3.1 – Why Bull Put Spread?

Similar to the Bull Call Spread, the Bull Put Spread is a two leg option strategy invoked when the view on the market is ‘moderately bullish’. The Bull Put Spread is similar to the Bull Call Spread in terms of the payoff structure; however there are a few differences in terms of strategy execution and strike selection. The bull put spread involves creating a spread by employing ‘Put options’ rather than ‘Call options’ (as is the case in bull call spread).

You may have a fundamental question at this stage – when the payoffs from both Bull call spread and Bull Put spread are similar, why should one choose a certain strategy over the other?

Well, this really depends on how attractive the premiums are. While the Bull Call spread is executed for a debit, the bull put spread is executed for a credit. So if you are at a point in the market where –

- The markets have declined considerably (therefore PUT premiums have swelled)

- The volatility is on the higher side

- There is plenty of time to expiry

And you have a moderately bullish outlook looking ahead, then it makes sense to invoke a Bull Put Spread for a net credit as opposed to invoking a Bull Call Spread for a net debit. Personally I do prefer strategies which offer net credit rather than strategies which offer net debit.

3.2 – Strategy Notes

The bull put spread is a two leg spread strategy traditionally involving ITM and OTM Put options. However you can create the spread using other strikes as well.

To implement the bull put spread –

- Buy 1 OTM Put option (leg 1)

- Sell 1 ITM Put option (leg 2)

When you do this ensure –

- All strikes belong to the same underlying

- Belong to the same expiry series

- Each leg involves the same number of options

For example –

Date – 7th December 2015

Outlook – Moderately bullish (expect the market to go higher)

Nifty Spot – 7805

Bull Put Spread, trade set up –

- Buy 7700 PE by paying Rs.72/- as premium; do note this is an OTM option. Since money is going out of my account this is a debit transaction

- Sell 7900 PE and receive Rs.163/- as premium, do note this is an ITM option. Since I receive money, this is a credit transaction

- The net cash flow is the difference between the debit and credit i.e 163 – 72 = +91, since this is a positive cashflow, there is a net credit to my account.

Generally speaking in a bull put spread there is always a ‘net credit’, hence the bull put spread is also called referred to as a ‘Credit spread’.

After we initiate the trade, the market can move in any direction and expiry at any level. Therefore let us take up a few scenarios to get a sense of what would happen to the bull put spread for different levels of expiry.

Scenario 1 – Market expires at 7600 (below the lower strike price i.e OTM option)

The value of the Put options at expiry depends upon its intrinsic value. If you recall from the previous module, the intrinsic value of a put option upon expiry is –

Max [Strike-Spot, o]

In case of 7700 PE, the intrinsic value would be –

Max [7700 – 7600 – 0]

= Max [100, 0]

= 100

Since we are long on the 7700 PE by paying a premium of Rs.72, we would make

= Intrinsic Value – Premium Paid

= 100 – 72

= 28

Likewise, in case of the 7900 PE option it has an intrinsic value of 300, but since we have sold/written this option at Rs.163

Payoff from 7900 PE this would be –

163 – 300

= – 137

Overall strategy payoff would be –

+ 28 – 137

= – 109

Scenario 2 – Market expires at 7700 (at the lower strike price i.e the OTM option)

The 7700 PE will not have any intrinsic value, hence we will lose all the premium that we have paid i.e Rs.72.

The 7900 PE’s intrinsic value will be Rs.200.

Net Payoff from the strategy would be –

Premium received from selling 7900PE – Intrinsic value of 7900 PE – Premium lost on 7700 PE

= 163 – 200 – 72

= – 109

Scenario 3 – Market expires at 7900 (at the higher strike price, i.e ITM option)

The intrinsic value of both 7700 PE and 7900 PE would be 0, hence both the potions would expire worthless.

Net Payoff from the strategy would be –

Premium received for 7900 PE – Premium Paid for 7700 PE

= 163 – 72

= + 91

Scenario 4 – Market expires at 8000 (above the higher strike price, i.e the ITM option)

Both the options i.e 7700 PE and 7900 PE would expire worthless, hence the total strategy payoff would be

Premium received for 7900 PE – Premium Paid for 7700 PE

= 163 – 72

= + 91

To summarize –

| Market Expiry | 7700 PE (intrinsic value) | 7900 PE (intrinsic value) | Net pay off |

|---|---|---|---|

| 7600 | 100 | 300 | -109 |

| 7700 | 0 | 200 | -109 |

| 7900 | 0 | 0 | 91 |

| 8000 | 0 | 0 | 91 |

From this analysis, 3 things should be clear to you –

- The strategy is profitable as and when the market moves higher

- Irrespective of the down move in the market, the loss is restricted to Rs.109, the maximum loss also happens to be the difference between “Spread and net credit’ of the strategy

- The maximum profit is capped to 91. This also happens to be the net credit of the strategy.

We can define the ‘Spread’ as –

Spread = Difference between the higher and lower strike price

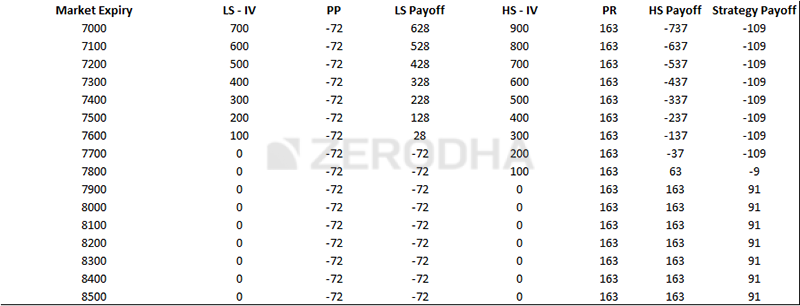

We can calculate the overall profitability of the strategy for any given expiry value. Here is screenshot of the calculations that I made on the excel sheet –

- LS – IV — Lower Strike – Intrinsic value (7700 PE, OTM)

- PP — Premium Paid

- LS Payoff — Lower Strike Payoff

- HS-IV — Higher strike – Intrinsic Value (7900 PE, ITM)

- PR — Premium Received

- HS Payoff — Higher Strike Payoff

As you can notice, the loss is restricted to Rs.109, and the profit is capped to Rs.91. Given this, we can generalize the Bull Put Spread to identify the Max loss and Max profit levels as –

Bull PUT Spread Max loss = Spread – Net Credit

Net Credit = Premium Received for higher strike – Premium Paid for lower strike

Bull Put Spread Max Profit = Net Credit

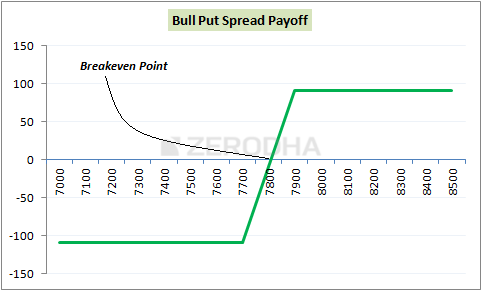

This is how the pay off diagram of the Bull Put Spread looks like –

There are three important points to note from the payoff diagram –

- The strategy makes a loss if Nifty expires below 7700. However, the loss is restricted to Rs.109.

- The breakeven point (where the strategy neither makes a profit or loss) is achieved when the market expires at 7809. Therefore we can generalize the breakeven point for a Bull Put spread as Higher Strike – Net Credit

- The strategy makes money if the market moves above 7809, however the maximum profit achievable is Rs.91 i.e the difference between the Premium Received for ITM PE and the Premium Paid for the OTM PE

- Premium Paid for 7700 PE = 72

- Premium Received for 7900 PE = 163

- Net Credit = 163 – 72 = 91

3.3 – Other Strike combinations

Remember the spread is defined as the difference between the two strike prices. The Bull Put Spread is always created with 1 OTM Put and 1 ITM Put option, however, the strikes that you choose can be any OTM and any ITM strike. The further these strikes are the larger the spread, the larger the spread the larger is the possible reward.

Let us take some examples considering spot is at 7612 –

Bull Put spread with 7500 PE (OTM) and 7700 PE (ITM)

| Lower Strike (OTM, Long) | 7500 |

| Higher Strike (ITM, short) | 7700 |

| Spread | 7700 – 7500 = 200 |

| Lower Strike Premium Paid | 62 |

| Higher Strike Premium Received | 137 |

| Net Credit | 137 – 62 = 75 |

| Max Loss (Spread – Net Credit) | 200 – 75 = 125 |

| Max Profit (Net Credit) | 75 |

| Breakeven (Higher Strike – Net Credit) | 7700 – 75 = 7625 |

Bull Put spread with 7400 PE (OTM) and 7800 PE (ITM)

| Lower Strike (OTM, Long) | 7400 |

| Higher Strike (ITM, short) | 7800 |

| Spread | 7800 – 7400 = 400 |

| Lower Strike Premium Paid | 40 |

| Higher Strike Premium Received | 198 |

| Net Credit | 198 – 40 = 158 |

| Max Loss (Spread – Net Credit) | 400 – 158 = 242 |

| Max Profit (Net Credit) | 158 |

| Breakeven (Higher Strike – Net Credit) | 7800 – 158 = 7642 |

Bull Put spread with 7500 PE (OTM) and 7800 PE (ITM)

| Lower Strike (OTM, Long) | 7500 |

| Higher Strike (ITM, short) | 7800 |

| Spread | 7800 – 7500 = 300 |

| Lower Strike Premium Paid | 62 |

| Higher Strike Premium Received | 198 |

| Net Credit | 198 – 62 = 136 |

| Max Loss (Spread – Net Credit) | 300 – 136 = 164 |

| Max Profit (Net Credit) | 136 |

| Breakeven (Higher Strike – Net Credit) | 7800 – 136 = 7664 |

So the point here is that, you can create the spread with any combination of OTM and ITM option. However based on the strikes that you choose (and therefore the spread you create), the risk reward ratio changes. In general, if you have a high conviction on a ‘moderately bullish’ view then go ahead and create a larger spread; else stick to a smaller spread.

Key takeaways from this chapter

- The Bull Put Spread is an alternative to the Bull Call Spread. Its best executed when the outlook on the market is ‘moderately bullish’

- Bull Put Spread results in a net credit

- The Bull Put Spread is best executed when the market has cracked, put premiums are high, the volatility is on the higher side, and you expect the market to hold up (without cracking further)

- The Bull Put strategy involves simultaneously buying an OTM Put option and selling an ITM Put option

- Maximum profit is limited to the extent of the net credit

- Maximum loss is limited to the Spread minus Net credit

- Breakeven is calculated as Higher Strike – Net Credit

- One can create the spread by employing any OTM and ITM strikes

- Higher the spread, higher the profit potential, and higher the breakeven point.

Download Bull Put Spread Excel Sheet

\”To implement the bull put spread –

1. Buy 1 OTM Put option (leg 1)

2. Sell 1 ITM Put option (leg 2)\”

Is this correct? I guess it\’s a mistake. we should buy ITM put and sell OTM put to implement this strategy.

That would be bull call spread, right?

Hi Sir,

In the bull put credit spread, the difference between OTM PE BUY LEG and ITM PE SELL LEG has a 200 points difference/distance while forming the spread.

But why 300 points distance while forming Bear Call Credit Spread in this tutorial you have considered?

Any logic? or is it random?

Thanks so much.

I\’ve kept Nifty spot in perspective and created a spread around it. One strike above and below. This also ensure adequate liquidity.

Hey Karthik

As the max loss is capped, but the option writer has unlimited risk right? Then how does the max loss justify?

Max loss is capped for the buyer, not writer. But yes, if you think the max loss = all the margin blocked, then thats a different thing 🙂

Why there is no strike selection chart for bull put spread ?

Strike selection chart as in? Can you please elaborate? Thanks.

Hi Karthik,

Thank you for your clear explanation. When I use this strategy, do I wait until the expiration date for the positions to close by itself or do I have to close it myself, meaning do a buy to close and a sell to close orders for the two legs order?

You can close it yourself, Matthew to prevent getting into physical delivery.

Resp. Sir;

Can I buy deep OTM long term bull put spread.

For example, 31 Oct. Bull put spread?

Yes, you can.

Can it be the other way around shorting the OTM option and buying the ITM put

The spread will be larger, meaning higher breakeven.

HI Karthik,

Thanks for the explanation. After reading through the strategies, I understood that these concepts are ideally for the trades that are left till expiry. How about if I wanted to square off both the legs before expiry, does the profit/loss go beyond of what you calculated through the chapter. If yes, are there any things that we have to consider or calculate to check if we can get profits before expiry?

Thats right, the assumption is that you hold the position till expiry. Otherwise, you can square off the position anytime, but the P&L will vary. You can plot this in Sensibull and get a sense of how the P&L will play out before expiry.

Hi Kartik,

I\’m in the process of rolling over a credit spread to the next expiry. I\’m attempting this on the last day of the current expiry, around 3:20 pm. However, I\’m facing difficulty rolling over the position at a net credit. In theory, longer-dated option contracts should have higher time value and volatility, leading to a net credit. Do you have any insights into why I\’m not able to achieve a net credit in this situation?

Bear in mind the elections and volatility and its impact on option premiums 🙂

How we will execute the Bull put spread strategy in our demate account?

You do that in trading account, Hritik, not DEMAT account.

Wont the margin be kicking if sell the put options, really sorry for this question. Just a new trader trying to figure out from my experience in paper trading

In case the IV suddenly shoots up, is there a chance that it can shoot up differently with respect to each leg so as to cause a significant premium difference between the 2 legs. For eg an IV of 20 for buy leg and 30 for sell leg due to sudden change in markets. I tried this experiment in Sensibull and found out that if this happens there will be a temporary higher profit or loss(depending upon how IV shoots up) before expiry although the final P/L is locked. But I would like to know how often does this scenario likely to occur if at all it happens. Have you seen this happen before? Thanks Sir.

Oh yes, IVs can vary for different strikes. This usually happens when there is some fundamental news for the stock.

hello Karthik ,

during high IV ,most of the time markets are likely to go down ,so should we really consider bull put spread & pls do check my msg on linkdin ,thank you

I\’m pretty bad at checking messaged on SM, this is a better place 🙂

Yeah, bull put may not make sense. Maybe bear put spread.

Hello Karthik ,

does it make sense to implement spread near expiry when the cost you are saving on spread in not significant

I\’d be a bit hesitant, given the time constraint. The spread is not encouraging enough.

Yes sir. But as you know LTP might not be in range with bid ask spread due to lack of liquidity. So Should the price be set based on LTP or bid ask spread? Thanks.

You can place an order by looking at bid-ask, just LTP can be misleading at times.

Sir in case of next month series like 17950 PE, volume is lower and bid ask spread is wide. I tried sell limit order below ask price, but didn\’t execute. In that case is it advisable to avoid those or if we want to execute, how to place limit order in such situations? Should we consider LTP or ask price for a limit order in such scenario? Thanks.

Yes, this happens due to the lack of liquidity, Sathish. Yes, please always use limit orders.

Thanks Sir. What surprised me the most is that none of the customer executives were aware of this fact(they simply assumed that I exited the hedge first) and no articles that I could find regarding this exist as far as I did my research. No complaints from customers in forums either which makes me wonder, \” Am I the only one facing this?\”. This really stressed me a lot. As a person who doesn\’t have any mentor, the only way to learn is through your varsity materials. Also if this issue indeed exists, then I would like to request you to update your education materials as well regarding the same. So if you come across anything, I kindly request you to let me know as that would be very helpful for me.

Totally understand. The thing with margins is that it keeps changing with the changing regulation. The objective of Varsity is to put up content which does not change conceptually. But I get your point. Maybe I\’ll put up a tweet around this to educate others as well.

No Sir. Its a NIFTY Index option only. Finally got a call from the RMS team. And the person told me a completely new aspect I never heard of. Seems that at the time of exiting a sell option, the system will look for available margin at that time and since a \’premium debit\’ is taking place while we square off a sell position, the system sequence it seems is like this debit will go from the available margin first. If at that time if the available margin is less than the premium debit, a shortfall could happen. This is probably why I might have received a margin call mail when I placed a limit order for exit since funds after getting blocked from my available margin went to negative margin of around 2000 according to the person. I never came across any of these information even in the links that customer care sent me from Zerodha\’s portal. Only main information(in this aspect) they have provided is that you need to exit the sell position first. I used to assume that after sell square off, margins would be released and that would prevent the shortfall. But seems that the system\’s sequence is that first it would look for the available margin post execution. Does this happen usually?

Yeah, with the changing regulations on how margin is charged, this can. Let me also double check this.

Respected Sir. Something uncommon is happening after execution of sell orders. Whenever I exit the sell order first, my margin goes into negative. I have given the screenshot of my sequence of order execution(to tell them I exited the sell order first) and the margin call mail timing to the customer care to show that it matched. I have no other additional positions apart from 2 legs in a bull put spread. This had also happened previously after I exited 2 sell positions in an iron butterfly strategy with only 2 buy legs remaining. I had executed these type of trades before with no issues. But isn\’t it weird that a margin goes to negative after you exit the most risky position? I also raised tickets in customer care with nobody calling me regarding this. They are telling reasons like volatility increase which has absolutely no relation to margin fall after you exit the position. It is taking like 1 week for them and yet no solution. I didn\’t have any EOD shortfalls. Even though peak margin penalties aren\’t passed to customers, I\’m hesitant to take further trades because of this issue. Can you suggest me something?

Ideally margin shouldn\’t shoot up for long put but I\’m assuming you might had physical delivery ITM position which might have attracted additional margin which we charge during expiry week.

What should be the correct stopLoss for this strategy , As we are applying this strategy so we need to maintain good risk to reward ratio so what is proper stoploss for it ?? Can anybody answer

You dont really need one as the SL is already baked into the strategy.

Thanks karthik !!

Happy learning!

Hi Karthik,

Hope you are doing good.

If i sell a put call of stock at 580 and buy put call of the of same stock at 570. At the time of expiry if price is above 580 or less than 570 and i didn\’t close my position.

What will happen after that ?

1) Will there be any kind of physical delivery or any other charges involved.

2) Simply profit/loss of the trade will be credited/debited to my account and contract will not exercise as they will cancel out each other.

1) Yes, physical delivery applies to options that have expired ITM

2) No, since the ITM options will be physically settled.

Sir, can we make spread in deep ITM ? Like nifty is at 17200 and it\’s resistance is at 17400 . Can we make bear put spread at 17400 and 17450 ?

Dear Sir;

Particular Value

Underlying Nifty

Spot Price 16240

Lower Strike (LS), Buy, OTM 16100

Higher Strike (HS), Sell, ITM 16500

Debit (LS) 236

Credit (HS) 444.8

Net Credit 208.8

I executed this bull put spread,for I was moderately bullish. I squared off as Nifty hit 16400 and my pay off is 108. I did not wait for expiry, that is May 26th. What is your take?

Thats fine, you can exit the trade whenever you want, no need to wait till expiry.

Suppose I have excited the bull spread statergy and I have made loss of 100 rupees but the net credit is 1000rs so is my profit =1000-100, and when we get the net credit in our accounts,??

2) can we receive net credit in intraday or we have to wait for expiry

1) On T+1 basis is the settlement for options.

2) No, settlement happens on T+1

Sir, Have some doubt:-

(i) Is it right if I am moderately bullish then I can apply any strategy from Bull call / Bull Put Spread ? If yes, then which is better one to apply

(ii) I apply this strategy only when there is some type of breakout or any result or reversal from support. Is this right ?

(iii) For major event like Policy, Election etc.. Is bull call / bull put spread better ? or any other strategy for that

(iv) Should I apply this strategy 2-3 days prior to corporate announcement

(v) Should I apply this strategy on that day when any breakout made ?

1) Yes, you can. I\’d suggest you try the Bull call Spread

2) Not just that, it can be applied for a combination factors

3) I\’d prefer short straddles and strangles for these

4) Yes, you can try that

5) YOu need to estimate the breakout and figure if will sustain through or not. BAsis that you can setup your trade.

Suppose market opens gap down at 6000 (nifty spot price). then how much additional capital I need to have in trading account so that I don\’t charged with margin penalty? thanks in advance.

This wont happen because there are Index circuit breakers.

spot price is above the strike price of a sold PUT option then why is the intrinsic value is 0

It will be zero right? It will have a positive value if spot is lower than strike.

Which strategy is better for a slightly bullish market bull call spread or bull put spread

Depends on which option\’s premium is more attractive.

Bull put spread is implemented when- \”The volatility is on the higher side\”.

This means currently(When we are creating position) volatility is high (and hence premiums). So it makes sense to go for bull put spread instead of bull call spread(Collect premiums as they are high). And in future WE EXPECT VOLATILITY TO DECREASE so premiums will fall and we will earn profit (as we are net credit here. We are more on selling side than buying).

Is this interpretation correct?

That\’s right. Higher the volatility, higher premium so you need to be on the buying side and vice versa.

Bt sir ITM OPTION HAVE INTRINSIC VALUE . So how can it become zero sir . Pls tell ! 🙏

Yes, it has intrinsic value, and cannot be zero. OTM has zero intrinsic value.

Hello sir !

IN this strategy as the expiry comes near the OTM tends to zero , bt what about ITM money option we sell to get the premium, is it aslo become zero at expiry to get us full premium if the market stays above our selling point . ? pls tell

Anukool, yes, whichever option does not have an intrinsic value, such option becomes OTM.

Hi Sir,

The contents that you give in layman\’s language is soo good, which could be understood by beginners like me.

its really an great initiative in this world where many others share these by collecting fees for this.

by the way this bull put spread downloadable excel doesn\’t show up the table for previewing the payoff.

kindly check and update.

thankyou.

Thanks Aravind. I\’m glad you liked the content. Let me check on the excel.

Hello Sir,

I hope you are well.

How exactly does on place a basket order wrt to options. The only way to do this is market orders as limit order is difficult to place for multiple options concurrently.

Kulmit, did you check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/holdings/articles/kite-basket-orders

Hi Karthik, I am having trouble understanding that how is a shorted 7900 PE an ITM option when the Spot is 7805. The only way we make money on the shorted put is if the the spot price crosses 7900.

Basically, the spot price should go up from the time you write a put option. So yes, 7900 or higher.

How to place spread order in kite, as i want place Bull Put spread with 7400 PE (OTM) and 7800 PE (ITM)

Check this, Ram – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/holdings/articles/kite-basket-orders

Hello Sir,

I hope you are well.

My question is when exactly do I decide to adjust my position or completely exit?

100 points above break even at my higher strike price?

I feel if the market breaks 17000 then I should exit my position. But if I wait till that long I could incur a substantial loss maybe 3 to 4 times my reward

Harpish, when you initiate a spread, you will know exactly what your worst-case situation is right? Likewise, you will know what your best case outcome is. So the question you need to ask yourself is if you are ok to deal with that. You will not have gains or losses outside this range at expiry. But if you are feeling uncomfortable with the position, then exit at a point where you think the losses are no longer tolerable.

Hello Sir,

Thank you for your valued advice.

Assuming I don\’t adjust as you mentioned. Over the period of the month, the market slowly moves down to 17000. Even though my breakeven of 16850 has not been hit I would be shown a very very large notional loss.

In that case do I wait for the market to breach 17000 and then adjust or just close my position all together?

Notional right? You need to have foreseen this situation and prepare yourself for it. The decision to hold depends on your position conviction entirely.

Hello Sir,

I have been writing far OTM Put options with the monthly contract and I have been successful with that.

My issue is that slight bad news or anything can completely immediately give me a large loss despite being far away from my strike price.

For example, If I have written 16900 PE and bought 16500 PE for protection when the CMP is 17700. Now if the market even moves to 17400, I will be shown a large theoretical loss despite my loss being around 16850.

The thing is I am not sure if the market if drops to 17400 and would come closer to 16900 or could reverse back to 17700.

How exactly could I adjust my position in such a case otherwise to gain 2000 I would lose 15000-18000.

Harpish, the thing is that you need to make peace with the risk and reward profile right at the start of initiating the position. The notional loss will then be baked in. I\’m suggesting this because, personally I\’m not a big fan of adjusting the positions, especially when there is a spread in place. But if you are keen of adjusting, one thing you can do is shit the spread, so instead of 16900PE, sell 16700PE and close 16900PE.

POINT 9) Higher the spread, higher the profit potential, —tHIS IS WRONG……As profit is net credit and Loss is spread credit…

Please look at it from the payoff chart perspective.

Hello Sir,

To follow up.

Predicting Nifty movement is obviously very tough and not as easy as in stocks.

My issue is If I were to write Nifty Weekly/Monthly options which would be better?

If were to enter an ATM/OTM combo or Far OTM OTM combo.

My issue is that writing OTM OTM combo is good most times, but you are wrong you become wrong very badly compared to the ATM/OTM combo.

So which one exactly could one do?

If you do an ATM/OTM COMBO it is easy to keep a tight spread but if you keep an OTM/OTM combo you have to keep a large spread which skews the risk to reward very badly.

Confused about this?

My all-time favourite is – monthly and OTM. But yes, if you are wrong, it will hit you badly, there are no two ways about that. As obvious as it may sound, I think market experience will eventually help you understand how to deal with this 🙂

Hello Sir,

I hope you are well.

I have seen you mention that it is best to set up bull put spreads and bear call spreads in monthly contracts as they become easier to adjust.

I have a few questions about this.

If lets say nifty is currently 17800 CMP, I create a bull put spread at 17000 PE and 16600 PE with october 28 exp.

When nifty increases it is good as my premium value erodes slowly however when ever vix increases or nifty slightly drops my premium value shoots up causing me a loss. I know my loss would be around below 17000 PE but that would be on the expiry of the month.

1) How do I exit said position? Do I wait till expiry? Do I exit before the week it becomes a weekly option?

2) If nifty does not move in my favor and moves down I would currently be in an unrealized loss. Time decay has not really affected my option as much was it should as it is still early in the month.

3) Ideally how far away should one write monthly options wrt to the CMP?

4) Lets say nifty/spot moves against me. How does one adjust this position despite it being a hedged position as the loss can be extremely high.

5) Is it better to write weekly options as time is on your side?

1) Exit depends on how you expect the market to pan out before expiry? Will it move higher, lower, or flat? So your point of view matters

2) You are right. Again, on the question if you should exit, depends on the first point. What isit that you expect from the market?

3) You can stretch up to 10% or even beyond, provided you set this up early in the month to benefit from higher premiums (owing to time to expiry)

4) Frankly, I\’d suggest you dont adjust, since the position is already fairly hedged

5) The behavior is the same, its just that you will be in and out of the trade quicker 🙂

Sir i didnt understood the point .the bull put spread is excuted when the market has cracked ? can you explain me in further simpler

Hi Karthik,

Thanks for nice article. Really appreciate.

Can you tell the reason behind this statement-

\”Personally I do prefer strategies which offer net credit rather than strategies which offer net debit.\”

Money coming first is always preferable 🙂

Hi Karthik,

Is there a delta value I should look at while picking the strikes.

You can if your objective is to create a position with a certain delta value.

Dear Karthik,

In Call Spreads and in Put Spreads, you have given the rule \”All strikes should belong to same underlying\” now does that mean all the two/three strikes in the spread should be short and/or long at the same price or does it mean that it should belong to same derivative or both should co-exist?

It means it belongs to the same asset. For example, if you are doing a put spread, you can deal with two different stocks. All options legs should belong to the same stock.

Hi Karthik,

I have initiated the following Bull Put Spreads with ADANIENT (1556) and ADANIPORT (751):

24 Jun 2021 1400 PE

24 Jun 2021 1500 PE

24 Jun 2021 700 PE

24 Jun 2021 750 PE

Kindly help me understand that if ADANIENT and ADANIPORT expire above 1500 and 750 respectively (which are the max. profit on expiry day), do I need to square-off the trade to avoid physical delivery (with STT) or squaring-off is not needed as both options will expire OTM?

Regards,

Amit

Amit, as long as both the options are ITM, they will offset each other and no physical delivery.

Hello Sir,

Thank you for your response.

If I hold to expiry is only when I will be able to get the full profit?

Closing my position early will result in me getting part amount.

Why is that the case? Even if my direction is correct and target is achieved I do not get the entire amount till expiry?

Thats because before expiry, many factors influence the premium..like volatility and time decay.

Hello Sir,

For all these spread positions.

What are stop loss you can maintain in case the position goes against you? Mainly for bull put spread and bear call spread?

What if I do not want to hold till expiry, when is a good exit position?

Thank you sir.

The spread itself is fully hedged, so it is very hard to find a meaningful SL here. YOu can exit anytime you wish, no need to hold to expiry. The exit depends on your ability to withstand loss.

Hello Sir,

Could you please answer my query?

Sorry, I must have missed it Can you please repost the question again.

Hello Sir,

For all these spread positions.

What are stop loss you can maintain in case the position goes against you? Mainly for bull put spread and bear call spread?

What if I do not want to hold till expiry, when is a good exit position?

Hello Sir,

How exactly do I go about finding this opportunity??

Do I need constantly monitor option chains of all stocks?

Yeah, you will have to monitor.

Dear Sir,

But generally Bull put, Bear Call spreads have risk to rewards of under 1. I have yet to see a strategy that even goes above 1.2-1.5.

For example I write ATM Puts nifty 15000 for 150 and purchase 14850 put for 100.

My Reward is 50 points while my risk is roughly 150 points.

What should I do about this sir?

This depends on when you spot the opportunity, many times premiums get attractive for spreads and offers RRR of upwards of 2.

Hello Sir,

For Bull Call and Bull Put spread and Short Strangle.

Do we pick strike prices that our 1, 2 SD away??

How does go about picking a strike price to short the option?

Hmm, no, you may not get good spreads if you go 2SD away. These are anyway hedged positions, you can stick to ATM and nearby strikes.

Ideally the moment index/ stock price reaches put short price, we should squre off.

Or you can even hold to expiry. Depends on how the market is moving.

Hi: ARe teh following features of the market / stock to be considered together or are these can exist individually:

The markets have declined considerably (therefore PUT premiums have swelled)

The volatility is on the higher side

There is plenty of time to expiry

That are these \”or\” conditions or \”and\” conditions

Thanks

These conditions can co exisit.

Dear Karthik sir,

There was no mention of Stop Loss in both the strategy, Although we can calculate the maximum loss possible in any of these strategy. Will it be fine to work with Stop loss so that the net risk will further come down which in turn would provide better risk to reward ?

The idea is to hold these to expiry, Vaishakh. Yes, you can think about placing a SL but I\’m afraid the basis for that (to place SL) would be a bit tricky. As what logic would you apply here? On the price movement of the underlying? Premium movement?

Please upload Cash Secured Put Strategy.

Noted.

Dear Sir,

From all your examples, the max risk was substantially greater than the max reward.

So essentially the RR would be less than 1.

All these strategies should be kept for multiple days and not intraday.

When do you suggest using bull put and bear call strategies during the start of the month when premiums are high?

Also when selling nifty/stock options 1 SD strikeprice 4 days before expiry do you employ spreads or naked writing. Could you give an example of such a spread if possible?

Are you sure, I think the worst case was 1:1, anyway, I will review again. I\’d suggest holding close to expiry. Yes, I\’d prefer to initiate the strategy when we are in the first half of the series (but that\’s just a preference).

At 1SD, and 4 days, I\’d take on the risk of a naked trade.

hello sir , sir can we implement his strategy with 0 balance in account ?

Nope, you will need margins 🙂

Strike selection graphs are not provided here.

Strike depends on what you the kind of spreads you intend to trade. But generally speaking, OTM – ATM combo is best.

Edit: Found it 🙂 Wasn\’t being the shown the second page. Great info!

Yeah, I just replied 🙂

Hello Karthik, I downloaded the excel sheet given at the end of this chapter and looks like its incomplete. All I can see is a couple of headers in it. Please let me know if the complete sheet is in fact missing or is it just me.

Anand, I think you are looking at just Sheet 1, please click on the 2nd sheet to see the data and workings.

Hi Karthik,

I have one simple question, all these strategies are good only for overnight trades? If my view is for intraday then do you think these strategies work or naked call/put options would be better?

Have you also discussed strategies for Intraday options in subsequent chapters?

For intraday, I\’d suggest you work with naked options. Which basically means you need to build a directional view and buy/sell options or futures. You can use almost all the patterns discussed in technical analysis.

I really appreciate you sir. You reply each and every question here. After reading a chapter, it\’s very interesting to read all questions and answers to clear all kind of doubts 🙂

Happy reading, Karan!

Hello sir, in the example which you gave above, you have given the formula for max loss as spread – net credit. But if we see the max loss it comes out to be 109 and according to the formula it should be 100-91 which is 9. Can you please explain me this? Pardon me if I have misunderstood something.

The max loss is with respect to expiry. It can vary slightly during the series.

what is the p&L before expiry(i mean in intraday) if today formed 11600pe(buy) and 11700 pe(sell)???

P&L before expiry would be hard to estimate.

Can take a both in the money strike price in bull put spread?

Yup, you can.

Maybe I was not able to express my calculation and doubts, so here an another attempt,

Here, the nifty expire at 7750,

–so the 7700PE which we had purchased(as per your example) expires worthless, and we paid a premium of 72 for it so for 7700PE we are incurring a loss of 72.

— And since we sold 7900PE and its intrinsic value is 150, but we received a prm of 163, so 163-150=13, so this means for 7900PE we are having a profit of 13,

so in net -72+13=59(dr)

so in net we are incurring a loss of 59, in this way by applying the bull put spread.

Please correct me if I am wrong, Thanking you in advance

Sir can you check my calculations, I would be very grateful to you, :-

If by expanding your example further

1) If nifty expires at 7750

The value of 7700PE= -72

the value of 7900PE= 163-150=13

so net = -72+ 13= -59

loss of 59 rs

Thankyou so much!

Yash, if Nifty expires at 7750, the 7700PE will expire worthlessly. Let\’s say the premium for this is 50, if you are long on 7700PE by paying 50, then you will lose the entire premium. If you\’ve written the option and received 50, then you will retain the entire premium.

Hii Karthik,

Is it mandatory to sell ITM strike only or Can we sell an OTM strike and further buy an OTM strike in Bull Put strategy?

You can sell any strike. But the profitability varies.

What short of adjustment need to done if on executing bull put spread market still have bearishness .pls make us understand with nifty example. Better if added in main subject regarding adjustment in order to curb max fix loss

Usually, the adjustment requires adding more CE or PE. However, I\’m not a big fan of this given the costs involved. Will try and put this across.

Thanks …. Let them expire to get the intrinsic value was the missing variable -) thanks

Happy learning 🙂

I understand the maths of this , but do not understand the magic 🙂

If I sell 7900 pe at 163

Buy 7700pe at 72.

Say Nifty expires at 7900, in that case the console will show both my legs as 0.00 or does it show 7700PE at and 7900PE as a non zero value.

Do I square off, or do I let them expire to get the premium

There is no magic without the math 🙂

Yes, both are OTM, hence 0. You can let them expire as is.

Hi kartik

How to put spread strategies on Kite?

Could you share link please

You will have to execute the individual legs one after another, Udbhav. It is always better to initiate the buy order first and then the sell order as it reduces the margin requirement.

Hi Karthik,

As it is a net credit strategy, what if we take the net credit in intraday and immediately exit the position ?

Is it possible ? Can we do that ?

You can. Your P&L would be the difference between the buy price and sell price of the options.

Sorry 1 ITM sell

Figured as much, yes, you can.

Sir i have doubt in order to reduce my risk apetite can i modify to 1ATM option sell instead of 1 OTM sell?

Yup, you can do that.

Hi Karthik,

I am trying to learn Option strategy from Zerodha, if you can help me with a query. If I sold a 7900 PE and purchased a 7700 PE, can i square off both the option before expiry or I need to wait for the contracts to be expired.

And, if I am allowed to square off my positions before expiry, what shall be my profit/loss on both the position.

Yes, you can square off the position anytime before the expiry, no need to wait till expiry.

Sir, i didnt understand why intrinsic value in 0 for two profitable cases here, when you buy put at 7700 and spot moves to 7900 we should have 200 loss if i am right excluding premiums received etc , why is intinsic value 0 for spot at sell PE level and higher (last 2 -profitabale cases

Intrinsic value is the value of the option you get when you exercise the option. In this case, if you exercise a 7700PE when spot is 7900, you get 0 right? Hence the intrinsic value is 0.

Today morning I bought Nifty 10300 PE paying a premium of Rs 22.60 & sold 10500 & received a premium of Rs 93.00. I took the spread after looking at the OI. After one hr the market started going down & closed 166 points down. Is this fall because Dow Futures coming down by 300 points. Why did the premium treble for all strikes.

The fall could have happened for many reasons, but along with the fall the volatility also increased, hence the premiums have shot up.

Is there any separate option in Zerodha for create a spread?

Not for now.

Sir it would be great if you can tell me about iron condor or you can tell me the chapter in varsity which explain about Iron Condor.

Thank you

Dont have a chapter on the iron condor but will add one soon.

sir, this bull put spread is also called as Iron condor? or it is something different?

They are different, Vaibhav.

Hey Karthik,

Hope you are safe and sound. I am writing this time, to sort of, express my disappointment with the stock exchanges in our country. Just want your opinion about it.

1. NSE, it seems, doesn\’t want us retail traders to participate in FnOs at all. This, I am saying with reference to the banning of FnO trades of YESBANK, IDEA and the like. One day its all ok and the next day we get to know without any prior intimation that they have banned the FnO trading of certain securities. I understand this must be because they are expecting high volatility and they want to prevent speculation and all but what about traders who had executed just the first leg of their strategies the day before? For e.g. I am looking to execute a bull put spread but decide to just short the higher strike first and wait for the price to move in my favor (maybe next day) before buying the lower strike? Surely, I would be forced to exit at a loss the next day if there would be a ban and I can\’t buy the lower strike to mitigate the risk. Or maybe I want to execute an iron condor, leg by leg, at different days. Again I would be stuck.

2. Then there is the compulsory physical delivery rule. This is just pathetic. Let\’s assume a novice trader with only 50k capital wants to learn the options trade. Now, even the simplest of the strategies, like buying a call would land him in trouble if his call goes ITM by expiry because he would have to take delivery.

Any spread strategy, which is usually executed to minimise risk will potentially have an unwanted layer of risk added. E.g. a bull put spread again. So long as the spot price is above or below both the strikes, it would be fine, because it would either expire worthless or be netted off respectively. But what if the price expires below the short strike and above the long strike? Would it still be netted off or forced into taking delivery?

Sorry for the long write up, but after months of reading and understanding FnOs (many thanks to you), it almost feels like a waste because of all these stringent rules. Why don\’t they just ban the retail traders all together from the FnO segment and save us the trouble?

~ Abudhar al Hassan.

1) Securities getting banned is not because of volatility, but because of the breach in the market-wide position limits. Check this – https://www1.nseindia.com/products/content/derivatives/equities/position_limits.htm , this is a standard practice

2) The physical settlement was introduced to curb excessive speculation and rigging of contracts. So this is a good thing for the retail trader. The trader can always exit the trade just before the expiry period.

Hi,

I have doubt. Is there any restriction like i need to first buy the OTM Option and then sell the ITM Option or do i have to sell first the ITM Option and Buy the OTM option in the second trade…. Or can i execute any of leg first based on the available price.

Thanking you in advance.

You can execute the trade in any order that you prefer.

Scenario 4 – Market expires at 8000 (above the higher strike price, i.e the ITM option)

Both the options i.e 7700 PE and 7900 PE would expire worthless…

Hi Karthik, how come short 7900PE will expire worthless if it is expiring at price of 8000? Am i missing something here?

7900PE will have intrinsic value only if the spot is lower than the strike. So the market will have to come lower than 7900.

Hey Karthik

Now that the client base of Zerodha has increased a lot. I am not able to apply good hedging techniques in bank nifty or nifty.

selling put in the money is fine but buying out of the money is now almost impossible with Zerodha reaching that 15% OI or 500 cr rule of SEBI. Strategically buying for hedging purposes in the range allowed by Zerodha will be a foolish trade.

Example

banknifty spot say 19000

I could sell say 19100 put

I wanted to buy 18400 put but was not allowed by Zerodha

Zerodha might allow buying 18800 put but the premium being very close to what I earned by selling 19100 put it makes no sense to make this trade.

I know the rule is by SEBI but I also know that this restriction is on me as I am with a broker who has a huge client base. the only workaround is moving to a broker who is new in the market like alice blue or 5 paisa etc. it would take a lot of years for them to reach the 15% OI of market and they are allowing all orders with no restriction.

Before I do that I want your opinion on any workaround by continuing with Zerodha which I would love to.

Also, I didn\’t understand the logic behind SEBI putting such a restriction. Why don\’t they allow all orders? How does it impact them?

Please share if you know the answer.

I also wrote a blog to SEBI that they should modify this rule on the percentage of client base rather than flat 15%. Like a broker with 1 million clients should get a 30% share and a broker with 100K clients should only get a 3% share of the market OI.

Awaiting your reply. Please also correct me if any of my information is incorrect

This is one of the issues we are trying to fix on priority, Kunal. We have identified couple of workarounds and hopefully, this should not be an issue going forward. Please do bear with us for a few more weeks.

Scenario 4 – Market expires at 8000 (above the higher strike price, i.e the ITM option)

Both the options i.e 7700 PE and 7900 PE would expire worthless, hence the total strategy payoff would be

how will short 7900PE will expire worthless when the spot price is above 7900?

You\’d have shorted the premium right and the position is taken before expiry.

Sir, I wanted to implement a bull put spread for Sun Pharma with one OTM Jan 440 PE and one ITM Jan 460 PE. But the ITM 460 PE strike has a low volume of only 6250. The bid-ask spread is also wide with a difference of about Rs. 1.50. Would it be a good idea to implement this strategy at this low volume and wide spread?

kiran , in that case your margin gets locked till the expiry! am i correct karthik ?

Yes, margins are blocked as long your positions are in places.

Karthik

I hope the same below theory holds for weekly bank nifty also. If it is out of the money, option value becomes 0. As i am new to options, i am asking you repeatedly.

Suppose if sell a call option for any company like wipro where share price is 200. Now i sell a call option where strike price is at 210 and option value is at 1. This is one day before expiry.

Now while expiring, share price reached 203 and as it is out of the money, will the option value will go to 0 or will it be 1.2

My idea is to sell a call option and leave it to expired in out of the money so that it will go to 0.

am i correct?

Yes, it is the same for all options.

Hi Karthik,

Suppose if sell a call option for any company like wipro where share price is 200. Now i sell a call option where strike price is at 210 and option value is at 1. This is one day before expiry.

Now while expiring, share price reached 203 and as it is out of the money, will the option value will go to 0 or will it be 1.2

My idea is to sell a call option and leave it to expired in out of the money so that it will go to 0.

am i correct?

Yes, Kiran. It will go to zero as the option is now out of the money and hence has no intrinsic value.

Hi Karthik,

I have noticed that sometimes seller price will be 0. this will not be for too much out of money.ie i see that powergrid share price is 204 and july 197put call sell price is 0 and buy price is .25. Why is it so?

That\’s because there are no sellers willing to sell the contract, Kiran.

Hi Karthik,

I thought about one options strategy. You can tell me if it makes sense or not.

I only buy either put or call option always out of the money. i.e if wipro share price is 250 and if i feel it goes down, i will buy put option with strike price at 237 which is 5% lower than current price 250. Also i only buy it if the option price is at 1. Now if it share price reaches at the money and option price goes to 3. i will be getting 200% profit and if share price still goes down and reaches 230, i may get still more profit.

If share price goes in opposite direction like from 250 to 265, my loss will be 100% only and not more than that.

My conclusion is limited loss and more profit. Also i will try these only 15 days before expiry because i will get low option premium price at that time only. Beginning of the month, option premium will be more.

Do you think it makes any sense?

But for you to profit from this, you need to be sure about the directional move, else you\’d lose 100% of your capital.

Hi Karthik

I hope STT will be more if it expires in the money or is there any new rules that zerodha only will auto square off before the expiry?

I read this link below

https://tradingqna.com/t/no-more-stt-trap-on-exercised-in-the-money-options/18977

Also one question. Suppose if i buy call option and i had some personal work on expiry day and forgot to square off the position. If it is in the money, zerodha will auto square my position or not before expiry? If it doesnt get auto square off, will the stt charges be something .125%?

If the option is \’Close to Money\’, then the option will not be exercised and therefore no STT. If it is ITM, no, there is no auto square off. You will have to ensure you square off the position on your own.

Hi Karthik

My question is suppose if i buy put option at price of 1 with any lot size like 2000, total investment here is 2000. At that think that for company wipro, share price is 200.

Suppose market went in my opposite direction(wipro share price went to 220) and put option price comes down to 0.2 or 0.1 and if there are no buyers here for me to sell it, then i have to wait until expiry day only for automatic square off. is this correct?

My main question is on expiry day if it gets auto square off to 0, will there be any extra stt or tax charges because i heard that one person lost 24 lakh on expiry day?

No Kiran, there wont be any additional charges.

Hi Karthik,

i didn\’t get the idea why i would make a spread because i think that the STT that i would be paying at expiry surely ruins all of my profits.? and i am unable to analyse the situation how i can sell before expiry and how the P&L calculations will change with respect to the one that we have calculated in the module??

Ankur, the idea with spread is to ensure that you are completely aware of your P&L. The spread can be squared off minutes before expiry and thereby avoid the STT implication. The P&L calculation is largely based on the assumption that the spread is held to expiry, but then..you can always square them off before expiry.

On 11th April 2019 weekly expiry I buy 5 lot of 11600 put with a price of 0.5 per share. And finally Nifty 50 settle at 11597. So my account will be credited by 11600-11597= 3*375= 1125 Rs. But till time my account not credited in my account. Plz suggest.

Manish, although this is an ITM option, your STT liability will be higher. Hence, for this reason, this option won\’t be exercised for you. Check this – https://tradingqna.com/t/no-more-stt-trap-on-exercised-in-the-money-options/18977

Hi Karthik,

I have a quick question. I have set up a bull put spread for a net credit for (Boeing) stock with 370/375 limits for a expiry in Mid May. The stock was trading at 368 at the time of the setup. Eventually it has risen above 375, now trading at 378. I do not want to hold this to expiry and soon want to close the position because of the volatility. What I am seeing is that although I am still profiting but the margin is becoming lower as the stock moves higher than 375. My question, what would be the best time to close the position and have bigger profit, when the stock price is (a) close to but less than 375 or (b) above 375.

Also would it be a good idea to break the spread and buy back the 375 put now and release my collateral (from the spread). And then wait for few weeks for it to go below 370 to sell the 370 put. Seems like a split sale would have a bigger profit provided the stock would come below 370 before expiry. Would I be exposing myself to unlimited loss if it does not come down below 370.

Please answer. Thank you so much & team Zerodha. You guys are doing great.

I\’m assuming you bought 370 puts and sold 375 puts. If yes, then both these are ITM option, right? Why did you do that? Ideally, it should be one OTM and one ITM, right? Anyway, What were the premiums you paid and received? I\’d suggest you plug in these numbers in the excel and you can visualize the price points.

Ideally, you should not break the spread or tweaking it again as it would increase your costs.

At the time of opening:

Spot: 368, 370 Put Buy (kinda ITM, slight OTM), 375 Put Sell (OTM) Lot: 100, PR: 18.4, PP: 15.7 Net credit: (18.4-15.7)*100 = 270

The very next day the stock rose to 378 making both my entries ITM.

I will put them in Excel. That is one of the many great advise I got from you. Makes thing so comprehensivable. But since I am not holding them to expiry I need your insight.

If I overlook the trading costs, because of Robinhood, would it make sense to break the spread.

Cheers.

375 PUT sell is not OTM, Partha. Its deep ITM. Anything lower than 368 will be OTM. So your set up should have been to buy a strike lesser than 368, say 365 and sell 370 or something like that. Unless you specifically wanted it this way.

You are right Karthik, 375 put is deep ITM and 370 Put too is ITM.

I have set up ITM puts as it gave me a higher credit to start with and usually I made more money if I close it in a few days.

Thank you and I would try few times in traditional setups to get a better feel.

Yeah, the higher the credit, the tougher it gets to breakeven in this. So you need to strike a balance.

Hi Karthik,

My question revolves around simultaneous two credit spreads. Underlying TCS, expiry 25-Apr-19. Spot Price: 2000.25.

My first spread is: 1950/2000 (Put credit)

Second one: 2000/2500 (Put Credit)

Would, if I set up like this, 2000 sell from the first one cancel out 2000 buy from the second one and will I be left with a 1950/2050 spread essentially?

Please answer. Thank you so much for putting so much effort.

Sorry for the mixed up numbers: Following are the correct ones.

Spread 1: 1950/2000 (Put credit)

Spread 2: 2000/2050 (Put Credit)

Got it 🙂

Yes, they cancel each other out and you\’d be left with 1950/2050.

Okay. Thank you!!

Welcome, Partha!

Hi Karthik,

Todays situation is(real numbers)

Nifty 10724

Employing bull put spread (outlook slightly bullish)

Buy Nifty Mar 10700 PE @ 98

Sell Nifty Mar 10800 PE @ 216

Spread: 100

Net credit: 216 – 98 = 118

Max Loss: 100 – 118 = -18( how -ve figure)

Breakeven: 10800 – 118 = 10682

I get confused when i see spot to be already above the breakeven. I dont understand how these premiums are, what they are and how do we say that outlook is bullish when the spot is already above the breakeven point.

Or does it simply mean that the way we have initiated this spread will result in positive if Nifty is above 10682 on the expiry date regardless what the spot price is.

Sorry i was checking on kite, and in evening time i guess the numbers are messed up. Latest numbers from nse and now the pay off nicely adds up. Thanks for the nice explanation of the spread

Nifty 10724

Employing bull put spread (outlook slightly bullish)

Buy Nifty Mar 10700 PE @ 177(Ask)

Sell Nifty Mar 10800 PE @ 213(Bid)

Spread: 100

Net credit: 213 – 177 = 36

Max Loss: 100 – 36 = 64

Breakeven: 10800 – 36 = 10764

Ah, I guessed as much 🙂

Adity, can you double check the premium, please? Rs.98, for a near ATM Put expiring in March does not seem right. Please double check with the LTP.

Hello Sir,

Both for Bull Call Spread and Bull Put Spread Strategies. We are trying to reduce our cost by appox 30% while capping our profit potential. on the downside increasing our investment ( Selling option=Selling Future) .

Is it not better to buy a call option of a different strike price where our cost is similar and doesn\’t have these disadvantages

It does, but the beauty of spreads is that you know all the parameters beforehand…I mean, knowing downside risk is great, but I personally think knowing when to book profit is equally good. This is where the spread scores over a naked option buy/sell.

Thanks,

I already have an account in Zarodha. I would like to go for Delta Neutral Strategies to generate Interest income of 24% PA. Could u tell me which module I should concentrate on.

Where Can I Check option Greeks of my strategy on Zarodha or suggest any other platform.

Also is there any other platform where one can seek your advise/ ask questions.

Asking questions here would lead to future readers being distracted as the question may not be relevent to the topic above.

All the strategies are available in this module – https://zerodha.com/varsity/module/option-strategies/. Please ask your queries here itself, it will enrich the platform with wider variety of discussion 🙂

When Max loss (Spread – Net Credit) becomes negative.Then what is the meaning of it.i will be in profit or will be in Loss.

My spread is 4 and Net credit is 5.65

So max Loss becomes =(4-5.65) = -1.65,

In that scenario i will be in Loss or in Profit?

Please help to reply back on this.

This means that the strategy is losing money.

Ok. Thanks for the reply…:)

Good luck, Sounak.

Hi Sir,

How to build a multi leg strategy in Zerodha Kite?

For Ex: If I want to enter a Long Call Butterfly Strategy.

Tata Motors

Long 1 Call 185 @ 13.2

Short 2 Call 190 @ 10

Long 1 Call 195 @ 7.2

all at the same time. How will the margin requirement and cost to buy the call options system work here?

Can that be done in PI Software?

Nope. Pi does not support this.

For margin requirements, I\’d suggest you check this – https://zerodha.com/margin-calculator/SPAN/

For execution, I\’d suggest you take a look at this – https://sensibull.com/

Hi The spread sheets that are being shared are good. If we are planning to design a strategy using Futures how do we calculate something like this. Any help

regards,

Vijay

Vijay, quite a bit avaialble here – https://zerodha.com/varsity/module/trading-systems/

Thanks will got through these

Good luck, Vijay.

sir i was looking for online payoff diagrams on net and came thru upstoxx option strategy builder. its really cool, populate the field with actual strike price premium and gives you break even and max p&l at different spot price. can that be done on zerodha because it would be an excellent tool for option traders.

Check out https://sensibull.com/.

hi karthik

Upstox provide free of cost while Zerodha charged for sensibull.this is not fare.

Tannu, have you compared the features? If not, I\’d suggest you compare the features once.

How can we buy and sell same stock at different strike price at same time .

Each strike (although same stock) is a different contract, hence you can buy and sell these contracts.

Hi Karthik,

Great work as always. Of all the modules that I\’ve gone through so far, this has been somewhat tricky in understanding. Many a times, I start reading this module from the beginning, on the way, it goes above my head and I tend to lose my shape, eventually closing it without completing. I believe a webinar would be really handy. I just wanted to know if it is already out there. I had checked for webinars on options trading. Few videos made by Abid have popped up. Please let me know if there are any made by the legend \”Karthik Rangappa\” 😉

Thanks in Advance

Kiran, yes, Abid has made few videos, which I think are pretty cool. Guess he is going to make more of them. Unfortunately, I\’ve not focused much on videos…but I think this one may be a relevant to you – https://www.youtube.com/watch?v=pVKfIxVw0Og&t=38s

Good luck 🙂

PS: There is only 1 legend and that\’s Rajini 🙂

Hello Karthik,

Thanks for the link. It really was helpful. I have got two questions.. I might sound ridiculous, Kindly bear with me.

1. Supposing that I have strong directional view for an Underlying (Upside/Downside),

Which of the following is more beneficial or more likely to be a winning trade?

a) For upside, Is it buying CE close to the spot price? Or, is it selling the PE Close to the spot price ? Please assume that I\’m ready to keep the margins required for selling PE. Similarly, on the flip side, is it beneficial to buy ATM PE or is it to sell ATM CE ?

2. I\’m asking this after back testing for 10 times, being successful on all ten times, including yesterday. In the starting of the series, If the major indices take a steep fall, like they did on 28.06.2018, How far is it sensible to buy CE of slightly OTM ? I have purchased 5 lots Nifty 10800 CE july series at 55. Today it had reached close to 80, almost 35% up. It might be pure luck.. but as there is whole month for the expiry, I believe these kinds of deals are worth for the taking. I know it is stupid to ask this after going through all your modules on technical analysis and professional options trading, but I couldn\’t help it.

PS : I have tested the above mentioned case in almost 10 cases of Nifty 50 and Nifty bank indices, they all have worked in my favor, credits to the time factor. But I was only investing in smaller lots as this has no strategy behind it. I wanted to go in with considerable amount of lots after hearing it from you. Please note, I\’m only banking on the Time (as you said, \”Time is money\”)

\”In the starting of the series, If the major indices take a steep fall, like they did on 28.06.2018, How far is it sensible to buy CE of slightly OTM ?\” Here, when I\’m referring to the start of a series, I\’m basically meaning when the current month is about to end and the next month is about to become the current month(I\’m not referring to the time when exchange releases the series), Or even in the first 5 days of the current month. Not after the first week at any cost, because I will only have 3 weeks to bank on.

Guess I answered this query in the other comment you posted.

Correct. You have answered in the other query. I was just giving more clarification on what I meant by \”starting of a series,\”.. thank you very much. It\’s clear. With more of varsity, I feel more confident, and convinced that markets aren\’t gambling, there is a lot of science behind it. All credits to you and your team.

of course, Kiran 🙂

Good luck and all the very best!

1) If it is a \’strong\’ directional view, I\’d suggest you buy slightly OTM CE. This is assuming there is also enough time to expiry

2) Well, if you have backtested and convinced then you should go ahead and buy with conviction. Since you have enough time to expiry, you need not worry about time decay. I\’d suggest you start with smaller amounts and then ramp it up as you gain more confidence.

In Scenario 1: I am not sure if I am interpreting this point correctly.

Since we are long on the 7700 PE by paying a premium of Rs.72, we would make

= Premium Paid – Intrinsic Value (Vikas: Concern is in this formulae)

= 100 – 72

= 28

I thing the formulae should be other-way round that is \”Intrinsic Value – Premium Paid\”

Vikas, for PE the formula for P&L of ITM option upon expiry is –

[Strike Price – Spot Price] – Premium paid – all applicable charges.

Thanks for you reply, it seems I did not phrased my intent clearly.

There seems a need of correction in this document for Scenario 1:

Extract from Scenario 1:

\”Since we are long on the 7700 PE by paying a premium of Rs.72, we would make

= Premium Paid – Intrinsic Value

= 100 – 72

= 28\”

My Concern: The premium paid is 72 and Intrinsic Value is 100, however as can be verified above under premium paid it is 100 instead of 72, and Intrinsic value is 100 whereas in formulae it is showing 72.

Kindly do the required correction or specify clearly why are the values different than what you have calculated above.

Thanks, Vikas, looks like a typo. I\’ll check this up. The money you make when you are long on a PUT option is –

[Max(Strike-Spot, 0) – premium paid – applicable charges].

Sir pl tell me if spreads are possible in day trading

Possible, but you may get stuck with bad liquidity.

Is there any facility in Zerodha to place this strategy in one order? instead of placing two order?

No, not as of now. You will have to execute both of them separately.

Thanks for the great explanation.

Can we imitate Bull Put Spread (net credit) with Bull Call Spread by selling an ITM call option and buying OTM call option (net credit but with bearishness)? Does it have a separate name?

Yes, you can sell an ITM and buy OTM and create a bull call spread.

If we apply the bull call spread or bull put spread , should we wait till expiry for profit or we can close the deal any time ????

You can close the position anytime you wish!

Hello,

Do you provide any kind of a tool which shows the payoff diagram for a particular option strategy?

Regards,

Anish

Elaborate OTM & ITM

Check this – https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

5/2/18

I am moderately bullish on auropharma… cuz its at a strong support zone and formed a piercing bullish candlestick pattern

CMP 614 i expect a move to around 650-655 which is around 6%

Expiry 22/2/18

(working) days to expiry 13

So according to buy call spread strategy i should buy (ATM) CE 620 which is available at 24.40 and sell (OTM) CE 660 for which i will get premium of is 11.40rs

Max loss = 24.40 – 11.40 = 13rs per share

Max profit = (660-600) – 13 = 27rs per share

And according to bull put spread i should buy (OTM) PE 600 which is available at 18.60 and sell (ITM) PE 660 for which i will get premium of 59.50 rs

Max loss = (660-600) – 40.90 = 19.1 rs

Max profit = 59.50 – 18.60 = 40.9 rs

I would go for bull call spread as i want my loss to be minimum

1st option paper trade 😀 . Lets see if this works out 😛

Kindly recheck the calculations and respond if anything is wrong with it. Thanks!

Thank you for the nice and comprehensive analysis.

Do you know how to create a vertical bull put spread of 90% chance of success with two strike price placed 2 standard deviation away(95%)?

Not really, please do share more details. Thanks.

How much Margin is required for spread order?

The maximum loss will be the, spread less the premium received, so why margin calulator shows more margin required than the difference between the spread?

Check the margin calculator – https://zerodha.com/margin-calculator/SPAN/

In today\’s market if I execute a bull put spread at 9300/9350, what will be my margin requirement. The Zerodha margin calculator shows 46K. Is that correct?

Yes, it would be approximately around that value.

Hi karthik

If i am not wrong in a 2 legged strategy the P/L will be calculated considering the total of 2 lots right, like 75*2 =150 for nifty ?

Thanks

Yes.

can u tell which part in previopus chapter ill be very helpful and will move to next chapter thk u

I\’d recommend you read through the whole module before proceeding here.

sir i tred virtual trading i sold eg 2900 pe for 108 premium when the atock stared rising premium showed 70 when we sell pe should it not be rising here it is decreasing pls explain

Please read the previous module thoroughly, I\’m sure you will get you answers 🙂

Hi Karthik,

Had a few queries on the same:

1. Though you have mentioned, I really could not understand under what scenarios Bull Put is preferred over Bull Call. Is it mainly dependent upon one\’s perception towards net debit or net credit? From my understanding, the RRR is more or less similar subjected to strike selection.

2. Like Bull Call, can we choose any strike combination in this case?

3. As per my understanding, the value in each spread is derived out of the extrinsic value of the option combination. Therefore, delta and volatility do play an important role in case both legs are way apart. Presumably, the effect of delta and volatility will be more pronounced for the lower strike option in case of both Bull Call and Bull Put. Please validate.

Regards,

Mohit,

1) This really depends on the volatility – remember volatility drives premiums. If the volatility is high, then premiums get expensive and this is a time when you should avoid buying expensive options. So in this case you may want to use a credit strategy (as in sell options). Likewise if the vol is low, premiums are inexpensive and this is a time I would deploy debit strategy (as in buy options).

2) You can, but remember the RRR profile changes.

3) True – volatility and deltas are very important and they have their influence on premiums.

Suppose nifty spot is at 8700.if i sell 1 lot of nifty call option of 8800 receiving rs.20 as premium how much taxes excluding brokerage i have to pay

Check this – https://zerodha.com/brokerage-calculator

Hii Karthik,

While applying bull put spread strategy to any Indiavidual Stock, Do we have to sell ITM put ?? If it is ITM, can it be assigned??

You can choose to square it off just before expiry…maybe a day before since liquidity in stock options can be low.

Dear Karthik , Similar to call spread, can you advice the selection of spreads for put spread initiation depending on whether you are in start of series or middle of series . You had given blue and green charts for call spread module. Thanks Naresh

We have discussed few spreads using Puts – Bull Put, Bear Put, and Put Ratio. These chapters have all the required information.

Thank you .. let me refresh

Sir,

What is the margin requirement for a Bull Put strategy? Can you please explain by giving an example.

Sir, Thanks for your replies. In the above chapter no graphs are shown for identifying the best strikes based on the expiry. Is it the Graphs shown in Bull Call Spread holds goo

It does, but why is it not showing up? It seems to be working fine for me. Can you please refresh the page once?

It would be very nice if , like other modules we can have a pdf of options strategies module also 🙂 🙂

Its taking a bit of time Saurabh, we will put it up soon. Thanks for your patience.

can we have micro enable Excel sheet, which fetch data automatically?

All the models are done and uploaded. I guess this can be done at your end as well.

Hello sir,

Thanks for the course materials . if i have option which is ITM and its get expired will i get some money over these or all go worthless.

Depends on how deep in the money the option is. For example if your cost of setting up the spread is 100, your option has to be over and above 100 for you to make money.

What is the margin amount to be maintained while selling options? how to calculate this amount? Also explain what happens to margin amount when the market goes up / down.

MArgins for selling option is similar to that of Futures. You can check this – https://zerodha.com/margin-calculator/SPAN/

Margins requirements also vary based on how the scrip moves.

Credit spread gives handsome profit if expiry period is of 2 to 5 months.

Well, you can create credit spreads with mid month and far month contracts. However liquidity would be an issue at the time of initiation.

Dear Sir,

Is it preferrable by me as a conservative and for simple constant gains to select a strategy by selling both CALL & PUT options by adding DELTAS from the middle of the month to take advantage when there is DECLINE on one side.

Thanks & Regards.

Sastry

The strategy you are talking about is a short straddle. Will be discussing this is great detail later in the module.

Hello,

Sir i want to know that, if i short GMRInfra 20 call at 0.05.

Lot size is 39000 * 0.05 = 1950.

Now if option expires worthless, and gmrinfra spot price on expiry is 17. Then my profit is 1950rs. ?

Yup, thats right.

Hi,

Does kite support these option strategies? would margin requirements differ for these strategies?

Regards

Margin requirements could vary. You can execute these strategies on any platform, including Kite.

Hello sir,

For taking trade on bull call/put spread. what shall be prerequisite. It can be initiated any day any time just depending on the market trend or some practical boundary conditions like premium value, difference in the premium / strike price etc are to be considered. Because we have seen that these spread positions are not taken by the expert any time, but they take positions few times only in a month. So what makes one to go for spread positions apart from the trend predictions?

These are directional bets, so what really matters is your opinion on the market direction. Do make sure that the volatility is on the lower side and you also expect the volatility to increase going forward. This will help the spread position.

Thanks,

But in case of volatility rise, will it not get nullified on long and short positions? Different strike price of the strategy will offcourse see different effect but both premium will increase and pay off may not be affected that much. Is it correct?

When volatility increases, the option premium increases, which is good for long naked option positions!

yes, but for strategy where long and short both positions are there, things may not straightforward. Is there any strategy volatility neutral?

Yes, we have volatility neutral strategies as well, although can be quite complex. Will discuss this later in the module.

Volatility on the lower side or higher side???

You can run vol strategies on both sides.

Sir, as writing option requires considerable margin especially if positions are to be kept overnight, can\’t we fine tune this wonderful strategy from intra day POV. Pay only 40% approx margin and take more qty.. Am I right…

You can, but frankly if your view is for intraday then you are better off with a naked call option.

Hi kartik

If spot increase by 10 points premium increases by 2 points while if same spot decrease by 10 points premium decrease by 2.5 points, specially in deep otm option. Why this all happens??? Please clarify

The change in premium is due to the Delta. In the first step when price increases, the delta also increase. In the 2nd step when price decreases the reduction in price is higher since delta is also high.

Hi Karthik,