13.1 – My experience with Option Pain theory

In the never ending list of controversial market theories, the theory of ‘Option Pain’ certainly finds a spot. Option Pain, or sometimes referred to as ‘Max Pain’ has a significant fan following and probably an equal number of people who despise it. I’ll be honest; I’ve been in both camps! In the initial days of following Option Pain, I was never able to make money consistently. However, overtime I found methods to improvise on this theory to suit my own risk appetite, and that yielded a decent result. Later in the chapter I will discuss this as well.

Anyway, now this is my attempt to present you the Option Pain theory and talk to you about what I like and what I don’t about Max Pain. You can take cues from this chapter and decide for yourself which camp you want to be in.

Option Pain theory requires you to be familiar with the concept of ‘Open Interest’.

So, let’s get started.

13.2 – Max Pain Theory

The origins of Option Pain dates back to 2004. So, in a sense, this is still a very young theory. As far as I know there are no academic/scholastic papers on it, which makes one wonder why the academia has ignored this concept.

The theory of options pain stems as a corollary to the belief – “90% of the options expire worthless, hence option writers/sellers tend to make money more often, more consistently than the option buyers”.

Now if this statement is true, then we can make a bunch of logical deductions –

- At any point only one party can make money i.e either the option buyers or option sellers, but not both. From the above statement, it is clear that the sellers are the ones making money.

- If option sellers tend to make maximum money, then it also means that the price of the option on expiry day should be driven to a point where it would cause least amount of loss to option writers.

- If point 2 is true, then it further implies that option prices can be manipulated, at least on the day of expiry.

- If point 3 is true, then it further implies that there exists a group of traders who can manipulate the option prices, at least on the day of expiry.

- If such a group exists then it must be the option writers/sellers since it is believed that they are the ones who make maximum money/consistently make money trading options.

Now considering all the above points, there must exist a single price point at which, if the market expires, then it would cause least amount of pain to the option writers (or cause maximum amount of pain to option buyers).

If one can identify this price point, then it’s most likely that this is the point at which markets will expire. The ‘Option Pain’ theory does just this – identify the price at which the market is likely to expire considering least amount of pain is caused to option writers.

Here is how optionspain.com formally defines Option Pain – “In the options market, wealth transfer between option buyers and sellers is a zero sum game. On option expiration days, the underlying stock price often moves toward a point that brings maximum loss to option buyers. This specific price, calculated based on all outstanding options in the markets, is called Option Pain. Option Pain is a proxy for the stock price manipulation target by the option selling group”.

13.3 – Max Pain Calculation

Here is a step by step guide to calculate the Max Pain value. At this stage, you may find this a bit confusing, but I recommend you read through it all the same. Things ill get clearer once we take up an example –

Step 1 – List down the various strikes on the exchange and note down the open interest of both calls and puts for these strikes.

Step 2 – For each of the strike price that you have noted, assume that the market expires at that strike.

Step 3 – Calculate how much money is lost by option writers (both call option and put option writers) assuming the market expires as per the assumption in step 2.

Step 4 – Add up the money lost by call and put option writers.

Step 5 – Identify the strike at which the money lost by option writers is least.

This level, at which least amount of money is lost by option writers is the point at which maximum pain is caused to option buyers. Therefore this is the price at which the market is most likely to expire.

Let us take up a very simple example to understand this. For the sake of this example, I’ll assume there are only 3 Nifty strikes available in the market. I have made a note of the open interest for both call and put options for the respective strike.

| Strike | Call Option OI | Put option OI |

|---|---|---|

| 7700 | 1823400 | 5783025 |

| 7800 | 3448575 | 4864125 |

| 7900 | 5367450 | 2559375 |

Scenario 1 – Assume markets expires at 7700

Remember when you write a Call option, you will lose money only if the market moves above the strike. Likewise, when you write a Put option you will lose money only when the market moves below the strike price.

Therefore if the market expires at 7700, none of the call option writers will lose money. Which means call option writers of 7700, 7800, and 7900 strikes will retain the premiums received.

However, the put option writers will be in trouble. Let’s start with the 7900 PE writers –

At 7700 expiry, 7900 PE writers would lose 200 points. Since the OI is 2559375, the Rupee value of loss would be –

= 200 * 2559375 = Rs.5,11,875,000/-

7800 PE writers would lose 100 points, the Rupee value would be

= 100 * 4864125 = Rs.4,864,125,000/-

7700 PE writers will not lose any money.

So the combined money lost by option writers if the markets expire at 7700 would be –

Total money lost by Call Option writers + Total money lost by Put Option writers

= 0 + Rs.511875000 + 4,864125000 = Rs.9,98,287,500/-

Keep in mind that total money lost by Call Option writers = money lost by 7700 CE writer + money lost by 7800 CE + money lost by 7900 CE

Likewise the Total money lost by Put Option writers = money lost by 7700 PE writer + money lost by 7800 PE + money lost by 7900 PE

Scenario 2 – Assume markets expires at 7800

At 7800, the following call option writers would lose money –

7700 CE writers would lose 100 points, multiplying with its Open Interest we get the Rupee value of the loss.

100*1823400 = Rs.1,82,340,000/-

Both 7800 CE and 7900 CE seller would not lose money.

The 7700 and 7800 PE seller wouldn’t lose money

The 7900 PE would lose 100 points, multiplying with the Open Interest, we get the Rupee value of the loss.

100*2559375 = Rs.2,55,937,500/-

So the combined loss for Options writers when market expires at 7800 would be –

= 182340000 + 255937500

= Rs.4,38,277,500/-

Scenario 3 – Assume markets expires at 7900

At 7900, the following call option writers would lose money –

7700 CE writer would lose 200 points, the Rupee value of this loss would be –

200 *1823400 = Rs.3,646,800,000/-

7800 CE writer would lose 100 points, the Rupee value of this loss would be –

100*3448575 = Rs.3,44,857,500/-

7900 CE writers would retain the premiums received.

Since market expires at 7900, all the put option writers would retain the premiums received.

So therefore the combined loss of option writers would be –

= 3646800000 + 344857500 = Rs. 7,095,375,000/-

So at this stage, we have calculated the total Rupee value loss for option writers at every possible expiry level. Let me tabulated the same for you –

| Strike | Call Option OI | Put option OI | Loss value of calls | Loss value of Puts | Total loss |

|---|---|---|---|---|---|

| 7700 | 1823400 | 5783025 | 0 | 998287500 | 998287500 |

| 7800 | 3448575 | 4864125 | 182340000 | 255937500 | 438277500 |

| 7900 | 5367450 | 2559375 | 7095375000 | 0 | 7095375000 |

Now that we have identified the combined loss the option writers would experience at various expiry level, we can easily identify the point at which the market is likely to expire.

As per the option pain theory, the market will expire at such a point where there is least amount of pain (read it as least amount of loss) to Option sellers.

Clearly, from the table above, this point happens to be 7800, where the combined loss is around 438277500 or about 43.82 Crores, which is much lesser compared to the combined loss at 7700 and 7900.

The calculation is as simple as that. However, I’ve used only 3 strikes in the example for simplicity. But in reality there are many strikes for a given underlying, especially Nifty. Calculations become a bit cumbersome and confusing, hence one would have to resort to a tool like excel.

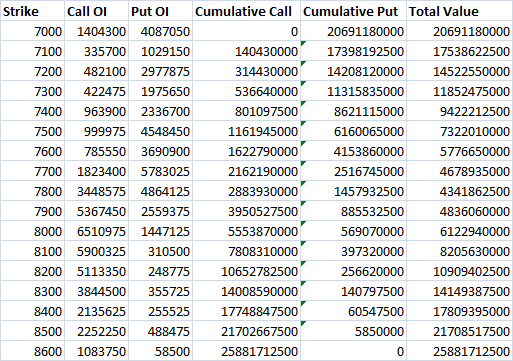

I’ve calculated the option pain value as of today (10th May 2016) on excel, have a look at the image –

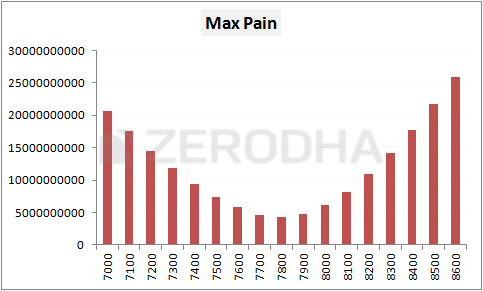

For all the available strikes, we assume market would expire at that point and then compute the Rupee value of the loss for CE and PE option writers. This value is shown in the last column titled “Total Value”. Once you calculate the total value, we simply have to identify the point at which the least amount of money is lost by the option writer. You can identify this by plotting the ‘bar graph’ of the total value. The bar graph would look like this –

As you can see, the 7800 strike is the point at which option writers would lose the least amount of money, so as per the option pain theory, 7800 is where the market is likely to expire for the May series.

Now that you have established the expiry level, how can you use this information? Well, there are multiple ways you can use this information.

Most traders use this max pain level to identity the strikes which they can write. In this case, since 7800 is the expected expiry level, one can choose to write call options above 7800 or put options below 7800 and collect all the premiums.

13.4 – A Few Modifications

In the initial days, I was very eager to learn about Option Pain. Everything about it made absolute sense. I remember crunching numbers, identifying the expiry level, and writing options to glory. But shockingly the market would expire at some other point leaving me booking a loss and I wondering if I was wrong with my calculations or if the entire theory is flawed!

So I eventually improvised on the classic option pain theory to suit my risk appetite. Here is what I did –

- The OI values change every day. This means the option pain could suggest 7800 as the expiry level on 10th of May and may very well suggest 8000 on 20th of May. I froze on a particular day of the month to run this computation. I preferred doing this when there were 15 days to expiry.

- I identified the expiry value as per the regular option pain method.

- I would add a 5% ‘safety buffer’. So at 15 days to expiry, the theory suggest 7800 as expiry, then I’d add a 5% safety buffer. This would make the expiry value as 7800 + 5% of 7800 = 8190 or 8200 strike.

- I would expect the market to expire at any point between 7800 to 8200.

- I would set up strategies keeping this expiry range in mind, my most favorite being to write call options beyond 8200.

- I would avoid writing Put option for this simple belief – panic spreads faster than greed. This means markets can fall faster than it can go up.

- I would hold the options sold up to expiry, and would usually avoid averaging during this period.

The results were much better when I followed this method. Unfortunately, I never tabulated the results, hence I cannot quantify my gains. However if you come from a programming background, you can easily back test this logic and share the results with the rest of community here. Anyway, at a much later stage I realized the 5% buffer was essentially taking to strikes which were approximately 1.5 to 2% standard deviations away, which meant the probability of markets moving beyond the expected expiry level was about 34%.

If you are not sure what this means, I’d suggest you read this chapter on standard deviation and distribution of returns.

You can download the Option Pain computation excel.

13.5 – The Put Call Ratio

The Put Call Ratio is a fairly simple ratio to calculate. The ratio helps us identify extreme bullishness or bearishness in the market. PCR is usually considered a contrarian indicator. Meaning, if the PCR indicates extreme bearishness, then we expect the market to reverse, hence the trader turns bullish. Likewise if PCR indicates extreme bullishness, then traders expect markets to reverse and decline.

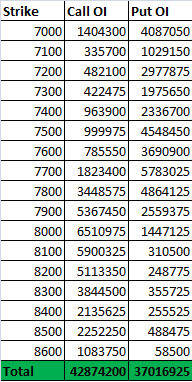

To calculate PCR, all one needs to do is divide the total open interest of Puts by the total open interest of the Calls. The resulting value usually varies in and around one. Have a look at the image below –

As on 10th May, the total OI of both Calls and Puts has been calculated. Dividing the Put OI by Call OI gives us the PCR ratio –

37016925 / 42874200 = 0.863385

The interpretation is as follows –

- If the PCR value is above 1, say 1.3 – then it suggests that there are more Puts being bought compared to Calls. This suggests that the markets have turned extremely bearish, and therefore sort of oversold. One can look for reversals and expect the markets to go up.

- Low PCR values such as 0.5 and below indicates that there are more calls being bought compared to puts. This suggests that the markets have turned extremely bullish, and therefore sort of overbought. One can look for reversals and expect the markets to go down.

- All values between 0.5 and 1 can be attributed to regular trading activity and can be ignored.

Needless to say, this is a generic approach to PCR. What would really make sense is to historically plot the daily PCR values for say 1 or 2 years and identify these extreme values. For example for Nifty value such as 1.3 can indicate extreme bearishness, but for say Infy something like 1.2 could be extreme bearishness. So you need to be clear about this, hence back testing helps.

You may wonder why the PCR is used as a contrarian indicator. Well, the explanation to this is rather tricky, but the general opinion is this – if the traders are bearish/bullish, then most of them have already taken their respective position (hence a high/low PCR) and therefore there aren’t many other players who can come in and drive the positions in the desired direction. Hence the position will eventually be squared off which would drive the stock/index in the opposite direction.

So that’s PCR for you. You may come across many variants of this – some prefer to take the total traded value instead of OI, some even prefer to take the volumes. But I personally don’t think it is required to over-think PCR.

13.6 – Final thoughts

And with this, I’d like to end this module on Options, which has spread across 2 modules and 36 chapters!

We have discussed close to 15 different option strategies in this module, which I personally think is more than sufficient for retail traders to trade options professionally. Yes, going forward you will encounter many fancy option strategies, perhaps your friend will suggest a fancy option strategy and show off the technicalities of the strategy, but do remember – ‘fancy’ does not really translate to profit. Some of the best strategies are simple , elegant and easy to implement.

The content we have presented in both, Module 5 and Module 6, is written with an intention of giving you a clear picture on options trading – what is possible to be achieve with options trading and what is not possible. We have thought through and discussed what is required and what isn’t. Frankly these two modules are more than sufficient to answer most of your concerns/doubts related to options.

So please do take some time to read through the contents here, at your own pace, and I’m certain you will you will start trading options the way it is supposed to be done.

Finally, I hope you will enjoy reading this as much as I enjoyed writing this for you.

Good luck and stay profitable!

Key takeaways from this chapter

- Option Pain theory assumes that the option writers tend to make more money consistently compared to option buyers.

- Option pain assumes that option writers can influence the price of options on the day of expiry.

- One can use the theory of option pain to identify the price at which the stock/index is likely to expiry.

- The strike at which the option writers would experience least amount of loss is the strike at which the stock/index likely to expire.

- The PCR is calculated by dividing the total open interest of Puts by the total open interest of the Calls.

- The PCR is considered as a contrarian indicator.

- Generally a PCR value of over 1.3 is considered bearish and a PCR value of less than 0.5 is considered bullish.

sir i still have a doubt on some platforms its mentioned that pcr greater than 1 is bullish on the others its mentioned as bearish sentiment

same goes with the pcr less than one so can u pls brief once that

pcr greater than 1 and 1.5

pcr less than 1 and 0.5 indicate what in terms of market sentiment not in terms of option buyer and seller

Hmm, best is to start using it yourself and see how it works in the market. No need to put in an actual trade, just follow through and paper trade it 🙂

Thank you for your response, sir — it truly means a lot that you acknowledged my query.

When I cross-checked my own observations on open interest (OI), I noticed that, most of the time, the contrarian OI theory tends to work well on indices — meaning, when the PCR is low, it’s better to be bullish, and when it’s high, to be bearish.

However, when I tried applying the same logic to individual stock options like IREDA and a few others, it didn’t seem to work out as expected. In fact, most of the time, I ended up being wrong. Could you please guide me on where exactly I might be going wrong?

Also, I understand that PCR alone shouldn’t be the only indicator to rely on while taking a trade, but I’d still like to know your insights on this part.

Krrish, like you said PCR alone may not suffice. Please use thing along side of OI interpretation as well. I too prefer using PCR as a contrarian indicator as oppose to its mainstream use. Understand stock specific issue, exists, so please run a back test, figure out where this can be applied and where to avoid.

thxxx a ton karthik

good night

Sir it has become some sort of an unorganized reddit forum can u make it Organized by any chance moreover I wanted somesort of a notification that a user or u have replied to my very comment by any chance if this kinda feature would be added it would be somewhat easier to communicate over this very forum

sir, i am not able to download the max pain excel sheet, please help

Can you please look at a different browser?

pdf on option pain computation is not available and pdf of volatility cone of previous chapter is also not available can you please check sir?

Will do, thanks.

Not working sir. Lot of z-connect links are also redirecting to 404 pages right now especially in futures module. Can you help update the links whenever you get free time, Karthik?

Can you please tell me which pages? I opened all 13 chapters within the Futures modules, and they seem to be working fine.

Karthik,

I am not able to download the option pain calculator excel. Can you help pls?

Can you please try downloading from another browser?

The interpretation of PCR under clause 13.5 seems need an update. PCR above 1 means bullish. above 1.3 extreme bullish, may reverse. PCR around 0.5 means bearish. below 0.3 means extreme bearish & may reverse.

Below is text from Sensibull:

PCR

High PCR (>1) means the puts are more in number than calls. This means the option sellers are comfortable selling puts more than selling calls. This is a bullish sign. Having said that, an extremely high PCR, usually 1.3+ might mean an overbought stock and may result in bearish reversal.

Low PCR (<0.5) means the puts are less in number than calls. This means the option sellers are comfortable selling calls more than selling puts. This is a bearish sign. Having said that, an extremely low PCR, usually around 0.3 might mean an oversold stock and may result in bullish reversal

Both indicate extreme PCR values as a possibility of reversals, right?

your answer is wrong.

PCR > 1 = Bear/Down market

PCR < 1 = Bull/Up market

proof: https://economictimes.indiatimes.com/definition/put-call-ratio?from=mdr

PCR if calculated by sellers data then >1 is bearish and vice-versa

Yes. Thats right.

Hi,

As we know in Indian options markets, we have open interest updated intraday. Is it the same in US options markets? If not, what other indicators do we have there in US to denote open positions.

Ah, not really sure about the US market, Rashmi.

Hi sir

I wanna know how to use the excel sheet. How do we fill the helper column? Or do we even need to change that or we can just use the OI values for strike price?

Ah, do refer to the Financial modelling module, I\’ve explained a bit of excel there.

In finnifty , sensex and midcpnifty options, injection candles are taking place (the option prices are jumping 10x within seconds and coming out back to their levels) in expiry , as you said it will recover quickly. So if I have placed a 4 leg spread order in the system and this injection candles occurs , it will not affect my trade right ? Because the 4 leg spread order will have a total exposure value of approx 40 lacs and margin require is just 60k.🙂

Injection candle is a new term for me 🙂

While thats the general expected outcome i.e. quick recovery, each individual experience is different based on how exactly you react to prices 🙂

Sir,

I have a question regarding freak trades in intraday index options, if I place a iron condor spread order from sensibull , the position is hedged itself , but my question is in worst case scenario , like NSE shuts down or a massive freak trade happens on the strike price that I sold , How can I handle that ? What are the precautions I can take before taking that iron condor trade with having a fear of freak trade? Because in trading , there is no compensation for losses even if it is a mistake 🙂

The circumstances you are refering to are extreme and the likelyhood of that happening is really low 🙂

But if it were to happen, the prices are expected to recover quickly as arbitrageurs will quickly kick in to fill the trades.

Hello , can anyone help me with Max pain Calculation PDF as iam facing trouble in excel . if any one here who can help me please drop your communication network so that i can solve my query with supported SS.

Maybe you can try downloading from another browser?

Hello Sir,

Than you so much for providing such valuable information.

I have doubt in Option Pain calculation table which you shown for many strike prices i.e. 10th May 2016 excel calculations.

Here what will happen for strike prices below 7000?

Thank you once again!

They will be ITM Yogita.

Thank you Karthik.

I could download the file using MS edge.

Super! Glad you got the file 🙂

The download link for Option Pain computation excel is not working for me.

Please rectify that or share the excel.

Regards,

Manas

Can you try downloading from another browser?

hi Karthik, thanks for the module.

Quick question… why are we interpreting PCR from the perspective of buyer rather than from the perspective of seller. As we know the sellers put in more money and considered to have the right view and more resources. Additionally, it has also been pointed out in previous modules ,I believe, that option buyers are usually retail investors where is option sellers are institutions. shouldn’t the interpretation be then a PCR greater than one means bullish view and a PCR lower than one means bearish view?

Additionally, we know that we also utilise the option chain to interpret support and resistance in the same manner.

PCR was designed from buyer\’s perspective, but you can look at Max pain, which is from the sellers perspective.

dear sir,

the all module videos please dubbed in Hindi language for all the people to better understand please do it sir

We have hindi vidoes as well, Arya.

Very nicely written all these chapters. It has cleared my many doubts, and yes most important thing is that it is written in very simple English language 🙂

Thanks, Milind. Glad you liked the content. Happy learning 🙂

This article really great technique if can apply in your daily trading cycle.

Would say the way has been explained, I never found anywhere, thx lot such effort and time.

Glad you liked the content. Happy learning, Ashok.

Hi Sir,

I couldn\’t download the \”You can download the Option Pain computation excel.\” excel sheet from here, looks it nned attention.

Yogendra, can you try from another browser?

Sir,

You have replied \”SL has to be more from your view on the spot.\” Can I estimate the SL based on the below?

1. Judge the underlying movement with Technicals and accordingly calculate the premium movement through delta.

2. Look for the time remaining for the expiry and accordingly calculate the premium movement through theta.

3. Look if there is any reason for volatility change and accordingly calculate the premium movement through vega.

Lastly, calculate the probable premium movement though the above three taking into consideration.

Am I missing somewhere else to finally give the SL on premium?

1) You wont get the exact premium movement as the premium is a function of many other variables and not just direction (TA).

2) Yup

3) Yes

You can do this.

Sir,

You have cited for writing options based on Max pain theory in the chapter. Similarly, can we also look to buy options based on the Max pain?

Yes, you can. But there are far better ways to identify buying opportunities compared to Max Pain 🙂

Sir,

With technical understanding we place SL in normal swing. Similarly, is there any technical/ fundamental way to place SL (on premium) on trading options?

SL has to be more from your view on the spot. Also, since options are short-term trades, there is no point in having fundamental based SL 🙂

sir i am not agree with your conclusion about pcr, because if it is more than 1 that means more put option are being sold by the writers which indicates market should be bullish not bearish. if i am wrong then please suggest me what is right.

It is a counterintuitive proposition, Gyanendra. I think I\’ve explained this stance in the chapter itself. Can you double check again please?

Hi Sir. Here you are calculating the loss for the Option writers by taking the difference between the closed price and the price at which they have written the options(consider market was against the seller so non-zero loss is there) and multiplying directly with OI. However, sellers have received some premium at front so why aren\’t you including that as total loss for call option seller in that case would be = (Closed price – strike price – premium)*(open interest)

That would be not easy to estimate as its not the same price at which all the writers would have written. Its better to take the activity at the strike level.

Sir,

I am in the verge of completing the Module-6. I started the stock market learning 4 months ago. As a novice, I would require your suggestion on the below to move ahead:

I have started the swing trades for the last 1.5 months and is successful for 70%-80 %. I have started building some positions for long term investment (25-30 yrs). I am a daily reader of chart for the Nifty 100 companies. Now, as I go through your entire 3 modules covering Futures, Option & its startegies, I find this area bit tender and which would require knowledge of 360 degree to feel convinced to put the trade. Thus, I would require your suggestion on the below:

(i) Should I start trading F&O right from now or wait to cover all the modules in Zerodha and then start trading? I have literally no knowledge on macro.

(ii) I am a highly failure in intraday who basically tried to go scalping (based on price movements). I know this should not be the strategy. I would require your suggestion here if I should position myself with target & stoploss while playing intraday (Like the ones suggested from many brokers). Or should I take more time to focus on intraday.

1) One good way is to start and learn on the job. You can use the content on Varsity to supplement your learning. But this also comes with risk. I\’d suggest you start small (like currency derivatives) and ramp up as you gain more confidence

2) Avoid scalping if possible. There is very little scope to apply logic and trade based on the thesis 🙂

Sir,

Regarding Max pain, where can I get data to calculate the Max pain for a particular day and accordingly to look for the expiry data to understand it more better?

This too, maybe you should check with Sensibull 🙂

Sir,

In your content, you have mentioned one paragraph as below:

\”Needless to say, this is a generic approach to PCR. What would really make sense is to historically plot the daily PCR values for say 1 or 2 years and identify these extreme values. For example for Nifty value such as 1.3 can indicate extreme bearishness, but for say Infy something like 1.2 could be extreme bearishness. So you need to be clear about this, hence back testing helps.\”

I would like to know that to calculate the PCR we have to depend on values of Call OI & Put OI and we can get the OI values only for the current only. Then how can we plot historically? I am confused. May be I am missing somewhere. Please guide.

Anirban, PCR calculation, I\’ve explained the chapter itself, right? For historical, you can check with Sensibull if they have.

Hi Karthik,

PCR above 1 suggests market turned bearish if looked from the buy angle, the same value suggests bullish if looked from the sell angle. How to interpret it, from buy or sell angle? I\’m literally confused, kindly clarify.

We have discussed this in depth in the chapter and comments. I\’d suggest you check this once 🙂

hello Karthik

In max pain theory you used 5% buffer to determine the range and planned your strategy accordingly but now nifty is at 18600 and if we assume 18600 strike price has less combined lost than other strike prices then 5% of 18600 is 930 which gives us a huge range of 18600-19500 so do you think this range is sensible for planning strategy in nifty ?

Yeah, since its 5% of a value, irrespective of the value of Nifty the price band stays relevant.

not able to download excel sheet

Please do check from another browser.

Hey Karthik,

Why OI on sensibull, nse website, upstox or other platform doesn\’t match,

all have different values which to trust?

I am checking it after market close.

Sunny, I\’d suggest you write to Sensibull for this and check with them.

Hello, Sir

I would like to thank you for this topic which is great but it is more helpful for the option seller, yes as an option is depreciating and because of theta the value depreciates more for OTM which I have learned practically and from your module. If, people like me (new bees) can\’t enter the option selling, as it makes margins very high. I like you discuss more topics about option buying where we can minimize the loss.

Then you should be checking spreads, Ramanathan. I\’ve discussed these in the next module, please do check.

Hi Karthik,

Is the PCR calculated based on the current expiry OI or the OI for all the expiries are taken into consideration?

Its for the current OI series.

Hello Sir,

Can you please explain how can we identify pain to option seller or writer.

Suppose At a particular strike price maximum put option writing happens on Monday. How do we understand that till expiry what should be the price of underlying asset at which it will cause pain to the put option writers, In case of weekly expiry and in case of monthly expiry as well?

Regards

So option pain concept is with respect to writers. Once you identify the least option pain, I\’d suggest you add a buffer to that and identify a range within which Nifty is like to expire.

You wrote: the 5% buffer was essentially taking to strikes which were approximately 1.5 to 2% standard deviations away, which meant the probability of markets moving beyond the expected expiry level was about 34%.

It doesn\’t make sence. Did you mean 1.5 to 2 standard deviations away instead of 1.5 to 2% standard deviations away? Above 1 standard deviations away the propability is 32% so how have you got 34%?

Yeah, 1.5 to 2 is what I meant 🙂

The 7th key take away \”Generally a PCR value of over 1.3 is considered bearish and a PCR value of less than 0.5 is considered bullish.\” is contradictory to what I see in sensibull.com i.e., \”Put Call Ratio: A high number (above 1) indicates bullishness and a low number (below 0.5) indicates bearishness. PCR is computed using 2 nearest monthly expiries for stocks and 2 nearest monthly and weekly expiries for Indices.\”

Thanks Karthik for the explanation and sharing your take on this

Your write-ups and responses to the queries are rare gems in the crowd of overloaded information coming in from all corners of the world without anything specific whatsoever

Waiting for many more from your side..👍

Happy learning, Amit. Keep going 🙂

Thanks Karthik for the clarification. I read your response to some other query here saying \”writing far options is like picking a dime in front of a road roller\” which I completely agree with. I am writing options using max pain calculation from last couple of months but haven\’t got any good success. I am able to save my capital only because I do hedging when I feel the risk of losing money or square off my positions in time since I am on the screen all the time during market hours. All this has led me to ask you that question about effectiveness of Max Pain theory because it looks so promising in theory. More importantly – without calculating Max Pain if I just find the average Nifty move on Weekly basis for last few weeks\’ expiries then that gives me enough idea about what far options I should be writting on either side and that comes pretty accurate. Given this I am yet to realise the potential of Max Pain in practical situations. I will still be doing it for some time until I am convinced to use it or not use it for my trading decisions..

Absolutely Amit. Market is full of such theories…be it Max Pain or PCR or OI analysis. These are theories developed by traders and it probably worked/will work under a specific market condition. We can adopt these strategies only after thorough testing. Testing leads us to develop a higher conviction, and that\’s the most important aspect of trading. So I guess you are on the right track 🙂

I have been trying this logic to current nifty50 for past few days. I\’m unable to hit even +/- 1 SD of the actual nifty value. I know that nifty value depends on other factors as you explained in earlier chapters. But Option pain seems to be not helpful atleast for me in arriving at the final nifty numbers. Did you happen to check the calculation with present nifty charts as this module was written long back!!!

The calculation remains the same, irrespective of the values. But if you are not comfortable, then don\’t trade on it. Observe it for a while, maybe paper trade it and use it only when you feel comfortable.

Hi Karthik,

I have read through your modified Max Pain theory and have created my own Excel with a bit maintainable formulas myself to find the max pain on daily basis by pulling the latest data (closing bhavcopy) to find the max pain point. The main issue here is – how to reliably find the max pain point during the course if the day because open interest data during live Nifty session may not be reliable. I watch US channels like CNBC and I don\’t see any discussion around Max Pain there as well. Even the max pain website link provided by you is non existent though the info is available elsewhere on the web. Do you use the max pain theory yourself in practice and how well does it work for you?

I used to use it, Amit. Now we are not allowed to trade, hence stopped. It gives you a reference to write options. I\’m not sure why no one talks about it. Yes, I do get your point that the values change. What I used to do is to calculate the max pain value about 15 days prior to expiry, build a band and write outside that band.

Hi Karthik,

Thanks for the great info here as well just like all your modules.

I have a query, here it goes. Max Pain point keeps changing over the course of the day every day. As per my observation the max pain point for Nifty may shift by 100 or even more points (sometimes even 200 points compared to the day before) on any average day. Given this fact how come one come to the conclusion about the exact max pain point on the day of expiry and adjust their positions accordingly? For retail traders it is very difficult – almost impossible if I can say – to find the max pain point on the day of expiry but wonder how come professional traders find it if they use the max pain point at all for their decisions. Also I don\’t see any discussion around max pain point in any of the prominent business news channels. It looks like the analysts there rely more on open interest data to come at the closing point on expiry and that is far more accurate than max pain as I see. Your take on all this please…

Thanks,

Amit Kale

Amit, not sure why ppl dont talk about it 🙂

Do read section 13.4 where I\’ve discussed the modification to the standard Max pain theory.

Hi Karthik sir,

I have some confusion about the PCR ratio. I trade options on Sensibull and their live option chart features indicate PCR above 1 as bullish because according to them, more puts are being sold than calls, which indicates bullishness. What is your take on that? Should we calculate PCR based on how many call/put are bought or sold?

Thats right, but what I\’ve tried to explain is using PCR as a contrarian indicator.

Hi Kartik,

Shouldn\’t we analyse PCR from the point of view seller? When greater than 1.1, it should mean that more puts are being sold.

It is considered a contrarian indicator, Saurabh.

Thanks Karthik sir, this is the best literature on option trading.

As I understood seller always have upper hand over buyer.

If seller are writing more put that means they are expecting market not to fall and have a bullish view.

If there are more Puts than calls then more sellers are on bullish side . Higher puts means higher PCR ratio. Then why high PCR is considered bearish?

Thanks Vishal.

There is a counter intuitive stance here which I\’ve tried to explain in the chapter itself. Do check that 🙂

At the bottom of NSE option chain, total OI for both call & put side is given…Can we calculate PCR from there?

Yeah, you can.

Had wonderful time learning Varsity

Just few ques before I start spending time in market

For predicting direction of nifty or bank nifty, do we have to use TA that we learned in module 2?

If yes , which time frame you choose for intraday…I guess 15 min ?

and last ques.. which is better Max pain or PCR ratio?

Learning TA & FA will help 🙂

As far as the time frame goes, I use the END of the day for all purposes as my primary chart.

Both Max pain and PCR serve different purposes, but if I were to pick one, maybe PCR.

Hey Karthik, Can we apply Max Pain theory, with modification as suggested on Weekly expiries(maybe +1SD)? Theta will be working on our favour; isn\’t it!?

Yes, you can.

What is modified Max Pain? How it is different from Max Pain? OPSTRA usually publishes it in their page. Please give the mode of calculation.

Not sure, need to check what they mean by it. Maybe they have an explanation for it on their page?

Higher put OI compared to call OI means higher put writing compared to call writing. Again assuming writers know better than buyers shouldn\’t a PCR of more than 1 be bullish and less than 1 be bearish.

YOu can use it as a trend reversal indicator considering over-bought and over-sold regions. By the way, don\’t just look at this one parameter; combine this with other parameters and then take a call.

Generally a PCR value of over 1.3 is considered bearish and a PCR value of less than 0.5 is considered bullish

I think there is a mistake in above statement.

Can you elaborate on it, please?

No problem Sir.,

If I get it .. I will share it with you., here.

Thanks.

Sure, happy learning 🙂

They come under premium subscription sir … I am unable to get data as i have crossed the free trail……It would be helpful if you guide me through this.

Ah, I dont have the data myself Krishna.

Hello Sir.,

How to check the Historical PCR value from NSE.. can you pls say the name of the reports available in nse to calculate historical PCR..?

what is your suggestion on taking historical pcr (i.e how many days)for intraday trade….. Will it be good decision to select the spot strike and calculate the pcr value to find extreme bearishness and bullishness of the current strike to identify a reversal or should i take the complete OI calculation. ??

Your Response would be highly helpful.. Thank You..

Ah, why dont you check with Sensibull. They may have this data.

excellent blog sir…

Thank you so much sir, indeed it worked, able to download from other browser ( Microsoft edge). Just for your information it is not getting down loaded form Chrome.

Many thanks once again!

Sure, thanks for letting us know 🙂

Dear Sir,

Firstly, thank you so much for your contribution to create such a great tutorial for the society, its\’s really a great philanthropy.

I am unable to download Option Pain computation excel from the hyperlink, may I request you to please re-hyperlink to enable it for downloading.

Many thanks once again sir !

Thanks, Shailendra. Let me recheck the link. Meanwhile, can you try downloading the link from a different browser?

Please check PCR ratio.

On Sensibul the PCR ratio is calculated like they place call and then Put so according to the sensibull PCR = Call Put Ratio

and as per the your point PCR= Put Call Ratio

So as per Sensibul:

PCR>1 or 1.3 is bullish

and PCR<1 is bearish

So please clarify this in module sir.

It is a ratio, divide the PUT OI by Call OI. If Sensibull is doing it otherwise, there must be a reason for it. Please do check with them once.

Thanks Sir your explanation super

Sir, there is a calculation mistake in 1st case of max pain calculation for 7800 pe i.e at 7800 PE.

there is one exatra 0 in that calculation- 4864125000 ( right one 486412500)

If i\’m wrong sorry for the inconvinience!!

Ah, quite possible. Let me check 🙂

Hi,

If I check Nifty option chain it has almost 50+ strikes.. Do I need to take every strike OI to calculate a Max Pain or I can take 15 above and 15 below from ATM. Will it work ?

2. Does MAX Pain work on one week expiry ?

Take the ATM and 10 strikes above and below. Maybe even 15 will do. For weekly, backtest before completely relying on it.

Thank you for sharing the knowledge, highly appreciated 🙂

Just one thing, am unable to download Option Pain computation Excel

Bhavika, please try downloading this in another browser.

Dear Sir; you explain max pain and say

\”option sellers tend to make maximum money, then it also means that the price of the option on expiry day should be driven to a point where it would cause least amount of loss to option writers\”.

As I understand, the options writers would try to drive the market to a point where there pain minimized. To days fall show that or seems to show that the call writers are enjoying to days fall and the put writers are run down. Naturally, they would try to push the market to a point where there pain is minimum. Weekly expiry is on June 16th. If my perception is ok, Nifty should go up at least on June 16th?

Whats your take? Two bits from you would enlighten us.

Regards. Ashutosh.

Yes, but these are all theories with certain odds. No guarantees in market 🙂

Sir,

Most of the IITs are writers.

Considering the above statement,

For example, if the PCR is >1, (put OI is more). Then we can come to the conclusion that more puts are being sold by the IIT. Which also says that PCR >1 is Bullish and <0.5 is bearish.

Can you please correct me if im wrong.

Sorry, what do you mean by \’Most of the IITs are writers\’.

Hi Karthik,

For BANK NIFTY weekly expiry, when do you calculate Max Pain. 3rd day?

Thanks,

Vignesh J

You can calculate around Monday/Tuesday.

\”Low PCR values such as 0.5 and below indicate that there are more calls being bought compared to puts. This suggests that the markets have turned extremely bullish, and therefore sort of overbought. One can look for reversals and expect the markets to go down.\”

This is written in the above theory.

Here as per my thought, we should think from the seller\’s perspective. It means more calls have been written compared to puts and thus the market may try to balance. It means the market may go up.

In key take away points (point no 7) it is written that \”Generally a PCR value of over 1.3 is considered bearish and a PCR value of less than 0.5 is considered bullish.\” This is suitable according to my thought as i mentioned earlier.

These two statements are controversial.

Please clarify if I am wrong.

Divesh, PCR as a concept itself is a bit tricky. The narrative changes based on how you look at it, i.e. seller or buyer\’s perspective.

Hello sir!

I wanted to know a bit more about the max pain theory. I was testing this strategy for weekly options and I found that the max pain keeps changing frequently. Despite having a buffer of around 100-200 points, there is too much fluctuation in the real-time max pain and eventual market expiry. The idea was to execute an iron condor strategy with the max pain point as the mid point of my range. Can you let me know your thoughts on this?

Yes, the MAX pain will change. Hence you need to pick a particular time to calculate the max pain and work with it, of course with a buffer. You can test this for few weeks to see how the results are varying and calibrate it as per the actual data.

Hi Karthik,

Could you please clarify this.

If the PCR value is above 1, say 1.3 – then it suggests that there are more Puts being bought compared to Calls.

Why are we consider buyers view here, why can\’t we take sellers view and think more Puts being Sold compared to Calls ?

Thanks

Satya

It is just that we are using the indicator in a contrarian way, Satya. Buyers = sellers here, so it does not make a difference. Historically PCR is always with respect to buyers, hence for that reason we continue looking at it from the same view.

Hi,

can we construct iron condor using max pain for weekly options and what buffer should take for weeklies?

You can. Not sure what exactly you mean by a buffer. Is it the spread? If yes, you can keep about 200-300 points.

dear team.

In the excel attachment, what is the data present in the R column?

Regards,

Meet

hi,

Is there data to confirm that the max pain value from 2 or 3 days before expiry actually holds good on expiry day for nifty or bank nifty? I am trying to understand how reliable an indicator it is?

Thanks!

Nope, there is no data to prove this. YOu will have to backtest and figure if this works for you.

I want to share something about historical PCR. There is one platform called Opstra, it gives us last 3 years PCR. We can download it and can run different statistical concepts 😀

Here\’s link for the same: https://opstra.definedge.com/pcr

Sure, hopefully people will find the link useful.

could you clarify what you mean by \”Strike = spot leads to losses to the buyers and a profit for the buyers.\”? And also elaborate on rk comment as to why it is or is not appropriate. There is a merit in that argument in my view and we would approximately get spot?

Sorry, kind of lost that context. Can you please elaborate on your query? Thanks.

the reason for my first comment is that at strike=spot, both calls and puts writers have zero losses. Hence, that would be the minimum loss point. Accordingly, this looks like a misleading/unconvincing strategy.

Strike = spot leads to losses to the buyers and a profit for the buyers.

or may be I am missing something in the strategy above. could you clarify?

Would this not always give approx. the spot rate when you are performing the analysis? That is, when you are doing it 15 days before expiry, then would the minimum loss point not be spot on that day (ie, on 15 days before expiry). So, basically using this, we say, oh the spot rate 15 days later (on expiry) would be within 5% of the spot on the date of analysis. Not convincing and actually unreliable/misleading?

Its an approximation, pretty much like every other tool/analysis. Hence we add a buffer to the max pain value to ensure there is margin of safety.

Also I request you to create one module about \”statistics & financial markets\”. I know this is not going to be easy and soon. But I would like to know key statistical concepts which are widely used in financial markets. Till this I know only few which were mentioned by you

1) Mean

3) variance

4) Standard Deviation

Please let me know just names of statistical concepts which are widely used in financial markets to gauge levels.

Actually, I\’ve explained these across different chapters in the options theory module. Please do check that once.

Thank you very much!

Que 1: You identified max pain level somewhere in half of series (considering monthly expiries). So do you initiate trade 15 day prior to expiry or wait till last Friday before expiry to initiate trade(theta perspective)?

Que 2: How do I backtest max pain levels and actual expiry level? Is there any article regarding same? Please elaborate on this.

1) Its always a tradeoff between reward and risk. Early in the series, the reward is higher and risk is also higher. CLoser to expiry, both are lesser. So depends on what you want.

2) Ah, for this you need historical OI data. Please check with Sensibull if they can help you with this

Hello Sir, I could not figure out the Max Pain Theory- \”If one can identify this price point, then it’s most likely that this is the point at which markets will expire\”. Option prices are derived from the underlying (& not vice versa as per my limited understanding). So as per Max Pain Theory, if a group of option writers want a underlying (e.g. Nifty 50) to expire at a particular strike price, they will have to buy/sell the underlying shares of an index so that expiry happens at their desired strike price. 1) How do they make that happen? Do they buy/sell the underlying shares of that index in order to move the index towards their target strike price? 2) How does the movement in call/put options affect the underlying? (i am not able to reverse engineer the process)

Ah no, its not like that. The assumption is that these traders (sellers) would have analyzed the underlying, and basis that established a price at which the market is likely to expire.

And yes, is there any way I can get access to historical PCR ratios to plot them or is there

Nope, unless Sensibull gives that to you.

Investopedia has given both angles for PCR ratio interpretation- General and Contrarian.

And here you have given stress on contrarian angle. So what should we use? This is really confusing

I\’d like to look at it from a contrarian perspective.

Thank you!

If I am not wrong on Sensibull they shows max pain in screener tab (https://web.sensibull.com/options-screener?view=table). If there is any another tab for MAX PAIN in Sensibull please let me know (Sensibull is quite big platform!)

Also-

Today (15-03-2022) Morning session -Nifty was at around 16850 and Max pain as on Sensibull was 16800 for monthly expiry(31st March). So how should I interpret this?

Nifty has already crossed Max pain level…

For the same reason, its best if you check with Sensibull. Their support is quite good and they will get back to you quickly.

What max pain indicates is that upon expiry, 16800 is where Nifty expires although Nifty has crossed the given level now. Do keep an eye on these levels closer to expiry. Most importantly, add a buffer to the max pain level to be on the safer level.

Is there any simple way by which I can easily calculate cumulative call n put columns while calculating losses for writers in excel? I am having around 60 strikes (As per downloaded from Sensibull option chain) so it\’s so time consuming to calculate for each n every strike.

I think Sensibull has a calculator for this ready-made right? No need to calculate yourself.

Thankyou, Karthik for providing this wonderful material. Also A vote of thanks to Zerodha for spreading financial education study material.

I\’m glad you like the content here, Akshay. Happy learning 🙂

Hi Karthik, For some reasons, Option Pain computation excel is not available on the mentioned link. Kindly help.

Let me recheck, thanks.

Crisp and precise explanations. I think you can still improve your narration,with colour graphics.Colours and pics create good impressions in learning..i have seen a chess demo for children,where the pieces come to life.Just like Animal Farm,novel.

Thanks Sudhir, will take that as feedback. Can you please share the chess demo link?

How much strikes price should be consider for calculating max pain? 10 strikes above and 10 strikes below are OK or we need to calculate every strikes?

Yes, thats good to go.

Sir for example this coming weekly expiry BANK NIFTY CLOSES AT 38050 AND BANK NIFTY JAN FUTURES CLOSE AT 38125 which value would be taken for max pain calculation is it the spot price or futures price of BNF ?

You can consider the futures price, Umesh.

Hi Karthik,

Why PCR is interpreted from the perspective of a \’buyer\’ of options? Isn\’t it a norm that writers/sellers are usually well-informed about the markets?

So, PCR of over 1 or 1.3 may be considered extreme bullish as there are more put writers than call writers?

Thanks!

Rinkesh, you can consider the OI as the total open position which includes both buys and sells. So that way you don\’t restrict your view to buyers or sellers.

Means value of 17000+17100+17200+17300 will give 17300 cumulative value.

And so on….

Thats right, Rajat.

Yes i checked excel sheet….but didn\’t understood from where you got cumulative call and cumulative put data.

From any source we need to get or we need to multiply call/put price with strike value

Or what?

You can add up the daily values to get the cumulative value of call and puts.

How to calculate total value.

Id this call/put current price x cumulative intrest or what?

Rajat, please check the excel sheet.

Yes Sir, have read it. Just wanted to discuss about the perspectives here. Thanks for clearing it out.

Good luck, Yashwanth.

Hi Sir , all the while we have been understanding the option charts from sellers perspective, since the sellers have lot to lose than buyer. But, only in this case ( PCR ) we are assuming that put and call OI from buyer\’s perspective. ( more put options bought hence extreme bearish and vice-versa ) . If we think from sellers perspective as done in all the other chapters, then more put OI than call OI would be bullishness , and that is what the actual outlook . Isn\’t that right sir?

Its originally considered from buyer\’s perspective. Did you check the section where I have discussed how to use this as a contra indicator?

PCR definition in sensibull suggests that PCR > 1 is considered bullish and PCR 1 means more puts are being sold than calls. Which definition to follow?

If you are using Sensibull, I\’d suggest you use the same. It will remain consistent with your trade plan.

The interpretation is as follows –

If the PCR value is above 1, say 1.3 – then it suggests that there are more Puts being bought compared to Calls. This suggests that the markets have turned extremely bearish, and therefore sort of oversold. One can look for reversals and expect the markets to go up.

Low PCR values such as 0.5 and below indicates that there are more calls being bought compared to puts. This suggests that the markets have turned extremely bullish, and therefore sort of overbought. One can look for reversals and expect the markets to go down.

i think the above interpretation is wrong ,pcr below 1 highly oversold and bearish market and there can be a trend reversal ahead and vic for pcr above 1 ,market is highly overbought and bullish and market can take bearish trend ahead

Hmm, but you have to go by the ratio right?

Hi Kartik,

Any books that you\’d like suggest for me to gain an in depth knowledge of the Max pain Theory and the PCR Ratio?

Dont think there are any dedicated books on these topics.

I failed to find a most suitable word in dictionary to express my gratitude towards you and TEAM ZERODHA, App ko mere Dhyanyawad se hi kam chalana padega dost.

Thats more than enough, thank you so much 🙂

So what would be the correct interpretation of the pcr right now? At 1.7 how would you interpret it? Also, it is the highest number in quite a while.

Umer, its just a ratio. The interpretation of this depends on what story you think is unfolding in the market 🙂

Not able to download Option Pain computation excel. Please help !

Checking on this, Gaurav.

Hello Karthik,

Was just going thr PCR section and wondering why you\’d say that a higher level of PCR of let\’s say 1.3 or 1.5 be considered bullish? You assumed that people have BROUGHT more puts than calls and hence the contrarion signal. I get that but it isn\’t it true that the smart money mostly sells calls/puts and doesn\’t buy (hence more numbers in the oi indicates selling not buying) hence the interpretation of the PCR is now opposite. Can you help me understand if there is any flaw in my logic. For example Nifty PCR today at this level is around 1.7, you can\’t exactly call it an oversold market isn\’t it?

The thing is that you cant differentiate between buy and sell OI. So you basically look at the OI and price in conjunction and take a call on where the market is heading or likely to head.

cant able to download option pain calculation excel

If I go long in the future and buy one PE if my MTM is at a loss, should I pay end of the day?

As hedge position, should I still be payment MTM losses.

Yes, futures will have M2M, regardless of your hedge.

Thank you for the additional input, but what I was actually asking is that isn\’t it 1 Standard Deviation(SD) away rather than 1 \”%\” SD?

Got a bit confused. Are both of them the same thing?

Ah no, for the buffer just a simple % will do.

Hi Karthik.

Firstly, really really appreciate the work you have done with Varsity. Big Kudos to you. You have created very strong foundational resources for anyone to trade in markets. The options modules have helped me to gain confidence and hopefully will (re)start options trading soon, hopefully profitable this time.

I had a doubt in the modification part(although a minor one, but still needed to be clear)

is it-\”the 5% BUFFER was taking the prices to 1.5 to 2 SD away rather than 1.5-2 % SD????

Thanks for the kind words, Rahul. 5% is not a fixed rule, you can experiment with what you think is reasonable. I know traders who are comfortable with 2.5% buffer.

Hi Karthik.

Have explained all the modules in a easy to understand way. Thanks. Was not able to download the excel sheet of option pain computation.

Glad to know that, Sashikala. Happy reading 🙂

Hi Karthik

You are doing a wonderful job and putting easy to understand method forward! Really enjoying the course.

Can you please upload the Option Pain computation excel as current uploaded file has no content.

Thanks, Yagnesh. If I\’m not wrong, I have put up the excel sheet for download. Please do look for it in the chpater. Else, maybe you should check Sensibull, they may have this already.

Hello Sir,

But I have written 16100 PE and bought 15600 PE as protection.

Why would I only shift the 15600 PE, do I not need to shift the 16100 pe to 16000 or 15900 or something like that?

At what point should I chose to shift my position and what point should I just accept the loss?

Tejas, ideally you need to move the spread, which means you shift both the options. But my only issue is the increasing transaction costs associated, including brokerage. Thats why I suggested only 1 leg.

Hello Sir,

A few follow-up questions.

I have written 16100 PE. Why would I square of my 15600 PE and move lower in the case the price drops.

When the price drops and volatility increases then my PE option that I have sold would incur a loss as the premium would shoot up correct?

Further away from ATM, lower premium and therefore lower costs.

Hi,

I need your help with some things.

I have written Nifty 16100 PE and hedged it with nifty 15600 PE. for September 9th expiry?

I have identified ranges around 16150 and 16245 as supports for nifty.

I have seen the open interest from sensibull showing strong put writing above 16200, 16100 and above. Nifty is currently ~16690.

1) Now suddenly if nifty starts to drop, what exactly should my stop loss be? When should I decide to adjust my position or completely square off my position at a loss?

2) If nifty drops, vix will mostly increase and I would be shown a loss on that also despite nifty not dropping in price much, so what could I do?

3) how do I adjust my position? Do I buy puts? move my puts position to 16000CE or 15900 CE??

1) Tejas, adjusting positions can be an issue because the transaction charges can be quite high. Also, since the position is already hedged, why would you want to tweak it further?

2) The drop in price should be higher than the drop in volatility (in terms of the impact it has on premium), that\’s when the position will turn profitable

3) YOu will have to sq off the 15600PE and initiate a lower strike. But like said, in most cases option adjustments is not required.

How do i set Risk to Reward Ratio in Option Buying? Given that the price of call or put depends on the underlying asset.

The risk to reward can be assessed by looking at the price which you buy and the price at which you intend to sell.

@karthik… its a commendable work by you in presenting us this valuable information in a very detailed yet simple format… Thanks a ton sir

Happy learning, Suresh!

Can you explain bank nifty Max pain 35500 bearish, what does it mean?

Sorry, can you add more context?

Thanks Karthik. I could download. I\’m using it for the current expiry on the index and multiple stocks to see how it works. Also if you could kindly answer my question on how to plan the stop loss for option trading. Is it based on RRR or should volatility based stop loss be considered for the option strategies?

Dipankar, I\’d suggest volatility based SL. It is one of the better ways to manage risk.

Hi Karthik

I could download the excel through the app. So if you help with the answer to my Stop Loss question, that would be great.

Thanks

You will have to download via the web portal, Dipankar.

Hi Karthik

You have explained this difficult topic of Options so well. Thanks!

Couple of questions – is there a way to have a Stop Loss in mind when trading options like we consider with equity trading? Why or why not?

On a separate note, the Max Pain excel is not available in the Download link. Could you please check?

Thanks again for the excellent content that you have uploaded. It is really helpful for novices like me. 🙂

I\’ll check this, Dipankar.

Hello Sir,

So if you initiate sell monthly contract, do you square off when you feel like the position could reverse or do you hold till expiry?

I usually try to hold to expiry, but open to act if required. Point is, don\’t have fixed rules, be flexible 🙂

Hello sir,

That is good for Option buying strategies. For option selling you don\’t have time on your hands how ever correct?

Also Will a weekly contract move roughly the same a monthly contract for the same movement in price?

Yes, from a selling perspective weekly is good. But for a similar risk, you get a smaller premium, just a thought.

Hello Sir,

Why do you prefer monthly contracts sir?

Could you give your reasoning?

Lot more time and easier to fix in case trade is going wrong.

Hello Sir,

Is it better to trade weekly nifty/bank nifty contracts or to trade monthly contracts.

Monthly contracts are more expensive.

Would it be better to implement buying strategies on monthly and selling on weekly??

I\’d prefer monthly contracts.

Thanks, Karthik! 🙂

I mean, if it is for the 22 JUL weekly expiry, would you still prefer placing the order on 9 JUL or something?

I prefer the monthly contracts Nitin 🙂

Dear Karthik, Do you also prefer 15 days buffer for weekly expiry?

You dont really get 15 days buffer for weekly right?

I have calculated this with Excel VBA code…testing now…for first week its given proper result.

Great concept.

Can u please tell me how to calculate daily expiry?

Daily expiry? I\’m not sure what you mean by this, Nilesh. Can you please share more context? Thanks.

Hello Sir

I have bought a bank nifty future.

Should I protect it with a Jul 8 expiry or july 29 expiry?

Can the july 8 expiry put protect me the same way as the july 29, till july 8?

July 29th I\’d say. July 8th Put will react slightly differently since the expiry is closer.

As per the information above market is bearish when PCR increases i.e. when OI in puts is higher and vice versa but as per the Basics of Option Chain video on zerodha youtube channel they explained that open interest on options give importance to option writers so for ex. If OI in puts increases that means more puts are sold than calls which means market is bullish.

OI is simply an indication of activity level. If the OI is high for a particular strike, that means both buyers and sellers are actively trading that strike.

I believe explanation on PCR is incorrect.

Why do you think so, Abhishek?

Hi, Zerodha education team and particularly Karthik for this excellent platform to educate the retail traders about the Stock market nitty-gritties. I personally gone through the Module 5 & 6 and its so lucidly explained and prepared by the team. Thank You with a warm heart and respect.

Thanks for the kind words, Anshul!

Why isn\’t the PCR used keeping the sellers in mind. Like if the PCR is more than 1.5 the markets should actually reverse downward since more puts were short.

You can look at it from both buyer and sellers perspective, Chetan.

Ok,

But i have one more big doubt.The prices are moving continuously here and there. And the essence of price action trade is that, we take different trading decisions (as per our startegy)based on different scenarios in the market and also we take a look at Volatility, Buyers/sellers sentiment, overvalue/undervalue scenario in intraday and other qualitative aspects of trade.

Let me illustarte it with example.

Lets asuume there is a major Resistance at Rs. 450, and CMP of stock is 435. And suddenly a big green candle of 15/30 min gains 4% and closes just above 450. At this point the RSI is still below (let\’s say) 60.

So, as per price movement I would say this is overvalued and chances of sustaining is less and price can reverse from there, so even though closing of the candle was just above reistance, I would stay out of Buy this share. But in case of Algo, even if I use multiple parameters, the trade would be executed above 450 without actually knowing the price movement and then SL will be hit.

So how can I make my machine to take changing market\’s qualitative decisions like price action trader takes ??

Hence you need to define that all actions and initiate trades based on a close basis, Vaishakh.

Sir, Over the last few quarters, I have been following a price action method for trading. My trading startegy is entirely based on Price patterns or the movement of price in the market i.e. pure technical analysis.

So my question is, will algo-trading suit my type of trading ?? (Given the fact that, in algo trading we need precise entry,exit strategy irrespective of market condition)

Yes, it should. Just the fact that everything is predefined helps a lot better when it comes to trading.

Hello Sir,

I would really like to thank you and your team zerodha for putting such learnings and experience over internet and that too free of cost. Before reading the Varsity, I was not sure where i would be learning the derivatives(F&O) and how to start with it. But after going through varsity from Module1-6, i have gained a decent knowledge and now i know what things to keep in mind if i want to enter the Derivatives market.

I know this learning is simply the tip of an iceberg and now have to put a lot of effort and have to gain real experience to start making profit. But now atleast i have the clarity in which direction i need to proceed.

Once again, I would to thank you and your team for making this possible for us.

Regards

Thanks for the kind words, Sangeet! Happy learning.

Hi Sir,

On Zerodha. lets say I have placed a bull put spread on nifty and another bear call ladder on nifty.

Total positions are 5 legs.

In my trade book it will show 5 different orders.

Is there a way I can club my orders so that I can know which strategy is making money and by how much instead of manually checking each order for payment?

Check this, Pia – https://zerodha.com/z-connect/console/tagging-on-console-trading-journal-tracking-goals

From where we can see Max Pain Data?

YOu can calculate this yourself, else try Sensibull. They may have this data.

Hello Sir,

Let\’s say I have bought 1500 SBIN shares at 420.

I feel SBIN won\’t be rising till 470 so I sell 480 CE naked for 2 points. I am implementing a covered call strategy

Will the system see that I have shares of SBIN and reduce my margin or will I get charged the full margin?

No, margins won\’t reduce for this.

Sir I stick to what Max pain shows in sensibull when there is 15 days to left for expiry and add 5% to that,it makes sense.

Yup, try that and backtest for a few expiries before you place a trade.

Sir do you recommend calculating Max pain in excel manually or it is readily available on sensibull

But in the chapter I calculated when there is fifteen days left to expiry but in sensibull Max pain keeps on changing daily basis

I\’d suggest you use Sensibull. Yes, as and when OI changes, max pain changes too. Hence you calculate the max pain 15 days prior and freeze on it.

If the PCR is above 1 then the markets have turned extremely bearish then how it can go up

Its a contrarian call, Shivansh.

Hello Karthik Sir,

First of all thanks for all the Options Strategies, I don\’t think anybody can explain more better than this:)Thanks you!

I have one question, do we deploy Max pain strategy as one naked trade(unhedged)? or this is a theory and we have to find a suitable strategy after finding the MAX pain?

Why I am asking this is because, above you say that -(I would set up strategies keeping this expiry range in mind, \’\’my most favourite being to write call options beyond 8200\’\’. \’\’I would avoid writing Put option\’\’)

Does this mean it\’s one naked trade(unhedged)? Since you suggested writing the call option and avoid the Put option?

Thats right, Gururaj. Max pain helps you identify a probable range within which the market is likely to expire. You need to figure strategies around this.

how can I calculate the value of total loss value of call and put options in excel sheet? I know its not important here still can you help me

You can do that by looking at the price you paid for the premium and the price you sold the premium. Basically, the difference between the buy-sell price of the premium.

Wonderful materials. Why there is no pdf version for option strategies. Would be great if you could put content in major Indian regional languages like Marathi etc., Would have great audience for these materials.

Does someone know where to download historical OPTION CHAIN DATAs from any website for backtesting?

Please do check with folks from Sensibull for this.

HI Sir,

Thank you very much for your efforts and stand for traders!

I am unable to download Max Pain Excel from the link given above. When I click, nothing happens. Can you please suggest on this…

Let me check, Satya. Meanwhile, can you please try this from another browser?

Hi. I am unable to download the excel. Is there any way that I can do this now?

Thanks

Hmm, can you pls try refreshing the page?

I want to know max pain theory

Yeah, please do read the chapter.

Hello Sir,

For writing options you have mentioned that we should calculate SD etc.

But this is an extremely tedious process to download data and calculate this every day correct? There must be a better way that calculates daily volatility and daily returns every day?

Hello Sir,

Past 4-5 months Nifty has generally had a PCR of 1.3-1.5..

As a contrarian this would mean that if Nifty is looking very oversold and everyone has already made their bearish position, so it makes sense for it to go up as that is the only place for it to go. Which is what happened past few months.

Am I right with my analysis ?

Can nifty remain sideways instead of going up when a PCR is 1.3-1.5??

It can remain sideways as well, and it can remain in that range for a long period, irrespective of the PCR reading.

I am thinking in a different way that if PCR is above 1 means there are more put writers than call. Which actually means many people are thinking that market will go up i.e. bullish therefore they have written more put than call and vice versa. Can you please help understand that why have we taken more put are bought it may be the other way round. Isn\’t it?

Thats correct, Hitesh. Traders write put options when they expect the prices to go up.

i recently learned that PCR is the ratio of puts sold to calls sold. So positive ratio would mean more puts sold and a bullish outlook, kindly confirm and for vice versa as well.

Yes, thats right. Have explained more in the chapter.

As u suggested as the safer side adding 5% to max pain. Why can’t be reducing 5% also. Ideally that 5% buffer should apply either side right. Can you pls guide on this..

The assumption is that you will write only call option, hence we add 5%. Of course, if you are writing Put, then subtracting 5% makes sense.

I actually only read the max pain section. Very well written. I’ve traded options for a long time, but wasn’t aware of this concept until a grade school friend sent me this link. Will read through all the chapters. A big thank you 🙏.

Happy learning, Samir!

hello sir,

sir i go through various module of technical analysis and still find difficult to know in intraday that market had reached its trend limit and is now exhausted and its time for some correction . getting all of these things just by reading candlestick chart is i think incomplete .is there anything which can help ?

That\’s only a matter of practice Rajat, I\’d suggest you keep at it and observe the markets for a while.

Is there any reliable portal where I can get the latest data (charts preferred) for Index PCR and Max Pain and can study the same over a period of time?

Hmm, I think Sensibull has this. Please do check with them once.

hello sir ,

sir with in 2 days the max pain strike price changed by 200 points provided its last 2 days of weekly expiry. sir is it work like this , that within short span it chnaged position too quickly ?

Yes, sometimes when the volatility is on the higher side, this happens.

hi sir,

sir, how to select strikes for max pain ratio calculation. How should be range of strikes considering away from ATM strike? 🤔

Please do check the chapter, have discussed this.

sir is there any link where we get all options strategy pdf format uploaded by you ?

Please check the PDF available at the bottom of this page – https://zerodha.com/varsity/module/option-strategies/

hello sir,

sir it is believed that elon musk wealth increased mainly because of increase in share price . but sir if price increase then the money made by buyers was arised out of the losses suffer by sellers . in this all money remain within the investors . then how it increased his wealth ?

It depends on the market position you have right? You are a buyer of an asset, and the asset price increases, then you do make money off it.

Thank You; Sir.

Sir;

1. Is the Max Pain theory also applicable on the weekly options; that means : whether the weekly options also tend to close near their Max Pain point ?

2. Is it advisable to trade Intraday option on expiry based on the Max pain concept ?

1) Yeah, you can use this for weekly