Could Trend-Following Be A Successful Trading Strategy? (Part II)

Part I of our trend-following series gave a brief introduction using the NIFTY 50 index. An unavoidable problem while using a single instrument for trend-following is that it tends to go through multiple years of flat returns after a drawdown. It becomes very difficult to stick to the strategy when faced with long periods of underperformance. A proven way to mitigate this issue is to diversify across different instruments and assets.

While diversification is widely considered to be the only free lunch served up by the market, you need to be careful before choosing the assets to diversify into.

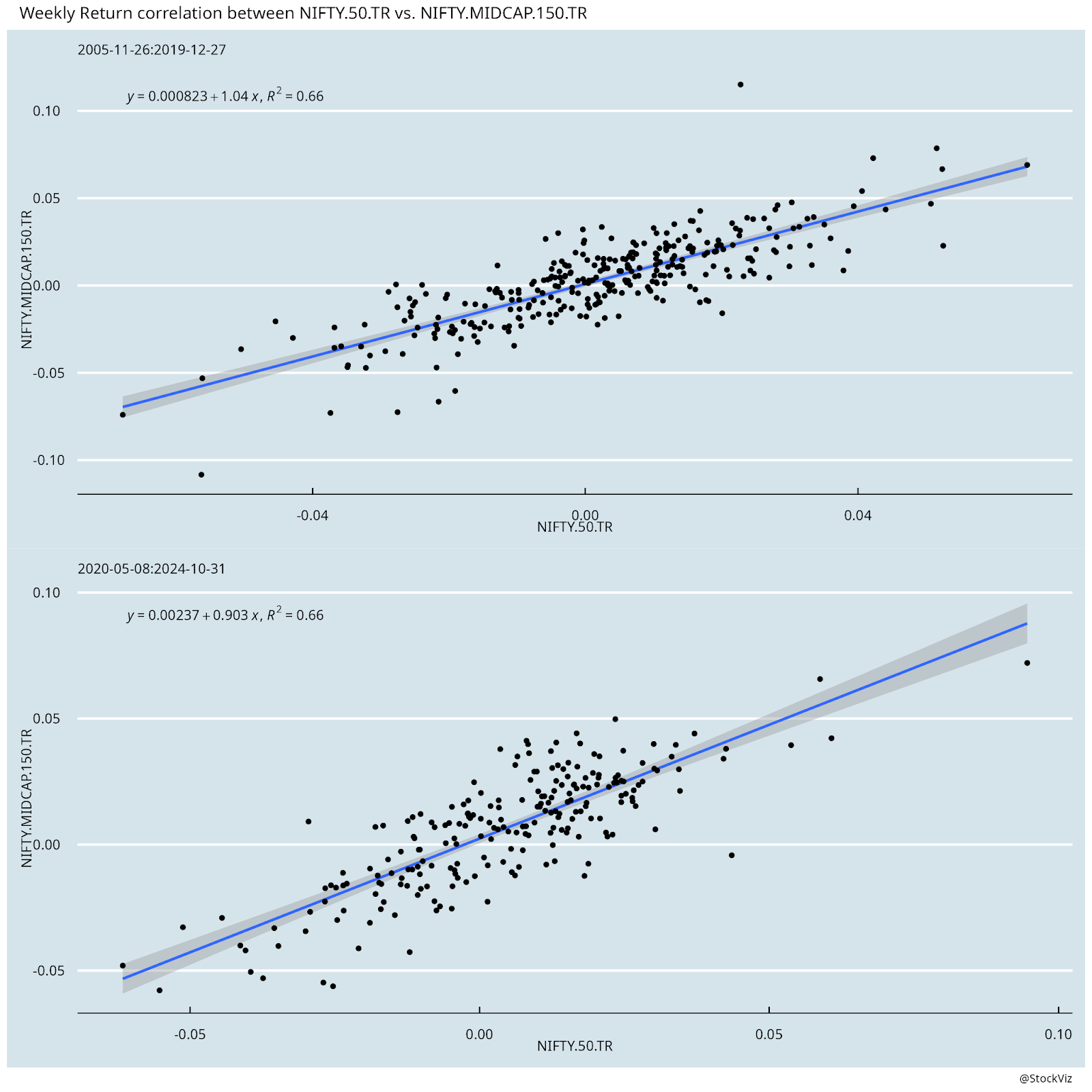

For example, you may be tempted to throw a midcap index into the basket, given how we now have futures listed on it now. However, the high correlation between the large cap and midcap indices makes it a poor choice for diversification.

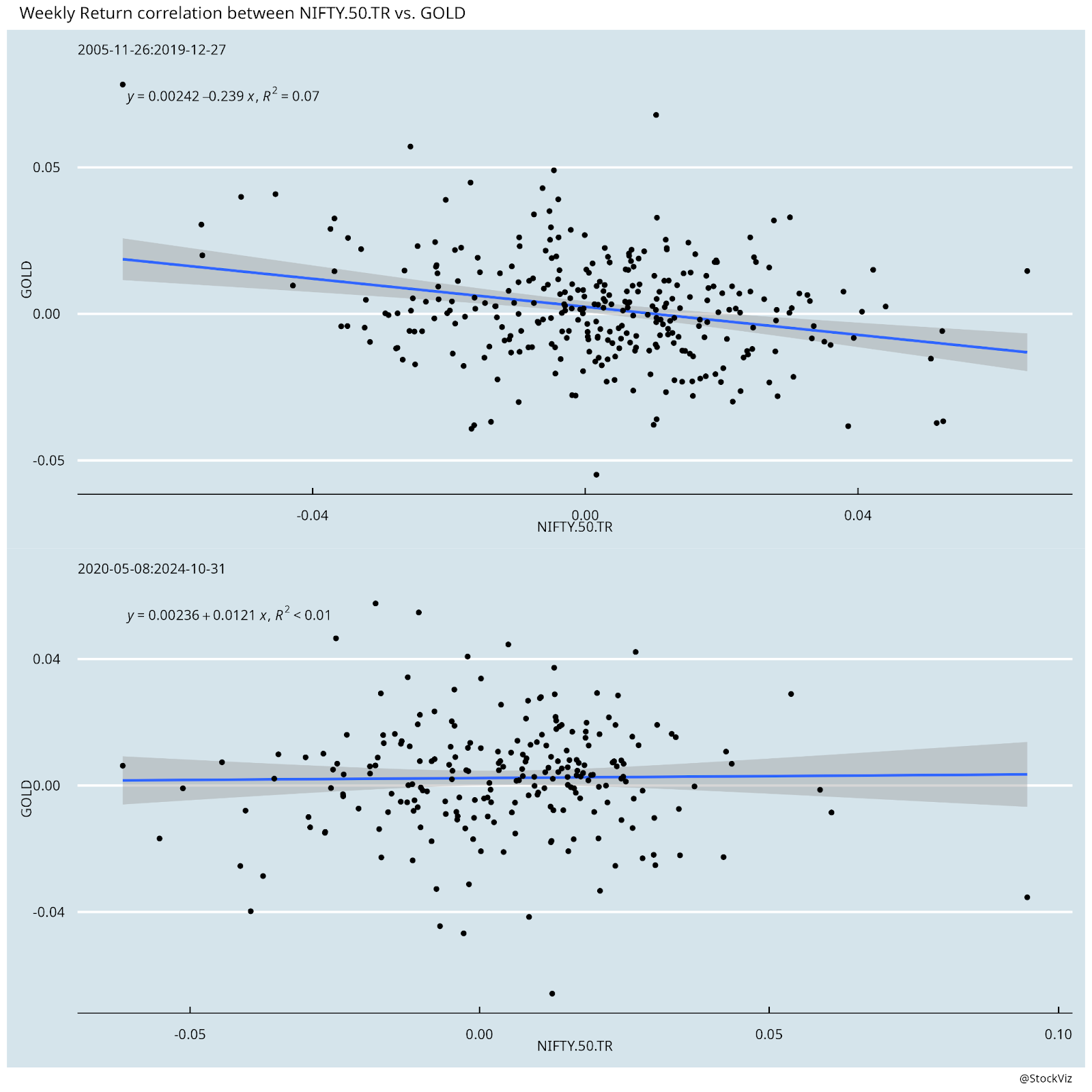

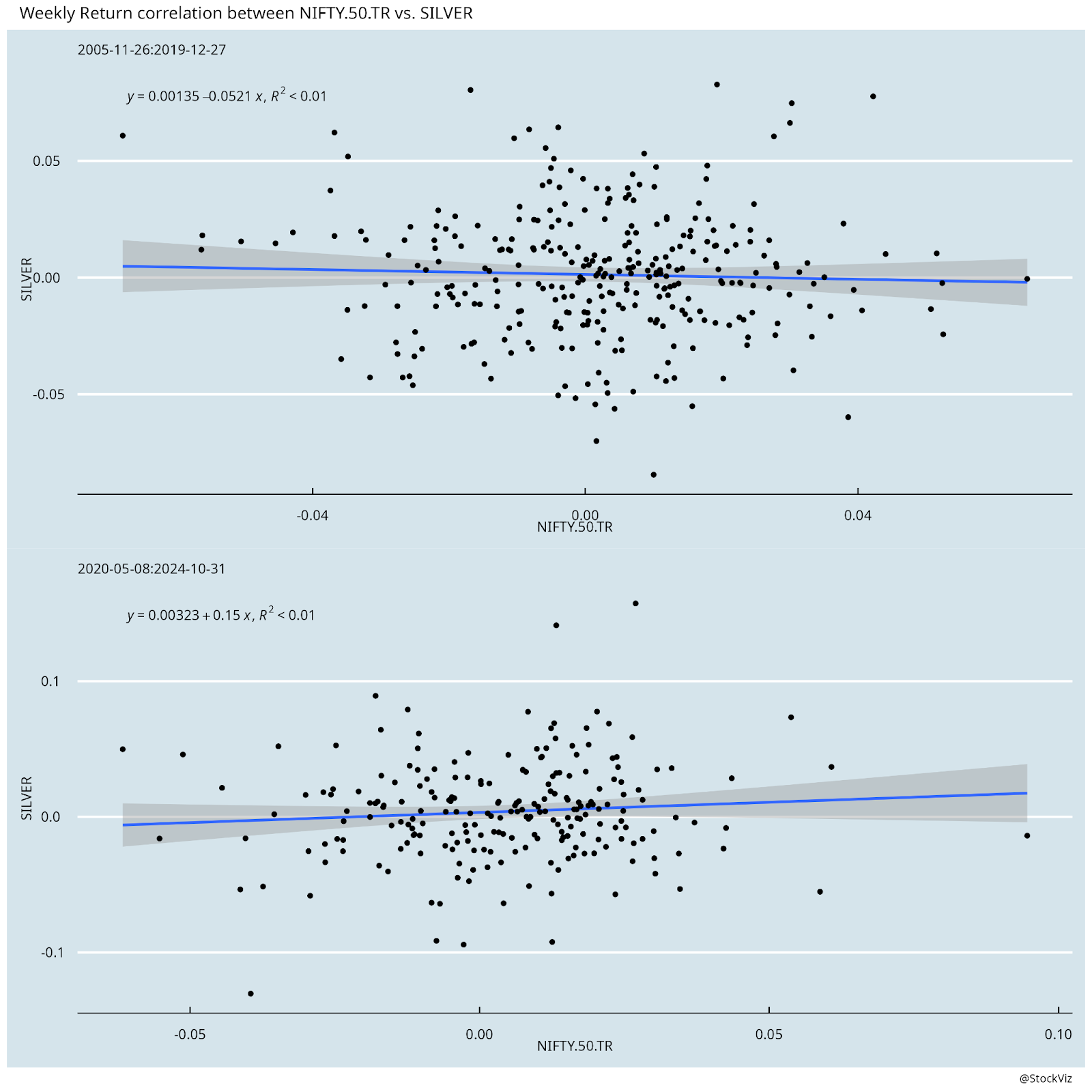

Alternatively, you could look at commodities. Gold and silver futures on the MCX are fairly liquid and might help us with diversification.

It turns out that gold is more negatively correlated with NIFTY 50 than silver. Making it a better choice between the two.

For gold, we simply set the short-term SMA lookback at 5 days to smooth out daily fluctuations and then brute-force the long-term SMA as the one giving the highest Sharpe ratio for our Training set. (This is not the best way to go about picking lookback periods but will suffice for illustrating the idea.)

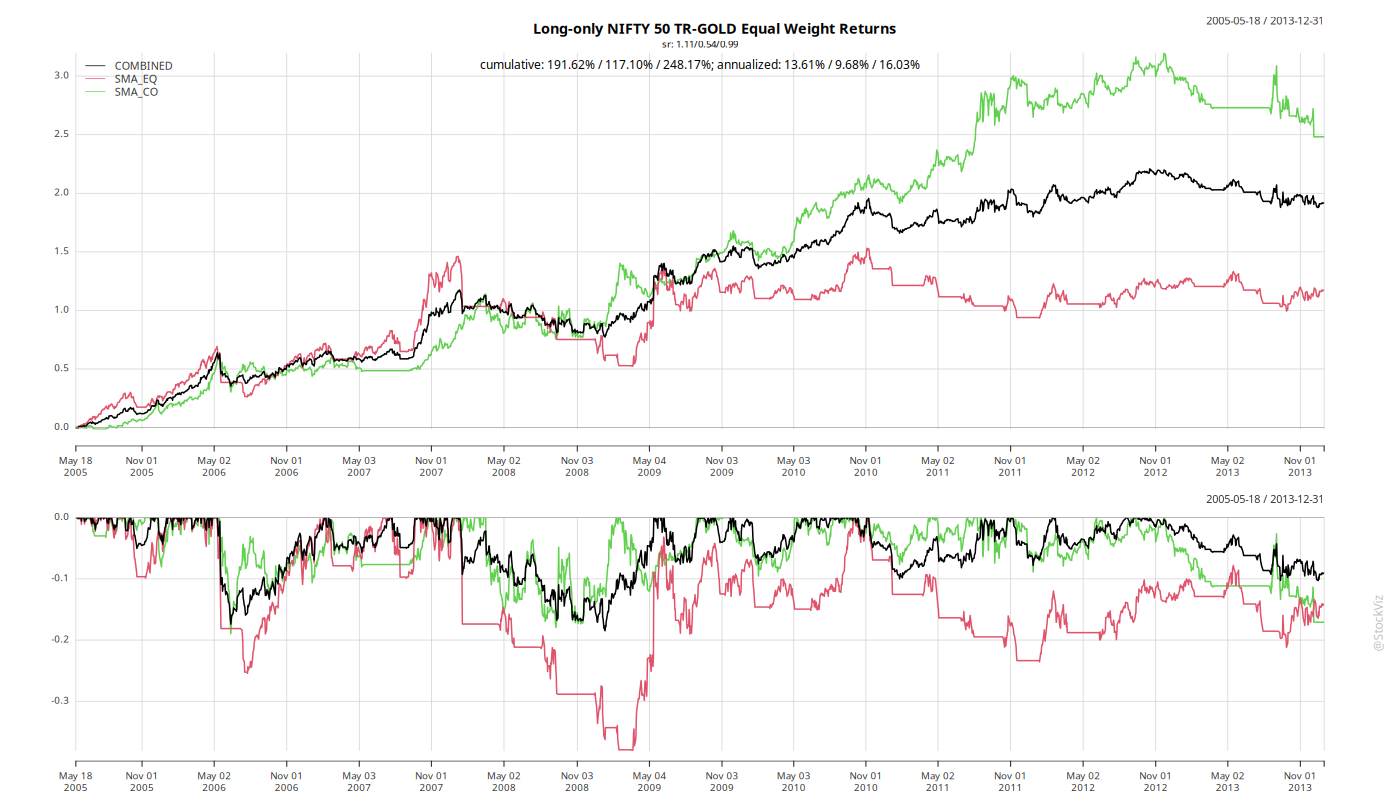

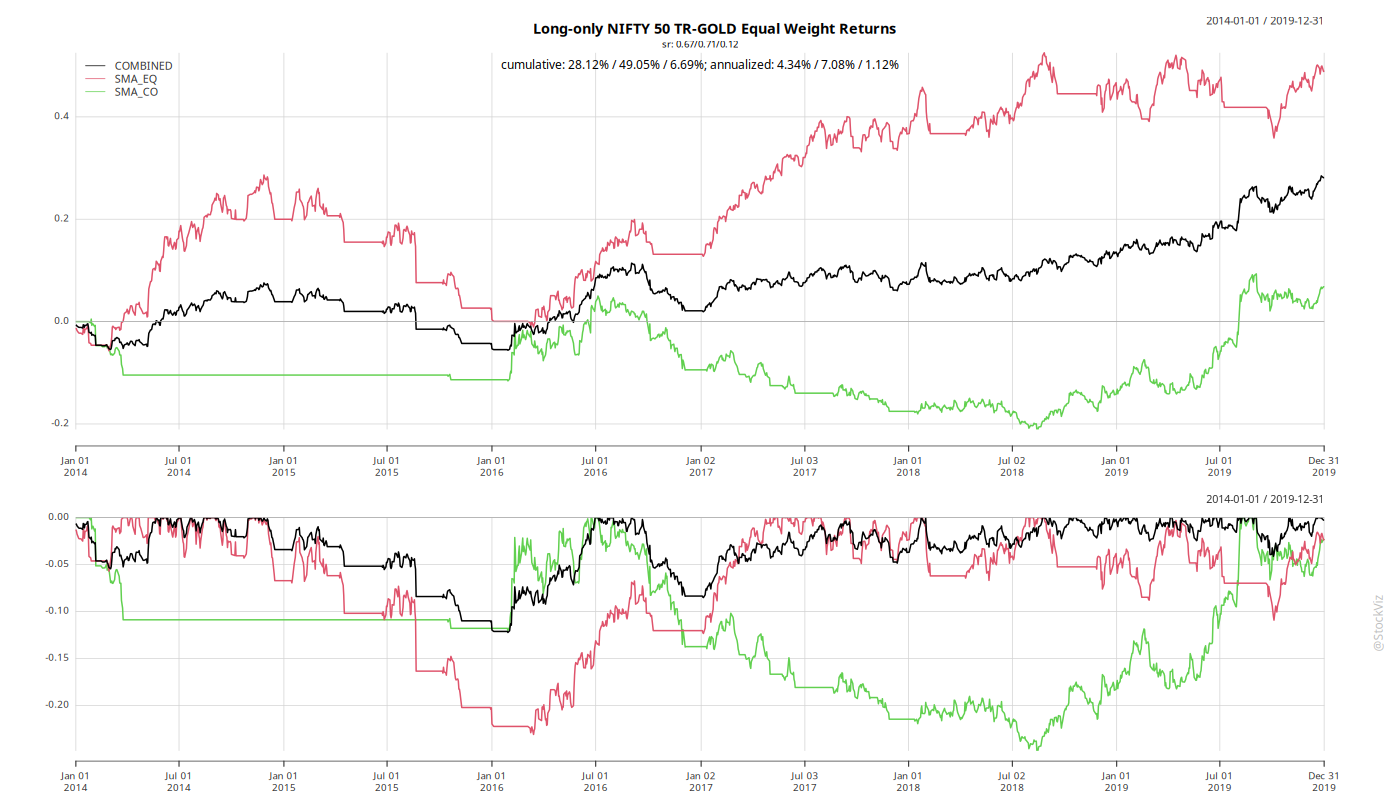

Turns out a combined, equal weighted, 5×50 cross-over for NIFTY 50 (SMA_EQ above) and 5×420 cross-over for gold (SMA_CO above) gives you a smoother ride than when using only one of them.

Looking at our Validation set, the biggest problem with the single NIFTY 50 or GOLD strategy would’ve been the 20% drawdown between 2014 and 2019. However, when combined, the max drawdown was 10%, with a fairly quick recovery.

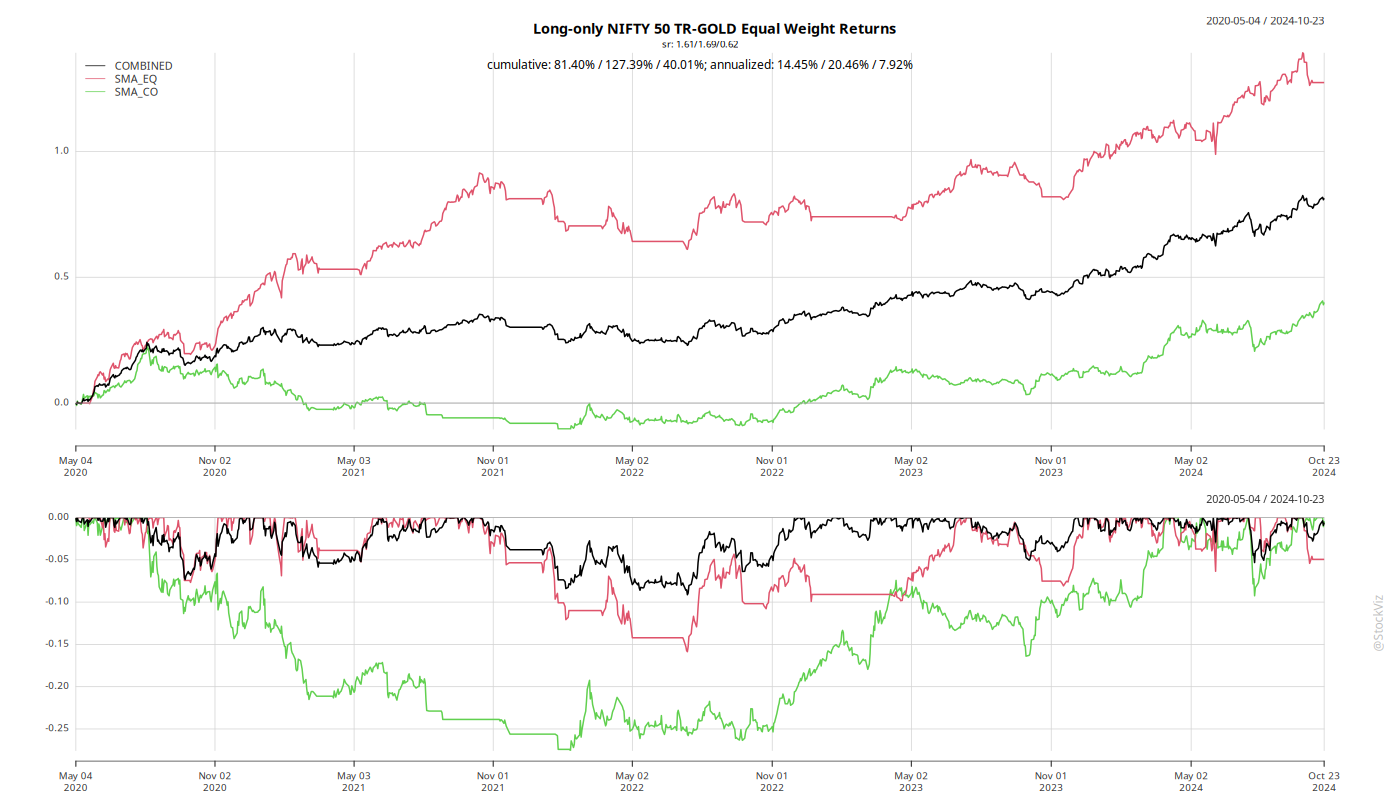

Post-COVID performance (our Test dataset) has been good as well. Before the current runup in gold prices, the yellow metal was languishing in no man’s land while equities were putting up one all-time-higher after another. Combined, the strategy delivered lower drawdowns with mid-teens returns.

Here’s how the combined, equal-weight, NIFTY 50 5×50 and GOLD 5×420 performed over the full dataset.

Lesson: Trend-following strategies benefit from diversification. Finding non-correlated assets to trend-follow is hard. However, the benefits are worth it!