8.1 – The Engulfing Pattern

In a single candlestick pattern, the trader needed just one candlestick to identify a trading opportunity. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. This means the trading opportunity evolves over a minimum of 2 trading sessions.

The engulfing pattern is the first multiple candlestick patterns that we need to look into. The engulfing pattern needs 2 trading sessions to evolve. In a typical engulfing pattern, you will find a small candle on day 1 and a relatively long candle on day 2, which appears as if it engulfs the candle on day 1. If the engulfing pattern appears at the bottom of the trend, it is called the “Bullish Engulfing” pattern. If the engulfing pattern appears at the top end of the trend, it is called the “Bearish Engulfing” pattern.

8.2 – The Bullish Engulfing Pattern

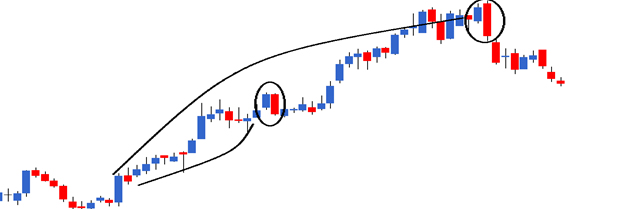

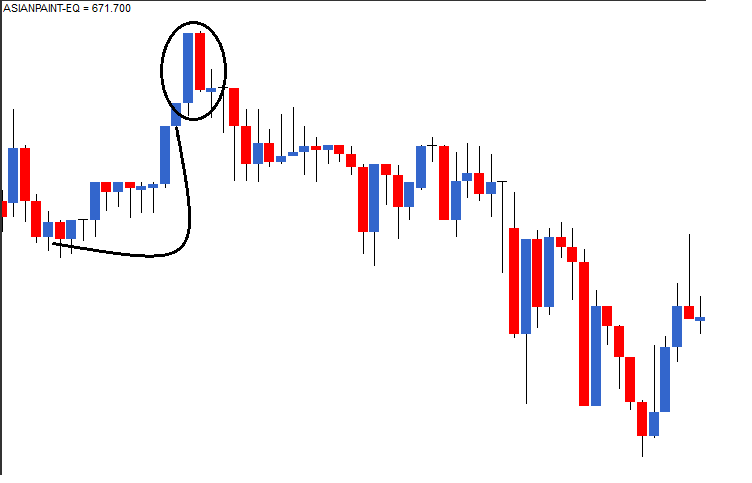

The bullish engulfing pattern is a two candlestick pattern which appears at the bottom of the downtrend. As the name suggests, this is a bullish pattern which prompts the trader to go long. The two-day bullish engulfing pattern is encircled in the chart below. The prerequisites for the pattern are as follows:

- The prior trend should be a downtrend

- The first day of the pattern (P1) should be a red candle reconfirming the bearishness in the market

- The candle on the 2nd day of the pattern (P2) should be blue, long enough to engulf the red candle

The thought process behind the bullish engulfing pattern is as follows:

- The market is in a downtrend with prices steadily moving down

- On the first day of the pattern (P1), the market opens low and makes a new low. This forms a red candle in the process

- On the second day of the pattern (P2), the stock opens near the closing prices of P1 and attempts to make a new low. However, there is a sudden buying interest at this low point of the day, which drives the prices to close higher than the previous day’s open. This price action forms a blue candle

- The price action on P2 also suggests that bulls made a very sudden and strong attempt to break the bearish trend, and they did so quite successfully. This is evident by the long blue candle on P2

- The bears would not have expected the bull’s sudden action on P2 and hence the bull’s action kind of rattles the bears causing them some amount of nervousness

- The bullishness is expected to continue over the next few successive trading sessions, driving the prices higher and hence the trader should look for buying opportunities

The trade set up for the bullish engulfing pattern is as follows:

- The bullish engulfing pattern evolves over two days

- The suggested buy price is around the close price of the blue candle, i.e. on P2

- Risk-taker initiates the trade on P2 itself after ensuring P2 is engulfing P1

- The risk-averse initiates the trade on the next day, i.e. the day after P2 around the closing price, after confirming the day is forming a blue candle

- If the day after P2 is a red candle day, the risk-averse trader will ignore the trade, owing to rule 1 of candlesticks (Buy strength and Sell weakness)

- On a personal note, in multiple candlestick patterns where the trade evolves over 2 or more days, it is worth to be a risk-taker as opposed to a risk-averse trader

- The stop loss for the trade would be at the lowest low between P1 and P2

Needless to say, once the trade has been initiated, you will have to wait until the target has been hit or the stoploss has been breached. Of course, one can always trail the stop loss to lock in profits.

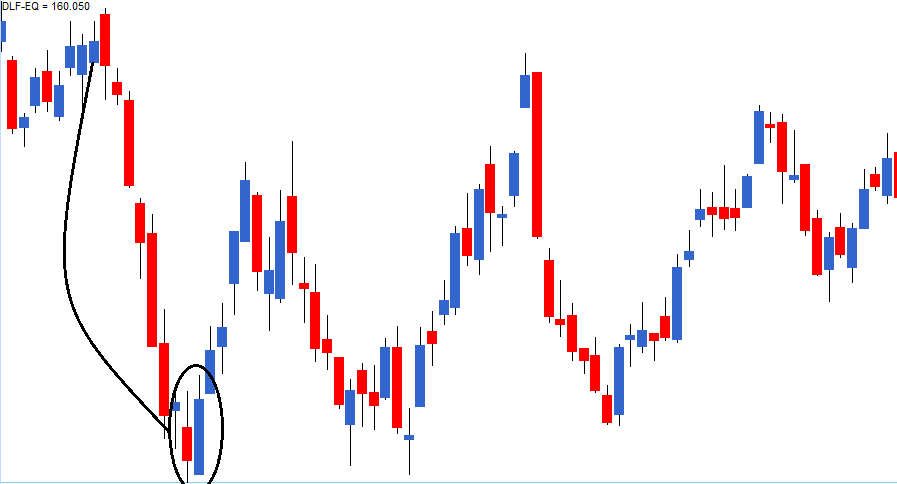

Have a look at DLF’s chart below; the bullish engulfing pattern is encircled.

The OHLC on P1 – Open = 163, High = 168, Low = 158.5, Close = 160. On P2 the OHLC details are – Open = 159.5, High = 170.2, Low = 159, Close = 169.

The trade set up for the bullish engulfing pattern is as follows:

- The risk-taker would go long on P2 at 169. He can do this by validating P2 as an engulfing pattern. To validate P2 as an engulfing pattern, there are 2 conditions:

- One, the current market price at 3:20 PM on P2 should be higher than P1’s open.

- Second, the open on P2 should be equal to or lower than P1’s close.

- The risk-averse will initiate the trade, the day after P2 only after ensuring that the day is a blue candle day. So if the P1 falls on a Monday, the risk-averse would be initiating the trade on Wednesday, around 3:20 PM. However, as I had mentioned earlier, while trading based on multiple candlestick patterns, it may be worth initiating the trade on pattern completion day itself, i.e. P2

- The stop loss on this trade will be the lowest low between P1 and P2. In this example, the lowest low falls on P1 at 158.5

In this example, both the risk-averse and the risk-taker would have been profitable.

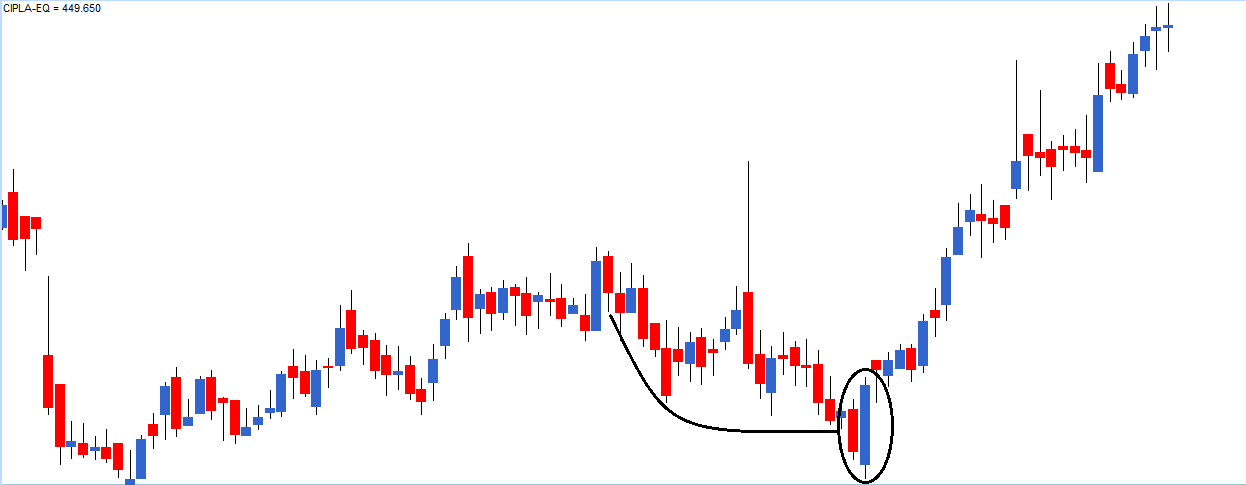

Here is an example of a perfect bullish engulfing pattern formed on Cipla Ltd, the risk-averse trader would have completely missed out a great trading opportunity.

There is often a lot of confusion on whether the candle should engulf just the real body or the whole candle, including the lower and upper shadows. As long as the real bodies are engulfed in my personal experience, I would be happy to classify the candle as a bullish engulfing pattern. Of course, candlestick sticklers would object to this but what really matters is how well you hone your trading skills with a particular candlestick pattern.

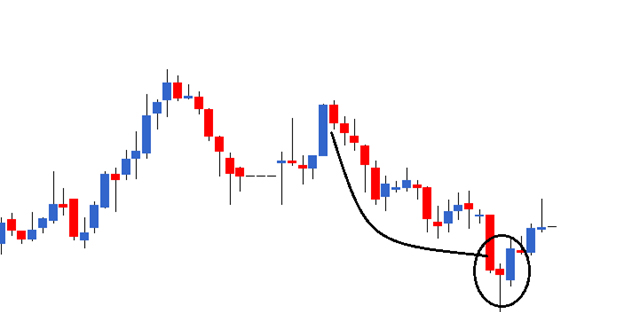

So going by that thought, I’d be happy to classify the following pattern as a bullish engulfing pattern, even though the shadows are not engulfed.

8.3 – The bearish engulfing pattern

The bearish engulfing pattern is a two candlestick pattern that appears at the top end of the trend, making it a bearish pattern. The thought process remains very similar to the bullish engulfing pattern, except one has to think about it from a shorting perspective.

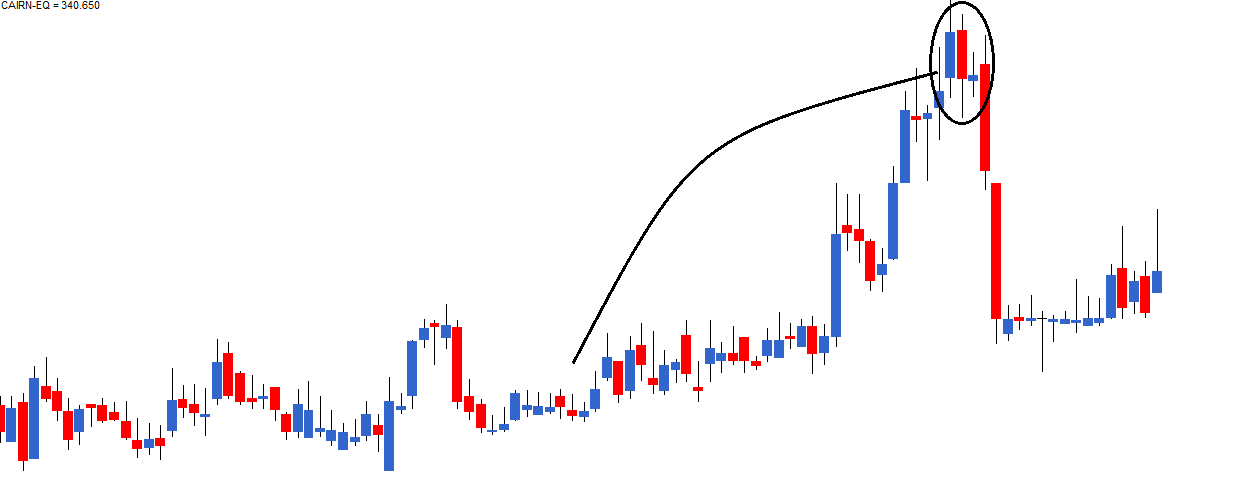

Take a look at the chart below, the two candles that make up the bearish engulfing pattern is encircled. You will notice:

- To begin with, the bulls are in absolute control, pushing the prices higher.

- On P1, as expected, the market moves up and makes a new high, reconfirming a bullish trend in the market.

- On P2, as expected, the market opens higher and attempts to make a new high. However, at this high point, selling pressure starts. This selling comes unexpected and hence tends to displace the bulls.

- The sellers push the prices lower, so much so that the stock closes below the previous day’s (P1) open. This creates nervousness amongst the bulls.

- The strong sell on P2 indicates that the bears may have successfully broken down the bull’s stronghold and the market may continue to witness selling pressure over the next few days.

- The idea is to short the index or the stock to capitalize on the expected downward slide in prices.

The trade set up would be as follows:

- The bearish engulfing pattern suggests a short trade.

- The risk-taker initiates the trade on the same day after validating two conditions.

- The open on P2 is higher than P1’s close.

- The current market price at 3:20 PM on P2 is lower than P1’s open price. If the two conditions are satisfied, then it would be logical to conclude that it is a bearish engulfing pattern.

- The risk-averse will initiate the trade on the day after P2 only after ensuring that it is a red candle day.

- Since the bearish engulfing pattern is a 2-day pattern, it makes sense to be a risk-taker. However, this purely depends on the individual’s risk appetite.

Take a look at the chart below of Ambuja Cements. There are two bearish engulfing patterns formed. The first pattern on the chart (encircled, starting from left) did not favour a risk-taker. However, the risk-averse would have completely avoided taking the trade. The second bearish engulfing pattern would have been profitable for both the risk taker and the risk-averse.

The OHLC data for the bearing engulfing pattern (encircled at the top end of the chart) is as below:

P1: Open – 214, High – 220, Low – 213.3, Close – 218.75

P2: Open – 220, High – 221, Low – 207.3, Close – 209.4

The trade setup for the short trade, based on the bearish engulfing pattern is as follows:

- On P2 by 3:20 PM the risk-taker would initiate the short trade at 209 after ensuring P1, and P2 together form a bearish engulfing pattern.

- The risk-averse will initiate the trade, the day after P2 only after ensuring that the day is a red candle day.

- The stoploss in both cases will be the highest high of P1 and P2, which in this case is at 221.

Both the risk-averse and the risk-taker would have been profitable in this particular case.

8.4 – The presence of a doji

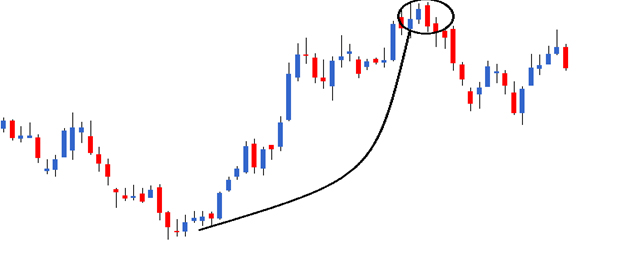

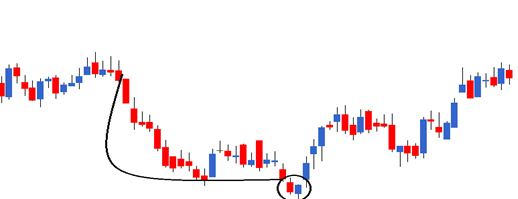

Now here is a fascinating chart. From my own personal experience, I can tell you, charts like the one shown below are highly profitable. One should not miss such trading opportunities

Take a look at the chart, what are the things that catch your attention?

- An obvious uptrend as highlighted

- A bearish engulfing pattern right at the top end of the upward rally

- A doji formation on the day following P2

What implication would a doji have in this chart?

Let us inspect this chart event by event:

- A prolonged uptrend in the chart confirms the bulls are in absolute control.

- On P1, a blue candle is formed, reconfirming the bull’s dominance in the markets.

- On P2 markets open higher and make a new high comforting the bulls. However, at the high point, a strong surge to sell builds up, to the extent that the prices close below P1’s opening prices.

- This trading action on P2 sets in a bit of panic to bulls, but they are not shaken yet.

- On day 3, let us call it as P3, though the opening is weak it is not much lower than P2’s close. This is not too comforting for the bulls, as they expect the markets to be stronger.

- During P3, the market attempts to move higher (Doji’s upper shadow); however, the high is not sustained. Even the low is not sustained and eventually, the day closes flat, forming a Doji. As you may recall, Dojis indicate indecision in the market.

- On P2 bulls panicked and on P3 bulls were uncertain.

- Panic with uncertainty is the perfect recipe for a catastrophe. Which explains the long red candle following the Doji

From my own personal trading experience, I can tell you that whenever a doji follows a recognizable candlestick pattern, the opportunity created is bigger. Besides illustrating this point, I also want to draw your attention to chart analysis methodology. Notice in this particular chart, we did not just look at what was happening on P1 or P2. Still, we went beyond that and actually combined two different patterns to develop a comprehensive market view.

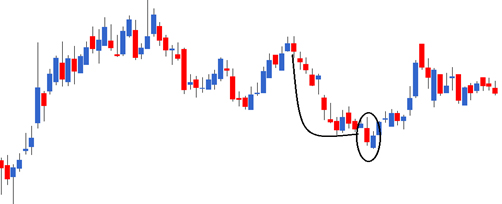

8.5 – The Piercing Pattern

The piercing pattern is very similar to the bullish engulfing pattern with a minor variation. In a bullish engulfing pattern, the P2’s blue candle engulfs P1’s red candle. However in a piercing pattern P2’s blue candle partially engulfs P1’s red candle. However, engulfing should be between 50% and less than 100%. You can validate this visually or calculate the same. For example, if P1’s range (Open-Close) is 12, P2’s range should be at least 6 or higher,r but below 12.

As long as this condition is satisfied, everything else is similar to the bullish engulfing, including the trade set up. Here a risk-taker would initiate the trade on P2 around the close. The risk-averse would initiate the trade, the day after P2 only after ensuring a blue candle is formed. The stoploss would be the low of the pattern.

Have a look at the following chart:

Here P2’s blue candle engulfs just under 50% of P1’s red candle. For this reason, we do not consider this as a piercing pattern.

8.6 – The Dark Cloud Cover

The dark cloud cover is very similar to the bearish engulfing pattern with a minor variation. In a bearish engulfing pattern the red candle on P2 engulfs P1’s blue candle. However, in a dark cloud cover, the red candle on P2 engulfs about 50 to 100% of P1’s blue candle. The trade set up is the same as the bearish engulfing pattern. Think about the dark cloud cover as the inverse of a piercing pattern.

8.7 – A perspective on selecting a trade

Typically stocks in the same sector have similar price movement. For example, think about TCS and Infosys or ICICI Bank and HDFC Bank. Their price movement is similar because they are more or less of the same size, have a similar business, and have the same external factors that affect their business. However, this does not mean their stock price movement would match point to point. For example, if there is negative news in the banking sector, banking stocks are bound to fall. In such a scenario if the stock price of ICICI Bank falls by 2%, it is not really necessary that HDFC Bank’s stock price should also fall exactly 2%. Probably HDFC Bank stock price may fall by 1.5% or 2.5%. Hence the two stocks may form 2 different (but somewhat similar) candlestick patterns such as a bearish engulfing and dark cloud cover at the same time.

Both these are recognisable candlestick patterns, but I chose between the two patterns to set up a trade. I would put my money on the bearish engulfing pattern as opposed to a dark cloud cover. This is because the bearishness in a bearish engulfing pattern is more pronounced (because it engulfs the previous day’s entire candle). On the same lines, I would choose a bullish engulfing pattern over a piercing pattern.

However, there is an exception to this selection criterion. Later in this module, I will introduce a 6 point trading checklist. A trade should satisfy at least 3 to 4 points on this checklist to be considered a qualified trade. Keeping this point in perspective, assume a situation where the ICICI Bank stock forms a piercing pattern, and the HDFC Bank stock forms a bullish engulfing pattern. Naturally, one would be tempted to trade the bullish engulfing pattern, however, if the HDFC Bank stock satisfies 3 checklist points, and ICICI Bank stock satisfies 4 checklist points, I would go ahead ICICI Bank stock even though it forms a less convincing candlestick pattern.

On the other hand, if both the stocks satisfy 4 checklist points, I will go ahead with the HDFC Bank trade.

Key takeaways from this chapter

- Multiple candlestick patterns evolve over two or more trading days.

- The bullish engulfing pattern evolves over two trading days. It appears at the bottom end of a downtrend. Day one is called P1, and day 2 is called P2.

- In a bullish engulfing pattern, P1 is a red candle, and P2 is a blue candle. P2’s blue candle completely engulfs P1’s red candle.

- A risk-taker initiates a long trade at the close of P2 after ensuring P1 and P2 together form a bullish engulfing pattern. A risk-averse trader will initiate the trade the day after P2, near the close of the day.

- The stoploss for the bullish engulfing pattern is the lowest low between P1 and P2.

- The bearish engulfing pattern appears at the top end of an uptrend. P2’s red candle completely engulfs P1’s blue candle.

- A risk-taker initiates a short trade at the close of P2 after ensuring P1 and P2 together form a bearish engulfing pattern. The risk-averse trader will initiate the trade the day after P2, after confirming the day forms a red candle.

- The highest high of P1 and P2 forms the stoploss for a bearish engulfing pattern

- The presence of a doji after an engulfing pattern tends to catalyze the pattern’s evolution.

- The piercing pattern works very similarly to the bullish engulfing pattern, except that P2’s blue candle engulfs at least 50% and below 100% of P1’s red candle.

- The dark cloud cover works similar to the bearish engulfing pattern, except that P2’s red candle engulfs at least 50% and below 100% of P1’s blue candle.

it took me way too long to realize that mouths and noses of the stick figure drawings at the beginning of chapters represent trends 🙂

Happy learning 🙂

(from 7/11 to12/11) a speaning top on p1(red candle) shoting star on p2(green candle) a hammer on p3(a green candle) then again a speaning top (a red candle) and its a clear downtrend on daily chart from august 2025. that means something or its just noise.

https://kite.zerodha.com/markets/ext/chart/web/tvc/NSE/HINDUNILVR/356865

The best way to establish this to correlate the price move with fundamental news. If there is some fundamental news impacting the business operations, then the downtrend is evident.

Hello Sir,

I had one doubt, lets assume we are in an uptrend and now we have a spinning top/Doji(green), let this be P1, now the next day we got a red candle (P2)which is large enough to engulf the P1. In this case what would be the situation? Is it going to be a downtrend?

How will i decide the target price is there any process for that too just like the stoploss

One of the easiest way is to look at support and resistance levels.

Question: What if a Doji occurs after bullish engulfing on P3, how to interpret it and what will be the trader\’s stance ?

On day 3, let us call it as P3, though the opening is weak it is not much lower than P2’s close. This is not too comforting for the bulls, as they expect the markets to be stronger.

During P3, the market attempts to move higher (Doji’s upper shadow); however, the high is not sustained. Even the low is not sustained and eventually, the day closes flat, forming a Doji. As you may recall, Dojis indicate indecision in the market.

On P2 bulls panicked and on P3 bulls were uncertain.

Panic with uncertainty is the perfect recipe for a catastrophe. Which explains the long red candle following the Doji.

The answer is in the lesson. please read… is it correct Ranganna?

Yes sir 🙂

That would be adding a dose of uncertainty, but I would consider this bullish 🙂

Whatif we found spinning top instead of doji after any recognised pattern..can we consider it big movelike doji?

Same reading 🙂

SilverMic(28Nov) seems to be forming 3 patterns.

1st: 16, 17 oct Bearish engulfing pattern.

2nd & 3rd: Its either a Bearish Hammer or a doji confirming the bearish engulfing pattern.

Well, my father bought 2 lots on 17 oct at 171800 and is currently at a great loss and he is still holding on it, I don\’t know why.

Should I ask him to sell now and maybe start shorting to earn some profit?

I meant Hanging man not Bearish Hammer.

Sure, please do check my previous reply.

What was the stoploss he had in mind? If its beyond the SL limit he had set, then he should liquidate. For fresh short – again, what is the premise? Take the trade if you are clear about the premise, stoploss, and target.

Thank You, Sir. Not going to take the trade because I am not completely clear on the premise, stop loss and target. I\’m still learning how to set them properly.

Super. By the way, the decision to not trade itself is a trade 🙂

What if the Nifty Bank is forming a Bullish Engulfing pattern? Does it have any influence on the banking stocks? Give your thoughts. And what do the fundamentals of a stock have on the technicals? Consider that I am looking at a longer time frame, and the fundamentals are showing positive signs, but the technicals are telling a different story. Which route to take?

Index goes up, stocks go up. They are all interconnected 🙂

What if P3 of Bullish Engulfing is a red candle and P4 is a blue candle? Is it still worth taking a trade? If not, then why not?

If the SL is not taken out, then yes, and why not 🙂

you have used daily timeframe for multiple candlestick pattern. Can I use 5 min time frame for multiple candlestick pattern in intraday?

Of course, you can.

Hello sir, I am totally beginner here. I just have one question. I can see candlestick charts for one session at a time. Generally I use kite app for this.

But how do you plot candlesticks for two different days? I could not find this option in the kite app or any other charting app. Could you please guide me?

The chart takes care of this, you dont really have to do anything specific for this 🙂

1..does it valid when at the bullish trend bullish green candle is bearish engulf with red one but not body (with mix of body and week) ??.. and also another one ,,2.., one bullish candle is formed and another red candle / green candle formed and after that bearish candle which engulf the first one . I mean there is one candle between them . does it also valid?? . ( 2 questions)

Hmm, not so much. Do check this – https://youtu.be/1kQjXFL4Mfc?si=vMlzseAliwvtivLZ

Sir, What if at the end of downtrend on P1 it\’s a doji with a very thin body and on P2 it was a normal bullish day easily engulfing P1 Candle, Should I go long with that?

Yes, as long your conviction on the pattern is high 🙂

Hi Sir,

Please guide what to do if the bullish engulfing pattern is formed during uptrend. I checked this in Dixon today i.e. July 14, 2025.

While it is not specific pattern, you can consider that the bullishness is ongoing 🙂

Karthik sir what is the difference between varsity app module and varsity website module

They are similar, just that app offers lot more features like quizzes, keeping track of progress, audio and video content etc.

sir, as we can see in the charts after a pattern formed – bullish/bearish engulf, after few minutes the pattern again starts changing. form this i understand that we should at the time of closing a stay on the trade for few minutes and book some profit and exit. am i right??

or else should we wait till the next day??

You can do this as well, based on your risk appetite.

Thats right, for this reason you need to fix on the pattern you are trading and id the SL and target.

Hello sir aditya here sorry to disturb you again but i had a doubt i was revising everything that i had studied in technical anaylsis module so doubts were popping up , sir in the piercing pattern after the red candle on P-1 there is a blue candle on P-2 on all the images that u have shown the blue candle is covering about 50 % to 100 % the lower half of the candle , but sir if the blue candle on P-2 covers 50% to 100% of the upper half of the candle is it still a piercing pattern , again sorry for taking so much of ur time sir

That wont be a piercing pattern, but I\’d consider it as a bullish sign. Check this – https://youtu.be/z0Rwoz6PduM?si=-fBQqrU5zCGyw6Qy

Hello kartik sir aditya here , sir if in the bullish engulfing pattern if the open price of candle in P-2 is higher than the close of P-1 but with a very minute difference can we still call it a engulfing pattern or no

Yes, you can still consider it as a bullish engulfing pattern.

hello kartik sir aditya here i had a doubt, sir suppose in the engulfing pattern the candle on P1 is extremely small as compared to that of P2 is it still a englufing pattern , like is there any restriction on candle size for this pattern

Technically no, but I generally tend to avoid trading such candles.

ohk thank you sir , i\’ll make a note of this

Sure, best wishes Aditya 🙂

How to place targets?? you emphasise a lot on having stoploss. My main problem occurs when i can\’t exit a trade after making profits. What can be the target for trade that we placed following a particular pattern?

For targets, you need to identify using techniques like support and resistance. Or it can simply be a time based SL or a fixed % as well.

Sir you said in the bullish engulfing pattern, \”Here is an example of perfect bullish engulfing pattern formed by Cipla Ltd, the risk-averse trader would have completely missed out a great trading opportunity.\” Can you just tell that how? is it like on the 3rd day, the day after P2 is a hammer?

Thats right, the risk-averse trader takes the trade after a confirmation is in place.

For the piercing pattern you said \”engulfing should be between 50% and less than 100%. For example, if P1’s range (Open-Close) is 12, P2’s range should be at least 6 or higher, but below 12.\”

Query – Suppose in the above example, range on P2 is 13 (i.e. more than range of P1) but it engulfs only say 90% of P1 candle. Would it still qualify as piercing pattern or both criteria, engulfing and range should qualify for the same?

Yes, anything above 50% qualifies.

Hello Sir,

I need one clarification for engulfing bearish pattern. It is suggested that after P2 validation we should take a trade. In the case you are planning to buy the share than are we not ending up buying at higher price when we know that trend is in for a reversal

The idea is to buy with a hope that the price will go higher 🙂

Oh got it

Good luck!

Sir, can I use these all patterns in crypto intraday trading.

I\’ve not used it myself, so cant comment. But I have seen ppl talk about using the same for Crypto.

sir please explain that as you said in presence of doji in up-trend, it will work in down-trend also?

and colour of doji matters?

Across sections covered in this module it is mentioned that a risk taker makes the trade on the same day as the candlestick pattern starts shaping up at around 3:20 pm, so all such trades would be delivery and not intraday right?

And if so, how come any short sell trade can get initiated at the end of the day? Are short sell trades possible in delivery too ?

Yes, these are trades that will happen in F&O where you can short and hold the positions overnight.

That has to be in lots not in few QTY , Unlike it cash segment ?

Yes, thats right.

Cash market = any quantity you want

F&O = multiple of lot size.

hai sir your content very useful in my question is using time for this 15 mins or 1 day time frame

I personally prefer end of day chart. But if you want to look at intrday, then yes, 15mins is good.

In the 3rd chart diagram on CIPLA chart, the previous bottom formed at the leftmost, Is it a morning star ? Thank You.

Looks like it. But dont really see a prior trend.

Can we consider the same conditions for Doji formation after a bullish engulfing formation?

Yes, you certainly can.

Hello Sir, in bullish engulfing pattern you have mentioned a sentence \”a bullish pattern which prompts the trader to go long\” , this means we can hold for a long term or it means the trend will go bullish. Can you please clarify

Yes, you can hold the positions for long.

bit confused . how can we trade bearish engulfing candle as a risk taker . Can we hold short position in equity?

For intraday you can. But if you wish to hold positions for multiple days, then its via F&O.

When market is in up trend…on day 1 we have a green candle and on day 2 there is a red candle engulfing the day 1 candle. So if i want to short the stock..i would probably sell it around the closing of day 2 right. So my question is regarding the stoploss, as the chapter says to have the stoploss around the open of day 2, would\’nt it be much more efficient to put the stoploss around the price you sold it at, in turn minimizing your loss instead of putting a stop loss around the opening price of day 2?

Thank you.

You can, but generally speaking, its the day\’s high (in case you are shorting) kept as the stoploss.

Thanks,Karthik.

You are helping me all the way…

Happy learning!

\”next few successive trading sessions\”

What you guys mean by this,some more days or some more hours.As a beginner i am little bit confused.

Every day is a trading session. For example – Mon, Tue, Wed – these are 3 consecutive trading sessions.

Hi Karthik, thank you for responding. Can you please tell me how do we calculate the momentum?

You calculate the returns on a daily basis and check. Here is a video that to help you understand – https://www.youtube.com/watch?v=eMuGV8t3ejo

August 22, 2024 at 10:47 am

Hi Karthik,

Is the candle of 20 Aug 2024 in daily TF of Bikjai an example of Dark Cloud cover pattern?

Thanks

Karthik Rangappa says:

August 23, 2024 at 10:42 am

Yup, you can consider that. But the stock seems to be in a good momentum.

In the above conversation you said the stock seems to be in good momentum, what does momentum here mean? Doesn\’t the appearance of a CS pattern means possible change in sentiment?

Thank you

Momemntum is the rate of change of returns. Higher the rate, higher is the momentum.

Right, thank you tho 🙂

Sure, happy learning!

No worries:)

Karthik can you please confirm the following in TCS Daily TF,

1. Latest trend is up (14th – 21st Aug 2024)

2. Candle of 22nd Aug is a Marubozu as well as a bearish engulfing?

Ah, Dixit, wont be possible to check and confirm stock specific trends 🙂

Thank you so much! What abut HDFC?

Ah, was unable to check.

It is Bikaji, sorry.

Also, would you say the CS pattern on 16th Aug HDFC Bank 2HR TF between 9:15 and 11:15 is Bullish Piercing?

Got it. I posted about Bikaji.

Hi Karthik,

Is the candle of 20 Aug 2024 in daily TF of Bikjai an example of Dark Cloud cover pattern?

Thanks

Yup, you can consider that. But the stock seems to be in a good momentum.

Yes! I had 15-30 mins chart in my mind whereas you meant EOD charts, got confused there a bit.

Thank You

Sure, hope all clear now. Good luck!

You said it takes 2 days to form engulfing pattern, but what if it forms on the first day itself? I\’m Confused.

Let\’s say a bullish engulfing forms on Monday at 11am itself, then why should one wait for day 2? He can go for a long trade at that time only right?

When you say it forms on Monday, you are talking about Friday and Monday candles together. Just Monday alone cant form a two candle pattern right?

I have a doubt with respect to the below statement for piercing pattern.

\”For example, if P1’s range (Open-Close) is 12, P2’s range should be at least 6 or higher,r but below 12.\”

Does this mean that (open-close) of p2 should be more than 50% of (open-close) of p1? or close of p2 should cross 50% of (open-close) of p1?

Close of P2 should be higher than the half way point (real body), of P1. Thats a easier way to look at it 🙂

Hi Karthik,

How would we know that it is forming engulfing pattern at the end of the day? Should we wait for another day? How long should or can we wait to know that an engulfing pattern would be forming?

You can compare the OHLC just before the close to get a sense of what has transpired during the day, compare it to previous day\’s candle and make a call 🙂

respected karthik

you made great sessions. can you please make it in downloadable pdf?? it will reduce dependency on internet. we can read it offline also.

once again thanks for making such great sessions.

The PDF is already made available, Shantanu 🙂

Hello Sir,

When doing short trades, one has to buy back shares before 3:30 p.m., so how will the risk taker make profit after going short at 3:20 p.m. on day 2? since he would have to buy at 3:30 right and there is no profit at that time.

You can short the stock by using derivatives contract like futures and options.

Hi Sir

when we can\’t short stocks overnight but only intraday ..

How can we use / make most of bearish engulfing or other beaish patterns ?

You can short via derivative instruments like futures and options.

Hi Mr. Karthik,

Your efforts in preparing these modules are really appreciable.

Could you please let me know,

Can we use these candlestick patterns to understand the price trade action for swing trading, if yes then what time frame is more suitable, because for a particular stock in a given time, the patterns are different in different time frame. Thanks

I\’d suggest for swing trade you look at the EOD charts itself. Any shorter time frame for this could be detrimental.

I see that you have mentioned that an MIS short trade is being initiated at 3:20 pm. But isn\’t shorting an intraday trade? If the trade is initiated at 3:20 pm, the trade would get squared off before 3:30pm right? I dug a bit and I got to know that brokers auto square off the MIS orders before 3:30pm.

You can initiate in derivatives segment.

I did not get it, EOD of the chart will be useful for intraday option and stock. If I am doing intraday on equity, what will be best 5 minute or 15 minute or 3 minute time frame

I know most people prefer 5 or 10 mins chart for intraday, but I personally like the idea of looking at EOD chart, developing a point of view for the day, and then looking at trade opportunities.

Also for intraday which time frame is best to see charts.

For intraday also, I\’d suggest end of day charts 🙂

https://drive.google.com/file/d/1it9UnH2iMqpng5wYbk4y5nV52DfquQwT/view?usp=drive_link

Thanks.

Hello Sir,

I am new in trading, learning and investing low amount in intraday. I would have attached screen shot

could you please explain pattern and price action for OIL(NSE) of 11the june (Today) for intraday 15 minutes and 5 minutes.

Thanks And Regards

Aman

Aman, you will need to upload the image to Google drive and share link here, make sure the link is public 🙂

Sir, in the trade set up of the Bearish Engulfing Pattern, you say that a risk taker would commence a short trade after checking prices around 3:20PM. But, making a short trade at 3:20PM wouldn\’t be possible right?

Its possible on a derivative contract, Vaib. You can short using futures or options.

Panic with uncertainty is the perfect recipe for a catastrophe.

This is so true.

Yup, holds true for a long time to come 🙂

sir it\’s work in small time pride??? like 15 minutes or 5 minutes or 30 minutes

Yes, but dont do not initiate the trade without any back testing.

Sir, how to determine whether after the Doji is created, we need to long or short the trade?

Just compare the real body – opening and closing, along with the shadow.

Sir good evening, Please pardon me if my question is stupid

In the bullish engulfing pattern you said \” The price action on P2 also suggest that bulls made a very sudden and strong attempt to break the bearish trend\”.

My question is where from these bulls come from very sudden and why these bulls take risk to enter in a downtrending market.

Its the same participants whose views change from bullish to bearish and vice versa.

I want to know whether the doji coming after a bearish engulfing pattern is only considered as a favourable position or is it applicable to a bullish engulfing pattern also.

You can consider this for all patterns, Sidharth.

In the comments section, i do not see the screenshots or imaoges, I am not sure why. Can anyone help me?

You cannot upload images directly, but people usually upload on Google drive and share links in comments.

If trading starts at 9:15 and the square off timing of zerodha is 3:20, then you place order and fluctuate price on 9:00 to 9:15 and from 3:20 to 3:30 ?

The market is not open till 9:15AM. So these are just pre open orders.

Why would a risk averse trader enter into trade on Wednesday 3.20pm rather than the day\’s opening time (considering P1 occurred on Monday) in case of bullish engulfing pattern?

That is to ensure that the pattern plays out as expected, so basically more confirmation before initiating the trade.

does these all candlestick patterns work in intraday trading and on 5 to 30 mins chart

These are all patterns which have odds, from my experience, better with on EOD basis rather than 5 mins.

Will the presence of a Doji after a bullish engulfing also mean a strong trade call??

Asking because, the above example you have mentioned is for a bearish engulfing pattern.

Yeah, generally it does 🙂

hey, should we have to keep in mind all the stick patterns (both single and multiple) while trading or is it fine either only single or only multiple, because i feel there are few patterns which signify upcoming downtrend but the trend tends to go up even after that also.

Check this Dhanush – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

Hello Karthik, in the cgart just above section 8.6, you can see two more bullish engulfing patterns being formed. But the prices have still moved downwards. It violated the bullish engulfing pattern. Can you explain that ?

There is no guarantee that the patterns work out. Patterns are just indicators of what is could likely happen, there is no certainty in the market.

Thanks for the link and it did help me to understand what\’s important !!Appreciate your revert !

Happy learning, Jitin 🙂

Thanks for the this Session, Just realized if we missed Harami Candlesticks in this session ?? If yes where can I get that info ? Thanks again !

Do check this, at some point you will have to look at the price action and move away from remembering patters – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

can we use engulfing pattern in a day or we can use it in intra day also like 15 minutes

You can use intrday as well, Anuj.

\”On day 3, let us call it as P3, though the opening is weak it is not much lower than P2’s close. This is not too comforting for the bulls, as they expect the markets to be stronger.\” Can you please explain this statement again Karthik sir.

If the opening on Day 3 is not much lower than on Day 2 it should be comforting to the bulls right?

In a bullish market, the traders, mainly bulls expect stronger opening. In the absense of a bullish opening, the confidence of traders to place long trades is not much and that can leads to giving way to the bears.

I am confused on days you said one candle will be on one day another will be on anoither day what does that means, what if graph is of the same day and the pattern forms. Why you are refering different canles with days?

Sorry, I\’m unable to get the context. Can you share with an example and elaborate your query?

can we use all of the things on 15 minutes time frame?

kuki agar hmko options me jana hai too 2 dino tk wait krna !!

please help??

Yeah, works on 15 minutes time frame as well.

You are using \’day\’ in the modules. Will these strategies work in 15 min charts if I want to trade intraday?

Yeah, the interpretation of candle stick patterns is the same across all time frames. My personal preference is to use it by end of day.

can this patterns be used in intraday trades or shorter time frames than a day?

is Color matters when we see an engulfing pattern ?

Yes, it does and I\’ve explained in the chapter on how the sequence should be.

The content published here is absolutely amazing, no amount of admiration for the teacher in the video is enough! If and when I feel confident about trading, Zerodha would be my preferred platform for the brownie points they\’ve earned for explaining to humanities student such as myself such difficult concepts so lucidly.

Thanks so much for the kind words, Bhavika. I hope you continue to enjoy learning on Varsity 🙂

Hi Karthik,

Let\’s assume a stock has down trend then appears the long red candel(p1) after next day gaps up and opens at half of the previous candle and covering p1 open

Shall we consider it as piercing.

Thanks

Yes, that is a piercing patter, although a little more than half of P1 is better.

I could not understand the failure of PIERCING & DARK CLOUD COVER PATTERN, Can you please explain it?

Which part, Padma?

do bearish engulfing pattern apprear in downtrend?

do bearish engulfing pattern apprear in downtrend?

Please refer today and yesterday pattern in Nifty 50

Bearish engulfing by defenition appears in a uptrend. If you see a pattern in downtrend, then its not really bearish engulfing.

Hello karthik ji,

Can engulfing pattern applied in day trade also on 15min chart

Thank you

Yes, you can.

Doji alone can\’t explain much, basically a doji means market is in confusion and anything can happen after a doji but to predict better, you should use multiple candlestick patterns or other indicators.

What if a doji is present as P1 of a bearish engulfing pattern?

Then its not an engulfing pattern 🙂

Hi Karthik sir, thanks for these mind-blowing lessons.

Asking this since it\’s not mentioned here in this module, can we use these multiple candle stick patterns in a 5 or 15 minutes basis for intraday?

Coz we only discuss about the \”day\” candles here.

Glad you liked it. Yes, you can, in fact have mentioned that candlesticks can be used across multiple time frames.

Hi Karthik and Team,

Thanks for the great explanations on all these. I completely learned trading basics from Varsity, Zerodha.

I have a quick question – Can we consider all engulfing patterns will make a change in the trend as a reversal?

Thanks

Thiru

Thiru, yes, in a way that works.

can also work on any time frame means,5min,15min,30min,45min

Yes, thats right.

1) In multiple candlestick pattern candle timeframe on daily chart is compulsory otherwise apply on 15 min/1 hour is also fine?

2) As a risk-averse in both piercing pattern/ dark cloud cover where we take trade

confirm p2 and take on 3rd day

low of p1 than initiaties the trade on 3rd day

1) Yes, but I\’d suggest you avoid 1-minute candles.

2) Thats right. On p3 at day opening.

Hey Can Anyone explain, how can shorting at 3:20 work, the markets will close and we have to buy back or else the position gets squared off on it\’s own. So how can someone ensure, whether it\’s a red candle day and then short?

Aniket, shorting can be done by futures contract or via options. These positions can be held overnight.

very informative

Hi Karthik, Can you help me connect with someone who can solve this issue, I am able to buy BSE stocks on Zerodha but unable to Buy NSE

Please do call the support desk for this 🙂

What is the time frame for the multiple engulfing pattern

A minimum of 2 days, Hari.

I have a confusion in selling a short in stocks. As explained in earlier chapter we can sell the stocks we don\’t have only in intraday. So how we short in long time in bearish pattern as this are day chart??

Can you explain??

To do that, you will need to short via futures or options. It is not possible in spot market.

Nice beautiful like

Sir we need RS(RELATIVE STRENGTH) in fx chart IQ

Please THANK YOU DHANYAWAD DHANYAWAD DHANYAWAD

The same charts are available for CDS too right?

What if Bullish or bearish Engulfing appears at sideways trend? can we prefer it as a englufing pattern or not?

These patterns need a prior trend Atharva. Priod trend is an integral part of the pattern, without which, we cant even consider it as a pattern.

thanks @asiam

thanks karthik sir

Happy learning!

@Dipu – yes, you can expect a downtrend, irrespective of whether it\’s Doji or other candle as it was engulfed by a Bear candle.

Having said that, you need to see whether the following P3 candle is breaking P2\’s low and sustaining. So this would confirm that the trend is reversed. (please consider at least 5&15min T-Frame for intraday and 1D T-Frame for swing). Along this, remember to consider other parameters like Resistance, Pattern too as this would help you to take a trade with confidence.

it\’s about a bearish engulfing pattern suppose on p1 green doji is formed on an uptrend, and on p2 red candle stick is formed engulfing p1. Can we say that the market will go on a downtrend because of the presence of Doji which explains indecision in the market and bearish engulfing saying it going to be a downtrend?

Hmm, so Doji should not be a replacement for a regular candle, but although in this case, I\’d be more comfortable with a short trade than a long trade.

i am new to trading,sorry if my questions sound naive.I failed to understand how the P1 & P2 pattern seen in a single chart,bcz both happens to be in 2 trading session i.e two days.Plz clear my doubt.

Dibya, a chart shows multiple trading sessions. So P1 and P2 occur on two consecutive days. I\’d suggest you check this video series – https://www.youtube.com/watch?v=yzRP-mA2eiE&list=PLX2SHiKfualH_xMbGM-3zWC47s9gUjGR_

Thanks Karthik

And can you also explain me that as a risk averse trader in the engulfing pattern when I am gonna take the trade if I am looking intraday

And also if I am looking EOD charts

Since, its intrday, you take the position on the same day but after ensuring there is a confirmation candle on P3.

And also I wanna know that we should look for P1 or 1st candlestick at the beginning or end of the trading period ?

Same for P2 candlestick?

P1 and P2 indicate the sequence of candles, Kunal.

Hi kartik

In engulfing pattern do P1 and P2 appear on same day or on different days?

If you are looking at EOD chart, then P1 and P2 appear on two consecutive days. If you looking at intraday, then yes, it will appear on the same day.

Sir, Its mentioned that a risk taker initiates the trade on the same day (P2 – in engulfing pattern). Which type of trade is initiated here (like Intraday or…)? How do we initiate trade at the end of the day??

These are overnight trades, Bibin. If you are buying stocks, buy under CNC or if its futures, then NRML will do.

Engulfing, Piercing and Dark Cloud Cover pattern\’s en pattern\’s ko intraday ke 5 or 15 minute chart par use kar sakte he kya?

Hello sir, hope you are doing well..

Sir, I was having a doubt regarding the piercing pattern, is it that the open for P2 must be lower than P1\’s close? Or holding it somewhat flexible, I can consider it as an piercing pattern if they both are same?

Thanks in advance

And sir, thank you for making all these educational contents, I want to know about financial markets(it\’s my dream, a obsession may be) and as an economics major student, wants to pursue my career in the same and these helps me a lot.

Subhrojyotee, its best if P2 opening is lower or, at best equal to P1\’s close. Definitely not higher than P2\’s close. So work around these constraints. I\’m glad you liked the content. Happy learning 🙂

Got it, Dark Cloud

Does PIERCING PATTERN is also valid for bearish engulfing?

Not really, in a piercing pattern, the candle on P2 just covers more than 50% (but less than 100%) of P1\’s losses.

Hi Karthick 🙂

Looking up the candles of ITC Ltd.(NSE) as on (21st November 2022 and 22nd November 2022), Can we name the pattern as a Bullish Engulfing? (The prior trend is a bearish trend)… and my next question is that should the High and Low of the P2 candle should also engulf the P1… or is it only the candle\’s body which would Engulf in order to form a Bullish engulf.

Yup, this can be considered as a bullish engulfing and as long as the real body engulfs, it is fine.

First of all, Karthik ji

Thank you for The lessons you have added and explained so amazingly. I am glad that I get to read it on daily basis.

My question is, when you mention Bulls and Bears who are creating buying pressure or selling pressure in market, who are they, on which basis do they trade? How do they decide that now is the time to sell or buy this particular stock? Is it based on News about a particular company or industry?

Since they are reasons behind this certain patterns in candlesticks.

These are traders like you and me, maybe institutions as well. All of them read the markets, the price action, and decide to be either buyers or sellers in the market.

Hi Karthik,

First of all, Thanks for this initiative being taken by Zerodha Team in educating all of us.

My Question: Do we have any trading system which notifies us whenever any such candlestick patterns like Hammer, Spinning Top, Bullish engulfing etc. are trigerred.

I practically feel this is very difficult to checkout all the stocks.

Raman, you can use scanners for this. Please check with folks from streak.tech once for this.

When two green candle merge/ bend , how the final green candle look like ( whats math behind it?)

When two red candle merge/ bend , how the final red candle look like ( whats math behind it?)

Ah, I;m not sure what you are referring to. Can you point to a real candle so that i can see what you are talking about?

can you tell me wheres is P1 and P2 in the chart because there is no sign on the chart so how can i understand ?

P1 is the last but 2nd candle from the right and P2 is the last candle on the right. Basically the recent two candles.

For engulfing patterns or any other candlestick pattern, there has to be a prior uptrend or downtrend. My doubt is that how many days candle we need to see to determine whether the prior trend was up or down?(I look at daily timeframe)

At least 8-10 trading sessions.

Hello Sir,I wanted to ask how many candles should we see to consider if there is an uptrend or downtrend? I mean if it\’s fine if the up/down trend is of about 3-4 candles.

For short-term swing trading, at least 8-10 trading sessions I\’d say.

Hi,

\”However, engulfing should be between 50% and less than 100%. You can validate this visually or calculate the same. For example, if P1’s range (Open-Close) is 12, P2’s range should be at least 6 or higher,r but below 12\”

I think the above statement is not entirely accurate, or I am probably missing something. If the P2 candle has to cover 50% or more but less than 100%, then we cannot specify based purely on the range of P1 what the range of P2 should be. Above statement says, if range of P1 is 12, then P2 should be at least 6 but not higher than 12, but what if P2\’s (blue) Open is well below close of P1 (red), so much so that it\’s range is 10 but it only engulfs P1 30% Does this pattern hold in that case ?

Would you be kind to clarify ?

Thanks,

Alok

In that case, it won\’t be a piercing pattern, but some other pattern. Check this – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

in the bullish engulfing pattern\’s first chart, we bought the share at 169 then how come we stop-loss it at 158.5? I think it is a loss-making trade and you have mentioned it as profitable for both risk takers and risk averse. please, let me know if I am wrong?

Buy at 169, SL at 158.5, and the SL was never triggered, right? So why do you think this was a loss-making trade?

Sir, why isn\’t that the open on day 2 in bullish engulfing pattern should be equal to or lower than previous day\’s close and why can\’t it can be higher and similarly for the bearish engulfing ?

The lower open entices the short sellers to build more positions. More leveraged position = higher panic when prices increase, which is better for a long position.

Hello Karthik,

Yeah you are right.

I got confused earlier in reading P1 and P2. And I understood it now.

Thank you for all the replies and clarification.

Sure, happy learning 🙂

Prior trend*

Hello sir, in one of the comments you told that with some flexibility we can consider the pattern as engulfing pattern even if prior to trend is not accordingly…can you specify those flexibility?! Would be grateful cuz i guess I am too late here😞 Also, thank you for such wonderful & informative content

There are many such points where you can bring in some flexibility. For example, in bullish engulfing open of P2 should be equal to P1 close…..but it is still ok if P1 close is equal to P2 open.

Why am I not able to see ss in comments? I am not able to clear my doubts

Hi Karhtik,

I was referring to 8.2 – The Bullish Engulfing Pattern. Yes candles between P1 and P2

Thanks,

Vinayak

But there is nothing between P1 and P2, right?

Thanks for replying Karthik!!

for multiple candle stick patterns we need 2 or 3 trading sessions data right? (Here trading session means 1D data??)

If I assume that as 1D\’s data then we should have only 2 or 3 candle sticks isn\’t it?

Examples which you have mentioned with the chart has multiple candle sticks between Pattern 1 and Pattern 2. I wanted to understand why there are so many candle sticks.

Please help to clarify

Are you referring to dojis? Which chart/example are you talking about?

Hi Karthik,

However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. This means the trading opportunity evolves over a minimum of 2 trading sessions.

If we go with above points how are we seeing so many candle sticks in between Engulfing Pattern?? Isn\’t it supposed to be 2 or 3 candlesticks?

Are we using any hourly based candle sticks between days??

Thanks,

Vinayak

Not sure what you mean. Can you quote an example?

In a Day chart of CG POWER near about 14 May is there bullish engulfing formed??

Around 11th May, you can consider that.

Hi Karthik,\’

This bullish engulfing and bearish engulfing pattern if it formed during the day time like around 10am to 1 pm so do we consider this opportunity for trade or does this patterns only work at day end time like 3:20 pm.

You can still use it for intraday trading, Sagar.

Sir one big Red candle and 5 to 6 candle inside it what that mean

Hi Sir!

what we have to choose as the stoploss , closing price or low price.

I\’d say close price, but sometimes intrday situations will force you to close right away without really waiting for the close price.

Sir with the engulfing pattern for example in bullish engulfing, the P2 open price should be lower than P1 closing price? Or It can open higher than P1 closing and still be called engulfing (provided all other conditions are met).

It can be slightly higher. But make sure P2 close is higher than P1\’s open.

Really wonderful chapter sir. Thanks.

in the 2nd chart of bearish engulfing (the first from left encircled), the p2 open is basically equal to p1 close but above you said the p2 open should be higher than p1 close. does it matter much?

What we can say is based on the time frame the trader is trading he can be classified as risk taker and risk averse.

Ex.In a 15mins time frame:-

1) A Risk Taker:-Will immediately initiate a trade after identifying a particular pattern or when a pattern is been forming.

2) A Risk Averse Trader:-Will verify the particular patterns trend after identifying the pattern by seeing the next candle. In case of bullish engulfing will verify when the third candle is formed.

Kindly throw light on the same.

Thanks in Advance! !

Yes, thats right Paras.

This is high quality.

Thanks for creating these modules !!

Happy learning, Shivam!

Sir, to conclude whether the prior trend is a downtrend or uptrend, how many candles in a daily chart should be considered. I am very confused at this point. The trend could range from a week to years and in between, there could be many ups and downs. Sir, please guide.

Rinkoo, I\’d suggest you consider at least the last 6 months\’ data to get a sense of how the market is moving (get a sense of the trend). Data less than that can be misleading.

So if the P1 falls on a Monday, the risk-averse would be initiating the trade on Wednesday, around 3:20 PM. Which means the risk averse will take position only for 10 minutes as market closes around 3:30.

And why not at the start of the day at around 9:15.

No, you can buy and hold. These are not intraday trade.

I use zerodha kite. The trading view is ok. What it would be like if zero dha kite signals when a particular candlestick pattern appears.

You can try the \’Candle pattern\’, indicator. I think its on ChartIQ.

sir,

at what timeframe the risk averse wil confirm the next day is red or blue candle day to make a decision for entring into the market for any type of candle

You can figure this out by end of the day around the market close. It will give you a sense of how market is likely to close and you can base your trades on that.

Hi Karthik,

what is the best time frame for candlestick analysis for intraday?

Would the time frame be the same for swing and intraday?

I\’d say EOD for both. But I guess 15 mins is a good time frame for intrday.

Sir what if I apply this trend in intraday strategy it will work or not if I use 5 min chart or 15 min chart for this strategy.

Sir please clarify.

You can. I\’d suggest you look at 15mins rather than 5 minutes.

shouldn\’t be the closing price of a stock be opening price on next day ? if it shouldn\’t be how that\’s happening ? can you help me understanding that ?

Nope, the opening price is different compared to the closing price. Of course, unless there is a new event which impacts the prices, the opening price wont be very different compared to the previous day closing price.

I have been studying here for last few days.

Every concept has been told in such an absolutely crystal clear way that even a layman can start understanding and following it. Great! Thanks.

Glad you liked the content, Devinder. Happy learning 🙂

as we cant short sell on cnc , so how we can short at the closing time of market if we see a bearish engulfing pattern

Dhruv, you can short via the F&O segment and carry forward the position.

As you mentioned the formation of a Doji after a recognized pattern may result in a catastrophe for either bull or bear. My question here is, in a bearish engulfing pattern, does the Doji have to be blue or it could be red as well? Either indicate indecisiveness, but to sum it up does the color of Doji matter in this case? Or if it is bearish Engulfing and a Doji has been formed the price is bound to fall irrespective of the color, am I correct.

(P.S: Tried framing the question twice i hope yall get what I\’m trying to say:))

It can be any color Mihir. The color of Doji does not really matter, it is just the pattern + doji that we need to look at.

what if bearish engulfing pattern forms on downtrend? Is it signal of further down in price?

Yes, I\’d treat that as a bearish signal.

Can these all candlestick pattern applicable for 5mins, 15mins Timeframe?

Yes, you can Vikas.

what if a good downtrend then we see a bulls try to pull the market upward and a dark cloud cover occur than what you will do

You just have to go with the flow and set up trades basis price action (candles). Once you do, stick to the trade and follow the target and SL.

Sir,

you explained reconzible candle with doji indicates more strength for reversal – is it applies only for engulfing patterns(bullish and bearish) or it applies all multiple candlestic patterns?

This is just a personal obseration, its applicable to all candles Sriram.

you said \”The open on p2 should be equal to or lower than p1 close\”. What if the open on p2 higher than p1 close? What is the psychology behind this..

That\’s ok, but it\’s comforting to see it open lower. Evaluate this on a case by case basis.

In bullish piercing pattern the green candle should open gap down ,is it necessary or not?

If you are asking my personal preference, then yes, I\’d prefer it that way.

others are added some charts, how to see them?

their charts are not visible

These are updated on the user\’s Google drive, not sure if they have deleted it.

for tata steel, 1 st dec candle, would you consider as hammer pattern or any other and is it trend reversal?(could u please check chart bcz idk how to add chart here)

other parms volume,support are satisfiyng

It is a hammer, Sriram. Would have liked it if the opening was lower than the previous candles with a longer lower wick.

Sir, what is the relation between lower time frame or higher time frame? Like we have a buy signal in 10 min but sell signal in 1-hour then which one to follow?

Stick to a single time frame, Aaksah. I\’d prefer the higher time frame charts.

Please Explain about GAP Theories. Runaway and exhaustion gaps

Sure, will add this to the list.

Does the position of p2 candle really matters in a dark cloud or a piercing pattern , as long as it is engulfing more than 50 -99 percent of p1 candle ?

Yes, plus ensure that the open is below the open of P1.

If a trader puts in a trade at either the end of P2 or at the end of day after P2 based on the risk appetite, wouldn\’t that trade be a CNC trade and not a MIS trade?

That\’s right, the idea is to buy and hold for a few days till the target is hit.

Great Learning!!

Happy learning!

Hello sir,

This is Ambuja cement chart.

The OHLC data for the bearing engulfing pattern (encircled at the top end of the chart) is as below:

P1: Open – 214, High – 220, Low – 213.3, Close – 218.75

P2: Open – 220, High – 221, Low – 207.3, Close – 209.4

The risk Taker will buy on p2 at closing price of 209.4 and stop-loss of higher of p1 & p2 i.e at 221.

My question is how can the stop-loss is higher than the closing price of p2 when there is downtrend in bearish engulfing pattern?

Thats right, SL is always at a higher price than your entry price for short positions.

Nice Read,

Can someone share their experience of using Engulfing patterns for intraday trading, where the candlesticks are available on a hourly basis. If these are not beneficial what other indicators would you recommend for intraday trading.

I hope others can answer this for you 🙂

Personally, this is one of the better patterns that I\’ve used.

all this module are super educative….superbbbb

Happy learning, Neelam!

Hi Karthik. Is presence of the Doji on a Bullish Engulfing Pattern a high probability trade. In your above teaching, you have mentioned it on a bearish Engulfing Pattern only?

Relatively yes, but please remember there are no guarantee in markets 🙂

Hi Kartik,

I am learning technical analysis from Varsity app. Thank you for bringing such an amazing content.

My query is regarding \”Presence of Doji\”. Here you have explained about the Doji following a Bearish Engulfing.

My Question: In case of downtrend if a bullish engulfing is formed followed by a doji irrespective of it being red/green, will the candle\’s real body be bigger on Day4?

The expectation is that day 4 will be a long bearish day.

How stop loss (i.e High of P1 and P2) in bearish engulfing pattern will be helpful ? As when bearish engulfing pattern formed , so one should short the trade and if stop loss is set to high of P1 and P2 then it is already reached , so trade will execute at any cost and we get loss from it?, please help to understand this. Thanks in advance.

No, SL is placed after you initiate the trade right.

Thanks for the reply sir!

Good luck, Aravindh.

Yes sir it is a EOD chart. As you had said for a bullish pattern the prior trend must be a downtrend. How many trading sessions should be considered to be qualified as a downtrend. I mean certain patterns form after a good down move whereas certain patterns form after a small down move like 4 or 5 candles. Which one can be considered as a downtrend.

I\’d look at at least 5-8 sessions of downward movement or at least 8 -10% decline in value for calling it a short term downtrend.

https://drive.google.com/file/d/1EfHAYiXi7XTVBCSDtBFnJqMSlWh67o9r/view?usp=sharing

In this chart the latest candle has formed a bullish engulfing pattern. But can it be considered as a downtrend because it is only a small move with 4 or 5 candles. How many candles or how much move can be considered as a downtrend or an uptrend?

It can be, I\’m assuming this is an EOD chart.

Sir there is a chart of Cipla in bullish engulfing pattern. So after the P2 pattern has emerged there is a red candle on the next day so does this mean that risk averse trader won\’t be executing the trade because of there is a red candle after the formation of engulfing pattern ?

Thats right, Bhavya. The risk-averse traders want a confirmation of the trade picking up in his/her favour.

Hello Karthik,

Fantastic Work!

1) Do these patterns apply to intraday 1 minute candles as well? I read your answers above and they suggest that they can for upwards of 5 min.

2) If i am trading intraday and and analysing at that granularity, then it means that my target will be not too above the CMP. In which case i will have to actually increase my position size to make decent profit = more brokerage+more transaction cost. Have you, in your personal experience, ever found this setup profitable?

Since most of the use-cases which you explain are in the swing-trading space.

Best

1) Yes, you can apply. 5 or 10 or even 15 mins is my personal preference. As a thumb rule, the higher the time frame better it is.

2) Yes, with such a short timeframe you\’d actually be scalping. This means your qty should be higher, leading to higher charges. I\’m not a big fan of this. I\’d rather do 1 trade a day with a proper setup than multiple scalps a day.

Sir to see a day candle patterns which time frames u would prefer ? & another doubt can we apply these all candle stick patterns to intraday trading sir ? and can we use this in options also ?

I\’d prefer the end of day candle, Babu. Yes, can be applied to intraday and options as well.

@karthick, Why it is mentioned as Day 1 & Day2 for the engulfing candles P1 & P2. Do we need to look the engulfing pattern in 1 day pattern chart?

Yes, I\’d suggest you use EOD charts for this.

What if Doji appears at the end of Bullish Engulfing pattern, can we consider this a big trading opportunity?

Yup, doji after any pattern indicates the possibility of a large move.

Hi Sir,

if a doji if formed on a bearish engulfing day then only a risk-averse trader can take that trading opportunity because the risk-taker would have initiated his trade on P2.. is this statement correct?

Thats right.

Hi sir,got to konw about this varsity through nikol sir\’s podcast in beerbiceps.

And it\’s absolutely fantastic content and it can be understandable with little effort as you have done the major part in realising it.🤗

Thank you very much.

I am confused to qualify a pattern as engulfing if the market open up with a gap up in bullish engulfing and gap down in bearish engulfing.

Please help me.

Happy to note that, Santhosh. I\’ve tried to explain this in the chapters itself. Do let me know if you have any questions about this.

How to select stocks for intraday?

I\’d prefer sticking to Nifty 50.

\”Day 1\” and \”day 2\” is representing the whole day of intraday trading or is it using in intraday trading?

It refers to a candle, if it\’s 5 mins intraday, then a 5 mins candle will be the reference.

Hi Sir,

Will there be any presence of doji in the downtrend?

Possible right.

I am unable to see any chart.

Please help..

Why? What is the issue, Anand?

Can you explain this (it was in the quiz)

Q. What would you expect when a doji is formed right after a bullish engulfing pattern

Doubt: you said when a doji is appeared it indicates indecision in the market, but the answer to the above question in the quiz was \”A large up-move

That\’s correct. Doji right after a bullish engulfing indicates a probable upmove.

Hi Karthik,

How can we short the position on day closing i.e 3.20 if we don\’t have shares & position need to be squared off the same day

You can always initiate the trade in the futures or in Derivatives.

Oh I did just above my last comment. I think you missed it

I\’m really beginning to be a beginner so pardon me if my question is a bit silly.

Not an issue, please ask whatever questions you have in mind.

Hi Karthik,

I didn\’t quite understand the reason behind a doji catalyzing the patterns\’ effects. When we discussed about doji in the \”single candlestick patterns\” section, it was mentioned a doji indicates indecisiveness of the market and that we could square off half our positions in the market at the occurrence of one, so why did our reception to a doji change from \’a possibility of trend reversal\’ to \’a pattern intensifier\’?

Thank you so much for such great content.

I had a smal doubt.

*From my own personal trading experience, I can tell you that whenever a doji follows a recognizable candlestick pattern, the opportunity created is bigger.*

I have borrowed this line from above text. 2 questions reagrding this:

a) If 2 dojis are formed after a recognizable candlestick pattern; is the opportunity created even bigger or should we reject it?

b) You have illustrated that doji after engulfing is better than only engulfing. Is it true with other candlestick patterns as well? With single as well as multiple candlestick patterns?

Ex. ( Marbuzo followed by doji is better than only marubuzo) or ( piercing followed by doji is better than only piercing) or ( haramifollowed by doji is better than only harami) etc.

a) 1 or 2 does not really make a difference. More than that, maybe the market is trying to signal something else.

b) Thats right, infact this is what I mean with the above line.

I really appreciate your effort on the lessons. On the few module I came across word called \’trading sessions\’. I didn\’t understand the term meaning. Is it meant trading days i.e Monday, Tuesday… Friday or stock market timings i.e pre-opening session, normal trading session. I have seen \’2 trading sessions\’ in this module also. Please clarify my doubt.

That\’s correct Leo. A trading session refers to the trading day.

ohh i got it because he is shorting !!

also a request could you change the comments layout the newest ones at the top would be much better.

Noted.

>A risk-taker initiates a short trade at the close of P2 after ensuring P1 and P2 together form a bearish engulfing pattern. The risk-averse trader will initiate the trade the day after P2, after confirming the day forms a red candle.

>The highest high of P1 and P2 forms the stoploss for a bearish engulfing pattern

sorry I did not get this if the price is going to go even lower the next day why would i buy and how highest high a stoploss

can you explain with your example of OHLC what happens how does he book profit ?

Tanmay, I\’ve explained the logic in the chapter and in the comments section. Can you please glance through it once? Thanks.

Can these trends be utilised for an intraday trade by seeing 5/10 or 15 mins chart or it has to be a one day chart ?

Yes, you can. Higher the time frame, the better it is.

What if a Doji follows a bullish engulfing pattern right at the bottom end of the downward rally.. ?

Check if the SL has been breached or not. Else continue to hold the position.

A trade should satisfy at least 3 to 4 points on this checklist to be considered a qualified trade.

What is checklist point ?

The checklist is mentioned in the latter part of this module. Please do check the same.

Sir, why is it ?

I would put my money on the bearish engulfing pattern as opposed to a dark cloud cover.

Bearish engulfing pattern — more bearishness

Dark cloud cover — bearishness (50% and below 100%)

Then, we should chose dark cloud cover right ? If not why ?

I\’d prefer the engulfing pattern since the bearishness is kind of clearer between the two.

Can we use this approach for intraday also

Yup, you can.

Hey karthik, Can you please explain about the Options and Futures?

Please do look at the subsequent modules.

\”This means the trading opportunity evolves over a minimum of 2 trading sessions.\”

In the above statement 2 trading sessions means minimum of 2 candlesticks right. So if its a 15 minutes chart then it means in the next 2 candlesticks the trading opportunity would evolve. Right?

Yes, two 15 mins candles, so basically over 30 mins.

What time frame to select for determining all these patterns for intraday trading

I\’d suggest 10 or 15 minutes.

hi! I have a confusion for uptrend and downtrend, like in the chart shown after 8.4, the presence of Doji, the uptrend shown has some downtrends too, so how many candles should be considered for it to be called a trend ? can 1 candlestick before the actual pattern also be called as a trend ? for eg, its an upward trend then 1 candle is bearish and then a hanging man is formed ? also, two conditions if its formed at the top and if its formed at the bottom?

Like I\’ve mentioned, at least 10-12 session you should consider.

Thank you sir👍🏻

Good luck, Ashish.

Dear Sir,

Does all these single and multiple candlestick patterns are applicable to identify trading signals for intraday trading too?? Or only swing for trading?

Warm Regards..

Ashish, it is applicable across all time frames, intraday and overnight.

In example you mentioned day1/day2……What about if we refer hourly chart???

You can use the same logic for hourly charts as well. Remember, TA works across all assets and all time frames.

P1 and P2 refers through out article are the candle sticks encircled in end of Day 1 and Start of Day2 or entire day?

P1 and P2 refer to the candle formation at the end of the time period, which could be the end of day or the end of an intraday time frame.

Sir from past one week even volatility based stop loss is getting triggered trade goes in my direction and one bad day like today 5-6% down and I\’m struck and no other option to exit

Hmm, thats because the markets are quite volatile Chandu.

Sir for Swing trade should we keep low as stoploss

I follow keeping volatility based stoploss due to this Risk reward ratio is not good I\’m avoiding trades because of this.

Yes, volatility-based SL is good Chandu.

Amazing content. I learnt a lot from these. Thank you for making this free for all. There is error in point no 4 and 7. Risk-averse and risk-taker is interchanged.

Thanks, Rishabh. Will make that change 🙂

Hello Sir, I am having a doubt this chapter begins with the statement

\”his means the trading opportunity evolves over a minimum of 2 trading sessions.\”

This term \”TRADING SESSION\” has been used for past few chapters does it simply mean one day? or does it depend on the timeframe in which we are viewing candlesticks

Trading session = 1 full trading day.

What would be the stop loss in the piercing pattern?

1. Low of the candle P2.

OR

2. Lowest low between the P1 and P2.

Lowest low between P1 and P2. Holds true of other patterns as well.

hi, i am looking at the candlestick chart of escorts ltd.with a 5 minute time frame, there bullish engulfing was formed 2 times and both the time the stock fell from that point. Not only here, in almost every stock i am seeing nowadays that the stock is falling after bullish engulf and rising after bearish engulf.

Rishav, there are no guarantees in the market, we just weigh in on the odds. Hence we have the checklist 🙂

It was really really knowledgeable.

Happy learning, Kevin!

can you add a dark theme

Sure, noted.

Hi sir,

Can we use these candlestick patterns to trade in intraday on 5 minute candlesticks?

By range I meant what would be the TRUSTABLE Candle Body Length for INTRADAY . And could we trust multiple candlestick pattern in intrady trading ??

Trust is a function of how rigorously you have backtested the candlestick patterns 🙂

Hi Sir ,

As mentioned Engulfing, harmai, piercing , dark cloud , morning & evening star Should be seen on 2-3 day timeframe. But when we do INTRADAY can these pattern be trusted in 5,15, or 30 min time frame & if yes then what Should be the reliable range of candle because in shorter time frame it\’s rare to have candle with 1 % body range

Thats right, Ayush. I\’d suggest you look at 10 or 15 mins candles, but I don\’t get your question on the range bit. End of the day, you only look for the pattern right?

Sir – for short term view say for few weeks – which time frame is useful on the chart – Monthly ??

I\’d say EOD.

Can elaborate EOD basis I don\’t what know what that means

EOD = End of day basis.

Are we supposed to use engulfing on only day basis ?

Can i use them in intraday as well for maybe 15min timeframe?

You can use it on EOD basis as well.

For uptrend should I set my stop loss at the support line or just below it?

Thank you so much.

Just below may be good since you have the trend going in your favour.

Sir, if a doji is engulfed by a blue or red candle, you can still call an engulfing bullish or bearish?

Thank you.

Hmm, technically yes, but I\’d not base my trades on that.

Hi Its a nice and very great effort by you . thank you so much for that..

few questions i have

Single candle stick works for which time frame best?

Does multiple Candle sticks always need to work on daily chart only, or it works on 15-30 minute time frame also?

From your experience and perspective, which candle pattern is most profitable?

There is no preference of single candlestick and timeframe. YOu can use all candlesticks patterns with all the timeframes. The profitability depends on how well you manage risk.

Sir how can one short stock when it is at resistance in spot market.. following the checklist if evening g star forms at resistance with prior uptrend should I go ahead and short if other checklist confirm

It could lead to short delivery right??

Yes, as I mentioned, give more emphasis on the CS pattern and everything else is auxiliary.