Do we really need a diversified portfolio?

We have been in a bull run for a few years now, it is safe to say.

If you were invested in any asset class – equity, debt, gold, or real estate – more likely than not, you have seen some robust positive compounded returns.

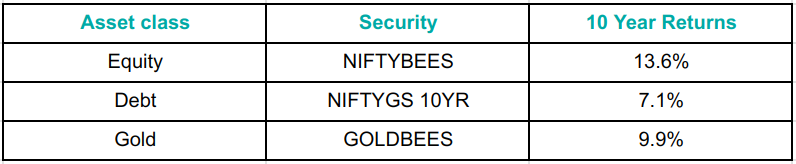

I took a few representative securities and looked at their ten-year returns from September 2014 to September 2024.

Does it make any sense to diversify across asset classes if all of them grew and gave reasonably good returns? More so, isn’t it better to invest just in equities because of their highest returns?

Let’s dissect our understanding of diversification.

To reduce risk in your portfolio, you diversify your investments across multiple asset classes that have little to no correlation.

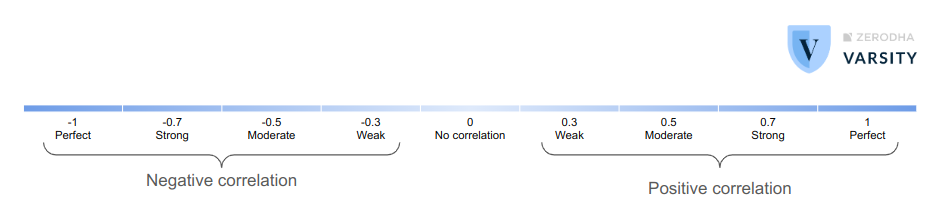

Correlation shows how frequently the prices of two asset classes move in the same direction.

- A correlation of 1 means that the two asset classes are moving in exactly the same direction.

- A correlation of more than 0 but less than 1 is positive but not perfect.

- A correlation of -1 indicates that the daily prices of the two asset classes move in opposite directions on any given day.

- A correlation of more than -1 but less than 0 is negative but not perfect.

Look at this scale and then the correlations of the representative securities.

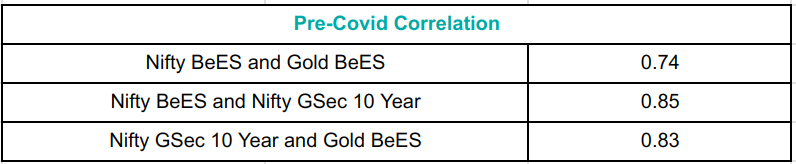

Correlation is generally seen in pairs like equity-debt, debt-gold, or equity-gold. Let’s first examine the pre-COVID correlation of the securities. Of the 10-year period under study, I took all the period up to 01 March 2020 as pre-Covid. The period after is considered post-Covid.

Clearly, the securities exhibited a strong correlation before Covid. Why am I looking at pre-Covid correlations? Many people have argued that correlations were weak before Covid and hence, it was sensible to diversify. They also believe that correlations have increased post-Covid, so diversification is not needed anymore.

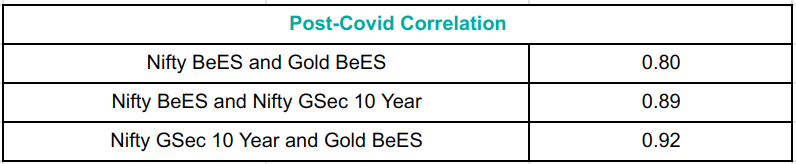

Have the correlations really increased?

The strong correlations have become stronger. It seems the asset classes are depicting similar behavior. So, the observers are right about the correlation. But does that mean diversification in your investments is not needed anymore? In fact, for that matter, since correlations were strong even before Covid, was diversification needed to begin with?

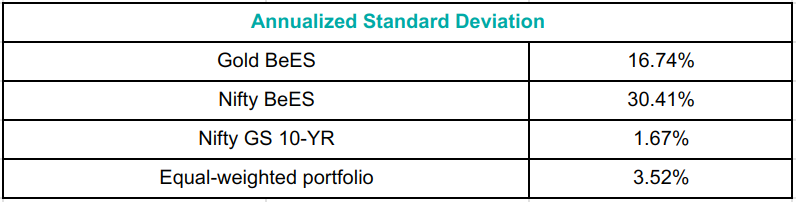

We diversify across asset classes to reduce risk in the portfolio. Risk is represented by standard deviation. Look at the table below. It shows the annualized standard deviation of the daily price returns of Gold, Equity, and Debt over a 10-year period between September 2014 and September 2024.

A higher standard deviation suggests a higher risk. Equity, represented by Nifty BeES here, is the riskiest. Debt carries the least risk.

While people usually don’t create an equal-weighted portfolio of equity, debt, and gold, if you still create a portfolio like that, it would have a much smaller standard deviation. So, the risk is reduced substantially. You could increase or decrease weights across equity, debt, and gold and see that the risk of a diversified portfolio will be lower than an individual asset class.

Sure, debt has a much lower risk, but most investors are usually not satisfied with just debt returns. They can take a little more risk, but not too much.

While different schools of thought exist, and people have had successful portfolios with and without diversification, the odds seem to favor diversification.

Very informative analysis! I’m curious about what happened during COVID. Also did other asset classes, like real estate, experience similar corrections?

Although short-lived, most asset classes witnessed corrections.

Real estate developers feared that job losses could dry up liquidity, so they announced some discounts. But when people started working from home, they needed larger spaces and more rooms. So, the demand also revived quickly.

As far as debt is concerned, many institutional investors sold even the highly-rated instruments at a discount to generate liquidity. Take a balanced advantage mutual fund, for example. They invest in both debt and equity. When investors panicked and requested redemption, these funds were under pressure to sell securities. Since they could not sell enough equity, they started selling debt. But liquidity was drying up in the whole system. So they sold the better debt instruments at a discounts to able to honor redemption requests.

Commodities had corrected too for the fear of shrinking consumption but the pent-up demand soon after helped revive commodities prices.