FY23-24: Do You Have Losses from Trading? Here Are the Set-Off and Carry Forward Provisions

Could I offset my trading loss with the profits I earned on my long-term stocks and mutual funds holdings? What are the set-off rules for trading loss?

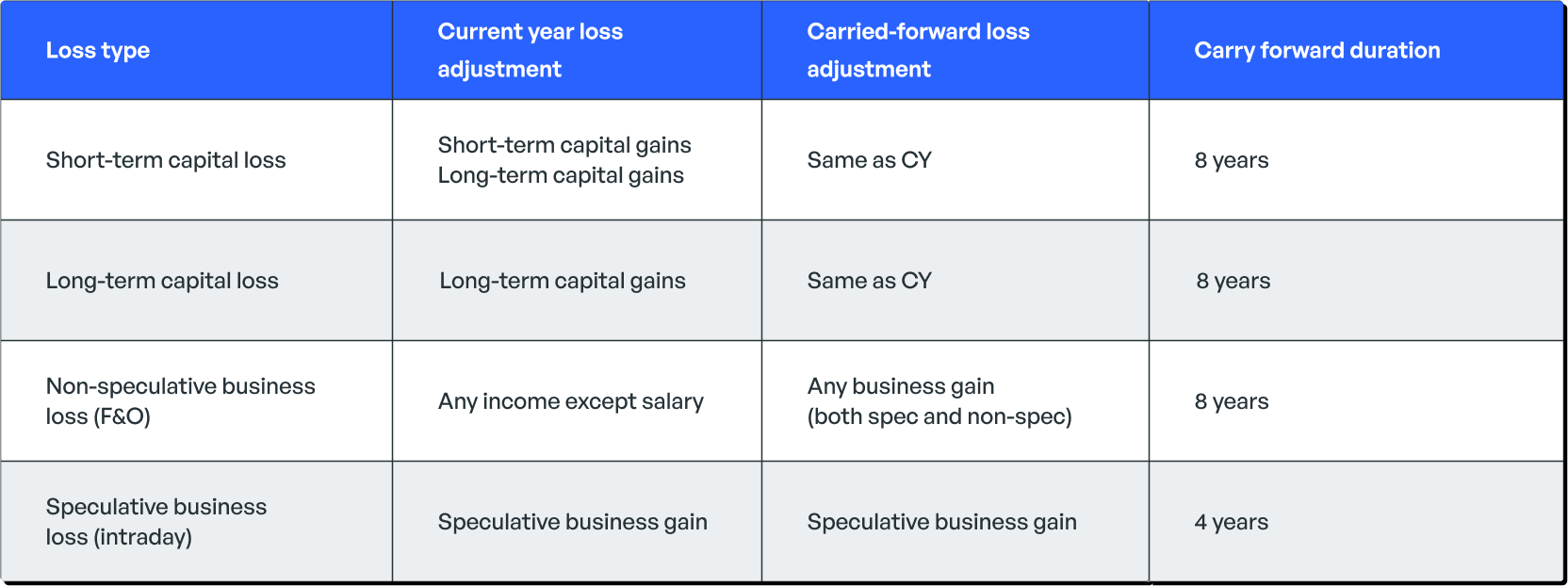

Let’s first understand how income from different transactions is classified. F&O trading is classified as a non-speculative business, while intraday trading is treated as a speculative business. Further, profits earned from stocks or mutual funds are considered as capital gains. Now, let’s talk about the rules for setting off trading losses.

Non-speculative losses, like those from F&O trades, can be offset against any other income head except salary income in the same financial year. This includes capital gains from stocks and mutual funds. So, you can set off your trading loss with the capital gains on stocks and mutual funds.

Remember, speculative or intraday losses can only be offset against other intraday profits.

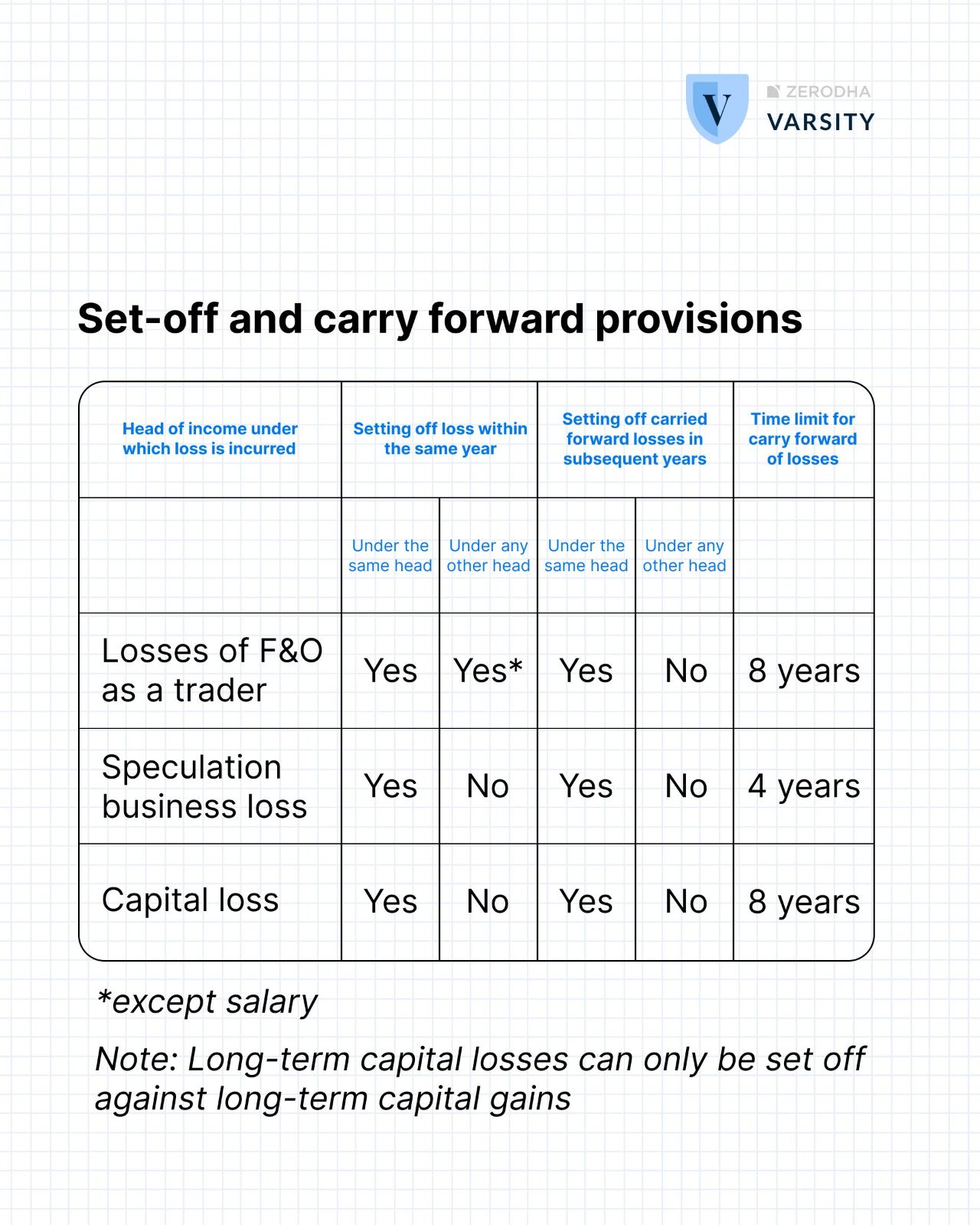

In the table below, we mention the set-off and carry-forward rules for capital gains and business income.

Can you explain how to carry forward the losses from trading?

Your trading losses will first be adjusted against incomes in the current year, and the remaining losses (if any) are carried forward to subsequent years. Remember that F&O losses can be carried forward for up to 8 years, while those from intraday trading can only be carried forward for up to 4 years.

Carry-forward losses become brought-forward losses for the next year. These brought-forward losses from F&O can be offset against any kind of business income in the subsequent years, including both speculative and non-speculative business profits. On the other hand, intraday losses can be used to offset other intraday profits in future years.

For example, say you have short-term capital gains of ₹1L and face a loss of ₹3L from F&O. You can offset this loss against your capital gains, reducing your net taxable gains to zero. The remaining losses of ₹2L will be carried forward to the next year. As mentioned previously, once carried forward, F&O losses can only be set off against business income (both intraday and F&O). Hence, if you have F&O profits of ₹2L in the next year, your brought-forward losses will be adjusted, and your taxable profits will become zero.

I incurred trading losses last year but did not file my income tax return for that year. Can I use the carry-forward provision to claim the tax benefits?

A. In order to carry forward your losses, you need to file the ITR before the due date, which is 31st July of the respective assessment year. If you fail to do so, you cannot carry forward the losses.

PS: If you have any tax queries, comment below, and we will get them answered.

The above questions are answered by Surbhi Pal from Quicko. This is for informational purposes only. Consult your tax expert for individualized advice.

I have F&O losses from past years. But now I don’t trade in F&O. To carry forward losses from past years, do I still have to show F&O trading as business in the business income of ITR3?

I have shown this information to 2 different CA in Delhi. They agree with this information as this is the current law. But they declined to adjust F&O loss (Non speculative business income/loss) under any other head. Reason.

Both CA mentioned that in reality, this is not the practice. Loss can be carry forward and adjusted under the same head. People sitting in Income tax office do not consider F&O loss/profit as non speculative. They consider it as speculative.

What would you suggest me to do?

Why is that my losses are not setoff with increased rates of treasury Bills, 10,000 loss previous year amounts to 10,300 today , so when it is setoff with today’s profits so it should be with today’s value of loss.Compounded annually with mentioned period of carry forward

I have Intraday turnover of 2 lakh and Short term realized profit of 1.23 lakh.

Can I get some relief in tax?

Dear Team,

Thanks for this information.

Can you please clarify if the intraday F&O losses can be set off against the Capital or Short term gain from the Mutual Funds?

Thanks.

Narendra

if salaried person filing ITR1 or ITR2 , how can they file trading losses

hi

my query

can short term capital losses (not intra day) be adjusted (off set) against dividend income. ie dividend income in 24-25 rs 6 lacs

short term lossses booked say Rs 5 lacs

can v take income as 6-5 =Rs 1 lac

pl clarify

tks

I have long term capital gains on sale of residential land.

I also have accumulated carried forward Long term capital losses from sale of equity shares of listed companies.

Can I set off the long term capital gains from sale of residential land against the above carried forward Long term capital losses?

I have FNO Profit of roughly around 14lakh in the current FY However Due to ongoing market correction my Equity portfolio has unrealized loss of more than the FNO profits . Is there any scope for tax loss harvesting in my scenario

Yes,

You F&O business loss in same year adjust against all head except salary head.

Your 27 L loss adjust against 4 L dividend & 22L LTCG.

During current Financial year I have incurred loss in F&O Rs.27.00 Lac But Long term capital gain Rs.22.00 Lac and Dividend income Rs.4.00 Lac. Please clarify whether Loss of Rs.27.00 Lac can be adjusted against Long term capital gain and dividend income.

Regards

S.K Doharey

Belated returns loss not carried forward, can I claim previous year loss to set off for current year?

Hi,

I incurrent losses in F&O 2 years ago. I have not been trading since then but i have carried forward my losses & want to offset business gains with that. Cn I offset interest income with F&O losses in the subsesquent years? Do I need to file ITR 3 or 1?

Can I setoff Mutual fund gains with Previous years F&O trading losses?

(a) My Income is 6,94,000 (b) C/F Short Term cap Loss of previous years on equity 1.70,000. (c) STCG Rs 12,000 (d) LTCG 92,000 on equity (well within Tax Exemption limit) so Tax Zero (e) I need to set off STCG of 12000. (e) My question is Can I set off STCG of 12000 only OR I will have to compulsorily set off 12000+92,000 =1,04,000 STCG+LTCG both)? Alternatively , Can Isimply pay 1800 Tax on STCG on 12000 and do not do any set off neither STCG nor LTCG? Regards Surbhi Ma’m.

Thanks for the info Surbhi, my query is below:

If my carry forward F&O losses are 15 lakhs and current year STCG from equity cash is 5 lakhs, can the STCG be set off against carry forward losses?

I have a doubt, F&O losses can be set off against both LTCG and STCG but which head is setoff first 🤔.

If i have 3 lakh F&o loss and 5 lakh LTGC with 2 lakh STCG then F&O loss setoff first against LTCG or STCG?

I have to pay 1 lakh LTCG tax with 2 lakh STCG tax or either have to pay 3 lakh LTCG tax only?

I have intraday f&o loss of few thousands and short term capital gain of few thousands in equity.

Can I offset this profit with intraday f&o loss?

Current year loss in F&O can be set off against any income other than salary. My question is ” Any income other than salary” includes 1)interest on saving account

2)Bank FD 3) zerodha liquidcase

Can I use Short-Term Capital Losses (STCL) from US stocks to offset Short-Term Capital Gains (STCG) from Indian stocks?

I have net long term capital loss from sale of shares. Can i carry forward these losses next year even if I just file ITR1 this year? Or is there a form/ ITR2 that needs to capture details of the losses from this year?

I have FNO losses in FY 23-24. I have sufficient LTCG to offset the business loss.

I do not want to adjust my LTCG profits against the FNO loss as I pay 10% tax on LTCG whereas I pay 30% tax on my FNO gains in subsequent years. Do I have the choice to not offset my loss and carry it forward to next year.

I am a salaried person who was filing ITR-1 all these days. What ITR form should be filled to show FnO Losses in the CY??

Hi,

I’ve F&O Loss this year and Short Term & Long Term Capital gain this year. My F&O Loss is getting setoff against Short Term and Long Term Capital Gain of the current year and then remaining loss is getting carried forward, all this is working fine. But, the problem is that my Capital Gain is also reducing my previous carried forward Capital losses (both Short Term & Long Term), so basically my previous carry forward losses are also reducing and current year setoff is also happening. So, I’m not getting right loss carry forward. If I remove setoff against current year capital gain loss then it gives an error on the validation page. Any recommendation on what could be the issue?

can I set off brought forward losses in F&O with long term capital gain of house property selling

Can I set of my F&O loss to my long term capital gain by sale of house property for same financial year

I have f&o business loss of 8 lac, LTCG of 5 lac and STCG of 6 lac. can i set off business loss first against STCG and then against LTCG or vice versa.

Hello,

I wasn’t aware of this AT ALL, I thought F&O gains and losses worked just like equities short term capital gain that is offset against short term capital loss equities only.

So does this mean if someone has missed out showing F&O loss in ITR all these years still he can show in the next ITR as carry forward and offset with non salary income?

Thanks a lot.

Is intraday profits/loss on F&O (MIS orders) considered as speculative or non – speculative?

Could it be added under income from business profession as usual?

I had post loss on share of 1 lakh 22-23 and I have a profit share 83000 fy 23_24 both long term will I have to set of losses of last year or will it cap below 1 lakh non taxable and that 1 lakh get carry forward

I had carried forward STCL of Rs.54517 in AY 2020-21 and LTCL of Rs. 159966. I have also had STCG in AY 2022-23 and AY 2023-24 but I forgot to offset those losses. I want to offset the STCL of AY 2020-21 this year i.e., AY 2024-25 and want to claim the LTCL of AY 2021-22 in some another year as my LTCG this year is below 1 lakh which is already tax free. Can I do it ?

I have loss of 19k in F&O can I set off against FD interest

As per brochure deta my short term capital gain is 67000 but as per AIS it is 192000. For f.y.2023-24.which about should I enter in ITR return file. I am in great tension.

Please clear it.

Hello

I have carry forward loss for short term n long term capital gain of around 4 lakh

And this year I lost fno around 6 lakh

And short term n long term capital gain of 5 lakh

Then is it mandatory to set off fno loss against current year of capital gain

Or

I can set off my this year capital gain with carry forwards loss under capital gain of previous year and pay remaining tax for capital gains and carry forward loss of fno

Thanks in advance

I am salaried employee and have not reported f and o losses for last 4 years

Can I claim that all this year?

I have a tuition income of 4 lakhs and f/o loss of 50k my current ITR will anyways be zero so I want can this 50k be careed to next year and this year I will fill itr of 4 lakhs (indirectly I don’t want to adjust this year but want to adjust this last next year is it possible)

Lets say a person have incurred FNO loss of 4 lakh in FY2023 and carried forward. Then in FY2024 he has 0 income from FNO but gains from equity trading (short term) of 2 lakh. Can he set off this gain with FNO loss.

If not as short term gain, can we show it as business gain and set off the amount?

hi,

short term realised profit from equity – 10 lacs

F&O loss – 12 lacs

can this F&O loss be set off against short term equity profit?

I have F&O Loss of 80000 and short term gain of 800000. Can I fill return without audit? Turn over is 2 Crore

I have 200000 loss in F&O few years back which is already motioned in previous ITR. Can I adjust that too in current year ITR against short term gain?

Please advise

Hi, I need info about set off f&o lose

Can I set of the f&o lose with VDA profit.

I have Intraday profit of 1.76 lakh and Short term realized loss of 1.23 lakh.

Can I get some relief in tax?

I have incurred F n O losses of few lakhs in fy 2017-18 2021-22. I reported it in ITR 3 for those years, after getting audit done.

Now this fy 2023-24 I have not done any trading/investment etc, nor I have any profit/loss from any speculative/Non speculative/stock/mutiual fund transactions.

So,do I have to file only ITR 3 for current year to ensure validity of those carry forward those losses ? Or can I fill ITR 1 this year and again ITR 3 next year, assuming trading profit occurs next year that may be set off against earlier losses of fy 2017-18.2021-22?

I am in a similar situation. What was the answer for this?

Can I carry forward intraday loss or F&O loss into next year under both new and old regime?

Fno is non speculative even if it is done in intraday? Also does the order type matter?

Like mis (intraday) or NRML(Carry forward) order effects the nature of the pnl as speculative vs non speculative for fno trades?

Thanks!

Hi,

All F&O trades will be considered non-speculative business. The type will not make a difference.

What is the process ?

You need to file the ITR before the due date and report the losses. These are then set-off and carried forward to the subsequent years.

I incurred a short term capital loss of ₹1.5 cr Last year. Though I provided the data to my CA, he outsourced to a TRP, who exactly copied from AIS & filed IT Return before July 31,2023 & this loss was not reported. I Received intimation for high value transaction, online After December 31,2023, even though intimation letter is dated December 26,2023. I Therefore could not file Revised return. So How can I claim & carry forward the above short term capital loss of ₹1.5 crore from investment in shares ?

Losses can only be carried forward if the ITR is filed before the due date. In this case, it will not be possible to carry forward the losses.