It’s the economy, stupid! Bad June rising

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

Construction obstruction

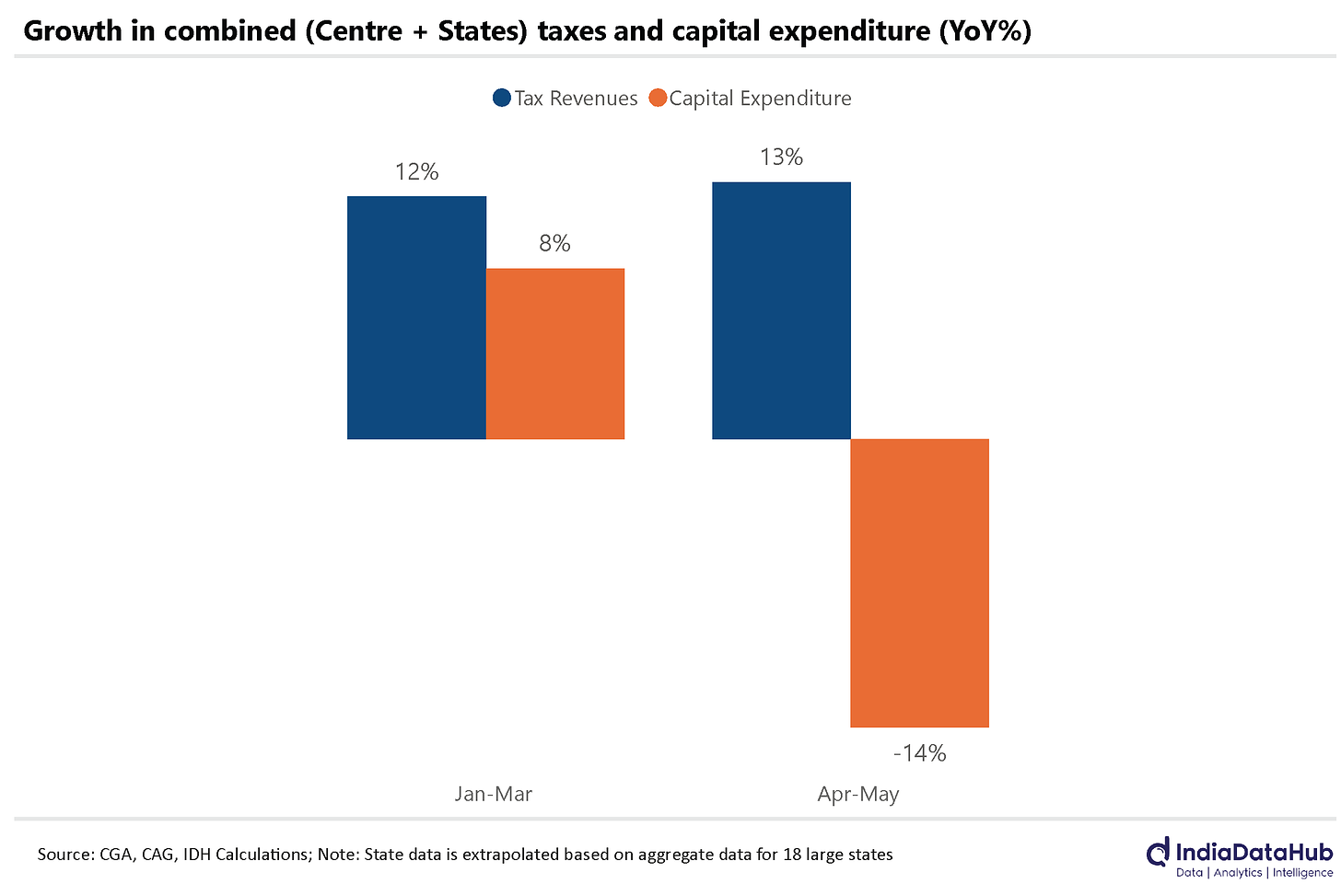

This financial year opened with a big lull in government capex.

Capex (or capital expenditure), as we’ve explained before, is the long-term spending you do for things (like buildings, machinery etc.) that you’ll use for years to come. This sort of spending creates assets that can pay for themselves many times over. All the government’s celebrated infrastructure projects — highways, bridges, ports and the like — are funded through capex. This is why high capex, if you can afford it, is usually a good thing.

Over the last few years, the government has been focusing heavily on capex. But that’s starting to come down a little. Over April and May, capex by both the centre and states was down by the double-digits. In total, over the two months, capex (for the central government and the 18 states we have data for) fell by 14% from last year.

Why so? It’s probably not for want of money — tax collections were up 13% over the same two months, as the chart above tells you.

It’s most probably because the government wasn’t functioning as normal, since most of its attention went to the Lok Sabha elections. If this is the case, and tax revenue continues coming in like expected, the drop will just be a blip. The government’s capital expenditure will return to normal soon enough. But while that’s likely, it’s not certain.

See, a government with an absolute majority is very different from a coalition government. After working with a free hand for a decade, the central government now faces brand new political pressures. For all we know, these pressures might make it reduce its capex and spend any money it frees up for short-term expenses like employee benefits and schemes. We’ll know for sure on July 23, when the government presents its budget.

Engines of the economy sputter

We have a lot of data this week on the economy’s performance for June. As we saw last month, May was a disappointing month for the economy, with most indicators signaling lower-than-average growth. Alas, that’s how June looks as well.

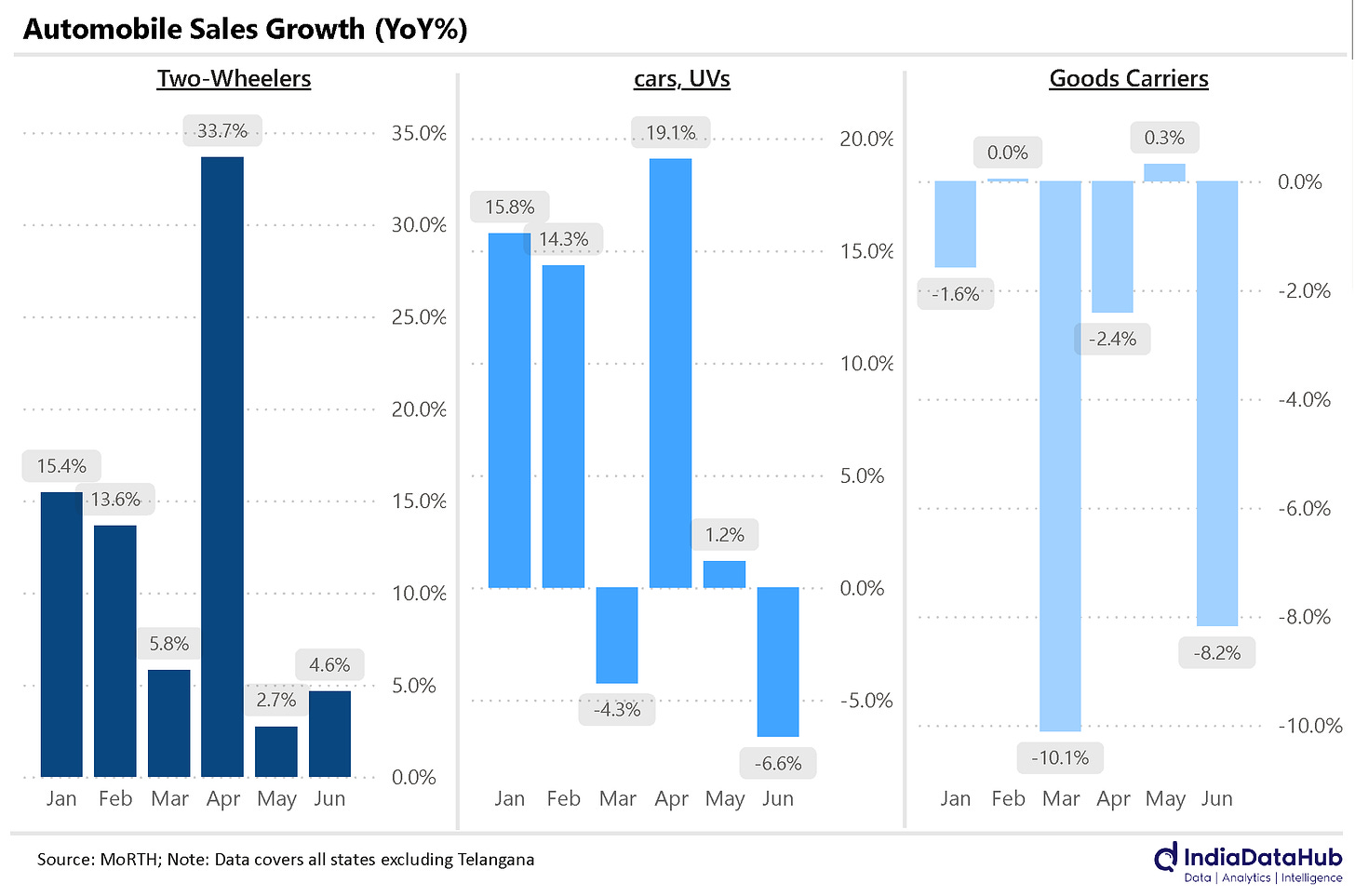

Let’s begin with automobile sales. This is important data because, as we’ve mentioned before:

“People always need vehicles. But vehicles are huge purchases, not made on a whim. People buy them when they have money to spare and feel confident that things look good in the foreseeable future. As a whole, then, Indian automobile sales tell us how good Indians feel about their economic prospects.”

Most of India’s middle class buys two-wheelers. While two-wheelers sold more this June than they did last year, the growth was modest — just 4.6%. May had seen even lower growth of 2.7%. Sales had been incredible in April, though (check the graph below) — which is why, all-in-all, two-wheeler sales for the June quarter were up 13% from last year, despite phoning in a flat performance for two out of three months. Somehow, that’s actually better than the March quarter’s 11% growth.

Slightly richer Indians prefer four-wheelers over two-wheelers. In June, four-wheeler sales fell sharply from last year, by 6.6%. They’d been pretty stagnant in May as well, growing a mere 1.2% year-on-year. Once again, it’s April’s magnificent 20% growth that makes the quarter look respectable — with a modest 4% growth rate. Really, though, it’s been an unremarkable quarter — well below the 8% growth the segment had seen for a while.

Commercial vehicles, however, have been hit the worst. 8.2% fewer goods carriers were sold this June than last year. The June quarter has been dismal for the segment. It’s the second quarter in a row where sales declined. Similarly, buses and construction vehicles sold less as well.

All in all, this June, the automobile industry has been rather weak.

Out of fuel

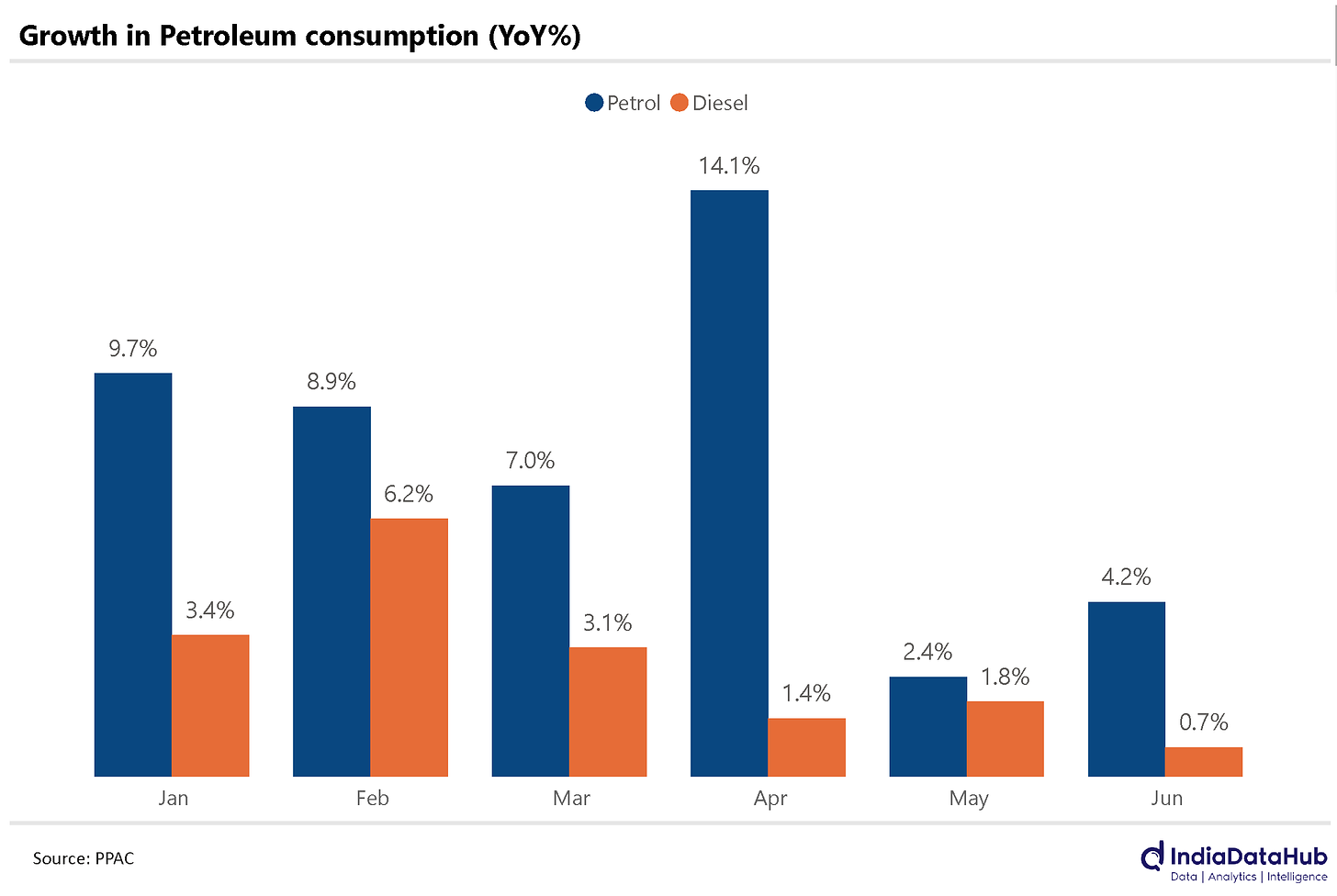

As with vehicles, so with fuel.

This June, Petroleum consumption grew in the low single digits from last year — as was the case in May. That’s well below the level we were used to seeing.

More worryingly, diesel consumption was almost flat — up a mere 0.7% since last year. Now, our economy has all but weaned itself off diesel. 90% of all diesel, these days, is used in trucks and other commercial transport vehicles. And diesel prices haven’t moved over the last year. So if diesel consumption is flat, the only possible conclusion is that the movement of goods across the country is flat.

That’s bad news. With few goods being moved around and less goods carriers being sold, it looks like consumption is grinding down. Once again, June hasn’t been a great month for the economy.

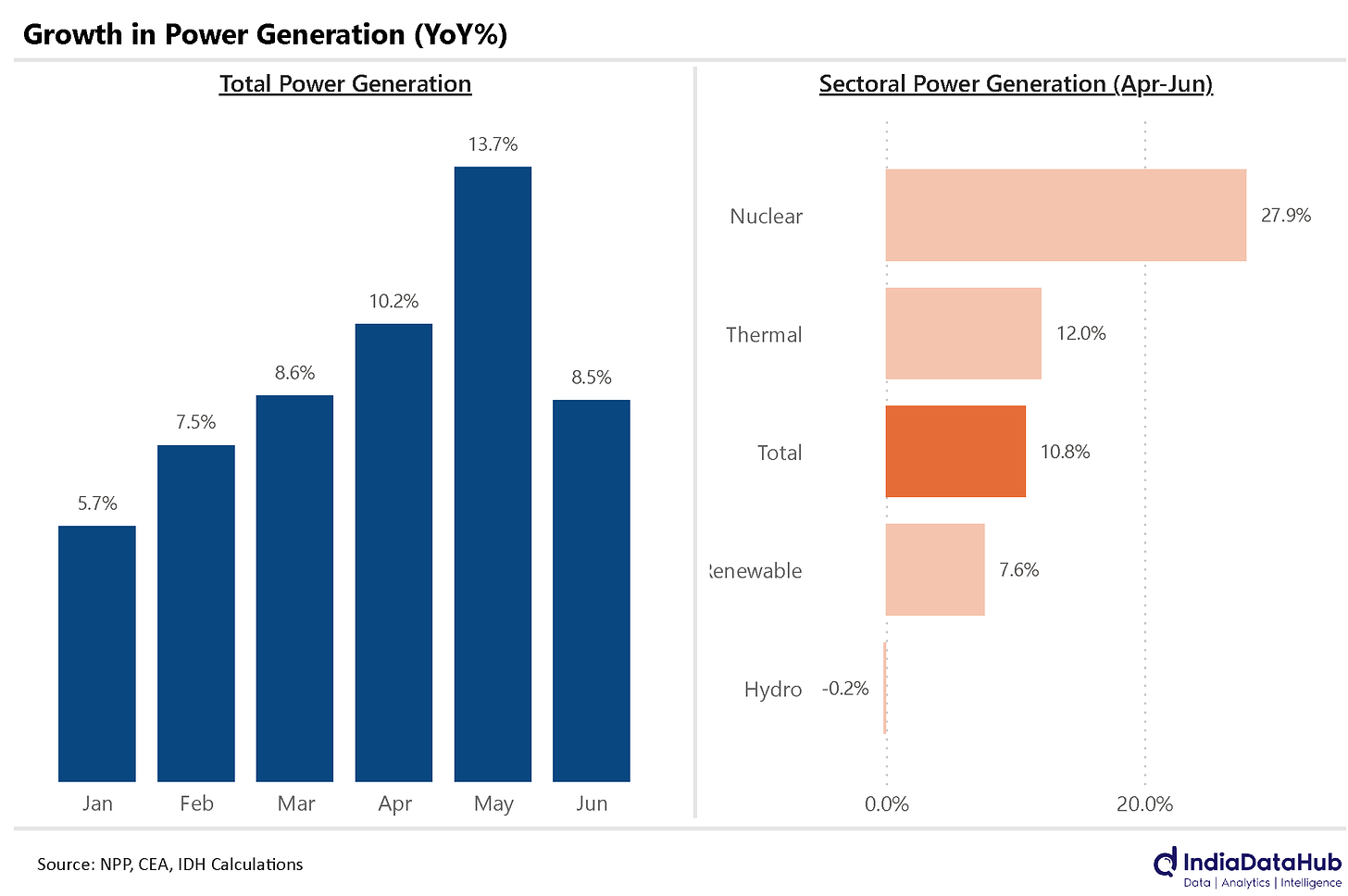

High power

If there’s one silver lining through all this bad news, it’s that power generation has grown well. Not as well as it did over the last two months, but still — at 8.5%, it’s seen healthy growth. As a whole, the June quarter has seen its power consumption grow ~11% from last year.

Power consumption is a good proxy for the health of the economy, given that everything — buildings, machines, factories, offices, and more — require power to run. The more power an economy consumes, the more things are probably running within it. That said, one shouldn’t read too much into the data. After all, India’s just been through a record heatwave. All that extra power, for all we know, might just have been running more air conditioners.

We’ve written before about a precipitous drop in hydroelectric power over the last year and a half. That’s continued in June. While hydel power generation was up in May, it dropped once more in June, wiping away any gains for the quarter. In fact, June saw the least amount of hydel power being generated since June 2018.

This shortfall is being met by coal, by and large. Interestingly, though, we’ve also seen a sudden jump in nuclear power generation. India added a total of 1400 MW in nuclear power since last May — a 20% jump in capacity. This reflects in how nuclear power generation has grown. This June quarter, for instance, we’ve generated almost 28% more nuclear power than the same quarter last year.

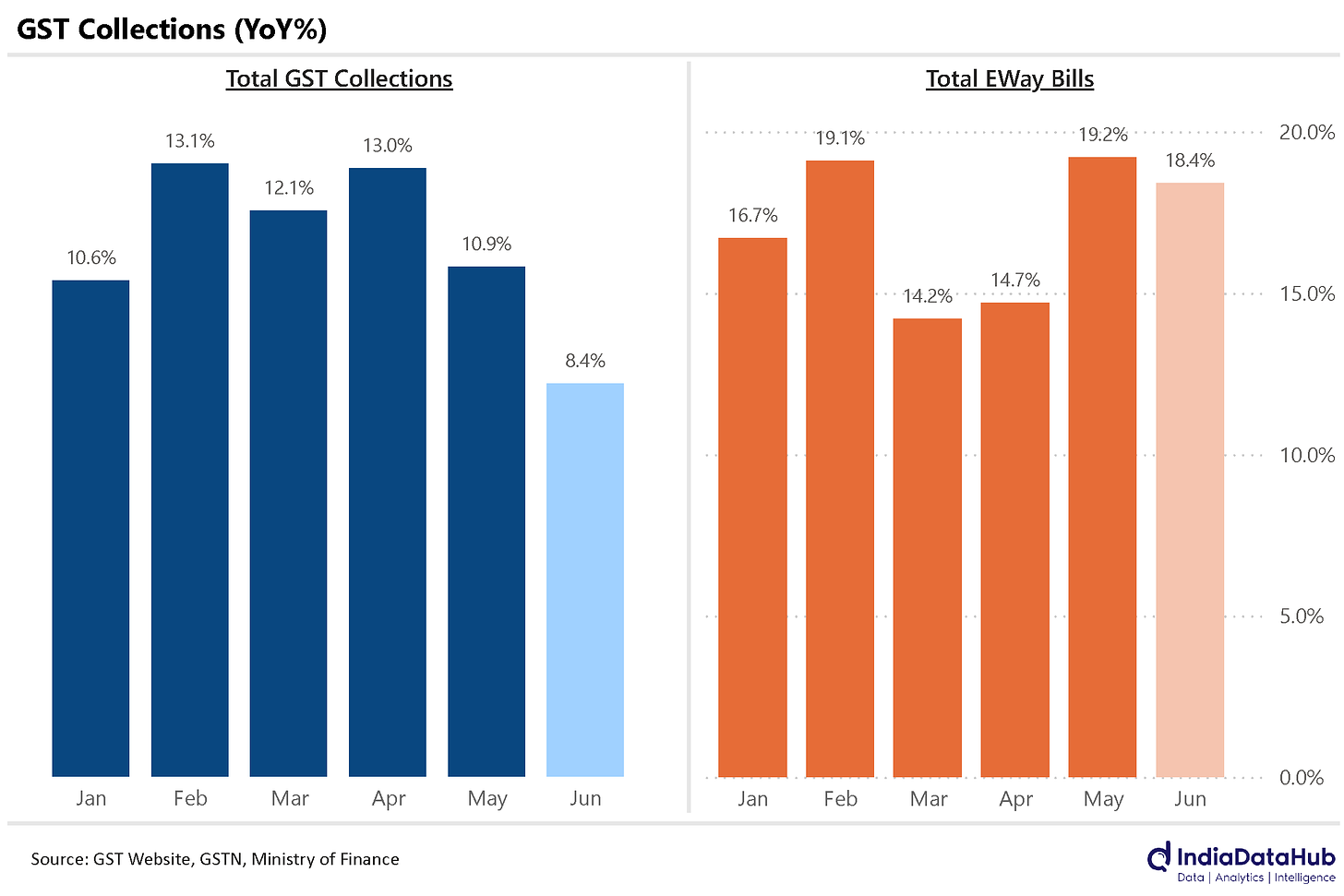

GST collections unimpressive

If you needed more proof that May was a sub-par month, you’ll find it in June’s GST data. See, we get GST data with a lag: companies file their monthly GST returns by the 20th of the next month. Now, we’ve just had June data come in, which tells us about all the business that happened in May. GST collections grew at 8.4% over the month, the lowest growth we’ve seen since early in the pandemic.

Curiously, though, E-Way bills tell a different story. You need to generate E-Way bills whenever you’re hauling goods worth more than ₹ 50,000. These went up by 18.4% in June and 19.2% in May! That’s actually better than the ~16% growth over the first four months of this year. Clearly, whatever ailment the economy is facing doesn’t seem to hurt big consignments. As for why that is: well, your guess is good as mine.

RBI, are you listening?

So, we have two months of subdued growth behind us. Let’s see how July goes.

If July is another bad month, it will be a signal for policymakers to take note. And the most immediate policy decision will be that of the RBI’s Monetary Policy Committee (MPC).

The RBI tries to maintain just the right amount of money in the system. The more money there is in the economy, the more business people are able to do. But when there’s too much money — more than there are things it can buy — everything starts becoming more expensive. The RBI has been keeping the money supply tight for a long time to fight inflation, and it could do so because the economy seemed to work well.

If July’s data is sub-par too, though, it’ll be an early sign that the economy is struggling. In such a scenario, the MPC might have to show that its willing to let more money enter the economy, even if it doesn’t cut rates right away.

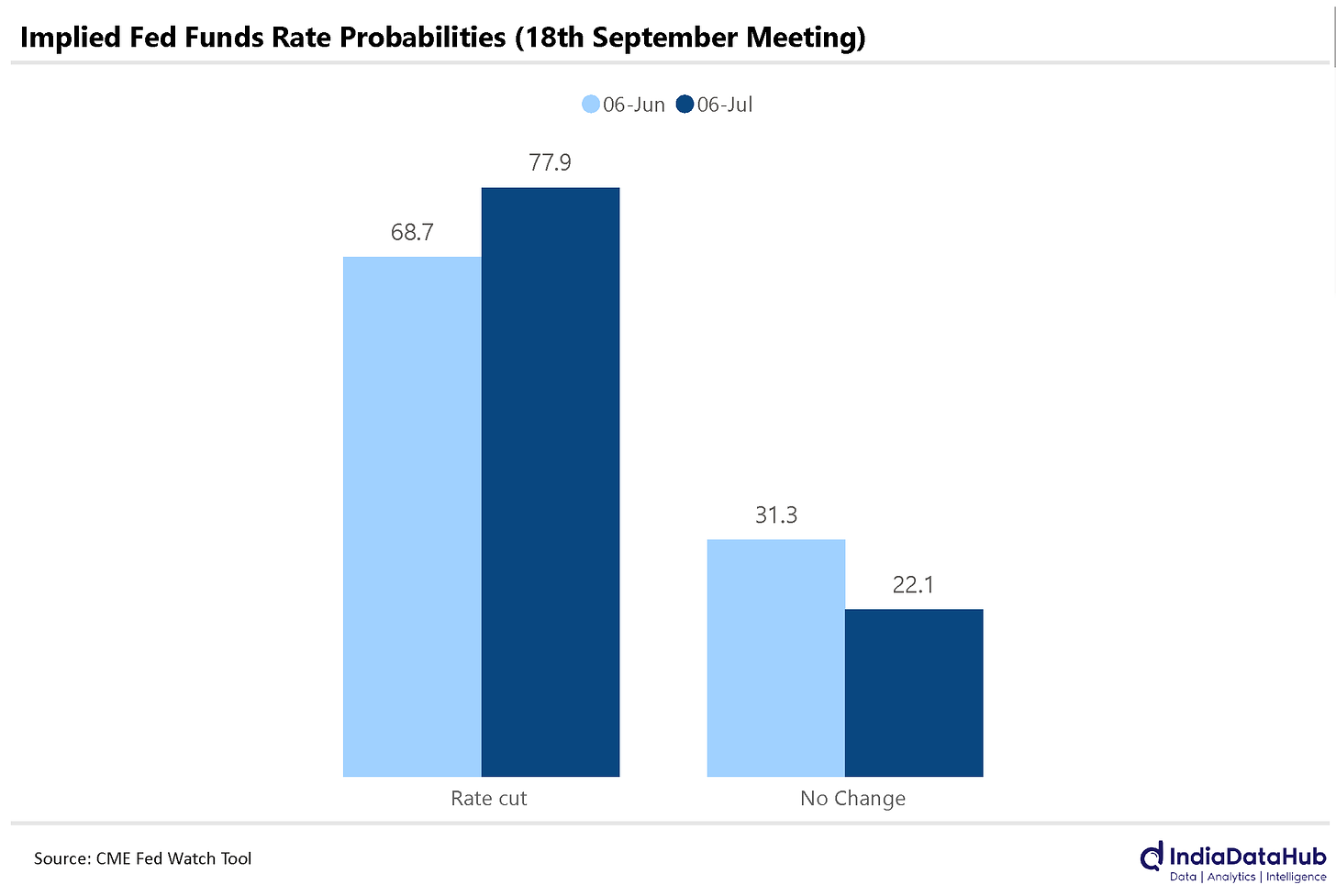

The Fed rethinks the US economy

The US Fed, at the moment, is considering the same questions as the RBI. It had some breathing room because the American economy was doing better than expected, and it used this to keep its own rates high — restricting money supply into the economy.

Off late, though, US economy is looking weak. There’s still some good news. Job creation was strong in June, as America added 206,000 jobs, compared to the 191,000 jobs the markets expected. Regardless, there are definite signs that America’s economic growth is slowing down.

American markets have started to factor this in. Fed fund futures indicate a 78% chance that the US Fed will cut rates at its meeting in September. One month ago, the markets only gave this a 70% chance. Things might be changing soon.

That’s all for the week, folks. Thanks for reading!

Good content. Though i am reading it late. i liked it 🙂

Glad to hear you liked it, Jagadeesha!