It’s the economy, stupid! Who pays the biggest phone bill?

KEY TAKEAWAYS

- Wireless telecom is on track for its biggest year since 2017 – having added 8.5 million customers between January and April.

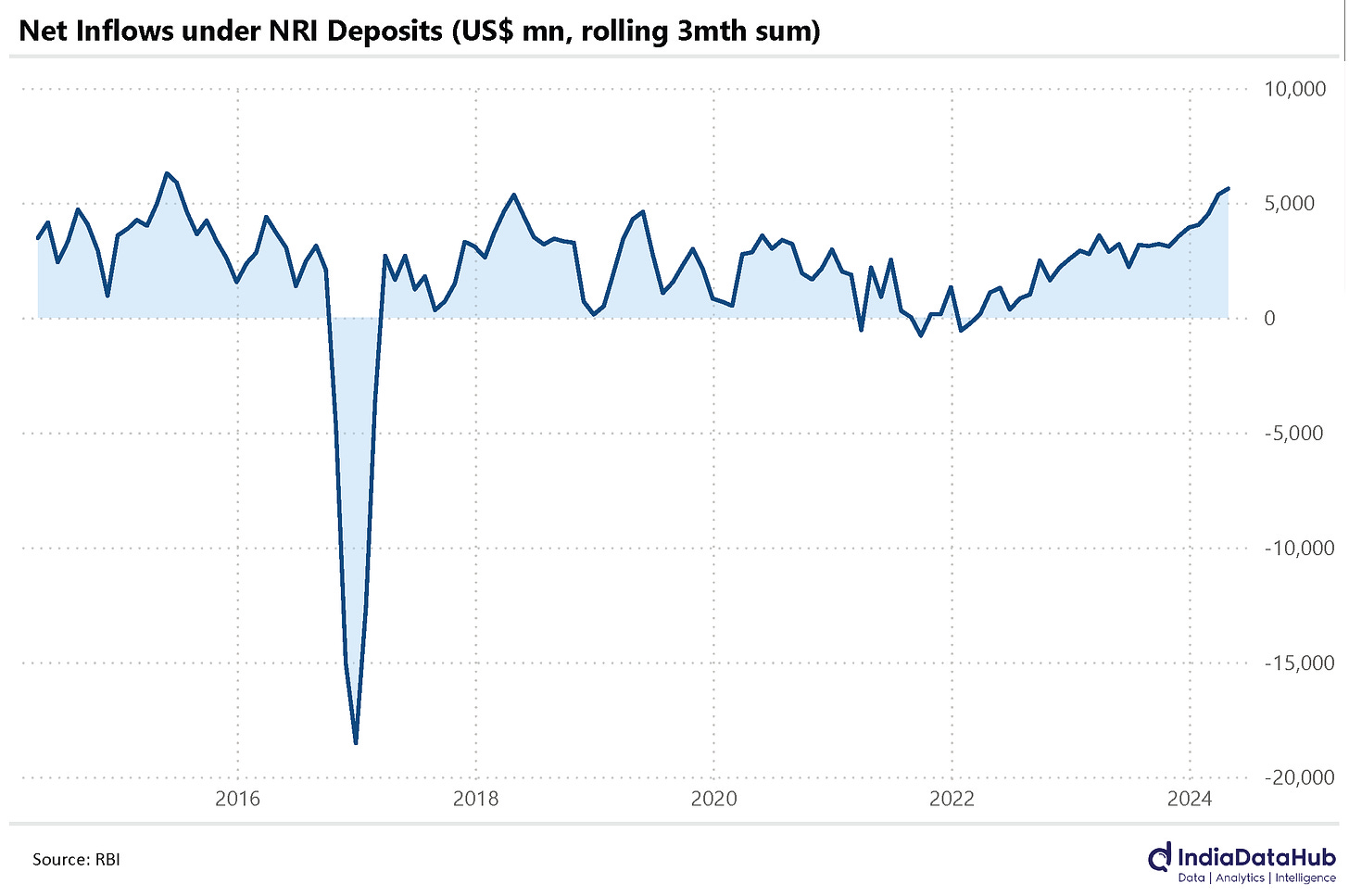

- NRIs deposited over $1 bn in Indian banks in April – the third month with billion-plus deposits.

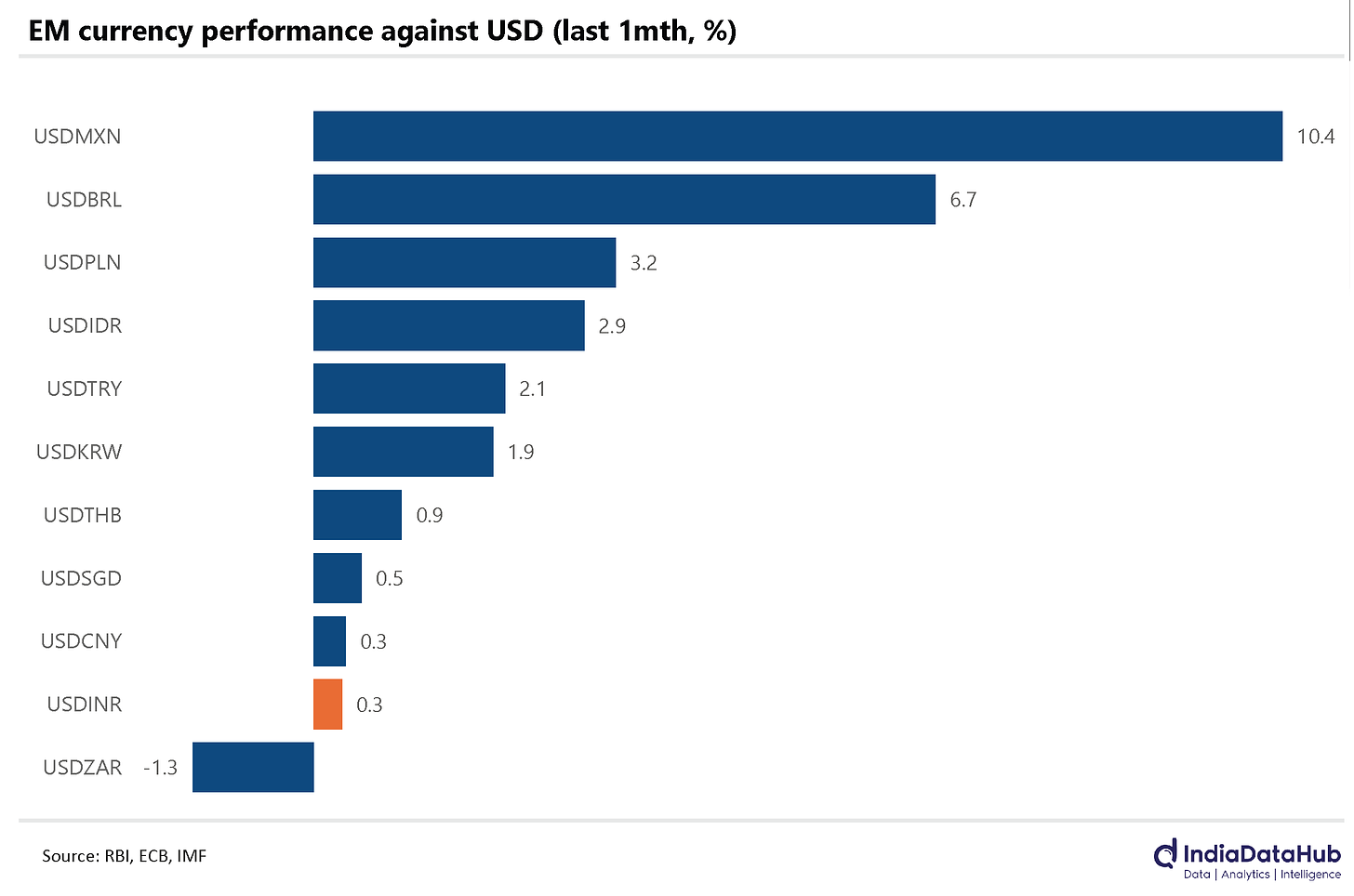

- The Rupee has performed better, vis-a-vis the US Dollar, than most emerging market currencies – depreciating by 0.3% in the last month.

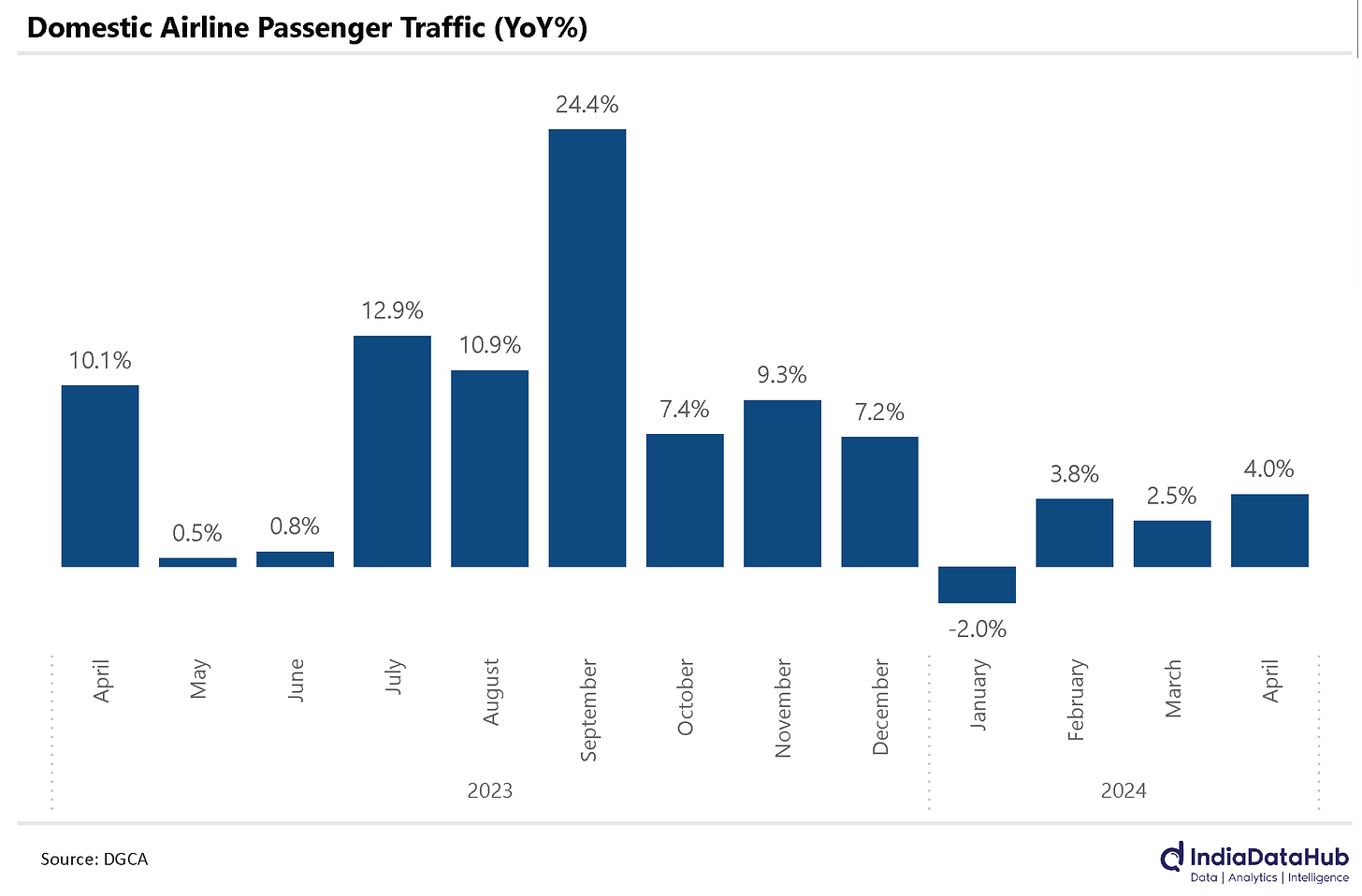

- Domestic aviation saw a weak May – with a falling PLF, and passenger growth falling to 4%.

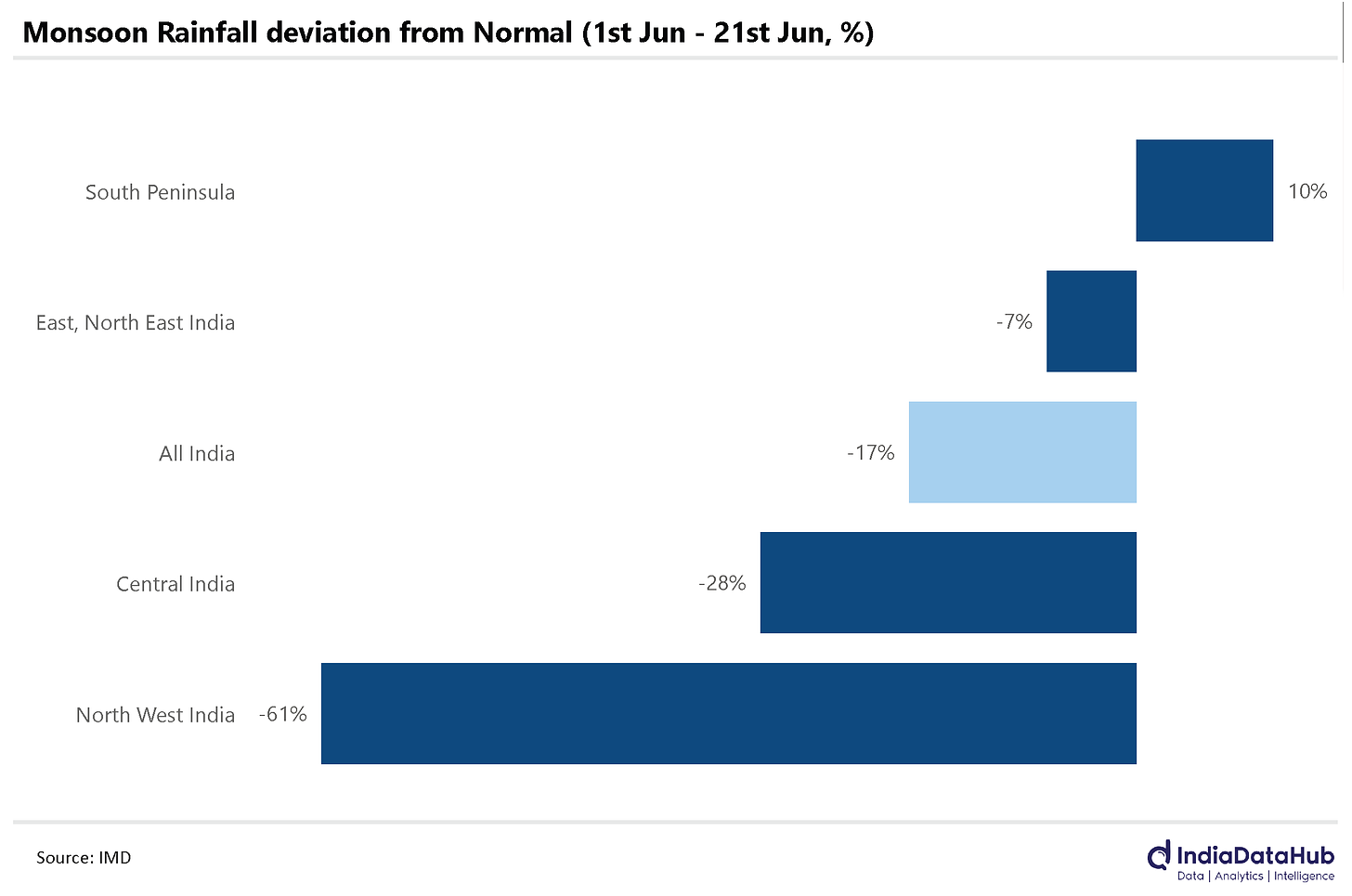

- Despite predictions of a higher-than-average monsoon, India is currently at a 17% monsoon deficit.

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

A new wireless explosion

Remember how mobile phones had sky-rocketed back in 2017? Jio had just entered the market, making the mother of all splashes — a premium mobile service that stayed free for a year. People flocked to the new service, which hit 160 million customers within 16 months of launching. Established players bled customers to the new behemoth, slashing rates to keep up. The price of 4G data fell to half of what it was before. This made data affordable to most Indians, changing the country’s relationship with the internet forever. Most players couldn’t keep up with the sudden intensity of the competition, either dropping off or selling their businesses away.

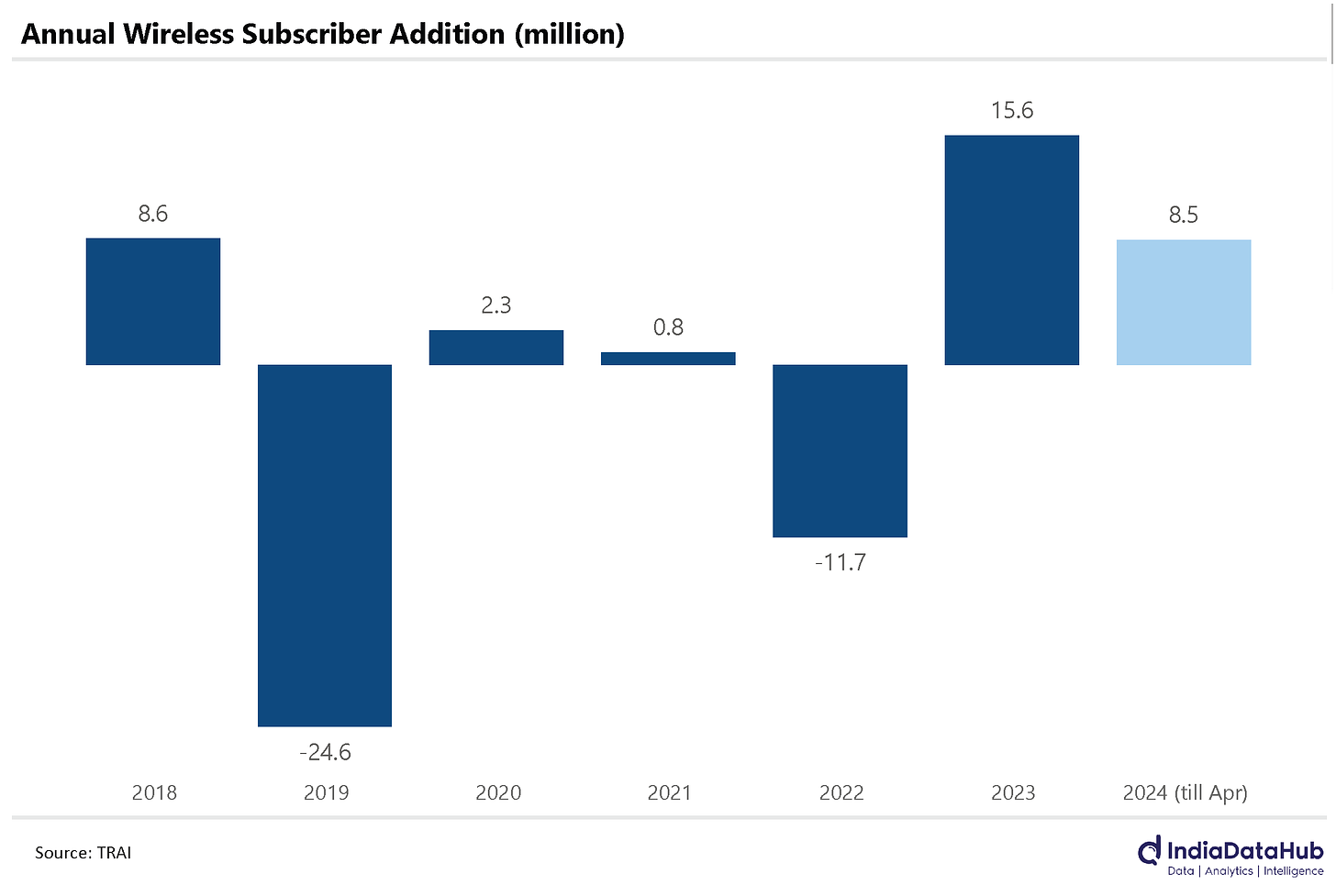

Here’s a fun fact: right now, wireless telecom is on track to have its biggest year since 2017.

April marks the twelfth straight month that wireless operators have added new subscribers. Between January and April this year, the industry added 8.4 million new subscribers. For context, they added a total of 15.6 million subscribers in entirety of 2023.

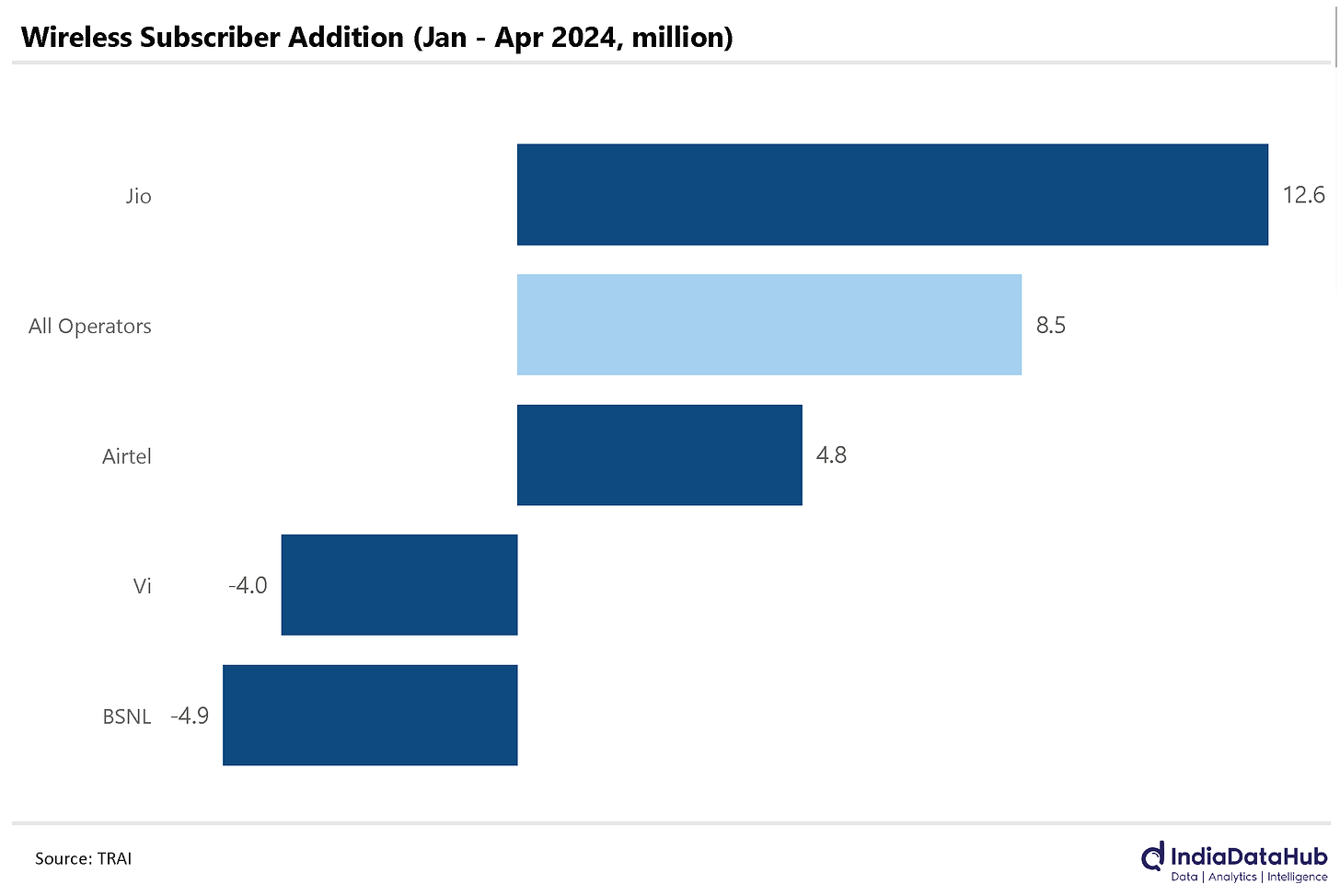

Jio leads the pack for the year with 12.6 million new subscribers. Airtel comes in second, with 4.8 million new subscribers. Together, they have added twice the number of subscribers as the entire industry.

How is that even possible, though? Well, it’s because not everybody has been adding subscribers — some are actively losing them. Vodafone-Idea lost 4 million subscribers in the first four months of this year. This is the 37th month in a row that its subscriber base has fallen — an overall loss of 64 million customers, or a quarter of its former customer base. BSNL, meanwhile, lost almost 5 million subscribers in April.

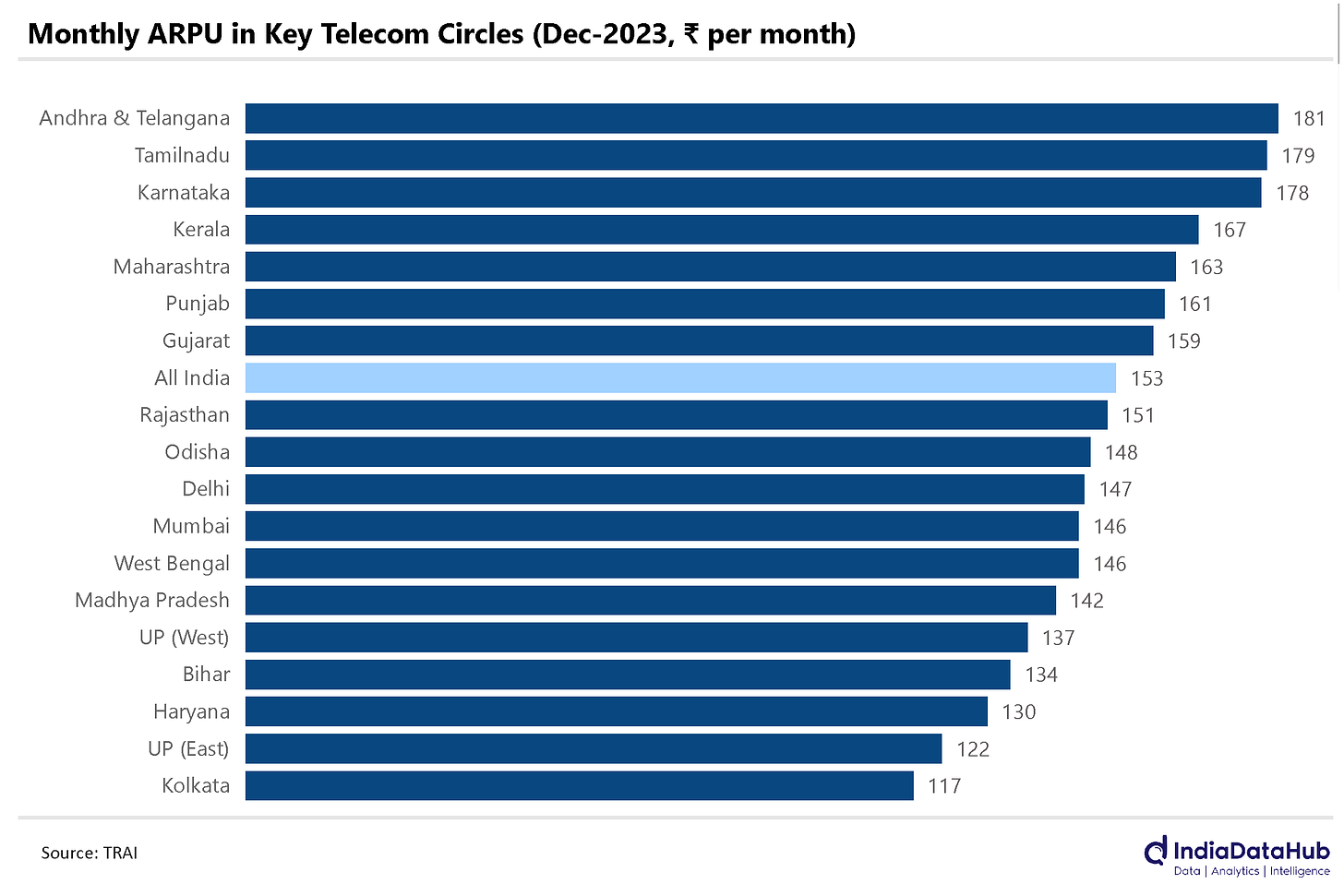

Quick quiz question, by the way: which part of India has the highest mobile bills?

The really big metro cities? Mumbai or Delhi? The richest states, perhaps? Maharashtra, Gujarat or Tamil Nadu? Well, none of the above!

As of December 2023, it’s Andhra Pradesh and Telangana! Users from the circle run up an average monthly mobile bill of ₹181. Here’s the complete list:

NRIs put money in Indian banks

We recently saw how, NRIs made more deposits in India this March than at any time since 2013’s taper tantrum.

The trend continues. This April saw NRIs make deposits of more than US$ 1 billion — the third month in a row where the billion-mark was breached. Collectively, the three months brought in US$ 5.6 billion. To give you context, the last financial quarter we had such numbers was in June 2015.

Here’s some interesting math: Our total current account deficit this financial year comes to around US$40 billion. If we continue receiving NRI deposits at this rate, they’ll off-set a remarkable 60% of this current account deficit.

We’ve gone into this before, but if the words “current account” mean nothing to you, here’s a refresher: Broadly speaking, countries send other countries money in two ways. The money either has strings attached (for example, if you make an investment or give a loan abroad — basically gaining a lasting right of some sort) or doesn’t come with any strings (for example, if you buy something — where the money, once paid, is gone forever). The latter is tallied together in the country’s ‘current account’. If more money leaves the country in the current account than what comes in, the difference between the two is its ‘current account deficit’.

All the other money we bring in — FDI, portfolio investments, whatever — goes on top of that. This is, in short, fantastic news for our balance of payments.

Flexing the Rupee

Perhaps because of all the money coming in, the Rupee currently looks stronger than many foreign currencies. It depreciated 0.3% against the US Dollar last month. Most emerging market currencies have done far worse. Look at this chart for the details:

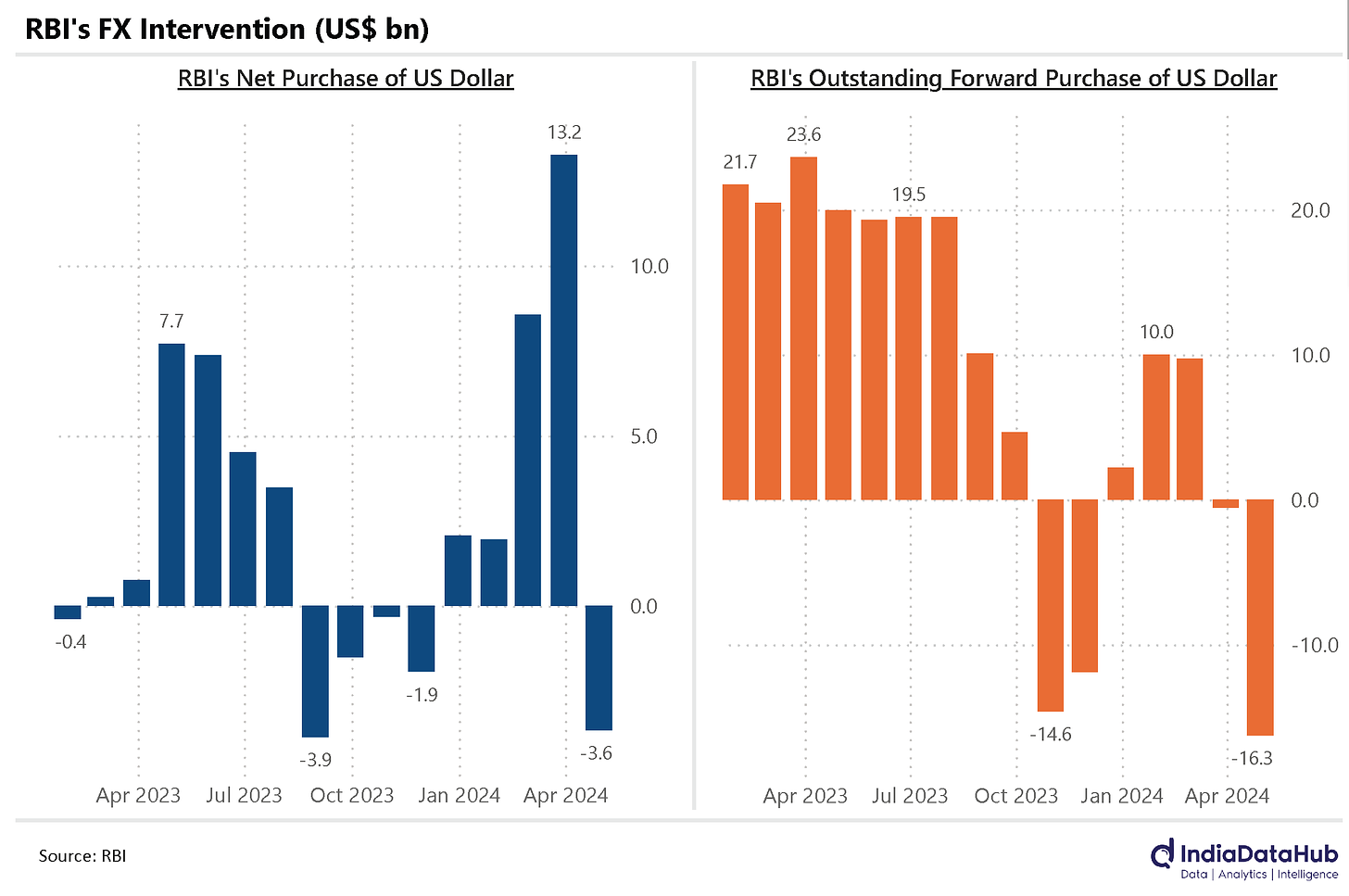

One abiding source of the Rupee’s strength is the RBI. The RBI has shown that it is willing to get its hands dirty and defend the Rupee whenever it grows too weak.

How, you ask? See, the ‘strength’ of the Rupee, really, is its relative demand in currency markets compared to the demand for the Dollar. When the Rupee has low demand, the RBI fills in — selling the Dollars it holds in reserve and buying Rupees. In April, for instance, many investors had sold their portfolio investments in India, creating a glut of Rupees in the market. The RBI jumped in, selling US$ 3.6 billion to buy these Rupees. It also took on new obligations to sell US Dollars in the future — to the highest it has in four years.

A low-flying economy

After the less-than-stellar high frequency data from a couple of weeks ago, we have yet more evidence that May wasn’t a great month for us. While domestic aviation usually grows slightly faster than the rest of the economy, this time around, its growth was tepid.

The health of domestic aviation generally tells you a lot about an economy. Flights are expensive, and people only pay for a ticket when they’re reasonably happy with their own financial situation. Most people fly either for business or for tourism — both of which matter to an economy. So when people seem less-than-keen on taking flights, it’s a sign that the economy is sluggish. Or, at the very least, that people and businesses are keeping their budgets tight and holding on to their money.

To be fair, things aren’t terrible right now. Airlines still carry more passengers than before. Unlike what we were seeing this time last year, however, the growth has slowed down massively. At the moment, it’s stuck in the low single digits.

The tremors in domestic aviation also come through in a falling ‘passenger load factor’ (PLF) — a measure of how full flights are. In April, the industry’s PLF fell by 1.5%. While we don’t have consolidated data for May, we do know that major carriers like Vistara and Indigo have seen their PLF fall in May as well.

Ghanan ghanan…

Did you know we’re already three weeks into the monsoon? Or do you still feel like you’re stuck in an endless summer?

You’ve probably felt the monsoons in their full force if you, like me, live in the beautiful city of Bengaluru. If you’re from elsewhere, though, this fact might simply have slipped past you.

Although we were slated to have higher-than-average rains this year, that isn’t how things have panned out so far. In fact, we’re currently facing a 17% monsoon deficit. Things are particularly bad in north-western India, where the amount of rainfall so far is a mere 40% of what is normal. Central India, meanwhile, has seen 30% less rain than usual. Down the line, this might mean worse weather and poorer harvests. And this, in turn, could send food prices even higher.

South India, though, remains blessed. Check this graph for more:

That’s all for the week, folks! See you in the next one.

Liked it

Thanks Raghavendra! We have plenty more that you might like on the Z-Connect blog! 🙂

Nice Article Pranav,

just a minute’s correction

The third Para of `Ghanan Ghanan` on the 3rd line *the* is mentioned twice: ”where the the amount”..

Overall I like the article

Thanks a ton, Bhide! I’ve edited the post. Keep tuning in for more! 🙂