3.1 – Insurance – An Introduction

In a broad sense, businesses can be into either manufacturing or services. The previous chapter was about cement, a manufacturing business. In this chapter, we will study how to analyze the insurance sector, a service business.

This chapter will mainly cover the following:

-

- The insurance landscape in India

- Types of insurance companies

- The sales channels used to sell insurance

- Risk management by insurers and Reinsurance

Insurance, in the simplest terms, is protection against risk. If your family depends on your regular income, you would prefer to insure your life. Vehicle insurance could pay for damages in case of an accident. Health insurance could cover your medical expenses if you have a health-related issue. Any unforeseen event that could cost you dearly becomes easier to deal with if you had insured it.

If insurance can make life so easy, why don’t all of us have insurance? Lack of awareness and inability to afford premium payments are common reasons. Those who can afford to pay premiums mostly use insurance only to save taxes. Even those who understand that insurance is essential may not see it as an urgent need. So they keep delaying the purchase of insurance. For many people, it is a psychological barrier – how can I put value into my life? Why should I think about what will happen if I meet with an accident or die? And how to discuss my death with my family? An easy way out is not having any insurance at all.

To think that psychological barriers might be more visible among the older, conservative Indians may be a fallacy. About 83% of millennials do not have life insurance. Millennials are now of working age and likely have dependents. If education and awareness, or any other solutions, do manage to bring about wider acceptance of insurance, there is tremendous potential for insurance companies to grow their business. If 83% of millennials do not have life insurance, only 17% do. It also means there is a five-fold market waiting to be tapped.

If you are an investor, the insurance sector indeed seems a hot and ripe investible opportunity. However, insurance is a tricky business. And it is regulated by IRDAI or the Insurance Regulatory and Development Authority of India. IRDAI attempts to safeguard customer interests, along with regulating selling practices, risks, and financial strength of insurance companies.

As an investor in the insurance sector, you must realize that insurance companies are in the business of acquiring risks. The risk that a policyholder is insuring is the risk that an insurance company is acquiring. So the question is, how does an insurance company make money from these risks?

The answer is twofold. Insurance companies make money from underwriting profits and investment gains. Underwriting profits occur when the premiums earned by the insurer exceed the total amount paid out in claims. The insurance company may not immediately need the funds from premiums to service claims. Until then, it can invest these funds to make investment gains, the second money-making stream for insurers.

While money-making happens primarily from just two sources, insurance companies differ in the type of insurance they offer. This also impacts the insurer’s approach to managing risks. Let us delve deeper.

3.2 – Types of Insurance Companies

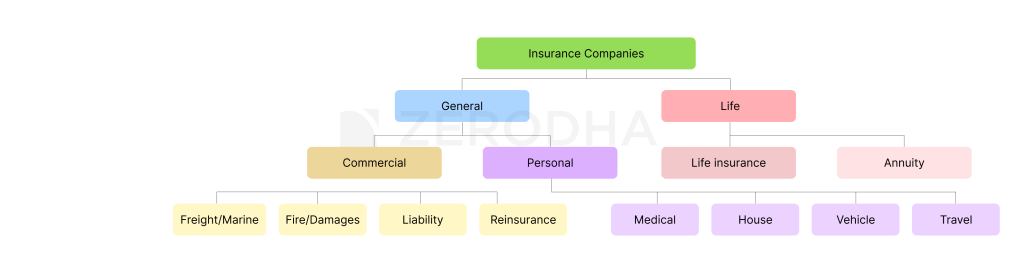

At the top, insurance companies are classified into two categories: life and general insurance.

-

-

- Life insurers offer insurance on life and related products. Term plans, endowment plans, ULIPs, and annuities are all products from a life insurance company.

- General insurers offer medical insurance, vehicle insurance, and property insurance. A particular general insurance company might offer some or all types of general insurance.

-

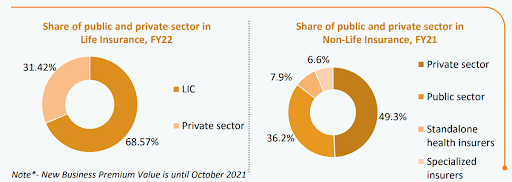

The industry comprises both private and public players. LIC alone commands two-thirds of the life insurance market in India. It is also the only government-owned life insurer. The general insurance segment is crowded with private players. The government also promotes six general insurance companies. These are the General Insurance Corporation of India, The New India Assurance Company, the United India Insurance Company, The Oriental Insurance Company, the National Insurance Company, and Agriculture Insurance Company of India.

When studying the insurance sector, it is essential to understand why and how the two types of insurance companies (life and general) are different.

Life insurers typically have obligations that are long-term in nature. Let me break this down. Life insurance policies span years or even decades. People keep paying premiums for several years. So there is a considerable gap between the time an average policy is bought and when its claim is settled. Hence, the long-term nature of obligations.

During this gap, the collected premiums are lying idle. These idle funds are called “float”. The life insurance company can invest the float to make investment gains. It can also take on additional investment risk because the time horizon is long. Higher risk, as you know, is taken in search of higher returns.

General insurers mostly have short-term obligations. Whether medical, vehicle, or property insurance, most general insurance policies have a maximum duration of one year. For example, you paid a medical insurance premium today. This policy will be in force until one year from today. Let’s say you did file a claim after six months. The insurer will have to pay you. For general insurance companies, any liability will arise in less than one year. Therefore, investments are also for a short duration and must carry minimal risk. Of course, if the insurance was not claimed, it is a gain for the insurer.

By the way, if you have read about Warren Buffett’s success, you have likely heard of the advantage his investments get from float money. Buffett’s holding company, Berkshire Hathaway (BH), is a large multinational corporation. Its main business is insurance. Insurance gives BH a large pool of float money. Float is free money – no borrowing cost or obligation to share investment gains with premium payers. A larger float gives more room to take investment risks. However, if there are losses on the Float, the insurer will have to pay for it out of its own capital.

Now let’s stop and ponder a bit. The ability to invest comes only if the premiums earned are more than the payments made toward claims. As an investor trying to understand the insurance sector, you must analyze where the premiums are coming from, if they are growing, whether there is any surplus after settling claims, whether all investments yield positive returns, and how the balance sheet is holding up to sustain long-term growth.

Let us first see where the premiums can come from or what are the sales channels.

3.3 – How are insurance policies sold?

Insurance is heavily reliant on selling efforts. When there is a lack of awareness around a product, marketing and selling become a significant force for increasing awareness and adoption. And those who do not look at insurance as an urgent need may require a little bit of nudge from insurance sellers. Insurance companies use multiple channels to sell their policies.

The snapshot from HDFC Life’s fourth-quarter investor presentation for FY23 shows the various channels HDFC Life uses to sell its life insurance products.

-

-

- The insurer might have a direct sales team to sell policies to the customers. This is naturally the most profitable channel. However, insurance companies do not have a far-reaching presence across cities, towns, and villages. Therefore, they rely on channel partners or agents.

- Many individuals become agents for insurance companies. LIC has the largest pool of agents spread across the length and breadth of the country. Many financial planners or distributors of financial services act as agents for insurance companies. Banks also act as insurance agents but are considered separate sales channels.

- Among all financial services businesses, banks have the broadest geographical coverage. Therefore, banks are the largest distributors of insurance products. The channel of selling insurance through banks has a name for itself – Bancassurance. Despite the growing digital presence of insurance companies and emerging digital distributors such as Policybazaar.com and Acko, Bancassurance remains the largest channel.

-

In fact, insurance companies that are part of banking groups rely the most on bancassurance and have an advantage over other standalone insurers. HDFC Bank, SBI, ICICI Bank, and Kotak Mahindra Bank have affiliated life and general insurance companies. These banks are also the largest bancassurance partners for these affiliates.

-

-

- Group insurance, mainly in the case of health insurance by corporate employers, is a common channel. This route takes care of the issues related to lack of awareness or affordability. Employees get health coverage for themselves and their families as part of their salary package. While this type of health insurance is cheap for an average person, the insurance company also diversifies its risk by offering coverage to a large group of people. The cost of sales is also low for the insurer as most of the selling efforts have to be made only initial stage of signing up with an organization. Once signed up, all their employees become customers. And renewal is continuous too.

-

- The latest technique is to sell insurance policies through plug-ins or add-ons. When booking a flight or hotel on a travel site, have you seen the “Add a travel insurance of ₹50000 only for ₹25”? This option is usually on the final billing page. You might not even notice it. And often, it is auto-selected, so you have to uncheck the option if you don’t want travel insurance. I think it is an exciting and shrewd cash-generation technique. The amount is not significant enough to warrant everyone’s attention. Even if you don’t like it, you may not want to spend your energy protesting a ₹25 issue. The risk for the insurer is high. But the probability of the payout becoming due in the few hours or days of that insurance is very low.

-

The concept is similar to chocolates placed next to the cashier’s counter at a retail store. While billing, you impulsively pick a few chocolates while not worrying about the small expense.

3.4 – Taxation on Insurance Customers

Tax saving is a powerful motivation for people to buy insurance. Premiums up to ₹1.5 lakh paid towards life insurance are tax-exempt under Section 80(C). Endowment plans, which come with some level of savings along with providing insurance, have been trendy. Taxpayers choosing the old tax regime are using these exemptions. However, taxpayers do not need these exemptions if they choose the new tax regime. A more significant number of people choosing the new regime could hurt the demand for insurance.

Similarly, exemptions under Section 10(10D) have been scrapped for annual premium payments of over ₹5 lakhs. Section 10(10D) makes maturity benefits tax-free if they are at least ten times the annual premium payment. Budget 2023 amended this provision. If annual premium payments are over ₹5 lakhs, the benefits become void. Essentially, the amendment took away tax benefits from insurance that the wealthy could enjoy.

When you are an investor in the insurance sector, you want to know how a tax policy is impacting the insurance business. The scenario can change every year with the annual budget.

3.5 – Diversification of Insurance Business

As I mentioned earlier, the business of insurance is about taking on risks. So it makes business sense to diversify these risks. Diversification has to be across geographies, age groups, customer profiles, investment assets, and the timeline of committed payouts. Let us discuss why each of these is important.

Geographies: High mortality rate in one region could be compensated for by the low mortality rates in other areas. Violence or natural calamities tend to increase the number of claims being filed; if policyholders are situated far apart, not all will have suffered the calamity of filing claims.

Age groups: Certain age groups may be more vulnerable to diseases or pandemics. For example, most cases of swine flu were in children, while the coronavirus mainly affected adults. Insuring across age groups would help life and health insurers to earn premiums from the unaffected group while settling claims from the affected groups.

Investment assets: This point is about asset allocation. Given the nature of the business risk that an insurer carries, it must carefully allocate investment assets to make optimum returns. This point is similar to the asset allocation chapter we discussed in the Personal Finance module of Varsity. The insurer must spread investments across asset classes and issuers to minimize risk and maximize returns.

Liability schedule (or timeline of committed payouts): The annuities are a fixed cost for insurers. There may also be annuities or pensions that the insurer must start paying out on pre-set future dates. The investment decisions have to account for these future cash outflows. Insurers also borrow funds to run their business. Repayment of this also needs to be taken care of. Spreading these obligations over multiple years could make it easier to honour them.

This is not an exhaustive list. Your analysis could show more ways of diversifying premium inflows.

3.6 – What is Reinsurance?

Apart from diversification, insurance companies also cover their risks by reinsuring the policies they have sold. They might reinsure all or part of their obligations. It is a great tool to protect against unusually high-payout events. For example, if there were a major earthquake in a region, homeowners’ claims could go up significantly. If the insurer had reinsured part of their obligations, the hit from the payout could have been mitigated.

Reinsurance is also used to comply with the regulator’s capital requirements. Insurers are required to maintain a minimum solvency ratio of 150%. What if an insurer’s liabilities are too high? Its solvency ratio could fall below the minimum limit. Here, reinsurance is of great use. The insurer could transfer part of its claim-related liabilities by reinsuring some policies.

General Insurance Corporation of India, promoted by the Government of India, is the largest reinsurer in the country.

In this chapter, we covered the business of insurance and its industry landscape. The next chapter is Part-2 of this one. We will use real examples to look at how to study a life insurance company and a non-life insurance company. We will look at metrics that show the effectiveness of selling efforts, cost management, and capital maintenance.

Key takeaways:

-

- Insurance penetration is very low in India, and hence, there is a huge untapped market potential

- IRDAI regulates the insurance sector

- There are two types of insurance companies – life and general

- Insurance companies make money from two sources – insurance premiums and investment gains

- Insurance is sold through various channels – direct sales, agents, banks, group insurance, plug-ins

- Investors in the insurance sector have to monitor tax policies on insurance

- Being in the business of acquiring risks, insurance companies diversify risks by selling policies across age groups and geographies. Investments are diversified across asset classes.

- Reinsurance is another tool for controlling risks.

Very well introduced and detailed insight about Insurance sector. Thank you for making such effort towards preparing and explaining these sectors in detail.

For the first time such a detailed sector analysis is provided.

Thank You

Thanks for the validation, Gaurav..

Its great to see this content. I am a firm believer this industry will grow like telecom did. Thanks and keep up the good work.

Thank you, Diya.

Can you please define solvency Ratio in simple terms?

Suppose you have a liability of 100 and you have 150 in your pocket, your solvency is 150%. This is the basic concept behind solvency ratio.

In case of insurance, not every customer is going to file a claim. But the insurance company has to predict how many customers will file a claim, and what would be the payable amount. This estimated payable amount + all other debt = total liabilities. Insurance companies must have financial assets that are at least 1.5X or 150% of the total liabilities. This 150% is the minimum solvency ratio that insurance companies have to maintain.

Hope that helps. 🙂

Learnt something new today

It is 10(10D) not 10(10)D. Please correct this.

Thank you for pointing it out, Sir. It is now corrected. 🙂