2.1 – Background

The spread strategies are some of the simplest option strategies that a trader can implement. Spreads are multi leg strategies involving 2 or more options. When I say multi leg strategies, it implies the strategy requires 2 or more option transactions.

Spread strategy such as the ‘Bull Call Spread’ is best implemented when your outlook on the stock/index is ‘moderate’ and not really ‘aggressive’. For example the outlook on a particular stock could be ‘moderately bullish’ or ‘moderately bearish’.

Some of the typical scenarios where your outlook can turn ‘moderately bullish’ are outlined as below –

Fundamental perspective – Reliance Industries is expected to make its Q3 quarterly results announcement. From the management’s Q2 quarterly guidance you know that the Q3 results are expected to be better than both Q2 and Q3 of last year. However you do not know by how many basis points the results will be better. This is clearly the missing part of the puzzle.

Given this you expect the stock price to react positively to the result announcement. However because the guidance was laid out in Q2 the market could have kind of factored in the news. This leads you to think that the stock can go up, but with a limited upside.

Technical Perspective – The stock that you are tracking has been in the down trend for a while, so much so that it is at a 52 week low, testing the 200 day moving average, and also near a multi-year support. Given all this there is a high probability that the stock could stage a relief rally. However you are not completely bullish as whatever said and done the stock is still in a downtrend.

Quantitative Perspective – The stock is consistently trading between the 1st standard deviation both ways (+1 SD & -1 SD), exhibiting a consistent mean reverting behavior. However there has been a sudden decline in the stock price, so much so that the stock price is now at the 2nd standard deviation. There is no fundamental reason backing the stock price decline, hence there is a good chance that the stock price could revert to mean. This makes you bullish on the stock, but the fact that it there is a chance that it could spend more time near the 2nd SD before reverting to mean caps your bullish outlook on the stock.

The point here is – your perspective could be developed from any theory (fundamental, technical, or quantitative) and you could find yourself in a ‘moderately bullish’ stance. In fact this is true for a ‘moderately bearish’ stance as well. In such a situation you can simply invoke a spread strategy wherein you can set up option positions in such a way that

- You protect yourself on the downside (in case you are proved wrong)

- The amount of profit that you make is also predefined (capped)

- As a trade off (for capping your profits) you get to participate in the market for a lesser cost

The 3rd point could be a little confusing at this stage; you will get clarity on it as we proceed.

Bull Call Spread

2.2 – Strategy notes

Amongst all the spread strategies, the bull call spread is one the most popular one. The strategy comes handy when you have a moderately bullish view on the stock/index.

The bull call spread is a two leg spread strategy traditionally involving ATM and OTM options. However you can create the bull call spread using other strikes as well.

To implement the bull call spread –

- Buy 1 ATM call option (leg 1)

- Sell 1 OTM call option (leg 2)

When you do this ensure –

- All strikes belong to the same underlying

- Belong to the same expiry series

- Each leg involves the same number of options

For example –

Date – 23rd November 2015

Outlook – Moderately bullish (expect the market to go higher but the expiry around the corner could limit the upside)

Nifty Spot – 7846

ATM – 7800 CE, premium – Rs.79/-

OTM – 7900 CE, premium – Rs.25/-

Bull Call Spread, trade set up –

- Buy 7800 CE by paying 79 towards the premium. Since money is going out of my account this is a debit transaction

- Sell 7900 CE and receive 25 as premium. Since I receive money, this is a credit transaction

- The net cash flow is the difference between the debit and credit i.e 79 – 25 = 54.

Generally speaking in a bull call spread there is always a ‘net debit’, hence the bull call spread is also called referred to as a ‘debit bull spread’.

After we initiate the trade, the market can move in any direction and expiry at any level. Therefore let us take up a few scenarios to get a sense of what would happen to the bull call spread for different levels of expiry.

Scenario 1 – Market expires at 7700 (below the lower strike price i.e ATM option)

The value of the call options would depend upon its intrinsic value. If you recall from the previous module, the intrinsic value of a call option upon expiry is –

Max [0, Spot-Strike]

In case of 7800 CE, the intrinsic value would be –

Max [0, 7700 – 7800]

= Max [0, -100]

= 0

Since the 7800 (ATM) call option has 0 intrinsic value we would lose the entire premium paid i.e Rs.79/-

The 7900 CE option also has 0 intrinsic value, but since we have sold/written this option we get to retain the premium of Rs.25.

So our net payoff from this would be –

-79 + 25

= 54

Do note, this is also the net debit of the overall strategy.

Scenario 2 – Market expires at 7800 (at the lower strike price i.e the ATM option)

I will skip the math here, but you need to know that both 7800 and 7900 would have 0 intrinsic value, therefore the net loss would be 54.

Scenario 3 – Market expires at 7900 (at the higher strike price, i.e the OTM option)

The intrinsic value of the 7800 CE would be –

Max [0, Spot-Strike]

= Max [0, 7900 – 7800]

= 100

Since we are long on this option by paying a premium of 79, we would make a profit of –

100 -79

= 21

The intrinsic value of 7900 CE would be 0, therefore we get to retain the premium Rs.25/-

Net profit would be 21 + 25 = 46

Scenario 4 – Market expires at 8000 (above the higher strike price, i.e the OTM option)

Both the options would have a positive intrinsic value

7800 CE would have an intrinsic value of 200, and the 7900 CE would have an intrinsic value of 100.

On the 7800 CE we would make 200 – 79 = 121 in profit

And on the 7900 CE we would lose 100 – 25 = 75

The overall profit would be

121 – 75

= 46

To summarize –

| Market Expiry | LS – IV | HS – IV | Net pay off |

|---|---|---|---|

| 7700 | 0 | 0 | (54) |

| 7800 | 0 | 0 | (54) |

| 7900 | 100 | 0 | +46 |

| 8000 | 200 | 100 | +46 |

From this, 2 things should be clear to you –

- Irrespective of the down move in the market, the loss is restricted to Rs.54, the maximum loss also happens to be the ‘net debit’ of the strategy

- The maximum profit is capped to 46. This also happens to be the difference between the spread and strategy’s net debit

We can define the ‘Spread’ as –

Spread = Difference between the higher and lower strike price

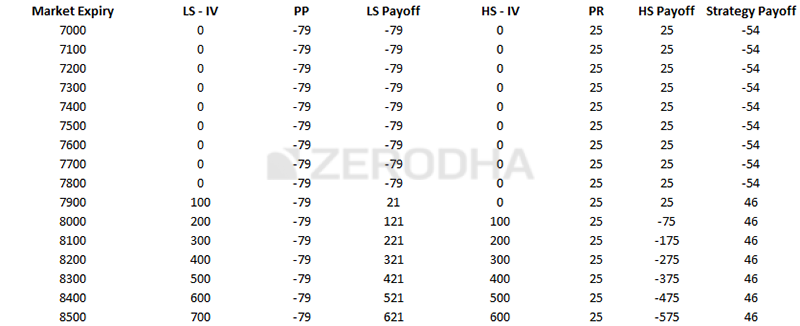

We can calculate the overall profitability of the strategy for any given expiry value. Here is screenshot of the calculations that I made on the excel sheet –

- LS – IV – Lower Strike – Intrinsic value (7800 CE, ATM)

- PP – Premium Paid

- LS Payoff – Lower Strike Payoff

- HS-IV – Higher strike – Intrinsic Value (7900 CE, OTM)

- PR – Premium Received

- HS Payoff – Higher Strike Payoff

As you can notice, the loss is restricted to Rs.54, and the profit is capped to 46. Given this,we can generalize the Bull Call Spread to identify the Max loss and Max profit levels as –

Bull Call Spread Max loss = Net Debit of the Strategy

Net Debit = Premium Paid for lower strike – Premium Received for higher strike

Bull Call Spread Max Profit = Spread – Net Debit

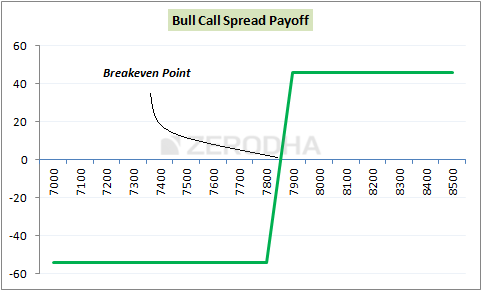

This is how the pay off diagram of the Bull Call Spread looks like –

There are three important points to note from the payoff diagram –

- The strategy makes a loss in Nifty expires below 7800. However the loss is restricted to Rs.54.

- The breakeven point (where the strategy neither make a profit or loss) is achieved when the market expires at 7854 (7800 + 54). Therefore we can generalize the breakeven point for a bull call spread as Lower Strike + Net Debit

- The strategy makes money if the market moves above 7854, however the maximum profit achievable is Rs.46 i.e the difference between the strikes minus the net debit

- 7900 – 7800 = 100

- 100 – 54 = 46

I suppose at this stage you may be wondering why anyone would choose to implement a bull call spread versus buying a plain vanilla call option. Well, the main reason is the reduced strategy cost.

Do remember your outlook is ‘moderately bullish’. Given this buying an OTM option is ruled out. If you were to buy the ATM option you would have to pay Rs.79 as the option premium and if the market proves you wrong, you stand to lose Rs.79. However by implementing a bull call spread you reduce the overall cost to Rs.54 from Rs.79. As a tradeoff you also cap your upside. In my view this is a fair deal considering you are not aggressively bullish on the stock/index.

2.3 – Strike Selection

How would you quantify moderately bullish/bearish? Would you consider a 5% move on Infosys as moderately bullish move, or should it be 10% and above? What about the index such as Bank Nifty and Nifty 50? What about mid caps stocks such as Yes Bank, Mindtree, Strides Arcolab etc? Well, clearly there is no one shoe fits all solution here. One can attempt to quantify the ‘moderate-ness’ of the move by evaluating the stock/index volatility.

Based on volatility I have devised a few rules (works alright for me) you may want to improvise on it further – If the stock is highly volatile, then I would consider a move of 5-8% as ‘moderate’. However if the stock is not very volatile I would consider sub 5% as ‘moderate’. For indices I would consider sub 5% as moderate.

Now consider this – you have a ‘moderately bullish’ view on Nifty 50 (sub 5% move), given this which are the strikes to select for the bull call spread? Is the ATM + OTM combo the best possible spread?

The answer to this depends on good old Theta!

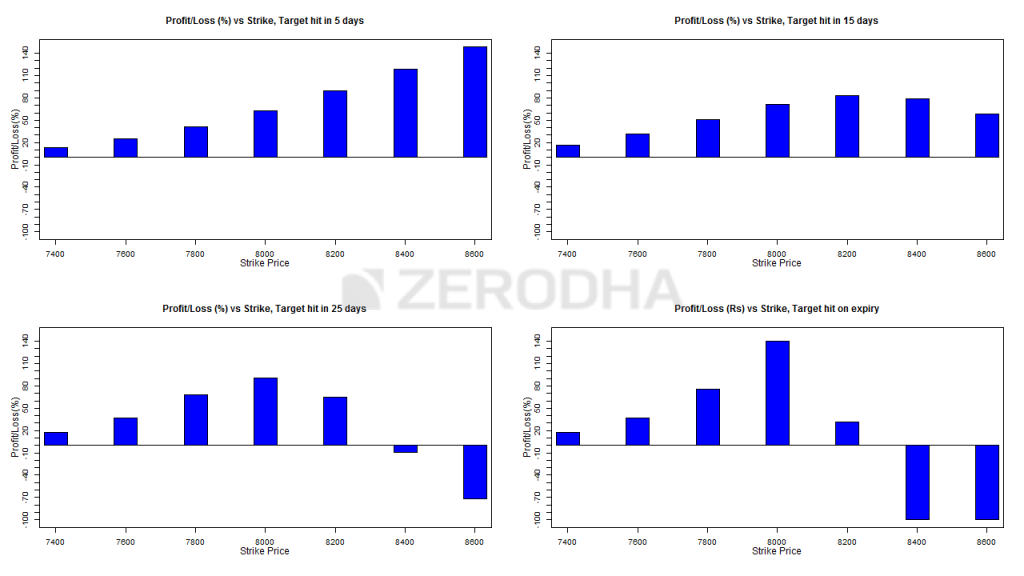

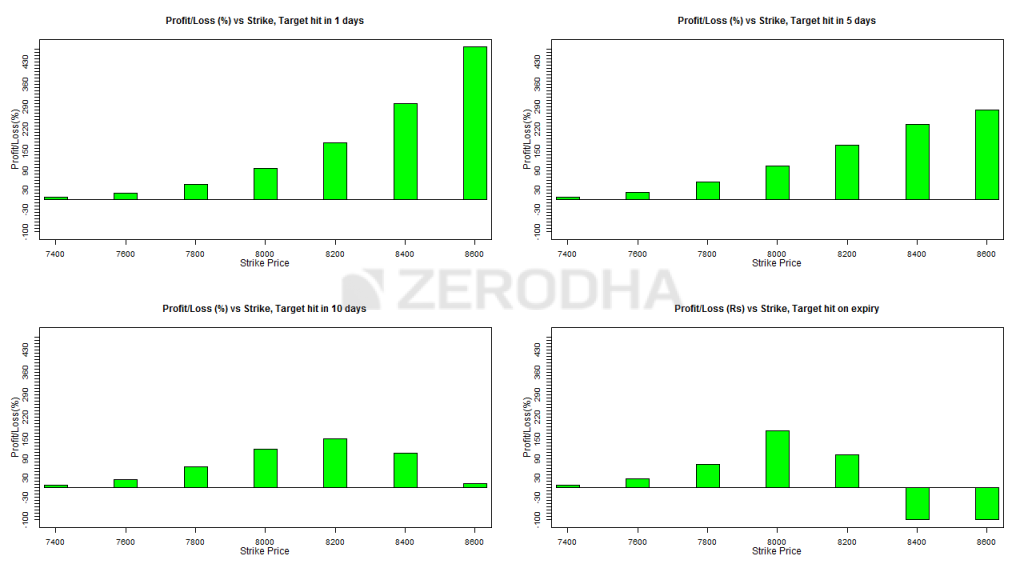

Here are a bunch of graphs that will help you identify the best possible strikes based on time to expiry.

Before understanding the graphs above a few things to note –

- Nifty spot is assumed to be at 8000

- Start of the series is defined as anytime during the first 15 days of the series

- End of the series is defined as anytime during the last 15 days of the series

- The bull call spread is optimized and the spread is created with 300 points difference

The thought here is that the market will move up moderately by about 3.75% i.e from 8000 to 8300. So considering the move and the time to expiry, the graphs above suggest –

- Graph 1 (top left) – You are at the start of the expiry series and you expect the move over the next 5 days, then a bull spread with far OTM is most profitable i.e 8600 (lower strike long) and 8900 (higher strike short)

- Graph 2 (top right) – You are at the start of the expiry series and you expect the move over the next 15 days, then a bull spread with slightly OTM is most profitable i.e 8200 and 8500

- Graph 3 (bottom left) – You are at the start of the expiry series and you expect the move in 25 days, then a bull spread with ATM is most profitable i.e 8000 and 8300. It is also interesting to note that the strikes above 8200 (OTM options) make a loss.

- Graph 4 (bottom right) – You are at the start of the expiry series and you expect the move to occur by expiry, then a bull spread with ATM is most profitable i.e 8000 and 8300. Do note, the losses with OTM and far OTM options deepen.

Here are another bunch of charts; the only difference is that for the same move (i.e 3.75%) these charts suggest the best possible strikes to select assuming you are in the 2nd half of the series.

- Graph 1 (top left) – If you expect a moderate move during the 2nd half of the series, and you expect the move to happen within a day (or two) then the best strikes to opt are far OTM i.e 8600 (lower strike long) and 8900 (higher strike short)

- Graph 2 (top right) – If you expect a moderate move during the 2nd half of the series, and you expect the move to happen over the next 5 days then the best strikes to opt are far OTM i.e 8600 (lower strike long) and 8900 (higher strike short). Do note, both Graph 1 and 2 are suggesting the same strikes, but the profitability of the strategy reduces, thanks to the effect of Theta!

- Graph 3 (bottom right) – If you expect a moderate move during the 2nd half of the series, and you expect the move to happen over the next 10 days then the best strikes to opt are slightly OTM (1 strike away from ATM)

- Graph 4 (bottom left) – If you expect a moderate move during the 2nd half of the series, and you expect the move to happen on expiry day, then the best strikes to opt are ATM i.e 8000 (lower strike, long) and 8300 (higher strike, short). Do note, far OTM options lose money even if the market moves up.

2.3 – Creating Spreads

Here is something you should know, wider the spread, higher is the amount of money you can potentially make, but as a trade off the breakeven also increases.

To illustrate –

Today is 28th November, the first day of the December series. Nifty spot is at 7883, consider 3 different bull call spreads –

Set 1 – Bull call spread with ITM and ATM strikes

| Lower Strike (ITM, Long) | 7700 |

| Higher Strike (ATM, short) | 7800 |

| Spread | 7800 – 7700 = 100 |

| Lower Strike Premium Paid | 296 |

| Higher Strike Premium Received | 227 |

| Net Debit | 296 – 227 = 69 |

| Max Loss (same as net debit) | 69 |

| Max Profit (Spread – Net Debit) | 100 – 69 = 31 |

| Breakeven | 7700 + 69 = 7769 |

| Remarks | Considering the outlook is moderately bullish, 7769 breakeven is easily achievable, however the max profit is 31, skewing the risk (69 pts) to reward (31 pts) ratio. |

Set 2 – Bull call spread with ATM and OTM strikes (classic combo)

| Lower Strike (ATM, Long) | 7800 |

| Higher Strike (ATM, short) | 7900 |

| Spread | 7900 – 7800 = 100 |

| Lower Strike Premium Paid | 227 |

| Higher Strike Premium Received | 167 |

| Net Debit | 227 – 167 = 60 |

| Max Loss (same as net debit) | 60 |

| Max Profit (Spread – Net Debit) | 100 – 60 = 40 |

| Breakeven | 7800 + 60 = 7860 |

| Remarks | Risk reward is better, but the breakeven is higher |

Set 3 – Bull call spread with OTM and OTM strikes

| Lower Strike (ATM, Long) | 7900 |

| Higher Strike (ATM, short) | 8000 |

| Spread | 8000 – 7900 = 100 |

| Lower Strike Premium Paid | 167 |

| Higher Strike Premium Received | 116 |

| Net Debit | 167 – 116 = 51 |

| Max Loss (same as net debit) | 51 |

| Max Profit (Spread – Net Debit) | 100 – 51 = 49 |

| Breakeven | 7900 + 51 = 7951 |

| Remarks | Risk reward is attractive, but the breakeven is higher |

So the point is that, the risk reward changes based on the strikes that you choose. However don’t just let the risk reward dictate the strikes that you choose. Do note you can create a bull call spread with 2 options, for example – buy 2 ATM options and sell 2 OTM options.

Like other things in options trading, do consider the Greeks, Theta in particular!

I suppose this chapter has laid a foundation for understanding basic ‘spreads’. Going forward I will assume you are familiar with what a moderately bullish/bearish move would mean, hence I would probably start directly with the strategy notes.

Key takeaways from this chapter

- A moderate move would mean you expect a movement in the stock/index but the outlook is not too aggressive

- One has to quantify ‘moderate’ by evaluating the volatility of the stock/index

- Bull Call spread is a basic spread that you can set up when the outlook is moderately bullish

- Classic bull call spread involves buying ATM option and selling OTM option – all belonging to same expiry, same underlying, and equal quantity

- The theta plays an important role in strike selection

- The risk reward gets skewed based on the strikes you choose

Download Bull Call Spread Excel Sheet

According to what you said, we are considering that in the bull call spread all the options are held till expiry. But what if I only hold till midweek? Are there higher profits possible due to changes in premiums? Or what\’s the case?

Sometimes maybe (theoretically), especially when the volatility is higher. Although I;ve not experienced it myself 🙂

My question is why the sell side of the bull call spread adds margin when there is no extra risk added by doing so.

simple example:

buy 26000 nifty call current week

sell 26200 nifty call current week

now when we add the sell, it adds margin but it should have reduce the overall cost due to the money coming from the sell.

In US market this is not the case.

The margins are reduced given its a hedged position. However, if the number of sell legs is higher than the buy legs, then the margins will be higher. Check this – https://zerodha.com/margin-calculator/SPAN/

A Bull Call Spread is most effective when your outlook is moderately bullish and you want to reduce upfront premium costs without taking unlimited risk. The key advantage lies in lowering the net debit compared to buying a single ATM call, while still participating in upside moves. However, traders should remember that the profit remains capped and strike selection becomes crucial—especially as expiry approaches, where Theta decay accelerates and affects both legs of the spread. Choosing the right combination of ATM/OTM strikes based on volatility and time-to-expiry helps improve the overall risk–reward and breakeven probability.

Yeah, thats right. Not sure what the query is though 🙂

Dear Karhik Sir,

I have analyzed few basic and technicall and bought Sunpharma 800 call at 4.75 today. As expiry is still too far is there possiblity to get some 20 to 30 % return in this trade

How can I say that, Subhash 🙂

If I or anyone could say that with certainty, then I we would be betting on it fully 🙂

Hi Karthik,

I am a bit confused on physical settlement of Stock Options.

Lets say i hold a Bull Call Spread (Long ATM Call and Short OTM Call)

Scen 1: Stock moves in favorable direction (+)

In this case both my options are now ITM on expiry day and my net obligation is 0, So

a) Will this be cash settled

b) Will I be subjected to additional Margin requirements near expiry

Scen 2: Stock moves in reverse direction (-)

In this case both my options are now OTM on expiry day and my net obligation is still 0, So

a) Will this also be cash settled

b) And will I still be subjected to additional Margin requirements near expiry

Thanks

Yes, in both cases there is no physical delivery.

I have a doubt, suppose I have 625 shares of Axis bank bought at 1000 in Zerodha demat, which is equal to one lot size

Axis CMP is 1125 and I sell 1130 CE at 20 and on expiry Axis is trading at 1250 which is more than 100 and 1130 ce strike premium has increased to 60

If I square off before expiry I will have to square off based on the current premium of the 1130 CE strike which will be close to 60, but If i wait till expiry then, I can settle the contract by delivering the shares which I already have with the broker. Am I correct.

The benefit I get if I wait till expiry is, I dont have to pay the increased premium, I can give delivery of the shares Which I already own at the strike price of 1130 and my P&L will be

20*625 = 1250 (premium received) + 1130*625 = 7,03,125 (credited to my ac by buyer on expiry) – 1000*625 = 6,25,000 (The amount which I paid to to buy 625 shares of Axis Bank.)

Is the above calculation correct, am I missing out on something

Yes, if your option position turns out to be ITM, and you are obligated to give delivery, then the shares from your demat will be debited to fullfil your obligation. The premium (ITM option) upon expiry is anyway equal to the intrinsic value of the option.

Sir what happen if the spread (difference of HS & LS ) is less then Net Debit of the strategy.Then Max Profit is -ve.So we can\’t select such strikes.

Hmm, ideally this is done for a credit. If you dont see a credit opportunity, then maybe you should reevaluate the trade 🙂

BEL CALL ATM is at 415 and delta is 0.57 .. premium 15.7

BEL CALL OTM is at 445 and it\’s delta is 0.24… premium 4.5

Let\’s say, I buy ATM and sell OTM. Since prices vary every minute and on a given day if underlying price moves up by 10 points, it means the AMT premium should move up by 0.57*10 = 5.7 and OTM premium drops 0.24*10 =2.4. If I decide to exit at this point, Can I assume my profit will be 5.7-2.4 = 3.3? I am keeping other factors like theetha, gamma etc as constant.

Yes, if you keep other greeks constant (which in reality does not work), your calculation is right. This is good for understanding the Greek behavior and its impact on premiums.

Thanks Karthik,I just wanted to confirm if my understanding is correct.

Sure. Good luck, Vamsi!

With below details

Lower Strike (LS) 690

Higher Strike (HS) 700

Debit (LS) 28

Credit (HS) 23.45

Net 4.55

The strategy pay-off is capped to single value (-4.55) for expiry value less than or equal to 690. The strategy pay-off is capped to single value (5.45) for expiry value greater than equal to 700.

If I change the HS and credit values as follows

Lower Strike (LS) 690

Higher Strike (HS) 740

Debit (LS) 28

Credit (HS) 9.6

Net 18.4

The strategy pay-off is capped to single value (-18.4) for expiry value less than or equal to 690. Whereas the strategy pay-off value is different for expiry values above 700 (say -8.4 for 700, 1.6 for 710 , 11.6 for 720, 21.6 for 730, 31.6 for 740 and 750)

Isn\’t the capped value is fixed on both the sides ?

Please ignore. I got the calculation for the difference in strategy payoff for values above 700 up to 740. and the capped value will remain 31.6 from 740 onwards. Thanks a lot for your explanation on all the topics.

Ah alright, good luck and happy learning 🙂

Yes, it is capped on both sides – upper end and lower end.

For instance I am at the start of the expiry series and i expect nifty50 to move upwards by 3%, I opted for bull call strategy and selected two options, ATM long and OTM short, the move occurred until 5 days, the premiums also increased sufficiently for the ATM long option but after that I learnt that the NIFTY50 is going to fall by 5 % due to some unprecedented incident , would it be wise to exit from both the options or leave it and accept the loss upon the expiry and also start with a new strategy based on the current situation.

Of course, you can hold on to the short, but when you do that you no longer have a hedged position. You need to be aware of that and be ok with a naked position 🙂

Where can I find the graph between p&l and various strikes based on period of expiry as shown above. Does zerodha app allow that.

These graphs were generated to show the likelihood of a certain P&L, and not the actual P&L. For example, if there is 15 days to expiry and you expect market to move up, then which strike is will be the most profitable? Thats what this chart tries to answer. For actual P&L, you can probably check Sensibull platform.

Can I view the -1 SD or -2 SD position in a stock if any through Zerodha kiye app charts

Replying on behalf of Karthik Rangappa – The easiest way to do this is by overlaying Bollinger bands. The upper and lower bands indicate 1 and 2 SD

Thanks

Bull call excel spread sheet is not getting downloaded.Its not even opening up

Hiren, can you try downloading it from another browser?

Hi Karthik,

For the spread to work, do I have to hold the option until expiry or can I exit before that?

Holding to expiry is when the spread fully unfolds, but many traders close the position before expiry as and when spread works in their favor.

I will skip the math here, but you need to know that both 7800 and 7900 would have 0 intrinsic value.

In this line, I think it should be 7700 instead of 7900?

Ah yes.

Can we place oder together bull call spread and bear put spread

Yeah, you can via basket order.

In Scenario 4 where marker expires @8000 and we sold an option 7900 CE of Rs 25, now if market expires above 8000 then we will loose premium of rs 25 but it is mentioned that we will loose 75, Can you pls clear this doubt

If you are a seller of an option, then you will lose to the extent of the intrinsic value of an option, even beyond the premium collected.

Please update the examples as per weekly expiries

Will do, Vikas.

I just want to know that what brokerage I have to pay on bull call spread strategy trading with 1 lot size

You can check this – https://zerodha.com/brokerage-calculator/#tab-equities

Hello sir

This question is regarding actual money required for taking a bull call spread

For eg

I am taking reliance bull call spread

Buy june 24 2900 ce

Sell june 24 3100 ce

Opstra says margin requirement is just 25000 rs but actual margin required is 60000 rs and some amount even I can\’t see in my funds

Please explain it

Is it like than when I will close the position the funds which I couldn\’t see till now will be added to my funds

Preeti, why dont you use a margin calculator to figure this? Here – https://zerodha.com/margin-calculator/SPAN/ , in fact you can even do this on the order window.

Hi Karthik,

I was unable to attach any photo here (wanted to attach the naked call long and bull call spread payoff charts here).

I am really confused here. If my stance is moderately bullish, wouldnt it make sense for me to sell a far OTM option and collect the premium. Wouldnt the returns percentage here work out to be more? Is liquidity the reason we are not thinking of dabbling with far OTMs and hence need to move to Bull call spreads etc.?

Yes, liquidity is one of the main reasons Yaqoot. Also, the premiums itself for far OTMs is lower, meaning your ROI will be lower too.

which position we exit first if we want to book profit or loss ? call buy side or call sell side

You can exit the postion that has your margin blocked.

HI Karthik, what is the meaning of 2nd half of the series? can\’t understand how first set of chart is different from second one?

You can look at the entire expiry as a series…for example, if there are 20 days to expiry, first 10 days is considered as the 1st half of the series and the next 10 days as the 2nd half of the series.

in the given example of Bull call spread with ITM and ATM strikes, break even point is 7769 which is lesser than spot price 7883. so we are already in profit!!!! why is so? can you explain this please….

Ah no, please check the details again 🙂

When I execute Bull Call Spread Strategy, it shows Margin Needed and Final Margin. I have fund which is fulfill the maximum amount. But during week, it shows you are out of margin, so add fund or else sqaure off position.

Please clarify this, how much maximum fund needed through the week, I am not aware of it.

Jayesh, I wont be able to help you with this, I\’d suggest you speak to support desk for this query.

Dear Karthik,

The profit/loss calculated on the basis of market\’s spot value upon option expiry (where profit and loss is fixed). However, you suggested to choose the strike based on time of option\’s expiry. If my target is achieved before the option expiry then my profit and loss will be different.

Thats right. Also, you can buy and sell options well before the expiry and there is no need to wait till expiry.

I find it difficulty in understanding strike selection.

Example :

The thought here is that the market will move up moderately by about 3.75% i.e from 8000 to 8300. So considering the move and the time to expiry, the graphs above suggest –

Graph 1 (top left) – You are at the start of the expiry series and you expect the move over the next 5 days, then abull spread with far OTM is most profitable i.e 8600 (lower strike long) and 8900 (higher strike short)

if movement is from 8000 to 8300 — How is LS=8600 and HS = 8900 most Profitable Please explain?

Anil, this is based on how the delta behaves for the given strike. Have explained in the chapter itself 🙂

hey karthik, would love to see video version of these modules too and BTW all the earlier ones helped alot thanks

Noted 🙂

Bull call spread with OTM and OTM strikes

Lower Strike (ATM, Long) Correct it OTM LONG 7900

Higher Strike (ATM, short)Correct it OTM SHORT 8000

You can create these spreads with any strikes. There is no right or wrong. The strikes determines your profitability.

Dear Karthik,

I wish to prepare \”Strike selection graph for current strike prices, how to do the same?

Could you please provide any guidelines?

Kind Regards,

Dipak Murudkar

Not sure if I fully understand your query, but please do check Sensibull once.

Hi Karthik

If I am taking a bull call spread on bank nifty 15 minutes chart sma cross over up side then according to you what should be the ideal target and stop loss for overall spread in percentage terms?

For any trade, the risk reward should be at least 1:1.5 i.e. for every 1 unit of risk, the reward should be 1.5 units.

Hi Karthik.

I have a question about profit calculation when bull call spread is not held until expiry. Let’s say,

Spot price = Rs. 98

Lower strike (LS) = Rs. 100, premium paid = Rs. 8

Upper strike (US) = Rs. 200, premium received = Rs. 4

If the market goes to Rs. 120 and the premium of LS increases by 60% (to Rs. 12.8) and US increases by 120% (to Rs. 8.8), in that case if I square-off the position then –

Profit on LS = 12.8 – 8 = Rs. 4.8

Loss on US = 8.8 – 4 = Rs. 4.8

Net profit = Rs. 0

Is this correct or am I missing anything? Can it happen that US premium increases at higher rate than LS premium?

Please let me know.

Thanks,

Yogesh

Yogesh, you can easily check this on Sensibull, no need to calculate.

THE MAX LOSS SHOWN IN THE SPREAD IS THE LOSS WHICH WE WILL OCCUR.. STOCK MOVES IN ANY DIRECTION. PL CLARIFY… IS IT SAFE TO TRADE STOCK OPTIONS WITH BULL SPREAD

Any spread strategy is better than a naked option trade, Sanjeev. But that gives you lesser peace of mind 🙂

Sir,

If I pledge G-Sec and can I use that margin to buy option spreads ?

G Sec is allowed as a pledge, but you cant buy options, only option sell is possible.

Please validate the whether the following scenario is feasible or not.

The maximum risk in this strategy is – difference in premiums for two strikes at two legs. Hence if we can adjust the difference to minimum, then the value of spread will be the max profit amount.

Please confirm.

But that also means your reward is lower right?

What will happen after expiry if bull call spread left unsquared

Based on the monyness of each option leg, the position will be settled.

Hi Karthik,

In the table of 1st example, why we are using column name LS-IV(lower strike – intrinsic value) when we are just calculating the IV in all scenarios i.e. Max(0, Spot – strike). And similarly with HS-IV.

Because in my understanding it will be 7800(LS)-0(IV) for lets say scene 1 from table.

Please help to clarify this doubt what is going on.

That is to put a particular formula in place to ensure the math does not go wrong when we have intrinsic value for the options.

Hello sir,

In the following section could you please make it clear what does it mean by the line \”Considering the outlook is moderately bullish, 7769 breakeven is easily achievable\”.

Set 1 – Bull call spread with ITM and ATM strikes

Lower Strike (ITM, Long) 7700

Higher Strike (ATM, short) 7800

Spread 7800 – 7700 = 100

Lower Strike Premium Paid 296

Higher Strike Premium Received 227

Net Debit 296 – 227 = 69

Max Loss (same as net debit) 69

Max Profit (Spread – Net Debit) 100 – 69 = 31

Breakeven 7700 + 69 = 7769

Remarks Considering the outlook is moderately bullish,

7769 breakeven is easily achievable,

however the max profit is 31,

skewing the risk (69 pts) to reward (31 pts) ratio.

By moderately bullish, I mean that the probability of stock moving slightly higher is more hence.

Dear Karthik, please let me know how & from where to read \”theta\” factor for selecting the right strike.

Theta is basically a declining greek, as time moves, the theta of an option keeps reducing.

Lower strike and higher strike given in brackets are all ATM in set2 & set3 ?

No, they are outside ATM strikes.

I did not mention the bullishness or bearishness level, My bad🙂. If I construct a spread it gives me 1:2 RR but, It will only be realized fully on Expiry. so it\’s not really 1:2 for an Intraday trade. How can I create a spread correctly if I am planning to hold it only for Intraday? Please Explain

I\’d not suggest you do a spread for intraday, the costs involved may not justify it.

Yes, but Firstly futures will not give room for volatility and we cannot avoid if the trade goes against us before going in our direction. And I am neither bullish nor bearish, it is just that Nifty might close positive if Nasdaq is positive and vice-versa. Might be mildly bullish/bearish is the right say.

Furthermore, we cannot define risk-reward, we have to take what is available with logical stop-loss and target.

Ok. I assumed you are outrightly bullish or bearish 🙂

Whenever you have a strong directional conviction, its better to trade naked futures.

Is it possible to design a spread position in the form of 1:2 or 1:1.5 etc..I am looking at the global market (for example Nasdaq) to predict the direction of Nifty every day. Their correlation is

Nifty = 0.3(Nasdaq)

If the signal is buy – Can I build a bull call spread with the desired risk/reward (1:2), to trade the signal?

If the signal is sell – Can I build a bear put spread with the desired risk/reward (1:2), to trade the signal?

Even if I build, I am able to realize the profit or loss only by the end of expiry, Is there a way to do this Intraday? Can I use futures instead? Please help me understand

As far as building is concerned, yes, you can, and that is the easy part. But my question is, if you are outrightly bullish or bearish based on the signals you get, then why not trade futures?

what is the brokerage charges if we enter in bull ce spread with one lot each

Rs.20 per executed order. Check this – https://zerodha.com/charges/#tab-equities

Pl explain how to place stop loss in this example.

The strategy itself has the SL baked into it, just like how profits are defined.

Hi Karthik,

I want to know whether zerodha provides option backtesting/simulator to its demat account holders?

If yes how to access it.

Thanks in advance.

Do check out streak.tech Mayank.

Karthik,

Your blogs are very informative and you explained them in such a ways that any body with minimum knowledge of the market can also understand.

Suppose i enter into a Bull call spread option strategy with a moderately bullish outlook of underlying. And underlying starts to approach HS and beyond that then isn\’t it be good if i square off my HS Short position so that i get to receive full premium then i trail my open LS Long position with modified SL ?

You can do that, but remember that when you do SQ off the HS, your position will be unhedged and will no longer be a bull call spread. You will have to trade this like a naked option position.

Sir,

At the initil phase of Mod-6, you have written a line to discuss \” Volatility arbitrage employing Dynamic delta hedging\”. Could you please share the link of the same?

I dint develop the content for this, Anirban. I thought it would be too heavy a topic for most of the ppl 🙂

Sir,

Regarding setting up trade based on fundamental perspective with respect to corporate result, should we judge a particular quarter result based on that quarter in the previous financial year or simply the previous quarter?

You can check the last few quarters and see the trend, basis which you can.

Sir,

All the strategies mentioned in Mod-6 are given w.r.t Index and for which the expiry has been considered. However, there might be good scenarios where we may equally like to trade options for stocks . So, I would like to know the below:

(i) Since, index option trading don\’t require physical settlement and only cash settlement on expiry, but stock options require physical settlement on expiry. Now, if we like to exit before the expiry of the stock options, can these strategies similarly behave (with respect to premium trading) as they do on expiry? Can we similarly deploy?

(ii) Like the futures trading, is it also a good practise to exit deploying these strategies before expiry for the stock options in general?

1) yes, but the P&L will vary a bit.

2) Yup, I prefer to close these positions before expiry.

Hi Kartik,

First of all thank you so much for writing such elaborate chapters which are easy to understand even for a novice like me.

I am facing a peculiar situation (might not be for you as I am new in options trading and it was my very first trade).

I bought 1 lot of Trent 1720 CE at a premium of Rs. 50 and sold 1 lot of Trent 1740 CE at a premium of Rs. 26. The spot price was 1693 at the time of buying/ selling options.

Now the spot has moved to 1714, but the premium for long 1720 CE is Rs. 42 and for short 1740 CE is Rs 31. How??

When the spot moved from 1693 to 1714, the premium for long 1720 CE should have increased.

So this happens primarily for three reasons –

1) Time to expiry is less

2) Sprike-specific volatility would have changed, leading to an increase or decrease in premium

3) Individual demand and supply variation for strikes.

Please do remember, the change in premium is a function of multiple things and not specific to just the movement in the underlying stock or index.

Hello sir,

I am confuse how you calculated profit/loss vs strike price bar plot at various expiry time. if possible can please some recommend some article related to calculation of same.

Thank you

Check this Rohit – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Is there any plan to create video series for this Module ? If not, requesting a video series. Much better way to learn than reading.

Noted. Will probably do it sometime soon.

when we trade intraday in option we already minimize our risk by stop loss on naked option,so why these strategy

is it that these are meant when we take delivery of options.

These are spreads, where the risk and reward is completely controlled. But yeah, if you have SL, that\’s ok.

Assuming that a bull call strategy works in our favour, the call short position must be making a loss. Does that mean that as the spot moves up, the margin will keep increasing, even though the overall positions will be in profit? Had a similar experience before. Hence the clarification. Thanks.

For the spread, the margins is more or less remain the same.

If I increase the HS, strategy payoff increases in case HS is equal or higher than expiry. Below is the reference:

Particular Value Legend

Underlying Nifty LS – IV Lower Strike Intrensic value

Spot Price 7846 PP Premium Paid

Lower Strike (LS) 7800 LS Payoff Payoff from Lower strike

Higher Strike (HS) 8200 HS IV Higher Strike Intresic value

Debit (LS) 79 PR Premium Received

Credit (HS) 25 HS Payoff Payoff from Higher strike

Net 54

Market Expiry LS – IV PP LS Payoff HS – IV PR HS Payoff Strategy Payoff

6800 0 -79 -79 0 25 25 -54

6900 0 -79 -79 0 25 25 -54

7000 0 -79 -79 0 25 25 -54

7100 0 -79 -79 0 25 25 -54

7200 0 -79 -79 0 25 25 -54

7300 0 -79 -79 0 25 25 -54

7400 0 -79 -79 0 25 25 -54

7500 0 -79 -79 0 25 25 -54

7600 0 -79 -79 0 25 25 -54

7700 0 -79 -79 0 25 25 -54

7800 0 -79 -79 0 25 25 -54

7900 100 -79 21 0 25 25 46

8000 200 -79 121 0 25 25 146

8100 300 -79 221 0 25 25 246

8200 400 -79 321 0 25 25 346

8300 500 -79 421 100 25 -75 346

Actually reward is showing more than predefined, I have used your excel as reference.

Sorry, can you add more context to that?

Hi Karthik,

In above example if we take OTM as 8200 and expiry goes below to ATM to any level the loss will be restricted to 79 only and in case if it goes above the ATM the profit will be increased with the level of expiry.

Am I missing something here ?

Yeah, both the risk and reward are predefined in these strategies.

Sir when i bought one leg and trying to sell another leg my price not get what i want. Should i two leg order manually or is there any facility to both of my legs execute simultaneously?

You can check this – https://support.zerodha.com/category/trading-and-markets/kite-features/basket-order/articles/kite-basket-orders

Sir, any guidance on when to book a profit especially in spreads? Is it something like 2-3% of the invested returns? I\’m asking this because, waiting till expiry is quite risky given the current macroeconomic situation right? And in options, it is also difficult to set a target, which complicates the matters more. Would be helpful if you could address this. Thank You!

Depends on multiple factors. But ideally, you should carry your spread close to expiry to ensure you extract maximum value from the setup. Cant really put a % number to this.

Dear zerodha,

I,Arijit Mallick, has opened account in zerodha in 2021 and is happy with zerodha but have some grievances as well. Sir from ch 6(option strategies) to ch 14(personal finance) no videos are provided. I will really be grateful to zerodha if apart from providing pdf if zerodha provides videos as well as it has provided from ch 1 to ch 5 but no videos are provided from ch6 onwards.Pls provide the videos for the remaining.

Arijit, we have started putting out videos for personal finance. Please check our Youtube channel. https://www.youtube.com/@varsitybyzerodha

Sir before buying a trade .

being a new trader what are the factors I should analyse first . Like check point

1 trends

2.Volatility

Etc..

Thanks for guidance

It depends on what you are trading, Sudhir. I have a 2 part video on this topic, please do check – https://www.youtube.com/watch?v=dMjce5P4j-Y

Got it both doubts are clear .

Thanks a lot

Happy learning!

One more question sir . We can square off our position any time before expire what ever position we are holding like buy call and buy put or sell.

Right

Yes, you can sq off anytime before expiry, Sudhir.

Suppose nifty is @17500

i buy one call option ITM 16800 @ 245 premium paid

Expire date March last Thursday

In the first week now nifty is dropped and treading @17300

So my p&L

Spot – strike=intrinsic value

17300-1680 =500

P&l =intrinsic value- premium paid

500-245=255

Is this correct calculation as of now I am not considering theta and delta part

Assuming the expiry is still sometime away, your P&L will be the difference between the current premium and the premium you\’ve already paid. Do check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Hi sir i have one doubt. Possible for you to clear it

Yes, please do post here. If I know, I\’ll clear 🙂

Respected Karthik sir,

Please make a module on option data backtesting with different indicator.

Varsity helps me a lot. It\’s like a cookbook for me.. and this is my request to you sir.

Options backtesting is very tricky due to data availability etc. But let me see what can be done.

The graphs (under \”Strike Selection\”) are confusing. How\’s the profit/loss percentage on Y-axis calculated? Or is it rough estimate?

And why is the X-Axis showing the strike price of a single leg instead of both legs of the spread? In the first graph, the explanation tells to short an OTM strike of 8900 but the graph shows only till 8600 strike.

It also says the bull call spread is optimized and the spread is chosen to be 300. Why is it said to be optimized? Is it because the spread has to be equal to the expected movement of the market (3.75% ≈ 300 as said later)?

These are generic expected P&L, Balu. The spread is net of both buy and sell, so it will be a single number right? Yeah, its best if the spreads are equal.

In this strategy, do we require entire premium paid for long and margin for sell or just the difference of debit?

You need to pay the full premium, but once you have the buy leg, the margin for the sell reduces a bit

Sir, I asked this question because I am confused about calculation, if market expires at 7925. Profit should be capped at 71 rs. As net payoff from ATM CE will be 46, and we\’ll also receive premium of 25 for OTM CE, as market expires at 7925

So ATM and OTM options carry no value upon expiry. Only the ITM option carries value.

In the very first case, what if nifty expires between 7880 and 7925?. Just share the calculation

I\’d suggest you use Sensibull for pre-expiry P&L.

Kartik sir, I didn\’t understand this point which is saying that \’Start of the series is defined as anytime during the first 15 days of the series\’ & \’End of the series is defined as anytime during the last 15 days of the series\’…because Expiry of index is on weekly basis. Then how can we consider this for index? Is this 15+15 consider for stocks?

This is with respect to the monthly expiry, Ashish. You can consider this wrt to weekly as well. Maybe the first 3 days as start and the last 3 days as end of expiry.

Thank You sir. So is it fine to assume that Volatility matters more in case of buying and selling single options and less in using hedging strategies generally speaking?

The other way to think about its that in hedged strategies, most of the risk factors are taken care off, so its much safer to trade spreads.

Sorry, wanna correct Before my mistake waste your time….

I by mistakenly select Strike as Buy Otm and Sell ITm

And luckily after lot evaluation I understood or rather discovered it\’s

🐻 BEAR call Spread.

Ah ok.

Hi,

The Formula mentioned above seems to be wrong or it contradicts in Sensibull (Either one of both is Wrong)

In Above Module, you have Indicated Below formaulas

1) Bull Call Spread Max loss = Net Debit of the Strategy

2) Net Debit = Premium Paid for lower strike – Premium Received for higher strike

3) Bull Call Spread Max Profit = Spread – Net Debit

However In Sensibull, When I just Build a custom Bull Call Strategy with Spot NIFTY at 18014.60

By Buying call for 318.20 and Selling call for 377.90

It Showing Max Profit as 2985 and Max Loss as 2015

Which means in Sensibull it is considering Opposite of what you have mentioned in above module

Means, it considering Max Profit as Net Debit

and It is Considering Max Loss as Spread – Net Debit

Please suggest, Your feedback will help me understand better

Let me recheck this. Also, please see the excel sheet I\’ve used in the chapter.

Sir what about iv? I understand that it is best to sell options during higher iv and buy options during lower iv. But in case of Bull Call Spread, we are buying and selling at the same time. I\’m just wondering if there is any specific way to look at iv in this type of strategy?

If you could answer this, it would be helpful. Thank You.

Yeah, so here the effect of Vol is not much. Delta matters 🙂

Hi Karthik, one question – Let\’s say you do a bull call spread on a stock option, and let\’s say the buy call expired ITM and sell call expired OTM. So in this case, the OTM would be worthless but wouldn\’t the buy call ITM lead to a physical delivery obligation if not squared off. If what I understand is correct then why nobody talks about this risk? everyone says by doing bull call spreads your loss is limited to a certain amount, but the physical delivery (stock options) would be a big problem right? Please help me understand this. Having this question bugging me so much

Pradeep, you are partially right, assumeing you consider an outcome leading to physical delivery a risk. Many traders keep physical delivery as a part of their plan. Besides, you can always exit just before expiry to avoid getting into physical delivery.

Dear Karthik,

I have a couple of questions.

If you are strongly bullish what is the best option strategy ? What is the probability of success of that strategy ?

Call / Put buyer probability of success is only 33% which means the Risk/Reward ratio must be at least 3.5 : 1 in every trade to be successful in the long run.

a)How do we structure an option buyer strategy to turn these odds in our favor so that we get at least 3.5: 1 Risk / Reward?

Thanks,

Suresh

As I mentioned in the previous comment, there is no such thing as the best strategy. But if you are strongly bullish, you are better off trading a futures contract.

Hi Karthik,

I have couple of questions regarding the best option strategy for long.

1) Is Call Ratio back spread the best long strategy when you are strongly bullish ?

2) I understand Call/Put buyer success probability is 33% and seller has the probability of 67%. If you are a buyer how do we reverse the odds to 67% in our favour ?

1) There is nothing like the best strategy Suresh. Different strategies come in handy at different times.

2) You can sell put

Volume is important

Sir

First time i entered in option trading, i placed bull call spread. The margin amount deducted was 34000/- but in my portfolio it shows only 16,800/- (For both the legs) , when i exit, these amount will be back ?

Maybe you should check with the support desk once. Not sure if you had any other open positions at that point.

Hai karthik,

Option strategies has been a bouncer for me, but i am struggling to read understand and memorize the logic.

I couldn\’t find any schedule in zerodha website for workshop.

My question is, should we put stop loss for option trading when we use these startergies or these option strategies should be left open untill the end. I am thinking, losses will be much lesser if stop loss is added. Inversely profits will be higher.

Naresh, we have may option strategies listed in this module. Please go through them. An option strategy has a baked-in SL, so maybe it\’s best left as is.

Dear Karthik,

In the examples of bull call spread and bull put spread, the risk is greater than reward. The loss is greater than profit then why should I initiate a trade with such R:R.

It is not always the case, it depends on the option premiums at the time you decide to initiate the spread.

Sir does this strategy protect us agains theta decay??

Not really, it is more like a directionally neutral strategy.

Sir

How can I take this , is it two trades or one trade at a time…also I heard the amount which I spend is low compared to a sell trade …please explain

Sorry, can you share the context again? Thanks.

Why the time to expiry vs strike graphs shown in this chapter are different from those given in chapter: reintroducing call and put options?

Because they are two different strtaegies, here we are discussing a spread and there we are discussing naked CE and PE.

what indicates rising in delivery percentage with decreasing price in stock which is not in F&O? strength or weakness.

if i am doing bull call spread because it involves two different strike price am i obligated to take delivery if i don\’t square off ??

No, you can square off before the expiry. No need to wait till expiry. But if you do hold to expiry and if any of the option expires ITM, then your position is subjected to physical delivery.

Hi,

Suppose underlying moves 100 points, the option premium wont move 100 points. It will move as a function of delta for that strike.

Shouldn\’t we consider this while calculating the returns?

The calculation of delta factors in this right?

Hi Karthik,

Example given here to considered are for monthly expiry. How do we determine 1st and 2nd half in weekly expiry?

Whether the graphs remains same for the weekly expiry.

You divide the number of days by two and split that as 1st and 2nd half.

Hello karthik Ji,

First of all thank you for such a beautiful content.

I have a query, it may not make any sense at this stage after reading all these wonderful modules by you & team, but I am really eager to know. Kindly provide your view on this. Query is as follows:

How can anyone know within how many days one\’s target will be achieved? I know from TA, using S&R levels or any other method one can expect what target can be expected in market. But it mentioned nowhere how to know time period within which one can expect these targets can be achieved. I think it is very much important to know this, because without knowing this time period one cannot choose correct strike option (whether Far OTM/ OTM/ ATM/ ITM to choose) either within 1st of of series or within 2nd half of series

I know you have already mentioned in one of the comment that one will develop this time period view with time, but I am still not able to do so. Because of this reason I am posting this comment.

Your guidance on this please.

Thank you in advance.

Right Sir. Thanks.

Dear Sir;

If we go for bull call spread on the day of expiry, what happens with IV?

SENSIBULL bull call spread for july 7th

Buy CE 3400 AT 149

BUY CE 34900 AT 24

DEBIT 125

THE EXCEL SHEET doesn\’t work the way it should. Pl comment.

I\’d suggest you use Sensibull\’s strategy wizard instead, AShutosh.

Hi Karthik,

Using this strategy or any other strategy having combination of CE/PE buy/sell/(buy/sell),

if one want to exit the option (based on profit/SL) before expiry my question is one has to leave/exercise all the options simultaneously.

Yes, else there can be a situation where the margin requirement may shoot up.

Sir what is the target for bul call spread

Suppose i buy banknifty 33600ce and sell 33900ce,expecting a bullish view, so is my target 33900ce kindly reply?

Yes, you make maximum profit when the price hits 33900CE.

Thanks Sir.

Karthik Rangappa says:

September 13, 2018 at 12:14 pm

Margins are not included, Chandra. I’d suggest you check https://sensibull.com/ for the P&L inclusive of margins. If you hold till expiry, then you will realize the full expected P&L.

Dear Sir;

What if Nifty starts coming down after 10 days of executing the bull call spread? Shall we still hold on to the expiry?

That depends on your risk appetite no? If you have the risk appetite and the required margins and the conviction on the trade, then sure do hold the trade, else you need to square off.

Karthik Rangappa says:

March 18, 2019 at 11:19 am

Thanks, Dharani. We are fully aware of the OI restriction, we are constantly trying to figure ways to fix it.

Hope this restriction is no more.

Dear Sir, now I am planning to go for suitable strategies. I am also activating sensibull pro. They also have \”TRADE RIGHT\” PKA \”EXPERT ADVISE\”. Shall I go for both?

Regards. Ashutosh.

There are still few restrictions.

gentle reminder. Appreciate if anyone can respond here.

question is once i get into a option strategy position to mitigate risk, but after a day or two, if i am sure about the trend with price action, can i exit one of the positions (could be BUY or SELL) so that i can maximize my profits.

Is there any catch if all goes as expected by EOD? And also any impact/change in Margin required in this case?

Yes, you can. But the margin requirement will go up if you wish to continue holding the short trade and square off the long position.

Thanks for this detailed explanation.

Can i square off one leg let\’s say (SHORT LEG) if i am confident the price is going to shoot up on the day of expiry?

Is it possible from the order placement pov and will it have any negative impact in P/L ?

sir, can spreads be deep ITM ? like buy deep ITM or sell deep ITM

Yup, you can. Costs go up.

Ashutosh Ghuley says:

May 24, 2022 at 4:17 pm

They say, IV(IMPLIED VOLATILITY) standalone is not of much use unless we look at IVP. Please find time and explain the concept. Also, how to calculate and compare both.

Regards. ETU737

Reply

Karthik Rangappa says:

May 25, 2022 at 10:10 am

IVP? Can you post the full form please 🙂

IVP-IMPLIED VOLATILITY PERCENTILE.

Got it, thanks.

Thanks Sir! Waiting for butterfly strategy.

Thanks for prompt reply. However, I have a confusion. When you say— \”target achieved in 5 days\”, do you mean to say that we have to square off on the day of achieving target or we will still hold on till expiry?

My understanding is as soon as we achieve the target we would square off. Pl correct me.

The expectation is that you will square off the position on the day your target is achieved. You\’d have no reason to hold the position post target hit right? Unless you have revised your target expectation.

Resp. Sir;

I am moderately bullish on Nifty. Nifty today at 16352. We are in the first half of the series. I hope Nifty would achieve 16700 in a week starting from Monday.

Remember, RBI may announce further increase of rate by .75%. Volatility would be increasing. Expiry on 30 june.

According to you, far OTM SPREAD is more profitable. So the spread should be 16600-16900. Pl correct me if I am wrong. Also, help me to choose the right strikes for the current scenario.

You are also requested to guide us in the selection of right strikes for both the halves regarding expiry. I am moderately bullish.

Regards. ETU737

Hope I am not disappointing you.

YOu can consider 16600-16800 maybe. But the key is that there should be enough time to expiry.

How would you quantify moderately bullish/bearish? I suppose a 2.5% run for nifty could be treated as moderately bullish.Am I right, Sir?

Yup, that can be. Also, it is very hard to quantify this, really goes with your conviction. For a day trader, a 2.5% move is extreme, but for a swing trader, it may not be.

IVP–IMPLIED VOLATILITY PERCENTILE.

Resp. Sir;

There were no weekly expiries when this module had been written. Now we have weekly expiries for Nifty and Bank Nifty.

Please find some time and enlighten us as to the impact of weekly expiries on option /future trading. A comprehensive note will help us all.

Regards. ETU737

Ashutosh, nothing really changes with weekly expiry except that the timelines shrink. The greeks continue to behave the same way and the technicalities of options trading still remain the same.

They say, IV(IMPLIED VOLATILITY) standalone is not of much use unless we look at IVP. Please find time and explain the concept. Also, how to calculate and compare both.

Regards. ETU737

IVP? Can you post the full form please 🙂

Sir, suppose my view is fairly bullish and I am taking slight OTM CE today (Thursday end of the day/Friday) for next week\’s expiry. Then should I wait till expiry or if the premium moves high due to gap up opening (Friday/Monday morning) I can square off (by keeping time decay in mind)?

What would be the ideal practice for building a discipline?

Subhra, you can square off anytime you wish, there is no need to wait till expiry. Depends on market situations.

Dear Karthik, what great service you have been doing to us all options traders. Hats off t u!

Just curious to know about your videos on you tube. Shall I subscribe to you or to zerodha varsity? Thanks and regards. ETU737.

I dont have a channel as such, please subscribe to Zerodha VArsity\’s channel. Thanks!

Hi Karthik,

Can u plz explain how to select spread(gap) between two strikes?

I have noticed that the wider the spread, we get more profit so we can always choose the wider spread for every time right.

If i am wrong with above statement please explain

Is there any logic behind selecting spread between two strikes?

That\’s right Pavan. A wider spread means higher profit potential, but then the probability of profits is also lower. The opposite is true with lower spreads, higher risk, higher chance of making a profit.

Sir can you please tell, approximately how much percentage loss will happen in Bull call spread, suppose my total capital implemented in the trade is 1 lakh rupees, approximately how much would I lose maximum in bull call spread.

At least can I save 50% of my capital ?

Gautam, that depends on the exact spread of the trade, right? You cant really generalize this.

Same error in Bull Put Spread as well.

Hello Sir,

The image of Excel sheet of \”spread\” in Varsity app is not correct.

As per the example please check.

Chapter 2 of Options Strategies about bull call spread.

Thanks, let me get this checked.

Hi Karthik,

I got a question from scenario 1,2 & 3. Buying at 7700 PE is we are sure that the market won\’t go beyond 7700PE and selling at 7900PE is market would grow over the said. If market has expired at 7600, then it should have lead to profit? Please correct me as I\’m confused on this. Also if the strike price is 7800 and moderate bullish, why should we go for OTM at 7700PE as it should have been ITM since the market is bullish?

Karthik, I\’m a little confused. We are dealing with calls here, right? Not sure why you are referring to PE.

\” The rate of change of delta also depends on how fast the spot is changing\”

If the spot is changing so does the moneyness of our strike, this indirectly means one would win in bull call spread with (Buy far OTM CE, Sell far OTM CE) pair only if the pair is reaching close to (ATM CE, OTM CE).

can I say instead of looking greeks individually, is it correct to have a view on moneyness transition? for example, if I\’m buying far OTM, then I should aim for buying leg to convert from far OTM -> OTM -> ATM?

If you think about it, they are all interconnected Punit. The movement of Greeks and the moneyness of options in the backdrop of the rate of change of spot.

Hi Karthik. I have difficulty in wrapping my brain around strike selection, here is my analysis on same:

classic Bull Call Spread:

Buy call ATM

Sell Call ATM

\”Graph 1 (top left) – You are at the start of the expiry series and you expect the move over the next 5 days,

then a bull spread with far OTM is most profitable i.e 8600 (lower strike long) and 8900 (higher strike short)\”

Start of the series is anytime between 1st and 15th of the month

Let\’s suppose I initiate Bull Call Spread on 14th of the month, and I expect target to hit on 21st of the month(5days). With this it\’s obvious that I will square off positions before expiry, and my P&L is purely based on change in premiums but not Intrinsic value.

Delta – (Buy Far OTM, Sell Far OTM) pair combined delta is less compared to (Buy ATM, Sell OTM) pair combined delta. Which

means for 1 point change in underlying my Bull Call Spread with far OTM premium changes slowly, which doesn\’t favour the argument (Graph 1 (top left)).

Gamma – The effect of gamma is more on ATM strikes only when we are close to expiry, so I would say gamma also doesn\’t support our argument of initiating bull call spread with far OTM

Vega – I agree from volatility smile that Far OTM has much more vega value than ATM strikes, but considering we are expecting a moderate move(moderately bullish) I would expect vega to have low value, hence vega doesn\’t support our argument too.

Theta – There is ample time to expiry, so there would be negligible drop in premiums due to theta. I would expect theta to behave same regardless of (Buy Far OTM, Sell Far OTM) or (Buy ATM, Sell OTM). to my knowledge theta has more or less same effect whether we buy far OTM or ATM. This doesn\’t support the argument.

can you please be kind to explain me how does strike selection work?

Classic BCS = Buy ATM CE and sell OTM CE, not sell CALL ATM. I guess that was a typo 🙂

Yes, P&L before expiry is just the change in premiums and not intrinsic value. The rate of change of delta also depends on how fast the spot is changing. If you don\’t expect a massive change in spot, then no point going for far OTM. Stick to ATM. In fact, I think sticking to ATMs most of times is safer.

Rethink on these lines 🙂

Dear Karthik sir,

Is it possible ever that both of the legs (options) in Bull Call Spread will make loss?

In other words is there guarantee that one of the legs will make profit?

Thanks

It\’s possible, depending on what premium you have paid and received. There are no guarantees.

But when i use stoploss with the naked call, my loss is limited.

So what\’s the need of BCS then? Does it prove useful in any other way?

Its just that with BCS, your risk, reward, and everything else is defined. YOu can sleep well at nights 🙂

Thanks a lot karthik for your patience and time

Dear Karthik sir,

Referring to Bull Call Spread strategy, suppose i am SLIGHTLY BULLISH about Nifty.

I can also buy a naked CE option and set a stoploss. I want to know what is the difference

between the Bull Call Spread strategy and the naked option with stop loss when your view is SLIGHTLY BULLISH?

Regards

With BCS, your risk is limited but risk is lot more with a naked position.

Dear Karthik sir,

In section 2.2 Bull Call Spread strategy, in the example we saw that the capped loss is 79 while capped profit is 46.

which means that the profit is less than the loss. Does it happen in the real world situations too that the profit is less than the loss?

Regards

Yes, that was a real-world scenario. But as a trader, its up to you if you want to take up such trades or not.

Dear Karthik,

Sorry to post so many questions, I\’m running this strategy in sensibull, it\’s a great tool to visualize the look and feel of payoff

Please find the below quires

1.Instead of naked call options buying we are hedging the option by selling, with that our loss and profit are fixed, is my understanding is correct ?

2.And when comes to geeks we need to consider the total value of delta,gamma,theta(i.e geeks for both the legs) ?

3.I\’m back testing this strategy in sensibull and using the strategy builder I set the target date and time(31/03/2022 and 03:15pm)

-when I set the date and time it shows the strike range by using the normal distribution(-2SD -1SD 1SD 2SD)

-From sensibull how they are calculating the normal distribution?, are they using the Index historical data to compute the normal

distribution, if this true then we can use the sensibull for the range of strike for stock/index?

4.Before we initiating the strategy we need to keep eye on the theta and vega(major factor),IV of the both strike, is this correct ?

5.At the start of the series, I initiated this strategy(ATM and OTM) but due to some event the Volatility shoots up drastically

=>So in this case, the call option which we bough will be in good position

=>then call the option which we sold will be in a loss (all the premium received will be lost), assume after the difference in premium there is a loss

=>In this case what one should do, should I have to exit the position or adjust the position, if possible can you share me one example for adjustment?(to minimize the loss)

Note: The point 5 I asked already, if possible, pls clarify if your time permits 🙂

1) Yes, thats is correct

2) Yes, you need to consider the overall impact of greeks on your combined option position

3) YOu will have to take this up with them

4) Yes, that\’s is correct

5) Although I\’m not a fan of this, you can sell the call and buy another call.

Thanks a lot karthik

Good luck!

Dear Karthik,

Thanks a lot this excellent content, I\’ve below quires need your help

– I understand the behavior this strategy but if my view is correct then instead of this strategy can I go for naked buying options with SL

For example: My view is bullish and I expect nifty would move 100 points and with the SL as 30 points

– And also during the holding period, If the market going against my view then how one do the adjustment or its better to exit the positions(both

legs),would you also teach us about the adjustment in the strategy module ?

Yes, you can, that will be more profitable if you are right on the direction. Even better if you opt for futures. Not a big fan of adjustments as such. But yeah, will try and put up some content around that sometime soon.

Scenario 3 – Market expires at 7900 (at the higher strike price, i.e the OTM option)

The intrinsic value of the 7800 CE would be –

Max [0, Spot-Strike]

= Max [0, 7900 – 7800]

= 100

Since we are long on this option by paying a premium of 79, we would make a profit of –

100 -79

= 21

The intrinsic value of 7900 CE would be 0, therefore we get to retain the premium Rs.25/-

Net profit would be 21 + 25 = 46

sir, here we are shorting the strike 7900 CE & it expires at strike i.e 7900

as the index value increase the 7900 CE\’s premium increases,hence we lose money as we r on short side of 7900 CE..

u mentioned that we get retain the premium of 25

how come that possible sir..

hoping for reply soon

The market expires at 7900, so all call options at and below 7900 will expire worthless Shiva. Hence we get to retain the premium we get by selling the option.

Thank you.

Good luck!

Hi Karthik, are these strategies applicable for trading intraday on premium as well? Or these are only for option sellers and buyers?

YOu can apply intraday as well. But it is best to look hold to expiry.

Hi,

In 2.3 how are strikes identified that gives max p&L based on expected time to hit target. can you brief on the process to determine this

Naveen it is based on B&S calculator, using which you figure which strikes give max profit for a given market situation.

Well! As a newbie I think going for 1st option (Higher odds of winning but less profit potential) is good 😃

Good luck! Everything is a learning experience 🙂

Great!

Here is one thing that I noticed while verifying this strategy.

As you said, when trading ITM & ATM strikes, breakeven is easily achievable but R-R is not much actually in favor of us. But at the same time, Probability of Profit increases as well. So how will you justify this? On one side we have attractive PoP and on other we have more risk than reward!

I have seen it on Sensibull.

Thats something you have to answer to yourself. What do you want to do as a trader? Trade with odds in your favor (but less profit potential) or take up risk 🙂

At the date of expiry, if the call option bought ends in ITM and the call option sold ends in OTM, do we have to take delivery? Or will it get canceled each other?

Yes, the ITM stock ends up going through physical delivery.

If both options are in the money on expiry day and if we don\’t square off both positions then is there any impact , penalty etc?

If both are ITM, then we are it gets net off and you can avoid physical delivery.

Thanks sir for your able guidance hope a number of youth of today\’s world gets inspired by these valuable content 🙂🙂

Happy learning, Chetan.

Sir how do we select strike for intraday when the movement expectations aren\’t very vast?? And how to we improvise strategies on intraday??

For intrday, stick to ATM options, its the safest 🙂

Sir if we expect market to move up in maybe 25 days … Then would it not make sense to buy a ITM option and sell a deep OTM?? Cause either may our deep OTM option premium is bound to be eroded ( thanks to theta ) does that not guarantee profits ??

Nothing really guarantees profit in the market, Chetan. By changing the strikes, you alter your breakeven point and the risk-reward profile, but no guarantee.

Hello Karthik,

First of all, thanks a lot for such nice, easy and informative teaching style. Indeed very helpful.

Secondly, a suggestion: could you kindly include in all spread strategy notes or at a common place somewhere that stoploss should not be placed in the spread strategies, since hitting stoploss in any of the legs breaks the strategy? I believe this is not mentioned anywhere, and by default since we all trade with stoploss, many traders would use stoploss while implementing option strategy, only to later regret and wonder why strategy didn\’t work even if market directional move anticipated was correct. This may create doubts about the strategy in the traders\’ mind, whereas actually the strategy works fine, but the stoploss is a culprit.

Vaibhav, thanks and I\’m glad you liked the content on Varsity. You do have a point, let me see if I can add this somewhere.

Hi Karthik,

In Equity derivatives, If a bull or bear call spread is setup, Can it ever end up in physical delivery ?

Or is it netted off all times?

Are there any unknown major risks defined in this strategy ? In other words, Is there any situation where the risk is severe or unlimited.

Yes, especially in the event where one of the legs in ITM and the other option leg is worthless.

Sir, do we have to consider India vix also, while using this strategy ?

You can use that as a proxy for volatility.

Is it necessary to set Stoploss in Bull call Spread??

Nope, its a spread so losses and profit are defined.

What do you mean by drastic change and how much it can change?

Sudden change in prices, Raju.

PLZ REPLY SOON

SIR,

I HAVE TAKEN BULL CALL SPREAD IN TCS FOR DEC 21 EXPIRY

3460 CE BUY@76

3700 CE SELL @11.30

FOR THAT MARGIN ABOUT 29500 IS BLOCKED.

NOW IN FUTURE IF TCS GOES UP AS I EXPECT AND WHEN PREMIUM OF BOTH THE CALLS WILL INCRESE . SO THE PREMIUM RERQUIREMENT WILL BE SAME WHICH IS BLOCKED OR I NEED TO HAVE SOME EXTRA AMOUNT IN ACCOUNT.

PLZ CLARIFY SIR

It will roughly be the same, unless there is a drastic change in price.

Hi Sir, I have a doubt regarding the contract closure. Earlier when options are held till expiry, they are cash settled but now since ITM Options if held till expiry are considered as delivery and gets deposited to our account and cause trouble. Considering any strategy ,( let\’s take Bull Call Strategy for this example ), what can a trader do on the day of expiry? Should he close his ITM CE Long option on the day of expiry to prevent conversion to delivery and leave the OTM CE Short option to expire?

Taking delivery does not cause trouble 🙂

One easy way to avoid delivery is to square off the position before expiry.

Thanks for your reply. It makes sense when the expiry is month apart. How would you be determine start of series when expiry is week apart e.g. NIFTY or most of the stocks that trade on NASDAQ or NYSE. Thanks in advance.

Consider this, expiry for the month of Nov is on 25th of Nov. I\’d consider Nov month to be in the 2nd half of the series since its half way past the series. On 26th Nov, I\’d consider the Dec series at the start of the series.

I read the previous comments but still figuring this out. More specifically,

– How do you know if you are in first 5 or 10 days of the expiry series? Do you determine this ball-park based on days remaining for expiry? Or there\’s a data point on the expiry series that denotes when a certain expiry series was added.

Please do check the previous comment. Thanks.

I am based in US and trade on Nasdaq, but I have found the educational material very relevant nonetheless. So thanks a lot for Varsity.

I have been struggling to determine \’Start of the series\’ – Where do you get the \’start of the series\’ data point from say for NIFTY? Thanks in advance.

Ketan, thanks and I\’m glad you liked the content and found it useful. The start of the series is the day on which the current month contract expires and the mid-month transition to the current month.

Hi Sir, I just wanted to confirm that the max profit considered in the above strategy is only calculated with respect to the Intrinsic Value hence it looks as if it is capped but in the real scenario, volatility and time value also comes into place and the change in premiums does not directly depend on the Intrinsic value .Hence, the premium change does not behave equally for both CE and PE options . So the max profit is not capped .I\’m confused here as to how can profit be capped here ? ( I understand that max loss is the premium paid – collected ) but how can profit be capped? Premium for CE keeps increasing based on Intrinsic + Volatility + Time and the Premium for PR keeps decreasing based on the same greeks. How can the max profit be a fixed value? Please clear my confusion here sir.