6.1 – The other currency pairs

We focused on the USD INR pair extensively over the last few chapters, and we now look into the other currency pairs that are traded in the Indian markets, namely the EUR INR, GBP INR, and JPY INR. The functioning of the other currency pairs is very similar to the USD INR. Think about it this way – you know how the Nifty 50 contracts work, then you pretty much know or are capable of knowing how Bank Nifty works.

Given this, the agenda for this chapter is to quickly run through the contract specifications of the other three crosses available for us to trade. In the 2nd part of this chapter, we’ll dwell on some of the common trading techniques, mainly employing technical analysis. With this, we will conclude our discussion on currencies and start looking into commodities.

So let’s get started.

EUR INR

Globally the EUR USD is one of the most actively traded currencies. However we do not have that contract yet in India, but RBI has given the exchanges a nod to list these crosses as well. So I guess it is a matter of time before we have the EUR USD pair along with GBP USD, JPY USD etc. But for now, we do have EUR INR to trade.

The EUR, as we know, is the currency of the European Union. Unlike other currencies, the EURO is backed by the economy of many European countries and not just one economy.

The EUR INR contract structure is quite similar to the USD INR contract. Here are the key details that you need to know –

| Particular | EUR INR | Remarks |

|---|---|---|

| Lot Size | € 1,000 | In equity derivatives lot is the number of shares, but here it’s a Euro amount |

| Underlying | The rate of Indian Rupee against 1 EUR | |

| Tick Size | 0.25 Paise or in Rupee terms INR 0.0025 | |

| Trading Hours | Monday to Friday between 9:00 AM to 5:00 PM | |

| Expiry Cycle | Upto 12 month contracts | Note, equity derivatives have an expiry upto 3 months. |

| Last trading day | Contracts trade till 12:30 PM, 2 days before the last working day. | Equity derivatives continue to trade till 3:30 PM of the expiry day. |

| Final Settlement day | Last working day of the month | |

| Margin | SPAN + Exposure | Usually, SAPN is about 1.5%, and exposure is around 1%. Hence roughly about 2.5% is the overall margin requirement. |

| Settlement Price | RBI Reference rate on the day of Final settlement | The closing price of spot |

So as you see, the contract specifications are similar to that of the USD INR pair. The only difference is that the lot size in EUR INR is € 1,000 as opposed to $1,000 in USD INR.

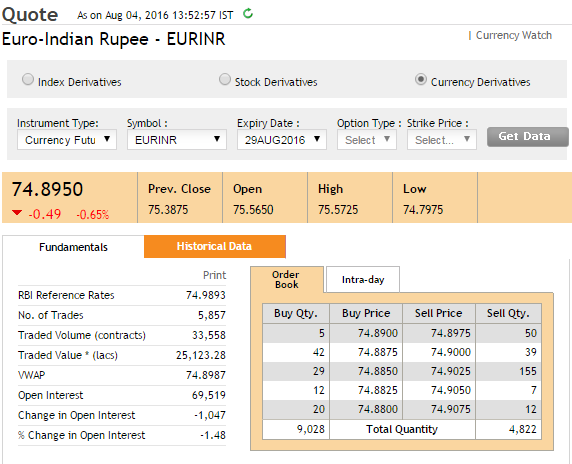

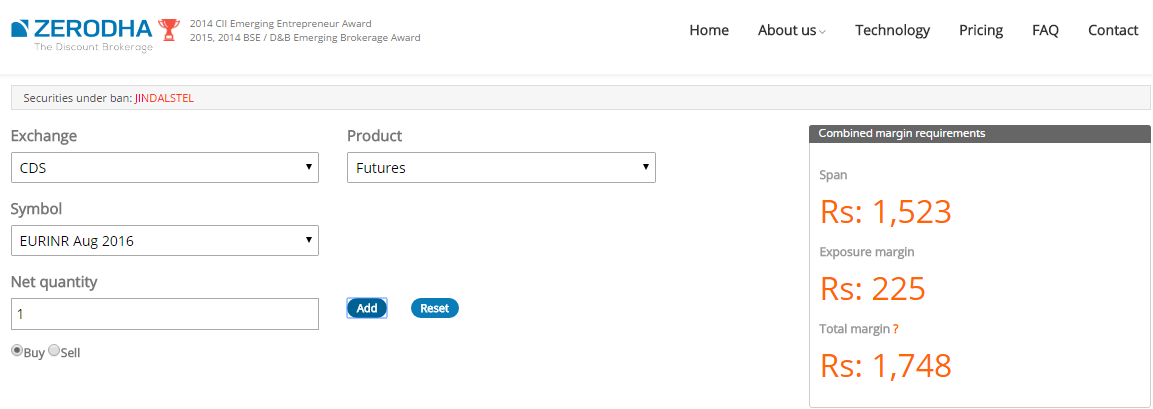

Let’s see how this would impact the margins; here is the snapshot of the EUR INR futures –

As you can see, the last traded price of the contract is 74.8950, with this we can estimate the contract value –

Contract Value = Lot size * Contract price

= 1000 * 74.8950

=74,895.0

Assuming the margin is approximately 2.5%, the margin should be in the vicinity if Rs.1,870/-, in fact, one can use the margin calculator on Zerodha to get the exact value of the margin required.

So the margins are slightly higher than the USD INR pair, but still way lower compared to what is required for any equity derivative contract.

GBP INR

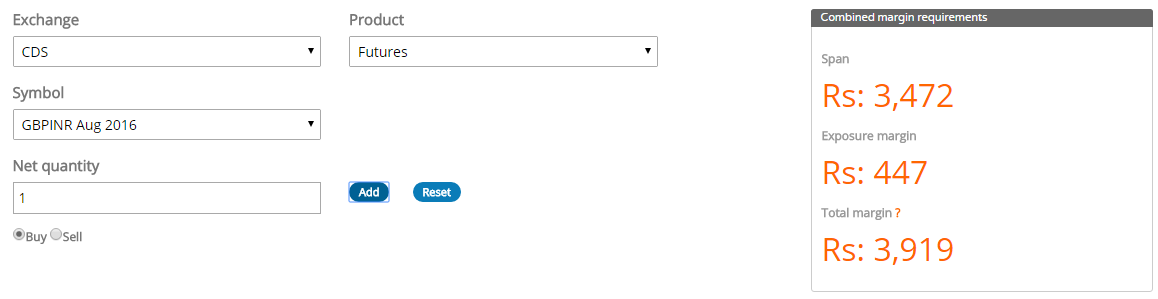

The GBP INR contract is probably the 2nd most popular currency contract after the USD INR pair. On the contract specification side of things, everything remains the same except for the lot size and the underlying. The underlying is the exchange rate of 1 GBP in Indian Rupees. The lot size is £1,000, which makes the contract value approximately Rs.89,345/- considering the futures are trading at 89.3450 as of 5th August 2016.

As you see below, the margin required for this slightly higher compared to the other two contracts we’ve already discussed–

By the way, did you know in the international markets that the GBP USD pair is also called the ‘Cable’?. So, when you hear a currency trader says he is short cable, he means he is short GBP USD cross.

JPY INR

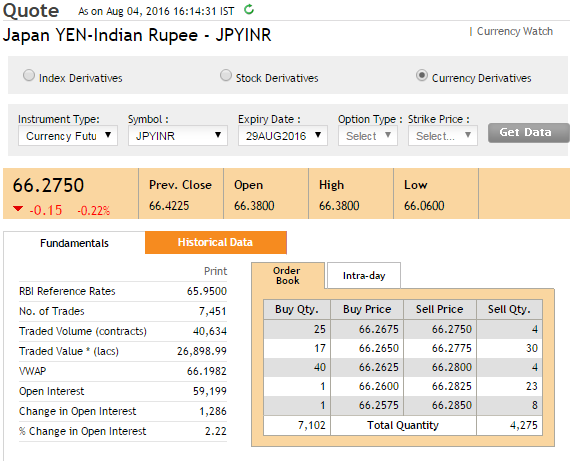

The JPY INR contracts are a bit tricky compared to the other currency contracts. The lot size is not the usual 1000 units, but 100000 and the underlying here is the exchange rate for 100 Japanese Yen in Indian Rupees.

So when we look at this –

We are essentially looking at the rate of 100 Japanese Yen, stated in Indian Rupees. In other words, it costs Rs.66.2750 to buy 100 Japanese Yen. Since the lot size is 100,000 the contract value is –

= (100000 *66.2750) / 100

= Rs.66,275/-

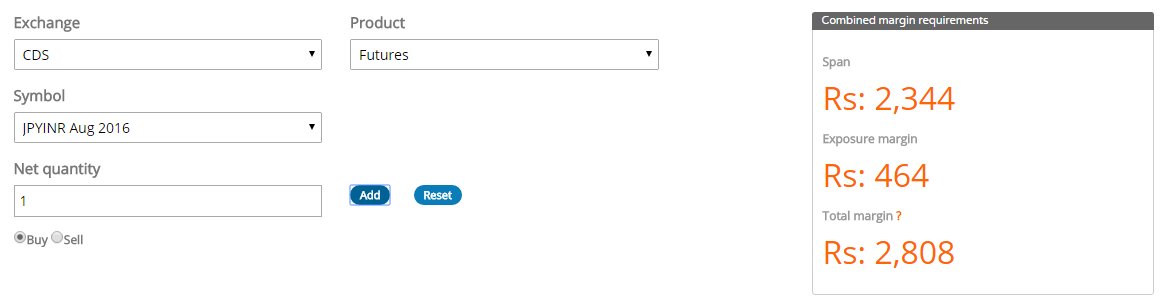

The P&L for one pip(tick) movement of the currency will be 0.0025*1000= Rs 2.5 which is the same for all INR pairs

The margin required for the JPY INR contract is Rs.2,808/-,, which translates to about 4.2%.

Clearly, the margins required for JPY INR contract is the highest in the currency segment, and I guess this is because this contract could be the most volatile (owing to lower liquidity). Of course, this is just a casual observation, and I’d encourage you to calculate the actual value on Excel to get a perspective on the volatility of JPY INR.

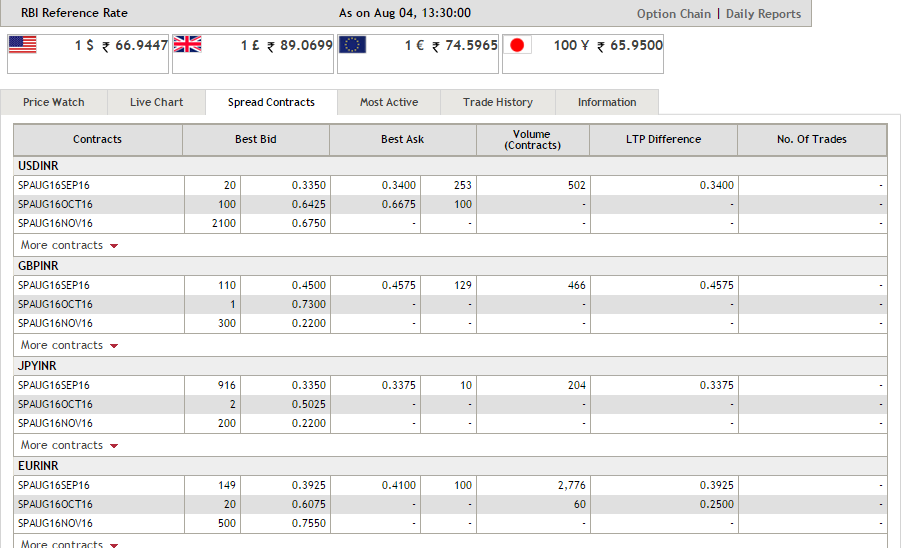

Spread contracts are available on all the currency pairs across all the expiries. Here is the snapshot of the same form NSE’s website –

But as you can see, the spread contracts (apart from USD INR) are not really liquid.

Finally, if you were to select contracts to trade based on liquidity, here is what I’d suggest you look at, in order of preference–

- USD INR Futures

- USD INR ATM Options

- GBP INR Futures

- EUR INR Futures

- JPY INR Futures

With this, I’m assuming that you are clear with the logistics involved in currency trading. We now focus on developing some basic trading approach.

6.2 – The test for seasonality

There is often a lot of debate on the seasonality involved in currencies. By seasonality I mean things like “USD INR always goes down in December” or something like “USD INR always goes up a week before expiry”. In fact, many people base their trades based on this expectation without actually validating for seasonality. Given this, we thought we should check for the seasonality in currencies, and needless to say, we picked the USD INR spot data to run the required test.

** Warning**

The following discussion can get a bit technical, and this is not meant for regular Varsity readers. If you want a direct answer for whether any seasonality exists in the USD INR pair, then the straight forward answer is – no, there is the seasonality of any sort across any time frame. With this conclusion, you can jump directly to the next section. However, if you have a statistical approach to things, then you may want to read through. Of course, I’ll try my best to keep it brief.

Also, this section is contributed by our good friend Prakash; any queries regarding this should be directed to [email protected].

Seasonality in any time series can be checked by employing a statistical test called “Holt-Winters test”. A typical Holt-Winters method has 3 components –

- Level

- Trend

- Seasonality

Level: this indicator measures the average change in USD INR on a YOY basis

Trend: This indicator measures the average change in USD INR on a month on month basis

Seasonality: This indicator measures if there is any seasonal impact on price change. For example – USD INR almost always rises in January, and almost always falls in April etc.

There are two possibilities for components (level, trend, and seasonality)

- Additive

- Multiplicative

I guess the details of this are beyond the scope of this discussion.

Holt-Winters test for seasonality:

In Holt-Winters test, we check for seasonality in a time series by building a forecast model (let us call it Model 1) and study its residuals. Model 1 does not have any seasonality component inbuilt. We then build another forecast model with a seasonality component (Model 2) and check for the errors of this model.

We compare the errors of both the models and compare to check if model 2 gives us a better forecast when compared to Model 1. We do this by employing ‘Chi-Square’ test to determine if accuracies are better. If Model 2 is statistically better than Model 1, then we conclude that there is some seasonal pattern in data. However, if the accuracies are the same for both models or if Model 1 has better accuracy, there is no seasonality in data.

Seasonality results for USD INR

Check for weekly seasonality:

Model 1 (without seasonality component): The best model is (M, N, N) with coefficients 0.9999

This model indicates that weekly data has only a level component and no trend component. The coefficient of “level” is 0.9999, i.e. next week’s price is about 0.9999 times this week’s price.

For readers who are aware of the Random Walk Theory will be able to appreciate these parameters. The model is suggesting that every week USD INR price movement is a random walk.

Model 2 (with seasonality component): The best model is (M, N, M) with coefficients 0.7 and 0.0786

This model indicates that weekly data have a level and seasonality component. The interpretation is that next week’s price is 0.7 times of this week’s price and the remaining price is contributed by seasonality.

Conclusion: Chi-square test concluded that there is a 100% chance that model 2 accuracy is the same as model 1 accuracy, i.e. forcing a seasonality model on USD INR isn’t increasing its accuracy.

This can only happen when there is no seasonality in the data. As the data is prepared for weekly analysis, we can conclude that there is no seasonality on weekly a basis.

Monthly seasonality:

Model 1: The best model is (A, N, N) with coefficients 0.9999

Like in the case of a weekly model, model on monthly data also suggests a random walk.

Model 2: The best model is (A, N, A) with coefficients 0.9999 and 0.0001

This model indicates that next month closing price is almost the same as this month’s closing price with a small impact of seasonality.

Conclusion: Chi-square test concluded that there is a 20% chance that model 2 accuracy is better than model 1 accuracy. In statistical terms, such improvement in accuracy might happen due to randomness, like the window period you choose, the sample data etc.

Typically in statistics, the norm is to look for at least 95% chance that model 2’s accuracy is better than model 1’s to conclude there is seasonality in data. So in the case of USD-INR, we can conclude that there is neither monthly nor weekly seasonality.

The last 8 years USD INR spot data for this is taken from RBI’s website.

So the next time you hear someone make a random statement like “the USD INR pair almost always goes down before Christmas”, then you know he is just trying to sound smart with no real insights. ☺

6.3 – Classic TA

Think about conducting a fundamental analysis of a company, for example – Hindustan Unilever Limited. Typically, you would study its business, financial statements, corporate governance, study its peers, and perhaps build a financial model to identify if the stock is worth investing in. Fundamental analysis is a straight forward affair when it comes to equities. However when you look at currency pairs, USD INR for example, they’re a lot more fundamental dimensions – the macroeconomics of the USA which is dependent on multiple domestic and international factors and the macroeconomics of India which is again dependent on multiple domestic and international factors. Once you understand these, you need to weigh each one of these against another and build a relative view.

This is no easy task, and not many are capable of doing this. It would help if you were an economist with a trader’s mindset to pull off quality fundamental analysis on currency pairs. Perhaps, this is the reason why Technical Analysis (TA) is so much more popular when it comes to trading currencies and commodities. As you are probably aware, Technical Analysis assumes that the price that you see on the screen discounts everything, including all the complex fundamental views that are panning out at the moment. With this assumption, you go ahead and analyze the charts and develop a viewpoint.

TA on currencies and commodities works just like it does on equities. If you are not conversant on how to use Technical Analysis, I’d strongly suggest you read through this module on TA.

I’ll post few snapshots of TA based trade setups –

The two encircled candles form a classic candlestick pattern called ‘Piercing pattern’. The piercing pattern suggests the trader go long on the USD INR pair. As you can see, the trade panned out well without triggering the stop loss.

Here is a bearish Marubozu on GBP INR –

The bearish Marubozu suggests you short the underlying with an expectation that the asset will continue to slide down.

Naturally, the trade setups can be endless. I know many people are under the belief that currency and commodities require one to know a different set of technical analysis, but this is not true. TA works the same way on any time series data, be it – stocks, commodities, currencies, or bonds.

And with this, I would like to end our discussion on Currencies and would like to start our discussion on the 2nd part of this module, i.e. commodity trading.

Key takeaways from the chapter

- The underlying for EUR INR is the spot rate of 1 Euro in Indian Rupees.

- The lot size for EUR INR is €

- The underlying for GBP INR is the spot rate of 1 GBP in Indian Rupees. GBP INR is the 2nd most traded contract in the currency segment.

- The lot size for GBP INR is £.

- Internationally GBP USD is also referred to as the ‘Cable’.

- JPY INR has the highest margin requirement in the currency segment, perhaps due to the higher volatility.

- Lot size in JPY INR is 100000.

- The underlying in JPY INR is the rate of 100 Japanese Yen in Indian Rupees.

- As opposed to popular belief, there is no seasonality in the USD INR pair – either every week or every month.

- TA can be applied to currencies just like the way it can be applied to stocks.

Hi, would like to know are GBP/INR options liquid to trade? Monthly options.

Not as liquid as USD INR 🙂

Hey karthik sir,

After the recent rbi alert list is trading forex in india EU/USD, USD/JPY LEGAL?

AND WHETHER IT IS LEGAL TO USE INTERNATIONAL FOREX BROKERS LIKE EXNESS WHICH PROVIDE THEIR SERVICES 24×5,LEGAL? AND ARE THEY LEGIT OR A SCAM AS THEY ARE BEING PROMOTED WIDELY BY EDUCATIONAL YOUTUBE CHANNELS.

THANK YOU.

These are scammy, please stay away.

Hi Team,

As of now currency derivative trading window is 9am – 5pm. Any possibility to increase this time slot and make it available for 24hrs.

thanks

Dont think it will happen, Nazim. It will be very difficult operationally.

Hi

Is EURUSD available on Zerodha now? I read a comment here that work has been going to make it work since 2018.

Sir, can we trade cross currency pairs other than INR through OctaFX? Is it legal to do so?

Nope, you cannot since it is not legal.

hi Karthik,

Is it legal to trade any pairs that do not include INR such as GBP/USD, EUR/USD etc. in India? Also, could you please list down the brokers who are authorized to allow such pairs to trade? I did a lot of search but did not find a satisfactory answer. Appreciate your guidance.

thanks,

Swapnil

Its legal to trade anything that\’s listed on NSE/BSE. So there is no problem with that.

Kindly inform the website where we can find the RBI reference rate for today or at least of the previous working day. I tried to search RBI site, they stopped publishing from Jul 218 and handed over this job to FBIL. FBIL site is always publishing these rates with 1 week lag. Today on 5 Jun 2021 they are showing rates of 28 May 2021, which is useless for trading purpose. Hope you will guide ASAP. Thanks

I\’m not glued in on this, will get back on this.

Thanks for the quick reply. RBI ref rate (now published by FBIL, as RBI stopped publishing it from Jul 2018) is available till 14 May 2021 only on FBIL site. On NSE (new) site Currency option chain page is showing FBIL ref rate as 73.37 now (eod 21-5-2021) which is actually the ref rate dated 14 May 2021 as shown on FBIL site, but yesterday weekly options expiry settled at 73.0233 (as shown in NSE historical options data). One week old ref rate is not really useful for short term trading. Is there a way to find out the latest RBI ref rate of the same day or at least of the previous day?

Ah, I need to double-check this myself. I\’ll try and get back to you on this.

Many Thanks for a nice tutorial on currency trading. I have read all the chapters on currencies. My question is –

1. USDINR options have 2 expiries in the same week, 1st on 27MAY2021 and 2nd on 28MAY2021. Why there are 2 expiries in this week?

2. What is the difference between these 2 and which one is better to trade?

3. I understand that these modules were written in 2016 and later in 2018 RBI has stopped publishing the reference rates and FBIL started doing this job which is fine. My question is – Weekly options expiry happens at 12h30 every Friday at the reference rate published by FBIL. It means that reference rate published at 13h30 on Thursday will be the expiry price on next day (Friday). This is like an exam with a leaked question paper and the correct answer is publicly available. An option seller knows in advance on Thursday after 13h30 which strikes will be OTM at 12h30 on next day\’s expiry. Is my understanding correct or is there any hidden twist here?

1) Weekly and monthly expiry. The one expiring on 27th (Thursday) is monthly expiry, and better to trade

2) As stated in the above

3) Hmm, its the RBI settlement price – https://www1.nseindia.com/products/content/derivatives/curr_der/cd_options_contract_specifications.htm#:~:text=For%20Weekly%20USDINR%20Options%20%2DEvery,at%20the%2012%3A30%20pm

Btw, there wont such glaring loopholes in the market, if yes, it would be arbitraged away 🙂

Is there any good book for Currency trading (Specifically for India) or must read for Currency trading.

Thank you.

Not sure, Amey.

Is forex trading now made legal in India? Can I trade cross currency pairs in India without any hassle.

Yes, these are available in NSE, unfortunately, we don\’t support this yet.

Hi @Kartik,

Just have a query, why NSE option contract would have a reference rate as quoted on day before yesterday and not on yesterday\’s?

e.g. o today 14 Jan, the reference rate on USDINR option contract is stated as on 12 Jan and not 13 Jan, even the RBI website (FBIL actually) states the same. Could you please elaborate?

Thank you very much sir for your reply… I hope trading with USD/INR works out very well for me..

Good luck, Raj!

Good Day Sir..

1) Can you please how much % tax we need to pay on profit in currency futures GBPINR etc ?

2)Are there slabs of taxes for profit ?

3) For eg if we hold the profits/ funds for more than a year does the tax % get reduced ?

4) lastly we need to pay tax anyways regardless of whether we keep same profit/ funds in demat account or same transferred to bank account right ?(sorry for asking such silly question)..but till now there is confusion among us

1) Taxation bit is here – https://zerodha.com/varsity/module/markets-and-taxation/

2) Please refer to the module above

3) Yeah, best to discuss this with your CA

Dear Karthik Sir,

I have read your module over Currency trading and I really appreciate your efforts to teach in simple language. However I have to ask some doubts regarding practical trading in USD/INR futures only.

1) Can I take intraday trade with 250 lots easily in it with less slippage..?? I mean not for scalping but for few hours..??

2) Is new margin framework applicable for USD/INR futures as well..?? like how margin reduced in Nifty futures..?

3) I am observing Nifty and USD/INR futures for some months and found that trading USD/INR is relatively safer to trade over Nifty futures. especially if I am trading in a timeframe from 10.15 am to 2.30 pm. I dont understand why most of the people/experts advice to focus on nifty for day trading..?? is there anything that I am missing..?

4) I am a small trader and I have my own trade plan which I see is working better on USD/INR… I dont have past data to backtest but as you said that USD/INR is less volatile, Can I gradually scale up sticking to only USD/INR intraday trading..?

Please guide me.

1) Yes, I think 250 lots should be doable.

2) Yes

3) Nothin really, its a matter of preference and familiarity

4) Of course you can, nothing stopping you from it 🙂

Hello Kartik sir does inr currency pair trade in any other excahnges apart from nse?

It does.

Hi Karthik sir,

Thank you very much, the way you\’ve written the modules are very excellent & useful.

Sir, I\’ve two questions for you………But i\’m not sure is this right to ask in this chapter… Please guide me..

1. what are the agenda\’s need\’s to be followed if you want to be trader & investor, Because I\’ve decided to study on stock market for one year by myself with the help your reference with this modules, it\’s been three months now, i\’m still little confused. Please advise if you can tell us what needs to be done on day to day base…..Please

2. Sir, I was looking at Forex trading market in which I\’ve an account over-there i saw the indicator which was \”Exponential Moving Average\”

So, i was using Exponential moving average Period of 30 & 10 but the question is what is meant by \”Shift\” is there any particular number you like to suggest sir that. hence i\’m using 30 & 10 period.

1) Depends on your risk appetite, Deepak. A trader\’s job is to identify trades on regular basis and stay glued to the markets on a daily basis. As an investor you need to study business, understand valuations, buy, and hold the position for few years. Given that these two are very different, you need to figure what works for you.

2) I\’d suggest you ignore the shift bit, stick to something like 20 EMA over 50 and see how it goes.

Hello,

This screenshot on the page (https://zerodha.com/varsity/wp-content/uploads/2016/08/Image-6_spreads.png) shows spread contracts.

Are these official contract from the exchange or they are just computed and displayed for ease of investors?

Basically I want to ask that if I trade spread contract, is it a 1-step process with no execution risk or is it a 2-step process involving buying and selling?

This is from the exchange. A spread contract is a single click, but I\’m not sure if it works smoothly.

hello,

in USD ,EUR,JPY,GBP

THIS 4 CURRENCY IF WE TOOK ONE LOT THEN WHAT IS THE MOVING POINT WE CAN GET

MEANS KITNE POINT MOVE KRE TO 1 LOT K SATH KITNA PROFIT HO SKTA HE

LIKE CRUDE 1 POINT 1 LOT 100 PROFIT

Depends on the lot size for these contracts. Request you to check the specs. Also, I\’ve discussed all the above in this chapter only.

Hello SIr,

Earlier Spot Currency Pairs Of EURINR, USDINR & Others Were Available But Now Its Not Available Here On Pi.

So tell me how can we trade without spot price in Futures?

And Why Its Not Available (Spot Prices Of Currency Pairs) ?

Why CDS Segment Is So Limited?

Thank You

Spot prices were never there as the spot market does not exist in electronic form.

Karthik sir ,

If possible can you please share Holt Winter Model excel sheet

Hmm, I\’m not sure about this, Raj. I need to research a bit on this.

Why no liquidity in GBPINR options.

Traders are not interested in trading the pair I guess 🙂

Yes sir.. Happened for me 1 time. Tq sir. I\’ll look into risk and money management hereafter.

Sure, Bala. Good luck!

Thank you sir, now got a clarity, one more doubt sir, If I got American or European citizenship, then can I trade these pairs? Because they can trade these pairs without any problem.

Yes, you can.

Because of leverage sir, my strategy is a small scalp which gives 1-3% returns daily and consistently. But for that high leverage is required. I\’ll get 500x leverage for EURUSD where in USDINR I\’ll not get that much leverage sir

Such excess leverage is really bad for your trading Bala. At 500x leverage, a small move of 0.02% against your position will wipe your position out. I\’d suggest you avoid it.

And 1 more thing sir, that foreign broker is one of the most trusted brokerage firms in EU. So no fraud issues.

Thats alright, but the issue is with the regulations set forth by RBI. By the way, why would you not want to trade USD/INR?

Hi sir, I don\’t know whom I can ask this question since a long time, now asking to you. I\’ve learned how to trade EUR/USD GBP/USD and I\’m ready to trade with a foreign broker and I also have international wallets for transaction of money. But some are saying trading this pairs in India is illegal and some are saying it\’s legal. What do you think sir? Can I continue to trade these pairs with the broker I have?

Thats right, Bala. I\’d suggest you avoid trading these pairs with these brokers. By the under RBI\’s LRS scheme, you cannot trade/invest in leveraged instruments such as these currency pairs. You can find all the information here – https://rbi.org.in/Scripts/NotificationUser.aspx?Id=11255&Mode=0

In USDINR price change in .01 is 10 Rupee, please give the other currency value or link to find.

Vijay, you just have to multiply the lot size with the tick size to get the change in INR.

If I want to trade on March 1 in USDINR then should I do my TA on March Future chart? Or Tradingview?

March Futures.

Hi when are we gonna launch cross currency quotes

I thought we (zerodha) will be the first to launch it

Unfortunately, it has taken a much longer time than expected.

Hi,

is it possible to trade in cross currency like euro/usd, usd/gbp on zerodha platform on 24*7.

No, not possible for now. Btw, these contracts do not trade 24*7.

Whether it is legal now to trade with international brokers like Olymp Trade to get 24×7 access?

My personal suggestion, please avoid.

hi kartik

now can we do treding in cross currency like usd / eur ?? is it legal ??

Yes, these are offered by NSE. We don\’t have this on Zerodha, yet.

Sir pls send me genune brokers

Please explain me about the account freezing limit at the cross currency

We don\’t have policies around this yet, Perumal.

how many lot can be traded in cross currency in a day

how many lot can be buy at a single order

15k lots max, 10k lots in one order.

Is cross currency trading enabled in zerodha?? I see the charts but no response..Margin calculators show that margin requirements are same as of GBP..please let me know

Not yet, Hari. Hopefully soon.

But charts are live with volumes..i could see its open till 7.30 pm..so where are the volumes coming from?? Are other brokers offering it? Thanks for your reply

Yes, there are few brokers who offer this. We will start soon, Hari. For now, you can just view the charts and prices.

When does Zerodha will be live with cross currency?

Why does cross currency margin are so high infact 200% of contact value…may be answer will be margin requirement are calculated as per RBI reference rate after converting Cross with INR….but do you think such high margin are logical even for pure intraday traders….

At least for MIS or BO/CO cross currency margin should be only 3-5% because on any given day currency like EUR/USD,GBP/USD,CHF/USD & USD/JPY very low probablity of moving 3-5% up or down. IF I am not wrong even on the day of Brexit GBP/USD moved something around 6-8%….if 3-5% margin as a broker you feel it\’s still risky as risk management then try 7-10% ( I know NSE span itself is high but as one among top 3 brokers in India Zerodha should explain NSE about the same and make cross currency successful with huge volumes)

Hope something good will happen in cross currency in terms of margin requirement.

Mahesh Gaddamedi.

We have not yet gone live with Cross Currency, Mahesh. Will know the actual margin requirements when we go live on this.

Where can I find margin requirements for JPYINR call/put options ? Is it good for hedging currency risk ?

Rahul, options are there only for USD/INR pair. No options in the JPYINR pair.

Hello sir if i leave eurinr future position open overnight is there any interest paid or charged?

No, no such charges.

I FORGOT TO SQUARE OFF EURINR APR FUT ON EXPIRY DATE,WHAT WILL HAPPEN NEXT?

The exchange will settle it for you.

What is the margin required for EURUSD PAIR for normal order

I\’m not too sure, but I suspect it should be under 5-7%, Murugan.

Dear Karthik Sir

When you are actually staring the Cross Currency??

Unfortunately, cannot commit a timeline on this.

Can you give me calculation of jpyinr pip size number of pips and profit calculation via an example. Thanks in advance

Guess, I\’ve discussed that in the chapter itself, Indrajeet.

Not. you didn\’t. can you show me profit calculation of jpyinr . and contract specification for jpyinr as mentioned on your site is different from nse\’s.

Dear Karthik

In the introductory section on Currencies and commodities, you mentioned there will be a chapter on \’Interest rate futures\’, but I could not find it anywhere …. can you pls let us know when a module on this will be available

Ah, yes. Decided to drop that chapter as there is not much action in that segment.

I have seen this in currencies in zerodha margin calculator 679GS2027 697GS2026 759GS2029… what are these?

You explained F& O of currencies in this module. There is a separate link to currency… What is the difference between these two?

Kindly reply me, sir

Thank you

I guess these are Government bonds which are tradable on the exchanges. No difference as such, I\’v explained all that you need to know about currencies here. Thanks.

Dear Sir,

For Technical Analysis instead of regular candle stick patterns can we use Heiken Ashi.

You certainly can!

if i buy 100 lots \”eur-inr\” at market price and sell it within minutes for 6 -7 ticks in my favour at market price again , does it get immediately sold , does it have enough liquidity to buy and sell 100 lots within minutes? it has volatility but is it advantageous compared to usd-inr futures which has liquidity but very less volatility to make profits ?

thanks karthik

I don\’t think its liquid enough to absorb 100 lots, maybe it\’s a good idea to place limit orders.

thanks for the answer karthik ,its a followup question wt do u think about buy-sell at market price for the below futures basically for scalping

100-150 lots usd inr futures

200 lots nifty futures

120 lots bank nifty

basically to understand which is the best futures to scalp in market price with enough volatility and liquidity

nifty i mean 3 lots of 225 size

bank nifty 3 lots of 120 size

Sure, I replied to your previous comment.

The highest to lowest in terms of liquidity –

1) Nifty Futures

2) Bank Nifty

3) USD INR

The higher the liquidity, the lower is the slippage while placing market orders.

thanks karthik for all the answers , if the part of market orders gets executed ,does the remaining lots get executed automatically on the availability of lots at the next market price ??

Yes, balance shares will be converted to a limit order at the LTP.

While trading currency, can I square off my normal position beyond 4:30 PM (eg. 4:55) or do I have to wait till next day ?

You can square off your position anytime you wish.

Hi Sir, I would like to back test technical analysis patterns on USD-INR (currency trading). how and where should i do this? for stocks i have 2 years data of the spot prices in candle patterns. Similarly forr USD-INR where should I look for last 2 years data to test the TA patterns. Please advice. Thank you.

If you are looking for spot data, then I\’d suggest you download this from RBI website. They do publish spot data. You may want to import this data onto Excel and run it through various strategies.

There is only close price available in RBI Site. It does not have open, high and low prices. Is the close price alone good enough to check for technical patterns like engulfing, hammer and shooting star? please advice if I am looking at the wrong place. Below is the link i looked at: https://www.rbi.org.in/scripts/ReferenceRateArchive.aspx

That would be an issue 🙂

Can you provide some inputs on if the movements in EURINR, GBPINR AND JPYINR is basically linked to the movement of EURUSD, GBPUSD and JPYUSD respectively… in mean is its all related to how those currencies are moving vis a vis USD or the dollar index………. or if there is specific INR related movements ?

Its a mix of both. Remember, USD INR pair has two currencies and both these currencies have their own set of fundamentals acting on it. The final price movement in a function of all these fundamental factors. With respect to USD INR, the Indian macros play an important role. In general, if the economy does well then the local currency (INR in this case) strengthens and if the economy weakens then the currency weakens.

Hi, karthik

Can you tell me when we will be able to trade EurUSD with zerodha

As soon as its made available on the exchange, which we are guessing should be soon.

sir kindly give full proof trading stratagy for usd inr

Buy low, sell high 🙂

Hi Sir,

This is SaikiranGarapati.I am learning basic things in Currency trading.

I would like to know why GBP is falling like that and what is your view on GBP for next week.

Please let me know your views on this. This is not for trading purpose just for knowledge.

GBP is as such a little weak post Brexit fallout. Hard to predict the currency…but if I were to make a trade, I\’d short the pound.

Thank you sir…

Welcome!

I have one more question…

Assume EURINR price is 75.000 and i bought 10 lots @75.0000 so my buy value is 75*1000*10 = 7,50,000/- and sold @75.1000. So My Sell value will be 75.1000*1000*10=751000/-. I receive messages from zerodha that your total traded value is 7,50,000+7,51,000=15,01,000/-.

Will this total traded value will affect me in future when filling tax? Is it my turnover? Or is just a value?

in last 7 trades, My total traded value is around 63,07,020 i.e 63 Lac.

Will it affect in future while filling tax?

what is this value actually? because most of the currency traders like me are confused with this value.

I thought in this currency module, all this information will be covered. Some points are still missing.

I Hope you cover all the information related to currency segment.

so it will be easy for new traders to understand and calculate all the things very easily.

Thank you

We have a separate section on taxes, which covers everything that you need. Check this – http://zerodha.com/varsity/module/markets-and-taxation/

Hello sir,

I usually trade in EURINR pairs only.

Total 7 trades in last 30 days and i m struggling.

I have a one question.

I always buy 15Lots of EURINR in intraday only.

I started with 10 Paisa profit a day strategy i.e 40 Ticks per trade strategy.

But then i changed it to 2 trades of 5Paisa i.e 20 Ticks a per trade. 2 Trades per day strategy.

But unfortunately EURINR moves in 100-200 points per candle i.e 4-8 Ticks per candle in direction.

So it was difficult for me to make even 3 Paisa profit per trade also even if i m trading with 15 lots.

My question is…

As per my last 7 trades…

3 trades triggered at 3 paisa profit i.e 12 Ticks. 1 Trade i squared off because i saw market was going down

and remaining 3 trades triggered 5 Paisa stop loss i.e 20 Ticks.

4 In profits and 3 in loss.

But the loss is higher than profit. My account is negative right now.

Question is…

Can i trade between 2-3 paisa i.e for 8-12 Ticks per trade?

Is it ok to trade like this? because there is no movement actually in EURINR currency.

so i m asking is it really ok to trade like this? Any policy in trading currencies?

I traded in international forex market also where i used to trade for pips. 5-10 pips per trade strategy.

2-3 trade was enough to make 15-30 pips in a day.

is it ok to trade between 8-12 or 20 Ticks per trade?

Thank you

Frankly, it is not the number of of trades. It is about profitability. You need to start identifying trades which can give you larger profits – say at least 5-10% (return on margin invested) per trade, and you need to do this consistently. For this you may even consider holding on to trades for longer period.

That\’s really true! Profitability. Even I started with 5-10% return on Invested margin strategy. Currencies moves in range.. so its even difficult to make 5% return on invested margin. So mostly i ended up with 3% return profit. Even from that 3% return.. brokerage taxes cuts. So thats why i place 2-3 trades a day to recover taxes brokerage.

3% is not bad, especially if you are with a broker like Zerodha!

do u trade for more eurinr lots now? r u able to buy-sell in market price within minutes ?

Sir while trading in currency if I am a short seller in a call or put so can we apply similar formula like nifty.i.e standard deviation or maxpain.please suggest……

Yes, of course. The same set of options rule apply.

what is the data source to get volatility of USDINR

Download the spot data from RBI and run a simple \”=STEDEV()\” function on excel. You will get it. All of these are explained at various different parts in Varsity.

Hi Karthik,

People call JAPANESE YEN the SAFE HEAVEN what is the meaning of that sir???

Thanks&Regards

When people call currencies ($ or Yen) as safe haven, then they are referring to the fact that their economies are strong enough to support their local currencies and therefore a collapse in their currency is unlikely. Hence you as an investor can invest in such currency and protect your capital.

Hi Karthik sir, I just started trading in currency future with zerodha.I have a question which i am writing here.

On 1 sep. 10:19 am buy 2 lot gbpinr oct fut @88.89. At 10:47 am when price declined i short 1 lot gbpinr oct fut @88.8125.

Now my positin shows only 1 lot gbpinr oct fut buy @ 88.89 and loss of rs. 77.50.

Sir, why short selling of 1 lt gbpinr oct fut @ 88.8125 is not considered as separate order from 2 lot buy of 88.89.

Now at 16:57 pm i sold remaining 1 lot @ 89.44 which i bought @ 88.89.

At 16:58 pm buy 1 lot gbpinr oct fut @ 89.4575 and position is open.

Sir, iam not able to see profit made on 1 lot gbpinr oct fut 88.89-89.44= .55×1000= 550.

Or will i get this profit after closing my buy position of 89.4575 ?

Yes, because it works on a \’Net position\’ basis. Its similar to the transaction in the vegetable market. Imagine you initially buy 2 kgs of onions…then you go back to the vendor and return 1 kg, how many kgs you have?

At the end of the day your profit or loss will show up on a net basis which is buy average minus sell average.

Hi Karthik Sir,

I was trying to approach currency trading using \”tradingview\” charts as they are NYSE close charts which means there is no gap up/down problem while visualizing and placing support and resistance levels. My question actually is just a concern regarding to trade management. What will be a worse case scenario if I follow \”tradingview\” charts for stops and targets but trade on NSE. How do you see this approach??

You will have to correlated it to the Indian markets and identify the corresponding S&R levels. You can track the international markets and get a sense of where the markets are moving, but from a trade management perspective you will have to deal with Indian markets.

Hi Sir, I recently opened my account in zerodha. I sell 1 lot of usdinr @67.60 and covered this position @67.49. what would be profit ? ze brokerage charged rs.75.06. How?

Your profit will be 67.6 – 67.49 = 0.11

0.11 * 1000 = 110.

Brokerage will be 20+20 for buy and sell, the rest would be applicable charges. Btw, you should check the brokerage calculator – https://zerodha.com/brokerage-calculator

Thanks for reply sir, I checked the brokerage calculator it shows rs. 17.9026 (13.509 brokerage+appliable charges) but I have been charged rs. 75.06 (49.22 brokerage + applicable charges) on 1 lot. I did two more trade of 1 lot and on every trade i have been charged rs. 75.06 as total brokerage. Please tell why brokerage charged is different from brokerage shown in the calculator?

Request you to please speak to the support team for this.

What about cross currency pair trading , how can we do that with zerodha ? After the recent RBI guideline is it legal yet to trade with cross currency pair, from india ? I want to trade in a 27×7 market to remove the gap Up/Down risk, is there any legal way to do that from india ?

RBI has given the exchanges a nod for cross currency pairs, I\’m guessing we will have it going sometime later this year. Please remember to trade these pairs only on recognized exchanges like NSE and not on other platforms.

Thanks for the reply ..

In this point I have two question

1>After launching the pair can we able to trade it 24×7 or it will have some time like 9 am to 7 pm IST , because my main moto is to remove the gap Up/Down risk at the time of market opening ?

2>Till now is it legal to trade these pair from india via any international forex broker (like alpari) because they give 24×7 market access ?

1) No it is highly unlikely that it would be made available 24×7

2) Nope

USDINR are Nifty are inversely related , what about other currency pairs?

I would guess they are, have not checked for this. If you happen to check this, please do share the results with all of us 🙂

Hello Karthik – Thanks for the lucid language used. I am a bit confused. My query is – As per your screen shot of margin in GBP INR section, you have inputted the quantity as 1. Is it actually 1 or it means (1 * £1,000) 1,000 units ? Also, as per the 1st NSE screen shot used, Buy Qty in Order book tab is showing as 5. Is it actually 5 or it means (5 * € 1,000) 5,000 units at 74.89. Thanks

1 here means 1 lot, 1 lot in turn refers to 1000. Similarly, 5 refers to 5 lots, or 5000.

Got it..!! Thanks for the clarification.

Welcome!

When will eurusd trading start in zerodha

Working on it, Rohit. Hopefully soon.