assuming that the target price met. I understand it is case to case basis, but just wanted to understand based on the past data. This is to plan how much i can invest on trading USDINR. is 500 lots a reasonable number for the orders to go through.

Thank you for your response , in advance.

Regards

Saatvik

I think there is a restriction on 100 lots per order. Will confirm this

Hi Karthik,

I have a doubt. Future prices and option premium change when the spot price of the underlying equity changes. But as you mentioned the spot price of the Dollar-rupee pair (reference price) given by RBI Remains constant for an entire given day. Then what is the reason for currency derivatives price changes, mirroring those of live actual FOREX market prices, without actual change in RBI’s reference price?

Is it the anticipation that the next day’s RBI’s New Reference Price will represent the price closest to that prevailing in the FOREX markets for the $-₹ pair at the time of its issue by RBI ?

Thanks

That is right plus the local demand and supply factor acts as a catalyst for movement in futures price.

What is the underlying for usdinr options, spot or future? If underlying is spot, where do we get real time chart of usdinr spot?

Underlying if Futures.

Karthik

This window doesnot have an option to attach a screen shot….below is what you get in the currency margin calculator tool…this just gives you an option to enter amount of cash against which it will display how many lots I can buy….but nowhere it there an option to enter a future and a call and check margin for a hedged trade.

USDINR: Jun 2020

Cash available

Price

Number of lots that can be bought

NRML 2108

47

Use this instead – https://zerodha.com/margin-calculator/SPAN/, under exchange dropdown, select CDS.

Karthik

My original question was – where can I see the reduced margin for hedged currency trade? your margin calculator has no provision for showing this for currency pairs

It seems to be available and working fine, Vijay. Not sure if I\’m missing something.

Kite margin is much much higher (approx 3x) of margin calculator…i again rechecked today….can you pls have this thoroughly investigated internally and revert?

This single clarification will completely alter the strategies and position sizes I use hence awaiting…

Addendum:

read few comments above – can you please confirm that the trading terminal (Kite) is in sync with the margin calculator and not continuing to charge previous margins?… if it is not, can you please advise by when it will be?

Both are in synch, Vijay. Margins on Kite is always right, margin calculator may at times have few minutes lag.

Thanks Karthik..

Your response on 2 – example and even your margin calculator tool shows this for Nifty/BankNifty….what about currency pairs – have you guys worked a provision for reduced margin for a hedged strategy in currencies?

Yes, for currencies as well.

Hi,

In the Zerodha margin calculator, there is no option of separately checking the margin for a currency future and a currency option. I only see pairs listed with various experies and margin next to them….

1. does this mean that the margins are the same for futures and options (shorting an option)?

2. If answer to 1 is yes, then is there any margin benefit for a covered call (as is the case for nifty covered call)?…and if so, where does one compute that?

1) Yes, they are more or less similar

2) New margin framework is here, it will benefit hedged strategies. Check this – https://zerodha.com/z-connect/tradezerodha/margin-requirements/new-margin-framework-for-fo-trades

when I try to access the currency margin file (currencySpan.pdf), it says \”file is in owner\’s bin\”

i would like to know the MIS and BO/CO margin for currency..

Suggest you please speak to someone from the support desk for this.

hi why i am not able to view weekly usdinr options and futures? Can you please provide the code for the same, say for next week expiry. And for more clarification, reference rate is now officially not polled by RBI. FBIL is now the designated agency to publish the reference rate which i believe is now used by RBI. FBIL has its own methodology of publishing rates daily from the one hour OTC spot market window 11.30 am-12.30 am and the earlier process of polling via banks has been discontinued. Since the methodology is opaque and not published freely, obviously there are many instances when rates published has greyness in them since lot of money is at stake!!!!

Let me reconfirm this from the exchanges, Keshav.

Hi,

>> Lot size is fixed to $1,000 but this can be changed by the exchange anytime.

How does one come to know what is the current lot size fixed by the exchange (if it has been changed by the exchange? I checked the USDINR contract on zerodha and it says the quantity as \”1\”, which I assume to indicate the lot size (unlike in stock index derivatives)

Vijay, thanks. Will get back to you on this.

Hi Karthik,

When I buy currency futures, there are 2 segments which come up – one is CDS which I believe is Currency Derivative segment, but what is the other segment which is named BCD. Can you please help with the explanation of the same.

BCD = BSE Currency derivatives.

i had bought 3 lot of usdinr and forgot to exit it on expiry day. as it was a intraday trade i want to know how much will i be charged.

Please do look at the contract note, Sandy.

1. Please correct wherever possible that FBIL and not RBI issues USD/INR and other Reference Rates from July,10, 2018

2. Referring to https://fbil.org.in/uploads/general/Registration_for_use_of_FBIL_Reference_Rates.pdf

\”Accordingly, commencing from April 1, 2019, the FBIL Reference Rates can be

accessed from the FBIL website, http://www.fbil.org.in, only on registration basis. However,

24 hour delayed data will be available for viewing without any fee.\”

Now my question is-

1. Does daily settlement and the month end settlement occur at the FREE DELAYED Distributed Rate or NSE has purchased the Rs. 3L per annum subscription from FBIL? https://fbil.org.in/uploads/general/Delayed_Data_Fees-Reference_Rate-7June2019.pdf

Thanks, Chirag. NSE still used the RBI reference rates, please check this – https://www.nseindia.com/products-services/currency-derivatives-contract-specification-inr , scroll to the end.

Hi karthik,

pls help me with following doubts regarding leverage offered by ZERODHA,

Account balance= 2000/-

NRML amount required to buy 1 lot of may futures of USD/INR quoting @75.8975 = 2265.

1)Now how many lots can I buy with MIS with 2000 Rs as per the formula given on your margin calculator = 1.8X(50% of NRML margins) .

2)Now how many lots can I buy with CO order with 2000 Rs as per the formula given on your margin calculator = 3.33X(30% of NRML margins).

I am unable to calculate how many lots can i buy OR how much amount do i need to buy 1 lot in MIS or CO.

Thank you

1) YOu can still buy 1 lot

2) Same as above

Thanks Karthik for you prompt response!

What I have observed is – though I book profits and close the trade the Currency Contract Notes which are received in email always show the the days closing price which is not the one at which I had closed my trade and net amount receivable dosent show the actual amount/ profits.

I assume Currency Contracts are similar to Future Contracts – let me know if I am correct.

I\’d suggest you speak to the support team once for this. I suspect this could be an expiry trade.

Hello Folks,

I have a very basic query and you can help clarify if my understanding is correct. Whenever I trade currency futures like USDINR and hold it for a day or two and sell it at a best profitable price in the mid of the day, I observe that the profit is calculated as per the day\’s closing price and not per the price at which I sold.

Is that how currency futures work?

No, not true. Your P&L is based on the price at which you buy and sell. That is the only reference price to settle your trade.

How to add spot price chart for currency pairs in Zerodha watchlist. As of now we can only only view Future charts.

Spot price is not available, Sunil.

RBI does not derive it\’s rate from futures, then from where it derives? Is it Google search usdinr rate ?

Have explained the process in the chapter itself no?

Hi sir …

Can I buy or short next week or other next week expiry option of usdinr in this week ,

And can I carry forward this week expiry option to next week ,

Is there monthly expiry option in usdinr ?

Will my premium becomes zero on expiry like f&o options ?

Which day is the weekly expiry day of usdinr options & at what time the position will square off sir ?

Yes, you can as long as you have the margins to support the position.

Yes, monthly expires are available.

Depends on the intrinsic value of the option.

Request you to kindly check the contract specs.

Hello team zerodha,

I am dealing in currency options weekly expiry. Every Friday they expire at 12:30 pm IST. It is said that on expiry the settlement rate will be the one as per the rbi settlement rate.

To monitor my positions, can you please guide me where can I get the Live tracking of dollar inr rate of rbi because in zerodha it only shows the future price. It is always greater than the actual settlement price.

Please guide

Regards

Kapil Arora

You cannot live track the rate because the rate is updated only once by RBI.

You said that the minimum lot size is 1000$ then how are people trading 75, 48, 94 etc in the screenshot you shared ??? Is it in lot size?

These are in lots so, 48 means 48 lots – 48*1000 = 48,000.

Is spot trade also possible in currency?

No, not possible.

You said that the minimum lot size is 1000$ then how are people trading 75, 48, 94 etc in the screenshot you shared ??? Is it in lot size?

Sir,

if i buy 76 ce at 0.2150 / 10 lot

another at 0.2000 / 10 lot , 2 different trades

and sold at 0.300/ 20 lot

then what is my brokerage? how can i caluculate? and what is my profit ? i\’m confused please explain me. sir.

Each buy and sell transaction (completed order) is Rs.20/-. Do check this – https://zerodha.com/brokerage-calculator#tab-currency

Hi Karthik,

When RBI states the reference rate, expiry will close at which price..?

ex: If USDINR April future is trading at 77.8(assume spot price at 77.5) on expiry morning at 11.25 am and If RBI announces the price at 77.5 (77.2 spot price)so it will be lose for whoever it is holding where earlier profit.

Yes, expiry happens at the reference rate.

Hi Kartik Sir,

What is the maximum Lot quantity of currency which can be traded? Also please tell what happens at the expiry for Taxes if I do not square off.

You can trade upto 10K lots if I\’m not wrong. Taxes are deducted by the broker.

Kartik Sir,

I want to trade to net creditoptions strategies but the margin requirements is very high for equity segment..

Is it profitable to trade option strategies in currency markets…??

Where to iv percentile data for usdinr pair

Yes, margins are a bit higher for his. I\’ve not traded currency options much, so can\’t really comment. However, profitability depends on the strategy anyway.

Can we place only one lot in currencies (USDINR) like Nifty index .

Yes, you can.

Hi

I need a video demo of currency trading on zerodha kite!

I tried everywhere but couldn\’t find one! And I\’m confused how do i buy and sell currency futures on kite! Can u help!?!

Hmm, I\’d suggest you call the support desk for this. They will give you a quick overview on how to place orders.

Hi!

I have not been able to generate & view Future & Option P/L Report in my wife\’s account. Currency P/L can be viewed.

However, in my own account I can generate & view both the P/L Reports.

And its being happening for quite sometime now. Any specific reason.

Regards,

Shyamal

Hmm, I\’d suggest you call the customer desk for this.

Sir since the liquidity in currency option is so less in nse, is it still safe to trade them?

(if trading otm to eat the premium)

I\’d be a bit hesitant to trade illiquid options as the pricing will always be an issue.

Thank you Karthik. Accounts were fine by mid day.

Regards.

Yup.

When I opened my trading account on Monday morning at 7.30 AM it was little surprising to see one of my account value going down from Rs. 1353600 on Friday to Rs.1157154.

And from Rs.36.00 Lac on Friday down to Rs.29.60 Lac in another account.

Any specific reason for this?

Regards,

Shyamal.

Can you please create a ticket for this, Shyamal?

Hi,

I have one question – How can I put a stop loss to a regular order to avoid risk on next day i.e if i am carrying my position to next day.

Thanks in advanace.

You can use a GTT order, Subodh https://zerodha.com/z-connect/tradezerodha/kite/introducing-gtt-good-till-triggered-orders

HI karthik,

i have doubt on i have one lot short option position and i dint buyback till expiry(expiry over). will i get any penalty or as settlement done as per p&l. please clear this.

No penalty as such. The P&L will be settled.

even on NSE SITE it\’s written 27th December.

Hmm, sorry dint realize you were talking about CDS. Yes, CDS expiry is 27th and EQ on 26th.

the last working day of this month is 31st December, that is on Tuesday, so the option will expire on Friday i.e., 27th December?

Expiry is on 26th (last Thursday).

What happened to an ill-liquid loss making ITM currency option(Selling) position on expiry if it is not square-off before expiry.

Example: 27th Dec Expiry.

My writing positions are as below: Capital 25.00 Lac. I am sitting with a profit of 1.00 Lac at today\’s close(19.12.2019)

Your Sensibull analysis says If USDINR closes at 71.5 on 27th Dec, My profit will be around Rs.3.25 Lac. which I am expecting.

200 – 71 CE / 200 – 71 PE

200 – 71.50 CE / 200 – 71.5 PE

200 – 72 CE / 200 – 72 CE

200 – 72.50 CE / 200 – 72.50 PE

But what will happen to 200 – 72.5 PE on expiry. At what price it will get settled. And what impact will be there in overall charges if this position are left as it is on expiry. Because this position will become ill-liquid by next week.

Sir ,

Can we trade on the pairs like eurusd ,gpbusd etc from kite .. bcz they provide more liquidity ☺️

Yes, you can.

Hi Karthik,

Writing to you after a long time. Hope all\’s well. So happy to see Zerodha\’s progress.

I have a basic query. I want to initiate a 1SD strangle in USDINR options for Dec series. Please advise what is the reference figure to look at – Dec futures price? Or \”REFERENCE RATE – FBIL *\” mentioned above option chain? Or spot rate as per Google? or some other rate?

Though I understood from the above that settlement price is RBI reference rate on expiry date. But my question is – what is the base price as on this moment?

Regards,

Pratheesh

All well and happy to hear from you again 🙂

I\’d suggest futures price as the options are based on futures.

Dear Karthik,

Greetings !!

Could you please tell me a good book or study material wrt price Action theory.

Entire candlestick theory is based on price action 🙂

Any order placed for USDINR Fut or other CDS Fut on Zerodha goes through NSE or BSE? Assuming that those go through NSE, is it possible that the order is placed through BSE?

Its not live on BSE yet, NSE for now.

Yup, you\’re right there it is reasonably big around 8 – 9 pips.

So you\’ll lose a bit from the impact cost itself.

Thanks sir, but as per my observation far contracts in USDINR have a bid and ask value of anywhere between 8000 – 10000 lots during any time in forex market hours. Please correct me if I\’m wrong.

Hmm, what about the bid-ask spreads?

Hi,

I wanted to ask that I recently went through the nse website, it is stated that the maximum open positions for an individual client cannot be more than 6% of total open interest or 10 million $ for USDINR, the question I have is that if I wanted to take 6 – 7 month far futures in usdinr, so if the amount goes to more than 10 million, so will I be the 6% oi rule be calculated on the specific contract that I am trading or it refers to 6% of total oi in all expires together?

Yes, that will be applicable. Btw, far month contracts do not have liquidity.

What is the maximum number of lot that I can trade in usd/inr ?

Check this – https://www.nseindia.com/products/content/derivatives/curr_der/position_limits.htm

Sir when USD INR futures was first introduced?

2007 or 2008 if my memory serves right.

which means even if I implement a trading system tested over 10 years of data, due to RBI intervention the probability of making money will decrease, isn\’t it sir? Which means I am better off sticking with indices?

Yes, fundamentals do play a role. Also, remember, RBI to looks at the market for arriving at the settlement price. So it is not completely dependent on RBI.

Hello sir, I am of the view that RBI can intervene any time to control USDINR unlike NIFTY, is it correct sir?

Yes, they can, Mani.

Where I can get chart of spot price of usdinr pair as futures chart of usdinr available on kite does not show prices after 5pm.

Pratik, spot chart is not available in Kite as it is not traded on the exchange.

Hello,

As per the specs table the settlement price should be the RBI rate on final working day of month.But in the calculation part you took price of last trading day which 2 days prior to last working day. Which one is correct?

THANKS

They are two different things 1) Settlement price upon expiry and (2) M2M P&L. For both, we end up using the RBI reference rate.

sir i short sell 30 usdin april futures but donot buy before expiry day what should be done

Your contract would have been settled at the settlement price.

Hey Karthik,

I was reading about L&T taking over Mindtree by a hostile Takeover, I was thinking why not a article or so should be added to the First module so we can learn about such actions.

P.S I think a tool should be added to the comments section so that when we are going through a article again, we can find our comments.

Ram, I posted a comment about this on the Varsity app…in the wall section. Did you check that?

That is an interesting tool, will check with the tech team.

Your awesome!!!!

Well, i am not able to put USDINR graph pair on Marketwatch. All i can see is future contacts. Is there any reason for that? Any symbol error?

Only USDINR futures are available, Savan. No spot data for that.

Thank you Karthik, but i want to know why spot data is not available.

You can download the same from RBI\’s website – https://www.rbi.org.in/scripts/referenceratearchive.aspx

Hi, If I take a USDINR trade overnight then do I book profit/loss every single day until I close the trade? Or I book profit/loss when I close the trade say next day or after a week.

Yes, that\’s called marked to market.

What about profits from day intraday trading? Does it get settled on the same day and added to my account balance?

All intraday trades are settled the same day, Sudipto.

Nithin,

Hello, I am looking forward to seeing a detailed documentation on the weekly CDS options.

It is noticed that MIS is not allowed for options… Please help me understand why or how I can trade options intraday.

hiii.

I wanted to ask that in the last few lines, you said that profit would be of 35 per lot.

so I can I calculate that in terms of rupees (with a minimum margin of aprox 2000 required for buying one lot as you stated) ?

In Kite, I found below issues while trading in USDINR weekly options (on all platforms Kite Web/Mobile/Android app).

– Unable to square off open positions from \”Positions\”. Buy/Sell buttons not working from \”Positions\” list.

– Unable to Modify order from Pending Order list. However, Cancel order is working. So I used Cancel and placed fresh order.

Above issues are only in USDINR Weekly options. Monthly options are working fine.

Please fix them.

Dhrutika, you can exit the open positions from the Marketwatch. There is an issue with exiting from Positions which will be fixed by the end of this week.

Weekly options

Hi sir

I want to know what would be last trading day for currency options Friday or Thursday and timing

Thanks

Rohit, the weekly options expire on Fridays.

Karthik,

I have observed that USD-INR quote on Google search is almost same as USD-INR current month NSE future rate during the 9-5 trading hours. However, beyond 5PM, the rate keeps moving on google and the next morning the NSE future price almost always opens at the price being quoted on google. What is the source of google data? I am assuming it is some other international exchange where the same pair is traded. Which exchange is it and should this information anyway affect our trading stratgey on NSE USDINR futures?

Thanks,

Akshay

I\’m really not sure about their data source (NSE I\’m guessing). However, you can check for disclosures on the Google finance page.

Hi Karthik, I have a question.

I have a Zerodha account and I have only NSE & BSE segments enabled. Can I trade USDINR with this or do I need to enable CDS or NFO?

Please help!

To trade the USDINR futures/options, you need CDS enabled.

What is the procedure to do the same?

Thank you!

Login to Kite, under profile check the segments enabled. If you do not see CDS, then I\’d suggest you reach out to the support team.

Is there any STT trap for \”in the money\’ currency options, like it is in case of EQUITY options?

Dear sir,

I am not able to understand how to calculate my profits for currency on brokerage calculator. Like in buy i entered 72.4400 & in sell i entered 72.4475 but what about quantity ? Do one lot means quantity =1000 ?

& if it so then it is showing a profit of around 5000. & since i can buy 1 lot for around 1000 or 2000 rupees, would i really profit 5000 from just 3 pips movement ?

Since 5000 seems to be crazy profit for just 1000 rupees or so, i think i am mistaken somewhere, am i ?

Manas, for currencies, one lot is equal to 1000$ for USDINR, 1000 GBP for GBPINR, 1000 Euros for EURINR and 1,00,000 Yen for JPYINR. So what you are seeing is for 1000 lots of USDINR

Thank you sir, I knew i was wrong somewhere. Actually for options we enter ( lot size X no. of lots ) as quantity in the brokerage calculator so i did same thing here, but now i know it\’s different here.

Cool. Good luck, Manas 🙂

Hiii sir good morning \’ I want to trade in usdinr options , will option value become zero on the expiry date as like nifty options

All options which are worthless become 0 upon expiry.

Dear Sir,

I have 10 lots of USDINR SEP 73 CE. Currently its showing Rs 200 profit. I don\’t know should I sold all 10 lots or hold it.

I want to know, how can I claculate profit/loss at end of SEP? If $ Price is say 73.0275 at september last.

Please answer?

Javed, you need square off the position and understand the basics and risk involved in this. I\’d suggest you take up the module on Options to know more about options trading https://zerodha.com/varsity/module/option-theory/

Dear Sir, my question is on intraday futures, what happens to the existing open position when I buy or sell intraday futures. For example, I have an outstanding long infosys carry forward position and today I short intraday infosys. Will my long position be squared off or there is no link between intraday and carry forward contracts.

No, because your long Infy position is NRML and short Infy is MIS. These are two different product types.

I couldn\’t able to understand a profit and loss calculation please help me to understand that

symbol=EURUSD

position=BUY

lot size=1000

tick size=0.0001

tick value=lot size*tick size=1000*0.0001=0.1

entry price=1.1639

exit price=1.1652

pip=exit price-entry price=1.1652-1.1639=13

CONVERTING FROM USD TO INR=pip*(usd to inr)

=13*69=897

is my profit calculation is correct or not if wrong means teach me how to calculate

Perumal, on the EUR USD paid, you make

Sell Price – Buy Price

= 1.1639 – 1.1652

= 0.0013

Multiply this with lot size

=0.0013 * 1000

=1.3

Since the pair is quoted in USD, this is $1.3, converting this back to INR @ fixed reference rate of 69-

1.3 * 69

=89.7. This will be your profit.

So when you take this position, there are 3 risky elements –

1) EUR

2) USD

3) INR Reference rate to USD.

still i have one more doubt that is in currency we will say

if Digit ==5 point=0.00001

if Digit==4 point =0.0001

pip=(close position-open position)/point

take profit=pips*no .of lots

my friend suggested this way to calculate profit is it right

The number of decimals is restricted to 4. A pip is defined as the minimum movement in a currency pair. For example, if EURUSD moves from 1.1784 to 1.1786, then its said to have moved 2 pips.

Profit = Number of pips in your favor * 1000 * lots.

I sold a put option contract at premium of 1000*0.01=10.. After few days premium was 1000*0.005=5… Wat premium should I receive 10 or 5 or 15

You will receive the amount at which you have written the option. In this case, it will be Rs.10.

There is a catch here.

Real example that was happened to my account.

on day 1: I bought USD INR position @68.99 and it was in loss of 8k since USD was gone down @68.75. I took it to carry forward. 8k debited from my account as daily settlement as loss.

on Day2: When market open, i had seen USD gone down @68.45 and it was showing loss of 17k because whatever the buying rate on day1 was still same (@68.99). on day2, 17k as loss had been debited from account. now total loss became 25k. this was huge loss and my account value reduced by 25k when I seen on day3.

Here catch was they had debited 8k again on day2.

Why this was happened, can someone explain?

Layka, how many lots did you have? The math is like this –

1) Day 1 – you went long @ 68.99, but EOD the price was 68.75. So you will lose 0.24*1000*number of lots. This gets debited from your trading account.

2) Day 2 – The reference price for the day is 68.75, but the day closed at 68.45, hence you will lose 0.3*1000*number of lots

The total loss for the 2 days is 68.99 – 68.45 = 0.54 * 1000 * number of lots you hold.

Hi I want to know if dollar increase then usd/inr will also increase and vice versa is this right

Also, can a correlation between dxy(dollar) and USd/inr can be done while trading

Yes, with $ going higher, the USD/INR is expected to go higher, which implies Rupee is weakening. You can use the DxY data points as an indicator.

Hiii

I have a confusion here

Suppose i have taken usd/inr 10 slots in Normal and its in loss so i keep it in postion for 3 days.. so everyday the loss will dibit from my account or only when i sell it.

Secondly will i get profit everyday

{if its profit} or only after selling it.

Thanks

Both losses and profit are settled on the same day. This is called Mark-to-Market settlement and is explained in this chapter

Yes, your P&L is debited/credited on a daily basis. This is marking to market.

What option you will execute if you are bullish and bearish in usd inr?

a)short put

b)long put

c)short call

d)long call

According to me and as i understand that for bullish we will go for long call and for bearish we will go for short call.But i am still unsure of the understanding or answer i have.Can you please clear my doubt whether i am right or not…???

If I\’m bullish, I\’d buy the USD INR futures, Calls, or Sel puts. If I\’m bearish, I\’d sell futures, buy puts, or sell calls.

Thank u alot…

I shorted 1 quantity of USD/INR JUN FUT at a price of 65.7675 hold it overnight and bought it back at the price of 65.7200 on the next trading day. On kite in positions it was showing a profit of 47.50 but when I checked my ledger it is showing credit of 59.99 and in particulars it is showing debtors on 2018-04-13. Please explain me why the credit is more than my profit.?

Also I saw the contract note, there it was written that position carry forward price of 65.7900(it was the closing price of the scrip) and buying price of 65.7200 also it was calculated as 65.7900 – 65.7200 = 70

Please explain me why there is difference in the selling price.?

I\’d suggest you speak to the support once for this. Thanks.

Hi Karthik,

Can you please explain the settlement of ITM Currency Options (Call & Put) if I leave it until expiry?

Thanks in advance…

Am looking for a detailed working example please…

That module is more than detailed 🙂

The settlement will happen based on the intrinsic value of the option. Have you checked the Options module? Its explained here – https://zerodha.com/varsity/module/option-theory/

If I sell 1 lot on GBP INR in one month of contract in option trading. Can I buy it any day within contact.

Yup, you can.

pls provide currency future demo videos…..

On our list of things to do.

\’\’Currency sticks to a tight trading range compared to equities.\”

Dear sir, I did not understand this sentence. Please elaborate a little.

Thanks!

It means just that – the range within which the currency operates on any given day is much lesser compared to equities.

Sir,

You are doing a great job by educating everyone in a simple language. My doubt is can we apply option strategies to currencies also?

Yes, you certainly can!

Hi Karthik ,

How much money one needs in his account to short 200 lots of usdinr ?

Its roughly 2K per lot. Check this – https://zerodha.com/margin-calculator/SPAN/

Dear Sir, as we do our homework in stock markets with EOD data of Open/High/Low/Close and volume, applying diferent indicators to adjudge the trend and important levels, is there any website to provide such historical EOD data for currencies ?

Thanks

RBI gives this information out on the webiste. I\’d suggest you take a look at their website/homepage.

Thanks !

And what if I am squaring off in loss ?

How will my profit gets calculated ? The loss incurred – Premium ??

Pls explain..

In this case you will have to take the loss. No profits. Again, the loss will be the difference between the premium received and paid.

Hi karthik, pls help me with the query :

Taking Darshan\’s example :

Suppose today I entered the trade “Shorted USDINR Sep 64 PE @ 0.15 with 200 Lots” then the premium I collected is Rs. 30,000.

Now on the second day if RBI ref rate is 64.5, can i square off my trade on the second day ? If yes, will i be getting margin – the loss(difference in USD) and also will my margin amount gets unblocked ??

Could you please elaborate.

Thanks

Yes, you can close the position next day (or anytime after you\’ve initiated the position). The moment you block the position your margins will be unblocked.

Suppose today I entered the trade \”Shorted USDINR Sep 64 PE @ 0.15 with 200 Lots\” then the premium I collected is Rs. 30,000. Please answer following questions to clear my doubt

If on settlement day (27-Sep-2017 @ 12.30 PM) if RBI ref rate is 64.5

1- Will this contract settle just like any other Equity / index contract i.e. CASH SETTLED ?

2 – Since this contract settled as OTM, it will expired worthless ?

3 – If this contract expires worthless than I as an option seller will keep the entire premium i.e. Rs. 30,000 ?

Thanks.

1) Yes

2) Yes

3) Yes

Thanks for the confirmation

Cheers!

If I trade with 1 lot of USDINR currency , and take profit of 1pip. . Then what is the profit in rupees?

Copy pasting this from the above chapter, for your reference –

Lot Size * pip (tick size)

= 1000 * 0.0025

= 2.5

This means to say, for every pip or every tick movement you make Rs.2.5/-

Hi Karthik,

As usual, wonderful wonderful work ………Is there any reason that options have such thin volumes on currency…..Considering the very low premium costs, shouldnt it be an attractive instrument for currency traders….

Thanks, Prashant, you\’ve been reading Varsity for a while now, glad you still like the contents 🙂

It\’s just lack of liquidity and nothing else.

Hi Zerodha,

Is there any possibility that Cryptocurrency like Bitcoin or Ethereum would be introduced for Trading on Zerrodha Platform?

I don\’t think exchanges would allow crypto anytime soon 🙂

Hi

If I buy call option (ATM)on 26 may and ref rate on 26 may is 64.55

On 29 may ref rate is 67 and on 31 may ref rate is 62

I want to know I would be in profits or in loss.

My profit or loss would be according to which reference rate

It depends on the strike price, but in general, a long call option position profits when the spot price increases.

Hi karthik,

I have lot of confusions

If I have option or future contract then after 11:30 on 29 may, I can not trade (May series)

Let RBI ref rate on 29 is 64.75

on 31 ref rate is 65.1

What would be settlement price?

Does RBI ref rate changes intraday wise

On one business channel I noticed they show Rs rate vs dollar. What is importance of that if I trade currency

Please reply

The reference rate would be 64.75 – basically the reference rate of the day of expiry. Note, ref rate of the expiry is also the settlement rate for the series.

No, RBI ref rate does not change intraday.

Hi karthik,

I want to know has options writing (mis)been blocked for currency in zerodha

You are right, MIS is not allowed for option writing in currency. These options are volatile and lacks liquidity. Besides the regular margins itself is very less.

I have a Zerodha Account. How can I view the USD-INR pair (the underlying ) while trading Options and Futures on Kite.

Goto Kite universal search and look for USD INR and you will get to see the pair in the list below. This may help – https://www.youtube.com/watch?v=5CNXns5AoHg&index=2&list=PLkxTRam6E2V-okv6gwQlt6dLTsn0v6CD1

Seems like the underlying is not available- for other pairs as well. I am able to see the Futures and Options Contracts but not the underlying. Will check with support if it is a single case. In case it is not to be there can you guys add it ? This section has really gotten me interested in the FX instruments.Cheers!

I guess you are talking about the option contracts. If so, then its made available only for USD INR. Options on other currency pairs are not made available yet by exchanges.

can i use pledged stockholding to write currency options?

Yes, you can.

Thanks for this module Sir. Is technical analysis concepts applicable on Currency charts as well?

Certainly, TA is applicable on any asset which has continuous time series data (open, high, low, and close).

Dear Sir,

Thanks for the chapter, I want to ask how many decimal places a currency exchange rate can go upto and is there a standard practice banks follow in terms of defining decimal places of an exchange rate?

Regards,

Joseph

It can go upto 4 decimal places. This is a standard practice.

Hi, I am a newbie as far as futures are concerned. When I am looking at GBPINR then there are two dates like….

CDS NORMAL FUTCUR GBPINR 26OCT2016 GBPINR16OCTFUT Why are there two dates 26 OCT and 16OCT?

Not sure where you are seeing the 16th Oct expiry. 26th Oct is a valid expiry.

Check this – https://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuoteCID.jsp?underlying=GBPINR&instrument=FUTCUR&expiry=26OCT2016&key=FUTCURGBPINR26OCT2016–24OCT2016

HI Karthik

well currently i don\’t have any question but just want to say thanks to you and all Zerodha team you guys are doing great job keep continue.

and I love Zerodha.

Thanks for the very kind words Vijay 🙂

Hi Karthik,

today on 19/9/2016

RBI ref rate INR/1USD =66.8737

SPOT USD/INR=66.9575 (FROM MONEY CONTROL)

FUTURES(28/9/2016) USD/INR=67.0600 (FROM MONEY CONTROL)

now my doubt is , [1]In the above chapter you said ref rate is spot rate.

[2]If i want to enter into futures contract today , at which price i have to enter AND if i want to square off my position at what price in the above list i have to close position.

I am totally confused . please give some clarity on this sir.

There are only two important rates here – RBI Ref rate and Futures Rate. RBI Ref rate is not tradable. You can only trade the futures…so this is the only rate that matters while initiating and closing the position.

As u mentioned there is negative correlation b/w nifty and usdinr. For eg nifty is giving the buy signal and the USD inr is in somewhat higher level with a major resistance. At this point if I buy nifty/sell usdinr can good a better result. Is it the right way by taking position in keeping view of the other with ta for the short term trades(may be intra or swing).if so what\’s the odds of winning as per ur exp.

Negative correlation does not mean a signal to trade is generated :)…but of course you can use this information to build a trading system of sorts, something like a pair trade.

How can I get the usdinr spot rate charts for technical analysis. I think its not available in pi only future contract charts are available. The rates I can get from RBI site as mentioned but is there any possibility to get the spot data chart in pi for better understanding??

Spot is not traded on exchanges, hence difficult to get the data. However you can download the data from RBI site and try plotting on the excel. Or you could try a site like xe.com or netdania.com

1) As u mentioned above if the rupee depreciates drastically RBI will intervene and buy the rupee to strengthen the local currency like wise fed also will do the same to strengthen the USD. That means both the parties trying to make the market move in sideways only. If so when will be there intervention if its -0.5/1 percentage..In this kind of scenario pls advice that ta is fully not realiable with ta..its better to blend ta with the levels-pls comment

I would agree….on a day to day basis probably TA works but there would be instances when you need to know the macros.

Sir, While trading intraday for CDS, will Profit or Loss be credited the same day.

Yup, just like equities.

Sir, thanks for your answer. i did go through CE and PE charts for USDINR, where the volumes seems to be low even for ATM strike. Would you say trading futures is better as compared to options in this case.

At the moment yes, but from what I understand the options segment is likely to attract better liquidity going forward.

Dear sir .. In currency trading my profit is .30 but lot size 2000= 600 in this circumstances my profit will convert Indian rupees… Please answer for this

Yes, all profits/losses are in INR.

thanks

Karthik Sir

I have 2 questions : for example if i buy 1 lot of (USD-INR Aug 2016) @ 67. 30 on july 28th 9: 15 am . if price falls to 67. 10 by evening ( 3: 45 pm ) . should i sell it at a loss of 20 paisa ( by 5 pm ) or hold it till next day to recover my loss ?

next day price moves to 67. 50 . should i exit next day with 20 paisa profit or hold it till expiry ?

If you expect the prices to recover then you should hold. Or if you a pure intraday trader and do not like taking on overnight risk, then its prudent to square it off.

For reasons such as this, you need to pre define your trade with stoploss, target, and timeframe…without this there are bound to be a lot of confusions.

Sir,

What is the normal average Volatility in Currency trading, Can you please give an example USD/INR

Check this chapter, have discussed some stats – http://zerodha.com/varsity/chapter/the-usd-inr-pair-part-2/

Sir,

What is Tick size and importance of tick size in currency futures and options.

We have discussed this here – http://zerodha.com/varsity/chapter/reference-rates-impact-of-events/

Hi karthik sir, in how much time any buy/sell order gets executed? Can we send buy and sell order in a single morder?

What is the Minimum Holding Period to sell, if i buy usd/inr today at 10 Am.

No such minimum holding period. You can sell it whenever you can.

Hi Amit/ Karthik please explain how carry trade can b executed in a sureshot way

KARTHIK SIR , can you share your cell no. for query , Sir are you providing training . please let me know.

I\’m available on Varsity 24/7, so please ask your queries here and I will be more than happy to share what I know.

Hi , milind here , i have checked

intrinsic value as per your chapter Mo.3 module 2 but today i have checked NIFTY side as per closed market 15/07/2016 – Option Chain (Equity Derivatives) in which IV (intrinsic value ) is not as per your formula Eg. for strike price 8500 & 8550 ( for both it is 12.59) , can you help me in that issue.

Regards

Milind Raut

9049248562

Where are you checking these values?

I think you are talking about implied volatility (IV) ….

Sir thanks a lot for ur efforts to teach new comers in the markets.. Its like \’BhagvatGita\’ of the Market… 😀

I\’m happy to know you liked the content here Avinash 🙂

Guru,

Eagarly waiting f4 next chapter.

Waiting to put it up eagerly 🙂 Next week I guess!

Sir Zerodha Varsity is helping me a lot in many ways , m Thankful and greatful a lot for all the previous chapters

I want to know in my future studies is How Volatility will affect the USDINR price……????

And How to calculate the Annual Volatility for USDINR…….??????

Please if possible means you can help in future chapters sir or else its ok ….

But still i will be Thankful to Zerodha Varsity Team

Thank You sir

Glad to know Varsity is helping you John!

Watch out for the next chapter on the USD INR pair!

ok Thank you sir

Welcome!

Sir in Currency Deravative we can Trade in 4 pairs of Future

USDINR

EURINR

GBPINR

JPYINR

When we come to options we need to trade only in USDINR options,

Options will be added to remaining 3 pairs or wat sir ……..??????????

Hopefully sometime in the future 🙂

Please explain about creating a Calendar spread with USDINR. Suppose I want to buy August series and sell September series, how do I do it using Ztrader or Pi ? How much margin will be required ? Will it be counted as one trade and brokerage charged accordingly ? How and when is it squared off ?

Will be discussing this in the next chapter.

hy

There are lots of currency pair are in the world and we can check each pair rate online in any forex website , my doubt is these pair are trading in which exchange , same currency pair trading different exchanges in the world?now (11-07-2016 08: 45) i watch investing.com forex market section and we can see price movement of forex pairs there . and they are trading which market…

please help karthik . i\’m totally confused..

There is no single exchange where the currencies trade – its an international markets and is open 24/7. I\’d suggest you read this chapter – http://zerodha.com/varsity/chapter/currency-basics/

Hi Kathik

What are these restrictions in the movement of currency prices that you are referring to?

About the RBI reference rate- It is arrived at, by polling quotes from major forex dealing banks. Does it mean that there is no singular spot rate? That if I am an importer and want to buy USD against INR then two different banks might offer me two different rates?

There are a set of designated banks that can participate in this process. RBI calls them individually and asks them for a two way quote, then RBI averages this and arrives at the rate for the day. This is the official rate that everyone quotes.

Restrictions is mainly in terms of RBI intervening whenever there is a drastic move in the markets – they either buy or sell dollars to support the currency.

I.e.

Short usdinr each month and carry this trade for the premium at expiry.

U will receive some 30 paisa.

I used to do this, but usdinr suddenly shoot from 66 to 67 during china news.

I booked loss. But if i would continued to hold my position would be in profit in next month or so.

Now i think the solution for such movement is sell puts.

Ur opinion.

Thanks

Correct*

From 64 to 67.

10 lots was there

Yup.

Ah, got it. This is good if you have deep pockets as you can accommodate for MTMs. I would prefer holding Futures as opposed to options.

Is carry trade a better strategy for usdinr?

Pls explain.

Can you explain a bit on the carry trade you are referring to? Thanks.

Dear Karthik , Since the trading is done till 12:30 on 27th July and the settlement is done based on RBI announced rates of 27th July, so at what time does RBI announce the rates for that day Thanks