It’s the economy, stupid! RBI loves taking bold moves

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

Prefer watching over reading? Here’s the video for you!

Is the RBI Playing it Too Cool?

In the first week of December, the Monetary Policy Committee (MPC) did exactly what everyone expected: absolutely nothing with interest rates. The repo rate still sits at 6.5%, which makes sense. Inflation is tricky, growth is shaky, and the RBI doesn’t want to rock the boat just yet.

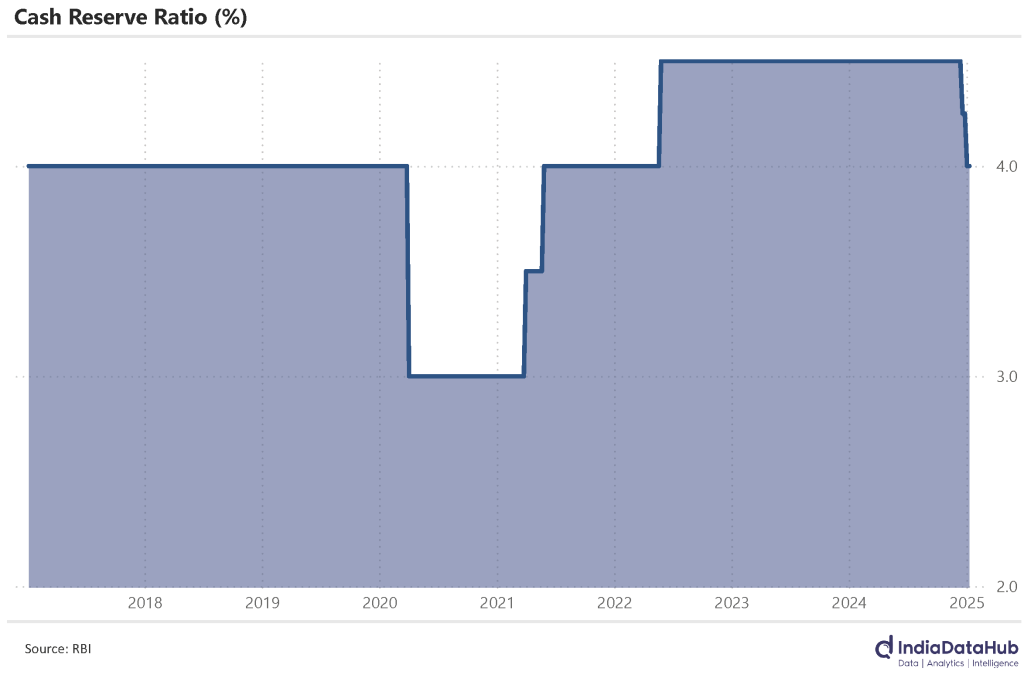

But they did not completely go silent. They cut the Cash Reserve Ratio (CRR) by 50 basis points (that’s 0.5% for the non-finance folks out there). This move could quietly add over $13 billion of cash into the banking system.

How does that work? CRR is the percentage of their deposits that banks are required to park with the RBI. It’s like a safety cushion—cash banks can fall back on during tough times. By lowering the CRR, banks now have to keep less money locked up with the RBI and can instead use that extra cash to lend or invest. Think of it as giving banks a little extra breathing room to boost credit flow.

Let’s quickly rewind:

- In the pandemic’s early days, the RBI had slashed the CRR to 3% from 4% to keep banks flush with cash when the world was falling apart.

- Once the worst was behind us, they hiked it back to 4.5% to soak up all that excess liquidity.

- And now? They’ve dialed it back to 4%, taking us right back to pre-pandemic times.

So, why did the RBI do this?

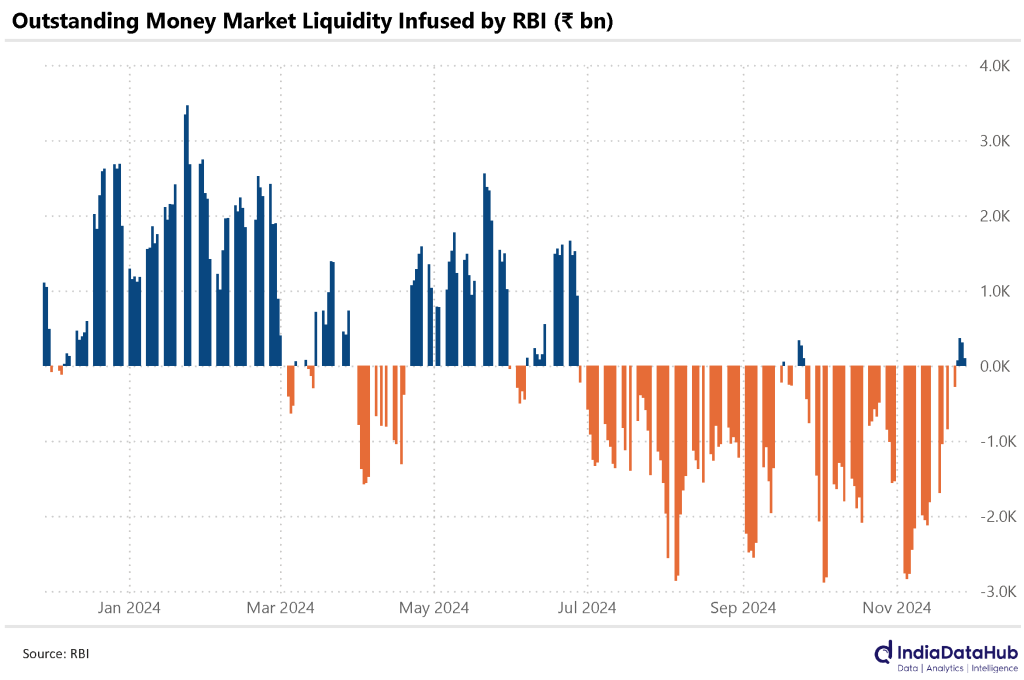

Because there has been a liquidity crunch lately, and one of the reasons is—ironically—the RBI itself. Over the last few weeks, they’ve been dipping into our foreign exchange reserves to support the rupee, which has been under pressure thanks to foreign investors pulling out of Indian markets. This drains rupees out of the system, making liquidity tighter.

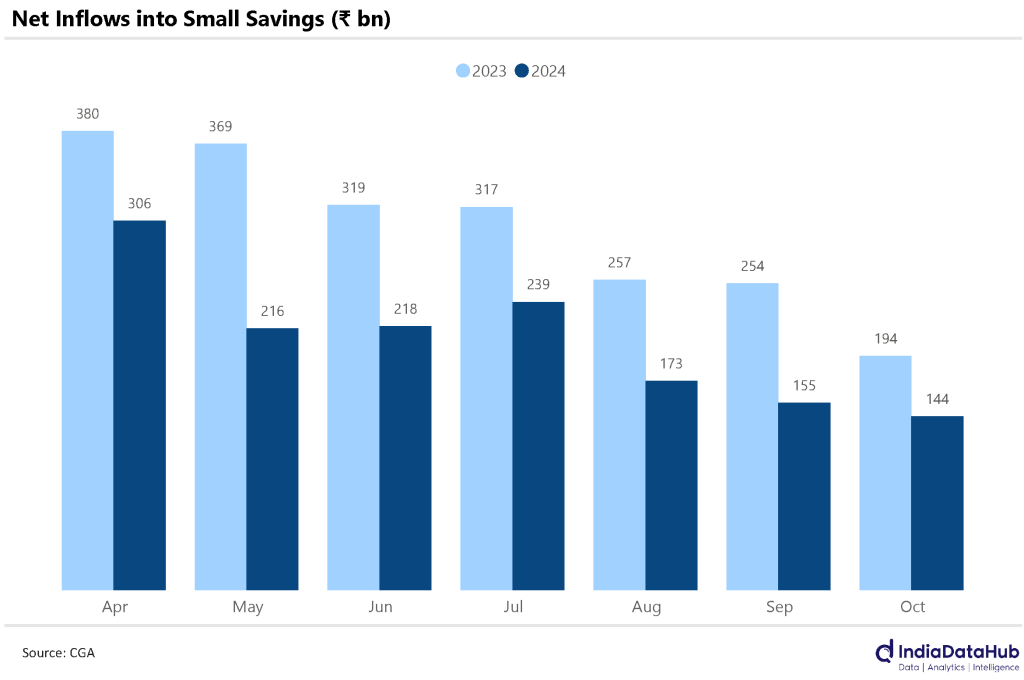

But that’s not the whole story. Falling small savings inflows are making things worse.

Small savings schemes—like the Public Provident Fund (PPF), Sukanya Samriddhi Yojana, and others—are a key funding source for the government’s fiscal deficit. This year, however, inflows have been falling fast. In October alone, net inflows dropped 25%, and for the first 7 months of FY25, they’re already down by 30%. If this continues, small savings inflows could fall ₹93,000 crore short of the budget estimate.

What does this mean? The government will have to borrow more from the market, and that’s where things get tricky. Higher government borrowings will crowd out liquidity as they’ll be competing with companies and retail borrowers for funds. And when the government takes a bigger slice of the pie, there’s less credit left for everyone else.

In fact, if you look at the data, the money market liquidity has already flipped. What was a large surplus since June has now barely balanced out. So, the CRR cut feels like the RBI’s way of balancing the scales—easing liquidity without causing all the problems by slashing rates.

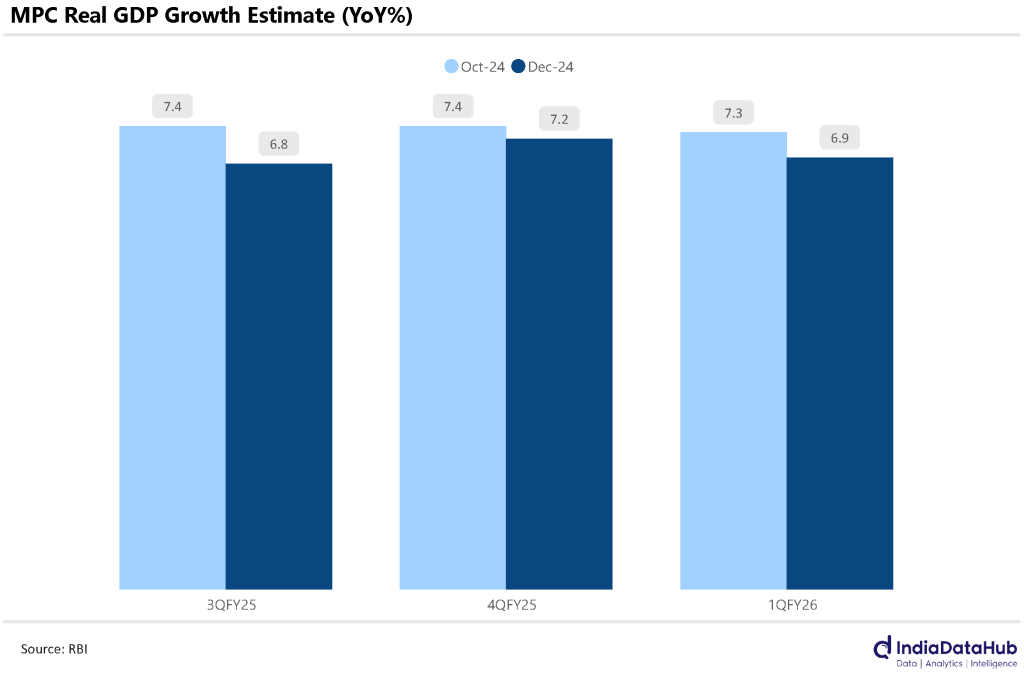

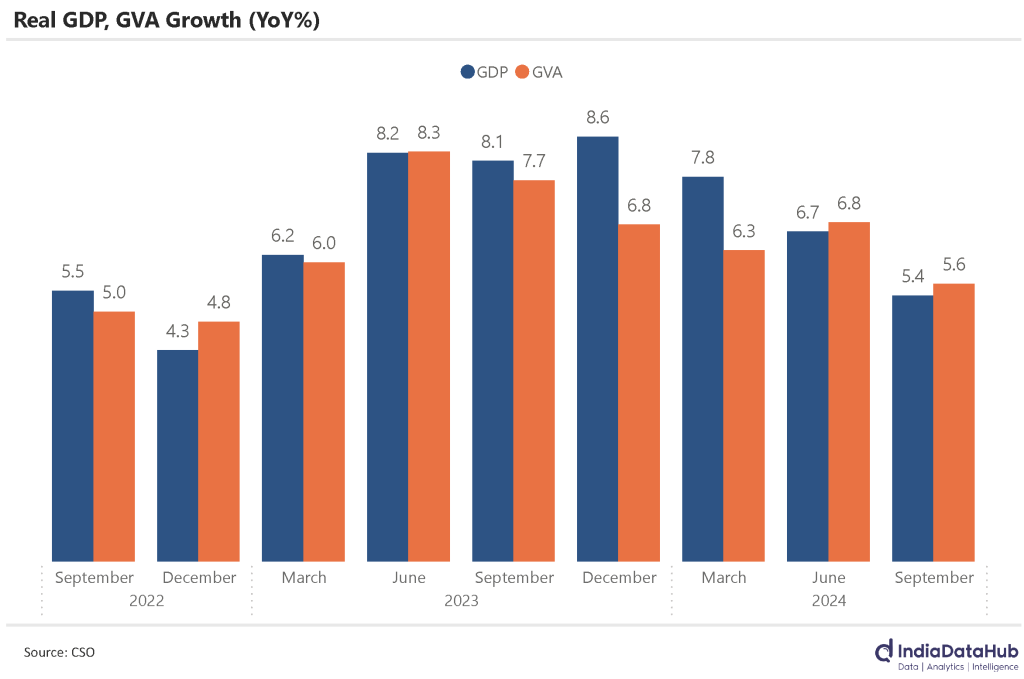

Now, despite all this, the biggest takeaway from the meeting is how relaxed the RBI still is about growth. Yes, they trimmed their FY25 GDP forecast from 7.2% to 6.6%, but most of the slowdown came in the first half of the year, where growth slipped to a disappointing 5.4%.

Yet, the RBI remains optimistic. They’re betting on a second-half recovery, expecting growth to bounce back to 7% YoY. Basically, they’re saying: “Relax, the dip was just a blip.”

In fact, they’re so confident that they stuck to their neutral stance—no hints of rate cuts or hikes.

But here’s the thing—not everyone on the MPC is on the same page. Two external members were against this stance, signaling some cracks in the consensus. If just one more member starts worrying about growth, a rate cut could come sooner than expected.

And with Shaktikanta Das stepping down as RBI Governor and Sanjay Malhotra taking over, this becomes even more likely—though Malhotra insists he’s staying neutral for now.

So what’s next?

It all comes down to the growth data over the next couple of months. If the recovery doesn’t look as solid as the RBI is hoping, they might have no choice but to loosen the purse strings further. Until then, we’ve got the CRR cut to tide us over.

Is Growth Back on the Menu?

We ended the last story saying growth is taking the centre stage of all our policy decisions. Now here we are, staring at the GDP numbers for the September quarter, and there’s no sugarcoating this one: growth slowed sharply to 5.4%, down from just under 7% in June and a solid 8% in the same quarter last year. To put it bluntly, this is the slowest GDP growth we’ve seen since the December quarter of 2022.

But does this mean the economy is wobbling again, or was the slowdown just a temporary blip as RBI believes? That’s the real question—and the answer, as always, lies in the data.

And the data was already hinting at what is about to come. Let’s face it—quarterly GDP numbers aren’t all that surprising. It’s like getting the bill at the end of your restaurant meal. You knew what you were ordering, how much it cost, and the bill just confirms it. Most of the data that feeds into GDP—like disappointing corporate earnings, muted consumption trends, and falling tax receipts—was already signaling a slowdown.

Let us take a closer look, starting with government spending.

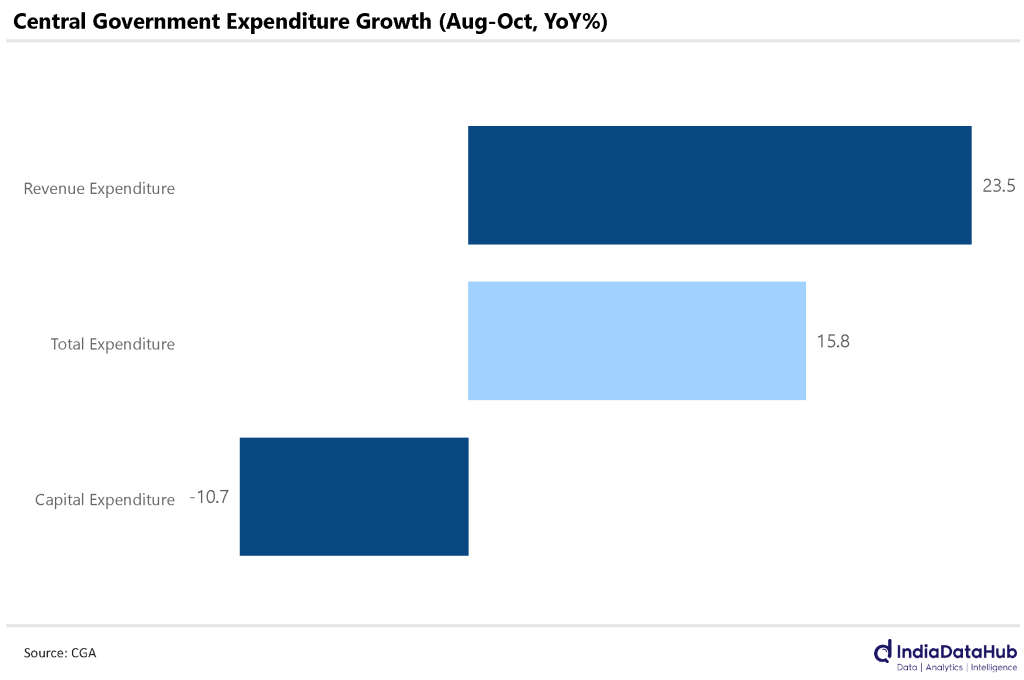

October offered an interesting mix of data. On one hand, government spending shot up by over 15% YoY during the August-October period. But all the growth came from revenue expenditure (day-to-day expenses like salaries and subsidies). Capital expenditure—which drives long-term growth—actually fell by 10% YoY, marking the third consecutive monthly decline. Not a healthy sign to see capex falling behind this much.

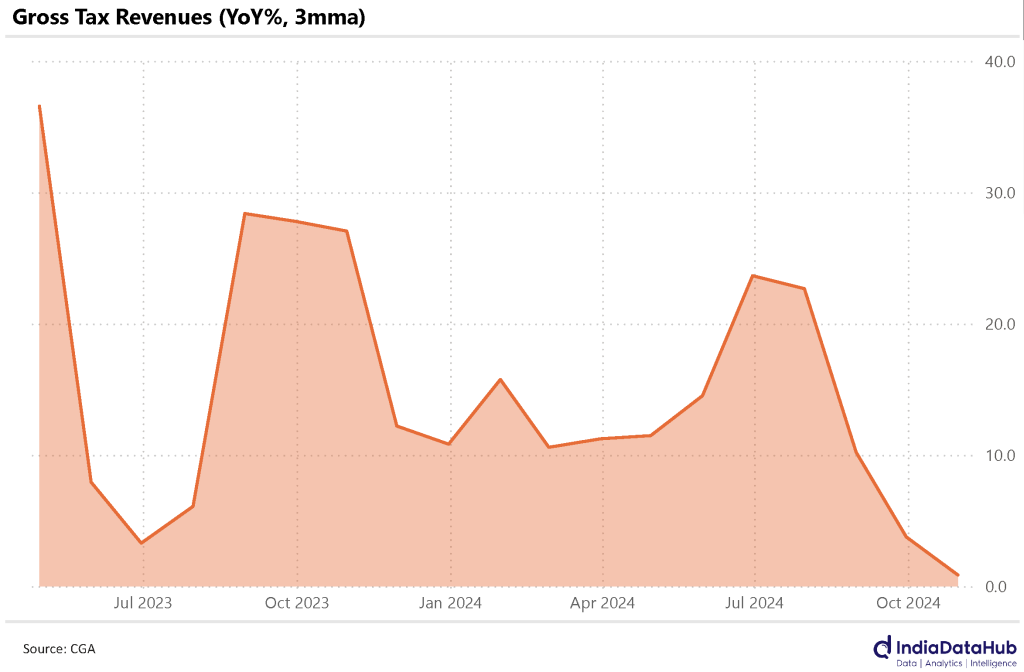

Even worse, on the income side the tax revenue numbers are looking weak. Gross tax revenues grew by just 2% YoY while corporate and personal tax collections both declined in October. In fact, over the past 3 months, tax collections have barely grown at 1% YoY.

If this trend continues, the government will likely miss its full-year revenue targets and may have to cut down on spending—something we really can’t afford when growth is already slowing.

So, while the government budget isn’t doing much to support falling GDP, the high-frequency consumption data may offer some much-needed relief. Let us now look at them.

[1] Automobiles

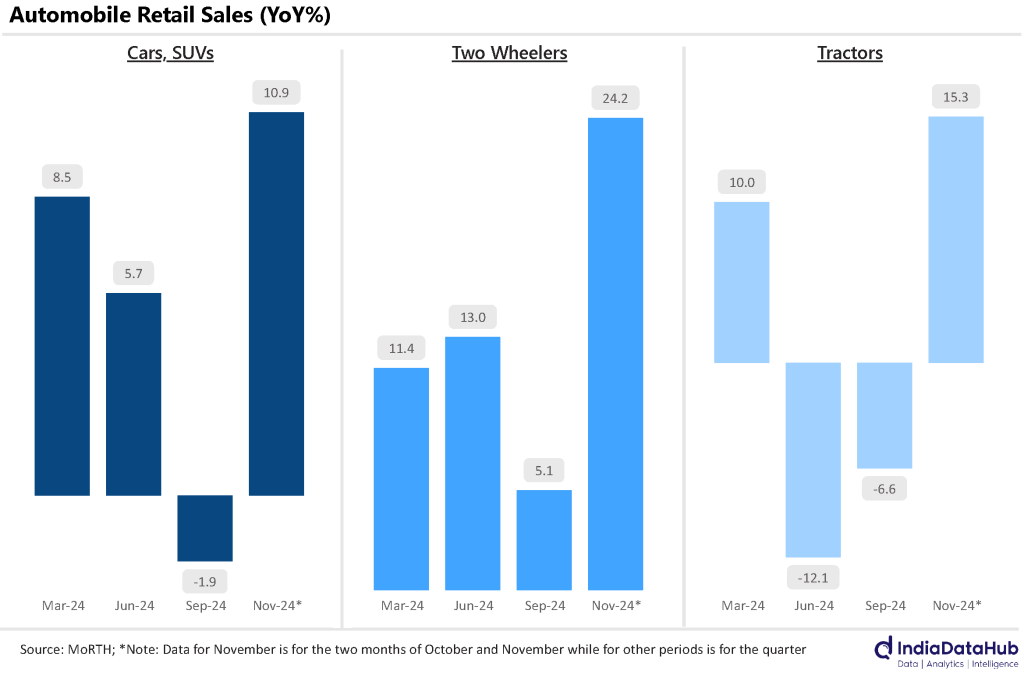

Consumption in the auto sector is showing signs of a turnaround. Yes, the timing of the festive season shifted some demand, but strip out the noise, and the numbers are solid:

- Cars and SUVs retail sales grew 11% YoY over the last 2 months, a sharp recovery from the 2% decline in September.

- Two-wheelers sales rebounded to 24% YoY growth, up from a modest 5% in the previous quarter.

- Tractors sales grew 15% YoY after falling 7% in Q2. This shows that the rural pulse is strong here

[2] Power Generation

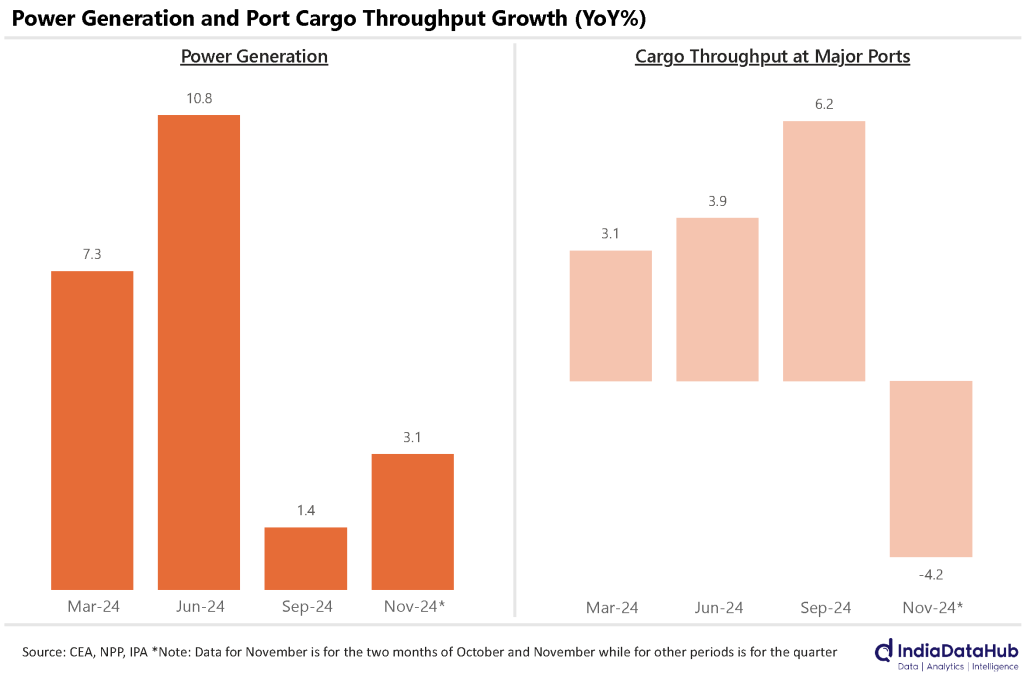

Power generation growth picked up slightly, growing by ~3% YoY during October-November, better than the 1.4% growth in the September quarter. It’s not a boom, but it’s not stagnation either.

[3] Cargo Throughput

Not everything is rosy, though. Cargo traffic at major ports continues to struggle. November marked the second consecutive month of decline, the first such drop since June last year.

- Most of the weakness came from lower throughput of coal and iron ore.

- Even container traffic barely grew, rising by just 1% YoY over the past 2 months.

That’s a sign of sluggish trade and industrial activity—something that can’t be ignored.

So, the big question remains “is growth bouncing back?”

Here’s the thing: the RBI and the MPC have been optimistic, brushing off the 5.4% growth in Q2 as a “temporary blip.” And to be fair, they might have a point.

The high-frequency data from November does suggest some recovery—particularly in consumption-driven sectors like automobiles and power generation.

But there are still big challenges:

- Government spending still needs to fire on all cylinders, especially capital expenditure.

- Tax revenues need to stabilize, or else growth could take a hit if the government is forced to cut spending.

- Weak industrial data, like cargo throughput, is still a concern and will need close monitoring.

For now, the MPC’s confidence doesn’t seem completely misplaced. The early data signals a recovery, but the scale —and sustainability —of that recovery is what we need to watch over the next few weeks.

So, is growth back on the menu? The signs are there, but we’ll need a little more data to call it a comeback.

Housing is Having its Own Moment

Let’s change gears for a moment and talk about something that gives every “finfluencer” sleepless nights—housing as an investment. You know the drill: stocks are flashy, crypto is cool, but housing? It’s that boring, old-school asset class that somehow keeps chugging along. And guess what? It’s quietly having its moment.

While everyone’s glued to equity markets, the housing market has slipped into a strong phase of its own. Property prices are rising, though you wouldn’t know it from the official indices, which are notoriously bad at capturing the ground reality.

Why? One possible reason is that they don’t account for the cash transactions that still form a significant part of property deals in the Indian market. So while the official data underplays the action, the on-ground reality is far more robust.

So if the official indices don’t do the job well, where’s the proof of booming housing?

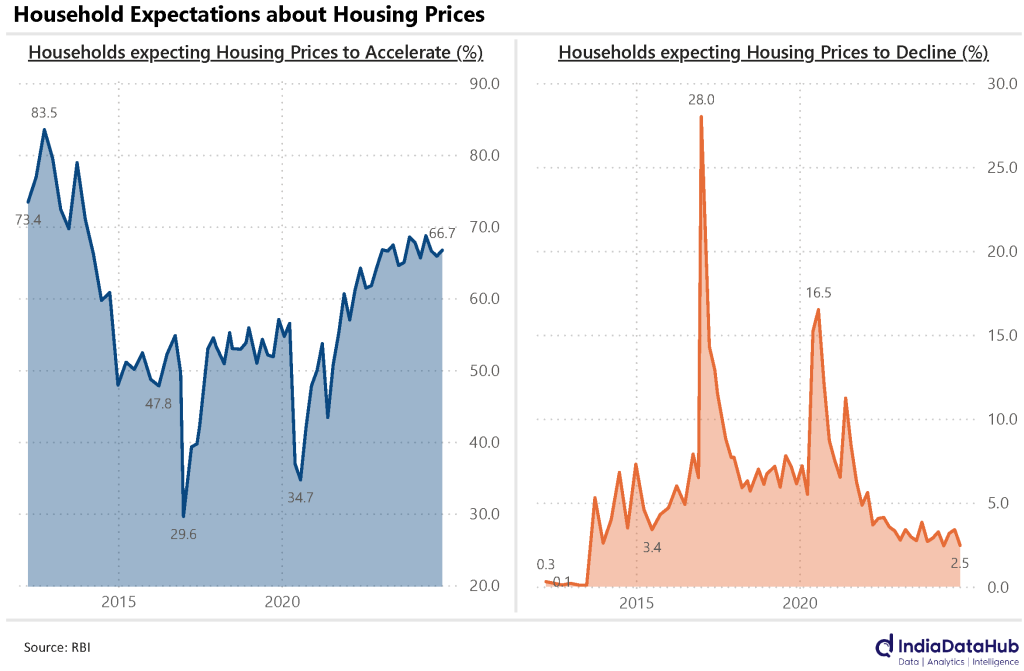

The answer lies in an unlikely place: the RBI’s Inflation Expectations Survey, conducted across major cities. And this time, the optimism is off the charts.

- Nearly two-thirds (66.7%) of respondents expect housing prices to accelerate, the highest level of confidence in over a decade.

- On the flip side, only 2.5% expect housing prices to decline, the lowest reading in 10 years.

Clearly, the housing market is defying all the “don’t buy a home” memes floating around. And this confidence isn’t just sentiment—it’s showing up in the numbers.

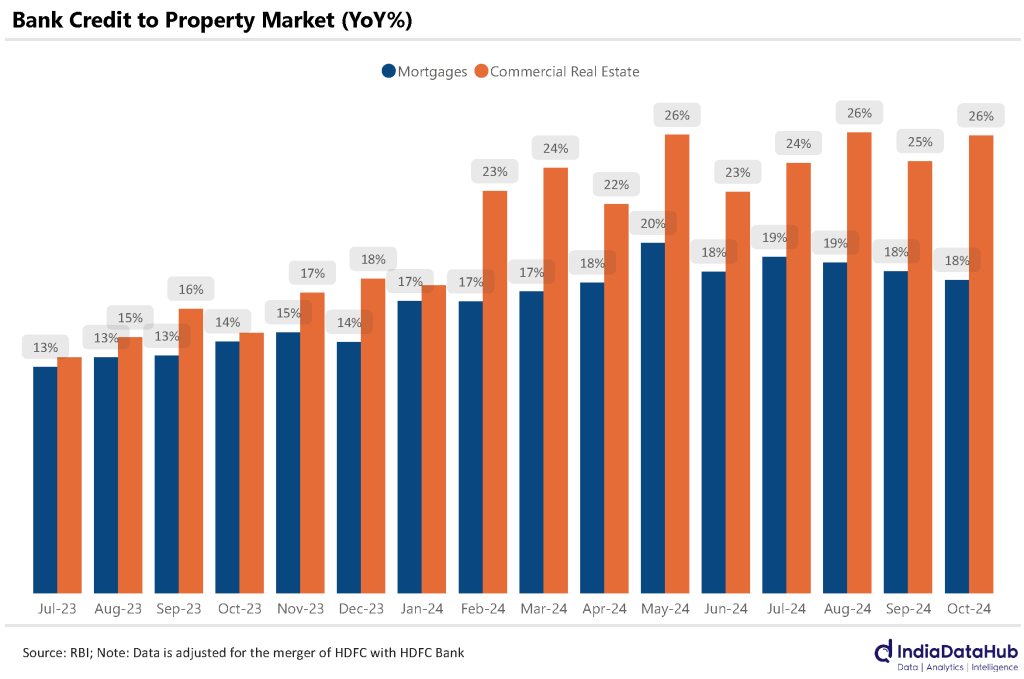

It’s no surprise that housing loans have been growing fast over the past year. Back in July 2023, they were rising at 13% year-on-year, but by October 2024, that number had climbed to 18%.

And it’s not just homes—commercial real estate loans have taken off too. Growth has doubled, jumping from 13% to 26% in the same period. Whether it’s buying houses or building malls and offices, everyone’s borrowing, and banks are happy to lend.

You know what makes this even more interesting? All of this is happening while overall bank credit growth for the entire banking sector has actually decelerated. So, the sharp rise in housing and commercial real estate loans is standing out, highlighting the sheer strength and momentum of the property market.

But here’s the flipside: this rise in housing demand isn’t without its consequences. As more people treat homes as just another investment vehicle to park their money, the very purpose of housing gets diluted.

Prices rise, making it a lucrative asset for investors, but at the same time, it pushes homeownership further out of reach for those who actually need a roof over their heads. For families looking to buy a home to live in, what was once a dream is now starting to feel like a luxury.

That’s all for this week, folks!