9.1 – Basics of the Index Futures

Within the Indian derivatives world, the Nifty Futures has a very special place. The ‘Nifty Futures’ is the most widely traded futures instrument, thus making it the most liquid contract in the Indian derivative markets. In fact you may be surprised to know that Nifty Futures is easily one of the top 10 index futures contracts traded in the world. Once you get comfortable with futures trading I would imagine, like many of us you too would be actively trading the Nifty Futures. For this reason, it would make sense to understand Nifty futures thoroughly. However before we proceed any further, I would request you to refresh your memory on the Index, we have discussed the same here.

I assume you are comfortable with the basic understanding of the index; therefore I will proceed to discuss the Index Futures or the Nifty Futures.

As we know the futures instrument is a derivative contract that derives its value from an underlying asset. In the context of Nifty futures, the underlying is the Index itself. Hence the Nifty Futures derives its value from the Nifty Index. This means if the value of Nifty Index goes up, then the value of Nifty futures also goes up. Likewise if the value of Nifty Index declines, so would the Index futures.

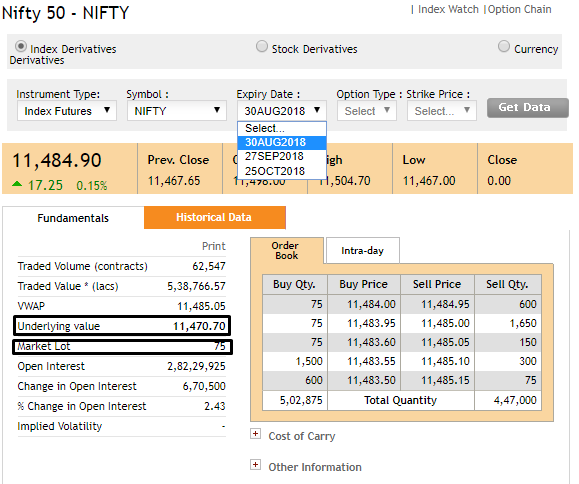

Here is the snapshot of Nifty Futures Contract –

Like any other futures contract, Nifty Futures is also available in three variants – current month, mid-month, and far month. I have highlighted the same in red for your reference. Further, I have highlighted the Nifty Futures price which at the time of taking this snapshot was Rs. 11,484.9 per unit of Nifty. The corresponding underlying value (index value in spot) was Rs. 11,470.70. Of course, there is a difference between the spot price and the futures price, which is due to the futures pricing formula. We will understand the concepts related to futures pricing in the next chapter.

Further, if you notice the lot size here is 75. We know the contract value is –

CV = Futures Price * Lot Size

= 11484.90 * 75

= Rs.861,367/-

Here are the margin requirements for trading Nifty Futures; I’ve used Zerodha Margin Calculator to get the margin values –

| Order Type | Margin |

|---|---|

| NRML | Rs.68,810/- |

| MIS | Rs.24,083/- |

| BO & CO | Rs.12,902/- |

These details should give you a basic overview of the Nifty Futures. One of the main features of Nifty Futures that makes it so popular is its liquidity. Let us now proceed to understand what liquidity is and how one would measure it.

9.2 – Impact Cost

Updated 24th August 2021 – As per the NSE’s definition, Impact Cost is defined as the cost that a buyer or a seller needs to bear when executing a transaction in a given security. It is a measure to gauge the market liquidity and provides a much more accurate picture of the cost traders bear when executing a trade in comparison to the bid-ask spread. It is measured separately for the buy-side & the sell-side and varies according to the size of the transaction. The Impact cost is dynamic in nature and keeps changing based on the order book. For stocks that are to be included in indices (like Nifty 50, Nifty 500), one of the criteria for eligibility is the impact cost being below a certain threshold (For more details about this, refer to the Index Methodology document).

The formula for calculating the impact cost is as follows –

Ideal Price = (Best Buy Price in Orderbook + Best Sell Price in Orderbook) / 2

Actual Buy Price = Sum of (Quantity * Execution Price) / Total Quantity

Impact Cost (for that particular quantity) = (Actual Buy Price – Ideal Price) / Ideal Price * 100

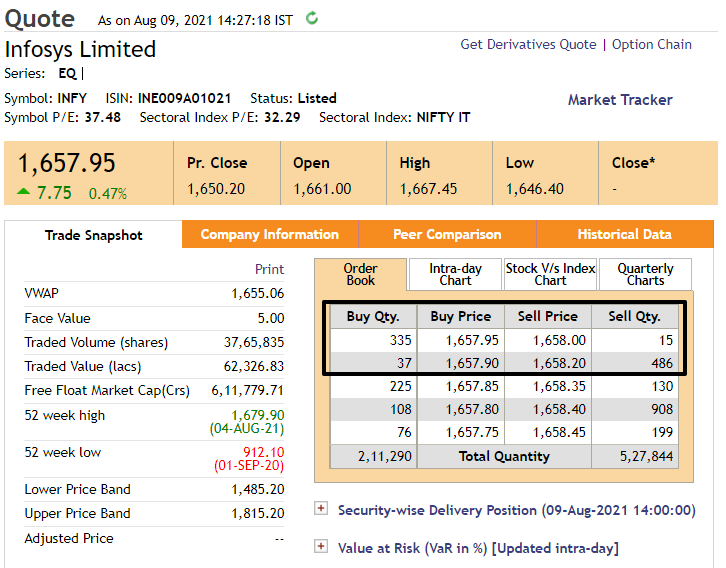

To explain this using an example, let us consider Infosys –

Let’s suppose a person wants to buy 350 quantities of Infosys. Now let us calculate the impact cost for this transaction –

Ideal Price = (1657.95+1658)/2 = 1657.975 ~ 1657.98

Actual Buy Price = (15*1658) + (335*1658.20) / 350 = 1658.19143 ~ 1658.19

Impact Cost for buying 350 shares = ((1658.19 – 1657.98) / 1657.98) * 100 = 0.012%

The few key messages that I want you to take away from this discussion are these –

- Impact cost gives a sense of liquidity

- The higher the liquidity in a stock, the lesser is the impact cost

- The spread between the buying and selling price is also an indicator of liquidity

- Higher the spread, the higher the impact cost

- Lower the spread, the lower is the impact cost

- Higher the liquidity, lesser the volatility

- If the stock is not liquid, placing market orders is not a great idea

9.3 – Why trading Nifty makes sense

As you know the Nifty Index is a basket of 50 stocks. These stocks are selected to represent a wide section of the India economic sectors. This makes Nifty a good representative of the broader economic activity in India. This naturally means if the general economic activity is going up or at least expected to go up then Nifty’s value also goes up, and vice versa. This also makes trading Nifty Futures a much better choice as compared to single stock futures. There are many reasons for this, here are some –

- It is diversified – At times taking a directional call on a single stock can be a tough task, this is mainly from the risk perceptive. For example, let us just say I decide to buy Infosys Limited with a hope that the quarterly results would be good. In case the results don’t impress the markets, then obviously the stock would take a knock and so would my P&L. Nifty futures, on the other hand, has a diversified portfolio of 50 stocks. As it is a portfolio of stocks, the movement of the Index does not really depend on a single stock. Of course, occasionally a few stocks (index heavyweights) can influence Nifty to some extent but not on an everyday basis. In other words when you trade Nifty futures you completely eliminate ‘unsystematic risk’ and deal with only with ‘systematic risk’. I know these are new jargons being introduced here, we will discuss these terms in more detail at a later stage when we talk about hedging.

- Hard to manipulate – The movement in Nifty is a response to the collective movement in the top 50 companies in India (by market capitalization). Hence there is virtually no scope to manipulate the Nifty index. However the same cannot be said about individual stocks (remember Satyam, DHCL, Bhushan Steel etc)

- Highly Liquid (easy fills, less slippage) – We discussed liquidity earlier in the chapter. Since the Nifty is so highly liquid you can literally transact any quantity of Nifty without worrying about losing money on the impact cost. Besides, there is so much liquidity that you can literally transact any number of contracts that you wish.

- Lesser margins – Nifty futures require much lesser margins as compared to individual stock futures. To give you a perspective Nifty’s margin requirement varies between 12-15%, however individual stock margins can go as high as 45-60%.

- Broader economic call – Trading the Nifty futures requires one to take a broad-based economic call rather than company specify directional calls. From my experience, doing the former is much easier than the latter.

- Application of Technical Analysis – Technical Analysis works best on liquid instruments. Liquid stocks are hard to manipulate, hence they usually move based on the demand-supply dynamics of the market, which obviously is what a TA mainly relies on

- Less volatile – Nifty futures are less volatile compared to individual stock futures. To give you perspective the Nifty futures has an annualized volatility of around 16-17%, whereas individual stocks like say Infosys has annualized volatility of upwards of 30%.

Key takeaways from this chapter

- Nifty Futures derives its value based on the Nifty Index in spot, which is its underlying

- At present, the Nifty futures lot size is 75

- The Nifty futures is the most liquid futures contract in India

- Just like other future contracts, Nifty Futures contracts are also available with three different expiry options (Current month, Mid Month, and Far Month)

- A round trip trade is an arbitrary quick instantaneous trade which involves buying at the best available sell price and selling at the best available buy price

- A round trip trade always results in a loss

- Impact cost measures the loss of a round trip as a % of average of bid and ask

- Higher the impact cost, lesser the liquidity and vice versa

- When you place a market order to transact, you may lose some money owing to impact cost

- Nifty has an impact cost close to 0.0082%, which makes it the most liquid contract to trade

Could I request to please add round trip trade example in this module. The explanation is present in summary but a little detailed example in module content would be highly beneficial. Thanks!

Round trip is basically to buy and sell immediately at the current bid-ask spread.

I think impact cost is apply in all stock?

Yes, to all traded instruments.

I am planning to trade in stock futures segment and wanted to ask if there is a liquidity issue in trading futures like option trading? for example i want to buy Bosch oct fut at 38650 rs as 25 quantity (1) lot.

will i be able to buy and sell at market price like how we place orders in equity?

Next question:- Is it safe to take next month contract post 15 of every month as the current month expiry is near?If i take next month futures then which month chart indicatior reading would be accurate?

Yes you can, but few contracts like Bosch could be not so liquid. Safety in terms of? Liquidity could be one issue to look out for.

Actual Buy Price = (15*1658) + (335*1658.20) / 350 = 1658.19143 ~ 1658.19.

Dear sir why 335 is multiplied with 1658.20 instead of 1657.95 please respond to my query.thank you

Its the transaction price, Suresh. We are volume weighting it.

Sir i think there is a mistake in the actual price quation. For 335 quantity of buy price you have put 1658.20 insted of 1657.95 for the 335 quantity. If im wrong about this please correct me.

Sell price = is the price at which you can buy

Buy price = is the price at which you can sell.

Hello Karthik,

Yesterday i was observing the nifty 50 and nifty may Future relative movement. I found that nifty spot decreased exactly 235 points, while nifty future declined by just 175 points between day\’s low and high. I learnt that nifty future exactly follow nifty spot since nifty future derives its value from nifty 50. Don\’t you think if nifty spot decreases by 50 points then nifty future should also drop by 50 points.

Could you tell me why this variance occurred on 26 April 2024 trading day.

Thanks in advance.

There will be variance due to the futures pricing formula. In fact, this leads to premium and discount of futures to the spot.

Ok. In case if we develop a trend following strategy based on Nifty 50 Index and trade takes on Synthetic futures, which ATM shall be considered? is it based on Nifty index or Futures?.

I\’d suggest you pick it based on futures.

Yes. Buying 1 ATM call option and selling 1 ATM put option for each Nifty Futures (For Long direction) and and buying 1 ATM put option and selling 1 ATM call option (Short direction). this would mimic the payoff of futures instrument in trend following strategy.

But still, I did not get your point. When I checked the cost of one lot futures and one synthetic futures, total cost of futures trading is Rs.260 per lot and for one synthetic futures, it is Rs.130.

Ah, I\’ve not checked the recent rates for synthetic, for some reason I was thinking the costs nearly equal.

The thing is that futures are costlier. Because of the value of the futures, higher STT and other charges. Synthetic futures are cheaper na.

If you think 1 futures is expensive, then a synthetic would involve more futures, so it will be lot more expensive that way. Just to sure we are talking about same synthetic as this – https://zerodha.com/varsity/chapter/synthetic-long-arbitrage/

Hi Karthik

My question is about trend following strategy on nifty index. If I want to develop a trend following strategy on nifty index using Synthetic futures, is that possible? As I have heard that nifty option prices are moving in accordance with nifty futures and not nifty index.

Yes, but if you want to follow the trend, then why even look at synthetic. Maybe just use plain futures, it will be cheaper and more directional.

Hello Sir Could you please why in the above example in actual buy price for 335 execution price is 1658.20 but not 1657.95?

That was the price available in the market at that point. Do check the bid-ask spread.

Please clear my doubt. I know NIFTY FUT os derivative of NIFTY. However Future is traded separetly and individual. Then how it is calibarated with spot price?

That is because the derivative infers its price from the spot market.

Hi,

Unlike options we have seller and purchaser in Call & Put option seperate. How can we determine if sellers r high or wise Versa

For any given contract, they are similar. However, you can look at the underlying\’s price movement and figure whats happening with the price sentiment.

Thanks a lot for providing such a valuable content.

I have a doubt- In the section 9.2(Example of infosys)

How the current market price(1657.95) is decided?(which is shown in the snap shot).I am calculating the average ACTUAL BUY PRICE of all the five rows , it is close to that but not exact.

Sharad, have explained it here – https://zerodha.com/varsity/chapter/the-stock-markets/

Hello Karthik,

My price action technique is good. But problem brokerage on future and options is high. Iam able to generate good but these charges pains a lot. What to do i want to trade nifty 50 only.

Dhanyvad

I have no answer for that, except for asking you to trade lesser and selecting trades where the probability of a larger profit is high 🙂

Sir please clear me if i have strategy and I want to back test them should I back test in nifty 50 index or future of nifty 50 which is good. Thank you

Depends on what you are trading, if the overall strategy requires you to trade futures, then you will need to backtest futures. Else, index works 🙂

Hi Karthik,

Thank you so much for your reply. This is a useful intormation for us to continue our implementation.

You guys are doing a fabulous job. There is no such clear platform to teach trading with such clarity.

Thanks

Thiru

Thanks for the kind words, Thiru. Happy learning 🙂

Hi Karthik,

Thanks for taking time to reply. Let me explain with the figures.

I have taken 4 lots of banknifty nov fut at the price of 45010 after a couple of days I could see my average price shows 44000 with the same 4 lots (60 units) and found a few thousands are adjusted from my funds.

This repeated three times until today and now the same bank nifty shows 42830 as my average price. Not really sure why this is fluctuating.

Thanks much

Thiru

As the value of the underlying goes against your position, the daily M2M will be adjsuted and at some point, you will need to bring in more funds (if you wish to maintain your position), as margin amount.

Hi Karthik,

I started trading in bank nifty quite

Frequently nowadays. Looks like every day the average price changes (mostly reduces) than the price I bought. But the number of shares are not increasing.

Could you please explain me why am I facing this?

Thanks

Thiru

Not sure what you mean by number of shares. The share prices are fixed to lot sizes.

what will happen nifty future for october-2023 ?

Ham jese Kam padhe lhike logo ke liye kyaa aap or jayada shi se samjaa shktee he kyaa sir ham bhi shiknaa chaate he but daut bhut saare aaate hee

Hi Karthik,

I am back with my query here. Nifty futures today is trading just at a premium of 10 rupees compared to Nifty spot. Even in last week it was trading at very low premium. Monthly expiry is still 9 sessions away. What\’s the inference to be drawn based on this data. Does this mean that the futures market is cautious and not seeing big upside or downside here? I have seen Nifty futures trading at more than 100 rupees compared to spot so many times. Please enlighten

Thanks,

Amit

Amit, it just means that the speculations is not much in the current markets. The premium/discounts widen when there is too much activity, and it sort of behaves normally when the speculative activities are subdued.

How do I know whether the spread is high or low, is there a number that i can go by as a thumb rule, please advise.

thanks.

also when you say difference between the buy price adn sell price. is the average buy / sell price you are talking about.

You need to look at the price difference between buy and sell prices, Shailesh. That will give you a sense of how wide the spread it. The price you need to look at is the absolute price as indicated in the best bid and ask price.

How Leveraged are NIFTY futures in real? Suppose if Nifty is at 18700 and lot size is 50 quantity ,which equals 18700×50 = 9,35,000 . And if margin required for buying one lot is Rs 1,06,000 this means Leverage of 8-9x (935÷106) . So for 1% move in NIFTY , the PnL will move by 8 or 9% ?

Arun, do check section 4.4 – https://zerodha.com/varsity/chapter/leverage-payoff/

Hi Karthik, Actually the screenshot of Infosys in section 9.2 has a table of \”Order book\” and the first row in the table has \”Buy Quantity = 335\” and corresponding \”Buy Price = 1657.95\”. Since it\’s not possible to attach or paste the screenshot here, I tried to draw the first row of \”Order Book\” of screen shot below.

Order Book:

Buy Quantity – Buy Price – Sell Price – Sell Quantity

335 – 1657.95 – 1658 – 15

Since total quantity is 350 (=335+15) and the price of 15 selling stocks is taken as 1,658, I assume the price of buying stocks 335 should be 1,657.95.

Therefore, the Actual Buy Price = (15*1658) + (335*1657.95) / 350 = 1657.952134 ~ 1658

Hope this helps. Thank you

You buy 15 stocks at 1658 and the next 335 stocks at the next best sell price right? Why are you looking at buy? Sorry, if I\’m missing something obvious here.

Yes sir. Actually I wanted to confirm about a calculation about the example of “Infosys” in section 9.2 – Impact cost.

The calculation is shown as:

Actual Buy Price = (1*1658) + (335*1658.20) / 350 = 1658.19143 ~ 1658.19

However Per my understanding the Execution price for buy quantity 335 should be 1657.95 in place of 1658.20 used in the numerator. Thank you.

How did you get 1657.95, Kamal?

Hi Karthik, just following up. Actually I am learning a lot from the text and just want to be clear on understanding. Thanks

Happy learning, Kamal. By the way, did I miss answering any query of yours?

Hi Kartik,

Just to confirm if I am following the calculation correctly for example of \”Infosys\” in section 9.2 – Impact cost.

The calculation shows as:

Actual Buy Price = (1*1658) + (335*1658.20) / 350 = 1658.19143 ~ 1658.19

Per my understanding the Execution price for buy quantity 335 should be 1657.95 in place of 1658.20 used in the numerator. Thank you.

Checking on this, Kamal.

Dear Karthik,

In order to trade in options (Call & Put – Nifty & Bank Ninfty ), Do we need to follow Nifty /Bank Nifty Spot chart or Future Chart.

Please advise.

Thanks

Either chart will do, Suresh 🙂

How to deal with the future premium. How we can decrease the premium during the Nifty future purchase compared to normal nifty index

Premiums are market driven, Prabat. Nothing much an individual trader can do about it.

How we can trade in nifty future? Using the technical analysis on chart of nifty future or something else is also there we need to look for..

Saurabh, you can start with TA on Nifty futures and see how it goes. Develop on it as you gain more trading experience. For example, you can combine TA dn FA to develop trading strategies.

Hi , I am unable to understand the impact cost. Can some please put it in simple terms here.

Let us say there is a stock that is trading at 400. The offer is at 404, and the bid is at 402. So if you quickly buy at 404 and sell at 402, you will lose two on this transaction. This loss is called loss due to impact cost.

Thank you very much for replying

Happy learning!

Hi Karthik, i added a basket in zerodha app, but the required margin is around 8 lakh & final margin is around 3 lakh. So do i need 3 lakh in my account or 8 lakh ??

You need to have 3L.

Got it, Sir!!

thank you so much

and a very happy teacher\’s day to you! 🙂

Thanks, Megha. Happy learning 🙂

hello sir,

Can you please explain point 4 of the impact cost section .. which says – \”Higher the liquidity, lesser the volatility\”

I am confused .. like ..doesn\’t liquidity means that there are enough buyers and sellers in the market that the transaction can easily be executed…if so, more buying and selling leads to change in market price at every moment making the stock more volatile ..

Actually i am still learning and would love if you could tell me at which concept I am lacking.

thank you

P.S- The way you explain every concept so is AMAZING!!

why haven\’t I came across it earlier !!

Megha, so higher liquidity means a higher number of transactions. The higher the number of transactions, the lower the cost of buying and selling. By cost, I mean the impact cost. To put this in context, volatility can increase or decreases in highly liquid stock. While the two (volatility and impact cost), they are different 🙂

I hope I dint confuse you further 🙂

Hi Karthik,

If the xyz future is liquid enough then putting a market order doesn\’t have any impact cost?

Is my thinking right?if not please make me understand😊

All contracts have impact cost, its just that liquid contracts don\’t have much impact cost.

Can nifty June future be hold till end of July?

No, June contracts expire in June itself.

Dear sir,

Do I have to worry about the impact cost when I use a market order

Yes, please do keep an eye on it, especially if you are trading intrday.

ok Sir…thanks a lot..!!

Hello Karthik Sir,

Please let me know what should be look back period for Nifty futures swing trading on 30 minute chart time frame..?

At least 3 months, Sooraj.

Even tv anchor says\”short covering rally\”. This is completely wrong. Short covering can not move index. But reverse is right. Index is moving upward therefore shorts are covered.

It all depends on the scale at which unwinding is happening. In other words, you need to see the OI built up and then figure.

Dear Karthik,

In reference to our earlier conversation, as asked by you, pls check \”Banknifty 5th May 36600 CE\”, the %age Bid/Ask spread is around 0.5% but the strike is fairly liquid (looking at volumes & OI). I even traded in this strike today without facing any issues. 0.1% seems to be great for Nifty/BankNifty Futures but I guess for OPTIONS this should be something different.

I\’ve not really checked the spread recently, so I could be wrong with 0.1%. Please do double-check that once 🙂

Dear Karthik,

0.1% seems to be a very tight value. As I can observe today in kite that strikes even with spread% of around 0.3 are liquid. Alternatively, can you pls let me know what can be condition/ value for \”Volumes\” for liquid index option strikes..?

Which contract did you check? Maybe you should check Nifty Futures, which has the highest liquidity.

Dear Karthik,

Just reiterating my query in a better way that I have understood the impact costs involved in Futures but can you please throw some light on what should be an ideal value (in %age or absolute) for difference between Bid & Ask prices for liquid \”INDEX OPTIONS\” Strikes?

PLease check the previous reply, Arun.

Dear Karthik,

I understand the impact cost in respect of Futures. Can you pls throw some light on what should be idea %age of Bid/Ask Spread for Nifty or BankNifty OPTIONS prices?? Would be highly oblidged to have your response.

Arun, the lower the better. I don\’t have a number for you, but 0.1% and thereabouts is good 🙂

Just to correct in above

** If i Buy trade in a Future instrument of stock worth Rup100 keeping stoploss to -10% or Rup90 **

Sure, got that 🙂

Namaskar Karthik Sir,

Thank you so much for all this great articles.

Had one query, was thinking about the worst case scenerio if i trade, the scenerio goes like this

If i trade in a Future instrument of stock worth Rup100 keeping stoploss to -10% or Rup10

1. What if suddenly the Stock Price dips to Rup80 – Does the stoploss get triggered or ignored ?

2.Same as point 1, but it dip to Rup80 the next trading day – Does the stoploss get triggered or ignored ?

My concern is the big gap in price that could change, how to strategize that.

Thank You.

1) If the price drop is sudden, then SL at 90 may not trigger and you will have a 20 Rupee loss

2) Same as above.

Basically, SL is not a guarantee. If you want a guarantee, then place SL market, but on the flip side, losses can be heavy.

Dear sir ,

My query is regarding interpretation of nifty future trading at a sudden huge premium or discount !

Like currently nifty future is at premium of more than 100 points , does it indicate topping out !

No, it does not. The fluctuation is simply a function of market demand and supply.

Please upload a module on algorithm trading on streak

This article says one NIFTY future contract is 75 lot. I believe now the lot size is 50. If so, this article needs to be updated?

Ah yes.

Sir, i could see the word \”round trip trade\” in the summary part

but could not see it in the main discussion part sir.

Ah, my bad. Round trip is basically to buy and sell the stock at market price quickly. Check this for more details – https://zerodha.com/varsity/chapter/nifty-futures/

Hi Karthik, I want to know how to select best put option strike price for hedging Nifty futures long position.

Ankit, I\’d suggest you stick to the ATM or slight OTM strike.

Hi, I am FnO learner , if u r successfully trading in futures or options , kindly message me [email protected]. thnx

What if the contract expires ITM? Which stock delivery shud the buyer or seller exchange with each other?

Depending on the position, you either give delivery or take delivery of the stock Abhishek.

I have activated put and future option but How to start ? Or any demo ? Any app Pl help me

I suggest you call the support team for this, Suresh. They will guide you over the phone.

i guess round trip trade and what is liquidity and how to measure it is missing in above.. but many thanks i aam new and especiaaly having no background since i am from science field, but ur teacchings have helped me alot and its very simplified in understanding. many thanks once again

Noted, let me recheck the content once Pratik. Happy learning 🙂

Sir How much capital required to trade in nifty futures buy OR Sell suppose every time I am hedging it with one lot at the money call OR put

At least 3-4L to trade 1 lot comfortably.

Why did you take the numerator as follows? Actual Buy Price = (15*1658) + (335*1658.20) , buy was 350, but you took 15 sell and 335 buy to do calculation with 1658 and 1658.20

Nisarg, thats how the order book is. 15 shares you get first and then the balance. Both at different prices.

good one Zerodha great appreciation to the writer who presented this in simple manner very nice for beginners

Happy learning, Prashant!

Nifty Futures is also available in three variants – current month, mid-month, and far month.

I mean this. Can you please explain

What do you mean by nifty future expiry short, mid and far

As I can see only monthly expiry for Nifty futures

I\’ve tried to explain this in the futures module, Venkat.

Hi team I\’m not able to trade in future intraday in zerodha as in the option there are no any BO CO function in my mobile app as before it was there in the app. what will be the reason ?

BO/Co order types are suspended for now, Milan.

pls make a module or chapter on ask – bid spreads and every topic around spreads , Is the website version of varsity different from mobile version because i discovered v some topics missing from the mobile version but they were available in the website version of varsity

We have discussed bid-ask spread here – https://zerodha.com/varsity/chapter/the-trading-terminal/

The content is the same across web and mobile, Madhav.

Hi Sir,

can we trade BSE index \”SENSEX\” like we do in NIFTY AND BANK NIFTY ?

Yes, but not in Zerodha just yet.

If I am short on Nifty50 and I buy 75 lots,what is the profit I make if Nifty50 falls by 100 points?

Is it 75×100=75000?

Yes.

If PE sold in any of the stocks and goes ITM we can buy the stocks at the strike price. We can buy the stock of a lot size or one fut contract.

In nifty, can we do the same? selling a lot of nifty equal to buying one future?

Please advise.

No, you cannot compare the lot size for this. You need to look at it from a delta perspective, Gokul.

I am new in trading and have done few. Mix experience of P&L but a great learning. These modules helped a lot and cleared most of the doubts. Thanks for this great help and answering all questions so nicely and patiently.

Happy learning, Naveen!

Who is the market maker in future market in nse?

I am confused that who will bear the loss if all investors get profit?

There is no concept of market maker in our market Vivek.

Thank you very much,once again Sir!

Good luck!

Thank you very much for your quick reply,Sir!

So,futures,options and cash market rise and fall independently?

Futures and Options vary after observing the cash market?

Cash market is the deciding factor for derivatives(F&O)?

Am I missing something,Sir?

It is hard to say. These are interconnected market segments. But yeah, in general, the spot market has a bigger/long term impact on the derivative market.

Sir,If FIIs buy 100lots of bank nifty Futures,will the price of bank nifty stocks rise in cash market? (proportional to their weightage}?

Hmm, not really. The futures will move up. Maybe the top weightage stock will.

Dear sir , I\’m bit confused in shorting concept . Suppose i short INFY at 9:30 in morning @1348 and sl is 1355 and suddenly at 9:35 trend gets reversed and about to hit my SL. So i decide to cover my short. As i\’m buying back at 1355 taking losses. My question is am i adding fuel to the increasing bullish momentum ?

If more and more ppl do this, then by virtue of shorts covering their position, the stock prices tend to go up. This is called bullishness owing to short covering.

Hi Karthick,

I\’m new to the Market. I have one small question.

In F&O like Iron condor strategy, i believe that Initially it recommends to Sell near ATM options and then to Hedge these we Buy Options Far OTM.

But In Zerodha it recommends that First Buy and then sell procedure is to reduce margin money.

If i follow these, First buy and then sell procedure, will i get same benefits like how i told in Iron Condor strategy ?

Precise to the point, Does this matter that placing the Order in sequence ?

If sequence of orders changes, will it change the benefits.

Im glad if i get clarified. Thanks

Yes, sequencing matters to ensure that the margins are reduced. If you are trading spreads, then ensure you have the buy leg first and then its sell counterpart to ensure you get margin benefit.

If I were to invest in Nifty index, I can invest through index funds (mutual funds). Instead of doing this, can I buy Nifty futures every month or every two months? Which one will be a better option and why?

Mutual funds are cost and tax efficient.

You spoke about volatility in the concluding part of the chapter. How to calculate volatility %?

Have explained that in the next module.

Hi Karthik

On the NSE site for equity (say MRF) the impact cost is directly mentioned.

But for Nifty and Bank Nifty, and other futures impact cost is missing. Do you think there is any reason for this?

I have not idea 🙂

I am clarifying the question.

Does Demand and supply in Futures Market have an Impact on the spot prices?

At times, especially if there are large quantities traded.

So does buying and selling of Future contract have any Impact on the spot price because of demand and supply in Futures market and spot market?

It may do so at a time, but not always true.

Hi Karthik!

Thanks for all the efforts you have taken for the content.

How is it possible to make and read candle stick chart for Nifty Futures. Since the underlying asset is an Index and the price of Index depends upon the Stocks forming the base and not on actual demand and supply. Is there any other way to Identify trend in Nifty Futures?

The same way you\’d for the stock makes no difference.

Hi sir,

What will be the capital I need to take 1 lot Nifty if nifty will be 15000 spot. From 01.09.2021 ( I mean end of 4th phase of margin cut) ??

Please give the calculation also

You will still need SPAN + Exposure margins Kiran.

Hi Karthik,

Happy New Year ! Just want to confirm about hedging future contract with options. Let\’s say Nifty is at 14,200 and I think it will go down from here so I decide to short March 2021 future contract at 14,200 and at the same time I\’ll buy a 14,200 call for Jan 2021 ( price at Rs270). My intention is to hold the contract till the end of Jan 2021 and ( maybe hold it till march if it goes in my direction ).

Now lets say the prices shoots up to 14,400 by the end of Jan 2021 which means my call option is now in the money Rs 200. So, I lose Rs70 ( which means I\’m not fully hedged. So, can you suggest what is better for me, to buy 14200 call for Jan 2021 or call for March 2021. Do you think I will save/hedge some extra bucks provide I close my position by the end of Jan 2021. Which is better option Jan call or March call.

Also, I was thinking that since I have decide to hold the short future position ( March 2021 ) till the end of Jan, is it a good idea to have long future position ( Jan 2021 contract ) in smaller timeframes like 5 mins or 15 mins chart to make some profits.

To sum it up, I\’ll have Short March 2021 futures contract, Hedge it with Long Call Jan/March Options and then try to time in 5mins / 15 mins chart to have long position in Jan futures contract. Do you think it makes sense and will I have any benefits from it.

Many thanks

Ron, it has to be Jan options, with march you\’ll end up paying a lot of time premium. Btw, why do you need March, why not short Jan and hedge it with Jan options and roll this over month on month?

Hi

I was referring to my earlier query:

\”Is it possible do medium and long term trading with NIFTY futures. For example with stock futures we can go in for a physical settlement and still continue to hold on if the direction goes against you. How do we do this with NIFTY futures?\”

And you had replied:

\”Yes, but may not be a good idea unless you have a deep pocket to sustain margins and mark to markets\”

With regard to this I wanted to know How I can do this and how much of minimum funds are required for this. Sorry for troubling you as I am new to the F & O market. I got interested in this after going through your lessons in VARSITY.

Thanks and best regards,

Girimon

Girimon, the minimum amount needed is the margin specified for each futures contract. You can check that here – https://zerodha.com/margin-calculator/SPAN/

Thanks Karthik, Can you please guide me through some strategies to do this. How much of approximate fund would be required.

Which strategies do you have in mind?

Hi Karthik,

Is it possible do medium and long term trading with NIFTY futures. For example with stock futures we can go in for a physical settlement and still continue to hold on if the direction goes against you. How do we do this with NIFTY futures?

Thanks

Yes, but may not be a good idea unless you have a deep pocket to sustain margins and mark to markets.

Thank you.

Good luck!

When is the expiry of bank nifty futures contract?

ie is it a weekly every thursday expiry or monthly last thursday expiry?

Both weekly and monthly series expires on Thursdays.

Thank you for this material. It\’s well organized and neatly explained. I just wanted to highlight a minor typo in this document, the buy and the sell prices in the section of \”impact cost\” have been interchanged.

Ah, thanks for pointing that. Will check that. Glad you liked the content 🙂

Does Zerodha charges everyday for holding future contracts?

No charges, but margins are applicable daily.

\”4. Higher the liquidity, lesser the volatility\”

Sir how would you justify this statement in case of volatility seen in Nifty and bank nifty F&O, despite the fact that they usually witness high open interest?

Think of liquidity as one of the factors influencing volatility. So it\’s one factor less in terms of driving the volatility up.

Hi Karthik,

I know how much people like me praise you it is less, in trading market whether anything lasts for long time or not but your name will be remembered by the millennials. Once again kudos to the content quality and explanation, you are a great driving force to the entire trading market and especially Zerodha!

Now I feel I should have known this some weeks back so that I would have bought Bank nifty future contract 🙂

One personal suggestion from you is required – Is it like we should enter futures and options market only after getting strong hold of equity market trading like equity MIS/ CNC? I\’m doing equity intraday for some months now and CNC for quite some time so planning to enter into derivatives market. Any lessons or measures you would like to tell?

Thanks for the kind words, Shashank 🙂

Yes, it makes sense to get a firm understanding of how equity works. This is good in the long run as it establishes a stronger foundation. Good luck!

9.2

\”Considering Nifty Futures is the most liquid contract in India, it is safe to set 0.0082% as a benchmark for impact cost. Going by this, MRF’s 0.3% is way higher than Nifty’s impact cost hence it is right to say that MRF is highly illiquid.\”

Why it written that MRF is highly liquid? in fact MRF\’s impact cost is high than nifty future and low impact cost means higher liquid. So nifty future is more liquid than MRF. whether I am correct.

MRF is highly illiquid — thats what it says right 🙂

Higher the impact cost, lower is the liquidity.

Hi Karthik,

Thank you for such a wonderful course on futures. Really appreciate the initiative.

I had a question regarding intraday trading for Nifty 50 futures. While trading on the 5 min chart, should I look at the nifty 50\’s chart or should I look at the chart of Nifty Futures? I am getting different signals depending on which one I am looking at.

Regards,

Gautam

Will there be interest charged on margin funding? Example if I buy 1 lot of nifty future (delivery) margin required is 1,41,143 (Price at 11667.9). The contract value is 8,75,092. So, will I be charged interest on the difference amount of 7,33,950 (@0.05%/day or 18% per annum)?

I searched zerodha and internet but did not find a clear answer. It would be helpful if you provide clarity with above example.

No, there is no interest applicable to this.

Trailing stop loss

I notice that the platform does not enable trailing stop losses on CNC orders. Can this be done?

BO

On BO it is possible to put a SL, trailing stop loss as well as a target. However I am a bit confused on the unit in which these are to be placed.

For eg if i buy a future at say 900 and want a target of 1200 with a trailing stop loss of say 50 points from the purchase price. do i need to input 300 or 1200 in the target field, 50 in the trailing stop loss field and 900 in the sl field.. What will happen if the stock does not reach 1200 but reaches 1100 and then falls down to 1000. will my order get triggered at 1050.

Trailing SL no, but you can set long-standing SL using GTT, check this – https://zerodha.com/z-connect/tradezerodha/kite/introducing-gtt-good-till-triggered-orders

BO is for trailing, so not an issue with that.

Is these the updated one of 2020

If I buy Nifty Far month order

Eg. if I buy NIFTYSEPT in July month

1.Can I sell it in July or Aug. (Before expiry and at any trading day)

2. Can I short it in CNC

THANKS ALOT

1) Yes

2) No

Sir, you didnt answer the question that why does the futures contract expire on the last thursday of every month.

Its as per the exchanges\’s norm 🙂

Nitin sir,

How can I get 10 years nifty intraday chart 30 min.. Please help

Thats a lot of data points, I really dont think it will benefit you in anyway. That said, please contact a NSE approved data vendor for this.

Thank You …

Hello Karthik,

I Have a small doubt in this module (The Nifty Future). you are telling in the snapshot of MRF. The market value was Rs. 32,351.45/-. And the first buy price was Rs. 38,266.25 & first sell price was Rs. 38.364.95 According to the snapshot. But in the percentage calculator you are telling the Buy price was Rs. 38.364.95 & sell price was Rs. 38,266.25. Kindly could you clarify that.

Its with reference to the BID-ASk rate. If you have to buy, you need to look at the sell rate and if you have to sell, you need to look at the buy rate.

awe some explination right from scratch….very use full to all new members

Happy reading!

excellent . simple write up.

query – Have devised a NIFTY trading system . This requires entry and exits as per the parameters defined . Entry as exit signals however do not overlap that of the Nifty Futures time frame . In other word can Nifty Spot be traded (without trading ETF instruments ) like in continuous contracts ? or are continuous contracts used in backtesting only ?

Amit, no spot cannot be traded. You\’ll have to do this on Nifty futures. ETFs are not good for trading.

Thank you

Welcome!

I am new buddy to stock market. May I know at which day futures contract expire every month in Zerodha ?

The monthly derivatives contract expires on the last Thursday of every month, Balaji. The date is set by the exchange, broker has nothing to do with it.

Hi,

I was observing a trend in a few of the auto stocks that the futures at longer expiries are cheaper. For Tata Motors, the spot is Rs. 102.5, Tata Motors Jun Fut is 102.15 and Tata Motors Jul Fut is 102.30. I was reading online about backwardation, but did not see any reference to the phenomenon in equity. Is this something that can be ignored or is there potential to exploit it.

Thanks for all the information and the help; I\’ve learnt more from Varsity than my college.

Premium and discount in the equities world is called contango and backwardation in the commodities market. They are the same 🙂

You can sell the spot and buy futures, but that\’s getting into SLB and stuff. Not so easy for retail traders.

Can I buy nifty bank futures with cash and carry(CNC) mode. Please anyone guide, since i am not sure about this.

Yes, please select NRML as product type instead of MIS>

Is there any tool which give nifty future volume ever min, both buy and sell?

YOu can look at the Nifty 1-minute chart and plot volumes against it.

Hi thanks for well written concept.

I would like to participate in nifty 50 trading .

But i see many options active for trade in nifty

Like nifty may 20 9500 CE/pe and so on …

How to pick good one with good volume so that I can make profits from trade using technical analysis

I\’d suggest you start paper trading with Nifty 50 Futures and then look at other instruments.

Is it compulsory that we buy NIFTY futures immediately the next day (Friday) of Expiry date(last thursday of month).

Can we wait for couple of days after expiry date for buying the NIFTY Futures . Like say if April20 futures ends on last Thursday for buying futures can i wait for some more days in May month and then buy before expiry and square off before expiry date of May month futures.

No, there no compulsion, you can transact anytime you wish!

can i trade intraday banknifty future with 10k capital ?

i will use BO/MIS with max 200 points SL which means 4k loss.

plz reply

hi, does the Bank Nifty Futures depends on bank stock or that month bank futures ???

Depends on the banking industry as such.

If I buy a far month nifty future (bought of June month expiry in April), can I square it off any day before June closing. I mean can I square it off any day in April, may or June. Pl reply

Yes, you can do that Suresh.

Hi Karthik,

I have couple of queries

1) can we buy Niftybees today, hold overnight and sell tomorrow? (Before it is credited in our dmat acc).

2) Does hedging Niftybees with proprotionate nifty futures works?

1) Yes, you can

2) Hmm, not really. ETFs are not very effective in India yet.

Hi Karthik.

\’Higher the liquidity, lesser the volatility\’.

Shouldn\’t it be other way round? That is higher the liquidity, higher would be volatility. My reasoning is that, if a stock/future contract is highly liquid, then it would be trading at every available price and the graph will be very smooth, making it highly volatile. On the other hand, for a less volatile stock/future, it would not be that easy to see change in price. Hence the graph would be slighly jagged, and the stock/future would be less volatile.

Higher liquidity, higher the trading frequency, more trades are smaller price intervals, hence lesser volatility. That\’s the rationale.

Hi sir – Thanks

Hi Sir,

I am doing backtesting for nifty future for 3 years , where in data provided by vendor was 3 month contract in single file .

Example – Below data provided by vendor

1. NIFTY410 – Having 3 month future contract from 20100129 to 20100429

2. NIFTY510 – Having 3 month future contract from 20100226 to 20100527

In order to consider for back testing effectively for 4th and 5th month future contract ,shall i consider below date alone for back testing

For April contract expiry date was considered – 26th mar\’10 to 29th Apr\’10

For May contract expiry date was considered – 30th Apr\’10 to 27th May\’10 for back testing or have to consider or whole 3 month data for back testing

regards

Elamparithi R

Hmm, I\’m not sure. Ask your vendor to give you a consolidated future rolling data instead.

Sir,

I want to know what will happen if I don\’t square my buy position in future contract till expiry.Do I need to mandatorily buy the shares as per number of lot in contract?.

Yes, please do check this – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

Hi Karthik,

Let’s say I short sold some shares and I bought the same amount of shares back at the end of the day. Now let’s say the shares that I bought do not get delivered to my account on T+2 day because the seller defaulted, I will not have enough shares in my account on T+2 which I was supposed to have. In this case, will I be penalized?

The shares that you buy covers you for the initial short position, so there is no question of shares hitting delivery or your DEMAT account. The trade is net off for the day. However, if you are unable to cover your position, then you run the risk of penalty.

Sir

In my previous query, kindly read \”who\” as \”how\” i.e. \”how the value of NIFTY in SPOT market is arrived at?\”

Thanks

Sir

Thanks for your quick responses. I want to know who the value of \”NIFTY IN SPOT\” market is arrived at?

Thanks and regards.

Thats the index value, changes as and when the stock price of the constitute companies change.

Thats the index value, changes as and when the stock price of the constituent companies change.

Sir

In the above examples of MRF and Nifty Futures, below the ORDER BOOK data from NSE Website, there is a link \”COST OF CARRY\”. What does this imply?

Thanks

Cost of carry, is a theoretical reference to the cost of financing a futures position.

Hi

In the starting of this chapter, you mentioned the price of Nifty in the spot market is Rs. 11470.70. I think one cannot buy shares of Nifty from the spot market as Nifty itself comprises of 50 companies. What do you mean by price of Nifty in the spot market?

Thanks

By spot, I mean the underlying index itself.

Hi karthik,

Have been following markets for quite a while now. I wanted to know what would be the logical implication if, the index fut is trading at a discount or premium to the spot price.

Thanks in Advance

Futures trading at a premium or discount to spot is quite common. However, if this is beyond the normal range then you can look at arbitrage opportunities. Expanded in later modules.

Hi karthik,

You are doing a great favour to people like me to learn about markets.Thanks for that.

1.can you please tell if we have underlying stock then how many future contract can be created on based of that one underlying stock?if its unlimited then how can we deliver the stock on expiry date.If its same as number of underlying stocks then who own the stock on expiry date?

2. What if you selling in future and it expired then how i am supposed to deliver the stock on settlement date.

3.If SGX NIFTY is just directional future then how they keep going up and down ,just simply on the basis of demand and supply means just a pure speculation on the underlying index or does it have any relation with nifty spot.

Thanks in advance.

1) The stocks that you have in the demat has nothing to do with the number of contracts you can trade. You can trade as many as you want as long as the margins are available.

2) As you move closer to expiry, you need to have stocks in your demat i.e. if you are short. Suggest you read this as well – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

3) Yes, demand-supply plays a key role. What drives the demand-supply is the sentiment about the underlying economy.

mr Karthik here i find only for nrml and not for MIS in the margin calculate.

MIS is usually 35% of NRML. I\’d suggest you call the support desk for this.

mr Karthik,

it is great learning through Varsity. can u please tell where is the margin for MIS given in zerodha calculator. Not able to figure out.

thanks

Here you go Vikas – https://zerodha.com/margin-calculator/Futures/

If I short one lot of Nifty future and plan to close position by buying it back before expiry. Now if at this stage, it is having some (unrealised) gains (say Rs 6000), What will happen to this gain ? Will it get added to my portfolio\’s (unrealised) gains or will it get added to my Zerodha funds or is there any other adjustment method?

The P&L gets adjusted on a day to day basis, this is called the mark to market settlement. Hence you won\’t be taking the P&L forward as it gets settled daily.

i don\’t know if this is a right question.does derivatives affect the underlying in any possible way?

It does but it does not hold for a long time.

Great. Many thanks for the reply.

Good luck, Ted!

Hi Karthik, great articles and info, thank you for sharing. I live in AU and am exploring Nifty futures as a trading instrument and have some questions if you\’re able to clarify?

– I understand there are 2 listed Nifty futures contracts: NSE and on SGX (Singapore). Can you advise what the difference is and why the 2 contracts exist?

– I did read about a dispute between NSE and SGX regarding the listing of Nifty futures on SGX but some resolution has been reached. Do you have any further insight into this matter?

– Are foreign individuals allowed to trade the Nifty futures on NSE? None of my brokers support NSE trading other than Interactive Brokers (but only for Indian residents/citizens per regulation?). Is this why the SGX contract exists?

– If

Glad you liked the article, Ted.

1) Nifty 50 is managed by these guys – https://www.niftyindices.com/indices/equity/broad-based-indices/NIFTY-50 whereas the SGX is owned and managed by the Singapore stock exchange. SGX follows Nifty 50.

2) Not really. AS far as I\’m aware, the arbitration is now settled and SGX is listed in GIFT city, which is a special economic zone for NRIs and FPIs to trade and invest in India

3) You can, but you need to set this up via SEBI\’s FPI scheme, check this https://www.sebi.gov.in/statistics/fpi-investment.html. This comes at an added set up and compliance cost. I suppose you are better off trading the SGX.

how to get impact cost for nifty options or bank nifty options and other stock options as well? i see in nse website there are impact costs report exist only for stocks. is there any source?

I\’m not sure if this is published. However, you can generally look at the bid-ask and get a sense of how good/bad the impact cost is.

Hi Karthik,

Avoid basis in futures wrt spot. I would like to know if we can avoid basis (future-spot) in futures trading since it is not always fixed( contango speed is not fixed)

Thanks,

Nikhil

Nope, its a part of futures trading, you cannot avoid this.

Hi Karthik,

Thanks for reply. Any alternative to avoid basis in index nifty?

Avoid basis as in?

Hi Karthik,

Is there any way we can buy index at spot price(delta=1).main reason for this to avoid basis risk in futures. Can you please guide how can we avoid basis risk in futures.

Thanks for your modules.

You can always buy a Nifty Index ETF https://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=NIFTYBEES , does not have the best of liquidity but works from a delta perspective.

Sir, thank you for ur fast reply. I want to know how STT & ETC are charged i.e., 1)What would be the turnover in index futures to calculate STT &ETC ?

2)May I know, why index charting number is different from actual exhibited number on expiry day ? Eg: on 26/12/2019 BN ended on 32020 on candle stick charts but real exhibited number is 31997. As per charts 32000CE is ITM, 32000PE is OTM. I\’m confused at the End of the Day numbers. Can I get clarity on that as well.

Hope a little patience from u 😊😊..

Tq.

1) You can check this for the charges and breakdown – https://zerodha.com/brokerage-calculator#tab-equities

2) The intraday chart shows you the LTP, whereas you maybe looking at the NSE site to see the close (post market). The close number is the average of the last 30 minutes. I\’d suggest you look at the EOD chart, this will match.

Hi sir, may I know how index futures will be taken as, for calculating STT & ETC ?

Eg: Nifty

Buy– 50lot×75×12,500 = ₹ 46,875,000

Sell– 50lotx 75×12520 = ₹ 46,950,000

Now what is turnover to calculate STT & Exchange transaction charges and other SEBI etc.,

How other charges excluding Brokerage is calculated on Fut stk & Index Fut ?

May I get clarity on this ?

Tq.😊

Kiran, this gets added to your other income and taxed at 30%. I\’d suggest post this query here https://zerodha.com/varsity/module/markets-and-taxation/

@karthik- is there any indicator or formula wherein in KITE or PI Software, i can make the VOLUME/ OPEN INTEREST Ratio in the charts?

Hmm, I need to check. No ready indicator that I can recall.

What is the best way to invest long term in NIFTY ?

Nifty ETFs, check this – https://zerodha.com/nifty-etf

Good morning Karthikji

There\’s buzz about SEBI giving to BSE Sensex to launch Futures-Options on its index… curious to know if it\’ll be launch in near future ?? Or is NSE Nifty will enjoy monopoly

There is hardly any trading in these contracts, Harash. So liquidity is just not available.

If I have 8.5 lakhs with me and wish to invest in NIFTY, wont it be more profitable to buy 1 lot of NIFTY futures month after month instead of investing in a NIFTY index fund? The margins required can be provided with JUNIORBEES + LIQUIDBEES. So the margin money also is not really idle. We just need to keep about 5% of 8.5 lakhs = 40000 as cash in the account always for MTM losses. What am i missing here?

It would, its just that most people are not comfortable accounting and buffering for M2M losses. If you can tackle this, then yeah, you can do this.

Dear sir ,

good morning !!!!

so you want to say i can BUY & SELL NIFTY 50 future NRML position before 15:15 PM as same day.

am i right.

Yup,thats right Anil.

dear sir ,

i go through with your this tutorial.

sir i want to trade nifty 50 future as a intraday without any leverage provided by zerodha how is it possible.

there is two option available in KITE ZERODHA while i tried to buy or sell NIFTY 50 future

1) MIS (means intraday only and get leverage)

2) NRML (position carried over night no leaverage provided by brocker)

Anil, you want no leverage, then you opt for the NRML position. Even NRML comes with some leverage, if you want 0 leverage, then you should buy Nifty ETFs.

I couldn\’t found \’Trading strategies\’ module as you mention in the Futures module

This module, Santhosh – https://zerodha.com/varsity/module/trading-systems/

how to set stop loss in Nifty Future (BO/MIS).

exp.

Buy Nifty Futures at 11500

My Stop loss is 11470

in bo / stop loss which is i indicate – A – 11470 or B 30 points

[email protected]

Hi.. this is going to be a long comment. Bear with me pls. I have been trying to understand this TRADING thing since last one year. I was confused with trading or investment as many successful people are from investment fraternity starting from Mr. Buffet, Charlie Munger to our own Rakesh junjunwala, Ramdeo agarwal, ramesh damani to name a few who have created greatest wealth over last 30 years. They could do such wonders because of magic of compounding over a period of time. They might have compounded their capital at a rate of around 25-30% per annum. If one can earn 26% p.a. on his capital of 10 lakhs every year compounded for 30 years, he will end up with staggering 100 crores. Just 26%p.a. (doubling money in every three years). There are many more illustrations to explain power of compounding which is the eighth wonder of the world as Einstein said. But my purpose is not to discuss compounding. But as traders we dont want to compound the money over time. We want to get rich quick. Want to make 10 20 30 percent in a day or week. Greed! and we complain.

On this line, a thought crossed over. We need to earn 25%p.a in trading. So what to trade? Well, its difficult to trade stocks. No meaning in chasing and following different stocks. Rather study just nifty. Far more predictable, liquid, less volatile compared to stocks. Over a period of time, one can gain some expertise.

Coming back to 25%p.a… The margin we get on nifty future is up to 30 times. So to earn 25% on capital, we need to capture .83% on nifty. Including charges may be 1% in a year. That is around 110 points per year. Just 110 pts PER YEAR. May be 10 points per trade and just one successful trade per month for 10 rs. Aila.. just this can make my 10 lakhs to 100 crore when i retire.

So to achieve this, I just need to practice and master one strategy/candle pattern/indicator/ any thing. Just one sure shot per month for 10 points or just one positional trade for 100 points and stay tuned till 30 years. Only nifty, no stocks.

Haaha… Easier said than done. Mathematically correct. But the discipline and mindset it takes, not every ones cup of tea. When you bet all your money on one trade when it gets big, one cant handle emotions. And of course, the loss too can be too big on highly leveraged trade. Thats why they say, trading is 10% strategy, 90% mindset or emotions. Can anyone achieve this?

please share your insight on this and Please refine my thoughts if it is not logical. Regards

Well, you\’ve answered your own question 🙂

Mathematically, this looks very easy but the complications can be quite crazy. What if you have 5 losses in a row? YOu\’ll lose 50 points straight and your capital will be will down lets say 30%. Now to make up for the 30%, you will have to make 42%, much harder.

So you really have to think through all the risks involved before you venture into such a plan 🙂

But traded value is found very much higher than \” total traded qty * traded price\”

Todays yes bank future traded value = 788 crore

Total qty = 2281400 (buy) + 4518800 (sell)

By considering yes bank avg price = 100

So total price = 68 crores only coming.

In every share i found very less value when calculatung.

1) You need to take the volume figure only, not buy and sell separately

2) Take the futures price

How the traded value showing in Derivate quote of a particular share is calculated?

Traded value = Quatity traded * traded price.

Sir please explain the following question

Suppose i wanted to trade in nifty future ,since it\’s future is derieved from index price,i wanted to know whether we can manipulate it\’s future price ……….suppose i have sold a large quantity of future lots(let say 100000 lots) at Market Price then what will happen??

It is very hard to manipulate the index. Even if you manage to do that, it will involve a lot of money.

sir how to find volatile stock, like witch stock give daily 5 to 8% move ?

You can do a quick calculation on excle for this. Explained here – https://zerodha.com/varsity/chapter/understanding-volatility-part-1/ and the subsequent chapters.

How many nifty lots will make market move?

Every lot has an influence 🙂

Hi Karthik,

Kindly clarify my query.

Which one these are better for intraday trading?

Nifty Future Vs USDINR Future ? (Pardon my ignorance, but which currency pair is the most liquid?)

Based on two minimum criteria

1. Liquidity, and

2. Brokerage (for similar BO margin and similar %age target and stoploss setting)

Brokerage is the same for both, however, in terms of liquidity, I think its the Nifty Futures.

Thanks Karthik,

One followup query,

Regarding Brokerage, my query was regarding the bottomline net profit for trader, post deduction of brokerage and statutory charges. It seems that, currency future doesnt have STT charges, does it make it more profitable?

Example:

Nifty Future – 1 Lot – BO Margin required Rs.13500 – Target 5 points (0.043%) – Profit before deduction Rs.375 – Profit after deduction Rs.200 – Net deduction Rs.175

USDINR Future – 20 Lot – BO Margin required Rs.14000 – Target 0.03 points (0.043%) – Profit before deduction Rs.600 – Profit after deduction Rs.500 – Net deduction Rs.100.

Above numbers are based on Zerodha Brokerage Calculator.

Disclaimer: Im a complete novice with currency future, kindly verify my understanding. Based on above calculation USDINR has less charges, presumably due to absence of STT.

The profitability should stem from the trading idea, Himanshu and not from lower charges. Yes, no STT, but GST is applicable. You can find all the charges here – https://zerodha.com/charges

Thanks Kathik, for prompt reply.

Welcome, Himansu!

Why zerodha does not have NFTYMCAP50 futures on NFO market even though NSE F&O provides it ?

You said we can sell lot or stocks immediately (like with in 2 minutes of buying) . So is this for futures or future option?

And please explain difference between future and future options .

There is nothing like \’future options\’, Deependra. You can sell the futures contract anytime you wish.

Hello Sir,

I read about benefits of trading Nifty futures over stock futures.still I have few doubts..I hope you clear this:-)

1)are these attributes applicable for bank nifty as well.?

2) which is more volatile nifty or bank nifty..?

3) whose futures should be traded for intraday trafing or scalping..Nifty or bank nifty..??

4) is it alright if I stick to banknifty for trading intraday and not nifty..?? Coz I heared nifty is more stable than bank nifty but during intraday instrument should have volatility..

Plz clear my doubt as I am getting confused which to select for intraday trafing nifty or bank nifty also you can suggest me your point of view..

1) Yes, not just Bank Nifty, but all futures

2) Bank Nifty because it is a sectoral index

3) That\’s your choice, you can trade both actually

4) Sure Bank Nifty is volatile and gives more opportunities. But volatility is a double-edged sword and, like as I said, it is your choice this really depends on the way you\’d choose to trade.

I really appreciate your reply sir..!!

You know I have developed a ridicule habit that I open chart of both indices and suppose when I see opportunity in Nifty, I confirm it with Banknifty also and vice versa. End result is I miss trading opportunity….making myself more cofused..

And I agree that volatility is double edged sword but I dont keep trades more than 5-10 minutes ( kind of scalping) so my heart says banknifty is good for me but mind says stay with Nifty as it is more reliable…I just somehow want to justify that less is better in stock market. Instead of sailing in two boats, I should concentrate only on banknifty..sorry that I am sharing my confusion..you have more experience, you

Know what I am going through…

Raj, this is a very typical problem, don\’t worry 😉

Here is a simple solution – stick to Nifty and not Bank Nifty. Concentrate only on this, get comfortable, and consistent…only after this, move to Bank Nifty.

Haha..:-):-)

Thanks for valuable suggession sir..!! I will stick to nifty before moving to banknifty..Its like always listen to your mind and not heart, be it trading or love…LOL:-P

You said it 🙂

Hi Karthik, Are there weekly contracts on Bank Nifty Futures like how there Weekly Bank Nifty Options.

No, there are no weekly futures.

Plz share Nifty future trading strategies with me….I am new in Nifty future trading. I want to trade Nifty so friends plz help me.

Karthik sir u cal also sugges me…

Thank you.

Here you go – https://zerodha.com/varsity/module/trading-systems/

Thank you sir..

Welcome, Asheesh!

Understood this after 5 years, made money in stock futures, lost money in stock futures and finally took a call that playing stock futures is not my cup of tea neither trading in cash is my liking. So finally trading Nifty and Bank Nifty & happy that I changed my trading equipments.

Happy trading, Prashant. Stay profitable 🙂

Karthik, When I buy one SBiN Futures contract of Dec Month technically i\’m buying 3000 shares(1 lot size) of SBIN or investing 3000 shares in SBIN and SBIN is having benefited here.

But When i buy one Nifty Futures contract of Dec Month which is 75 Quantity.. who is benefited here.. i mean will 75 quantity will be invested back to Nifty 50 stocks ?

SBIN does not benefit directly or indirectly when you buy its futures. The future is a contract on the underlying. I\’d suggest you read through this module for more clarity.

Hello Sir,

1. What is max/min stop losses(in points) can be applied on nifty swing trade of say 1-2 weeks

2. What time frame chart can be used in it.

3. Can i swing trade in nifty futures with capital 75k with all the technical disciplines…

TIA

1) This really depends on your risk appetite.

2) I\’d suggest end of day chart

3) You can.

Thanks a lot sir🙏

Welcome!

what is nifty50 TR2 leverage index, Is it of any use .

Omi, this is an index with 2 times leverage. No practical use for retail participants.

Are Foreign instituional investors allowed to trade FnO . (Not for hedging but to speculate)

Yes, they can.

Dear Karthik,

In TA module you urself said that alternate to bid ask spread is one can check for volumes greater than 500000, then why to take so much pain of finding bid ask spread, impact cost, round trip loss etc. when simply we can check liquidity by checking on volumes?

No one really does the impact cost calculation while trading especially if the quantity traded is small. As you said, you can just look at the volumes and take a call.

Dear Karthik,

I am bit confused. Apologetically speaking, if we dont need to look at bid ask spread, impact cost, etc at all, then why this full length chapter on the same?

If we do need to look at them, then broadly on what instances we shall?

Arun, the idea is to be aware of what impact cost is and how its calculated. When you build strategies, factoring in slippages due to impact cost is very crucial.

Dear Karthik,

thnx for ur reply.

Regarding rollover plz clarify that we have to sell current month future on expiry and buy mid month future? or there is another way of doing rollover especially in zerodha?

That\’s the only way to rollover Aurn 🙂

Hi Karthik if we join for any support jobs at zerodha can we learn even more about markets.Do we have any good courses to learn so practically.

Yes, please do talk to our HR dept for openings.

Sir, is it true that trading nifty futures with renko charts is very profitable?.I have back tested past three years using 30 size blocks with 10 and 30 SMA with some rules. Sir, it is giving more than 100 percent return every year. is it really possible in the live market. Shall i start implementing my strategy.

Not really, these just random things people say 🙂

Btw, I\’ve never used Renko charts, so I cannot really comment on this. But as a general advice, if something is too good to believe, then probably it is 🙂

Hi Karthik,

Yesterday I got mail from zerodha about \”Increase in F&O margins due to exposure margin increase.\”

It said about Additional price change for Index Futures, 0.5% for 14 sept, 1% from 28 sept upto 2% from 30 nov . What it means exactly?

1. How it will affect the Intraday index futures trading?

2. Will exposure margin increased?

3. For positional traders their is need to settle it Physically on Expiry?

4. I have an account with 35k as i am a intraday index futures trader, Should i need to increase the amount?

1) Margis for both intraday and overnight positions will go up

2) Exposure margin remains the same, SPAN goes up

3) Yes, that is if you intend to keep your position open to expiry

4) You\’d still be able to trade MIS Nifty positions with 35K, but personally, I\’d advise you don\’t 🙂

Thanks for quick response Karthik,

As you mentioned in 4th point you advice me not to trade MIS nifty futures positions…..

1. What are the risks in it?

2. If there is risk how should i overcome it? Should i need to increase my acc amount to 100k to avoid the risks?

3. or is there risk related to with the expiry of the contract?

1) Risk of trading with relatively small capital, Pradeep.

2) Yup

3) Its the above risk.

Hi Karthik,

as per the proposed sebi rule wherein a trader\’s exposure will be computed based on his networth/ITR, is it applicable only to the f&o segment or will it be imposed on cash segment too (BO/CO orders)?

I\’d suspect that its applicable to F&O, but its best to wait for SEBI\’s final say on this.

please tell which global indices is likely to affect nifty most or how can we get a view of global economic developments likely to affect indian markets.

As far as I understand, Dow certainly has an influence. Apart from that, Hang Seng does have an influence.

sir, the modules are very informative and the way it is written is exemplary. sir i there any way to track the institutional investors, and at what price they are buying so that i can follow them and be profitable.

regards

IMRAN

Imran, thanks for the kind words. The only way to track this would be to look at the bulk and block deals on the exchange. Check this -https://www.nseindia.com/products/content/equities/equities/bulk.htm

Hi karthik, is there a live chart that plotting bids and offer of nifty futures ? Or anything related to it ?

You can open the market depth on Kite, you will see where the maximum liquidity lies in the stock.

Thanks for reply. How can I see the values 1 hour before the time of me logging in?

Sorry, can you please elaborate?

chart of nifty Aug future gives me the value today at 9.51am was 11464, When I logged in at 7pm today. How to know the bids and offers at 9.51 am today ?

You cannot. The Bid-Ask prices varies every second based on the order flow. These values are not stored for later reference.

Hi Sir,

1.If we are to trade Nifty / BANKNIFY futures, on looking at the underlying NIFTY and BANKNIFTY index, there is no volume data found for the underlying in Zerodha Kite. Then how to ensure that the volume is above average in these underlying (NIFTY and BANKNIFTY) indices,though other checklist items can be verified?

2.Is there any other way we can get volume date of these underlying (NIFTY and BANKNIFTY) indices ?

1) The index does not have volume. You can look at the overall market turnover for this

2) Overall market turnover should be a substitute for this

Hi Sir,

1. In one of the comment, you have mentioned that time of expiry future and spot tend to converge to a same price without any difference in price between them.Why this happen so?Kindly explain in detail.

2.Will the above happen for all stock or only for few specific stocks?

3.If future and spot price will converge to same price during expiry, will there be any trading opportunity because of this?

4.If Oder book can change anytime, means then the impact cost can also change right !!! Also impact cost can change anytime because of sudden change in demand and supply because of any news,etc,If So then what is the use in calculating it if it can keep changing?

5.Should the difference between trigger price and order price in SL order should be based on Impact cost?Is this how the impact cost can be used?Is there any other usage available for Impact cost?

1) Becuase at expiry, there is no \’cost of carry\’ and hence the future and spot price converge to a single price point

2) Yes, to all futures contract

3) Yes, a simple example is buying futures sell spot or the reverse

4) Impact cost remains the same more or less, but the buy and sell rates and quantities keep changing

5) Yes, you can look at a technique where you strategies SL and trigger based on the spread between bid and ask, rather than looking at impact cost.

Good luck.

How many times nifty futures can roll overed?

Pl tell me how to rollover a future contract. ie. The procedure.

Does it have a time frame. ie. can i rollover a contrct of may to june today.

what about the loss it made ie. about -6000 where will it refect ? in the new contract ?

Rollover is simply the act of closing the position in the current month contract and initiating the same position in the mid/far month contract. The loss is settled with the respective contract.

That means i will have to sell the may nifty and buy the june nifty. isnt it. With the current loss will i have margin for the new buy.

That really depends on how much funds you have in your trading account.

Hi Karthik

Thanx for all the previous info.

My new doubts

1. Can we buy a future contract of say of July today and sell it the same day.

2. Which contract is more advantageous This month\’s or next month\’s or the far month\’s.

3. and finally why do they have three months contract at a time.

1) Yes, you certainly can

2) This month (current month) always has more liquidity, hence better

3) To facilitate hedgers with slightly long-term perspective.

Thanks buddy ,, appreciate your time to answer my silly queries !!

No query is silly my friend 🙂

Keep learning!

Even I feel Future intraday is not that felexible like spot/Cash trading ..In future we have to trade a lot size ,however in cash we even can trade significantly low quantities compared to Future lot size of many stocks..That way Cash/Spot buying should be lucrative compared to Future ,however still many traders ( including you as you mentioned somewhere in the QnA ) prefer to trade in Future while looking into Spot …Not able to correlate the rational behind this .. Kindly advise ..thanks in advance !!

You can carry forward the leveraged position, but in spot you cannot.

Hi Karthik , appreciate your prompt response ..however still confused in Spot and Future buying ..even in Spot we get good leverage which is upto 30-40 times for A category of stocks ,than why do you trade in Future..Infact I know many traders who looks into Spot and trade into future ..Kindly elaborate with example ,if possible. Thanks in advance

The leverage in spot is only intraday leverage, you cannot carry that forward like futures. Plus futures have the added advantage of M2M wherein your profits and losses are settled end of the day.