Pre-market/Post-market/After-market Orders

Traders,

1. Pre-market Orders:

NSE started the concept of pre-open session a few months back to minimize the volatility of securities during the market opening every day. Between 9:00 AM to 9:15 AM is when the pre-market session is conducted on NSE. During the pre-market session for the first 8 minutes (between 9:00 AM and 9:08 AM) orders are collected, modified or cancelled. You can place limit orders/market orders. After 9.08 AM to 9.15 AM no new orders can be placed, orders placed are matched and trades confirmed. So technically you can place orders only for the first 8 minutes and only on equity segment. More on Pre-market orders on this link.

2. Post-market Orders:

Similar to pre-market orders, post-market orders are allowed only for equity trading. The post-market session or closing session is open from 3:40 PM to 4:00 PM. During this session, people can place buy/sell orders in equity (delivery segment using the CNC product code) at the market price, but do note that even if you place a market order it will be placed on the exchange at the closing price. So for example, if the closing price of Reliance at 3:30 PM is Rs. 800, between 3:40 PM and 4:00 PM, you can place market orders to buy/sell Reliance at market price (will be taken at Rs. 800). Post-market session is not very active and you can look at the movement of stocks by opening the marketwatch window from 3:40 PM to 4:00 PM.

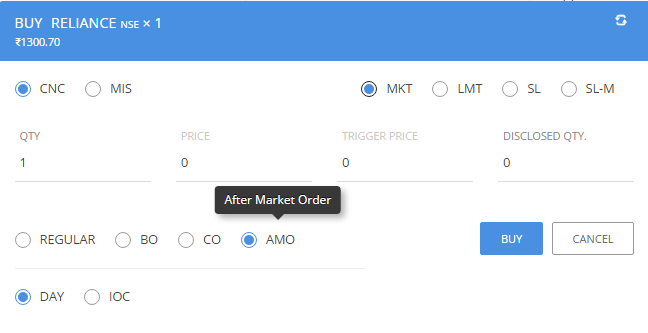

3. After-market Orders (AMO):

This facility is available on Zerodha for people who can’t actively track the markets from 9:15 AM to 3:30 PM. You can place orders any time from 3:45 PM to 8:57 AM for NSE & 3:45 to 8:59 AM for BSE (until just before the pre-opening session) for the equity segment and up to 9:10 AM for F&O. So you could plan your trades and place your orders before the market opens. After-market orders can be placed on all the exchange segments. Please note that if you place any after-market order between 9:15 AM and 3:45 PM, they will be rejected. AMO is allowed only between 3:45 PM and 8:59 AM for equity and up to 9:10 AM for F&O. For currency derivatives, AMO is allowed from 3.45 PM the previous day to 8:59 AM only.

After-market orders are also allowed for commodity trading. After-market orders for commodity can be placed anytime during the day, orders will be sent to the exchange at 9:00 AM (MCX opening). So if you place an after market order at 8:59 it will get sent today and if you place it at 9:01 AM it’ll get sent tomorrow.

To place an AMO, click on the Buy(B) or Sell(S) for the scrip, click on “More options” at the bottom of the order window and select “AMO”. You can look at the image below to understand better:

Placing an AMO

If you are looking at getting the best fill first thing in the morning, placing a market order at opening is a much better idea than using AMO. We typically have thousands of orders as AMO, which are sent together to the exchange at market opening and this might take a few seconds for the orders to be placed. AMO is a feature mainly for the investing community, who can’t get online during market hours.

Happy Trading,

Please confirm why AMO of ETF orders were rejected in the Pre-opening session

Hi Yogesh, we’ve explained this here.

Very very useful content. I am very much happy with this information and thank you for your subject matter. Thank you Zerodha

Unable to place AMO in zerodha app. Before applying getting window which is getting closed.

Hi sir,

Please clarify my AMO order will get executed during price matching secession (9.08 – 9.15), or after opening of market i.e 9.15?

Hi Anupama, AMO orders in equity segment are sent to the exchange for execution at 9 AM. If the order is not executed in the pre-open session, it’ll be carried over to normal market. More here.

I want to place a time-based order like the price-based orders. Is that possible for like 9:30 AM or 9:45 AM? I will place the order before these times, but it should execute at that time

Why couldn’t i able to trade in commodities after 5 pm? It say available margin is zero even though i have funds. ”Kite is undergoing scheduled maintenance. You can see your margins, positions, and holdings from 7:00 AM tomorrow.” What am i supposed to do?

Hi Rama, we’re sorry about this. Could you please create a ticket on: https://support.zerodha.com/ with details of the issue, so we can have this resolved at the earliest?

Does this AMO get active or trigger at 9 am or 9:15 am ?

”Hi everyone, I have a query regarding AMO orders and pre-market trading. If I place an AMO order at around 8:00 AM for a stock that typically sees heavy movement during the pre-market session (from 9:00 AM to 9:08 AM), will my order get executed at the previous day’s closing price or at the new pre-market price when the market opens? I’m mainly interested in intraday trading and want to understand how the execution price will be affected by placing an AMO versus placing a direct order during the pre-market window. Any insights would be appreciated!”

how to select 1 stock for day

Become the best vision of yourself

Mindset is everything

Best things in life are free

IYKYK

If i have a after market bid for a stock that has hit upper circuit will it be taken before the pre market bid I put the next day

Can I use AMO for purchasing UC stocks?

Can I place bank nifty future order at market price between 9.00 AM to 9.08 AM

Hi Sanjay, F&O contracts don’t trade in pre-open session. You can place AMO orders until 9:10 AM and normal orders once the markets open.

Hi,

How to buy a stock every hour at market price? Any way to implement this?

Regards,

Mahesh

How does it work for a stock which is going through upper circuit for multiple sessions, as a user when I place a order at 09:00 in Kite, will it be same as any other use placing order at 09:02? If I want to increase chance of buying a stock which might be a upper circuit stock, is manually adding order at 09:00 is enough or is there a better faster way?

Hi,

Can I place AMO in banknifty and nifty?

What if market opens with gap up or gap down?

Why AMO is not allowed with market price?

Hi Annoop, yes you can place AMO for nifty and banknifty. It is allowed for all product types, i.e. CNC, MIS, NRML. You can also place AMO order with limit / market price.

Pmo ki jankari d

I need AMO PMO and bracket order, how can I get it from zerodha, currently I m getting only gtt orders

Hi Rajeev, we’ve explained the pricess for placing AMO orders here. There is no seperate order type for pre and post market orders, you can place regular orders during these sessions.

I placed an AMO order for the stock at the rate of 20% upper circuit. Any guarantee for the stock it will definitely buy for me.?

Does this imply AMO orders does matter to decide the price, and if so then they must be there since 9:00 or 9:07? I guess since 9:00 cause from 9:08 they start to match the order, so at 9:00 AMO or PMO which one stay ahead in queue? I read contradict ans, some say A other says B, don’t know the truth

Can I place a F&O market order between 9:08am-9:15am?

Hi Vishal, AMO orders in the F&O segment can be placed until 9:10 AM. Regular orders can be placed once the market open at 9:15 AM.

Dear Sir,

Suppose, I want to order some shares in premarket sessions, then how can I order and what is the time period to execute my order. Also, how can I check that what orders are executed in market and on which rate. So that I can get confirmed that my order will be 100% executed. I hope you understand my point sir

Dear Sir,

Suppose, I want to order some shares in premarket sessions, then how can I order and what is the time period to execute my order. Also, how can I check that what orders are executed in market and on which rate. So that I can get confirmed that my order will be 100% executed. I hope you understand my point sir.

Hi,

Can I place intraday buy/sell order for a particular scrip at the pre-trading session? Like around 9:10 AM.

Thanks.

Hi Prashant, intraday orders can be placed in the pre-market session. More here: https://support.zerodha.com/category/trading-and-markets/trading-faqs/market-sessions/articles/what-are-pre-market-and-post-market-sessions-and-orders

Hi, I have placed few AMO orders on the previous day for the next day but when I checked them just before the market opens, the orders were in cancelled status. Not sure what was the issue. Can anyone please tell me if you faced the similar issue and what could be the reason for cancel?

Hi Kamesh, could you please create a ticket at support.zerodha.com so our team can check and assist?

What if market open gapup or gapdown then what will happen to AMO

Hey Kaustubh, it depends on the type of order you have placed. A market order will execute at the best available price in the market. While if you have placed a limit order, then it’ll only execute at the price specified or a better price. You can learn more on how the market and limit orders work here.

y

I have 2000Rs in my Zeroda kite wallet, I want to place a bid for 4 different stocks, each worth 2000rs, one of it gets executed on next day market hours right? which ever bid is less, that will get executed and stocks order gets placed. please clarify as I am new

Hey Sharanya, could you please create a ticket at support.zerodha.com and elaborate your query clearly? If you are placing an order for 4 different stocks you will have to maintain sufficient funds for its execution in your Kite wallet.

AMO order I could succeed.

Thanks

Yesterday I placed an AMO order for Buy- JSW steel 100 nos at limit of 760 Rs.

Today when the market opened at 9.15 I found JSW steel was bought at 750 against 760.The stock completelty went down and I had serious loss. How it was purchased at 750.ANy body can tell?. What was the mistake

?

Hey Jagadeesha, could you please create a ticket at support.zerodha.com, so we can have this checked and clarified for you?

How Can a After market order can be repeated automatically daily?, because stocks trading in low volume, the order was cancelled by the Exchange in the End of Trading Session

Hey Vignesh, the order cannot be repeated automatically daily. You’ll have to manually place the orders again.

Hi @nitin kamat the pre order link is unavailable, please update it thanks

Hey Sudarshan, the link is updated 🙂

Which order will execute first if I make an AMO order for sale between 5 PM and 8 AM on January 17, 2022, and another Regular order at 9:01 AM on January 18, 2022?

Hey, order execution depends on the price specified by you can market factors at the time. Using AMO or placing an order manually at 9 AM won’t make much difference.

can i place stop loss market(SLM) order on IPO between 9:45 to 10:00 AM on listing day to be executed after 10:00 AM?? or i must have been place after 10:00 AM??

Hey Alpesh, you will not be able to place Stoploss orders before trading starts at 10 AM. You can however place a GTT order anytime you wish to. You can learn more about GTT orders here.

Please go through below mentioned details . I booked the order at 9.00.01 hrs, but the system shows the order booking time as 9.00.10hrs .

Why the system showed the different time?

Time Status Exch. time Exch. update Qty. Filled qty. Avg. price Price

09:00:10 OPEN 09:00:10 09:00:10 825 0 0 13.3

09:00:10 OPEN PENDING — — 825 0 0 13.3

09:00:02 VALIDATION PENDING — — 825 0 0 13.3

09:00:01 PUT ORDER REQ RECEIVED — — 825 0 0 13.3

Please clarify.

regards

M Murugan

Hey Murugan, best if you create a ticket on our Support Portal

not able to place amo order for selling after 3.45pm and getting error kindly place order after 5.00pm why?

Hey Parth, if your account is non-POA, the AMO orders can be placed from 5 PM onwards. We’ve explained this here.

Can i take option trade (Bank Nifty/Nifty) order with AMO market in Zerodha Kite.

Hello Team,

I was trying top place bank nifty buy option call at market price, but my order is getting executed only after 2 to 3 seconds delay.. Why so due to which i am facing 30 to 50 points difference some times.

which may end up in loss.

let me know how to over come this?

i am unable to order silver on mcx……..my account code IRY760……….i have also trfd rs 25,000/- to commodity account……..it is showing commodity no active

Can we place pre-order market order and post market order on Zerodha?

AMO order if placed to buy and the market open in gap down so will the order get executed.

i still have not under stand if relaince closing is 1500 and have placed the Order AMO at the same price and the next day market drop with a gap opening of Rs 1490….will the order will get executed or canceled.

Hello,

If I place AMO at market order, at what price the order will get executed? Is it closing price of previous day or opening price of next day?

Please reply @zerodha

Hello,

I had a normal trading order open around 500 @ 480 3:29:02 PM on 29th June 2021, which was executed in the post market partially 119 @ 486.05.

question is can normal trading hours open order be automatically executed in post market with a avg price?

Yes.

hello sir…how to place a order buy above the high or sell below the low in pre market session… ???

Greetings,

Please clear below mentioned doubts.

1. Can I sell My CNC purchase same day the next day, instead of waiting for DEMAT procedure.

2. Please explain BTST or STBT transaction with ZERODHA.

Thanks in advance.

In between 9 to 9:08 there is movement in stock prices, but in Kite watch list i am not able to see that. please start this facility in kite and in app.

My sell order has been triggered by GTT and it was rejected for authorization through CDSL. However, I have authorised later after market has closed. This happened today (29.04.21). So, how can I sell this now. Under Holding Tab, it is showing as triggered but it has not been executed yet. I am a new user. Please help me.

Hey Kaushik, we send an alert as soon as the GTT is triggered and failed because of lack of CDSL auth so that you can place a fresh order during market hours. For now, you can place a fresh order and authorise the sale.

Hi,

AMO or PreOpening which will get executed faster? like I am placing AMO order and next day at pre open some orders are placed. which will get higher priority?

Regards,

Manish R Gurnaney

i also want the answer for the same

Hi, Can I place intraday SL M order (buy or sell) in AMO?

how to place pre-market order @ zerodha .Kindly make a proper tutorial for youtube.

Thanks.

I have placed a limit order for F&O, but the order got executed with any consideration to the Limit I provided.

Above issue is for AMO orders

Hey Mamta, if you place a limit buy order above market price, or sell order below market price, the order executes at the current market price because it is a better price. This is how limit orders work.

What about the charges of post market??

Where i can see RS ( Relative Strength) Indicator. Not RSI just RS

1) Where i can see my stop loss order?. Means where i an see the orders where i put the stop loss and the order where i did not put the stop loss.

Is there any extra charges AMO order?

daily I have to use AMO order and I have to place place market limit and there enter my limit price but last many time trigger price above / below my limit price?

please inform me why not place order at same price as I have put in my limit order.

It’s not good for me due to order triggered above / below at my limit price.

What time does Zerodha AMO for Coffee Day open on Saturday in NSE and BSE ?

Can we place more than one amo order for a stock? For example if stock price is 100 and i’m placing amo of 102 and another one for 105 just in case the first one doesn’t get executed.

Future order place with AMO, but disabled the the stop loss field .. currently trances are in pending since not opened the market yet .. how can I set the stop loss for future trade while it’s allowed me to complete with leverage…

Hey… I place an AMO for BALAXI yesterday. The shares were bought this morning at Rs.134.75. But guess what the shares never went to 134.75. How did you purchase the shares at a price that it did not go to?

How can I buy/sell shares at market opening price?

I am trying to buy upper circuit share since one month from zerodha online account.but not even a single order is executed.I tried different timing and different qty but same result.

Than someone suggested to try MARWADI broker Ltd they have good result for upper circuit shares.

so place same order at same time with same quantity with Zerodha and Marwadi both.It was unbelievable that my Marwadi order is executed and Zerodha didn’t.

Can you plz explain this? Looks like something fishy in zerodha.

I have all the document proving this both transaction just in case if you need it.

Rahul, if the share is in upper circuit, you getting execution is very unlikely. If someone is able to guarantee execution, that seems fishy. 🙂

brother, now what is the condition can you tell me. surely Zerodha, Angelone are not giving desired result and I confirm that. what other broker you are using and what are the results?

The last paragraph is pretty conflicting to what one finds on the internet, please clarify –

For someone who is stuck with a share with lower circuit and wants to exit, what would be the best option

1.) Placing a market order AMO at 3:45 pm. ( Popular opinion)

2.) Placing a Limit order AMO at the lower circuit at 3:45 pm.

3.) Just placing an AMO order anywhere between 3:45 pm to 8:57 am as time doesn’t matter.

4.) Placing a Market order at 9:00 Am (ASAP) (As suggested by the above article)

I have a genuine query regarding placing an order. If I place an order in AMO and that does not gets executed and due to upper circuit remains in pending order list till closing hours. Meanwhile, during market hours, to increase the chances of getting stocks, I make a new order. Now the question is – will this new order be standing in last of order book of upper circuit price ?

Because if this new order stands last in order book, then there are close to zero chances of my order to be executed.

Hi, did you find any perfect solution for this ?? Kindly reply Mr Harsh Rao or Zerodha Team

Hello can i buy a share for MIS i.e intraday in AMO and sell it after the market opens at 9.15am -3.30pm.Please Clarify

Yes

when I want to buy shares that increasing-price value at 9 am or regular trading time, purchased shares are getting cancelled automatically. how to buy shares which are increasing their values ?

Not sure what your question is. Best reach our support desk for help.

ht3716 kindly not i sold 25 shares of ambuja cement in nse today 10 @191 15 @ 192.95 nad squared up later on at 191.75 the square up by you is shown at bse instead of nse if you see my kit holding every thing is in nse i dont i dont under stand how this mistake has occured at your side you are requested to do the need ful

Hi, does zerodha allow users to save chart studies for each stock separately?

I had placed an order at 15:19 hrs today but it didn’t get approved, however, the amount was deducted from my funds. I canceled the order and placed it again at 15:57 hrs. under post-market orders. I need to understand that if my order will be approved at the same rate I had placed the order or it will be approved at the price at the time of opening tomorrow. Please guide.

Can we place AMO for Options buying/Selling.

If yes for example if I place options AMO at 10000 & previous day close at 10000. Now what if market opens at 10100?

Will it buy at 10100?

Hi,

if i place pre open market order between 9 to 9:08 on prev close, After 9:15 when order confirmed will it place order on prev day close or current open market?

for example xxx trader prev close is 100 rs, nd market opens at 104 rs, if i place pre market order at 100(prev close) for buy order, what price it will consider?

Is there any problem if so many orders are placed in a day?

No.

Can I use SL or Anything to sell the stock if it reaches certain profit , Eg I’m buying a share for 100 rs and can I instruct to sell it when it reached 120 rs

More on Pre-market orders on this link.

The link isn’t working. Please update

If I AMO order place on market price. And it not exacute beacuse market volatility so high. Is it possible?

Hi,

I placed a CNC AMO order at MRKT price at around 9 AM today in FRETAIL share(which is having UC). It got converted to LIMIT order at 9:07 AM, but still not got executed. Did I do anything wrong?

Why I have been charged brokerage for CNC Orders??? Can you please explain what does this mean ”where you have partially squared off your CNC position before the end of the trading day”

Explained here, Santosh.

Hi,

Suppose today, i have bought 10 stocks of Reliance @ 1000 Rs and i have put it on hold for tomorrow.

But i want to set the limit of those 10 stocks to 1100 Rs for sell, after the stock market ends at 3.30pm.

So can i set it with right click and sell under AMO option?. Or will it trigger and set a fresh new Sell of 10 stocks @ 1100 Rs ?

You can place an AMO. If you want to hold it for more than one day, you can also place a GTT order. GTT orders are explained here.

If already set, will GTT trigger in AMO duration? or a dedicated AMO order needs to be placed for after-market timings?

Hi,

If I buy a share in post market sessions at around 3:45

since only delivery orders are placed at the closing price, means I will for sure get the stock on T+2 day

and hence Can I safely sell it on T1 & T2 day(before the actual delivery),

knowing that it will never be short sold as it will only be a delivery order.

Is my understanding correct , or dere is special preferences with few kind of direct members of the exchange or something similar.

This is true. However, if the seller doesn’t deliver the shares for any reason, it could still be short delivered to you.

what will be the scenario when seller will not deliver, since it will not be a short but a delivery sale which is a long position ,

if its not delivered due to NDSL not working or technical error, i don’t think it will go for auction in that case

second scenario can be he sold me on 1 jan and i sold on jan 2 , but jan 3 was holiday and we both might have to settle the sale on same day after holiday on same date., which is the T2 date for me and the person who sold me one day before will be same

but in that also i will get mine from him

and and give that to the person whom i sold it to.

as he sold me first i think first i will get from him and it will be credited

and then mine will be debited

T+2 is always 2 working days from date of sale/purchase. So in your example, first settlement happens on Jan 4 and the second on Jan 5. Also, technical error are something the exchange will not take into account. If you have sold a share you are expected to deliver it.

Hi,

So that means

if I buy a stock between 3:40-4PM

it will be not be a short sale as short selling is not allowed during that period

and since it will not be a short sale, it will be delivered for sure

and since it will be delivered for sure, i can confidently sell that stock on the T1 or t2 day

is my understanding correct ?

If i place a AMO at Market price instead of limit, will it clear as soon as market opens ?

Yes, provided there’s a counterparty available.

thanks Matti for the helpful response. As per the SEBI Document, stock market does not accept Market orders for new ipo releases in premarket sessions. but in one of the tradingqna posts Nitin mentioned that we can place Market orders for this scenario. Is zerodha doing anything special in the matching process?

Hi Matti, Thank you for your response. Can I place multiple market orders in smaller quantities at 9 AM pre-market time with few seconds in between orders?

Yes, you can.

Did not get answer on Zerodha’s tradingqna, nobody is answering phone at 080-49132020. I am new to Trading and Zerodha. I am planning to buy few thousand SBI Card shares as an investment. I am looking to buy at PreOpen price or at the price of first few ticks on Mar-16. I know this is a large quantity, What options(type of order) do I need to choose through kite and When should I put in the order to satisfy my need? Since this is a big order, I dont want it to be rejected or partially filled. Is it safe to place the order through phone? The sales rep told me to place order online ratherthan through phone.

The best bet is to place a market order on Kite at 9 AM on the 16th. If you aren’t sure of being able to place the order at exactly 9, you can place an AMO. However, either way, execution is entirely dependent on the availability of sellers on the market.

Today I have entered After market order for 10500 PUT at price 30. Order placed successfully but when i checked status of it after market open around 9.30 my order got rejected. Due to which i suffered loss of 4500.

Can you please confirm why my order get rejected on opening of market.

Looking at the 10500 PE, I can see that your order was outside or circuit limits and that’s why it was rejected.

Hi Team,

I have placed AMO BUY on Thursday(20/02), but Friday is NSE holiday(21/02). So, do i need to cancel them or they will be approved on the next NSE open day likely on Monday(24/02). Please suggest.

Thanks,

Parveen

If I place an AMO order for an Option to buy at a value of 100 or less. And if in the opening 5 Min, the price is between 80-95, will Option be purchased for my order or not?

Please inform me how to place an AMO order for any value and lesser than that value in case of buying, or any value and higher than that in case of selling.

Hey Virendra,

in the scenario you’ve provided, the order will go through as a market order as the price is higher than the current market price.

You could use Stoploss order to buy higher, learn here how SL orders work.

Hi,

I want to exploit the Gap-up, if it happens, in Commodity futures Pre-open trading, i.e. before 9:00am

I want to purchase the Commodity futures at previous days’ close & sell it later during Market hours.

Is it possible to purchase at previous days’ close ? If yes, how ?

I understand that Market order will be required in such a scenario.

Please inform what would be the best tool for this type of situation – ”Regular” order , ”Cover order” or ”After Market Order” ?

Also, can I use MIS for more Leverage – or I have to do with NRML only ?

i would like to cancel an amo order placed, for which i am getting an error, NEST gateway closed. Y am i getting the error, how to cancel it before the market opens, as tickets raised will be addressed only next day after market is open which is of no use.

Can I place intraday minilots order in after market order ?

Yes, you can.

If stock is available in demat and goes on Upper Circuit then how can i put Stop loss order incase it go lower again

Eg. Stock in demat at: 50

20% UC now at :60 then how to place order at 58?

You can simply place a limit sell order at 58.

Hi,

I have placed a few orders for which money was deducted. But I could not complete the execution. Fund balance still remains the same. If orders were not executed that means buying didn’t complete. then what happened to the money involved?

The margins are blocked for all open orders. If you cancel the order, the margins are released.

Hello everyone,

I want to know what would be the outcome of the following order cases;

Let’s assume RELIANCE closes at 1200 at end of trading day today.

Now in after market session I will place the following order;

BUY ORDER :

LAST DAY CLOSE – 1200

ENTRY – 1202 (above close)

TARGET – 1205

STOP LOSS – 1197

Now I want to know what happens in the following 4 cases on the next day open;

Case 1 – Opens at 1206 (above target)

Case 2 – Opens at 1203 (above entry and below target)

Case 3 – Opens at 1201 (below entry)

Case 4 – Opens at 1197 (below stop loss)

I would like to know this if AMO order is placed before it gets triggered.

I placed AOM order for the selected trade last night. The order got rejected. What is the reason. Do you have any idea how much I have lost because of the cancellation of this order ? ZERODHA is sometimes very very confusing guys. What you explain in your KB and what happens in actual scenario is really very bad. I booked this lot on 4.90 that should get executed on market opening as per you have written in KB but guess what now the stock has touched 17 but by order got cancelled. God knows. Total loss. YOu are answerable

Hi Prasad. Best raise a ticket on our Support Portal for account-specific queries like this.

why my order automatically cancel at 3:22 pm.?

market timing is 9:15-3:50.

Hey Debabrta, we start our auto square-off process around 3.20 PM and all MIS orders are canceled in that time period. The reason being it takes time to cancel orders for all users.

sir,

During normal session 3.15 AM to 3.30 pm

if we have sold off ALL shares of a company at a profit.

Then….by…….3.30 pm the share prices have crashed….

and……

as we feel the share price can still go up next day.

can we buy those shares in the post trading session from 3.40 pm to 4 pm.

will it be considered as a fresh cash buying without affecting our earlier sell off during normal session.

please clarify.

Does Zerodha allow cash buy in post trading session from 3.40 pm to 4 pm ???

thanking you

Tushar Mody

Hi,

Is there a way i can place order with more validity.

Thanks,

Mohan.

Not right now, but we’re working on this.

Sir please add a feature drag drop to modify a order and view of placed order in charts like fyers trading platform.

It is very useful.

Working on this.

The order placed in CNC is not executed till 3.30pm, will it continue tomorrow?

No, you’ll have to place a fresh order for now. We’re working on creating order types that stay valid longer.

Hi,If i placed AMO @ 200 for a stock that has been closed @ 198 during the day and in next day if in the pre market session if it jumps and opened at 210,whether my order @ 200 will get executed or not????

If it’s a limit order, it’ll wait for the stock to reach 200.

I placed Buy order for pre market session as market-regular order… And i did not get any qty.. After 9.08 this order was automatically converted into limit order… Please tell me why my order was converted?

Hey Haresh Jambucha,

This happens at the exchange level. Unmatched orders in the pre-open are carried over to the normal session. Market orders are carried over as limit orders at the opening price. If the opening price is not discovered, market orders will be carried over at the previous close price. Check out this presentation from NSE on Pre-open for more.

Pre openorders are only market orders?

can we place multiple ”Limit orders” of small quantities of single or different stocks ?

basically if sgx nifty futures showing lower open, placing a low bid limit orders! (not market orders!)

say my Limit orders placed between 9-9.08am nots get filled -will they be carried forward after 9.30am regular trading? or I have to cancel them to realease margin & place fresh orders ?

Hey Christ,

Please refer to this Support article.

Do we get any ROI too?

Hi.. Suppose I purchased 1 lot of SBIN Future for overnight position. Is there any way I can place my SL order today itself so that I don’t have to login tomorrow at 9:15am to put my SL? I mean is there any possible way to put my SL even in overnight position until my position is open?

For now, you can place an SL AMO after markets close. This is valid for 1 day. Longer lived orders are on our list of things to do and will be available in the near future.

Hi NITIN,Can I place a intraday order in between 9:00 AM TO 9:15AM?

Also can I also place bracket order for the same?

Please reply back its urgent

You can place intraday (MIS) orders, but not BO/CO.

I am providing an example. Suppose I placed an AMO-SL for BANKNIFTY 26500PE @ 110. When market opened, it was 33.7. Can I modify it to 34-35 ?

Yes, you can.

Nithin Sir, Suppose I have placed AMO & not execute as market opens. Can I modify the price ?

If I want to buy/sell equity at pre open market price. How can we buy or sell? ie can we put a buy /sell in between 9.10 AM and 9.14 AM

Can we place pre-market orders (between 9 to 9:08 am) for options in zerodha?

I have seen that in angel broking app, we can place orders for options in pre-market (between 9 to 9:08 am)

F&O trading opens at 9.15 AM only. The pre-market session is conducted only for the Equity segment.

You can place an AMO order till 9.10 AM and the orders will be fired to the exchange when F&O starts trading at 9.15 AM

Hi,

Can a F&O order be modified after market?

If it’s an AMO order, yes, it can.

thankyou Zerodha team, many years wasted my valuable time and money with SK(blood sucker), recently i have adopted your trading system,it is very easy , friendly and economical. It motivate meH and change the openion about the sharemarket.

TRUE

I bought 101 Sanguine Media Ltd stocks at rs 1.6 a long time ago. Now the stock price is rs . 25. But now whenever I try to sell that stock it says ’adapter is down’ all the time. Please solve the problem as soon as possible. My Client Id is SS2076.

I want to place order which is not cancelled till executed or which is valid till ’x’ days. Is this possible ?

(Basically don’t want to place the order everyday)

Not right now, but we will be offering this order type soon.

i have placed an amo limit order on thursday but canceled when market open,today my fund balance shows 0 ,how

WHAT HAPPENED TODAY??

IS STOCK MARKET CLOSE ”20 SEPT 2018”.

READ IT LOUD!!

Today I place amo tata motors at Rs 277 & order executed at 9.05am Rs 276. Is it possible

Is there a premarket for commodity, if so how do it work and what is procedure for it thank you

The request for Good Till Cancelled (GTC) / Valid Till Cancelled (VTC) orders has been sticking out for about 6 years now. Not having this is a big handicap. As much as I like Zerodha for its simple interface and low trading fees (among other things) I am considering moving to other platforms that provide GTC/VTC.

Why doesn’t Zerodha have it yet?

Hi

Example :-

Sell – Bank Nifty – Call (LTP = Rs.85) (Hold For the Day)

Can I Place Stop Loss on Rs.95 in AMO for last day hold position, to avoid any big loss.

Is it will work or not??? or is there any other way for the same.

Regards

A.K. Aggarwal

Hi

Example :-

Sell – Bank Nifty – Call (LTP = Rs.85) (Hold For the Day)

Can I Place Stop Loss on Rs.85 in AMO for last day hold position, to avoid any big loss.

Is it will in any case or not???

Regards

A.K. Aggarwal

Correction

Hi

Example :-

Sell – Bank Nifty – Call (LTP = Rs.85) (Hold For the Day)

Can I Place Stop Loss on Rs.95 in AMO for last day hold position, to avoid any big loss.

Is it will or not??? or is there any other way for the same.

Regards

A.K. Aggarwal

So in this case it would sell when it touches 101.9 correct?

In this case of example, if I select CNC-SL & wish to sell my shares at 102. What should I give in Price? and Trigger?

My understanding is I should give 102 in Price. And 101 in Trigger Price, so that it would sell as soon as it reaches Trigger 101 & I would be gaining 1 rs profit ?

Let me know on this please.

If you want to sell at 102, it’s best to give a trigger of 101.90 and price of 102. So the stock would be sold within this range. If you wish to, you can also specify both trigger and price to be 102.

Hello,

For intraday or AMO, Suppose I have 1 share buyed at 100 Rs & current value of a share is 98.

I’ll select CNC – LMT to Sell & put PRICE as 102. What will happen?

Will it sell for 102 or 98. If it waits till it reaches 102, then it is similar to Trigger price is it?

The limit order will stay in the system until the price reaches 102. Only then will it execute. The difference between Limit and SL orders is that limit orders are meant for ’best-price’ execution. This means, if you try to sell below market price, the order would execute at the current market price as that would be a better sell price. SL orders are used to place stoplosses, so would only execute if the trigger is hit.

Hi

I am new….can u please help me in understanding in zerodha

Reliance close at 1000 ,open at 1001 and I want to buy it

Trigger 1002,Target 1010, Stoploss 999

How can i set Trigger,Target and stoploss in AMO order.

Thanks

Amit Gupta

Hi Team,

I have question on CNC. Lets suppose reliance closed price is 800 at 3.30pm. I want to place order at 800 only to buy this share. How can i place it this order which time Morning or evening, what is the best time for this.

Pl suggest

Thanks

Shubham

[…] Pre-market/Post-market/After-market Orders – Z-Connect by … […]

GUIDE ME TO BUY BULK STOCKS SAY FEDERAL BANK, AMBUJA CEMENT, TATASTEEL, SUZALON ENERGY,RCOM FOR 10 LAKHS RUPEES EACH.

Hi,

How does stop loss amo orders work? Will it get placed in the pre market session as limit orders or will it be carried over to normal trading hours? Since prices don’t fluctuate in pre market session how does stop loss amo sell order work or get placed?

Please help me understand this in both the cases given below

A) when stop loss amo trigger price is below pre market equilibrium price.

B) when stop loss amo trigger price is above pre market equilibrium price.

Thank you.

Orders for equity are placed in the pre-market session while those for F&O are placed at 9.15. The orders are just entered on the exchange orderbook and they wait to be triggered.

ARE AMO ORDERS BE TAKEN EVEN ON SATURDAYS AND SUNDAYS ????

Hey Vinod. Yes, they are accepted on weekends.

I am a novice and I tried intraday order by buying and selling just one stock of around 300-400 rupees within 5 minutes. I probably got less than 1 rupee profit. and then again I bought the same stock (quantity 2). I know it sounds risky and stupid perhaps. But how does this affect over all?

Hey Sowmya, you end up paying more in charges. The right thing for you to do is to learn more about the markets before you start trading. You can start investing in mutual funds in the meanwhile on Coin. We run a couple of popular educational initiatives, you can check them out here.

Hello Nithin Kamath

1. I would like know to if I can place buy orders at Rs 10, Rs 8 and Rs 6 assuming that previous day’s close price is Rs 12 and also I would like to place a stop loss order at Rs 4. I would like to know if this is possible using AMO orders. Similarly can I place AMO sell orders at different price levels and place a AMO stop loss order.

2. Assuming that previous day’s close price is Rs 12, I would like to place two separate orders, one is CNC limit buy order at Rs 6 and another is MIS limit sell order at Rs 14 and a MIS stop loss order at Rs 16. I would like to know if this is possible.

3. What happens if the opening price is less than AMO buy order or if opening price is greater than AMO sell order.

4. Is it possible to know or calculate lower circuit or upper circuit and what happens if AMO order placed happens to be below the lower circuit or above the upper circuit.

Thank you.

1. Yes

2. Yes

3. If limit, the order will execute immediately

4. Orders will be rejected if they are outside the circuit limits.

There is no VTC(Valid Till Cancel) like thing in kite. An investor who wants to buy on dips a particular scrip. cann’t place such order. Please introduce it on ZERODHA platform

Sir I wanted to know can I place bracket in premarket session i.e between 9:00 to 9:08

* bracket order

I wanted to trade with aayush on 5/6/18(Today). But it was not opened till 10.25 pm. The same case with water bae also. Why? Do all the companies will not start trade at the same time

I tried to place AMO for Bajaj Finance today. But order is rejected and reason state is ” admin stopped AMO”. Why…?

AMOs can only be placed between 4PM and 9AM, Manu.

I have not seen the feature of converting mis orders to CNC

Kindly embed this feature as we are not able to convert MIS to CNC even if we have surplus funds. This is the biggest Glitch that I have encountered while trading on your mobile application for Android

Just click on the position and select convert. The option has always been available. Check this: https://kite.trade/docs/kite/kite-mobile/#convert-positions

AMO order can be placed in bracket order or not

Hello,

I had placed two AMO orders (BUY TCS @ 3510 & SELL TCS @ 3471.5) for 13 quantities. But when market opens next day both orders have been executed @ 3509.8. I am not able to understand, why my quoted price have not been executed.

hi, i want to trade or take long positions in options. however i work in a factory thus cant carry person computer along during market hours. we do not have access to pi on company laptop.

Additionally, as i observed, not all options/ strikes of a stock are seen in kite. can u pls help me understand how i can trade in options by using kite alone. (note = i couldnt see all option strikes shown for a stock in market watch).

shall appreciate your response by tomorrow

i have placed the order in pre-market session @ 09.01 AM, however it dint get executed and waited for all day, By EOD was cancel, how can i sell i am stuck in Vakarangee,

Please help.

R/Yogender

With stocks like this hitting circuits, you can just place orders and wait.

Hi

Is there any option like good for 30 days or 60 days to buy or sell with a target price?

SIr, if I placed a one order on pre market session what price the order will placed?… For example If reliance closed on 800rs on 26/04/2018 , can i get my order for the same price on 27/04/2018 in pre-market session?…If not what is the possible way to do ???

The pre-market session is where a price is discovered. You can place an order at any price and if there’s a counter order for the same price and quantity, it’ll be filled. Read more here.

Can i place a market order (day validity) after pre-open market closes and before normal market opens (between 9:08AM and 9:15AM)

No, you will have to wait for the markets to open.

Hi How to buy and hold stock in zerodha for long term.I am not big fan of Intraday trading & hence i want to buy and hold for long term and sell as per my convenience.

Hello,

In the case i place an buy AMO (after market order) at the price of Rs 345 the

previous evening and there is a gap up opening from Rs 280 to Rs 370.

Is there a chance of my order being executed.

Kindly clarify and thank you for the same.

Can I place stoploss market order with OCO in pre-market session? Say closing price of SBI is 287. I want to buy it at market price only if it reaches 288, with target points of 2 Rs. and stoploss point of 1 rupee. Is this possible in premarket session? (9.00 to 9.08 a.m. I suppose)

Only market and limit orders are allowed in the pre-market session, Umesh.

What are the extra charges associated with pre, post and after market orders?

No extra charges. 🙂

I want to exit from a script as soon as possible.The last few days it is in lower circuit.

Which one is the best option to execute on zerodha : AMO, Pre-Market Order or Regular-Market order?

Please guide

You can place an AMO, but in such cases, there is no guarantee of getting a fill.

Can we place a BO or a limit order order once pre-open market is closed but before 9:15?

No, you can’t place orders at this time.

Sir Good Morning. How to exit(sell) a stock which is continuously locked lower circuit level ?

Do you have Good till cancelled or Valid till cancelled type orders for investors?

Its really a very good feature other brokerage houses such as ICICI Direct has.

Its mainly useful for implementing auto profit booking for investors,

once you do that, I’ll ask for stop loss orders for Investors 🙂

Can you please consider this?

Yes, these long-standing order types are on our list of things to do Kiran.

please provide notification tone in mobile for kite apps if order executed.

This is on our list of things to do Abhishek.

I purchased a share today. How do I place a permanent stop loss and target order?

Hey Ritesh. The exchange flushes all pending orders at the end of the day. You’ll have to place these orders each day for now. We’re working on building long-standing orders that will be valid for a longer period.

if I place an order during pre-market order or buy as soon as the market opens. which will be faster?

Can we convert MIS to CNC and CNC to MIS orders?

Why there is no option to place future orders on equity? We have to place limit orders on daily basis and if the limit is not reached it cancels at the end of day. I want to place future order so that whenever it reaches that price it should automatically execute the order.

Sir , I have following questions…

1. Can I place MIS-CO-Market order in pre market session?

2. Can I place MIS-AMO-SLM order in AMO market session?

Hey Yuvraj.

1. CO orders aren’t allowed in the pre-market session. Only limit and market orders are allowed.

2. Yes, you can place MIS SLM AMO orders in off-market hours.

thank you for your guidance.

Thanks Mr Matti for yur prompt reply.

Your Q&A terminals are very impressive & quite exhaustive and many thanks for your patience in giving awesome answers to n number of customers.However I also need a small valuable advice on these AMO’s and Pre-market orders session.

AA)Yesterday(09/02/2018) I have shorted one futures stock on NRML basis and end up with a small loss as per the closing price shown at the end of the day but did not square off.But expecting a huge break-up of the price on this stock on the next trading day and to avoid this huge loss ,can I place SL-M buy order(AMO)or Pre-market order? Or any other better suggestion to prevent this huge loss followed by the expected break-up of price?

BB)On the other way ,If such a huge break-down of the price occurs on this particular stock on the next trading day contrary to my expectation,ofcourse I will be benefitted with the presesent situation.But by placing the above mentioned SL-M buy order,will it by any chance triggers even in the case of break down also?

Need your valuable advice at the earliest possible please

Hey Narasimhan,

A. You can only place and AMO order in this case as derivatives don’t trade pre-market. This SLM AMO order will act as a stoploss that would square off your position if there’s a move adverse to your view of the market.

B. No, in such case, the order remains open and will wait for the price to rice to the trigger level to be executed.

Hey,

I placed 3 AMO sell orders (of stocks I already own) today morning around 8.30. Status was “AMO REQ RECEIVED”. Then at 9:00 am following message appears “Due to technical reasons your aftermarket orders (AMO) won’t be placed today. Please place your order once again after markets open.” Now after so many hours the order book still shows status “AMO REQ RECEIVED”. I cannot modify or cancel, nor are they auto cancelled. Also, it shows zero in my holdings, so I cannot even trade for those stocks, what to do now ?? How would they be cancelled? Also, the limit has exceeded for them now so I don’t want to sell for low prices.

Pl. enable basket orders option at single click in Kite Platform also as available in NEST. Thanks.

This is on our list of things to do.

I will get out of Zerodha….

Sir I am selling my shares in AMO in market order….

It is automatically converted into Limit Order….

Please help me to solve this problem…

Hello Nitin Sir…..

I have to sell my shares…..

I have applied in AMO but my shares are not sold on next morning….

I am in urgent requirement in selling shares because it is continuously hotting lower circuit….

Please help me to sell my shares….

Its Urgent… Nitin Sir..

If there are buyers available, your order would go through. I’m afraid you’ll have to wait for a buyer. If the stock is hitting lower circuits, this means that the liquidity is quite low and so execution is not guaranteed.

Sir It is Urgent I want to sell my shares any how…..

Suppose I cancel my AMO order immediately on friday night, when will I get my money back ?

After the market open on Monday ?

Is there an option to place orders and the order validity is till the user cancels it or executes itself after fulfilling.

For example: I want to sell the share ABC when it reaches Rs100 currently its Rs45, to reach Rs100 it might take several months so I can place the order open now, executes itself at Rs100 after several months?

Not as of now Giri, but we are working on this.

I think that’s going to be a great feature if you ask me, which can hold good for buying and selling both.. And obviously I believe you let it know everybody when you have this feature/option 😉 ..

Good Luck !!

Dear Team,

is it possible to place After Market Order in MIS with SL or SL-M using Zerodha Kite APP?

Yes, you can.

I am not able to place AMO. The error ”the request not registered” appears. please advice

regds

I too get this error sometimes, especially in the nights after 12. You will also notice that you cannot login into Pi with a ”no response from server” error. Try after some time…

We run a daily maintenance process on our servers post-midnight, at which time the platforms are inaccessible.

Hi,

Can I place AMO order for SME shares? There is no concept of Pre-market session for SME shares and market opens at 9:15am.

If yes, how much time it will take actually to send order to Exchange; less than 30 seconds or more than 30 seconds?

Regards

Hello,

I am a beginner in the field of stock market, I have been through Zerodha varsity, but still there is a doubt, suppose a hypothetical situation where Nifty 50 Jan fut is closed today at 10641 and tomorrow it opens directly at 10700 so there is a difference of 59 points ( max profit 59*75 =4425) and I want to trade tomorrow with intraday approach . My question is ,if it is really possible to get this profit in a day then what type of order should I place and at what time? Thank you. Zerodha Rocks.

i can’t get one thing when stock price is suddenly gets fall down ( i.e it comes 500–>490–>480–>450) At this time every body it trying to shell their shock then who are the buyer at this moment.

same Reversly

it stock price is suddnly getting up (i.e 450–>480–>500). When every body want to buy and a person who has already buyed they keep holding. so who are the seller at this time..

Can you plz guide me…Since 6-8 month i have started with zerodha…if i place any order in amo…I’m not getting Exchange Order ID & time exactly at 9.00.00am. It take delivery on 9.00.32 or 9.00.48 seconds….Any i had never seen my number come first in buy or selling….of any of script…What to do…How will i get exchange order id & time exactly on pre-market timing 9.00.00am..

Awaiting for your revert..

Hi

I purchased 30 quantities of idea at 105.05 on Thursday and sold them at 117.15 on Friday to book the profit. I repurchased the 50 quantity at a price of 115.20 on Friday. In my P&L section its showing a profit of only Rs.30 , profit on the 50 quantity . When the profit on the 30 quantity which i bought on Thursday will be reflected?

Thanks

Aadhar

What happen if I can’t squre off my future position on exipirty date ???

As we trade on cnx nify futures of any particular month, can we trade on normal nifty 50 index

Jay Bharat

I have trading account in zerodha

Sir,

My question related to Pre Opening of market is

1) Can we place post closing order between 3:40 to 4:00 pm in ZERODHA

2) If I place AMO order at 8:00 pm.(For Example TATA Steel) I put After market order of CNC to buy at Price of Rs 835. Now Previous close price is 830 and next day at 9:15 am Opening price is Rs 840. So at opening of market will my order will execute ??

3) Will it execute before 9:15 ??

4) Is our After market order is automatically converted in to Pre open order at 9:00 am ?

5) Or we have to put Pre open order only between 9:00 to 9:07 am ?

6) Can i see my pre market executed order in my order book before 9:15 am ?

7) All above case are for both CNC and MIS

Hi,

Have been trying from past few days to place an order in pre opening session but the order is not getting executed. Please guide as to how to place an order in pre opening session. Thanks in advance.

In the pre-open session, there is no way to guarantee execution, you can only place a market or limit order and wait to see if it goes through.

1. What is SEBI listing obligations & disclosure requirements….Means…????

2. When a company get delisted from stock exchange…After Meeting of board of director done.

3. How to prepare ourself by lossing our money from stock market…..Before delisting of any company.

Dear Sir ,

Kindly clarify whether I can place disclosed quantity in after market orders.

No, disclosed quantity cannot be used for AMOs.

i want to hold stocks for 1 or 2 years so how would i do purchase stocks..???

Just place a CNC buy order.

dear sir,

my question is can we take leverage and trade in pre market and sell in post market.

I’m afraid not.

Hello Team,

I wish to migrate to Zerodha from another DP.

How can I do that. Is there a smooth way to that.

Regards,

Shashank Aggarwal

Yes, you can. Check out this post.

Hello sir,

I am sjvenkatesan i need more than 5 page in market watch list kite.. its is possible .? Compare to other trading platform zerodha have limited market watch list page upto 5 , at the same time we can’t add market watch title on your given 1 to 5 pages. Kindly please add multiple page options. Its really very useful.

Thanks,

SJ Venkatesan

When will you guys enable After Market Stoploss order, now AMO can only be placed as a limit order, I am asking this for a very very long time

Hi Nithin,

I had a query related to the Futures & Options segment. If I have an open position in commodity futures, I know I can place a SL order for the same but I want to know whether I can place a limit order as a target for the same open position? I am holding the position overnight. Probably for a few days even. Will the limit order be executed as a target order for the open position I have or will it open a fresh position?

Would appreciate your help. Thanks.

~Abudhar al Hassan.

You can place a Limit order. But if the target executes, make sure you cancel the stoploss order to prevent opening another position.

why don’t show the total cost of order in your equity order box? If I type the quantity, you do show ”Stock price” x ”quantity” in the blue header. But there is no value for that multiplication.

We’ve tried to keep the platform as lean as possible. This is something that is quite a straight-forward calculation and was left out in the interest of speed. Will talk to the team and see if it’s possible to display.

i am new in trading, please suggest if i buy or sell one stock around 20 times in same day, then brokerage charge for total value of one share or charge one by one buy and sale value

Rakesh, the brokerage is charged per order. So if you execute 5 buy orders and 5 sell orders, you’ll be charged for the ten orders, irrespective of whether this was for the same stock or different stocks.

How can my order can be first order in the market?..This I am asking ’cause few shares with very low volume & very high demand do executed on daily basis. However, though I am placing AMO order, It’s not get executed since I am not the first one to place an order. Is there any method in kite so that probability of my order to be first in the market increases.

No way to guarantee that, I’m afraid.

Sir,

I have query regarding pre-open market trading.

At which price, I could place an order?

If I place order during pre-open session, can I sell on same day(Intra-Day)?

Regards,

M.Maheshwari.

At what price you place an order in the pre-market session is your choice, really. You can only place Market or Limit orders though. Yes, you can place intraday exit orders for these positions.

At what price AMO sell order is processed.

If you’ve placed a market order, it is executed at the best available price one the markets open. This need not be the open price you see on the market depth as there are a lot of orders that hit the exchange as soon as markets open. Whenever your order is queued in, it’ll execute at the price available then. For limit and SL orders, you define the price. If you’ve defined limit price below whatever the market opens at, it’ll execute at the market price.

sir

I want to know if i placed order in equity during PMO , order will be placed on that day limit or can i put a limit of buying and selling then place it

Hey Dilip, you can place a limit order in the pre-market session. If your order is not filled in this session, it is automatically carried forward to the normal trading session.

(i)What’s the DP charge showing

in ledger?

(ii)How DP charges calculated ?

Akhil, check this post out.

Target: To get a buy into the pre-opening market at market price for a particular derivative

Question: Which one is better? AMO placed at 1615 hrs. OR Placing the same order at 09:01 am?

Kindly clarify..

Derivatives aren’t traded in the pre-open session. An AMO placed after market would execute at 9:15. You’d have better chances with placing a market order at 9:15 though.

can i place mis order in pre open market order?

Yes, you can.

how to pre-trace any company equity share are going to be suspended by sebi in bse or nse…

There is no way to know in advance. You can keep track of the announcements on BSE and NSE circulars page.

what does quarterly board of meeting means….is related with BSE or NSE to stop the trading in stock exchange or any other idea….

Is leverage provided on AMO orders as well. Kindly guide.

Vatandeep, leverage is provided only for intraday, so no.

how can i buy using kite in pre market trade.

which one is better AMO or pre market orders.

Are there any options like GTD in sharekhan.( ie. can we place an order which is valid till a particular date?)

Can AMO order be cancelled during market hour.

If you have placed an AMO for the next day today then you can.

Can we a buy a stock of type regular after market hours without using AMO in kite?

Dinesh, the post-market session or closing session is open from 3:40 PM to 4:00 PM. During this session, you can place buy/sell orders in equity delivery segment using the CNC orders.

RESPECTED NITHIN KAMATHJI, I SHALL BE HIGHLY THANKFUL AND WILL BE IN THE INTEREST OF INVESTORS IF YOU KINDLY START THE MARKET TIPS FOR EQUITY MARKET AS I AM ALWAYS OBSERVING YOUR FRIENDLY AND PROPER GUIDANCE TO THE INVESTORS LIKE US.

Ravikant, at Zerodha we’ve always believed in educating traders and investors. You can check out our educational initiatives here.

what does the message adapter is down mean ?

How can I place pre-market order through Zerodha ?

Debjyoti, the pre-market session is open between 9:00 AM and 9:08 AM, you can place orders during that period.

I tried to place a AMO stoploss order, but it got rejected and I got a message ”cannot store amo orders.order type cannot be sl or sl-m”, last month you guys told that you are activating the amo sl or sl-m order but till now it is not available. Please activate it .

Debkrishna, we are working on it and you should be able to place SL/SL-M AMOs soon.

Can I place buy/sell order for OPTIONS between 9 am and 9.05 am ? and can I modify/cancel the order before 9.08 am? when and how will I know wheather the order has got executed or not ?

thanks

Yes, you can place AMO orders. You can place, modify and cancel orders for F&O till 9.10 AM. All AMO orders will be sent to the exchange at 9.15 since there is no pre-market for F&O. You can keep track of your orders from your orderbook.

can we place AMO for currency futures

Yea.

Sir,If i placed buy order xyz share with order type CNC in AMO and suppose it gets executed at 9:16 can i take delivary of that stock ?or do i need to square off before 3:20?

You can either sell it intraday or take delivery.

I opened only trading ac. Can I see the nifty index open.high.loww.inthe MarketWatch

Which indicator is best in renko chart and box size.

Thanks

Valliappan

With only trading, you can’t see index. You will be able to see F&O contracts only. If you have any other demat account, email that to us. Our team will have that mapped.

Nithin,

When Gtc: Good till cancel order will be available.

Savita, on our list of things to do but will take time.

How to calculate margin for AMO ?

Not for futures.

I want to buy suppose IDEA stock at 79 today after 4 PM, let say 1000 stock.

Will my order get executed on 9:15 AM next day as i don’t have 79000 Funds in my account. Assume market opens next day at 79.

I know if it opens at 80, my order will be in pending mode.

Just a confusion about AMO margin.

Margin for AMO and normal market are the same. You can use this calculator: https://zerodha.com/margin-calculator/Equity/

If i order to buy NBCC share at 9:01.at that time its price is 210.30 so when the order will executed? And which price?

all orders are collected and matched at 9.07 am in premarket. If your limit price there is an offer it gets at that price, otherwise the order will continue to be open when the normal market opens.

Sir.. That means if i place market price order.So that order will executed that price which will shown at 9:07 am.Is it true sir?

Pls tell me..

Yes. But this is only if equilibrium price is found during premarket by the exchange. Otherwise, the order will continue to normal market.

Sir…I wont to open my demat account in ZERODHA.but i am 17 year old. I have my PAN CARD.but in pan card it show that i am minor.. Will i open demat account in zerodha? If not let me suggest when i will abale to open my account?

Ah no Nirmal, you have to be 18 first.

Sir.. In pre market which order that i will place? AMO or REGULAR

Regular

Hi Nithin,

I want to know that, if i search any share in kite. Two option displayed, for example i search for reliance, it will show Reliance-Be and Reliance-Bl what is that??

Check this answer.

Sir.. Can i buy equity share in pre open market session?

Yeah

Is it use for intraday trading?

Yeah, once something is bought in premarket it can be sold once normal market opens. But within premarket, u can’t buy and sell.

How i placed pre-market order for equity?

Place an order as AMO or between 9 am to 9.07 am, it automatically is placed in premarket.

Sir,

i want to put a buy order at 9 am for a particular stock. at that time can i know at what price it will open.

Opening price will get determined when market starts at 9.15 am.

I have tried to sell the stock at limit price of triveni engg at 88 rs in amo. The previous day closing price of triveni engg was 90 rs. So next day triveni engg opened with gap up opening around 93rs and still my order get executed even though I place sell limit order 88 rs. Kindly explain

If you place a normal sell order with price lesser than market price, it will get executed at market when it opens. To place Stoploss orders, check this video.

Sir, I would like to know more about CNC trading 1. Is it possible to sell the stock on T+1 and after some time the stock price goes down so again purchase the same stock and same quantity to keep in the holding. is it possible to do the same thing for the stock which are in demat account that means after T+2. From where i will get more knowledge about this/ please guide me.

Yes, possible to do both without affecting your holding.

Those pre market details are available in NSE india website. If the pre market data is bullish, does that mean the market will also be bullish?

Thank you

That’s a question we’ll refrain from answering, on purpose 🙂

Today the pre-market seems bullish. Market opened gap up but it went down steadily.

Confused in AMO

SBIN Currently at 279 in Kite left side market watch (Actually at 278.70 by NSE), 278.94 in Chart and many different reading in chart by different time frame.. Now i want to place AMO for buy as well as sell. Three different values

Buy : 279.70

SLM : 277.25

Buy Exit at 280.70

Sell : 277.20

SLM: 279.80

Sell Exit : 276.20

Query

How many orders will be executed(expect opening price will be between 278-279)

1. If market goes to 281 uptrend, it will reach 277.70(Buy) then it will reach 277.80(SL for sell)…this means i gain 10 paise profit ?

after market reverse

2. What if market goes down and hit SL for buy which is at 277.25 or it will execute my sell order which is at 277.20

I just want to book trade of previous day(OHLC) calculation on AMO. With stop loss of both the way, either uptrend or downtrend.

How many AMO order i have to place ?

Which order is priority AMO or Pre Market which will get executed first? Is it like AMO will be executed only @9:15 or after as compared to Pre Market which gets executed @ 9:00 to 9:08 AM.

All AMO’s are placed at 9 am itself in the premarket. So when market opens, they have the highest priority. If you place a market order at open, it will have lower priority.

Can AMO orders be cancelled?

Yes they can.

sir, please provide guidance regarding hoe to place short sell order.

Your regards.

thanks,

You just have to chose MIS and sell. Why don’t you go through the video playlist here.

Is AMO applicable to limit losses on outstanding FnO positions.

If yes, what will be validity of such SL trigger order?

Thanks!

You can’t place SL AMO orders.

Dear Nitin,

Many other online trading platforms offer a concept of ”Good till Cancel” order. In this case the order stays valid till the date mentioned by the investor. The date can be 365 days from today’s date and works for both buy & sell orders. The order is executed as soon as the price is hit.

Is there any particular reason this is not present in Zerodha platform? Please include it, this is very useful for long term investors.

Currently the Equity Exchanges don’t support GTC orders, brokers who are providing you this facility are using a very hacky way, something we aren’t comfortable doing. We’ll let you know once this facility is out.

When you guys are enabling AMO SL order which is very useful, currently only AMO limit order can be placed . Can you give us any timeframe within which you are enabling this feature.

Hopefully in the next 3 to 4 weeks.

Is there any premarket or post market sessions for Nifty options? or for that matter any derivative instruments?

No pre/post for derivatives.

Hi,

Can I get scrip-wise, date wise details of all my trade in excel which shows details of brokerage, STT, GST, Turnover tax etc. (scrip-wise, date-wise) for a particular period as I get from another brokers.

Thanks and Regards

Ravi Kumar Chona

Login to q.zerodha.com and click on tax P&L under reports.

Respected Sir,

In Zerodha there is no Graph chart for 5hr duration …

after 1hr it shows directly for 1day …??

Sir,

5hr graph is very vital … Please Provide the same at the earliest…

Thank You

Arvind

I buy 3500 share of dwekar ind but now i can’t sell it my order is always pending there is only sell in this stock wt can i do no.call trade phone no i want.

Ravi, the stock is hitting circuit down then. There is no way to sell such a stock if there are no buyers.

What is soluti for this stock now what can i do any futures for this stock

These kinds of stocks are not allowed trading on futures an options. Nothing much you can do.

My money gone for this stock i thing

Hello Sir,

You have provided almost all types Orders, But the GTC Type Order whose validity will be till the expiry date, is not available with you, for the investor type, positional trader, this is a very convenient and helpful Order type, i have found this with every other broker i have experienced … Please consider this and please provide this at the

earliest ..

For positional traders GTC Stop Loss Orders is very vital, to protect your clients during Gap Up and Gap down Openings

Sir On Realizing its importance , Zerodha does not look complete without it …

Sir,

Awaiting your positive Response

Thank You for Your Support and Cooperation …

Yours

Arvind

Yes Arvind, we are trying to get this enabled.

Thank You Very Much Sir,

Your’s will be the BEST Platform Around …..

All the Best …

Thank’s Once Again …

That was exactly what i was searcing for also..

would be great if zerodha added that feature also

Hi,

I have a query on the way orders are squared off in MIS.

In case the square-off order is not executed at the end of the trading session, how is it handled?

For example, if a BUY MIS order was executed during the trading session, but the SELL order did not get executed at the end of the day, how are these shares handled?

Does the user have to bear any additional charges?

Thanks

The onus of squaring off position vests entirely on you, as a broker we’re only facilitating squaring off of MIS orders. In the eventuality, the position could not be squared off for whatsoever reason, you’ll have to bear the costs that come along with it.

Hello sir,

I have few doubts:

1) What is the purpose of ”disclosed quantity” option in buy/sell window??

2) At what time the AMO are sent to market at 0900 or after 0915??

3) Could you please elaborate actually what is cooked up between 0900 and 0915??

4) What I understood is we can not place BO &CO premarket session, only place simple limit order will I get leverage for the same or not??

From your point of view How can we make best use of pre-market session??

SUGGESTION:-In kite it will be useful, if you provide an option to name the market watch instead of numbering them 1,2,3….etc

Regards

1. Check this.

2. Equity orders at 9am and F&O at 9.15

3. Explained in the post above.

4. Yes. Pre-market isnt’ really meant for trading, it essentially put to reduce the volatility at the market open.

Want to know about Validity in Order placement. Can we use VDT option while trading in Cash??

Not currently.

Please tell me, can I used AMO order to put stoploss in equity after 4 pm to 8.59 am.

Does NSE have the historical data of Pre-open market sessions ?

No

Hello Nithin Sir, I was wondering why a concept of short selling in cash segment more than intraday is totally lacking in India..

In USA, traders can short stock in cash segment by holding the short position for more than one day by borrowing equity shares from their brokers at some interest charges. Some US brokers who provide this are THINKORSWIM , ETRADE , INTERACTIVE BROKERS etc.

Is it possible to bring this concept in India?

That would be awesome if that can happen..

please reply…

Rajat, for this concept to come through, we need to have a vibrant Stock lending and borrowing mechanism. This is not popular in India currently, but SEBI is trying. Check this.

Thanx for your quick response, sir.

I checked the link It says that only those stocks can be borrowed and lent which have futures and options. does it mean others stock can not be borrowed and lent?

I have demat acc with Zerodha. How can I apply for SLB through zerodha?

Yeah, currently SLB is available only for F&O stocks. There is no liquidity in the SLB market, so no activity as such currently. Check this.

When suppose to expect the rupees refund process from exchange if any company stock has been suspended…

hmm..there is no concept of refund if a stock is suspended.

If I may! Can you explain me about pre market order? Like if I buy a share b/w 9:00 to 9:08 and it was previously closed at for eg. 800 and opening price starts at 820 so will I book that profit? Or it will start at opening price and can I trade it in MIS or it will be traded in CNC

It is explained in detail on the post above. Check the video on AMO here. B/w 9 to 9.07, you can just place orders, no trades will happen. Order matching happens after that.

Sir as Harsh Sharma asked earlier my question is same ; that if I place bracket order in the pre market session with a limit price of 801 when a stock previously closed at 800 then if market opens at 820 then can I book that profit or not? if not then what will happen to my buy order. will it be cancelled or not?

and also if I place a selling Bracket order at 780 during pre market session and market opens at 790 then what what will happen ? will my order be executed at the lower price of 780and I have to take loss of 10 rupees or if when price will reach to 780 then my order is executed? Please explain ..

In premarket brackets are not allowed. It will get rejected.

but if only limit order is allowed then can I place both stoploss limit order and buy or sell limit order simultaneously in pre market session? if yes then on the above situation i’e” if I place limit order in the pre market session with a limit price of 801 when a stock previously closed at 800 then if market opens at 820 then can I book that profit or not? if not then what will happen to my buy order. will it be cancelled or not?

and also if I place a selling limit order at 780 during pre market session and market opens at 790 then what what will happen ? will my order be executed at the lower price of 780and I have to take loss of 10 rupees or if when price will reach to 780 then my order is executed? Please explain ..

Vikas, SL orders are not possible in premarket. Since exchanges don’t allow setting of triggers in premarket session.

If you place a limit to sell at 780, the order gets collected and matching can happen at 780 itsef and execute after 9.07am. It won’t wait till 9.15 am for market to open for trade to be executed.

Sir one last question.. 🙁

is margin order is allowed in pre-market session or not? and if place a limit buy order at 20 and market opens at 25 then what will happen to my order, will my order be cancelled ?

and also ”Thank you Sooo much ” for very quick response and clearing my doubts… which were stopping me to trade… Thank you again.. 🙂

Yes margin orders allowed. If market opens at 25, your limit buy at 20 becomes pending. 🙂

when can i expect the gtc order to be available.

That will be really helpful.

Will take more time.

How do I placed ”stop market order” or ”stop limit order ” for entry in KITE. e.g. if price is at 100 and i want my buy order to be executed as soon as any trade occurs at 101 not before that.

Check the video on stoploss here.

Can AMO orders placed in Basket ??

No

After placing order in AMO will it be available for preopning session.

I want to place order exactly at 9:00 AM.

You can manually place it at 9.00 am.

Check this answer Preet. Bonus shares can take upto 2 weeks to be credited. Until the new stocks get credited, the P&L wont’ show right.

Hi, if i buy a stock in F&O Normal Mode between 3:25 To 3:30 PM.. how can sell that on next day at open price . can i place AMO sell Market order, is it execute at open price once market opens.

kindle advice

Yes you can place AMO. But AMO is like a market order placed when market opens. So no guarantee that you will get the bestopening price.

I am new to trading and have recently open account in Zerodha. I have downloaded kite on mobile and also using kite web but i dont get any link for downloading Pi desktop version. Please help. My ID is ZI9562.

Also please advise, in case of any problem in ordering to whom should i contact for quick resolution during market hours?

Check this link: https://zerodha.com/z-connect/category/tradezerodha/pi-tradezerodha, explains all about Pi. You can call 080-40402020 for this.

Today morning, I gave limit order to buy federal bank call option. Even though limit price was reached trade didn’t get executed. And after some time, call option price went up before my eyes. I was disappointed. Is it that AMO orders are first executed? Please let me know so that I can trade effectively.