The topic of Fibonacci retracements is quite intriguing. To fully understand and appreciate the concept of Fibonacci retracements, one must understand the Fibonacci series. The origins of the Fibonacci series can be traced back to the ancient Indian mathematic scripts, with some claims dating back to 200 BC. However, in the 12th century, Leonardo Pisano Bogollo, an Italian mathematician from Pisa, known to his friends as Fibonacci discovered Fibonacci numbers.

The Fibonacci series is a sequence of numbers starting from zero arranged so that the value of any number in the series is the sum of the previous two numbers.

The Fibonacci sequence is as follows:

0 , 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610…

Notice the following:

233 = 144 + 89

144 = 89 + 55

89 = 55 +34

Needless to say, the series extends to infinity. There are few interesting properties of the Fibonacci series.

Divide any number in the series by the previous number; the ratio is always approximately 1.618.

For example:

610/377 = 1.618

377/233 = 1.618

233/144 = 1.618

The ratio of 1.618 is considered as the Golden Ratio, also referred to as the Phi. Fibonacci numbers have their connection to nature. The ratio can be found in the human face, flower petals, animal bodies, fruits, vegetables, rock formation, galaxy formations etc. Of course, let us not get into this discussion as we would be digressing from the main topic. For those interested, I would suggest you search on the internet for golden ratio examples, and you will be pleasantly surprised. Further into the ratio properties, one can find remarkable consistency when a number is in the Fibonacci series is divided by its immediate succeeding number.

For example:

89/144 = 0.618

144/233 = 0.618

377/610 = 0.618

At this stage, do bear in mind that 0.618, when expressed in percentage is 61.8%.

Similar consistency can be found when any number in the Fibonacci series is divided by a number two places higher.

For example:

13/34 = 0.382

21/55 = 0.382

34/89 = 0.382

0.382, when expressed in percentage terms, is 38.2%

Also, consistency is when a number in the Fibonacci series is divided by a number 3 place higher.

For example:

13/55 = 0.236

21/89 = 0.236

34/144 = 0.236

55/233 = 0.236

0.236, when expressed in percentage terms, is 23.6%.

16.1 – Relevance to stocks markets

It is believed that the Fibonacci ratios, i.e. 61.8%, 38.2%, and 23.6%, finds its application in stock charts. Fibonacci analysis can be applied when there is a noticeable up-move or down-move in prices. Whenever the stock moves either upwards or downwards sharply, it usually tends to retrace back before its next move. For example, if the stock has run up from Rs.50 to Rs.100, it is likely to retrace back to probably Rs.70 before moving Rs.120.

‘The retracement level forecast’ is a technique that can identify upto which level retracement can happen. These retracement levels provide a good opportunity for the traders to enter new positions in the trend direction. The Fibonacci ratios, i.e. 61.8%, 38.2%, and 23.6%, help the trader identify the retracement’s possible extent. The trader can use these levels to position himself for trade.

Have a look at the chart below:

I’ve encircled two points on the chart, at Rs.380 where the stock started its rally and at Rs.489, where the stock prices peaked.

I would now define the move of 109 (380 – 489) as the Fibonacci upmove. As per the Fibonacci retracement theory, after the upmove one can anticipate a correction in the stock to last up to the Fibonacci ratios. For example, the first level up to which the stock can correct could be 23.6%. If this stock continues to correct further, the trader can watch out for the 38.2% and 61.8% levels.

Notice in the example shown below, the stock had retraced up to 61.8%, which coincides with 421.9, before it resumed the rally.

We can arrive at 421 by using simple math as well –

Total Fibonacci up move = 109

61.8% of Fibonacci up move = 61.8% * 109 = 67.36

Retracement @ 61.8% = 489- 67.36 = 421.6

Likewise, we can calculate for 38.2% and the other ratios. However one need not manually do this as the software will do this for us.

Here is another example where the chart has rallied from Rs.288 to Rs.338. Therefore 50 points move makes up for the Fibonacci upmove. The stock retraced back 38.2% to Rs.319 before resuming its up move.

The Fibonacci retracements can also be applied to falling stocks to identify levels upto which the stock can bounce back. In the chart below (DLF Limited), the stock started to decline from Rs.187 to Rs. 120.6 thus making 67 points as the Fibonacci down move.

After the down move, the stock attempted to bounce back retracing back to Rs.162, which is the 61.8% Fibonacci retracement level.

16.2 – Fibonacci Retracement construction

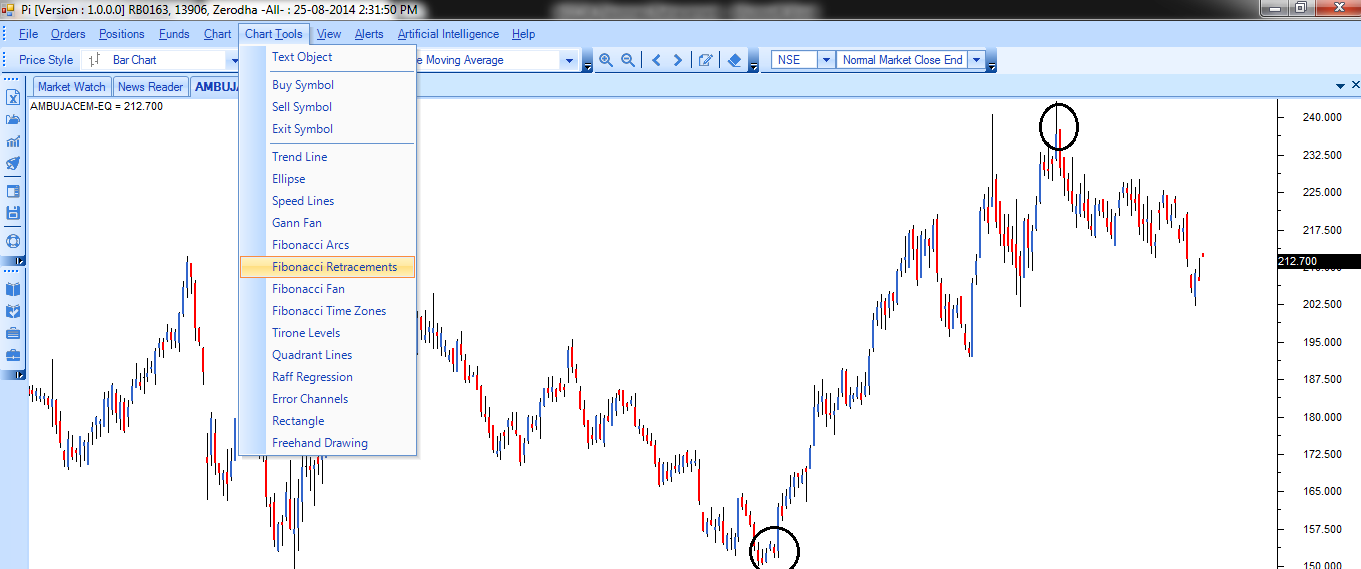

As we now know, Fibonacci retracements are movements in the chart that go against the trend. To use the Fibonacci retracements, we should first identify the 100% Fibonacci move. The 100% move can be an upward rally or a downward rally. To mark the 100% move, we need to pick the most recent peak and trough on the chart. Once this is identified, we connect them using a Fibonacci retracement tool. This is available in most of the technical analysis software packages including Zerodha’s Pi 🙂

Here is a step by step guide:

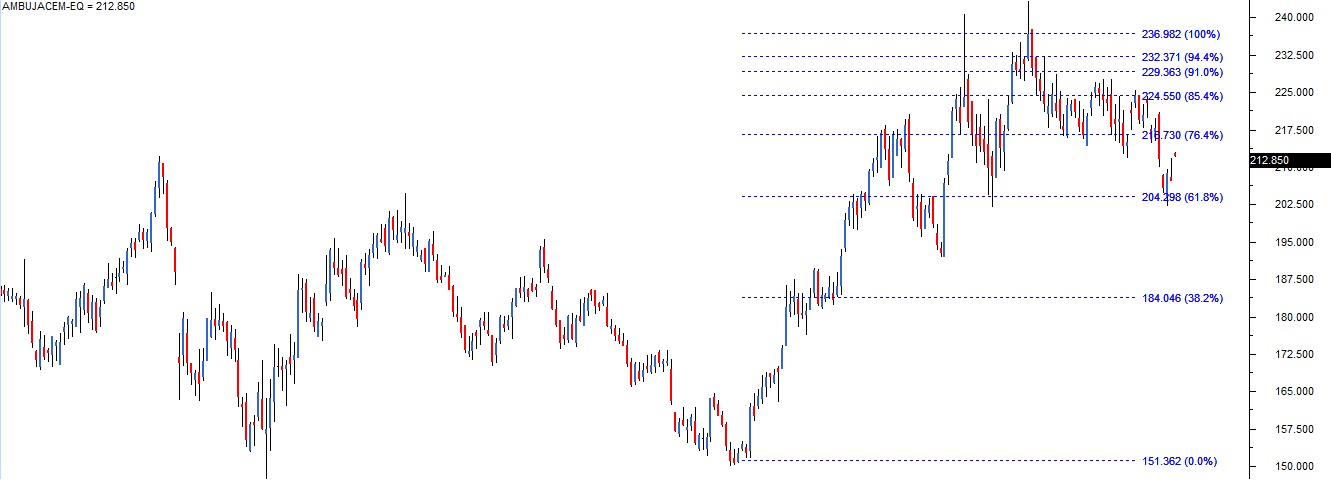

Step 1) Identify immediate peak and trough. In this case, the trough is at 150, and the peak is at 240. The 90 point moves make it 100%.

Step 2) Select the Fibonacci retracement tool from the chart tools

Step 3) Use the Fibonacci retracement tool to connect the trough and the peak.

After selecting the Fibonacci retracement tool from the charts tool, the trader has to click on trough first, and without un-clicking, he has to drag the line till the peak. While doing this, simultaneously, the Fibonacci retracements levels start getting plotted on the chart. However, the software completes the retracement identification process only after selecting both the trough and the peak. This is how the chart looks after selecting both points.

You can now see the Fibonacci retracement levels are calculated and loaded on the chart. Use this information to position yourself in the market.

16.3 – How should you use the Fibonacci retracement levels?

Think of a situation where you wanted to buy a particular stock, but you have not been able to do so because of a sharp run-up in the stock. The most prudent action to take would be to wait for a retracement in the stock in such a situation. Fibonacci retracement levels such as 61.8%, 38.2%, and 23.6% act as a potential level upto which a stock can correct.

By plotting the Fibonacci retracement levels, the trader can identify these retracement levels, and therefore position himself for an opportunity to enter the trade. However please note like any indicator, use the Fibonacci retracement as a confirmation tool.

I would buy a stock only after it has passed the other checklist items. In other words, my conviction to buy would be higher if the stock has:

- Formed a recognizable candlestick pattern

- The stoploss coincides with the S&R level.

- Volumes are above average.

Along with the above points, if the stoploss also coincides with the Fibonacci level, I know the trade setup is well aligned to all the variables, and hence I would go in for a strong buy. The word ‘strong’ usage indicates the level of conviction in the trade set up. The more confirming factors we use to study the trend and reversal, more robust is the signal. The same logic can also be applied for the short trade.

Key takeaways from this chapter

- The Fibonacci series forms the basis for Fibonacci retracement

- A Fibonacci series has many mathematical properties. These mathematical properties are prevalent in many aspects of nature.

- Traders believe the Fibonacci series has its application in stock charts as it identified potential retracement levels.

- Fibonacci retracements are levels (61.8%, 38.2%, and 23.6% ) upto which a stock can retrace before it resumes the original directional move.

- At the Fibonacci retracement level, the trader can look at initiating a new trade. However, before initiating the trade, other points in the checklist should also confirm.

Hello karthik sir, I want to check Fibonacci retractment but zerodha have discontinued pi software as it was handled by third party. So how to check above indicator now?

Why not try it on Kite?

Not able to find fibo indicator

Do call the support center for this, Aniket.

Hello karthik sir,

Sir is it possible to use this indicator for intraday trading for accurate confirmation or should i use this for only for few days or weeks. And also, what should be the ideal timeframe for the candles if im using the indicator on intraday and swing trading?

By the way sir love the way you have curated the modules which is easy to understand even for a begineer like me.

Thanks for the kind words Nikhil. Glad you found the modules useful.

I personally prefer to use these indicators on an EOD basis.

I want to appreciate in that your illustration it teaches me yo draw the fibonacci retracement and l know to follow the trend and to understand the price action of the chart.

Sorry, can you please elaborate on this?

I am unable to see this indicator in Zerodha. please help.

I\’d suggest you call the support desk for this, they will help you with this.

How much will the stock go up once it bounces from particular level? It would go up to resistance.

Correct me if I am wrong

That no one really knows, but yes, the expectation is that it will go back to recover all the way till resistance.

Sir my Question is, How do we know whether the price reverse in 61.8 or 38.2

Ah, that nobody can say, we can only draw inferences, thats it 🙂

sir,how can i identify whether it is a 100% fibbonaci move? And for what time in each time frame it must see a sharp trend?

Its not possible Prashant, its all based on your observation and reading of the markets. The indicator only gives you hint, but there is no guarantee.

fibonacci indicator is not available on zerodha, what to do?

Have you checked the ChartIQ version? Else, please call the support desk, they will help you with it.

hello kartik sir , sir but when the stock prices come back to the Fibonacci retracement levels how do we know whether the prices are gonna go up or down ,

That no one will know, Aditya. Your guess is as good as mine. But the indicator suggests that there is a chance of reversal from these levels.

Hey Kartik,

What should be the 3 targets, after stock is retraced back to 23.6%.

Based on the immediate resistance will work.

Okay, thnx alot

Happy learning!

sir please help me understand what should be the S&R for intraday trading and swing trading. I specifically want to know what should be the timeframe for these tradings and how many previous candles I want to consider?

You can look at 15 mins or even 30 mins candle for plotting intraday S&R. The minimum look back period for this should be 15 days.

Hi karthik,

In one of your comments you suggested to read all the modules first then start trading

but can start with paper trading now. I have reached reading till here.

Can you please suggest how do i start doing paper trading?

Harshit, paper trading is just about identifying a real trade with real SL, target, position sizing, etc., but not actually taking a trade but only tracking it virtually. This way, you will know if your thinking is right about a trade.

1. What is the importance of the 61.8 % ratio in an uptrend?

2.What is the importance of the 61.8 % ration in a downtrend?

3.What is the importance of the 38.2 % ratio in an uptrend?

4. What is the importance of the 38.2 % ration in a downtrend?

5. What is the relation between.618 and 1.618?

6. What is the relation between.886 and 1.13?

7. What is the relationship between.786 and 1.272?

All these numbers stems from the theory backing the retracement theories 🙂

Unable to see the Fibonacci tool on Kite

It is on the Draw/pen tool

Hello kartik sir how I can find kite app ? Pls help

Look for Zerodha Kite on play store or the app store 🙂

Can u explain the significance of fib ext and how the price reaches 1.618level after making a swing high and swing low and when we connect those points with fib ext in future the price is extending towards 1.618 level can you tell me why

We explain this and more in Varsity Live. Please do consider joining the session, its free anyway – https://varsitylive.zerodha.com/programmes/f4747acb-e1f7-458a-94bb-1a154d256795

Hii Karthik!

While studying the chapter, I noticed that in most Fibonacci Retracement images, the 0% level is positioned at the top. However, there are a few instances where 100% is at the top. Additionally, the Construction section states that the top should be marked as 100%.

From my Observation:

– When drawing a retracement from Low to High on the graph, the 0% level appears at the top.

– When drawing a retracement from High to Low on the graph, the 100% level appears at the top.

Does this mean:

1. If a stock is in an uptrend and we want to determine the levels it might retrace to before resuming its upward movement, we should draw the retracement from Low to High, placing 0% at the top.

2. If a stock is in a downtrend and we want to identify potential pullback levels before it continues downward, we should draw the retracement from High to Low, placing 100% at the top.

Additionally, can we consider these Fibonacci retracement levels as potential support or resistance zones, depending on the trend of the stock?

Thank you in advance.

So if a stock is in an uptrend and then it starts to decline, then our objective is to find out (via fib retracement) to what extent it can retrace. So the top will be 0% and 100% and the bottom. Exact opposite when the stock is in a downtrend.

Btw, you can check this – https://varsitylive.zerodha.com/programmes/f4747acb-e1f7-458a-94bb-1a154d256795 we run a live demo of this during class.

I am unable to find fibonacci extension to ol in kite, with which name I have search in kite?

Please call the support desk, they will help you with it.

The problem is where to identify and plot the fibonacci diagram when there are many peaks and troughs. You said \”immediate peak and trough\”, but how to identify that whether we are choosing the right peak and trough ?

Yup, in a typical chart there are many peaks and troughs. However, what you can do is look at only the recent one. The older ones wont matter anyway.

as the trough is 150 and the peak is 240 how a 90 points is 100 % ?

From the peak of 240, if the stock declines to 150, then it is a 100% decline.

For fobbonacci retrace ment which time frame should be used please guide me

You can use any timeframe that you are comfortable with. My personal preference is EOD.

Due to my personal experience of huge losses just following Fibonacci only, I would say that Fibonacci indicator is only useful up to a certain levels,like 38% 61% 161% and upto 261% level . And if you trying think more deeper about it, no-one worst as worst as Fibonacci. I would say that the Fibonacci trader is always confused and desperate to make a confirmed decision. In my opinion, it is better to make trading decisions by predicting moving average and RSI indicator along with Fibonacci indicator.

Sure, thanks for sharing your perspective.

This article is outdated. As per https://support.zerodha.com/category/trading-and-markets/corporate-actions/general/articles/where-can-i-download-pi Zerodha has discontinued Pi and no longer provides support for it.

In Kite i can\’t find any indicator for fibonacci .

Where can i find it ?

The indicator remains the same, Asha. No change in that 🙂

Hey Karthik!

What if the retracement breaks down? i.e. what should be the strategy after it breaks the 61.8 ratio too? what to expect after this point?

You should position your trade in such a way that you are prepared to deal with a situation where there is a break. No pattern or indicator gives your guarantee, they are all just odds. Some odds are better than others.

I think it was posted in 2014 but am reading it in 2024. Someone will also read it in 2140. If the world still exists .

I hope so too!

I must commend the team behind Zerodha Varsity for their exceptional work in imparting invaluable knowledge on stock market fundamentals, technical analysis, and broader financial concepts. The effort and dedication put into creating such a comprehensive learning platform are truly commendable.

As someone who spends significant time studying indoors, I find myself constantly engaging with your content. However, I believe incorporating a dark mode feature would significantly enhance the user experience. A darker interface not only reduces eye strain but also aligns with the preferences of many users who work in low-light environments.

I look forward to seeing how Zerodha Varsity continues to innovate and cater to the needs of its users. Keep up the great work!

Thanks so much for the kind words, Erik. Your feedback on dark mode is noted. I\’ll share this with the team.

Isn\’t the 4th pic in Fibonacci Retracement construction section wrong. As per my understanding if there is an uptrend move, the levels should from the bottom of the uptrend with 100% and move till the top to 0%

Hmm, open for interpretation. There is no perfect way of doing this 🙂

I think all methods are unable to predict 100% . But all the methods work upto a certain limit.

Only experience gives good result

That is perfectly correct 🙂

nice

hey hii all can any one tell me there is a setting in fibonachi retracement of reverse for what purpose that option are there????

you can aslo check on trading view by draw fibonachi tool then click on seeting icon then click on STYLE tab scroll down then the option will appear……

Its for figuring shorting opportunities, Devansh.

http://zerodha.com/varsity/wp-content/uploads/2014/10/M2Ch16-chart6.jpg

In this image here, I agree with the circle you have placed on the peak, but I find the positioning of the trough slightly confusing. Why haven\’t we considered the local minimum at 202.5 as the trough. What is the correct selection criteria for peaks and troughs.

I believe this depends on the trader. If you are an intraday trader, you see last few sessions\’ or last few days\’ data. Whereas if you are a swing trader, you would look back at a greater amount of time in the past.

I prefer to see the data for last few days, Eshaan and prefer to pick the trough which is the lowest within my viewing period.

good reading and info

Thanks. Happy learning!

Hello Sir! I want to clarify something if my current trend is at highest price and I am planning to buy stock then which level should I wait for the current price to fall?

Ah, this really depends on the stock price and the trend in the stock price. One answer wont fit all situations.

Hi , Karthik in kite if i select through first it shows 100% so i have to select peak first then drag it to through in uptrend so that peak will be in 100%

Thats right, basically you have to connect the peak and trough in the direction of the stock movement.

The level from where it has been retraced till 23.6 it would be the next target if share bounce back towards original direction after retracement is my interpretation is correct regarding target

What should be the stop loss sir in this case?

Lets say the staock cracks from 100 to 76, now you expect the stock to go back to 100, so one thing that you can do is keep, 76 as a your initial SL and keep trailing it as and when the stocks inches towards 100.

Hello Karthik Sir,

I have a question for you, let\’s say the particular stock retraced by 23.6% and we are lucky enough to identify it at the right time and accumulate it.

What should be my price target in this particular trade for exit? And What should be my stop loss?

Could you please answer this? I will be looking forward for your reply.

Thank you and Wish you a very happy new year🎊

One easy set up is that the min target could be the price from which it retracted with the 23.6% retracement price point as your SL.

Hi how to we plot the next retracement in case the peak breaks.

By using a trend line, Mahesh.

0.5 is also an important Fibonacci level.

Correct me if I am wrong.

Yes, since its 50% retracement.

What period should be selected on x-axis – day or moths or 3 months

You could look at maybe 6 months data as a starting point.

sir..

1) Fibonacci retracements previous trend on applied otherwise going on trend apply ?

2) Going on trend in how to find peak point? through resistance?

3) trough meaning?

4) AND sir i am new in market learn through varsity…now i want to pratcies all i leant …suggest any paper trading app/website to apply TA

1) Not sure about this query, can you share more context?

2) The point at which the price changes direction marks your peak and trough

3) The end point of the crash

4) YOu can look at markets and track any 2-3 stocks of your linking and get a sense of how the market is behaving.

Sir please suggest book for reading on fibonacci trading strategies. Thank you

Nothing specific for fibonacci itself, Gireesh. Its a small concept and is usually one chapter within any TA book.

Whether it is drawing Fibonacci or trend Line , Rectangular or any other mark/ high lightened mark is not able to use or see once refresh the chat. Once again we have to draw the line .

S it is my request to modify and make some arrangement just like fyer etc , where one we plotted the trend line , Fibonacci etc , it will be on the Chart even after refreshing the chart . But in Zerodha this facility is not available.

Suresh, I\’d suggest you speak to the support desk for this.

Thank you sir

Happy learning 🙂

If possible then please make a script or video on how can we draw fib retracement in different condition to get levels to trade

Noted. But meanwhile, you can also call our support desk to figure how you can use the tool.

I am unable to find Fibonacci retracement tool on kite .pl do the needful .

I\’d suggest you call the support team for this, they will help you with it.

can I use Fibonacci retracement in case when stock price breaks initial support/resistance

and now for knowing new target ?

Dont think you can use what we have discussed here. But I guess there is something called Fibonacci projections, which you can use. Please double-check this, as I\’ve never used this myself.

Sir , some people connect low to high & some High to low , what should be exactly in selling and buying ,low to High or High to low . And it is feasible in weekly chart too?

Sir , some people connect low to high or some high to low , please tell what we should do in buying or selling .is it feasible in weekly chart also?

If the stock has rallied a lot, then connect the low to high to see the extent of retracement. If the stock has declined, connect the high to low to see the extent of bounce.

The charts in 16.1 and 16.2 show opposite values of 0% and 100%. I\’m assuming 16.1 is the correct one. If so, please update the chart in section 16.2.

Sure, let me check this.

Serodh,

I like the way you handle queries with grace. Please what is the highest vertical distance [trend] a stock or a currency pair can make before retracing … Hear from you soon ✅

Thanks, but no one can really predict that 🙂

Hi Girish,

Is Gann still working for you?

What would be the most appropriate time period to consider for forming a trough and peak line?

There is no such thing as an appropriate time; it is dependent on how the market is moving.

Hi Karthik,

Regarding Fibonacci retracements, is there a reason as to why it works from a market participant point of view? For example, you had explained what each candlestick pattern meant in terms of what the bulls and bears are thinking. I was wondering if a similar explanation exists for Fibonacci retracements. It just feels a little hard to digest, that these Fibonacci ratios which have nothing to do with the market at all can end up explaining the markets so well(ofc not in all cases). Also a hearty thanks for designing these modules, really helpful 🙂

Regards,

Abhishek

I\’m also not sure, Abhishek 🙂

Great Sir. I used to plot Fib chart but did not know the meaning and sense. I can now plot the graph with knowledge and confidence. Thanks for the concept.

Happy learning, Swetha!

I AM NOT ABLE TO DRAW FIBONACCI RETRACEMENT IN ZERODHA KITE PLEASE GUIDE.

Please call the support desk, they will help you with it.

Hi, in the fib tool 23.2 % retracement is not visible on the chart despite ticking it in checkbox, can anyone help please by letting know how to get it on chart, thanks

Can you please speak to the support desk for this?

Can we use this theory in very short data of option trading to catch fast moves..??

I\’d avoid doing that, Bhaskar.

Hi,

Could you please show with example how from Kite platform we can use the Fibonacci retracement as now we don\’t have PI anymore supported by Zerodha.

Thanks and Regards

Dont have Fibonacci in particular, but you can find tons of other things related to TA here – https://www.youtube.com/watch?v=yzRP-mA2eiE&list=PLX2SHiKfualH_xMbGM-3zWC47s9gUjGR_

thanx a lot sir ji.

you responded this query sir but still not clear to me .

Please see my recent comment. Hopefully that will help.

sir my 3rd point was can we use (EOD) daily time frame for intraday because you said for intraday we should use 5min, 10 min,or 15 min timeframe, so is it good that we can use daily time frame (i.e EOD chart) for intraday, i think daily time frame is suitable for long swing… please clear my doubt and please tell me is it ok to use daily time frame for intraday trading.

Neeraj, you can use EOD chart for intraday as well. Check this – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

The basic question being how do you know the stock has peaked and ready for retrace

You will know that only after the stock starts to correct. Not possible to identify the peak.

1- If i am trading F&O in bank nifty and i have to check volume and apply TA, So i have to apply TA on bank nifty original chart(spot chart) not the derivative and but for volume what should i do , should i check volume on future or option chart for this, is it right, but will this not be typical to go through both different chart.

2- another query is you said most of the time that EOD is preferable according to you most of the time because larger the time frame less will be noise and quality signal will occur, but EOD chart analysis can be apply for futures and options both. OR it is just for swing, \’

3- we cannot use EOD chart for intraday right? it should be 5,10,15 min . please elaborate all point sir ji thank you

1) Yes, you can do that. But for stock, you can only look at stock chart (spot)

2) You can apply for F&O also

3) You can, no problem with it. Its just that most people find it comfortable to use intrday chart for intraday trading.

🙏 Thanks.

Got it, thanks 🙂

Hi Karthik, I know it\’s been a while since you posted this, but hoping that you still answer queries for the same.

Q: WHY exactly does the Fibonacci retracement work? I read online that it\’s mostly just self-fulfilling, is that the only reason?

Shankar, I really dont why. Maybe its self fulfilling 🙂

Sir, I have read all the concepts prior this fibonacci theory and dow theory, based on those concepts can I start the trading journey or should I learn all of it first? please let me know.

I\’d suggest you complete the module to the end. But do start off with paper trading now itself.

What is S&R?

Can we take the trough and peak during the first two hours of trade and plot Fibonacci drag graph for the rest of the day

Yes, you can. But not very effective, I think. Please back-test it once.

You have suggested to

1 stop loss, S & R levels

2 volume be above average

My query is

1 what is S & R levels?

2 how to check volume?

1) S&R = Support, and Resistance

2) You can check volume on charts, usually present below the price chart.

I\’ve explained both these concepts in this module.

Is there any book to learn about Fibonacci or specific video collection, please refer that to me.

No, I\’m not sure if there is one on this specific topic.

What are the key rules to become a giant in stock market?

No idea.

What is that method about?? If you can…put some light on it..

Thank you…

Which method, Jignesh?

The logic is purely psychological. Right

Because most of the traders expect these level are of some reversal stage so it bounces back

Is this correct

Thanks

Yup, these are psychological levels which seems to have caught the fancy of traders many years ago 🙂

Why Volume Bars below Charts are not showing in Bank Nifty Chart?

Check Bank Nifty futures.

Hi Karthik,

Is there any video that can help understand how to draw & use the fib retracement and fib extension tools in Zerodha environment ?

Thanks

G

Ah, no video on this Gunjan.

sir,

what is the actual meaning of 100% fibonacci move.

It means that the stock price has cracked to the point it started its upward movement. For example, if a stock rallied from 100 to 140, and then falls back to 100, then it\’s a 100% decline.

Hey kartik \”I would now define the move of 109 (380 – 489) as the Fibonacci upmove.\”

How can u decided that it is a 100% upmove? I mean what should be the value or persentage to confirm a Fibonacci upmove or down move..

Pari, so a stock falls from 140 to 100, then the 100% fall is 40 here. Out of this, if the stock recovers to 120, then its 50% recovery from the fall.

sir please tell me which levels are important in fibonacci retracement?

All the levels, Subhankar.

Why does Fibonacci retracement work practically? I\’m really interested in knowing the mathematical concept behind stock prices always tracing back to such levels. It would be very helpful if someone can clarify it or share any resources on it.

Thank you.

Ayan, this is an empirical observation. I don\’t think it is backed by maths.

Atleast how many candlestick we should take in consideration while drawing Fibonacci retrancment

If you are looking at EOD charts, then maybe at least 2-3 months of data will be good.

If we believe what is being taught, you will never success , as its manipulation.

Now go back to any stock , commodity, crypto, and check 0,25,50,75,100. u will b amazed.

If we believe what is being taught, you will never success , as its manipulation.

Now go back to any stock , commodity, crypto, and check 0,25,50,75,100. u will b amazed.

Can anyone help me to calculate Standard Pivot ( support & resistnce ) levels that we see in Kite app on any Time frame chart ?

Fibonacci tool not available in zerodha .

Sir, after drawings fib level. please provide fib extension for both direction. (ie 1.6 and -1.6 level ) in zerodha tv chart.

Hello Karthik,

Could you please guide me how to draw fib tool correctly?

Like from Open/Close to another Open/Close of candle OR H/L to another High/Low of candle?

Means whether the wick to be considered or not?

Thanks!

You can ignore the wicks, just connect the open and close accordingly.

Fib retracement is available.

1. Select icon below trend line icone on left hand side.

2. select last option there, *fib channel*.

There u go, apply n enjoy retracement.

Should we include the peak and trough\’s wicks as well as. During plotting the retracement levels

Not necessary, real body is good enough.

Dear Sir

I am a ZERODHA Customer.

My friend was telling me that 23.6 has no value.

If the price closed above 38.2%, It will definitely move to 61.8%,

If the price closed above 61.8% It will definitely move to 1.618 Or 161.8%

How far this is valid.

Please clarify if possible in details.

There are no guarantees in markets, these are just probabilities 🙂

What is by perfect Fibonacci move means

Perfect is when the price bounces from the expected fib levels or retraces from the expected fib level.

JI

i couldn\’t find the Fib retrace from the new system. could you guide me to where it was located in the new window.

Ranjit, there are no changes as such. Not sure what you are referring to.

in intraday, u said that we should 5 to 15 mins timeframe to analyze the chart but what if I use a daily timeframe to analyze which candle will be a form bearish or bullish use multi candlestick pattern is that okay do like that

It\’s absolutely ok to do that, Jabastin.

Fibonacci extention is not available in kite app

I find difference in contents between app and website. which one should I follow and which is the latest one?

Mano, both places have the same content. No difference as such.

Hi Karthik,

Fibonacci Retracement regarding: Are the Retracement levels to differentiate between pullback and reversal different for different stocks? In any case they should be 23.6% or 38.2% or 61.8% right?

If I am conservative, I would keep the levels smaller right?

Second question is for Intraday traders, does one keep updating the Fibonacci retracement as new price levels are formed?

Yes, you can Sathya. Fib is not a great indicator for intraday if you ask my opinion 🙂

Hmm guys it\’s available that indicator is not available on indication options

There is option in insert drowning and below trend line that option is available 👍

How do I apply this tool in a live trading?

YOu can plot this on a 10 or 15mins chart intrday, Arif.

Can we use Fibonacci retracement tool as a long term trade? Or it is only for intraday?

You can use it for short term trades, not long term 🙂

can i apply fibonacci in intraday

Yes, you can.

WHAT IS THE TIME FRAME BETTER FOR Fibonacci

End of day if you ask me.

Hi,

In the below statement you said \”Step 1) Identify immediate peak and trough. In this case, the trough is at 150, and the peak is at 240. The 90 point moves make it 100%.\”, whereas we can see few troughs in between the two points you selected. For the highest point(240) you have chosen, the immediate trough would be around 202. Could you please clarify?

BR

Idea is to select the highest peak and lowest trough.

Sir can we use fib extension to keep stoploss when stock is trading at ATH

Yup, you can.

I really like the way you used the trade setup method to help us understand when to buy and sell in candlestick topics. Can you add something like that in Fibonacci retracement or just reply to my comment?

I know it\’s an indicator and it should only be used to scale up but still, it will help.

I;ve tried to explain the same in the chapter, do let me know if you get stuck with specifics.

I didn\’t find anything regarding Harmonic pattern in zerodha e.g. what\’s significance, how to draw etc ?

Yup, we don\’t have any articles about it on Varsity.

Conviction of buy/ sell decision 3 checklist points were intimated.

1) CandleStick pattern – ok

2) Stop Loss co-inside with S&R Level… ? S& R Level , where to check?

3) Volume is above average? Average Volume & current volume, where it\’s available?

Pls clarify. Thanks, Kumaran

You need to calculate the volume by plotting the 10-day simple average. Have explained this in the volumes chapter.

Sir what you prefer using Candle or Heikin Aishi for all such indicators or candlestick pattern?

Candlesticks on any given day 🙂

Sir, Nice info. This tech. analysis course is awesome, well-explained. thanks. I have one doubt – while plotting fib retracement which exact points to be considered? for trough and peak – wick of the candle or body of the candle?

Thanks and regards.

YOu can connect the candle body, and ignore the wick Pallavi.

In the fibonacci tool, in settings please give an option \”Select All\” for selecting ratios. This will save a lot of time for the user.

Need to check if the charting engine supports this.

Hello Sir,

While choosing the trough in step 1, why you have taken 150 instead of a trough around 200. I am a bit confused. Please help me out.

Because I thought 150 represented a better trough.

Sir where to keep stoploss for range breakout should we keep near breakout line or one ATR below breakout line?

2) Sir my fib S&R and manually drawn S&R is not matching l,should I need to worry about this are go-ahead with manual S&R

Just below the breakout line. This is to ensure the stop does not get taken out due to a false retest of the range. Fib and S&R wont really match, these are drawn based on two different theories.

Sir it is better draw recent peak and trough or low and high which is visible in the screen for say 9 months

The recent peak and trough are better.

https://drive.google.com/file/d/1Es0IsIHb6zMVVcWX3LgBag6WfBySQcDY/view?usp=drivesdk

Sir am I plotted well,you can see my Fibonacci S&R and my S&R is not matching what\’s the mistake

Using Fibonacci really confuses me sir whether I\’m plotting crct or not. I not found single relevant video on internet on how to draw Fibonacci

I heard people saying that Fibonacci levels act as support and resistance

When I draw support and resistance the Fibonacci S&R does not match

I will share my pic

It supposed to act, although I\’m not a big fan of fib levels.

Good evening sir,

Sir how many months or range should one consider while drawing Fibonacci levels

You need to connect one trough and one peak in the chart, this can occur at any time duration.

Hi Sir,

Can you explain upper/lower circuits for stocks?

Why do some have a 5% circuit and why do some have 20%?

Also why do some stocks get stopped permanently for the day and why do some reopen?

Circuit limits are in place to ensure that there is no excessive speculation in stocks. Based on the size of the trading volume the limits are set. I\’ll probably add a chapter to explain this.

Hi Karthik,

Fibonacci ratios are based on natural numbers, what is the relation between those percentages and retracement levels? why the stock has to retrace at those percentages? I feel those are not related to each other. Am I missing something here?

Thanks in advance

Satya

This is an observation as such. Please do read the chapter for the rational.

Is there a way to lock the custom Fibonacci settings, so that the same custom settings appear on every chart? Really cumbersome to set them manually on every chart.

I think there is a way. Maybe you should check with the support for this.

How many days/weeks/years of data should be considered while applying Fibonacci?

Hmm, this depends on when the trough and peak are formed.

23.6% retrenchment level is not displayed on kite web.

Is it no longer important or I need to add it manually on chart?

You need to plot this by connecting the peak and trough on the chart.

https://drive.google.com/file/d/1-FuZiUYp5CZICkUQ2TLDHCm8d5U4TPqr/view?usp=drivesdk

Am I plotted correctly Sir

Ready to learn from mistakes 😊

Yeah.

Sir while drawing fib for upward rally first retracement level is 0.236,0.382,0.5,0.618 when I plooted without uncliking when I unclick it starts from 0.786

Am I plotting correctly

Can you please recheck this? I\’m not sure about this, Chandu.

I mean sir, what does market structure mean? Ex:look at the market structure before choosing moving areas

Aman, I\’m not sure, but this could perhaps refer to the generic chart patterns that this stock is making.

What does market structure mean, sirji? Appearance of candles n price structure?

Sorry, not sure what that means. Can you share more context? Thanks.

Thank you sirji. Besides can you plz help me understand what an area of value is in simplest ways? I am not really getting it.

Sorry, I didn\’t get that query. Can you share more context?

So alongside fibb retracements, we need other tools as well, correct sirji?

Thank you.

Thats right, Aman.

Sir, which ratio is more reliable for a trend reversal?

Thank you so much.

I have a special soft corner for moving averages 🙂

Exactly. But just by looking at a specifif ratio like 50% ,can we say the trend will reverse?

Nope, hard to justify.

Sirji, what\’s your take on fibb Retracement? I mean we r expecting the trend the reverse after it reaches some fibb ratios?

Thank you.

Its a good to know thing, won\’t base my trades entirely based on fib ratios.

Sirji, when you are at looking at the downtrend the lowest is 61.8 n in uptrend the highest is 61.8 , correct?

Seems like it 🙂

Sir

Sincere apologies, could not find Fib extension.

Read the comment, to which you replied to check the studies. Cursorily checked other articles in varsity, could not find. Googled, to no avail. Tried drawing Fib fan and Arc, they don\’t give extension.

So I am using Fib retracement twice: trough-peak connected, peak-retracement connected.

Can you please guide me to the article (which topic it is under).

Ah, I\’m sorry, I mean \’the studies\’ in Kite chart 🙂

We don\’t have notes for fib extension on Varsity. I\’ll try and include something on this, as soon as I can.

Sir for drawing SandR for intraday levels I\’m facing some issues, and sir can we draw support line touching body and what is look back for drawing intraday levels

What will you look while trading intraday and will you use any EMA or SMA for intraday sir

Yes, you can draw S&R with real bodies. Look back can be 5-8 days assuming you are looking at 10 or 15-minute chart. I\’d always prefer EMA.

I\’m not confidence using Fibonacci, shall I go ahead and use pivot point instead, and is there any module written by you sir for pivot points

Yes, you can. I\’d even prefer classic S&R.

I apply Fibonacci retracement but after that price in marketwatch & in chart show different why???

Sorry, dint get that.

sir fibonacci is not available in kite ?

It is.

Hi Karthik,

What is the difference between fibonacci retracement and fibonacci projection available in kite?

Sunil, retracement is used to identify stoploss and entry points, projections for targets.

Sir can fib or pivot point indicator used as support and resistance

I\’d like to plot the S&R points manually, but between the two, I\’d prefer pivot points.

Fibonacci Retracement is not available in indicator on Zerodha. Is there any change in indicator list.

Its available right?

Valuable lessons

Hi Karthik,

Would you be kind enough to help me how do i plot the Fibonacci for intraday trading as I use 3 mins candlesticks? Do you need to wait for the chart to make the lows and highs for the particular day or do we use the previous days high and low or is it a combination of two or three days candles highs and lows. Also if Bank Nifty makes retracement what levels of Fibonacci retracement are considered most healthy for reversals, keeping in mind the volumes patterns.

I\’d suggest you load the last 2-3 days on intraday data and connect the trough and peak which is closest to the current market price. This will help you get the fib numbers for intraday trade.

Sir,

Could you please let me know ” WHAT IS THE MOST PRECISE POINT TO START FIBONACCI RULER FROM POINT ZERO GOING ALL THE WAY TO POINT 100″ ( Assume Uptrend). I am using HA Candle and 15 min chart.. whihc swing low should I consider while drow fibonacci? Is there any date period range should I consider.. please guide

Have posted a reply to this y\’day.

Respected Karthik Sir,

I have read and scanned the internet in search of answers. \” WHAT IS THE MOST PRECISE POINT TO START FIBONACCI RULER FROM POINT ZERO GOING ALL THE WAY TO POINT 100\” ( Assume Uptrend).

I\’ve understood if pick the wrong levels for starting and ending points, it will encourage buying or selling at prices that don\’t make sense, and I\’ll undermine profitability. But my question is \” What is the most precise point to start Fibonacci Ruler from point Zero going all the way to point 100\” ( Suppose Assume Uptrend). Say for example Nifty is on uptrend last 7 days and has a couple of Swing high & swing low which Swing Low to start from in creating the Fibonacci extension levels. while I want to enter in a trade on the day 8th..

Could you please suggest me best book on Fibonacci!

Thanks & Regards

Not sure if there is a book dedicated just for this, Soumen. Btw, in my opinion, this is not something you should be spending a lot of time on.

Hi, So we shouldn\’t invest in a stock while it is rallying up ? From what I understood is that let the stock reach a peak and when it falls down, we can calculate fibonacci percentages(23.6, 38.2, 61.8) and wait the stock to reach those points…..see the volumes and all that in the checklist and then buy …..Did I understand correctly ? If not what\’s the strategy to invest in a stock which is going up continuously from let\’s say 10 sessions and one more thing …..when we talk about volumes, we can\’t be sure about the volumes unless the day finishes right ?(may be some mutual fund or an institutional investor may invest a bulk amount just before the closing time)…so should we invest in the immediate session after that ….If yes…we can\’t be sure about how it opens the next day right(may be a gap close) and again same story ….pls clarify on this . Thanks in Advance 🙂

Thats correct. The fib ratio forms only when the peak and trough are connected, which means to say that you will have to wait for both these points to form.

on mobile app where is fibbonaci

Hi Sir,

When should i setup trade in fibonacci ? When candle will touch any of the fibonacci level ?

But there is a possibility that trend will continue till next fibonacci level or retracements is also possible.

So forget about practical even in theory also we can have multiple result.

Kindly have a look at maruti fibc. Can i Setup a long position with below values :-

Entry :- closing price of p1 i.e. 6891

Stoploss :- low of p1

Target :- 6960.45(61.8%)

Link :- https://drive.google.com/file/d/1pIL8iwOGeCd5JEXkYJJSaq42VjOlfGdw/view?usp=sharing

Unfortunately, you cannot time this. Yes, the retracement could exceed and fall further. YOu will have to evaluate and take the call 🙂

I am confused weather i should draw it from Top to Bottom or vice versa. Kindly confirm.

Depends on long or short positions.

Hi Sir,

(1) Can i simply match 52WHIGH TO 52WLOW ?. I mean to ask do we have to mind about particular time frame while selecting High and Low ?

(2)Kindly have a look at today\’s maruti chart or refer link :- https://drive.google.com/file/d/1O4x9JWOnbo9bGwpCAEGR6MAPs3qz4F6O/view?usp=sharing

Can i say maruti will rise from 6891 till 6960 (61.8%) ?

Regards

Ishwar

1) Yes, you cannot look at large time frames and connect the peak and trough. For better results (from personal experience) try and connect the peak and trough formed within say 3 months. Given this, you can connect 52W H and L if they occur within say 3 months.

2) Unable to open the link.

Hi Kartik,

Kindly have a look if my fibonacci chart is correct or not ?

Can i say that price retracted back at 50% and 38%

Link :- https://drive.google.com/file/d/1Ii6jakCXgwX2PrP2cyLgkttDsCoayv2J/view?usp=sharing

Regards

Ishwar

Unfortunately, the image is not loading.

Sir,

Thanks a lot for your quick reply.

Regarding my Question no. 2, I understand it needs to look on case basis. But What should be the percentage change in range on EOD basis to consider trending market or sideways market for index/stock. Being a new learner I need your valuable input on same.

Regards.

There is no fixed range as such, this needs to be looked up based on the recent volatility in the stock. Higher the volatility, higher the range and vice versa.

Hi Karthik Sir,

Hope you are going great. Please clarify my following doubts :

1. Is it advisable to apply Fib. retracement in Swing trade ? Or it is mainly for longer trade ?

2. What should be the percentage change on EOD basis to consider trending market or sideways market ? Please suggest in case of a particular stock as well as Index both.

3. In Kite chart, when I draw Fib.retracement, percentage retracement line (like 61.8%, 38.2%) are featuring but exact value are not featuring. Do we need to identify retracement value by our own from range ?

Regards

1) YOu can use it on a swing trade

2) You need to look at it from a case to basis

3) Release will provide this soo

this chapter is not in varsity app. many other also not there

Which other chapter is missing apart from this?

Karthik, please advise the study to judge and apply this tool in real live market scenario. Example, if I am trading in Bank Nifty Futures and chart is moving I am sitting in a live market so how can I use this tool to judge the next retracement where I don\’t have the highest peak so that I can go long in it. Also please tell that particularly on which time frame chart this works the best, I have seen it working in pre-formed charts at all time frames but in the live market which time would be the best to apply it and which one to take as the highest peak?

Works best on EOD charts. However, if you are using this on an intraday basis, I\’d suggest you connect the two most recent troughs and peaks to identify the retracement.

Thank you sir for sharing your knowledge..

I have a question:

If the nifty is negative for the day does it affect our positions and short term investments and should we be worried or just stay invested and wait for the market to correct..

Yes, usually the broader markets do tend to influence all stocks and take these stocks in the same direction.

1 How do you distribute total funds for the trading

for example if I have 100K and have shortlisted 4 stocks

so shall I distribute 25K per stock ?

2 what is your strategy on distributing the funds

3 are you more of a fundamental or technical guy or both ?

thank you for your time 🙂

1) Yes, you can do an equal weight, but this is not the only way. But I guess its the easiest way 🙂

2) Function of portfolio optimization

3) Mix of both 🙂

Good luck!

Hello Sir,

Is this theory still applicable ?

1 – indentify chart

2- check s&r

3- check volumes

check indicators…..

and how to distribute your funds to stocks (equally like SMA or like EMA 🙂

Yes, still applicable 🙂

The most recent peak and trough concept of choosing the points for plotting the Fibonacci retracement is not very convincing. I have tried it at multiple places however, results seem to not align with the general notion.

Is there any further filtered way of choosing the peak and trough?

Hmm, I\’m not sure. This is the standard process, Harsh.

when applying Fibonacci, what do you mean by troughs and peak?

Is it high and low of highest and lowest candles respectively in the chart

or

opening and closing are the trough and peak for an uptrend chart

I explained badly though, I hope you will get what I really questioned.

thank you

Assume you are looking at a 6 months chart, peak is the highest price point in the chart and trough is the lowest price point, as easy as that 🙂

Sir, i am looking at the charts of tata motors and preparing for a swing trade. The pattern is currently trending upwards and the MACD indicator confirms the trade. The RSI doesnt do so, should i look for buying opportunities if other factor also confirms as RSi works well in sideways and not in trending markets.

Mohit, don\’t mix up the indicators. Your trade signal should come from CS or the price action. The confirmation from indicators should be secondary. Also, no two indicator will give the same signal, so stick to one that you understand well. Good luck.

I request Zerodha to Please provide AUTO FIBONACCI RETRACEMENT indicator

Noted, will pass the feedback.

Thanks for the reply. And yes I bought this share since it was at low price from a long term perspective( atleast a year).

But Sir from long term perspective how to know at what point to exit? If not fib retracement then should I wait for only resistance to hit or there is some other indicators?

Hmm, you can keep trailing the SL and have a generic 25-30% return expectation. However, the right way to do this by looking at the business, tracking fundamentals, financials etc.

Hello sir, I have bought few shares of India hotels @85, which is close to the trough and the current ltp is 102. It is a uptrend and its been only few sesions.

So should I draw fibonacci retracement from 85 to 102?

and for only few trading sessions is it helpful or the uptrend has to continue for more sessions before I can use this tool??

How long is your holding period? If you intent to hold on to this for few years, then there is no point in drawing the fib levels. However, if you have a trading perspective, then maybe yes.

Hi ,

Please help me with drawing Fibonacci and If I were to do intraday in options then shall I chart Fibonacci on 1 day candle, Whats the ideal number of days to use to plot Fibonacci?

Yes, EOD is perfect for plotting Fib ratios.

On May 12, 2015 at 6:38 am you replied to a comment saying that \”Absolutely. Many people end up making the mistake of applying TA on Options, which is not really a good practice.\”

I do not understand. In many of your comments you have asked us to use various indicators of Technical Analysis for NFO. Then why do you say that it is not a good practice? I am asking as I specifically trade in Nifty 50 Options and whatever I have learnt from Varsity till now has helped me a lot. I do not understand why do you say so? Can you please explain?

So shorting in equity market is not possible for a period of days or weeks?

Nope, only in Futures.

Can we short for a period longer than a day? What I saw, was that if we short sell, our position would be squared off at the end of the day. (I must be wrong). How long can we hold a short position, and how do you hold a short position for longer than a day in Zerodha?

You can short and hold positions overnight in the futures market, Abel.

No. It is not there

Why don\’t you provide Fibonacci Projections in Pie

I\’m guessing its there. Need to double check on this.

Hi Karthik,

What exactly do you mean by below statement

\”If the stoploss also coincides with the Fibonacci level then I know the trade setup is well aligned to all the variables\”

Let\’s say after a sharp decline I want to buy the stock, in that I understand that the low of the pattern acts as Stop loss in this trade but I don\’t understand how my Stoploss will coincide with the Fibonacci level. I understand I can set the target as 23.6% if the stop indeed changes the direction. Please elaborate on this

Ah, it is just that the low will also coincide with fib ratio it adds more weightage to the trade you intend to take. For example, if 23.6% retracement coincides with say 89, and 89 also happens to be the pattern low and also support, then it just adds more weight to the long trade.

for example, On Sun Pharma chart there is a hammer formed on july 6. there is a green candle appeared on july 3. Can i consider june 24- july 3 as a decline or bearish trend ?

If the correction is at least around 8-10% from the peak extended over 10 days, then it would be a convincing decline and therefore a valid period trend. Everything else is a workaround 🙂

Hi Karthik, this is the last question for today from my side, so please bear with me. there is a bulli When looking for prior trend lets say there are there is a price decline from 10 days with 6-7 red candles and remaining green candles of different ranges(not green on the previous day of pattern formation). can i consider it as a decline? or there must be only red candles?

Yes, also ensure that there is a price decline of 8-10%. Btw, please don\’t restrict yourself from asking any amount of questions. Questions are what enriches this platform!

Hi karthik, SBI stock moves from 152 to 196 (May 26, 2020- June 8,2020), there is a increase of 44 rs. while selecting Fibonacci Retracements, when I point at 152 and drag up to 196, these are the lines i observed

line – price

0% – 196

38.2% – 179.23

50% – 174.5

61.8% – 169

100% – 152

what does it mean? if there is a price correction, chances are it may come to 179.23 (38.2%) or 174.5 (50%) or 169 (61.8%) and bounce back right, But my question is we need to calculate % from end or start of trend? and we should consider end price or start price of trend for calculating correction or do we need to consider trend range for correction?

Satish, what you\’ve done is correct. The price increase of 152 to 196 is considered as a trend (that you are interested in). So this is 100% of the trend. If there is no retracement, then the stock stays at 196, hence 0% correction. If the stock declines by 39.2% (fib ratio), then the correction takes the stock price to 179.23. If the stock corrects 100%, then all gains are gone and the stock goes back to 152. Fib ratios are the likely places from which the stock is expected to bounce back.

Hi Karthik, What does \”Fibonacci retracements are movements in the chart that go against the trend\” mean

Sometimes stocks retrace from their main trend, before going up further. Thinking about it as taking 10 steps forward and 4 steps backwards before taking another 8 steps forward. The 4 steps backwards you take is called retracement. Fibonnacci retracements help you identify how many steps you are likely to retraces. In trading terms, fin retracements help in understanding how many %points the stocks are likely to retrace before it jumps up higher.

Hi Karthik,

What are fibonacci retracement, extension, Projection?

These are different types of estimates which measures the likelihood of retracement, trend, and timeline. I\’m not a big fan of these estimates.

Sir, because the support and resistance move sideways and a straight line is drawn for support as well as resistance but in fibonacci retracement there is a sharp uprally and when there is correction in the market the price retraces in 23.6%, 32.8%, so how can we draw support and resistance levels here.

You can switch to trend lines Mohit.

Sir doesn\’t the fibonacci retracement theory contradicts the support and resistance level theory? How can we use both at the same time?

Nope, these are two different methods. I see no contradiction here. By the way, why do you think it contradicts?

Hi Karthik,

I am trying to use fibonacci retracement for NIFTY/BANKNIFTY options trading. Do you think i can use it on futures chart with hourly candles? Also, how many days i can look historically to identify the trough and peak to draw the trend line for fibonacci calculations?

Yup, you can use it, no problems with that. If you are using hourly charts, then I\’d suggest you look for at least 5 trading sessions.

Hey, I loved your way of explanation. Is the fibonacci retracement method useful for intraday as well? If not, which tool is the best for intraday trading?

Thanks 🙂

Yes, traders use this to identify points from which a bounce back is likely to happen.

Sir how can one get to know that at a particular point the price of a stock is going to retrace. Alzo lets say that that a stock price retraced by 23.6% furthermore it might retrace to 31.2% or 61.8% or it might move in its original direction so how are we going to know this. Because nobody knows what might happen in future.

Exactly, these are things that no one can guess. You just act based on probabilities.

Hi Karthik ,as you said above when the stock in uptrend for sometime and it should retraces back to some position w.r.t fibonacci percentages so my question is how do we know whether it is going to decrease by 23.6% or 32.8 or 61.8%, if i seen the position in RSI indicator the value is above 80(strong sell) and followed by a doji. how should I select the stop loss in that position.

That you can\’t say Vinay 🙂

Fib levels are probable levels at which bounce back will happen. You can always look at other indicators to evaluate if the scrip is likely to arrest its fall or not.

Why is fibonacci retacement not included in varsity app?

Are you sure? Let me check this.

Is Support & resistance tool and pivot points tool are same? else,what is the difference between them? please provide your answer.

thanks

They serve the same purpose but the means of calculation are different. S&R is a visual concept, you draw them on the chart based on how the stock moves, pivot on the other hand is calculated using a formula.

Please add Fibonacci retracements tool in kite applications for mobile users

The new chart update will have this, Pankaj.

Sir in the recent high and the low, do we need to account for only the candles body or also the candles shadow

Ignore the high/low candle shadows if they appear to be unusually long, Vignesh. Else do consider them.

Sir, kindly suggest some free as well as paid virtual trading platforms where one can get actual hands on experience cause I am new to the market and have never traded before.

Not sure about that, Surya.

Sir

How can I save my drawings as templates in kite charts on web?

Request you to kindly call the support desk for this. They will guide you through it.

Could you please tell me if ROC (Rate of Change) indicator and Pivot is present in Kite.

Thanks in advance.

Will be adding a chapter on CPR shortly, will include in that. Thanks.

Sir

My drawings in zerodha charts gets automatically removed after few days…..is there anyway to save my drawings in it?

Save them as templates.

Hi Kartik sir, I appreciate you explaining model.

Pl let me know about drawing fibonacci Retracements in TV as same couldn\’t be located in KITE.

Thank you

Please check the left panel, you will find the fib tools.

Is it necessary that retracement in this 61.8% ,38.2% ,23.6% ) particular order ? or reverse order (23.6%, 38.2%, 61.8%) can be possible ?

The market does not follow any order, so it can be any which way 🙂

Hi,

In Kite application in Fibonacci I don\’t see a 23.6% line once i draw it…..it is only showing 38.2, 50, 61.8, 100….

why is it so..??

Regards,

Hmm, not sure. Need to check.

Hi sir,

1. In the Fibonacci retracement construction, for identifying the 100% Fibonacci move, which recent trough should be considered. Recent refers to what time? As we go back in time, many troughs are seen.

2. For calculating 10 Day moving average of volumes for checking for higher volumes on the trade initiation day, which MA should be used? SMA or EMA?

1) Use EOD charts, and look at the most recent highest and lowest point. That is good enough.

2) SMA on volumes is good enough.

Hi Karthik! One doubt. You have mentioned that:

1. For average gain and average loss calculation for RSI, a look-back period of 14 days is used.

2. For MACD 12 day EMA and 26 day EMA is used. And for signal line, a 9 day EMA is used.

3. For the middle line in BB, a 20 day SMA of the closing price is used.

Are these constant for trading for any duration? Like would they be different if I want to complete a trade in a few days to 2 weeks, or for a few months, or even for a few years?

These values were set as default values by traders who invested these systems. Of course, you are free to play around with these and set them to what you think suits your risk and reward temperament.

Hello sir, there is a bit confusion !

In the section 16.1, in the first chart, while the stock is making new high, in Fibonacci level it is depicted as 0.00%

Whereas, in section 16.2, n the last chart, while the stock is making new high, in Fibonacci level it is depicted as 100.00%

Kindly clear this, thank you !

The % being referred to here is the quantum of retracement, Anup. Look at it from that context.

Hi Karthik,

Firstly, thanks a lot for the continued help and this excellent post. I can not locate the Fibonacci Retracements on the tradingview layout in kite. Is it avaiable on TV?

If you expand the left panel, you can see that in the studies.

Sir , you said stoploss should coincides with fibonacci level . But percentage level are so high in retracement that it probably hit stoplos s before making strong trade .

That is a general guideline. Please evaluate on a case by case basis.

Hi,

Do you plot starting with the trough or peak first? When i plot starting with the trough, the 0% mark features at the peak. (opposite to the diagram shard above)

Yes, you need to start from the peak to trough.

Fibonacci retrachement and extension chart not available on technical analysis

Request to make it (Fibonacci retracement tool) available for Zerodha Kite software users……

thanks,

I guess this is available on both chartIQ and Trading view.

where is FIBONACCI EXTENSION DRAWING TOOL .Please note i am not asking for FIBONACCI Retracemnet

HI Karthik,

Thanks for giving us such a wonderful topic.

I had a doubt though,

Trough @ 150

Peak @ 240

How does the above makes a 100% Fibonacci move? I failed to understand this, kindly reply

Once you identify the peak and trough, then that becomes your 100% move…for example in this case the 100% move is the 90 point move between 150 and 240.

Karthik sir. I can\’t able to use (not active) draw tool in kite pls help.

What is the issue? Maybe you should call support for this.

no, I checked today it is not available

Fibonacci Retracement was earlier available on Studies section in Zerodha, now i cannot find it. Can anyone please help?

Thanks.

It is still available, Kapil.

Hello Sir ,

I love Zerodha very much reason is ,it\’s very easy to use and understand .

What I am additionally looking is , Do you have any tool that can plot Fibonacci Extension like trading view or investing website has

That could very helpful to address the target including Fibonacci retracement.

Thanks

Suhas

The extensions aren\’t there, for now, Suhas. I will check with the team anyway.

how to put on fibinocci metric

Right-click > settings.

Hello Zerodha team,

many users are asking for Fibonacci Projection or Extension tool, what you have is only Fibonacci Retracement tool.

could you please reconfirm on Fibonacci projection or extension tool availability in Zerodha Kite, if yes can you please send us the link how to draw in Kite.

Thanks

Rajanish Mayanna

Rajanish, this is available on Kite, trading view. Request you to check the same. Thanks.

My question is: what constitutes a 100% Fibonacci up move- is there a percentage associated with increase from the trough to the high?

100% retracement implies that all the losses are erased and the stock is back to the point from which it started to crack.

why this chapter is not in varsity mobile app and please also add hindi language in mobile app

Let me check this.

Time scale to select: I want to integrate selection of time scale with price target of a stock. Zerodha enables a user to view monthly, weekly and daily chart. Presumably, higher time scale confirms more reliable price movement or trend. Thus, we restrict to monthly or weekly. Now, the question is how do we select a time scale? Because, retracement levels depend on the latest high and low based on \’time scale\’. What is your recommendation?

I\’m guessing this is for short term trading, if yes, I\’d suggest you look at the EOD charts and not really the monthly or weekly chart.

Karthik Sir,

How Is This Fibonacci Pivot Is Calculated?

Also,

Fib Projection & Fib Extension Tool.. When Its Going To Be Available On Pi?

Also,

Day Separator Line Disappears If Candle Chart Changes To Heineken ashi.

Need To Fix This Issue.

Also,

Chart Scroll Should Be Given. Because If You Look At Chart.

The Candle Bar Appears At Right Side Of The Screen Where Screen Almost Ends.

That\’s Its Default State.

Allow User To Scroll Chart To Left Side Of The Screen Like We Do On Kite.

Also,

If CrossHair Is Selected, Then Only Crosshair Works And Not Able To Move Chart To Right/Left And Also Not Able To Remove Horizontal/Vertical Line/Fibonacci. Needs To Disable It First And Then Able To Remove Lines From Chart.

But Not Happens This On Kite. We Can Move Chart Right Left Up Down Even The Cross Hair Is On.

Thank You.

Thank You.

I\’d suggest you look this – https://tradelab.in/pidoc.pdf

Hello,

Fibonacci retracement tool is suitable for bank nifty intraday? and How to use this for bank nifty and time frame?

You can use this is with any stock/index.

which is better moving average crossover system??

Depends on your risk and reward temperament 🙂

For me, 9×21 works for intraday. 100×200 for longer term trends.

which is the good moving average (periods) sir

I\’d suggest you look at EOD charts.

sir,

how to find out whether its trend up day and trend down day to calculate fibonacci retracement ?? wat are the criteria??

To identify the trend you can use a moving average crossover system.

Hello Karthik,

thanks for such wonderful material!

the question is related with Pivot points (Fibonaci) in the Kite chart;

the Pivot Point and the corresponding two Support and two Resistance levels that is drawn in the chart,

request please help with the formula for the same, thanks!!

Ah, I need to figure the formula myself Prasanna 🙂

Will try and do that.

Thanks Karthik,

My understanding is, the next day\’s SUP & RES levels [Fibo] are calculated post taking in to account the previous day\’s high, low and close price, as follows:

Resistance 2= Pivot + (PD high – PD low) * .5 or .618

Resistance 1= Pivot + (PD high – PD low) * .236 or .382

Pivot = [High+Low+Close] / 3

Support 1 = Pivot – (PD high – PD low) * . 236 or .382

Support 2 = Pivot – (PD high – PD low) * . 5 or .618

but these are NOT the values I see in the Kite Chart, hence I ask this question, if you folks are using a different formula, could you please elaborate, thanks!!

Best Regards

I guess you are talking about chartIQ. Let me see if I can get the formula used by them.

The explanation of how pivot points are calculated on our ChartIQ charts is explained here.

Thanks Faisal bhai,

but one clarification please, in the Kite Chart S&R levels there are two types provided one is Standard and other is Fibonacci, in the link you have provided only one type formula is provided which to me it looks like Standard, what about the optional Fibonacci formula?

could you help provide clarity, thanks!!

how to set chart if stock is downtrend

Set the chart as in? Can you kindly elaborate?

What is the difference between pivot points (standard) and pivots points (Fibonacci).??

Both are formula driven, Manish. Pivot points standard is a formula-driven method to calculate the support and resistance levels. Likewise for fibonnaci pivots (to identify retracements)…however, I\’ve not used the fibonnaci pivots, so cannot comment much.

Hi Karthik,

Is the Fibonacci extension option available on kite?

Thanks.

Hey Karthik ! Is it safe to say that the Fibonacci Retracements are an alternative to S&R levels ? I am getting pretty good results by using this tool. Tank you !

Not a convincing yes 🙂

hi, Im using kite and you dont have a Fibonacci retracement tool. Can you please include this in kite?

thanks

Ravi, its there. Click on \’draw\’ (in the chart) and the select the Fib retracement as the tool.

Hi Sir,

I hope you are doing well..!!!

I have a small Doubt regarding fib, You had told that need to draw Fib based on Most recent High and Low.

1.for intraday trading , for today\’s trading should i draw fib based on previous day\’s low and High?

2.after that, the same day after some time(consider 30 minutes or 1 hour whatever it is ) Forms Day\’s low and high again, in this case should i draw again Fib based on most recent High and low (OR) should i consider previous days low and high for entire day?

3.if 2nd point is true , should i repeat the process on latest Day\’s high and low?.

Thanks in advance for your Kind Reply.!!!

1) I\’d suggest you take the at least 5 trading session and draw the fib lines between the low and high

2) This depends on the range, if it in a small range, then stick to previous levels, else take the fresh high and low

3) This depends on the 2nd point

Good luck.

Hi sir,

Thanks for quick reply.

This depends on the range, if it in a small range, then stick to previous levels, else take the fresh high and low:: How much Range should be consider ??

Since its an intraday, I\’d suggest you keep around 1-2% as a range.

Will the Fibonacci levels, BB lower band, candlesticks patterns, etc will be considered as support or not?

Also there are many types of Fibonacci. So can you please help us understand about some of them like gann fan, Fibonacci trend, etc

Thanks

BB band lower and Fib levels can be considered as support. I\’d suggest you look for Fib reversal (explained in this chapter) to begin with.

What is fibonacci projection? How to plot this in metastock?

What is fibonacci projection? How to plot this in metastock?

Fib projections is same as fib retracements, except that they help you identify targets. I\’m afraid, I\’m not too familiar with MetaStock.

Sir I am not getting Fibonacci options after clicking on studies please help me

You are looking at the wrong place. You will find it under the Draw option.

Hi Karthik,

I understand that the retracement levels as percentages of the total fibonacci move are calculated from the immediate crest(move up), or the immediate trough(move down), which is confirmed by the examples provided in this material. However, in the example demonstrating the construction of fibonacci levels using charting tool on pi, the order of the levels seem upside down, i.e., shouldn\’t the 0% level be at the crest(236.982 price point) intead of the 100% level??

Since we are trying measure retracement, we need to start from the crest. Remember, we are interested in looking at what extent the stock may fall from the peak, so standing at the crest we look at the trough.

Exactly!! Therefore shouldn\’t the 0% level be at the crest itself as we are trying to find out the level till which prices will fall? In the example, the 100% level is shown to coincide with the crest, where we are trying to determine the price fall after an acute increase. Kindly pardon me if my questions seem shallow.

It like this – from the bottom to the top is considered a 100% move, we are interested in knowing how much of this 100% will get eaten away when the correction starts.

What is meant by pullback and how to differentiate it from Fibonacci retracement?

If a stock goes up from 80 to 90 and falls back to 85, the move from 90 to 85 is called a pullback/correction. Fibonacci retracement is a way to measure the magnitude of this pullback.

what about elliot wave theory,it will be good if you guys teach elliotwave theory

I\’m not too familiar with EW. However, we will try and put up something in that regard. Thanks.

I cannot use the Fibonacci Retracement in Kite. Please check.

Why? Can you please explain what issues you are facing? Thanks.

In the studies list, the fibonacci is not listed.

It is under \’drawings\’ and not studies. Click on drawings and you will see a new drop down on your left. Look for Fibonacci there.

hello Karthik,

If one looks at the EOD chart of AXIS BANK it clearly shows the rally from Rs.450 to rs.625.After it formed the top it is now retraced more than 62% and has given three consecutive closes below this level. What should be the analysis from Fibonacci perspective? should we assume that next support for axis bank is at 450 itself from where the rally had begun?

That will be a 100% reversal. Axis Bank has massively consolidated around 500 between March and Sept 2017. I\’d suspect there would be some buying interest around these levels here.

Where is Fibonacci Retracement in Zerodha chart

Please check under \’studies\’. Thanks.

Hello Karthik.. I might sound stupid.. but I check in studies a few times but i didnt find it.. what is the name used in studies.. may be a short name or something..