The morning star and the evening star are the last two candlestick patterns we will be studying.

Before we understand the morning star pattern, we need to understand two common price behaviours –gap up opening and gap down opening. Gaps (a general term used to indicate both gaps up and gap down) are a common price behaviour. A daily chart gap happens when the stock closes at one price but opens on the following day at a different price.

10.1 – The Gaps

Gap up the opening – A gap up opening indicates buyer’s enthusiasm. Buyers are willing to buy stocks at a price higher than the previous day’s close. Hence, the stock (or the index) opens directly above the previous day’s close because of the enthusiastic buyer’s outlook. For example, consider the closing price of ABC Ltd was Rs.100 on Monday. After the market closes on Monday assume ABC Ltd announces their quarterly results. The numbers are so good that the buyers are willing to buy the stock at any price on Tuesday morning. This enthusiasm would lead to stock price jumping to Rs.104 directly. This means there was no trading activity between Rs.100 and Rs.104, yet the stock jumped to Rs.104. This is called a gap up opening. Gap up opening portrays bullish sentiment.

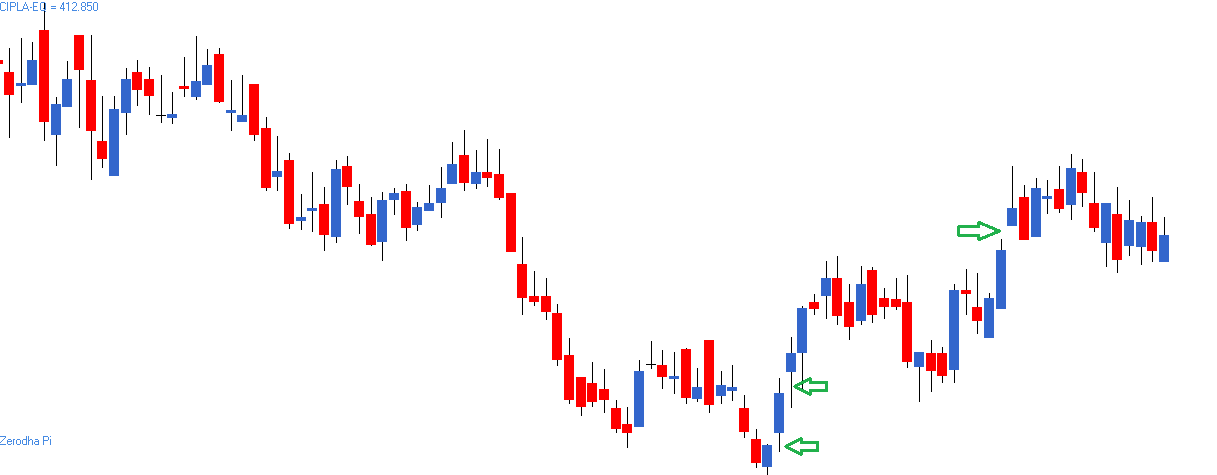

In the following image, the green arrows point to a gap up openings.

Gap down opening – Similar to gap up opening, a gap down opening shows the bears’ enthusiasm. The bears are so eager to sell that they are willing to sell at a price lower than the previous day’s close. In the example stated above, if the quarterly results were bad, the sellers would want to get rid of the stock and hence the market on Tuesday could open directly at Rs.95 instead of Rs.100. In this case, though there was no trading activity between Rs.100 and Rs.95, the stock plummeted to Rs.95. Gap down opening portrays bearish sentiment. In the following image, the green arrows point to a gap down opening.

10.2 – The Morning Star

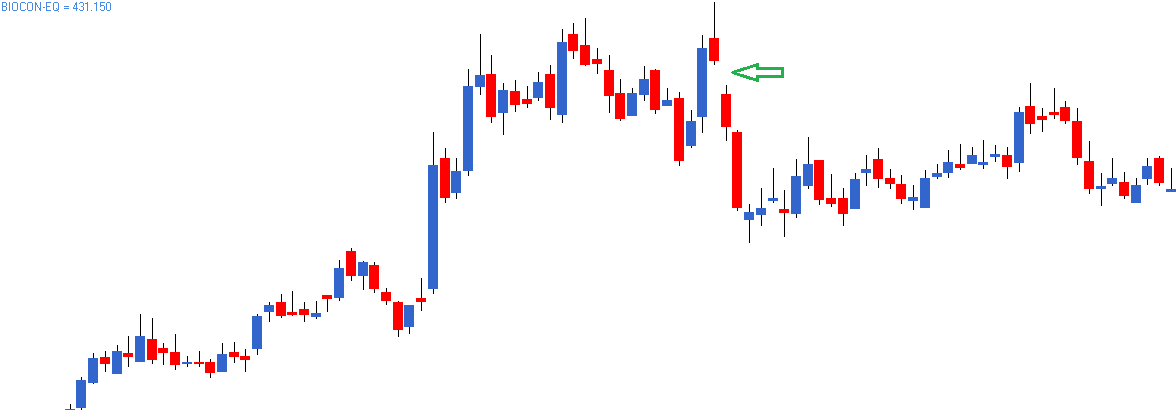

The morning star is a bullish candlestick pattern which evolves over a three day period. It is a downtrend reversal pattern. The pattern is formed by combining 3 consecutive candlesticks. The morning star appears at the bottom end of a downtrend. In the chart below the morning, the star is encircled.

The morning star pattern involves 3 candlesticks sequenced in a particular order. The pattern is encircled in the chart above. The thought process behind the morning star is as follow:

- The market is in a downtrend placing the bears in absolute control. The market makes successive new lows during this period.

- On day 1 of the pattern (P1), as expected, the market makes a new low and forms a long red candle. The large red candle shows selling acceleration.

- On day 2 of the pattern (P2), the bears show dominance with a gap down opening. This reaffirms the position of the bears.

- After the gap down opening, nothing much happens during the day (P2) resulting in either a doji or a spinning top. Note the presence of doji/spinning top represents indecision in the market.

- The occurrence of a doji/spinning sets in a bit of restlessness within the bears, as they would have otherwise expected another down day especially in the backdrop of a promising gap down opening.

- On the third day of the pattern (P3), the market/stock opens with a gap, followed by a blue candle that manages to close above P1’s red candle opening.

- In the absence of P2’s doji/spinning top, it would have appeared as though P1 and P3 formed a bullish engulfing pattern.

- P3 is where all the action unfolds. On the gap up opening itself, the bears would have been a bit jittery. Encouraged by the gap up opening buying persists through the day, so much so that it manages to recover all the losses of P1.

- The expectation is that the bullishness on P3 is likely to continue over the next few trading sessions, and hence one should look at buying opportunities in the market.

Unlike the single and two candlestick patterns, both the risk taker and the risk-averse trader can initiate the trade on P3 itself. Waiting for a confirmation on the 4th day may not be necessary while trading based on a morning star pattern.

The long trade setup for a morning star would be as follows:

- Initiate a long trade at the close of P3 (around 3:20 PM) after ensuring that P1, P2, and P3 together form a morning star

- To validate the formation of a morning star on P3, the following conditions should satisfy:

- P1 should be a red candle

- With a gap down opening, P2 should be either a doji or a spinning top

- P3 opening should be a gap up, plus the current market price at 3:20 PM should be higher than the opening of P1

- The lowest low in the pattern would act as a stop loss for the trade

10.3 – The evening star

The evening star is the last candlestick pattern that we would learn in this module.

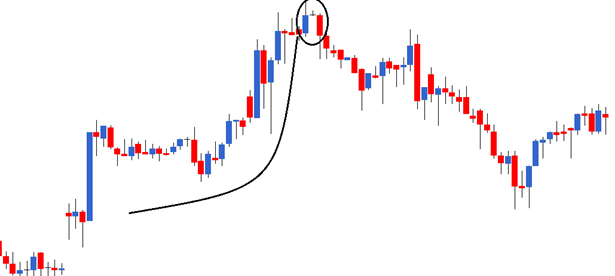

The evening star is a bearish equivalent of the morning star. The evening star appears at the top end of an uptrend. Like the morning star, the evening star is a three candle formation and evolves over three trading sessions.

The reasons to go short on an evening star are as follows:

- The market is in an uptrend placing the bulls in absolute control

- During an uptrend, the market/stock makes new highs

- On the first day of the pattern (P1), as expected, the market opens high, makes a new high, and closes near the day’s high point. The long blue candle formed on day 1 (P1) shows buying acceleration

- On the 2nd day of the pattern (P2), the market opens with a gap reconfirming the bull’s stance in the market. However, after the encouraging open, the market/stock does not move and closes by forming a doji/spinning top. The closing on P2 sets in a bit of panic for bulls

- On the 3rd day of the pattern (P3), the market opens gap down and progresses into a red candle. The long red candle indicates that the sellers are taking control. The price action on P3 sets the bulls in panic

- The expectation is that the bulls will continue to panic, and hence the bearishness will continue over the next few trading session. Therefore one should look at shorting opportunities

The trade setup for an evening star is as follows:

- Short the stock on P3, around the close of 3:20 PM after validating that P1 to P3 form an evening star

- To validate the evening star formation on day 3, one has to evaluate the following:

- P1 should be a blue candle

- P2 should be a doji or a spinning top with a gap up opening

- P3 should be a red candle with a gap down opening. The current market price at 3:20 PM on P3 should be lower than the opening price of P1

- Both risk-taker and risk-averse can initiate the trade on P3

- The stop loss for the trade will be the highest high of P1, P2, and P3.

10.4 – Summarizing the entry and exit for candlestick patterns

Before we conclude this chapter let us summarize the entry and stop loss for both long and short trades. Remember, during the candlesticks study, we have not dealt with the trade exit (aka targets). We will do so in the next chapter.

Risk-taker – The risk-taker enters the trade on the last day of the pattern formation around the closing price (3:20 PM). The trader should validate the pattern rules and if the rules are validated; then the opportunity qualifies as a trade.

Risk-averse – The risk-averse trader will initiate the trade after he identifies a confirmation on the following day. For a long trade, the candle’s colour should be blue, and for a short trade, the candle’s colour should be red.

As a rule of thumb, the higher the number of days involved in a pattern, the better it is to initiate the trade on the same day.

The stoploss for a long trade is the lowest low of the pattern. The stoploss for a short trade is the highest high of the pattern.

10.5 – What next?

We have looked at 16 candlestick patterns, and is that all you may wonder?.

No, not really. There are many candlestick patterns, and I could go on explaining these patterns, but that would defeat the ultimate goal.

The ultimate goal is to understand and recognize that candlesticks are a way of thinking about the markets. You need not know all the patterns.

Think about car driving; once you learn how to drive a car, it does not matter which car you drive. Driving a Honda is pretty much the same as driving a Hyundai or Ford. Driving comes naturally irrespective of which car you are driving. Likewise, once you train your mind to read the thought process behind a candlestick, it does not matter which pattern you see. You will know how to react and set up a trade based on the chart you are seeing. Of course, to reach this stage, you will have to go through the rigour of learning and trading the standard patterns.

So my advice to you would be to know the patterns that we have discussed here. They are some of the most frequent and profitable patterns to trade on the Indian markets. As you progress, start developing trades based on the thought process behind the bulls’ actions and the bears. This, over time, is probably the best approach to study candlesticks.

Key takeaways from this chapter

- Star formation occurs over three trading sessions. The candle of P2 is usually a doji or a spinning top.

- If there is a doji on P2 in a star pattern, it is called a doji star (morning doji star, evening doji star) else it is just called the star pattern (morning star, evening star)

- Morning star is a bullish pattern which occurs at the bottom end of the trend. The idea is to go long on P3 with the lowest low pattern being the stop loss for the trade.

- The evening star is a bearish pattern, which occurs at the top end of an uptrend. The idea is to go short on P3, with the highest pattern acting as a stop loss.

- The star formation evolves over a 3 days period. Hence both the risk-averse and risk taker are advised to initiate the trade on P3.

- Candlesticks portray the traders thought process. One should nurture this thought process as he dwells deeper into the candlestick study

Can Kite identify these patterns for the trader ?

Hi.. Can you pls explain exactly why the gap ups and downs are formed during the next trading session. For example In gap ups you have mentioned that there\’s no trading activity between 100 and 104. Why would anyone buy at a higher price(ie.,104) if it is available for 100 itself? is that because the minimum sell offer is only at 104?

Check this – https://youtu.be/m8uOKO6cCkE?si=GzA9FMuyNEuIVLIF

hello kartik sir will keep it short, sir as you said there are more than 16 candlestick patterns but we need not know all of them , so sir could u please give me an example of how the thought process that we have learned from all these 16 candlesticks will help us ahead in trading

Check this – https://youtu.be/z0Rwoz6PduM?si=ITxkZX-c6-uxv5N-

Hi Karthik!

The movement of the market is determined by multifold factors—known and unknown, right? So, is it possible for an analyst to calculate the mathematical probability of the market movement? Like, can I calculate and say that there is an x% chance that the market will move up/down tomorrow…or anytime in the future? If yes, how?

Yes, while there is no certainty with markets, you can assign some probabilistic values to market movements. If fact, the normal distribution principals is a good place to start.

Hey Kartik,

Should there be good volume on p1’p2, and p3 while formation of morning star

Yes, at least on P1 and P3.

Hi,

Suppose we enter a trade by checking all the points in the checklist and the pattern was suppose bullish engulfing. Next day, though I didnt hit stoploss but the market is forming another recognizable pattern, say harami or shooting star. What should I do? Wait until I hit the stoploss or exit the trade?

You wait till your SL or target is achieved. Else there will always be multiple positions you will be in and out of 🙂

None of the patterns have targets or the amount of shares we need to purchase. Can you clarify how to know this?

Yeah, that\’s right. Candlesticks dont do that.

Sir, is it true that the Stock always covers the Gap formed. From your reference example, if Abc closing price is 100 and the next days opening price is 104 and there is a gap being formed and which also indicates a bullish pattern but after few days or few trading sessions, Abc will turn bearish and touch the 100 rupee mark ?

I dont think so. Please watch out for our YouTube channel, we will be discussing this topic soon 🙂

Name of the youtube channel bro??

Hi Karthik,

First of all thanks to you and your team for educating us.

My query is selecting the time frame for analysis the Multiple Candlestick pattern for a Swing trader who has a time of investment as few months.

If i select the weekly frame then I can see the pattern clearly as Bearish engulfing for CDSL.

If i change the time frame then the pattern is not clear.

So, How to make the decision regarding choosing the time frame for a swing trader while analyzing the TA.

So you need to stick to a time-frame that you think matches your risk appetite. For example, if end of day works for you, then EOD charts is your primary charts, all your decisions will be based on this. You can look at weekly as a supplementary study.

I am not gonna enter the market now. I am thinking of learning upto 3-6 months then try with small capital. Then if i think i am ready i will enter then. And sir if possible can you suggest study materials after completing varsity.

Sure, you can always take your time. Good luck!

First of all thanks for all the modules they are very great sir. I completed my graduation recently and i am from computer science background and i am thinking of entering into market as intraday trader. I want your suggestions about is it possible for me to earn in current market where AI and machines are making trading automatic, and big investors are manipulating market.

Akash, glad you liked the module 🙂

If you are new and just getting into markets, then please dont try your had at intraday trading. Intrday is hard with very little success ratio. You may as well give swing trading or long term investing a shot.

Karthick, I appreciate it very much.

Happy learning!

Hi Karthik,

I am a newbie to trading. When you say Day 1, Day 2, and Day 3, which is the exact time to look at the long red candle on Day 1, doji or spinning top on Day 2, and blue candle on Day 3? Do these patterns occur at the end or start of the day?

The pattern is complete by end of day, so look for these pattern formation by the close of the day.

How can same say pattern be observed at 3:20 pm. Im trying to understand how can eod chart come by at 3:20 for same day

You can initiate a trade in derivatives, Sandeep.

Hey, are the chart examples that are being taken single day candlestick charts?

For single candlestick pattern yes, otherwise it is over 2 or 3 days.

What is target to be reached or stop loss initiated??? From where do we we assume the target

Please do read through the module, we have discussed this in detail.

How can i short a stock if i can\’t carry forward my positions overnight in equity market.

You can do so via derivatives – futures and options 🙂

What percent can be considered as gap up/down ?

Even if its 0.5%, it can be considered as a gap up/down opening.

Thanks for the prompt response, Karthik!

Cheers! Good luck Kashish!

Hi Karthik,

In the Varsity modules, the trade examples suggest entering trades around 3:20 PM. My question is: how can one go short at 3:20 PM when we know that short positions can only be taken on an intraday basis in the spot market and cannot be carried overnight?

Looking forward to your insights.

You can short using the futures or options, Kashish.

As a rule of thumb, the higher the number of days involved in a pattern, the better it is to initiate the trade on the same day. plz elaborate with example

So if its a 3 day pattern, you can initiate the trade on the 3rd day itself instead of waiting for the confirmation on 4th day. If its a 1 day pattern like Marubuzo, maybe you can wait for the 2nd day confirmation.

Will you please explain,what you mean by a long trade and a short trade?

Please do check the previous module for this 🙂

Regarding Chat patterns I unable to understand what going on market while learning it feels super easy I can easily identify candlestick pattern & chat pattern when I open trading terminal I unable to Identify what will happen

Next

Here is a suggestion, forget all the CS patterns, but pick one pattern that you\’ve understood well – try to identify that across multiple stock charts. Once you are comfortable, move on to other patterns. Basically, go one at a time, this will help.

Hii Karthik Rangappa even after completing technical analysis it seems difficult to me this my 3rd time completing technical analysis

it is difficult to find candlestick pattern and difficult to understand what\’s going on the market please give me some advice

Where and which part are you finding difficult, Naveen? If you have any specific are of difficulty, then u can try helping you with it.

Like you didn\’t explained about chart patterns like cup and handle, double top, symmetrical triangle ,falling wedge, triple bottom,Head and shoulder

Have explained all the patterns that are important. Once you understand these basic ones, you can easily pick up any pattern that you\’d want to learn.

In varsity everything is explained every well but why is chart patterns topic is not there how can we trade without knowing about chart patterns everytime we can\’t trade using candlestick pattern we mainly need about chart patterns

Candlesticks is a chart pattern right? Not sure what you are talking about.

Thank you for responding:)

Thank you, can you please help clear the following

1. So in a morning star instead of a \”gap down in p2 and a gap up in p3\” if it is \”gap up in p2 and a gap up in p3\”, it still works right?

2. how many dojis are acceptable in the morning/evening star pattern?

Thanks

1) Yes, it should

2) Nothing specific around this, generally 2-3 is also ok.

Thank you for responding, but is it necessary that there is a gap-down if it is a morning star pattern, what if it is gap-up? Does it invalidate the pattern?

Also, how many dojis are acceptable in the morning/evening star pattern?

Thanks:)

It does not invalidate, its just that a gap down is text book definition of a morning star pattern. As I mentioned at the start, you can be a little flexible around these patterns.

Hi Karthik,

Is it necessary for a gap down in the P2 of a morning star pattern?

Can you kindly take a look at FINPIPE in Daily TF, the dates are 9,12,13 June 2023. The pattern seems to be morning star and the trend is also down and the following rally is also good, but p2 is a gap up doji

Awaiting your response

Thank you:)

Yes, gaps are required in both morning and evening stars.

Hey kartik i would like to disturb you again and apologize for that.should i do paper trading to start trading.

No need to say that, I\’m here to answer queries, so pls dont feel the need to apologize.

Paper trading, you can. But instead why not trade with very small amounts to explore how orders, patterns work?

Hello Karthik, I had a question for you, can you tell me whether the multiple candles you have drawn in technical analysis can be used in Forex trading?

Yes, you can. It can be applied to any asset which has a historical time series data.

Hi Karthik Sir!

A captivating and insightful Module so far that brilliantly demystifies the stock market, offering both novice and seasoned investors valuable wisdom.

As a novice starter, I dare to ask if the color of the Doji matters in The Morning or Evening Star?

Glad you liked the module, Arun. No, the color of doji does not really matter 🙂

Sir,

You have not mentioned on P3 at what time Risk Averse WILL ENTER IN MARKET ?

Either at open or take a position for next day by close.

Hi Sir, firstly thanks for all this content.

In previous module you tell us about that we can\’t hold short positions for long term. So how a risk taker make short position at 3:20 and hold it till next day.

Thanks, Udit. You cant hold positions in the spot market, but you can in derivatives markets.

I did not quite get the technicalities behind the gaps. Lets say the previous day close is 100 and the buyers before the market opens today keep their buy order at last trader price. Then the traders gets executed one by one and the gap up occurs. Is this how it works? if so then how come the traders gets executed before the market opens and not displayed in chart?

Lets say the previous day the market closed at 250 per share for a certain company. After the market closes, the CEO makes a statement saying the next quarter will be tough for them as they are facing raw material challenges. This news, makes the stock unattractive and people may want to sell the shares.

The next day, the stock price will no longer open at 250, rather it will open a bit lower..maybe around 240 or 230, thus creating a gap.

hi,

do you have any whatsapp group where you share knowledge and stock market update. if yes kindly add me.

9970250000

Not really, but you can follow us on Twitter and Instagram, look for \’Zerodha Varsity\’ 🙂

Hi Karthik sir,

Can doji or spinning top of be any color red or blue in both morning and evening star?

Yup, the colour does not really matter for doji and spinning top.

Hi Karthik. Can I follow the candel stick patterns on future and option? If yes what time frame(5mn/15mn/1hour) will I follow?

Yes, you can. I\’d suggest 15mins or higher.

Hi, What is meant by long trade and short trade. I don’t understand when you say the highest of the high is the stoploss for long trade and lowest of the low is stoploss for short trade. Should I understand them as buy and sell respectively?

I\’d suggest you read the earlier module to understand some of these basic nuances.

Hey Sir,

Firstly, thanks a lot for the valuable resources; they\’ve been incredibly useful. As a beginner in stock market trading. Should my initial focus be on shorter time frames, such as one day or less, to anticipate market movements?

Thanks, Akshit. Your initial focus should be on longer term investments 🙂

Karthik sir 🙏

Because of your teaching and great module I am understanding share market to some extent.

Now my problem is, I am unable to see the charts in comment section. I tried all way but has been failed to see the chart. Please help me in this regard.

Thanks for the kind words, Virendra. I\’m glad you liked the contents on Varsity 🙂

The charts in comment section is uploaded by users, they usually provide links to Google drive from where one can see charts. If they deleted or changed the location of the file, then it will no longer be available for review.

Sir I just want to know that what is the effective way to practice or use to with candlestick pattern as I am a beginner n eagerly understand the pattern style pls.n suggests some paper trading app or website

Pls

Check this – https://www.youtube.com/watch?v=1kQjXFL4Mfc&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=10

While analysing an intraday 15 min chart how do I check the bullish engulfing or any 2 day pattern without having the day complete and can you please also tell me the trade setup for a 15 min time frame?

TA can be applied to any time frame, Devak. Treat 15mins as an EoD candle 🙂

Hey kartik

So going well with zerodha but does all these patterns we studied wroks on 1 day frame or any time frame?

Please reply

Yes, these patterns work on both intrday and swing positions. I personally prefer swing positions.

thankyou karthik and gourish.

In the text, it is mentioned that a risk-taker enters the trade on the last day of the pattern formation around the closing price (3:20 PM). If a risk trader shorts a trade at around 3:20 pm does he have to close the trade by 3:30 pm that day itself?

You must short via derivatives (via futures or options) to carry forward the positions, Gourish.

Sir I have a confusion regarding shorting of the stock after identifying the candle patterns. As discussed in the earlier module it was said that shorting is an intraday activity but how can we short a stock @ 3:20 PM ?

Karthik sir,

can we use these single and multiple candlestick patterns also in 5 and 15 min charts?

You can, better on 15 or 30 mins compared to 5 🙂

what should be the prior trend in Gap-Up or Gap-Down opening?

No prior trend for this as you don\’t really buy or sell based on gaps.

Sir, Even if a company announces something which is super positive, it does not make sense that share prices are opened with a Gap Up the next morning without any trading activity. In fact, it suggests that there are factors which can easily manipulate prices other than trading activity.

Trading factors are derived from all these factors anyway 🙂

As a rule of thumb, the higher the number of days involved in a pattern, the better it is to initiate the trade on the same day. what does this mean?

It just means that in longer patterns, even the risk-averse traders can initiate the trade on the pattern day only and there is no need to wait for another confirmation day.

what will be the conditions and code for 3 outside bullish pattern ,it is not defined in varsity?

Not sure which pattern you are referring to, Rakesh. Can you share more clarity?

As a rule of thumb, the higher the number of days involved in a pattern, the better it is to initiate the trade on the same day.

What does this mean?

And I am a big fan of yours karthik🙂

Amar, thanks for the kind words!

So what I mean by this is that….on a marubuzo candle (single candle stick patter), you can choose to act the day its formed or the next day. But something like a morning start, which takes 3 days to evolve, you are better off initiating the trade on the day the patter evolves.

Hi Kartik,

Why do gap openings occur? Is it due to the traders putting AMOs and/or bidding in the pre-open market?

Thank you

It is basically the overnight demand and supply pressure resulting in gap ups and downs.

Hi Karthik,

As per the explanation to form the morning star pattern we have to wait for 3 days and then take the trade.

What if the same morning start patterns come in an hourly time frame during intraday can we trade on it considering it as a morning star pattern?

It still works the same, the idea is to ensure that 3 candles form the pattern. It could be over 3 days or 3 hours, or even maybe 3 minutes.

In evening star If we short at 3:20 it will square off automatically by Zerodha at the end of trading session… I don’t think you imply that gain will be made in just next 10 mins…next day a new short is to be opened… plz revert….

Certainly not by shorting in the cash market. The assumption is that the shorts are made in the futures market or via an options instrument.

Sir,

Can u plz tell what to expect when a doji occurs right after a bullish engulfing pattern?

I\’ve explained this in the chapter itself. A doji after any pattern enhances the probability of the outcome that the patter suggests.

sir, as you have mentioned in module these are profitable patterns for indian market, is it not applicable on any foriegn markets?

These are good patterns to know, but over time you just have to understand the underlying price action, I\’ve spoken about it here – https://www.youtube.com/watch?v=z0Rwoz6PduM&t=0s

hello dear Karthik Rangappa sir

i have one question that is in gap up and gap down opening the trade transaction will take place at what time i am bit confused in this.

is it before pre marketing hours or after 9:15

Its always during the market hours 🙂

Thank you Sir for your reply ..So could you please clarify that, Is Zerodha Varsity just a business perspective to attract people towards Zerodha rather than educating people ..Sorry to be blunt ..Not trying to belittle your effort although..and I have also seen one of Zerodha owners Interview stating Zerodha\’s 95% Revenue comes from stock traders rather than Investors.. So are all these people wasting their time and Money…or Is it a good profession if one is skilled in trading ..

No 🙂

Intent is to educate people interested in trading and investing to do it correctly. Provide them with all the information and knowledge without holding back anything. We try to say is that, dont make trading your full-time profession by sacrificing your main profession with an agenda to make a living out of your trading career, because of all the reasons I explained in my previous comment. Keep trading as a secondary source and do it well. The resources provided is to help you do that.

Sir,I Would like to know one thing if you don\’t mind please…My doubt is that you people by owning a Trading Platform with crores of rupees Turnover and also by painstakingly creating this zerodha varsity for educating common people about stock market trading,why you and other stalwarts of Zerodha try to demotivate people from entering stock market for trading in all your the interviews given and in various tweets ..being Highly paradoxical.. Could you please give some light in to it ..So that this will help people like us to know whether to learn this or stay away from this..

The problem is that people take up trading full time by sacrificing their primary careers. They look at stock markets as an easy source of revenue. But over the years, we have seen that it is not. You need to have a main profession that pays a salary, and your family\’s safety is taken care of. Trading can be a supplemental source of income, provided it\’s done right. We try to educate people on this aspect.

Correction *did not*

Hello Karthik,

I would like clarity on a query already posted by Rakesh Hansalia as I did find a clear response.

Let’s assume conditions for P1 and P2 are satisfied then body color (blue or red ) of doji (for P2) really matters in morning or evening star pattern?

Thanks.

Manoj, the body color does not matter for the P2 candle in an evening star.

yeah

Sir, a different doubt than what you have taught in this module…..so sir in the first image where you shown the gap ups there there is blue long candle after a downtrend in the stock….can we say that the long blue candle is a bullish bald candle right?

You mean to say bullish marubuzo?

Hi Karthik,

Good Day! Thank you for helping the retailers with your extensive knowledge.

Couple of doubts about candlesticks formation in the intraday chart.

1. What would be the minimum ideal timeframe to check for the candlestick formation? 5 mins /15 mins?

2. In Nifty and Bank Nifty, I see multiple candlesticks formation at consolidation, Eg: Bullish engulfing followed by a morning star and then a hammer. Or a failed Dark cloud, then an evening star followed by a 2-3 Doji etc.

Are all these candle stick patterns valid in consolidation as well?

Posted 2 charts of BNF :

https://postimg.cc/rdGp73zg (Morning star candle on 23 Jun 1:30 PM in 15min Time frame)

https://postimg.cc/47J3GP9G (Series of candle stick patterns on 23 Jun 10:55)

Please advise.

1) I personally prefer higher time frame candles. So 15 mins is better for me compared to 5.

2) Yes, this is quite common. Usually you act basis the latest candlestick pattern. So if you spot bullish engulfing and set up a trade, you wont exit that trade just because the following pattern is bearish marubuzo. You hold on to the initial trade either till your target is achieved or SL is triggered.

Hi Karthik

Can you please explain me the statement?

:::QUOTE::

The trade setup for an evening star is as follows:

1. Short the stock on P3, around the close of 3:20 PM after validating that P1 to P3 form an evening star

::UNQUOTE::

If I understand right, you can short equities only for intraday positions. This means on day 3 if you short at 3:20 PM, your position will be closed by 3:30 PM. This means that you will be holding only for 10 mins. Is my understanding correct?

Thanks

Regards

Kalyan

Ah no, for overnight short positions, you can use Futures or options.

I have a lot of similar doubts about patterns and their behavior. Also, how do I go deeper with technical analysis? This is because I am genuinely interested in the way these systems are created. I am not only asking for trading-related purposes.

I\’d suggest you read the book by Edward Magee on Technical Analysis.

What if the fourth day produces a doji or a spinning top, considering i am a risk averse trader?

Thats ok. Once your trade is initiated, you hold on to till the SL or target is hit.

Hi Karthik,

How can this morning and evening star pattern be used in intraday trades as well? Like in 15 mins and 30 mins or 1hr timeframe. Is it possible?

Just like the way you\’d use for EOD. You can use 15 mins chart and trade these patterns.

Sir

Is any continuation candles .

Is exist , how much they are because this time market goes in trend.

And many times also

Sorry, I dint understand your query, can you please eloborate.

Sir.

I like to do Swing trading..which time frame is good to find candlestick patterns?

I\’d suggest you look at EOD candles, Alex.

I have just started learning about stock markets in my investment journey, and after learning about all the candlestick patterns, I am longing for one question: How to apply these patterns ? I mean what time frame should I look for (days, weeks, months) if I am a beginner and want to learn long term trading (as suggested in one of the discussion forums) ??

I\’d suggest you stick to end of day time frame till you get a hang of things, Kishore.

P3 candle should close above P1 appears to be a bit confusing as texts elsewhere do not mention this. In fact P3 closes below P1. Kindly clarify.

Which pattern are you referring to, Veni? If its the morning star, then you need to ensure P3 closes above P1.

Sir,

I have seen your story on instagram, Congratulations for reaching that mark sir, your efforts made us to gain more knowledge about trading, markets and investing.

And also I noticed that your starting video series on marketing, is it true? if yes when will you releasing it, where and is it paid or free?

Thanks Pavan. The series is live, please click on the video icon (1st 3 modules), its right below the module name in the landing page.

1)How do we overcome false signals? is there any strategies?

if we take an example of TATA STEEL, 3 days back(21 dec) it forms bullish harami with satisfying check list like good volume and also met with good support area.But from yesterday it starts again falling,

2) In these conditions what to do? (not only tata steel, some times other stocks also do as it is)

There are no pre-set formulas to overcome these false signals, but over time, as you gain more experience in the market, you will know which signals to avoid. One thing that helps though is to check if the trade that you wish to take is aligned with the overall direction of the market. For example, if I were to go long on Tata steel, I\’d be happy to see that the overall market is also bullish.

Do candlestick patterns still work? I mean, I have read a number of posts online which outrightly put down the effectiveness of candlestick patterns. Is that so? How reliable are the patterns today?

Riadh, each trader\’s experience is different. I\’d suggest you figure this by making your own observations and trades in the market.

Hii Karthik ji. Your lessons are super easy to understand. They are helping me a lot, who thought that it will be impossible for someone like me to even understand how the markets work. Thanks for this initiative! I have one doubt that might have been covered in the following lessons still I am asking anyway. If we are gonna buy only on the blue candlestick day and sell on the red candlestick day then how are we gonna make a profit in it?

Thanks for the kind words, Rutuja. The idea is to buy when the trend is picking up and sell when we identify a reversal. It is impossible to catch the entire trend, aim of the game is catch at least a portion of it, consistently 🙂

Sir,

How does a Gap Up or Gap Down opening actually occurs, what is actually going on at technical levels ? like when a stock that closed at 100 for the previous day, the next day the buyer\’s intent would be to buy it at 100 only or rather less, right even if there is some good news? so why would he put down an ask for Rs.104 ( would he try multiple asks and try to get it at any cost – can you please explain the technical aspect of actually doing this on Zerodha like

1) maybe the buyer would place a Market order, so if the seller offers at 104 the buyer would get the stock at 104- but does this mean that the sellers come first on the market but when the buyer actually bought the share at 104 = then the system decided the Opening price of that particular stock ?

2) what happens if the buyer has put up a limit order to buy ? will his order will remain pending throughout the day? but then how was this new opening price decided on system /exchange?

Think about a regular vegetable market – the price of Onion is 30 per Kg on a closing basis. Market closes for the day. Overnight, there is rain destroying the crops. Do you think the price of onion the next morning will still be at 30? No right, it is bound to increase and will probably open at 40 or 50. Same thing with stocks, overnight news can after the open price leading to gap up or down.

Hi Karthik

Hope you are enjoying the festive season.

I had a question regarding today\’s bank nifty movement (14-Oct-21) from 38825 at about 1:00 pm to 39000 and beyond half an hour later. I didnt notice anything significant in the candlestick pattern and closed my call buy position with a minor loss based on the Stop Loss. But then it simply zoomed and I missed out on the opportunity. So wanted to know what did I miss in the charts? Thanks for all your help and support

Regards

Dipankar

Trading has multiple dimensions to it. While you pay attention to candle patterns, you also need to pay attention to the market demand and supply situation. Excess demands tends to increase the stock price and it may not always show up in candle patterns.

but if then there is a pullback and a retracement then how will I know that that is the lowest low of the pullback or it is not the final low of the retracement then I should take the trade then?

Nobody can time that, I guess your own experience will help here 🙂

hello Karthik

suppose the stock is in an uptrend and then there is a pullback/retracement in the stock and then it forms a bullish reversal candlestick pattern like a hammer or an inside bar so in this case, I should be taking a long position in the stock. so how should i know that the momentum is strong and this is a good trade to take?

how should I confirm on a larger timeframe that the momentum is strong?

or

should I be looking at a larger timeframe or a smaller timeframe to confirm the momentum?

and how should I confirm the momentum? like should I be using an indicator for this on a larger or smaller timeframe? If yes, then which inicator should I be using?

The only way to get a sense of how strong the momentum is to look at the previous trend and figure how bullish the stock was. If you see a nice rally with very little volatility, then it indicates a strong bullish undertone.

Hi Karthik

A lot of the modules mention \”the risk taker places the trade on 3.20 PM on the last day of a pattern\”. If the trade is a short trade, how can one place a short trade at 3.20, the same day? Shorting for stocks only works intraday and auto-settlement kicks in at 3.20 PM on Zerodha, so how can the trade go through the same day? Are you always referring to futures when it comes to shorting?

Indranil

Indranil, you can always short via futures or options, there is no issues with that.

hey karthik,

I wanted to know if I can use these candlestick patterns in a pullback/retracement?

for example, the stock\’s primary trend is uptrend but then it retraces or there is a pullback, and then it forms a bullish reversal candlestick pattern like a hammer or a bullish harami or a morning star pattern so then can I buy the stock, based on that bullish reversal patterns in pullbacks or retracements where the primary trend is an uptrend?

Of course, you can. The point is that candlestick patterns are manifestation of price action, hence you can use this to identify pullbacks and retracements.

Zerodha university people explained concepts very well and Kudos and Hats off to you. I love zerodha professionalism in all aspects. Great platform to trade and great university to learn.

Thanks for the kind words, Reddy garu. Happy reading!

Hi Sir,

What if there\’s a situation where we see a gap up and also there is some bearish formation like shooting star on the same day. You can see it on the last example of gaps in 1st image.

I\’d go with the shooting star since it\’s the latest formation (wrt to the gap).

What should be the trade if there is continuous Doji formation for the past 1 week and then (P1 Doji formation on P2 it is a bullish candle ) what we should be expecting eg Rpower

Wait and watch, since dojis and spinning tops convey indecision in the market.

Thank you for the clear and concise explanation on candlesticks. Is there any app/ site where we can practice predicting the trend based on the candlestick pattern? Thank you

Maybe you should try Streak.tech

Sir this was the far best interpretation of candle sticks i could have ever got.

nice words simple words point-to-point things and many other things which let us go more deeper in the chapters-modules.

Cant thankyou enough for writing this, you are a true insipiration sir :).

I\’m glad you liked it, Harsh. Happy learning 🙂

sir, what trading platform does Zerodha use?

We have an in house trading platform called Kite.

7. In the absence of P2’s doji/spinning top, it would have appeared as though P1 and P3 formed a bullish engulfing pattern.

Did you actually mean PIERCING Pattern ?

As the Blue candle (P3) doesn\’t cover the whole of Red candle (P1).

Thanking you in advance.

Engulfing, since there was a gap up opening.

Hi,

Hammer or Marubozu formation on weekly ,monthly chart is more strong signal to buy stock for longer duration ?

Yeah. If you are looking at weekly charts, then your holding period should be long enough.

It will be so nice, if you guys make complete video guide, the learning would be at next level..:)

We are thinking about it, Kaizu. Hopefully, we will have something out soon.

Sir,

Please add multiple candlestick time frames analyasis chapter for the benefit of traders

Thanks

The concepts remain the same across all time frames and assets.

thank you karthik sir! you solved my big doubt.

Good luck!

sir, when you say stock specific in this scenario it means despite the sector at resistance some stocks till move up bcz of their own factors?

Yes.

sir, I got what you are saying. I read them over and over and they gave me an idea. Sir now my doubt is if the sector is resisting then obviously most of the stocks are resisting and now if a few stocks start moving up, should I be suspicious or I should consider that they are moving up bcz of their own factors(stock specific)?

Thank you so much,sir!

Yup, likely that the stocks make the first move.

sir , now why should I look a the sector? Just to see what majority of the stocks are doing ? I mean when I see sector going up, being at resistance I can deduce that the most of the stocks are going up and are at resistance respectively?

The easiest way to test this is by eyeballing and check what happened in the past. That will give you a quick perspective.

yes sir, if a stock with heavy capitalization starts to move , it will move the sector. But when a heavyweight starts to move does it also move other stocks?

Yes, it will exert some influence to impact other stocks.

Sir for a better example, nifty 50 n nifty bank sectors are at an all time high and resisting, this is bcz the stocks are resisting, right?

Nikhil, what I\’m trying to say is, yes there will be interdependencies, but its not necessarily true all the time. For example, a bunch of stocks can be a resistance zone, which means Index too may be at a resistance. However if an index heavyweight, like HDFC is trending, then the index is likely to move.

sir, you mean to say its the stock that move the sector and bcz the stocks are at a resistance the sector is resisting?

Hmm, to some extent its true. But not always. Both have their own factors at play.

sir, if sector is resisting, stock will resist na sir? Please give in your detailed explanation.

Not really, Nikhil. Why do think so? While a stock follows the sector trends, stocks can also have their own factors (unsystematic influences) which can move the stock.

Sir, nifty auto sector is at resistance right now n is resisting, but I don\’t see any resistance zone in bajaj auto but it\’s still resisting, this is bcz of the sectoral impact?

Sector-wise resistance is different from stock-specific resistance, right?

This is w.r.t to Morning star. In day 2 ,can we say that buyers feel that falling price as a good opportunity to buy at cheap price. This might be one of reasons for indecisiveness, hence doji formation?

True, these mixed opinions and weak efforts to buy/sell is what causes a doji/spinning top.

sir, but sometimes I feel its the stocks that move the sector, so why should I look at the sector? Can you clear my misconception?

They are all related, especially if the stock is a sector heavy weight. For example HDFC Bank is a banking sector heavy weight.

karthik Ji, in your experience do 100 and 200 Moving averages act as support or resistance?

I\’d say reliable 🙂

Ok nice. Sir I traded Bajaj Finance today n my doubt is it\’s a part of nifty 50 as well as nifty finance so which sectors chart should I look at? I\’m confused.

Both, just to have a better perspective 🙂

Good evening Karthik ji, I have a follow up to the other gentleman\’s question. is 50day Moving averages work as effectively in 15 mins as it does in hourly and daily? I see it does but I just want to know the expert opinion.

Thank you Karthik ji!

Although the answer is yes, I personally prefer EOD charts 🙂

sir, all moving averages hold significance in all the timeframes, right? I have been giving more importance to 20 day moving averages in daily but not in hourly n 15 mins. Please clear my doubt.

Not really, for example, I\’d not use any moving average on 1 minute chart. Its too much noise anyway.

wow, that\’s quite amazing as well as astonishing to know!

Good luck and happy trading 🙂

wow! sir, what is surprising is all the stocks from a sector move similarly, how is it possible?

Think about it – HDFC Bank, ICIC Bank, Kotak Bank, all Pvt sector banks and they move similarly. Do check their charts. Likewise TCS, Infy, HCL. BPCL, HPCL, IOC etc. This is because, for the given sector, the factors that impact the sector are all similar.

one more thing what I am noticing is sir, the support and resistance zones of the sector n its stocks remain the same. Is it because the stocks move the sector?

That\’s right, stocks from the same sector tend to move similarly. Hence similar S&R levels.

sir, before trading in a stock from an index, in this case say Nifty Metal, should I check the Nifty Metal chart ?

Yes, that will add some value to your analysis.

yes sir, they are interchangeable, a red candle after a green candle means it came to retest the support line,right ?

Thank you sir.

Yup. However, what matters more than the colour of the candle itself is the current market price with respect to the S&R lines.

sir, I have a doubt. when the candle closes above the resistance line and becomes support and then a red candle closes exactly at the resistance line that became support, sir should we say the red candle went to retest the support line?

Thats right, Nikhil. Support and resistance lines are interchangeable.

Sir, for my equities I see that I got to choose CNC for delivery. Now what is trigger stop loss, sir?

SL is the price at which you intend to book a loss, in case the stock is moving against you. Tink of the trigger price as a means of activating the SL price.

Thankyou Sir

Good luck!

Ok sir, I want to start with equities so what option should I select?

Thank you.

Start as in like to trade intraday or make investments?

hi kartik

the doji/spinning top (p2) should be bullish for morning star or can it be bearish ? And vice versa for evening star?

The colour of the doji/spinning top does not really matter, Bhavesh.

Sir, cnc is equity and mis is intra day?

CNC is to take delivery of stocks, MIS is intrday.

sir, the most important thing we have us understand is like support n resistance zones ,even a single candle(its high n low) acts as support n resistance, right?

Thats right, these are the building blocks of S&R.

sir, when the resistance is broken n the prices come back in we call it fake break out but when the price breaks resistance makes a U shape (rounding top)n come back in again, can we call it a fake break out? please take a look at the image below.

https://drive.google.com/file/d/1JqXC85qfCrjM_qwGszUcHjE-0ZqOzjtE/view?usp=sharing

Yeah, it is still a false breakout.

Sir, what is the buy signal in ADX? I have chosen 60 and 40 for RSI. please let me know abt the ADX.

Thank you.

Hmm, have explained this in the chapter itself right?

sir, I got the login credentials, thank you sir!

Good luck and happy trading, Nikhil!

sir, I have got the TPIN to avail e-DIS facility and while tracking the status of my account, its saying that the login crendentials have been mailed but I dont see any mail as such.

Nikhil, please do check this with the support team.

sure sir. Besides if I see two bullish patterns at one time, is it a strong sign of a bullish reversal?

Strong maybe no, but signs maybe 🙂

It probably is.

sir, I just now created a zeroda account . can I change my bank account linked to zeroda account anytime?

Yes, you can. Do check this – https://support.zerodha.com/category/funds/adding-bank-accounts/articles/how-do-i-change-my-primary-bank-account-linked-with-zerodha

The colour of the (2nd pattern) evening or morning star doesn\’t matter?

Thanks a lot.

Good luck, Kushal!

got it sir. Sir , do we even consider dojis or spinning top in bear or bull counter attacks?

Yes, they always play a role.

I got it and that doesn\’t mean I should back out from going long with a short time bullish mindset, right?

Thank you sir.

Yes, you need to ensure your position is in sync with the trend.

sir basically I have this doubt plaguing me. If the higher time frames such as monthly n weekly are down, I should consider any bullish pattern in daily or hourly as either short lived or invalid since the higher time frame is bearish. sir, in such cases I should treat lower timeframes as we treat them when the higher timeframes are bullish, right? Kindly clear my doubt, sir. Its been hindering me .

The shorter time frame could pose a secondary trend which can be a counter trend, although this may not sustain through. You need to be aware of this and trade accordingly.

Sir, when the higher timeframe such as Monthly n weekly r down but I see a price hike in daily, hourly, can I just overlook them saying it\’s only a correction n then the price will go down?

Hmm, that would be a tough call. You need to see the overall trend and get a perspective on how the market is moving before you take any action.

Sir kindly clarify

How it is possible to Short the stock on P3, around the close of 3:20 PM after validating that P1 to P3 form an evening star.

Case 1 INTRADAY Order

How is it is possible in intraday to Short the stock on P3, around the close of 3:20 PM after validating that P1 to P3 form an evening star?

CASE 2 CNC ORDER

How is s it possible to Short the stock on P3, around the close of 3:20 PM after validating that P1 to P3 form an evening star?

Sir could you please clarify when and how to short our position on P3 on 3:20pm. Can it be possible to carry forward our CNC shorting order for next days or or more days?

1) You will have to do short trade on F&O for this

2) CNC short is not possible

Are these 1Day Charts?

Thats right, these are 1 day or EOD chart.

Ok sir, thank you.

Sir, should I rely on indicators in sideways or bear Market? In bull Run it\’s not really needed. Can you please enlighten me?

I\’d always rely more on the candlestick pattern, Nikhil compared to the indicators.

Sir risk to reward ratio is calculated from sl to entry n then till the target, right?

Thats right Nikhil.

https://drive.google.com/file/d/1764ReLdx16M72RjIl-EYLl3HuiNqh1al/view?usp=sharing

sir, is this a 1: 2.82 trade? I am not understanding how to read it. can you please guide?

Thank you.

Looks interesting. I\’m a bit confused about the entry-exit points, do apply this formula –

RRR = SL points/Target points.

sir, is it really possible to calculate risk reward ratio while we are about to enter the trade? I mean it takes time and i could end up missing points. Please enlighten me, sir.

Yes, why do you want to punch in a trade in a hurry, you can always take all the time 🙂

Hi Karthik,

Is there a free software/chart which can identifiy the candlestick patterns automatically that you have mentioned so far?

The reason I ask the question is that I want some validation/verification that I am identifying the patterns correctly. Without that, it doesnt provide me the confidence to enter into a trade as a beginner. Is there a zerodha community chat/channel where these patterns & indicators are discussed?

Appreciate if you can guide me to the appropriate chat/channel which discusses about the pattern formation and analysis.

As many of them suggested, it will be really great if you can introduce some LAB/practical simulation sessions which can provide confidence for a novice.

Akil, you can use the candlestick pattern on ChartIQ for this, not the best, but will help you get started. Do check this – https://zerodha.com/varsity/chapter/the-central-pivot-range/

Sir, no matter how trivial or insignificant a small support or resistat zone is it should not be overlooked? I have this bad habit of overlooking, plz enlighten me.

Yeah, it is always good to keep track of these price zones 🙂

Sir when taking a short position should I even consider these small support zones? Please look at the pic, sir.

https://drive.google.com/file/d/13Q3hLYltohE1pBDt4XI_DqmrhQJ7tG6W/view?usp=drivesdk

Yes, makes sense to generally be aware of these price points.

Sirji, I got you but if the green candle 2 opens above the close of the green candle 1, n I enter on the top of candle 2 , should my stop loss be below the candle 2 or candle 1?

Candle 2.

Karthik sir, i would pershallt enter after it broke the first previous resistance. That\’s a safe move? What would u do?

Then the first resistance becomes the new support. Remember, support and resistance levels interchange.

Suppose there r two candles sir, the present n the previous, if I am entering at the top of the present candle, should I stop loss be below the present candle?

If the two form a pattern, like say bullish engulfing, then take the lowest low of the two candles as the SL.

https://drive.google.com/file/d/13H0GU1kiIUrzGo_p6EKqVar7JQF1g62T/view?usp=drivesdk.

I forgot to post the link in my previous message, sorry sir.

Tough call 🙂

Sir , according to you should I enter after 1st resistance or second resistance? Let me know your opinion, sir.

Depends on your trading outlook and risk appetite.

Hello sirji, aman here. how are you? I hope u remember me. Sirji, if I am entering the trade(long) on top of a candle should my stop loss be below the present candle or below the previous candle?

Yes, for all long trades, SL is below i.e. the low of the candle.

Thank you sir😊

Good luck, Nikhil!

Hi Kartik,

would be very kind if you explain

All the candlesticks pattern you\’ve mentioned it is only effective for day trading

can we use this pattern for 10,15,30 min. candles and is it the same like the day pattern

and I\’m new to the trading could you give me some tips about it as i can\’t afford to buy costly softwares for observing about stocks, wanted to trade some units initially for practicing & maybe in large in the future – (using zerodha kite currently)

and congratulations for all of your articles.These are very helpful and effective for the new people.

Thats right, Vibhor. You can use the patterns across all timeframes and are not restricted to just EOD trades.

Exactly sir. I thought the same bcz if changes it\’s direction from there, you could call it support area. Even the below pic can\’t be a support area, right sir?

https://drive.google.com/file/d/12YHzyjSva_QWu62_cyT7n0Enl1wPjv6z/view?usp=drivesdk

Thats right, Nikhil.

wow, what a point you just made sir. I wasn\’\’t looking at it from the trendline support point of view. Sir, if there wasnt a trendline and I was just looking it from the previous support area, could you have called this candle a support area? Its a tad confusing sir.

No Nikhil, from a regular support standpoint, this does not appear to be.

Sir, in an uptrend it suddenly starts to consolidate and then a big green candle appears , do u call this support area? Please take a look at the pic shared and let me know your explanation 😊

https://drive.google.com/file/d/12YHzyjSva_QWu62_cyT7n0Enl1wPjv6z/view?usp=drivesdk

This could be supported at a trendline, Nikhil.

Sir this candle is small but can it be called bullish engulfing?

https://drive.google.com/file/d/12KIJiOs0Ei42uELUAsHE-bqmXeQwwUdo/view?usp=drivesdk

Thank you sir.

Yeah, I guess you can.

Sir, sorry for not being lucid. Let me try to ask again.

, if a big red candle(p3)(but forms a dragonfly doji) doesn’t form after a evening star and a big green candle(p3)(but forms a gravestone doji) doesn’t form after the morning star and yet the trend is downward and upward respectively, are the patterns qualified to be called evening and morning stars respectively?

Nikhil, you are saying big red candle but a dragonfly doji, both are contradicting right? Is there a chart you can share for me to understand this better?

sir, if a big red candle(p3)(but forms a dragonfly doji) doesn\’t form after a evening star and a big green candle(p3)(but forms a gravestone doji) doesn\’t form after the morning star and yet the trend is downward and upward respectively, are the patterns qualified to be called what we usually call them?

There is no name as such, but I guess you would know the price action drift in such cases.

Dear Sir

The way you explained the candle stick patterns is just amazing. Feels the hard work you did to prepare this material, that to free of cost. Thanks again for spreading great content. Happy trading!!

Paras, thanks for the kind words. Happy learning!

Hi Karthik!

Are these pattern and strategies equally profitable for any Time Frame. What Time-frame is considered the best, Daily, weekly or Monthly? What has been the most profitable from your experience?

The analysis remains the same across all time frame, Hamza. I personally prefer the EOD candles.

I am sorry but I didn\’t quite understand that.

Should we short future contract of our target price? or something else

but even they will be squared off by EOD?

No, futures can be carried overnight.

Hi Karthik,

Aren\’t short positions only intraday?

If we short at 3:20 they will be squared off at 3:30

Thats right. But you can short futures positions, Soban.

I would personally not make an investment in this case. Would it be wise considering the formation of a doji?

Thank you.

Depends, on what strategy you are following. Short term trades can still be considered, but maybe not investments.

Sir,

If there is a doji at P3 I am sure both risk takers n aversers wouldn\’t want to invest, right?

Beautiful explanation

Not really, end of the day, different opinions is what makes a market!

Thanks

Sir,

How many candles should be considered to recognise the trend (uptrend/downtrend)?

Most of the times, there are only two or three consecutive candles going in the same direction and then it reverses.

You need to look for at least 10-15 sessions before calling it a trend.

Evening star: How to short at 3:20 PM (Intraday shorting square off will be done by 3:15 right?)

You can short using the derivatives instrument.

In P3 gap up opening and candle closed 50%the range of P1 candle can be considered as morning or evening star

I\’d not be very comfortable with just 50% recovery.

Hi karthick..

with reference to the previous comments,

My Question: what is the exact reason for gap up or gap down? can we assume it is bought or sold between 9-9.15am?

Your answer: Ganesh, sudden excess demand or supply leads to the gap in prices.

How will the exchange know there is excess demand or supply overnight, i mean after market hour? can you please elaborate?

Thank you so much..

It is the supply and demand that kicks in right at the pre-open and at the opening of the market.

Hello Karthick!

First of all thanks for the wonderful content.

what is the exact reason for gap up or gap down? can we assume it is bought or sold between 9-9.15am?

Ganesh, sudden excess demand or supply leads to the gap in prices.

Okay, Thank you!

one more point to clarify – or P3 can also be further gap up and green candle instead of Bullish Engulfing or Piercing? would it be considered as morning star?

Yes, you can.

Hi Karthik,

10.2 Morning Star, pointer # 7 : In the absence of P2’s doji/spinning top it would have appeared as though P1 and P3 formed a bullish engulfing pattern.

My question is – Is it necessary for P1 & P3 to appear as \’Bullish Engulfing\’ only or it can also appear as \’Piercing\’. In the morning star tutorial chart, P1 & P3 don\’t really appear to be bullish engulfing and looks like piercing instead as P3 doesn\’t really engulf complete P1 candle.. Kindly advise! Regards, Gaurav

It can appear as a piercing pattern also, and if it does then you will have to treat it the same way as you\’d treat the piercing pattern.

Hello sir,

I noticed in chat IQ , it identifies some multiple candlestick patterns ,not described in varsity,

What can be a good place to read about these , or is there a detailed manual on zerodha\’s platform itself?

Also , there are a big variety of indicators in \”studies\” section.

Where can we find a detailed explanation of each of them?

Dr.Gargi, the list of CS pattern is endless. Instead of learning all, it is better to figure the price action context so that the moment you see the chart, you\’ll now if its a bullish or a bearish setup.

Sir, here can the encircled one be marked as an evening star?

https://www.tradingview.com/x/GI9lCUn3/

Sort of, yes. This can be considered.

Lol! Sir are you trolling your student? If markets would never respect patterns, how are we supposed to get the trades right?

Not trolling Prashant, its the truth. Imagine a situation wherein a pattern occurs and markets have to obey that pattern and behave in a certain way? That would make life easy for everyone right? Patterns are only an indicator of what is likely to happen, not a guarantee. Thats what I meant to say 🙂

Hello Sir! On Friday Morningstar Pattern was formed on the daily chart of Bharti Airtel. The prior trend was a downtrend and the pattern formed near the support and yet it failed today. Here is a screenshot of it

https://drive.google.com/file/d/1EWsJyu2H9AcKpyykbZV_sDiB25TGHruh/view?usp=sharing

I\’ve been trading for 3 weeks and the market is hardly respecting any pattern. It\’s been a frustrating experience for a beginner like me. Please give some advice.

Markets will rever respect the patterns, if only it was that easy. Patterns indicate the probability of an event occurring. There is no guarantee here 🙂

Hi Karthik,

As you explained w.r.t to Gap up and down, that it occurs due to new information or change in sentiment while markets were closed.

But how are these new information quantified into a price. What formula is used to calculalte this price change or new price? As trading is closed and markets participants cannot affect price.

There is no price definition for such new information, hence the gaps form in the first place.

In all the candlesticks patterns in the modules you are explaining using 1 days candles.

My question is can i take a trade by recognizing patterns in 15min or 30min candle?

Do all the patterns work in lower time frames? Else please list out which can work well in shorter time periods for intraday trading

Yes, its the same. Candlestick patterns works the same across all time frames and assets.

Thanks a ton!

Hi, I know we should go long on bullish harami pattern. My query is should we take long trade on Bullish harami cross pattern ?

Yes, may not have the same conviction as a bullish harami pattern, so you may want to reduce the exposure to the trade.

Okay. Thanks a lot! Should we take long trade on Bullish harami cross pattern ?

Yes, the bullish harami pattern requires you to initiate a long trade.

Thank you so much for prompt reply.

Please let me know what is bullish harami cross pattern ?

Bullish Harami cross is P1 = regular red candle, P2 = doji/spinning top.

Hey Karthik,

As per my understanding, look back period for any stock should be 6-12 month for swing trade. Hope I am correct? If not,what should be look back period for swing/positional trade ? Also, in current scenario of pandemic whether this rule is still applicable ? Kindly guide.

Thanks in advance.

Regards

Yes, that right. You need to ensure the look back is at least 6 months.

Dear Sir,

Thank you so much for educating us.

My doubt is , here you\’re teaching us to predict the trend with 1,2 or 3 day candle.

But what about a day trader, I\’m actually not a day trader but does trading in futures of stocks, whenever a sudden spike comes, I don\’t know when to exit.

So during day trading what candle patterns to be followed. Pls guide.

I\’m using EOD data to set up EOD trades. You can use the same technique for intrday trade. YOu just have to look at an intrday chart and apply the same.

Whats the time frame for morning star

The pattern spans over 3 days.

On an average how many previous days need to consider for detecting prior trend for swing trader?

Is it last 5 days trend or 10 days or more than that?

At least 15-20 days of EOD is good to get started.

Hey Karthik , had a doubt does the color of the doji/spining top make a difference provided it has opened gap up/gap down respectively .

No, the colour of doji/spinning top does not make any difference.

INFY today\’s Gap-Up (https://imgur.com/a/es1JA6E)

Sir my doubts are,

1) Is it possible to catch the GapUp initial trend?

2) Is it advisable to trade based on the financial result?

3) since there are 4 quarter result, and an annual result in a year, when will companies usually post these result and is there is any place to track the upcoming results?

1) Not unless you have a position the previous day

2) Yes, but you need to have the right setup

3) They usually let the investors know when the results would be announced in advance. You need to keep track of the announcement.

Dear Karthik,

When I look at a monthly timeframe chart, it shows banknifty is below support.

But when I look at a daily chart, it shows some positive candles formed.

In this scenario, how to decide which timeframe to follow.

Thanks and Regards,

You will have to stick to 1-time frame and take your trades accordingly Satish.

Can you also help to teach us on heiken aish pattern. This I guess is a very important pattern for traders.

Not very familiar with that, hence have not included in the module.

Hi Karthik,

In the attached NIFTY day candle chart, it seems to be an evening star pattern formation. off course third candle (P3) doesn\’t open as a GAP DOWN but it seems to have all other factors in it!!! it even engulfed First Candle(P1). could you advise whether it can be considered as evening star or not.

Thanks.

You can ignore the missing gap-down, although I\’d not be very comfortable 🙂

Very well explained the patterns, with good examples.

Looks like, need rigorous practice to apply this learning to take right calls.

Thanks a lot, it\’s very informative.

Thats right. Good luck with that Naresh.

Hi Kartik,

Please explain the following statement a bit, as it is still unclear to me ? Are you talking about the higher no. days in the prior trend or higher no. of days for the pattern itself (single candle, 2-day pattern, 3-day pattern etc ? )

\”As a rule of thumb, higher the number of days involved in a pattern the better it is to initiate the trade on the same day.\”

I\’m referring to the pattern itself. For example, you may want to act quickly on a morning star but may want to wait a day more for engulfing.

Dear Sir,

I\’ve studied all the candle stick patterns you included in this module of TA.

I have a doubt.

In explaining all the patterns, you took reference of 1 day candle.

Can all these patterns be applied to 1 minute candle in options trading as well?

Please let me know.

Thank you.

Hmm, you should not be looking at the options chart to trade options in my opinion. But anyway, yes TA can be applied to any time frame. However, I\’d personally avoid looking at 1-minute charts.

Hi Karthik,

In the gap up chart, the upper shadow shows that the bulls are pulling the market up right, so shouldn\’t the upper wick be longer

Not necessary, Shreya. What matters is the real body of the candle.

Initiate a long trade at the close of P3 (around 3:20PM) after ensuring that P1, P2, and P3 together form a morning star.

My question is:

Then product type should be MIS or CNC?

If we place MIS then

All open MIS orders are auto squared-off by our RMS team at 3:20 pm* and you will be charged Rs. 50 (+GST) for that.

what should be the product type?

Morning star is usually a swing trade, hence a CNC.

Hello,

\”As a rule of thumb, higher the number of days involved in a pattern the better it is to initiate the trade on the same day\” Not understood this point. Could you please clarify again?

Thanks!!

A bullish engulfing is better than marubuzo and morning star is better than engulfing. So on a so forth. That\’s what I mean by this.

Dear Mr Suyash, I was going through the comment. On 20th may, the closing of HDFC was 857 after Bullish Harami was formed.

As per your comment, you entered the trade at 838. Can you tell when did you entered the trade and when you made an exit. I am newbie here and trying to understand the candle stick pattern.

hi sir,

why do i am unable to see charts of comment section. i have tried various browsers , on mobile too, even on ipad ….TIA

Trying to figure out. Not sure why.

sir could u pls check, not able to see any chart which someone has attached in the comment. if someone has shared a link able to see it. earlier u said that if someone has deleted the chart, we can\’t see it, but it is happening with every comment chart. hard to believe that everyone has deleted it. Could u pls check sir, would be a great help to see the chart and see ur reply against that query.

I will get this checked, Siddharth. Thanks.

Hi Karthik,

Varsity is excellent in explaining all these concepts in such a simplified manner. Keep up the great educational work.

I had one doubt. For the trade setup for an evening star pattern you had mentioned short the stock on P3 at the close of trade ? From what I’ve read on the Zerodha FAQ pages short selling needs to be closed in the intraday window itself or is it possible to carry forward shorting trades ?

You can short and carry forward the position overnight in the futures market. If you short in the equity market, then you will have to close the position the same day by end of day.

sir can u check and tell chart of ABB 22 may 2020.last 2 candles and what does that say and what is that pattern called as.

Looks like the stock is in a bearish trend.

Hi Karthik,

Firstly, I would like to appreciate and thank you for putting your intellect in such a flawless manner. Zerodha Varsity material helped me to identify proper trade set up and make capital (at the same time it also emphasizes on exiting the trade when SL is hit)

Secondly, I would like to share some trades as under I took based on TA in the month of May 2020. Thanks to Kartik sir.. 🙂

1. Reliance Industries Limited formed an evening star pattern on 12 May 2020. (short selling opportunity)

2. HDFC Bank formed a bullish harami pattern (due weightage was given to Volume, Support, RSI and Bollinger Band) on 20 May 2020. Entered a trade at 838 and sold at 878. I wish i could carry it but the noise around the RBI presser made my trade vulnerable.

3. Asianpiants formed a morning start pattern on 21 May 2020 (due weightage was given to Volume, Support, RSI and Bollinger Band & MACD). Entered a trade at 1515 and sold at 1595.

Currently, I am analyzing L&T Infotech which may provide us with an opportunity to short sale soon (hope an evening star pattern gets formed on Tuesday). Also keeping a tab on banking sector, what\’s your say on it @kartiksir 🙂

Thanks a tonne.. 🙂

All I can say is stay profitable 🙂

Good luck and happy trading!

Hi karthik!

I was looking at some 4-hour chart, it shows a perfect entry point for going long. but then I look at the same chart at 1-hour or shorter time frame it just shows the bearish trend. How to proceed in that dilemma.

You have to stick to1 time frame. The different time frame has different data points, hence different outcomes. Does not help.

Hi Karthik,

I have a confusion for the multiple candlestick patterns. For the bearish patterns (evening star, bearish engulfing pattern etc), it has been said that we can short the stock by end of P3 (around close of 3:20 PM). However, shorting is valid for intraday which ends at 3:20 PM. So should we buy and sell in that short time frame (5-10 mins)

You can use a futures contract to short and carry forward the position.

Hi Karthik, this information and the queries posted in the forum are very useful for learning. For some reason, i couldn\’t see any of the charts people have been posting their queries based on. I tried it both on Safari and chrome latest versions. Can you please help

These are user uploaded charts, if they have deleted it then we won\’t have access to it. The charts posted in the chapter remains.

Hello, thank you for sharing your knowledge with us 🙂

I would like to ask if multiple candlestick patterns can be applied on intraday basis with a time frame of 15minutes?

Yes, you certainly can.

If you think the stock is going to be bullish(up), it means you \”long\” the stock. i.e., you buy the stock first at lower price and sell later at higher price. Similarly if you think stock is going to be bearish(down), it means you \” short the stock\” i.e., you sell the stock first at higher price and buy the stock later at lower price. The shorting opportunities will be provided by SEBI in intraday, derivatives and commodities. Basically, you cannot short delivery trades.

SEBI does not provide any trading opportunities 🙂

You can short in the futures market though.

Hi Karthik,

I didn\’t get one thing. What do you mean by shorting opportunities? During the evening star formation when we already know about the market going down why to even trade at such time? I have seen similar things in the previous lessons also. I\’m quite sure I\’m missing something here as I have just started. Please help me out and thanks in advance.

Guess you should read this chapter – https://zerodha.com/varsity/chapter/shorting/