9.1 – Background

We discussed the “Call Ratio Back spread” strategy extensively in chapter 4 of this module. The Put ratio back spread is similar except that the trader invokes this when he is bearish on the market or stock.

At a broad level this is what you will experience when you implement the Put Ratio Back Spread

- Unlimited profit if the market goes down

- Limited profit if market goes up

- A predefined loss if the market stays within a range

In simpler words you make money as long as the market moves in either direction, of course the strategy is more favorable if market goes down.

Usually, the Put Ratio Back Spread is deployed for a ‘net credit’, meaning money flows into your account as soon as you execute Put Ratio Back Spread. The ‘net credit’ is what you make if the market goes up, as opposed to your expectation (i.e market going down). On the other hand if the market indeed goes down, then you stand to make an unlimited profit.

I suppose this should also explain why the put ratio back spread is better than buying a plain vanilla put option.

9.2 – Strategy Notes

The Put Ratio Back Spread is a 3 leg option strategy as it involves buying two OTM Put options and selling one ITM Put option. This is the classic 2:1 combo. In fact the put ratio back spread has to be executed in the 2:1 ratio meaning 2 options bought for every one option sold, or 3 options bought for every 2 options sold, so on and so forth.

Let take an example – Nifty Spot is at 7506 and you expect Nifty to hit 7000 by the end of expiry. This is clearly a bearish expectation. To implement the Put Ratio Back Spread –

- Sell one lot of 7500 PE (ITM)

- Buy two lots of 7200 PE (OTM)

Make sure –

- The Put options belong to the same expiry

- Belong to the same underlying

- The ratio is maintained

The trade set up looks like this –

- 7500 PE, one lot short, the premium received for this is Rs.134/-

- 7200 PE, two lots long, the premium paid is Rs.46/- per lot, so Rs.92/- for 2 lots

- Net Cash flow is = Premium Received – Premium Paid i.e 134 – 92 = 42 (Net Credit)

With these trades, the Put ratio back spread is executed. Let us check what would happen to the overall cash flow of the strategies at different levels of expiry.

Do note we need to evaluate the strategy payoff at various levels of expiry, as the strategy payoff is quite versatile.

Scenario 1 – Market expires at 7600 (above the ITM option)

At 7600, both the Put options would expire worthless. The intrinsic value of options and the eventual strategy payoff is as below –

- 7200 PE, would expire worthless, since we are long 2 lots of this option at Rs.46 per lot, we would lose the entire premium of Rs.92 paid

- 7500 PE would also expire worthless, but we have written this option and received a premium of Rs.134, which in this case can be retained back

- The net payoff from the strategy is 134 – 92 = 42

Do note, the net payoff of the strategy at 7600 (higher than the ITM strike) is equivalent to the net credit.

Scenario 2 – Market expires at 7500 (at the higher strike i.e the ITM option)

At 7500 both the options would have no intrinsic value, hence they both would expire worthless. Hence the payoff would be similar to the payoff we discussed at 7600. Hence the net strategy payoff would be equal to Rs.42 (net credit).

In fact as you may have guessed, the payoff of the strategy at any point above 7500 is equal to the net credit.

Scenario 3 – Market expires at 7458 (higher break even)

Like in the call ratio back spread strategy, the put ratio back spread too has two breakeven points i.e the upper breakeven and the lower breakeven point. 7458 marks the upper breakeven level; of course we will discuss how we arrived at the upper breakeven point a little later in the chapter.

- At 7458, the 7500 PE will have an intrinsic value. As you may recall, the put option intrinsic value can be calculated as Max[Strike – Spot, 0] i.e Max[7500 – 7458, 0] hence 42

- Since we have sold 7500 PE at 134, we will lose a portion of the premium received and retain the rest. Hence the payoff would be 134 – 42 = 92

- The 7200 PE will not have any intrinsic value, hence the entire premium paid i.e 92 is lost

- So on one hand we made 92 on the 7500 PE and on the other we would lose 92 on the 7200 PE resulting in no loss, no gain. Thus, 7458 marks as one of the breakeven points.

Scenario 4 – Market expires at 7200 (Point of maximum pain)

This is the point at which the strategy causes maximum pain, let us figure out why.

- At 7200, 7500 PE would have an intrinsic value of 300 (7500 – 7200). Since we have sold this option and received a premium of Rs.134, we would lose the entire premium received and more. The payoff on this would be 134 – 300 = – 166

- 7200 PE would expire worthless as it has no intrinsic value. Hence the entire premium paid of Rs.92 would be lost

- The net strategy payoff would be -166 – 92 = – 258

- This is a point where both the options would turn against us, hence is considered as the point of maximum pain

Scenario 5 – Market expires at 6942 (lower break even)

At 6942, both the options would have an intrinsic value; however this is the lower breakeven point. Let’s figure out how this works –

- At 6942, 7500 PE will have an intrinsic value equivalent of 7500 – 6942 = 558. Since have sold this option at 134, the payoff would be 134 – 558 = – 424

- The 7200 PE will also have an intrinsic value equivalent of 7200 – 6942 = 258 per lot, since we are long two lots the intrinsic value adds upto 516. We have initially paid a premium of Rs.92 (both lots included), hence this needs to be deducted to arrive at the payoff would be 516 – 92 = +424

- So on one hand we make 424 on the 7200 PE and on the other we would lose 424 on the 7500 PE resulting in no loss, no gain. Thus, 6942 marks as one of the breakeven points.

Scenario 6 – Market expires at 6800 (below the lower strike price)

Remember, the put ratio backspread is a bearish strategy. It is supposed to make money once the market goes below the lower breakeven point. So lets understand how the pay off behaves at a point lower than the lower breakeven point.

- At 6800, 7500 PE will have an intrinsic value of 700 and since we are short 7500PE at 134, we would lose 134 -700 = – 566

- 7200 PE will have an intrinsic value of 400. Since we are long 2 lots, the intrinsic value would be 800. Premium paid for two lots is Rs.92, hence after adjusting for the premium paid, we get to make 800 – 92 = +708

- Net strategy payoff would be 708 – 566 = +142

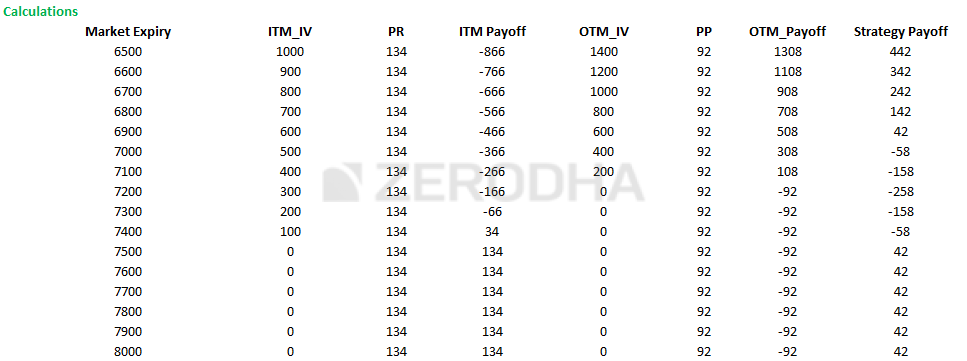

Likewise, you can evaluate the strategy payoff at different levels of market expiry and you will realize that the profits are uncapped as long as the market continues to slide. The following table showcases the same –

Plotting the different payoff points, gives us the strategy payoff graph –

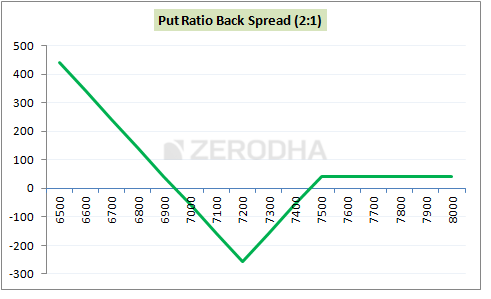

Clearly from the graph above, we can conclude –

- If markets go down, then the profits are unlimited

- There are two breakeven points

- The point at which maximum loss occurs is at 7200

- If markets goes up, then the profits are limited

9.3 – Strategy generalization

We can generalize the key strategy levels as below –

- Spread = Higher Strike – lower strike

- 7500 – 7200 = 300

- Max loss = Spread – Net credit

- 300 – 42 = 258

- Max Loss occurs at = Lower strike price

- Lower Breakeven point = Lower strike – Max loss

- 7200 – 258 = 6942

- Upper breakeven point = Lower strike + Max loss

- 7200 + 258 = 7458

9.4 – Delta, strike selection, and effect of volatility

As we know, the strategy gets more profitable as and when the market falls. In other words this is a directional strategy (profitable when markets go down) and therefore the delta at overall strategy level should reflect this. Let us do the math to figure this out –

- 7500 PE is ITM option, delta is – 0.55. However since we have written the option, the delta is –(-0.55) = +0.55

- 7200 PE is OTM, has a delta of – 0.29, remember we are long two lots here

- The overall position delta would be +0.55 + (-0.29) +(-0.29) = – 0.03

The non zero Delta value clearly indicates that the strategy is sensitive to the directional movement (although negligible). The negative sign indicates that the strategy makes money when the market goes down.

As far as the strikes are concerned, I’d suggest you stick to the classic combination of ITM and OTM options. Remember the trade needs to be executed for a ‘Net Credit’. Do not initiate this strategy if there is a net outflow of cash at the time of execution.

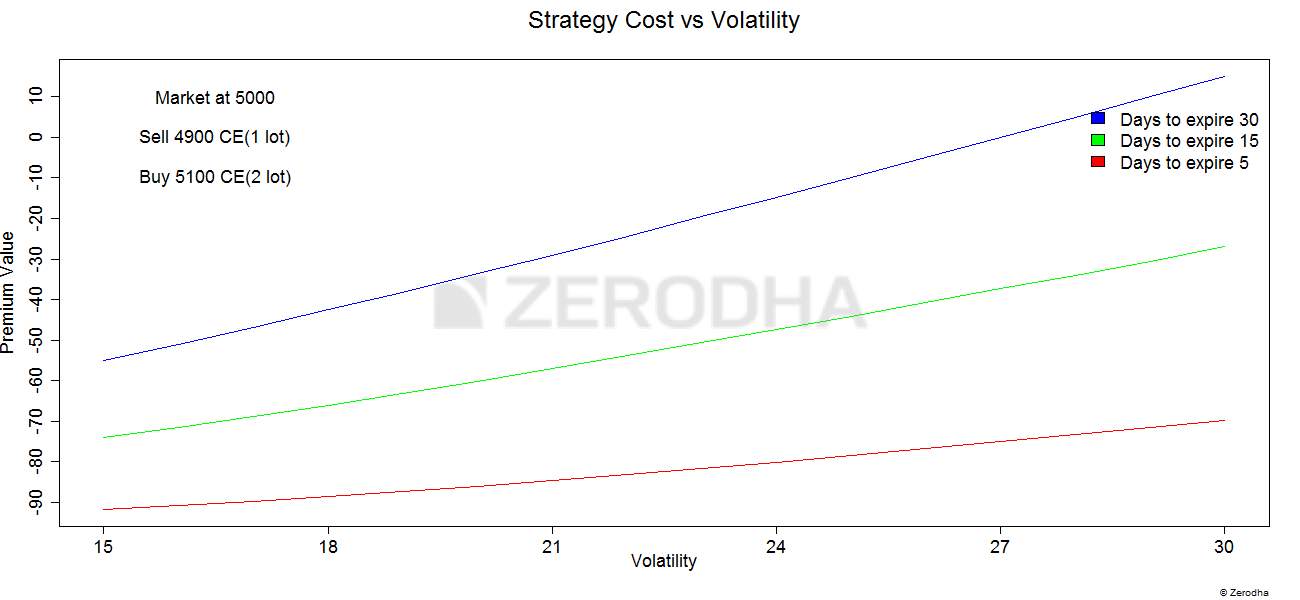

Let’s look at the variation in volatility and its effect on the strategy –

There are three colored lines depicting the change of “premium value” versus change in volatility. These lines help us understand the effect of increase in volatility on the strategy keeping time to expiry in perspective.

- Blue Line – This line suggests that an increase in volatility when there is ample time to expiry (30 days) is beneficial for the Put ratio back spread. As we can see the strategy payoff increases from -57 to +10 when the volatility increase from 15% to 30%. Clearly this means that when there is ample time to expiry, besides being right on the direction of stock/index you also need to have a view on volatility. For this reason, even though I’m bearish on the stock, I would be a bit hesitant to deploy this strategy at the start of the series if the volatility is on the higher side (say more than double of the usual volatility reading)

- Green line – This line suggests that an increase in volatility when there are about 15 days time to expiry is beneficial, although not as much as in the previous case. As we can see the strategy payoff increases from -77 to -47 when the volatility increase from 15% to 30%.

- Red line – Clearly increase in volatility when we have a few days to expiry does not have much impact on the premium value. This means, when you are close to expiry you only need to worry about the directional movement and need not really worry much about the variation in volatility.

Key takeaways from this chapter

- The Put Ratio Back spread is best executed when your outlook on the stock/index is bearish

- The strategy requires you to sell 1 ITM PE and buy 2 OTM PE, and this is to be executed in the same ratio i.e for every 1 option sold, 2 options have to be purchased

- The strategy is usually executed for a ‘Net Credit’

- The strategy makes limited money if the stock price goes up, and unlimited profit when the stock price goes down

- There are two break even points – lower breakeven and upper breakeven

- Spread = Higher Strike – Lower Strike

- Net Credit = Premium Received for Higher strike – 2*Premium paid for lower strike

- Max Loss = Spread – Net Credit

- Max Loss occurs at = Lower Strike

- The payoff when market goes up = Net Credit

- Lower Breakeven = Lower Strike – Max Loss

- Upper Breakeven = Lower Strike + Max Loss

- Irrespective of the time to expiry opt for ITM and OTM strike combination

- Increase in volatility is good for this strategy when there is more time to expiry

Download Put Ratio Back Spread Excel Sheet

Hi Karthik Sir,

I know that the above mentioned scenario\’s are in the expiry. But in case as the above example of Sell 1 7500PE and buy 2 7200PE.

We are experiencing the down move as expected and the market is going below 7200 and continuing to go below. Now we know our direction well and may not bounce back most probably. So to avoid the further increase in the intrinsic value of the 7500 PE. can we exit the 7500PE to increase our profitability in advance, By holding on the 7200PE till the end? (I know it will convert into the pure vanilla option) but now we are right on our direction? that\’s Y.

Sure, but when you do change the option legs, you will have a different sequences of returns and risk. You need to evaluate on that and check if the P&L works for you.

As per TA when DOJI appears there is indecisiveness in the market so market go either way so according to you which strategy is best when seeing DOJI if i am risk appetite is moderate? (i) the long staddle (2) Call Ratio Back spread (3) Put Ratio Back spread.

As far as possible, stick to the strategy that you understand well. Also, there is no one strategy that works across all market situations.

sir in Strategy Notes

you tell 3 options bought for every 2 options sold

plz check that

Thats the ratio, Darshan.

In fact the put ratio back spread has to be executed in the 2:1 ratio meaning 2 options bought for every one option sold, or 3 options bought for every 2 options sold, so on and so forth

sir that is 4 option bought for every 2 option sold

Ah, yes.

I think if call and put ration both applied on Dec 24 options would be best as time to expire for loss is maximum

Pls help

Want to execute on monday

Akash, better to us a platform like Sensibull to evaluate your positions in terms of risk and reward.

Ok, thank you sir.

Sure, good luck.

Sir, there is one more doubt that between \’Long straddle\’ and \’Call back ratio spread\’ strategy which is better for intraday as well as for short term plz clarify. I am confused to use among them.

In my opinion, none of these should be used for intraday. These are strategies where you should target to hold for a few days so that the spread can unfold.

Sir, I am a school teacher and

hardly get time to see the market (i. e. Hardly 5-10 min to see the market between two teaching periods). I tried all option strategies, every strategy has some merits and demerits.Even I took some overnight positions, but I faced loss due gap up and gap down of market. So I request you to suggest such trading strategy for intraday or short term which will be suitable as well as profitable for me plz.

There is no single strategy that can be used across multiple scenarios. You will have to experiment and see what works for you 🙂

Sir in strategy notes 9.2, the ratio is 2:1, and you have mentioned that:

3 options bought for every 2 options sold, so on and so forth.

but if we buy 4 options then we will still need to sell 2 options as per ratio

so all that i am getting is, for 3 options bought or 4 options bought we need to sell 2 options likewise, if we buy 7 options or 8 options we need to sell 4 options.

Oh ya, thats right. I must have made an inadvertent error here.

Could you kindly advise if there could be any extra benefit – if Both… the Call Ratio Back Spread and the Put Ratio Back Spread are implemented at the same time…. to take advantage of any trending moves either on the upside or the downside?

Secondly.. I have noted that though the Call and Put Ratio Spreads…are significantly profitable on the Strikes at extreme wings… either on the upside or the downside… BOTH give the maximum loss…on the Strikes where the Longs were purchased. Is there a way to mitigate this risk/loss? Thanks & Rgds

You cannot use these interchangeably. CRS is when you expect the markets to move up, and PRBS is when you expect the market to crack. These strategies are designed to manage risk…as in the risk management bit is baked into the strategy.

Is there any study material on option chain.

Yes, I\’ve spoken about it in this video – https://www.youtube.com/watch?v=bCRw8YN-4QY&list=RDCMUCQXwgooTlP6tk2a-u6vgyUA&start_radio=1&rv=bCRw8YN-4QY&t=20

Suppose market is bullish and bank nifty spot price is 39598 and we bought the call option strike of 40000 (OTM) @LTP 220

Aa per the option chain maximum resistance is at the strike price of 39900 as per the OI data.

So my question is

Should by this strike 40000 because LTP IS cheaper and anyWAYS if market will goes up by 39598 and close under 39900 (suppose 39800). Still in that case I will make a profit. Because market has gone up by almost 200 points.

You cant always generalise this, Sudhir. The option premium is a function of many factors and needs to be evaluated, keeping volatility, time to expiry, speed at which the market is moving along with of course the market direction.

Hi sir

In option chain there r two options OI and OI change.

Suppose Oi is 14.1lac and OI change is -4.2lakh . What does it indicate?

OI indicates the total number of open contracts, up until now, on a cumulative basis. OI change indicates the change from y\’day to today.

Hi Sir i want to do a course on option trading. Where I can interact with faculty . Would you please guide me .

Thanks

We have put a ton of content on this topic here on Varsity, Sudhir. Please do letif you have any specific queries, will be happy to resolve that for you 🙂

Hi sir where I can ready more about open interest and open interest change .

Is there any platform where I can communicate directly. Or any course .

This is the platform, Sudhir 🙂

Hi Karthik,

I had a question regarding this and the other strategies in this series. If the spot price is at 7506 and we expect a 506 point drop in the index to 7000 (target), the strategy would still make a loss according to the table above, and would need to go below 6942 for it to make money. Is the target wrong or am i missing something? Please guide..

So basically, the strategy makes money as the spot falls more. In this case 6942 or lower.

In \”9.2 – Strategy Notes\”, this line \”3 options bought for every 2 options sold, so on and so forth.\” is a typo mistake because it should be 4 not 3

Checking this.

Sir, I think there should be a correction under Strategy Notes sub-heading \”2:1 ratio meaning 2 options bought for every one option sold, or 3 options bought for every 2 options sold\”. It is 2:1 ratio right? so instead of \”3 options bought for every 2 options sold\” it should be as \”4 options bought for every 2 options sold\”, that sounds right isn\’t?

Ah, let me relook at this. Thanks. By the way, I\’ll be updating the content and looking at fixing all these typos soon.

How to get the PCR online during the market in my Kite app??

How to get the PCR online during the market??

Do check with Sensibull if they have this feature.

Wow! It means when volatility cools off, execution could be possible. Good indicator,isn\’t it? Thanks Sir for your prompt reply.

Happy learning 🙂

Call ratio back spread or put ratio back spread, when it is possible to execute it? I never see selling ITM strike could finance buying 2 OTM strikes!

Thats when volatility increases and premiums swell. You need to keep track of the premium and spot these opportunities.

Upper Breakeven = Lower Strike + Max Loss

I think this formula is wrong

Correct formula is

Upper Breakeven = Lower Strike – Net Credit

Checking this again, Mohan.

This will help me understand but also to know what is happening with

Good luck! Happy learning 🙂

Hi Karthik,

In the \’Strategy Notes\’ section while explaining the example, you considered Nifty at 7506. Then you selected strike 7500 as ITM. Isn\’t 7500 an OTM strike ?

Thank You

Since its 5 points in, its ITM. But usually the strikes in and around the spot is considered ATM 🙂

3 options bought for every 2 options sold, so on and so forth.

typo* In strategy notes

I think 4 OTM options should be bought for 2 ITM sold

Re checking this.

Hello Sir,

I am getting confused in one part.

When the Volatility is high(Say 30%) at the start of the series(30days to expiry), the premium is high so I should take this strategy instead of avoiding it as Put Ratio Back Spread is a Net credit strategy.

Sir, where i am going wrong in this thought, can you please clarify it.

Thank you.

You can take this strategy, but the thesis of taking is not just the fact that you get high credit. You need to ensure you have a view on both volatility and direction of the market.

Sorry, i haven\’t checked all the comments. I got the answer for my question. Thanks.

Happy learning, Vishvas 🙂

Hi, as you have mentioned while executing this trade spot is at 7506 and 7500 put should be sold which you have mentioned to ITM option. Would\’nt it be that Options above 7506 are ITM Options while 7500 option is either ATM or slightly OTM. Please clarify.

Hi Sir,

In section 9.2 , i think you made mistake. The rule is to follow 2:1 ratio for strategy.

But you gave example : \’ there should 3 option bought for every 2 option sold.

Mathematically for above example ratio for buy/sold becomes \’ 1.5/1\’ .

Which unfollows 2:1 rule

You can say \’there should 3 options bought for 1.5 options sold. (just saying). Then only 2:1 maintains.

Plz correct this n let me know if i am wrong. thank u🤗

Ah, I get that. Let me review this and fix (if it needs to be), thanks for pointing though 🙂

Just one query, in a scenario, if there is an opportunity for a Call Ratio Spread and another opportunity a Put Ratio Spread. Which opportunity should be more preferred??

I asked this because as the market moves up the Volatility comes down, but when market moves downwards volatility starts shooting up. And I\’m sure both wouldn\’t give us the same outcomes.

There is no generic answer to this, you will have to evaluate this on a case to case basis based on the premium.

Above in 9.2 when Nifty spot price is 7506 . How can 7500PE is a ITM instead of being ATM . Explain ??

7500PE is ATM, Ayush. Must be a typo, let me check.

Sir

In the strategy notes, you mentioned 3 options bought for 2 options sold, shouldnt it be 4 options considering 2:1 ratio?

And Thanks for your simple explanation of all the strategies, it was really helpful.

Ah, that\’s right. Will make that change 🙂

hi karthik ,coincidentally figures given in illustration provided in the chapter is matching with excel sheet.try with current figures of nifty and check upper breakeven.

Checking this.

hi karthik have a query regarding formula of upper breakeven mentioned in this chapter.calculations done for upper breakeven by the formula doesnt match with the figures done on sensibull virtual trade and even excel calculator provided in this chapter.kindly check and reconfirm and correct me if i m wrong.

Manish, the formula i.e. lower strike + max loss, is the same in excel and as explained the chapter. Not sure why it does not match with Sensibull. Maybe you should write to them 🙂

Hi Sir,

I am new comer in the option and would really like to start trading in options. Could be please guide me how to place order and which strategy to follow to begin with minimum risk.

Regards,

Order placement is the easy bit. You need to develop a market view first. Do check out the module on TA to develop a sense on markets.

Cant we just buy a long straddle ?

Aint this strategy capping our profits in one direction ?

And the range for profits is still the same as long straddle

If i am wrong please correct me kartik sir!

Ajay, it is always a balance between the risk and reward, volatility versus directional bets.

Sir ,

After knowing about Put Ratio Back Spread , I Executed it on Mothersumi , on 2:1 Ratio Bought 2 OTM PE of Strike 65 for Rs., 2.70 and Sold 1 ITM PE of Strike 80 @ 9.65 . Till Yesterday i had Approximately 160 Thousand as cash in funds . Yesterday I Also Sold One SBIN CE Strike 210 @ 0.20 , Because Option Pain shows at Strike 190.00 i Assumed i shall Collect 0.20 Premium as it will End worthless by 30th April , At this point i still had 5000 cash left in my account .

Today i.e. 29th April i was shocked ro see My Funds have gone -568000 Negative . in fear i Exited MotherSumi 2 OTM PE of Strike 65 ( Which i Had Bought ) , Only to See my Funds to go -6,73,653.34 Negative after exit . I am Confused and in Deep Panic . I also have one NIFTY FUT APR which i had shorted and one NIFTY FUT JUN on which i am Long .

Please Explain the Whole Concept why is that my funds are negative to such an extent 6,73,653.34 . as per your postings which i read and as per my understanding i was suppose to make some money but now i am in deep red i dont know who to settle this . Should i exit all my Positions and book heavy losses .

Mothersumi 1 ITM PE of Strike 80 @ 9.65 is Now 0.55

Mothersumi 2 OTM PE of Strike 65 for Rs., 2.70 in Now 0.05( Already Sold in panic)

Mothersumi Option pain is at 75.00

NIFTY APR FUT Bought @ 9238.00 Currently NIFTY APR FUT @ 9461.00 NIFTY Spot 9483.00 Option Pain @ 9300.00

NIFTY JUN FUT Bought @ 9299.00 Currently NIFTY JUN FUT 9481.00 Spot 9483.00

SBIN 210PE Sold @ 0.20 Current Value 0.15 Option Pain @ 190.00

Please Advice what should i do now . Am I , in Hole for this Huge Amount of 6,73,653.34 . ?

Mothersumi 1 ITM PE of Strike 80 @ 9.65 is Now 0.55 — > Since this is short, you made money on this

Mothersumi 2 OTM PE of Strike 65 for Rs., 2.70 in Now 0.05( Already Sold in panic) – Since you are long, you have lost 2.7 here

Overall, I think your position is profitable.

NIFTY APR FUT Bought @ 9238.00 Currently NIFTY APR FUT @ 9461.00 NIFTY Spot 9483.00

NIFTY JUN FUT Bought @ 9299.00 Currently NIFTY JUN FUT 9481.00 Spot 9483.00

Both these positions are also profitable

SBIN 210PE Sold @ 0.20 Current Value 0.15 Option Pain @ 190.00

This position is also profitable.

SO where is the question of a loss? Are you referring to the margins blocked? Please call the support desk once to seek clarification.

Sir ,

If Im to Execute put-ratio-back-spread should i Square off ( The Higher strike which is Sold and the Lower strike which we had Purchased ) or Simply Let is Expire worthless on the Expiry date and collect the profits if profits are made . Please explain

If it is worthless (heading that direction), you can as well let it expire.

In 9.4, Strike selection in missing.

sir when very few days to expiry like 1 week, you have mentioned slightly ITM and deep ITM spread for call ratio back spread. similarly can we apply slightly OTM and deep OTM spread for put ratio back spread .

Just the opposite, Prasanth. You set up a spread with OTM options when you have ample time to expiry.

Hi Karthik,

From your example\”

Nifty Spot is at 7506 and you expect Nifty to hit 7000 by the end of expiry. This is clearly a bearish expectation. To implement the Put Ratio Back Spread –

Sell one lot of 7500 PE (ITM)

Buy two lots of 7200 PE (OTM) \”

In this scenario, both are below 7506 so either 7200 was written as OTM is a typo or 7500 must be an ATM. How come both strikes below the spot price are considered as ITM and OTM as both are considered as OTM for puts?

7500PE is considered ATM and 7200PE is OTM.

Hi,

But technically OTM and ITM should be on opposite sides right?>

Opposite side meaning?

Hi Sir, I am tracking 10600 PE and 10400 PE, the percentage change in 10600 PE is less than that of 10400 PE. I expect the reverse because the spot is around 10600, how? Is that the mere effect of IV. Also in sensibull while tracking my position, the Delta for 10600 PE is lesser than 10400 PE, how this will be correct?

The percentage change is a function of not just IV but also gamma. Would suggest you read this – https://zerodha.com/varsity/chapter/gamma-part-1/

About Sensibull showing lower Delta for ITM, maybe you should write to their support for an explanation.

Thank you very much…

Welcome, Sanjeev!

Hello sir…Thank you for all your previous replies they were really helpful.

I am at commodities module end now but i was revisioning this module and here are my queries which you can explain.

First i want to know that why the Payoff vs Volatility chart of Call ration backspread CRBS and put ratio back spread PRBS are different. I mean in PRBS if volatility changes when there is ample time the net payoff decreases coz there is increase in premium and when there is less time and volatility changes there isnt much effect. But in the module previous to this you tole that. [when volatility increases (or is expected to increase) – option writers start fearing that they could be caught writing options that

can potentially transition to ‘in the money’. But nonetheless, fear too can be

overcome for a price, hence option writers expect higher premiums for writing

options, and therefore the premiums of call and put options go up when volatility is expected to increase.]

And next question is why payoff increases with volatility in bear put spread when at the same time net credit decreases if we opt for bear call spread.

And the last thing i wamt to clear that this is annual volatility we are talkin abt here or is that some other kind of volatility.

Thank you

Hi Team,

I want to execute multiple orders simultaneously in 1 order. Is there any facility to do the same in Zerodha.

eg Buy BankNifty 27000 ce , sell 27500 ce Buy 28000 PE and sell 28500 PE all should be executed in 1 order.

Awaiting for your feedback

Regards

Sunita.

Yes, Sensibull lets you do this as a single order, check this – https://sensibull.com/

1) In this example, wouldn\’t 7500 strike be ATM and not ITM since the spot is at 7506? And for the OTM strike, why did you choose 7200 & not 7300 (because in some examples, the difference between strike & spot is only around 200, here it\’s around 300)?

2) Have noticed that you always take the strike price which are in multiples of 100 in your examples. Is it because they have more liquidity compared to strikes in multiples of 50 (only)?

Thanks!

1) You can implement this with one ATM (or an ITM close to ATM) short and 2 OTM buy. So given this, its ok to have 7500.

2) Larger the spread, higher is the reward. The expectation is that Nifty will to 7000, so more bang for the buck.

3) Yes, that\’s the only reason.

Hi Nithin/Karthik/Zerodha

Could you please start a module on interest rate trading. From basic to practical. That would be really helpful.

We will put this up sometime soon. Thanks.

Dear karthik,

i was trying to put in the strategy around the current nifty values to get a better understanding but stuck up with delta calculations.

spot=9120

days to expiry=4

bought 2 9000PE option. (delta as per zerodha calculator after putting in IV of 12.24 = -0.137)

Sold 1 9200PE option. ( delta as per zerodha calculator after putting in IV of 10.33 = -0.77)

So net Delta = -0.137-0.137-(-0.77)=+0.496.

please explain

thanks

Since you have shorted an ITM PE, you are net long – remember delta of PE is -ve, when you short a PE, the delta turns positive. So in your example, you are short a ITM PE whose delta is overpowering the deltas of 2 OTM PE.

in this strategy as expected if volatility and movement does not come than @ what point should we exit the trade

You can hold the position till expiry…but if the position is making you uncomfortable, then you should exit.

please confirm while sell ITM and Buy OTM must be done in a time frame,or i can buy PE 2 lot OTM and sell ITM some other day or few days later like after 7 days ,then whether this strategy will work .and what should be ITM strike position along with volatility .

It has to be executed as a set in one shot, you cannot spit it over time.

Do we need to make the delta neutral while implementing this strategy and suppose if we put this strategy then can we make adjustments by keeping delta neutral after respective time interval???

By its structure, the strategy will remain delta neutral.

sir, i am new trader, i read your articles. All are too good. but i am not having that much time now to concentrate on market. is there any paid service to give successful traders ideas or calls

You should check out – https://opentrade.in/

Very useful topic. Plz clear my small doubt. Can we executive a call ratio back spread or the put ratio back spread on net debit? Do zerodha allows that? Kindly clarify.

You can execute it for a net debit…for example if you sell ATM and buy a strike just next to ATM then it \’may\’ result in a net debit. However its best if you can execute it for a next credit. You can do this with any broker, not just Zerodha.

Thanks for the prompt reply Karthik. It\’s clear now. If I have to impliment the ratio spreads with an intraday or 1-2 days view, what sort of monyness you recommend for the option strike price.

I would not suggest you do this for intraday. However if you wish to set this up overnight, I\’d suggest you look at the standard combo – ATM and OTM.

a VERY tricky question regards to Hedging which time and strike price would be the best in bank nifty or nifty for doing hedging regardless volatility in the market. also how could we identify trends in the market like bullish or bearish trend?

This comes purely based on experience, Sanjay 🙂