5.1 – Background

The ‘Bear’ in the “Bear Call Ladder” should not deceive you to believe that this is a bearish strategy. The Bear Call Ladder is an improvisation over the Call ratio back spread; this clearly means you implement this strategy when you are out rightly bullish on the stock/index.

In a Bear Call Ladder, the cost of purchasing call options is financed by selling an ‘in the money’ call option. Further, the Bear Call Ladder is also usually setup for a ‘net credit’, where the cash flow is invariably better than the cash flow of the call ratio back spread. However, do note that both these strategies showcase similar payoff structures but differ slightly in terms of the risk structure.

5.2 – Strategy Notes

The Bear Call Ladder is a 3 leg option strategy, usually setup for a “net credit”, and it involves –

- Selling 1 ITM call option

- Buying 1 ATM call option

- Buying 1 OTM call option

This is the classic Bear Call Ladder setup, executed in a 1:1:1 combination. The bear Call Ladder has to be executed in the 1:1:1 ratio meaning for every 1 ITM Call option sold, 1 ATM and 1 OTM Call option has to be bought. Other combination like 2:2:2 or 3:3:3 (so on and so forth) is possible.

Let’s take an example – assume Nifty Spot is at 7790 and you expect Nifty to hit 8100 by the end of expiry. This is clearly a bullish outlook on the market. To implement the Bear Call Ladder –

- Sell 1 ITM Call option

- Buy 1 ATM Call option

- Buy 1 OTM Call option

Make sure –

- The Call options belong to the same expiry

- Belongs to the same underlying

- The ratio is maintained

The trade set up looks like this –

- 7600 CE, one lot short, the premium received for this is Rs.247/-

- 7800 CE, one lot long, the premium paid for this option is Rs.117/-

- 7900 CE, one lot long, the premium paid for this option is Rs.70/-

- The net credit would be 247-117-70 = 60

With these trades, the bear call ladder is executed. Let us check what would happen to the overall cash flow of the strategies at different levels of expiry.

Do note we need to evaluate the strategy payoff at various levels of expiry as the strategy payoff is quite versatile.

Scenario 1 – Market expires at 7600 (below the lower strike price)

We know the intrinsic value of a call option (upon expiry) is –

Max [Spot – Strike, 0]

The 7600 would have an intrinsic value of

Max [7600 – 7600, 0]

= 0

Since we have sold this option, we get to retain the premium received i.e Rs.247/-

Likewise the intrinsic value of 7800 CE and 7900 CE would also be zero; hence we lose the premium paid i.e Rs.117 and Rs.70 respectively.

Net cash flow would Premium Received – Premium paid

= 247 – 117 – 70

= 60

Scenario 2 – Market expires at 7660 (lower strike + net premium received)

The 7600 CE would have an intrinsic value of –

Max [Spot – Strike, 0]

The 7600 would have an intrinsic value of

Max [7660 – 7600, 0]

= 60

Since the 7600 CE is short, we will lose 60 from 247 and retain the balance

= 247 – 60

= 187

The 7800 and 7900 CE would expire worthless, hence we lose the premium paid i.e 117 and 70 respectively.

The total strategy payoff would be –

= 187 – 117 – 70

= 0

Hence at 7660, the strategy would neither make money nor lose money. Hence this is considered a (lower) breakeven point.

Scenario 3 – Market expires at 7700 (between the breakeven point and middle strike i.e 7660 and 7800)

The intrinsic value of 7600 CE would be –

Max [Spot – Strike, 0]

= [7700 – 7600, 0]

= 100

Since, we have sold this option for 247 the net pay off from the option would be

247 – 100

= 147

On the other hand we have bought 7800 CE and 7900 CE, both of which would expire worthless, hence we lose the premium paid for these options i.e 117 and 70 respectively –

Net payoff from the strategy would be –

147 – 117 – 70

= – 40

Scenario 4 – Market expires at 7800 (at the middle strike price)

Pay attention here, as this is where the tragedy strikes!

The 7600 CE would have an intrinsic value of 200, considering we have written this option for a premium of Rs.247, we stand to lose the intrinsic value which is Rs.200.

Hence on the 7600 CE, we lose 200 and retain –

247 – 200

= 47/-

Both 7800 CE and 7900 CE would expire worthless, hence the premium that we paid goes waste, i.e 117 and 70 respectively. Hence our total payoff would be –

47 – 117 – 70

= -140

Scenario 5 – Market expires at 7900 (at the higher strike price)

Pay attention again, tragedy strikes again ☺

The 7600 CE would have an intrinsic value of 300, considering we have written this option for a premium of Rs.247, we stand to lose all the premium value plus more.

Hence on the 7600 CE, we lose –

247 – 300

= -53

Both 7800 CE would have an intrinsic value of 100, considering we have paid a premium of Rs.117, the pay off for this option would be –

100 – 117

= – 17

Finally 7900 CE would expire worthless, hence the premium paid i.e 70 would go waste. The final strategy payoff would be –

-53 – 17 – 70

= -140

Do note, the loss at both 7800 and 7900 is the same.

Scenario 6 – Market expires at 8040 (sum of long strike minus short strike minus net premium)

Similar to the call ratio back spread, the bear call ladder has two breakeven points i.e the upper and lower breakeven. We evaluated the lower breakeven earlier (scenario 2), and this is the upper breakeven point. The upper breakeven is estimated as –

(7900 + 7800) – 7600 – 60

= 15700 – 7600 – 60

= 8100 – 60

= 8040

Do note, both 7900 and 7800 are strikes we are long on, and 7600 is the strike we are short on. 60 is the net credit.

So at 8040, all the call options would have an intrinsic value –

7600 CE would have an intrinsic value of 8040 – 7600 = 440, since we are short on this at 247, we stand to lose 247 – 440 = -193.

7800 CE would have an intrinsic value of 8040 – 7800 = 240, since we are long on this at 117, we make 240 – 117 = +123

7900 CE would have an intrinsic value of 8040 – 7900 = 140, since we are long on this at 70, we make 140 – 70 = +70

Hence the total payoff from the Bear Call Ladder would be –

-193 + 123 + 70

= 0

Hence at 8040, the strategy would neither make money nor lose money. Hence this is considered a (upper) breakeven point.

Do note, at 7800 and 7900 the strategy was making a loss and at 8040 the strategy broke even. This should give you a sense that beyond 8040, the strategy would make money. Lets just validate this with another scenario.

Scenario 7 – Market expires at 8300

At 8300 all the call options would have an intrinsic value.

7600 CE would have an intrinsic value of 8300 – 7600 = 700, since we are short on this at 247, we stand to lose 247 – 700 = -453.

7800 CE would have an intrinsic value of 8300 – 7800 = 500, since we are long on this at 117, we make 500 – 117 = +383

7900 CE would have an intrinsic value of 8300 – 7900 = 400, since we are long on this at 70, we make 400 – 70 = +330

Hence the total payoff from the Bear Call Ladder would be –

-453 + 383 + 330

= 260

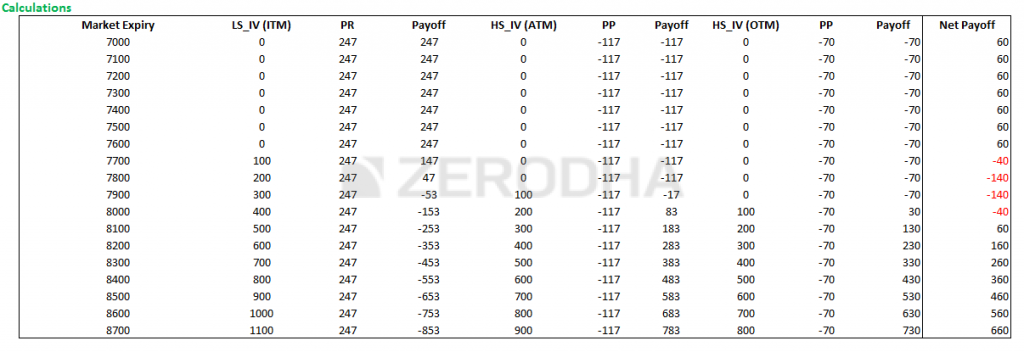

As you can imagine, the higher the market move, the higher is the profit potential. Here is a table that gives you the payoffs at various levels.

Do notice, when the market goes below you stand to make a modest gain of 60 points, but when the market moves up the profits are uncapped.

5.3 – Strategy Generalization

Going by the above discussed scenarios we can make few generalizations –

- Spread = technically this is a ladder and not really a spread. However the 1st two option legs creates a classic “spread” wherein we sell ITM and buy ATM. Hence the spread could be taken as the difference between the ITM and ITM options. In this case it would be 200 (7800 – 7600)

- Net Credit = Premium Received from ITM CE – Premium paid to ATM & OTM CE

- Max Loss = Spread (difference between the ITM and ITM options) – Net Credit

- Max Loss occurs at = ATM and OTM Strike

- The payoff when market goes down = Net Credit

- Lower Breakeven = Lower Strike + Net Credit

- Upper Breakeven = Sum of Long strike minus short strike minus net premium

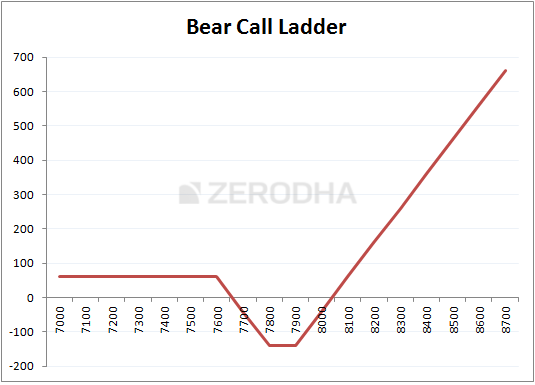

Here is a graph that highlights all these important points –

Notice how the strategy makes a loss between 7660 and 8040, but ends up making a huge profit if the market moves past 8040. Even if the market goes down you still end up making a modest profit. But you are badly hit if the market does not move at all. Given this characteristics of the Bear Call Ladder, I would suggest you implement the strategy only when you are absolutely sure that the market will move, irrespective of the direction.

From my experience, I believe this strategy is best executed on stocks (rather than index) when the quarterly results are due.

5.4 – Effect of Greeks

The effect of Greeks on this strategy is very similar to the effect of Greeks on Call Ratio Back spread, especially the volatility bit. For your easy reference, I’m reproducing the discussion on volatility we had in the previous chapter.

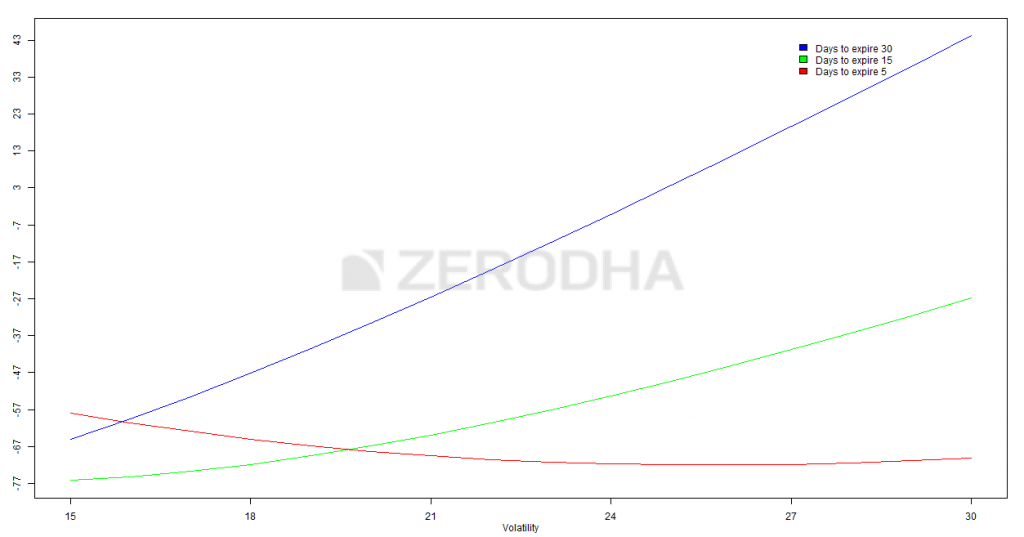

There are three colored lines depicting the change of “net premium” aka the strategy payoff versus change in volatility. These lines help us understand the effect of increase in volatility on the strategy keeping time to expiry in perspective.

- Blue Line – This line suggests that an increase in volatility when there is ample time to expiry (30 days) is beneficial for the Bear Call Ladder spread. As we can see the strategy payoff increases from -67 to +43 when the volatility increase from 15% to 30%. Clearly this means that when there is ample time to expiry, besides being right on the direction of stock/index you also need to have a view on volatility. For this reason, even though I’m bullish on the stock, I would be a bit hesitant to deploy this strategy at the start of the series if the volatility is on the higher side (say more than double of the usual volatility reading)

- Green line – This line suggests that an increase in volatility when there are about 15 days time to expiry is beneficial, although not as much as in the previous case. As we can see the strategy payoff increases from -77 to -47 when the volatility increase from 15% to 30%.

- Red line – This is an interesting, counter intuitive outcome. When there are very few days to expiry, increase in volatility has a negative impact on the strategy! Think about it, increase in volatility when there are few days to expiry enhances the possibility of the option to expiry OTM, hence the premium decreases. So, if you are bullish on a stock / index with few days to expiry, and you also expect the volatility to increase during this period then thread cautiously.

Key takeaways from this chapter

- Bear Call Ladder is an improvisation over the Call Ratio Spread

- Invariably the cost of executing a bear call ladder is better than the Call Ratio Spread, but the range above which the market has to move also becomes large

- The Bear Call Ladder is executed by selling 1 ITM CE, buying 1 ATM CE, and 1 OTM CE

- Net Credit = Premium Received from ITM CE – Premium paid to ATM & OTM CE

- Max Loss = Spread (difference between the ITM and ITM options) – Net Credit

- Max Loss occurs at = ATM and OTM Strike

- The payoff when market goes down = Net Credit

- Lower Breakeven = Lower Strike + Net Credit

- Upper Breakeven = Sum of Long strike minus short strike minus net premium

- Execute the strategy only when you are convinced that the market will move significantly higher.

Download Bear Call Ladder Excel Sheet

Spread = technically this is a ladder and not really a spread. However the 1st two option legs creates a classic “spread” wherein we sell ITM and buy ATM. Hence the spread could be taken as the difference between the ITM and ITM options. In this case it would be 200 (7800 – 7600)

in above actual is difference between the ATM and ITM options wrongly mentioned right?

The spread is 200 i.e. the difference between 7800 – 7600. Not sure if I\’m missing something 🙂

Sir in 5.3

Maximum loss will be difference in spread and net credit.

But spread is written difference between itm and itm option, it will be itm and atm option.

Even in 1st point it\’s the same mistake.

Thanks for pointing, let me check this again, Aditya.

Hi Karthik,

I would like to understand the below better as it seems to be at odds with my understanding till now.

Call ratio back spread: Sell 1 ITM CE and Buy 2 OTM CEs

Bear Call ladder: Sell 1 ITM CE and Buy 1 ATM CE and Buy 1 OTM CE

Its clear that the only difference between the two is in buying 1 ATM in place of 1 OTM CE.

But since premium paid for ATM is higher than premium paid for OTM, Net credit for Call ratio back spread should be higher and hence cash flow for call ratio back spread should be better (and hence profit for the downside should also be better).

Then why have you mentioned the below? Pls clarify

In a Bear Call Ladder, the cost of purchasing call options is financed by selling an ‘in the money’ call option. Further, the Bear Call Ladder is also usually setup for a ‘net credit’, where the cash flow is invariably better than the cash flow of the call ratio back spread. However, do note that both these strategies showcase similar payoff structures but differ slightly in terms of the risk structure.

Agreed. The only difference is in the pay off, where in there is a no change in P&L if the market is stuck between the upper and lower strike.

In my backtest, I minimized my trading zone when the India VIX (IndVIX) is 28 or higher; I do not trade under these conditions. The market typically reaches ATM+600 once or twice a year. If all the trades are profitable, I make around 500 per month. My capital is 60,000.

When I set a small stop-loss, it gets triggered before the market reaches ATM+600. For example, on May 13, 2024, the market opened at 22027.95, reached a high of 22131.65, a low of 21821.05, and closed at 22104.05. On this day, I entered a trade with a strike price of 22450. On the first day, I experienced a loss of around 300 per lot. Why did this happen?

Loss is a different question, but 500 bucks for 60K, do you think the risk and reward justifies the risk?

Date Open High Low Close

16 May 2024 22319.2 22432.25 22054.55 22403.85

15 May 2024 22255.6 22297.55 22151.75 22200.55

14 May 2024 22112.9 22270.05 22081.25 22217.85

13 May 2024 22027.95 22131.65 21821.05 22104.05

my trading plan is to sell ATM+600 in 3 day before expiry(monday).

what stop loss is suitable for it.

It depends on your risk appetite.

Hello Karthik. I have couple of questions and would really appreciate your inputs.

1. In this example (7600 CE short, 7800 CE long, 7900 CE long), let’s say market hit 8300 BEFORE EXPIRY (Scenario 7) and the net position is in profit (+260). In that case, do I still have to bring in additional margin to meet the new margin requirements of 7600 CE short?

2. Let’s say a particular strike (e.g. 7800 CE long) has no liquidity at the time of expiry. In this case, irrespective of the liquidity, I will still get the profit if my option expires ITM. Is that correct?

Please let me know.

Thanks,

Yogesh

1) Not really

2)Yes, but upon expiry.

Hi karthik,

can you please clarify below doubt?

Sometimes profit calculation is done like this: \”intrinsic value – premium paid\”

and sometimes its done like this \”difference of premiums( (buy and sell) or (sell and buy))\”

Both of above formulas i see in above or previous materials? so which one to consider and when?

Both are correct, depends on the time –

1) On the day of expiry (assuming you help the option to expiry), then the formula is – intrinsic value – premium paid

2) In between the series (before the expiry), its the difference between the premiums.

Bear call ladder where to find in zerodha or sensibull strategy…

Kindly send an email for it……if possible…it\’s a request….

I\’d suggest you write to Sensibull regarding this, Bhavesh.

Options strategies are simple and complicated depending on our understanding, market behaviour and our analysis. I have been trying many combinations. I punched theories and made my own theory work. One simple strategy is in an uptrend week and uptrend Dow Jones carry a call Atm or otm next day you would get huge profit. Tried and tested. Happy trading guys!

Sure, there are many option strategies and possibilities. Good luck.

Thank you so much for providing knowledge to everyone. I appreciate your team work varisty. Please provide videos on this Module also it will be easier to understand this amazing strategies of option chain. Thanks Again😇

Noted!

Sir,

Here you\’ve written Spread (difference between the ITM and ITM options). Can you please clarify? As we are selling only one ITM option.

Yes, the spread always refers to the difference between the two different option legs under consideration.

Hello Sir

I have a doubt.In bear call ladder

1st Expiry 01st dec

Spot 18512

sell 01st dec 18300 CE ( ITM )

Buy 01st dec 18400 CE (ATM)

BUY 01st dec 18600 CE (OTM)

breakeven is (18329,18671)

The sample I did for Dec last Expiry (Sir i didnt change any strikes)

spot 18512

sell 29th dec 18300 CE ( ITM )

Buy 29th dec 18400 CE (ATM)

BUY 29th dec 18600 CE (OTM)

breakeven is 18906(so in this only if its moving up i make profit when it moves down i only make loss)

why is the difference sir,keeping the strike ,spot same.I have only changed the expiry.can u please explain sir.

Thank you

The difference is because of the change in premium for these options. With the change in premium, the spreads too change.

I use zerodha kite for trading

Thankyou sir for providing such a good content it helped me lot to understand the stock market from basic to intermediate level. I have read almost all the chapters , I have some questions please answer this

1) from where i can get historical option chain data in free ? once the option expires the data for that is not available in nse website , i needed for checking the strategies i prepared will work or not

2)suppose i have created my own option strategies for that i am able to make the payoff and charts in excel

a) but i want to know how to have the graphs that will help me identify the best possible strikes based on time to expiry ?

b) how to get the graph (effect of greeks) as per volatility ? which softwares required

1) Mahi, please check with Sensibull. They may have this data.

2) Again, Sensibull for this 🙂

sir,

As you said the profit are limited at lower strike price, but as when analyzed through sensibull the profit shows only above breakeven point and below breakeven it shows limited loss..

Yes, you need to cross the breakeven hurdle first, Dinesh.

And also if my view is outrightly bullish because of xyz factor(and market goes up), will the premiums have negative impact even when I choose 5 days expiry options?

Yes, if the stock falls that it along with the drop in volatility.

Suppose my view is bullish and I opt this strategy. But I want to exit the trade today itself then which expiry am I supposed to choose? (Considering the volatility)

Also if my view is right and the market is bullish, will the payoff decrease when I choose 5 days expiry?

Why does increase in volatility decreases the payoff in the last 5 days?

You can choose the current month expiry, Anshul. The payoff is max at expiry, if you choose to sell before then yes, it will be lesser.

Hello Sir,

In the Blue Line paragraph it\’s written:

\”For this reason, even though I’m bullish on the stock, I would be a bit hesitant to deploy this strategy at the start of the series if the volatility is on the higher side \”

My confusion: In the graph, clearly shows that as the volatility remains on the higher side payoff is higher, so why one would be hesitant to deploy this strategy at that time?

Thank You

Because if volatility declines (and looks like it will decline), so will the premiums. Such situations are good for option sellers though.

Thanks Sir! Ample scope for human imagination.

Yup! You can craft many things with options 🙂

Sell 1 ITM PUT–14600 NIFTY

Buy OTM CALL–15850 NIFTY

Sell OTM CALL–15800 NIFTY

EXP –16 JUNE

This strategy is offered by Sensibull.

I am not interested in pay off. However, I just want to know what the strategy is called. They call it–Nifty Bear Spread.

You have not covered this strategy in the module.

Please comment.

Regards. Ashutosh.

Ashutosh, there are plenty of options strategies, but I\’ve only covered the most important ones. Yes, this looks like a laddered bear spread.

the net credit of the statergy is negative so what mistake am i making or the volitily is high so the premiums are high

Wrong spreads, try other spreads.

Right Sir. Thanks!

Happy learning!

Let’s take an example – assume Nifty Spot is at 7790 and you expect Nifty to hit 8100 by the end of expiry. This is clearly a bullish outlook on the market. To implement the Bear Call Ladder –

Sell 1 ITM Call option

Buy 1 ATM Call option

Buy 1 OTM Call option.

Dear Sir; being a bullish strategy with target 8100, the real money comes after 8040. Thus the journey from 7790- 8040 with target 8100 is hopeless. Why one would wait till 8300 to make some big profit and 8300 is not on the agenda?

Sir, I am dim wit. Pl bear with me and try to convince me that the strategy is ok just the same.

Regards. ETU737.

Ashutosh, if you are extremely bullish and have a lot of conviction on your point of view, the best bet is to take a futures trade. But strategies like this come into play when you want to define your profitability and risk before initiating your trade.

Sir bear call ladder figure is wrongly mentioned

Nope, its not.

Hi Karthik,

Thank you for your modules. I learnt about financial markets entirely from Varsity and big fan of yours.

I am learning options strategies and trying to calculate on paper trade. Further, when I look at Bear call ladder strategy and premiums, I am getting profit when underlying moves up but I am getting loss when the underlying moves below ITM CE as well. I am trying to look at charts in 1-2 day intervals and not till expiry.

For example, spot price is 760. I am calculating for Sell ITM 750 CE, Buy ATM 760 CE and Buy OTM 770 CE. But when spot moves below 740 also, I am ending up in loss when I calculate premiums. Please tell me if I am missing something else.

Thanks.

Dhana, its very difficult to tell whats happening without know all the details. Why don\’t you enter the values in excel or maybe in Sensibull to see the pay off?

Hi Karthik Sir, all these strategies and the upcoming strategies will be more suitable \”if we keep the options contract till the expiry date\” sir?

Yup, that generally helps.

There\’s graph issue in the app shows for bear put 🙂

Checking on this.

In app pay off graph is shown for bear put spread.

Let me check on this, Vijay.

\”Increase in volatility when there are few days to expiry enhances the possibility of the option to expiry OTM, hence the premium decreases.\”

Karthik, wouldn\’t the high volatility also mean there is high possibility of the option to expire ITM, because markets can move in either direction?

I personally think contribution of time decay \’Theta\’ has more to this drop in premiums than the Volatility.

Please share your thoughts on same.

Thank you for educating us to trade conceptually! : )

That\’s right, volatility increases the odds of the spot moving in either direction. Think of vega acting as a catalyst to theta 🙂

Hi karrhick sir

Good afternoon.

In case of the buying the Call option (ATM + OTM strikes)., we pay the premium ., So calculating the Payoff will Intrinsic Value – Premium Paid., but in the table the PP is shown negative.. Can you plz explain that. or why this has to be indicated as negative before the PP.

If the intrinsic value is 0, then it means we lose the premium paid, hence its -ve.

In what way bear call ladder strategy is better then the call ratio back spread as you said that its an improvisation form.

It is all about the premium and how it is playing out, Priyanshi. It is very hard to say one strategy is better than the other.

Hello Karthik,

You have mentioned that it is best to implement bear call ladder, bull put ladder call ratio backspread and put ratio backspread when expecting a stocks quarterly results.

I think it is very rare the the market moves in favor of the results. I was recently seeing NMDC had very positive results yet the stock dropped. Sometimes it works in that favor.

What could someone do to predict results better so I could implement such strategies?

Sandesh, I\’m putting up this module on Financial Modelling. That will help you get a better perspective on this.

Hi Kartik,

I never see prices of ITM strikes covering prices of ATM and OTM strikes. They only get covered when u go buy deep OTM strikes.

True, but you get this opportunity when there is a sudden spike in volatility where the option prices get distorted for sometime.

Would do. Thank you for relentlessly guiding us 🙂

Happy trading, Prashant!

Sir you\’ve mentioned that in Bear Call Ladder the cash flow is invariably better than the cash flow of the call ratio back spread. I fail to understand how. Be it a bear call ladder or a call ratio back spread, we sell an ITM strike. However in call ratio back spread, we buy 2 OTM strikes whereas in bear call ladder we buy 1 ATM and 1 OTM strike. The cost of buying an ATM strike is more than the cost of buying an OTM strike. Then how would the cost of executing a bear call ladder be better than the call ratio back spread? Please help.

Since you are buying an ATM, perhaps you can sell a slightly better ITM strike. Hence the better cash flow. Do test this couple of times on paper before actually implementing this in the market.

Hello Sir,

Often to ensure this is a net credit I have to choose higher OTM strike prices or even do it as an sell ITM CE and buy OTM CE and buy another further OTM CE.

This results in a very high breakeven and roughly requires almost a 9-14% move from the current spot.

So should one just choose a net debit bear call ladder?

Thats true, your breakeven range gets larger. Its best done for net credit, but you may not get this situation all the time in the market. Hence its best deployed when the premiums are attractive to give you a net credit.

Hello Sir,

Why is the name of the Strategy is \”Bear call Ladder\”.

What does the word \”Bear\” has Significance in this??

Thank you

Well, effect of Greeks – In short

* If volatility is low -> premium (higher), in case here our max loss (calculated) will be less : above example (-140). Here if volatility rise, then we can just pocket the premium, if demmed fit.

* If volatility is on higher side (say double), then our max loss calcuated loss will be higher : (-280)

*At start of series – higher the premium (time value) – we are exposed to more risk here

* Middle of series – little lower the premium (less time value)

So it all depends on our risk appetite, how higher we take our risk exposure, based on spread & premium paid. Above example (-140) -> it\’s upto us

Am I right?

Thats right Virendra. The key to remember is that besides directional moves, every other aspect of greeks matters in deciding the premium of an option.

Hi,, Kartik

I would like to know the difference about stocks and indexes. and now in this pandemic situation, is it better to play with options or hold the stocks as m newbie in this market so

I\’d always suggest investing, pandemic or not.

You taught us about the Bear call ladder. Thanks. But how about bull put ladder??. Can u pls provide an explanation and excel sheet for that too….

Sure, will try and do that 🙂

Dear Sir,

What about bull put ladder?

Hmm, have not included that Janta. Decided to cover only the main strategies.

Hello Sir,

Can you explain why you mentioned that purchasing a bear call ladder is cheaper than a call ratio back spread.

In a call ratio back spread you sell an CE ITM and purchase 2 cheaper CE OTM. While in a bear call ladder you sell an ITM CE and purchase 1 ATM CE and 1 OTM CE. The ATM cost is much more than OTM.

Also can I also perform a bull put ladder? By selling an ITM put option and buying 1 ATM PUT and 1 OTM PUT

Janta, not exactly cheaper. The BCL is a slight improvement over the ratio spread.

Hi, The bear call ladder payoff graph in the varsity app seems inaccurate. Can you please look at it and check if a rectification is required?

Will recheck on this, Prabal. Thanks.

sir what if the underlying starts going up and volatility starts coming down, is it a good idea to implement bear call ladder and bull ratio back spread ??

Yes, you want to volatility to increase in these cases.

It says \”Even if the market goes down you still end up making a modest profit. \”

But I have been observing from past many weeks that, if the price goes down, we will still end up in loss.

For example in the current month ( on 1st of Aug )

ITM CE premium price is 325

ATM CE premium price is 291

OTM CE premium price is 240

Here if I do the same calculations ( 325-291-240 ) = -206

Meaning if the price goes against us, although the loss will be fixed but it won\’t come in profit as your graph shows above.

The P&L described in the chapter is with respect to holding the options to expiry. Before expiry there could be instances of loss.

Hi Karthik,

Please clarify on the sqauring off the multiple legged strategies. This could be done on KITE??

Squaring off the strikes at the same time. PLease clarify

I\’m not sure if I understand your query correctly. Yes, you can square them off on Kite?

May be a stupid question, i dont know, for your above response…. but then i would assume all would want to do this same thing, meaning everyone will want to wait and close them out just before going to expiry. if everyone (both buyers and sellers) try to do this, i am unable to comprehend how this will work out finally. how will those many contracts be closed before expiry, as everyone will try to only close, isnt it… no one will want to take a new position? what am i not understanding.

Note – I dont know how to make it appear as a reply to your reply. it always is being raised as a new question.

Thanks

Sri

You are right, in fact 80-90% of trades are closed before expiry. New positions are initiated in the next month series as the current month is about the expire. In fact, this is called the rollover of positions.

Hi

But will all of these change with this new physical settlement rules?

In many scenarios, we either have to deliver or buy physical shares. In that case, is it still a strategy traders can follow?

Thanks

Sri

True, but then you can hold right upto expiry and close them out without going to expiry.

In bear call ladder, number of strikes having negative strategy payoff is more compare to call ratio back spread. Also, payoff graphs of both show the same that spread between two breakeven points is large in bear call ladder than call ratio back spread. So, why one should choose bear call ladder over call ratio back spread?

It all depends on the volatility and the associated premium 🙂

Given this, you need to figure which strikes to buy/sell given the market situation.

No I mean the margins you pay when you write options. Similar to selling futures, when you write options, you need to have a certain amount in your account as margin which gets blocked right (Initial Margin + Exposure).

So when you calculate net in any strategy at the start, shouldn\’t it be something like:

Premium credited – Premium debited – Margin debited (IM + Exposure)

Premiums are any day lesser than the margin you pay, so by that logic, this equation should give a negative value

Not sure if I\’ve missed something or I\’m wrong conceptually here.

But you get back the margins when you close the position right?

Hi Karthik,

I have a doubt and a question:

1. When you say net credit is positive, you mean the difference between the premium received and premium paid is positive. But when you\’re selling an option, you have to pay margins also right. So ideally you\’re still in a net negative. Isn\’t it?

2. The strategies you explained until now are all valid when you wait until expiry. Are there any options strategies when you deal with short term options or when you square off before the expiry?

Thanks!

1) Hmm, why would you say so? Are you considering the cost of capital?

2) There are no specific strategies as such. But you can use the same set of strategies for short term as well.

Dear Sir , kindly explain ,

Max Loss = Spread (difference between the ITM and ITM options) – Net Credit. I could not get it. Thank you.

The maximum loss that can make in this strategy is the difference between the two strikes minus the net credit you\’d have received at the time of initiating the position.

Thanks Karthik.

Btw the reply button on any of the comments is not working for me, hence have to post a new comment. Please get it checked once. Thanks again.

Will do. Thanks.

\”Blue Line – This line suggests that an increase in volatility when there is ample time to expiry (30 days) is beneficial for the Bear Call Ladder spread. As we can see the strategy payoff increases from -67 to +43 when the volatility increase from 15% to 30%. Clearly this means that when there is ample time to expiry, besides being right on the direction of stock/index you also need to have a view on volatility. For this reason, even though I’m bullish on the stock, I would be a bit hesitant to deploy this strategy at the start of the series if the volatility is on the higher side (say more than double of the usual volatility reading)\”

Hi Karthik, can you please help me understand the above – if increase in volatility is beneficial for the bear call ladder then why you would be hesitant to deploy the strategy at the start of the series if the volatility is on the higher side.

If vol is on the higher side, then the chances of vol cooling off (decreasing) is high. After you initiate the position, you want the vol to increase and not really reduce right? Hence.

Thanks Karthik!

Welcome!

Hi Karthik,

One generic question after going thru strategies from first four strategies. SL and Target is not mentioned for any of the strategy. I get a feeling that SL/target is that way not needed for strategies that have fixed P&L. For this and Call ratio back spread strategy, profit is higher after upper break-even point. So its individual\’s discretionary call to square off/exit after achieving desired level. Hope this is correct assumption.

Thanks,

-Sachin

It is needed Sachin. While risk is defined, it is not like they are foolproof. The SL and target can be concluded by looking at the spot chart…perhapse at S&R levels.

Sir,

Thanks for the prompt reply. However, I meant to ask something else. I know that we can exit an option strategy anytime but from last module we also know, that the calculation of Intrinsic Value (e.g. Spot-Strike for CE) is valid when options are held till expiry. If I exit before, I am not sure if the calculations of Intrinsic Value and P&L would remain the same.

Further, I also know about the revocation of STT trap but the taxes here still remain relatively high, if I am right (0.125% on intrinsic value vs 0.05% on premium value)?

If I exit before, I am not sure if the calculations of Intrinsic Value and P&L would remain the same ——> This is right. The calculation changes. I\’d suggest you look at https://sensibull.com/ for the P&L calculation before expiry.

For exercised options, it was 0.125% of the contract size.

Sir,

I again have a very basic question. When we are not applying the option strategies and just buying or writing Calls and Puts, it is always advisable to square off before the option expires to avoid STT trap. However, what I am unable to figure out is, when any strategy is used involving options in any ratio depending upon strategy, what has to be done? We can not square off before expiry, right? Then, What burden will STT have on P&L?

Sidhant, there is no more STT trap. STT will be levied on the intrinsic value of the option and not really on the contract value. Check this – https://tradingqna.com/t/starting-sep-1st-finally-no-more-stt-trap-on-exercised-options/61795

By the way, you can square off the option contract anytime you wish, no need to wait till expiry.

Hi, can you please explain this? This is bit weird.

\”Max Loss = Spread (difference between the ITM and ITM options) – Net Credit\”

Typo, I guess 🙂

It should read (the difference between the ITM and the OTM strike)

How can I download DCF MODEL in Zerodha Varsity?

You can download the entire module here – https://zerodha.com/varsity/module/fundamental-analysis/

Hello karthik,

Can we apply this strategy for intraday trading also?

You can, but these options strategies are best when you keep expiry in perspective.

Pay attention here, as this is where the tragedy strikes!

Wants to trade options to learn, but has no money to loose (:

Is there any back testing platform from zerodha, to test stratergies without loosing money ?

Of course, please check – https://www.streak.tech/

Hello karthik!

Great series. Throughly enjoying reading the various modules.

My question is how to calculate the effect of volatility (section 5.4) on this strategy?

Thanks,

Prashantha

Glad to know that, Prashantha.

No calculation as such…as long as you are aware of the effect of Volatility on the strategy.

Hi Karthik

What is the benefit of taking this strategy instead of a naked Slight OTM Long Call Option assuming that the presupposition is that the market will move definitely higher? For instance in the example cited above, the maximum Loss for the Bear Call Ladder is 140 Points and the profits will only start when the NF crosses 8040. Whereas a naked Long OTM 7900 CE has a max loss of 70 points but will be in profit as soon as NF crosses 7900.

Well, the only reason to initiate spreads is to cover yourself against unfavorable directional/volatility movements. Otherwise, nothing beats the profitability of naked options.

Hi Karthik,

I was lookup at nifty option chain to implement this strategy.Below are the particulars

Nifty spot=8602

ITM-8500-201.95

ATM-8600-141.65

OTM-8700-91.4

So in this case we are having a net debit instead of a net credit.So how to we choose strikes in this case.Is it that we have to choose ITM and OTM that are 200 points away from ATM.Seems like the near ITM and near OTM are creating Net debit.Please clarify

Yes, you will have to consider 8400 CE. However, this may skew your payoff and the trade my not be favorable.

I am confused.so choosing the 8500 ITM CE is not creating Net credit .so choosing this strike also will deviate from the trade set up right?

You are required to buy 1 ITM CE to finance the purchase of 2 CEs. Since 8500CE (ITM) is resulting in a net debit, I\’m suggesting you try 8400 CE.

I am using Zerodha PI also out of curiosity logged into Kite as well. But never seen OPTION Greeks for the contract, which is critical data point to trade options as options rather than mere levering tool that many used to do.

More over you have provided this valid option strategy, but do you have your system built to cater to execute these strategy.

Bare minimum : your software must show 1) GREEKS for each contract and 2) one FILTER for Probability of ITM. If possible 3) Probability for Touching. Item 1 and 2 are critical to understand what you do and trade options. Or it amounts do really you do not understand what you do. So, suggest if you have them in your system, or do you have any plan to introduce them in near future.

We do plan to introduce this in the future Jaikrishnan!

Hi,

I think the call ratio back spread is more better than this as loss happens only in 7800 while here loss occurs at two points

Yeah, I personally like the ratio spreads!

Sir How to calculate If nifty is now 7550 then his premium is ? please give the clarity how to calculate the premium.

You can use this calculator to calculate the premiums – https://zerodha.com/tools/black-scholes

Make sure you read through the instructions.

Sir

Please will you explain the moving averages and RSI. How can we apply on candles. How can we study them

Please comment on it sir

Suggest you look at the module on TA – everything is explained there – http://zerodha.com/varsity/chapter/moving-averages/

Sir,. I am big fan of your`s. No doubt you are one of the biggest market expert in india.

I want to know how useful are these strategies. If market goes against my expectations I will definitely loose money.

If I follow another strategy I will definitely make money

Let today nifty spot is 7700. I long one lot of nifty future and short one lot another month series. I sell one lot if nifty goes above 7700 (whenever) and square off another position when nifty goes below (whenever it goes). However rollover may be required.

Sir please comment

Ankit, I\’m not a market expert. In fact market is so vast, no one can be an expert, you can only be a good student of markets 🙂

As long as the market moves in any direction, you stand to make a profit. But if the market stagnates in a range then you will make a loss. So make sure you are certain about a movement in the market, irrespective of the direction.

Instead of buying and selling so many times, why don\’t you consider the Synthetic long arbitrage (explained in the next chapter).

sir,i asked shall i try till u come

You could 🙂

sir can we learn tradescript in pi software &what is pattern recognition will thesebe useful actually i wanto remove all humanemotions in trding if it is useful however hard it is i will learn are u comming with any module educate

Yes, we do plan to have a module on risk management and trading psychology, but this will be at a much later stage.

Hi kartik

When I buy option with premium of 100, my total cost is 100*75=7500. So if premium become 200, my capital become 15000.

But in writing option if I sell at 100 when my capital becomes double???also in option selling, almost double money freezes than buying as exposure margin.

Please correct me where I wrong.

For this you need to understand the payoff diagram of the option writers. Remember option writers have limited profit and unlimited risk. For this reason there is no question of doubling your money when you write option. Margins are blocked because you carry unlimited risk.

On option selling , if premium get half my money doubles if premium gets one fourth, my money becomes 4*. Am I correct???

If you sell an option at 100, then 100 is your 100% premium received. If it halves to 50, then you get to retain 50% of the original amount..so on and so forth. In option writing, the best scenario is to retain 100% premium.

Thank for past answer.

Hi kartik

Suppose I sell nifty 7300 call which has premium of 125. If next day market goes to 7200 and premium comes down to 62. Then I close my position by doubling my capital without waiting for expiary.

Yes, you make a profit of 125-62 = 63.

Hi kartik,

Clearly for the same price movement,call option looses more value than it gains. Also with the passage of time option written would be beneficial. My question is suppose price moves very sharply in very short time period in against option writer then 100% broker cut position after end of margin and he fails to do so, how does he recover extra losses from trader?? Since it is only point of concern in writing option.

The broker will not cut your positions as long you maintain sufficient margins in your account. Ensure that margins are always higher than the SPAN margin requirement.

What is the benefit of strategies like Bear Call Ladder compared to Long Straddle?

The difference between any two option strategies is payoff and cost of execution.

Hi when can we expect further chapters in this module to be uploaded.

One per week is what I\’m targeting but unfortunately its taking a bit more time.

Hi kartik

For selling options zerodha keep some money as margin, but if a very sudden and intense price movement occurs and losses are more than blocked margin, then who is liable to pay extra losses??

This is market risk, and the person who initiates the position bears this risk. Brokers are not liable for this.

Hi kartik

Can you give me a recipe of technical indicators to good enough, because it is very difficult and confusing to apply many indicators???

I would suggest you look at candlestick patterns rather than indicators.

Sir will you explain that how can we gaze the market trends for next days. What are the technicals can support to find out the marker way. Sir

Suggest you read the module on Technical Analysis – http://zerodha.com/varsity/module/technical-analysis/ . You will get many pointers here.

If the market in the bearish trend it is better to sell one lot ITM CE. and Buying one lot ATM CE. I think that enough to make money. Why we should buy one OTM call option. Plz clarify that sir

You could try that, in fact I would encourage you to plot the individual payoff and check how it works. This will be a practice for you!

How can we always in the profit zone while we option trading,?

By being right all the time 🙂

The best time to implement this strategy is during the first 15 days of the month, 4-5 days before the announcement of Quarterly results of a company, just before the volatility picks up so that the pay off increases due to the increase in volatility in the following days?

Also, when would be the right time to exit from the strategy? Once the results are announced and the stock reacts or on expiry?

Ajay – yes increase in volatility (especially in the first half of the series) is great for this strategy as this tends to lift the payoffs to the positive territory.

If you are playing this for results, exit the positions after the result announcement – once the directional movement picks up.

\”In a Bear Call Ladder, the cost of purchasing call options is financed by selling an ‘in the money’ call option.\” what is the meaning for this line.

It means, when you sell options you receive premium money, you can use this money to buy another option.

Hi,

When you refer to Volatility, do you refer to the Stocks Volatility or Indexs Volatility?

Depends on the asset, if you are dealing a stock, then you need to look stock\’s volatility. Likewise with Index.