It’s the economy, stupid! Is BSNL having its “Jio” moment? Maybe?

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

Telecom customers are still chasing value

Life today is worlds apart from what it was a decade ago. Now, we have grocery apps delivering everything we think we need in just 10 minutes, OTT platforms streaming our favorite sports matches or movies at the click of a button, and a wealth of free, insightful education through videos, podcasts, and blogs. It’s almost surreal to look back and think, “When did all this really start changing?”. I may be wrong, but one date always stands out: September 5th, 2016.

That was the day Jio made its grand debut, rolling out free data, unlimited talk time, and no roaming charges. What followed was chaos in the telecom industry. Customers were thrilled; competitors? Not so much. Jio’s offer was so affordable, people genuinely wondered if it was too good to be true.

Fast forward eight years, and there’s another shift on the horizon, though maybe not quite on Jio’s scale. This time, it’s BSNL making moves. While private telcos have been hiking prices by 10% to 27%, BSNL’s kept its prices steady, pulling in value-conscious customers who just aren’t ready to pay more.

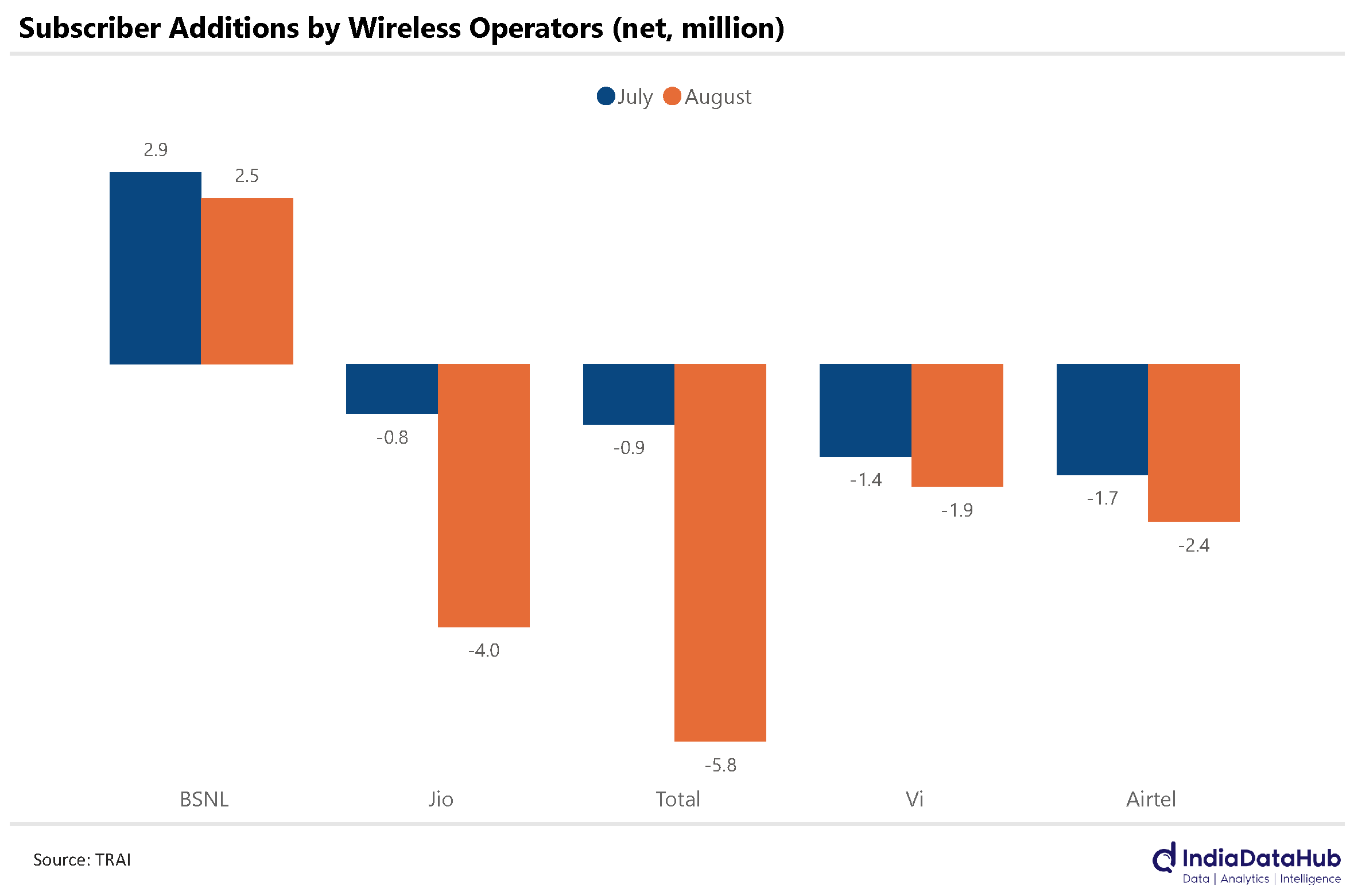

Is BSNL having its own “Jio moment”? Well, maybe it’s too soon to call it that. But here’s what we know (a) BSNL has kept prices down, and (b) it’s managed to gain quite some market share because of it. This is the second month in a row that BSNL gained subscribers—a feat it hasn’t pulled off in two years. After nearly 3 million new subscribers in July, BSNL added another 2.5 million in August, boosting its base by over 6% in just two months. Where’s this growth coming from? Private telcos, who are losing ground as BSNL muscles in.

BSNL isn’t just relying on low prices, though. The Ministry of Communication recently announced that BSNL has installed over 50,000 sites as part of its 4G rollout. These telecom sites are the large areas that accommodate the equipment used in telecom networks. And BSNL’s goal? 1 lakh sites by mid-2025 when it officially launches 4G. To give you some context, Jio is running its operations on 1.36 lakh such sites. So it’s pretty decent.

As if that wasn’t enough to get attention, BSNL’s new logo and rebranding made it loud and clear: it’s ready to play hardball. Is this a true turnaround? Or just a momentary uptick? Only time will tell. But after playing second fiddle to private telcos for a long time, BSNL’s steady prices have won it a lot of ground.

In August alone, Jio, Airtel, and Vodafone Idea shed 4 million, 2.4 million, and 1.9 million subscribers, respectively. That’s a total industry loss of 5.8 million subscribers—more than BSNL’s gain.

In August alone, Jio, Airtel, and Vodafone Idea shed 4 million, 2.4 million, and 1.9 million subscribers, respectively. That’s a total industry loss of 5.8 million subscribers—more than BSNL’s gain.

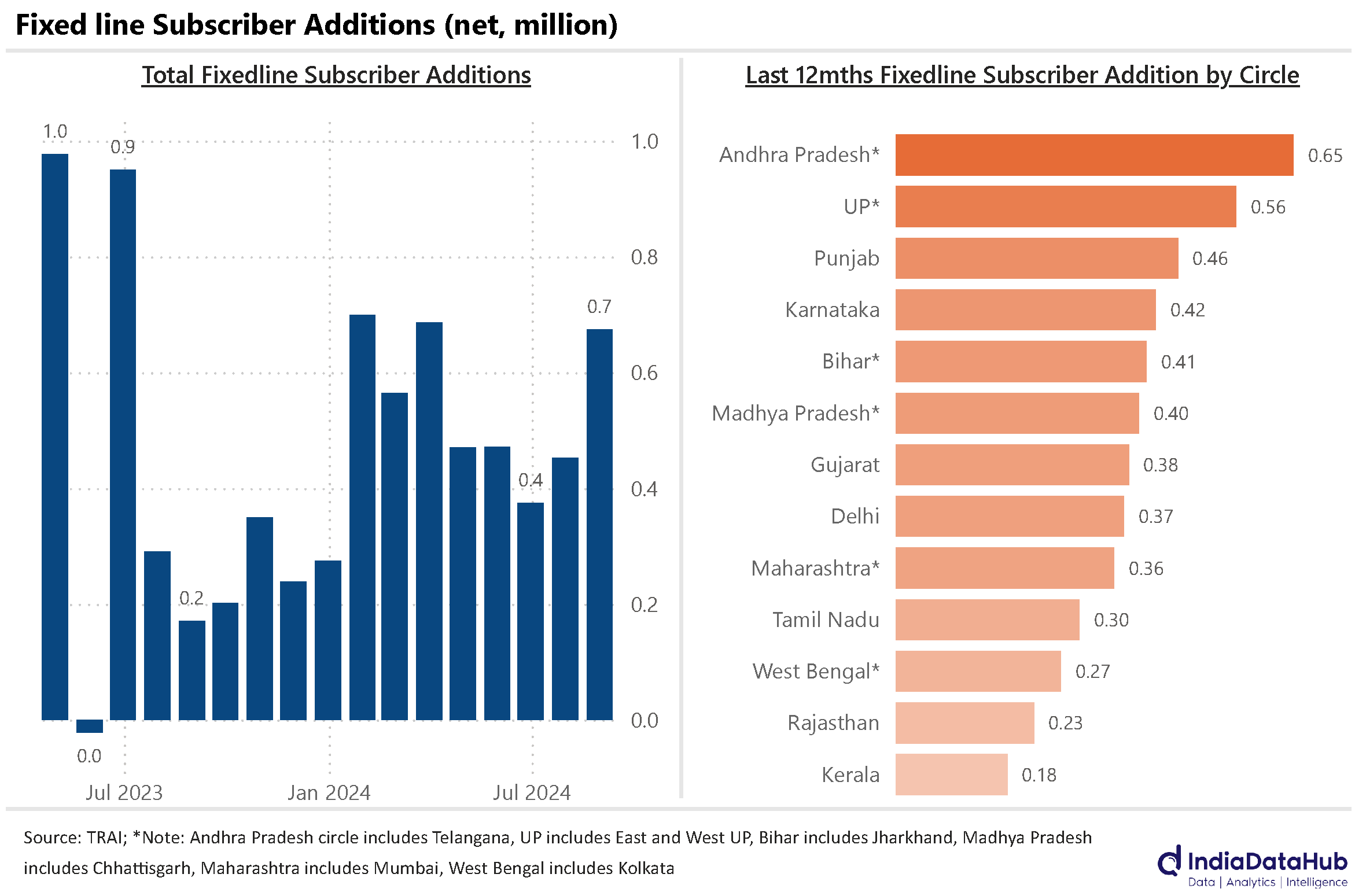

Meanwhile, the broadband scene is a bit more predictable. Fixed-line services are growing as expected, and August saw 7 lakh new subscribers join the ranks—the biggest monthly bump since March.

Now, here’s the insight: the highest growth in fixed-line subscribers came from Bihar, a region with historically one of the lowest teledensity. In the last year, Bihar added over 4 lakh fixed-line subscribers, marking a 50% increase. This is the largest of any region nationwide. And since broadband growth tends to follow the demand for high-speed internet, this shift is pretty important. Bihar, one of India’s least economically developed states, is showing that high-speed internet might just be the next staple in India, right up there with roti, kapda, makaan… aur internet.

The Story Behind India’s Credit-Deposit Shift

Remember when the RBI Chief was sounding the alarm because loans (credit) were growing faster than deposits? That had economists and media houses all worked up, diving deep into debates on what it meant for the economy. And yes, we hopped on that bandwagon too, sharing our own take in one of our Daily Brief episodes.

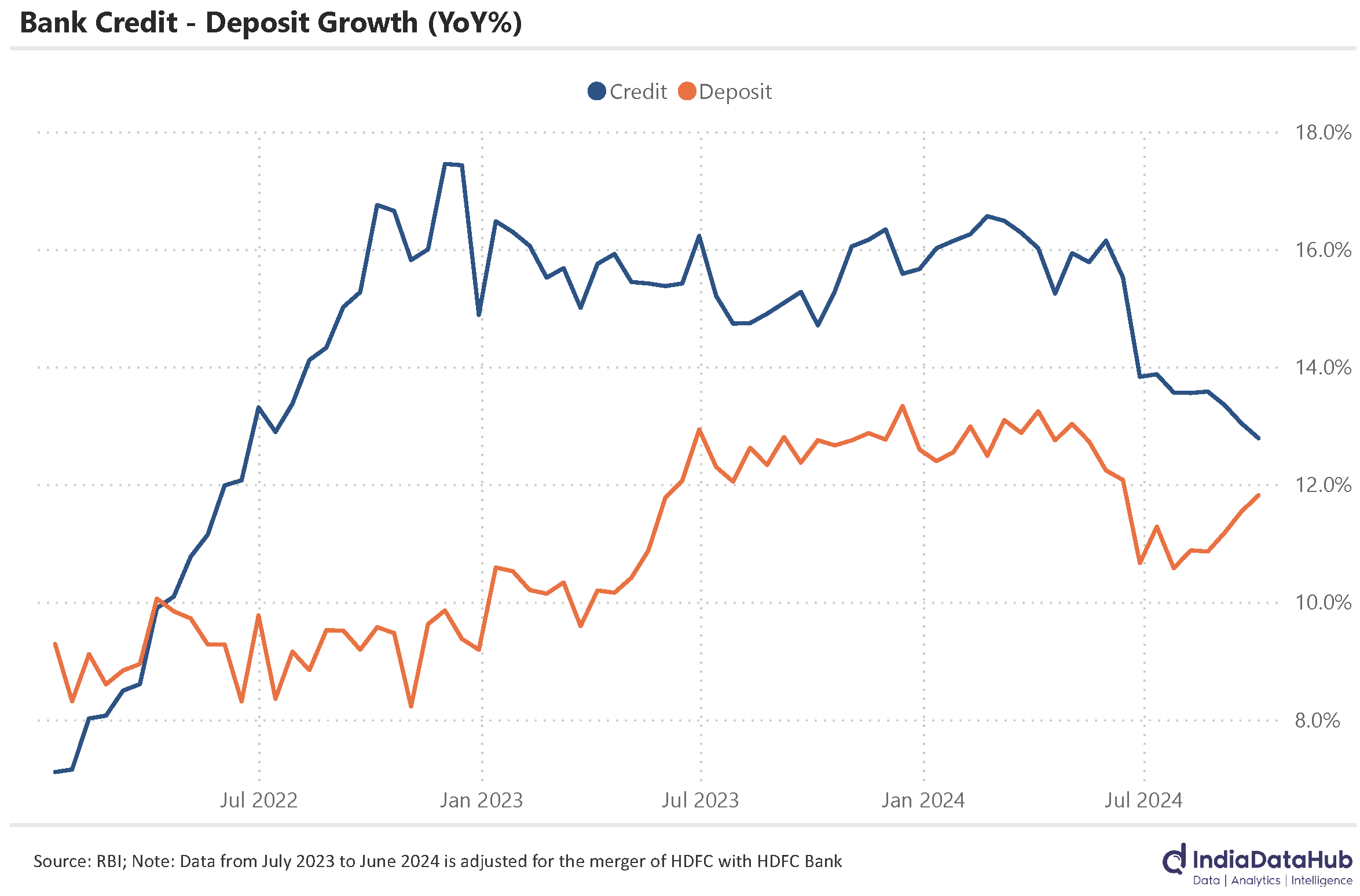

But you see, things are starting to change now. After nearly 30 months, banks’ deposit growth is finally catching up with credit growth. Now, this could’ve happened in one of two ways: either deposit growth picked up, or credit growth cooled down. Right now, it’s largely the latter.

After the COVID lockdowns lifted, credit growth picked up pace. Credit was growing at over 17% year-on-year, while deposits were inching up at just 9% at one point in time. By the end of 2022, the gap had widened to 8%, but now it’s shrunk to less than 1% as of early October. Why? Credit growth has slowed to below 13% YoY, the lowest we’ve seen in over two years.

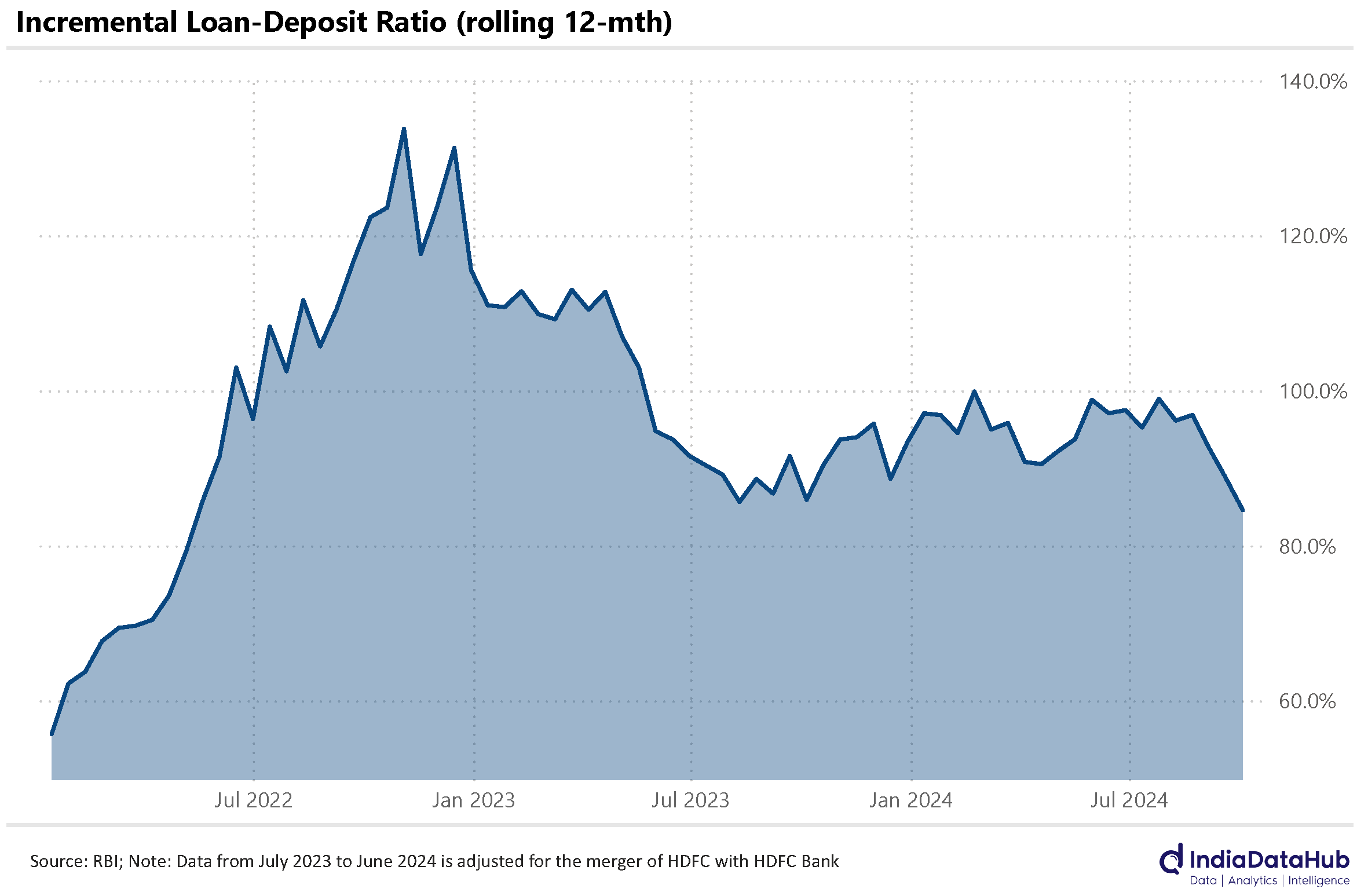

You know what this resulted in? The incremental credit-deposit ratio has fallen from over 100% last year to under 85% as of early October. What this means is that for every ₹100 banks receive in new deposits, they’re now lending out only ₹85. Compare that to late 2022, when banks were lending out ₹130 for every ₹100 in deposits.

Now, it’s worth noting that overall deposits in the banking system were still higher than loans. But incrementally—meaning, in terms of the new money flowing in—credit was growing faster than deposits for a while. Banks were stretching the new deposits they received, lending more aggressively relative to the fresh money coming in, which put a strain on the system. This recent shift shows that banks are becoming more cautious, aligning their lending with the pace of new deposits coming in.

How did we get here? Thank the RBI.

The RBI’s attempts to close the credit-deposit growth gap might finally be paying off. It’s tricky to say what’s really driving the shift, but a few things could be at play here. The RBI’s gentle nudges—what they call “moral suasion”—probably encouraged banks to focus more on pulling in deposits. Plus, their choice to hold off on cutting rates sooner might have made borrowing a little less tempting, nudging people to save instead. Add to that some regulatory changes, like bumping up risk weightings on consumer loans and setting stricter liquidity rules (LCR norms), and it seems these moves might have helped slow down credit growth. But, honestly, it’s tough to say for sure if any one thing did the trick.

Indians’ Love for Travel is Keeping Remittances High

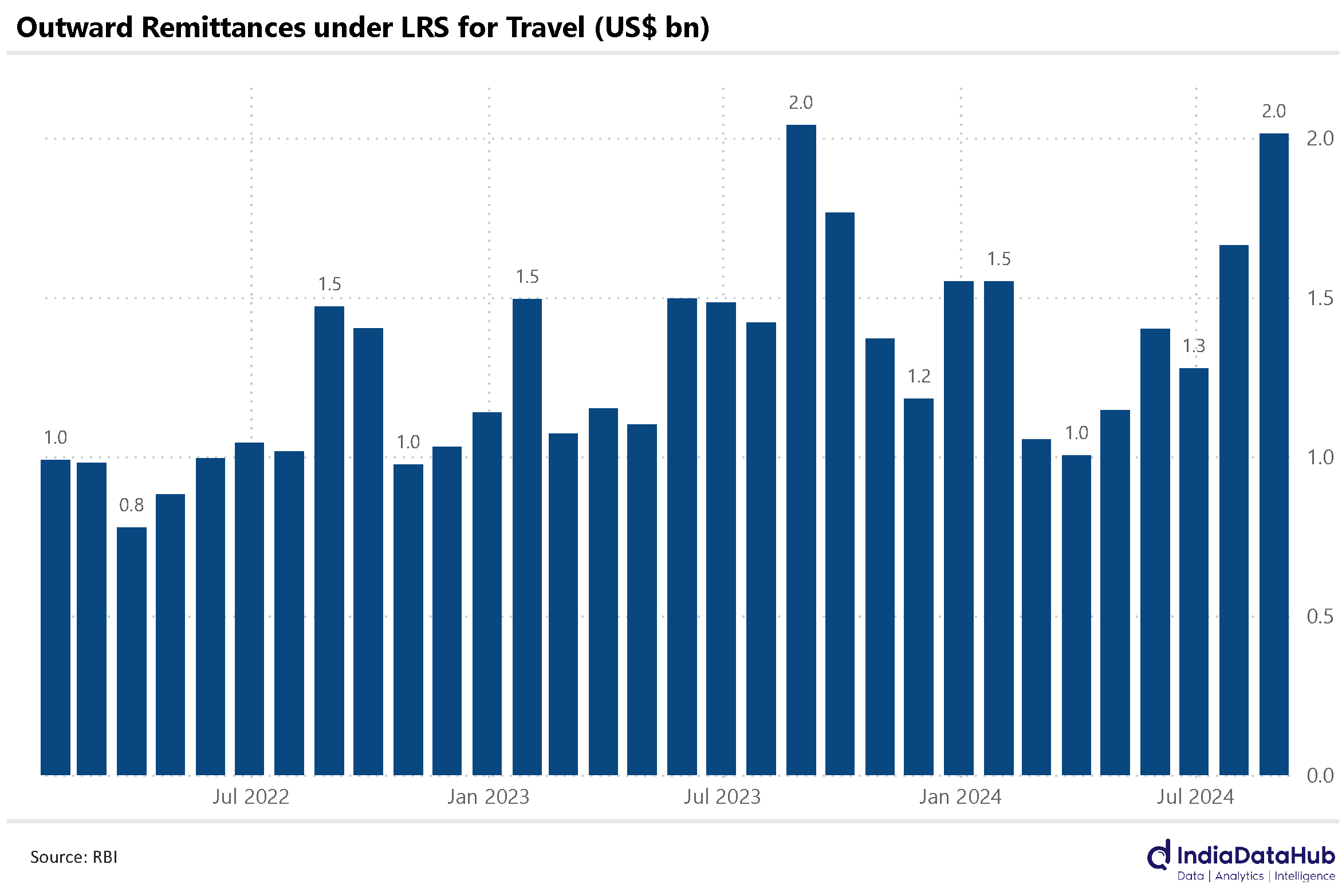

It seems India’s love for overseas travel isn’t slowing down anytime soon. August recorded the second-highest monthly outward remittances by Indians for international travel. Indians sent over $2 billion abroad. This is just 1% lower than the all time high outflows of August last year.

The first five months of this year alone saw Indian travelers sending $7.5 billion overseas for their travel expenses. While that’s a slight dip compared to last year, it’s worth noting that 2023’s numbers were driven higher by the revised Tax Collected at Source (TCS) rules. This tax is collected at the time of payment, adding a certain percentage of tax to the transaction. So last year people were front-loading their remittances to avoid the TCS.

So, why is demand still high? Indians have a strong post-pandemic urge to explore. The trend is clear: Indians aren’t cutting back on overseas travel, and the remittance numbers show it.

India’s FDI: Money In, Money Out

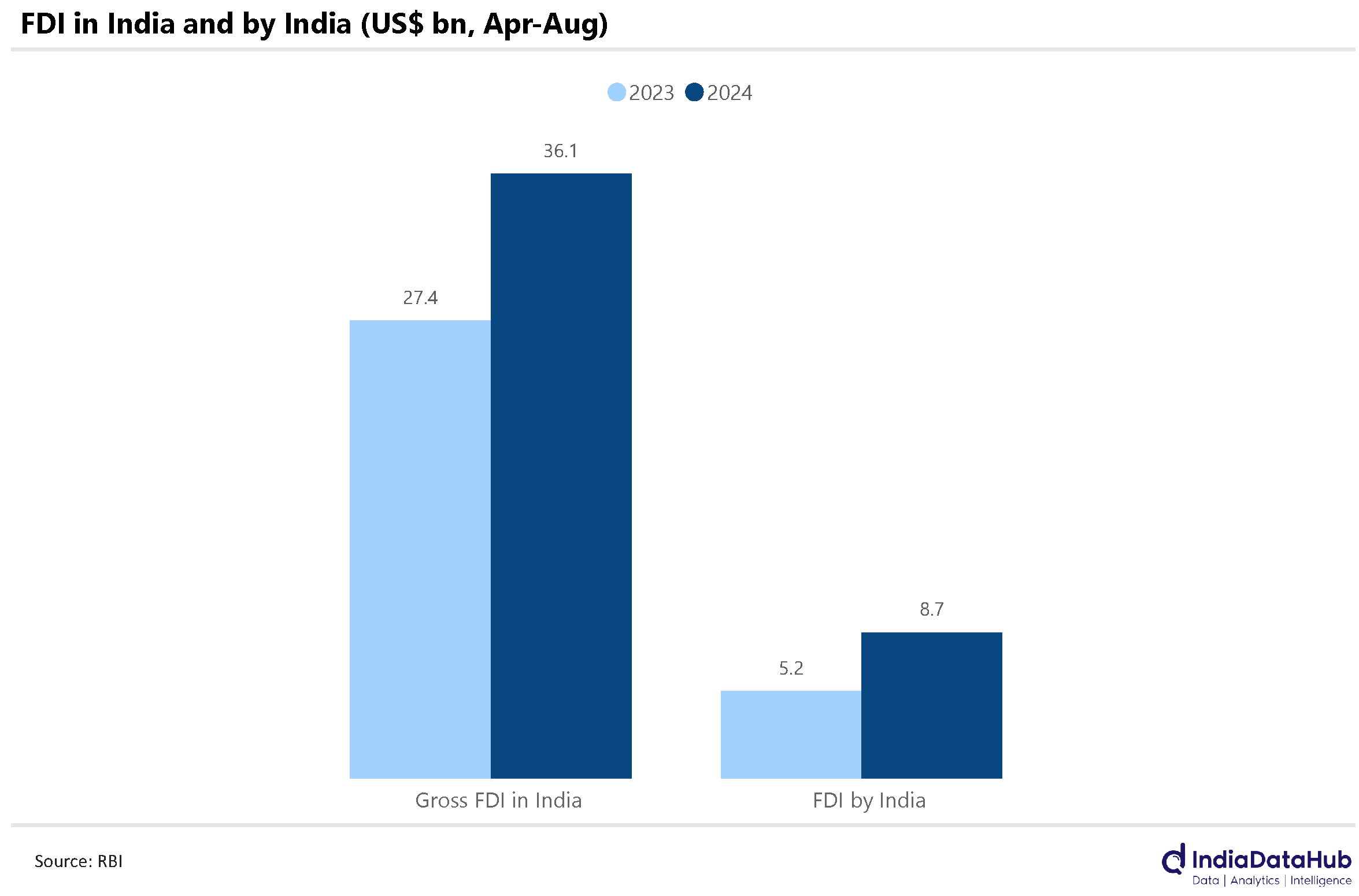

India’s foreign direct investment (FDI) kept climbing in August, bringing in $8.6 billion—the highest in a few years and a 75% jump from last August. So far this year, FDI inflows total $36 billion, which is up 33% compared to last year. Clearly, global investors are excited about India’s growth potential.

But it’s not just about money coming in—Indian companies are also making big investments abroad. August was the second month in a row with outward FDI above $2 billion, adding up to $8.7 billion in the first five months. This is almost 70% more than last year. And if you count March, when outward FDI was over $3 billion, Indian companies have nearly doubled their overseas investments in just six months.

It shows that Indian businesses are not only attracting investment but also looking out to explore global opportunities.

That’s all for this week, folks!