It’s the economy, stupid! Inflation’s high… or is it?

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

Prefer watching over reading? Here’s the video for you!

Headline CPI Inflation Breaches Limits, but All is Not Grim

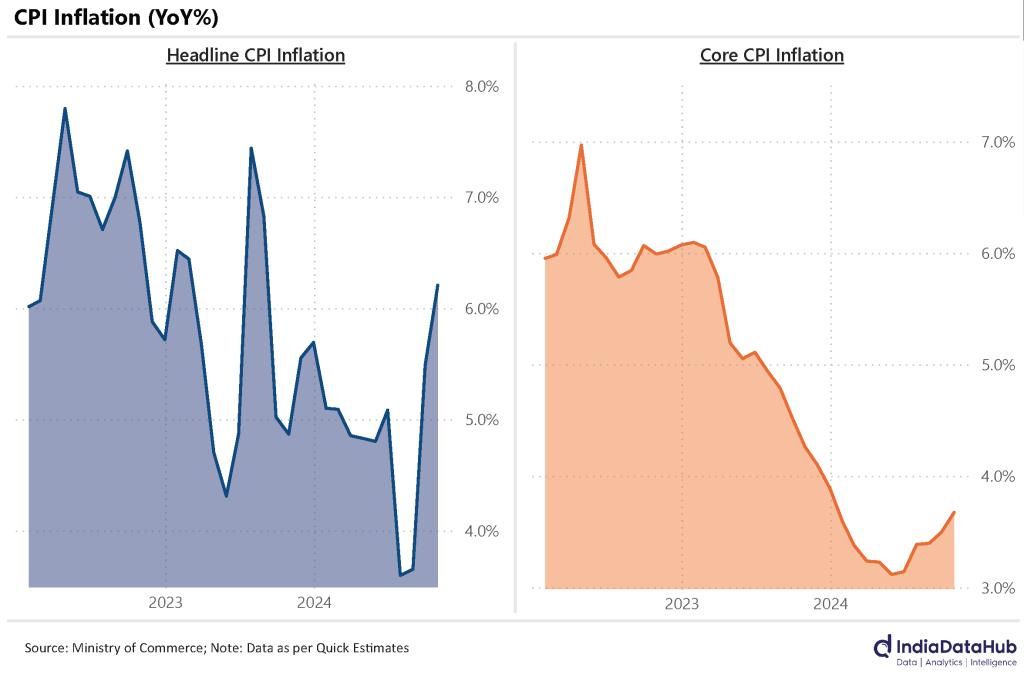

Let’s talk about October’s inflation. The headline CPI inflation hit 6.2%, a 14-month high, and food inflation zoomed past to 9.7%, levels we haven’t seen since last July. It’s tempting to hit the panic button when you hear this. After all, inflation climbing above the RBI’s comfort zone of 6% is no small matter.

But before we sound the alarm, let’s take a closer look. There’s more nuance here than the numbers suggest.

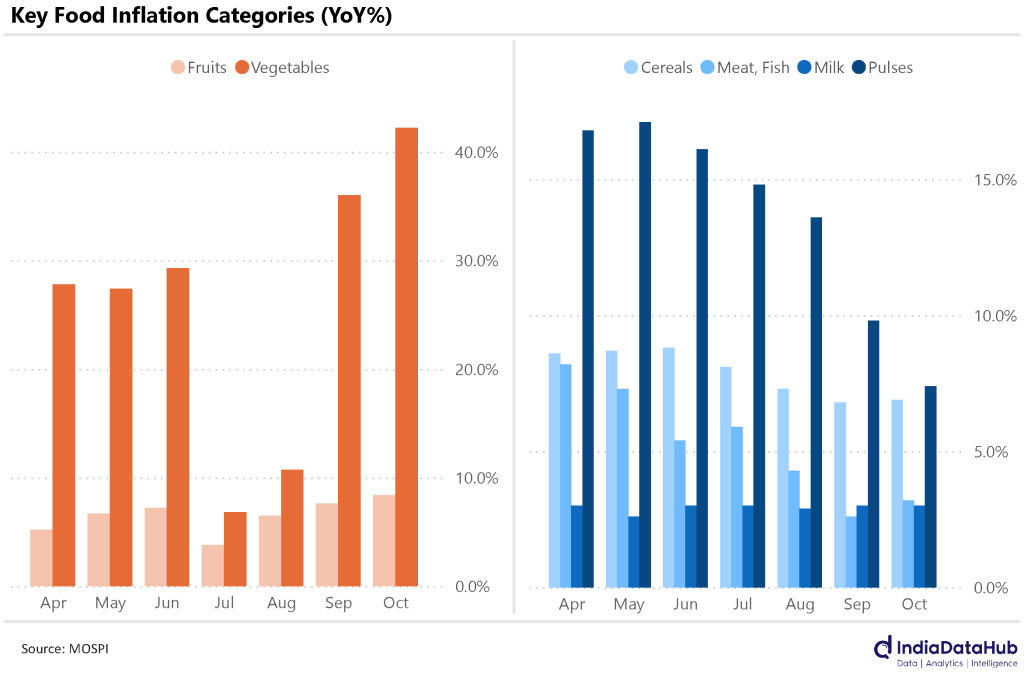

First, the obvious culprit: food prices. Inflation in fruits, vegetables, and oils shot up sharply. But here’s the silver lining—not all food categories are guilty. Cereals? Meat? Dairy? They’ve either stayed calm or even cooled off a bit. This isn’t a full-blown food inflation party—it’s just a few troublemakers stealing the spotlight.

Second, core inflation is still playing it cool. At 3.7%, it’s climbing up ever so slightly but remains below 4% for the 11th month straight. And if we dig into “core-core” inflation – this is when we exclude retail fuel and precious metals here – the story gets even better. It’s been steady as a rock.

Here’s where it gets complicated. Growth is clearly losing steam, and that 2Q GDP number everyone’s been speculating about? It’s expected to come in around 6% to 6.5%. When that happens, it could trigger a wave of downgrades to full-year growth forecasts. Even the RBI’s and IMF’s ambitious 7% target is starting to look like wishful thinking.

Normally, a slowing economy would prompt the RBI to cut interest rates to give growth a gentle nudge. But with inflation now sitting above 6%, the RBI is caught in a classic catch-22 situation.

Err on the side of growth, and you risk fueling inflation. Err on the side of controlling inflation, and growth might take a bigger hit. There are no easy answers here.

The good news is that this spike in CPI might be short-lived. Inflation could dip back below 6% by November or December, thanks to seasonal moderation in food prices.

But here’s the catch: the December MPC meeting will likely take place before November’s data lands. And even if inflation calms down, the average for the December quarter will still sit uncomfortably high at 5%—a full percentage point higher than the previous quarter.

So, what should the MPC do? Play it safe and prioritize inflation? Or take a calculated risk and back growth? It’s a classic trade-off, and December’s meeting could set the tone for the months to come.

Exports Surge After a Long Slump, but Imports Stay Calm

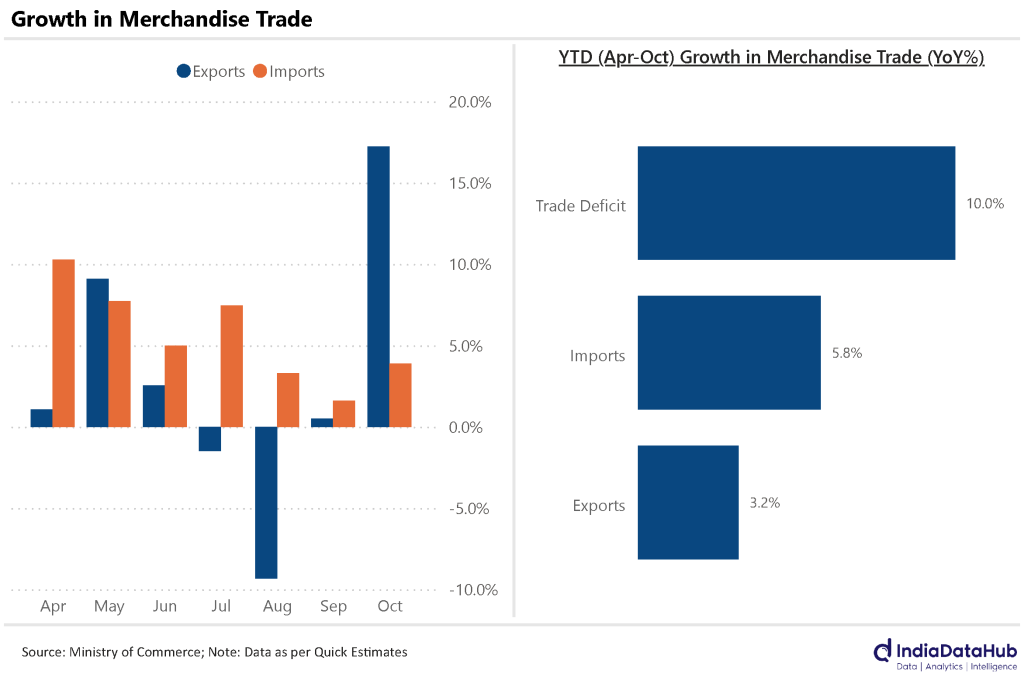

October brought some long-overdue cheer for India’s exporters. Exports jumped 17% YoY, marking the strongest growth since June 2022. And it’s about time—after seven consecutive months of either negative or single-digit growth, this bounce feels like a breath of fresh air.

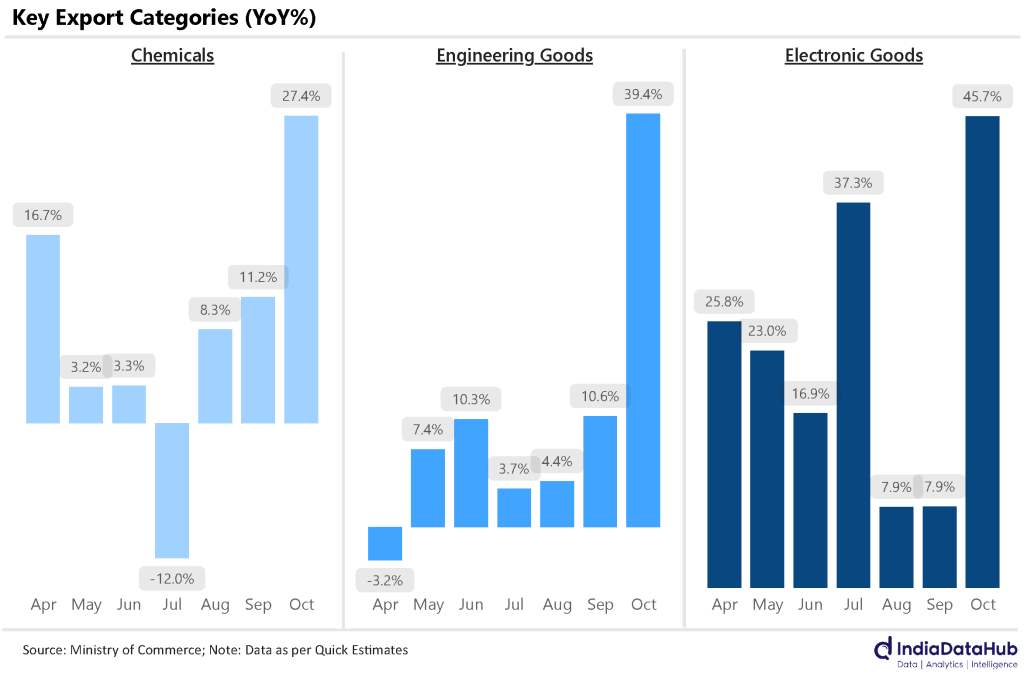

What’s behind this surge? The usual suspects: Chemicals, Engineering goods, Electronics, and Ready-made garments led the charge. On the flip side, Petroleum exports continued their losing streak, falling by 22%—the fifth straight month of declines.

Imports, meanwhile, rose a modest 4% YoY in October, continuing their streak of low single-digit growth for the third month in a row. The good news? This helped shrink the trade deficit on a year-on-year basis. But before we celebrate too much, let’s remember that there’s always a bit of seasonality at play—this year’s Diwali came earlier, pushing a lot of festive demand into October, which makes the numbers look better than they might otherwise seem.

If we zoom out and look at the April-October period, the picture reveals more depth. Exports have grown by just 3% YoY, while imports have risen by nearly 6%. As a result, the trade deficit has widened by 10% YoY and is now on track to breach the $250 billion mark for the full year. Not exactly the kind of number you’d want to see in the ledger.

While October’s surge in exports is a welcome development, the broader trend shows the challenges are far from over. A growing trade deficit coupled with sluggish global demand (especially for petroleum) will continue to test India’s resilience.

The question now is whether October’s momentum can be sustained—or if it’s just a festive-season blip. Either way, the trade numbers will remain a key watchpoint in the months to come.

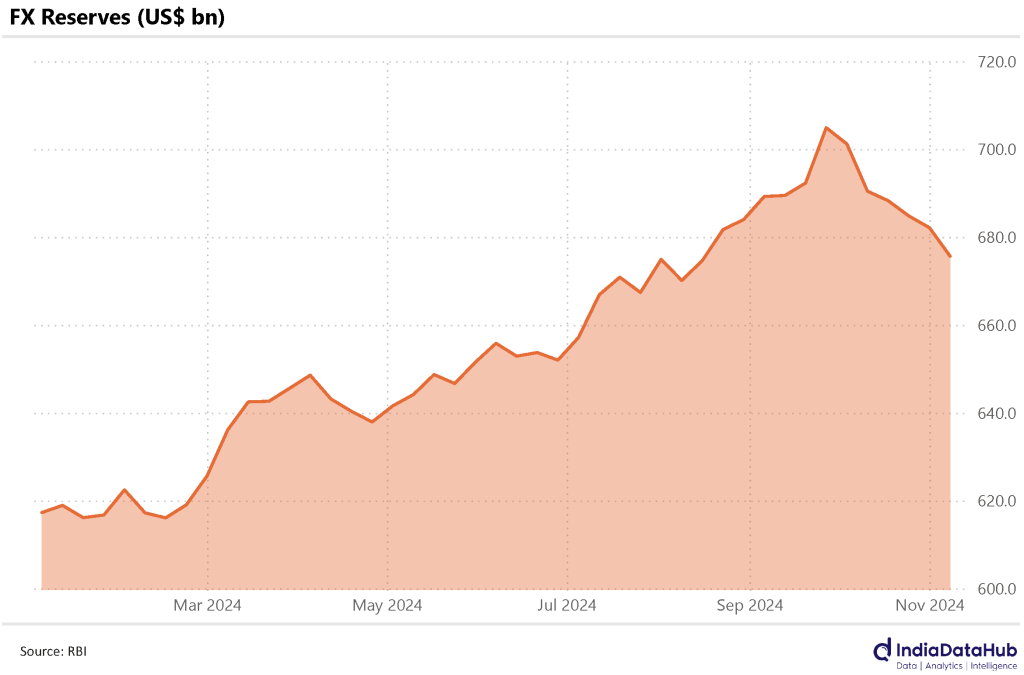

FX Reserves Take a Hit—What’s the RBI Up To?

India’s FX reserves dropped by $7 billion in the first week of November, marking the sixth consecutive week of declines. Over this period, reserves have shrunk by a total of $30 billion. That’s a pretty steep slide, but it’s not exactly shocking.

Here’s why: foreign portfolio investors (FPIs) have been pulling money out of Indian equities, and those outflows have been significant. To offset this selling pressure on the rupee, the RBI stepped in, dipping into its reserves to stabilize the currency. What this tells us, though, is that the rupee could’ve taken a much harder hit if the RBI hadn’t intervened to cushion the fall.

So why is the RBI so keen on defending the rupee? It’s not just about keeping the currency stable for its own sake—it’s also about inflation. A weakening rupee can drive up the cost of imported goods, adding pressure to core inflation. And with inflation already a headache, the RBI is clearly trying to prevent things from getting worse.

Some High-Frequency Indicators: Auto Sales, Energy Demand, GST Collections and Banking Growth

After delving into macro-level data, let’s now turn our attention to high-frequency and micro-industry indicators to get a closer look at what’s happening on the ground.

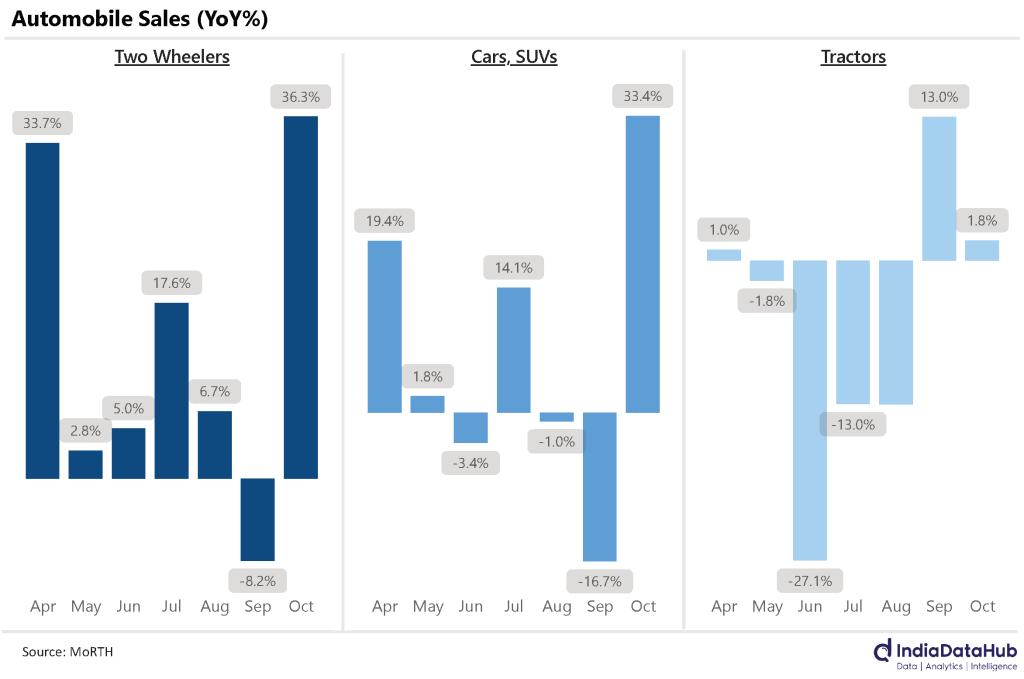

As expected, October brought a wave of positivity across the automobile sector. Two-wheeler sales surged by an impressive 36% YoY, while Cars and SUVs weren’t far behind with a 33% jump. Even construction vehicles, goods carriers, and passenger vehicles joined the party, all posting solid growth.

However, tractors stood out as the outlier, with growth moderating sharply—likely a reflection of softness in the agricultural economy, which has been facing its own set of challenges.

But here’s the catch: this festive boost comes with an asterisk. As we explained in the exports story above, festivals like Dhanteras, which was on 10th November last year, were pulled forward to 29th October this year. So, October’s stellar numbers might be inflated by the timing. November’s figures, likely to be weaker, will balance this out.

To gauge the real state of consumption, we’ll need to look at cumulative growth for October and November—it’ll paint a more accurate picture.

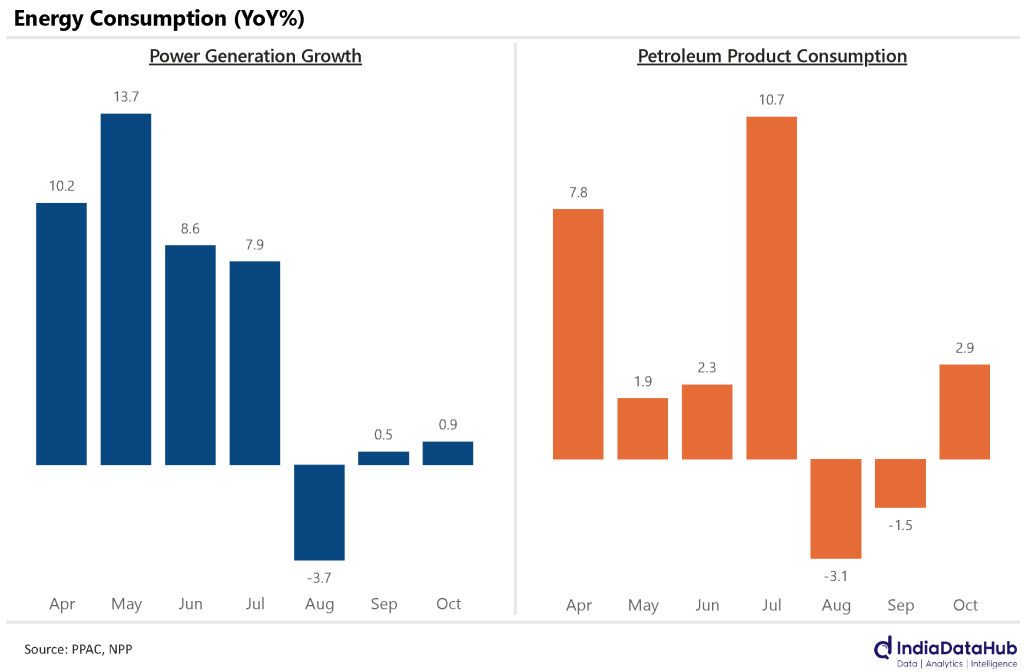

Petroleum consumption recovered slightly in October, growing by 3% YoY after two months of declines. Diesel consumption, however, was nearly flat (+0.1% YoY). Power generation didn’t offer much relief either, giving out less than 1% YoY growth for the second straight month. Taken together, these numbers point to a general cooling in energy demand over the last few months.

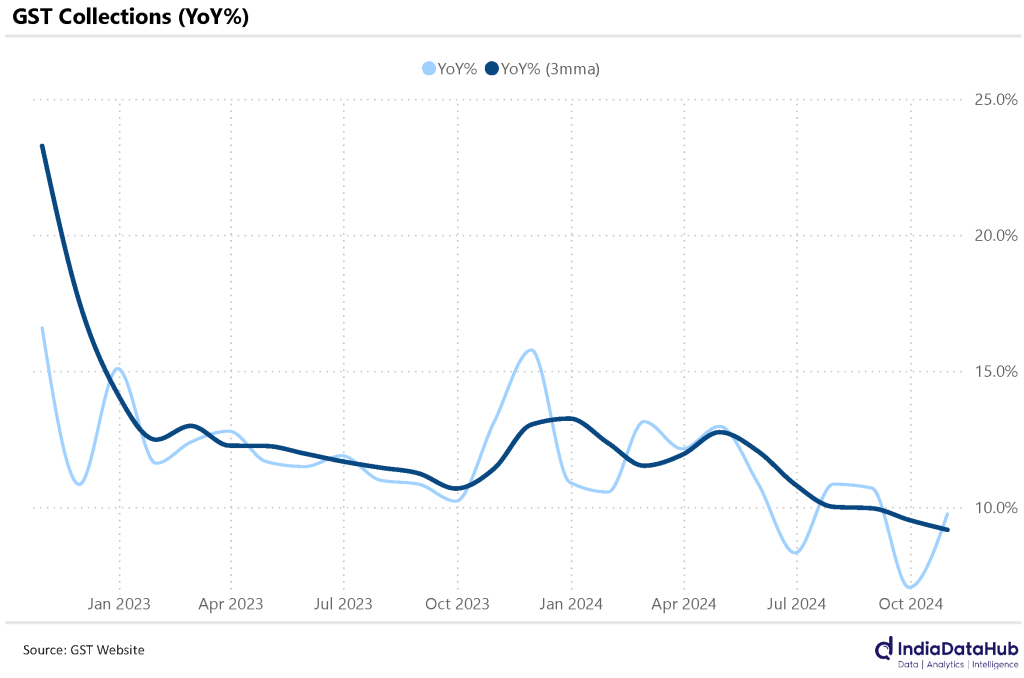

GST collections grew in single digits for the second month in a row this October. Over the last three months, growth has averaged just over 9% YoY—the slowest pace we’ve seen since early 2021, when COVID was wreaking havoc.

But EWay bills? They’re telling a completely different story. Growth in EWay bills hit 19% YoY in October, matching September’s strong performance and coming in well above the June quarter’s average.

So, what’s the deal with this divergence? You see, GST collections show how much the government is making from goods and services sold in the economy—a solid proxy for measuring economic health. On the other hand, EWay bills are generated whenever goods worth over ₹50,000 cross state borders (or even within states, in some cases). Essentially, they’re more about compliance than pure economic activity.

The takeaway? The sharp growth in EWay bills likely reflects better enforcement and stricter compliance with the rules rather than a actual rise in goods movement or economic activity.

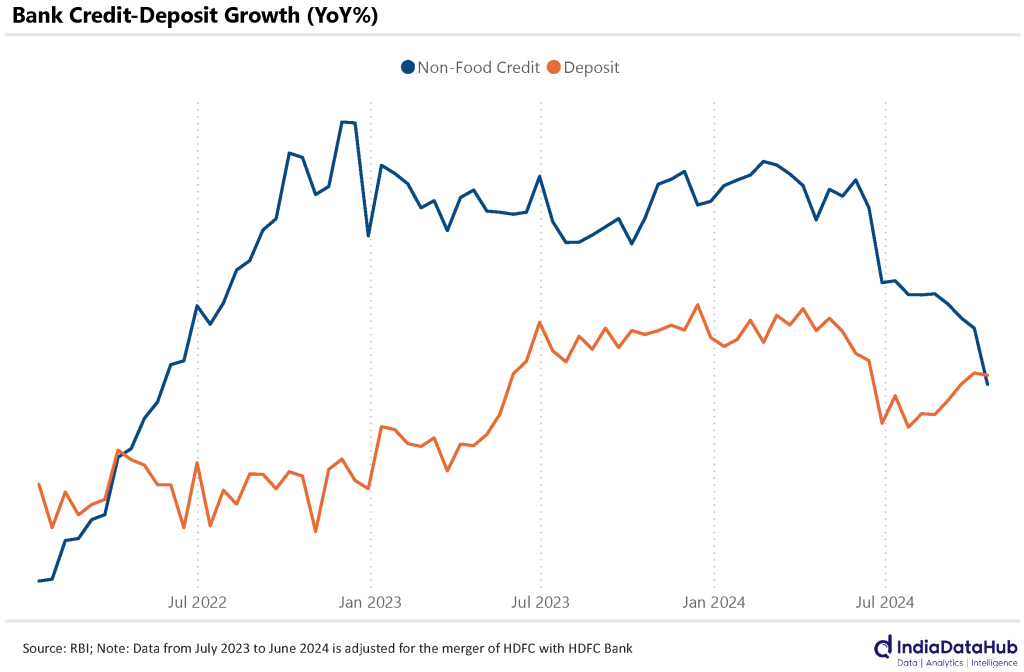

And finally, let’s talk about Banks. Bank credit growth dropped below 12% in mid-October—the slowest in over two and a half years. Compare this to the start of the financial year, when credit growth was charging ahead at over 16%. Deposits, on the other hand, have grown modestly but have now overtaken credit growth.

Remember all those debates about credit growing faster than deposits because of stock market inflows? Turns out, that argument didn’t hold water—and now, it doesn’t matter.

That’s all for this week, folks!