12.1 – Background

If you have understood the straddle, then understanding the ‘Strangle’ is quite straightforward. For all practical purposes, the thought process behind the straddle and strangle is quite similar. Strangle is an improvisation over the straddle, mainly to reduce the cost of implementation. Let me explain this further.

Consider this – Nifty is trading at 5921, which would make 5900 the ATM strike. If you were to set up the long straddle here, you would be required to buy the 5900 CE and 5900 PE. The premiums for both these options are 66 and 57 respectively.

Net cash outlay = 66 + 57 = 123

Upper breakeven = 5921+123 = 6044

Lower breakeven = 5921 – 123 = 5798

Therefore to set up a straddle, you spend 123 and the breakeven on either side is 2.07% away. As you know the straddle is delta neutral, meaning the strategy is insulated to the directional movement of the market. The idea here is that you know that the market will move to a large extent, but the direction is unknown.

Consider this – from your research you know that the market will move (direction unknown) hence you have set up the straddle. However the straddle requires you to make an upfront payment of 123.

How would it be if you were to set up a market neutral strategy – similar to the straddle, but at a much lower cost?

Well, the ‘Strangle’ does just that.

12.2 – Strategy Notes

The strangle is an improvisation over the straddle. The improvisation mainly helps in terms of reduction of the strategy cost, however as a tradeoff the points required to breakeven increases.

In a straddle you are required to buy call and put options of the ATM strike. However the strangle requires you to buy OTM call and put options. Remember when compared to the ATM strike, the OTM will always trade cheap, therefore this implies setting up a strangle is cheaper than setting up a straddle.

Let’s take an example to explain this better –

Nifty is trading at 7921, to set up a strangle we need to buy OTM Call and Put options. Do note, both the options should belong to the same expiry and same underlying. Also the execution should happen in the same ratio (missed this point while discussing straddle).

Same ratio here means – one should buy the same number of call option as that of put option. For instance it can be 1:1 ratio meaning 1 lot of call, 1 lot of put option. Or it can be 5:5, meaning buy 5 lots of call and 5 lots of put option. Something like 2:3 is not considered strangle (or straddle) as in this case you would be buying 2 lots of call options and 3 lots of put options.

Going back to the example, considering Nifty is at 7921, we need to buy OTM Call and Put options. I’d prefer to buy strikes which are 200 points either way (note, there is no particular reason for choosing strikes 200 points away). So this would mean I would buy 7700 Put option and 8100 Call option. These options are trading at 28 and 32 respectively.

The combined premium paid to execute the ‘strangle’ is 60. Let’s figure out how the strategies behave under various scenarios. I’ll keep this discussion brief as I do believe you are now comfortable accessing the P&L across various market scenarios.

Scenario 1 – Market expires at 7500 (much below the PE strike)

At 7500, the premium paid for the call option i.e. 32 will go worthless. However the put option will have an intrinsic value of 200 points. The premium paid for the Put option is 28, hence the total profit from the put option will be 200 – 28 = +172

We can further deduct for the premium paid for call option i.e. 32 from the profits of Put option and arrive at the overall profitability i.e. 172 – 32 = +140

Scenario 2 – Market expires at 7640 (lower breakeven)

At 7640, the 7700 put option will have an intrinsic value of 60. The put option’s intrinsic value offsets the combined premium paid towards both the call and put option i.e. 32+28 = 60. Hence at 7640, the strangle neither makes money nor losses money.

Scenario 3 – Market expires at 7700 (at PE strike)

At 7700, both the call and put options would expire worthless, hence we would lose the entire premium paid i.e. 32 + 28 = 60. Do note, this also happens to be the maximum loss the strategy would suffer.

Scenario 4 – Market expires at 7900, 8100 (ATM and CE strike respectively)

Both the options expire worthless at 7900 and 8100. Hence we would lose the entire premium paid i.e. 60.

Scenarios 5 – Market expires at 8160 (upper breakeven)

At 8160, the 8100 Call option has an intrinsic value of 60, the gains in the call option would offset the loss incurred against the premium paid towards the call and put options.

Scenarios 6 – Market expires at 8300 (much higher than the CE strike)

Clearly at 8300, the 8100 call option would have an intrinsic value of 200 points; therefore the option would make 200 points. After adjusting for the combined premium paid of 60 points, we would be left with 140 points profit. Notice the symmetry of payoff above the upper and below the lower breakeven points.

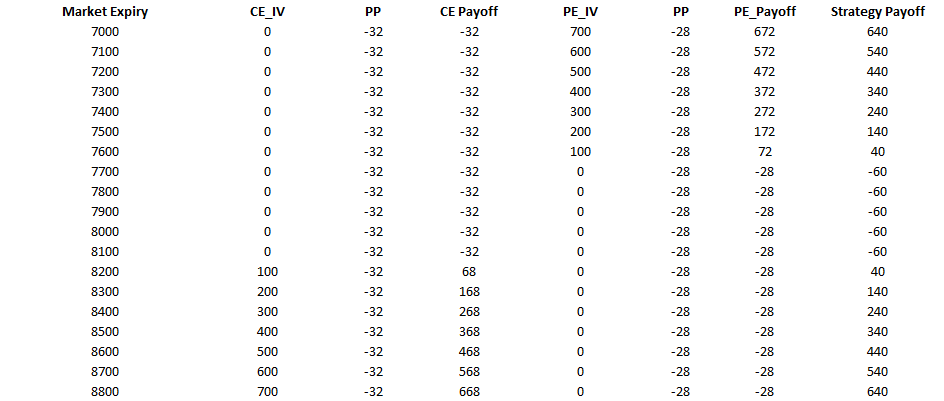

Here is a table which contains various other market expiry scenarios and the eventual payoff at these expiry levels –

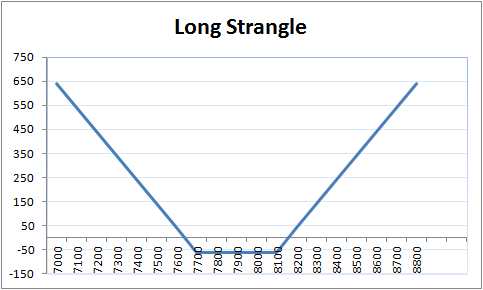

We can plot the strategy payoff to visualize the payoff diagram of the strangle –

We can generalize a few things about the ‘Strangle’ –

- The maximum loss is restricted to the net premium paid

- The loss would be maximum between the two strike prices

- Upper Breakeven point = CE strike + net premium paid

- Lower Breakeven point = PE strike – net premium paid

- Profit potentially is unlimited

So as long as the market moves (irrespective of the direction) the profits are expected to follow.

12.3 – Delta and Vega

Both straddles and strangles are similar strategies, therefore the Greeks have a similar effect on strangle and straddles.

Since we are dealing with OTM options (remember we chose strikes that are equidistant from ATM), the delta of both CE and PE would be around 0.3, or lesser. We could add the deltas of each option and get a sense of how the overall position deltas behave.

- 7700 PE Delta @ – 0.3

- 8100 CE Delta @ + 0.3

- Combined delta would be -0.3 + 0.3 = 0

Of course, I’ve just assumed 0.3 for both the options for convenience; however both the deltas could be slightly different, hence we could not be delta neutral in a strict sense. But then the deltas will certainly not be too high such that it renders a directional bias on the strategy. Anyway, the combined delta indicates that the strategy is directional neutral.

The volatility has similar effect on both straddles and strangles. I’d suggest you refer Chapter 10, section 10.3 to get a sense of how the volatility impacts the strangles.

To summarize the effect of Greeks on strangles –

- The volatility should be relatively low at the time of strategy execution

- The volatility should increase during the holding period of the strategy

- The market should make a large move – the direction of the move does not matter

- The expected large move is time bound, should happen quickly – well within the expiry

- Long strangle is to be setup around major events, and the outcome of these events have to be drastically different from the general market expectation

I suppose you understand why long strangles have to be set up around major market events; we have discussed this point earlier as well. If you are confused, I’d request you to read Chapter 10.

12.4 – Short Strangle

The execution of a short strangle is the exact opposite of the long strangle. One needs to sell OTM Call and Put options which are equidistant from the ATM strike. In fact you would short the ‘strangle’ for the exact opposite reasons as to why you go long strangle. I will skip discussing the different expiry scenarios as I assume you are fairly comfortable with establishing the payoff by now.

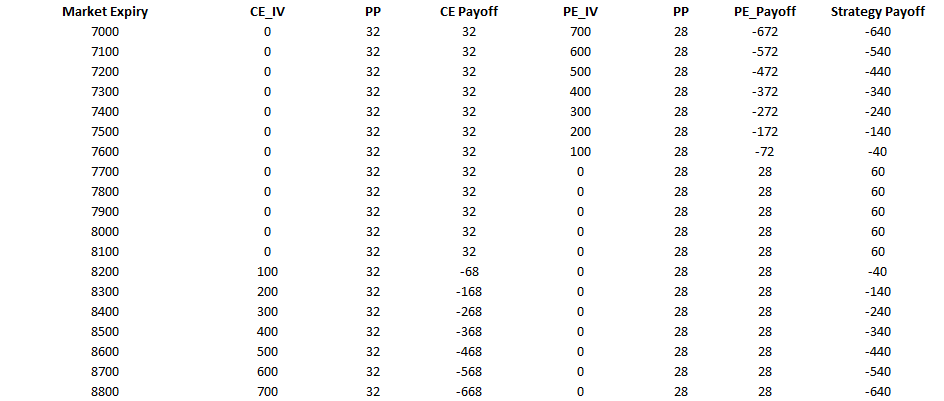

I’ve used the same strikes (the one used in long strangle example) for the short strangle example. Instead of buying these options, you would sell these OTM options to set up a short strangle. Here is the payoff table of the short strangle –

As you can notice, the strategy results in a loss as and when the market moves in any particular direction. However the strategy remains profitable between the lower and upper breakeven points. Recall –

- Upper breakeven point is at 8160

- Lower breakeven point is at 7640

- Max profit is net premium received, which is 60 points

In other words you get to take home 60 points as long as the market stays within 7640 and 8160. In my opinion this is a fantastic proposition. More often than not market stays within certain trading ranges and therefore the market presents such beautiful trading opportunities.

So here is something for you to think about – identify stocks which are in a trading range, typically stocks in a trading range form double/triple tops and bottom. Setup the ‘strangle’ by writing strikes which are outside the upper and lower range. When you write strangles in this backdrop make sure you watch closely for breakouts or breakdowns.

I remember setting up this trade over and over again in Reliance couple of years ago – Reliance was stuck between 850 and 1000 for the longest time.

Anyway, here is the payoff graph of the short strangle –

As you can notice –

- The payoff of the short strangle looks exactly opposite of the long strangle

- The profits are restricted to the extent of the net premium received

- The profits are maximum as long as the stock stays within the two strike prices

- The losses are potentially unlimited

The breakeven point calculation is the same as the breakeven points of a long strangle, which we have discussed earlier.

Key takeaways from this chapter

- The strangle is an improvisation over the straddle, the improvisation helps in the strategy cost reduction

- Strangles are delta neutral and is insulated against any directional risk

- To set up a long strangle one needs to buy OTM Call and Put option

- The maximum loss in a long strangle is restricted to the extent of the premium received

- The profit potential is virtually unlimited in the long strangle

- The short strangle is the exact opposite of the long strangle. You are required to sell the OTM call and put option in a short strangle

- The Greeks have the same effect on strangles and straddles

Download Long Short Strangle Excel Sheet

Hi.

Can you please throw some light on the following

I shorted Nov Reliance 1200 PE today.

if 1200 PE goes in the money at Expiry I will be happy to take the delivery.

Is there any way I can take that delivery on MTF(Margin Trading Facility)

No, that wont be possible 🙂

Sir, In a Long strangle does the price matter. Ex Say 23500 CE is at 100 and 23400 PE is at 75 can be said a good trade or 23500 CE @100 and 23400 PE@ 98 is a better one?

Huge gap in prices or smaller gap is better?

The price matters because your profitability and your breakeven points depend on it.

Dear sir,

thanks for hearing !

and hats-off for the great effect.

i would like to know the expected move of a stock

where to check in Zerodha paltform

i know the formula but can we pls explain with a example

brds

Expected move is something you will have to figure yourself. For actual prices, you can log into Kite and see the prices.

Hey Karthik, I think there is a mistake in the \”key takeaways\” part as in the 4th point the maximum loss in both long straddle and long strangle is the net premium paid and not received,

Thank You.

Sure, let me check.

Hi sir,

I have tested a strategy with sensibull\’s virtual trading that selling far otm options in intraday for finnifty index 350 points away from ATM with having hedges having a probability of 74% but with not good risk to reward. But what are the things I have to keep in mind before applying this strategy with real money?

How can I identify the volatility of fin nifty whether it is high or low ?

How can I use the IV percentile ?

Take bank nifty vol as a proxy for fin nifty vol. Or if there is enough data, you can calculate the historical vol for fin nifty. Start small and see how it goes 🙂

Hi Karthik,

For short strangle, We do not necessarily have to choose close OTM call and put options essentially means we can give ourselves a very great winning chance by selecting very far OTM options (which makes the range for fluctuation very broad and would be exceeded very rarely). What is the catch here, am I missing something? Seems too good to be true.

And can you explain what would be the difference between payoffs if I choose to exit the short strangle after just half an hour and if I choose to exit the short strangle at the expiry of the option (Or exit after a couple of days from the day of entry). Lets assume volatility was high during entry and cooled of later and the graph of the underlying stock remained flat until expiry.

Gireesh, so the only catch is that the far OTM options will have lesser premiums to capture. Most traders dont find this attractive enough for the margins they have parked.

Yes, you can exit the trade intraday as well, especially on days when you feel the volatility is high and will cool off intrday.

Hii kartik!

I have been reading varsity for a while and I’m just loving it . I have even completed the certification. My question to you is have you read ernest chan and what are your opinions about him, are the books good for quants and algo trading?

Thank you

I\’ve not read his books, let me know if there is anything recommendations.

I presume, winning probability would be higher in short strangle over long strangle, if u able to find ideal stop loss, then u can make profit in sideways as well as in one side direction either. Or u can exit cost to cost or less loss.

Is my understanding correct?

There are different aspects to this and it is probably not the right approach to conclude that one strategy is better over another one. Each strategy should have a place in your trading book 🙂

It was typo error, kindly read as

Ar the time of Breakout or momentum should we initially long straddle, and once momentum is completed take exit.

Hope, now it is clear to you

If you see momentum picking up, and if you have time by your side, then why not futures? But anyway, the decision for straddle and strangle should also be based in volatility of the underlying, so please factor in that as well.

It was typo error, kindly read as

At the tile of Breakout (PDH/PDL, Day high/low or any structure) should we initially long straddle, and once momentum is completed take exit.

Sorry, not sure if I fully understand your query. But yes, once the momentum in volatility cools down, you can exit the trades.

Hi Karthik,

I am not saying it is not a risky instrument, as part of curiosity I want to know that if at end of month Bank nifty is higher (any side) than being of month (while taking position), what will happened? it will give profit consideration of few sideway days in a month.

I am pretty sure, if there a doji candle at the end of month, definitely we will lose money both side. But what will happened with strategy if month close is higher than month open.

If you\’ve shorted and the month results in a doji (where nothing happnes), then you will get to retain the premiums (assuming both legs are OTM upon expiry). If you are long, then upon similar conditions, you will lose the premium you\’ve paid.

If we initiate poison (long strangle) with the monthly expiry then we need to check volatility.

How many chanses Of loss in monthly expiry becuase there are rare chanses for same index at start of month and end of moth and hence, i am asking this question for curiosity

At the end of the day, these are risky instruments. There is a chance of loss and there is nothing like rare chances 🙂

Where do i see the long straddle strategy based on vega. How to identify the volatility and find the liquid stocks as indices. Can i apply straddles to stocks.?

You can apply straddles on stocks. Not sure if I understood your first comment fully.

Sir,

Delta neutral strategies should add up delta each time for the strategy to be meaningful. However, what should be the strategy to check and make adjustments through buy/sell more F&O?

(i) Is it to check at end of day each time?

(ii) Is there any maximum difference of delta that could be neglected?

(iii) Is there any particular standardized way of execution for these particular delta neutral strategies? I would request if you could share any link here.

1) Yes, EOD chaeck is fine

2) Nope

3) You will have to evaluate the position and then make adjustments. No other way.

Sir,

Can we trade freely without the fear of physical settlement for index options at expiry?

Yes.

Sir,

While setting Option strategies, we are simultaneously buying & selling strikes. Do we still have to face physical settlement in stock options at expiry?

Physical delivery is not there if the positions offset each other, provided they are ITM.

Sir,

We have seen several bullish/ bearish/ delta neutral strategies. Also, strategies are there where we have seen unlimited profit vs. limited loss/ unlimited loss vs. limited profit etc. Now, if we could already set naked trade with stoploss, is there any more facility that these strategies provide us with. I would request if you could kindly help understand this point.

Is it something like in swing stoploss are more clear whereas, in options since, there are several ways to influence, hence, these strategies are preferable than stoploss. I am surely missing somewhere here. Request you to guide.

Sorry, your query is to not too clear. Can you explain with some more context? This will help me answer better.

Sir,

In case of normal swing, we can set stoploss on the \”price\” parameter. Likewise what are the parameters on which stoploss can be given in Options trade?

(i) Can we set stoploss on premium?

(ii) Can we set stoploss on price of the underlying?

(iii) Are there more ways to set stoploss in Options?

Yes, basing it on premium works really well. You can base it on underlying as well, but it can get a little complex for someone who is just starting off.

is it mandatory to sell OTM (call & put) with equal distance in Short Strangle or we can chose these OTM with different strike, for example CMP is 17,600 then we need to sell 17,800 CE (200 point above) & 17,400 PE (200 point down). or I can select 300 up from ATM # 17,900 for CE & 250 down from ATM # 17,350 for PE.

please answer

YOu can select different strikes, there is no problem with that.

very good bro

Happy learning 🙂

sir if i place a short strangle , i can see that i am getting some margin benefit but what if the market starts moving at either direction and somehow i manage to figure out a strong move and i am planning to square off one short (ce or pe as per market direction), will my broker show me any margin shortfall? if out of two shorts i square off one.

In the PDF the title is written as The Long And Short STRADDLE (when it should be STRANGLE)

Checking on this, thanks for pointing.

Sir mujhe short strangle ke bare me or bahot kuch janne ki iccha ho rahi hai kya koi mujhe batayega so please 8200630139

the details you have explained everything is amazing.. can you help with butterfly and other strategies. also like to know if you have a a known range of the market .. how do you play vertical trade on the range..

Sure, will try and make a video on this topic soon.

Sure, will try and do a video on this soon.

In KEY TAKEAWAYS… item 4.

It\’s mentioned that in long strangle loss is restricted to premium recvd…

But in long straddle you don\’t recv.. you pay premium … RIGHT ??

Yes, thats a typo. Will fix it.

Hi , am new to option trading, can someone tell where I can do virtual trading for practice.

Try Sensibull.

How to calculate strangle/ spreads margin. So to plan number of lots to trade as per capital in hand.

YOu can use the Zerodha margin calculator for this – https://zerodha.com/margin-calculator/SPAN/

Karthik,

Is by buying monthly or two weeks later Strike for Delta Hedging is a good thought? Or it neutralises Vega not Delta ?

Both change with change in market consitions. I\’d rather look at delta neutral.

Hello,

Ahh.. honestly there is no as such any reason behind it. I was once doing the backtesting looking at the charts. Once my setup for Strangle had arrived and post to that if there were spikes , upon adjustment at .25D it worked.

But these days I am realizing that at times 0.25D is too late. I need to take action sooner .

Some traders do the Delta Hedge when there is change in 50 points ( Nifty ). But my brain could not absorb this idea.

1. Thus what should be appropriate Delta value for adjustment ? Please guide me on this.

2. When people do adjustment based on Delta..say…0.20D…then what exactly is their approach behind this logic ?

Thank You.

I asked that question for you to ask me your first query 🙂

1) There is no appropriate delta value adjustment. The sooner you do, you end up paying quite a bit in terms of charges and do it at a later stage. It may come with a heavy price tag. So either way, adjustment is a pain, so I don\’t recommend most of them to do these adjustments.

2) I don\’t know 🙂

Hello Karthik,

I hope you are doing well 🙂

Karthik,

I try to manage Strangle on Intraday upon Spikes with Inside Hedge. I chose Delta Managing.

Although I am doing it with 0.25D. I mean once the overall delta of the trade reaches .25D ( + or – ) I do the adjustments.

What should be the appropriate Delta value for adjustment ? As sometimes I realize that it is 0.25 is too late.

Please suggest something or any other way of managing.

But why are you waiting to adjust till 0.25D? What is your rationale for this?

Thanks Sir! Salute to your patience. You are a great teacher. I am learning a lot with you.

Glad to note that, happy learning 🙂

Of course, volatility has to be considered?

The Short Strangle–

\”In other words you get to take home 60 points as long as the market stays within 7640 and 8160. In my opinion this is a fantastic proposition. More often than not market stays within certain trading ranges and therefore the market presents such beautiful trading opportunities.\”

Can\’t it be treated a BTST trade pocketing the profit the next day? Why shall we wait till expiry? Even today, if we execute this strategy today, Can I not pocket profits tomorrow?

Regards. Ashutosh

Yes, you can. What you will make is the theta decay 🙂

Suppose we create a short strangle, and take it overnight. Next day markets open significant gap up or gap down because of which premium shoots up(current scenario because of inflation) what can we do?

You can act based on your risk appetite. If you can sustain the adverse movement, then hold, else close out the position.

Please ignore. These points are already addressed

Karthik – we did not discuss OTM strike selection and effect of theta for strangles.

Effect of theta: As straddles and strangles are executed around a hot event, so effect of theta is negligible?

OTM strike selection: Should we choose any OTM or the one right after ATM?

The effect of theta is not so negligible if the event itself is far from expiry. However, it does matter quite a bit if the event is close to expiry, which works in your favor if you are shorting any of these two strategies.

You can move 1 or 2 strikes away from ATM.

sir ,

in iron condor or short strangle , should we look for delta neutral strategy ?

These are delta neutral when you initiate the trade.

In Key Takeaways, it is mentioned that maximum loss on long strangle is to the extent of premium received. I thought we pay premium in long strangle. Please clarify or am I missing something?

Ah yes, it is to the extent of premium paid, not received 🙂

Is short straddle better than short strangle because we get to pocket more premium if price don\’t move much ?

Each strategy has a place in the market, you cant rank one over the other 🙂

Thank you Sir

Sure, happy learning 🙂

Sir, I understand that this strategy is a call on volatility and not direction. You\’ve taught me really well 🙂

But suppose I initiate it on Monday keeping Thursday expiry in mind, it could be that there comes a big move on one of the days out of the three. Hence I was asking if it can be used for positional trading. Also can you please give a hypothetical example on how to arrive at a stop loss if the trading capital is say, Rs 50 lakh?

Yup, you can use it for positional Prashant. In fact, it\’s better as a positional trade as you can also benefit from theta decay. Going by the standard 2% SL rule, if you deploy 50L on this trade, you can risk up to 1L on this trade.

Sir, what should be the stop loss on both the legs of the short strangle? Also is it preferable to deploy a short strangle just on intra-day basis or can it be used even for positional trading? I have reservations about using it for positional trading considering if the market gaps up or down large, it would potentially wipe out a large chunk of trading account in one session itself.

Prashant, ideally the stop loss should be on the entire strategy and not really on single legs. So keep a Rupee value as stop loss (which can be calculated basis your trading capital). You can deploy this on both intraday and positional basis. But largely this strategy is a call on volatility as opposed to the direction.

Thank You Karthik Sir. May god Gives you more and more wealth and knowledge.

Hi..

In the example breakeven shouldn\’t it be 5900+123 instead of 5921+123.

Kindly clarify.

It\’s a long strategy, so its +.

Chapter no. 12\’s Title is wrong. It should be \”Strangle\” not \”Straddle\”.

If sold call and put are both remain OTM at expiry … And became zero

Do we still need to do physical delivery?

No, the option is worthless, hence no physical delivery.

In stock…what will happen if we not closed the strangle till expiry & stock closed inbetween our short call and put range?

All ITM options will expire and result in physical delivery. This is for stock options. Index options will be cash settled.

Hi sir,

for the long strangle, do we need to buy the OTM options equidistant from the ATM, like we do in short strangle??

Yes, that would be better.

Dear Karthik,

After making short strangle on a stock which is considered to be in the range of 200 points up & down and If the stock also was settled within the Upper & lower breakeven on expiry, but one of the leg either Call or Put strike price in the money what would be the procedure of settlement on expiry.

Yes, the strike which is ITM will be settled physically. However, if both the strikes are ITM, then it would be net off and no physical settlement would happen.

Sir,

One statement where i got confused while i was concluding. Isn\’t the premium is paid instead of received as we are buying in long strangle.

4.The maximum loss in a long strangle is restricted to the extent of the premium received.

Ah, yes, in long strangle, we pay premium. This is a typo 🙂

Dear Sir/Madam,

Ünder the Heading\” Key takeaways from this chapter\” In Point No.4 (The maximum loss in a long strangle is restricted to the extent of the premium received) instead of Premium \”Paid\” it is mentioned as premium \”received\”

Pls Check and Correct it.

With Regards

Nagendra Kumar

Thats right, its premium paid. Will correct this. Thanks.

Hello Sir,

2 questions

1- which options shall we choose – monthly expiry or weekly expiry? (for Straddle as well as Strangle)

2- since we are not worried about the direction of move, suppose the move comes in Call option (in both strategies)

What if we add more position in the CE only? (considering your point of same ratio)

& what if we sell the PE and only keep CE?

Regards!

Thanks in Advance!! 🙂

1) I\’d prefer monthly, but yeah, either work

2) Yes, you can sell PE and ride just of CE, but that would also mean that you would be riding on a unheadged position.

Sir, is there any rule or something like that, that the price of PE we are selling in a short strangle should be less than the price of CE at the time of selling!?? or the prices of PE and CE doesn\’t matter in short strangle

No rule as such, but generally speaking the prices should be around the same.

As mentioned above \”In other words you get to take home 60 points as long as the market stays within 7640 and 8160\”. If I am not mistaken, these (7640 and 8160) are the breakeven points in the trade. Max profit of 60 points would be if Nifty stays between 7700 and 8100. Please correct me if I am wrong Sir.

Thanks.

Thats right, think of these points as the critical levels for you to be profitable.

Sir,

Under key takeaways, this statement seems to be incorrect :

The maximum loss in a long strangle is restricted to the extent of the premium received. It should be to the extent of premium paid.

Please correct me if I am wrong.

Ah, yes. That\’s right Ayush.

hello sir,

sir many people predict next day gap up /down , they are not always right but most of the times they are right and as per their prediction they are taking trade . sir how can also we analyze the same next day gap up / down ?

While its hard to predict, I guess one should workaround with the assumption that a 0.5% gap either way would always be there.

if I make a short strangle trade and after receiving the premium and I immediately square off my positions as I know that my profit would be fixed(correct me if I am wrong)

Yeah, you can. Your trade will be settled and you\’ll be out of the market.

Namaste Sir,

It is a given that volatility will always rise near upcoming events like budget, rbi policy, quarterly results.

How does one know if a companies quarterly result will be very good or flat?

Could you care to explain?

The actual results do not really matter, Harsh. What matters is the fact that volatility increases leading to an event and expected to reduce post the outcome of the event.

Dear Karthik,

Need your assiatnce please.

Today, morning was a carnage session but from afternoon Bank Nifty stayed in the range of 32550-32850 (300 points) till the end.

During around this range time, a short strangle was created at around 14:00 pm | BN @ 32,720 | Short 34500 CE @47/- | Short 30600PE @55/- | Total Premium collected 102/-

I tried Delta neutral while testing but while final order it shifted to (-8) | IV of CE @ 53 & IV of PE @ 48

I understand that Delta was not in NEUTRAL, but BN remained in the range of just 300 points.

However, till next 90-minutes the premiums didn\’t decay much, stayed there and by 15:28 hrs premium came down for each just around 3-5 points. Rather, it should have decayed much more than just few points. Isn\’t it?

Can you please advise what was missing?

– Is it due to high IV or Delta not-neutral or anything else??

The theta decay won\’t be much now considering the fact that there is more time to expiry. The strategy will play out provided IV drops rapidly or the market itself falls (or both). In this case, IV was increasing, holding up the premium.

To exicutive long strangle premium must be equal or no need worry about premiums ?

1

Example 14900 ce – 110

4700 pe – 140

Both are liltl out of the money with iv 18 and is

Example 2

14900 ce – 129

14700 pe – 132

Same iv

Which example is best to exicute long strangle ?

Its best if they are equal, but its very hard to get such prices. Little differences is ok.

sir i have a doubt.. 1.does the volatility matters while setting up the trade short strangle ?

2.shall i go naked call or put in short strangle if im sure about the direction in expiry ?

1) Yes, you want the vol to decrease when you set this up

2) Sorry, don\’t get this.

I have a query. For straddle/strangle, shall I have to hold my position till expiry to get a profit?

You can, but if you feel the need, then you can cut your position before expiry as well.

So ultimately the price that matters is expiry day right? So if I have written my OTM CE option and it becomes ITM and the premium increases but it eventually expires OTM. It should not affect me right? Only thing would that my Margin would increase in the duration it becomes ITM?

So if you write a short strangle, and the price moves in one direction, one OTM option LTP would decrease and the other one would increase. When does it make sense to actually settle the trade?

Thats right. Usually, with SS, it makes sense to close both the positions in 1 shot. The expectation here is that one option loses more premium compared to the other.

Dear Karthik Sir,

I initiated a short strangle on 30/01/21 on Nifty. Nifty closed at ~13650. I wrote 12850 put option and 14450 call option pocketing Rs.22+Rs25 premium respectively. This is for Feb 04 expiry.

So after todays 01/02/21 Budget, Nifty closed at 14200. My 12850 PE premium dropped to 8 while my CE 14450 rose to 45.

Am I currently losing money if my CE 14450 is now valued at 45. Will there be MTM/ margin call for my 14450 CE option as it is still currently OTM and expected to become zero in 3 days?

Lets say Nifty reaches 14600 on expiry then my OTM 14450 CE becomes ITM. Will there be margin call then as I would be losing Rs. 150 per lot on expiry?

What if Nifty rallies to 14600 and again drops to 14300 on expiry. My CE 14450 will be OTM and expire worthless.

For situations like this should I have squared of my CE option or just wait for expiry to pocket the premiums completely?

I don\’t know if Nifty will hit 14450, but as long as Nifty stays below that (on expiry day), your option will expire worthlessly and you get to retain the premium. But yes, margins will increase as and when the position goes against you.

Hi sir,

there are weekly expiries for nifty, niftybank etc.

Then,from greeks perspective, like for 30 days seies we divide it in two halves.( before 15 days and after 15 days)

Considering above, for weekly expiries, how greeks play?

Do We also need to divide those 7 days series in two halfs🤔

Confused.

Yes, first 3 days and then next 🙂

I\’d suggest you stick to monthly contract though, a lot easier to trade.

Sir,Good evening. I am a Zerodha customer and operating demat account since last two years.My question is I did a short strangle of December expiry in IOC the other day as under: sold 1 lot 84 PE @ 0.80 paise and 1 lot 100 CE@ Re 1.00 when the cmp of the stock was around Rs.90.Now I am incurring a loss of Rs.6000 as IOC price has shot up to Rs96 and came slightly lower and closed under Rs94 on Friday the 12th December 2020.How should I go about to avoid loss?Thanking you in anticipation,

With regards

B.Rajendra Prasad

YOu can make adjustments to this, by selling far OTM CE, but that will turn out expensive affair. Btw, this seemed like a heavily skewed strangle, with PUTs almost invaluable and the CE very expensive.

Hi Karthik,

Some more clarifications please.

1. I would like to buy 26000 CE. But, Zerodha margin calculator page shows that this strike price not allowed. As per NSE option chain volume is 16k. Does it it mean those people bought it early?

2. Assume I bought 24000 CE 2 lots for 100 and after some time the market moved otherside and the premium went down to 50. Now I want to buy 2 more lots to reduce my average to 75. But, due to open interest restrictions, Im not allowed to buy further. Is it not unfair to the investor?

3. Instead of short strangle, can i just sell a far away OTM @40 on the expiry day and allow it to expire. will i get credited 40?

Kindly clarify. Thanks and best regards

1) We don\’t allow these strikes due to the OI restrictions. Please do check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/articles/trade-all-strikes

2) I understand, please do check the link above

3) Shorting is not an issue as long you have the margins in place

Dear Karthik,

My best compliments for the nice explanations you have given on short strangle strategy. Further more, I have few queries.

1. Today bank nifty closing 23700 (contract close 15.10.2020). If I sell 24700 CE@ 80 and 22700PE@ 62, it will form short strangle. I will ensure delta is close to zero and volatility above 18% before taking position. Assuming I take position tomorrow (13.10.2020) and the contract expires within my levels (worthless) in 2 days, i will receive 80+62 = 142 per lot. Am I right?

2. Will similar strategy work in SBI options also?

3. What are the possibilities (risk) that I would lose my premium? and how I can avoid those risks?

From your discussions, I understand this is safe and winning strategy. Please clarify me for more understanding.

Thanks and best regards

3.

1) Yes, that\’s right

2) Yup, depends on how the stock moves

3) If the underlying moves in any one direction, then you will incur a loss. Its best if the underlying stays within the range

Its safe, as long as the underlying is range-bound.

Hello Karthik & Zerodha Team,

Thank you for your work on the varsity. Keep up the good work. I have two questions. Please clarify.

1. If the Banknifty spot is trading at 22500 if I want to do long strangle, what would be the typical strike prices away from the spot, Should I buy 22600 CE and 22400 PE or 22700 CE or 22300 PE or any suggestion?

2. Is it best to trade on weekly expiry or monthly expiry for bank nifty?

3. If I take the long strangle position for weekly expiry, can I take on Thursday?

Please reply. Thanks.

Harish

1) Each combo of strike offers different risk and reward profile. You need to choose what works for you

2) Monthly

3) Yup, you can.

hi sir is it possible to implement short strangle by implementing two itm\’s?

YOu can, the risk and reward will change accordingly.

i like to know something about delta decay.

we know asbour the decay graph, which suggest that option prices decay due to time lapse slowly in the initial days of any monthly expiry and speeds up as the time passes by.

my question is does that holds true for all kinds of option i. e. ATM options, ITM OPTIONS AND OTM AND DEEP OTM OPTIONS.

PLEASE GUIDE FROM THE OPTION SELLERS POPINT OF VIEW.

Naveen, I\’m not sure about delta decay. Haven\’t come across this term. Do you mean theta decay? Yes, theta decay has an impact on all options. The degree to which it will decay depends on the option strike.

Sir, in long strangle we pay small premium thats why we choose otm so on short stangle why we are going with otm where we get small permium ,we can go with itm for big premium. Pls explain.

Big premium implies closer to ATM or ITM, which means the probability of the option expiring ITM is high, hence you need to avoid writing such options.

Mr. Karthik,

Theres also a version of short strangle \”Short guts\” strangle, where ITM options are shorted instead of OTM. In what scenario, one would choose short guts over normal strangle? given the fact ITM option are more expensive and carries more risk.

I\’ve never done this, so cant really comment. But there could be only one explanation for this – you expect the price to stay in a range up until expiry.

Hi zerodha,

Can u explain how to find breakeven points for intraday in strangle ?

Thanks in advance

On intrday basis, there is no concept of break even, you profit if the the premium price increases from your purchase price.

Hi,

My query is regarding Short Strangle.

What if we choose the strikes for CE & PE Deep OTM? The spread will be wider. The premium to take home will be reduced but the chances of market staying within the CE & PE strikes will be increased. When Delta is not playing that much important role in this Market Neutral strategy, can we go for this approach?

Thats right, so what you need to evaluate as a trader is the risk and reward ratio and see if this really works for you.

Hii Karthik,

Can we adjust short strangle?

Let\’s say I sold Nifty 11100PE and 11500CE considering Nifty spot at 11300.Now if Nifty start going in one direction let\’s say towards PE then should I adjust my PE leg or CE leg?

Kindly explain this in details as it also help others to know the adjustment.

You can, but this is a little tedious. You need to ensure the deltas add to 0 so that you are delta neutral all the time.

Sorry ..nifty expired @11300

Then, in that case, CE is deep ITM, you gain a bit on PE.

Hi sir

I sold 10950 put @ 21.45 and sold 10400 call @ 29 nifty expired @10300 …what is my profit or loss ?

10950 is deep ITM, you\’ll lose close to 650 points on this along. Plus gain 29 from the 10400CE.

I would like to execute short strangle and I set my range in BANKNIFTY, now how to choose strike like biased on delta or premium

For strangle stick to 1 strike away from ATM, this usually works well for all underlying.

In short strangle we should match premium or delta?

But what context are you trying to match?

Hi sir, will BNF short strangle make profit in intraday whatever be the volatility as long as it is in range. Suppose, for intraday, Bank Nifty has rarely moved +/-4% from previous day closing price. Knowing this, can we apply short strangle daily for profits, choosing a wide range like +/-800-1000 points, whatever be the volatility? Or does this work better for Nifty?

Yes, as long as the premium decreases – maybe because of delta or theta decay or decrease in Vol, you will make money.

The Long Straddle/Strangle

SHOULD WE DEAL IN WEEKLY OR MONTHLY EXPIRY

Monthly is better in my opinion.

Hello Sir,

I have a doubt here. The options strategies that we are discussing are based on the expiry right? I mean these strategies are curated keeping in mind that they must be executed after the expiry(Obviously if they are in our profit range).

I just had a doubt that the lot size is generally big (Like 505 shares for reliance right now) If I devise a strategy and execute it do I need to have 505 shares worth of money in my account(As there will be physical delivery of shares)?

That would be a lot of capital if the answer is yes!

Thats right, the max P&L realised at expiry, but it can be closed before expiry as well. Yes, as you head close to expiry, margin and stock requirements come up and you\’ll have to comply.

Hii. Karthik….

I have one question..

CAN YOU TELL ME IF VOLATILITY INCREASES IN SHORT STRANGLE STRATEGY THEN PREMIUMS ALSO GOING TO SHOOT UP… REGARDLESS IF STOCK IS TRADING IN MY RANGE.. ITS GOING TO GIVE ME LOSS.. AM I RIGHT.. ???? PLEASE TELL ME…

Thats right, volatility going up is not a good thing for option sellers.

Hi Karthik, if I create a short strangle selling 10800 CE and 10800 PE, with a lower and upper breakeven points of 10387 and 11213, can I create a no-loss short strangle, buying protection for each of the sides? If yes, please inform how near or far the call and put strikes should be. Thank you.

Yes, you can do that by buying OTM CE and PE. This strategy is called the Iron Butterfly. But it won\’t be any loss situation, it will have some loss based on the premium.

Hii Sir… I want to clear my doubt.. ACTUALLY I USE THIS STRATEGY YESTERDAY ON 14 july 2020 on NIFTY. not real trade just paper trade (ON SENSIBULL) … Please help me as i am now going to tell my position to you…

Nifty =10807 spot price.

(Short Ce of 11050 having premium of 16 rs.) and (Short Pe of 10500 having premium of 11.4 ) . I dont know whats the IV at that time… But after market is closed at 10609 it shows me loss of 2000 rs. Not only that the option premiums Of Ce comes down to 4.5 rs and option premium of PE goes up to 38 rs. I check IV OF BOTH call and put After market is closed which is 26.7 of 10500 Pe and 31.7 of 11050 Ce. SO NOW QUESTIONS ARE

Question no.1 Is it because of effects of implied volatility??

Question no. 2 Is it because lf greeks gaama vega and delta??

Question no. 3 HOW IMPLIED VOLATILITY AFFECTS OUR P/L

Question no. 4 If market moves in any particular direction like in this case then obviously premiums are going to change.. But if one premium goes to zero ( 0) then what happens??

TELL ME WHAT IS THE REAL CAUSE BEHIND IT PLEASE.?? REPLY…….. FROM BALDEV SINGH

Baldev, the premium of CE going down to 4.5/- is understandable, but I cant see why 10500 PE increased in value when the market increased from 10807 to 10609. Are you sure about this?

1) If the direction of the market cant explain, then the volatility does. This is usually true, but I suspect something is wrong in this case

2) Yes, all options are impacted by the greeks

3) Higher the implied vol, higher is the premium. Lower the implied vol, lower is the premium

4) Then you should be compensated by the increase in the other premium.

But please do double check the premium values.

Hi Karthik,

Regarding the adjustment for the short strangle for keeping the position delta neutral, please inform if the adjustment should be done even if the underlying remains well within the lower and upper breakeven points, but begins to move in one direction . Thanks.

You will need to adjust the position if the underlying moves in any particular direction. As long as it is in a range, its ok Kumar.

if both the trades are under same underline with same expiry then why it doesn\’t get squarred off????

These are different strikes.

Hi Karthik,

Please correct me if Im wrong

Is Long Term Options & Far OTM Buying allowed in Zerodha?

If not ,what strategies we need to exclude in Zerodha platform.

This depends on how the OI is moving, Krishna.

Hi Karthik,

Last week I tried this strategy with slight change, when Nifty was at 10200 I bought a put 10000 PE (slight otm as in current scenario there are chances of going down are high) and a call 11000 CE. As expected the Nifty went down to 9900 on Thursday and there was 10k profit (net profit ~8k) in put so I exit the trade but next morning there was a huge gap down opening and the premium of 10k put was ₹200 higher than the previous day and I missed the opportunity to earn ₹15k, if I hadn\’t exit the trade on Thursday my profit would have been ₹25k. Is there any way to cover such situations?

If market moves and reaches at or below one strike price, there would be profit, can we cap this profit without exiting the trade so that if market go back we will not lose profit and if market goes down earn more profit?

Ah, these things are really hard to time 🙂 The best you can do is to trail your stop loss. Also, for a minute assume what if the reverse would have happened. How would you have handled such a situation?

Hi Karthik,

First of all, great job on Varsity to your and the entire team. I have a quick question. I can observe that banknifty is trading in the range of 21000 to 16100 since the covid crash. Is short strangle possible for such a long range and if yes, how ? Is there a better strategy for doing the same ?

Yes, you can set up a short strangle here. YOu can do an Iron condor, which is an improvisation on the short strangle

Sir.i am new to option trading ..when I am selling to otm call and put options in bank nifty thinking the contract expires between the two strike price options ….I choose 1000 points away for both side call and put….sometimes I end up in profit and some time in loss… Please guide me the option Greek to keep in mind for this strategy …

Firstly you need to ensure you\’ve picked the right strikes. Set it up closer to expiry so that you can benefit from Theta decay.

Thank you! Karthik for quick reply.

Welcome!

Hi Karthik,

This chapter is really helpful to understand the strangle strategy. Could you please write one chapter or point out good books on options strategy adjustment? Also if possible, advise on which options strategy is good for trading weekly index options.

I\’d suggest this book – https://www.amazon.com/Option-Volatility-Pricing-Strategies-Techniques/dp/155738486X

Also, I\’d suggest you stick to monthly options instead of weekly options.

Hey Karthik,

Just for clearance. So, the total loss (if it occurs) will be 9000 (60*150). Right? Correct me if I\’m wrong.

The number of lots, so if it is 2 lots, then 75*2 = 150.

Hello there!

A very good notes for option strategies. I love it. But, I have a doubt. Loss or gain we get respect the strategies, is it with respect to 1 lot or total lots we engaged in a strategy? For example, in case of long strangle, will the total loss be 60*75 (since present lot is 75) or 60* 150(for lots). I did not get that. Please let me know Karthik.

It will always depend on the present lot size, Krishna.

Kartik sir thank you for the lesson. Do we have a excel sheet for Long strangle ? Please share on this page.

I think in Key takeaways from this chapter

4th point there\’s a misprint of premium received instead of premium paid.

Thank U Sir for all the Strategies !! 🙂

I am thankful for all ur efforts to teach us selflessly.

Thanks for pointing that out, Abdul. Let me check 🙂

thank you soo much sir …

Good luck!

hiii sir … good evening sir …

am new for trading sir

my id is RK2613

sir please tell me one best intraday stratagy for banknifty and stocks

and which is the best indicator in zerodha trading platform sir ?

i request you sir please help me

Please do take some efforts to read this module – https://zerodha.com/varsity/module/technical-analysis/

Brother i am still confused with lot.for ex: in nifty you are saying premium for 1 lot in nifty CE is 55 ok but 1 lot = 75 so the premium price is 55×75=4125 but ur saying u can pay only 55 per lot i am confused with that.i am fresher for stock market

Its 55*75 = 4125.

Which one is a better way in short strangle

1)select 2 otm strikes which are fixed points away from spot

2)select 2 otm strikes in such a way that it is delta neutral

Observed that if you choose in the way 1 there is a delta difference

Hmm, yes, but its based on an assumption that its delta-neutral 🙂

Hi Mr. Karthik,

I tested Short strangle by taking 1sd and 2sd upper and lower limits for Nifty and Bank Nifty by selling it on Thursday evening and squaring them on Wednesday morning. That went well. But I am little afraid of black swan, as the situation is volatile and India VIX is still at 40. In that case, Should I hedge these OTM call and Put sell options? or do I have any other solution for it?

If I can hedge, can you explain me that strategy and adjustments to be done as per the market condition.

Thank you.

The only way to hedge is to buy far OTM strikes, in that way the cost is contained. But yeah, when volatility shoots up, the premiums too kind of shoot up for these positions and hence hedging may not be very cost-efficient. But this is the only way to hedge a black swan event.

Hi Kartik, Can you kindly explain that how Vega is calculated, and how does it change, Specifically I want to ask that whether Implied volatility is used in Vega calculation and how exactly it is used. More importantly, How India VIX is linked with Vega calculation.

By the way , your lectures are great and I am loving it.

Vega is derived out of the B&S calculator. I\’d suggest you look into the math involved for B7S calculator. India ViX is considered as a proxy for the implied volatility of the ITM option.

Happy reading!

HI ,

WHAT IS MARKET PROFILE .I WANT TO LEARN ABOUT THAT

Another technique to trade markets. We don\’t have any content on that, suggest you look online for some resources.

HI KARTHIK ,

HOW CAN WE MAKE DELTA NEUTRAL IN OPTION SELLING BOTH IN CE AND PE

Thats how it works, sell both CE an PE, ensure delta adds to 0.

hi karthik .

if i square off my position before expiry .otm (profit).wat will happen in my p and l

Depends on the premium. The P&L will be the difference between the buy and sell price of the option premium.

hi karthik,

suppose nifty 8500

i have sell 9000 ce premium 100 rs

effect of secutrities transaction tax if my ce is OTM

1.on expire day if i dnt square off.(what is gud good we should square it off or not ).

2.Before expiry if i square off and not square off

square off we have to do or not if ce is otm (profit)(option seller)

1) Assuming the option expires worthlessly, you get to retain the entire premium

2) Depends on your trading strategy. But if the option is OTM, you need not have to worry as its worthless anyway.

HI KARTHIK,

PLZ WRITE AN ARTICLE ON FII AND DII BUYING AND SELLING IN CASH MARKET AND F AND O(BOTH STOCKS AND INDEX)

HOW IT AFFECT MARKET SENTIMENTS.

Sure, Ankit.

hi karthik.

what is nifty bees it value remain the same .ie 1000

how return is calculated on it if we invest 10lakhs

You- It is an ETF based on Nifty 50. Returns are dependent on the index.

ME -hi karthik ,

we get dividends in it .

can u provide a link of any source of it

so i can read better and understand it .

i want to use it as collateral in options and futures for margin

YOU – Sorry, can you please the context? I seem to have lost the previous msg.

Here you go Ankit – https://www.nipponindiamf.com/FundsAndPerformance/Pages/NipponIndia-ETF-Nifty-BeES.aspx

About Dividends – https://www.nipponindiamf.com/investor-service/downloads/dividend-notice

hi karthik ,

we get dividends in it .

can u provide a link of any source of it

so i can read better and understand it .

i want to use it as collateral in options and futures for margin

Sorry, can you please the context? I seem to have lost the previous msg.

hi karthik.

what is nifty bees it value remain the same .ie 1000

how return is calculated on it if we invest 10lakhs

It is an ETF based on Nifty 50. Returns are dependent on the index.

hi karthik .

ha u written any article on it .if yes plz refer it on varsity .

if not .plz write one article on it

hi karthik.

how to hedge a future position with ce and pe and vice versa .plz explain with an example

You will have to match the delta of position. For example, if you have 1 long Fut position, delta of which is 1, then you can offset this with 2 ATM CE short position, delta of which is -0.5.

okay, Thank you!

Hi,

Hope you are doing good!

Could you write an article on hedging portfolio using options? The strategy is to get returns (Index returns or higher) normally in good market but hedge portfolio during crash so that returns doesn\’t go below zero for that year. This actually helps in keeping the compounding effect in tact. Any thoughts/comments on this would be appreciated.

Ah yes, its been pending for a while now. Will try and do that one of these days.

HI,

REALLY LIKE UR STUFF .GOD BLESS U KARTHIK.UR DOING GREAT WORK

I WANT TO KNOW DID U WRITE ANY ARTICLE ON OPTION SELLING ADJUSTMENTS

Thanks for the kind words, Ankit. No article on option selling adjustment.

Hi,

Can you please give me some material or link where i could learn how to adjust and hedge my short strangle?

Thanks,

Raj

Hmm, I\’m not sure. Maybe you should check with Sensibull team for this.

Hey! Karthik

I have a doubt regarding requirement of \”delta neutrality of strikes\” for short strangle. Suppose with past analysis of price movement, I have arrived at a price range for selecting strikes for short strangle. However last close is quite far from mean of upper and lower strikes making strikes not equidistant from ATM strike.

While potting this case on excel I realized that payoff is mainly dependent of option expiry, and loss by one trade is not compensated by other during any directional movement. Hence should delta neutrality at all be of any concern?

Kindly correct me if I am wrong..

Thanks

Technically, the delta neutrality should be maintained all the time. However, this can get a bit expensive in terms of continuous adjustment of positions. For this reason, its always good to stick to ATM and strikes thereabout.

Hi Kartik,

Suppose I short 1 lot of nifty for 70,000 on 1st of a month (used my nifty bees to pledge and obtain a margin) and collect a premium of Rs 30. Suppose the position goes against me and the premium rises to say 250 on 16th of the month. How does the margin and loss work in that case. In case I am holding it till expiry hoping for a theta decay and suppose premium actually goes to zero one day prior to expiry.

Will I be asked to add additional funds or will losses be booked in the middle when premium rises above a particular number ? I am confused on this aspect. Please throw some light !!

You will be asked for additional margins when the position goes against you. In case you don\’t bring in the margins, the position will be closed.

Hey! Karthik

One thing which is scary about short straddle and strangle is unlimited losses..

Will putting stoploss for both the trades outside expected fluctuation range eliminate the risk for unlimited losses?

For that matter, any short option strategies are a bit scary for the exact same reason. Yes, placing the stoploss helps, Varun.

Sir

Thanks for explaining strategy. Your exel sheet is not giving following details automatically.

Details

Spread

Lower Breakeven

Upper Breakeven

Max Loss

Max Loss level

Max Profit Unlimited

Please update these calculations so that they are shown automatically when we plan to build a strategy to trade.

Thanks

It should, but let me recheck again. Thanks.

Can we of set up short strangle with ITM options? Advantages/ disadvantages?

Yes, you can create it around the ATM strike and not at the AMT.

Karthik Sir,

Why zerodha cant provide margin benefits for banknifty option selling like astha trade does. People with small capital can benefit from that right? Also is it true that sebi is reducing margin requirement from 1st nov 19? Is there any probability that zerodha can provide some margin benefits like astha trade in near future?

We provide MIS/BO/CO for bank nifty option selling, Amlan. This is a good amount of leverage in my opinion. New margins will be updated ones the systems are tested and ready.

Can we create strangle or straddle charts in zerodha? if not any plans to add them in near future?

This is possible on https://sensibull.com/

Thanks for explaining short long strangles beautifully sir. You also told short strangle is a beautiful way to make money when market moves sideways. You have also provided the excel sheet for the same. But the excel sheet is missing import information. It won\’t give us max loss, upper and lower breakeven when data is fed. This issue has been brought to your notice by few others and you have replied saying you will correct it soon. But correction has not been done

Please correct this faulty components of excel sheet at the earliest sir. I beg you please please correct it at the earliest. Thanks

Udupa

Udupa, I missed doing this. Checking this now.

Hi, I brought nifty 11150 ce quantity: 225, now in portfolio its showing double (450) quantity. I checked ordered history, statement also ther quantity is 225. Please help

Jayesh, can you please check this with the support team, please? Thanks.

Hello,

Can you please add a section on how to manage the short strangel when the market moves up / down. As the market moves the delta will become negative and we do not know when to exit the stratagy.

In begining of Aug 2019 i created a short stradle with 1200 CE @ Premium of ~30 and 11100 PE at premium of ~40, ut the market fell upto 10,800 and the 11100PE premium went up. so how to manage such situation and when to exit .

Please advice.

The only way to do this to continuously rebalance the delta and ensure its near 0 aka delta neutral. This can be an expensive affair.

Dear sir

The long short strangle excel sheet provided by you is missing spread, upper breakeven and lower breakeven, max loss. It has column but it won’t give spontaneous calculated values. It remains empty.

So please update the excel sheet accordingly so that it calculates all these values.

(Your excel sheet for long straddle gives all these but this long short strangle is not giving these values).

Thanks

I\’ll check this, Punta.

Karthik Rangappa says:

August 19, 2019 at 12:07 pm

Yes/no, it … and (pocket the difference in premium). = you mean its Profitable amount (Invested amount + profit), right sir ???

Yes.

Sir,

If Nifty on 11250 and i buy Nifty at 11300CE and premium of 250 and suppose nifty spot price on 11280 but premium value is 275, then should i go to sell it or not ?

Pls explain :

1. yes

2. no

Yes/no, it depends on how convinced you are about the position. You can sell it anytime you wish and pocket the difference in premium.

Sir,

If i trade as per your option strategy C12 short strangle, like as currently nifty spot price is 11109 and I sell it on 11300CE & 10900PE in morning 9.30 am, then please explain:

1. whether the amount will credit in my ledger with multiple of premium value ?

2. if not then how much margin required for it ?

And suppose I nifty goes on 11150 at same days in afternoon and I want to buy it, then:

1. is it possible to buy on same days ?

2. as per your chart & excel calculations, will that particular amount (excluding differences) retain in my ledger or not ?

1) Yes

2) You can check the margin required here – https://zerodha.com/margin-calculator/SPAN/

2.1) Ye

2.2) Depends on the markets

Sir

Please update the corrected excel sheet calculator for long short strangle at the earliest as market is very volatile and I want to trade using these strategies.

Please please update and upload the corrected sheet at the earliest.

Thanks a lot in advance sir

Tanu

Dear sir

The long short strangle excel sheet provided by you is missing spread, upper breakeven and lower breakeven, max loss. It has column but it won\’t give spontaneous calculated values. It remains empty.

So please update the excel sheet accordingly so that it calculates all these values.

(Your excel sheet for long straddle gives all these but this long short strangle is not giving these values).

Thanks

Tanu, thanks for pointing this. Let me check this and get back to you.

Hi, I had a question, can I buy 6 options, with all the 6 being sold, I mean 3 pairs of options, 1 pair (ce and pe) of Itm, 1 pair for Atm and 1 pair for Otm. This way I\’ll receive a massive premium, which will almost guarantee me a profit. Is it possible to do this?

Renuka, technically you can sell as many option contracts as you want. However, all I know is that there are no guarantees in the markets 🙂

Good evening Karthikji

All the strategies here u\’d wonderfully explained. It\’s upto us as traders to remain disciplined executing with maximum specific knowledge about options trading.

Although we have missed some of 2-3 more popular important strategies esp from 4-Leg wingspread families namely- The Iron Condors & The Butterfly spreads. It\’s in my opinion is more safer than the 2 legs strategies although the cost is much more but chances of winning trade is high depending on volatility situation. The point is u would have more beautifully presented it & taught us. Just missed this important strategy. Although I understand that all the strategies u\’d shown is more than sufficient. In fact of all strategies, the short strangles r more easier & beautiful if implemented with proper Std Deviation & closer to expiry in mind plus identifying range bound stocks.

I agree Harsh, the only thing is that the costs go up with 4 legs. Don\’t know how I missed writing about it, will do so sometime soon 🙂

Sir,

Nifty is around 11450, what is the best range to SHORT STRANGLE?

Max pain is 11400.

What is the minimum amount is required for shorting 10 lot each?

Thanks,

Vidyadhan

The range honestly depends on your risk appetite. Check this for the amount required – https://zerodha.com/margin-calculator/SPAN/

sir is it advisable to short nifty strangle for mid month expiry, have you?, what are the things to keep in mind?

Shorting really depends on your take on volatility and direction. Yes, I\’ve shorted strangles across different time period.

Dear Karthikji,

Happy New year to you and all our zerodha family,

With weekly expiry what is the impact of Theta & Vega on options buying as both seems to be tilted towards seller favour (provided if volatility is high). Here are few questions in components wise I\’ve ?

1)Although personally I prefer selling (due to Greeks factor) but how to execute business of buying. Just in 28 days expiry it\’s 1st half of 15 days that\’s most favourable for buying, then what is similar in 7 days ? Is it first 3 days or so ??

2) What\’s SEBI physical settlement (I understand that it\’ll be executed in a phase manner) compared to Cash one & how to do it ? Explain this in layman term kindly

Thanking you for giving your time

Harsh, wishing you a very happy and prosperous new year!

1) If you are convinced about buying, then I\’m assuming you\’d expect a directional move in the underlying. Based on the intensity of the move, you can either buy a slightly OTM or ATM option. I\’d suggest you stick to the ATM strike.

2) Here is everything you\’d need to know about Physical Settlement – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

Good morning & Thanking you Karthikji 🙂

Also a very very Heartly Congratulations to Team Zerodha of becoming no.1 stock trading firm, zooming past all the established Goliaths. We\’re proud of part of family even before achieving this great feat.

I believe Zerodha is unique not only because of understanding business but in that the firm has provided sturdy foundation of stock education in the form of Varsity of which particularly you\’d piloted a great mentor role. It\’s like writing a Ram Charitra Manas of equity science !! We\’re proud of your painstaking & patience work.

So thanks again in making stock investment & trading not only an affordable one but also a wise person in creating wealth 🙂

Hey Harsh, thank you so much for all the kind words 🙂

Investor education is something close to our heart, we will continue doing it as long as possible 🙂

Welcome Karthikji

One more thing I\’m giving you little trouble with few more questions with respect to above link about physical settlement (I read it once, will thoroughly go through it again)

1) OTM expires worthless, so we don\’t have to buy shares on expiry (physical settlement) when selling OTM or far OTM options. Only requirement is margin ??

2) These one is little confusing as buying options also require MARGIN now instead of straight forward buying qty*premium price in a lot ??

I\’m new to options kindly correct if I\’m wrong anywhere ??

1) Yes, for OTM options, you don\’t have to worry about the physical settlement. The option expires worthless.

2) Buying option does not require margins. You just need Qty * Option Premium.

With Nifty weekly Expiry getting in soon, at Zerodha are all having any software up-date plan in process to have weekly expiry margin calculator for Nifty weekly expiry.

Regards,

Shyamal

We will have this available to trade soon.

Taking your advise I have decided to be on the Call Side and is working pretty much in line with my expectations.

I will be taking the following position on Monday (23rd December ) for January Expiry in Nifty

Sell 3000 – 11400 CE – Rs.23.00 X 3000

Buy 300 – 10800 CE – Rs. 218 X 300

Margin Require is 20.00 Lac.

In the current market this looks a Low Risk Strategy to me. Please Correct me if I a wrong.

Regards,

Shyamal.

Well, I cannot really comment on specify positions, Shyamal. But hopefully, this should work for you, good luck 🙂

Thank you Karthik,

I got you.

Regards.

Cheers!

Hi Karthik,

My friend is on the verge of resigning from his service and starting his option trading soon. Only option selling in Nifty 50 index.

He will be accumulating around 60.00 Lac from his savings and would be putting around 70% ( 45.00 Lac ) in Zerodha account. He is a active trader with fairly good option writing knowledge.

Does he have to inform SEBI or any other regulatory body?

No, considering the major decision and largish amount, he just has to inform his family about this 🙂

Good luck to him!

I like your alarm bell !

But I like his strategy.

20 days to expiry

1000 points profit zone in Nifty

500 points in Call side ( OTM)

500 points in Put side ( OTM)

He only sells option ( Far OTM)

Expected profit – 20 points ( 75 X 20 = Rs.1500/Lot) – 3% a month. Makes sense to me. He is doing it for some time now and his profit spread sheet looks quite steady.

Good luck, Shyamal. Just be cautious about writing Puts, panic spreads quite fast in the market 🙂

Hi Karthik,

Hope you are doing well. My query is regarding currency options this time.

1. Is there enough liquidity in currency options? If so, which pairs according to you would be the best to trade (i.e. option trading) ?

2. The margin calculator of Zerodha was showing 420/- as premium receivable for one lot of USDINR 74 CE @ 0.16 Nov series. But when I typed in the same values in Zerodha brokerage calculator, with 0.16 as sell value and 0.01 as buy back value the profit was shown as 132/-. What is wrong here? Shouldn\’t the margin calculator also show 132/- as premium receivable coz that is the profit right?

3. Are all option strategies mentioned in Varisity (including all materials on options such as Greeks etc.) applicable to currency options as well?

4. Is there a separate chapter or module dedicated to currency options? If yes then could you please share the link(s) here.

Looking forward to your response.

~ Abudhar al Hassan.

1) I\’d suggest you check the USDINR options, they are fairly liquid

2) MArgin calculator and the brokerage calculator are two different things. Margin calculator shows the margin required for entering the trade, this is not necessarily the profits you make

3) Yes

4) No, we don\’t have anything for currency option. The working of options remains the same.

Thanks Karthik.

1. So then, could you explain what is the premium receivable that we see in the margin calculator? I mean what does it denote?

2. Also, in the Margin Calculator, we can only select BankNifty monthly expiring series and not the weekly expiring ones..anyway to include the latter? Or the margin requirements for weekly and monthly expiry is fairly same?

Thanks & Regards,

~ Abudhar al Hassan.

1) Margin calculator gives you the margins required for a position

2) Weekly expiry is not there. Will get back to you on this.

Thanks Karthik. Waiting on the margin requirement bit.

Also, since we can\’t see the spot candlestick charts of the currency market in Kite, what charts can we look at to get a fair idea of the currency market support and resistances? The futures? If so, then anyway we can get continuous data on currency futures like we have for commodity futures?

~Abudhar al Hassan.

Spot candlesticks are not available because the spot market is largely an interbank OTC market, given this, you can look at the charts of the futures. This should be available with us soon.

Also, from your experience can you say that short strangle is a very good strategy for Nifty 50 stocks as usually they do not give much movement and will be range bound and hence the probability of pocketing the premiums received is higher?

I\’m tempted to say yes, but I\’ll reserve my comments 🙂

Point is, there is no 1 shoe fits all phenomena in the market!

Hi Sir,

In the example given by you, Nifty is around 7900.. However, even if the markets move to 7650 on the lower side or 8150 on the higher side (which is a movement of more than 3%), I am still in losses.. Thus, can we say that Straddle would be better than Strangle as it will give us some profits if the market gives this type of movement?

Not really, Yazad. It really depends on which strategy and the present market condition. There is no one strategy that fits all market conditions.

Hi Karthik,

I am back to pester you again…my apologies in advance.

Please tell me if I am wrong about this:

Let\’s say I want to execute a short strangle on BANKNIFTY, its spot being 25000.

I short the 24000 PE @ premium 20 (let\’s say). So premium received for this leg, 20X40=800 (40 being the lot size).

Simultaneously, I short the 26000 CE @ premium 20 (assuming for simplicity). So premium received for this leg also would be 20X40=800.

Hence, Net Premium received for both legs = 1600/-.

1. This also means I can lose up to 1600/- and my capital won\’t be affected. Right?

2. With the help of Zerodha\’s brokerage calculator I could see that if I buy back an option at 58 that I initially sold at a premium of 20, my loss would be 1569/- (or close to 1600/-).

3. So would it be safe to assume that if I place a Stop Loss order for my 26000 CE option at 58, I won\’t be losing more than 1600/-? Likewise, if I place a Stop Loss order for my 24000 PE option also at 58, I wouldn\’t be losing more than 1600/-?

4. And if any one of my SL orders gets hit, I can just exit the whole strategy and my capital would remain intact?

5. Do I need to be worried about the greeks here now?

Please tell me whether I am making any sense here or am I being silly? 🙁

Regards,

Abudhar al Hassan.

1) Since this is a short trade, your losses can be unlimited. Your profits are limited to the extent of 1600.

2) Your loss will be 58-20 = 38.

3) This also depends on where the other option is trading at the time of square off

4) Yes, you can exit the whole strategy. Your capital depends on the price at which you have executed the strategy

5) Ideally, short option strategies depend on the volatility/greek. So you may want to pay some attention to it.

Thank you very much Karthik.

Actually, from the first query above, what I meant was that the net premium of 1600/- would be credited upfront to my account right? So in case, after initiating the above strangle I go into a loss and assuming somehow I cap my losses to 1600/- and exit the strategy (by monitoring P&L etc.), my initial capital won\’t be depleted right?

Nope.

Hey Karthik,

How have you been? Hope u r doing well.

Could you please help me out with these questions?

Supposing, I want to execute a short strangle strategy on NIFTY. The ATM strike price is 11000 and I am planning to short Deep OTM 12550 CE @ 4.5 premium and 23% IV, along with Deep OTM 9450 PE @ 4.75 premium and 29% IV. My view is that NIFTY spot wouldn\’t cross either of these two strike prices any time soon, hence I intend to hold the options till expiry and thereby collect the net premium received. Now,

1. Do we really need to worry about volatility in this case? I mean since I intend to hold the options till expiry then I\’d need to worry only when both CE and PE becomes ITM right? The surges in volatility shouldn\’t be an issue so long as the spot remains within the range till expiry? Coz then the options would expire worthless and thereby IV would also decrease?

2. How do I put up Stop Loss orders in this case? I wouldn\’t want to lose more than 1% of my capital. So should I exit both the positions when I see the spot reaching either of my breakeven points or is there any way I can set SL orders near the breakeven levels? I think not since the SL orders in this case would be premium based and not price based right? So then what should be done? How can I restrict my losses to 1% of the capital?

3. Will the P&L be cash settled on expiry day? I read somewhere that some stocks are not going to be cash settled anymore. But NIFTY being an index, I dont think it would fall under that.

As always, your advice is highly valued. My apologies for the long questions.

Regards,

~ Abudhar al Hassan.

1) Yes, because the volatility can really change the game. If the markets continue to fall, then the IVs will shoot up, driving the premiums higher. This can play mind games with you 🙂

2) Add up the premium received, your SL would be premium received + 1% of margins blocked. You will have to exit both the positions, cannot really ride one only 1

3) The index is cash settled.

Hey Karthik,

Can you help me understand the Stop Loss bit with an example?