It’s the economy, stupid! The real job of the RBI

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

KEY TAKEAWAYS

- India’s inflation falls to 4.75%, largely due to a further reduction of core inflation.

- Falling inflation alone does not guarantee a repo rate cut. RBI’s main job is to ensure monetary stability, not growth.

- Most people agree that housing prices will go up even faster than they are right now.

- India’s trade deficit came to $23 bn, after imports grew by 8%, while exports grew by 9%.

- The US Fed hasn’t cut interest rates at its last meeting, and probably won’t start until September.

Why we aren’t cutting rates already

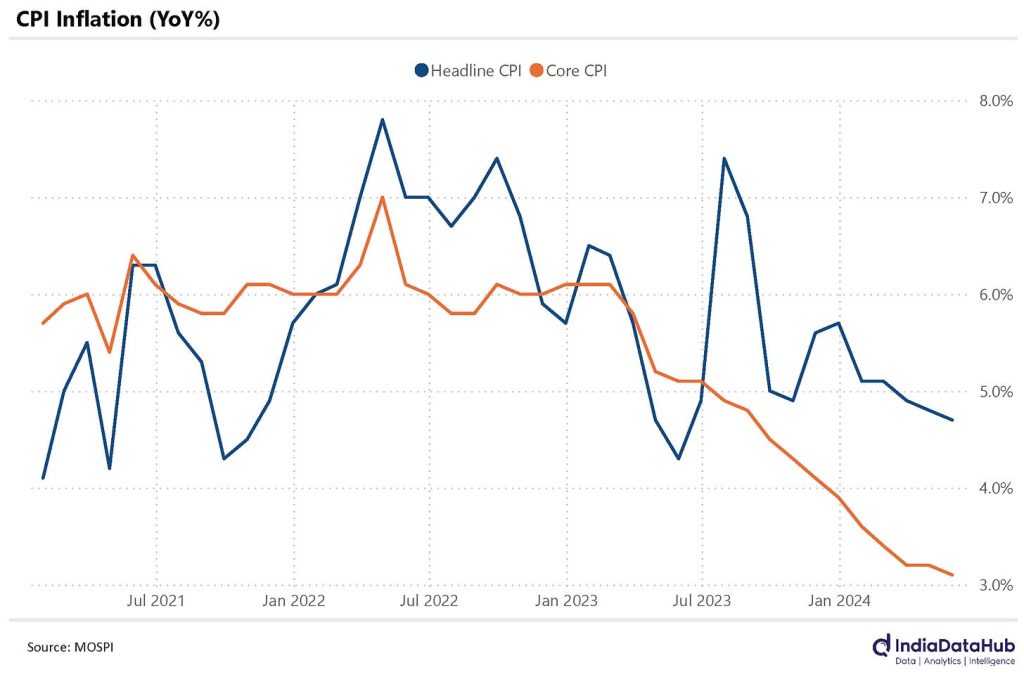

India’s Inflation has now fallen for the fifth month in a row. Our inflation reading came to 4.75% — 0.08% below April. Between December last year and May, inflation has fallen by almost a full percent —- dropping from 5.69% to 4.75%.

As has been the case for many months now, our core inflation has been falling. It’s now at 3.1%. Most of our price rise, on the other hand, is because food prices continue to climb. And that has continued in May, when food prices were 7.9% higher than a year ago.

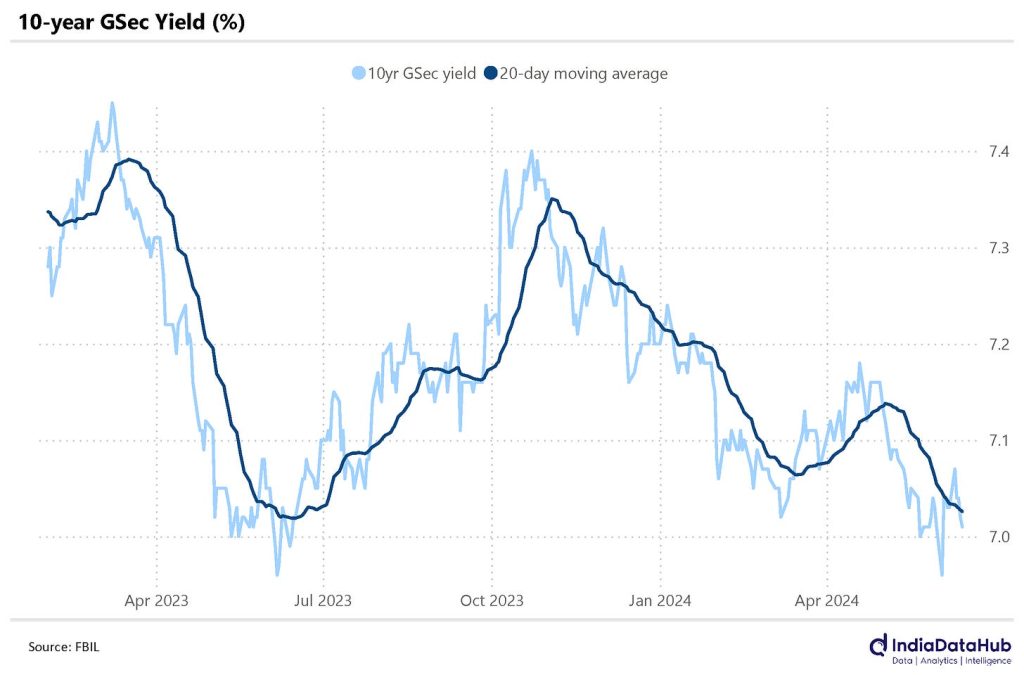

The markets are pricing this falling inflation into the yield on government bonds. When inflation is high, you’ll want a better deal if you’re giving money to the government —- after all, inflation is quickly eating into the value of that money. With lower inflation, people are more comfortable with less interest. And so, now that inflation is falling, 10-year G-sec yields are at their lowest in a year — at 7%.

This fall also comes, in part, because the markets seem to think a rate cut might be close. As we saw last week, two of the six members of RBI’s board now want rates to be cut. If rates are cut, money becomes cheaper for the economy. Then, people aren’t quite as insistent on earning a high interest.

But if inflation is going down, why isn’t the RBI cutting rates already? What’s taking it this long? Here’s the thing: the RBI only looks at inflation to hike rates. Inflation coming down, on the other hand, isn’t reason enough for the RBI to cut rates.

I know, I know. That seems unfair. But it makes sense when you really think about it. The RBI only cuts rates when it’s worried for the health of the economy. If India’s growth starts to falter under the strain of high rates, it will relent and bring them down. If not, though, it’ll probably continue with high rates.

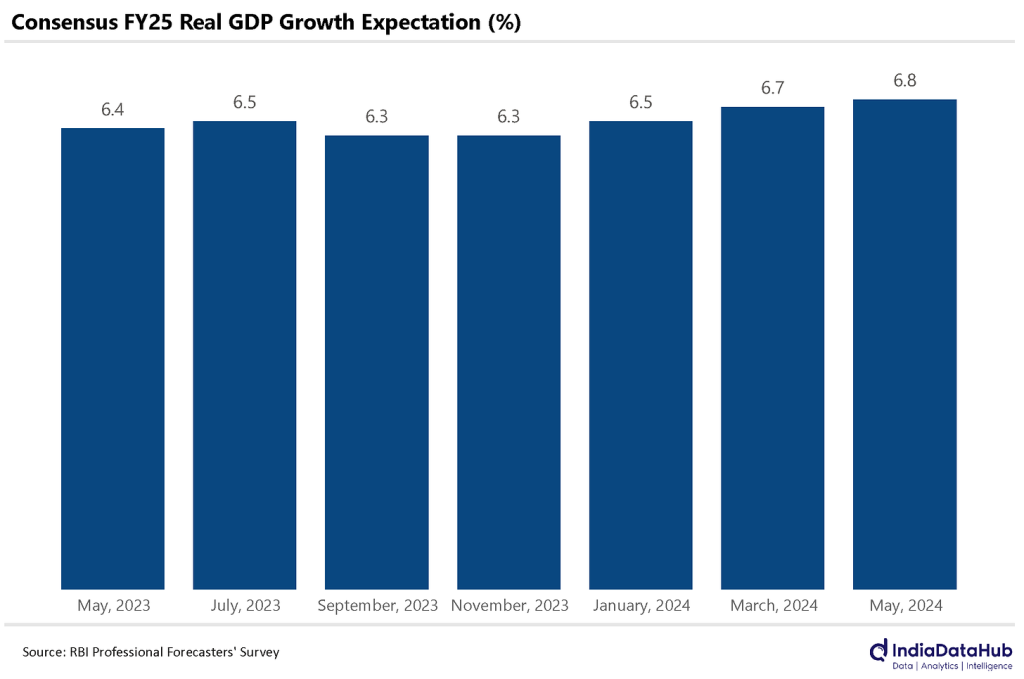

Right now, the economy isn’t faltering at all. It’s quite exuberant, really. Retail investors participate in the markets at an unprecedented rate, real estate prices are rising, unsecured lending is going up — these aren’t signs of a struggling economy. If anything, these are indications that the economy is heating up a little. The MPC needs to be cautious. It is prudent for it to keep rates a little higher than it would otherwise like.

While many people think the RBI just balances growth and inflation, its bigger goal is to ensure monetary stability. It isn’t supposed to chase growth. Its job is to be the sane voice in the room. It’s supposed to think about risk.

Booming stock markets and credit-based spending make an economy look good. But when they rise faster than the economy that’s underneath them, there’s always a chance that something will go wrong. It’s the RBI’s job to stop things from getting to that point. At the moment, people’s optimism about the economy is only growing. Look at the chart above for instance — GDP growth expectations for FY 25 have been only going up, off late. There simply isn’t a big reason for the RBI to cut rates just yet.

Prices hitting the roof

Indians think housing prices will climb very, very quickly this year.

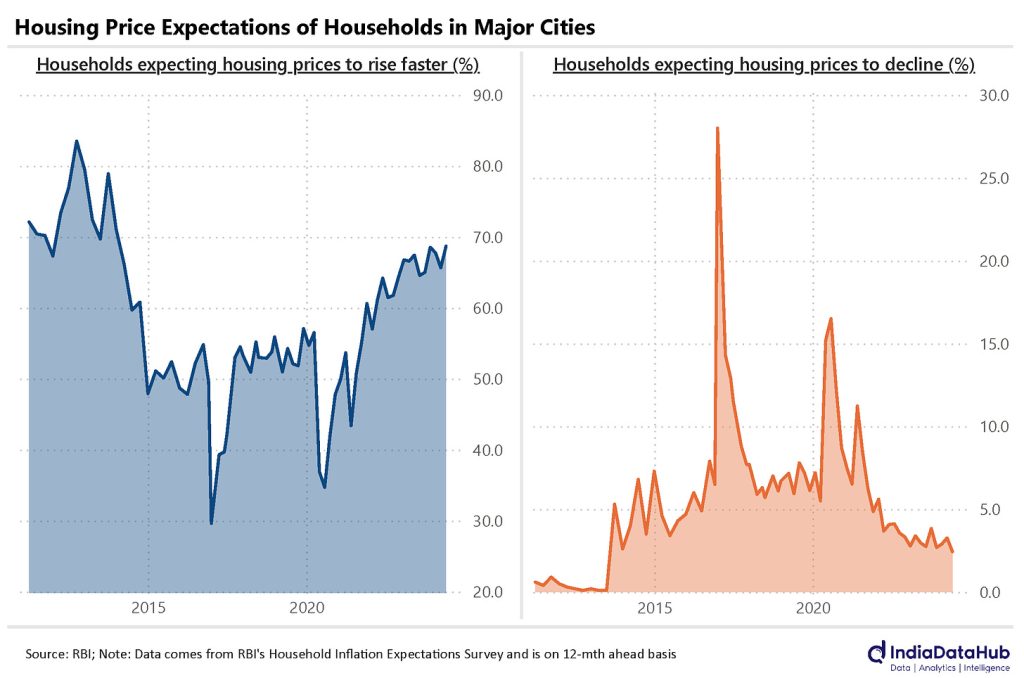

How do we know? Well, take a look at RBI’s Inflation Expectations survey, which comes out once every couple of months. It asks people how they think housing prices will move in the next year.

Look at the graphs above. Two things tell you that housing prices are heating up:

- More people think housing prices will jump up faster than currently are than at any other time in the last decade.

- Fewer people think housing prices will decline than at any time in the last decade.

Seven in every ten people wonder how long they’ll be able to afford housing for, while almost nobody thinks houses will be cheaper any time soon. That’s great news if you’re a home-owner, and terrible news if you aren’t.

May trading

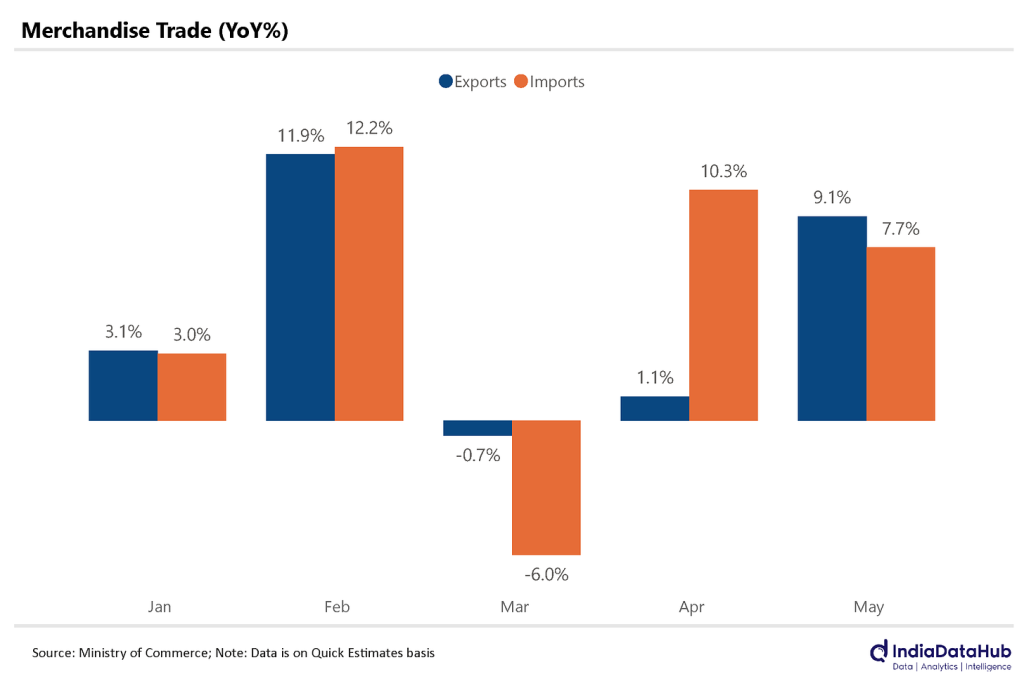

We have the latest numbers on how much India traded with everyone else in May. Here are the highlights:

- India’s exports went up by 9%, year-on-year.

- India’s imports went up by 8%, year-on-year.

- India’s trade deficit (that is, imports minus exports) came to ~US$ 23 billion. That’s much more than it was last month, but around where it was last May.

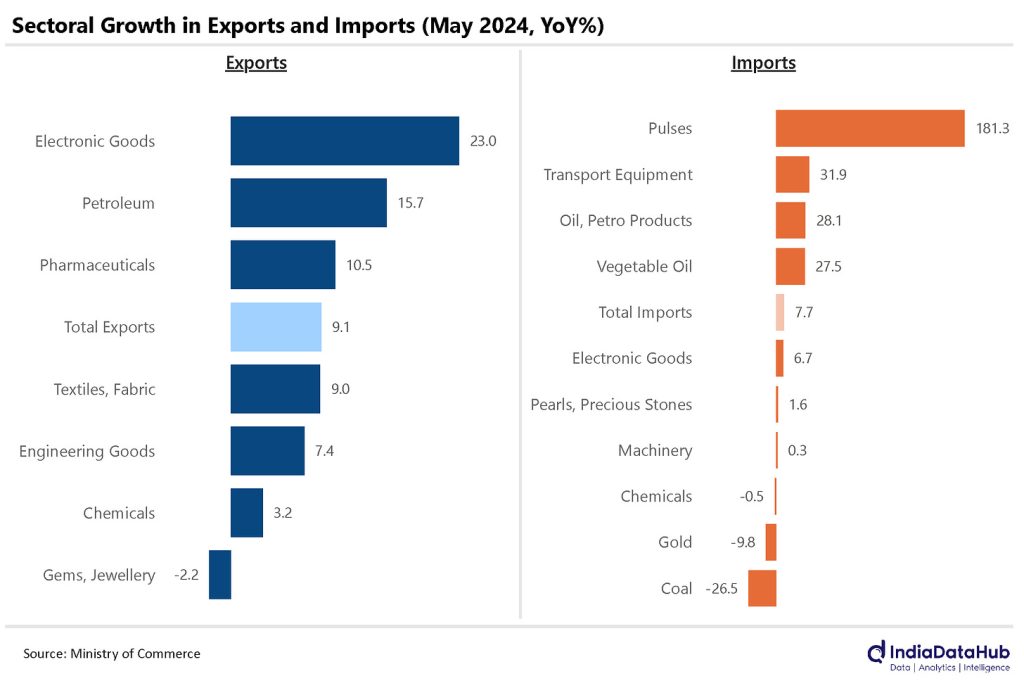

Here’s how we’ve fared on individual items:

Pulses are an interesting story. India’s pulse production took a bad beating this year. This has sent the price of pulses up by the double digits, and is keeping food inflation high. In response, we’ve been importing pulses in bulk. May makes for the third month in a row when our imports went up by more than 100% year-on-year.

No country for low rates

Remember how, last week, nobody expected the US Fed to cut its policy rates? Well, they were right. The Fed met last week and kept its rates unchanged.

Here’s what will happen next, at least as per the markets: The Fed will next meet on July 31, when it’ll probably leave things unchanged once more. The cuts will start at its subsequent meeting, in September. By the end of the year, people expect, rates will be down 0.5%. Or, well, that’s what they believe right now. The end of the year is still a long time away.

(Why do we keep talking about US rates here, you ask? We’ve written about this before, but in a nutshell: when US Fed rates are high, the RBI finds it harder to beat inflation.)

A couple of quick updates from the rest of the world:

- Japan kept its interest rates unchanged yet again. Its inflation has stayed high for a few months — though nobody knows if this is a good thing. After all, it saw 25 straight years of deflation before this, and that wasn’t too great either.

- In May, China’s inflation climbed to 0.4% — the fourth straight month of inflation. That’s definitely better than the deflationary tail-spin it was in a few months ago.

That’s all for the week, folks! Thanks for reading.