16.1 – History and background

I know this chapter on Natural Gas is coming in late; we should have discussed this much earlier, probably when we discussed Crude oil. Unfortunately, I missed doing this; but anyway, better late than never!

We will discuss Natural Gas in this chapter, and with that, we will conclude this module on Currencies and Commodities.

As usual, let us start our discussion with some background information, history, and how natural gas is extracted.

Natural gas is a naturally occurring, non-renewable, hydrocarbon gas mixture, primarily consisting of methane. Natural Gas is a fossil fuel and is used as an energy source. Natural gas has many applications in our day to day lives, including electricity (generation process), heating, and cooking. Besides, natural gas also has a wide variety of application in the fertilizer and plastics industry.

Apparently, way back in 1000, B.C., natural gas seeped from the ground, on Mount Parnassus in ancient Greece, caught fire and a flame was lit.

The Greeks believed this was the Oracle at Delphi, and a temple was built. This has to be the first-ever reference to Natural Gas. By the way, do you wonder how natural gas can seep through the land surface? Well, have a look at this picture of natural gas seeping from the ground and catching fire –

Source: Daily mail online, UK.

The Chinese discovered Natural Gas around 500 B.C., and they put this to better use – they started using bamboo “pipelines” to transport natural gas that seeped to the surface and to use it to boil seawater to get drinkable water.

However, the first commercialized application of natural gas occurred in Great Britain. Around 1785, the British used natural gas produced from coal to lighthouses and streets.

By now, you must have guessed that ‘Natural Gas’ is somewhere hidden deep below the earth’s surface. The question is – how and why is natural gas present there?

Millions of years ago, when plants and animals died, the remains were buried in sand and silt. The buried remains mixed further with sand and silt, got buried deeper, and decayed further. Pressure and heat converted these materials into coal, oil, and natural gas. This entire process panned across millions of years. In some places, natural gas moved into large cracks and spaces between layers of overlying rocks, while in other places natural gas just settled on the porous surface of rocks. Natural Gas, in its original form, is colourless, odourless, and tasteless. Now, practically this can be an issue – imagine if natural gas leaks and spreads, there is no way one can identify its presence in the atmosphere, which is a highly hazardous situation. Hence, producer of natural gas adds a substance called ‘mercaptan’, which gives natural gas a pungent, sulfuric odour, making it easier to detect in case of a leak.

The search for natural gas is quite similar to the search for crude oil. Geologists identify land parcels which are likely to contain natural gas. Sometimes, these land parcels are on the surface of the earth, and sometimes this can be offshore, deep inside, on the ocean floor. Geologists use the seismic surveys to identify the right place to drill to maximize the probability of finding natural gas. If the site seems promising, then an exploratory well is drilled to investigate further. Further, if the economics favour, then more wells are drilled, and the natural gas is extracted from the ground.

India is the 7th largest producer of natural gas in the world, accounting for nearly 2.5% of the natural gas production in the world. The bulk of the natural gas produced in India is used towards power generation, industrial fuel, and LPG. A large chunk is also used in the fertilizer industry as feedstock.

Needless to say, this discussion on Natural Gas – production and application can get quite vast, but I guess we are good to stop here, considering we are looking at Natural gas from a short-term trading approach.

We will move ahead to discuss the contract specification.

However, no discussion on Natural gas is complete without talking about the ‘Amarant Natural Gas gamble’. J

16.2 – Amaranth Natural gas gamble

Amaranth Advisors, established around 2000, was a US-based multi-strategy hedge fund operating from Greenwich, Connecticut. The fund had its interest in various hedge fund strategies ranging from convertible bonds, merger arbitrage, leveraged assets, and energy trading. By mid-2006, the fund had become a $9 Billion behemoth; this included the profits that were ploughed back to the fund. This positioned Amaranth as one of US’s top-performing hedge fund.

Amaranth’s energy trading desk picked up activity (and a lot of attention) when a star trader named Brain Hunter joined Amaranth’s trading team. Hunter had previously gained a lot of popularity for his energy trading strategies (mainly natural gas) at Deutsche Bank. Apparently, he made few millions of dollars as annual bonuses. His success continued when he joined Amaranth to head the energy desk – where he traded natural gas for obvious reasons. Hunter ensured profits rolled for Amaranth and its clients, so much so that Amaranth netted close to $2 Billion by April 2006. Hunter’s trading skills quite seduced both Amaranth’s clients and management.

At this stage, I have to mention this – although an international commodity, natural gas trading was highly vulnerable. Any midsized hedge fund could easily corner the market by taking positions in a few thousands of contracts. This made Amaranth one of the largest hedge funds operating in the natural gas market.

Anyway, here is what happened post-April 2006 –

- Hunter noticed a surplus inventory of natural gas in the US, which would drive the price of natural gas lower in the US.

- Inventory of Natural gas, unlike oil, cannot be easily moved to cater to supply-demand pressures.

- He also expected a harsh winter (or perhaps a hurricane) to ensue, which quite obviously would exert pressure on the supplies and push the price of Natural gas higher.

- Apparently, Hunter had profited when hurricane Katrina and Rita had hit the US coastlines in 2005

- He set up complex strategies at multiple points across multiple contracts to benefit from his staggering point of view. These were highly leveraged, speculative futures positions.

- However, nature had a different game plan for Hunter and Amaranth – the possibilities of a hurricane diminished, supplies continued to pour.

- Bulls started to unwind, triggering the price of Natural Gas below the psychological support of $5.5

- This further triggered a panic sell leading to a single day fall of 20% Natural gas’s price.

- Amaranth was hit quite hard, but Hunter’s conviction and reputation were still intact. They now borrowed money and doubled down on their positions.

- The leverage was as high as 1 to 8, meaning for every 1 USD of their own capital, they had 8 USD in borrowed capital.

- This didn’t stop natural gas prices to tank. Further, prices continued to crash, and along with the price Amaranth too crashed.

- Amaranth was forced to liquidate and take a hit of USD 6 Billion, making it one of the largest hedge fund fiascos in the world.

If there is one key lesson you get to learn from the Amaranth’s episode, then it has to be (yet again) the importance of risk management. Risk management sits above all and has the authority to question every aspect of your trade.

Respect risk and risk respect you back, ignore it, and it will show you the corner.

For this reason, we will dedicate the whole of the next module to Risk and trading psychology.

For now, let us proceed to discuss the contract specs of Natural Gas.

16.3 – Contract specifications

The contact specs for Natural Gas are as below –

- Price Quote – Rupee per Million British Thermal Unit (mmBtu)

- Lot size – 1250 mmBtu

- Tick size – Rs. 0.10

- P&L per tick – Rs. 125/-

- Expiry – 25th of every month

- Delivery units – 10,000 mmBtu

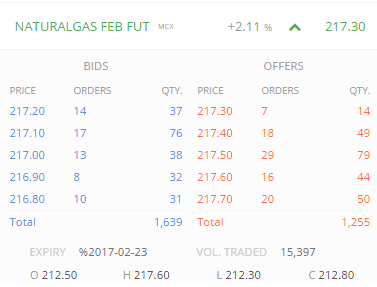

Here is the snap quote of the Natural gas expiring in Feb 2017 –

The price, as seen here, is Rs. 217.3 per mmBtu. Therefore the contract value would be –

Lot size * price

= 1250 * 217.3

= Rs. 271,625/-

The NRML margin is as shown below –

As you can see, the NRML (for overnight positions) margin is Rs. 40,644/-. This makes it about 15% margin for NRML orders (probably one of the highest in the markets) and MIS margin is Rs.20,322/- which makes it about 7% for MIS positions.

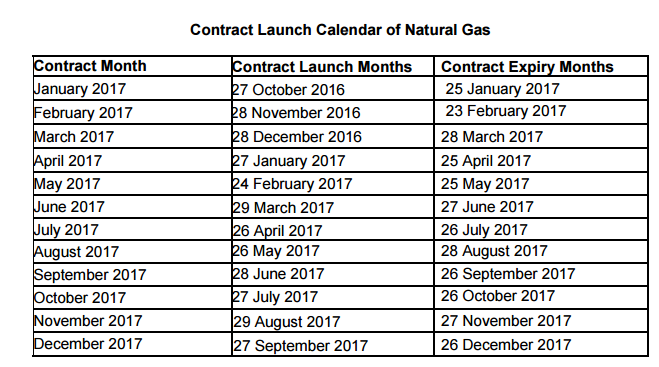

The contract introduction and expiry logic is quite straightforward, have a look at the table below –

Every 4 months, a new contract is introduced. For example, the January 2017 contract was introduced in Oct 2016, and this contract expires on 25th of Jan 2017.

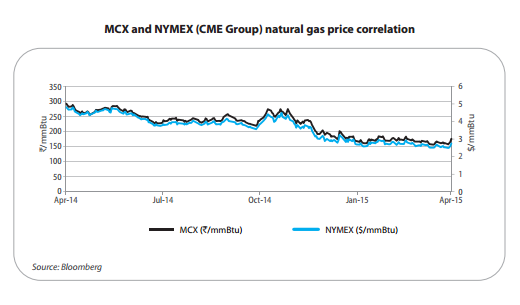

Here is something that you need to know – although, Natural Gas in an international commodity, its spot price in India is also dependent on how the domestic demand and supply situation pans out. However, the futures contract listed on MCX closely mirrors the Natural gas listed on NYMEX.

Have a look at the image below –

This is the graph of the Natural Gas futures contract on MCX overlaid with NYMEX – quite evidently, both the futures contracts move in unison. Given this, the following events have a significant impact on the natural gas prices on NYMEX and therefore MCX natural gas futures –

- Natural Gas inventory data – an increase in inventory tends to lower the futures price and a decrease in inventory data tends to increase the futures price.

- US weather conditions – the US is the biggest natural gas market, so US weather conditions really matter. A harsh winter in the US leads to more natural gas consumption (as people use natural gas to heat homes) and therefore the inventory is consumed rapidly, leading to an increase in price.

- Hurricane in the US – Hurricane besides disrupting the weather conditions also tends to disrupt inventories. Hence, if you see a hurricane approaching the US coast, be prepared to go long in Natural Gas or at least, do not short natural gas contracts.

- The price of Crude oil – Natural gas is not only a cleaner fuel compared to crude but also costs much lower. Historically, the two contracts are highly correlated, although the correlation is not holding up over the recent few months. Check this!

So, next time you are trading natural gas, make sure to check how the sun is shining in the US!

And with this, folks, we will conclude this chapter on Natural Gas and this module on Currencies and commodities. We hope you liked reading this module as much as we enjoyed writing it for you.

Onwards to Risk and Trading psychology!

Key takeaways from this chapter

- Natural gas occurs naturally and is found deep underground.

- Natural Gas has been in use since ancient times.

- The primary use of natural gas includes power generation, heating, cooking etc.,

- India is the 7th largest natural producer of natural gas.

- Lot size of natural gas is 1250 MMBtu, price quote if for 100 mmBtu.

- P&L per tick is Rs.125/- per tick.

- Natural gas futures on MCX mimic s the price movement of Natural gas on NYMEX.

Respected Madam/Sir,

My question is that After buy NG options, how many days maximum can be held continuous , without breaking any rule ? Please guide.

You can hold it till the expiry of the contract, Dushyant.

What is margin in natural gas as today ie Oct 23 .

You can check the margins on the order placement window only.

The link to show correlation between crude oil and natural gas is not working.

Checking, can you also try another browser?

Answer to – What is the Formula to convert Nymex NG to MCX NG??

coz multiplying USDINR * Nymex NG = price remains lill different according to Price of MCX NG..

The exact conversion rate being used is not something we can know easily. Need to check if MCX has any info on this.

Also, no need to go after finding the conversion rate, it\’s futile for trading related analysis. Stick with basic technical analysis

I kind of agree 🙂

For Example

If the P&L ratio value is 200000

In this case if I buy one more lot, whether the loss value will down come or not? Or How it will be

Kindly anyone share the reply pls

You buy one more lot, and the price increases, then it will loss will come down a bit.

ok, so multiple intraday natural gas trades can be made in one day…cool.

Thanks!

Good luck!

Hii…how many intraday trades can be done for natural gas in one day? Is there any limit? Are we allowed to make multiple intraday trades in nturl gas?

No limit as such.

What is the Formula to convert Nymex NG to MCX NG??

coz multiplying USDINR * Nymex NG = price remains lill different according to Price of MCX NG..

thanks

Not sure about this myself, need to check.

Hi sir,

How can I trade e-mini and micro natural gas futures in Zerodha?

These contracts are not available on MCX I guess.

Hello Karthik,

I am having one small query. Why is margin requirement so high for natural gas contracts?

As per current price, the contract value of 1 lot of natural gas is around Rs3,26,250 ( 1250* 261) and margin needed for 1 lot is around Rs1,10,000 which is around 35%.

But for other commodities, margin requirement is around 15-20% of the contract value.

Can you please help me to understand the reason behind it? Or please correct me if I am missing anything.

Thank you

Umang, the margins are dependent on the volatility of the contract. Higher the volatility, higher is the margins.

where can i find the expiry date/ auto square off date of each contract in zerodah website ??

You can identify the expiry in the instrument name itself.

Does the Lot size of commodity changes? Like in stock F&O once the contract value goes beyond 10 lakh, the lot size is adjusted to bring it back to 5-10lakh range.

For Example, For Natural gas in 2020 the price was around Rs 130, was the tick size and lot size still the same?

YEs, lot size of commodities can also change.

This is wonderful knowledge It is so deeply related to geology and formation of rocks / fossils during cooling process of Earth .

Hi Karthik!

I was wondering if you could recommend some books/resources to get a deeper understanding of how weather, natural disasters, and other factors that you mentioned affect the price of natural gas?

I\’m not sure if there is a book on this, but a ton of info here – https://www.ppac.gov.in/content/155_1_GasPrices.aspx

Please update this article as lot price is more now due to the new margin policy.

The idea is to explain the concept as such, not sure if its possible to keep the lot size updated as and when it changes 🙂

in which head it comes in taxation rule (natural gas trading)

Sir, how many days we can hold natural gas future purchased on margin

Till about the expiry of the contract.

Hello sir,

Sir every time earning gets released , I am always late to found out(few hours). I get to know about earning from kite event node. Is there any specific time at which all earning gets released or is it company choice at what time they wish to release the data.

TY

Not really, it differs for each company, this is not standardized.

Hello sir,

I have heard this that every week Thursday 8 pm natural gas data is released. So it is matter of seconds after releasing of data there is huge fluctuation of prices. But I tried searching for it. Do you have any idea where can I find this , like official place, so coming thursday I can make use of it too.

Ty

Yes, information, in general, has a big influence on the price movement. However, I\’m not sure about the natural gas data.

What is the current lot size for Natural gas future trading ?

In Kite it is showing 1.

What 1 is represents for ?

1 in kite is 1 lot which is 1250 MMBTU.

good information, there is hardly few information on NG.. thanks a ton..

Happy reading!

excellant story and is very useful for trading ones

Today 30th July 2020, I saw natural gas lower circuit price was 148.4 and was expecting that it should not go below it, still it did breach that price and went well below it. Any particular reason why it did went below the lower circuit price?

At lower circuit, the contract is paused and no trading happens. Trading restarts after the cooling period.

hello..

today natural gas futures for jul 20 priced 130+, what will be the quantity for 1 lot size ?? is same with 1250???

Yeah.

There seems to be a mistake in the 5th point of the \’Key Takeaways\’, it should say 1 mmBtu instaed of 100 mmBtu, creates confusion, please change. Great module nonetheless.

Thanks, will look into this.

I feel very sorry now!

Why I wasted my time here and there and watching you tubes.

I was very late to read these wonderful content.

Pls accept my compliment♥️

Humbled! Happy reading 🙂

Where can i learn risk management for fundamental investing?

Fundamental Analysis is here – https://zerodha.com/varsity/module/fundamental-analysis/

is there any limit set on buying lot in natural gas? can just buy 100 lots if i want in this commodity?

Yes, you can.

Sir,

Can i know when is Natural Gas Jan 20 futures expiry date is?

Regards

Sachin

Thanks for your immediate response, Karthik

Good luck!

Hi Karthik,

I am not able to trade on NG Feb Future, i try many time but it shows the msg : MIS / BO / CO orders are blocked for this instrument (try CNC / NRML) or it has been restricted from trading. When the Feb month Future starts. Pls reply. Thks

Can you please check this with the support once, Santhosh.

Hi Karthik,

Ok. But for learning purpose please see if you can accommodate something on Power trading.

Regards,

Satish

Will do, thanks, Satish.

Hello Karthik,

Incredible article. Thanks for that. Could you maybe please tell me, a maximum of how many lots of Natural Gas Futures can I buy without worrying about liquidity issues ?? Because I don\’t see huge lot sizes in the market depth, considering that it is a global market.

Do check this Priya – https://youtu.be/rcQN4h3T_tY?si=jdSG7-WlBKSF14r5

Hi karthick,

i have read chapter on natural gas and arbitrage, currently Natural Gas nov month future is trading at lower price than Dec natural which looks ok to me , but January is trading lower than December.

Please explain about this and what are the chances that January price will go higher than December .

Where i can get the natural gas spot price in Rs to calculate the average as you have shown in chapter.

Can we trade January contract in November.

I don\’t think you can trade the Jan contract, Nitesh.

Hi karthick,

i have read chapter on natural gas and arbitrage, currently Natural Gas nov month future is trading at lower price than natural which looks ok to me , but January is trading lower than December.

Please explain about this and what are the chances that January price will go higher than December .

Where i can get the natural gas spot price in Rs to calculate the average as you have shown in chapter.

Spot data is not available, Nitesh. You will have to work with the continuous futures data. The difference in price can be attributed to the demand and supply dynamics of each contract.

I am sure it\’s traded. We have two power exchanges IEX (https://www.iexindia.com)and PXIL in India.

IEX has no liquidity, Satish.

Hello can you please explain me what margin should I maintain to hold the position for more days in natural gas in future market

Sneha, you can check this – https://zerodha.com/margin-calculator/Commodity/

Hi Karthik,

Power(electricity) commodity is missing. No chapter on it?

Regards,

Satish

Not sure if that\’s traded, let me check.

Mcx not planning to launch natural gas options?

Hopefully by next year!

Amaranth name is so confusing… I was reading it Amarnath whole time… ??

Yeah, I thought the same when I first heard the name 🙂

Natural Gas has been reaction on Mondays at around 6:30 PM IST. The EIA report for it is released every Thursday. Is there any other report that gets released every Monday at around 6:30 pm IST that impacts the prices of Natural Gas.

Ashwini, I\’m really not sure about this. I\’ve not tracked Natural Gas (or events that impact it) in a while. However, let me check if there is something of this sort.

What happens if my commodity margin sufficient exceeds the required margin available in my account.Will it be automatically squared off at the closing time?I have bought the commodity as NRML position.If so i have 3 positions, which one will be squared off?

Hi Karthik !

As per your explanation above about having a bullish outlook on natural gas during times of bad weather and hurricane approaching, the natural gas prices was expected to rise given Hurricane Irma is likely to hit US mainland on Sunday. But on the chart, its price doesn\’t seem to have moved as expected. I want to know the reason for the same.

Well, the real answer is I dont know 🙂

Maybe there are some other fundamental factors at play with respect to IRMA. One really has to investigate further.

Zerodha is a gift to the \”aam adhmi\” (common man). I knew nothing about the market. But now, though not an expert, at least I know enough to be able to trade/invest.

You guys/girls have done wonders. I\’ve read all the modules up to module 9. Zerodha VARSITY is so good, clean & useful that It could actually come at a premium. But thanks to Zerodha again, and in particular \”Karthik rangappa\” for making things \”simple and clean\” and \”Nithin kamath\” for giving it out FREE. I loved it so much that I ended up drawing all the cartoons in my book. Drawing acted as a good break while reading.

Lots of love to Zerodha?, from rakesh, though I failed the 60-day challenge.?

Thanks for the very kind words, Rakesh 🙂

We are really glad that you liked the content here. Happy reading and all the very best!

The pdf file is corrupt and gives all sorts of error.

I have checked. It is no corrupt download fault.

The structure of pdf itself has errors,

When trying to open or combine pdfs it gives errors about fonts extraction

and number out of range

Thanks for pointing this out, will look into this.

Thank u sir

Welcome!

Sir, in continuation to my earlier request, i came to know that the Lovely Professional University, Punjab is offering full time MBA Course in Capital / Financial Markets in collaboration with National Stock Exchange. Is it worth-full to do the MBA with LPU? kindly advise sir

With regards

K.Saicharan reddy

I have no idea about that course, you may want to do some research before joining the course. Good luck.

Sir, i am a final year B.Com. student and new bee to the stock markets and going through the modules i am interested to make career in financial markets. i request to kindly suggest the courses which are helpful me to build a career in financial markets-

Thanking u sir,

k.Sai Charan Reddy

CFA from the US is a great certificatio, else you could even try the CAIA or if you want to get into quants, then CQF. FRM if you want to get into Risk mgmt. No other certification may be worth it.

Thank u very much Sir, kindly suggest procedure to get CFA certification and related material/books/coaching centers?

with regards

K.Sai Charan Reddy

Please check the procedure here – https://www.cfainstitute.org/pages/index.aspx

Sir, im a clg student 2nd year undergrad so i\’ve got some time to expand the domain of my knowledge on market trading and investing but im cluless on how to do so i mean what books and online content should i look up to please guide me sir.

Please start from Module 1 , chapter 1 – http://zerodha.com/varsity/module/introduction-to-stock-markets/

Hello sir when do you plannig to upload PDF\’s

Very soon.

no chapter on interest swap which you mentioned earlier is this end of module or u will upload it

There are hardly any trading volumes there Raj. However, I\’ll try and add some supplementary notes to it.

When all these files will be available as pdf formats. As part – 1& part-2

Trying my best to get this done.

Sir,

Can we trade currency in internation market mean after 5:30 pm

Is zerodha provides such gateway to international markets like dow nikkei or shanghai com….

No, we do not have this option.

Still no pdf

Will follow up on this. Thanks.

This is pointless. It tells me nothing.

Sorry to know that Kumar. Most people trade commodities either intrday or at the most hold the position for a day or 2. I guess from that perspective, knowing the contract specs well plays a key role. That\’s the focus of this chapter.

What are positional limits and order limits

What is the respective limits for currency and natural gas

Exchanges stipulates limits on positions of client and trading members. Check this for limits on currencies – https://www.nseindia.com/products/content/derivatives/curr_der/position_limits.htm and this for Natural Gas – https://www.mcxindia.com/docs/default-source/default-document-library/natural-gas-january-2017-contract-onwards5029784657fb64e3bdfdff00007acb35.pdf?sfvrsn=0

Waiting for PDF took photocopy of 7 modules waiting for this one please make PDF of all the module will be useful

Will share it soon. Thanks for the patience.

Hey Karthik,

Thanks!!

The modules are great for a beginner.

Any idea when are the next modules(9&10) coming up?

I\’ve started work on Module 9, plan to put up the first chapter sometime next week. Thanks for your patience!

pl give me proper guide line for trading crude oil in commodity market

Have you checked out the 3 part series on Commodities ? Have a look at this – http://zerodha.com/varsity/chapter/crude-oil-part-1-digging-the-past/

Whats the min amount required to trade in commodities??

Depends on the commodity, I guess you need about 8K to enter into a mini lead contract on MIS.

When is the PDF copy for this module coming up ? Can\’t really wait to devour all that priceless information !

We will put this up soon, Yash.

sir please add option to put limit in cover order also. in pi software we can place trigger price both for sl and placed order while in kite app in mobile do not give such option

I\’d suggest you speak to our customer care for this. Thanks.

Really Informative and in very simple language for anyone to understand… Really appreciate the work.. Keep continuing…

Thank you 🙂

Thanks for the Chapter..

Was there any story on ZINC METAL ?

None that I know 🙂

Amazing story about Amaranth disaster! waiting for supplementary chapters.

Cheers!