6.1 – The Margin Calculator

In continuation of our discussion on margins in the previous chapter, we will now discuss the margin calculator. Over the next two chapters, we will discuss the margin calculator and learn a few associated topics related to margins.

Do recollect, in the previous chapter, we learnt about the various types of margins required to initiate a futures trade. Margins vary from one future contract to another as the margins depend on the volatility of the underlying. We will talk about volatility in the next module, but for now, remember that the volatility changes from one underlying to another; hence the margins vary from one underlying to another. So how do we know what is the margin requirement of a particular contract? Well, if you are trading with Zerodha, chances are you would have come across the ‘Margin Calculator’.

Zerodha’s margin calculator is one of our popular offerings, and rightly so. It is a simple to use tool that has a very sophisticated engine in the background. In this chapter, I will introduce you to the margin calculator and help you understand the margin requirement for the contract you choose. We will revisit this topic on the margin calculator when we take up the chapter on Options in the next module; at that point, we will understand Zerodha’s margin calculator’s complete versatility.

Let us take up a case where one decides to buy the futures contract of IDEA Cellular Limited, expiring on 29th January 2015. Now to initiate this trade, one needs to deposit the initial margin amount. We also know that the Initial Margin (IM) = SPAN Margin + Exposure Margin. To find out the IM requirement, all you need to do is this –

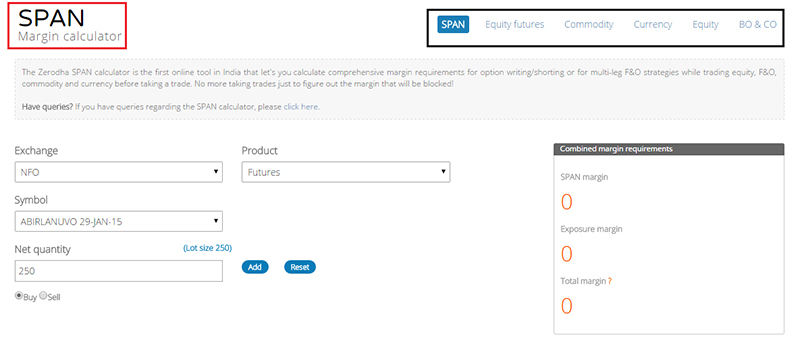

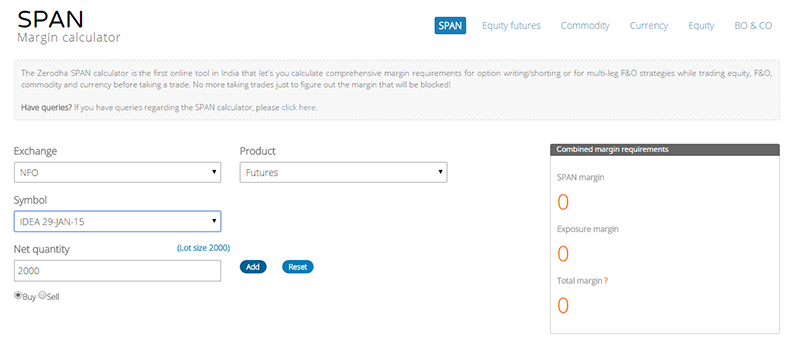

Step 1 – The link to the Margin Calculator is https://zerodha.com/margin-calculator/SPAN/. As you can see from the image below, many different options are available (I have highlighted the same in black). However, our focus, for now, will be on the first two options called ‘SPAN’ and ‘Equity Futures”. In fact, you will land on the SPAN Margin Calculator subpage by default, highlighted in red.

Step 2 – The SPAN Margin Calculator has two main sections within it; let us inspect the same –

The red section has 3 drops down menu options. The ‘Exchange’ dropdown option basically requires you to choose the exchange you wish to operate. Select –

- NFO if you wish to trade Futures on NSE,

- MCX if you wish to trade commodity futures on MCX

- CDS if you wish to trade currency derivatives on NSE

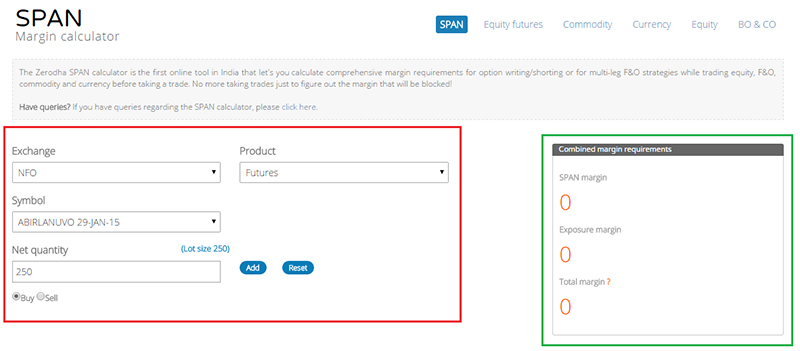

The next drop down on your right is the ‘Product’; choose Futures if you wish to trade a futures contract, or if you wish to trade options, select Options. The third drop-down menu lists symbols where all the futures and options contracts are made available. From this drop-down menu, choose the contract you wish to trade. Since we are interested in IDEA Cellular Limited expiring on 29th Jan, I have selected the same; please see the image below –

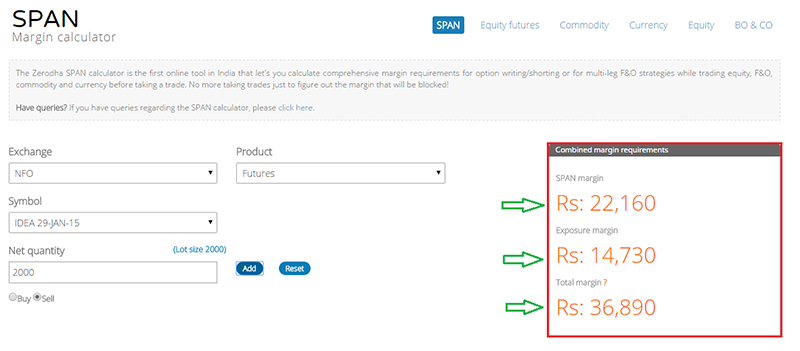

Step 4 – Once you select the futures contract, the Net Quantity automatically gets pre-populated to 1 lot. If you wish to trade more than one lot, you need to enter the new quantity manually. Notice in the image below, as soon as I select the IDEA futures contract, the net quality has changed to the respective lot size, 2000. If I wish to trade, say 3 lots, I have to type in 6000 (2000 * 3). Once this is done, click on the radio button, either a buy or sell (depending on what you wish to do) and finally click on the blue “Add” button

Once you instruct the SPAN calculator to add the margins, it will do the same, and it will give you the split up between the SPAN, Exposure, and the total initial margin. This is as shown below, highlighted in the red box –

The SPAN calculator is suggesting the following –

SPAN Margin = Rs.22,160/-

Exposure Margin = Rs.14,730/-

Initial Margin (SPAN + Exp) = Rs.36,890/-

With this, you know how much money is required to initiate the futures trade on IDEA Cellular; it is as simple as that! The next interesting section within the margin calculator is the “Equity Futures”. We will discuss the same in the next chapter. However, before we understand this, let us quickly understand 3 more topics, namely the Expiry, Spreads, and Intraday order types. Once we understand these topics, we will be placed better to understand the “Equity Futures” on the margin calculator.

6.2 – Expiry

In the earlier chapters, we briefly figured out what the ‘Expiry’ of a futures contract means. Expiry specifies the last date up to which the contract lasts, beyond which it will cease to exist. Consider this; if I buy IDEA Cellular Limited futures contract at 149/- expiring on 29th January 2015, with an expectation that it will hit 155, it simply means that this move to 155 has to pan out by 29th January 2015. Obviously, if the price of IDEA is below 149 before the expiry, then I have to book a loss. Even if the price of IDEA futures hits 155 (or in fact any price above 149) on 30th January 2015 (1 day after the expiry), it is of no use to me as the contract has already expired. In simple words, when I buy a futures contract, it has to move in my favour on or before the expiry day, else there is no point.

Does it really have to be so rigid? Is there any flexibility in terms of going beyond the stated expiry date? Let me illustrate what I mean –

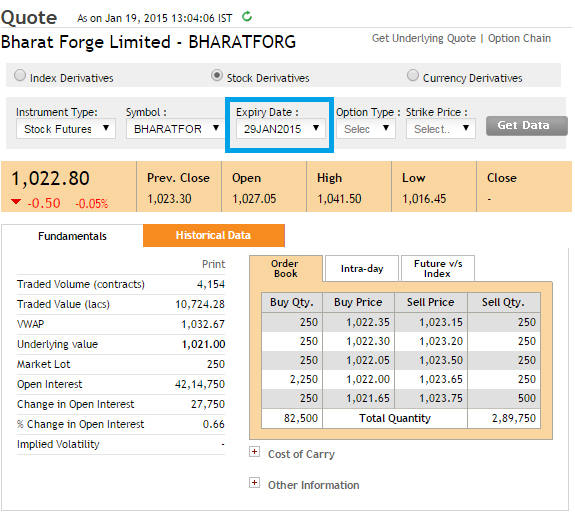

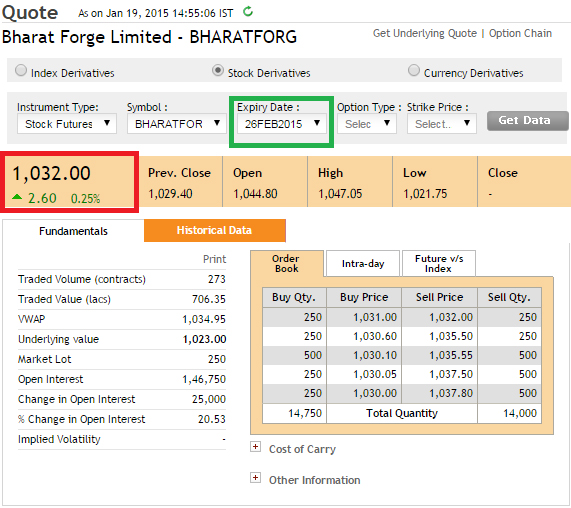

I know that the Central Government budget is expected sometime around the last week of February 2015, which is a little more than a month away (considering today is 19th Jan 2015). I expect a good budget this time around, and I’m hopeful that the manufacturing sector will significantly benefit from the budget in the backdrop of the ‘Make in India’ campaign. Given this, I would like to bet that Bharat Forge, a manufacturing major, will significantly benefit from the upcoming budget. To be precise, I expect Bharat Forge to rally from now, all the way till the budget (pre-budget rally). Therefore to exploit my directional perspective on Bharat Forge, I would like to buy its futures today. Have a look at the snapshot below –

Bharat Forge January 2015 contract is trading at Rs.1022/-, but here is a situation – my view is that Bharat Forge will rally from now, all the way till the last week of Feb 2015. But If I buy the futures contract, as shown above, it expires on 29th Jan 2015, leaving me stranded halfway through.

Clearly, since my directional view goes beyond the January expiry period, I need not be bound to buy the January expiry contract. In fact, for reasons similar to this, NSE allows you to select a contract that suits the expiry requirement.

At any given point, NSE allows us to buy a futures contract with 3 different expiries. For example, we are in January; hence we have 3 contracts of Bharat Forge with different expiry –

- 29th January 2015 – This is called the near month contract or the current month contract

- 26th February 2015 – This is called the mid-month contract

- 26th March 2015 – This is called the far month contract

Have a look at the image below –

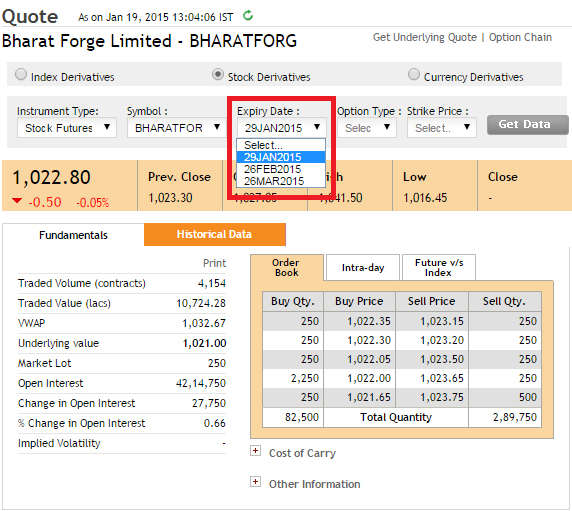

As you can see, from the expiry drop-down menu, I can choose any contract between the current month, mid-month, or far month based on my specific requirement. Needless to say, I would choose the mid-month contract expiring on 26th Feb 2015 in this particular case (as shown below) –

One thing that stands out clearly is the change in futures price. The contract expires on 26th Feb 2015 is trading at Rs.1,032/- while at the same time the contract expiring on 29th Jan is trading at Rs.1,022.8/-. Which means the mid-month contract is more expensive compared to the current month contract. This is always the case; the larger the time to expiry, the higher is the price. In fact, as I write this, Bharat Forge Limited’s March contract expiring on 29th March 2015 is trading at Rs.1,037.4/-.

For now, remember this – The current month futures price should be less than mid-month futures price, which should be less than far month futures price. There is a mathematical reason for this; the same will be discussed when we take up the futures pricing formula.

Also, here is another important concept you need to remember – As I had mentioned earlier, at any given point, the NSE ensures there are 3 future contracts (current, mid, and far month) available to trade. For now, we know, Bharat Forge contract is expiring on 29th January 2015. This means the January contract can be traded till 3:30 PM on 29th January 2015, after which it will cease to exist. Does that mean from 29th January 2015 onwards, the January contract goes out of the system leaving behind just the February and March contract?

Not really; till 3:30 PM on January 29th 2015, the January contract is available, after which it will expire. On 9:15 AM 30th January 2015, NSE will introduce April 2015 contract. So on 30th January, we will have three contracts –

- The February contract would now graduate as the current month contract from the mid-month contract until the previous day.

- The March contract would now be considered the mid-month contract (graduated from being the far month the previous day to a mid-month now)

- The April contract, which is newly introduced, becomes the far month contract.

Likewise, when the February contract expires, NSE will introduce the May contract. Hence the market will have March, April, and May contracts to trade. So on and so forth.

Anyway, continuing with Bharat Forge Limited futures contract example, because I have a slightly longer-term view, I can buy the futures contract expiring on 26th February 2015 and hold the February contract till I deem appropriate. However, there is another alternative, as well. Instead of buying the February contract, I can buy the January contract, hold on to it until around expiry and very close to expiry. I can square off the January contract and buy the February contract. This is called a ‘rollover’.

If you watch business news regularly, the TV anchor usually talks about the ‘rollover data’ around the expiry time. Well, don’t get too confused about this; in fact, it is quite straight forward. They are trying to convey a % measure of how many traders have ‘rolled over’ (or carried over) their existing positions from the current month to the mid-month. If many traders are rolling over their existing long positions to the next month, it is considered bullish; likewise, if many traders are rolling over their existing short positions to the next month, it is considered bearish. This is as simple as that. Now is this a proven technique to draw any concrete inference about the markets? Not really; it is just a perception of the market.

So under what circumstances would one want to roll over rather than buy a long-dated futures contract? One of the main reasons for this is the ease of buying and selling, aka ‘The liquidity. In simple words, at any given point, there is more number of traders who prefer to trade the current month contract as compared to the mid or far month contract. Obviously, when more traders are trading the same contract, the ease of buying and selling gets better.

6.3 – Sneak Peek into Spreads

We are now at an exciting stage. You may find some of the discussion below a bit confusing, but just read through this and try to grasp as much as you can. At the right time in future, we will talk more about this in detail.

Just think about these two contracts –

- Bharat Forge Limited Futures, expiring on 29th January 2015

- Bharat Forge Limited Futures, expiring on 26th February 2015

These are two different contracts for all practical purposes, priced slightly differently; both derive its value from the same underlying, i.e. Bharat Forge Limited, hence they behave the same. If Bharat Forge stock price in the spot market goes up, then both January futures and February futures price would go up. Likewise, if Bharat Forge stock price in the spot market goes down, then both January futures and February futures price would go down.

At times there are opportunities created whereby simultaneously buying the current month contract and selling the mid-month contract or vice versa, one can make money. Opportunities of this type are called ‘Calendar Spreads’. How to identify such opportunities and setup trades is a different topic altogether. We will discuss this soon. But at this moment, I want to draw your attention to the margins aspect.

We know why margins are charged – mainly from the risk management perspective. What kind of risk would exist if we are buying the contract on the one hand and selling the same type of contract on the other? The risk is drastically reduced. Let me illustrate this with numbers –

Scenario 1 – Trader buys only Bharat Forge Limited’s January Futures.

Bharat Forge Spot Price = Rs.1021/- per share

Bharat Forge January contract Price= Rs.1023/- per share

Lot Size = 250

After buying, assume the spot price drops to Rs.1011/- (10 point fall)

Approximate futures price = Rs.1013/-

P&L = (10 * 250) = Rs.2500/- loss

Scenario 2 – Trader buys January and sells February Futures.

Bharat Forge Spot Price = Rs.1021/- per share

Long on Bharat Forge January contract at Rs.1023/- per share.

Short on Bharat Forge February contract at Rs.1033/- per share

Lot Size = 250

After setting up this trade, assume the spot price drops to 1011 (10 point fall)

Approximate price of January Futures = Rs.1013/-

Approximate price of February Futures = Rs.1023/-

P&L on January Contract = (10*250) = Rs.2500/- loss

P&L on February Contract = 10*250 = Rs.2500/- profit

Net P&L = – 2500 + 2500 = 0

Scenario 3 – Trader sells January and buys February Futures.

Bharat Forge Spot Price = Rs.1021/- per share

Short on Bharat Forge January contract at Rs.1023/- per share

Long on Bharat Forge February contract at Rs.1033/- per share.

Lot Size = 250

After setting up this trade, assume the spot price increases to 1031 (10 point increase)

Approximate price of January Futures = Rs.1033/-

Approximate price of February Futures = Rs.1043/-

P&L on January Contract = (10*250) = Rs.2500/- Loss

P&L on February Contract =(10*250)= Rs.2500 /- Profit

Net P&L = – 2500 + 2500 = 0

Clearly, the point that I’m trying to make here is that when you are long on one contract and short on another contract, the risk is virtually reduced to zero. However, it is not completely risk-free; one has to account for the liquidity, volatility, execution risk, etc. But by and large, the risk reduces drastically. So when risk reduces drastically, the margins should also reduce drastically.

In fact, this is what happens, have a look at the following snapshots –

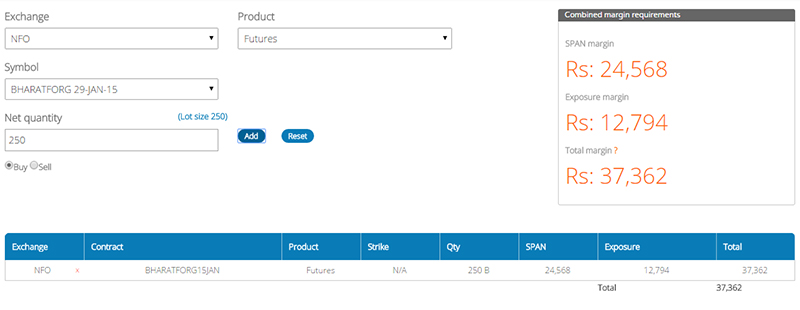

This is the margin requirement (Rs.37,362/-) when we intend to buy January contracts of Bharat Forge.

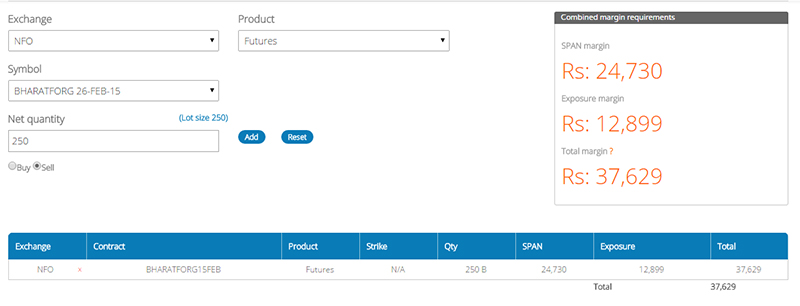

This is the margin requirement (Rs.37,629/-) when we intend to sell February contracts of Bharat Forge.

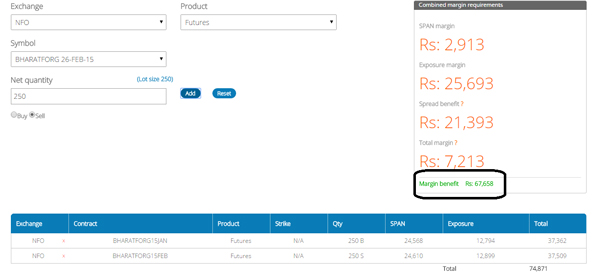

And this is the margin requirement (Rs.7,213/-) when we intend to buy January contract and sell February contract simultaneously.

As you can see, individually, the January and February contracts require Rs.37,362/- and Rs.37,629/- respectively. Hence a total of Rs.74,991/-. However, when a futures contract is bought and sold simultaneously, the risk reduces drastically, hence the margin requirement. As we can see from the image above, the combined position requires a margin of Rs.7,213/- only. Another way to look at it would be from a total of Rs.74,991/-, Rs.67,658/- i.e. Margin Benefit (highlighted in black) is reduced, and the benefit is passed on to the client. But do remember this – A simultaneous long and short position is built only when opportunities arise. These opportunities are called the ‘Calendar Spread’. If the calendar spread opportunity is not there, then there is no point initiating such trades.

Key Takeaways from this chapter

- Zerodha’s margin calculator is a simple tool that lets you calculate the margin required for a futures contract.

- The margin calculator has many versatile features inbuilt.

- The margin calculator gives the split up between the SPAN and Exposure margin.

- At any given point, NSE ensures there are three contracts of the same underlying, which expire on 3 different (but consecutive) months.

- A trader can choose the contract of his choice based on the expiry date.

- The contract belonging to the present month is called ‘Current Month Contract’, the next month contract is called ‘Mid Month’, and the 3rd one is called “Far Month Contract.’

- On every expiry, the current month contract expires and a new far month contract is introduced. In the process, the mid-month contract would graduate to the current month contract.

- A calendar spread is a trading technique which involves buying a certain month contract and selling another month contract simultaneously for the same underlying.

- When a calendar spread is initiated, the margins required are lower since the risk is drastically reduced.

\”The exchange releases SPAN files periodically, reflecting the updated margin requirements based on changing market conditions\”. is there a nse link to get the raw span data? Does retail investor/trader has access to these numbers?

Thanks.

Ah no, this is a broker file and I dont think NSE makes it public.

1) Does zerodha provide .xlsx file containing these information?

2) how often during trading hours these numbers get update i.e from 09:15 to 15:30? (somewhere i read 6 times)

3) what is the meaning of \’MWPL\’ @ https://zerodha.com/margin-calculator/Futures/

Thanks

1) No

2) Thats about right

3) Market wide position limit

1) if span numbers get updated ~6 times in a trading day then is there particular interval of updation say first updation at 09:15 then at 10:15 then at 11:15? or its randomized?

2) Have u covered Black-76 in varsity module?

1) Ah, I\’m not glued on when the exchange updates the margins, need to check that myself.

2) I had, not on Varsity but somewhere else, long back 🙂 …unable to find that link 🙁

In calender spread example,buying JANUARY contract, margin required is 37362 & selling February contract margin required is 37629 .So the margin required for this ca.ender spread turns out to be Rs.7213 where span margin is2913 ,exposure margin is25693, spread be efit is 21393 & total comes to 7213.I would like to know the detailed calculation .How did u arrive at the figure of Rs.67,658?How one detect calender spread opportunity?

That calculation is based on SPAN technique used by exchanges. You should ask them for details 🙂

sir i had a question.i do understand that proFit in calender spread just depends upon the difference in price of 2contracts but i do not get-

1.if suppose i have bought a contract of value 100 and sold a conctract of value 110.now value of first contract decreases to 90 and of another contract to 104.now individually i have made a lose of 10 of first contract and profit of 6 on another.so overall lose is 4,

But if we look from prespective of spread i have made a profit of 4 as gap has increased from 10 to 14.

So according to market prespective how does it work??

In classic calendar spread, the idea is that both these contracts converge towards a single price point making it a profitable spread. That said, what you\’ve highlighted is also a possibility.

As shown in last contract total margin is 7,213 how is it possible when exposure is 25,693.

Sorry, dint get your query. Can you pls elaborate?

I think these type of technic are useful if there is spread of 40 or 50 points diffrence.

Of course, higher the spread, the better 🙂

As you shown in 6.3 scenario no3 that trader sell jan contract and buy feb contract and after that p&l is 0.

My qus is after selling jan contract for +2500 if one exist from the positon not waiting for feb contract to expire.

One can exit or have to wait till feb contract expire.

Yes, you can, but that will make it an unhedged position.

If on 29jan after booking 2500 profit i want to exit form contract i can or not ?

Profit booking means you exit the position right?

Is it possible to buy two contract of same company at same time ?

Ex : current and mid month

Yes, you can.

How can we earn profit from the caleder spread as there is zero risk and zero profit whats the use of spread can you elaborate ? i know our margin requirement becomes very less in total .

There is risk, Raj. You have execution risk.

Sir, how is margin calculated in calender spread order.

Since calendar spread is a hedged position, there is a reduction in margin basis risk. Not sure about the exact math 🙂

hi karthik, if the expiry date is 28th of January, do i need to buy the total lot and what happens to my margin, and what about p&l?

Yes, you cant really breakdown the lot size so you have to buy the entire lot. Yes, margins are fully blocked.

\”A simultaneous long and short position is built only when opportunities arise. These opportunities are called the ‘Calendar Spread’. If the calendar spread opportunity is not there, then there is no point initiating such trades.\”

Hi Karthik,

Can you pls help with this, a bit more elaboration with an example – when opportunity arise, when not.

Check this Siddharth – https://zerodha.com/varsity/chapter/calendar-spreads/

Sir, iam talking about Bharat forge future calendar spread ,where there is a 10 point difference between the spread.

Sure, that is quite a bit, you can try and capture it, i\’ve discussed the technique here – https://zerodha.com/varsity/chapter/calendar-spreads/

sir,

Upon expiry is not there 10 points profit OR the P&L WILL remain zero ?

It depends on the moneyness of an option. It will have a difference if the option is ITM, else it will expire worthless.

Initial Margin is equal to span and exposure margin but the total margin is calculated by adding initial and exposure margin

Do check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/funds/articles/what-is-span-and-exposure-margin

how to initiate calendar spread ?

Check this – https://zerodha.com/varsity/chapter/calendar-spreads/

Don\’t have words to appreciate you enough. The knowledge, the way of explaining, examples, everything is incredibly awesome.

Thanks again for all the kind words. I do hope you continue to enjoy reading and learning on Varsity.

Sir,

I am finding difficulty to set \”Target\” & \”Stoploss\” simultaneously after long/short for the following in Kite:

(A) How to set \”Target\” & \”Stoploss\” simultaneously after long when trading in spot market under MIS?

(B) How to set \”Target\” & \”Stoploss\” simultaneously after short when trading in spot market under MIS?

(C) How to set \”Target\” & \”Stoploss\” simultaneously after long when trading in future market under NRML/CNC? Can I do this through GTT? Pl. advise.

(D) How to set \”Target\” & \”Stoploss\” simultaneously after short when trading in future market under NRML/CNC?

Kindly help with pointwise response (as per kite) since, I am quite perplexed with this since the time I am learning.

Anirban, please check these videos – https://www.youtube.com/watch?v=GcZW24SkbHM&list=PLX2SHiKfualH9XGLv9r1sdKucoGky35J7

Sir,

I understood the above.

Sure, happy learning 🙂

Sir,

I am trying to calculate margin requirement for simultaneous \”long & short\” position for a future share. But the margin calculator is not allowing this. Once I add the share future for buy to calculate the margin, it is not allowing to add again for sell.

I am confused, how to see the margin requirement considering with spread. Please help.

Check this, Anirban – https://support.zerodha.com/category/trading-and-markets/kite-features/basket-order/articles/kite-basket-orders

Sir,

Kindly confirm if this is the new page from where we can see margin for future trading? https://zerodha.com/margin-calculator/SPAN/

Also, please suggest how to see margin for \”Spreads\”?

Thats right. You add the different legs of the position and you will get the margin required.

Yesterday I bought RELIANCE FEB 2100 PE NFO with 250 quantity with an average price of 2. But today I wanted to sell that 50 quantity. But I am not able to do so because its required a margin of Rs 72195. and i bought that 250 quaintity of Rs 500 margin. so why they are asking for Rs 72195 to sell that 250 quantities. please explain me what is the problem, and why they are asking that huge amounts… please

Why is near month contract more attractive among traders? mid month and far month should be the best because it gives more time period, you can also exit anytime.

Near month contracts are liquid, Ajay, hence more attractive to traders.

Happy New Year sir, I am enjoying this module a lot

Got a doubt, in calendar spread do we only need the difference of margin or the entire margin amount for the current and mid months to initiate the trade?

Happy new year to you as well, Saurabh. You get a margin benefit when you initiate a spread, so you only pay the difference.

Hi sir ,

Two small doubts?

Q.1 when one has a long position on futures in mid term and wants to roll over and then one will have to sell the near term futures and then buy the mid term futures right….even though he is incurring loss in the near term.

Q.2 Last, sir you explained that we can exploit the hedging of contracts only when calendar spreads exists, but is it not like that it will alwyas exist as

when prices go down it will always go down for both near term and mid term type of contracts right?

1) Yes, thats right

2) Not sure if I get this query fully. The calendar spread itself is hedged, right?

Sir, in the snippet in this chapter in which you are showing data regarding Bharat Forge, can you please tell what software/ trading terminal you are using?

That is NSE\’s website, Shaib.

If our new p/L = 0

Why we initiate this trade.

Which trade are you referring to?

hi sri,

i am unable to understand benifit of calender spreads as net profit or loss is Zero, what is the use of doing such trade when profit is zero?

how can we benifit from \”Trader sells January and buys February Futures\”.

Its not zero, you lock in a certain value here called the spread. Check this – https://zerodha.com/varsity/chapter/calendar-spreads/

sir how can we execute spread trade in zerodha ?

Yes, you can.

Sir i want to ask that if we execute calendar spread trade , in that one future we have to buy and other sell simultaneously and one future price goes up and other down and our p&l is 0 as it shown above as an example, then how we gonna earn profit by using this strategy called calendar spread.

Thank you

Yash, to earn a profit, you need to identify a spread. Have discussed more of it here – https://zerodha.com/varsity/chapter/calendar-spreads/

(1) I have heard that the futures contract can be renewed upon the expiry. How to do that?

(2) Does the rollover and the renewal of the futures contract are the same things?

(3) In the rollover, the brokerage charges are same as charged for each trade or will is the rolling over considered as the continuation of the previous trade?

(4) In the rollover, does the price of the next month futures contract remains the same as the current month (which is expiring) to get the benefit of roll over or can it differ?

1) Simple, you buy the next month\’s contract and keep it going. This is also called \’Rollover\’.

2) Yup

3) Yes, its the same

4) Price will vary based on the market.

Why should anyone go for Calendar spreads,if no profit occur??

If one shorts a current month contract and and go long on mid month contract,and at one instance the stock is trading very low,as a result the current month contract is in profit,and in accordance of calendar spread I could square off the mid-month and hold on to current month contract,If this is how calendar spread works what is the need to buy 2 contracts, couldn\’t one normally buy or sell at that instance?

Do check this, Franklin – https://zerodha.com/varsity/chapter/calendar-spreads/

Hello sir you have mentioned about calendar spreads in the chapter 6 (margin calculator) in future trade moudule you showed how risks decreases and p&l turning zero but you didnt mention how we will start earning profit and when to use calendar spread, is there any detailed chapter ????

A comprehensive yet complete in-depth description available anywhere on the internet.

Thank You

Happy reading, Gaurav!

In the calendar spreads by shorting on february contracts you mean to say that sell first and buy later. And also the february future contract can only be purchased in feb itself or in january also

Thats right. Feb can be purchased when it is introduced, which I guess happens end of Dec.

I heard rollover can be done only 3 times. But going by the logic of rollover, i think, it can be done any number of times, if we just need to square off a position and enter the next month contract..? Pls throw some light on this..

Not sure why 3 times, but at the end of every experience, one can roll over.

Replying to users doubts since 2015, nice work sir.

Sir

What is difference b/w Margin and leverage of stocks in intraday

They both kind of are the same, Vishal.

Sir in margin calculator provided by zerodha only monthly expiry of index options are given.But if we want to check margin requirement and margin benefit for weekly index option we cannot check because it is not available.What to do for it?

Margins are similar for both monthly and weekly options, Nishad.

How can we identify the opportunity for spreads?

You will need to build a system to track these opportunities.

Hi Karthik,

Suppose I\’m going for a calendar spread i.e. Buy for Nov 20 expiry and Sell for Dec 20 expiry.

1. One can gain profit out of this trade only when stock rallies in next couple of days and falls in December right? So that once you get enough rally Nov 20 contract will be squared off and then after subsequent drop in underlying I need to exit Dec 20 contract?

2. As you mentioned above there is a problem of liquidity for mid and far month contracts, but soon that problem will shrink down once current month expires? So as long as underlying is going in the direction of what I assumed it is safe to buy mid month contract as well.

1) Yes, provided both positions move in your favour. Yes, you need to unwind both positions.

2) Yup, but the problem exists when you initiate the position right.

Isn\’t the risk to reward ratio is 0 here, as the only price one is paying is the brokerage and other charges.

Ya, but you do have a price target right?

Thank u 😊😊

Also if u cud explain this, though not from this topic it\’s from commodities specifically silver

1- as explained in the topic there is silver 1000 , but I can\’t seem to find it trades section or margin calculators part..

2- difference between lot size and delivery units, and also given the fact that zerodha doesn\’t let u do a delivery settlement what will be the difference between silver micro and silver1000

3- advice me if I want to trade on silver and do not want to leverage ( read it as f&o) , how do I trade..? I have directional view on it but no time frame plus I don\’t wish to leverage ( carries a significant downward risk)

1) Trades happen with there is liquidity, not sure if there is enough liquidity here. Haven\’t tracked the contract in a while 🙂

2) I think the micro contract is gone, no longer exists

3) Silver, the only option is to trade via F&O.

Hi Karthik,

I have a couple of queries with the explanation in calendar spread trade

1- why would anyone initiate such a trade,if any movement in price results in zero p&l ..

2- if we do initiate such a trade ( assuming there is profit ), current month we buy and mid month we sell, ( our margin requirements have reduced) .. now when we are at the end of current month and the current month contract has expired/ settled in cash.. now will the margin requirements shoot up or remain the same ?

1) Not 0, the idea is to lock in a spread.

2) The requirement will go up for the current month. Also, you need not necessarily wait for the expiry, you can close the position when its deemed profitable.

Sir, what is the benefit of calendar spread then? The profit that i will earn from one contract will be taken away by the loss incurred on another contract! And my money will also be blocked by the margins.

And when the current month contract expires, there will be an increase in margin for the other contract. So how can we benefit form the calendar spread, it reduces risk but how will the buyer or sell earn profit?

The idea is to capture a spread between the two contracts! Do check this – https://zerodha.com/varsity/chapter/calendar-spreads/

Thank you for your response sir

Good luck!

Hello sir, my question is regarding collateral margin

supposing we have nifty bees of Rs 2L and we pledge it, then after the haircut of 14.24%(as on 07/07/2020) we will recieve Rs171,520 as collateral margin…now since nifty bees is considered as a cash component then

1) Can we buy options with this money for the purpose of hedging

2) Can we only write options with this money

3) For overnight positions since its a cash component will the 50% rule of compulsory cash be applicable? ( I asked you somewhere in a different chapter about nifty bees and you said that its good as cash)

1) No, you cant buy options

2) Yes, you can write options

3) Sorry, don\’t know why I said NB is cash, it is not. So 50% rule is applicable.

Good evening sir ☺

My doubt is…. What is the point of buying these contracts if there is no profit or loss. (I mean buying contract of current month and mid month together).

Whatever points it falls or rise

Risk will be zero right!?

You will do this to lock in a spread between the two contracts.

Sir this was from the previous question, I am not able to make it a tread, somehow it was formed as a new question!?

Ah, ok sir, thank you sir for the quick response. Sir but just wanted to know their utility, if you have any article written on it or find some useful resource to read from to get more knowledge about it, please.

Sure, I will try and do that Aryan. Thanks.

Hello Karthik sir, sir as you told we have three types of expiry in the futures contract Near month, mid-month and Far month, but sir as I was looking in the Zerodha platform I was able to see the contracts of the option(not future) of September as well as December, how is it, possible sir? And sir what are the use of these contracts?

These are long-dated options, Aryan, and its available only for Nifty. However, there is hardly any liquidity here.

Hi sir,

Why is it so that the initial margin is different for futures with a different expiry date?

Near month margins increase as we head closer to expiry.

\”The current month futures price should be less than mid month futures price, which should be less than far month futures price.\” This is mentioned in the expiry section of this chapter. But when I checked the prices on different expiry dates on NSE, this was not the case. Far months contract were cheaper than that of the mid month for some companies.

True, the statement that I have made is based on a \’all else equal\’, basis. The prices can fluctuate based on the demand-supply situation.

what happens when futures contract is not exercised or squared off even on expiry date?

No question of that as all contracts are deemed expired on the expiry day.

How do I rollover Currency future ?

Close the current month contract and initiate the same position, same quantity in the next month contract.

Hi Kartik,

Thank you for the explanation.

It\’s clear now 🙂

Good luck!

The Spread would also reduce the profile margin like the loss risk right?

I mean If I have a Long Futures (Current Month) and a short futures(Next Month) and the stock goes up then

all the profits generated by the long future will be countered with the loss in the short future isn\’t it?

Kindly correct me if the understanding is wrong.

Thats right, Pranay. However, it also depends on how you lock in the spread. In the case of arbitrage strategies, if executed well, then the spread is locked and irrespective of where the market heads, your profit is locked.

Sir

Kindly have at least one module on the concept of HEDGING also.

Thanks.

Have you checked this – https://zerodha.com/varsity/chapter/hedging-futures/

Hi

In your margin calculator, total margin = SPAN margin + Exposure Margin – Spread Benefit.

What is \”SPREAD BENEFIT\” ?

Thanks.

If you offset the risk by having a hedged position, then you get the benefit of a reduced risk position. This is spread benefit.

Hi Karthik,

Apologies for the previous question about placing orders in kite. Found those 🙂

Actually, i am trying to figure out how to find out the exact margin requirement for weekly contract, since the calculator does not have weekly expiry dates. You said that weekly requirements are 10-15% lower, but is there a way to check the exact requirement beforehand.

Thanks,

Alok.

Not on Zerodha\’s website, Alok. Approximation for now.

Thanks Karthik. Also, can you help me with placing orders for weekly contracts. Kite is showing only monthly contracts.

Thanks,

Alok

Hmm, as of now you can trade only Bank Nifty. Hope you are not looking for anything else.

Hi Karthik,

I tried to check the margin required for weekly F&O expiry. However, i could not find it in the Zerodha calculator. In one of the previous comments, you said that margin requirements for weekly contracts are the same as monthly. But weekly contracts have much smaller time-frame so ideally shouldn\’t the margin required be also lower than monthly?

Also, how do i place orders for weekly contracts? Could not find that in Kite.

Thanks,

Alok.

MArgins are a function of risk, which is the same as both weekly and monthly. Of course, weekly is slightly lesser, hence the margins as well. So give or take about 10-15% difference.

Hi Karthik,

Somewhere on Varsity, I read that margin calculations are same for Futures and Options. Bid/ask prices differ for weekly and monthly option series. Span calculator shows margin for monthly options, but not sure if margin can be calculated for weekly options. Questions:

1) Is margin calculation for weekly options supported? If yes, how?

2) If not, is there anyway to deduce it from monthly options margin requirement?

Thanks,

-Sachin.

Margins for futures and option writing are similar. Bid & Ask differ for each instrument, Sachin. Weekly options have similar margins as monthly.

1) No separate calculator for weekly option

2) Margins are similar to monthly

Dear Sir ,

Please Provide a Link at the end of the the Article which would take us to the Bottom of the page i.e. Post a Comment . and a Link at the bottom to take us back to the Main Article .

Calendar Spread : How to do it using Kite . There is either Buy or Sell . Does it mean if i Select Buy first and then sell next the Margins will be calculated as per Calendar Spread . Some time back in the Article Leverage you had discussed about avoiding Leverages above 12X . with Calendar Spread it is 27X or so on . What is the risk here , will a slight change wipe out the entire margin in Calendar Spread ? . is Calendar Spread too risky where a Slight change will be wiping out the entire capital ( Margin ) .

Thanks for the feedback, I\’ll share this with the tech team.

Yes, you have to take up the 1st position and then you for the 2nd leg, you will get the margin benefit. The calendar spread is hedged, so you don\’t really have directional risk…so it is kind of safe to trade these spreads. The only risk the execution risk…meaning the spread may shrink by the time you place your orders.

Good evening Karthikji

Thank you for the link above u sent 🙂 But I need to understand & go through Pair trading 1st 🙁

Only my last query about same is how will Pair Trade BENEFITS trader or will give ARSENAL in F&O trading ?? Only brief insight u mention so that there\’ll be more curiosity in beginning to learn same as u\’d empowered us in Module 2,3,4 & 5 🙂

Thanking you for your time & hv a great evening 🙂

Harsh, two different techniques to pair trade is explained in this module – https://zerodha.com/varsity/module/trading-systems/

Good morning Karthikji

Thank you for your kind response 🙂

One more question. U\’d said calendar spread has some strategy to be deployed. In which module shall I go for Calendar Spreads best strategy? ?

Thankingagain for ur time 🙂

Here you go Harsh – https://zerodha.com/varsity/chapter/calendar-spreads/

Good morning Karthikji

There\’s few questions regarding Rollover

1) It\’s said Futures position can be rolled over to next month whether profit or loss

So how to do Rollover. I searched whole of Net & Zerodha had no such option of Rolling over button. What to do? ?

2) Suppose only I\’m giving examples. If I\’m long at 11000 Nifty Fut Price then my Avg price is 11000. Bt by Oct expiry if Nifty declines to 10800 then I\’ll be at loss of 75×200=15000. According to theory I should Rollover to now November Nifty Fut. That I\’ll buy at suppose @10800. Bt still I\’ve to book loss na of Rs 15000 & then enter Nifty Nov Futs?? Am I correct

3) If point 2 is correct about booking loss & entering new contract then what\’s the FUSS about the term \”Rollover\” ???. What is its practical meaning if same booking loss or gain wehave to do to enter new contracts ??

I\’m sorry to ask such questions but only need ur clarification on solution for Rollover & how to do in case of loss. Thanking you 🙂

1) Rollover is nothing buy closing this month\’s position and initiating the same position in the next months series. For example, if you have 1 lot of Nifty futures long in Oct futures, then to roll over, you square off 1 lot of Nifty Oct futures and initiate a fresh buy for 1 lot in Nov series

2) yes

3) There are two things, you book a loss and get out or market, or you book a loss and continue to hold the position with an expectation that the market will move in your direction. When you roll over, you are essentially doing the 2nd.

In the spread example, Span margin got reduced to around 2000 from around 24000.

How was it calculated? Also total margin got reduced to around 7000. What was the calculation behind it?

Anurag, if the position is hedged, then there is very little risk, hence the reduced margins. I\’ll check for an explanation for the margin calculation, don\’t have it handy for now.

You need to update the URL for STEP 1 to access margin calculator. The current link does not list the calculator. The correct link should be https://zerodha.com/margin-calculator/SPAN/

Rohit, thanks for pointing. Its changed now 🙂

When margin falls below what is required position gets squared off. Is there any difference for this for futures or short options.

Sir, As simultaneous long and short position will create almost zero profit then why would anyone do that??

You do this across two different expiries, but the same contract.

Whats the current intrady margin for stock sort options in zerodha. Is it 50 percent or 40 percent of total value.

Thanks

Depends on the contract, check this – https://zerodha.com/margin-calculator/SPAN/

Hi Karthik,

I have read almost all the previous sections and literally I am learning quite a lot.

I have one small doubt in calender spread, how can I decide which stock I need to buy/sell or which contract I need to sell/buy?

Can we term it as arbitrage opportunity due to pricing mismatch between two months.

Further I want to get one more idea like I am regularly trading in cash segment. So can I pledge my securities and trade which the money I have received in future segment

As a thumb rule in arbitrage, you always buy the cheaper asset and sell the expensive one. Yes, you can pledge your shares to trade. But you may want to think twice before doing so 🙂

Can you just elaborate what are the starting point of such arbitrage.. to be more precised what is the trigger point for a stock which induces an investor to do such arbitrage

The only trigger point is the difference in price, Arun. Apart from price mismatch, there is no other reason to initiate an arbitrage trade.

Sir,

Great presentation, good job.

In the snapshot you have shown above the underlying value of the current month contract and mid month contract are different, also the previous close is shown different. I am a bit confused. Can you explain?

Thanks in advance.

Vishnu

That\’s because they are two different contracts, Vishnu.

Sir,

So how come the underlying value of different contract of a stock is different when there is only one price for the stock in spot market. Correct me if I am wrong.

Vishnu

Can you kindly quote an example for me to understand this better?

If I buy stock future X, one lot in Normal and another lot in MIS at the same price 300 Rs/share and selling both of them at same price 301 Rs./share. My understanding is that only profit % varies between Normal and MIS but the actual Profit value remains same for both Normal and MIS (if the buy and sell price is same). Am I right?

The profits measured as a % over margins would differ. Clearly, it will be higher for the MIS trade. The actual profit remains the same.

A particular stock future X require total margin of 50K in Normal leverage. I want to go for \’Long\’ position with buy price as 200 RS in Normal leverage. Another sell position at 198 Rs in Normal leverage which act as Stoploss(with SL-market order). Another sell position at 204 Rs in Normal leverage(with limit order) which act as target. How much amount I want in my trading account to place all the three orders at the same time?

Ramesh, I\’d suggest you feed in the details here – https://zerodha.com/margin-calculator/SPAN/ , you will get the exact margins required.

I have been trading mainly in cash segments and sometimes in options in Zerodha.

From the write ups ,I have three doubts .

1.Huge cash minimum 7to 8 lakhs is required to invest in equity shares to keep as hedge as lot size or price are very high to trade in futures .

2.If future price on expiry is higher ,one may have to sell the shares to compensate for loss in futures.Coud you tell me from your experience,will such large chunk of shares get sold say in 1 or 2 days before expiry?,

3.Are the returns generally above 9% p.a. ,after paying brokerage,STT,income tax.What has been past exprience?

1) Not really, if you intend to hedge with futures, then the margin is about 70K

2) This really depends on the liquidity of the stock and also the value of the transaction you are talking about

3) Well, this no one can really predict, depends on your trading strategy.

Hello, recently discovered these gem of a series! I have a dumb question, when the exchange issues a new \”far month\” futures contract (a day after expiry of current month\’s contract), is there a fixed number of lots (each lot = some fixed no. of shares) issued? I\’m trying to compare this with say an IPO, where (if my understanding is correct) a fixed number of shares are introduced to the the spot market.

Thanks for this great series!

Subhajit, each contract will have the same lot size and would not vary, unless there is some sort of corporate action in the stock, leading to change in lot size.

There is a grammatical error in section 6.3 –

\”For all practical purposes these are two different contracts, priced slightly differently, both derives its value from the same underlying i.e. Bharat Forge Limited, hence they behave exactly the same.\”

It should be \”derive\” and not \”derives\”.

Thanks, Vaibhav. Will make the correction.

Which stop loss order for future NRML order until i exit the position?

Suppose I buy one lot of NRML future of XYZ Company on August 6, 2018 and if I want to hold the position till August 21, 2018. Which stoploss order should I put? Should I place stoploss order everyday when the market opens. Should I place stop loss each and everyday until I exit my position? Can you share your insight on this.

Thank you.

Yes, you will need to place a stoploss order under NRML product type every day after market open(You can also place an AMO order every day if that\’s convenient for you(between 4 PM and 9AM))

Today Bank of Baroda OPEN=149, HIGH= 152.05, If I would have placed an intraday trade at 149 & sells=high using 50000 and margin available 14xMIS (AS GIVEN https://zerodha.com/margin-calculator/Equity/), What would be my intraday profit?

Number of shares that can be bought

CNC 1x MIS 14x

335 4793

please correct me if I m wrong!

Your profit or loss calculation is straightforward its the – Difference between the buying and the selling price * Number of shares.

in topic 6.2 the rollover of contract, is making old contract new one or purchasing a new one?

Square off the old contract and re-initiate the same position in the next month.

or your point of saying is that we have to buy shares in spot market then sell these shares as feb future in market and buy its jan future from market

Suggest you read that article on shorting, Aman. Good luck.

sir i have confusion in calendar spread as you are saying Trader buys January and sells February Futures.my Confusion is do we have to buy both jan and feb contract first at same time before selling feb contract as how we can sell feb contract without buying.can you please ellaborate more on this.

No, you will have to first buy Jan (this is the 1st trade), then sell Feb contract (this is the 2nd trade). When you do this you will have two positions – (1) Long Jan Contract (2) Short Feb Contract.

sir how we can sell feb contract without buying it first as we cant sell something without buying it.

Yes, this is called going short. Check this – https://zerodha.com/varsity/chapter/shorting/

Sir,

I have one basic doubt. In futures say when you buy long on intraday, you pay margin amount as per requirement, when you square off later in the day by selling say with profit, will the margin amount + profit will be added back to my funds on same day. Please clarify.

Yes, it would. Check for the funds balance the next day morning to see the final amount after adjusting for brokerage and charges.

Sir

What is the difference between trading strategy and trading system?

A strategy can be formalized to create a trading system.

Hi i plan to sell options and the margin calculator shows i need a total margin of Rs 145000.

do i need to keep that much of cash in zedoda account?

if I have Rs 10 lakh worth of shares in my dmart account, from where do i known how much F&O margin that gives me? can i utilise the same to write the options.

please guide

regards

Yes, if the margin requirement is 1.45L, then you need to have at least so much in your account. You can pledge your shares for margins, more on this here – https://support.zerodha.com/category/q-backoffice/portfolio/articles/what-is-pledging

Hi Karthik,

On shorting, let\’s say I short TCS shares intraday and I forgot the buy back the share before 3:20PM and I have 0 cash balance in my trading account. What will Zerodha do in this case as 3:20? How will it square off the intraday short? Will it use its own funds to buy back the shorted TCS shares? If yes, how will it recover the funds from me?

To add to this, along with 0 trading balance, I don\’t have any stocks in my portfolio as well for Zerodha to sell. What happens in this case?

The position will be squared off in event of non availability of margin funds.

The position will be squared off. Also, its best if you use MIS as the product type if you are shorting intraday.

Hi Karthik,

1. If I just place a sell order on a futures contract(wout having a long position) of let\’s say IDEA, it basically means I am shorting it right?

2. If I already have a long position in IDEA futures and I sell it before or on the expiry date, this means i\’m squaring off and not shorting right?

3. Are all the concepts of TA applicable for futures (NIFTY futures, stocks futures etc..) candlestick charts as well?

For now, I have understood all the concepts you have explained in this module.

Just an yes or no on the above questions will do:)

1) Yes, that is how shorting is done

2) Yes, that is correct. When you short, you basically initiate a fresh position. Closing an existing position is also called square off.

3) Yes, TA (in any form like Dow, Candlestick) is applicable to any asset with time series data.

Good luck, and happy learning!

If the \”rollover\” is just a term. Where in you actually are doing two transaction (Selling one month and buying the other month future).

So it would be impossible to calculate the rollover data by Media House. Can you please clarify how do they get the rollover data.

In fact, I\’m not sure about that myself 🙂

What is the \”REAL WORLD APPLICATION\” of futures in equities? At the end it is zero sum game. Is not it purely betting? Only the government and broker (in terms of taxes and brokerage) benefit and those who win the bet. In normal equity market you buy a part in company but what about futures?

If you speculate without any logic, then yes, you are wasting your time and money. However, you can setup trading systems to trade based on logic, this is the approach you need to take. Check this module – https://zerodha.com/varsity/module/trading-systems/

Will this effect to Leverage when we take margin benefit

Yes, it would.

hii kartik my name is sahil i just wanted to know when is the favourable time to do rollover say holding xyc contract and expiry is of the contract is 27 jan and today is 26 jan and i know i might have to hold it for couple more days so should i sell the contract on 26th jan and simountaniously buy feb contact or i should sell the contract on expiry day and buy the feb at the same time and if yes what is the time one should prefer to do rollover around what time should be it 2:30 to 3:30 or earlier

Rollover should be done close to the expiry date – like a day before expiry.

who sets the price in a Futures contract?

In Forwards contract it\’s set and agreed by the buyer and seller. But I am confused about the price setting of futures

Let\’s say, if I want to buy the futures of Idea, which is currently at 102.25. But my outlook is that the price will go down and I want to short it. Then how can I make money by buying it? I can only make money when the price goes above 102.25, which, I think, is unlikely.

Please clarify

The price is decided by the market participants. This is also called \’price discovery\’. If you expect the price to go down, then you need to short it and buy it back later.

Sir,

Unable to open the next chapter(margin calculator part 2) section.

Trying since morning.

Plz check.

Thanks in advance

Try this – https://zerodha.com/varsity/chapter/margin-calculator-part-2/

Yup it\’s working thank you sir.

Cheers!

Sir,

Unable to open the next chapter(margin calculator part 2) section.

Plz check.

Can you try now?

spread margin benefit is there in commodity, currency also ?

Yes, you can find calendar spreads in commodity and currencies too

How do we make profit in calendar spread scenario?

How do we identify an opportunity of calendar spread?

Can you explain this with example

Will discuss the strategy in detail here – https://zerodha.com/varsity/module/trading-systems/

I recently opened a account with Zerodha. Please help with these two queries-

1) I transferred 1 lakh into my account (equity). Under the \’margin available\’ column, it\’s showing Rs 1,99,989 & under the \’Total account value\’ column, it\’s showing Rs 99,989. Why the difference? And I presume the 11 rupees which have been deducted are due to the payment getaway charges (Rs 9 + GST) ?

2) If I had to buy a future contract, say Dec nifty 50, for which the total margin required is approx. Rs 60k. So, should I transfer the margin amount to another category where it\’ll be blocked? Or since 1 lakh is already there in my account, Zerodha will automatically block that amount from my (equity) account when I place the order?

Thanks!

1) Now, it\’s showing the same value for both columns. Don\’t know why it was different yesterday.

Ok, not sure about this.

1. The Rs 11 deducted is actually the Payment Gateway charges(Rs 9+18% GST= Rs 10.62). Funds was showing only 99,989 yesterday because the remaining 1 lac was showing under Payin. This has been added to your account in the daily ledger update which happens after market hours

2. With your Equity Balance, you can trade, Cash Equity, Futures & Options and Currency, so, you don\’t need to add funds separately.

1) Can you give a link where one can see which all shares are in the F & O category?

2) Is it worth buying futures of a share which is low on liquidity? Guess the answer here is no. So then, how would you define \’low liquidity\’? What criteria?

3) Though I understood the concept the of a rollover, I didn\’t get why one would go for one. Like in your example, why wouldn\’t someone straight away take the February (mid month) contract when the Budget is coming in that month only? Is it because that early (when you bought the January contract), the mid month liquidity isn\’t that high? Even then, one could wait till somewhere around the end of January contract or the first day of February contract? Or is the reason something else entirely?

Thanks!

1) https://zerodha.com/margin-calculator/Futures/

2) Check section 9.2 – https://zerodha.com/varsity/chapter/nifty-futures/

3) When you are convinced of your position and carry forward the same, you have no option but to roll over.

3) Okay, but then, wouldn\’t it make sense to buy the contract for the particular month when the event is happening [like mid month in your example] ?

Yes, it does. In fact, it is best if you can take the position before the event to take full advantage of Volatility skews.

Hi karthik,

I am a new client. I have loaded 6000/- in TA. I was trying to place a MIS equity order for testing purpose in kite mobile app. I could not find how many shares i am entitled under normal mis, BO and CO. What i understand now is that i have to go to margin calculator by opening any browser and there i have to find out the same. To be frank, this is just a big downside . How is it convenient for a person wanting to trade on mobile on the go to use a web browser to first ensure from margin calculator and then use kite app and place order. A lot of time will have elapsed and he would surely miss the bus. What is the purpose of mobile app then ? I am sure nobody has raised this issue. But, before i go any further, kindly confirm if what i am fearing is true or not. If it is true, then there is no use of kite android app in intraday for a scalper which i want to be. Thanks

Raghuram, this is completely a valid point. This is something we are working on, this should be in place sometime soon.

Dear Sir,

Pl read Board Meeting as on 01/11/17 instead 03/11/15 as typographic mistake.

Thanks.

Got it.

Dear Sir,

ROLLING OVER CONTRACT AS EXPLAINED IN MARGINN CALCULATOR PART 1 IS QUOTED BELOW :

QOTE:

\” Anyway, continuing with Bharat Forge Limited futures contract example, because I have a slightly long term view, I can buy the futures contract expiring on 26th February 2015 and hold the February contract till I deem appropriate. However, there is another alternative as well – instead of buying the February contract, I can go ahead and buy the January contract, hold on to it till around expiry, and very close to expiry, I can square off the January contract and buy the February contract. This is called a ‘rollover’.

UNQUOTE:

1.Squaring off position is as good as closing previous contract .

2.Will not be there any change in buying price? as Near Month/Mid Month /Far month future prices are different.

Kindly guide on above.

Please also throw light on below mentioned statement as per given by 1 of the company:

Board meeting is on 03/11/2015 to declare Q2 result. Trading window will be closed from 01/11/17 to 15/11/17.

What is meant TRADING WINDOW WILL BE CLOSED.

Thanks & Regards.

1) Yes

2) Yes, there will be slight difference in prices

3) Trading window is for the company insiders. They cannot buy/sell the companies shares during that window period.

Hi Karthik, Does margin requirment change from broker to broker or is it same across all brokers?

Margins are roughly the same.

Hello Karthik,

Nice platform for discussion,

If i have long future in current month , and after i week i sense that market may fall, with this anticipation , if i decide to short equity of same stock ( same number of shares as in future lot) ;

Do i need to pay ? or it will consider as hedge position ?

pls reply

Thanks in advance

Regards

Remember you can short the stocks only on an intraday basis. You cannot carry forward your short position. I don\’t think you will get a margin benefit for this.

Hi,

I am reading your detailed chapters today and enjoying. And as someone said, just one reading more than suffices. Amazing work!

But while reading, it seems to me that you have tried to explain things heavily from a buyer\’s perspective and not a seller\’s perspective. And it really matters to the beginners like me to be able to know the nuances of placing a sell order also in the futures trade. The questions like, what is a short position in a futures contract?, Do we need to own the the future securities in order to short it? need to be answered explicitly. In fact, I could not understand the term \’short\’ when I first encountered it in your article!! It was nowhere explained before! I hope this is taken care of! Even if it isn\’t, I have no words to thank you for the amount of effort you have put in writing all this for free!

Since I am new to stock trading I want to ask–and I am sure you will help–how do we research about a stock to form a trading opinion about it, I mean which websites to look for?, which softwares to use and how? Is it necessary to use the softwares at all? How to interpret different news about a stock? etc. I know this requires a long answer, but I believe you could still guide this beginner to some extent as I don\’t want to go just with the flow and do some blind trading. I would be much obliged. Thanks!

Regards

M. Zia ul Haq

Zia – thank you so much for the kind words!

Here is a chapter which explains shorting in great details – https://zerodha.com/varsity/chapter/shorting/

Have you looked at the module on Technical Analysis – https://zerodha.com/varsity/module/technical-analysis/ this will help you get started on trading.

Thanks, I actually discovered later, after posting my comment, that Zerodha is a very big platform where almost everything is covered. I did not know it before but bumped here through Google! And it has been a love at first sight story with Zerodha, with the only difficulty that I don\’t know how to pronounce the name of my lover!!! 🙂

Zia, thanks for the kind words! I\’m glad you are enjoying your time spent on Varsity.

So your lover\’s name is pronounced as – Ze (like Zero) – row- dha …Zerodha! 🙂

Will you marry me Zi..Row..Dha ?

(Karthik you don\’t need to reply to this. Let it be between me and my lover. 😉 )

I mean for banknifty options

What is exact amount to sell bank nifty, your margin calculator is showing exposure margin as zero, is it right???

Are you sure? Can you check again?

Hi Karthik,

Site link has changed, don\’t see link to check SPAN Margin

https://zerodha.com/technology.

Check this – https://zerodha.com/margin-calculator/SPAN/

Is it better to place SL or SLM for liquid scrips?

Of course, SL is always a good practice to have.

I do not get time to keep eye on market flactuations. Can I just keep stoploss and relax. I am told that it many times results in losses. Pl. give proper suggesion.

Stop loss orders are valid only for the day. You cannot carry forward the today\’s SL order over to tomorrow.

hi sir,

suppose i took position in option spread like sell bank nifty 22600 pe and buy 22200 pe. how much total margin i have to pay?

I used zedodha calculator, if i sell only 22600 pe then i have to pay Rs. 60400 as a margin and if i add buy position of 22200 pe, then Rs.57800

i get only 3000 benefit in option spread margin. is it ok?

Yes, the benefit is to the extent to which the calculator suggests.

55000+56000=110000

Got it.

Hi karthik

Thanks for clearing my doubts and

Sorry to bother you again, still I have one doubt

If I long one mid month contract and short one current month contract (calendar spread)

For both the contract 55000 +56000=11000(approx)

amount is needed

After execution of order margin blocked would be around 20000(approx)

After execution balance remaining in account would be around 95000,If I withdraw this amount and after that I square off my one position, then what will happen to another contract, will that be square off automatically?

Thanks

Yes, as there would be a margin shortfall for that contract alone.

Hi karthik

I have 2 doubts

First calendar spread means shorting one month contract and buying another month contract

Is it compulsory to buy near month and short another month contract?

My second doubt is regarding margin

Today I (zerodha client) short future contract of Nifty of may series

About 54000 margin was blocked and about 25000 was left in my account

At 3:25 I decided to long nifty June series contract and did not square off my position but message displayed \”margin required………. \”

Please let me know why this was displayed

Thanks

1) No it can be the other way round as well

2) Yes, this is because you need 54K as margins per lot. First 54K was blocked for May futures, after which you were left with 25K. For June futures you need another 54K, since you were short of funds, the system did not allow you to take the position.

It means for calendar spread initially margin for 2 lots must be in the account?

Yes, at the the time of placing the order.

\”Which means the mid month contract is more expensive compared to the current month contract. This is always the case; the larger the time to expiry, the higher is the price.\”

sir, please look into the links for images for infy futures on 25 may 2017 and 29 june 2017.

the mid month contract https://ibb.co/dUhEd5 i.e. 29 june 2017 is for 924

and current month contract https://ibb.co/mE89BQ i.e. 25 may 2017 is for 933.95

please correct me sir if i am missing anything here.

moreover the far month furure contract https://ibb.co/n9ORrQ 27 july 2017 for infy is priced at 930.90

the prices are as of 6 May 2017.

Yes, there is a spread, but it does not seem to justify a trade. Usually, something like 3% or more would qualify as a juicy trade.

sorry but i did\’nt get you here.

should we take the june futures or may futures ?

i mean clearly the liquidity of the may futures will be more but i get a better profit on the june futures

Yes, May futures has the highest liquidity, so its best to consider May – or in general the near month futures.

Hello karthik sir,

i have a question in this chater tooabout ROLLOVER

Assume i have a nifty April futures and margin deposited is (imagined word) 55000 Rs

and at expiry i decided to rollover this to may . so what is the difference between me and a fresh buyer of may future after all we both had purchased a may future from start it should not matter for media house what ever a trader is doing it should be simple as a fresh postion is created in market for may future. If not thrn we are all rolling over our possitions month by month like this Buy jan then square it at expiry then again buy /sell feb and then square it off at expiry->_>_>_>_>_>Now again 1st april HAPPY NEW YEAR

OR i have option do not close a particular months option and carry forward it to the next month

Then expiry date is useless right

Please have light on my thoughts

Thank you sir…

Rollover is a debatable concept. I\’m not sure how the numbers are calculated by media. So I\’d advice you to look at it with a pinch of salt.

Thank you Karthik

Welcome!

Hi Karthik.

You have mentioned some business news giving information of monthly rollover.

Can we get separate data of bullish and bearish roll over for any contract?

Thanks

Hard to source this information.

thank you

Welcome!

Please advice if it is possible to get benefit of calender spread when we short position in profit from current month future by buying new current month future at lower price same day. Thanks.

Yes, you would. Please select the exact contract you want trade in this calculator – https://zerodha.com/margin-calculator/SPAN/ and see the spread benefit you\’d get.

Is it ok, if i point out small mistakes, like spelling mistakes and different word used.

In this chapter, on step 4, line 3 it\’s written quality, but it should be quantity.

Let me know if it\’s ok, to point out such mistakes, as i found them in other modules too.

Please do. I know that I make a lot of these silly typos, I\’ll be happy to take note and correct. Thanks.

Can I buy a future contract in equity commodity currency and niffty

Yes, you can.

Lets say i bought one lot of Nitfty with 50,000 margin for swing trading. I am in long position. Next day because of some serious news nifty opens below 1000 points and continue going down (just a hypothetical scenario). I only have 50,000 in my account but as soon as the market opens i am in loss of Rs.75000 (1 lot has 75). So what happens? I need to pay extra Rs.25000?

Yes, else the position will be cut by the brokers themselves (for lack of funds).

I have seen that in some cases the price of the mid month and far month contract is lower than spot price. In this case is it possible to buy mid or far month futures and square off in the current month itself….it seems that this wouldnt be possible though.

Thanks for the inputs!!

Yeah, but to do this you will have to estimate the fair value of the futures. For the position to be hedged, you need to ensure long on mid/far month contract and short on current month.

Hello karthik,

I have one more query please.

As I was going through stock watch on nse website, I found that SBIN opened at 277.00 and that is the high throughout

In whole day it has traded below its opening price(even though a gap up of 8 points from previous day. My question for the stock shown in green, the gap up is the factor considered ? Because whoever would have taken the position today for intra day would not have benefited at all even though with so called positiveness in the scrip.

Thanks in advance.

The comparison is always with respect to the previous day closing price.

Thanks karthik for the reply.

I am going through all the modules and then will join zerodha for sure.

I got your point karthik, just still confused with the term \” per executed order\”.

For eg if i place order of 1000 shares, my order might be executed in one go or say partially like 100 + 500 + 200 + 200 = 1000. So in this case i got my 1000 shares but from 4 different sources , so should i consider these as 4 executed orders wherein brokerage charged will be 4 times say 20*4 ? Am i correct in my interpretation ? If yes then how often these partial execution happen ( all in INTRA DAY)

Thanks karthik in advance.

As long as you press \’buy\’ once it will be considered as 1 order for us. After you place the order, the order can get executed in 1 trade or maybe 10, it does not matter. All that matters to us is how many executed orders. Also, please note the difference between \’executed order\’ and trade.

Hi karthik

Greetings for the day.

I have one doubt, can you please guide

From above eg of bharat forge if i buy one lot then i will be charged the brokerage for that particular lot, but instead if i buy 250 seperate shares then it may not be necessary that on the opposite side a seller is having 250 shares ready, so if there are 5 sellers with 50 shares each on the opposite side then would my brokerage will be 5 times more ( all in intra day)

Thanks in advance.

I\’m assuming you are trading with Zerodha. Brokerage on equity transactions (not intraday) is zero. It does not matter if you but 1 share of 100000 shares, we charge you nothing. Its completely free. However, equity intraday and futures trade is charged at Rs.20/- per executed order. Here is Zerodha\’s complete charge list – https://zerodha.com/charges

If I buy a 1lot (250) of future and its executed in multiple( like 5

) order to get the 250 shares. then Zerodhs will charge me 20/order*5= 100rs to me?

Thanks karthik, My question is answered below. I did check it.

Your all article are wonderful

Happy reading, Rajendra!

Good luck 🙂

No, 1 lot will be transacted in a single chunk. Lots cannot be broken down into smaller bits. So you will pay only 20 per transaction.

I have some doubt I heard that all future contract will expire at the last Thursday of that month then how the mid month contract works on I buy a Jan contract can I extend till may

At any given point, there are 3 futures contract available to you. Current, mid, and far month contracts. The one that expires on the last Thursday is the current month contract.

The link https://zerodha.com/technology is not working . Can somebody help ?

https://zerodha.com/products has all products now, you can also click on the menu button on top right of the webpage.

When checking for IDEA16DEC contract, the lot size is 5000 but on IDEA17JAN contract, the lot size is 7000. Why is that so?

Must be some corporate action or exchange has decided to increase it as the share price has reduced. You can check the circular for this – https://www.nseindia.com/circulars/circular.htm

Thank you for the prompt reply! Keep up the good work. Just out of curiosity, how do you manage your time to reply to each and every comment, write great articles and trade all at same time? Looks like there is so much we can learn from your apart from trading 🙂

The trick is to love what you do, I guess 🙂

Hi karthik,

The concept of calendar spread seems similar to hedging where the losses arising out of one position are negated by the profits in another opposite trade.Is my understanding right?

Thats more or less the way it works.

Thank you so much for your amazing explanation. Your style of explaining things is the same way a loving mother would explain things to her children. That\’s why even though I typically need to re-read material twice or thrice to understand properly, one reading of your articles more than suffices. Grateful to you!

Wow! Thanks for the kind words Mike 🙂

Hi Team Zerodha

I would like to know as to how to place spread orders for futures in Pi? I want to rollover long position of current month future to next month.

Rollover is to be done manually by squaring off the current month contract and buying the next month contract.

Sir,Suppose i purchased at future contract of X company ny paying margin money of Rs 65000.The share of the company rose by 10% on that day but i didnt square off by selling it and on the next day the margin money got increased to Rs 95000 from Rs65000.So my question is should i pay difference in margin money or not on the next day (i.e Rs 30000)?????

No since you are sitting on M2M profits, it will suffice as margins.

Sir amazing work done by you…..

But as you quoted Bharat forge of calender spread in which you buy and sell the same stock on different expiry date and getting margin advantage.But sir what will happen if sell one conract before expiry and keep other contract on hold??Do i need to pay extra margin then??and if yes by when and how much??Please explain me this with an example where in you settle one contract before expiry and hold the other contract and how will be the margin money affected and impacted.

Yes, once you release a contract you will have to top up the margins. The margins will be as per SAPN+Exposure requirement as indicated in our margin calculator.

Dear Karthik Sir,

Does Kite software provide Braket order/ Cover order for intraday…?? becasue I find them on Pi software but not on Kite..

Very soon this will be made available on Kite.

I am waiting……but must say your kite android version is really superb….it doesn\’t ask for transaction password and also remains logged in even if I switch my data off….!!! that\’s exactly I wanted…!! nice work sir…!!

Glad you liked it, good luck!

Hi,

I have a basic question about rollover