1.1 – Overview

Fundamental Analysis (FA) is a holistic approach to study a business. When an investor wishes to invest in a business for the long term (say 3 – 5 years), it becomes essential to understand the business from various perspectives. It is critical for an investor to separate the daily short term noise in the stock prices and concentrate on the underlying business performance. Over the long term, a fundamentally strong company’s stock prices tend to appreciate, thereby creating wealth for its investors.

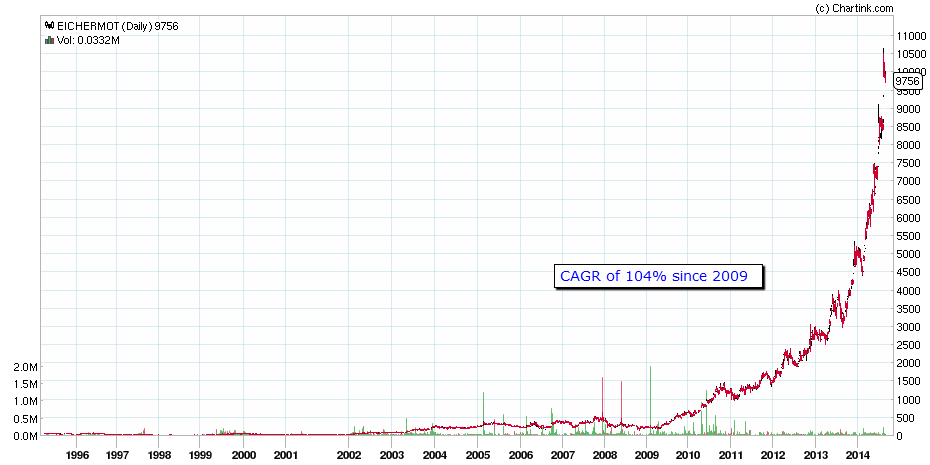

We have many such examples in the Indian market. To name a few, one can think of companies such as Infosys Limited, TCS Limited, Page Industries, Eicher Motors, Bosch India, Nestle India, TTK Prestige etc. Each of these companies has delivered an average over 20% compounded annual growth return (CAGR) year on year for over 10 years. At a 20% CAGR, the investor would double his money in roughly about 3.5 years to give you a perspective. Higher the CAGR faster is the wealth creation process. Some companies such as Bosch India Limited have delivered close to 30% CAGR. Therefore, you can imagine the magnitude and the speed at which wealth is created if one would invest in fundamentally strong companies.

Here are long term charts of Bosch India, Eicher Motors, and TCS Limited that can set you thinking about long term wealth creation. Do remember these are just 3 examples amongst the many that you may find in Indian markets.

At this point, you may think that I am biased as I am selectively posting charts that look impressive. You may wonder how the long term charts of companies such as Suzlon Energy, Reliance Power, and Sterling Biotech may look? Well here are the long term charts of these companies:

These are just 3 examples of the wealth destructors amongst the many you may find in the Indian Markets.

The trick has always been to separate the investment-grade companies which create wealth from the companies that destroy wealth. All investment-grade companies have a few common attributes that set them apart. Likewise, all wealth destructors have a few common traits which are clearly visible to an astute investor.

Fundamental Analysis is the technique that gives you the conviction to invest for a long term by helping you identify these attributes of wealth-creating companies.

1.2 – Can I be a fundamental analyst?

Of course, you can be. It is a common misconception that only chartered accountants and professionals from commerce background can be good fundamental analysts. This is not true at all. A fundamental analyst adds 2 and 2 to ensure it sums up to 4. To become a fundamental analyst, you will need a few basic skills:

- Understanding the basic financial statements

- Understand businesses concerning the industry in which it operates

- Basic arithmetic operations such as addition, subtraction, division, and multiplication

This module’s objective on Fundamental Analysis is to ensure that you gain the first two skill sets.

1.3 – I’m happy with Technical Analysis, so why bother about Fundamental Analysis?

Technical Analysis (TA) helps you garner quick short term returns. It helps you time the market for a better entry and exit. However, TA is not an effective approach to create wealth. Wealth is created only by making intelligent long term investments. However, both TA & FA must coexist in your market strategy. To give you a perspective, let me reproduce the chart of Eicher Motors:

Let us say a market participant identifies Eicher motors as a fundamentally strong stock to invest and therefore invests his money in the stock in 2006. You can see the stock made a relatively negligible move between 2006 and 2010. The real move in Eicher Motors started only from 2010. This also means FA based investment in Eicher Motors did not give the investor any meaningful return between 2006 and 2010. The market participant would have been better off taking short term trades during this time. Technical Analysis helps the investor in taking short term trading bets. Hence both TA & FA should coexist as a part of your market strategy. In fact, this leads us to an important capital allocation strategy called “The Core Satellite Strategy”.

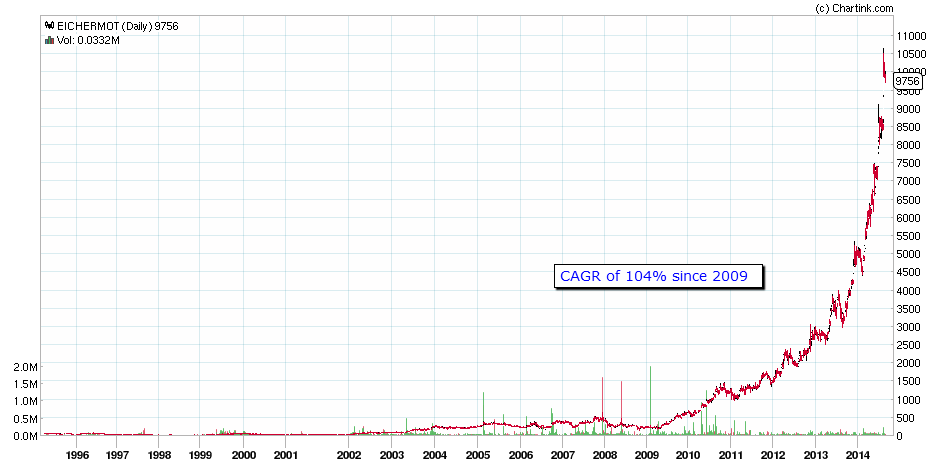

Let us say, a market participant has a corpus of Rs.500,000/-. This corpus can be split into two unequal portions; for example, the split can be 60 – 40. The 60% of capital, Rs 300,000/- can be invested for a long term is fundamentally strong. This 60% of the investment makes up the core of the portfolio. One can expect the core portfolio to grow at least 12% to 15% CAGR year on year basis.

The balance 40% of the amount, which is Rs.200,000/- can be utilized for active short term trading using Technical Analysis technique on equity, futures, and options. The Satellite portfolio can be expected to yield at least 10% to 12% absolute return every year.

1.4 – Tools of FA

The tools required for fundamental analysis are fundamental, most of which are available for free. Specifically, you would need the following:

- The company’s annual report – All the information you need for FA is available in the annual report. You can download the annual report from the company’s website for free

- Industry-related data – You will need industry data to see how the company under consideration is performing concerning the industry. Basic data is available for free and is usually published in the industry’s association website

- Access to the news – Daily News helps you stay updated on the latest developments in the industry and the company you are interested in. A good business newspaper or services such as Google Alert can help you stay abreast of the latest news

- MS Excel – Although not free, MS Excel can be extremely helpful in fundamental calculations

With just these four tools, one can develop a fundamental analysis that can rival institutional research. You can believe me when I say that you don’t need any other tool to do good fundamental research. In fact, even at the institutional level, the objective is to keep the research simple and logical.

Key takeaways from this chapter

- Fundamental Analysis is used to make long term investments.

- Investment in a company with good fundamentals creates wealth.

- Using Fundamental Analysis, one can separate an investment-grade company from a junk company.

- All investment-grade companies exhibit a few common traits. Likewise, all junk companies exhibit common traits.

- Fundamental analysis helps the analysts identify these traits.

- Both Technical analysis and fundamental analysis should coexist as a part of your market strategy.

- To become a fundamental analyst, one does not require any special skill. Common sense, basic mathematics, and a bit of business sense are all that is required.

- A core-satellite approach to capital allocation is a prudent market strategy.

- The tools required for FA are generally fundamental; most of these tools are available for free.

Sir, we need a module on Global macroeconomics and Capital flows

( How RBI, Fed, goverment policies, international trades, geopolitics affect the market/economies ).

Just for curiosity.

Noted. Will try and this 🙂

very goog suggestion

Dear karthik,

1. It seems silly, but still i have doubt. Say suppose a company is listed in market. say on april 1st, its share price is 250. after the finacial year end the share price is 300. say have owned 5000shares of that company. what i feel is that the share of any company for that matter is independent of the profit it is making. say it has made a profit of 50cr in last year. but, it does not provide divident or bonus of its share holder. then where is the profit for me being a share holder. and if in case it has given divident or bonus also as soon as it is disbursed the share price gets lowred right?

2. you might say that this divident itself is your profit, but look here. this year the share prices of almost all the stocks are lower than thier start i.e., apr 1st price. does this say that the companies have not made any profit. no right. what do the company for the share holders this year? if divident then as sson as it is given again the share price will fall???

3. say a company is willing to make an investement of 100cr on assets. from where do they bring this from? ours only right? means last/last few years profit has been set aside for investement? if that is the case then why do they they take the depreciation into account in the upcoming years.(Any one should be there right).here they are cutting i twice. i.e., when calculating the net profit they are cutting the depreciation and in the net profit also they are keeping some money aside for future investement. am i right??

1) Profit sharing with shareholders is via dividends and bonus issue. Otherwise, the gain if only via capital appreciation.

2) Well, thats why equity investing is risky. There are no guarantees here.

3) Hmm, its not entirely \’ours\’, it could also be fore internal accruals. Also, depreciation helps in bottom line of the company, its an accounting expense and added back to cashflow.

Sir i only want to trade in equities as intraday or swing trader for now, I don\’t want to invest for long term and i am not interested in futures and options as of now. so for now i completed for first two chapters what are the remaining related chapters i need to know.

Then you need to understand how markets function, how to place orders etc and technical analysis. If you are comfortable with both, then you can start placing small trades to experience the market.

Sir if i want to trade in equity market only currently what are the related modules for it .I completed first two modules at present.

Everything on Varsity is related to Equity markets.

Team,

how to know stock falls under which sectoral indices ???

big question asked to many without any answer

Can you please put focus on it

Its mostly intuitive right? A bank stock would fall under a banking sector, FMCG company under the FMCG/Consumption sector, Software companies under IT sector etc.

I am passionate about the stock market, and I am loving this course. Thank you Karthik Sir!!!!

Thanks for the kind words, Anvesha! Happy learning 🙂

Starting My Journey Today ,

Great Content Karthik Sir!!!

Wishing you the best, Joseph. Happy learning 🙂

Certainly, sir. I will keep this in mind. Thank you for your valuable time.😊

Happy learning 🙂

First of all thankyou for the effort you put into this , its been really helpful for beginner like me. the way of put the all this complex topic in such way, just awesome. Since I started my journey by following your design framework, I like to have some advice regarding my training. sir I\’m able to join one of top Brokerage and trading firm of our state. Sir my goal is to became a Trader, with expertise in Technical and fundamental but don\’t know what was is my priorities to learn that, because in that firm there are many people , persons with different opinions so I decided to learn from you. what will be my framework for it or correct way to follow the path. your response is really useful for my future endower. Thankyou for your time and consideration.

Vijay, congratulation on your new job. One thing you can do, especially with TA is to start practicing. Start applying your learning to markets and start taking trades. Make sure its not a big amount you are trading with. The idea is to validate your learnings. I think this real practise session itself will teach you many new things are market.

thanks for this resource, Really appreciated.

Happy learning!

Was there a change in the fundamentals of Eicher Motors in 2010 that led to the stock increase? Also, how can a fundamentally good company not grow for 4 years? (considering a good fundamental investment is for a time horizon of 3-5 years)

Perhaps the fundamental goodness was already factored in by the market?

Please remove tijori appfrom your app previous was good but this is not good as it is not understandable please fix this problem as previous platform was proving better clarity than tijori ,

What is the ideal values for Operating profit margin, return on equity, profit after tax margin, interest coverage ratio, debt to equity ratio, price to sales ratio, price to book ratio and price to equity ratio for maximizing profit?

There are no benchmark values like this, they all vary for different companies, different sectors. One way to look at it is to see what the industry average is and then look at the company\’s value in specific. By that, you will get a perspective.

Really good article

Glad you liked it. Happy learning 🙂

It will be great if you can add option to highlight important points

There is key takeways at the end of the chapter, Siddharth.

Dear Sir, Thank you so much for sharing all this detailed information with us which will be useful for all the earners like me for the years to come. Sir I just have one humble request, if you can guide us on how we can study and research the companies using the modern tools that we have now, such as ticker-tape, screener.com, etc so that we can short list the stocks for long term investing, or find about the good growth companies. If you have already shared this knowledge then please let me know where do i access that from. your sincere student, jitu.

What we have discussed here are essential principals and core fundamental concepts. Portals like ticket tape, screener, or Tijori helps you extract the information. Not sure if we can delve into explaining how to use such portals. But let me check if there is any material on that.

dear kartik sir, your exlainations are wonderful. so easy to understand. its really becoming interesting to read and learn from varsity. Thanks so much to you and your team.

Happy learning, Doctor 🙂

Sir,

Will you add a Reference and Resource Section and further reading section

If the Varsity is in Kannada it would be good.

I\’d love it too, but its too difficult to make this in regional languages.

In chapter 1.4 – Tools of FA, librecalc included in libreoffice may also be mentioned, which is an open source & free tool which can be used instead of MS Excel.

Yup, at that point I was using only MS excel, so recommended just that. But you certainly can use opensource software.

i love you sir

We love you too 🙂

Where will i find the indusrty releated data in Internet?

There is difference between \”trader\” and an \”investor\”.

How can a investor make a living if the said has parked their money for a longer period of time. How he/she may manage their daily expensis (Considering stock market is the only source of income)

I have changed my stream from core mechanical engineering to finance and would like to know how an investor can make a living out of stock market.

Thanks in advance!

It depends on what kind of investor you are. I know many large investors live off company dividends, but their investments in such companies is quite a bit. Otherwise, it is not possible for ppl to make a living from investments.

Thanks sir for this erudition of fundamental analysis .

My question arise from the 4th point of tools of F.A

How ms excel can be used as fundamental calculation in F.A

Can you please answer with an example?

You will get an idea in this module 🙂

https://zerodha.com/varsity/module/financial-modelling/

Simple and very clear explanation

Thanks for the effort

Happy learning, Basim 🙂

I have read module 1 i.e basics now can i start with fundamental analysis directly without reading technical analysis?

Beautifully Explained, And if Chat GPT is opened in a new tab, this is really interesting to learn !

Thank you for creating and wonderfully compiling all the information in an easy to understand language!

Can you tell which CAGR you are referring here? Income / EBITA ? Where I can generate such charts?

Check Tijori Finance, Leena – https://www.tijorifinance.com/timeline/all

how?

Sir , As a intraday trader I required to know about fundamental analysis??????

Not required, but it harm if you do 🙂

Thanks Karthik for arranging the information in a simple and understandable way. Really helped me in understanding the concepts

Great read for newbies to stock investing

Glad you liked the content, Rakesh. Happy learning 🙂

Hi Sir , Like where can we find the smallest to biggest news related to the market in Depth which is easily understandable.. Please Sir , tell us some sources !

Check this Vishwas – https://pulse.zerodha.com/

A huge bow to Karthik Rangappa and to the whole Varsity team for providing such a decorum, as an adolescent I\’ve owned some of the destructor business you mentioned above without having zero FA-TA knowledge so this write-up is a enormous roadmap as for me. Thankyou

Thanks for the kind words, I hope you continue to enjoy learning on Varsity 🙂

In versity app. There shall be a provision for highlighting a specific line, numerical or etc. For better summarizing our reading & taking notes. Is it possible?

Anyhow, this is a very good tutorial.

Thanks a lot .

Thanks Mohan. Making a note of this. But there is a bookmark feature which you can use.

Please provide Hindi pdf.

very very useful videos thank you

Glad you liked it. Happy learning!

helpful thanks

Happy reading!

After Announcemet of corporate actions like split, issuing bonus shares; is there any specific duration in which it would be completed. (or)

What is the duration between announcement date and record date ? is there any policy it would be done in specific duration or it depends on Company?

There is, Pavan. Its just that I don\’t have that info handy for you 🙂

Hello Sir ,

First of all thanks a lot for this beautiful and organized course .

I am a collage student and I have a bit busy schedule , so I decided to skip the technical analysis part and focus more on fundamental analysis , but the course first covers technical analysis . Can I follow zerodha varsity for fundamental analysis directly ?

Thank You

Yes, Atharva. Both are independent topics are not really related. Good luck.

Concepts nicely explained for a layman to understand. Thanks for sharing your knowledge and expertise

Happy learning!

Thanks for you guidance sir 🙂

Happy learning!

Hello sir ,

How can we compare corporate bonds and know about their risk involved and find the right one as per our risk appetite and desired returns

I\’d suggest you look at the Mutual funds module, have discussed this.

Hello Sir

I have query that if I complete any of the goven modules in Varsity, how will I be able to take the quiz for achieving a certificate?

Parul, you will have to take the quiz and certification on Varsity app.

Dear team Zerodha,

Thanks for making available this reading material pertaining to fundamental analysis. The explanation is in a lucid manner and simple enough for even people from non-finance background to grasp the underlying financial concepts really well.

Happy learning, Sanjay!

Hi Karthik,

for getting the latest news about the companies. Please mention some good tools or websites those are helpful.

You can download Zerodha Pulse on both Android and iOS.

If we are a long term investor can we skip Technical Analysis and start with Fundamental Analysis

Yes, you certainly can. But TA is also good to know, may help you at some point.

Very much useful for beginers.

Also everyone should have this knowledge before trading .

Appreciate your effort

Thanks guys.

Greg from Navi Mumbai

Happy learning, Greg 🙂

Thank you, Karthik. How can one stay updated with all the new good financial blogs and/or magazines like Value picker, value research etc?

Try RSS feeds if they have one. You can follow us on Twitter to be updated about our activity.

Thank you Karthik for putting in all the work. Have some questions,

1. Is there any value investor club present in India which publish value-stocks / good-businesses? These resources help you to start research on stocks that are meaningful as others are eliminated. I understand that we will have to carry fundamental research anyway.

2. As there are a lot of great value investors in US, and resources that are present there(like Berkshire newsletters) Does it make sense to start value investing in US? I understand accounting policies and all would be different and would require learning.

1) Not sure Mohit, but I think there could be sub-groups within the Value picker forums, maybe you should check that. Also, check the Moneylife network for this

2) From what I understand, finding value in very difficult. But I could be wrong, I\’ve got 0 experience in the US markets.

I am beginner in the stock market and I am interested in investment, will these documents help me?

Yes, it certainly will help.

Respect for company grows after every line of reading !

Thanks and happy reading, Kishan 🙂

An alternative to excel is Libre office spreadsheet. Almost equal to excel for the intended work of FA

Yes, but I\’ve not really used it, so cannot comment on it.

Good Introduction of the Subject with purpose of study for FA

Happy learning, Tulasi.

If I would want to know the CAGR of the stock then how do I find it. Please advise

Lots of websites publish this information Gaurav. Please do look around.

Sir why don’t you believe in technical analysis as much as fundamental , The returns in options are far superior than that of value investing. If Investing is superior, is it even possible to make a career trading in the markets?

I like both the techniques, just that I have a soft corner for FA 🙂

Thank you. This is motivating.

Happy learning, Sandesh!

Ok Sir. Thanks.

Hi Sir, coming back here after a brief time, just wanted to ask whether Zerodha or True Beacon hires candidates in research area for entry level role ? Where can I forward my resume for the same ?

TB probably does, not Zerodha.

Zerodha varsity is the best platform for digital financial literacy. Special tha ks to Mr. Karthik for keeping the concept in lay man language.

Thanks for the kind words, Jay! Happy learning 🙂

is it necessary to have good knowledge of Technical analysis for getting fundamental analysis knowledge?

Not really, both are different.

Your Explanation and crisp and clear. A huge Thanks for your work 🙂

Happy learning, Manju!

valuable lessons

Hi,

I am not interested in trading and dont want to split corpus into 60, 40 respectively. I just want to invest long term 100% like 10 years +… do i still need to have technical analysis abilities?

Nope, you dont need to learn TA for that.

First upon nanu zerodha ge dhanyawad galannu helali ichhisuttene ,estondu completed aada marketing Annu istondu sarala bhasheyalli barediddarala,so I want TA&FA are to be let\’s more details like maping, statistics etc.

Thanks for the kind words 🙂

Happy reading!

Why mobile version content is different from PC content

No, not really. It\’s the same content broken down to small bite size content.

Hi Karthik

Considering working professionals might not have time daily for short term trades, is it a safe bet if we go only for long term wealth creation investments? What is your opinion on the same?

There is no term called, safety in markets, but yeah long term is better than short term.

Thankyou in advance😊😊😊

Happy reading 🙂

Hello sir I am a 7 year old kid and I wanna know that if i want a great profit should i go to be a long term invester or a short term one………..

And if a short term invester could u pls explain why😊☺

Woah! Are you sure you are 7 years old? I\’m amazed!

You need to be a long term investor 🙂

Hi Karthik, Unable to find annual report of OIL INDIA LIMITED neither in its website nor in NSE website. What can i do?

Can you do a generic google search? You will find the link from BSE.

Hi. If I have shorted a scrip but it has hit UC, what would be the implications with the fund balance. I had 32K as my fund balance while I experienced this scenario on Thursday. I\’m yet to see any margin reflected back in my account. Request info in this as to what is this scenario and its recursions?

The position will hit an auction and you\’ll have to buy it at a much higher price. I\’d suggest you please speak to the support desk for this.

Hi Karthik, I have a thought . We can achieve 0.25% returns per day on our investment(intraday) using technical analysis . after adding up this small percentage together we can achieve 75% before charges and i think ~60% return after removing charges. For the same .25% return we can accumulate ~27500% for 10 years and ~7500000% for 20 years. Can this idea of doing intraday trade and earning/ Accumulating wealth sustainable for long term?

No, not possible.

Hi Zerodha team,

If we check stock trade price retrospectively and cross validated with NSE data, there is huge difference between the prices appearing in yours graph and actual price on any historical day (2-3 year old date).

For example: I bought Motherson Summi stock at 313.40 on 13th June 2018 but if now I check the price, yours graph says that on that day this share was traded in 206-209 price range. Even I checked the value on NSE site and found that 313.95 was open price and 309.40 was close price. How come its possible?

Either I am missing something or there is some technical error.

Such a gross difference is not possible. I\’d suggest you call our support for this and get this clarified. Thanks.

Sir,

I am new to stock market.I am in learning phase so at present i have invested a very little amount in direct equity. I want your view on mutual fund investments regarding Lump-sum and SIP. Sir i have studied performance of various mutual funds and made a plan to invest 30% of my corpus in Large Cap, 20% in Index Fund ,20 % is large&Mid cap and 30% in small Cap. Sir i am of opinion that i should invest in these MFs in lump-sum to maximize the return. I have developed plan with respect to benchmark indices MFs are following to invest at different levels. Sir kindly give your view on it. Will lump-sum be beneficial over SIP or should i re-access my strategy?

I have heard about this website from a friend and i am in the process of learning FA. Till that time i am investing in MFs only through Zerodha Coin.

Large-cap and index fund is like of overlap, I\’d suggest you stick to index funds. If you have 100 to invest, start with 50 lump sum and then keep sipping. MF is a great way to invest, so please get started on it 🙂

Good luck.

Thanks a ton Karthik !!!

Welcome!

Hi Karthik,

Your explanation and notes are simply superb! Precise and to the point, very well explained. I\’m very thankful to you for this.

Taking fundamental analysis further, Karthik can you please solve this query for me. There are 2 US Rates mentioned below.

Where can I find the Indian Rates for the same? Also Is there any website I can refer to find these current rates every time.Your

Help is greatly appreciated. Thanks!!! 🙂

1.20 AA Corporate bond Rate %

2.Discount Rate 10y fed note %

Yes, it is avaible here – https://www.rbi.org.in/ , look at current rates on the right-hand side.

Thanks for the courses. TA course was an awesome one.

Team Zerodha. Keep Innovating.

Cheers.

Happy learning!

कृप्या हिंदी भाषा मे उपलब्ध कराएं

Thanks to Team Zerodha

हम इस पर काम रहे हैं, कह भी जल्द ही उपलब्ध कराया जायेगा।

Dear Sir,

Where should we get CAGR data of all Nifty stocks.

Thanks in advance.

Vidyadhan Gedam

CAGR of what?

\”Deferred Tax Liability’. The deferred tax liability is basically a provision for future tax payments. The company foresees a situation where it may have to pay additional taxes in the future; hence they set aside some funds for this purpose. Why do you think the company would put itself in a situation where it has to pay more taxes for the current year at some point in the future?

Well this happens because of the difference in the way depreciation is treated as per Company’s act and Income tax. We will not get into this aspect as we will digress from our objective of becoming users of financial statements. But do remember, deferred tax liability arises due to the treatment of depreciation.\” Is deffered tax liability already incurred taxes but not yet paid? Or is it different? Pls. enlighten me. Thank you.

Think of it as a suspense item, it may or may not be required to pay. The company would be working on clarity and if they are required to pay, then they would have buffered for it anyway.

Thanks a lot Sir, for providing the valuable information.

While accessing the varsity through phone we do have 3 levels of Information(for Beginner, Intermediate and professional ), where do we get those options while accessing through laptop.

That\’s the app, Kumar. We don\’t have such distinction on the web version.

Sir, Please suggest me a good news paper for FA.

HBL.

Thank you,

I was looking for information on these all over internet. I appreciate for your patience and time to make this.

Happy reading, Praveen.

Sir, do Indian markets follow the GICS, if yes then where can we get the data for classification and if no which classifications standards are used

Ah, I\’m not sure about this. Maybe you should explore this – https://www.niftyindices.com/

Thanks Karthik for quick reply. When the pdf versions for chapter 11 & 12 are going to release?

Module 11 will be available when its complete. Not possible for 12.

Hi Karthik,

I am looking for \”pdf\” format downloadable files for modules in Varsity. Where i can download it? I cannot see any \”download as pdf\” button.

Please Reply.

Scroll to the end of the page and you\’ll find the PDF download option. https://zerodha.com/varsity/module/fundamental-analysis/

We don\’t have the PDF for module 11 and 12.

Sir how can we get the hard copy of annual report of any company?

You will have to contact the company directly, Gaurav.

Thanks ……

Can u just explain in brief how to read a finance newspaper in an efficient way to get maximum useful news out of it

Gaurav, here is a simple trick – try and make a list of journalists who write meaningful articles and follow them on Twitter. Whenever they write something new, they usually tweet about it. It does not matter which publication. So you kind of curate your own news feed this way.

Sir that is what i am asking how to track the company apart from annual reports

I usually set the company\’s name in Google alert. Any developments will appear on the google alert.

Sir suppose we started studying a company.

Then after doing fundamental analysis we found the company suitable and we buy the shares of that company.

After that how we can track that company and that sector on a periodically basis other than annual and quaterly reports

You will have to stay glued in on the news and track the company closely, Gaurav. No other way 🙂

thank u sir for the material.

just want to ask you that the material u have provided in this fundamental analysis course is that enough to analyse a company and to make a decision , or we need to study further something else?

It is more than sufficient to get started, Gaurav.

Thankyou sir 🙂

Good luck, Palak.

i daily study economic times. Can you please tell me ur best pick among newspaper. 🙂

I prefer ET and HBL 🙂

Hello sir,

You are doing great job !!

Just want to know to study economy or industry, we need to read alot of news. So, how can we gather all the news realted to stock markets and do analysis of the same. I am using zerodha pulse but still there is always some news that are left.

So, Can you please tell me how you get updated from all the financial news.

Thanks

Palak, the best way is to pick a good business paper and read through it consistently for a few weeks and you will be completely updated on economic activity of the country.

Sir,

Will you post any PDF regarding Value investing & intrinsic value? How to Calculate intrinsic value?

They are kind of covered in this module, Dinesh.

sir,

so it means delivery is the best according to your opinion

Yes, especially if you are starting new.

Sir,

may i know is which one is less risky among intraday, call and put options, delivery.

All have their own features,

intraday is minimum loss if qty is less but for safe if i put a stoploss it hits and then it reaches my target most of the time

call and put if it goes reverse all my investments goes off but advantage within shortperiod big amount

delivery is safe but when it goes low and never rise in its price that becomes again a loss

so am talking here only about losses i want to know which among these is less risky

Intraday options are the riskiest in my opinion 🙂

iam asking you .what is the use of ms excel in technical analysis can u provide some information about that?

You don\’t really need to work on an excel if you have a good trading/charting platform like Tradingview or Chartiq.

Good Start .

Hi,

I could read in on of the comments that Long term trading returns are not taxable. Could you please let me know at least for how much time I will have to invest so that it can be tax-free.

Thanks in Advance..!!

Vinod, investing in Equities is no longer tax-free. LTCG (long term capital gains) was not a taxable event until it was taken out 2 years ago. It is now 20% for gains above Rs.100,000/-.

Can you please provide this document in Hindi.

Please explain how we can find this type of effect early with fundamental analysis (Eicher motors stock made a relatively negligible move between 2006 and 2010. The real move in Eicher Motors started only from 2010) .

We are considering the regional language version, hopefully soon 🙂

I think the only thing that helps is to read the balance sheet and P&L properly and get sharp at it 🙂

thankyou sir

Hello sir,

I have one query.

Can we invest in those stocks that are in ASM : Stage 1 ?

I have one stock; at that time it wasn\’t in the list but now on BSE site it shows ASM : Stage 1.

Please clarify.

Thankyou.

You have to invest in stocks which are fundamentally strong…and you need to invest for a long term period. I\’d suggest you look for the criteria for ASM, if it cast any doubt on the business prospects (Which is what matters for the long term) then it may not be worth it, else it could be. Check this – https://www.google.com/url?q=https://www.nseindia.com/invest/content/FAQs_Additional_Surveillance_Measure_ASM.pdf&sa=D&source=hangouts&ust=1552372486445000&usg=AFQjCNHFc19VQ3LtMJEj6qqmKrJQMW4InQ

Thank you for reply sir

I didn\’t found that data

Amit, check screener.in or ratestar.in , you will get the info.

Hi sir

From where can I get data of all stocks market cap.and quarterly gdp data ( figure)?

Check out these guys – https://www.tijorifinance.com/

Hi Karthik,

What is the website to find Industry related data for Capital goods sectors like Heavy Engg and Road construction?

Thanks,

B Dutta

The annual reports (management discussion and analysis section) is a great place to source this data.

the app and the information is very helpful in nature and it is quiet good enough then i must say that the information of the company about trading and the knowledge it is imparting is very good for the company to retain its customer and also it is very helpful for the customer who are the beginners in trading.

Glad to hear that, Partha! Happy reading, keep going 🙂

1. As you mention above annual report is best for fundamental analysis of company. Is there any additional thing, which we can go for??

2. Money control data is reliable for technical analysis and also mention some websites which is helpful for TA and FA.

1) AR is the best resource, no substitute for that.

2) For both I\’d suggest you use Kite. Kie has great charting for TA and also has the Thomson Reuter\’s FA report called Stock Report+

Thanks for the very good content on stock markets. In the TCS chart shown above, the price is shown around 2500, but when I seached the same chart in google shows a different price at that time, can you please check?

Ajith, please check this – https://tradingqna.com/t/why-is-there-a-difference-in-the-ltp-on-the-marketwatch-and-on-different-timeframe-charts/15801

Sir,as you mention chapter 6.7 is not visible in my module,does it because of not a member,sir or do I have to login first

Not really, Atul. All sections are freely available for all to read. Please do refresh your browser once.

HOW TO LOOK FOR \’CAGR\’ of the company OR WE HAVE TO CALCULATE IT PLEASE EXPLAIN

Check screener.in, they give out CAGR on various fundamental parameters.

it\’s a simple form personified ever, can\’t get an analysis as simple as this, thanks ZERODHA, woke up very late to ZERODHA,really regreting ,please let me know where to look for CAGR as I am in a initial stage of learning, please do convey,atul

Its never too late to learn, Atul 🙂

CAGR can be calculated easily, check section 6.7 in this chapter –

https://zerodha.com/varsity/chapter/the-stock-markets/

does stock price chart in kite gets adjusted after dividend is declared or paid like it happens on issue of bonus shares .

Yes, it does.

Sir initially thanks for your guidance.

I got gold chart in market watch page.

That name is gold share.but I couldn\’t get the smallcase screener in mobile.

What will I do sir? Thank you.

Joseph, I\’d suggest you check with the smallcase team for this.

Hai sir.

I am in zerodha client.i have to trade only zerodha mobile app .

Sir i want to see gold price chart .

How to get the details .and how to activate zerodha small case screener.pls help me sir.thankyou

For gold chart, load the gold\’s future contract on in the MarketWatch and then click on the gold contract. When you do so, you will see the chart option. For screener, I\’d suggest you check this -https://help.tickertape.in/hc/en-us

Sir from where you have taken charts? Can you please help me on that?

All charts are from Chartink.

Hai sir.

How to get details of promotor and directors

Wikipedia if you have suugest any application or website.

In ex: if promoter or director charged in any illegal activities their punished by law.

How to get these details sir.

Best is to look at the annual report, you will get the entire details 😉

plz publish a new pdf format

Are you unable to download this?

If Eicher Motors was fundamentally so strong, why didn\’t its priced moved significantly between 2006-2010. And what was the cause of sudden \”Burj Khalifa\” like chart movement after 2010?

Well, the stock was not \’discovered\’, during that point. I like the Burj Khalifa comparison 🙂

Haha…Thank You..:)

Hello sir

About companys Executive chairman\’s ,CFO ,directors salary

For example

1.Haldyn glass( market cap 200 cr)

Executive chairman salary 1.25 Cr ( annual)

Director salary 1.22 Cr( annual)

And its peers borosil glass ( m cap 2331cr)

E.chairman salary annually 3 Cr

Directiors salary annually 3.5 Cr

All data taken from their Annual reports

Now my question is

Haldyn glass salary to high in compare to borosil glass even a small company ???

Or borosil salary to low even big company compare to haldyn ??

Plz elaborate it .clear my confusion

I;d consider the former i.e \”Haldyn glass salary to high in compare to borosil glass even a small company \”, not a great corporate governance sign according to me.

Hi

Thank you sir

Hi sir

Could u suggest me some ration related to chairman ,directors salary ?

Like net profit to salary ratio etc ?

Check the annual report, Amit. It will have all the details you\’d need.

Welcome!

Hi sir

I got detail from annual report but according g to you which salary is good in proportional to market cap ,net profit etc ?

Because in kesar petroprodycts limited

Net profit 20 Cr

Chairman salary 310000 annualy

So I am confuse about salary which is ideal ?

So I request you to post your view in detail.

Ideally, the salary of the top guy should not be more than 4-5% of PAT.

hello sir,

i am 1st year student , a curious beginner learner about stock market.

i want to learn ….in what way i can use FA to value and analyse growth of Small Cap companies and medi cap ??

Also ….there are lot of small cap companies …..using the skill of FA …how to Filter the right one ???

Happy to note that you\’ve taken interest in stock markets this early on in life, good luck 🙂

I\’d suggest you use stock screening filters such as https://www.screener.in/ and https://screener.smallcase.com/welcome to filter stocks.

Hi Karthik!

Thank you so much for the content. It is really very good. I want to know about how passive investors can use NIFTY strategy indices, NIFTY SME EMERGE (How to identify which strategy is useful in which context)?

This is a very tricky segment, Akshay. You will have to analyze the companies here like a VC investor, the risk element is quite high. Also, there are lot sizes here, which means there is a minimum number of shares you will have to buy.

Thanks Karthik! How can we use NIFTY strategy indices( NIFTY alpha 50, NIFTY low volatility 30 etc.) for passive investments? Is it a good strategy to pick 10-15 stocks from these indices & restructure our portfolio as per changes in the indices? How to decide which strategy index to choose for a particular market scenario?

Akshay, if your objective is to build a passive portfolio which mimics an index, then maybe you should check out the ETFs. There are quite a few decent ones listed on the exchange. Of course, the liquidity is low, but then should be ok for a passive strategy.

Thank you very much Karthik!

Cheers!

Hello, Superb information for beginners. Fundamental knowledge. Thank you very much.

My question how to know the company is going to change and going to be multibagger. Like Eicher motor in your example, if someone would had checked in 2010 about the past 5-7 yrs performance of the company, its not fitting into fundamentally sound company. What one would had looked in 2010, to decide that that compnay is going to give enormous return in future?

Tejas, you cannot know this in advance nor can you time it. The only thing you can do is deep dive into fundamentals and know the company well. If the market is undervaluing the company, then you can hope to see a multibagger. Remember, a good company with good fundamentals cannot remain undervalued for long, eventually, it will be discovered.

Hi All

Above fundamental and basic details are good which every trader should know and follow.

But my question is common thought every one thing of it.

Is there any website where we can get top performing companies list every day. it helps to fresher to view and invest….

This depends on what information you are looking at, Raghu. There are quite a few sites. Check screener.in or ratestar.in or https://screener.smallcase.com/welcome .

Sir, thanx for ur efforts towrads educating peoples

I try to find latest quaterly result of companies

but not able to find all details even it not present in

company or exchange website. So can u plz suggest me

any source where i can find quaterly ressults for doing my research.

Check out screener.in

How can we track the small good companies whose little data is available.

And also how can we come to know about the core managment, as we dont know about them much. Whatever we find is not appropriate.

If it is listed then to a large extent, you will get the data required. Look for it on the company\’s website, under the investor\’s section. However, if it is unlisted, I\’m afraid data is not so easy to get.

ಜೆರೋಧಾ/ಕಾರ್ತಿಕ್ ರಂಗಪ್ಪ ಅವರೆ,

ಜೆರೋಧಾ ವಾರ್ಸಿಟಿ ಚೆನ್ನಾಗಿದೆ. ಆದರೆ ಕನ್ನಡದಲ್ಲಿ ಯಾಕಿಲ್ಲ?

ನಮಸ್ಕಾರ – ಸರಿಯಾದ ಟ್ರಾನ್ಸ್ಲಟೋರೆ ಸಿಕ್ಕಿಲ್ಲ ಸಾರ್.

Happy New Year…….one query, if we invest passively in nifty etf, we get decent return so why cant invester do sip in nifty riskfree basis. eg in USA max funds parked in Index ETF (Vanguard, SPY, Ishare)

You can, in fact, this is as good as investing in a Mutual Fund. But do note, it is not risk-free.

Sir,

Suppose if we have a short position open and divident is declared for the same position should the divident amount will be an expense for us as we are short on position… Please clarifay my doubt

Thanks

No, you are not entitled to dividends if you have short futures (or intraday) position.

Thanks sir

Cheers!

sir,please tell me when to buy and square off the fundamentally strong stocks based on technical indicators.Thanks in advance.

Very hard to summarise this as there are multiple parameters. This will come to you naturally as you devote more time to markets. But yes, if you are starting off now, look at moving averages as an option.

Hi, this is more of an opinion than a query exactly

>One can expect the core portfolio to grow at a rate of at least 12% to 15% CAGR year on year basis.

If MFs(even including expense ratio) and good smallcase baskets can deliver this, is learning to value companies worth it for individual investors instead of leaving it to institutions and fund managers that specialise in it?

And if retail investors can do better than this, is regulation(possibly in terms of allowed risk and how that risk is modelled) the only thing stopping institutional investors from using these same strategies, or is it the quantity of AUM that exceeds the capacity of some strategies?

I\’d suggest you read this book – https://www.amazon.in/One-Up-Wall-Street-Already/dp/0743200403 🙂

Anyway, yes, if you are happy with 12-15% returns (which I think is fantastic), then a structured (or ready made) portfolio is a great approach. The only thing stopping institutions investors is a mix of both regulatory and internal investment policies. This is explained very well in the book that I\’m talking about.

Cool, thank you!

Cheers!

Hi Karthik,

Thanks for lucid tutorials .Really enjoy them as a refresher.

I have a question. What database do professional analysts use to screen stocks. In US , i remember using Compustat or Factset for research. What is the indian alternative. Please advise.

There are quite a few options – check out –

1) smallcase.screener.com (paid)

2) screener.in

3) ratestar.in

Thank you.

Cheers.

Dear sir,

U have told u ll upload financial modelling so when could we expect that excel sheet and also kindly mention for which site it will suitable to upload ur excel sheet

That will take sometime Kiran, I\’m currently working trading systems.

Ok tq

Dear sir,

U have told u ll upload financial modelling so when could we expect that excel sheet

I\’m so grateful for these modules and I have been following them for quite some time. The fondness actually led me to open a Trading Account at Zerodha if I may say so. But I really miss the earlier quality of the modules. I notice some changes and I really feel the need for a \”contents/index\” page which is not included anymore. The full page cover looked better too in my opinion. Just saying.

Thanks.

Vivaswant, thanks for the kind words. I guess you are talking about the UI bit, which was changed few months ago. Will pass this feedback. But I hope you continue to like the quality of the content 🙂

Hello sir

How are you? India imports a large chunk of its crude oil imports from OPEC nations. Then why does the fluctuation in Brent crude oil affect india\’s CAD?

Thank you

Varsity student

Guess we import Brent like variety from OPEC nations.

its nice module, great induced me

Its all yours to read 🙂

Hi Karthik. What is the benefit of bonus share to shareholders when the price of stocks adjust accordingly after giving bonus? Please elucidate. Amit DUBEY

The bonus is a stock reward and you will end up with more number of shares (dividend is cash reward). The dividend yield goes up when companies give out bonus. Apart from that, no other benefits.

MS Excel is propreitary software hence is not free. Libre Office is free, open source and available on any operating system. It has a spreadsheet program \”Libre Office Calc\” which has the same features as MS excel.

Download link is as follows: https://www.libreoffice.org/download/download/

It\’s good to include your point in main content.

Hiii sir,

can you tell me how can i download all the module in pdf format.

I like to inform you that i dont have any accout with zerodha.

Zerodha Varsity is free for all and not really restricted to Zerodha\’s clients – although we will highly appreciate if you can join us 🙂

Scroll to the bottom of the page to download the PDF – https://zerodha.com/varsity/module/fundamental-analysis/

Hi,

Previously there were link of ibook of each module but now there is only pdf available , can you please provide the link of ibooks of all the modules.

We had few issues with ibooks, Nirmal. Hence withdrew links.

Hi,

Recently my dad transferred his portfolio of equity shares in my demat account some of which aren\’t trading on stock exchange or may have been de-listed like Elder pharmaceuticals, Melstar Info, Zenith infotech, Arms Paper ltd

How do I sell them ?

Few people suggested to contact the co. directly, but how do I go about it?

You will have to touch base with the company\’s registrars for this Jinal. If they are delisted and closed down, then I\’m afraid there is nothing much that can be done.

By regular investing through SIPs, I have created wealth more than 50 lacs at the age of 39 Years. Around 4 months back, I liquidated 25 lacs and invested in PMS of Birla Sun Life for better returns. Considering different types of fees of MFs and PMs charge thus eroding your wealth, I am planning to enter in equity market independently in around 1 year time. Till then I will study stock market to be a confident stock investor. Yours is a good source of knowledge which will definitely help me to become independent investor. Thank you so much!

Query: Once I become knowledgeable in stock trading, would it be a good option to shift all corpus invested in MFs and PMS in direct equity or should I still have the exposure in MFs? Please suggest.

After all these years in markets, I still do invest in MFs. This is besides having my own little EQ portfolio. So if you ask me, having exposures to MFs is good….I consider that as a hedge against my own investing… but I do secretly wish, both MFs and my own investing eventually pays off 🙂

Thanks Karthik Sir for the prompt response.

My next question: How much % of total corpus should be exposed to MFs and how much % to equity (assuming a good knowledge of investing in stocks) ?

If you are fairly comfortable investing in Stocks, then invest at least 30-40% in direct equity and the rest in MFs. Over time, you can think of increasing this to at least 60% in direct stocks.

Hello Kartik

Can you explain me TA in some more depth. Or the provess of conducting TA.

Have you gone through the module on TA? I think it\’s a great place to get started.

hi,

how can i do fundamental analysis on mcx and also does the same technical analysis work for mcx.

Best Regards

Shashishekar T S

FA on commodities will be quite tricky as it varies for each commodity. Yes, same TA can be applicable on commodities.

where can i learn FA on commodities in zerodha…or do you suggest any book

I\’m not sure about FA on commodities. I guess the information is scattered and not really contained in a single place.

can you suggest any book to read for FA and TA for commodities…

Nothing that I know of.

hi,

i have account in zerodha. i want to trade in mcx . i want to learn about commodities. i went through all your education. now i have doubts. where and how can i learn about trading commodities. can you suggest some books (both for technical analysis and FA). can you suggest . where can i get news related to commodities. is possible that you put up strategies for commodities trading like you did for options or can you suggest books for commodity trading strategies.

Best Regards

Shashishekar T S

I\’m assuming you have read through this – https://zerodha.com/varsity/module/commodities-currency-and-interest-rate-futures/

The same set of TA rules applies to commodities as well, nothing special. FA on commodities is not easy, as it changes for each commodity.

Good Day Karthik,

I was analyzing one of the script which is under good management and consistently growing at a good pace.

But when I calculated using DCF model it gave the Intrinsic value between (2,325.7) – (2,842.5)

What does it indicate?

P.S: I have cross checked

In this case how to identify it real intrinsic value.

Please advise

Siva

I guess the growth rates could be high? DCF is sensitive to all these variables. You need to be cautious.

Good Evening Karthik,

I have couple of queries.

1. I assume the DCF cannot be used to value the intrinsic value of bank stocks, in that case what are the other methods i can use to so?

2. Where can I get the EPS or ROE of a scrip for say 5 – 10 years?

3. I want to hear from you about Godrej Consumer Scrip, product wise I see the company has less exposure to consumers when compared to HUL in that case do you think Godrej consumer is overly priced at the moment?

1) Relative valuation model can be used

2) Check out – https://screener.smallcase.com/welcome

3) Not sure, Siva. I\’ve not been tracking that company.

Thanks, usually the annual report of the company ends in March 31 but many companies hasn\’t released their annual report yet what is the reason but I see they release the quarterly report in time.

It could just be internal delays.

Regarding NIFTY dividend yield-

1. are dividends paid every day in nifty 51 stocks …? I think its once in few months so how come they have given nifty divident yield value for each dy?

2. what is the relevance of nifty dividend yield? like by increasing P/E we can assume that market is overpriced…in the same way what conclusions can be taken from dividend yield

1) Companies pay dividends (if at all paid) once or twice a year

2) The dividend yield is adjusted every day. Remember the yield changes as Nifty spot changes value

3) You can plot the historical dividend range and peg that against the Nifty\’s spot price….and then arrive at some conclusion on oversold and overbought Nifty regions.

I need to know where to get the quarterly reports as soon as they are published?

For example, few days back, Sun Pharma published q1 results. I checked their website immediately after reading thw news, but P&L statement was not there yet. Still I can see all the news about it. So from where do these news people get the information so fast?

Basically I am interested in getting to know the financial news of a scrip as soon as possible.

It will be made available on the site really quickly. If not for the official source, I\’d suggest you check a 3rd party tool like MC, but I personally don\’t rely much on 3rd party source.

Previously pdf. version was also available for download and offline reading. PDF version is very convenient for self study and marking. But now I could not find a link to download content as pdf version. Please help.

We will bring them back.

Sir i am in confusion

what is the differnce for Net profit For period from financials and Reported NET PROFIT .

It is the same.

Dear karthik,

can you post a separate chapter on how to read and analyse, earnings report or any report published by a brokerage research. That would be great if you do so..

Will add that to my list, thank you 🙂

FA is indeed a very time tested investment philosophy. However I am keen to know how to take the first step ? For e.g. how to get a list of say 5-10 companies for further research and analysis. Do you suggest using some screeners or using Lynch\’s approach ?

You can certainly start with screeners. Smallcase has just launched a screening tool which will help you identify stocks. Apart from this you generally need to develop a good investment mindset which will help you identify stock ideas. Yes, Lynch\’s approach is a great way to start.

I am not aware of Lynch’s approach. Can you put some light on it.

You got to read this book – https://www.flipkart.com/one-up-wall-street/p/itme3d77qmktnj6k

its a fantastic source to make a fundamental analysis

thanks at all.

Good luck and happy learning!

Sir

Only technical analysis is sufficient for short term investment

Depends on how you define short term. If its for few minutes or hours or maybe few weeks, then TA is good. Something like 3 months or more then its good to be aware of the fundamentals as well.

Sir,

Where will get companies valid annual reports directly for analyzing datas,

Thanks

On the companies website, under the \’Investors\’ section.

Hi Karthik,

Can we rely on the fundamental data provided in Moneycontrol for any stock ?

I would not 🙂

I like to look at the numbers from the Annual Report directly.

Hi Sir,

It would be of great help if you can send me the excel sheet which have explained in the the tutorial. I\’m struggling to create one from looking at your tutorial

Thanks!

-Anand

Which excel are you referring to?

Is there any excel created for doing this kind of fundamental analysis. Just like you have created for knowing the current value of the stock. I know formulas are already there in this tutorial but it would helpful if we get an excel sheet for the same.

I soon plan to put up a module on Financial Modelling…this will include everything in one excel sheet.

Karthik Sir – I\’m still eagerly waiting for an excel sheet. I would be helpful to start doing research. Could you please let me know by when you are planning to put up module on Financial Modelling and excel sheet?

Anand – I\’m afraid a module on Financial Modelling is still a bit far away! Maybe towards the mid of this year.

I will be waiting for it then.. 🙂

Thanks for you patience, Anand.

Sir – Any updates on the Financial modelling and excel sheet which was planned earlier?

Trying to finish the current ongoing model on Risk management, fin modelling next.

Thanks for the updates Sir!

Cheers!

dear sir,

I am eagerly waiting for your financial modeling, kindly when could we expect your financial modeling so that it will help to our understanding the analysis of company

That will be after the ongoing module on Trading System.

Sirji, any updates on the Financial modelling and excel sheet which was planned earlier??!!

Not yet, Daljeet, I would love to put up the module, but unable to find the time.

Hi Karthik

As you have written \” You will need industry data to see how the company under consideration is performing \”

Please provide some source where i can find Industry Related Data.

Thank You

Every industry has its own association which provides this data.

For example sugar has this – http://www.indiansugar.com/ and automobiles has this – http://www.siamindia.com/ and IT has this – http://www.nasscom.in/.

Sir,

can u please give link of sites for all industries from where we can get the relevant data ? I know that i am asking a lot – but please treat this as a request. You can start with details of a few industries and keep on updating the same periodically.

Thanking you in anticipation

Regards-A Bhapkar

Have you checked out screener.smallcase.com?

Hi Karthik, I am one among those who came into stock market without knowing what is Stock Market. I read few basic books (Intelligent Investor, Common Stock & uncommon profits, One up, Fooled by Randomness etc) to get a perspective. Very recently I can across varsity (Luckily!). It is very useful and I like the way you explain. All these basic books are completely against Technical Analysis. Could you please tell me if it is possible to get returns greater than FD rates by following technical Analysis CONSISTENTLY ? I did go through the fundamental analysis modules. Is it worth to dig deeper into Trading(Understanding Black & Scholes and trading strategies etc) ? Please clarify. Thank you .

I\’m happy to know you liked Varsity 🙂

Yes, there are traders who make more than FD rates consistently while trading. We have even interviewed few of them to understand their mindset – http://zerodha.com/z-connect/category/zerodha-60-day-challenge/winners

This is hard work, but can be worth if you do it the right way.

Karthik, Thank you very much for replying. Looking at the winners, isn\’t it the survivor bias (I am getting reminded of the Monkeys on the Typewriter analogy )? I am convinced that money can be made on long term(Thanks to you & Varsity team!). I am just skeptic about technical analysis and short term trading. If I learn more, does it help? is it wroth learning the TA or luck plays a major part?

There is no denying about the survivor bias here. But the practical problem is that its very hard to interview people who have lost money, they tend to shy away :). Read through the interview and treat it as just one set of inputs. Trading via TA requires a great amount of discipline, which let me assure you is not easy.

Here is what I\’d suggest – spend time learning (the right way) and give it shot with smaller amounts of money. Scale only when you feel there is substance.

can u name some site where i can track the performance of company industry.

Check screener.in and ratestar.in

Hi Karthik,

I have a basic question. As per most of the good investors it is advised that long term mindset should be set to become a successful investor in stock market. Companies performance does not contribute to the price of the shares as share price is totally dependent on investors emotion and market news. So how can we ensure that the current share price will not come down to its initial invested value after 5-6 years?

In the long run, it is the performance of the company that takes the stock price to its true value. As an investor one need to spend more time analyzing the business of a company rather than the price of a stock, this will naturally ensure your investments are safeguarded.

Hi Karthik

This could be trading strategy related question. I have read in a book that the author invests in shares of a company and exits after a year leaving the profit and withdrawing the principal amount invested. Which leaves the profit money to grow and principal is safe (of course the principal shall be invested elsewhere in order to get benefitted).

What could be the disadvantages or advantages in this kind of approach?

Well, not a bad idea…but then long term investment is all about wealth creation, if you pull off the principle then you are essentially reducing the investment, not sure why one would want to do that.

Yeah, need to ask Robert Kiyosaki – why he does that – and still has a huge net-worth! 🙂

lol 🙂

Hi

Impressed! Very interesting way of learning.

Is it possible on can target dividends in a short term trade? E.G. Today for company x\’s dividend declared and buy on the same date then one can expect dividend? Please elobrate on complete process, declaration date, record date etc

Yes, some people do this. It is called \’Dividend Stripping\’, check this article – http://www.thehindubusinessline.com/opinion/all-you-wanted-to-know-about-dividend-stripping/article8179784.ece

Hi Karthik,

I read from Intelligent Investor that bonds and stocks should occupy 50:50 amount in portfolio. When stocks become expensive then bonds get valuable and vice versa. Because of your excellent articles I am now confident in stocks. But I know nothing about the bonds. So, could you please introduce a lesson about bonds?

Thanks,

Deepak

We will try and put up information on bonds sometime soon. However, the bond market in India is not really vibrant for retail participants.

Hi Karthik,

Could you explain more on getting the news about the companies. Please mention some good tools or websites those are helpful.

Thanks,

Deepak

I\’ev shared the URLS for your previous comment.

Where can we find the banking industry data?

Is there any official website available to know about banking industry data?

RBI has tons of data, suggest you explore the site.

i bought a share in 5000 quantity, cupid ltd 2 years back at 30 rupees.i sold the at 500 .now share are trading at 353 rupees .its valuation are not seems correct..should i reenter ?

I would not know that as I don\’t follow the company 🙂

In where I got 5 to 7 year data for FA for a company ?

Check this, quite nicely done – http://www.ratestar.in/

Sorry earlier was a typing mistake,How do i contact companies for historic annual reports??

Contact the investors cell within the company.

I do i contact companies for historic annual reports

Yes you can.

Where can we find the industry data?? and i can not find 10 years of annual reports for many companies in their respective websites could only get hands on 3-5 years of data so what to do 10 years of data??

Usually the industry data is made available by the industry association/lobby. For example you can get all automobile data you could check SIAM – http://www.siamindia.com/ . I guess for historical AR you could check with the company directly, you will be surprised to know that most of the companies oblige and point you to the source.

The Satellite portfolio can be expected to yield at least 10% to 12% absolute return on a yearly basis.

If the stock market is giving me just 10%, then why should I even care to do so much of hard work in analyzing stocks when I can get 9%(just a percent less) just by simply keeping it in the bank\’s FD!!!

Couple of things here Adam –

1) Long term Capital Gains tax is nil. Hence if you manage 12% on your portfolio over the last 365 days then do remember this is tax free

2) FD returns are taxable – so 9% after tax is about 7%. So contrast 7% versus 12%!

3) 12 % is a bit conservative…well managed Equity portfolios can generate over 15%

4) At 15% year on year your money will start working really well in your favor. To appriciate this point I would suggest you read the next chapter \’Mindset of an Investor\’, especially section 2.2.

I have a question.

Will it be feasible for me to enter stock market by this much technical knowledge ?

I want to do short term trading and I am entirely new to it.

Thanks in advance.

Yes, please be through with everything we have discussed on Varsity and I\’m confident you will be on the right track.

Varsity is really good and this educative series has really helped in understanding the technical aspects of the market

Glad to know this, please stay tuned for more 🙂

i would like to ask a question that how much years of past data is considered while doing proper analysis of a company

Look for at least past 5-7 years of annual data. They say when a company completes every 7 years of business, it would have undergone 1 economic cycle. Hence when you look at 7 years of data, you will be factoring (and analyzing) 1 full economic cycle.

BUT KARTHIK THESE CYCLES CAN VARY, HOW WOULD I KNOW THAT AT WHAT TIME PERIOD THE ECONOMIC CYCLE OF THE COMPANY STARTED. WE ARE JUST ASSUMING THAT THIS CYCLE COULD HAVE STARTED EXACTLY 7 YEARS BACK.

No, that would be flawed. Clearly, it would vary company to company.

Good overview covering the positive and negative aspect and comparing with TA which depicts the picture more clearly.

One query – What is the role of MS Excel as a tool in FA ?

Excel is a very important tool! Helps a lot while building financial modelling.

Can I Get the soft copy of the modules

Thanks, but this may not be possible for now !

Fundamental analysis is very useful to create our self openion on company strategy .there is given very nice illustration on fa.

Thanks, glad you liked it 🙂

Please provide downloadable for taking print and read keep it as a reference guide.

Maybe sometime in the future Ram, thanks.

[…] Introduction to Fundamental Analysis – Zerodha Varsity. […]

Versity is good, however most of the charts given are not legible. The coordinate labels appear very small to read, probably on full HD display. Also the charts are marked by circle and arrow but not by word. For example while explaining the candlesticks the word doji, spinning top etc should be written.

Thanks for the feedback, I would agree with you. Most of the images are real time screenshots from live markets, hence the drop in image quality.

My humble request to you kindly provide Fundamental & Technical Analysis in Hindi language.

We will try and do that, Vinod. But cannot give a timeline to it.

sir i am n reading fundamental , I need CGAR calculation for i have checked your notes i did not get any answer Please advise me

Check section 6.7 here – https://zerodha.com/varsity/chapter/the-stock-markets/

Hello Kishor I need historical fundamental data of Indian equities. Any references would be useful. Note that I already have end of the day data. I am specifically looking for fundamental data.

Thanks and appreciate your response.