8.1 – The First Digital Industry

I opened my first bank account at the age of 13 or 14, I think. I had to fill out and sign an account opening form. My friends and I would love to go to the bank and have the passbook printed. We would deposit and withdraw ₹20-30 all the time just to increase the passbook entries. If you are a Gen-Z reader, this experience might be alien to you. You could still do all this at your bank, but why would you?

You can now open bank accounts digitally from your home. Sending money was already easy through banking apps, but now we have the comfort of UPI apps. You can even have loans approved on apps.

This evolution is no wonder. I would like to take the liberty to call banking the first and most digitized industry.

8.2 – The Banking Industry

Banks are often called the lifeline of an economy. We hold our money in the banks. We make fixed deposits. We take loans from banks. Some of us also buy insurance and investments through banks. Banks facilitate foreign trade. Every business maintains a bank account, and many businesses also take loans.

When there is optimism in the economy, enterprises are willing to take risks. They borrow funds and expand their businesses. Their vendors and buyers also see renewed demand. Money starts rolling in the ecosystem, and banking activity picks up. The inverse is true when there is pessimism in the economy.

Basically, economic health has a direct impact on the banking sector. However, the relationship is a bit layered. We will see that later in this reading.

8.3 – The Banking Landscape in India

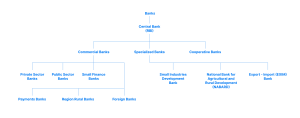

India’s banking system has a tiered structure. The Reserve Bank of India (RBI) regulates all banking activities in the country. The three broad types of banks are scheduled commercial banks, specialized banks, and cooperative banks.

-

- Scheduled commercial banks are called “Scheduled” because of their inclusion in a particular Schedule of the RBI Act 1934. Since our focus will be only on listed scheduled commercial banks, let us call them commercial banks for convenience.

-

- Specialized banks are focused on a particular economic activity. Small Industries Development Bank (SIDBI), as the name indicates, focuses on small industries. NABARD is meant to support and promote agricultural and rural business activities. The EXIM Bank extends financing to foreign entities looking to import from India.

-

- Cooperative banks offer services similar to commercial banks but on a much smaller scale. The main difference is that the members of a cooperative bank act as both its owners and customers. These banks are governed by the State Cooperative Societies Act. RBI is the regulatory body of cooperative banks.

As of this writing in July 2023,

-

- India has 138 Scheduled Commercial Banks

- It has a total of 1,59,718 banking offices or branches

- The number of ATMs is 2,55,796

- The total number of savings accounts with SCBs is 212 Cr

- State Bank of India is the largest Indian bank by the number of branches

- HDFC Bank is the largest Indian bank by market capitalization

- Popular banking indices: Bank Nifty, Nifty PSU Bank, Nifty Financial Services, S&P BSE Bankex, S&P BSE Financial Services

As I mentioned above, the focus of this reading will be listed commercial banks, most of which will fall under private, public, or small finance banks’ categories.

8.4 – How is banking different from other sectors?

Banks differ from regular businesses. They pay their customers for maintaining deposits. They earn interest for giving loans. They make fees and commissions from other financial products. All these services deal in money for money. There is also no manufacturing or warehousing of products. Therefore, banks do not have inventory or cost of goods sold in their financial statements.

Their peculiar nature is perhaps why banks have a separate regulator, the RBI. It is also considered one of the most important institutions in the country. Its policies and actions have a direct bearing on many industries and an indirect bearing on all. The RBI is expected to stimulate economic growth when there is a slowdown and tame it when there is inflation.

The RBI sets regulations for banks with respect to customer account opening and maintenance, permissible business activities, scale of operations, liquidity requirements, capital adequacy, and non-performing assets, among others.

The global financial crisis of 2008 showed how a crisis in the banking sector could ripple across sectors and countries and severely dent their economies. As a result, central banks across the world agreed on a set of strict principles to regulate banks. These principles are called the Basel-III norms. The idea was to monitor and control the risks that banks took.

The RBI adopted Basel-III norms but took a step further. It mandated stricter requirements for the Indian banking system. Since we are a developing economy, stricter risk parameters seem prudent. 🙂

8.5 – How to Analyse a Bank?

Just like insurance, the heavy regulations in the banking sector are an advantage for an analyst. Banks are mandated to report a number of ratios every quarter. The formula for calculating these ratios is stipulated by the regulator. You will get most ratios directly in the banks’ financial reports and investor presentations. Therefore, a comparison of ratios across banks is easier.

Sources of revenues: A bank’s revenues are split based on the type of customers.

-

- Corporate / Wholesale: Corporate revenues are those that are earned from trusts, partnership firms, companies, and other business concerns. Loans to corporate entities typically are of larger ticket sizes. A large ticket size gives a quick revenue boost but also increases concentration risk in the loan book.

-

- Retail: Loans or banking services given towards housing, vehicles, personal loans, credit cards, etc., are categorized as retail loans. Retail loans have a small ticket size and are large in number. Therefore, the risk is distributed across many small customers.

Within retail, banks in India are also mandated by the RBI to lend to the priority sector. Borrowers eligible for priority lending can be from agriculture, MSME, education, housing, social infrastructure, renewable energy, and other weaker sections. There are further minimum limits to lending to these sections. For example, out of a bank’s net credit in FY2024, 10% has to be lent to small farmers and other weaker sections.

- Retail: Loans or banking services given towards housing, vehicles, personal loans, credit cards, etc., are categorized as retail loans. Retail loans have a small ticket size and are large in number. Therefore, the risk is distributed across many small customers.

-

- Treasury: Treasury income comes from the entire investment portfolio of the bank. A bank actively invests in stocks, bonds, and derivative instruments to manage liabilities and make gains. These gains are treasury gains.

Banks also have to maintain investments in safe and liquid government securities as part of the mandatory SLR requirements. I will take SLR later in this chapter. Gains from SLR investments are also part of treasury income.

- Treasury: Treasury income comes from the entire investment portfolio of the bank. A bank actively invests in stocks, bonds, and derivative instruments to manage liabilities and make gains. These gains are treasury gains.

-

- Others (Insurance / Investment Banking / Associates): All other sources of revenues that cannot be classified under any of the above three categories are part of other revenues. Subsidiary revenues are also part of other revenue. For example, ICICI Bank’s subsidiaries include ICICI Securities, ICICI Prudential AMC, ICICI Prudential Life Insurance, and ICICI Bank Canada, among others.

Growth in corporate and retail loans is essential for the growth of core banking operations.

Revenues can also be split into interest income and non-interest income. The next section on net interest income discusses this elaborately.

Net Interest Income and Net Interest Margin: Net Interest Income is the difference between interest earned and interest paid. A bank earns interest on loans, credit lines, and credit cards. It pays interest on savings accounts and fixed deposits. It makes business sense when interest earnings are more than interest payments.

Interest earnings – Interest payments = Net Interest Income (NII).

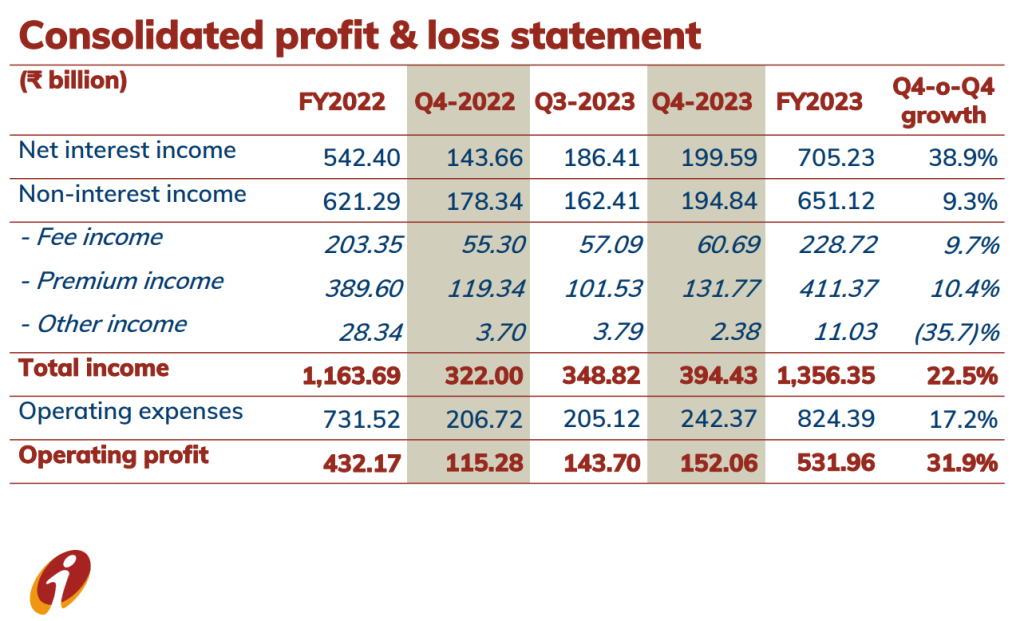

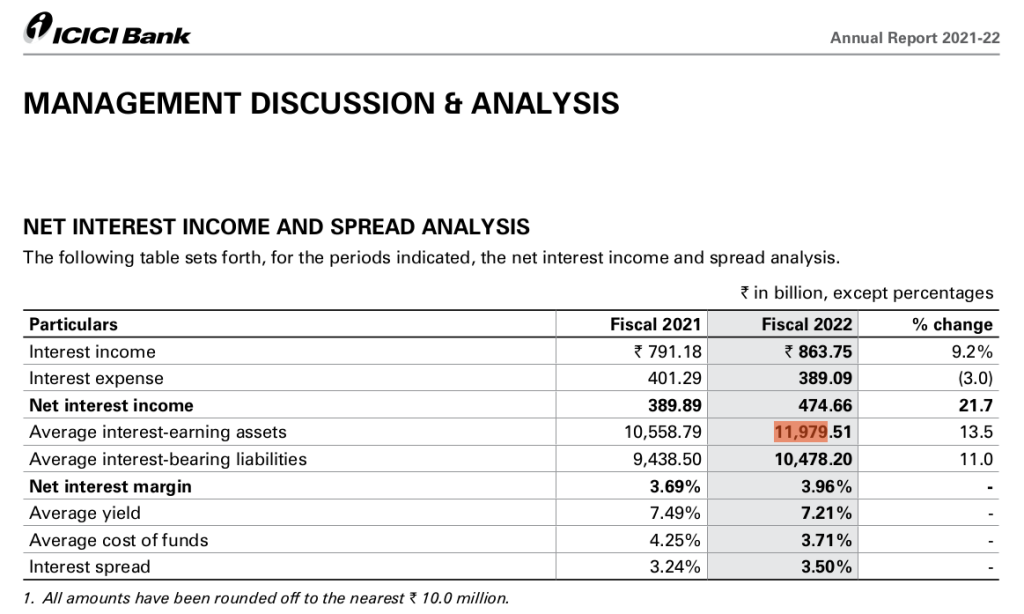

If you are reading a bank’s investor presentation, the net interest income figure will be given. You can see it in this snapshot from ICICI Bank’s presentation.

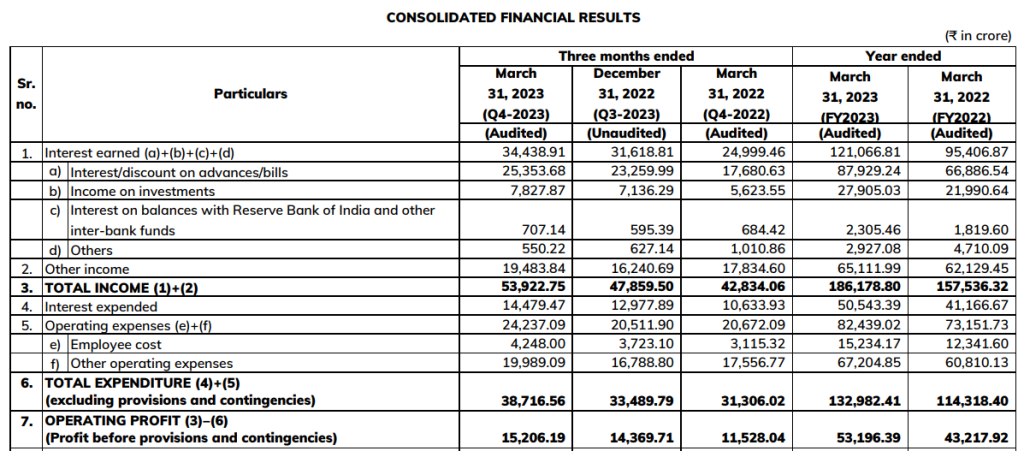

If you are reading the bank’s financial statements, you can compute it using the NII formula. Interest earned = (34438.91)

Interest expended = (14479.47)

NII = Interest earned – Interest expended

= (34438.91-14479.47)

= 199.59 Billion or about Rs.19,959.49Crs.

= 19959.49 Cr. This is the same as 199.59 billion, as shown in the presentation.

It is essential that a bank’s NII is positive. Negative NII means interest expenses are more than interest earnings. That means losses from the main banking operations.

Net Interest Margin (NIM) gives perspective to NII. Dividing NII by the average interest-earning assets gives NIM. The issue here is that the figure of “average interest-earning assets” is available only in the annual reports. But we don’t have to worry – the banks are mandated to declare NIMs every quarter.

A wider or growing NIM is a positive sign for the bank. It means the bank is either borrowing at lower interest rates or lending at higher interest rates. It could even be a combination of the two.

In fact, in FY22, ICICI Bank’s NIM grew compared to FY21 even when its interest earnings fell. This is because interest earnings declined by 28 bps while interest payments declined by 54 bps.

If the NIM is narrowing consistently over a few quarters, it could be a warning sign of the bank’s probably declining fundamentals and creditworthiness. Even when a bank is steadily improving its fundamentals, it is considered stable only when it has significantly improved and stabilized its NIM.

There is no ideal NIM figure. Perhaps you could use the industry average to judge a bank. Or you could even compare a bank’s NIM with an independent forecast. For example, Fitch Ratings expects the average NIM for FY24 to be 3.45%. So, any bank’s NIM higher than 3.45% is a good number.

Capital Adequacy Ratio (CAR):

A measure of a bank’s ability to lend, CAR is also known as Capital to Risk-Weighted Assets Ratio (CRAR).

Here, assets are basically loan assets. The loans given are a bank’s assets. Based on the nature of the borrowers and the types of loans given, each loan asset is assigned weights according to the level of risk it carries. Accordingly, the total risk-weighted value of all loan assets is determined. The ratio calculates capital as a percentage of total risk-weighted assets.

CAR = (Tier 1 Capital + Tier 2 Capital)/Risk Weighted assets

Again, you do not have to compute CAR, as the banks are required to report the ratio every quarter. Understanding the concept is important.

A bank is in the business of lending loans. It can lend roughly 4-5 times its equity capital. One of the biggest risks is the loans not being repaid. Loan losses directly hit the equity capital. If equity capital reduces, the bank’s ability to lend also reduces.

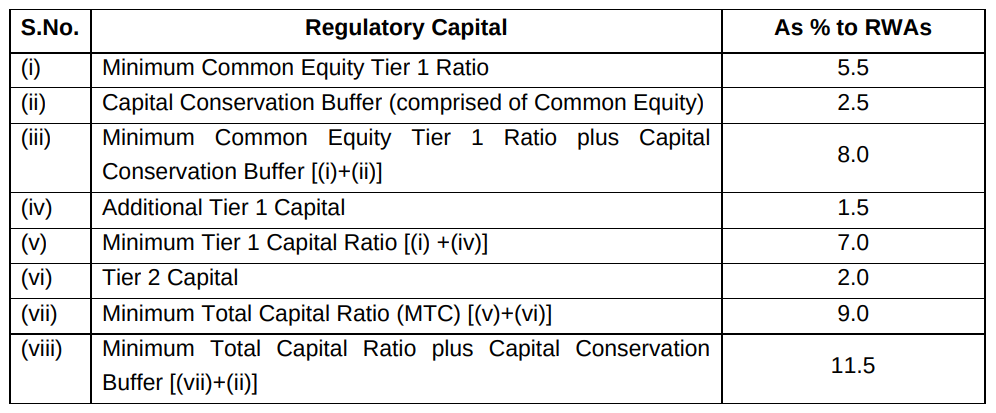

Suppose a bank has a capital of ₹2 Cr; it can lend roughly ₹10 Cr. What if loans worth ₹50 lakhs went bad? That amount of ₹50 lakhs is a loss that directly hits the equity. So, the remaining capital is ₹1.5 Cr. At roughly five times, the bank can lend ₹7.5 Cr. But it has already lent ₹9.5 Cr (after allowing for bad loans). In this case, it will have to either sell the loans or raise new capital. Both options can trigger events for the overall banking system. Therefore, the RBI mandates banks to have a minimum capital adequacy ratio of 9%. Basel-III norms have guided for an 8% CAR, but the RBI is stricter.

-

- Tier 1 capital should be 7% of the total risk-weighted assets. It is made up of Common Equity Tier 1 (CET 1) and Additional Tier 1 (AT1) capital.

- Common Equity Tier 1 (CET 1) includes common equity, reserves and surplus, and statutory reserves. It should be 5.5% of the RWAs.

- Additional Tier 1 capital can comprise preference shares, debentures, or other instruments approved by RBI. AT1 should fill the rest of the Tier 1 requirements. Therefore, AT1 can be 1.5% of RWAs.

- Tier 2 capital comprises provisions held as reserves for future, presently unidentified losses, preference shares, debentures, stock surplus, etc. Tier 2 capital has to be at least 2% of RWAs to satisfy the total capital requirement of 9%.

AT1 and Tier 2 instruments can be similar, but AT1s are subordinate to Tier 2 instruments. If a bank were to suffer losses, AT1s would be written down or written off before Tier 2 instruments.

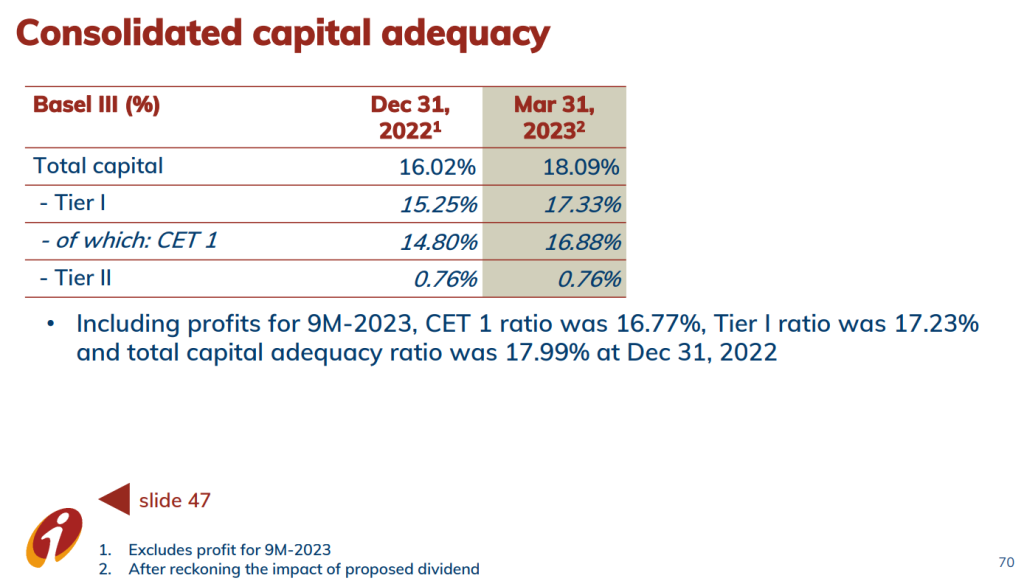

This snapshot shows that ICICI Bank has a CAR of 18.09%. This is well above the required 9%. We can say that this bank is well-capitalized. It has enough space to accommodate bad loans.

Banks are also required to maintain a buffer of 2.5%. It is called the capital conservation buffer. They are expected to build this buffer in times of good business. When there is stress, they can use this buffer. When the stress fades away, they can refill this buffer by reducing dividend payouts.

This snapshot from RBI’s Master Circular on Basel-III Capital Regulations shows the types of capital requirements for banks.

When a bank becomes excessively large, it becomes a systemically important bank. Any stress in such banks can have adverse ripple effects on the economy. Therefore, such banks have additional capital requirements. Only three banks fall into this category. SBI has to maintain additional common equity tier-1 capital of 0.60%. HDFC Bank and ICICI Bank have to maintain 0.20% additional common equity tier-1 capital.

A Note on risk-weighting of assets – Investments classified as Held for Trading (HFT) or Available for Sale (AFS) are given risk weighting mainly for market risk and not credit risk. This could understate the risk associated with such assets. A lower risk-weighted asset value would require lower amounts to maintain capital adequacy. A bank could buy non-convertible debentures of a risky company, classify it as Held for Trading, and under-report its risk. This could overstate the bank’s capital adequacy.

When studying the banking sector, you do not have to generally worry about large banks or banks with comfortable capital adequacy. But you must be careful when studying banks with only borderline capital adequacy.

In order to not stuff too much information in one chapter, I will take up asset quality, liquidity, and other parameters critical to analyzing banks in the next chapter, Banking – Part 2. It will also contain a checklist of all the parameters covered in both chapters that you can use as a reference while analyzing banks on your own.

Key Takeaways:

-

- Banking is perhaps the most digitalized sector.

- Banks can be commercial, specialized, or cooperative. Our focus is on listed scheduled commercial banks.

- Banking is a highly regulated industry. Given that we are a developing economy, the RBI’s norms are stricter than the Basel-III norms.

- Analyzing a bank involves studying its revenue structure, interest margins, capital adequacy, asset quality, deposits, loan book, and liquidity.

- Revenues sources generally include corporate, retail, treasury, and others (investment banking, insurance, etc.)

- Capital adequacy is judged from a bank’s tier-1 and tier-2 capital

- Asset quality is judged by a bank’s Gross NPA, Net NPA, and Provision Coverage Ratio (PCR) (Asset quality ratios will be covered in the next chapter).

Any thoughts on how to estimate the fair value of banking shares? I am not sure if DCF works for banks.

Classic DCF will not apply, one of the better ways to get a sense of valuation is to look at relative valuations and of course, the book value.

Excellent explanation and very helpful. Please add Pharmaceutical and Specialty chemical sector analysis.

Can you guide us on how would we project the Bank balances other than the above Cash and Cash Equivalents component?

We derived the cash component as the Net of Cashflow activities while creating the Financial Model. But how would we project the above field?

Hi, Can you pls put up PDFs of the following Modules, like the earlier modules, it is easier to study / make and mark notes and revisit highlighted areas without having to go through :

Module 13. Integrated Financial Modelling

Module 14. Personal Finance – Insurance

Module 15. Sector Analysis

Module 16. Social Stock Exchanges (SSEs)

Would be much obliged if the PDFs for the above modules are uploaded as well. It will be of great help.

Many thanks

Kunal

Hi Kunal, we will do that. Thanks. 🙂

Thanks a lot for this, I am waiting for FMCG, FMEG and retails sectors eagerly.

Hi Rishabh, the retail chapter is out now. FMCG is in progress. 🙂

capital adequacy ratio not explained properly also not in simple language i want to learn it

I am sorry for that. Let me try to list some simple points here. 🙂

1. Capital adequacy ratio (CAR) shows a bank\’s preparedness for risk.

2. You can get a bank\’s capital adequacy ratio from its annual and quarterly financials.

3. A higher capital adequacy ratio is better. The RBI mandates a minimum CAR of 9%.

4. Basically, a bank\’s invested capital (equity shares, preference shares, debentures) as a percentage of all the loans given out gives an idea of its CAR.

Great deal and much informative for noobs

Eagerly waiting for the Retail sector which is changing like never before. A article over it will be very useful

Can you give a few examples of weighted assets? Also Additional Tier 2 capital and Tier 2 have the same parameters like preference shares,debentures etc. Kindly elaborate. Thanks

Hi Dipan,

All loans that a bank gives are risk-weighted assets. Depending on the type of borrowers and terms of loans, each loan asset will be assigned a different weight.

Tier 2 and AT1 instruments are similar, but AT1s are subordinate to Tier 2.

Have updated a few lines in the chapter, too, to clarify these things.

Some headings like Capital Adequacy Ratio are not fully explained in detail. A lot is left to guesswork.

Hi Dipan, could you please elaborate on what is missing? Or help me with the questions that came to your mind when reading this chapter? I will try to address the questions or edit the chapter accordingly.

Thanks a lot for this, I am waiting for aviation sector

Alright Himanshu, adding it to the list. 🙂

Thanks a lot for choosing this sector. Was waiting for it. Kudos !

Happy learning. 🙂