Volume plays a very integral role in technical analysis as it helps us to confirm trends and patterns. Consider volumes as a means to gain insights into how other participants perceive the market.

Volumes indicate how many shares are bought and sold over a given period of time. The more active the share, the higher would be its volume. For example, you decide to buy 100 shares of Amara Raja Batteries at 485, and I decide to sell 100 shares of Amara Raja Batteries at 485. There are a price and quantity match, which results in a trade. You and I together have created a volume of 100 shares. Many people tend to assume volume count as 200 (100 buys + 100 sells), which is not the right way to look at volumes.

The following fictional example should help you understand how volumes add up on a typical trading day:

| Sl No | Time | Buy Quantity | Sell Quantity | Price | Volume | Cumulative Volume |

|---|---|---|---|---|---|---|

| 01 | 9:30 AM | 400 | 400 | 62.20 | 400 | 400 |

| 02 | 10.30 AM | 500 | 500 | 62.75 | 500 | 900 |

| 03 | 11:30 AM | 350 | 350 | 63.10 | 350 | 1,250 |

| 04 | 12:30 PM | 150 | 150 | 63.50 | 150 | 1,400 |

| 05 | 1:30 PM | 625 | 625 | 63.75 | 625 | 2,025 |

| 06 | 2:30 PM | 475 | 475 | 64.20 | 475 | 2,500 |

| 07 | 3:30 PM | 800 | 800 | 64.50 | 800 | 3,300 |

At 9:30 AM there were 400 shares exchanged at the price of 62.20. An hour later, 500 shares were traded at 62.75. At 10:30 AM if you were to check the total volume for the day, it would be 900 (400 + 500). Likewise, 350 shares at 63.10 were traded at 11:30 AM, and upto 11:30 AM, the volume was 1,250 (400+500+350). So on, and so forth.

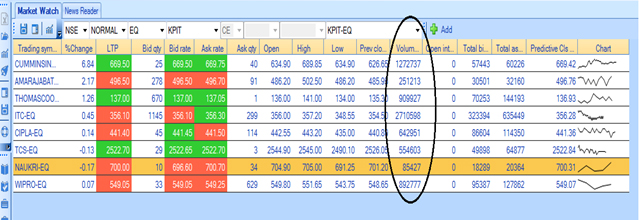

Here is a screenshot from the live market highlighting the volumes for some of the shares. The screenshot was taken around 2:55 PM on 5th of August 2014.

If you notice, the volume on Cummins India Limited is 12,72,737 shares. Likewise, the volume on Naukri (Info Edge India Limited) is 85,427 shares.

The volume information that you see here is the cumulative volume. Meaning, at 2:55 PM, a total of 12,72,737 shares of Cummins were traded at various price points ranging from 634.90 (low) and 689.85 (high).

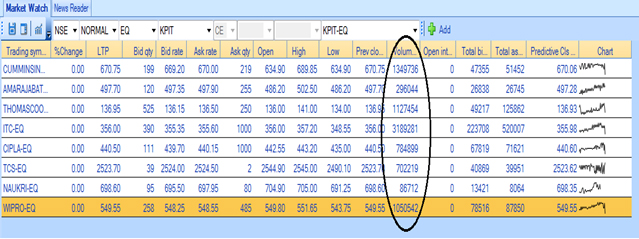

With 35 minutes left for the markets to close, it is only logical to expect the volumes to increase (assuming traders continue to trade the stock for the rest of the day). In fact here is another screenshot taken at 3:30 PM for the same set of stocks with volume highlighted.

As you can see, the volume for Cummins India Limited has increased from 12,72,737 to 13,49,736. Therefore, for Cummins India, the volume for the day is 13,49,736 shares. The volume for Naukri has increased from 85,427 to 86,712, making 86,712 shares as the volume for the day. You need to note that the volumes shown here are cumulative.

12.1 – The volume trend table

Volume information on its own is quite useless. For example, we know that the volumes on Cummins India are 13,49,736 shares. So how useful is this information when read in isolation? If you think about it, it has no merit and hence would actually mean nothing. However, when you associate today’s volume information with the preceding price and volume trend, volume information becomes more meaningful.

In the table below, you will find a summary of how to use volume information:

| Sl No | Price | Volume | What is the expectation? |

|---|---|---|---|

| 01 | Increases | Increases | Bullish |

| 02 | Increases | Decreases | Caution – weak hands buying |

| 03 | Decreases | Increases | Bearish |

| 04 | Decreases | Decreases | Caution – weak hands selling |

The first line in the table above says, when the price increases along with an increase in volume, the expectation is bullish.

Before we understand the table above in detail, think about this – we are talking about an ‘increase in the volume’. What does this actually mean? What is the reference point? Should it be an increase over the previous day’s volume number or the previous week’s aggregate volume?

As a practice, traders usually compare today’s volume over the average of the last 10 days volume. Generally, the rule of thumb is as follows:

High Volume = Today’s volume > last 10 days average volume

Low Volume = Today’s volume < last 10 days average volume

Average Volume = Today’s volume = last 10 days average volume

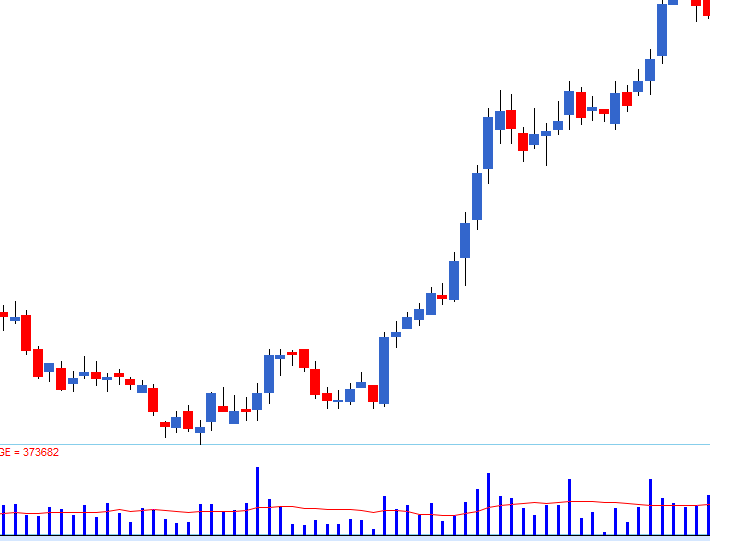

To get the last 10-day average, all you need to do is draw a moving average line on the volume bars, and the job is done. Of course, we will discuss moving averages in the next chapter.

In the chart above, you can see that volumes are represented by blue bars (at the bottom of the chart). The red line overlaid on the volume bars indicates the 10-day average. As you notice, all the volume bars that are over and above the 10-day average can be considered as the increased volume where some institutional activity (or large participation) has taken place.

Keeping this in perspective, I would suggest you now look at the volume – price table.

12.2 – The thought process behind the volume trend table

When institutional investors buy or sell, they obviously do not transact in small chunks. For example, think about India’s LIC; they are one of India’s biggest domestic institutional investors. If they would buy shares of Cummins India, would you think they would buy 500 shares? Obviously not, they would probably buy 500,000 shares or even more. If they were to buy 500,000 shares from the open market, it would start reflecting in volumes. Besides, because they are buying a large chunk of shares, the share price also tends to go up. Usually, institutional money is referred to as “smart money”. It is perceived that ‘smart money’ always makes wiser moves in the market than retail traders. Hence following the smart money seems like a wise idea.

If both the price and the volume are increasing this only means one thing – a big player is showing interest in the stock. Going by the assumption that smart money always makes smart choices, the expectation turns bullish, and hence one should look at buying opportunity in the stock.

Or as a corollary, whenever you decide to buy, ensure that the volumes are substantial. This means that you are buying along with the smart money.

This is exactly what the 1st row in the volume trend table indicates – expectation turns bullish when both the price and volume increases.

What do you think happens when the price increases but the volume decreases as indicated in the 2nd row?

Think about it on the following terms:

- Why is the price increasing?

- Because market participants are buying

- Are there any institutional buyers associated with the price increase?

- Not likely

- How would you know that there is no meaningful purchase by institutional investors?

- Simple, if they were buying, then the volumes would have increased and not decrease.

- So what does a price increase, associated by decreasing volumes indicate?

- It means the price is increasing because of small retail participation and not really influential buying. Hence it would help if you were cautious as this could be a possible bull trap.

Going forward, the 3rd row says, a decrease in price along with an increase in volume sets a bearish expectation. Why do you think so?

A price decrease indicates that market participants are selling the stock. Increase in volumes indicates the presence of smart money. Both events occurring together (decrease in price + increase in volumes) imply that smart money is selling stocks. Going by the assumption that smart money always makes smart choices, the expectation is bearish, and hence one should look at selling opportunity in the stock.

Or as a corollary, whenever you decide to sell, ensure that the volumes are good. This means that you too, are selling, along with the smart money.

Moving forward, what do you think happens when both volume and price decrease as indicated in the 4th row?

Think about it in on following terms:

- Why is the price decreasing?

- Because market participants are selling.

- Are there any institutional sellers associated with the price decrease?

- Not likely

- How would you know that there are no meaningful sell orders by institutional investors?

- Simple, if they were selling, then the volume would increase and not decrease.

- So how would you infer a decline in price and a decline in volume?

- It means the price decreases because of small retail participation, and not really influential (read as smart money) selling. Hence it would help if you were cautious as this could be a possible bear trap.

12.3 – Revisiting the checklist

Let us revisit the checklist and evaluate from the perspective of the volume. Imagine this hypothetical technical situation in a stock:

- The occurrence of a bullish engulfing pattern – this suggests a long trade for reasons discussed previously

- A support level around the low of bullish engulfing – support indicates demand. Therefore the occurrence of a bullish engulfing pattern near the support area suggests there is indeed a strong demand for the stock, and hence the trader can look at buying the stock.

- With a recognizable candlestick pattern and support near the stoploss, the trader gets a double confirmation to go long.

Now along with support near the low, imagine high volumes on the 2nd day of the bullish engulfing pattern, i.e. on P2 (blue candle). What can you infer from this?

The inference is quite clear – high volumes and a price increase confirm that large, influential market participants are positioning themselves to buy the stock.

With all three independent variables, i.e. candlesticks, S&R, and volumes, suggest taking the same action, i.e. to go long. If you realize this is a triple confirmation!

I want to drive across the fact that volumes are compelling as it helps the trader confirm a trade. For this reason, it is an important factor and therefore, must be included in the checklist.

Here is how the updated checklist now stands:

- The stock should form a recognizable candlestick pattern

- S&R should confirm the trade. The stoploss price should be around S&R

- For a long trade, the low of the pattern should be around the support

- For a short trade, the high of the pattern should be around the resistance

- Volumes should confirm to the trade

- Presence of above average volumes on both buy and sell day

- Low volumes are not encouraging and hence do feel free to hesitate to take a trade where the volumes are low

Key takeaways from the chapter

- Volumes are used to confirm a trend

- 100 share buy and 100 shares sell the total volume 100, not 200

- The end of day volumes indicates the cumulative volume across trades executed throughout the day

- High volumes indicate the presence of smart money

- Low volumes indicate retail participation

- When you initiate a trade to either go long or short always make sure if volumes confirm

- Avoid trading on low volume days

Dear sir , thanks a lot for this valuable content in free.

Sir I have a question-

In the EOD chart , there is a gap up opening and has a red candle with closing higher than previous day\’s closing which was also red candle. IN This situation, volume bar is red . By definition , it should be green bar because candle closing is higher than previous day closing.sir its very confusing.

Plz clarify about red and green bar in volume.

I know its confusing, for this reason, I dont really check the colour of the volume bar. It does not matter. What matters is if the volume is above or below the last 10 day average.

Thanks a lot sir ❤️❤️

Happy learning!

Hello sir.

I want to ask one thing. When I open any index’s spot charts in tradingview, what does volume there represent? For example, in nifty spot charts, what does volume in those chart represent? Is it nifty future’s volume? Or volume of all 50 scrips combined and formulated to some sort of average? Or something else?

Its most likely Nifty 50 fut volumes. Please do check with the support desk to reconfirm.

When u say that the vol needs to be high, what do u mean by that? What i mean is that we can check vol ideally post market closure. ( or i assume that is the way to see), so if i want to trade on a particular day should i see vol of the previous day to meet the condition you mentioned .

Yes, you can reference to the previous day. But do check how the vol is trending during the day. A quick check on ViX should give you that perspective.

Hello Karthik,

please clarify,

1. If there is a morning star formation,so the P3 candle\’s volume bar should be above the average MV of 10 days. Simply, which candle is entry decision candle that candle volume should be above mv.please correct me,if I\’m wrong.

2. I have another query, in back testing I found sometimes mv line is too high, even good volumes bar compared to previous volumes also could not touch the line.so what we should in this case, Can we consider if the volume bars is bigger than previous 2 to 3 volumes bars or draw trend line from previous volume bars then decide on break in intraday as an alternative of mv?

In summary, any candle formation, the entry candle should touch the mv line,if mv is far can we compare volume with previous volumes 2 to 3 bars…or can we draw trend line with previous volumes if the current volume bar breaks the trend line can we consider for trade?

1) Yes, the volume on the candle you trade on should be higher.

2) Yes, this is also ok. But the only issue is – how do you quantify?

Hello Karthik,

As you asked in the above response that how do I quantity – I am thinking like if the volume of the entry candle reached 1.5x times than previous 2to 3 candles then I consider as confirmation for an entry…is this fine?…I have a query, your lecture is 1day timeframe perspective..I am day trader, so in my case too the mv line of volume should be 10 days or any changes need to be make for mv line value of volume for day trading.

Yes, 1.5x means at least 50% more volumes than usual, so you can consider taking the trade. Even for day trading, 10 moving average day is good enough.

Hi ,

How do we figure out if high volumes are because of High frequency trading ? because that can be quite misleading for a retail investor

But volume is supposed to capture just that 🙂

Hey Kartik,

Already you have answered at many places. Still I am not clear about how to add 10days moving average over volume panel. I have already displayed volume panel. Thanks

Garima, in this case I\’d suggest you call our support desk and speak to them once. They will guide you step by step.

Thanx a lot

Happy learning!

I think ,this worked for me

Your answer to previous query

Open the chart and select the Day timeframe.

Under Study, select Simple Moving Average. In the popup menu that will open up, under Source, select Volume from the drop down.

Once the average line is added to the chart(replacing the candles). Click on the line and drag it to the Volume panel.

Great! Thanks for sharing 🙂

Go to indicator section and add volume , once you add the volume you will find gear symbol now click and you will find a new window , you will find input ,style & visibility now select / tick volume MA and now AVG. volume horizontal line will get added in your chart

Hi Karthik,

Besides bulk or block deals, when FIIs sells, DIIs buy and vice versa in the open market. Does it happen coincidently or how? Thanks!

Yes, a trade happens when a buy matches a sell.

Dear zerodha, please in Forex, what does it mean when a red volume bar is formed under a green candle stick.. I use mt5 and it\’s been difficult understanding volume this way.. Thank you…

I hope you do know that these platforms are unregulated and should not be used for trading. The useage of candles is same as explained here.

Hi Karthik,

I have a question regarding off-market transactions.

I believe that a seller with a large number of shares should be available for a bulk or block deal, which falls under off-market transactions. These types of transactions cannot happen at any time simply at the request of the buyer or seller. Therefore, there should be a pre-deal agreement or discussion that takes place before the actual transaction occurs. Could you please clarify this for me?

Hi Raja,

Yes, these deals are pre-negotiated and happens through what is called a ‘deal making process’. Typically there is an information flow through an institutional broker who has intel on who wants or who maybe interested in buying/selling a particular stock, at a particular price. So the deal maker ensures all parties agree. Once agreed, the deal itself happens via the exchange. Please note, the price reference for all these deals is the price that we all see on the exchange. So its not like Asian Paints is trading at 2450, but a deal is happening at 2400.

Thanks so much for the info. Satya!

Hi, I am not understanding price increase and decrease is relative to what and which price(open,close,high or low) we take for that?

It depends on the time frame you are looking at. For example, if you are looking at EOD chart, then the reference is previous day\’s close. If you are looking at the 15-minute chart, then the reference is the previous close of the 15-minute candle.

I am re-posting someone\’s question as I could not find answer for this

Vivek singh says:

November 28, 2018 at 12:47 pm

In in kite platform inside market depth.. There is showing bid and offers… If in any stock bids quantity is increasing.. Say its double the offer quantitie… Inspite of this stock price is not going up. Rather going down… Why sir… Does demand and supply theory doesn’t work in stock market….. Price of stock should go up Na… If bid quantity is greater… Plzz reply sir… This is a heavy confusion

Plzz reply sir

Karthik, I found the answer! Thank you. I believe the chronological order of questions and answers in the comment section was much better previously. The way recent comments are displayed now has created confusion, forcing me to scroll back to the first comment to gain clarity, which was unnecessary before. While I understand that people prefer new comments to appear first, I don’t see the logic in this approach. The core concept remains the same, and it doesn\’t matter whether comments are old or new when it comes to addressing doubts.

We are going to rework on the comments section soon to make it easier to see the latest comments 🙂

Stock prices will go up only when demand and supply match. One-sided bid/ask will not drive the price unless there is a matching quantity.

Can you explain it in more detail.?

Sure, but please share full context.

Information about the volume is good. Thank you. Suggest how to choose stocks.

Stock selection depends on various criteria. You need to take a call with what you are comfortable with – TA or FA.

Dear sir I want to ask what it means by saying that volume decrease with increase in price ,

means will it not increase to some extent remain same as previous or not in 2nd row

Means volume can increase due to buying or selling

How come decrease??

Or correct me please if I am wrong

It means that the prices are going up on lesser trading activity, Krishna. Which is not a great thing for establishing a longer term up trend.

Sir Is there any indicator that tells average volume of last ten days as you have an average line on your volumes, or I have to calculate it manually?

You can drop a simple moving average on the volume bar to get this information.

Sir In the beginning of the module you wrote 3 rules one of them was Be flexible can we apply same with the volumes?

Hmm, no. Volume is very specific data point.

Hello all, I have a query related Demand and supply zone. How can we see this particular zones in kite app.

The easiest way to do this is by plotting a support and resistance line. I\’ve explained this in the next chapter.

Hello sir, if the fundamentals & future prospects of a company is good but the trading volume of its shares is consistently very low, is it okay to consider such stocks for long term investing.Whether low volume should be considered a redflag?

Not really. Some good stocks can just have low float. Pay more attention to the business fundamentals.

Hi Karthik,

I am Sandeep.

I am trying to find the indicator for volume with moving average, but couldn\’t able to set it in the chart, bcos I see only volume indicator and there is no option in the setting to set the moving average (10day or so) in this particular indicator.

Could you please let me know how to set this indicator (Volume with moving average).

Sir,

Is it important to look after the color of volume bar, whether Green or Red? what it signifies ?

Not really, in my opinion just look at the volume in comparison to the previous day/weeks volume. That should suffice.

Hello sir

while using volume for intraday what period of SMA is preferable if we are using 5 mins timeframe?

You can use the same period SMA for 5 mins as well.

I had a Doubt for 3rd scenario. where price decreases and volume increases, we are saying that institutions are selling and thats why volume increased but volume is a transaction where buy and sell both happen meaning that if volume is high during price decrease , it will also mean that there are buyers as well who bought these many share. so how do you define this?

Yes, thats the reason why we look at the price along with volume and not volume in isolation.

Do these volume quantity include volumes of futures and options trades.?

If yes,is there any way to evaluate cnc,btst or intraday volumes from them.

No, each segment reports its own volumes. They are not combined.

Sir i have a doubt.

I understand the volume is increasing mean the transction happen.But how volume decreasing. Here decreasing meaning is the volume is decreasing from the 10 days average volume or what. And again help me to understand volume increasing or decreasing meaning. The standard point from which we look to evaluate volume is increasing or decreasing.

Here are the steps –

1) Plot an average line over volume. This could be a 10 day simple moving average.

2) Compare today\’s volume over the average of last 10 day.

3) If today\’s volume is higher than the last 10 days average volume, the consider today\’s volume as high.

4) If today\’s volume is lower than the last 10 days average volume, the consider today\’s volume as low.

Hope that gives clarity 🙂

Hello sir

Is there any way to apply average volume line in kite.

Thank you.

Yes, you can drop the simple moving avergae line down to the volume bars instead of the price.

Please explain the up volume and down volume.

Its explained in the chapter itself, Ansh.

Which indicator we should use to see volume bar as given above in the chart.

Please give a specific name

N how to draw a SMA over it

A SMA over volume bar is good enough for this, Shweta. I\’d suggest you speak to the support agent to help you with this.

so if today\’s volume is more than yesterday\’s it\’ll be green, is that what it means?!

does it not have anything to do with the price movements of the stock?

in the module you gave a table in which buy and sell qty were equal (400 and 400, 500 and 500 and so on), so i was asking what the volume would be if they were not equal,

The colour of volume does not really matter. You just need to see if today\’s volume is higher than say last 10 days volume.

hey Karthik, appreciate the blogs. pls clear this doubt for me:

1) what do green and red colored volume bars suggest? does it depend on the price of market (ie, bullish is green and bearish is red) or is it something else?

2) also, in the module, you explained the volumes when both bullish and bearish activities were equal, what if bullish activity is like 300 and bearish is 200, would the volume be 300 here or their average, ie 250?

Hey Aadi, the colours indicate in volume in comparision to the previous day. Your 2nd question, I\’m not sure if I fully understand. Can you add more context?

How will we know that specific days\’ volume beforehand to make the trade?

You wont know the exact volume figure for the day until the end of the trading session. But if you know what the previous day\’s volume is, then you can continuously compare volume at specific points during the day and check if today\’s volume is equal, more, or less compared to the previous day.

What if the price is in a sideways trend and the volume is also in a sideways trend?

Then you expect no major movement 🙂

Where can I read the price vs volume live chart, while trading sir?

You can check the charts on Kite.

I have seen a senario, (Stock – ITC, Day – 9/05/2024, 1 candle representing 1 day movement), Indicator RSI shows that the reletive price movement will be going upwards, and the indicator combo of EMA 25 and 50 are crossing eachother showing that the price movement will be upwards, and volume is reasonably above the average volume in the last 10 days, everything is showing great that the bear market will turn out to bullish (Market reversal), but the last 3 trading days forms a clear evening star, so in this senario what can be understood or determined by an agressive trader?

Guess I answered your query in the previous comment.

Hi Yantesh,

In any stock, if one person sells 100 shar3s, and another buys those 100 sahres, then how do the price move? Like if there were total 1 lakh orders, it means 1 lakh shares were sold to buyer who bought 1 lakh shares. Then how do price move up or down?

Price moves when the buyer quotes higher price and the sellers are willing to pay that price. And when more and more such trades happen, both price and volume increases.

I have seen a senario, Indicator RSI shows that the reletive price movement will be going upwards, and the indicator combo of EMA 25 and 50 are crossing eachother showing that the price movement will be upwards, and volume is reasonably above the average volume in the last 10 days, everything is showing great that the bear market will turn out to bullish (Market reversal), but the last 3 trading days forms a clear evening star and a huge red candle, so in this senario what can understood by an agressive trader? (Stock – ITC, Day – 9/05/2024, 1 candle representing 1 day movement)

I\’d go with the evening star. I\’m not a fan of RSI, and EMAs can be choppy in sideway markets. So you need to consider these things as well.

Hi Karthik,

Can you please explain how VWAP works in analyzing price moments. I heard that its good indicator to learn.

VWAP I\’ve explained in \’Other indicators\’, chapter.

hi

first of all i want to thank u and u team for such insightful content that u guys gives us 🙂

And i want to ask that suppose the price of the stock is decreasing and the volume is increasing so is it necessary that we consider it as a bearish signal why we cannot assume that it a positive sign as buyers are interested in buying the stock at this price.

Please help me understand this concept.

Thank u team Varsity 🙂

The only explanation basis price action – of price falling and volume increasing is that its bearishness. Think about it, if there was buying interest with high volume, the price would increase right?

Karthik sir Good morning. Sir you are great because of your hard work today I am able to understand the abc of stock market .

Sir I want to know what is bull/ bear trap, please explain it.once again very very thanks

Thanks for the kind words, Virendra. Any of these traps is basically a situation for you to buy or sell into a stock thinking that a bull run or a bear run is about to take off. But in reality, the market quickly takes a U turn and continues its previous run.

Hello,

I have a couple of questions on applying average line on volume chart on zerodha kite.

1) Do I apply simple average or exponential ?

2) I do not understand the \”offset\” field under edit settings for moving average.

Would be grateful for a reply.

Regds

1) Yes, simple moving average works for volumes.

2) You can ignore that till you get comfortable with using moving averages.

As you spoke about the double or triple confirmation with the candlestick pattern , support and the volume , when do we enter the market , what is the stoploss or is there no stoploss , and mainly what is the target , like u said go long but what should be the target and how do we prevent more loss and what is the stoploss

Tanish, we have discussed all these things and more in the TA module only, right?

If Mr A sold 500 shares to Mr B in a particular time, so volume is 500 of that particular time but what if Mr.B sold that same 500 share to Mr. C ( in same particular time) in that case is volume still 500 or 1000?

That would be 1000.

Thank you for Varsity!

On the Volume bars, should we draw an SMA or EMA line as a beginner in the stock market?

SMA is good enough, Bikas.

Referring to the Volume bar, how do I know whether smart money is involved int he volume or not? Basically, what is the benchmark/ threshold level that indicates the involvement of the smart money in the volume?

Example: If Price i increasing and so is the volume doing, what is that threshold level of the volume based on which I can understand that smart money is involved in the volume?

Thanks,

Pankaj

One quick way to figure this is by checking the avg volume over the last 10 days. If today\’s volume is greater than than the last 10 days volume, then that is an indicator of the presence of smart money.

Hi Sir,

T had a doubt.

Can I analyze volume on premium chart instead of futures chart?

Please give me right suggestion.

Thanks in advance

Hmm, you can do that, but for the larger picture I personally prefer checking the volume on spot charts.

Hello Sir,

Sir from the volume charts I can infer whether there is some institutional trade that has taken place or not. I just wanted to know how these FII and DII trade.

Do they invest in individual stocks, or they invest a lot of money on a prospective sector (So that all stocks in that sector grow). Because I thought given their size, scouting for individual good stocks would be difficult. So, they find out a sector which has good growth and invest in it. Can you give some idea on their mechanism of investing. Or is there any varsity module or content that I can refer to.

It really depends on the institutions. But yes, lot of them directly invest in stocks as well. But every action is caught in the volume bar and we have discussed all there is to volumes here itself 🙂

Thank you!

Hi Karthik,

I have the following queries:

i) what is the indicator that i need to use in Kite for increase in volume? Is it \”Volume Oscillatory\” or just plain volume with mean graph?

ii) In volume oscillator, going by your theory, should i input short length as 1 & long length as 10.

iii) 1 & 10 – is it generally recommended for all timeframe of trading – i.e intraday, weeks, months?

Please clarify.

Best,

Shambhavi.

1) Just plain volume should do.

2 & 3) I\’ve not used volume oscillator, so cant really comment.

sir what is the sufficent volume requried,to trade in options and stocks in intraday

It should have volumes good enough for your capital. For example, if the daily traded volume is 100000 contracts and if the quantity I wish to trade is 100, then thats good enough volume. But at the same time, if your quantity is 50,000, then 100000 may not be a great volume.

my doubt is that if a day is green, why did people sold stocks that day?

They could be booking profits, Salman.

sir,

I observed that some stock price is increasing well but the volume is less than 50000 k but the same time some other stock is up and moving done slowly even though their good volume is 1 cr or 1.5 cr etc . Why?

Depends on the overall liquidity, Sathish.

Sir, can you pls tell which time frame to use for intraday,short, Swing and long term derivative option trading?

I\’d suggest you used EOD regardless.

Thank you Karthik. I will call your support folks. 🙂

Please do, wishing you the best.

I have the candle volume in candle format. What I am looking for us, within the candle image numbers of the volume displayed. For instance:

2,35,767

68,007

3,89,657

1,89,433

All these volume numbers in real-time, within the candle.

What I am trying to accomplish by this, is to see the volume numbers in real-time to get better clarity for gauging the trend.

I am sorry if I am not being clear with my question. 🙁

Sheryl

Ah, you want the volume overlay (printed) on the candle itself? Is that what you are looking for? Why dont you call the support desk and ask them to connect you with someone who can explain chart settings well, maybe they can help better. I\’m not sure if that option exisit, but its better if they clarify it 🙂

Hey Karthik,

Crystal clear explanations above. Thank you.

I am looking at candles where the volume numbers by the second appear on the charts, within the candles. Do we have this capability within the kite app? (To understand my question better, just imagine a candle and within the candle the volumes traded by the second are displayed) I could have shared a picture here, but I don\’t see an option for an attachment.

Can you help? 🙂

Sheryl

Thanks Sheryl, yes, there is something called \’Candle volume\’, that gives you this information. Do check that 🙂

Hello karthik,

Since we are to consider volumes above 10 days average, should we ignore candlestick bullish/bearish patterns formed with volumes being below 10 days average ?

Ideally yes, as volume would be a key trigger to initiate trading positions.

If suppose I am looking at a 5 year old chart. What is the average I should be looking at? Last 10 month moving average? If yes, how can I calculate it?

You can consider a 100 or a 200 day moving avergae as these capture the broader trends in the market.

Hi Sir,

I have a Doubt on the volume Table…so u said that when Price decreases and volume Increases its a Bearish signal…But what if the smart money keep on Buying when Retailers Selling so that they Accumulating that stock…In this Scenario too Volume will Go Up while Price Falls Right??? Correct me if im Wrong Sir…So in this Scenario its Actually Bullish as Smart Money is Accumulating, Isnt it??? And Vice-Versa for Bullish Signal…Am i right, Please Clear My Doubt Sir…

Siva, usually the retail selling does not cause the price to move.

sir if price is not going up but there is a big volume showing in volume indiactor what would be the major reason for this can you explain any logic behind this

It just means that there is a lot of trading in a narrow price range.

Sir I have few doubts coz recently I tried some volume techniques to trade in intraday.

I shared my process of trading in Intraday please correct me if I am wrong in any side.

I trade on stocks only

Here is my process of trading

👇

1.I plot Pivot point standard on stocks

2.I look for first 5 mints candle and look if it\’s break any pivots and closed below/ above this

3.Then look in the volume bars

4.If price fall and volume bar showing increasing volume then I wait for the volume bar to be decreased (So I identify that sellers are now weak )and search a form of a buying candle pattern at any pivots then I go for Buy trade

VICE VERSA FOR THE SELL TRADE

Please correct me if I am wrong at any point????

Animesh, there is no right and wrong process. You only need to improvise on what is a starting point. Start with what you have and see how the results are, then improvise to enhance the results. You can use https://www.streak.tech/home for all sorts of backtesting.

sir

how i can plot moving averaages in volume bar

Please call the support desk for this. They will help you with this.

Dear Sir,

Is there any tutorial available on the operation of the Kite-Zeroda app.

I just have opened an account in Zeroda. I want to learn, how to place an Intraday / long trade with Target & stoploss. Also wnat to learn how to trail stoploss.

Pls hepl me out.

Regards

Rajesh, can you call the support desk for this? They will help you with this.

How to plot volume graph lines in groww\’s technical analysis chart ?

Not sure, please do check with their support team for this.

How do i plot volume indicators in the technical analysis graph ?

You can load this at the bottom of the price chart. Do check with the support team for details.

Hi Karthik sir,

Are there any FREE zerodha PI like ticker-reading software in today\’s world for day trading ?🙂

You can use Kite for pretty much anything trading related 🙂

Dear ma\’am/sir

My doubt is which time period I should use in volume moving average based on chart time frame

Ex.

I want to trade in 5 minutes chart so which time period I have to set in volume moving average???

Kindly share me all time frame of chart with relation to all time fram of volume moving average

Thanking you in advance !

You can use end of day time frame for this, Milan.

I am not sure whether anybody from Zerodha is still responding to the queries on this forum .

My query is regarding the colour of the volume bar. What does the red and green colour of volume bar indicate ??

I tried to correlate with the previous day\’s volume , average volume etc but couldn\’t. Please advise ? Thanks

Here you go, Rohit –

1) The volume bar will be green if the candle\’s closing price > the previous candle\’s closing price

2) The volume bar will be red if the candle\’s closing price < the previous candle's closing price

moving average i am not able to chart on the volume chart how to do it in zerodha and how to read volume profile

Hmm, not sure if I understand your query fully. But maybe you can call support desk, they will help you with this.

Dear sir ,

Why is my volume bar (volume chart) in Zerodha Kite mobile app red and green instead of blue?

You can customize these colors to your preference, I guess.

Sir, what should one do when the stock is in an all-time high or low region? We can\’t draw resistance or support. So what should one do, if one wants to go long or short? What aspects should one look for?

Thank you, Sir, Varsity is helping a lot!

Hi Karthik,

Thanks for your hard work to make the knowlege freely avaiable.

Want to know your view, if we are using VWAP, is it required to check SMA on Volume or both provide similer information

Its good to check SMA on volume, just to keep an eye 🙂

Are institutional deals more often than not Off the market transactions? If so, would it not impact adversely the credibility of volume data?

Block and Bulk deals are off-market, but these transactions do get reported to the exchange and added back to volume.

If total buy = 150 and total sell = 100, what will be the volume?

Buy and sell will be equal when a trade occurs. What you are looking at is bid and ask, which can differ.

Baroda Rayon Corporation Ltd

This particular stock remains a confusion to me. I saw the volume chart after going through the article. I was surprised to see there was no seller of the stock. Only the buyer.

Everyday it opens on Upper Circuit and it\’s already given returns of 2700% in just 4 months. How the new buyers are purchasing this stock when there\’s sell volume?

Finance also looks week at least to me. What am I missing? Anyway to check the volume of traded stocks if it\’s small quantity, say 100-500?

Its just that right at the open, the stock is getting bought and there is no activity for the rest of the day. Quite common with stock which hit the upper circuit. Finance is not complex, we have tried to make it simple here. Do give it a read 🙂

Sorry Sir, I didn\’t get the answer of second question: \”The color is largely basis the previous day volume\”.

If I try to find the answer form your answer then result might be as follow for me, but the doesn\’t fit in volume chart.

1. Today\’s volume >previous day volume = green color and vice-versa.

OR

2. color of volume depends on color of candle.

My bad, on Kite (ChartIQ) –

1) Volume colour = green if today\’s close price > the previous day

2) Volume colour = red if today\’s close price > previous day

Hello Sir,

https://www.tradingview.com/x/pXcKoGD6

In above link of TATA steel, their piercing pattern has formed & volume is 10 days above MA. Even though market has red candle for next 3 days in day chart.

Can you guess the market ideology for such movement. This chart is of previous week from 22 to 26 august.

2. if 100 buy & 100 Sale is 100 volume, then how zerodha is calculating growing & falling volume. As growing has green color & falling as red color.

For example: today\’s TATA Steel volume is 5,98,95,805 qty

calculation: Buy 59895805 & sale 59895805 = volume 59895805. it is a green color volume

so here how we decide red color volume or green color volume here.

1) Ronak, these patterns only enhance the probability, but there is no guarantee as such. So patterns can fail and you need to be prepared for this. However, the good thing is that in case the pattern fails, you also know the stop loss price and the price at which you can exit the trade.

2) The color is largely basis the previous day volume.

sir what should be the delvery volume percentage(above 50% or 70 %) to consider entry for swing trading?

Higher than the average volume of 10 days.

Zarodha is fooling gived no volumes for nifty n bank nifty looks hands in glooves.

No 🙂

Nifty and bank Nifty in the spot has no volumes. Only futures has volume and OI.

Can I get every 15minutes breakout in zerodha when intra day timings?

Not sure what you mean, but if its 15 minutes charts, then yes, you can.

Yes.

I was analysing Volume on intraday basis more than Overnight.

Thank You Again.

Thank You Karthik.

Hello Karthik,

I hope this link of the chart screenshot is visible.

https://www.tradingview.com/x/LR2geiIM/

On this chart :

MA on Volume is 20.

Resistance ( Orange line ) : 16690.25

13.40 Candle breaks this Level with 90.6k Volume ( which greater than 75.56k of MA ).

13.45 Green Candle with 238.9k Volume

13.50 Green Candle with 136.5k Volume ( MA is 86.59k )

but…

13.55 Red Candle which however does not breaches the above level downwards but it has Volume of 91.25k which is greater than MA of 87.35k.

1. Now should I squre off my trade considering :

1.a)that Smart Money will be booking profits as this 13.55 Red candle Volume is above average?

1.b)that this Red Candle’s volume is greater than 13.40 Green Candle volume ( the one which had broken the Resistance ) ?

Or

2. I should continue to hold my PE sell considering that 13.55 Red Candle Volume i.e 91.25k is still lesser than the “recent 13.50 Green Candles” Volume which is of 136.5k ?

Karthik,

3 Where will you exit seeing the chart ?

4. Does the First Volume bar holds any significance ? First 5min candle’s Volume bar ?

Thank You.

And…the same link for these queries :

https://www.tradingview.com/x/e06SNXST/

With respect to :

“4a) Not necessary. When breakout happens, it usually is on high volume, so don’t compare just on the basis of the previous candle. Look at the average”

And

“4c) Look at the price movement. Is it surging with a big % price change?”

Above…

Q1. Ain’t any candle with Volume above it’s MA is High Volume candle ?

Q2. At 10AM MA is 188k, Volume is 140k. Then there is contraction in MA is seen. At 11.45AM, MA is 46k, Volume is 130k. Now how will this 130k volume be taken as…High Volume or Low. ?

a) As it is lower than Previous Volumes like 140k at 10AM so Lower?

b) Higher cos it is greater than its MA i.e 46k ?

Q3. How much price surge will be treated as actual surge ?

—-

1) No necessary. Breakouts can also happen backed by low volume.

For the rest of the queries, hopefully my previous response will give you an answer.

Kathik,

Here is the link for these queries :

https://www.tradingview.com/x/LR2geiIM/

On this chart :

MA on Volume is 20.

Resistance ( Orange line ) : 16690.25

13.40 Candle breaks this Level with 90.6k Volume ( which greater than 75.56k of MA ).

13.45 Green Candle with 238.9k Volume

13.50 Green Candle with 136.5k Volume ( MA is 86.59k )

but…

13.55 Red Candle which however does not breaches the above level downwards but it has Volume of 91.25k which is greater than MA of 87.35k.

1. Now should I squre off my trade considering :

1.a)that Smart Money will be booking profits as this 13.55 Red candle Volume is above average?

1.b)that this Red Candle’s volume is greater than 13.40 Green Candle volume ( the one which had broken the Resistance ) ?

Or

2. I should continue to hold my PE sell considering that 13.55 Red Candle Volume i.e 91.25k is still lesser than the “recent 13.50 Green Candles” Volume which is of 136.5k ?

Kathik,

3 Where will you exit seeing the chart ?

4. Does the First Volume bar holds any significance ? First 5min candle’s Volume bar ?

Thanks, Hemant; please ignore my previous comment. I can see the chart and your queries.

1) So volume as a concept is more applicable for overnight trades than EOD. Dont spend too much time on volume analysis if you are intraday trading. If I were you, I\’d hold the trade and base my decision to sell (or, for that matter, buy trade also) based on price behavior. Also, the difference in volume here is hardly anything, so don\’t worry too much about this

2) Exit depends on a few things – do you have a target in mind and has it been achieved? What is the stop loss? Is it intact or has it been hit? Is the stock exhibiting momentum after you took the trade? If yes, do you want to trail the profit and hold on to the trade? So think on these line for planning an exit rather than just volume analysis.

Good luck.

Karthik,

Here it will open :

https://www.tradingview.com/x/1S5zOsUE/

Thank You.

Hello Karthik,

https://kite.zerodha.com/chart/ext/tvc/NFO-FUT/NIFTY22JULFUT/13756162

Is there a way to share the screenshot ?

Or

Please tell me a way to share the link…as I tried opening the link from another ID but it was not opening there as well.

You can upload the chart\’s screenshot on Google drive and share the link here. That will work. But when you do, please compile your queries again, so that I can see the chart and your query in the same comment and respond. Thanks.

With respect to :

\”4a) Not necessary. When breakout happens, it usually is on high volume, so don’t compare just on the basis of the previous candle. Look at the average\”

And

\”4c) Look at the price movement. Is it surging with a big % price change?\”

Above…

Q1. Ain\’t any candle with Volume above it\’s MA is High Volume candle ?

Q2.

a) Say on the first 2 hours MA on 5min chart was 200k. So every 5 min candle above 200k in those 2 hours will be counted as high volume no ?

b) Say after 2 hours…MA contracts to 100k. Then candles with Volume like 120k/130k/190k will be treated as high Volume? Or it will be treated as low volume since it is still lesser than the 5min \”high candles\” from the first 2 hours candles ?

Q3. How much price surge will be treated as actual surge ?

Karthik,

Why am I flooding you with questions because I have not been able to ride the trend like many traders do. All cos the concept of Volume which has been amalgamated in my brain stops me from doing so.

As after \”a breakout any Red Volume candle greater than MA\” I take it as Smart Money has done the profit booking even though it is still above Resistance and I exit. There is something to it which others have caught it well but I am yet to catch it.

Also

A1.

Say at a resistance a Green Candle it tries to break with 230k Volume which is above MA but fails.

A2.

And it tries again after half an hour but with lesser volume say 120k and fails this time too. MA 110k.

A3.

But on third attempt it breaks it but with just 100k Volume, MA at 90k.

A4.

And the very next candle after it gets 200k Green Volume candle.

Where will you enter ?

If :

1. At A3 : then ain\’t the Volume at A3 where it actually got the BO is lesser than in the previous 2 attempts ? Should not this be called a Fake Breakout as Smart Money was more in previous attempts?

2. At A4 : Then reason is it that after A3 you were waiting for more confirmation with Volume since it was lesser in previous two attempts that\’s why after A4 you will enter ?

Thank You.

Like I mentioned, the chart is not visible 🙂

Hello Karthik,

Thank You for taking all the queries and coming back with detail replies. Thanks Alot.

I did\’nt knew that we can share charts link also.

Link :

https://in.tradingview.com/chart/ZvXSEGpu/?symbol=NSE%3ANIFTY1%21

On this chart :

MA on Volume is 20.

Resistance ( Orange line ) : 16690.25

13.40 Candle breaks this Level with 90.6k Volume ( which greater than 75.56k of MA ).

13.45 Green Candle with 238.9k Volume

13.50 Green Candle with 136.5k Volume ( MA is 86.59k )

but…

13.55 Red Candle which however does not breaches the above level downwards but it has Volume of 91.25k which is greater than MA of 87.35k.

1. Now should I squre off my trade considering :

1.a)that Smart Money will be booking profits as this 13.55 Red candle Volume is above average?

1.b)that this Red Candle\’s volume is greater than 13.40 Green Candle volume ( the one which had broken the Resistance ) ?

Or

2. I should continue to hold my PE sell considering that 13.55 Red Candle Volume i.e 91.25k is still lesser than the \”recent 13.50 Green Candles\” Volume which is of 136.5k ?

Kathik,

3 Where will you exit seeing the chart ?

4. Does the First Volume bar holds any significance ? First 5min candle\’s Volume bar ?

That link is not working, Hemant.

Hello Karthik,

Also how to read the first Volume bar of the day on 5min chart ?

Does that signifies something?

Thank You.

It is the volume for that 5-minute duration, which will complete after the 5-minute duration ends.

Thank You for this quick 🙂

With respect to ..

3) It broke 16500 but Volume bar was less than its MA line. But on the next candle it did broke 16525 that too this time with Volume bar greater than MA line. So I thought that the first breaking of 16500 was fake. In this case when will you enter seeing the Volume ? After it breaks 16525 ? or 16500 itself ?

4) Say MA line is at 130k. It broke a resistance with Green candle say Volume 140k. I entered into the trade. Say just after this a red candle appears but with Volume 135k ( MA is still 130k) – Four Scenarios :

4.a) If this red candle with 135k Volume is still above resistance but Volume is more than MA line but lesser than above Green Candle\’s volume ( i.e 140k ) so this is pull back ?

4.b) If this red candle with 135k Volume is breaks down the resistance but Volume is more than MA line but lesser than above Green Candle\’s volume ( i.e 140k ) so will this be a pull back too ?

4.c) If this red candle comes with 145k Volume is which is more than previous Green Candle\’s volume but it is still above resistance so what do we understand by this ?

4.d)If this red candle comes with 145k Volume is which is more than previous Green Candle\’s volume but this time it breaks down the level…then this should be clear cut case of BD. Right?

Please elaborate.

1) Probably 16525 since the volume is more convincing

4a) Not necessary. When breakout happens, it usually is on high volume, so don\’t compare just on the basis of the previous candle. Look at the average

4b) Same as above

4c) Look at the price movement. Is it surging with a big % price change?

4d) Perhapse

Btw, imagining these situations in comment is very difficult with no context. Best if you ask these by sharing link to chart, only then i can respond with clarity.

**

a) A green candle with Volume less than MA crosses 16500 ( P is +, V is -)…but after this another green candle but with Volume greater than MA ( P is +, V is + ) crosses 16525 ..so should one take the trade here ?

Hello Karthik,

This is wrt to this comment : \”Also, always make sure you compare real-time volume (on intra day basis) with the previous day volume to get the bigger picture.\”

1.Please share the visual example as to how do we compare it with PD\’s volume for intraday.

2.By default setting of MA on volume is 20. So should we keep it to 20 or change ? What factor decides what could be the appropriate MA on Volume?

3. Say 16500,16525,16550 are the resistance…

a) A green candle with Volume MA

( P is +, V is + ) crosses 16525 ..so should one take the trade here ?

b) If Yes then please elaborate…as the first breakout at 16500 was fake..without volume ?

4. Say MA line is at 120k. It tries to break a resistance say 17000 with Volume of 130k but it returns back. Again after few minutes it again tries to break but with Volume 125k (lesser than previous attempt & MA line is still at 120k) but it does not comes back after this all throughout the day. How to read this scenario as ? As in first attempt it did with 130k but came back…but in next did with 125k..succeeded?

Hoping to get the answers of these.

Thank You.

1) Load the EOD chart during market hours with volume and compare today\’s volume with the previous few sessions

2) YOu can change it to anything that you think makes sense, I prefer 10

3) I\’d take the trade. How is the 1st break out at 16500 fake when the price is at 16525?

4) This is a typical pull-back situation that happens. Do check the volume when the price declines, it should ideally be on low volumes

Good luck.

SIR LET\’S TAKE AN EXAMPLE IF THERE ARE 100 BUYING QUANTITY AND 200 SELLING QUANTITY VOLUME THEN WHAT IS THE ACTUAL VOLUME?

That cant be right, reported volume should match selling and buying volume.

Banknifty option chain OI change kese hota hai or kitana time me update hota hai

Its real time, Manoj.

because result of both the impacts are similar .i guess

These are two different things –

1) When there is equal buying and selling pressure, price does not move.

2) When transactions happen via bulk and block deals, price is not impacted.

But how to recognize that which one is happening and when between above two points.

1) Yes, usually results in doji or spinning top

2) Yes, since its off-market only volume gets reported

Also please clear my doubt sir, i understood that on volume bar i have to plat 10 or so on SMA to check current vol higher or lower than last days volume, i come to know that how to plot but please i dont know where to see and how to see is there any number to watch that todays volume is higher than last 10,20 … days MA plotted on vol bar or vice versa. because i have plotted SMA on vol bar but how to analyze and recognize my today vol is high or low than previous average , means i am not able to get the data of that, however i know only how to plot sma on vol bar but not able to get data from where to know todays vol high or less than previous last days average .. please explain sir.

For that, compare today\’s volume bar with the moving average latest value, you will know.

But above you said we should check volume compare to previous 10 days moving average, if vol is higher than previous MA vol than current vol will be higher, and vice versa

Yes, 10 days moving average of the volume.

For swing trade which moving average is better to use for SMA over volume , is 10 day SMA is good or 20 SMA is good or else default 50 SMA is good as select in field source. Also suggest for intraday and F&O both. Means suggest days for compare volume over ;last moving average.

Hard to say 1 MA is better than others, you need to select what works for you.

Thank you for your reply sir, not sure how to use trading view, but the way I found to get the 10 days avg volume line , was to select \” Show MA \” under \” volume \” settings.

Earlier we had to select \” Field \” as \” Volume \” under \” MA \” settings, as mentioned by you in earlier comments. Please can you elaborate a little about trading view, Thank you.

Ok. No problem. Let me know if you need any further clarity on this.

Sir,

First of all thank you so much for all the info, you have provided.

I think kite has evolved over the years, some info that were true earlier now seems to have changed.

For example.

After having the volume chart visible in kite , I want to apply the SMA to volume but in \” Source \” of SMA there is no option to select volume?

So how can I get the 10 days average volume line superimposed on the volume chart?

Ah no, its still pretty much available, Bhasakar. Try using Tradingview.

one of your reply of my query was \”Ah, it just means that there was a lot of buying and selling activity, but the price dint move much, which further implies that the bulls and bears had an equal impact on the stock price.\” the query was there is high volume but price didnt move much. you said bulls and bears had an equal impact, but on my another query you said that it may be block/bulk deal by institution due to which price didnt move much .

So i want to ask which one response is correct in between them.

These are two different things –

1) When there is equal buying and selling pressure, price does not move.

2) When transactions happen via bulk and block deals, price is not impacted.

\”1) Yes, I’d do that myself. Check volumes on spot and then take action in F&O

2) It makes sense to check spot volume, its available on Kite.\”

what is the meaning of above two points, and what is the meaning of spot market and spot volume.

Please dont mind for this back to back long questions sir , As i m fresher and eager to get deep knowledge .thanks

\”Check volumes on spot and then take action in F&O\” means??? this comment is yours sir.

For example, if there is infosys spot and Infosys futures, then to trade futures, I\’d refer to the action on the spot chart and then basis that trade the futures. It may sound a little complex until you get the nuances of the futures and spot.

Also want to ask that how to know the volume confirmation after confirming the pattern and price, because there is sometimes one long volume bar after that some lower than previous again some low again some higher, mean to say that how to confirm the volume at last like one single long high volume bar is created but after that some fluctuation created in the bars some are high some low means not exact measure some long some short . so should we consider only first long candle and can make confirm that its going long,

means how to read volume bars because there are multiple bars formed after confirming high single bar

If today\’s volume is greater than the last 10-day simple moving average, then consider today\’s volume as good. Else, don\’t.

one more query sir, one of the above comment you mentioned \”. The green indicates an increase in volume and the red indicated a decrease in volume – both compared to previous day.\” but in my query you told me that color of the volume bar we should ignore ,and if color of volume bar is red and green that does not mean green is high volume and red is low volume. Because i think color is depend upon previous close, means if volume bar is green color that means that volume bar is higher than previous bar cloase ,and if vol is red color that means vol bar is lower than previous vol bar ,according to you . is it right? So now getting confused by your above comment that green means high volume and red means low volume,. please explain sir

Neeraj, the thing is that we need to compare the volume of today with at least last 10 days to get a sense if today\’s volume is high or not. One way to do this is to compare today\’s volume with the 10-day simple average. Given this, the color of the volume becomes redundant.

very very thank you sir for responding all my queries in such a easy and nice manner .

And if they trade on market via exchange like as normal retail traders , so this should impact price . and also they always take trade in huge quantity or transactions and block/bulk deals are also huge transaction so can we say both are same types . I mean to say both the transaction done by institution are in huge quantity either block/bulk deals or via exchange like retailer. so what is the difference between both that why they do off market transaction instead of on market txns trading platfrm.

Yes, transactions are usually huge. If done on exchange, it will impact the price. So exchanges has the provision to route it off market.

sory for back to back rubbish queries sir last one doubt that if there is bullish engulfing pattern at bottom of prior downtrend means the may be we can take trade long,also S&R matched ,also volume bar is higher than previous 10 days average and long but that volume bar is red in color, all 3 checklist are matched but confusion is volume bar is red but also long high volume, so please tell me should i go long for that trade because doesnot matter that either volume bar is red color aur green color its just only about high or less volume,because color of volume bar is basically depends on previous close bar ,if todays bar is higher than previous close then color of volume bar will be green and if less than previous close than it will be red, only just to see volume density and ignore color , and take the trade accordingly..AM I RIGHT ?? please answer all my above queries as a point… thankyou so much

You can ignore the colour of the volume bar. The only thing that you need to check for is today\’s volume versus the previous few day\’s volumes. If the volume is high, then that\’s good enough.

Also above mentioned institutional investor is smart money when they buy it will be huge amount,so volume should increase price should increase,but in some cases volume increased but price still same not move much then you said it will be block/bulk deal thats why price moves not that much or still about same.but please tell me that block/bulk deals also taken by institutional investors as smart money then why price not moves not much, it should move up or down na? because block/bulk deal are happened by only those institutional buyers /sellers

Block and Bulk deals are off-market transactions, Neeraj. So these transactions won\’t impact the price. Only if the price is impacted by volume is when you can take trading action. Since bulk and block deals are off-market, they should not impact your trading decision.

because as you mentioned above we can make confirm the trade after high volume bar as checklist rule.

Yes, but like I mentioned, high volume should match with a price move as well.

thanks a ton for replying sir. Ok so that means ,it is not necessary that price will move upward or downward if there is high volume bar is there at bottom, right? which means we cannot make sure to take the trade or not make it confirm about to take the trade long or short if already high volume is there. because i thought if high volume is there in chart, there will be some opportunity to take trade may be long and short according to above table of volume and price. i thought we can make sure or confirm to take the trade after seeing high volume (red or green) or confirm the trade after seeing high volume bar. is it? please explain sir.

Thats right, Neeraj. The price should confirm with the volume for you to take any trading action. Just volume without any price action is no good for a trade.

No sir, i didnt mean it, actually i opened the RIL chart and i want to ask that there is one long red volume bar which means high volume at that point, but there is no much price change , please could you check https://chartink.com/stocks/reliance.html which you told me,in this same at last end from the right please see there is one long red volume bar what does it mean,it should be high volume, but according to this price didnt change as much. please elaborate me what is the effect of that long red volume bar in price chart. i am not able to attach the chart of RIL

Ah, it just means that there was a lot of buying and selling activity, but the price dint move much, which further implies that the bulls and bears had an equal impact on the stock price.

Hi sir,i am not able to attach file,please elaborate if there is one EOD chart in trading view of reliance industries there is one red volume candle at bottom in volume bars which is very long as compare to other bars which shows high volume having selling pressure but there is no downward movement showing in candle stick patterns.there is some upward movement at some points thenafter it becomes downward after somedays ,i am confused because at long volume red candle it should be downward movement.please suggest

Neeraj, are you talking about how the chart appears for RIL? Why don\’t you log into Kite and check? Else you can check here as well – https://chartink.com/stocks/reliance.html

I have a confusion. That if there is big volume spike on a particular day and price increases..How could it point out to take long call as investment while there is only say less than 30% delivery volume?

Shouldn\’t we only rely on delivery volume for taking long call as intraday volume doesn\’t make sense(as it makes no sense after day close) for buying stock for swing trade. I am confused that why delivery% is not focused upon for swing call and how could just trading volume which has major portion as intraday helps to take swing trade. Kindly help me understand.

Delivery volume can be misleading. For example, even if I do a BTST trade, it will show up in delivery volume but the intention is to sell the stock t\’row. So I\’d rather use EOD volume.

What we can say in other words is increase in volumes indicates that buying and selling has subsequently increased on large scale as compared to last 10 days average.

However as volumes indicates equal buying and selling we cannot decide the direction based on only volumes.To validate volumes we need to combine it with price action.i.e an increase in price indicates although buying and selling were equal,demand is huge for buying hence price is shooting up.

Similarly in case of decrease in price indicates although buying and selling were equal,supply is huge for selling hence price is falling down.

Is this more precise now?

Do confirm

Thanks in advance!!

Yes, this is exactly what I\’ve tried to convey as well.

1 buy and 1 sell indicates 1 volume.

The differentiating factor to go long or short is the combination of volume with the increase or decrease in price,An increase in volume with increase in price indicates that buying has been preferred on large scale,however selling has also taken place with same numbers only the buying was heavily preferred than buying and vice-versa in case of selling.

Is this explanation right?

Do confirm

Thanks in advance!!

Yes, and you can substantiate that with the increase in price. Hence you need to combine both price and volume, Paras.

Volume bar above average line

And if it is bullish bar

Should we buy? Becase whenever we buy seeing huge Volume in upside And also seeing candlestic pattern like bullish engulfing we see it goes down, so how to use volume as it show smart money why it goes down And what Strategy we Should adopt seeing huge volume in upside or downside

Kamal, don\’t rely just on the volume bar. Use it as a supplement to the candlestick. Do review the checklist given in later chapters. Go with that flow.

Is it better to exit the trade if the volumes are below MA10?

In case, If we have already entered the bullish trade based on Marubozu candle, But don\’t know when to exit?

can we depend on volumes to exit the trade?

Nope, I\’d suggest you trade basis the pattern. Use volumes as a supplementary analysis tool and not the main tool for decision making.

Hello sir,

First of all thanks for explaning in such a wonderful way..

I have one doubt sir about price change.

Suppose in 5 min TF. If volume increased but price do not. Actually, price change like the candle open at 200 and went till 205 but closed at 201 so what that means price changed or not as it move till 205. What we should consider this the first scenario or second.

Or we should see candle body or only price after closing of candle.

It just means that a lot of transactions occurred in that TF but it had no real impact on prices, so it will be hard to call the direction. By the way, don\’t read too much into the volume change in these short ultra-short timeframes.

How to find Institutional investors or FII are buying some stake in the company officially

How to find Institutional investors are buying some stake in the company officially

Keep an eye on the bulk and block deals, Arun.

Hello Karthik ,

Last question with regards to the topic

When you say color of the candle does not matter you are talking about candle color or volume bar color ?

Many Thanks

Shaan

I\’m only talking about certain candles like spinning tops and dojis. Every other candlestick colour matters 🙂

Thank you Karthik ✌

Happy learning!

Hi Karthik ,

Just to clarify

if assuming current Trend is up & price has corrected to support zone(LH) forming a Hammer with Red High volume candle – so in this scenario whom to we consider more strong Buyers or Sellers because volume suggest sellers are strong so how do we trade in this scenario

Regards

shaan

If the hammer is backed by high volume (hammer formed after a brief sell), then do look at long opportunities. By the way, the colour of the candle does not really matter.

Thank You Karthik for your prompt response , just wanted to get a clarity on the below

Assuming the trend is up & the price has corrected and currently at or near a major support Zone – Previous candle was a bearish candle with high volume and closing on or near the support Zone .

So is it like this –

if seen a hammer forming with high volume on this support zone or near to it which means both bulls/bears are at equal force n there is indecision in the market , so enter a long trade on the conditions depending on risk taking or risk averse trader

if seen a bearish candle with high volume on this support zone or near to it means bears are still going strong which means price is still correcting breaking the current support zone & wait for the price to reach next support zone to enter the trade(Assuming trend is still upwards)

Regards

shaan

A Hammer at the end of a downtrend is bullish, right? This implies that bulls are in control. So it\’s a one-sided trade.

As you have mentioned that take only those trades whose volume is higher than 10 days average but how we know that today\’s volume will be higher than 10 days average at the commencement of the day ?

I hope that you have understood that what I am trying to say.

Thankyou

Keshav, you can do two things –

1) Check the previous day\’s volume and get a sense of how the volume is compared to last 10 days.

2) Track intraday volume and see how if it\’s moving higher than the average of the last 10 days.

Hello Team ,

Could you please help me with this – When you say increase or decrease in price from the volume & price perspective what would be your input for the below scenarios

Assuming we have a candle which can be doji or spinning top on Support or Resistance Zone with high volume – What do we think of price in this scenario

Assuming we have a candle which is a hammer or a shooting star on a Support or Resistance Zone with high volume – What do we think of price in this scenario

Regards

shaan

1) Doji/Spinning top near S&R with high volume indicates heavy-duty action by both bulls and bears with no conclusive outcome. The value of S&R increases here, as in I\’d trust the level higher

2) Again a good sign to base your trade on.

Sir , will we use previous day volume to trade tomorrow ?

The previous day\’s volume is used as a reference for taking a decision on today\’s trade. Just to give you a perspective on the volume trend.

As you have written in the last point that do not trade in low volume. But how would we know that that todays volume is low or hight because we know the volumes at the end of the day

You can compare today\’s volume with respect to the last 10 days\’ volume by taking an average and then figuring if the day\’s volume is high or low.

S & R points act as SL POINT ?

Yes, very much.

In 2nd and 4th, volumes are decreasing in comparison to last 10 days volume average?

Am I correct

Perhaps, but take the average volume under consideration.

Jaise Aapne bataya tha ki Bearish Marubozu mein risk taker trading period ke end mein short karta toh usko phir same day hi short position ko square off karna padega ?

Yes or no

Jitne shares sell kare kisine Utne hi shares kisine buy bhi toh kiye honge.

Toh phir price down kyo hua ?

Isliye hi Toh nahi ki traders ko future expectation mein down dikh raha tha

I.e they sold the shares at low price ?

Keshav, price is a function of demand and supply. If demand goes low, the trades also happen at a lower price. Likewise for price moving upwards.

which type of M.A. is best for intraday for time frame 5min or 15min . on candle charts.

hello sir, as you suggested : use SMA on volume charts (any time frame like- 5min or 15min)

can you also suggest us, which moving average we can use on candle sticks on intraday chart of time frame 5min or 15min.

and how we can make decision on trend by observing that M.A. either to look for buy or sell.

hello sir, as you suggested : use SMA on volume charts (any time frame like- 5min or 15min)

can you also suggest us, which moving average we can use on candle sticks on intraday chart of time frame 5min or 15min.

and how we can make decision on trend by observing that M.A. either to look for buy or sell.

Manish, you use use a simple 10 day average on volume that will help. Volume is considered high if the volume bar is higher than the average and less otherwise.

Hi,

Is there are any way to Bid and Ask Price in a live market through scanner for specific list of stocks.

Thanks & Regards,

Veera

YOu can pick any stock, please a bid and ask for 1 stock to see how it works 🙂

If no share transactions for buyer n seller are same then What does colour of volume bar indicates.

It indicates the relative strength wrt to the previous day, Hemant.

How do we know that volume is high or low? What I mean is that should we see volume with respect to total shares e.g if the volume of stocks of some company is 1000, and the total shares of the company are 2000, then it seems to be a good volume. But it total shares of the company are 1,00,000, then 1000 volume seems to be very less. Am I right that whether we should compare current volume w.r.t total shares or something else?

Amit, one easy way is to check the current day volume and compare it with the last 10 average volumes. That gives you a sense of how high or low the volume is.

Kindly tell me difference between Ask Quantity and Bid Quantity and what are their significance if bid quant. is more or less than ask quant?

Also how ask and bid quantity is different from volume?

These are the quantity available for sale and purchase. It makes no real difference, unless you are an HFT trader. Remember you see this on the market watch and these numbers change constantly. Here is an example – I may come to the vegetable market to buy 5kgs of beans. But if the vegetable seller has only 3kgs, then the transaction happens for just 3 kgs. Here buy quantity was 5, sell quantity was 3, and volume (a transaction that took place), is 3.

Hi Sir, Greetings!

I have a doubt that let\’s suppose if the institutional investors have a huge number of shares to buy or sell then why would they do it in such

a way that it would reflect in the volume indicator since the retail investor will catch their activity with the help of Volume Indicator.

So my question is that can they not buy or sell in such a quantity that the indicator won\’t be able to capture the exceptional quantity if yes then how retailers will get to know something like that have happened?

Sonu, every market participant should comply with the regulations. No one can trade outside the regulatory framework. So all trading activities of all the players will be captured by volumes.

And what it means if lot of trades are buying at same price

It means, that the transactions are happening at a constant price.

Hi Karthik thanks for replying to each and everyone with lot of patience

I have observed 4 following things and hopefully u can help me with that