What is the best SIP frequency for investing in mutual funds?

Unless you live under a rock, you would have probably heard the term – SIP (systematic investment plan) – in mutual funds.

Using SIPs, one can conveniently invest a fixed amount in mutual funds periodically, usually monthly. Unlike lump-sum investments, where a large amount of money is invested at once, SIPs involve spreading the investment over regular intervals. It is just like a recurring bank deposit, where a fixed amount is deposited regularly.

Mutual fund SIP investing is particularly popular among salaried individuals, as the amount can be automatically debited from their accounts once their salary is credited, making it easier to budget the remaining funds. SIPs typically allow investors to start with relatively small amounts, often as low as ₹500 per month, making it accessible to a wide range of investors.

In my humble opinion, SIP is one of the most impactful inventions in the mutual fund space. The reasons are two-fold: the convenience of investing in the stock market and how it allows for rupee cost averaging.

Rupee cost averaging is a strategy where investors regularly invest a fixed amount of money regardless of market conditions. When the market is down, the fixed investment amount buys more units (say, 50 units for Rs 1000 at Rs 20/unit).

But when the market is up, it buys fewer units (25 units for Rs 1,000 at Rs 40/unit). Over time, this helps to average the cost of purchasing units (Rs 26.6 per unit – total of 75 units for Rs 2000). This also helps reduce the impact of market volatility on overall investment.

Some investors wonder if different SIP frequencies – daily, weekly, or quarterly – yield better returns than monthly SIPs.

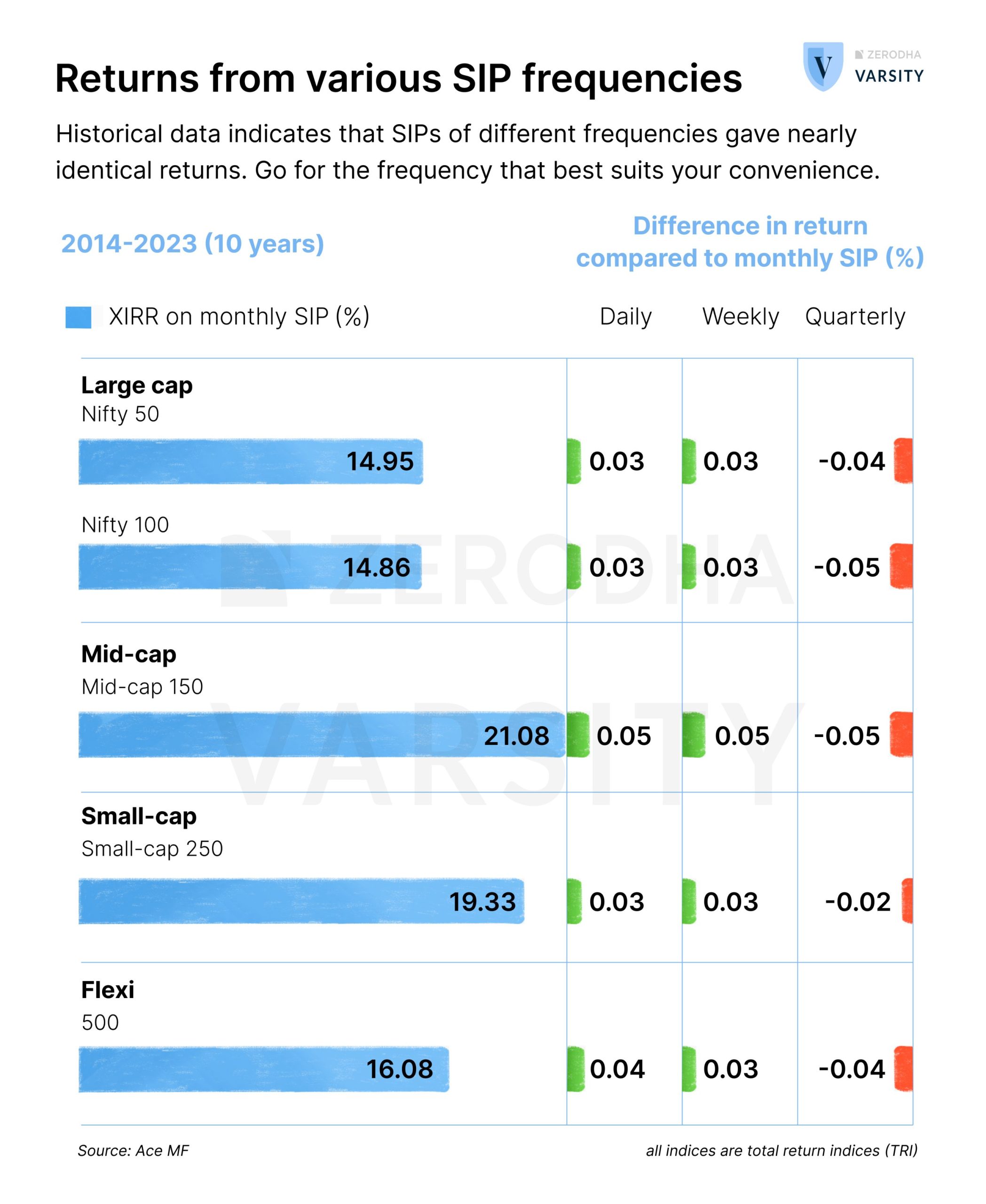

To address this question, we analyzed SIP returns of various indices, such as Nifty 50, Nifty 100, Nifty Mid-cap 150, Nifty Small-cap 250, and the Nifty 500 over a 10-year period at different frequencies.

As shown in the above figure, the historical data revealed that SIPs of different frequencies generally provided similar returns compared to monthly SIPs. Daily and weekly SIPs delivered a few extra basis points of return, but it is insignificant.

Therefore, investors need not worry too much about which SIP frequency is the best; rather, they should choose the frequency that best suits their convenience and financial situation.

Dear SS, Suppose I invest 100/- monthly Vs 25/- weekly in SIP for 10 years. I invest 12k in first case BUT I end up investing 13035.71 in weekly SIP. Now calculate the returns please.

My age is 45 years. Which SIP best for me,? Please advise.

What about the charges on different frequencies,are they same or different??