11.1 – Hedging, what is it?

One of the most important and practical applications of Futures is ‘Hedging’. In the event of any adverse market movements, hedging is a simple work around to protect your trading positions from making a loss. Let me to attempt giving you an analogy to help you understand what hedging really is.

Imagine you have a small bit of vacant barren land just outside your house, instead of seeing it lie vacant and barren you decide to lawn the entire plot and plant few nice flowering plants. You nurture the little garden, water it regularly, and watch it grow. Eventually your efforts are paid off and the lawn grows lush green and the flowers finally start to blossom. As the plants grow and flowers start to bloom it starts to attract attention of the wrong kind. Soon you realize your little garden has become a hot destination for a few stray cows. You notice these stray cows merrily gazing away the grass and spoiling the nice flowers. You are really annoyed with this and decide to protect your little garden? A simple work around is what you have in mind – you erect a fence (maybe a wooden hedge) around the garden to prevent the cows from entering your garden. This little work around ensures your garden stays protected and also lets your garden flourish.

Let us now correlate this analogy to the markets –

- Imagine you nurture a portfolio by picking each stock after careful analysis. Slowly you invest a sizable corpus in your portfolio. This is equivalent to the garden you grow

- At some point after your money is invested in the markets you realize that the markets may soon enter a turbulent phase which would result in portfolio losses. This is equivalent to the stray cow grazing your lawn and spoiling your flower plants

- To prevent your market positions from losing money you construct a portfolio hedge by employing futures. This is equivalent to erecting a fence (wooden hedge) around your garden

I hope the above analogy gave you got a fair sense of what ‘hedging’ is all about. Like I had mentioned earlier, hedging is a technique to ensure your position in the market is not affected by any adverse movements. Please don’t be under the impression that hedging is done only to protect a portfolio of stocks, in fact you can employ a hedge to protect individual stock positions, albeit with some restrictions.

11.2 – Hedge – But why?

A common question that gets asked frequently when one discusses about hedging is why really hedge a position? Imagine this – A trader or an investor has a stock which he has purchased at Rs.100. Now he feels the market is likely to decline and so would his stock. Given this, he can choose to do one of the following –

- Take no action and let his stock decline with a hope it will eventually bounce back

- Sell the stock and hope to buy it back later at a lower price

- Hedge the position

Firstly let us understand what really happens when the trader decides not to hedge. Imagine the stock you invested declines from Rs.100 to let us say Rs.75. We will also assume eventually as time passes by the stock will bounce back to Rs.100. So the point here is when the stock eventually moves back to its original price, why should one really hedge?

Well, you would agree the drop from Rs.100/- to Rs.75/- is a 25% drop. However when the stock has to move back from Rs.75/- to Rs.100/- it is no longer a scale back of 25% instead it works out to that the stock has to move by 33.33% to reach the original investment value! This means when the stock drops it takes less effort do to so, but it requires extra efforts to scale back to the original value. Also, from my experience I can tell you stocks do not really go up that easily unless it is a raging bull market. Hence for this reason, whenever one anticipates a reasonably massive adverse movement in the market, it is always prudent to hedge the positions.

But what about the 2nd option ? Well, the 2nd option where the investor sells the position and buys back the same at a later stage requires one to time the market, which is not something easy to do. Besides when the trader transacts frequently, he will also not get the benefit of Long term capital tax. Needless to say, frequent transaction also incurs additional transactional fees.

For all these reasons, hedging makes sense as he is virtually insulates the position in the market and is therefore becomes indifferent to what really happens in the market. It is like taking vaccine shot against a virus. Hence when the trader hedges he can be rest assured the adverse movement in the market will not affect his position.

11.3 – Risk

Before we proceed to understand how we could hedge our positions in the market, I guess it is important to understand what is that we are trying to hedge. Quite obviously as you can imagine, we are hedging the risk, but what kind of risk?

When you buy the stock of a company you are essentially exposed to risk. In fact there are two types of risk – Systematic Risk and Unsystematic Risk. When you buy a stock or a stock future, you are automatically exposed to both these risks.

The stock can decline (resulting in losses for you) for many reasons. Reasons such as –

- Declining revenue

- Declining profit margins

- Higher financing cost

- High leverage

- Management misconduct

All these reasons represent a form of risk, in fact there could be many other similar reasons and this list can go on. However if you notice, there is one thing common to all these risks – they are all company specific risk. For example imagine you have an investable capital of Rs.100,000/-. You decide to invest this money in HCL Technologies Limited. Few months later HCL makes a statement that their revenues have declined. Quite obviously HCL stock price will decline. Which means you will lose money on your investment. However this news will not impact HCL’s competitor’s (Tech Mahindra or Mindtree) stock price. Likewise if the management is guilty of any misconduct, then Tech Mahindra’s stock price will go down and not its competitors. Clearly these risks which are specific to the company affect only the company in question and not others. Such risks are often called the “Unsystematic Risk”.

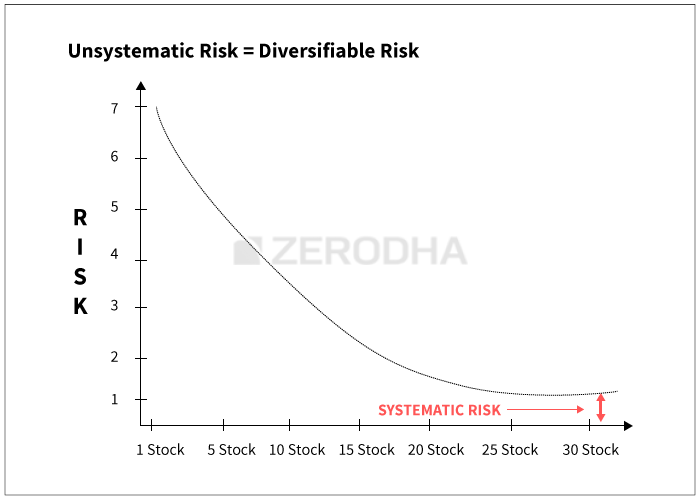

Unsystematic risk can be diversified, meaning instead of investing all the money in one company, you can choose to diversify and invest in 2-3 different companies (preferably from different sectors). When you do so, unsystematic risk is drastically reduced. Going back to the above example imagine instead of buying HCL for the entire capital, you decide to buy HCL for Rs.50,000/- and maybe Karnataka Bank Limited for the other Rs.50,000/-. Under such a circumstance, even if HCL stock price declines (owing to the unsystematic risk) the damage is only on half of the investment as the other half is invested in a different company. In fact instead of just two stocks you can have a 5 stock or 10 or maybe 20 stock portfolio. The higher the number of stocks in your portfolio, higher the diversification and therefore lesser the unsystematic risk.

This leads us to a very important question – how many stocks should a good portfolio have so that the unsystematic risk is completely diversified. Research has it that up to 21 stocks in the portfolio will have the required necessary diversification effect and anything beyond 21 stocks may not help much in diversification.

The graph below should give you a fair sense of how diversification works –

As you can notice from the graph above, the unsystematic risk drastically reduces when you diversify and add more stocks. However after about 20 stocks the unsystematic risk is not really diversifiable, this is evident as the graph starts to flatten out after 20 stocks. In fact the risk that remains even after diversification is called the “Systematic Risk”.

Systematic risk is the risk that is common to all stocks. These are usually the macroeconomic risks which tend to affect the whole market. Example of systematic risk include –

- De-growth in GDP

- Interest rate tightening

- Inflation

- Fiscal deficit

- Geo political risk

Of course the list can go on but I suppose you got a fair idea of what constitutes systematic risk. Systematic risk affects all stocks. So assuming you have a well diversified 20 stocks portfolio, a de-growth in GDP will certainly affect all 20 stocks and hence they are all likely to decline. Systematic risk is inherent in the system and it cannot really be diversified. However systematic risk can be ‘hedged’. So when we are talking about hedging, do bear in mind that it is not the same as diversification.

Remember, we diversify to minimize unsystematic risk and we hedge to minimize systematic risk.

11.4 – Hedging a single stock position

We will first talk about hedging a single stock future as it is relatively simple and straight forward to implement. We will also understand its limitation and then proceed to understand how to hedge a portfolio of stocks.

Imagine you have bought 250 shares of Infosys at Rs.2,284/- per share. This works out to an investment of Rs.571,000/-. Clearly you are ‘Long’ on Infosys in the spot market. After you initiated this position, you realize the quarterly results are expected soon. You are worried Infosys may announce a not so favorable set of numbers, as a result of which the stock price may decline considerably. To avoid making a loss in the spot market you decide to hedge the position.

In order to hedge the position in spot, we simply have to enter a counter position in the futures market. Since the position in the spot is ‘long’, we have to ‘short’ in the futures market.

Here are the short futures trade details –

Short Futures @ 2285/-

Lot size = 250

Contract Value = Rs.571,250/-

Now on one hand you are long on Infosys (in spot market) and on the other hand we are short on Infosys (in futures price), although at different prices. However the variation in price is not of concern as directionally we are ‘neutral’. You will shortly understand what this means.

After initiating this trade, let us arbitrarily imagine different price points for Infosys and see what will be the overall impact on the positions.

| Arbitrary Price | Long Spot P&L | Short Futures P&L | Net P&L |

|---|---|---|---|

| 2200 | 2200 – 2284 = – 84 | 2285 – 2200 = +85 | -84 + 85 = +1 |

| 2290 | 2290 – 2284 = +6 | 2285 – 2290 = -5 | +6 – 5 = +1 |

| 2500 | 2500 – 2284 = +216 | 2285 – 2500 = -215 | +216 – 215 = +1 |

The point to note here is – irrespective of where the price is headed (whether it increases or decreases) the position will neither make money nor lose money. It is as if the overall position is frozen. In fact the position becomes indifferent to the market, which is why we say when a position is hedged it stays ‘neutral’ to the overall market condition. As I had mentioned earlier, hedging single stock positions is very straight forward with no complications. We can use the stock’s futures contract to hedge the position. But to use the stocks futures position one must have the same number of shares as that of the lot size. If they vary, the P&L will vary and position will no longer be perfectly hedged. This leads to a few important questions –

- What if I have a position in a stock that does not have a futures contract? For example South Indian Bank does not have a futures contract, does that mean I cannot hedge a spot position in South Indian Bank?

- The example considered the spot position value was Rs.570,000/-, but what if I have relatively small positions – say Rs.50,000/- or Rs.100,000/- is it possible to hedge such positions?

In fact the answer to both these questions is not really straight forward. We will understand how and why shortly. For now we will proceed to understand how we can hedge multiple spot positions (usually a portfolio). In order to do so, we first need to understand something called as “Beta” of a stock.

11.5 – Understanding Beta (β)

Beta, denoted by the Greek symbol β, plays a very crucial concept in market finance as it finds its application in multiple aspects of market finance. I guess we are at a good stage to introduce beta, as it also finds its application in hedging portfolio of stocks.

In plain words Beta measures the sensitivity of the stock price with respect to the changes in the market, which means it helps us answer these kinds of questions –

- If market moves up by 2% tomorrow, what is the likely movement in stock XYZ?

- How risky (or volatile)is stock XYZ compared to market indices (Nifty, Sensex)?

- How risky is stock XYZ compared to stock ABC?

The beta of a stock can take any value greater or lower than zero. However, the beta of the market indices (Sensex and Nifty) is always +1. Now for example assume beta of BPCL is +0.7, the following things are implied –

- For every +1.0% increase in market, BPCL is expected to move up by 0.7%

- If market moves up by 1.5%, BPCL is expected to move up by 1.05%

- If market decreases by 1.0%, BPCL is expected to decline by 0.7%

- Because BPCL’s beta is less than the market beta (0.7% versus 1.0%) by 0.3%, it is believed that BPCL is 30% less risky than markets

- One can even say, BPCL relatively carries less systematic risk

- Assuming HPCL’s beta is 0.85%, then BPCL is believed to be less volatile compared HPCL, therefore less risky

The following table should help you get a perspective on how to interpret beta value for stock –

| If Beta of a stock is | Interpretation |

|---|---|

| Less than 0, Ex : -0.4 | A -ve sign indicates the stock price and markets move in the opposite direction. If market moves up by 1%, then –ve beta stock of -0.4 is expected to decline by 0.4% |

| Equal to 0 | It means the stock is independent of the market movement. The variation in the market is not likely to affect the movement in the stock. However, stocks with 0 beta is hard to find |

| Higher than 0 lesser than 1, Ex : 0.6 |

It means the stock and the market move in the same direction; however the stock is relatively less risky. A move of 1% in the market influences the stock to move up by 0.6%. These are generally called the low beta stocks. |

| Higher than 1, Ex : 1.2 | It means the stock moves in the same direction as the markets; however the stock tends to move 20% more than the market. Meaning, if the market increases by 1.0%, the stock is expected to go up by 1.2%. Likewise if the market declines by 1% the stock is expected to decline by 1.2%. These are generally called the high beta stocks. |

As of January 2015, here is the Beta value for a few blue chip stocks –

| Stock Name | Beta Value |

|---|---|

| ACC Limited | 1.22 |

| Axis Bank Limited | 1.40 |

| BPCL | 1.42 |

| Cipla | 0.59 |

| DLF | 1.86 |

| Infosys | 0.43 |

| LT | 1.43 |

| Maruti Suzuki | 0.95 |

| Reliance | 1.27 |

| SBI Limited | 1.58 |

11.6 – Calculating beta in MS Excel

You can easily calculate the beta value of any stock in excel by using a function called ‘=SLOPE’. Here is a step by step method to calculate the same; I have taken the example of TCS.

-

- Download the last 6 months daily close prices of Nifty and TCS. You can get this from the NSE website

- Calculate the daily return of both Nifty and TCS.

- Daily return = [Today Closing price / Previous day closing price]-1

- In a blank cell enter the slope function

- Format for the slope function is =SLOPE(known_y’s,known_x’s), where known_y’s is the array of daily return of TCS, and known_x’s is the array of daily returns of Nifty.

- TCS 6 month beta (3rd September 2014 to 3rd March 2015) works out to 0.62

You can refer to this excel sheet for the above calculation.

11.7 – Hedging a stock Portfolio

Let us now focus back to hedging a portfolio of stocks by employing Nifty futures. However before we proceed with this, you may have this question – why should we use Nifty Futures to hedge a portfolio? Why not something else?

Do recall there are 2 types of risk – systematic and unsystematic risk. When we have a diversified portfolio we are naturally minimizing the unsystematic risk. What is left after this is the systematic risk. As we know systematic risk is the risk associated with the markets, hence the best way to insulate against market risk is by employing an index which represents the market. Hence the Nifty futures come as a natural choice to hedge the systematic risk.

Assume I have Rs.800,000/- invested across the following stocks –

| Sl No | Stock Name | Stock Beta | Investment Amount |

|---|---|---|---|

| 01 | ACC Limited | 1.22 | Rs.30,000/- |

| 02 | Axis Bank Limited | 1.40 | Rs.125,000/- |

| 03 | BPCL | 1.42 | Rs.180,000/- |

| 04 | Cipla | 0.59 | Rs.65,000/- |

| 05 | DLF | 1.86 | Rs.100,000/- |

| 06 | Infosys | 0.43 | Rs.75,000/- |

| 07 | LT | 1.43 | Rs.85,000/- |

| 08 | Maruti Suzuki | 0.95 | Rs.140,000/- |

| Total | Rs.800,000/- | ||

Step 1 – Portfolio Beta

There are a few steps involved in hedging a stock portfolio. As the first step we need to calculate the overall “Portfolio Beta”.

-

-

- Portfolio beta is the sum of the “weighted beta of each stock”.

- Weighted beta is calculated by multiplying the individual stock beta with its respective weightage in the portfolio

- Weightage of each stock in the portfolio is calculated by dividing the sum invested in each stock by the total portfolio value

- For example, weightage of Axis Bank is 125,000/800,000 = 15.6%

- Hence the weighted beta of Axis Bank on the portfolio would be 15.6% * 1.4 = 0.21

-

The following table calculates the weighted beta of each stock in the portfolio –

| Sl No | Stock Name | Beta | Investment | Weight in Portfolio | Weighted Beta |

|---|---|---|---|---|---|

| 01 | ACC Limited | 1.22 | Rs.30,000/- | 3.8% | 0.046 |

| 02 | Axis Bank Limited | 1.40 | Rs.125,000/- | 15.6% | 0.219 |

| 03 | BPCL | 1.42 | Rs.180,000/- | 22.5% | 0.320 |

| 04 | Cipla | 0.59 | Rs.65,000/- | 8.1% | 0.048 |

| 05 | DLF | 1.86 | Rs.100,000/- | 12.5% | 0.233 |

| 06 | Infosys | 0.43 | Rs.75,000/- | 9.4% | 0.040 |

| 07 | LT | 1.43 | Rs.85,000/- | 10.6% | 0.152 |

| 08 | Maruti Suzuki | 0.95 | Rs.140,000/- | 17.5% | 0.166 |

| Total | Rs.800,000/- | 100% | 1.223 | ||

The sum of the weighted beta is the overall Portfolio Beta. For the portfolio above the beta happens to be 1.223. This means, if Nifty goes up by 1%, the portfolio as a whole is expected to go up by 1.223%. Likewise if Nifty goes down, the portfolio is expected to go down by 1.223%.

Step 2 – Calculate the hedge value

Hedge value is simply the product of the Portfolio Beta and the total portfolio investment

= 1.223 * 800,000

= 978,400/-

Remember this is a long only portfolio, where we have purchased these stocks in the spot market. We know in order to hedge we need to take a counter position in the futures markets. The hedge value suggests, to hedge a portfolio of Rs.800,000/- we need to short futures worth Rs.978,400/-. This should be quite intuitive as the portfolio is a ‘high beta portfolio’.

Step 3 – Calculate the number of lots required

At present Nifty futures is trading at 9025, and with the current lot size of 25, the contract value per lot works out to –

= 9025 * 25

= Rs.225,625/-

Hence the number of lots required to short Nifty Futures would be

= Hedge Value / Contract Value

= 978,400 / 225625

= 4.33

The calculation above suggests that, in order to perfectly hedge a portfolio of Rs.800,000/- with a beta of 1.223, one needs to short 4.33 lots of Nifty futures. Clearly we cannot short 4.33 lots as we can short either 4 or 5 lots, fractional lot sizes are not available.

If we choose to short 4 lots, we would be slightly under hedged. Likewise if we short 5 units we would be over hedged. In fact for this reason, we cannot always perfectly hedge a portfolio.

Now, let as assume after employing the hedge, Nifty in fact goes down by 500 points (or about 5.5%). With this we will calculate the effectiveness of the portfolio hedge. Just for the purpose of illustration, I will assume we can short 4.33 lots.

Nifty Position

Short initiated at – 9025

Decline in Value – 500 points

Nifty value – 8525

Number of lots – 4.33

P & L = 4.33 * 25 * 500 = Rs.54,125

The short position has gained Rs.54,125/-. We will look into what could have happened on the portfolio.

Portfolio Position

Portfolio Value = Rs.800,000/-

Portfolio Beta = 1.223

Decline in Market = 5.5%

Expected Decline in Portfolio = 5.5% * 1.233 = 6.78%

= 6.78% * 800000

= Rs. 54,240

Hence as you can see, one hand the Nifty short position has gained Rs.54,125 and on the other hand the long portfolio has lost Rs.54,240/-. As a net result, there is no loss or gain (please ignore the minor difference) in the net position in the market. The loss in portfolio is offset by the gain in the Nifty futures position.

With this, I hope you are now in a position to understand how you could hedge a portfolio of stocks. I would encourage you to replace 4.33 lots by either 4 or 5 lots and run the same exercise.

Finally before we wrap up this chapter, let us revisit two unanswered questions that we posted when we discussed hedging single stock positions. I will repost the same here for your convenience –

- What if I have a position in a stock that does not have a futures contract? For example South Indian Bank does not have a futures contract, does that mean I cannot hedge a spot position in South Indian Bank?

- The example considered, the spot position value was Rs.570,000/-, but what if I have relatively small positions – say Rs.50,000/- or Rs.100,000/- is it possible to hedge such positions?

Well, you can hedge stocks that do not have stock futures. For example assume you have Rs.500,000/- worth of South Indian Bank. All you need to do is multiply the stocks beta with the investment value to identify the hedge value. Assuming the stock has a beta of 0.75, the hedge value would be

500000*0.75

= 375,000/-

Once you arrive at this, directly divide the hedge value by the Nifty’s contract value to estimate the number of lots required (to short) in the futures market, and hence with this you can hedge the spot position safely.

As far as the 2nd question goes – no, you cannot hedge small positions whose value is relatively lower than the contract value of Nifty. However you can hedge such positions by employing options. We will discuss the same when we take up options.

Key takeaways from this chapter

-

- Hedging allows you to insulate your market position against any adverse movements in the market

- When you hedge your loss in the spot market it is offset by gains in the futures market

- There are two types of risk – systematic and unsystematic risk

- Systematic risk is risk specific to macroeconomic events. Systematic risk can be hedged. Systematic risk is common to all stocks

- Unsystematic risk is the risk associated with the company. This is unique to each company. Unsystematic risk cannot be hedge, but can be diversified

- Research suggests, beyond 21 stocks unsystematic risk cannot be diversified any further

- To hedge a single stock position in spot we simply have to take a counter position in the futures market. But the extent of spot value and futures value have to be same

- Market beta is always +1.0

- Beta measures the sensitivity of stock

- Stock with Beta of less than 1 is called low beta stock

- Stocks with Beta higher than 1 is called a high beta stock

- One can easily estimate the stock beta in MS Excel by employing the ‘Slope’ function

- To hedge a portfolio of stocks we need to follow the following steps

- Calculate individual stock beta

- Calculate individual weightage of each stock in the portfolio

- Estimate the weighted beta of each stock

- Sum up the weighted beta to get the portfolio beta

- Multiply the portfolio beta with Portfolio value to get the hedge value

- Divide the hedge value by Nifty Contract Value to get the number of lots

- Short the required number of lots in the futures market

- Remember a perfect hedge is difficult to construct, for this reason we are forced to either under hedge or over hedge.

Does the stock beta calculated always correspond to 6 months against the NIFTY 50?

Not necessary, it can be for a longer period.

Hi Karthik, great explanation!

Keeping in mind that this is an another transaction, should we not account taxation on the profits we generate, and overhedge a tiny bit to account for this to perfectly balance the negative in our actual portfolio?

Thanks in advance.

thankyou for the great lessons sir…..

if in hedging if i buy a suppose current month nifty fut of 75 qty(volume-around 90lakhs) and hedge it with a nifty pe of say next month of 75 qty(volume-12 lakhs) does it qualify for a hedge, question is does the volume also need to be similar when we hedge pls help understand

Yes, that is a hedge. But not a perfect hedge. A perfect hedge is when the exposure value is matched with the hedged value. In your example, it is under hedged.

I am little confused on hedging part , since were are shorting 4 or 5 NIFTY FUT it will require a substansial margin amount so to hedge the portfolio we need extra money to do so right . Is it really worth the extra money ?

Thats right. It depends on your perception of how deep the correction in the market is likely to be. If you think the market will fall 10-15%, the maybe you want this. That said, many dont bother to setup hedge for even 10% corrections.

Hi Karthik,

1. If we have a more extensive family portfolio, even to hedge this amount, we will have to set aside a substantial value. So, is there an ideal split for investing:hedging?

2. Should that entire amount be in Liquidbees when unutilized? Are they liquid enough for me to withdraw as and when needed? Any specific benefits of parking the cash in Bees rather than other liquid assets like savings a/c?

3. If Options are too technical for me straightaway, can I focus on learning and doing well at TA and applying the same with naked futures for leverage for years before I get comfortable with Options? Or is taking only directional naked bets very risky?

1) No ideal split, as its usually dependent on your portfolio size.

2) Yes, that is a good option

3) That is a good way to get started. In fact I know many traders who deal only with Futures and dont really get into options.

Hi,

Great resources.

I cant download the excel for beta calculation.

Can you please try and download from another browser?

Sir Answer my few more question because I am confused.

1. If I not Exit the positions What will happen?

2. If market goes down & down even after the futures expiry, then what we have to do? Do we have to hedge again?

3. What I have to do to hedge the positions? I know I have to sell in the futures. But till what time?

1) Then the ones that are due for expiry will expire, and your position will be unhedged

2) You can always rollover the position. Check this – https://youtu.be/FqRB7NGnOtA?si=0GtgvxuhZnrSbn4W

3) You need to have your hedge till you think the market conditions have not stabilized.

HI, I HAVE A LITTLE DOUBT REGARDING THE ABOVE REPLY:-

1) AT THE EXPIY IF NOT EXITED THEN WHAT EVER LOSS OR PROFIT IS THERE WILL BE BOOKE AUTOMATICALLY??

3)SO WHEN I HAVE TO EXIT THE POSITION IF I HAVE ROLLED OVER? WHEN BOTH THE PRICE OVERLAP (CORRECT ME IF I AM WRONG)

1) Yes, if you hold the position, then upon expiry the settlement will happen.

2) Yes, but rolling over is a manual process.

Sir I am bit confused with the statement that \’hedging does not neither make profit nor loss\’. Suppose in the above example when we short nifty position that contract have an expiry on which it will expire, and we have to take action before it expires so squaring off the position would make me profitable and what if just after few days the market started upward movement resulting my portfolio to move upward so, after few days/weeks/months my portfolio come at the levels they were before. Isn\’t it going to be profitable?

Or even if the market going down for next few days/weeks/months, I would simply take another short position and before expiry I would square off that generating the profit so and so until the market moves in the upward direction. Which in net will generate me a profit.

I hope you get my question.

This is possible, but its an unhedged position right? Not really hedged.

Sir can you also make a course on US fed rates and major global events that play role in volatility but are not easily understood by normal individuals.

I usually find it difficult to grasp what fed rate cuts are usually talked about in the market and how to make a view on market with that info.

And Thank you so much for your valuable lessons.😇

Check this, Roopam – https://zerodha.com/z-connect/varsity/us-fed-rate-cut-how-it-affects-traders-and-investors

which option i should exit first buy or sell in nifty option hedging trading ?

You can exit the sell first so that you free up the margins.

How to hedge with regards to Options? Is it safe to say the strategies like bull spreads are known as hedging?

There is nothing like safe, Prem. It all depends on your risk appetite. But that said, bull spreads are hedged.

Hello sir ..my ques is when will you become a billionare? because u r full of knowledge..and if u become one pls send me few bucks ..thanks

You can\’t equate the two. Knowledge is gained through experience, money is made by taking risks 🙂

Please check if I am on a right track

To hedge a portfolio of stocks we need to follow the following steps

A) Calculate individual stock beta

Done.

B)Calculate individual weightage of each stock in the portfolio

=Current Value of particular stock investment / Total Portfolio Current Value

C)Estimate the weighted beta of each stock

=Beta*Answer(B)

D)Sum up the weighted beta to get the portfolio beta

Done

E)Multiply the portfolio beta with Portfolio value to get the hedge value

=Weighted Beta*Total Portfolio Current Value

F)Divide the hedge value by Nifty Contract Value to get the number of lots

Done

G)Short the required number of lots in the futures market

Done

Please check my question number B & E

As i have taken current value of all, While calculation instead of investment value.

Please confirm karthik. Am i on a right track?

Yes, the steps listed seems correct.

Hi Karthik,

Thank you for sharing this great peice of knowledge,

I have a little doubt, when there is uncertainity,

If the portfolio is in positve MTM, Don\’t you think the hedge should be on current value rather than invested value.

Please give your opinion and enlighten us.

Thanks

Aagam

Thats right, you can take in the current market value.

Hi Karthik,

Can yuu please share the wesites where I can monitor below information. I tried to find but it\’s very confusing to me.

1. GDP growth forecasts from the World Bank and RBI.

2. Check inflation and Monetary policies and factors that can drive inflation up.

3. Keep an eye on commodity, crude oil, Dollar, and the USD-INR prices.

4. Track Monsoons and its impact on inflation, CPI and food price inflation.

5. Keep a check on International and domestic political situations

Atleast 1,2,4 which you prefer to visit and check this data.

This would be really helpful if you can respond❤

You can probably check this – https://tradingeconomics.com/

Hello Karthik Sir could you please suggest me best resource for swaps

Ah, I need to check this myself, not sure 🙂

for calculating portfolio beat, when you say \”sum invested\” is it the \”total buy value\” or \”total current value\” of the portfolio? assuming its the latter?

You will have the consider investment value.

Hi Karthik,

Wish you a very happy new year!

You have made trading easy for us with your simple illustration of concepts and the process. Thank you so much!

I am thinking of exploring Equity Futures to take directional calls on Indices and Stocks. Does Zerodha provide past trading data (daily) of stocks to see the patterns and run some tests? Does Zerodha provide financial data (assets, liabilities, earnings, etc.) like some of the paid websites (Capitaline/Prowess)?

Thanks Pranav. Wishing you the same!

YOu can check kite.trade for the data, hopefully that should help.

Hi Karthik,

I need little more clarification to understand. Actually Long position is insulated by short position and vice versa. So will be minimal or no loss. I agree but it will impact returns percentage because one position dilutes the returns of the other position. So my understanding is that hedging minimizes losses and dilutes the returns as well. Please explain with some example if my understanding is wrong.

When you hedged, your position is fully insulated to market movement. You do that only when you feel the market goes down. If the market does go down, then your positions are unaffected, rather you outperform the market. But in the case the market goes up, you are still unaffected but that also means you dont really get the returns that markets have to offer you.

Karthik,

It was good explanation of hedging long stock positions with short Nifty futures. Please explain the same example if Nifty goes up by 500 positions. What will be impact of Short Nifty contract vs Portfolio value. It will help me as a beginner.

The position will be insulated, Krishna. The portfolio will not get impacted by either movement as the portfolio is fully hedged.

Good Morning Karthik Sir i have never seen negative beta on stock screening websites i know negative beta examples are defensive stocks like pharma and FMCG but in real life i have never seen value on any website can you help with this query

For the longest time Airtel had a -ve beta, dont know if that has changed. Maybe you can check once.

First off, thank you Zerodha & team for the wonderful educational chapters provided. Always a pleasure to learn from the valuable information given in such a simplified manner here.

My question might be a bit extraordinary. I am wondering, if when a single leg index option\’s contract is sold and is moving directionally against me (from OTM to ITM), would it make sense to hedge this losing option position by taking an opposing trade in a futures contract? I have read more about hedging futures positions by options rather than the opposite. Love to hear your thoughts on this.

Yeah, you can hedge it with futures or perhaps another options position, but make sure the overall value of the delta is zero or neutral. I have explained delta in the options module.

If its a non-zero delta position, it will remain unhedged.

My share portfolio is for long term. So, to hedge it do I have to keep selling and repurchasing nifty on each expiry OR is there a carry-forward mechanism?

If its long term, then maybe just leave it as is?

Dear Karthik,

The stock which i have does not always respond as per its beta value and behaves differently.Is it because of some news related to the particular stock?How to hedge in this case?

Thanks

Maybe on a day to day basis, it wont 🙂

Loved this chapter. Derivatives are useful for long term investors to protect their portfolio in corrections.

Yup, a point that many have missed 🙂

If a stock position is hedged, profit in one position will be compensated by loss in another then how is it beneficial? Kindly explain.

Its just that the position itself is insulated to all market directions. You hedge to protect your positions, not to make a profit or suffer a loss.

Hi Karthik – Can you help with the excel sheet for Beta, its not opening with the link above currently.

Can you also include a topis on relative strength and how can one use this to our advantage. Also, if you can pass a message to the zerodha team to please include the Relative Strength as an indicator or the spread charts flexibility !

thanks a lot !

Vikkas, can you try downloading the beta excel from another browser? Also, we have already discussed relative strength here – https://zerodha.com/varsity/chapter/indicators-part-1/

Thanks a lot Karthik. The dhapters on Pricing of future and Hedging were real eye openers.

Question:

Is there any reliable site or tool that can be used for extracting beta value of stocks ?

Raam, glad you liked the chapter. Cant think of any site, but maybe NSE itself provides this somewhere. I remember seeing it long back.

Can we use the same hedging approach for mutual funds as well? If so, where can we find the beta for each mutual fund.

The factsheet of the fund will give you the beta. But my advice, don\’t worry about hedging, the fund manager does this for you 🙂

Hello Sir, I just had a small doubt. Which type of investors usually hedge their portfolio? In the above example you mentioned that selling the stocks and then waiting for the price to decline to buy them back is not practical because of tax and transaction cost purposes, but if the investor wants to be invested for a longer period of time why would he bother with a short term downturn. Wouldn\’t it be better for him to just buy more stocks when the prices go down, why would he shell out more money just to hedge this portfolio rather than buy more?

Hedging works when you have a large portfolio where the M2M can be significant. Or it can also help in cases where the portfolio is held for the short term. As a long-term investor, you don\’t really have to worry much.

Can I buy 1 lot of future and sell 1 lot of future (next month) for hedge?

Yes, you can.

I just want to thank you for this wonderful course.

Happy learning 🙂

Ok sir, thank you..

Happy learning 🙂

Sir, if I hedged SBIN future with put or call, then it shows max loss 18700/- on Sensibul, at expiry. My doubt is that when call or put expires,we have lot size *premium =loss (as above ), then

1) what happens about future, if market goes against?

2) why is max loss of 18700/- only or is there possibility of more than it at expiry?

Plz clarify

You will have to consider the overall P&L. So basically the P&L (Futures position + Options position). So for futures P&L its the difference between the entry price and exit price. If you do it this way, you will know why its 18700.

Thanks Karthik

Happy learning, Amit!

Do you mean Nifty spot ATM? That\’s my exact question. Sorry to bother you again…

Yes, thats right. Nifty Spot is what I\’m referring to.

Hi Karthik,

I have a query related to Nifty futures hedging. Currently Nifty spot is at 17594 and Nifty Mar Fut at 17661. So if I long 1 Nifty Mar futures then to hedge it should I buy Nifty puts with the strike of 17600 (spot ATM) or 17650 (futures ATM)? Precisely what strike should I select here if I want to buy ATM puts? Should it be spot ATM puts or futures ATM puts?

Thanks in advance for clarifying on this

Thanks,

Amit Kale

I\’d suggest ATM, Amit.

Is it permitted to short sell cash settled futures? Post the SEBI notification of phasing out cash settled futures, is it completely phased out?

Yes, of course, its possible.

Hello Sir,

I am investing in Nifty 50 index fund through SIP. How do we hedge this position? Is there a way to find beta value of the mutual fund ? Or is there a way to get beta value of Nifty 50 index? Is it readily available? Kindly help me with this.

I\’m guessing Nifty 50 you are investing for the long term. If yes, why do you want to hedge?

Thanks. Did you mean I should be shorting 2 ATM calls? This is because I am not short 1 future but long 1 future as mentioned in my original query

Ah sorry, so if you are long Futures, you can buy 2 ATM puts.

Hi Karthik, You have put in a wonderful content in Zerodha varsity as a whole so thanks a ton for that. I have a specific query though. 1. Current Reliance spot and futures price for 23 Jan is 2524 and 2542 respectively

2. I want to long Reliance 23 Jan 2540 future 1 lot and hedge it by going long on put

3. The question is – should I go for 2540 put (23 Jan) or 2520 put (23 Jan) here? This question is because – if the price of Reliance goes down then it\’s future price too will go down and near to the expiry the spot and future price will converge. So if the expiry happens around 2520 then I will lose entire put premium. We really don\’t know at the beginning of three month if the spot price will move more towards future of the other way round. Precisely my questions is – while hedging long future with long put should I use spot price or future price as the strike price for put?

Please share your take on this

Thanks

If you want a perfect hedge, you can think about the delta. Since you are short 1 future, the delta is -1. To offset it, you need +1 delta…so shorting 2 ATM puts (2520), will give you the perfect hedge at the time of initiating the position.

The excel sheet for beta calculation is not opening. Can you please share the correct link.

Can you please try downloading for another browser?

Ohh! Okay. Thank you!

Sure, good luck.

Currently (today 27 Sep 2022) I designed one trade on Sensibull.

Here I

1) bought Next month Bank nifty future contract (27 Oct expiry) @38770 and

2) sold current month Bank nifty future contract (29 Sep expiry) @38593.70

And I am getting clear-cut fixed profit of 6% (no matter where I set underlying price or days left to expiry). Also I checked and these contracts are liquid. I can get them at specified price and still payoff is constant 6%

I would like to know what\’s happening here. 6% in 2 days 🙄

How\’s this possible?

The assumption is that both contracts expire on same day, but its not right?

Hi Karthik,

Very well explained. Thanks a lot. But this example illustrates hedging when one is in long position at spot market. How can one hedge if one is having short position in future. And how does one square off?

You can buy a call option to offset the short futures position in futures.

Congratulations on your efforts to help learning

Thanks, and happy learning!

Can we place SL for futures trade??

Of course, you can. In fact you should 🙂

Dear Sir

What will be cost / charges, etc of hedging

Regular trading charges are applicable.

\”Systematic risk is the risk that is common to all stocks. These are usually the macroeconomic risks which tend to affect the whole market. Example of systematic risk include –

De-growth in GDP

Interest rate tightening

Inflation

Fiscal deficit

Geo political risk\”

perfectly playing out in 2022

These things usually unfold in a pack 🙂

Hello Sir,

Beta Calculation Excel is not Downloding

sir i got the answer of the q. how to calculate the beta value

😊😊

sir high beta stocks are better?

as India is a developing country and definitely the indices will move up and with respect to that stock will do the same, and in respect to this we can gain more profits in high beta stocks.

in the continuation of the above question

is beta value changes?

if yes, then in which respect?

Yes, with change in price, so does the beta.

hy sir

how the beta value of stock is calculated? can you brief it?

I\’ve done that in this chapter itself right?

Dear Sir,

Then what is the use if there is not profit or no loss ?

Just time pass in Trading Terminal ?

For that we are not here

Regards

Sure.

Superb…Never had such a simple and detailed explanation of hedging…

One question- we hedge against the loss of portfolio, but what if market is in bull phase and portfolio is rising. In that case, if we have already employed hedge, then we would be at no gain at the end.

Please suggest

Thats right, to hedge a portfolio, you need to have an opinion on the market direction.

Currently (2022) How the beta value is calculated..? and How can i hedge my equity portpolio using Zerodha platform..Pls advise

The technique of calculating beta is the same, and that wont change with time 🙂

By 9,00,000 hedge value do you mean to say the notional value?

Yes, thats the notional value of the portfolio which needs to be hedged.

What if I have a position in a stock that does not have a futures contract? I dint get this point, if doesnt have future contract how will short it and hedge the position

That won\’t be possible at an individual stock level. You will have to hedge it along with the portfolio.

In key takeaway #5, you said \”Unsystematic risk cannot be hedge, but can be diversified\”, but there is a whole topic on hedging a single stock. I don\’t understand how they are different. Please explain.

That chapter on hedging is about hedging a portfolio. That said, single stock can be hedged by its futures or options, but not all stocks have futures and option contracts on them.

Hi Mr. Karthik, please clarify me the below

on expiry day, do i have to take or give delivery if any of the below goes CE OR PE GOES ITM.

what happens if futures goes up and down.

i want to know how settlement takes place if i do not exit before epxiry of contract

Position Entry Price Current Price Exit Price P&L

-1x 27JAN2022 FUTURES 1875.55 1876.9 0 -742.5

+1x 27JAN2022 1880CE 52.45 49.4 0 -1677.5

-1x 27JAN2022 1880PE 58.45 54.2 0 2337.5

Total P&L -82.5

Please check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement/

Hi Karthik, so basically If I hedge, I am insulated from the market volatility, so ideally let\’s say your portfolio is 20% up, and we expect a fed tapering, we should probably hedge always! I didn\’t because I hadn\’t read this article. 🙁

How do you hedge with options? because there is a premium factor that comes into play?

would you buy a put option, atm?

Or short an OTM call option?

can you point me to a document/blog which deals with such details?

Pankaj, to hedge a portfolio with options, the safest bet is to buy an ATM Put option. Will try and put up an article around this soon.

I am Looking for prefect hedge for nifty ( selling options ). I don\’t want let my portfolio to be negative ! I have studied wheres theory but they all saying buying Gold is the only option for me but now a day it is not working .To hedge which is the best instruments USDINR or Gold ,Give some idea to float my position even if stock crash. Buying PUT will also lose time value ! I am waiting for your answer !

Thanks

Happy learning!

very nice article

which future contract will you ideally employ to hedge , current or next month contract ?

Current month contract, Shaji.

thanks @karthik rangappa sir

Good luck!

Simply Brilliant Karthik !

Happy learning!

Want to ask some questions

1) expiry of options – are they expire at last Thursday of the month or before that Thursday

2)impact of elections on market

1) Last Thursday of the month

2) See what the street expects and the actual outcome is.

Could you share the excel for the Beta calculation, the link is not working for chrome

I\’ve explained the same step by step in the chapter, Nisarg.

Is it better to square off position before expiry of future contract as you mentioned price at spot market and price of a future contract converge at the date of expiry . Suppose

Spot price – 445

Future price – 450

If I am long on future contract buy at 450 definitely price would come to 445 at the date of expiry .

It\’s means I should always square off the position before expire when we are on long .

Not really, futures and the spot always converge. The decision to hold or sell depends on your expectation of the trade, Shubhika, and not on the fact that the futures and spot will converge.

Hi ,

1. I have a stock of Devyani international limited in my portfolio and it has been listed on stock about a month ago . So how can I calculate beta of this stock .

As we need at least 6 month or 1 year report of daily closing price of the particular stock .

2. And some takes a 6 month report and other take 1 year report to calculate beta . I would want to know does it make any major difference in the beta value by taking different time ( 6 month or 1 year ) of report .

1) Yeah, 6 months at least

2) Both values are different, people use them according to trading style. For short term = 6 months, 1 year for long term.

Dear Karthik, the Beta value of the stock would vary for different lengths of the period ( say 6 Months, quarterly, annual, etc ) considered for its calculation. Which beta to be considered for hedging a portfolio for an event like annual budget or otherwise?

At least 6 months, Shanshak.

Suppose I calculated the beta of my portfolio it is stands at 2.0 % . now to calculate the risk I have to check the market movement and we assume Nifty goes down by 5.5%

Now my question is how do we calculate this 5.5 % change in the market

What is the particular formula to calculate the market

Like – current price – previous day close / previous day close * 100

This formula use for particular time % change in nifty index and it\’s changes every second of the day

So I have to keep an eyes on the market and check every second either I bear a lose or book a profit.

Do we have any particular formula to calculate . where market changes can calculate for the entire day .

I hope you get my question

Thats right, the formula you\’ve stated works to figure the % change in the market. But there is no need to calculate the change so closely.

Can I compare my portfolio ( beta of the all stock ) with daily % change in nifty index .

Like using the formula – current price – previous day close / previous day close *100

To get the result of how much my stock will move for a day .

Is it justified to compare as percentage changes in every second .

Either beta of the stock can only compare with beta of the market indices for better results .

Hmm, not really Shubhika. YOu don\’t really have an advantage looking at the change in beta second by second.

Hi,

Assume I calculated the beta of my portfolio till the date of 24 Aug 2021 . On the next day 25 aug should I calculate the beta of the portfolio again as beta is calculated on the daily return .

If not , so what is the duration or after how long we supposed to calculate the beta of the portfolio again

You can check the beta once in 15 days or so, unless there are really big moves in the stocks.

Hi,

As you mentioned the beta of the market indices ( Sensex and Nifty ) is always +1 .

May I know how to calculate the \’ beta market indices \’ in percentage .

You have already mentioned the formula for calculate the beta of the stock but you didn\’t mention the formula for market indices.

If you don\’t mind would please mention the formula to calculate how much percentage has change in the market

I\’ve shared the excel steps. So when you do beta of the market, you essentially run a slope function of Nifty (or Sensex) with Nifty (or Sensex), and hence you get 1 as the answer.

I Sir, is cash needed to be there in account to short the nifty futures for portfolio hedging

Yes, but since its a hedged position, the requirement may be lesser.

When we hedge and try to minimize the risk, aren\’t we also dampening our returns? Well, I do appreciate the reasons to hedge, but it is going to impact returns adversely isn\’t it? Or am I missing some critical piece that will make hedging more appealing from a return standpoint?

When you hedge, the idea is to insulate the entire basket to both positive and negative returns. Its like you don\’t have any positions in the market. So no risk, no return.

Hi Karthik, thanks for building such an informative body of knowledge – I visit Varsity frequently as my \”go-to\” reference.

I have an observation regarding risk – I feel terming these as systemic would be a better fit than systematic. Systematic and systemic both come from system. Systematic is the more common word; it most often describes something that is done according to a system or method. A systematic approach to learning that involves carefully following the program\’s steps. On the other hand, Systemic describes what relates to or affects an entire system. For example, a systemic disease affects the entire body or organism, and systemic changes to an organization have an impact on the entire organization, including its most basic operations.

Please see https://www.merriam-webster.com/dictionary/systemic and https://www.merriam-webster.com/dictionary/systematic

Thanks and please keep adding to this awesome body of knowledge.

Thanks for the detailed explanation, Ashish. I kind of agree with you. But I think the common industry/academic practice is to use Systematic. For example, I was going through this from Columbia University – http://www.columbia.edu/cu/business/courses/download/B7301-XX/glosten/slides21.pdf and here too they use Systematic (slide 9).

Can I have latest video clip how to book buy or sell hedge in zeroda mobile app

There are no video clips 🙂

I\’d suggest you speak to a zerodha support executive for this.

Dear Zerodha team,

I want to buy a Nifty CE at a price 2.5% higher from where Nifty future is currently trading. But its not reflecting in dashboard.

Please guide.

Regards

Sorry, I dint get that. Do you want a strike that is trading 2.5% higher than Nifty Fut?

Sir, While calculation of Hedge value, Do we have to consider initial invested amount only or current value of Portfolio?

Current value, Amoghha.

Hi sir

Thank you for beautiful explaination. I am going thru your option chapters and I must say it\’s a well done job(though I still feel futures are easier to understand)

My query is

1) If I am holding a position in future already, can I hedge it with option later( dep on stock performance) or is it advisable to always take a hedge future position.

2) How to hedge future with options?( Always with Itm option?)

1) YOu can hedge it with options, no issues there

2) Not necessary, you can hedge with OTM or ATM options as well. But most prefer ATM)

Hello sir, all these contents are still deemed as fresh in 2021??

Or it is obsolete now?

Yes sir. These things are core concepts and will remain the same over time.

There is a margin to be paid to sell the futures. In your working above you haven’t considered that cost. Shouldn’t that also be calculated while deciding the hedge value?

Hmm, not sure how you can factor in margins here. It may just get very complicated.

we hedge porfolic with shorting nifty future of mid month expiry.we have to sqare off future at expiry(or roll over).how hedging work if portfolio (and nifty) goes up and we have to settle future at expiry with loss.In this case we do not want to sell portfolio .

The idea is to insulate the portfolio completely. When you do so, you neither make a profit or loss.

Also, since I learnt everything from you, I should probably let you know that I was able to keep my pnl positive for last three financial years sir, also made sustainable return. I am active in varsity for nearly 4 years and with zerodha for nearly 10 years. What I like the most is you answering every question without judgement or bias to the best of your knowledge. I think this consistency and integrity of yours rubbed on me too sir.

Mani, thanks for the kind words. I\’m glad to know that you\’ve been profitable. I hope its stays that way! Happy reading and good luck to you 🙂

yes sir, is there a website that gives beta value?

Not sure, Mani.

1) If you want a perfect hedge, you will need to short 2 lots

2) Thats right

Its not a perfect hedge, you can have this if you want it that way. Else, you can create a perfect hedge and let work as a fully insulated solution.

Okay, I understand. I am planning to position size in such a way that my risk of ruin is 15%.

Sure, please back test this before you take the trade.

Yea sir, I guessed the same, does it mean, that high beta stocks are better for intraday.

You want stocks to move so that you can easily trade intrday, so high beta works. But please be aware, risk and return are two sides of the same coin. So be extremely cautious when trading intrday, it is super easy to lose money.

Is it possible for you to look at momentum 30 stocks selection criteria and shed some light on the math used.

Will try and do that. I guess it\’s based on returns. Have explained the logic here – https://zerodha.com/varsity/chapter/momentum-portfolios/

In NSE site under strategy indices. Basically I am looking for socks that moves faster than nifty sir.

Yup, momentum 30 is a good bet.

Sir what is the difference between momentum 30 and High Beta 50 stocks? I went through the selection methodology, I couldn\’t under momentum 30 selection math. Primarily what I am trying to do is I am looking for stocks for intraday trading. So which list is better sir? or is there any other way to shortlist stocks for intraday?

Mani, where are you looking for the Momentum 30 stocks? My guess is that this will be a better bet.

I wonder after I read this chapter because in the middle the Author takes an example of Taking vaccine if u affected virus….(It is like taking vaccine shot against a virus).

Yeah, its like a hedge 🙂

Thank you sir for all this amazing knowledge.

I had a question in my mind regarding the expiry of the Future.

When I buy a Futures contract, I am digitally signing a contract that says on a specific date I will be buying the stock at the price I entered the contract.

Que1- Is it really necessary for me to buy the shares in the spot market at the expiry or I can have my profit or loss as it is without buying shares?

Que2- What happens if do nothing on the expiry date after I have bought a future?

Once again thank you sir ji😊

1) If you end up holding till expiry, then yes, you will be obligated. Else you can even square off your trade before expiry, which is also ok

2) It will be settled based on the market prices 🙂

Hello Sir,

How does one hedge with options properly?

Long positions can be hedged by buying puts or selling calls.

Short positions can be hedged by buying calls or selling Puts.

Hello Sir,

Would it be better to hedge each individual stock in my portfolio or just hedge against Nifty options?

For hedging with futures you have mentioned hedging the portfolio value (adjusted with beta) with the appropriate nifty value.

How does one do this for options?

Its better if you hedge the portfolio as a whole. An individual stock hedge can get very expensive.

Hello Sir,

I thank you for responding.

An ATM put has a delta of 0.5. Will it be sufficient to hedge against a long position that has a theoretical delta of 1?

You will need 2 ATM (delta = 1), that way the position will be offset and fully hedged.

Hello Sir,

Hedging with a future is good, but it has substantial M2M cost if it goes the other way.

So ATM put provides half a future but there is time and volatility also at play.

Which expiry time frame should one take?

So should one implement a hedge with an ITM option?

Could you explain hedging with options as it is not present in the option strategies module?

You are absolutely right about the M2M with futures and volatility and time decay of options. If M2M is not your cup of tea, then perhaps you should consider ATM Puts as a hedge for your long spot position. I\’ve not really put a note on this, will try and do this sometime.

Sir , various types of video available in you tube for future option Hedge. My question is Is Hedging beneficial and could zerodha allowed this Hedging pl.reply with an example.

Yes, you can hedge. For example – long Reliance stock, you can hedge by shorting reliance future.

Thanks sir, I have found the link.

Hello Sir, is the historical data in NSE site adjusted for splits and other actions? If not, where can I find corporate actions details? I searched through nse site, I couldn\’t find it, I have the link of old nse providing corporate action details but it not working now.

I dont think they do. Please check, its been a while since I checked.

Hi Karthik!

A great learning about hedging from you indeed. I have one query. We do hedging when we think that the market is going in reversal mode (I am a long term investor and I expect that market will go down). What if my expectation is wrong and market does not change its direction! Since I have hedged my portfolio, there must be loss to me in this situation?

When you hedge, you will neither have a loss or a profit. But yes, if the market goes up, then you will miss the opportunity to participate in the upmove.

I think you have accidentally skipped my previous comment.

Hello Sir,

One should only hedge with ATM and slightly OTM options correct?

Assuming I hold 300 shares of SBI, and sbi gets some short term bad news. Overall long term position is good. Short term is bad.

This news only affects SBI and not Nifty and bank nifty so I cannot use them to hedge.

How would I hedge adequately since SBI has a lot size of 1500?

Yes, if you hold SBI, then hedge with SBI only. No need to use other instruments. As a thumb rule, single stock positions should be hedged with their own contract as long as its available.

Hi Karthik,

From what I understood about hedging after reading the chapter, I feel that hedging the portfolio is kind of waste of money(maybe too harsh). On one side we are putting almost same money as our portfolio value to hedge the portfolio and at the same time we are ensuring that net portfolio value remains same.

This does not seem right because I have invested money to gain profits not to neutralize the portfolio.

So can you explain in detail as to how does hedging benefit oneself?

Piyush, its not a waste of money. Think about it, you have 20L deployed in the market, you don\’t want to withdraw this heavy amount because you expect a short term crash in the market, you\’d want to stay invest but still protect your capital. What will you do?

Hello Sir,

One should only hedge with ATM and slightly OTM options correct?

Assuming I hold 300 shares of SBI, and sbi gets some short term bad news. Overall long term position is good. Short term is bad.

This news only affects SBI and not Nifty and bank nifty so I cannot use them to hedge.

How would I hedge adequately since SBI has a lot size of 1500?

You gain nothing, loss nothing

whats the purpose of hedge here . .

(Why do we simply trade? To make nothing?)

You gain nothing and loss nothing, whats the purpose of hedge here . .

( Why do we simply trade? To make nothing? )

To protect your position in the market, while you are still invested.

Hi karthik, once I will create hedge in options. Will it triggers automatically? Or again I need to monitor or stop loss is required to set for both buy and sell. Using zerodha kite how it works in realtime..

Depends on what kind of orders you use to place the hedge. If it\’s limit or GTT, then yes, it will trigger.

Taking the current pandemic example,

Let\’s assume I had 250 (1 lot) shares of Reliance in equity.

Then WHO declared a pandemic.

The market started falling and I took a hedged position by shorting Reliance Futures (1 lot).

The bottom was formed on 23rd March.

At this point, I would be profitable in futures and losing in spot.

So my question is, what is the correct way of hedging?

Booking the profits of futures and let the spot move back to its original position or remaining in both positions( spot and fut ) till the tide passes and close the position at breakeven?

Hope I have placed my question

Thank U sir

Abdul, you hedge neither to make a profit nor to make a loss. You hedge to protect your position. You can choose to remove the hedge when you think its the right time to do so, once you do, your position will be exposed to directional risk.

Dear Sir,

Will an atm put option be able to adequately hedge a position?

Lets say I nifty put options to hedge against a stock. Do I have to buy enough atm puts to create the same valuation of the stock I own or would 1 put suffice?

1 ATM PUT option is good enough to hedge roughly 3-5L worth of underlying. YOu can keep this as a thumb rule, not really accurate, but works.

Hello Sir,

Lets say I have 250 shares reliance for the long term. Market price 1903

To avoid short term volatility I need to sell exactly 1 lot futures (250). So overall more loss would be roughly neutral.

But I were to buy puts instead do I buy ITM/ATM/OTM put? Do i need to purchase multiple lots of puts to make up the same valuation of my stock holding.

It is best to stick to 1 lot of ATM if your purpose is to hedge.

One of best explanation for beta stock and future headging

Happy reading 🙂

And one more question how to calculate the Beta of a Portfolio of Mutual Funds?

The same way as you would for an individual stock, consider the entire MF portfolio as a single stock, take its daily returns and run the slope function against the necessary benchmark\’s returns.

Sir, so, if I have understood it correctly, to hedge the Portfolio for a 1 yr I have to keep rolling over/squaring off, the contract and offset the Losses and Gains in my Future positions with my Portfolio value (since both will be opposing in nature) and will also incur transaction costs in the process.

That\’s absolutely correct, Rajdeep.

Sir, I have a doubt about the Duration of Hedging strategy by Futures.

Suppose I have a portfolio of 10 Lac and I want to Hedge it using Nifty Futures for say 1 Yr?

How can I do that?

You will have to keep rolling over the contract every month, Rajdeep.

Hi Karthik sir

What if i sell Current month futures contract and buy next month futures contract to collect the premium??? Will i get the premium?? Is there any downside risk?

There is no concept of the premium collection in futures trade.

>>The point to note here is – irrespective of where the price is headed (whether it increases or decreases) the position will neither make money nor lose money

Please clarify one doubt about this statement. Does it mean I need to sell my holdings in order to not lose money?

My understanding is, after shorting the future, if the price moves ups, I\’d start losing money. So, in order to balance it out, I need to sell my holdings.

No, think about it, on one hand, you have stocks (long position), and on the other hand, you have a short future position, both combined together, you are long + short, so directionally neutral. It does not matter which direction the market moves, it makes no difference to you.

Sir,

When we hedge our loss in the spot market is offset by gains in the futures market, then what is the rationale behind Hedging?

The rationale is to insulate your position from an adverse market movement. Think of it as protecting your position from a downfall. The flip side is that when mkts move up, you don\’t really make a profit (nor a loss).

Class, excellent outstanding explanation. These chapters are the best to understand the market.Thanks a lot to the team

Glad you liked it, Mahesh 🙂

best explanation. These chapters are the best to understand the market.Thanks a lot to the team

Happy learning, Mahesh!

Hi Karthik,

Thank you for your reply, not sure why I mentioned name as \’Nilesh\’.

Please correct me if I am wrong, if we are long on equities then there’s no ‘hedging’ strategy wherein we buy futures.

If you are long in equity, and want to hedge, then you should short futures.

Dear Sir,

How is cost of carry calculated?

Could you explain with an example?

Cost of carry is kind of baked into the price of the futures itself, Trace.

Thank you, Nilesh!

So if I understand it correctly, if we are long on equities then there\’s no \’hedging\’ strategy wherein we buy futures. Please correct me if I am wrong.

Hello Sir,

Thank you for such a wonderful explanation. Quick question please, so as I understood the crus is that the position in the futures contract should counter the equity position. Or, is there any dependency on the price movement also. For example, if say I expect my portfolio value to increase (expect spot price to increase), then should I buy futures for hedging?

If I may ask it in a different way, what will be the scenario when one will need to buy (go long) the futures contract for hedging?

Saurabh, if you expect the future price to increase, then you can –

1) Continue to stay invested in the portfolio without hedging, or

2) Buy futures, or

3) Have your portfolio plus have a futures position

Hedging prevents us from market fluctuation and incurring losses. But we are not making any profit either (in the examples here) as the stocks in the portfolio (long) and the NIFTY FUTURE (short) move in the opposite directions. So, how can we get profit here?

That\’s right, you hedge to stay insulated, which means you neither make a profit or loss 🙂

By hedging, if we\’re notgaining or loosing, then why all these activities done of trading..?

I am scratching my head..please help..😊

Suni, by hedging you are insulating the portfolio against adverse market reactions, you don\’t hedge to lose or gain from the portfolio.

sir, If we have done headging of portfolio means that if the market moves downward or upward we will be on in loss and not in profit as well, is that correct.

Thats right.

As, Headging of portfolio ( 8 lakh ) at 9.784 lakh in future is done ,

suppose that market moves (10 lakh) so we will not get profit too right in future position their would be loss and in spot profit we will be in profit,

i am correct or wrong!!!!!!!.

Tushar, when you hedge your portfolio, the loss in the portfolio is offset by gains in futures or vice versa. So you\’ll not make any profit or loss when you hedge.

Hi Karthik, I am really impressed with the way Zerodha is educating people about financial markets. I have question for you. You said that the only way to hedge risk is through futures and options, but what about hedging through intraday trade in spot market. In intraday trade (shorting) we may miss to hedge overnight risk, however we can hedge a day to day risk. Am I right. Kindly provide your suggestions on that.

Yes, you can do that, but remember short positions have to be closed by EOD. Which means you can not hedge overnight risk.

How would do the similar example pan out if the beta was negative, instead of positive ? What would the investor do in this case ?

Then it suggests that the portfolio is anyway uncorrelated with the market.

Hi karthik sir,

i have one query regarding hedging the portfolio. let suppose my hedge value required is 375000 [(stock value)500000x(beta)0.75]

so i need to short 0.37 number of lots of nifty future 375000/1012000. which is practically not possible

so can i do this hedging with any option which has a delta of .37

if yes ,then what will be the limitations??

please reply.

Regards

sorabh dhiman

Client id- ps5803

Yes, Sorabh. That is the next closest thing that you can do.

Hey Karthik!

1. Is 6 months of past data enough to calculate beta? What would be considered overkill?

2. I calculated beta for my portfolio which comes out to be 0.61. Current Nifty Dec futures price = 13424.8 & currently one lot size Nifty futures = 75. Which makes contract value = 1006860 ~ 10 lakhs. My hedge value is 197854 ~ 2 lakhs Which makes number of lots to be shorted as ~ 0.2. How do I get around this?

3. If options is the answer for 2, how exactly should I optimally do it?

Thanks!

1) It is. 6 months to 1 year is good enough

2) The portfolio beta is 0.6, which is less than the market. So roughly you need to 6L worth of short for every 10L worth of contract value. Tough to hedge this, unless your portfolio is more than 10L. The other alternative is to buy PUT options

3) 2 lots of ATM will be good for this.

How frequently do you\”ll hedge a stock or a portfolio? Please share your experiences.

I used to do it quite often when I\’d take active portfolio positions, but I no longer do as company regulations don\’t permit me to trade/take active positions.

Sir for profitable hedging we should always buy cheap(whether the spot or futures price) and short the expensive one(remaining of spot or futures price), only then we will have fixed profits, right?

But otherwise hedging(knowing maximum losses) is possible even by buying expensive and shorting cheaper one, is that correct sir?

many thanks as always!

There is nothing like \’profitable\’ hedge. When you hedge, you insulate your position against the market movement, so you neither make a profit nor make a loss.

sir you say that -\”Unsystematic risk cannot be hedge\” but i dont think its necessarily true. As in if there\’s any turmoil in the company and a person manages to foresee it then why can\’t he/she take a short position in the futures market and stave off any temporary losses. isn\’t this an example of hedging against unsystematic risk?

many thanks!

Technically yes, you can. But the assumption is that the hedge value and the shares you hold perfectly match.

One more ques. I\’ve been reading different chapters in sequence. Should I start puting the learnings so far in some action or first complete all modules then start investing. Also, any dummy trading portal that you\’d recommend to practice?

You should start validating, at least by taking paper trades 🙂

About hedging, Assuming I\’m long at X in spot, not to hedge I should go short on Future. What would be the difference if I square off in short only and again buy the shares back when I feel ok.

Also, what would be ~ difference in the charges between Spot vs Future (Asuuming complete cycle at same CV)

Thats also ok, but by doing so, you are losing on your average buying price plus incurring transaction charges.

There is no mention of how long we should hold the hedge position, which would make this chapter more complete.

The tenure of the hedge is dependent on your opinion on markets, just like how you take a call on when to initiate the hedge.

We see situations when certain established banks(popular blue chip) do not perform well( all of them) for a long while( 6-8 months or more) & lets say i hold 3 such bank stocks + 2 nbfc ..This is unsystematic risk as maybe banking sector is doing ok but my chosen(holdings) stocks are not performing.

Will Hedging in Banknifty be a good idea mainly done to hedge this ?

Yes, this is assuming you are only exposed to the banking sector.

Nicely explained! Please guide when should we book profit in futures. It may happen that after some fall the market halts or bounces a little. At that time we are not really aware that a big fall is likely to follow, so we close the futures hedge and book profit in it. After that market starts falling again severely and we are caught without hedge. So timing of booking profit in futures is very important, how to get the timing right or nearly right?

Thanks

When you hedge, there is no concept of a profit. You need to look at it from an overall perspective by considering both the portfolio and futures, the gains from one will offset the other. The decision to remove the hedge depends on your outlook on the market, just like the way you\’d have got one at the time of initiating the hedge.

I am a beginner and trying to understand this.

So if i am an investor and i would want my portfolio for a very long periods of time then does hedging make sense? because in case my portfolio falls by a good % as a long term investor i may want to in fact buy more stocks.. Am i right?

If you are long term investor and you don\’t expect too much of a crash, then its ok to leave the portfolio as is.

Hello Karthik,

Thanks for the nice blog.

One question: How could we know whether somebody (smart money) is creating hedging positions or real position in Futures/options?any technique to know that?

It is impossible to figure the intent behind these trades, Rahul.

Hi

When we hedge using short or long nifty

1. if it is for our long term portfolio, always better to hedge with a a future that is cheaper irrespective of the month is that correct.

2. If my stock is not part of nifty, would then the logic of hedging using a nifty long short be a near perfect hedge or no

1) Yes, in fact you can stick to the near month contract.

2) Thats right.

Hey sir.

In the example, the portfolio loss stayed unrealized but the nifty position gave 54k profit. So do we have to pay 30%(or whatever according to slab) on this 54k?

Yes, the taxation bit is different altogether.

Hello sir

This was a great lesson on futures markets