10.1 – The Commodities superstar

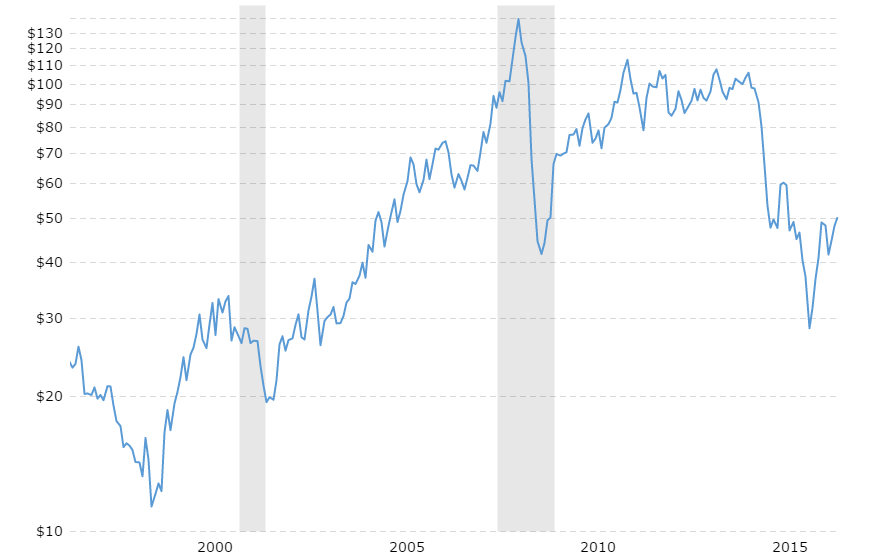

If I have to pick one international commodity which can give you all the dramatic ups and downs of stock markets as portrayed in the movies, then it has to be the ‘Crude Oil’. Wonder why? Have a look at the chart below –

The dramatic rise to $140 per barrel to the immediate sharp correction, then a recovery back to near $110 to a merciless crash to sub $30, the crude oil chart can invoke all human emotions, just like a perfectly well-directed movie! The fact that this is an international commodity, actively traded by hundreds of thousands of traders across the globe only adds to the complexity of it all.

So what is really going on in crude? Why did crude crack from the highs of $115 all the way down to $28? What caused this manic panic? What is happening to crude now? Where are we headed now? To understand this fully, we need to rewind and dig into the recent history of 2014 – 15.

This is exactly what we will do in this chapter. For the sake of this chapter, let us go back to the first half of 2015 and see how things looked back then.

10.2 – The crisis revisited

From over $110 per barrel in January 2014 to a low of $28 per barrel in January 2016, the Brent Crude oil has perhaps seen the worst decline in prices over the recent 5 years. While this dramatic price decline has brought cheer to a few corporate and perhaps few countries, it has disrupted oil producing economies. Literally, nobody saw this coming; even if someone did, the magnitude of this fall (over 75%) was beyond everybody’s wildest imagination. Is this the bottom of the crash? Well, your guess is as good as mine, but the intensity of the crash in crude oil is so severe, it would be hard to believe the bottom is in sight.

So what really went wrong?

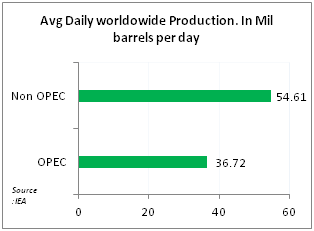

To understand what went wrong, we need to understand the dynamics of crude oil and how business was carried out before the recent crash. This discussion also doubles up as ‘oil basics’ for you. Oil rich countries produced several million barrels of crude oil which were exported to The US, China, India, and European countries daily. The oil-producing countries are split into two baskets –

- “Organization of the Petroleum Exporting Countries (OPEC)” nations which include countries like Saudi Arabia, Qatar, Kuwait, UAE, etc., and

- Other oil-producing countries such as – Brazil, Canada, Russia, Mexico, Norway, etc., choose not to be part of the oil cartel, i.e. OPEC. Hence they are just referred to as ‘Non-OPEC countries”.

Between the OPEC and non-OPEC countries, close to 90 million barrels of oil were pumped daily. The graph below shows the daily oil production split between OPEC and non OPEC countries –

The Trigger

Different countries produce oil at different rates; this rate at which they produce mainly depends on the individual country’s finances and technology. While production depends on internal factors, the sale of oil has always been driven by markets. Clearly, the breakeven point (expressed on a per barrel basis), is the rate at which countries need to sell per barrel of oil to cover the expense of producing the same, varies from country to country. Naturally, selling oil below the breakeven point implies that the country cannot balance its state budget. The table below shows the breakeven points for the OPEC countries –

| Country | The breakeven point on a per barrel basis* |

|---|---|

| Iran | $130.7 |

| Algeria | $130.5 |

| Nigeria | $122.5 |

| Venezuela | $117.5 |

| Saudi Arabia | $106.0 |

| Iraq | $100.6 |

| UAE | $77.3 |

| Qatar | $60.0 |

| Kuwait | $54.0 |

In the backdrop of these trade dynamics, a triple digit oil price till early 2013 worked really well for the oil producing economies. However, recent developments changed the landscape of crude oil business dynamics. Specifically, the following three major events turned the tables around for crude oil prices –

- American Shale Oil – The American shale oil, which comes from oil shale (sedimentary rocks containing bituminous material), which is an alternate to crude oil became technologically viable, and the cost of producing the same became relatively cheaper. The output from the American Shale oil production increased, flooding the market with cheaper oil. By current estimates, it is believed that the US has enough shale oil reserves to last generations. Shale oil from Texas and North Dakota displaced exports from OPEC members to The USA. This set the stage for a collapse in crude oil prices.

- Lack of co-ordinate action – In the backdrop of increased shale oil production in The USA and the ongoing slide in crude oil price, one of the methods for oil producing countries to control the situation was to lower the supplies and regulate the demand supply situation. However, OPEC was not really successful in convincing OPEC and other non-OPEC oil producing countries to cut the crude oil production to support the crude price. In fact, cutting oil production is considered more expensive than pumping oil.

- China Factor – China has been one of the largest consumers of major international commodities, including iron ore, coal, and crude oil. In fact, in 2013, China surpassed The US in oil imports. However, reports suggest that the Chinese economy is not growing at the same pace as it used to, resulting in lower demand for international commodities. Needless to say, this has a significant impact on the spiraling crude oil prices.

- Market Dynamics – The above three points triggered a steep sell off in crude oil, adding fire to this sell off was the heavy short positions built upon Crude Oil contracts.

Generally, when the price of crude oil falls, the US dollar tends to get stronger, especially over the currencies of the emerging economies. This is quite natural as an increase in oil price widens the US current account deficit (remember the US also imports oil from the Middle East), which obviously is not a great factor for the US Dollar, and the reverse helps the dollar strengthen. Hence the Dollar and oil share an inverse relation. Do recollect, in 2008 when Oil hit a peak of $148, the US Dollar was trading at 1.6 to the EURO.

The Russian Episode

Russia is one of the largest (non OPEC) producers and exporters of oil. The Russian federation’s oil exports contribute nearly 40% of the total exports. With a slump in oil prices, the Russian economy seems considerably weakened. Three factors are working against Russia, two of which can be directly attributed to the oil prices –

- Oil Price – Russia needs the oil prices to be approximately in the region of $105 – $107 to balance its budget and keep its finances in order; clearly, with oil at $50, Russia gets a severe blow on its budget.

- Rubble Trouble – Remember, Russia is an emerging economy. With the slide in oil price, the Russian Ruble has massively weakened against the US Dollar. So much so, that the Russian Central Bank increased the interest rate overnight by 7.5% to defend the Ruble (yes, this did happen back in 2015).

- Crimea Curse – Western countries continue to impose sanction cuts on Russia for its aggression on Ukraine. This means access to external capital is extremely difficult (especially when it’s most required) for Russia.

Add to this the Syrian crisis, and a host of other local factors, there is little hope that Russia may not actually slip into a financial coma dragging the federation into a recession.

The India macro angle

On the face of it, the fall in crude oil seems to benefit India as the pressure on petroleum subsidy eases significantly. India is a net oil importer (nearly two-thirds of India’s oil is imported), pays a heavy bill for its oil imports. Naturally, the fall in crude oil means an improvement in the fiscal deficit, easing of inflation and the possibility of an interest rate cut. All of which is desirable for India in the backdrop of the current economic situation.

But there is another angle to low oil prices. While low oil prices help the domestic import bill, it will also impact our exports receipts. Most of the exports from India are to countries whose economy depends on oil – UAE, US, Saudi Arabia, Kuwait, Iran, China etc. Quite naturally, with low oil prices, the spending by these countries also decreases, thereby impacting business with India.

In fact, if you go back and look at the October 2014 import & export data from RBI, it clearly suggests the same – while the oil import bill reduced by 19% (y-o-y), the exports also declined by 5%. Clearly, the advantage of low oil price is not the boon it seems to be. In fact, on 6th January 2015, we got a glimpse into what can happen if the oil price continues its fall – the NSE Nifty fell over 255 (~ 3.0% decline) points creating a ruckus on the street.

Impact on the Indian Companies

State owned oil marketing companies (OMC) such as HPCL, BPCL, and IOC are a direct beneficiary of low oil prices. The low oil price has a positive impact on oil marketing companies (OMC) in terms of reducing the stress on their working capital requirements. In fact, both BPCL and HPCL have retired over 50% and 30% of their short term borrowings over the last two years, respectively. If the price of crude oil prices stabilizes around the current level of $50 per barrel, then naturally it will be great for these companies in term of cleaning up their balance sheets and improving their bottom line.

Is this the end?

Well, this just depends on the supply-demand situation. Clearly, as Saudi Prince Al-Waleed Bin Talal says, “If the supply stays where it is, and the demand continues to be where it is, then there is little hope for the oil prices to bottom out here”. Besides, the US has withdrawn the 40-year ban on the export of oil– which means more supply to the market, thereby putting more pressure on prices.

Last month, i.e., September 2016, OPEC has finally agreed to cut the production to support the oil price. You can read the article on Bloomberg.

American shale oil has no doubt created a ripple in the market, but there is another angle to this – how strong are the balance sheet of these companies fracking shale oil? Are they over-leveraged? Are they overstating the reserves? These are things the market will learn sooner or later; which will again impact crude oil prices.

However, at this stage, if you ask me – is this the bottom of the oil price crash? Well, your guess is as good as mine.

Please note, unlike all the previous chapters on Varsity, this chapter will not have any key take away points as I’ve just narrated what really happened to crude. What we have discussed today could just be a piece of irrelevant history going forward!

PS: I have taken all the inputs for this chapter form The special report on the oil crisis was published by Dalal Street Investment Journal, authored by me.

Hi i like to learn about commodity market for a to z on videos ?

Dont have videos yet, but soon, hopefully. Meanwhile you can checkout all our other videos here – https://www.youtube.com/@varsitybyzerodha

Reading in Oct 2024 and still it\’s relevant, very well written, thanks for your efforts

Happy learning, Raju 🙂

Hello Sir, Who are some of the top oil traders in the world ?

There are quite a few international commodities companies that trade Oil, Febina.

Sir,

Like equity, do we have provision of trading in spot market for the currency/ commodity?

Nope, no spot data, Anirban.

Nice Blog Sir, I find evergreen content brings the most success as a blogger.

Thanks 🙂 Happy learning!

Thank you sir.

Can you recommend books on commodities?

Not sure myself, Dayanandan. Let me check.

can we invest in crude in spot market through Zarodha ????

does MCX allow spot market buying in crude commodity???

could you please give me the whole procedure of investing in crude through Zerodha kite platform??

No, the spot market is not available for Crude.

Amazing you predicted this 5 years back…what do you think about oil now? Russia rather than taking a backstep is now producing it more aggressively?

I\’m not sure if I predicted anything, its just chance and coincidence 🙂

The equation is quite straight forward, More supply + less demand = lower price.

\”American shale oil has no doubt created a ripple in the market but there is another angle to this – how strong are the balance sheet of these companies fracking shale oil? Are they over leveraged? Are they overstating the reserves? These are things the market will learn sooner or later; which will again impact crude oil prices.\”

Well, sir as you said, market has taught the lessons to these companies, most of them are in a situation of bankruptcy, because of their debt burden.

We are living in crazy times 🙂

Sir you have provided most of the lessons in Hindi & trust you remaining lessons will also available soon in Hindi. I request you to please provide its download option like English so we can download it.

Thanks for your best doing

Yes Sagar, everything will be translated to Hindi. We will also work on the download option.

Hi,

I have a question regarding Crude Oil, as I am new to this. I understand, as we buy stocks of a company, they are credited to our Demat account and we can hold them for any number of days or years and sell them, whenever we like to.

I could see while trying to buy Crude Oil from Kite App, the same options to select NRML, Market/LML, RGLR/BO, DAY, like while buying a share.

I would like to understand, does buying crude oil also works the same as buying shares of a company. Only difference is, that it comes to our commodity account instead of Demat account and remains there for as much as I want. Or does it works in a different manner?

Any help is really appreciated.

Regards,

Raman

Shares sit in DEMAT but there is no concept of DEMAt for futures and option.

and if i want to trade in EQ Futures so i think i should analyze spot market as well ?

Yup, you need to look at the spot market.

While trading in a commodity or future\’s market which chart we should consider to analyze. For example I\’m trading in CRUDEOILM so can I analyze CRUDEOULM or I should analyze CRUDEOIL.

You should look at the chart of the most liquid contract, in this case, Crudeoil.

Why the heck are my far away placed CO orders getting exited even when price hasn\’t gone there at all?? And its getting exited 10-15 points away from my co level, what the heck guys??

Why can\’t you give us limit option in CO- why are you selling us to institutions??/

Zerodha, i have been your customer since 7 years, I seriously am thinking of changing now

Rajesh, please read my comment posted to Manoj in the same thread.

I have been a part of zerodha since the time when Nitin kamath himself used to call the customers to explain the Omneysys aplication n all but only now i understood the reason why Zerodha is the cheapest…

No wonder zerodha is No 1, every trader who trades everyday is only trying to recover the losses of yesterday… i bet there are more losers than gainers. And being no 1 is a proof that most of them are over trading…

Do read my reply to your previous query.

I request zerodha team to please mention in all the portals/blogs where it displays that zerodha is the no 1 broking company that the data that zerodha provides to its customers is not the best/accurate and any misinterpretation caused due to this in placing the trades is not zerodha\’s responsibility… please mention the percentage of deviation from the real time price movements and the data provided by zerodha… this is a request from a customer not a bloody hater as all the charting and all the new stuff that you provide every now and then is useless unless the very data used is useless… After sooo many years of being a customer i feel like cheated… Really disgusting as i am not able to make head or tail of why one of the trades i had placed was exited and if not it would have made a huge difference… i Feel like all that i have learnt over these many years is useless as theres as no amount of education or strategy that can predict how people with resources are tricking or fooling us all along…

Manoj, there is no way this can happen. You need to spend more time understanding how the system works.

Do you know that each and every trade that happens on the exchange can be verified directly from the exchange, check this (NSE) – https://beta.nseindia.com/invest/first-time-investor-trade-verification and this one for MCX – https://www.mcxindia.com/login

I think you\’ve placed a trade and the SL for the trade has triggered and you may not have seen that price on the chart, leading you to believe that we are cheating you.

Kindly note, that it is impossible to capture and show all ticks in the chart, please see this – https://tradingqna.com/t/why-does-the-same-technical-charts-for-the-same-stock-from-nse-tame-google-finance-yahoo-finance-amibroker-not-match/1688

Hi Karthik,

I noticed that MCX has delisted Nickelmini, copper mini already and from December on Crude oil mini is also being delisted.

Why are they doing this?? What is the future for retail commodity traders??

Thanks

When will Zerodha introduce BO in commodities

Sid, we don\’t have this for now. It will take some time to implement this.

thanks

i saved some layout…but it is not there in chart TV. How can i find it. it happened twice. Some time it appears and sometime it not.

Barun, only 10 layouts can be saved at a time. When you add a new one, the last one gets flushed out (FIFO).

how to find crude oil continuous chart in trading view in zerodha and also usdinr spot chart or continuous chart of usdinr future.

plz hep.

That chart is there on ChartIQ, but not on TV yet. We are working on this, hopefully soon.

Karthik where did you get this ocean of knowledge from?

Markets teach you stuff, as long as you are willing to learn 🙂

Hi Karthik,

I am new to Commodity. I wanted to trade in Crude oil. Few stuffs i am bit confused.

This is for Crudeoil for 100barrel. Suppose if i buy crudeoil future at 4100 and it went to 4150. Profit will be 50*100= 5,000 is it and loss will be same vice-versa?

please help me in understanding this profit and loss.

Yes, that\’s right Kiran.

But if we invest 4lakh or 8lakh, that doesnt matter is it? only matters is how much points it goes up and down?

Yes, in other words, what really matters is the percentage return.

Trading in commodities is less risky and more profitable, if someone trade with trends than why volume traded in majority of the commodities is very less in comparison to stocks.

Its the otherway round, Pradeep. Margins are lower and commodities are more volatile. So it is quite risky to trade commodities.

Hi,

I am using Zerodha account. I am not able to see current Crude oil CE5400 contract for October19 but it showing in MCX.

Pl. help.

Can you check again, Bharath? I can spot both 5400 CE and PE.

where can i find fresh data of \”breakeven-price per barrel\” for all countries?

I think this is published by OPEC, I\’d suggest you look at a few of their publications.

Hello Sir,

Sir I need to know where I can look for Crude Oil 1 Min Chart since inception. 1 Day and every other time frame is available. It will be a great help for me sir. Hope to get a positive response soon sir.

Regards.

Currently, continuous charts are available for Day candles and higher.

We plan to add continuous charts for all timeframes soon.

Dear sir, please add bracket order option in commodity also.

Ayush, there have been a few delays concerning this.

We will be implementing it soon.

Can we trade more than 100 lots in crude ?

if yes, then what is the limit ? and any rules/ conditions ?

Check this – https://tradingqna.com/t/what-is-the-maximum-limit-of-crude-oil-trading-lots/3473

i didn\’t asked max. order size sir,

what is individual trading limit? can we place 100+100+100…

I think its margins upto 1 Cr (max limit). Check the details here – https://www.mcxindia.com/docs/default-source/default-document-library/crude-oil-august-2018-contract-onwards.pdf?sfvrsn=5706f290_0

Dear Sir, I have Zerodha A/c of equity. In equity A/c the fund is near about 15000/-. Now I want to trade in commodities. Please guide me how can I add or transfer my amount for trading into commodity. I had tried to put an order of Crud Oil M 18 July Future but the order had been rejected. Please guide me.

Looks like your commodities account is not open, Murari. Can you touch base with our support desk? Thanks.

Dear karthik ,

\” In fact cutting oil production is considered more expensive than pumping oil\” as quoted in this chapter.

why is it so??

Becuase of the expensive ecosystem involved. Keeping this ecosystem ideal can be catastrophic.

I am trying very hard to get continuous profit in crude oil … but couldn\’t ……

Well, we all do 🙂

Hi Karthik,

Thanks a lot for sharing your immense knowledge with us.

I think a small correction is required in this chapter.

OPEC stands for The Organization of the Petroleum Exporting Countries, not \”Organization of the Petroleum Countries\”.

Thanks.

Ah, thanks for that Rishab. Will rectify.

Hey Karthik,

CME is open 23 hrs, MCX only 14,

Is investing.com chart data reliable for 23 hr crude charts? (for Wave analysis)

If not can you suggest any other charting websites please?

Thanks 🙂

Investing.com is quite reliable 🙂

okay 🙂

Really appreciate your prompt replies.

Happy learning!

Hello Karthik,

What is the underlying spot price to monitor for trading Crude Oil on MCX? Is that Brent Crude Spot (UKOIL) or WTI Crude (USOIL)?

Also, what is the difference between UKOIL and BCOSD pair? I saw different scrips on TradingView but trading at same price!

Regards,

Pratik

@Kartik – will appreciate your attention and advise. Thank you.

Cheers! Happy learning.

Hi Karthik, I can\’t thank you enough for the work you have done here on Varsity. This is tremendous and incredible treasure for any learner. I have a question – might be very basic though – can you tell me how you see the open price of a stock or future at the start of the day? For example, if you see crude oil mini future for August 21 expiry, the 1 Day candle shows the open & low price as 3088 for 26th Jul 2017 but when you change that to 15 minutes candle the price did not come below 3091. Also, the first candle\’s open price is 3126. It\’ll be of great help if you can clear this.

I\’m using Kite to see these values and chart – just an FYI.

Thanks for the kind words, I\’m happy you liked the content we have put up here.

This happens because of the following reasons –

1) It is very normal for a contract like Curde Mini to get volatile at open

2) A volatile scrip like this can attract 1000\’s of ticks per second

3) It would be impossible to capture all these ticks – hence the chances of missing ticks at open is very high

4) At the end of the day, we sync the OHLC data with the data provided by exchange\’s \’Bhav copy\’ – so the EOD charts are always more reliable

So yes, I\’d prefer to see the EOD data….however, if you are doing intraday there are not many options.

Oh Ok!! Thanks again for your detailed explanation!!

Welcome!

Hello Sir,

I have opened a commodity account with zerodha. I am not able to fund it as I am abroad and I get no cellphone network and hence I am not able to receive OTP. Hence I am not able to carry out any online transaction. Can you please tell me of a way to fund the account. Can i transfer some funds from my equity to commodity account?

The other way would be issue a cheque I guess. I\’d suggest you please write to [email protected] for this. Thanks.

So, i have few questions regarding commodity positional trading…

Do I need to square off 5 days before expiry to avoid physical delivery?

What happens if i don\’t square off?

What to do if i find a trading opportunity before 2 days of expiry? Should i ignore that?

It depends on the commodity. Some 5 days and some are 4 days. If you dont then, it implies that you have expressed interest in participating in physical delivery…so additional burden of warehouse receipts etc.If you find and trading opportunity 2 days before, then its best to implement it in the next months contract.

Thank you. I read somewhere that my position will auto square off in Zerodha before 5 days to avoid physical delivery? It this true?

Hi Karthik.. Thanks for providing knowledge & insights.

I m a businessman & part time commodity trader. My nature of work does not allow me to be in touch with market during working hours. So 4 Hrs or EOD TF suits me best. Can u please suggest me some good strategy to positional trade in Crude Oil? Thanks in advance.

Have you looked at the TA module? – http://zerodha.com/varsity/module/technical-analysis/

These candlestick patterns work equally well on commodities as well.

Thanks.

Welcome!

Hi, how to buy crude oil in lot? when i try to order it takes for only one quantity, it is not showing in lots.

Its 1 lot by default…if you want to buy/sell more than 1 lot, just replace the same with whatever number you want.

How underlying price of a comodity is determined?who decides it?how it changes second by second?

The regular demand supply for the underlying commodity dictates the price of the commodity in the spot market. For example, the price of an agri commodity like cotton is dictated by the farmers and buyers at the mandi.

Hi Karthik,

Can we use technical analysis for commodity . Where can I find underlying commodity graphs (Spot price graphs).?

PS: Good learning from you. You have created a invaluable resource for simple and effective knowledge. Felt like reading 100 books :).

Thanks for the kind words Prashant!

Yes, TA can be applied to commodities. In fact, it can be applied to any asset which has time series data. The futures charts are available on Kite/Pi. I\’m not too sure about where to find the spot price charts.

Hi Karthik,

From commodities perspective, suppose I buy 1 lot of aluminium with a margin of around Rs. 33k and if I go into loss suddenly by 1 or 1.5 point. Will my position get automatically squared off? In general, What percentage of margin reduction from the prescribed one will cause the position to get automatically squared off ?

The position will be squared off if the loss exceeds the SPAN requirement and you do not have sufficient funds in the account.

Hi Kartik,

Can you please explain the correlation between the US dollar and the crude prices in detail. I didn\’t get it. 🙂

Check section 11.4 – http://zerodha.com/varsity/chapter/crude-oil-part-2-the-crude-oil-eco-system/

Sir, simply great work by Zerodha team by sharing mammoth amount of knowledge and that too in simple words.

I would like to point out problems with Kite. On the day of Brexit/US election results, the slow performance is understandable e.g logging in. But not on days like today, 15 Nov. Kindly ask your tech team to work on it to utilise it better. Many thanks.

I understand. Our tech is fully aware of these issues, if any. They are working hard to sort them out.

Hi kartik

Why many COMMODITY like platinum, pladinum are not traded in mcx. If I want to trade them what should I do

Platinum futures are available over the international exchanges…but not yet in India. I guess introduction of commodities on MCX is a function of the real world application of the commodity in our day to day lives…platinum from what I know has very small real world application…maybe at the most 1/10th….and paladium is highly sensitive, given its application in nuclear warfare.

Anyway, this just my guess work, if I get an opportunity to speak to someone from MCX, I\’ll find out what they think about this as well.

Sir when wil this chapter come & when will the risk management module come? Will it be completed by jan 2017? Please reply

I understand the delay is quite a bit. This is because of various other activities that\’s happening. I\’m guessing I\’ll be able to pick up pace in couple of weeks from now. Thank you for your patience.

Hi Karthik,

this query is not related to above topic.

how can we get NSE live stock prices in Excel. is there any way.

thanks in advance

You can use Pi for this, suggest you email [email protected] for this.

From the above comments i read heading in futures. i found that you mention hedging with options also in the options module, but could not find it in the options module..

\” However you can hedge such positions by employing options. We will discuss the same when we take up options.\”

——————- This mentioned in the Future hedging chapter

Can you please let me know , where is the location for hedging with options on this varsity, please.

We somehow missed this part Dhiraj. Will try and include this sometime soon.

Excellent job thank you for zerodha

Welcome 🙂

Hi.

Can you pls share some idea about other commodity loke zinc nickel copper , aluminium etc

Wht are the factors that influence price of these commodities and what us the best strategy to trade them ?

Of course we will, this module is work in progress. We will eventually add chapters on all the commodities.

+1 There Kaushik, I am also interested in trading commodities, however, don\’t have enough knowledge. All works good on paper, however, when I enter a trade, it\’s a mess :(.

Thank you, Karthik .

Just to add my 2 cents – most of the good things initially starts in a mess, idea is to keep going 🙂

Hi Karthik,

Thank you for your two cents, I\’ll always keep that in mind.

I am highly impressed with you, Nithin and all the team members at Zerodha, the way you all are striving to help people and would like to thank each one of you and specially you with the efforts of sharing and making all the knowledge available to us at Varsity….please keep up with the good work that you guys are doing.

Thank you so much…. 🙂

Thank you so much for the kind words. Good luck and happy trading.

Hi Karthik,

Just one more request, I read the stories of winners and consistent performers at the Zerodha connect page, I felt that there are only people who are trading in futures and options, stock market and nifty who have given their success stories, however, I want to know whether there are people who are trading in commodity market also. I would like to request you to add their stories as well.

Thank you,

Good idea, will give this a shot.

Thank you again, Karthik.

Welcome!

WISHING TEAM ZERODHA A HAPPY & PROSPEROUS DIWALI

Thank you so much! Wishing you and your family the same!

Wishes u and yr family very happy Dipawali.

Thanks so much, wishing you and your family the same.

Dear Karthik,

You and your team is doing remarkable job, I have read all the modules its very simple and easy to understands, I have request I am very much concern about the Risk Management, Reward Risk .

I am making the excel file for reducing the risk in day trading. For making the perfect file i will be required to understands the risk management – Can You please help me out to solve my problem.

Thanks

Vivek Dubey

Thanks Vivek. I\’m happy you liked the content.

In fact we are planning on developing a module on Risk management soon.

Sir I very much like this chapter

This chapter give me knowledge about fundamental of crude oil

I hope the next chapter has its technical part

Glad you liked it. We will discussing the contract details in the next chapter, which hopefully should be out next week.

in kite, it applies same settings of first chart to all subsequent charts. is that normal?

Yes, but you can change the chart settings to anything you want.

Thank you very much for this chapter sir.. And also thanks for not delayed this chapter.

Welcome!

If I have physical gold then how can I sell it to market or if I am gold business how commodity will be beneficial for me

If you are in a business which requires you to deal with Gold/Silver, then you can hedge your physical exposure to these metals by hedging in the commodity market. I will put up a detailed chapter on the same, but for now I\’d suggest you have a look at this – http://zerodha.com/varsity/chapter/hedging-futures/