19.1 – The new beginning

In a fascinating new development, NSE in collaboration with RBI has recently made it possible for retail investors to start investing in Government Securities, mainly the long-dated bonds and the treasury bills (T-bills).

These were products which were available only to banks and the large financial institution, but now we can invest in them and take advantage of attractive and guaranteed returns. However, since these are new financial instruments (at least to the retail participants), understanding the nuances before investing is important. For this reason, we have put the following conversational FAQs with a hope that you will be able to figure out the basics.

Do read on and post your comments below.

19.2 – FAQs on G-Sec

What am I investing in?

You are investing in Bonds/T-bills issued by the Government of India. Since the Government of India backs these, these are virtually risk-free investments. The guarantee from the Government is also called ‘Sovereign Guarantee’.

What are bonds/T-bills?? Tell me more.

Whenever you and I need money, we go to the bank to avail a loan. Against this loan, we promise to pay the bank periodic interest and also return the money after a certain amount of time. This is common practice, where the interest and principal are repaid to the bank.

Likewise, the Government of India also needs money to build roads, bridges, dams, hospitals, etc. When they run short of money, they approach their bank for a loan, which is the RBI. The RBI, in turn, auctions the loan in the form of bonds/T-bills that you can purchase. Essentially, you are lending a part of the overall loan the government is seeking. Against this loan, the Government of India, promises to pay periodic interest and also repay the principal at the end of the tenure.

The loan which the government intends to repay within a year is called the Treasury Bills or T-bills. Loans which the Government intends to repay over many years are called the Bonds.

What should I choose? T-Bills or Bonds?

Both are great investments if you seek the safety of your capital. There are a few easy to understand variables that you need to look at before deciding on an investment in these two G-Sec instruments.

Variables like what? Start with T-bills, please.

There are three T-bills variants, and they vary based on the maturity period. They are 91 days, 182 days, and 364 days. T-bills do not carry an interest component; in fact, this is one of the biggest difference between T-bills and Bonds. T-bills are issued at a discount to their true (PAR) value, and upon expiry, it’s redeemed at its true value.

Woah! That sounds complex. Give me an example, please!

Ok, consider a 91-day T-bill. Assume the true value (also called the Par value), is Rs.100. This T-bill is issued to you at a discount to its par value, Say Rs.97. After 91 days, you will get back Rs.100, and therefore you make a return of Rs.3. Think of it; this is as good as buying a stock at Rs.97 and selling it after 91 days at Rs.100. The only difference is that this is a guaranteed transaction, meaning, there is no risk of you selling below 100 (or above 100).

This sounds quite straightforward, is there anything else I need to know about T-bills?

That’s it pretty much. You need to remember that t-bills are issued at a discount to par, and upon maturity, you get the Par value. Of course, you can get a little technical and measure the yield of this investment if you want.

I’m all ears, let’s get technical!

Yield essentially measures the return on your investment on an annualized basis. After all, all investments should be measured by its returns on an annualized basis. So if you have made 3 bucks over 91 days on investment of Rs.97, then at this rate, how much would you have made every year?

The formula is –

Yield = [Discount Value]/[Bond Price] * [365/number of days to maturity]

= [3/97]*[365/91]

= 0.0309*4.010989

=12.4052%

So in other words, the T-bill offers a return on investment of 12.4052%, but since you held it for 91 days, you will enjoy this return on a pro-rata basis.

Typical 91-day yields are around 6-7.5%. Needless to say, the higher the yield, the better it is.

What happens upon maturity of a T-bill?

Upon the maturity, the Government debits the T-bill from your DEMAT automatically, this is called ‘Extinguishment of Securities’ and the par value gets paid to the bank account linked to your DEMAT account.

Is that all about T-bills? Is there anything else that I need to know?

Nope, that’s it. You are all good to start 🙂

Alright, tell me how the bonds work.

Bonds differ from T-bills on 2 counts. Bonds have long-dated maturities, and they pay interest twice a year.

Sounds, interesting. Can you give me an example?

Every bond issued will have a unique name or symbol. The symbol contains all the information you’d need. For example here is a symbol – 740GS2035A, and here is what this really means –

Annualized interest – 7.40%

Type – Government Securities (GS)

Maturity – 2035

Issue – ‘A’ means it’s a fresh issue (don’t worry much about this, be aware that this is NSE’s internal nomenclature for their own book-keeping )

This issue is expiring in 2035 or 17 years from now (we were in 2018). If you were to invest in this bond, you would receive a 7.4% interest every year until its maturity in 2035. Please note, the interest will be paid semi-annually so that you will get 3.7% interest twice a year. Finally, upon maturity, you will also get back your principal amount.

Here are few more government security (GS) symbols –

| Symbol | Annualized Interest | Semi-annual interest | Maturity Year | # years to Mature |

|---|---|---|---|---|

| 662GS2051 | 6.62% | 3.31% | 2051 | 33 |

| 668GS2031 | 6.68% | 3.34% | 2031 | 13 |

| 737GS2023 | 7.37% | 3.68% | 2023 | 5 |

Can you give me an illustration to help me understand how much I earn if I were to invest in a bond?

Fair enough, but before we get into the details, you need to know one more thing.

Every bond has a Par value, of say Rs.100. When you invest in a bond, you usually invest either at a discount (ex: 98, 97 etc.) or par (100), or a premium to par (101,102 etc.). The price at which you invest in a bond depends on something called an ‘auction process’. More on that later, but for now, you need to be aware that you can invest in a bond at par, at a discount, or a premium.

Now, consider you invest in 700GS2020 (7% with a maturity of 2020 or 2 years from now) at a discount price of 98.4. Assume, you invested in 150 of these bonds, so you’d pay –

150*98.4

= Rs. 14,760/-

From the time you invest, the interest cycle starts. The interest is paid on the face value of the bond. The total amount you earn is as follows –

| Time Period | Interest | Cash flow | Remarks |

|---|---|---|---|

| 0 – 6 Months | 3.5% | 3.5% * 100 * 150 = Rs.525 | Half year interest |

| 6 months – 1 year | 3.5% | 3.5% * 100 * 150 = Rs.525 | Half year interest |

| 1 – 1.5 years | 3.5% | 3.5% * 100 * 150 = Rs.525 | Half year interest |

| 1.5 – 2 years | 3.5% | 3.5% * 100 * 150 = Rs.525 | Half-year interest |

| At Maturity (2 years) | Principal repayment at Par | 150 * 100 = 15,000 | Additional Rs.240 |

So on an investment of Rs.14,760/- you will earn –

525 + 525 + 525 + 525 + 15,000

= 2100 + 15,000

= Rs.17,100/-

If you do the math, the yield on this works out to approximately 7.88%. RBI has beautifully explained the calculation of yield here, do check this if you are keen to know more.

I’ve heard the term ‘ Yield to Maturity’, is this the same?

Hmm, not really. The concept of ‘Yield to Maturity’ or YTM is a little tricky. The YTM calculation assumes that you reinvest the interest payment back into a similar bond, which further generates interest on interest. Bond traders and institutional investors only look at YTM because this is the true comparable value between two different bonds.

This is similar to reinvesting the dividends from a stock back into the stock.

Alright, tell me about the interest payment? How does it get paid?

The interest payment gets credited directly to your bank account linked to your DEMAT account, just like the way you receive the dividends from a company.

Can you give me some insights into the auction process?

Till recently, investment in G-Sec bonds/T-bills was restricted to banks and large financial institutions with a minimum ticket size of 5 Cr. However, recently NSE and RBI have opened it up to retail investors with a minimum of Rs.10,000/- investment.

However, the price you pay for the bonds is still decided by the banks and other major financial institutions. They place bids on RBI’s auction platform, and RBI decides the price of the bonds based on these bids placed on their platform. So the auction process is basically a process to discover the price you’d pay for the bond, also called the weighted average price of the bond.

So it is the weighted average price of the bond, the price I need to pay to purchase the bonds?

Yes and no.

At the time of placing your order, you pay a slightly higher amount. This amount is called the ‘amount payable’. Once all the orders are placed, the auction process starts and RBI evaluates the weighted average price. Any difference between the ‘amount payable’ and ‘weighted average price’, is credited back to your account the very next day.

Wait for a second, what do you mean by ‘option to sell in secondary market’?

This works exactly like how you buy and sell stocks.

Let’s say you decide to invest in 740GS2035A. This means you will continue to enjoy a semi-annual interest payment of 3.7% every 6 months for the next 17 years, till 2035.

Now, after a few years, you no longer wish to hold this bond. In such an event, you can decide to sell this bond in the secondary market, pretty much like how you buy and sell stocks on NSE.

Check this post on TradingQ&A to know more about selling G-Sec in the secondary market.

Great! It looks like I’ve got my basics right. Is there anything else that I need to know?

Think of the whole thing as applying for an IPO followed by the stock getting listed on the exchanges. It’s pretty much the same. The auction process is like the IPO, and once the bidding is done, the Bond (or T-bill) will get listed on the exchange. You can sell the bond whenever you want, or you can even trade the bond once it gets listed!

The minimum ticket size is Rs.10,000/- and its multiples and a maximum of Rs. 2 Cr. You can place the orders when there are new auctions (just like an IPO). However, the good part is that RBI notifies the auction dates and schedule well in advance.

Here is the calendar for the upcoming t-bills auctions.

Here is the calendar for the upcoming bond auctions.

Here is the link of all the bonds that have been issued by RBI. Do pay particular attention to the nomenclature, coupon rate, and year of maturity.

What are SDLs?

To meet the budgetary requirements, State Governments also raise loans from the market, and these loans are called State Development Loans (SDLs). These loans are similar to the dated securities issued by the Central Government, the interest is credited half-yearly, and the principal amount is repaid at the time of maturity. SDLs also qualify for Statutory Liquidity Ratio (SLR), and they are also eligible as collaterals for borrowing through market repo as well as borrowing by eligible entities from the RBI under the Liquidity Adjustment Facility (LAF) and special repo conducted under market repo by CCIL. You may read this FAQ from RBI for more information.

Here is the calendar for the upcoming SDLs auctions.

How does the Floatation and Yield of SDLs work?

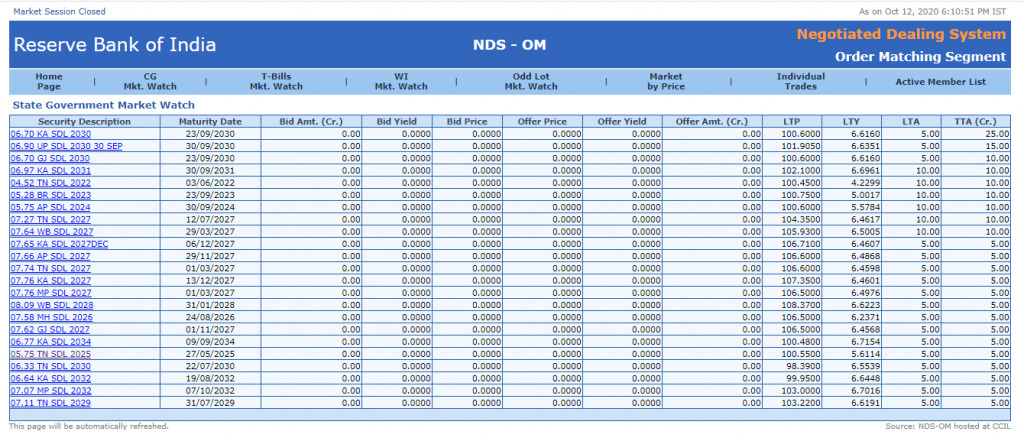

RBI facilitates the issue of SDL securities in the Market, and the auctions are generally held every fort-night. These are traded electronically on the RBI managed NDS-OM (Negotiated Dealing System-Order Matching). Below is the snapshot of some securities floating for auction as on October 12th, 2020 on the NDS-OM managed by RBI.

Like every other Government Security SDLs also have a unique name or symbol. For example, let’s take 05.75APSDL2024 Security from the above snapshot. And, here is what it really means:

Annualized Interest – 05.75

State Code – AP (Andhra Pradesh in this case)

Type – SDL

Maturity – 2024

This issue is expiring in 2024, i.e. 4 years from now (we are in 2020). If you were to invest in this bond, you would receive 5.7% interest semi-annually until maturity, which is 2024. Please note, similar to other G-Secs the interest for SDLs will also be paid semi-annually so that you will receive 2.8% interest twice a year. Finally, upon maturity, you will also get back your principal amount.

What about the Risk Assessment?

Unlike most G-Secs that have Implicit Sovereign Guarantee ( High Risk or significant funding cost advantages for the institutions that benefit from them), SDLs are associated under Explicit Sovereign Guarantee, which basically means, according to CRAR prudential norm released by RBI the risk accompanied with SDLs is weighted as zero. Banks are not required to keep any capital for investing in SDLs. Hence, making it the risk-free instrument to invest in than most of the other Central Government Securities.

What about taxes?

Bonds – Interest income is credited to your bank account. It is considered as income from other sources and taxes have to be paid as per the income tax slab. If there is any appreciation in the bond price, it is considered capital gains. Long-term (LTCG) is 10% flat or 20% with indexation. STCG is as per the applicable slab rate.

T-bills – You buy at a discount and sell it at par. This appreciation is considered as short-term capital gain, and taxes as is per the applicable slab rate.

In the case of G-Secs, the gain is considered long-term (LTCG) if held for more than 3 years. Otherwise, it is short term capital gain (STCG).

Will I get assured allotment if I place my order?

These securities are issued for limited amounts, and there is no guarantee of allotment if the number of bids received is higher than the issue size. However, if you fail to get an allotment, you can try again next week. RBI carries out multiple issues a month.

This sounds good. How do I start?

Happy investing!

Post your comments below.

\”When interest rate of bond decreases, older bonds become expensive (both comparatively and in market) & it provides the companies incentive to default on their previous expensive issued bonds\” Is this true & does this phenomenon occur frequently or rarely if it does occcur?

But defaulting impacts all outstanding debt and also equity holders. Not a good thing for any company to do.

Yes, but sensei considering you have been involved in market for more than 15-20 years probably, I want your personal opinion, what you have observed, whether decrease in interest rate is a factor in companies defaulting or not?

Not at all. This is not a reason basis which companies will default.

Hi Karthik,

Thank you for being our wonderful teacher.

Question : yesterday i received this email from Zerodha :

\”You currently hold the following shares that are pledged for margin.

746GS2073

The clearing corporation has stopped providing margin against these shares and has removed it from the approved list of securities for margin pledge. Hence, your pledged holdings in these security will be unpledged and released in your demat account.\”

Why clearing corporation stopped providing margin against a debt instrument?

How can one be aware of this happening beforehand and is my money still safe in this debt instrument or should i just sell my securities on the open market and take the loss if I\’m not getting any margin benefit?

Any light you can shed on this will be really appreciated.

If T-Bill opted say for 91 days, can participant sell/close prior maturity date ? As like Fixed Deposit can be break any point of time (except FD with tax saving scheme)

Yes, you can.

\”Now, consider you invest in 700GS2020 (7% with a maturity of 2020 or 2 years from now) at a discount price of 98.4. Assume, you invested in 150 of these bonds, so you’d pay –\”

Update this with the latest year @admin

The idea is to help readers understand how to invest in these instruments. Actual data points change yearly, but the underlying mechanics remain the same.

How can I figure the interest payout dates. Is there a link ?

It will be indicated in the bonds issue page.

Hi Sir,

Just a small suggestion, the capital gains tax mentioned in this article is not updated( 10% or 20% with Indexation benefit), would be great if that can be updated.

Checking on this. Thanks.

What is green sovereign bond

Green = Sustainability, environmental causes

Sovereign = Issued by the Govt.

Can I invest for a short duration say 20 – 25 days. I have not done this but would like to explore for both safety and a better return than FD. I have some money but need to pay only after 20 days. Can you suggest and guide the best way to park this money. thanks

Yes you can. But if its just 20 odd days, why not keep in SB account itself?

ok, but i read somewhere, that ccil takes a month to approve new issue of securities-tbills , gsecs. could u pls check n confirm?

Possible. I\’m not sure about RBI/CCIL\’s process of issuing new bills.

hi karthik,

firstly,thanks for the explanations and answers above .

im planning to invest in1. tbills and 2. gsec\’s purely for the sake of margin trading. (f&o Selling).

i checked the link you have shared above. …..https://www.linkedin.com/pulse/now-pledge-t-bills-collateral-margin-zerodha-ynxaf/

i still have few queries

if i invest in t bill today(T), when will i get to see the tbill in my demat account, when can i pledge it and when can i start using it for margin ?(T+ –?)

please answer the same for gsec as well.

thanks

Its settled on T+1 basis, which is when you can start to pledge and trade. But let me also double check this once 🙂

Sir,

I am little bit of skeptical on how relationship between bonds and stocks work in the financial markets when interest rate increases or decreases.

if I am building a personal portfolio for long term wealth creation, 80% of my money I invests in government bond and t-bill, 20% of the money in stocks.

so if any major correction happens , I can purchase dividend-growth-value stocks at a cheaper price by liquidating the bonds.

But, I want to know how the bond price will react and how much it can correct in case of worst case scenario like 2008 financial crisis or covid-19 pandemic.

according to my understanding,

if interest rate decreases , it is good news for the businesses that they can borrow money at a cheaper rate use it to run business. So stock prices increase and bond price will increase, why? because newly issue bonds will come at a lower interest rate than existing bonds. so existing bond prices will increase because investors will purchase it and drive the bond prices higher.

if interest rate increases, it is bad news for the businesses that they can borrow money at a higher rate. So stock prices will go down and bond prices will also go down because the newly issued bonds will be issued at a higher interest rate, so existing bond holders can sell the bonds and move it to the newly issued bonds that come with a higher interest rate, making the existing bond prices down by selling.

According to my current observation:-

While Nifty has corrected 11% since all time high. I have 2028 Gsec bond in my portfolio, it decreased by 1%.

The problem with the above view is that you are looking at markets and the things that impact markets in silos. For example, here you think its only the interest that is changing. Usually interest rate is the last thing that changes….before interest changes, there could be a set of economic factors at play which would impact the prices of both bonds and stocks.

Greenbond and Gsec are different right? Which are better?

Yes, they are.

If I want sell t bill bedore it\’s maturity what\’s the procedure ? Also can I sell it partially?

Partially, you cant. I\’d suggest you call the support desk for this, its easier to explain over call 🙂

Hi Karthik Sir,

1. I can participate in auction process and also i can buy debt mutual funds like SBI magnum gilt funds right? Does these MF give the interest semi annually to our account or it is re-invested and starts to compound?

2. If i buy these MF in lumpsum and can i pledge on the next day itself?

1) No, this is not allowed for retail. Depends on the fund, some funds do.

2) Yes, once they are fully settled in your account.

Please share Charges that will be applied by Zerodha and CDSL / NSDL for dealing with Government securities and Bonds

You can check all the charges here – https://zerodha.com/charges#tab-equities

Hello,

I just want to confirm, the yield on G-sec or bonds that we get yearly, is it that it gets compounded yearly, or we get the yield as in as simple interest?

Thank you

Not the yeild, but the interest/coupon offered. But then this will hit your bank account and the assumption is that you will plough back this money in the same bond for it to compound.

Hi Karthik

By mistakenly i have invested in Govt Securities i didn\’t have regarding this any knowledge only about govt securities

I have taken 2 it 7.04%GS2029 and 7.09% GS 2054 its in process how can i close or how can i exit from this

You can sell it off in the platform itself. I\’d suggest you call the support desk for this, and they will help you with it. Easier that way.

I have purchased T-Bill for the first time of 10000rs for 91 days. I see the T-Bill is processed but the amount is not deducted from the Zerodha Kite Fund App or the linked Bank account.

What could be the reason?

Chirag, can you please call and speak to the people at the customer desk for this? Thanks.

Same issue

Hi,

I bought CG stock, clean price shows 100.8 and my investment close to 51k. 3 year maturity.

can you help me to calculate the returns

Senthil, not sure if I can help you with this. Can you please raise a support ticket for this?

I had bid for Maharashtra SDL 2033 and it got allotted but where can I see it

Please share link for this

It will be there in your holdings. Please do call the support desk once.

Hello Sir,

Recently I bought G-sec. I want to understand how much interest would be received and on what amount. Also can you please let me know difference between Clean & Dirty Price. Details mentioned as below. Request you to please help me.

Description Quantity Clean Price Per Unit (PU) Accrued Interest PU Dirt Price PU Net Total Value

723GS39J24 1000 101.88 1.27 103.15 103145.25

Ideally, you should figure all these things before buying so that you know what you are getting into 🙂

1) Interest = 7.23%

2) Interest will be paid on the face value of the bond

3) Dirty price = This is the trade price of the bond in the secondary market, which also includes the interest rate as on date

4) Clean price = The actual price of the bond.

For a 7.10% GS 2034 the indicative yield is less than 7.1 (for example, 6.86% in kite). Could you please share on why there is a difference in the two yield values? From my understanding, auctions are based on weighted average price and that means a GSec might be bought in a premium (say, 101) resulting in a lower yield. But, the interest which GoI pay will still be 7.1% at par value – am I right here?

The yield depends on the price you pay. The coupon remains fixed. To know the yield of the YTM, just use any of the online YTM calculators.

In rbi retail direct MW i come across this

CG/SD/T+1 & CG/OD/T+1

What does OD & SD mean please explain

Thank you

Ah, not sure. Need to check the context.

Hello sir,

I made my first t-bill investment on February, this year in zerodha kite & that got matured in first week of this month. It was a great experience after learning from this varsity chapter.

&

I have never seen bear market in my life, and curious to know when markets are in 🐻 territory, the index and all the stocks will correct. But how the government bond and t-bill prices will react as compared with the equity ? Please answer my query from your past experience.

Happy to note, this. Wishing you the best 🙂 T-bills wont react as there is sovereign guarantee.

Are G Secs a good ‘trading’ bet for an interest rate cut outlook for the next 12-18 months.

Would the gains from the increased price (LTCG if post 12 months) + semi-annual interest payments (assuming for 1 year) make this an effective strategy?

Ah, I think professional institutional bond traders do trade, but they do it with really large capital as you can imagine. But as a retailer, I\’d not get into this 🙂

Thanks, I found it here: https://tradingeconomics.com/india/government-bond-yield

Good luck!

I would like to know the historical 10-year yield of GoI GSecs but I am not sure where to find this data. Could you please suggest any platform for this?

Hey, maybe you should try investing.com or tradingeconomics for this.

Hi Sir,

Please note if I have purchased a Sovereign Gold Bond from secondary market, which is originally issued in primary market on 1st January 2023 and I have purchased it in the secondary market on 1st April 2023 and the semi annual interest payment date of said bond is 1st July 2023, then as I have purchased the bond from secondary market on 1st April 2023, shall I be paid interest proportionately for 3 months on 1st July 2023? Please confirm how the calculation of interest payment works when bonds are purchased in the secondary market?

The price you pay is called the \’Dirty price\’, and the price includes the interest earned by the seller. However, you will get the full interest, but then a portion of that full interest will be offset since you\’ve paid dirty price to the seller.

what account transfer amount for investment in securities? bank account or demat account?

Bank account.

Hi Karthik, great article – thanks !

About t-bill taxation, would be good to add this in the main document/post \”The taxation would be applicable to the year in which you square off your position…\” (i.e. when t-bill matures) especially for t-bill spanning across boundaries of FYs.

I searched through all QnAs to find your answer to one of the Qs. Hopefully putting in main doc will help others find it quickly 🙂

Hey Ajay, thanks. Yes, that makes sense and I\’m surprised I\’ve missed adding it 🙂

I want to quit of government bonds. What should I do

YOu can sell it in the open market. I\’d suggest you call the support desk as speak to the agent to figure how you can place a sell order for this.

On the other hand, I came across buyback of GSecs – https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=57914 . From what I understand about it, GoI buys back the GSecs. Why does it do it and at the same issue, re-issue/issue new GSecs?

What is re-issuance of a GSec? For example, in this press release from RBI – https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=56986, it says about re-issue of securities. What exactly are they reissuing – is it the securities issued already?

Mike, I think it refers to raising more funds for an already exisiting bond via re-issuance. I need clarity as well, will research 🙂

Hi Karthik,

If i invest 100000/- in 364 days T bill. Can i pledge it? Will i be allowed to purchase shares post pledging from that amount? What are the possible uses of funds that we get after pledging – like purchase of shares/ Option buying/ selling/ futures? What is allowed and what isn\’t allowed?

You can check all details here – https://www.linkedin.com/pulse/now-pledge-t-bills-collateral-margin-zerodha-ynxaf

Hi Karthik, I had a question about taxation for treasure bills. Let’s say I purchased 91-day T-bills on Jan 15, 2024 which mature on April 16, 2024. Those are issued at a discount and redeemed at the face value. For the above example, I’m not clear on the financial year in which I’d be liable to pay taxes. So, in this case, would I pay tax in FY 2023-24 or FY 20024-25? Thanks.

The taxation would be applicable to the year in which you square off your position, in this case 2024-25.

What is the bid? How I can place it as small investor?

Payment for the purchase of bonds will be one-time or in installments?

One time payment Shubham.

Hi sir. Is this the last chapter for this module ?

Yeah, unless we feel the need to add another chapter 🙂

Total 3 types of t bills

91days

182days

364days from this which one is better to invest?

They are all the same, they differ in holding period.

i get 91 day t bill (6.87% yield.)

Whene i invest 10000 for 91 day.

So i get 687 profit?

Yeah, thats correct.

i want to buy t bill order failed twice what to do to place ok order

Please call the support desk for this 🙂

Does the interest earned of T-bills counted as automatically shows as saving interest in Inocme tax portal? Or we need to explicitly mention it as income?

Ah, I\’m not sure about that Maulik. Maybe you can check once with your CA?

How do I sell this SDL – 767AP38A-SG? I am stuck with it since I bought it. I can\’t even place a sell order. Thanks.

You will have to wait for liquidity Nikhil.

Sir,

I have invested in t-bill around 1 month ago, in the kite app it is showing 182D08082024- TB but now the return is showing (-0.07). It will mature on 8th August 2024. I am confused how I can sell it as there is no liquidity and what will happen on the maturity date?.🤔, I bought at 96.56 rs and it\’s my father\’s money 🙂.

YOu can hold upto maturity, you will get the full face value of Rs.100.

Great. Thanks Karthik!

Happy learning, Maulik 🙂

Hi Karthik,

Let’s say, t-bill (expiry after 3 month) is trading at 96.50 rs in open market. If I buy it, then on maturity I will get 100 rs per unit? Note that, I am referring to purchase t-bill after it gets listed.

Yes, you will get the face value of Rs.100 if you manage to buy it at 96.5.

I have purchased a 91-days t-bill but till now the rate of interest in my dmat a/c is less than 1% , it\’s 0.51% .

I am little bit nervous that will I get the same rate of interest between 6-7% or 3.5%.

Because I have read it depends on how many months we invest.

Kindly help my knowing my actual rate of interest I have invested a corpus of 200000.

How much return is possible on it please let me know that.

The rate of return is expressed in annualized terms, it will be lesser that that for 91 days 🙂

What would be the tax liability because of interest from bill and govt bonds, how will the tax on interest will be shown in Zerodha report

There is a page \”What is Indicative yield?\” which refers to this page. Oddly, neither page answers the question What is Indicative yield? Why is this term such a mystery? Nowhere online can you find a definition.

Sorry about that, let me check. Indicative yield, as the name states is an indication of what is the likely yield you will enjoy by purchasing the bond at a given price. Indicative yield is an approximate and not accurate value, its purpose is to give you a quick ball park figure.

What is Lock in period for sovereign gold bond

5 years lockin I guess.

Hi Karthik Sir, I\’m a newbie in the stock and share market, I already invested in some companies. Now I want to learn more and invest more, Can you please suggest anything? Recently I saw the GSec and 2 year Maturity bond are there. Now I want to know that if I buy that Gsec are there any terms and conditions I need to worry about or be careful about? Also, I have a Demat account on Zerodha but it\’s for Equity Debt only, can I buy Gsec from this account without facing any issues?

Yes, the same DEMAT can hold GSec as well. GSec comes with the highest level of guarantee as they are issued by the Govt of India.

Is there an established secondary market available for both tbills and bonds?

sir ,

we need to first whatch the vedios then , are we suppose to register? or we need to register ourself first ?

and vedio for module 11 is missing.

You can start learning from here itself, Garima. But do check out the videos.

Thank you 🙏,

Today , the t-bill is showing in the kite app but the amount is N.A. can you please elaborate 🙂

Maybe its yet to list. Can you check on Monday?

Sir,

First time in my life I bought Treasury bill of 182 days duration from kite. And it got allotted, after learning one thing , understanding it and applying it increases the dopamine level immensely.

But I got the email today and it showing 9652 rs , I have paid 10000 rs, but it is not reflecting on the kite app, it\’s showing allotted in the govt securities section. And will I get the refund of 348 rs to my bank account? And in the invoice it\’s written clean price unit and dirty price unit, what are the meaning of this two things ?

Super happy to note that, Swarnava. Good luck with the investment. Clean price is the price of the bond without any accrued interest, dirty price includes accrued interest. Maybe we will cover these terms in the ongoing \’Unboxing\’, series on instagram 🙂

If i purachase a GSec bond and my coupon payment is within 1 month of purchase, shouldn\’t i get interest based on 1 month. Why would i receive 6 month interest after holding the bond only for 1 month?

Thats because the price you\’ve paid has also factored this in, Tanish.

They are issued at discount. But I think I have received less amount back. Don\’t you think sir?

For the calculations part, I\’d suggest you speak to the support desk for this, Satya. They will explain the charges and its split up better.

Hey Karthik, In the first week of January 2024, I applied for 364 Days T-bills worth 100000. I got refund of 6652.90 . I was alloted 1000 T-bills @ 92.65 costing 92650. Then, Why I received 697.10 less refund?

Satya, T bills are issued at a discount. I\’d suggest you call the support desk for this, Satya.

What if I wanted to sell it before maturity,what are the charges there

You can, all charges are mentioned here – https://zerodha.com/charges/#tab-equities

Hi All,

How inflation would affect this in long term? e.g. 1 lackh Rs that I invest today would be equivalent to just Rs 50k approx after 15 yrs. So overall I will be earning only 7% on my base amount. So if am I am able to understand after 15yrs this 1 lakh Rs will be equivalent to say some 50 to 80 k apprx due to inflation. That means me gettjng 7%interest on 80k. Hope I am able to put doubt clearly here.

In simple terms, on one had you earn at a certain rate (7%), and on the other hand, you lose due to inflation, lets say 8%. Net net you lose 1%. I\’d suggest you check this – https://www.youtube.com/watch?v=Qx3YMdcLTZo

What is the difference between investing in tbills and gsec via zerodha(coin or auctions) and rbi direct ? What is the best method? What abt the charges and brokerage for purchase and selling of sdl, gsec and tbills? Thanks

I cant really really comment on RBI direct, have never used it. As far as our charges are concerned, here it is – https://zerodha.com/charges/#tab-equities

Hi,

So after being alloted with the Tbills or say the Gsec, we can see it in the portfolio section in kite.

Now this shows the ltp of these Tbills and Gsec. So can we get the value of more than say Rs 100 (considering the face value) on the Tbills and Gsec?

Yes, this will show up in the holdings.

Where are the details of charges? Is it better to buy in secondary market or buy from bidding directly?

Looks like zerodha charges 0.06% as brokerage charges. No details on if there will be STT, GST anywhere.

However if we buy from secondary market brokerage charges are nil, but stamp duty, STT, GST are there just like any stock we buy.

Can you give more details about these charges and which approach is usually better?

All charges are listed here – https://zerodha.com/charges/#tab-equities

I\’m seeking clarification regarding Government Securities (G-Secs).

If I purchase a G-Sec in the secondary market with a 7% interest yield, I\’d like to understand how the interest is calculated and when it will be credited.

Additionally,

if I buy a G-Sec at a discount rate of 95 for a lot of 10 units (equivalent to 95,000 rs), I\’m curious to know what interest will be credited in this scenario. I\’d appreciate your clarification on these matters. Thank you.

The interest is calculated based on the principal you invest and the time duration you hold the bond. It is credited based on the timelines specified, usually twice a year. If you buy it at a discount (like in case of T-bill), you will get the face value.

If we invest in T.bills after maturity date amount will credit automatically to our demat account

Maturity amount to your bank account.

When I invest in T – Bill, the amount should be available in kite or bank account

Your trading account i.e. Kite.

I want to understand how to identify ex date for intrest credit. How can we do that? It is clearly defined in T-bills but not in bonds.

Please check the bond\’s fact sheet, it should have all the details.

Can I sell bonds before maturity?

You can, no issues with that.

What is the difference between \’Date of Issue\’ & \’date of auction\’ ? Date of auction always seem to be 1 day prior to the date of Issue. Doesn\’t the auction happens after the Issue ?

&, What do you mean by \’floating for auction\’ as mentioned in the chapter

No, auction happens first and then the issue.

I bought T 91 bill of 1000 but receipt I got was of 9830 only. I want to know where my 170 Rs gone.

I\’d suggest you raise a ticket for this, Saurabh.

How these interest are calculated on T-bills & G-Securities.

Is there any source(any ticker or charts or table) where I can see the historical data of these T-bills & G-Securities.

The interest rates are set by RBI, Sanjay. Please do look up RBI site/archives for historical data.

How i bought gold bond and from where ??

Please do check this – https://support.zerodha.com/category/mutual-funds/understanding-mutual-funds/about-coin/articles/investing-in-nfo-sgb

In the above case, can i get both bond price appreciation as well as 7% interest after an year

ok you said there will be interest rate risk ?

is the gsec interest rate fixed or floating rate?

if ibuy gsec at par value of 100 at 7% interest rate and after a year if bond price goes to 107 then can i sell in secondary market at 107 price after receiving interest of 7%.

appreciation as well as interest.

Thy are all fixed rates, Ram.

759RJ46-SG appearing on my portfolio

Can anyone help what this is?

I\’d suggest you speak to support desk for this. I wont be able to help you with this.

If we buy G-secs at premium value, eg. @10500 for 100 bonds, which is the minimum order, what is the value we receive at maturity? Is it 10000 only? (Besides the interest we get twice a year)

Yes, you will get the maturity of 10,000, which is the face value at maturity.

I want to apply for t bill but don\’t know from where the money will be debited. Is it debited from bank or from demate balance ?

From your trading account, Jay.

I placed order for Tbills. Tomorrow is the due date. When should I pay. Whether money should be loaded to wallet or I will know what amount I have to pay. Please guide me.

It will be debited today, ensure you have funds in your trading account.

It\’s very good to see gsec on platform. Thax zerodha . There is no option to place a bid it is constant amount we have to invest. If I want to bid at lower price how can I bid.

These are retail bids, unfortunately you can\’t do that 🙂

This FAQ is five years old, No change or modification has not done in TBill / GSEC ?

Please look into it.

There are not many changes, but will check.

7.37% GS 2028 is available in auction, if I buy this GSEC, how long will it take to be accepted as Pledge for Collateral. Cause when I see the list of GSECs which can be pledged, I don\’t see 7.37% GS 2028 there, maybe cause its a fresh GS.

This G-Sec was issued on 23rd October, so should be available for pledging from next month. Clearing Corporation updates its list at the end of each month.

As per zerodha illustration of T-bill its said if T-bill will be issue at discount and no interest will be received and at the end redemption will be at par but while place the bid suppose 10000 is par value then 10000 is been deducted where the case of discount arise please clarify the issue

You will get Tbill at price less than 10,000 but upon selling, it will be at face value i.e 10,000.

G-sec: I want to know if Zerodha sends our bids under the competitive or Non-competitive category in the auction. Do all non-competitive bidders get the allotment in every auction? I checked a few of the RBI auction results and noted that # of non-competitive bids is significantly lower than competitive bids

Thats right, only non competitive and not everyone gets allotments. Sometimes there will be one security of which the auction will be 0 to retail.

Great Article!

Where can I find List of outstanding STATE Government Securities ?

I think RBI website should list this somewhere.

The newly openend trance of T-bills by rbi in october is showing all the three variables (91,182,364)

but when we wants to bid via zeroadha its showing year wise 2028-33-53 for investment and prices are also higher then 100. 107.76-105.81-105.74

what is the mechanics i will get my moeny in 91 days or the year for which i purchase bond and what amount or yeild i will benefited by doing so ?

Kindly please help very confused .

I guess you are checking tbills but the gsec that are open for bidding, next tbill non competitive bidding opens up on Monday and closes on Tuesday you can apply for that I guess.

Indian Bonds are giving around 7% intrest rate per annum…Being so why people are investing in US Bonds which just gives around 4.8% for 10yrs or say around just 5.1% for 2 yrs…Comparing this then Indian Bonds are safe high return invesments then why go to US Bonds???

Thats right, but if you are refering to a foreign national investing in Indian bonds, then they also carry compliance cost and currency risk, which may not workout for investors.

Hello, i have question related to script name after the listing of g-sec. Say, as on 27-sept-23 there are few g-secs bid available on kite. One of them is 7.17% GS 2030, which is not listed/allotted as of today to anyone. Now if you search for scrip 717GS2030, it is already available. So if i get todays listed above mentioned bond and if i have to sell it, will it be sold under the same \”717GS2030\” script, or is there any different scripts as per the allotted dates? Thanks in advance.

Once the scrip name/ISIN is alloted, there wont be any change in it 🙂

Hi Kartik,

When I try to place a bid thru the Zerodha Kite portal, it does not tell me whether the price is at a discount, at par value or at a premium to par. How can I place the order without knowing this?

If the price is more than face value, its at a premium, at face value means its at par, else its at discount.

Is there any brokerage or commission charge by Zerodha while buying Govt. Securities.

Yup, please check this – https://zerodha.com/charges/#tab-commodities

To invest in government bonds and securities on Zerodha do I have to keep enough balance in my Zerodha demat account or the exact amount will be directly deducted through my bank?

It will be debited from the bank, Suhas.

if i place order in t-bill how to allotted to me . 100% confirm allot or randam select like ipo method

You will get the order, Parthasarathy. Not to worry.

in rbiretail direct login,in FAQ segment regarding taxation on Gsec… it is said that \” As per clause (iv) of Section 193 of the Income Tax Act, 1961, no tax shall be deducted from any interest payable on any security of the Central Government or a State Government effective from June 1, 1997. However, as per Finance Act, 2007 and Government of India Notification No. F.4(10)-W&M/2003 dated May 31, 2007, tax has to be deducted at source on the interest exceeding Rupees ten thousand payable during a financial year on 8% Savings (Taxable) Bonds, 2003 with effect from June 1, 2007….

your thouht on this sir….

Thoughts as in? If there is a tax to be paid, then we have to 🙂

Can we pledge T-bills for margin? Would it be considered as cash equivalent?

No, you can\’t pledge these instruments. Check this – https://support.zerodha.com/category/console/portfolio/pledging/articles/what-is-pledging

Are 364 Day T-Bills considered as cash component?

After how many days does the t-bill maturity amount gets credited to the bank account?

T+1 from maturity date, Aayush.

Can be used Treasury bills (T-bills) in india as collateral?

Please check with the support desk for this.

I want to see my SDL but i am unable to see my bid ask price or anything. I am not able to sell it, please help me with it

Request you to please call the support desk for this.

hello sir

suppose i buy some gsec on premium price of 102 so when they expire ,what price i will get back 100 or 102?

You will always get the face value i.e 100.

typo: please read 107.06 instead of 1007.06

I was trying to place an order yesterday on Coin for GS2028 bond having interest of 7.06%. The unit price is 107.16. If I pay 107.16 for the bond which is supposed to return me 1007.06, how do I benefit from this? Shoudn\’t the bond price be at 100. If it is more than 100 then I will not get quoted interest rate. Please help me understand the bond pricing

Thats not trading at 107, the exchange is blocking an extra amount before the auction, the extra funds are reversed post allotment.

As per the RBI website, there is a Tbill auction on tomorrow i.e 26.07.2023 but while going on coin portal it is saying that come next monday for auction.

Why this ?

I think the bid ended y\’day itself.

How can we check the weighted average price of the bond after auction ? as broker does not send contract note regarding this.

Thanks

Can I gift GSECs to other persons, just like how I can gift stocks to others?

Not yet, Sandeep. We will soon name it available.

1.If we buy gsec from zerodha like how we buy stocks and not via auction on coin since they are already there in secondary market then will we get interest .

2.Also ,some gsecs have different interest date ,then can we buy one gsec and get interest and then exit it at the same price and move to the next gsec and buy and get interest and move .

3.suppose a gsec is 10.18 percent 2026

Whose 1 unit is at Rs.116 today I.e in 2023 may then if we sell at 117 then what are the charges .

4.Also ,how to find the historic price of a gsec when it came to the secondary market

1) Yes, you will

2) I\’d advise you don\’t do this 🙂

3) Check this – https://support.zerodha.com/category/mutual-funds/government-securities/articles/charges-gsecs

4) Please do call the support desk for this.

consider you invest in 700GS2020 (7% with a maturity of 2020 or 2 years from now) at a discount price of 98.4. Par Price = 100; Assume, you invested in 150 of these bonds, so you’d pay

98.4*150 = 14,760

7% interest = 2100 (for 2 years)

Upon maturity = 17,100

How yield is 7.88? Can you explain what formula is used.(I have seen RBI page but it doesn\’t match with my answer)

Can anyone please explain this?

Thank you

YTM calculation is quite tricky, you can use the YTM function on Excel for this. You can check this as well – https://www.investopedia.com/terms/y/yieldtomaturity.asp

Do we need to maintain the order value of T-bills amount in our Zerodha Funds or to our linked Bank account?

If I buy a G-sec at Rs.107 which was issued at Rs.100 with 7% annual interest and old till maturity, I\’ll get Rs.100 back. So, I\’m loosing Rs.7 which is equivalent to a year interest value. Ultimately, I\’m loosing a year interest by buying at higher price. People who are investing for pledge purpose should consider this before buying from secondary market.

Correct me if I\’m wrong.

Yes, thats right. But people who buy Gsecs understand the concept of yield and hence would avoid buying at low YTM, hopefully 🙂

NEW GS 2030 7.17%

7.41% GS 2036 7.34%

Above two are listed bonds, what is the difference between NEW GS bond (interest not mentioned in the bond name)and 7.41% GS. Is it dynamic one(floating interest). If so which is better for current situation (2023)

NEWGS refers to a new govt bond being issued. For a new bond both the yield and the coupon are the same. The yield/coupon for new bonds are discovered in an auction where institutions participate. Once a coupon/yield is discovered the bond is allotted. Post the allotment the name of the bond will change, similar to GS 2036.

As for getting a sense of what the coupon/yield of a new bond will be, you can check the yield of existing bonds of similar maturities.

Yield formula should have (yield_value*100) to understand how the expression 0.0309*4.010989 becomes equal to 12.4052%

I understand that % sign after the value makes it understandable but showing proper calculation will be much easier to understand it.

Noted, Dhruvam. Will try and make that change.

1. If the yearly yield is for 6.93%then why the bond is

for 91 days

2.And if we reinvest after 91 days in the same year

then will we get 6.93% on the invested amount

3. Does it means foreg. 100par value will get discount of 98 means a profit of 2rs then if aperson invest 10,000then if he gets it 9800 then he have profit of 200 and then interest of 6.93 %on par value means 600-700 then total around 1000 on 10000

1) Yearly its 6.93%, so for 91 days it will be proportional.

2) Yes, provided the next Gsec also offers the same yield

3) Yes, that\’s right.

I know it will be accepted as collateral but Will it be accepted under cash component of collateral or non cash component.

Hi,

If i place an order for T-bills through zerodha and its get allocated on my demat account and later if i want to sell that T Bill, Is it possible through zerodha

Yes, but ensure there is liquidity when you decide to sell.

I am not clear with the way Risk assessment section is written. It says:

\”What about the Risk Assessment?

Unlike most G-Secs that have Implicit Sovereign Guarantee ( High Risk or significant funding cost advantages for the institutions that benefit from them), SDLs are associated under Explicit Sovereign Guarantee, which basically means, according to CRAR prudential norm released by RBI the risk accompanied with SDLs is weighted as zero. Banks are not required to keep any capital for investing in SDLs. Hence, making it the risk-free instrument to invest in than most of the other Central Government Securities. \”

My Questions:

1. You wrote G-secs have implicit soverign guarantee, SDLs have explicit soverign guarantee..

Am not clear if Implicit guarantee is better or Explicit guarantee? Which one is 100% risk free, pls clarify?

2. If G-sec are risk free then beside the term implicit soverign guarantee you also wrote \”(High risk …)\” , which is confusing.

3. I was under the impression that Central government can never default (unless there is some nuclear war or very bad governance etc) but state governments based on mismanagement of funds /local governance might default .. am I wrong?

so am confused with the statement \”Banks are not required to keep any capital for investing in SDLs. Hence, making it the risk-free instrument to invest in than most of the other Central Government Securities. \”\”. Pls clarify.

4. Which ones should I use for Retirement purpose : Gsec or SDL?

1) SDLs dont. Only G Secs have. G Secs is deemed risk-free as we expect India not to default on its debt obligations. But individual states can, although they try their level best not to default.

2) You need to see the context in which I have used high risk. Default risk is minimum for G sec, but not credit rate risk

3) Nope, you got that right. Also, its not like \’never\’, default, the Govts try their best not to.

4) I\’d suggest GSec, but do check with an advisor once.

Hello Sir,

05.75APSDL2024

This issue is expiring in 2024, i.e. 4 years from now (we are in 2020). If you were to invest in this bond, you would receive 5.7% interest semi-annually until maturity, which is 2024.

5.7 is annual interest. Not semi. a small typo mistake is there.

Thanks

Ah, sorry. Thanks for pointing that out 🙂

Pls share any monthly income government bonds

Monthly income? Can you share the context?

When we sell GOI Bond – GS – before completing 6 months (i.e. before my first Interest Date), do I get the interest on the days which I held it?

Yes, you will.

Sir, I have a doubt regarding buying a bond in secondary market. Today I checked the prices of bonds in kite. Bond 669GS2024 is trading at 103.05 but 618GS2024 is trading at 99.08. I understand that 103.05 includes a accrued interest(dirty price) but why is 618GS2024 is trading at 99.08, it looks very cheap, am I missing something here.

Can I calculate the dirty price of bond based on number days from current date till expiry?

Hi Karthik,

This is the first time I invested in a t-bill from Zerodha. 364D161123-TB. I can see that it is now listed and is trading at a discount to the price at which I was allotted( it is now trading at 93 vs my allotment price of 93.58).

My queries are –

1. If I buy more(for ex – 1000) from secondary market now what will happen at the expiry? Will RBI transfer 1000*100 = 100000 in my account when the t-bills expire in addition to the quantities I already hold?

2. I\’m assuming my returns will increase when t-bills expire as I\’m averaging down but selling would be fixed at rs. 100/-. Is this assumption correct?

3. At the time of expiry, is there any liquidity issue? I want to know whether any action would be required from my side or it\’ll all happen automatically?

1) Yes

2) Yes

3) No action is required.

Can a partnership Firm invest in T-Bills, if yes, then what KYC will the RBI expect, since, one cannot expect an AADHAR card of a Partnership firm,

Kindly advice if possible.

Thanks 👍 in advance 💯😎

Yes Sanjay, partnerships can invest in G-Secs.

Hi sir is there any broker limit decided for government securities like in case of liquid funds it is decided..

No, there is nothing of that sort, as far as I know.

Taxation of T-Bills for INDIVIDUALS.

1.T-Bills are Promissory notes. They Don’t pay interest. They are issued AT A Discount.

2.Since by definition these are not SCRIPS ,so No Question of STCG.

3.Since they don’t pay interest, It’s not INTEREST INCOME.

4.THERE IS NO INCOME TAX ON DISCOUNT. If someone contests please show section.

5.T-bills THEREFORE QUALIFY AS NO INCOME TAX INSTRUMENTS!

Income tax department and CA’s are interested parties who somehow want to earn money, have distorted the tax treatment of T-BILLS.

Sure, thanks for pointing. Let me relook at this.

Taxation of T-Bills for INDIVIDUALS.

1.T-Bills are Promissory notes. They Don\’t pay interest. They are issued AT A Discount.

2.Since by definition these are not SCRIPS ,so No Question of STCG.

3.Since they don\’t pay interest, It\’s not INTEREST INCOME.

4.THERE IS NO INCOME TAX ON DISCOUNT. If someone contests please show section.

5.T-bills THEREFORE QUALIFY AS NO INCOME TAX INSTRUMENTS!

Income tax department and CA\’s are interested parties who somehow want to earn money, have distorted the tax treatment of T-BILLS.

Hi,

I heard that the liquidity for T-bills in secondary market is not high if one wants to sell the tbills before the maturity date. How true is this, can you tell?

Thats right, secondary market liquidity is not high.

Can we pledge T bills at zerodha to get margin money.Will zerodha treat it as cash component as margin

Hey,

Greetings for the day.

Im a new investor for Tbill, today i have bided for Tbill, and i want to know how to check the allotment status so can someone help me to check.

If I pledge these Government securities and If I forgot to un pledge these government bonds while maturity. what will happen ?

If I\’m not wrong, you will be notified by CDSL to unpledge the security before the maturity date.

so there isn\’t any other option to sell them ??

Nope, can\’t think of any. Off-market transfer is another option.

general question; how t-bills can be sold other than the exchange as their is almost no liquidity for them when they get listed

It is via the exchange or held to expiry.

HI,

Can we download the t-bill reciept. Like if we have invested in a t-bill do we get a reciept like we get it while we do FD.

You can see that in your DEMAT, Sameer.

I want to place order for G-sec bonds, i am new to zerodha platform, where i need to add money for this or whether it is as per ABSA method used for IPO.

You can add it to your kite account.

Hello sir/medam,

i want to invest in t bills how can I invest in t bills. And sir if any sites are working for them then which site going and which places means which one option select And also what is the difference between t bills vs mutual funds vs government sgbond.

And sir if I want to buy t bills which period i select to hold that given best profitable return ?.

Please kindly inform me.

Sahil, you can invest via Coin. Check this – https://coin.zerodha.com/gsec

In the section \’Can you give me an illustration to help me understand how much I earn if I were to invest in a bond?\’, you have table and you have a comment \’Additional 240 Rs\’. What does this mean?

Is it possible for the weighted average price of a G-Sec to be more than the amount payable?

Its the coupon payout like I have explained.

How can one knows which bond got interest among 3 or 4 bonds in demat account

YOu need to check your bank statement for the credit description.

like what is the discounted rate ?

why we need it?

and how it is calculated?

I\’ve explained all these things in this module – https://zerodha.com/varsity/module/financial-modelling/

and also sir, please could you simplify this DISCOUNTED RATE which is used for the valuation of bonds?

Simplify in terms of?

Sir, I have read that bond price is the present value of the future cash flow of the bond.. can you please tell me what this actually implies?

and why do we need to find out the present value? Is this something related to trading them in the secondary market?

thank you so much!

Bond\’s value is dependent on the future cash flow. Hence taking the present value of future cash flow helps you determine the bond price.

Hi,

how to decode information for T bills like 182D011222.

Pratik, I\’ve explained this in the chapter itself.

Thanks Karthik, Could you please help me by telling any security/investment on which i can claim 80C rebate and same can be pledged for margin as well

ELSS funds offer 80c but cant be pledged. Govt securities can be pledged, but no 80c. Can\’t think of an instrument that offers both 🙂

Hi Karthik

I bought RBI Bond and pledged for margin. I understand that i will get my interest semiannually. but what will happen if I forget to unpledge these bonds at the time of maturity. will system automatically unpledge these bonds and I will get my principal amount back in my account?? or I have to unpledge it manually than only I will get my principal amount.

I\’m sorry, I think you posted this comment earlier also (was it you or someone else, I forget) and I forgot to reply.

Anyway, so this can\’t happen, when your securities are due for maturity, the broker will send a message saying this particular bond is due for maturity and hence you will have to unpledged and pledge something else for margins. Upon unpledging, you will get the monies due to you.

Hi Karthik

I bought RBI Bond and pledged for margin. I understand that i will get my interest semiannually. but what will happen if I forget to unpledge these bonds at the time of maturity. will system automatically unpledge these bonds and I will get my principal amount back in my account?? or I have to unpledge it manually than only I will get my principal amount.

Hello sir

i am unable to pledge T bills for collateral margin in holdings section.Is it possible or not sir.

It should be. I\’d suggest you call customer support for this.

Sir, my question was for 10 quantities will I get interest, and after maturity will I get my amount back .

Sir, my question was for 10 quantities will I get interest, and after maturity will I get my amount back

Yes, the principal amount will be paid back upon maturity.

Dear sir, from secondary market GOI bonds minimum purchase is 10 quantities still i will be getting interest for this amount (10*100) suppose i dont want to sell it after maturity it will be deposited to account.

But how can you hold the bond after its maturity?

Excellent article. I would like to know if RBI\’s Floating rate bonds (seven year term period, currently offering 7.15% returns) are also available for investment in Zerodha Coin\’s Gsec orders page. I am able to see Gsecs, T-bills and SDL but no Floating rate bonds.

Chandra, I think these bonds got sold out. I\’m not sure, need to check myself.

Hello Karthik, yesterday I had purchased units of 6.69% GS 2024 through Coin. If I\’m not wrong, these were part of a re-issue:

https://rbidocs.rbi.org.in/rdocs/content/pdfs/GOIE01082022.pdf

a) One of the coupon dates is June 27th, and the maturity date in 2024 is also June 27th. So on June 27th 2024, I\’ll get the coupon payment & the principal amount both deposited in my bank account? Is there some purpose for keeping the dates same?

b) Since these already exist in the market (IN0020220052), the ISIN for this re-issue will also be the same?

c) What exactly is the significance of a re-issue? Why does the govt. go this route? Is it because they couldn\’t fill the original quota?

Bit of a longish post but would appreciate an answer. Thanks.

1. Don\’t think there\’s any reason, just one of those things I guess.

2. Yep. The same securities are recycled.

3. RBI keeps buying and selling Govt bonds. For example, when RBI does an Open Market Operation (OMO), it buys bonds from the market and sits on them. When it has to issue bonds at a later date to raise money, it can just sell the existing bonds instead of issuing new bonds.

Hi Karthick

I have read few comments here , Does 91 T bill profit is calculated on yearly basis

So let\’s take a example

Let\’s assume interest rate is 6 percent in current case

I have invested 100 rs in 91 days T bill . And after 91 days I will be getting 3 months / 12 months profit

So after 91 days I will be getting (6 rs / 365 days)* 91 days ??

So I will get 2.49 Rs after 91 days ?

Am I right Karthick??

Thats right, the interest rate is annualized; what you get is on a pro-rata basis.

Hello

Does 91 days T bill gives me around 6 – 7.5 percent profit ?

On the other hand 6 months or 1 year T bill will also give me 6 – 7.5 percent profit..

So everyone will try for 91 days T bills , why some one will go for longer period if they are getting same prodfit in shorter time

I am Missing something ,please clarify..

Thanks in advance

What other options would you have to invest for 1 year? In case you want to park funds for a 1 year?

If I want to withdraw my T-bill before the maturity rate, will there be penalty of any sort?

No penalty as such. YOu will get the rates prevailing in the market.

Please explain the terms dirty price and clean price associated with the Gsecs. Please also advise the for filing the income tax returns for income from gsecs and Tbills. I use ITR2.

Hey Linson, I\’ve explained the terms in the chapter itself. About IT returns, please do check with your CA.

Sir, can u explain the right time to buy the bonds as it depends on some factors like inflation and interest rates.

So would please explain this and when is the right time to buy bonds?

It depends, on what do you base your decision to buy? If you intend to hold to maturity, then you can buy anytime, wont make any difference. But if you are trading bonds, then that is a different thing all together.

I placed an order for goi bond 1000 unit on coin. It showed price is Rs 105250. It should be 100,000 only why i have to pay a premium of 5250

The excess will be refunded. Check this – https://support.zerodha.com/category/mutual-funds/government-securities/articles/reserve-blocked

Hello Sir This is Chetan, with another query

So exactly today I saw that in coin there was GOI dated bond 6.95%GS2061 so as the name suggests it should have a yield of 6.95%

But Coin also showed something as Interactive Yield of 7.67%

What is interactive yield and how\’s it different from the other one

Could you please take a moment and explain it in pretty brief 🙂

Indicative yield is the likely yield you will get basis the auction, but its not accurate. Will change slightly 🙂

Also, what are the charges(GST and Service charges etc.) if any from govt.\’s side and zerodha\’s side? So if I buy 100units @ 10000 and the yield is 5% p.a., how much will I get after all the deductions(after brokerage, TDS etc. whichever are applicable)?

O.06% or Rs 6 for every Rs 10,000 invested will be charged as brokerage. 18% GST will be applicable on the total brokerage incurred.

HI, I was checking the 91 day T-bills and I see that the minimum is 100 units priced at 100INR. So the price comes at 10000INR for 100 units. As fas as I understand, on maturity I will get 100per unit and hence 10000INR. So what is my profit? Could you please clarify if I am missing something?

Ambar, when you buy, you will buy it at a discount and after 91 days, the value will be 100, the difference is your profit.

Thanks for being so kind Karthik Ji Wish you and your family a happpy and long life ahead:)

Happy learning 🙂

Sir loving your work ever since no place for doubts matter is given with superb clarity 🙂

something to always look forward to 🙂

However you see I have a coupe of fundamental doubts

1. Are Gsecs and RBI issued Gold bonds freely tradeable in the secondary markets?

2. Can we trade forex round the clock with zerodha?

3. Can we tarde in MCX no agri commodities full time as per exchange (timing being 9 am to 11 30pm) with zerodha?

1) Some are, Chetan. But from whatever I know the liquidity is not great.

2) No, that is not available..you can trade only during the market timings.

3) Yes, you can trade as long as the market is open.

Pls. share link of all outstanding SDL\’s. I want to buy some in secondary market

Check this, Pankaj – https://tradingqna.com/t/issuance-calendar-for-government-bonds-goi-dated-securities/49990

what kind uncertainty you mean is there in longer duration bonds

Interest rate risk, Shivansh.

what kind of uncertainty are you talking about

hey I recently looked into new issues of government bonds and found something strange can you please explain me about it:-

a) Central govt. bond maturity date 15th Dec 2051 fixed coupon rate of 6.99 p.a.

b) Central govt. bond maturity date 23rd May 2036 fixed coupon rate of 7.54 p.a.

what\’s this, that longer maturity bond has lower interest rate and short maturity bond has a higher interest rate

Look at this way – the longer maturity bond gives you an opportunity to lock in a known interest rate for a longer time. Hence these rates also tend to be lower compared to shorter tern bonds, where the uncertainty is higher.

Sir similar to the question I asked earlier but slight different question

1. So cross currency pairs are listed in NSE then why isn\’t they allowed at Zerodha??

2. The apps that allow trading FX are they even legal ?? Or SEBI registered??

3. Is it legal for a Indian to open a trading account with a international broker and directly trade in FX market or even securities in S&P , or CBOE??

1) Its not yet available – https://support.zerodha.com/category/trading-and-markets/corporate-actions/general/articles/can-i-trade-cross-currency-derivative-contracts-in-zerodha

2) Yes. As a thumb rule, if they are not registered under SEBI, its fraud

3) Yes, it is. Always trade and invest via a SEBI registered broker.

Sir on another note … Can we trade cross currency pairs via Kite ?? Because they did not show up on the margin calculator for currencies… It showed only the ones that contained INR on one side

Not yet Chetan.

Hello sir,

I\’m once again appreciating you on a wonderful chapter .

On ending note i just have one question .. as of today (21st may 2022) how do we invest in GSecs via zerodha …

Here you go – https://coin.zerodha.com/gsec

Sir if i buy Govt bonds directly from secondary markets

1) can i give it as collateral for option selling?

2) and am i entitled to receive interest on these bonds?

1) You can (SBGs) – https://support.zerodha.com/category/console/portfolio/pledging/articles/pledge-sgb

2) Yes, you will.

You can find the list of approved stocks here – https://docs.google.com/spreadsheets/d/1vRI4NKpJ-3mnOWxUhSRMSQD5txy8QNumzSQrdfGKyL0/edit#gid=0

Sir in coin website i could see around 3% interest against 91 day T-Bill

my doubt is that 3% an annualised figure?

Yes, annualized indicative yield.

yes I was asking specifically for the govt bonds only (don\’t long term Govt. bonds carry interest rate risk)

Yes, they all do.

what do you mean by \”not really specific\”

My bad, I thought your initial query was specific to Govt securities.

and don\’t they carry interest rate risk (the long term bonds)

They do, but thats not really specific to Govt bonds.

what type of risks does government securities have

Risk of default, but that is very low.

for treasury bills above you have mentioned that a typical 91day Tbill yield is 6-7% how\’s that calculated, cause as in the above eg. for Tbill if the annual yield is 12% then on pro rata basis for 91 days it should be around 3-4%.

Treasury rates are set by RBI, yield is a function of market demand and supply of the t bills.

Hi,

I have bought State Development Loans orders (737AP38-SG) from Coin and it reflects in my holdings also but Avg. cost is not there. It further shows a warning that \”There may be a discrepancy with this stock\”. It gives an option to manually add the trade but when I tried that, system couldn\’t recognise it.

Sanjay, can you please create a ticket here – https://support.zerodha.com/category/mutual-funds/government-securities/articles/buy-gsecs

How the T-bonds and G securities behave during the following situations: war, stock market crash as in 2008, high inflation (say, over 10%)?

The price of such bonds can reduce due to increase fear of sovereign default.

I have purchased 1 lot of SDL. Can it be pledged as collateral for margin (for options trading)?

Nope, this can\’t be used as collateral. Check this – https://support.zerodha.com/category/console/portfolio/pledging/articles/list-of-stocks-pledge-zerodha

Sir if I buy long term govt bond and need to liquidate the bond in between, will I get the same amount which I have invested in the bond. Or it can go low

No, bond prices fluctuate. So you will get the prevailing market price at the time you decide to sell.

Doubt 2:

When the bond is sold before its maturity, why is the capital gain/loss calculated as the difference between amount sold for v/s carrying value, instead of amount sold for v/s cost of acquisition?

Thanks again!

Ah, are you sure about this? Can you please check with your CA?

Hello sir, hope you are doing good!

Sir can you explain why would a bond trade at a premium when coupon rate exceeds YTM and vice versa?

Many thanks!

This happens when the demand increases for the bond, which in turn happens for two reasons –

1) Uncertainty in the equity market, leading to bond-buying

2) When the interest rate on the bond is more attractive compared to other bonds.

Btw, increase in bond rates decreases the YTM of the bons.

How to check already purchased 91 day t bill from coin zerodha? It is reflecting in cdsl but where to find in zerodha?

You can check here – https://coin.zerodha.com/gsec/invest

Will the balance amount after purchasing of T-Bills be credited to my trading account or bank account? After the bid closes on Tuesday, when can I expect for the T-Bills to get credited to my DEMAT account?

Revanth, it will hit the trading account. Settlement by Friday.

How to decide whoch Bond is suitable for my investment goals, between capital indexed, inflation indexed, savings bond etc. Where to find detailed read on Varsity for these different types of Gsec bonds

Noted, will try and include more details on this.

If I will buy bond from stock market,I will receive semi annual interest or not ?

Yes, you will.

Hi sir, lets say i invest in 923GS2043 at 114.9 (LTP), and lets say at maturity LTP gets below the face value of bond (assuming 94), how will affect my overall returns??

At maturity, you will anyway get the face value of the bond, so LTV dropping it does not matter much.

I invested XX lacs in T bill for 3 month and received XX which become roughly 0.81% for 3 month and annually 3.24% and Zerodha charged me 0.07% out of 0.81% and ultimately i received 0.74% (2.96% annually) this is all bulshit !!! Here only zerodha makes money as we could earn more than this in FD at least 5%

Nirmla, we have explained these charges right at the landing page – https://coin.zerodha.com/gsec . Btw, this is how much a liquid fund charges, cant go lower than this.

It was of great help

Happy learning!

Dear Sir,

I am having government security of 7.19%GS2050. Is the interest return from it taxable ?

It\’s exempted, but please do check with your CA once.

Whats the process of investing in these bonds through Zerodha app

Fairly straightforward, check this – https://coin.zerodha.com/gsec and this – https://coin.zerodha.com/bonds

Can I invest and pledge the upcoming g securities? Because In secondary market g securities are not liquid..

I\’m not sure if it\’s accepted in the pledge list, I\’d suggest you speak to the customer desk once.

if I buy SGBs in secondary market and hold them till maturity, will the Capital gains be taxed?

I don\’t think it would make any difference in terms of taxation. Its better you check with your CA once.

Can we sell g-sec before maturity or hold it until tell end?

What is the difference between indicative yield and sec name like 6.67gs2030 but indicative yield shown is 7.1%?

You can sell before maturity. Yield changes with the change in price, indicative yield is the yield you\’d expect given the current price of the bond.

1) The current return from treasury bills is around 3%. The return from GOI bonds are also around 6%. What is the expected return from SDLs?

2) How do I know the interest rate of SDLs? In the GoBid platform I find that those will be available @105/-. But the interest rate is not given. So how do I calculate the return?

1) SLDs carry higher risk, so expected returns are higher from SDL

2) Have you checked the SDL page for these details?

Hello Sir,

I hope you are doing well.

1) Are all T bills issued under par?

2) Now lets say I purchase a bond with a 8% rate and maturity date of 2030

a) Are the interest payments done like a dividend?

b) What if decide to purchase before the half-yearly /yearlyinterest payment. Will I get payment?

1) Yes

2a) Yes, on preset dates.

2b) Yes.

Hey as someone very new to any form of investing, I have a few basic doubts

1. What should be my minimum balance in trading account to make the least NC bid for 91 day T-bill (is it 10,000 or more?)

2. On maturity the amount deposited in my trading account would be (amount invested + profit (100-9x)) correct ?

3. The minimum bid is 10000 for retail investors. So for example, if 99 is the discounted rate, the minimum tranche should be 10098. And say the amount in trading account was 10050, Issue would be refused correct? and final return would be 10200. Is this understanding correct ?

Sorry about series of questions, kindly explain if possible.

Hi!

I invested in UP SDL 2030 last year [14 December 2020] with a maturity of 10 years. As per the article, I am supposed to get an interest every 6 months but I am yet to receive any interest.

Are there different cycles for different schemes? Is there a place where I find more about a particular SDL [here UP SDL 2030]?

Regards,