14.1 – New margin framework

These are fascinating times we are living in, especially if you are an options trader in India 🙂

Starting 1st June 2020, NSE’s new margin framework is live, which essentially brings down the margin requirement for the hedged position.

What is a hedged position you may ask? Well, we have discussed this several times in this module, but for the sake of completeness of this chapter, we will quickly discuss this again.

Assume you are riding a bike at 75Kms per hour, without wearing a helmet. Suddenly you come across a pothole, you slam the breaks to cut speed, but it’s too late, you crash and fall. What is the probability of injuring your head? Quite high given the fact that you are not wearing a helmet.

Now imagine the same situation, but instead of being carefree, you decide to wear a helmet. Given the crash, what is the probability of injuring your head? Low probability, right? Because the helmet protects you from an injury.

The helmet acts as a hedge against a potential disaster.

In the same way, a naked futures or options position in the market is like riding a bike without wearing a helmet. The risk of market-moving against your position, causing capital erosion is high.

However, if you hedge your position, then the risk of losing capital reduces drastically.

Now, think about this – if your capital loss is minimal, then it implies that the risk for your broker is also minimum right? Now, if the risk for the broker reduces, it also means the risk for the exchange reduces.

So what does this mean to you as a trader?

Remember, the critical margin dynamics – the lesser the risk you carry, the lower the margin requirement. Higher the risk, higher the margin requirement.

Therefore, this means whenever you initiate a hedged strategy, the margins blocked by your broker is less compared to the margin required for a naked position.

In essence, NSE has proposed the same in the new margin framework.

You can check this presentation by NSE for more details.

The presentation is quite technical; you do not have to crack your head to understand this unless you really want to.

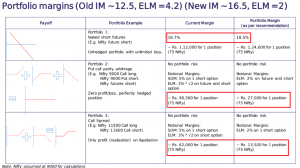

From a trader’s point of view, there are three key takeaways from the new margin policy; all the three highlighted in 1 slide of this presentation, here is a snapshot –

Starting from the top –

- Portfolio 1 – Margins have increased for naked unhedged positions to 18.5% from the current 16.7%.

- Portfolio 2 – 70% reduction in margins for market-neutral positions

- Portfolio 3 – 80% reduction in margins for spread positions

What does this mean to you as an options trader?

Well, some of the useful strategies, which looked great on paper but were prohibitive to implement due to excessive margin requirement, now look enticing.

A trick question for you here – why do you think the margin reduction is higher for spread position compared to a neutral market position?.

Do think about it and post your response in the comment section.

So given this, I want to discuss one more options strategy in this module, I had not discussed it earlier since the margin requirement was very high, but now, it’s no longer the case.

14.2 – Iron Condor

The iron condor is a four-legged option setup. The iron condor is an improvisation over the short strangle.

Have a look at this –

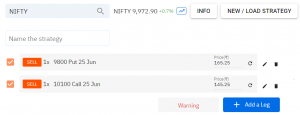

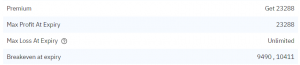

I’ve taken this snapshot from Sensibull’s Options Strategy Builder. As you can see, Nifty is at 9972.9, and I’m trying to set up a short strangle by shorting OTM calls and puts –

- 9800 Put at 165.25

- 10100 Call at 145.25

Since both the options are written/sold, I get to collect a total premium of 164.25+145.25 = 309.5.

For those of you not familiar with the strangles, I’d suggest you read through this chapter.

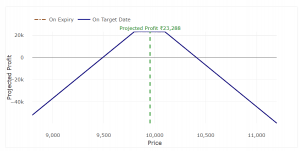

The pay off for this short strangle set up is as follows –

I love this strategy because it lets me retain the premium as long as Nifty stays within a range, which most often it does. Besides, this is also a great way to trade volatility. Whenever you think the volatility has shot up (usually it does around big market events) and therefore the option premiums, then you’d want to be an options seller and pocket the high premiums. Short strangles is perfect for such trades.

In a short strangle, since you sell/write options, it results in a net premium credit. In this case, you get a premium of Rs.23,288/-.

The only issue with short strangles is the exposed ends. The strategy bleeds if the underlying asset moves in either direction.

For example, this particular short strangle has a range of safety between 9490 and 10411.

I agree this is a wide enough range, but markets have taught that it can make crazy moves within a short period. Most recent being the COVID-19 crash in early 2020 followed by quick recovery from the lows.

If you are caught with such a rapid market move, the potential loss can be colossal and can wipe your account clean. Now, because the possible loss is unlimited, this means the risk to you and the broker is quite high. Eventually, this translates to higher margins as well –

The margin to set up a short strangle is nearly 1.45L, which is quite prohibitive for many traders.

However, this does not mean that you have to say goodbye to a short strangle. You can improvise on the short strangle and set up an iron condor, which in my opinion is a far better strategy.

An iron condor improvises a short strangle by plugging in the open ends. Think of an iron condor in 3 parts –

- Part 1 – Set up a short strangle by selling a slightly OTM Call and Put option

- Part 2 – Buy a further OTM Call to protect the short call against a massive market rally

- Part 3 – Buy a further OTM Put to protect the short Put against a massive market decline

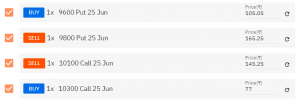

This makes an iron condor a four-leg option strategy. Let us see how this looks –

- Part 1 – Sell 9800 PE at 165.25 and sell a 10100CE at 145.25, collect a premium of 310.5 or Rs.23,288/-.

- Part 2 – Buy 10300 CE at 77 to protect the short 10100 CE

- Part 3 – Buy 9600 PE at 105.05 to protect the short 9800 PE

The trade setup looks like this –

If you think about this, the short option premium collected finances the long option positions.

Since you buy two options to protect against two short options, the profit potential reduces to a certain extent –

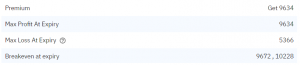

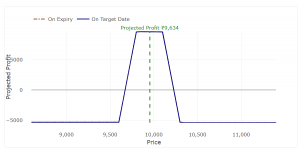

As you can see, the max profit is now Rs.9,634/-, but the reduced profit comes with reduced stress 🙂

The max loss is no longer unlimited but restricted to Rs.5,366, which in my opinion is awesome because I now have visibility on risk and it is not open-ended.

The profit is restricted, as long as Nifty stays within a range, in this case between 9672 and 10228. Notice, the range has shrunk compared to the short strangle.

The payoff of an iron condor looks like this –

Now, what do you think about the risk? The risk here is completely defined. You have clear visibility on the worst-case scenario. So what does it mean to you as a trader, and what does it mean to the broker?

You guessed it right since the risk is defined, the margins are lesser.

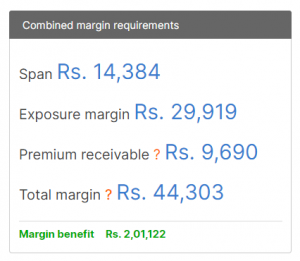

This is where the new margin framework of NSE comes into play. An iron condor requires you to pay an upfront margin of only Rs.44,303/-, contrast this with the short strangle’s margin requirement of Rs.1.45L.

Besides, before the new margin framework, executing an iron condor was not very viable for a retail trader. For these strikes and premiums, the margin requirement for an Iron Condor was roughly in the range of 2 to 2.2L.

14.3 – Max P&L

There are a few important things you need to remember while executing an iron condor –

- The PE and CE that you buy should have even strike distribution from the sold strike. For example, here we have sold 9800 PE and 10,100 CE. We have protected the sold strikes by going long on 9600 PE and 10,300 CE. The difference between 9800 PE and 9600 PE is 200 and 10,100 CE and 10,300 CE is 200. The spread should be even. I cannot protect 9800 PE by buying 9700 PE (difference of 100) and then protect 10,100 CE with 10,300 CE (difference of 200).

- The Max loss occurs when the market moves either above long CE i.e. 10,300 CE or moves below long PE i.e. 9,600PE

- Spread = 200 i.e. the difference between the sold strike and its protective strike.

- Max Profit = Net premium received. In this case, it is 128.45 (9634/75)

- Max loss = Spread – Net premium received. In this case, it is 200 – 128.45 = 71.54.

I’d suggest you look at the excel sheet at the end of this chapter for detail working of this. Please note, I have updated the excel sheet 2 days after I wrote this chapter, hence the values are different.

14.4 – ROI and Logistics

By setting up a short strangle, you receive a premium of Rs.23,288/- and for the iron condor, the premium receivable is Rs.9,643/-. Agreed, in terms of absolute Rupees, the iron condor offers a far lesser premium inflow. But when you measure this against the margin requirement, the ROI flips in favour of the Iron condor.

Short strangle requires a margin of Rs.1,45,090/-. Therefore the ROI is –

23,288/1,45,090

=16%.

The margin requirement for iron condor is Rs.44,303/-. Therefore the ROI is –

9,643/44,303

= 21%

As a trader, you need to think in terms of ROI and not absolute numbers, and the margin benefit makes a significant difference here.

The sequence of trade execution makes a big difference here. If you are considering an iron condor, then here is the trade sequence –

- Buy the far OTM call option

- Sell the OTM Call option

- Buy the far OTM PUT

- Sell the OTM PUT option

The point here is that you need to have a long position first before initiating the short position.

Why? Because short option position is a margin guzzler, so when you have a long position, the system knows the risk is contained and hence will ask you for lesser margins for the short position.

Please note, I’ve only considered the margin blocked for the ROI calculation, I’ve not considered the money paid to buy the options and the money received when you write an option.

So traders, as a next step, I’d urge you to select different strikes for the long positions and see what happens to the premium receivable, breakeven points, and the max loss.

Do post your observation and queries below.

Key takeaways from this chapter

- NSE’s new margin framework reduces the margin requirement for market neutral and hedged strategies

- While the short strangle is an excellent strategy, it has open ends with potentially unlimited losses

- The iron condor is an improvisation over the short strangle

- In an iron condor, the long OTM calls and puts protect the open ends of the short strangle

- Margin required for an iron condor is far lesser compared to a short strangle

Download Iron Condor Excel Sheet

Karthik sir, correct me if I\’m wrong, strategies such as Delta Hedging, Gamma scalping, Dynamic hedging require continuously adding or exiting trades, so you Maintain hedge with changing market conditions, these are not really viable for retail traders because costs like brokerage and other charges, will not make sense when you have to transact continuously. Hence may be we can focus on static hedging strategies such as bull call spread etc.This is my guess, correct if wrong.

Thats absolutely correct 🙂

Is it necessary that in an iron condor one needs to have buy position which is more OTM than the sell positions ? Can the buy positions be of lesser OTM. Please see the data as under

Expiry 9th dec 2025 Qty One Lot (75)

Nifty 26500 CE Buy Price Rs. 5.5

Nifty 26450 CE Sell Price Rs 8.2

Nifty 25800 PE Sell Price Rs. 5.6

Nifty 25750 PE Sell Price Rs. 4.85

Max Profit Rs 259 Max Loss Rs 3491.

if one changes the buy position to the following

Nifty 26400 CE buy Price Rs 13.5

Nifty 26850 PE buy Price Rs. 7.5 both the positions are lessr OTM than the sell positions

Max profit Rs 3236 Max loss 514

Is this a good strategy > is it an iron condor ?

Hey Bhushan, you can actually key in these positions on Sensibull and check the payoff to verify if its working in your favor. You can visualize the risk and reward situation also.

Today I have created a iron condor stretegy in basket for nifty option using the below details:

buy 26400 ce @ 2.15 (1 lot)

buy 25850 pe @ 1.16 (1 lot)

sold 26200 ce @ 12 (1 lot)

sold 26900 pe @ 4 (1 lot)

But margin requirement is 191000. I don\’t know why somuch margin required?

For this, I\’d suggest you call the support desk, Hitesh. Maybe you have other open positions?

i have a query in deciding which combo of strikes should we choose whn multiple options are available based on the importance of the following parameters and in what order?

1. among the parameters , POP, Risk/reward ratio, outstanding OI of the concerned strikes, distance frm ATM, 1SD/2SD, Max profit/loss, margin amount reqd, simplicity of the combo in terms of easy execution, possibility of forced to take or give delivery, stocks volatality and time of execution ie, 1st,2nd,3rd or last week of the month.

Gopalan, we have discussed which strikes to choose in the chapter itself right? That should help.

Thanks for the reply sir…..I did study the.. Wonderful material no doubt..for getting the right knowledge in the right quantity and the right time… but in terms of various parameters that drive the decisions in choosing the strikes, I thought I cud get a slightly deeper knowledge in terms of which parameter shd be given more weight than the other based on ur exposure to the subject. when we r presented with a situation of more choices, we should have some basis for such a decision. right? And another query, when we see the words unlimited loss, tht creates a fear and we tend to overlook such an option choice. Is there a way to add a number .. a probability number to that Unlimited loss situation? Or is it that we shd never get into trading such options?

Ah get it. When you set up the short IC, focus on the middle part first i.e. the short strangle. Identify the spread you are comfortable with. This depends on your reading of the market. If you think the market will be within a range for the longest time, then spread the range as wide as you can from the current marlet price. Shirnk it if you think otherwise.

Once the range is set, the purpose of the other two long position is to only protect the exposed ends, this can be the immediate liquid strikes available from the stikes you;ve sold. There is no point going further away into the OTM region.

Thank u so much sir…

Happy learning 🙂

one query I missed to ask.

1. When u choose the strike prices for building an iron condor, how far away the strike prices shd be frm the ATM? And do the call nd put option shd be equidistant from ATM?

This is can be a min 2 strikes away. I\’d prefer them to be equidistant 🙂

sir, this is reg.option strategies.

1. while building up an iron condor strategy, is it mandatory that we shd do all the 4 legs of them simultaneously?

2. Can we wait and do the call buy nd put sell whn the market is down and the call sell and put buy whn the mrkt is up, as within a mnth we do have reasonable movements in Nifty and other stocks so we can have a better net premium in our hands whn the strategy is fully built?

3. How do we sell them individually without increasing our margin requirements?

4. How do we identify the strike prices tht will give us always positive values whn building a long box or short box strategy? Is thr a tool to identify such combo of strike prices?

1) Not necessary, you can build them one after the other. However, you need to be aware of the execution risk while doing do. The overall cost of final iron condor may have varied.

2) Hmm, technically yes. But keep the above in mind.

3) Not possible, when hedge is broken, margin requirements go up.

4) Maybe Sensibull has, please check. I\’m not sure. But most of the math required can be summed up in your mind by looking at the premiums I guess, this could be faster than using a tool.

HII!

IF I WANT TO DEPLOY A STRATERGY TO BENEFIT FROM THE RESULTS MOVEMENT AS THE OPTION PREMIUM ARE HIGH DUE TO THE EVENT SO BUYING LOOKS EXPENSIVE BUT A SURE SHOT MOVEMENT IS EXPECTED. WHICH STRATERGY WILL TO EXECUTE TO REAP A BENEFIT OF THE MOVEMENT WITHOUT OVERPAYING FOR THE EVENT VOLATILITY ?

THANKYOU

I wish I knew the answer to your question, YAshod 🙂

Resp. Sir,

When you were writing this,there were no weekly expiration,but now we do have weekly life span for our strategies.For neutral Strategies like iron condor, iron butterfly, short strangle/straddle and so on, is weekly life for our strategy ok or risky? I need your guidance on this,for there are authors like optionstradingiq.com,who tell that weekly options strategies are risky. Please enlighten me.My good luck to have you as my mentor. Hats off and kudos to you!

The expiry timeline obviously shrinks, but otherwise, the conceptually nothing changes. Options in general are risk, there is no doubt about that..and it does not matter if its weekly or monthly 🙂

Sir,

If have a dematha balance of 5-6 cr.

On nifty expiry I usually select a strike price 5-8% above and 7-8% below and sell calls and puts naked for same day expiry after market opens. I look at open interest and see local maximum and minimum for support and resistance areas.

I do not even try to sell near by options and closest I have written is 5% away. Premiums are low and risk reward is poor. But i am consistent in making passive income.

What bothers me is that I often get scared that all my effort can go away in one day?

The risk is one day market after open rises 5% or falls 5% as my quantity large.

So I am confused if I should continue or stop.

I thought of trying a hedge but if I am writing far otm options at 15 and 20 pause then how to I hedge the same as I will never get any profit only.

Please guide ?

I have been trading past 6-7 years and yet to face a loss like this.

I avoid trading near events and elections.

There are two things –

1) The risk of ruin exist, you can hedge, but as markets moves the hedge sometimes may not be sufficient hence the risk of losing.

2) Estimate the maximum loss you can bear to shock events, and ensure you are ok with that. This way once your max loss is known (or nearly estimated), trading becomes easier.

The volume did not chsnge but last traded price has changed how is that possible ? (last column is volume)

this is tick by tick data from Zerodha , is it a data error or I am not understanding something ?

NIFTY25031322400CE 20250306 09:46:09 147.4 2272200 4543125

NIFTY25031322400CE 20250306 09:46:09 147.4 2272200 4543125

NIFTY25031322400CE 20250306 09:46:09 147.9 2272200 4543125

NIFTY25031322400CE 20250306 09:46:10 147.9 2272200 4543125

NIFTY25031322400CE 20250306 09:46:10 147.05 2272200 4543350

NIFTY25031322400CE 20250306 09:46:11 146.15 2272200 4544175

NIFTY25031322400CE 20250306 09:46:11 145.75 2272200 4544175

NIFTY25031322400CE 20250306 09:46:12 145.6 2272200 4544175

Hesham, I\’d suggest you speak to the support desk for this. Not sure if I can be of help.

Sir, how do we create a strategy in Zerodha ?

Check this – https://www.streak.tech/home

Sir, I have already activated an account at streak.com through Zerodha. In the meantime as I currently don’t have the expertise to select f&o myself, hence I took the help of moneycontrol pro. They suggested one iron condor strategy as follows

DLF

Strategy Name Short Iron Condor

Expiry Date 29 May, 2025

Analyst: Santosh Pasi

Particulars

Sell 690.00 PE. price 7,136.25 qty 1 lot

Sell 740.00 CE price 8,126.25 qty 1 lot

Buy 670.00 PE price 3,877.50 qty 1 lot

Buy 760.00 CE price 4,290.00 qty 1 lot

Net Spread (Rs.) 7,095.00

Current Returns (Rs.) 247.50

MTM Target(Rs.) 4,700.00

MTM Stoploss(Rs.)-2,400.00

– [ ] At first I clicked on new strategy

– [ ] Then selected the buy option

– [ ] Followed by selecting both the option for buying

– [ ] Then I selected the sell button

– [ ] Followed by selecting both the option for selling

– [ ] then selected some condition for triggering

– [ ] Finally submitted for backrest

– [ ] I noticed that it does not ask for the name of the strategy I.e iron condor here but asked for providing customer name

– [ ] Also in the list of options selected it does not mention which one is selected for buying and which one for selling.

– [ ] This poses a doubt and I want to ensure whether the selections were correct.

– [ ] Also it does not mention how much will be the total margin required

– [ ] Is that because I am trying this today I.e on Saturday

I don’t know how to manage this situation. I wish to add that I tried these in the streak app .

I\’d suggest you speak to someone from Streak for this, they will be happy to handhold you on this.

Sir, in the example above,

I think Net Spread (Rs.) 7,095.00 is the net amount, I receive at the time of executing the transaction,

Also, does MTM Target (Rs.) 4,700.00 implies that even though I have received rs 7095 as net spread, but at the time of expiry it will be reduced to rs 4,700.00

Also what does Current Returns (Rs.) 247.50 mean ?

Also what does MTM Stoploss(Rs.)-2,400.00 mean ? does it imply maximum loss would be rs 2400

How to calculate these figures ?

That\’s the max spread, what you get will depends on how the spread performs upon expiry. Likewise, SL is the max loss.

Is it possible that in an Iron Condor the max profit is lesser than the max loss due to skewed option prices ?

obviously the risk to reward ratio will not be conducive for trade ?

when does such an instance occur?

Hi Karthik sir,

I think I have not explained well before.

I want to place short iron butterfly with all four legs getting filled or none gets filled , how should I do it.

Ah, as of today, this is not possible.

Good explanation with excellent examples.

Thank You

I want to place short iron butterfly with all four legs getting filled or none gets filled , how should I do it.

Karthik Rangappa says:

May 16, 2025 at 5:30 pm

Ah, as of today, this is not possible.

Is it possible to develop such tool from scratch , does NSE support such orders ?? please advice

I think you will have to develop an algo, Heshman.

Hi , I read that NSE allows basket order which can be treated as single order which can be at a specified limit price on combined premium.. like for example if it\’s a short iron butterfly, the combined premium received from all four legs can be specified example.. 50 points for ATM put sell, ATM call sell minus otm1 buy hedge for both call and put… They say it\’s net premium limit order so when the condition meet all orders are filled or none is filled.. it\’s a guaranteed way not to be partially filled and carry un intended positions… Interactive brokers seem to have it, does zerodha have it or is there a way to place algo orders which can either gaurentee net credit or no fill ??? Please clarify sir.

I want to place 4 legs like all or none order at a limit price for each leg or combined premium… Is there any way to achieve it. A way to code the logic.. I am sure that NSE allows all or none order type

Please check this – https://support.zerodha.com/category/trading-and-markets/charts-and-orders/basket-order/articles/kite-basket-orders

Are you referring to this – https://support.zerodha.com/category/trading-and-markets/charts-and-orders/basket-order/articles/kite-basket-orders

Basket orders are not processed as one order, I want to fill all orders in the basket or none. to avoid the risk of holding partial orders.

I also read that the spread can be traded with spread limit prices , lets say we sell atm and buy otm a call or put , we have 2 legs , instead of placing limit price on each leg we can place limit on combined premium. they say its combo order or spread order.

Hi Karthik,

Can you explain how stoploss works in Nifty options if the price gets triggered in the premarket in the morning due to onesided rally. So will the stoploss get executed as unlike stocks prices ,option prices are not moved in premarket open.

Ah no, you will have to wait till the markets open and price ticks.

Hello Sir,

Can we please have a chapter explaining the Wheel Strategy in options trading? Quite confused about how it works and the conditions under which it is profitable and when to avoid it.

Thanks

Sure, perhaps will make a video of it 🙂

Thanks for reply on Iron condor.

For PE Sell, why margin is so high?

If I buy PE margin is very less, when I Sell PE, margin required is full.

e.g ICICIBANK buy PE 1180 requires only INR 950, but same Sell PE 1180 requires INR 115350.

Is this correct?

Hi Karthik Sir,

As per my knowledge we need to use 50 % of cash component and 50% of non cash component for Option selling Margin. Is this margin rule for both positional and intraday ? I have Mutual funds and want to pledge for Option selling. I just want to know whether we we can use 100 % margin as non cash component for intraday option selling trades or Even for intraday do we need to maintain both Cash and non cash component. I don\’t keep the position over night and my requirement is purely for intraday option selling. Please clarify this.

Thanks & Regards

Satya

This should be possible.

Did not receive any feedback on my 20-Dec query! Does anybody has knowledge of this?

For Iron Condor,

Could you please confirm when to exit these PEs ans CEs? Do we need to wait till expiry or can exit anytime ? If all 4 PEs and CEs are bought, can only partial be exited and c/f remaining and exit lated?

Or does all 4 options have to be exited at the same time? How do we know the profits/loss real time after entering Iron Condor? Does the app shows the P/L?

Appreciate a reply soon

You can exit this anytime, dont really have to wait till expiry. YOur P&L will reflect in the position tab of Kite.

thank you so much sir

Best wishes, Karan.

Hello,

For Iron Condor,

Could you please confirm when to exit these PEs ans CEs? Do we need to wait till expiry or can exit anytime ? If all 4 PEs and CEs are bought, can only partial be exited and c/f remaining and exit lated?

Or does all 4 options have to be exited at the same time? How do we know the profits/loss real time after entering Iron Condor? Does the app shows the P/L?

Appreciate a reply soon

I had predicted market neutrality and decided to hold the iron condor setup till expiry. Zerodha asked for extra funds (which I loaded in my account) on the day of expiry. My doubt is, even though my losses are capped, why should I be loading extra funds?

The margins of the portfolio itself can increase given the intrday volatility. Please do check once with the support desk. Thanks.

–An iron condor with a risk/reward ratio of 2 and a POP of 61%

–Given that the upper and lower breakeven points of the iron condor are positioned at the resistance and support zones respectively, would it be wise to take this trade?

Yeah, with lesser lots you can give it a shot.

Sir,

In options strategy builder, if the max loss is more than the max profit, it has a higher probability of making a profit. But when the max profit is more than the max loss, then the probability of making profit is drastically low.

So there is a only one option strategy that is iron fly which comes with good risk to reward

we sell a straddle and buy 200+ ATM hedges, but comes with 28% probability of profit.

In case of iron condor:-

we sell a strangle(200+ ATM) and buy (400+ ATM) hedges , it comes with a 55% probability of profit, but the max loss is more than the max profit. the reward is lower than the risk we are taking.

Q1) Then as a trader, what option is favorable?

Q2) Theoretically, shorting naked options come with unlimited risk and higher probability of profit. But is the \”unlimited risk\” practical in real world? Because I haven\’t experienced a black swan event in my life.

1) Always opt for the one which gives you confidence of higher odds of profitability. Odd of making a proft > profit itself

2) That is the idea. Black swan event is very rear, but when it happens, it can wipe down your P&L.

Thanks for the response Karthik.

If I am trying to improve the RRR i.e. let\’s say close to 1:1, I start to see POP less than 50%, which also essentially means If I execute 100 such trades, I will eventually lose money.

Let me know if I am missing out something.

TIA

Thats right, why not optimize it for a higher RRR? Even a small increase may lead to a positive outcome.

Hi Karthik,

Thank you for the great explanation, I have a following question:

In the Iron Condor strategy, I\’ve observed that there is a trade-off between achieving a good range and maintaining a favourable risk-reward ratio (RRR). For instance, with a probability of profit (POP) of 70% and a RRR of 3:1, theoretically, over 100 trades, I would win 70 times, earning 70 units, but lose 30 times, resulting in a loss of 90 units (30 x 3). This would lead to a net loss of 20 units after 100 trades. Given that this is a delta-neutral strategy and I have no directional bias, how can this strategy be profitable? Are adjustments the key to making this strategy work effectively?

Note: The RRR and POP numbers are taken for example.

But why would you want to even up take up a trade that does not have a favorable RRR?

So if lot size of nifty is increased to 50

then will my margin requirement get doubled ?

Yes, it will. Higher the contract value, higher the margin required.

But there is one more change about lot size and contract value which says minimum contract value has been increased from 5-10 lakh to 15-20 lakhs which as a result will increase lot sizes from 25 (of nifty) to around 60.

I\’m really unable to understand this new rule.

Is this new rule of change in contract size going to increase my margin requirement ?

Yes, with the increase in lot size, contract value changes, and therefore your margin requirement.

Hi kartik !!!

Currently I trade via option selling with monthly expiry contracts.So, assume I sell 2 lot call option and 2 lot put option with 0.2 delta each for october end expiry on 1st october.

Currently I\’m required to keep around 1.2 lakh as margin with broker.

So my doubt is under new f&O rules released on 1st october, 2024 , how much margin will I be required to keep with broker ?

This wont really change. What changed is the calendar spread on expiry day.

how different options strategies utilize the Greeks? how are they incorporated into the decision-making. And many times I have seen strategies specific to a particular greek like gamma or Vega what are those strategies and how do they work out.

Check this – https://zerodha.com/varsity/chapter/greek-interactions/

I mean, this strategy is to cap the losses right? then what about short straddle since it has maximum losses too?

Yes, since both the legs are short positions.

Can this strategy also be used in short straddle?

Hmm, but thats a different strategy right? Its 2 legged, and this one is 4 legged.

Hi,

Can someone please tell me where can i donwload historical option data for stocks and indices? for last 2-3 years?

Thanks in advance

Ah, not sure if this is available. You can check once with Sensibull though.

Hi Karthik

When i check the iron condor for today on Sensibull using its strategy builder, I find that the equations of max profit and max loss do not hold. Pls help with why this is so.

Sharing the values below since I cant paste any image here.

Expiry: 6th Jun

Spot- 23000 NIFTY

Short 22800 PE and 23200 CE (premiums are 300 and 342)

Long 23700 PE and 23300 CE (premiums are 273 and 292)

all 1 lots each

Net credit- 77

max loss should be spread-net credit= 100-77=23; so 23*75= 1725 but in Sensibull it says max loss is 569

Max prof shuld be net credit=77 so 77*75= 5775 but in Sensibull it says ma profit is 1931.

Am i missing something here?

Sensibull takes in Future prices, are you considering Nifty Spot?

Are options based on futures price or spot price? Why sensibull option chain shows 23250 strike as ATM option when the Nifty spot is trading at 23008 and Nifty futures at 23262?

Its technically based on spot, but futures is fine too.

thank you sir

Welcome!

Sir quants means quantitative analysis?

Yes, thats right.

Sir something about technical analysis,

trading psychology and options trading

For TA – please check CMT resources, you will find all that you need there. For options trading, check this book called Options Pricing by Sheldon Natenberg. Good luck 🙂

sir from last one year i read varsity first 6 modules for 5to6 times and other modules for 2 time and i trading from last 2 year and i want to get some more knowledge about trading that\’s why i asking you for suggesting some books please suggest some books sir

Which direction do you want go? If its investing the I can think of few books related to investing, if its quants then i can suggest a few in that direction.

sir please suggest some technical,options,and trading Psychology books

and please suggest some at least 10 books which you like please sir

Everything you\’d need is mostly on Varsity. I\’s suggest you give it a read first and then look for other sources.

when will you be discussing about delta hedging and volatility arbitrage (the topics you mentioned to discuss at the start of this module)

Note sure, maybe I\’ll do a video 🙂

Could you please explain how to do adjustment, if I do short straddle monthly expiry and also do strangle with weekly expiry for margin benifit… What will happen after the weekly expiry…

I\’d suggest you key in these positions on Sensibull to see how the margins are offset.

Karthik Rangappa says:

March 30, 2024 at 7:39 am

Thanks! Will be happy to help 🙂

DEAR KARTHIK SIR, HOW CAN WE COMMUNICATE WITH YOU. PLEASE GUIDE US. THANKS AND REGARDS

This is the best channel to communicate with me 🙂

Dear karthik, Kindly update PDF to include last chapter also in the main page. Currently Iron Condor is not selected.

Ah, sure. We will do that. Thanks.

I trade with 1 lot only as a beginner for learning and testing. 🙂 As currency derivatives no longer available for retail , the lot size of nifty is reduced to 25. 🙂

Thank you for your suggestion,

I will try it after learning chapter 8 (Currency, Commodity, and Government Securities) on varsity 🙂 and

Another question :-

If we look at the open interest data ,

let\’s take an example :-

Fin nifty is trading at 21170

The call OI of 21200 CE is higher than any strike on expiry.

The put OI of 21150 PE is higher than any strike on expiry.

and open interest signifies the buying and selling is happening very high on that strike prices.

Someone is buying and Someone is selling.

But can we assume that the power of sellers is more here , because option selling requires bigger margin and big institutions have that. and statistically , the winning probability of option selling is high in trading.

So fin-nifty will expire in between 21150 and 21200 , today I have experimented this theory with a trade and it was successful. 🙂

But looks like currency derivatives may no longer be available for retail. Its a developing story, need to see how regulations play out.

Yes, you can move with that assumption, but dont bet heavy on it. Realist is that no one really knows what the full position is, for all you know a sell on a certain strike could be hedged with a buy on a certain other strike.

Sir,

Last month , I taken my first option spread trade . I had a capital of 43k , the margin required for the spread order was 40k. The strategy was iron butterfly, I applied the strategy in fin nifty index . After 3 hours of placing the order, I got a margin call from zerodha, I got scared and immediately exited my position made a loss of 1000 Rs.

This was the message:-

\”EQUITY margin utilization for LGE648 has reached 294.89% of available balance. Add funds immediately on https://zrd.sh/funds. Positions can be squared off if margins are insufficient. Team Zerodha\”

But the m2m was – 1000 Rs , I had excess margin of 3k in my account in cash. Also there was no negative balance in my trading account after receiving margin call.

Then I learned about margin penalty and peak margin shortfall from zerodha support team. But sir, if I have a 50k capital and I have 10% excess margin in my trading account , will it be risky to test my knowledge and take trade with option spreads like iron butterfly , iron condor , bull call and bear call spread. I will be trading single lot only with spreads. I am currently testing it through sensibull\’s virtual trading , but when it comes to real market , the scene is very different.🙂

My questions:-

1) As a beginner trader, What are the things to keep in mind to avoid margin call and margin penalty ? How much excess margin we can have before taking a trade ? if iron butterfly strategy\’s margin required is 42k , should we keep 150k margin in our trading account to avoid the margin call and margin penalty ?

2) A 4 legged spread order, there is 2 sell and 2 buy order. so every sell order requires a margin of at least 1 lac each , so for 2 sell orders the absolute margin required is 2 lac , so if we buy 2 buy hedges , the margin reduced to 50k , so will we have to keep 2 lac in our trading account to take a option spread trade that costs 50k?

3) If I receive margin call everyday, what are the side effects of it in trading ?

4) In 4 legged spread order, the position is itself hedged, so if there is a gamma spike happens on expiry on my sell position , should the hedge save me from that spike or for safety I have to place a stoploss limit order on sell orders ?

🙂 A lot of this questions occurred in my mind after making a loss 🙂

1) Usually having some more capital as margin will help avoid such situations. Given peak margin requirements, there is no specific percentage I can give you, but something like 10-15% additional capital is not a bad deal.

2) But you do get a margin benefit here, right?

3) No side effects, except that its annoying 🙂

4) It should.

By the way, I do get your point that real trading is very different from virtual. However, here is my suggestion – instead of fin nifty, why not do this on USDINR? Margins are lot lesser and it gives you the real market feel 🙂

it would be our pleasure to get your help in our learning curve. we all are very excited with your positive response. thanks.

Thanks! Will be happy to help 🙂

dear karthik sir, we have been learning a lot about finance with help of zerodha varsity. we have a discussion meeting every saturday where we discuss the knowledge about finance and varsity comprises 98% of our discussion. so you can imagine how much helpful it is for us. thank you so much. wish you all good health and good wealth. thanks. dr devendra agrawal

Thanks so much for letting me know 🙂

If there anything we can do to make these Saturday sessions better?

🙂I got fooled by randomness.

We all do, but important to figure and get moving 🙂

Sir,

I am currently testing iron condor strategy through sensibull\’s virtual trading for last 20 days.and I have been profitable there with a capital of 59000rs.

My setup is selling 200 points below and above ATM at 10:00am.

With a hedge of 50 points below and above otm that I sold.

My question is I recently looked into one YouTube video that more than 20000 crores of straddles is being sold in the markets during expiry . That\’s why massive spikes are happening in expiry (also known as injection candles) in 1 minute the option prices going tremendously up and coming down without much change in price of the underlying. My question is that before deploying real money to this strategy, I am really very worried about this massive spikes. What can I do sir , should I deploy real money to this strategy or stick to positional trading ? I spend a lot of time learning about options from varsity but this spikes are not making me confident to put real money here. 🙂

There is no way in the world anyone can say that there are x amount of a certain strategy being sold or bought in the market. If someone on Youtube is saying that then that person is an idiot, so please unsubscribe from that channel 🙂

Sir, strikes of far OTM are blocked by exchanges, which makes building strategy difficult. How to buy far OTM?

Please suggest.

thanks!

They are not blocked by exchanges, but rather the broker would have hit OI limitations. One way is to sell OTMs first and then buy the strike you need. I know its margin intensive, but thats how you can 🙂

Why options trading is such a negative thing in trading? In television, YouTube there is so much negativity, everyone saying it is dangerous.

🙂 Are people trying to get rich overnight or they are gambling , because if I use spread strategies, the risk and reward is limited. And if I do it consistently in the long run, I will get the compound effect .

Its just that options trading involves a lot of understanding on nuances, but that hardly anyone does. Half hearted attempt to learn options often leads to disastrous outcomes.

No, the risk to reward is not okay but if I see the probability it is 74%. And the neutral option strategies don\’t have a good risk to reward but 90% of the time nifty moves in sideways.

Sure, the best way to see what works is by actually executing it and figuring if it works for you 🙂

But do easy and don\’t deploy a lot of capital straightaway.

Sir,

I built this strategy on sensibull after learning this :-

https://sbull.co/s/WRgGl6pr/

Please have a look on it :- 🙂

Are you ok with the risk reward skew?

Sir,

I have 50000 rupees of capital in my account, if I make a basket order of short iron condor , the margin showing in sensibull is 39000 Rs for fin-nifty expiry and Funds required is showing 44000 rs approx.

I have some questions

1) if I take this strategy for intraday expiry and don\’t close the position. Will I be charged penalty ? and are there any issues if I square off the trade early as my capital is limited and very close to the fund required ?

2) What are the tail-risks of taking this strategy in intraday ?

1) No, there is no issue if you close this prior to expiry.

2) This is a fairly hedged position, but one thing you need to keep an eye on is the extreme volatility movements after you initiate the trade.

Got it Sir. If you could share a good trailing stop loss method, it would be helpful. Can we do this based on a specific MA in a shorter timeframe or if you could be specific about a certain method you use, it would provide value. Thanks.

One common way is to simply move the SL by 0.5% as and when the underlying moves in your favor by 2%. But note, this also depends on the stock in consideration and the momentum its exhibiting. If there is a lot of momentum, this may as well be 1% and 5%.

Just received a mail from the Streak team Sir. Seems like they have a seperate pro version for Streak which is a paid version and that is where we can test option strategies in expired contacts. I guess it also comes with algo benefits. In the free version, we can do strategies for cash market like based on MA, volume breakout etc and has a free scanner.

So could you suggest any other method to backtest option strategies? I don\’t know coding sir.

Sathish, not sure about any other platforms. Maybe you can ask for a demo of how the platform works and see it makes sense before you subscribe 🙂

Because in spread strategy we take two sides of a coin and hence there is no need to take delivery of stocks as it is nullified

Yes, thats there. If two opposing positions are ITM, then they nullify each other.

Sir, I was just exploring Streak. It says that it is free for Zerodha users. But I don\’t know as to what extent it is free. I would like to back test strategies like Iron Condors and spreads. Can I do the same with the free version, and if not could you suggest any other method?

The entire platform is free, but I\’m not sure if you can backtest strategies like IC on streak. Please do check with them once.

Karthik the current open interest for monthly 22000 strike is 57,308. Do it means that that many lots are being traded of this strike or is it 57308 ÷ 50 = 1146 lots traded ? Also if only 1146 lots are being traded then will it be a problem for a trader who wants to buy 1 or 2 thousand lots of this strike through iceberg order & then square them off the same day ?

Ah no, 57,308 is the number of lots traded.

Thank you very much for replying karthik. Actually 3 months back when a freak trade happened in bank nifty, the reason most people agreed on was that placing large orders through algo to do spoofing was the main reason. Also jp morgan was charged few years back for spoofing, that\’s why i wanted to know that how come wall street and nse are unaware of this that it\’s so easy to manipulate a strike ?? Just place large orders, cancel them & boom there you go

Ah, no..regulations are the same for all 🙂

But what can cause something like this is a large market order, which most of the institutions wont place I guess.

Hi karthik, my question is that there is a freeze order on nifty lots to buy at once, but when it comes to algo there is no such limit & algo traders take advantage of it and cause freak trades by doing spoofing, why isn\’t there any limits in algo ?

Not true, Sabu. Freeze qty cannot be breached by anyone – retail or algo. The only possibility is them placing multiple orders via iceberg or custom algos, but freeze qty remains the same.

Hi Karthik, I just want to let you know that, you and varsity team has did splendid job by providing us with such great content…Kudos man and to varsity team, Just want to ask that how to do research by own on building own trading system and learning more advanced level concepts to trade more efficiently just wanted to know how to educate ourself in this field….,

thank you….

Thanks Surya. The only thing that you need to do is look opportunities in market based on what you\’ve learnt and try to improvise on it. That way, you will constantly learn and evolve 🙂

Good luck.

Sir,

I have been a vivid follower of your discipline and have read the whole Zerodha conent during the last 10 months. I had no idea before 10 months about the capital markets. Meanwhile, except F&O, I have tasted all the areas like Day trade and Positional trading. Below are the experiences:

1. Day trades: Incurred loses consistently

2. Positional trades: Incurred profits consistently.

Coming to Future trade and after reading the content, I understood that this should not be my cup of tea since the methods require Programming skills and consistent watch. Being a full time employee, this is not getting suitable for me.

Coming to Options trade, I have learnt the modules and understood the articles and decisions that needs to be taken at various market situations. Now, since, you have been associated with this area long, what should be your advice regarding Options trading? How should I start taming this animal? I highly require your advice here.

N.B: Regarding investment, I have already created a portfolio and keep on SIPs. Have good health & term insurance.

Anirban, realising what works for you and what you should avoid in the market is a very big step. People take years before they can figure that out, I\’m glad you\’ve been able to acheive that in a much shorter time.

Options is a ok, as long you have a positional trade in perspective. Intrday and short overnight trade maybe risky and may require you to watch prices constantly, unless you are doing expiry trades. But expiry trades can be risky in terms of volatility 🙂

Sir, I checked around noon and found that puts were added heavily and consistently throughout the day. Even last 1 hour data in Sensibull showed that in net,the Calls were squared off with puts being heavily added. Futures OI change was also flat. But inspite of this, market suddenly went 30 points down. Would this be due to cash market\’s activity or something else? Thanks.

Very hard to say, Sathish. Also derivatives data is now staggered across multiple instruments and very hard to conclude based on just one are two contracts.

Hi,

Is there anyway I can enter the expiry date in this excel and all the data get adjusted automatically in it?

Thanks!

Ah no, you cant. But do check Sensibull site for this, they do have an option for selecting the expires.

Dear Karthik Sir,

For covered call for example if I sell HDFC bank 1720 CE for RS. 1.50 (Net value 550 X 1.5 = 825). Total margin required is Rs. 80000 which means cash margin is Rs. 40000. Now if I do not have the Rs. 40000 cash I would have to borrow at 12% interest ie 1% a month is covered call is a monthly strategy. Assume interest cost is Rs. 400 + transaction charges brokerage etc comes up to 430-440. So ideally the gain is 430 pre-tax (30%). You cannot even now hedge your portfolio using futures or calls since the cash requirement.

I don\’t know what the point is considering this completely destroys option selling. Option selling required huge margins, high risk low reward and now adding 50% cash compulsion makes it not feasible for anyone.

How does smart money deal with option selling as they are required 50% cash or liquid fund as margin and which basically is detrimental as that money does not get deployed and not practical to keep in bank account.

I guess we discussed this already. Yes, option selling is a margin heavy business. Another way to think about it is, if you have your own cash, you save the interest payment. Like I mentioned, think of cash as the raw material for your business of trading. No other way around this.

Hello Sir,

Thank you for your valued response.

SO how does one go about doing basic strategies like Iron Condor, covered call etc? Or should I completely stop doing the same??

This is a strange time and I am not sure the point of giving 100% collateral and then still asking for 50% which essentially makes my collateral worth 35% assuming a 30% haircut on the initial collateral?

What are the professionals and smart money doing as there would be no way they would keep so much cash undeployed in a bank account or put it in a liquid fund??

Covered call you can do, but you get margin benefit as your stocks are in EQ segment and option is in FO segment. Iron condor, yes, you need margin money, there is no doubt other way around it 🙂

Yes, regulatory requirements, no way around this as well.

They dont keep it idle, they use it for active trading, so in that sense, money is always deployed.

Reposting this incase this was missed by you sir.

Hello Karthik.

This SEBI rule of 50 % Collateral and 50% cash is effectively killing positional iron condors and any type of option selling and even killing basic strategies like covered call or secured put.

If I have pledged 1.5 crore worth of equity and after the haircut I get a 1 crore margin. If I initiate a strategy of Iron condor worth 50 L I need to have 25 L cash on hand. Who would keep that much money as cash on hand or even put it in a liquid bees as it would just be a waste?

Even basic strategies like selling 15%-20% far OTM calls for equity stocks which one owns as a covered call is useless as you need to keep that cash on hand or otherwise pay 13% interest for the entire month which each up whatever that is earned.

After all this headache you have to pay 30% tax.

The only other way to prevent this cash requirement instead of margin is to do intra-day selling which is practically useless as intraday trading is risky and you cannot consistently make money in the same.

How does one go about this?

Tanmay, apologies, I may have missed your earlier message. Yes, i do understand what you are saying, but unfortunately there is no way around this. One way to think about the cash requirement is to look at it as the \’raw material\’ for your business. If you are actively trading, then cash component is an essential part of that business.

About tax, well, what can I say about it 🙂

Hello Sir,

Any update??

Hello Karthik.

This SEBI rule of 50 % Collateral and 50% cash is effectively killing positional iron condors and any type of option selling and even killing basic strategies like covered call or secured put.

If I have pledged 1.5 crore worth of equity and after the haircut I get a 1 crore margin. If I initiate a strategy of Iron condor worth 50 L I need to have 25 L cash on hand. Who would keep that much money as cash on hand or even put it in a liquid bees as it would just be a waste?

Even basic strategies like selling 15%-20% far OTM calls for equity stocks which one owns as a covered call is useless as you need to keep that cash on hand or otherwise pay 13% interest for the entire month which each up whatever that is earned.

After all this headache you have to pay 30% tax.

The only other way to prevent this cash requirement instead of margin is to do intra-day selling which is practically useless as intraday trading is risky and you cannot consistently make money in the same.

How does one go about this?

Can we initiate position on last day of expiry (at the closing time) and keep open till next expiry. what would be the max loss and Proft.

Yes you can, P&L depends on prices.

What is difference between required margin and final margin

Vikrant, so it is SPAN and Exposure Margin that you need to look at now. Check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/funds/articles/what-is-span-and-exposure-margin

how the Rs.9,634/ premium received can you explain it

Thats what I\’ve explained in the chapter.

Otm call, put buy is rejected in zerodha(sensibull)

Please execute the sell orders first, Ritesh.

Seems like an all time winning strategy. But I am sure it must have its own limitations.

Could you please mention the scenarios in which an iron condor fails and what/how are the effect of these failing scenarios on our P&L.

More than failure, money management is the key here. You need to figure out if the cost is worth the trade.

Hi Karthik,

I was trying to execute an Iron Condor on Zerodha today. While the system allowed me to execute the strangle (short trades), it blocked me from creating the hedges (long positions) citing some 15% OI restriction rule. Is this expected or am I missing something? Pls advise.

Vishal, you must have had an open position or something else. Else, the buy should go through if you have the sells in place.

How breakeven is calculated if a new position is added to adjust an iron condor?

Assume market is going up so as a part of adjustment if I sell PE then how is breakeven calculated ?

Swanand, this can be easily computed by platforms like Sensibull. You just have to enter the relevant values and the platform computes it for you.

I have a question that is unrelated to the current topic. What is the career scope of an equity dealer? Is it considered a good career path?

You can join AMCs, PMS, AIFs etc. Ideally, it would be best if you focused on becoming an investment officer rather than a dealer. I\’ve put up 3 videos on the same topic here – https://www.youtube.com/watch?v=qI_Dr9P76Bw&list=PLX2SHiKfualEz2gJkDLFmc9WlufjfLBUx

Thanks for the response Karthik, I guess I will take a second opinion from someone outside Zerodha 😉

Yup, please do 🙂

Hi Karthik,

Do you have a view/recommendation on which tool or platform (Sensibull, Opstra etc.) is best for screening option trading opportunities, designing and deploying strategies?

You are asking the wrong person, Vishal. I\’d say Sensibull any day 🙂

Hi, great article. Say I enrolled in this stretegy on Tuesday for the upcoming expiry on Thursday. Shall I let the 4 legs(2 calls and 2 puts) expire on their own? Or do I need to watch for them time to time?

It is good to keep an eye from time to time, just to check the options have transitioned from OTM to ITM. If ITM, then you need to think through from a physical delivery perspective.

Thanks Karthik 🙂

Understood this one 🙂

Sure, happy learning!

Karthik, I kind of find it hard to believe that the ones who are actually moving the markets looking after candlesticks and indicators. or am I missing something here?

Not necessary that they are looking at CS. They could be looking at other factors as well. But irrespective of what they are looking at, their final act will manifest in price action, which we read via candlesticks. Do check this video – https://www.youtube.com/watch?v=1kQjXFL4Mfc

Hello Kartik

I really appreciate the effort that went into these modules.

However, a suggestion I\’d like to give is if it is possible to make a module on the Smart Money concept and how to form a directional bias.

Thanks, Chetan. If you think about it, entire TA is about chasing how smart money operates 🙂

why is margin more than the maximum loss that can occur in iron condor strategy?

Margins are mandated by exchanges, Hardik.

Thanks a lot for the confirmation, please update here if you find any exact figures of such scenario in live market or backtest or if you hear any such incident from anywhere. Appreciate your efforts bro 🙂

Shivam, Sensibull is your best option 🙂

Hi Karthik, your explanation is awesome. Although i\’ve understood the funda of max loss and max profit, but i still am not convinced if market opens a gap up/down of 1000 points(which is rare in Nifty) then what will happen to our position, in case of monthly expiry -> expiry day, 1st week, and middle of the month. Will i incur a loss more rhan max loss defined. And vix lets suppose reaches 20+

Of course, if there is a 1000 points gap up or down, then there will be a skew in your position and may lead to a change in the P&L. But that said, I\’m guessing the change won\’t be drastic since a strategy like IC is fully hedged.

Thank you again for quick response.

To be frank I\’m yet to go thru\’ the link.

But just a quick question, does this link also cover \’how to trade the adjustments to be made in the strategies\’?

In my view, there is no need to adjust these trades as there are 4 legs to this trade and anything more is over-engineering 🙂

Also, the cost of adjustment is quite high, so its better to avoid.

Hello there,

Great work once again!

I\’m a kind of new in options and would like to know how to execute these four orders simultaneously in a trading system?

Sumit, you can check this – https://support.zerodha.com/category/trading-and-markets/kite-features/basket-order/articles/kite-basket-orders

Sir in new website of NSEINDIA, where to find the historical data of option chain, in old website it was easy to find out. can youp please share the link.

You can click on historical data for any stock you want – https://www.nseindia.com/get-quotes/equity?symbol=INFY

Hello There,

Thank you for excellent work on these strategies.

Somehow this 14th chapter is not coming in the .pdf.

Thanks in advance.

Checking this, Sumit.

Sir, in new NSE INDIA website from where to get historical option data , strike wise and with different expiry period. in old site it was possible and easy to get……kindly help and share the link…or any website from we can trace the old data..

Try here – https://www.nseindia.com/market-data/live-equity-market

Hi,

When you use the Iron Condor, on expiry day should we close out the positions or do nothing.

Thanks

VT

I\’d suggest you close the position before expiry to avoid physical delivery, unless you want physical delivery.

Hello dear Karthik Rangappa:

Great lectures and Excel sheets!

You wrote: Max Profit = Net premium received. In this case, it is 128.45 (9634/75).

It is not clear what the 75 represents ?

Yet do you know good strategies with 8 legs for volatile markets?

It was the lot size back then 🙂

Thank you sir and Thanks to the Zerodha varsity community

Happy learning!

But sir many of other traders and websites states that indexs F&O are cash settled but you are stating that index are physically settled. I am confused a lot right now

Index is cash-settled, and stocks are physically settled.

Respected Sir,

I know stock options are physically settled but what about index options. Whether nifty and banknifty are cash settled or physically settled?. If cash settled only difference amount is credited/debited right?. If physically settled how it is possible?

Index are physically settled, Sudharshan 🙂

Respected Sir,

Let say \”I have shorted out of the money CE on Monday evening (weekly expiry) and margin blocked for this position required lets say 1.1 lakhs and exited the position on Thursday morning, will entire margin blocked for this position will be released at the time of exiting the position or only 60-80% of the blocked margin will be released at the time of exiting the position\”?

Yes, the entire margin will be released.

Please add this chapter in PDF

Will do.

True Sir. But the reason I asked regarding adjustments is because there are some OTM restrictions as imposed by sebi. In that case I\’m aware that I have to execute the sell order first followed by buy order to avoid the nudge. But that takes away the purpose of margin benefit right? This is difficult especially in case of banknifty, as the range can be vast. So any solutions for this sir?

– Also would iron condor be a good strategy in case of stock options as well since it\’s a 4 legged strategy?

I get your point, Sathish. Let me thing through this. IC usually works well.

Also I\’m having a long time confusion on an aspect. Hope you would help me with it. I\’m aware that BANKNIFTY can drag NIFTY up or down. But is the inverse of this situation possible considering only NIFTY contains major bank stocks, but BANKNIFTY doesn\’t have enough concentration on stocks of NIFTY other than banking stocks?

Simply put, can NIFTY drag BANKNIFTY ?

Nifty is the overall market, so weakness in the overall market impacts bank nifty and other stocks/indices as well.

Sir what about adjustments?

Eg – NIFTY is currently at 17953. So considering this I construct an iron condor as follows,

Sell – 18000 CE, 17800 PE

Buy – 18100 CE, 17700 PE

Now lets say spot moves near 17800 and the lower breakeven is around this. Assuming that I think the spot can move upto 17750 – 17700, can I adjust the strategy by squaring off the 17800 PE, 17700 PE positions and opening up new positions in 17700 PE and 17600 PE, provided I get the right balance?

Not a big fan of adjustments, Satish. It is expensive and a constant fight to keep up with the changing deltas. Besides, why do you want to over-engineer an already well-engineered strategy?

Dear Karthik Rangappa Sir!

When we initiate iron condor strategy and for any strategy for that matter, the general idea is to keep the set up till the expiry day. Am I correct?

At the same time, I have the freedom to dismantle the setup any time before the expiry provided I arrange for the margin requirements. Is that correct?

Yes, that\’s the idea, but as you said, you can dismantle or square off the setup anytime you wish.

I like the way you used the word \’dismantle\’ in the options spread context; I guess I\’ll borrow that from you 🙂

Since we are expecting the premiums to come down during consolidation and profit from it in case of Iron Condor, we need theta factor to work in our side. So is it better to choose a second series expiry or anything which is going to expire sooner for this strategy rather than a beginning one? Or am I missing something?

Its always a tradeoff, if you choose further expires, you get higher premiums. Series which will expire soon means lesser premiums.

Dear Karthik Sir,

What is your suggestion this iron condor will suit for weekly/monthly positions or for Intraday??? Please guide us….

These four leg strategies could be overkill for intraday, Brama.

Regarding to the trick question, in spread we long and short options in equal quantities where as in put call parity arbitrage, we long a call option +short a put option + short a future option. So that extra short future increases the risk of portfolio for broker as well as for exchange also, thats why spread has higher margin reduction as compare to put call parity arbitrage. Although, the in put call parity arbitrage is very tiny.

Thanks😊😊

Correct me please if i was wrong

Yup, good luck, Abhishek 🙂

NEED TO LEARN MORE HOW TO SELECT A TRADE AND ENTER , HOW TO BUY INSURANCE , HOW TO SHIFT POSITIONS AND WHEN TO EXIT .

I AM KAMLESH SHAH FROM MUMBAI. 9820073106 IS MY CELL NUMBER. KINDLY CONTACT ME IF YOU CAN TEACH ME HOW TO TRADE IN LIVE MARKET. YOUR FEES SHALL BE PAID SIR.

Everything we know is already discussed here Sir.

Hello Karthik thanks alot for such a wonderful content, can you please add articles about specially for expiry day trading and expiry day trading strategies

Noted, will try and make a video on this sometime soon.

Hi Karthik, reading your articles was so very exciting. With very limited understanding of computers, I tried to build a payoff diagram for Iron fly Strategy which I couldn’t. Can you please upload the excel sheet for ‘Iron Fly’. Thanks in advance.

Sure, I\’ll try and do that soon.

will I be paying 4 brokerages for four legs and what about while exiting. With limited profit and charges plus STG tax what I am left with miniscule subject to getting profit. am I right

Since there are four legs involved, you pay brokerage on all four legs. Hence, you need to evaluate the situation (spread) and figure if the trade is worth executing or not.

Hi sir. The steps of entering ( the sequence of order execution ) an Iron Condor is explained. What is the sequence of exiting the iron condor before expiry

You can exit the positions for which you pay margins and those for which you pay the premium. Basically shorts first, longs later.

sir im new comer so a question coming to my mind, that after observing and studying this module It seems that most of these strategies are only useful when you are about to hold the trade till the expiry But if you do scalping or intraday or swing trade its not much of use (except for hedging).

Thats right. If you are scalping, you are better off trading naked positions or even futures rather than a spread position.

Why is margin required for Iron condor not equal to Maximum possible loss?? In this case shouldn\’t Margin be 5366 instead of 44k?

What if you remove the hedge of an iron condor and break the spread? Also, the margin is a function of SPAN calculations.

Hi Karthik,

For-profits as mentioned in the table should I have to wait till expiry or can exit before as welll ? Currently my stock is in the range however profit is minimal , way lower than projected

You can exit anytime you wish, Amit. No need to wait till expiry.

Hello Karthik, according to you which strategy is better Iron Condor or Iron Butterfly?

If both are similar, then how to choose between this two?

I prefer the condor 🙂

\”The sequence of trade execution makes a big difference here. If you are considering an iron condor, then here is the trade sequence – Buy the far OTM call option\”

Unfortunately these days, I believe this is not allowed. What is the best workaround to this?

YOu can sell the options first and then buy.

What will be the brokerage and other charges any tentative figure ?

It is 20 per executed order. More details here – https://zerodha.com/charges/#tab-equities

Dear @Karthik,

Thanks again for lucidly explaining the Option strategies..But can you include Certain key strategies like Calendar/reverse calendar,Iron Fly ..as these are highly relevant in the given market…

Awaiting your input,

Rajiv

Noted, maybe I\’ll try and do a video on this.

Try using the include existing positions.

HI SIR ,

Today at 9-21 I create basket order I added 38500 CE to short in NRML it got added but when I added 41000 CE as a hedge zerodha NUDGE POP UPS u cannot go for NRML . U said [ As long as you have your NRML shorts in place, you can also have NRML longs ]. but its not happening

Hi Sir ,

In that video he buys 3000 pts DEEP OTM OPTIONS IN NRML . For option selling its possible to get NRML but for option buying i did not get it . If you still do not understand what i am trying to say you can watch the mentioned video [ https://youtu.be/R8wEjB2HEyg ] . In which he buys

As long as you have your NRML shorts in place, you can also have NRML longs.

Hi sir

ANSWER NEEDED

On 4 October POWER OF STOCKS in YouTube posted video named learn from my loss in which he sell 37500 CE for hedge

U buy 40500 CE . My question is how can anyone get 3000 points Hedge in NRML because when I tried in ZERODHA a pop up comes saying it\’s not allowed as per sebi rules to go for NRML u can take it in intraday but can\’t convert into NRML

It is an open interest restriction. Btw, you can sell the option first and then buy. You wont have any restrictions that way.

My queries please

1.Best time to enter into Iron Condor

2.What does Unlimited Loss actually means – I mean if underlying is going out of Break even on either side can we exit the sell position and limit the loss.

3.Is there any criteria for premium receivable and paid.

1) Its not time-based, its a situation based. So look for whats happening in the market and deeply to IC if the situation demands

2) Yes, you can always do that and your loss is restricted to the price at which you exit

3) No criteria as such

Can you please make a study material on how to adjust straddles and strangles

I\’ll try and make a video on this, Pranav.

suppose i have created a short strangle at the starting of the month considering that market will expire in between the range.

but i want to convert the short strangle into iron condor after 20-25 days to limit my losses because at that time i can have the clear picture where the market are about to move.

1) is it possible to convert already purchase short strangle into iron condor afterwards?

2) if yes, then my net credit should be calculated by considering latest premium of sold CE,PE or the premium value at a time of sold(i.e month starting value) ?

1) Yes, you can convert by adding the other legs of the condor

2) You will have to consider the value you pay/receive from the recent legs (to make the condor) and the premium already paid/received from the previous legs.

Hi karthick

I am unable to put the learning to practise ,whenever i do,i am ending up in loss.can you please suggest me ways to resolve it

Where are you getting stuck? Which part? I can try and help you with that.

Hi Karthik,

Can you please work on Leaps Options

Noting this down, maybe in future.

Hi Sir ,

I have a query. Today 5/9/22 at 9:50 5 min Candle Closing Bank Nifty spot was trading at 39697 i shorted 40000 PE at 522. At 10:15 Bank Nifty spot on 5 min candle make a high at 39823 and my PE make a low of 457 same time 10:15 5 min candle . My question is when I enter my PE was 300 points ITM and on 10:15 it\’s was 200 points ITM so my PE should have eroded atleast by 100 pts but why it eroded only by 65 rupees.

The premium is a function of many different variables, not just the direction (delta). At the time market direction changed, other variables also change right – like speed, vega, time etc?

how to calculate Upper Breakeven point and Lower break even point?

Dont know how I missed adding that bit here. I will try and make a video on this, but for now you can check Sensibull for BE points.

Pl clarify that in iron condor strategy,I have to purchase both call and put option at the same time and similarly write both option at the same time other wise premium calculations will change.

Pl detailed

Yes, and you can use baskets to do that.

Hi Karthik Sir, hope you are doing good!

One clarification

For example if required margin is 100000 and final margin is 40000

40000 gets blocked..right?

Can we use remaining 60000 for trading other stocks.

Yup, you can.

Please do a module on Algo trading; it\’s been pending for so long. Meanwhile please guide me on how do I get started on it given that I have required coding skills in python. I have been trying so long to find a solution where I can get all the basic knowledge to help me get started but most of it is paid and very expensive. Even a short 3-hour course on NSE costs upwards of 5 to 6k rupees. Please do help, I\’ve been stuck at searching for resources for so long…I just want to get started with learning.

Shaib, why don\’t you try simple strategies to begin with? Something like a moving average crossover system.

Dear Sir,

Accept my heartiest gratitude for this wonderful information. I am into stock market for more than 20 years and have read many many books. What i had got was bits and pieces and still felt something is missing. But you presented all this information in very logical and systematic manner, which is more useful than around 25 high profile writer(s) book. Awesome.

Thanks a lot.

Venkat Das

Venkat, thanks for the kind words. I\’m really glad you liked the content here. Happy learning 🙂

Yes I may put SL at 2.5 or beyond but if by chance SL got hit even once all gains may be erased. Is there any way I can make adjustments to my positions in case market goes against me?

Adjustments is not easy, come with its own costs, and whatever you do, the charges will pile up.

Sir I don\’t know what\’s wrong with me. Initially I was trading on 1.5 SD, hit loss. Then now I started 2 SD Iron condor. After 1 month I hit loss again. Loss is not problem but loss is so big that it surpass all the profit accumulated over time and it takes more than that. When I look back at my P/L report either I am zero or in loss. I don\’t know why is this happening. And I am like well I haven\’t earned anything over these months!

Any specific reason or anything I am missing on? I do check calculations 3/4 times and Sensibull also shows SD levels which matches my calculation with some slight buffer. Today I squared off my 2 SD Iron Condor on bank nifty. Got hit in PE options. -5.5%

Dhananjay, it is very hard to figure out what is going wrong. Maybe you\’ve picked a volatile stock or for that matter indices too are volatile. By the way, I\’d prefer SL at 2.5 or beyond and definitely not 1.5SD.

Hello sir,

I am newbies and trying to understand trading… I tried some option buying but most of are in loss… Can\’t say all in loss… Now today I got to know about this strategy… Will try once and then if have any query will send here… Thanks for provide so informative strategy…

Happy learning, Pradeep. Maybe you can paper trade for a while before deploying your own funds.

Thank you sir! I will just go ahead with what I need to do right now. It seems path will get clear with time

Sure, good luck!

This might be my repeated question but I am really not getting path to get starting to learn quantitative trading. Here\’s what I understood

– Mathematics and statistics

– Computer programming

Then what? When I will learn these two things, what next? Is there anything other domain I will need to learn or do I have to practice same things? Do you know any quant from India whom with I can connect (May be not now but sometime in future)

Its just that actually 🙂

A combination of Math+Stats+CS is applied to markets. There are plenty of people who are doing this in India.

Can i exit one of the positions out of four. will it impact my margin requirement.

Yes, that will have an impact on your overall margins.

@ Karthik Rangappa sir pl can you explain how effect of time chart (for various expiry days) can be created in Excel sheet

Mahesh, as far as I know, this was rendered in R software. Not sure how this can be done on excel.

Hi Karthik,

I am new to trading and had a quick question.

If my iron condor setup hits breakeven in any direction before expiry, can I square off all positions at zero loss or will I incur some losses?

Yes, you can square off the position, no need to wait till expiry.

do we need to put stoploss in ironcondor positions sir??

Not necessary in my opinion.

However, delta neutral strategies seems interesting to me. Will delve more into it!

Sure, good luck!