Broking goes mainstream – Dec 2021

I was at the Blossom Book House in Bengaluru last week buying some comics for my son, when a 20-year-old recognised me (behind a mask!) and got really excited. In my head, I thought to myself, “hmm… why?”. And this reaction pretty much defines how the last two years of the business have been for me. The broking business, and in turn, Zerodha, are now mainstream.

From personal trainers to cab drivers, to prominent business people, almost everyone seems to be slowly and steadily increasing their exposure to stock markets. I have, like many others, been questioning what all of this growth means for the capital markets, and in turn, for the country. I thought I should answer a frequently asked question around user growth, share some learnings, and as we head into the new year, maybe also take a shot at predicting the future of the broking businesses.

I would like to remind everyone that I have been horribly wrong with many of my predictions about our industry in the recent past. Actually, I have never been so wrong as I have been in the last couple of years, while thankfully ending up on the right side in terms of business outcomes. I have been right because, even though my predictions were wrong, my decisions inadvertently stuck to the trend. If I were a trader and Zerodha was a stock, maybe I would have tried to do the impossible, which is to time the market, and may have tried to exit early. I am reminded over and over that the only way to create wealth when investing is to be able to sit tight, ride long term trends, and let the magic of compounding do its thing.

The user growth

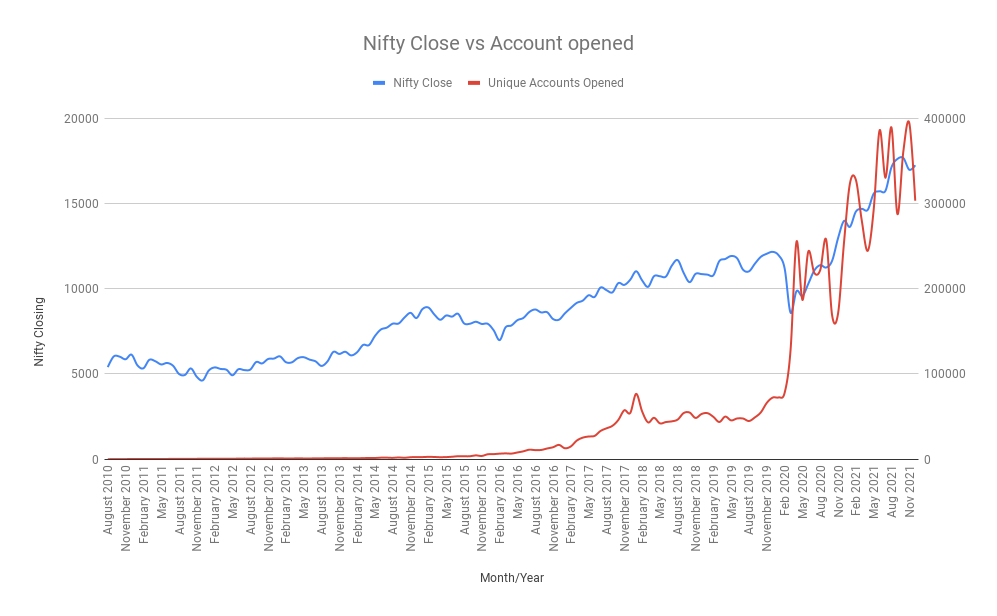

This chart of our monthly user growth plotted against the Nifty broadly shows our journey over the last eleven years.

Nifty vs our account openings

It took us six years to get the first 100,000 customers and nine months for the next 100,000. It took us eight years to reach 1 million customers and only 1.5 years for the next 1 million. It took us almost ten years to get to 2 million customers, which was around the time COVID hit, and then we added our next ~6 million customers in just 18 months. Just for added context, we added 400,000 customers in October 2021, while it took us seven years to add our first 400,000. So yes, the last 18 months have been spectacular, not just for us, but broking businesses around the world.

I think that this trend of user growth at Zerodha is maybe a better gauge of the actual market sentiments than the overall exchange data that everyone tracks. This is because all our user acquisition is organic without any marketing or advertising pushes from us. In addition, we actually charge a small account opening fee on user signups to cover our compliance costs. Most importantly, we do not incentivise people to sign up by offering random freebies. So, our new users come to us of their own accord, with a clear intent to trade or invest.

The journey

Until mid-2015, we offered the same 3rd party white-labelled trading platforms that many other brokers also offered at the time. The first serious uptick in our user growth started when we launched our in-house platform, Kite, in late 2015. Our gut-based decision to offer 0 brokerage on all equity delivery trades in Dec 2015, along with love for the newly launched Kite, gave the business virality for the first time.

However, the tipping point was when users could finally open an account fully online using (Aadhaar linked) digital signatures around mid-2016. Until then, like banks, brokers with the most offline branches acquired the most users as opening an account involved printing and signing several dozen sheets of an account opening booklet.

Online onboarding disrupted the status quo. The convenience of opening an account online has been one of the biggest reasons for the massive increase in retail participation over the last few years. Within a year of launching online account opening, we went from opening 5000 new accounts a month to almost 30,000 new accounts a month. Of course, the launch of the Kite mobile app, Coin (our direct mutual fund platform), the success of Varsity, Rainmatter partnerships and other initiatives were why users were coming to us in the first place, all via word of mouth.

From the beginning of our business, user growth at Zerodha has been a mirror image of the Nifty mid-cap index. That changed in February 2020. For the first time, we saw a divergence. We went from opening 70,000 accounts a month towards the end of 2019 to almost 250,000 a month by April 2020, all while the markets collapsed due to COVID.

The divergence wasn’t just between the underlying markets and user growth correlation. I can’t remember the last time in the last 20+ years of trading the markets when so many new users made so much profit so quickly when markets recovered. This, I think, was another tipping point for the industry, not just in India but across the world. The stock market became cool for a certain younger segment of the society when they were stuck at home and had some extra disposable income to invest, which they could now, fully online. Quick profits also triggered greed, which helped market participation increase faster, probably the fastest ever in the history of capital markets. IPOs listing at lucrative premiums also caught the fancy of this younger audience. Many opened new trading accounts for extended family members, hoping to get lucky with an allotment by applying to IPO through multiple accounts. Many of these accounts that were initially opened for IPO also transitioned into direct investing and mutual funds.

The plateau

While the growth over the last 18 months has been spectacular, we are starting to see a slowdown. This plateau coincides with the markets topping out. While the broader indices are not very far off from highs thanks to a few heavyweights, there are significant drawdowns underneath the indices. The general user behaviour we have seen in the past is that if the investments don’t recover quickly from a drawdown, most users become inactive fairly quickly. So, if the markets don’t bounce back quickly, the plateau could soon turn into a steep drop. It took the Indian capital markets almost ten years to add the same number of trading accounts in a year after the previous peak made in 2007, just before the financial crisis.

This time could be different though

While I can look at the past and anticipate what could happen if the markets don’t bounce back, it could potentially be different this time. The best part about the huge user addition over the past two years has been that the majority of these users are under 40 years. These users are trading with comparatively smaller amounts of money compared to their future earning potential. I don’t think we have ever seen such an influx of young people as we have seen this time around In the history of capital markets around the world.

The younger users trading with smaller amounts of money, making smaller mistakes, can learn without losing as much capital as older folks did trading with the majority of their life savings. So maybe this new breed of users will not become inactive when there is a drawdown in the account, unlike in the past. And as long as this audience is active, they will continue to influence others to invest in the markets through social media. It will be interesting to see the behaviour whenever markets have a large drawdown of over 20%.

The growth in users bodes well for India. Maybe finally, our dependency on foreign capital to determine our fate and fortune will reduce over the next decade. Philosophically, this is also one of the key reasons why we do what we do as Zerodha. We believe that our country can be truly financially independent if more Indians back Indian entrepreneurs by investing in their companies vs keeping money in gold, real estate, or FDs. Wealth creation could happen locally and more inclusively.

Future of broking

Broking is as unpredictable and as cyclical as an industry can get. Except for those two months last year, user growth has been dependent on how the underlying markets perform. New user growth is extremely important for brokerage businesses because, as I mentioned earlier, existing users tend to become inactive quickly whenever there is a drawdown in their portfolios. Brokerages have to keep adding new customers just to be able to maintain the same revenue. It almost feels like being on a treadmill, having to constantly run just to stay where you are.

With venture capital (VC) chasing the brokerage industry, the competition is also now picking up the pace like never before. The industry works on wafer-thin margins, and unlike international broking firms, there aren’t as many options to generate revenue in India. At such low margins, the only brokers who will be able to scale well are those who will be able to survive the next three years. Scaling well does not only mean getting large enough for economies of scale to kick in but being ready technologically to handle the scale when it materialises. The technology required to run a brokerage firm is extremely complex due to the numerous dependencies from exchanges, depositories, clearing corporations to banks and to the vast and ever-changing regulatory and compliance requirements. What users see on the outside, the trading platforms, are just the tip of the iceberg.

As the competition gets tougher, the cost of acquisition per user is going up. The biggest challenge with the now defacto discounted pricing model is that it is quite tough to generate revenues. Instant signups also have a flip side; users aren’t as sticky anymore. The industry is already finding it tough to generate enough lifetime value (LTV) to cover the cost of acquisition (CAC). Thankfully, at Zerodha, we don’t spend any money on marketing or advertising or promotions, so we don’t really have a CAC to worry about or compete on. Moreover, we are in no hurry to grow faster. We believe that if we focus on the quality of products and services, the rest will happen on its own. This mantra is what has worked for us over the last decade.

I do feel that we have maybe hit the near term peak in terms of an industry, and it will likely get worse before we hit the next new peak. This is because the increased competition will mean new customers getting distributed amongst multiple players. To do well in a low-cost business model, you need to be able to scale, which becomes tough when customers get distributed. Consolidation within the industry is tricky because of regulations. We are also probably close to hitting the near term peak in terms of tapping the target audience or customers with disposable income with an intent to trade or invest. With large drawdowns in international tech-first brokerage firms (Robinhood is ~40% below its IPO price and ~75% below 52-week high), new funding may not be that easy as well.

Who will do well

While everyone focuses on adding more users, I think brokers who can find ways to retain existing customers by finding ways to reduce the money mistakes they commit will do better than their counterparts. This potentially means foregoing revenue in the short term. It is maybe finding the right product for the users and nudging customers away from higher-risk products, while this is the antithesis of popular business models in the industry. It may sound weird coming from me, but I believe that most Indians aren’t ready yet for equity as an asset class. Maybe the right product is a fixed income product where the risk is lower than equity but returns higher than bank fixed deposits. From there, equity can be introduced gradually as risk tolerance increases. Another approach might be building an advisory-first platform. These are things that I spend a lot of time thinking about.

All that said, these are exciting times for everyone tracking the capital markets. I look forward to updating this post at the same time next year, maybe every year going forward. We are in uncharted territory, and I am sure everyone who loves trading will want to track what happens to the broking industry as well.

The ultimate investment

As we head into the new year, the other thing I wanted to remind everyone is the importance of taking care of your physical and mental health. Full-time trading can be mentally taxing, and when you’re stressed, it ultimately shows up physically.

I had also shared this recently. The number of people developing severe heart issues in my extended circle going up was a rude reminder for me. It’s very easy to get caught up in the hustle and bustle of things and take your health for granted. This is even trickier given that many of us are working from home. So please do take care of your health, your ultimate investment.

Wishing that the new year brings you a lot of health, wealth, and happiness. Also hoping that 2022 will see COVID being handled much more safely and effectively.

Best,

helloooedit

hellooo

Yas

Insightful information!

Excellent and honest narration.

All the best team Z.

This is an excellent read

Indians are ready for the stock market. Some one to show the clear path to profitability is all that is needed. In that context advisory first platform will do well if advises are such that it can be followed consistently. As a customer I look for low cost, better product experience and execution freedom and reliability from the stock broker. So do all the fellow traders I know. Nudges that hamper the trading process is a big 👎 for us. E.g :- far OTM naked selling allowed but not buying unless a sell position is live. This means option sellers cannot get margin benefit when they place the order. How is this good for the customer ?

Good

Very good

Thanks

Ok

I open the account,but dont get mi id

Hey Dhammasevak, please create a ticket at support.zerodha.com. Our team will have this checked and assist.

Teach streak to streak subscriber.

I am using sensibull. I want to start arbitrage in future. In sensibull margin showing 20000 but when adding order in zerodha kite it showing margin required approx 2.5 lacs

Please clarify

We want volume column in market watch without clicking market depth. In kite. Zerodha. Com

You have beautifully explained the intent of the Article by Sri Niathin ji and also given vivid description of the need for financial literacy among our citizen at primary school level and also you have given appropriate prescription for the sustainable grow for Finteck Companies/Entrepreneurs and to the Institutions. An illustrated information on the subject on this platform will go in a long way for the benefit of the new-age investors which would help the Industry and eventually the National Economy for ensuring Atmanirbhar Bharath. Thank you very much Nithin Ji & Ajith ji.

Last week I open my new account but still I don’t got my zerodha id

Hey Shamal, we’re sorry to hear this. Please reach out to us at support.zerodha.com. Our team will have this checked and assist.

Please send a complete video of options buying at kite

no one pick up phone when need support

Hey Monturanjan, sorry about that. Our call volumes have been slightly higher than usual of late. For a quicker reply, can you please create a ticket here support.zerodha.com?

Thank you Nitin for the thoughtful post. You have built such a wonderfull app making our lives easier and helping us earn a parallel income.

It was a nice reading and quite surprised and very unlikely from the CEOs of a company of this sort of message…stay blessed.

High respect for ur Thoughtful messages Nithin and love the reports kite throws in.U also have customers from other traditional brokerages who can shift by sheer word of mouth which can lead to new customer acquisition. I was one where I got converted in April 2020 still having my traditional bank brokerage account too.All the best

Mr.CEO you are really a genuine person. Zerodha is extension of your personality. Please stay same and Never leave Zerodha.

Also, if you have enough money now, please try to startup something in Vehicle RTO and Real estate space. These are the one of most corrupt sectors in India right now and needs disruptor like Zerodha 🙂

Hi Nithin, a very Happy New Year to you and the Zerodha family.

You wrote, ”The number of people developing severe heart issues in my extended circle going up was a rude reminder for me”, and that brought up a thought I had buried recently, thinking we may never know authentic answer to this question.

Have you, by any chance, noticed this alarming rise AFTER the vaccinations started? Is there any source that you know or can suggest where one can check this?

I am asking because the stories of sudden deaths in the last 6 months, especially in the age group 35-50, among people I knew directly or indirectly, has been very unsettling.

Will be grateful if you can direct me to some repository of authentic data.

1. Please provide option chain (sensibull) in the nse stock page at the bottom, like technical and fundamentals are present in the mobile app.

2. I am facing a problem while placing a limit order. When placing a limit order, it will be at market price immodestly.

Hey Raghu, thanks for the feedback. We’ll look into the possibilities of incorporating this. Regarding your second query, this happens if you place a buy limit order above or sell limit order below the CMP, it’ll execute as a market order. As the limit order allows you to buy or sell a stock at the price you have set or a better price. Explained here.

Great post Nitin,

I like your approach on differentiation using different products for those risk-averse equity investors. You already have one – Coin! However, the fact the coin stores the funds in demat form (unless they are created as AMC funds which has its own disadvantages) and the lack of STP/SWP (all of which has been pending for years now is a barrier to entry and something your competition is taking away from you.

I hope you put serious thought behind making Coin the MF platform similar to Kite in 2022

Hey Suraj, we know it’s taken a while. We had built an SWP where you could do it across any scheme across any AMC but suddenly this SEBI circular came out which changes the way Coin works and whatever we had built no longer works. We are currently working on transitioning Coin and once we’re done we’ll introduce STP/SWP. Please bear with us.

Hey Nitin,

Earlier the growth was majorly because of investment for long term and post Covid it’s majorly been because of F&O.

Looking at the YouTube and Twitter influencers who have gotten people hooked to money markets, and people have learnt that money can also be made trading the bear run might not effect the Broking industry as much. The ideaology amongst young is’nt about making money only in bull market but to trade irrespective.

I see a lot of veterans warning against F&O, however many just turn a deaf ear. Instead focusing on educating or tutoring how to manage risks and fixing it mentally would be a good approach than just demoting day or short trading in the age of info availability, monstrous amount of data points and accessible data.

Now that zerodha and many others are here to stay, maybe unlocking the secrets of making money through stock markets by educating, sharing experiences can be the reason for next set of growth for Broking industry. After all people will learn how to fish,

Thank you Nitin and we wish the same to you and your family and ”Keep Rocking Zerodha”.

Great. My two young daughters working from home ever since pandemic started are using Zerodha and making good strides in equity investment

I love zerodha stock broking very very trusted broking account my money is safe and regular growth thank you zerodha team and nitin Kamat ji.

Sir mera password galat bata raha hai mai kya karu

Hey Dinesh, please check if you’re entering the right password. Alternatively, you can reset the password and login. You can check the process here.

Jharoda ki application bahat acchi ha

I want my account Opening form

Hey Felu, you can check the account opening form and documents submitted while opening an account on Console. You can follow the process given here.

Good morning sir,

Wish you and all Zerodha Team members a very happy, healthy and prosperous new year 2022.

I always read your articles published on ET or on google news, it realy gives a very good experienced informations to us.

Thanks sir.

Hello, good morning & happy new year to you & your broker house zerodha. Your artical about stock market and broker house increase in our country individual invester, it is good our Economy develop purpose. My one question to you as a individual investor entry & excit timing signal to develop your kite app. Is it necessary in present time. India leading broker zerodha can do it.

Your concern for the investors and traders in stocks comes out clearly through the views you have expressed frankly,apart from the business model that you have been following all these years. Yours is fair business caring for your customers.That you can make big profits still, increases our faith in ethical business practices in India.

Excelkent platform. Though i am sr. Citizen finding very ease to operate. However reqyest you to open a telephone window to ckarify doubts/pricedure for sr. Citizen to acquire full knowlledge in reading and working with kite

I am using it since nov 2021. My experience is wonderful with Zerodha and I refer with my friends too

Congratz. Team Zerodha

It feels very nice to read this article .I am using zeerodha ,a easy convenient, user friendly trading module.Thanks to zeerodha thanks to Nitin sir

Can I invest in us stocks using Zerodha?

Hey Kalyan, not yet. We’re exploring the possibilities and have discussed it in detail here. Btw, if you wish to invest in US stocks or just have some exposure to global markets then, international mutual funds are the easiest way. You can check the list of international MF’s here.

I am using zerodha kite app last 2 years, when i was a new in stock market. I am so happy & satisfy from zerodha broking service.

Best wishesh from me to zerodha Business and Nitin kamat sir…

Hi Nitin,

Please ensure Zerodha application is functioning properly as the Order Buying and Selling execution is not apt when compared to other brokerage companies even though the Buy/Sell price comes the orders are not executing and causing the losses, especially to Retail brokers, please look into this issue and quickly get this fixed.

Hey Ravinder, we’ve been working fine. Orders always get executed on a ‘first come first serve’ basis. If multiple bids are placed at the same price and there is only one offer to counter it, the execution will happen for the person who placed the bid first. More on this here. If you’ve further queries, please create a ticket at http://support.zerodha.com. Our team will have this checked and assist.

I appreciate your excellent service to the investing customers by charging nominal fee irrespective of turnover. Though I opened demat account with two well known brokers, I was introduced to Zerodha by my client. My holdings worth more than Rs 19 Lakh with Zerodha within one year time of opening account with you. I referred customers to Zerodha from my friends and relatives numbering 7 without mentioning my name to Zerodha. The tax P & L and other reports developed by Zerodha are very useful for filing Income Tax return.

My wishes and congratulations to Zerodha for the services rendered to investing public (silently without and advertisement)

M Rajamani

Chennai

The excellent Broking firm& team work under the Stalwart leadership of MR. KAMATH & COMPANY, WISH EVERY SUCCESS IN HIS FUTURE ALL ENDURANCE, ALMIGHTY MAY BLESS ALL 🙏

I opened my Zerodha Trading Account on 6th October, 2020 and my experience for the past 15 months has been great. The Kite app is fantastic besides being user friendly. The entire experience is technology driven. I never ever found the need for getting any of my queries telephonically resolved as initiating a ticket in support.Zerodha is once again user friendly. My best experience has been while selling a scrip on the very first day of turning XD in the market and not having fo telephone your support deck when the companies would disburse dividends. The credit entry would reflect in my trading account within the following 3/4 days max which i truly appreciate. Wishing you’ll all the very best in your future endeavours. Stay blessed abundantly dear Nithin & Nikhil.

The best part is Varsity. The online written material gave knowledge of stock market made me profitable for last two year. Thanks to all Zerodha team.

Great article…

Completely agree on the need to consistently add new clients…as the life span of the traders is short and it will become more difficult for the broking industry during bear phase…

Also agree on the point that the brokers need to move away from promoting high risk products/services to retail clients….and encourage more sustainable long term options like SIP in Direct equity, positional trades in quality stocks etc….But may need to incorporate an advisory-Broker model…

Don’t agree with moving clients to bonds…this can be a small portion but equities offer much better opportunities and if done properly offers a much better chance of beating inflation and wealth creation.

The problem as you mentioned is a very short term view …Brokers are looking for short term income by encouraging high risk product like intraday/F&O and client goes away after losing his money in 6 month to 1 year.

The advantage of long term products/services is…the clients would stay very long term 10-20 years+ and would also give a higher wallet share…you won’t have to worry much about the bear phase…

I am having total 34 holding in my portfolio, while I opened my portfolio it shows 33 holding why GDL is missing in my portfolio.

Hey Thomas, The shares of GDL has undergone a scheme of amalgamation with Gateway East India and Gateway Rail Freight and have been suspended from trading from January 5th onwards.

As per the scheme, you will receive 4 shares of Gateway Rail Freight for every 1 share held in GDL as of the record date (January 6th).

The amalgamated shares will be visible in your holdings on Kite once they are credited in your demat account and listed in the exchanges. You can check more info here.

Is there any ETA on when Gateway Rail Freight Limited will be listed or the shares credited?

Paarthy, currently there is no ETA available for the credit of shares.

Kudos Nithin. I have been tracking the growth of Zerodha since its modest beginnings around 10 years ago at a small modest setup on Banerghatta road not far from IIM Bangalore, and the explosive growth, once your new age platforms came on board. I am myself responsible for getting 25 new users to join the Zerodha family investing in equity and consistently making good returns. The availability of good productivitivity tools such as the API’s for placing orders and retrieving information has made trading a truly enjoyable experience. I hope the recent consultation paper by SEBI doesnt take us back to the dark ages of purely manual trading.

Thanks and keep up the good work.

In the period of covide we recommend many of our colleagues and friends to open his/her demat account in zerodha… maximum are in this is a first timer…and big thing is everyone open his/her account in zerodha…and the reason behind it is… easy to use…thank you…

Hi Nithin

Thanks for your words

While I appreciate the level of support you provide for your clients I appeal to you to waive the charges that’s levied for transferring funds from Bank a/c to Demat a/c.

Thanks and regards,

Can you write in Hindi ?

I don’t know English language.

Great 👍 Real Unicorn. People are expecting advisory also. Best of luck to Zrd and its investors in new year.

Beautiful thoughts from an amazing person about the broking industry , capital markets as a whole as well as the importance of physical &mental health in the comprehensive scheme of things . Good luck for the brighter times ahead to team Zerodha.

Hi 0dha…!

Like mentioned in the opening lines of the address… I was quite excited to get introduced to the trading business and the vibrancy of this portal which has put up sincere efforts to promote genuine trading… Kudos to the entire team & Nitin…. Love reading the content posted here as well as in Varsity… Stupendous work by Karthik Rangappa… Three cheers… Wishing all A very Prosperous New year ahead…!!

Hi zerodha,

It is such a good user friendly app…

Since 2018 I am using this app,this is very easy to operate even unskilled pupils also…

My no 9894685438…

I want sub broker contract with zerodha…

Hi Nithin, congratulations for your open heart statment. It’s little lengthy, but you have explained everything, all the zerodha family members can understand.

I am very proud that ,Being one of the pioneer member of the family .

My ID RK 0109.

Indian education especially, secondary and PU level needs financial education very much. Majority knows only making FDs for easy cash requirements, Insurance, gold for risky time and real estate and land purchases for long term investments. We need to educate on investment in good company stocks how it is also make good returns.

Excellent insights Nithin! Appreciate your unbiased views. You truly set high standards and that is a great quality as an entrepreneur!

With zero CAC in Zerodha’s business model and your philosophy of growing organically, i think your enterprise will be sustainable for a long period of time, given that the ”word of mouth publicity” and support from your retail clients, is powerful thing to have, based on good quality products and services that your firm offers today !

Undoubtedly ’Mind share gets market share’ , and if customers begets customer, that is a indeed a very powerful business, demonstrating a solid moat within Zerodha’s Fintech business model!

Zerodha is the ’best-in-class FinTech platform’, and you continue to raise the bar with integrity, transparency and honesty, which augurs well for the Indian capital markets!

Kudos to you and your dynamic team for generating the growth capital from internal accruals, and not depending on, or getting attracted to the lure of VC / PE investments, which would erode your competitive strengths or competitive advantages in the long term, And also erode your ”unique positioning as well” in the minds of retail investors, given the lowest level of integrity in the capital market eco-system e.g. we have witnessed state of affairs of IPOs and their performance in India, or Europe or even in US markets. Also the not-so innovative products they invent/develop, which is useless for its users, like credit cards, derivatives, considering huge costs etc.. So it gives comfort to retail investors to know that your firm’s philosophy to grow organically remains, and that is the bedrock of your current and future success!

If at all, should you need growth capital in future to grow globally( to disrupt E-Trade /TD Ameritrade etc.), Indian retail investors would be able to provide you growth capital / risk capital by investing in your best-in-class platform, and foreign VCs/PEs are not required as investors in my view.. Zerodha would then become the crown jewel of Indian FINTECH SPACE backed with nationalistic fervor, fueling more investments into Zerodha by educated retail investors, large Indian corporates treasuries, and top high quality Indian banks as well !

Indian retail investors’ participation in Equity markets would grow 10X -15X within 5-10 years as we grow our GDP from USD 2.95Trillion to USD 10 Trillion within next 15 years; this is possible assuming India’s GDP growth CAGR of 8.28%, backed with reforms, improvement in ease of doing business, growing FDIs, growth across MFG., Auto/EV, Pharma/Healthcare, and Tech. sectors backed with AI / ML backed innovation in EdTech, Fintech, AdTech, AgriTech, FoodTech among other..

Higher financial literacy among young Indians especially those entering job markets would grow the equity markets. Currently, just 3% of Indian population invest in India Equity markets compared to 55% of U.S population in U.S Equity markets…Imagine the potential impact, if we reach U.S’ retail participation level in Equity markets within 15 years or so. It looks impossible today… however not untenable, since 70% of population is under 35 years of age and they have disposable income, so this could accelerate if we educate the youth of India about how useless the investment in saving bank account is, or how useless Fixed Deposit scheme is, or how useless mutual fund returns are after factoring their fees/TER and factoring inflation!

Less than 1 % of total number of MF and PMS firms, put together in India, would be worth looking at or worth engaging, and 99.5% funds are led by unworthy team / fund managers, who should not even earn their salaries given their fund’s /PMS’s 10/15 year performance on TRI basis.

Hope Indian Government or SEBI mandates a LAW that that a third party agency must publish 10/15 year returns DATA of all approved MFs & PMS firms’ in India, in the 1st week of every year in JAN, and aggressively promote a financial literacy campaign, educating Indians that FD SAHI NAHI HAI , and MUTUAL FUND SAHI NAHI HAI, based on actual facts / report cards on actual returns on investments, and educate average Indians on Inflation and Inflation related impact on investments !

This suggestion is for the young people who are around 22-25 years of age, entering job market , and i reckon, not for senior citizens above 70 years of age, who would be more comfortable with savings/ fixed incomes / govt bond etc.

Inflation and Tax are certainties of life, so we must educate one and all, especially those needing financial literacy to grow and protect their investments.

Zerodha Varsity could play a more aggressive role to elevate Financial Education ..I think Basics of Money management should be taught in all private schools from class 6th onwards at the least… so that after graduation/post graduation , these students enter equity markets with solid knowledge and adequate financial literacy to take decisions and multiply wealth over long term!

Therefore, i truly believe potential to scale, potential to grow the market size , potential to expand the pond.. and much more advantages exist in India for the right company offering superior technology and zero-touch platforms. In the long term, Zerodha can disrupt most broking companies with its’ strategic intent’ in the future… sooner than later ! Here’s my best wishes to Nithin and the entire Team @ Zerodha in 2022 and beyond. Happy 2022!

Hi, Nitin,

Happy New Year to you and your team. I’m using Kite platform for over a couple of years now. I’m a long term trader and investor, generally go for long only trades. I’ve been investing since 1988 in the market starting with a small initial investment of about Rs.10,000 only. I heard about your platform from a Institutional trader and opened my account in 2015 when I shifted base from Kolkata to Bangalore. I use coin regularly for my SIP and in general Kite is very good. Your observation on Brokering Business and its growth is spot on. As Mr. Anton Kreil of Institute of Trading says there is an inherent conflict of interest between Brokers and Retail Investors and I see how Zerodah has avoided that trap. That I think one reason your platform is outdoing others in the market. Please keep up the good work. All the best.

Good Experience with Zerodha

I am using it since Jan, 2021. My experience is wonderful with Zerodha and I refer with my friends too.😊 .

Congratz. Team Zerodha

Congratulations, since from seven month I am using zerodha platform, user-friendly and I wish for the future endeavors

Dear Nithin

We wish you ,your family,your zerodha working family members a Warm Well Prosperous Happy New Year 2022. May God Almighty bless you for more and more honest desciplined customers to grow Zerodha. I understood market very well in Zerodha. We all substining in Market because of Zerodha. Please keep growing, we also grow along with you to build our wealth for generation.

मैने दिसम्बर मे ज्वाइन किया है जीरोधा को

मुझे बहुत अच्छी लगी ये कहानी

मेरे ओर से जीरोधा टीम को बहुत बहुत बधाई

I have experience of trading with Stock Holding Corporation,HDFC Securities ,ICICI Securities, Zerodha and rate Zerodha brokerage house 10 out of 10.

Thanks and best wishes.

Honest, Unusual and absolutely frank post from an entrepreneur. Nithin, you have set a new standard for doing business honestly & grow too. Helping others grow too while spreading awareness among customers to stay physically & mentally healthy. All the best to you & Zerodha. Wish you good health and prosperity.

Insightful

Sir,

I have knowledge in stock market, but no guide I got. In the lock down period I tried to do something on on-line. There, I got advice from my friend JAHIR ,about ZERODHA. Then I started Investment. Thanks a lot sir.

I am in touch with stock Markets (ON and OFF) for the last 35+ years. Rarely, I have come across a more honest and fact based Article on investing in Stocks, as this Field is considered more as a speculative one. Investment in Stocks based on the Fundamentals and self study is a science by itself as I have found out. Many a times, we blame Companies for not investing their liquid Money for expanding their Businesses. But, as individuals, we always tries to conserve all our savings to be safer. We must invest in Stocks and IPO’s to help our Enterprises to avoid depending on Foreign Money to grow. I feel, Nithin, you have brought out this point very well. As a Country, we can’t afford to deploy all our Money on passive Investments like Gold, Real estate etc.

Hi Nithin,

Hearty Congratulations to the Entire Zerodha Team for a tremendous journey.

The trueness in your heart reflects on your firm. I wish you continue to post the value information from time to time for the best interest of retail traders.

Regards,

Happy Zerodha Trader.

Hi Nithin

Nice write up and thanks for your new year wishes

We grow with Zerodha and best wishes from my side to the ZERODHA family

It’s fantastic write up, Happy new year, your motivation is tremendous,

Really wonderful insights were given about the broking industry with your honest opinion

Your trading platform is very very good

Zerodha platform was suggested by one of my friends and I am 100 % sure this is the best platform, Thank zerodha team.

your trading platform is good but I suggest plz add trading view premium platform

Dear Nithin

We wish you ,your family,your zerodha working family members a Warm Well Prosperous Happy New Year 2022. May God Almighty bless you for more and more honest desciplined customers to grow Zerodha. I understood market very well in Zerodha. We all substining in Market because of Zerodha. Please keep growing, we also grow along with to build our wealth for generation.

Good writeup. Loved trading and investing in Zerodha. Hope the percentage of investors grows even more in 2022 and reduce the impact of FII’s in Indian equity.

Hi Nitin , Wish you a very happy New Year. I have no confidence to invest in stock. Zerodha maid my life very easy.

I am thankful to u and your team .

Happy New Year to you and your family .NithinThanks for your new year wishes and sharing your invaluable thoughts God bless you all.

Hii, wish you the same a very Happy & prosperous New Year,

Zerodha is the platform which i love most, my first account is with this platform, & my journey Begins..

Thank you for taking care of your Big family,,,

Regards

Ravi

I almost gave up investment / reading after K10 episode due to high transacting chargest but thanks to Zerodha I m backninto investment /trading.

Congratulations Zerodha for your transperant deals . All the very best too

Thanx for such an honest opinion.My tryst with Zerodha has become stronger now.Pls take care of business ethics and integrity as ours hard earned money is invested.

Hi Nithin, First of all wish u a very happy new year, nd thanks for the best services for equity transection by Zerodha nd more over for ur guidlines.

Thnx

For giving nice and smooth experience with zerodha.its a great pleasure to b with one of the best broker of India.

Hallo dear

Happy New year 2022. All member’s.

Thanks

Happy new year too to toy

Happy New Year to you and your family Nikhil! Thank you for all that you’ve done and all that you strive to do!

Kudos to Team Zerodha for this creating this amazing platform.. Let’s hope this time it is different and people keep on converting their physical investments to financial ones.

I would request you though to make coin-app more feature rich. It still lacks some important features like, STP, SWP.

Thanks

Hi Nithin,

All the Best with these many customers for your wonderful trading platform. I hope you gift Zerodha traders as by implementing one time monthly charge(obviously some less amount) instead of per order execution. 🙂

Regards,

Timus Mehta

Lol..

That’s their business model.. 😁

How can they function without that?

But their charges are lower than competitor DEMAT providers..

Thank you very much for sharing your valuable thoughts sir.

Very nice sir bur Zerodha owned Algo trading required to traders sir.

Good

Truly Inspiring story,you are a living revolutionary to the whole broking industry in-turn the whole retail trading community in India.

Thank you Nithin for giving us zerodha! I am new in stock and honestly speaking one of my friend advised me to install zerodha and use it. I found it quite simple and you have a best customer support, FAQs, lots of youtube videos to understand the platform and make best use of it. So thank you for giving us zerodha!!

It’s you patience and discipline reflected in your business growth. ZERODHA reaches new milestones in near future.

Plz help me a iam new invester how doing start business in Zerodha

Hey Sugana, you can check out the Kite user manual to help you get started. Would also recommend you check out Varsity to learn all about stock markets 😀

मे नेपाल से हु जेरोदा मे एक्उन्ट खोल्न इच्छा हे होस्कता हे

Hey, please reach out to us at [email protected] and we’ll have our team assist you. More here.

I have been using Zerodha over last 2 years, nowhere I felt to use different broking app, thanks to u and ur team fr developing app like this n good user experience. It s good to support existing user also rather than concentrating on new users always, as a trader I too lost so much of money, still I beleive I can make it, thank you n wish u happy new yr

Hi Nithin,

Nice article and fantastic data points. Well said. I feel going forward increased investment advisory service will boom as many of these Robin hood investors will become busy with their professional career and would need time to take investment decisions like stock market and hence you can look at alternative but future oriented offerings as bundle to stay afloat.

Regards

Sameer

Thank you Nitin. Such post we don’t usually come across

Hearteast congratulations.

With patience, fair practice and dedicated team, your venture will set higher benchmark and keep raising itself to new heights.

Wishing you well.

Appreciate your frank opinions here Nithin. Saw your interview yesterday around the lowest percentage of retail traders actually making profit, speaks volumes about your integrity and most importantly ethics in your business practices. Thank you!

Great Post Nitin, I tend to miss these interviews, if it is available online, could you please share.

Hi I need help please

Hey Shekhar, please create a ticket at support.zerodha.com. Our team will assist you with this.