What’s the PRC Matrix of Debt Funds?

Debt funds are usually considered to carry lesser risk than equity funds. In fact, many believe that funds cannot give negative returns simply because they invest in debt instruments.

However, interest rate risk, liquidity risk, and credit risk are all real risks carried by debt funds. The presence of risk indicates the possibility of a price decline—the possibility that you might get back less than what you invested.

So, starting in 2022, SEBI mandated that mutual funds declare the potential risk class of their debt mutual funds through the PRC Matrix. Mind you, the potential risk class is different from a fund’s stated category risk.

Let us understand this risk matrix.

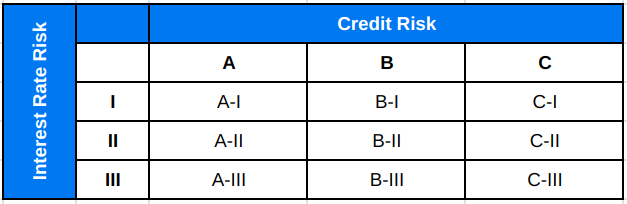

It plots the two most crucial risks that debt funds carry – interest rate risk and credit risk.

Interest rate risk occurs when interest rates go up after you have invested in a debt instrument or when they go down right when you want to reinvest your matured funds from another fund.

Credit risk is the possibility that the borrower fails to pay their dues.

In the PRC matrix, across the vertical axis, interest risk is graded I, II, and III, with I being the lowest interest rate risk and III being the highest.

Across the horizontal axis, credit risk is classified into A, B, and C, with A having the lowest risk and C having the highest.

A fund with A-I rating has the lowest interest rate risk and credit risk. A fund with C-III has the highest levels of both risks. Similarly, A-III would mean the fund has a low credit risk but a high interest rate risk.

Don’t worry. You do not have to construct this matrix for any fund. You just need to be comfortable reading and interpreting this matrix which funds are mandated to report every month.

Look at this Medium to Long Duration fund by ICICI Prudential AMC.

The stipulated standard benchmark for this category is the Crisil Medium to Long Duration Debt Index. The risk class of this benchmark is A-III. The funds are also mentioning the benchmark’s PRC Matrix in the factsheet. Now, see that the fund’s PRC is B-III. This means that the fund has a style drift compared to its benchmark. It is taking more credit risk than its benchmark index.

But who placed the fund in the B-III category? The fund manager is supposed to self-evaluate and accordingly place itself in the PRC matrix. It must then stick to the stated risk levels.

In the same factsheet, the risk-o-meter of this fund is shown like this. Moderate.

So, the risk to be assumed according to the PRC matrix and the actual risk assumed seem similar, that is, moderate. A fund is said to be sticking within its risk limits if the level of risk assumed is less than or equal to what it has specified in the PRC Matrix.

If, let’s say, the fund exhibits high risk in the risk-o-meter, it has taken more risk than it had specified. In such cases, investors are free to exit the fund without any exit load at all. A fund may take lower risk, but not more than what is disclosed in the PRC matrix.

You might also wonder – if a fund has assumed different risks than its benchmark, shouldn’t it follow a different benchmark?

Yes, and no.

For that, SEBI introduced a two-tier benchmarking system. Under this system, a particular category of fund must follow a benchmark that AMFI specifies for that category. This system applies to both equity and debt funds.

For example, some ELSS funds would benchmark themselves against the Nifty 250 index, while others would benchmark themselves against the Nifty 500 index. Now, all ELSS funds can benchmark themselves only against the Nifty 500 or S&P BSE 500 indices. Only one of these two can be their First-Tier Index.

If an ELSS fund invests predominantly in the top 250 stocks by market capitalization, it is free to report the Nifty 250 Index as its Additional / Second-Tier Index. However, declaring a second-tier index is optional.

The first-tier benchmark should reflect the fund’s broad category. The second-tier benchmark may reflect the specific style or strategy the fund manager adopts.

Look at this factsheet for Motilal Oswal Ultra Short Term Fund.

As the name suggests, it is a short-duration fund. Hence, the primary benchmark is the CRISIL Ultra Short Duration Index. The fund’s risk category in the PRC matrix is B-I, the same as its benchmark.

However, the fund may be tilted toward a liquid strategy. That’s why, to reflect its style, its additional benchmark is the CRISIL Liquid Debt Fund.

In the previous example of the ICICI Bond Fund, its additional benchmark is the CRISIL 10-year GILT Index. This seems justified when you look at the portfolio in the second snapshot. It has a significant concentration in government securities.

The tier two benchmark, or the additional benchmark, puts a fund’s PRC in context. It helps you compare a fund’s performance with the investment style it follows and the risks it assumes.

The two concepts – PRC Matrix and Two-tier Benchmarking – together offer quite a comprehensive understanding of risks.