Tax loss harvesting

“Check out our detailed module on taxation while trading/investing on varsity.”

Traders,

FY 2014/15 has been a great year for the markets with over 30% increase in the benchmark Nifty index. There have been stocks that have been multi-baggers and there have been laggards as well. With a few days left for the end of the financial year (31st March), I would like to share with you a way to optimize your post tax returns using a concept called “Tax Loss Harvesting”. This is quite popular among traders/investors who have access to specialist chartered accountants and tax planners.

We have made it easy for each one of you by creating your personal tax loss harvesting report on Q that can help you save as much as 30% of your trading profits, that you would have to otherwise pay as taxes.

Taxation while trading

Our post “Taxation Simplified” is probably the most popular post on the internet with over 1200 comments for all your basic queries on taxation while trading on the markets.

In the context of this post, a few things that you need to know:

- While trading the markets and filing your income tax, you can consider yourself a trader (business of trading) or investor.

- You are a trader if you partake in any F&O trading, intraday trading (speculative business), and/or trade equity delivery very actively as if it were a business.

- You are an investor if you trade only equity delivery once in a while.

- As a trader, your taxation is as per the IT slab (0-2.5 lakh: 0% | 2.5 -5 lakh: 10% | 5-10 lakh: 20% | 10 lakh > : 30%). So you sum up all your income (trading + any other income including salary), reduce all the expenses, and then pay taxes according to the slab you fall in. The good thing of declaring your trading as a business is that any expense incurred towards trading (internet bills, cost of advisory, financial newspapers, depreciation of your computer, and more) can be offset from your income.

- As an investor, any gain that you make in a stock by holding for more than 1 year (LTCG or long term capital gain) is exempt from tax. Any gain you make by selling your stock before 1 year (STCG or short term capital gain) is taxed at 15% of the gain.

- Do read our post on taxation simplified for a detailed explanation.

Tax loss harvesting?

Tax loss harvesting is an opportunistic way to bolster your post tax returns. It is the act of booking any unrealized loss to reduce the tax outgo on your realized gain before the end of a financial year.

Investor

As an investor, if you have any short term capital gains for the year you will have to pay 15% of this as tax. Assuming you have stocks sitting in your portfolio making a short term capital loss, you can book this loss, set it off against the gains, and hence reduce your tax outgo.

So assume you have made Rs 1 lakh in trading profits from your short term equity delivery trades. This would mean your tax liability is Rs 15,000 on this gain. If you had stocks in your portfolio which are making Rs 50,000 in short term losses, you can sell these and book the loss. So now your net profit for the year is Rs 50,000 and hence your tax outgo is Rs 7500 (15%), a saving of Rs 7500.

To make up for the stocks that you just sold to book losses, you can either immediately buy a similar stock or wait till those stocks are delivered from your demat to buy them back again. So if you sold ICICI Bank to book a loss on Monday, you can either buy say a HDFC Bank immediately for the same value or wait for Wednesday to buy back ICICI Bank again. So you continue to hold the same portfolio, but by doing this transaction you would have saved Rs 7500.

As an investor, long term gain is exempt from taxes, and hence you can’t use long term capital loss to adjust against short term gain. Only short term capital loss can be adjusted against short term capital gain.

Trader (Trading as a business)

As a trader, any gain is a business gain, and any loss is a business loss. So if you have net realized business gain (short term capital gain, long term capital gain, F&O profits) you may have to pay up to 30% as taxes based on the slab you fall in. This tax outgo can be reduced by realizing any business loss which would mean you could sell any stock where you are making either a short term or long term capital loss, and use this to reduce your tax outgo.

Once you have sold the stock, like explained above you can either buy back a similar stock immediately or wait for the stocks to be delivered from your demat and buy back the same stock again after two days.

So in the same example above, say 1 lakh was a business gain and say you are in the 30% bracket, that would mean a tax outgo of Rs 30,000. By booking Rs 50,000 loss, your net tax outgo will be 30% of Rs 50,000 which is Rs 15000. A saving of Rs 15000.

As a trader, your can set off any other business profits (any other income of yours excluding salary income) against this loss as well.

Note: You have to ensure that to book the loss for this financial year, you have to exit the stocks before March 31, 2015.

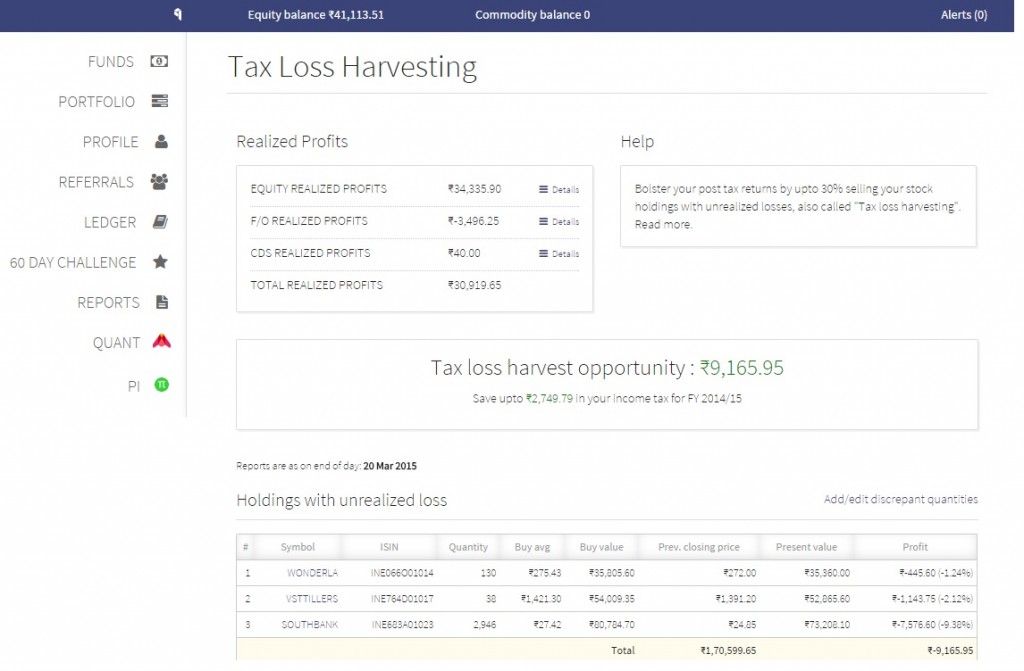

Tax loss harvesting report on Q

We have created for you a report on Q to easily spot any tax loss harvesting opportunity on your account with us. The report will give you a quick view on all your realized profits for the year, and all unrealized losses on your equity holdings which could be booked by selling the stock and hence reduce tax outgo on your realized profits.

You can access your personalized report by clicking this link or under Tax P&L report in Q.

See a sample report below on how by selling the 3 stocks and buying back again can save upto Rs 3000 in income taxes. We have spotted tax loss harvesting opportunities where clients can save lakhs of rupees that would otherwise have to be paid as income tax.

Psychologically it is tough to sell loss making stocks, and the typical reaction is to postpone the decision making. If you are someone who is sitting on realized profits, make sure to use any unrealized loss to reduce your tax outgo. Every penny saved is a penny earned, and following financial discipline is important for long term success in the stock markets.

Happy saving,

Hi,

I have LTCL from equity of around 1.5 lakh in previous 2 years and having STCG around 1.5 lakh in commodity futures this year. Can this be compensated in this year taxation ? Please advise

I want to keep same portfolio but save tax. If I sell shares and buy them again on same day, it is treated as intraday trading. How to buy/sell same share such that its treated as long-term delivery.

Hey Rohit, for tax-loss harvesting, the shares have to move out of the demat account through a delivery sell transaction and can be subsequently purchased the next day.

For tax loss harvesting in Zerodha, can we purchase back same stock on T+1 or have to wait will T+2?

Hey, you can buy back the stock sold the next day, ie. T+1. You can check out more details here.

Sir I realize long term capital gain by selling two different stock one is 50 thousand and other is 60 thousand. Dose my gain exempt for tax on 1lak criteria or tax given on 10 thousand,.

Considering the latest update from SEBI for a debit of shares on T. Will it be possible to purchase back the tax harvested sold shares on 31/03/2021. I would like to purchase back today on 01/04/2021.

The main question that rises now is earlier T+2 was followed for purchase back. Can it be T+1 with the latest debit on T

Can I buy and sell the same shares in a single transaction for tax harvesting purpose?

Regards,

Seenu.

Till now I have not realised any STCG or LTCG, investing in stocks and mutual funds using ITR 1 form. This year I want to carry forward STCL, which form i have to use . If not insists to claim any STCL can I continue ITR1.

While Tax Loss Harvesting is a great concept and utility, I have been trying to find some easy report to understand which of my investments (mutual funds and stocks) are in LTCG and which are still in STCG. An easy to use report will make me book LTCG quickly, instead of painfully going through each of the transaction dates.

I am a Zerodha customer.

Hey Nikhil, the portfolio holdings page on Console shows the number of stocks held on a long term basis with a separate tag. Say for example if you are holding 100 shares of Infy and 50 shares are long-term holdings, Console will show these 50 shares with a separate tag next to the stock symbol. You can also check the holdings breakdown by clicking on options >> view breakdown. Here we show the purchase breakdown of the stock with the date, quantity, price, and period of holding.

Can I set-off short term gains in Equities with short term losses incurred in Options for tax loss harvesting? What is the last date this year when I can sell my shares to recognize losses for tax loss harvesting?

31st Dec, 2020 is the last date for IT filing

I have a concern that my holdings in Manpasand and 8K Miles will get delisted on 31 Oct 2019 without me being able to sell them off. There is a big loss harvest here but how do I book/show it?

Which is the last date of trading considered for Tax loss harvesting for the year 2018-2019?

29th March.

Tax Loss Harvesting Report generated on console for me was entirely wrong. Only today i.e, last day of financial year they got it corrected. Instead of blindly trusting zerodha, I should have verified myself. Uffffffffffffff without any reason generated loss by myself………..for having trust on………………

Vijee, can you raise a ticket from our support portal explaining the issue? We’ll have it checked.

Ticket was raised, and with confidence Zerodha replied that ” Reports are updated correctly in Console.”

In response to their answer I have replied ” If I provide you the proof, then will Zerodha tender its apology in open forums and will Zerodha compensate my losses because of your goofups……”

Waiting for their reply

Will have this checked. You can expect a reply on your ticket.

Nitin,

The loss/gain we make from MCX are not mentioned in ”Markets and Taxation” blog from varsity. My earlier question of total short term gain/loss from EQ+MCX are to be considered together or they are treated differently in terms of tax? The tax loss harvesting report is not considering loss/gain of MCX???

Thanks & Regards,

Sanjoy

Sanjoy,

Income from trading in both equity and commodity derivatives is categorized under non-speculative business income and tax must be paid according to the slab applicable to you. Income from equity delivery based investments if declared as capital gains can’t be set off with non-speculative income. You can read more here.

I could not find the tax loss harvesting option in the console. please help locate in the updated web interface.

Its updated now. Check this post.

Thanks!

ZERODHA team why tax lost harvest & whole Quants tab have disappeared from kite.

Hello Nithin ,

Is there a way to download the Profit and Loss report script wise / day wise . Current reports gives consolidated view of Buying and selling of particular stock .

The requirement is to show the date wise transaction per script . Example I had purchased and Sold stock 4 times during the year then it should show all 4 transaction date wise for that particular stock .

its available in Trade book but it will be great if this format also gets added in P&L report .

Hi Nitin/Zerodha Team,

I am unable to see anything except ”Tax loss harvest opportunity :” text. I applied for CDSL IPO and sold the shares on 1st day. I think this should account for short term capital gain tax and should have been shown under realized profits. This profit I want to settle by using Tax Loss harvest opportunity by seeling stock which are in loss but it does not show anything except for above text.

Thanks,

Jignesh

Jignesh, there’ll be an opportunity only if you have a net profit in the year.

Thanks For reply. I want to let you know that my status is as below,

Company 1 Profit – 10K

Company 2 Profit – 1K

Company 3 Loss – 2K

So Profit runs out to – 10+1-2 = 9K

I want to use the tax loss harvesting opportunity to sell the ”Existing Stock in my Demat which are in Loss”

Example – Company 4 Loss – 2K Company 5 Loss – 3K Company 6 Loss – 4K

Can you advise on above scenario ?

Correction –

Jignesh says:

March 27, 2018 at 9:03 pm

Thanks For reply. I want to let you know that my status is as below,

Company 1 Profit – 10K

Company 2 Profit – 1K

Company 3 Loss – 2K

So Profit runs out to – 10+1-2 = 9K So Tax = 9K*15% = Rs. 1350

I want to use the tax loss harvesting opportunity to sell the “Existing Stock in my Demat which are in Loss”

Example –

Company 4 Loss – Rs 500

Company 5 Loss – Rs 500

Company 6 Loss – Rs 350

Can you advise on above scenario if Tax loss harvesting opportunity can be used by selling Company 4/5/6 and nullify the STCG?

Yes you can sell all 3 stocks.

hmm yeah, like I have explained in the post above.

Hello Nitin Sir,

Till date I have REALISED PROFIT₹-20,458.20, TOTAL CHARGES₹3,581.74, UNREALISED PROFIT₹-15,449.95. And also I have some holdings which are in lower circuit so I cant sell it because there is no buyer. 1 I sold today, 1 with loss of Rs.1000 and other with loss of RS.16000 , in this case what should I do for tax as well as to close these positions.Total Holdings with unrealized loss of ₹-17,949.20.

Please give any suggestion to plan my losses properly.

Unfortunately nothing much to do when stock hitting circuit. Since you are in net loss, no taxes to pay. But you have to file ITR. Check this: https://zerodha.com/varsity/module/markets-and-taxation/

Since in budget 2018 and the recent passing of the Finance Bill in 2018, LTCG will be taxed at 10%. Can you please tell us the impact of the same? And whether loss in LTCG can now be used to offset LTCG/STCG profits?

1) If i sale a stock for tax los harvesting can i repurchase the same immediately ? next day ?

2) whether the stcg loss can be carried forward?

I had a loss of 19000 in the financial year 2015-2016, This year i m going to file IT return for the year 2016-2017. Is it possible to deduct the 19000 loss from this year IT return?

Can i set-off car depreciation from speculation profit. What are the other admissable expenses that can be set-off against specualtion profit. I am a salaried person

Hi,

Regarding loss harvester method as you mentioned that we should realized the unrealized loss making lot to offset the realized gain….So i have two questioned regarding the same.

1) I think below method is use for loss harvester

Short term loss

Long term loss

Long term gain

Short term gain

is it right or we should just realized the unrealized loss making lot to offset the gain making lot as you mentioned above?

Thanks,

Best check out the taxation module on Varsity.

Hi Nithin,

I have two basic questions,

1. Suppose my turnover is 10k and realised profit is 1k which is 10% of turnover. In this case, as turnover is less than 1 cr. and profit is greater than 8% I don’t required an audit.

Now in continuation to that, suppose if I do tax loss harvest by booking loss of 1k by selling 30k worth of my equities. In this case, my total turnover is 40k and profit is 0%, Do I need an audit?

2. Suppose I book net loss with turnover of 40k do I need an audit?

Hi Team,

Has the tax loss harvesting page of Zerodha become obsolete? I do not see any possibilities in my account although I have possible stocks that I can sell to save on tax.

Is the feature broken?!

Yes, Tax loss harvesting is broken. The worst part is that Portfolio–> holdings also doesn’t display the holding days(I used this feature to manually calculate Tax harvesting opportunities). I raised a ticket more than a month back, called their support numerous times and also sent emails to Nithin and other Zerodha people. But, they don’t seem to be bothered.

Hi Nithin,

I am a salaried employee and is a investor (primarily long term). But, only from this August ’17, I started trading in F&O. Until today, F&O turnover would be around ₹1.5 CR and it seems it will go around ₹2.5cr till the next March 18. But, profit is ~₹30k till date, not sure of future. Sidewise, I am also investing in equities, let say ~₹1-2 lakhs in whole year. Equity turnover would be ~₹2-3 lakhs. I have a few queries:

1) Do I have to mandatory file ITR as Trader?

2) Will I have to get my books audited? Also, please specify the criteria for mandatory audit?

3) If above two are yes, then I am falling under the head business, then have I also need to get GST registered?

4) And, in case of Trader, can I offset my profit with losses from equities I am holding for the last 5 years?

5) Last one, Would I have to declare my existing portfolio (all more than one year) under business and not investor, as I have few stocks giving long term capital gain. Can we do pick and choose?

Gaurav, contract turnover isn’t the turnover for taxation. Suggest you to go through this: http://zerodha.com/varsity/module/markets-and-taxation/.

1. yes

2. Do go through the chapter on audit in the above link

3. No GST registration for trading.

4. No, your equity gains are long term capital gains. There is no tax to pay on it.

5. If you have been holding it for a while, best to show it as capital gains. You can decide what you want to do on those which you have taken recently.

Sir,

i am central government employee and have zerodha account. I purchased some shares and mutual funds for holding it long term. No plan for selling it fully/partially in next three years. please clarify the following doubts.

1. As a central govt employee(in 30% income tax band), can i purchase share? (Just investment for long term ..not trading)

2. Monthly i am buying shares for 30000(with salary). i have not sold any share in this financial year either long term/sort term. Do i have to show this in IT returns? or just filling IT returns as per form 16 enough? Which IT returns form i have to file?

1. Yes don’t see any issues unless there is specific restriction on your department.

2. If you haven’t sold any, there is no capital gains to declare, so normal ITR1 is okay. Once you sell, you can show it using ITR2

Sir,

I am pensionar. I regularly trade in all segment .I am done always much lose.

My cl.Id. RG1289. As par my transaction in all segment in year 2016-17,I don’t know what is my total turnover in all segment.

Pls. give me total turnover in all segment.

As par my total turn over I need Audit my Zerodha Account ?

Pls. guide me.

I can’t give you a one line answer. There are different ways to calculate turnovers. Check this: https://zerodha.com/varsity/module/markets-and-taxation/

Hey. If we sell on NSE and buy on BSE then the wait period of 2 days can also be bypassed right?

Yeah.

Sir,

I am unemployed.I have some FD’s.TDS is being deducted by Bank.

Which code/Nature of Businesses should I use while filling a return and which form?

From this year I am trading with Zerodha,Equity account.

pls reply

If only FD, then you will need to use ITR2. If you are also trading, then Trading-others (Code: 0204) on ITR 3. Check this: https://zerodha.com/varsity/module/markets-and-taxation/

Sir,I did equity trading from Sharekhan Broker last year.Turnover is just 1L.

FD interst is only 75k.I dont have any job.I just want to claim TDS refund.

I dont want to show this 1L turnover,is it ok?

so which ITR sir?

Hmm.. Best to show the turnover. ITR2, you need to use.

Hi Nithin,

When I’m checking tax loss harvesting in Q portal, It is showing realized loss there but it is not showing Tax loss harvest opportunity amount. It is showing ”Save upto 0.0 in your income tax for FY 2014/15” while I’m checking for 2016-2017.

Can you help me on this?

Thanks and Regards,

Vishal Goyan

The tax loss harvesting option isn’t working on Q now. We’ve stopped that service for now.

Can the loss incurred in trading F&O be set off against my INTEREST income.I have interest income(bank FD’S ) over 5 lacs and F&O loses are over 1 lac.

Regards

Hi zerodha,

I have profit/loss less than 8% and turnover is less than 1cr. My annual salary income is less than 2.5 lks, i think i need not get books audited. Please advice. Also which ITR should my CA used while filing? So that before meeting to CA i should know.

Yeah, audit not required. ITR4. Suggest you t go through this: http://zerodha.com/varsity/module/markets-and-taxation/

Hi Nithin Sir,

This year my income from trading was 4.48Lakhs.

I did a small mistake of submitting 15G at bank.As per 15G,income should not exceed 2.5L limit.

Will I attract any penalty?

In case of equity, trading income for the year is uncertain. So I guess you can always explain this reason if you had to explain to the ITO.

Yes Sir.

One more query,I am confused.Are we paying a double tax on FD’s?

Example-My income from trading is 4.48Lakhs+1lakh FD income=5.58Lakhs

Here we are paying Income tax on above income after 80C deduction.

But we are paying TDS on FD interest too.

So 1st part we paid TDS

2nd part when this FD income added with main trading income,we are paying tax there too.

Am I right Sir?

What you have paid as TDS can be considered like a portion of tax to be paid at end of year. No double taxation. If you have paid excess tax, you can claim for refund.

Hi

Can the ”tax loss harvesting” be done by selling short-term loss making shares exactly on 31st March?

Or, should it have been done at least by selling on 29th March 2017 (i.e. T-2 i.e. 31st – 2 = 29th)?

Thanks

Ekta

You can sell on 31st.

Hi Nithin:

Website https://q.zerodha.com/ is unreliable and doesn’t work most of the times as expected.

This is highly frustrating at times. Especially during the weekend, I get Bad Gateway error most of the times.

Is this being looked at?

Regards

Harikiran

Yes, we are working on replacing the current vendor based backend which is causing this. We should have a solution for this soon. Btw we had done some quick fixes, where are u seeing the gateway error?

Thanks for the reply Nithin. Good to hear that.

Reports and Quant sections do give this error intermittently.

Regards

Harikiran

Hi Nithin,

I am holding 200 shares of a company and the unrealized loss on such shares is Rs.12,000/- (holding period is 6 months).

I want to book this loss for tax purposes (tax loss harvesting).

Suppose I sell the shares on 22nd March, 2017 and buy the same shares immediately on the same day, will this be a short term capital gain or will it be a intraday trade?

I have already done such a transaction on Zerodha before and I was charged STT @0.025% on the sell side only. So I think as per NSE it is an intraday trade. Just wanted to clarify how will it be considered for tax purposes.

Thank You,

Priyam

Yes, intraday trade. You will have to sell the shares wait for it to go from your demat and buy back again to take advantage of this capital loss.

Thanks for the reply.

Can I sell these shares on NSE and purchase the same on BSE on the same day or vice versa (so that I don’t have price fluctuation risk which I will have to bear in case I wait for T+1 or T+2).

I reckon this way delivery of shares will be happening as trade is routed through two different exchanges (STT would be charged @0.01% on buy as well as sell) and I can claim the loss as my short term capital loss.

Thank You,

Priyam

Yep, you can.

Thank you

Kamath Ji,

I want to short sell 1 lot of Nifty CE or PE.

Zerodha calcuator says initial margin 23160,exposure 20080,total margin 43246.

How much intraday margin does it require?

40% of this Rs 43246

For Tax Harvesting… IF i sell a holding/delivery on NSE to book Loss and rebuy instantly on BSE at same price.. Does it amount to Tax harvesting/Loss Booking ??

Grey area, technically yes since the stocks will get debited from demat and then credited. So it is as if you have booked a loss.

Hello Venu Sir,I have 2 queries-

1)I get 1.5lakhs(online transfer) from my parents,do I need to mention this amount in ITR-4?

is this amount taxable?

2)I made a profit 2.25Lakhs+FD interest 65k.

My f&o turnover with Zerodha is 32L.Do I need audit?

-Nidhi

1. Yes, best to show it on ITR4 as a gift. Gifts from parent are not taxable.

2. Not required

Hi Nithin,

intraday turnover(no delivery)=10,000

profit=2000

charges=2400

what is my tax liability and what to show in itr 4s, assuming that i have to fill itr 4s(salary+trading.

Similarly,

intraday turnover(no delivery)=10,000

loss=2000

charges=2400

what is my tax liability and what to show in itr 4s, assuming that i have to fill itr 4s(salary+trading.

Thanks

Good Post. Please keep updating your posts on daily basis. Users like me are eagerly waiting for them.

Thanks

Mike Craig

IT Solutions

Hello Nithin,

my turnover is below 1Cr,profit from f&o is 4.10lakhs.I paid a tax Rs 15750,as I dont have any 80C investments yet.Do I attract audit?In above reply of Tushar you said that nil tax so no audit.

Also,what about the 8% rule?When do we apply that?I’m totally confuse though I read your other readings.

thx

Suggest you to go through this module: http://zerodha.com/varsity/module/markets-and-taxation/. If profit less than 8% of turnover, you are required to get an audit also. So if your turnover is more than 50lks and profit at 4lks (8%), you will need an audit. Go through the chapter on turnover in the above link.

Ohh,looks like I misunderstood.I got confused in words. Pls confirm Nithin

——-Turnover is below 1Cr and profit less than 8% of turnover,you need an audit———-

Here Profit less than 8% of Turnover means(which one is correct) –

1)Profit(4.10Lakhs) less than 8% of Turnover 1Cr i.e, 8 Lakhs?? So,my profit is less than 8 Lakhs,so I need audit

or

2)Profit(4.10Lakhs)less than 8% of Turnover(my f&o turnover which is 29L) i.e, 2.32Lakhs.Here its above 8%,so no audit,right??

Yes and Yes

no.

we are considering which Turnover for 8%?

1Cr or 29L??

🙂 ah, 8% of your turnover (29L) or Rs 2.32 lks.

Thanks Nithin.

I will ask 1 yes and no type of query EOD covering all scenario of audit/no audit case.

Sirji,F&O turnover in ”Tax P&L report” showing 5 lakhs,but in ”Tradewise future turnover report” its showing 11.91Lakhs.

Which one is the correct turnover to be consider?

Can we file return and do audit after 30 Sept too?Any fine/penalty for audit after 30th Sept?(date is extended but asking to clear the doubt)

Tushar

Tushar, turnover calculation is a very grey area, different people follow different rules. It is upto you how you want to calculate, check this chapter explains.

yes,I went through that beautiful and detailed explanation by you.

Proud to be a part of Zerodha as a Trader.

My query related to above remark-

”Different people follow different rules”

-Ok,but will I get a scrutiny notice by ITO someday for-The turnover they got to see on my PAN database is different than the turnover I’m submitting in my audit report??

Will someday ITO ask me that,” your turnover showing on database is 3.87Crs but you showed in audit report is 2.17Crs…”

Even if I pay taxes properly,there will be huge difference between “Tax P&L report” and “Tradewise future turnover report”

Possible??

Tushar, turnover has bearing only to decide if you need an audit or not. It makes no difference to how much tax you have to pay. Also the turnover reports we give is just for your reference, you don’t have to submit for filing income tax returns. There is also no set rule from the IT department on what exactly should be used as turnover, so as long as you don’t evade taxes and have a logical explanation on what you consider as turnover, you should be okay.

Wow,Super Quick Reply 🙂

Ok,pls tell do I need an audit or not,then I’m done with queries-

Turnover is below 1Cr(Tax P&L report” showing 5 lakhs,but in “Tradewise future turnover report” its showing 11.91Lakhs)

F&O/Equity Intraday Trading Income=3.5L

FD Income=1.5L

Total Income=5L

80C deduction=1.5L

Small loan deduction=1L

Tax=Nil

Audit or no audit Sirji?

Total tax is Nil, Turnover is less than 1 crore, so no audit.

Huge Thanks 🙂

Nithin/Venu Sir,one query-

Sir,I am trading 2 lots Bhartiartel Fut with Zerodha.I’m basically a scalper.

Now,I want to trade 10 lots of Bhartiartel.My concern is about the order filling.

1)Will my all 10 lots be get executed at say long 10lots @ 351 and cover @ 352 and this I’m doing as a scalp which works fine with 2 lots,but will it work on 10 lots too?

2)How many lots of Bhartiairtel can a retail trader like me trade at a time?

Thanks

N.Bhardwaj

Very tough to say. Best to increase your lot size slowly and see this for yourself.

One negative side of tax harvesting is that, after realizing the loss should the share price rise, buying at the higher price may negate whatever tax saving we gain on the realized losses. If the share price continues to rise in the long term and would not be somewhere near the selling price, then the trader will not have an opportunity to benefit from tax harvesting.

Is it possible to sell and buy at the same instance, so that the share price fluctuation is overcome?

Dear Sir

I was Transferred to overseas and getting my salary here (oversea) in i have trading account before i come here which was linked to my local (inidan) account after coming here i have traded shares both delivery and intraday through the same indian tradaing account now i want to file my incometax return. and i am going back to india do i needed to open another NRI account for trading or it was ok. which form should i fill for ITreturn.

Joe

Yeah, you should open another NRI trading account. IT returns using ITR4 since you have done intraday trading.

Hi,

How to save/optimize on tax given the following:

I had bought shares of company X, which gave a 1:1 bonus.

The price of shares became half, though the portfolio size remained the same.

I want to book 50% short term loss by selling the per-bonus shares.

Since the price of the post-bonus shares is 0 they will be considered 100% capital gains(short/long depending on duration held), so I don’t want to sell them.

After selling and booking short term capital loss, I want to buy the shares again.

Just wondering if the following is possible…

Attach two demat accounts to trading account, lets call them primary and secondary.

When I buy shares they get credited to my primary demat account.

Post selling the per-bonus shares in the above scenario, transfer the post-bonus shares to the secondary demat account.

Then the shares bought post booking the short term capital loss can be sold-bought without any hassle(of attracting capital gains).

I would like to know if the above is possible. If yes, which depository participant offers the lowest transfer charges and how much?

If the above isn’t possible, what is the best way to isolate the bonus shares(buy price = 0).

Thanks,

Srini

Hello Nithin,I am considering to trade 20 lots in BNF.

How many rupees slippage do you advice for entry?

This query got answered by a big BNF trader in Traderji Forum.

thx anyway

Hi sir,

I am a retired govt. official & my main source of income is Pension+FD Interest. Now i am also srarted online trading before 6 months in Equity/Future/Option segment of stock market & during FY 2015-16 I have made Profit/Loss in different segment as under:-

(a) Short term capital gain in equity:- 1848/-.

(b) Profit in Intraday trading of equity:- 744/-.

(c) Loss in F&O trading:- -36727/-.

My turnover during 2015-16 is below 1 crore.

Now i want to know:-

(1) When my turnover is below & no any net profit earned, so in my case Audit is necessary or not.

(2) As i have minor short term capital gain but Loss in F&O segment then i will be treated as Investor or Trader or Both.

1. If you don’t have any taxable income (including pension + FD), then yeah no audit required. Btw, you can setoff your interest income with the F&O loss

2. It is upto you how you want to declare yourself. Suggest you to check this module: http://zerodha.com/varsity/module/markets-and-taxation/

Thanku for answering my questions but I am still confused on AUDIT point, because my income from Pension & Interest is above 4.60 Lac PA, which is taxable & as per your answer Audit is necessary in my case even after net loss in trading of shares…..

If you have any taxes to pay for the year(which you are, since income over 2.5lks), in such cases audit is required even if net loss due to trading.

ok….. & Thanks again….

Nithin Sir,off topic query which arised after reading some interviews here.

I trade just 1 lot of Relinfra or Tatasteel Future.

If I trade same quantity in equity i.e,1300 shares of Infra or 2000 shares of Tatasteel using SL-M order,will they get filled at the same price?

I generally look for a quick 1rs profit,but if it reverse in Future,I make a loss.So,If I trade equity I can control the number of shares.

So,If I trade 6000 shares of Tatasteel Equity or 5200 shares of Infra,will they fill at the same price like it fill in Future?

Entry at say 540 and target at 541(5200 shares of Infra)

Hope you understand my concern.

-Kabir

In equity since there is no lot size as such, so the shares can get traded at different prices. What you will have to track will be the average price of your exit on SL-M getting triggered.

Sir,pls update NOW setup 1.13.3.5 under download section.It has no setup file(no dll file in the setup,it has just the icon of NOW and pdf)

We believe in Zerodha. 🙂

This time the NOW team has given us only a replaceable exe for already existing NOW installations, which is why the confusion arose. We’ve now added the previous version of NOW along with the latest exe. We’ve also uploaded instructions so you won’t have a problem during installation.

Sir,Module 6-Option Strategies(under Varsity) has no download option..Pls enable it.

And pls update Module 8,9 and 10.

Yep

Hi Sir,I do ATM scalps intraday.My query is,1)I want to buy 10 lots PE and hold.So do I need to select Normal or MIS?

and 2) I will be doing ATM scalps with 10 lots.How to do this so that my Intraday and Swing trades wont get mixed and cover off.

thx

1. NRML if you want to hold to the next day. If you want to intraday (until 3.20pm) then MIS

2. Swing trades you can do using product type NRML and the others using MIS.

But I’m using NOW Sir..

Nithin Ji,I too have a query on Option.

I had bought 10lots NF 7800CE @ XX price and put a target order.

But when I tried to put SL order it rejected(RMS rejection).Why so?

with other stock futures or even with NF,we use buy order,then SL order+target order with the same funds we have with you.

But why not allowing SL order with options?

When you trade in options, buying options require lot lesser money than shorting. So unlike futures, it will ask for extra margin when you are trying to place both Exit and SL order.

One more question and I’m done with the questioning Captain 🙂

NF 7950PE price is say 80Rs and I want to short sell it and hold it for next 2-3 days(or till expiry).I read above that short selling needs full margin..So full margin means how much?

(Do you mean 17600rs which is required for 1 lot Nifty future?)

So,can I short sell 6 lots if I have 1 Lakh amount with Zerodha and hold it till it expires?

Thanks

Check this post on basics of option writing. Full margin for Nifty future is around 47K. But yeah for writing 1 lot, since option writing has unlimited risk, margin required will be around the same. Btw, you can use our SPAN calculator to check option writing margin requirement.

Dont know where to post this query..found this section active.Pls reply my query Nithin Bhai-

1)Nifty 7800CE premium price is say 65.

Margin for 1 lot=4875Rs.

So can I buy 10 lots=4875*10=48750Rs and hold few days?

Margin available is 60000rs in my a/c.

thx

Xitij, while buying an option it is called premium and when shorting/selling first it is called margin. Yes, once you pay the premium of Rs 48750, you can hold it till the end of day of the expiry of that contract. Suggest you to go through: http://zerodha.com/varsity/

Sir,Please answer my these queries, I put down some scenarios of some of the friends-

All Full Time Trader Cases-

1)F&O Turnover is below 1Cr,(only Futures contracts,thus turnover is below 1Cr)

Income from trading is only 3 lakhs,

FD interest I receive is 1 lakh,do I need audit?

2) F&O Turnover is above 1Cr,(Option Trading increases the turnover figure )

Income from trading is only 3 lakhs,

FD interest he received is 1 lakh,does he need audit

3) F&O Turnover is above 1Cr,

Profit made is only 1.15 Lakhs

FD interest he receives is 80k, does he need audit?

4) F&O Turnover is above 1Cr

Loss made 1 Lakh.

FD interest is 1.25 Lakhs.

Do I need audit? I don’t want to carry forward this 1 Lakh loss.Just a plain ITR return of interest received on FD we will show,it it ok?

5)If I take only futures trades with a nice strategy,I could make(may be) 10 Lakhs profit,but my turnover will be below 1 Cr,when we take option trades then only this turnover figure rises and we have to pay a big amount to CA.

Thats the reason I avoid taking option trades 🙁

your views on this please.

-Kabir

1. Yep you will need audit. Check this module.

2. Yep

3. Yes, since turnover more than 1 cr even though no taxable income.

4. Yes, even if you don’t want to carry forward the loss.

5. Hmmm.. if you have maintained all books and your accounts properly, a CA to audit shouldn’t take more than Rs 10 to Rs 15000.

Btw from this year the turnover limit is revised to Rs 2crores.

Hello Sir 🙂

I never paid income tax so far and never filed a return as the income was always below the limit.(last year you replied some of my tax related queries).

But this year,my income is 6.68Lakhs+.

74k from FD interest

1.27Lakhs from Option Trading

and around 4.5lakhs++ from active futures trading.(and still running)

I deposited 1.5lakhs towards PPF.

My queries,pls do reply-

1)When do we pay taxes for F&O? before 31st March??

2)how do we pay taxes?

3)As I may fall in audit case,do we pay taxes after the audit has done?

4)or is it ok to pay taxes once the audit is done by CA?

5)I did small mistake.I submitted 15G form for my FD’s considering my income wont exceed the tax limit..but this year luckily my trading performance improved.

The 15G rule is broken by me,what to do now?

-Lini

Firstly congrats on the profits. 🙂

We have taken this module on taxation, which has answers to all your questions. check it out.

1. Advance tax before 31st march, and for final qtr after 31st march. Check the module

2. Online

3. Audit is done by a CA at the end.

4. You have to first pay taxes and then get the audit done.

5. Should be okay. Speak to a CA.

Sir,Under CHALLAN NO./ITNS 280,

Which Type of payment we select-(100)ADVANCE TAX or 300)SELF ASSESSMENT TAX or (400)TAX ON REGULAR ASSESSMENT ?

Profit made Credit goes to Zerodha only.

Without Zerodha ,I’ll be giving half of my profit towards brokerage n taxes.

-Lini

Advance tax if paid before March 31st, Self assessment if paid after.

Can one set off equity delivery short term capital losses against gains in futures?

I am a full-time salaried employee. i mostly do equity delivery transactions but occasionally take future positions as well.

This year i have about Rs 1 lakh as short term capital losses in equity delivery. I also have about Rs 2 lakh in gains from futures. Can i set off the losses from equity delivery with gains from futures and pay taxes on the remaining amount?

If you are showing equity delivery trading as a business, then yeah you can. Check this module.

2)If I made the money from buying-selling,from where I am getting the profit money?

The company is giving or the broker is giving as some1 else lost the money?

Pls clarify this P&L process along twith above query Sir.

If you’ve made a profit, someone else has made a loss. The markets are a what we call a zero sum game. Someone’s profit is someone else’s loss.

1)That means we are doing pure Satta/Speculation,right?

2)If you have say 100 clients.90 clients are very small traders,loosing money and rest 10 clients are making huge money.They are big traders.How do you give money to them?You get the money from the exchanges to pay those 10 big traders?

i.e,how the money flow?

3)Zerodha is a Genuine Firm.But is it possible that other firm could refuse to give profit made to the traders?

Thanks for answering my queries Venu Sir.

All settlement happens with the exchange. So if tomorrow you loose money, exchange debits the money from your broker (on your behalf) and pay to the broker whose client made money. Remember that all money anyways is accessible to the exchanges, so trader or broker can’t say that they won’t pay money. Suggest you go through http://zerodha.com/varsity/

Nithin and Venu Sir,Pls answer my query below:

I bought 1000 shares of XYZ company and I sold it Intraday or after few days.

Broker made the money,The Govt also made the money.I also made the mode(or may be I lost some).

My query is, what’s the profit of XYZ Company here? What are they gaining from my buy-sell?

thx

The company doesn’t make any profit out of the transactions you make. The company raises capital from the markets through an Initial Public offer. The secondary markets only provide a platform for exchange of such shares.

hi…can a off market buy/sell transaction be made of a listed company without the shares actually going through a DEMAT account.

You’ll have to initiate the transfer of physical shares if you don’t want it to be routed through a demat account.

does SEBI still allow a listed company to issue shares off market in physical form

If you’re holding shares in demat form, you can get in touch with your DP and ask for it to be ’rematerialized’. On re-materialization, you get share certificates.

hi…can a listed company offer shares off market to her sister concern at a price much lower than prevailing market price ??

Technically, yeah possible.

Dear Sir,

I am having an trading account with Zeroda, I am housewife. my husband is NRI. right now we are decided to invest in Equity market of Rs. 10 Lakhs.

I bought stocks worth of around 6 Lakhs right now, and going to invest every month around 1 Lakh up to level of 10 Lakhs.

Initially I thought of doing trade for long term like 1-2 years. But present markets are very volatile. So I am thinking doing short term trades, based on profit booking.

I don’t have any other incomes.

My query is that if i do Trade (Turnover) of 1 crore in month am I need to pay any Income tax on this?

If yes, taxes applicable on Profit?

Please help me with all relevant information.

Suggest you to read this: http://zerodha.com/varsity/module/markets-and-taxation/. If you have only equity delivery trades, you can show it as capital gains and hence don’t need an audit or file using ITR4. For short term delivery trades, it is 15%.

Great information here! Just shows how Zerodha is truly empowering the trader/investor in making well informed decisions and they truly care. Such a refreshing change from other brokers who are only looking to make money off the customers, while they do not care for them. Keep innovating guys! Cheers!

Sir,

I have recently opened an account with Zerodha (3 weeks backs) and started trading on it. I have also have an Demat with Zerodha (newly launched one). Though i am happy with the brokerages aspect, I am facing lot of issues in terms of getting my shares listed in the holding page

To give you an example,

I have purchased shares for intraday and converted into CNC, all these shares are getting listed under T1& T2 holding list for 2 days. After this period, ideally this should be listed under my holding pages for me continue trading however this is not getting reflected in holding page and as well in the equity fund summary as well

I have reached out to Zerodha customer care, I am told that there is an ongoing issue with Zerodha demat and hence i am seeing this issue. Rather, Demat and account was not mapped or so.

As of now, they are manually adding into holding page at 9:15 IST for trading every day and i am also making calls to zerodha on a daily basis in the morning.

Not sure, when this will be resolved. I am really not comfortable doing trading having this issue. Please resolve it asap. I am at the risk of loosing money if its missed to manually add even on a single day in the holding page.

As a result, My equity holding summary and all other summay are giving wrong info,

Prasanna, this issue will be fixed by monday/tuesday. Initial hiccup we are facing with our new DP process. Sorry for the inconvenience.

Thank you sir, Very much pleased to see your response.

Dear Zerodha & Nitin Sir,

I am a Insurance advisor(self employed) and having commission income(4,67,000) and I am a regular F&O trader in zerodha, Now for FY 2014-15 I have incurred loss of 1.5 Lakhs and my total turnover as per p&l statement is 14 lakhs. I want to know which ITR form should I use, Does tax audit required? and I want to carry forward the loss. As I am planning to declare the loss for the first time. I tried contacting many CAs and other friends. But unable to get the complete clarity. As tomorrow is last date for filing and in case of loss carry forward. Kindly provide me suitable solution ASAP.

You will need to use ITR 4. Ur total business profit (comm – trading loss) seem like it is more than 8% of turnover. So u will most likely not need an audit. Check this module:http://zerodha.com/varsity/module/markets-and-taxation/ explains everything.

Sir

I consider myself as a trader (use ITR4) and show income as business income. My most income comes from f&O, so if i buy ABC ltd company shares and hold for more than 1 year then can i consider this income as tax free or business income (30% Tax)

F&O income is business income, so you have to pay according to the tax slabs. Check this: http://zerodha.com/varsity/module/markets-and-taxation/

What i am saying is f i buy ABC ltd company shares and hold for more than 1 year then can i consider this income as tax free or business income (30% Tax)

Yes if you buy and hold shares for more than 1 year, it can be considered as LTCG and hence no tax.

Sir I traded in equity in 2012 for just two months and incurred loss of around 40000. I was a student that time and did not file ITR since i had losses…

Now I too have recieved income tax dept letter sayinh pls file ITR for 2013-14 year …

What is the process now I have to do …. I can’t go and meet the ITO due to some busy schedule.

Pls help

If they have asked you to file ITR for 13/14, you can do it now. Delayed returns, but you can. But if the notice is for 2012/13, then you will have to go meet the ITO with your P&L, bank statement, no other way.

Sir I am trading since 2012. my salary is just 2.0 lac per year.I didn’t gain anything from stock market.already lost aprx 4 to 5 lac till now. I thought that I don’t need to file income tax return but I received a letter from income tax department for not filing income tax. what I have to do

Since you have received the notice, do go meet the ITO. You can’t file returns for 2012/13 now anyways. Take your P&L statement and ledger when you go to meet, and explain that you were in loss and hence didn’t file.

dear sir, i have traded more than 5 crore delivery base in one financial year but i am in loss, then i need to pay income tax over traded amount?

No Ram, no tax has to be paid on traded amount. Tax is always on profits earned. Check this : http://zerodha.com/varsity/module/markets-and-taxation/

Thanks sir, one more query I need to audits or not

Check out the chapter on turnover here: http://zerodha.com/varsity/module/markets-and-taxation/. You may/may not need an audit.

for filing it returns which p&l statement should i download, the normal p&l or the tax p&l, the loss shown in tax p&l is more, i am confused kindly help asap.

Use the tax P&L, the calculation differs slightly based on how P&L is calculated.

Sir,I fall under Case 1-

1)I traded F&O in year FY 2013-14 and my turnover as per Zerodha report is-

FY 2013-2014 (AY 2014-15)

My F&O gross profit was -2200rs

Future turnover was -11900rs

Bank FD=7lacs So, Interest I received is Rs 59500rs.

=Income Below 2 Lacs

2)Same Turnover was for FY 2014-15,

FY 2014-2015(AY 2015-16)

My F&O gross profit was -8500rs

Future turnover was -12300rs

Bank FD=8lacs So, Interest I received is Rs 72000rs.

=Income Below 2 Lacs

Sir,Few Queries here, please do reply in your free time-

1) For Bank FD I provided 15G form. Is it a good practice of providing 15G as I am doing F&O trading(not regular though)?

2) I don’t have any other income source,Do I need to file a return as the income is below 2 Lacs?

3) Will IT dept trouble me in future if I make a very good money from trading next year and they will ask for AY 2013-2014 return,AY 2014-15 return, AY 2015-2016 return?

Thnaks

Lini Deshpande

If your income is in the zero tax slab (note it is 2.5lks now), then yes you can give 15G form, there is no issue. 15G form has not relation with F&O trading.

Since your total income is below Rs 2.5lks, there is no need for you to file returns, but it is good practice to do so. Might help you if taking any loans tomorrow.

IT department can ask you, but you can clarify. You aren’t violating any rules, but like I said earlier it is best file ITR.

Hi Nithin,

Please suggest, should I go for Audit by CA . Please find the particulars below.

Total Turn over (EQ+FNO+MCX) = 10,03,897.50

Net Loss excluding brokerage : -34,609.69

Net Loss + Brokerage : 87,928.25

As per below statement which I found in Q application.

’ If turnover < ₹1 crore and profitability is less than 8% of turnover (Section 44 AB)'

what i understand is, we have get the audit done only if there is any profit. In my case since I am in net loss, audit is not required. Please suggest.

Regards

Vinay

Vinay, check this: http://zerodha.com/varsity/module/markets-and-taxation/, everything around taxation explained in detail.

In your case if trading is your only income, then no tax liability since you are net down for the year, and hence no audit required. But if you had other income as well and you fall under a certain tax slab and if your profit is less than 8% of turnover, then yeah audit required.

Dear Sir,

I am a salaried person. so i have to deposite form 16C in every year to income tax dept. Now i booked losses Rs.1701.30 intraday turnover Rs.5793 and total charges Rs. 966.07 in FY 2014-15. Now should have to i deposite ITR4 seperately before 31st july? And if i have to deposite ITR4 ,then how?

Joyonta, why don’t u read through this module: http://zerodha.com/varsity/module/markets-and-taxation/

can u pls tell me which stock futures are liquid,where I can grow upto trading almost 15-20lots as Intraday Scalper?

thanks

Karan

Check this link on NSE, and click on stock futures in the drop down. The top 10 are the most liquid contracts.

I traded in FNO for July-Dec 2014 (around 18-20 transaction), net loss around 20-25 k, turnover 80-85k. I otherwise invest in equity (not a daily trader) and MF. Should I file return as a trader/investor?

PS – I don’t intend to do FNO trading in future, neither did I do after Dec 14 (it was just a learning/experimentation exercise)

Prateek, you will have to use ITR4/4S to be able to show this F&O trading loss.So you will have to do this as a trader or trading as business income, but you can still show your equity and MF as investments under capital gains.

And for that I’ll have to get an audit done through a CA? What all do I have to get audited?

We are putting up a detailed module on taxation on http://zerodha.com/varsity/. CA will create your balance sheet, and P&L and sign on it. He will cross verify this with your bank and trading account, that’s it.

Hi Nithin,

almost a month old in Zerodha and i must say I’m loving it! right from all the innovative indicators in quant to trading platform Pi and ofcourse the brokerage, it shows a lot of thought has gone in the architecture.

just wanted to know is there any special way to declare yourself as a trader while filing returns, also is there any plan to improve on the mobile application coz in the entire experience of Zerodha, i think thats the only sore spot, takes a long time to do anything and positions only gives day to day M2M not the total M2M. Cheers!

Chintan, Kite mobile on its way. http://kite.trade/

If you use ITR4 for declaring your trading income, that means you are a trader, or trading is a business income. Check this post: http://zerodha.com/z-connect/traders-zone/taxation-for-traders/taxation-simplified. Also we will soon introduce a module on everything you need to know about taxation.

Sir,

2 queries,trade related-

1)If we buy 20 lots Tatasteel Fut @ say 450 using SL-M order,will all the 20 lots get filled at 450?

2)and if we want to square of immediately at 451,will all 20 lots get filled?

thx

1. SL-M is in essence a market order. When the trigger is hit, a market order is sent. So no, the 20 lots can get filled anywhere around 450.

2. If you are using a market order, there is no guarantee at what price it will fill. But you can use a limit order at 451 to sell 20 lots, but if you use limit, there is no guarantee of execution.

Pls tell me how to put these orders-

1)CMP is 420 and I want to buy 10 Lots at 421.15

2)I want a target order at 422.65 so that all of my 10 lots will be get sold

3)I want to put SL order at 419..

While trading the order get slipped..I may be putting wrong orders,so pls tell us how to put abv all 3 orders.

Thanks Sir

1. Buying SL-M order. Trigger price 421.5

2. Limit sell order, price: 422.65

3. Selling SL-M order, trigger 419

Nithin Sir,

I am a Scalper trading 3-4 lots of Relinfra and The order get fills with 5 to 20 paisa difference.

Being a Scalper I book on just 1-3rs profit.If I trade 10 lots Relinfra,

will be there any order slippage of 75paisa to 1rs while trading with such a bigger quantity?

I use SL-M order to buy/sell.

-Karan

Karan, very tough to say what could be the impact of placing an order for 10 lots. But yes it is possible that impact could be 75 paise or more when trading bigger quantities on a not very liquid Relinfra.

hi nitin

i m deepak..will u plz TELL ME IF I SELL ICICI BANK CE OF STRIKE PRICE 350 AND ITS SPOT PRICE IS 320..I HAV TO GIVE

FULL MARGIN OR GIVE LESS MARGIN AS IT IS DEEPLY OUT OF THE MONEY..

Margin required is around Rs 49000. You can calculate this yourself on our SPAN calculator. Check this: https://zerodha.com/margin-calculator/SPAN/

hello team,

Now tradewise turnover report is available on Q. but when i download it for DP1528. for turnover we take sum of profit & loss (both positive) as it becomes 22,52,726.25.

but for gross profit when we take sum of them with sign (profit as positive & Loss as negative) , it reduces to just Rs -54,001.25.

though actual gross profit for dp1528 is 4,63,167.50

a lot of difference in gross profit is there.

so pls check the same . thanks

Ajay, For calculation of turnover, all credits and debits make turnover together (they don’t negate each other). So if you made profit of Rs 100 and then loss of Rs 100, the turnover will be Rs 200, and not Rs 0.

Hope this clarifies.

Hello team ,

i am convinced that For calculation of turnover, all credits and debits make turnover together (they don’t negate each other). but my concern is gross profit according to this.

if this tradewise turnover calculation is right. gross profit must be difference of all credits and debits , So gross profit for dp1528 is according to given tradewise turnover is -54,001.25.

though actual gross profit is 4,63,167.50 for dp1528.

there is big difference in actual gross profit and calculated tradewise gross profit.

which clearly indicates method applied to calculate tradewise turnover is wrong.

Ajay tradewise profit need not match your actual P&L because of the way it is calculated. That calculation is only for helping you calculate turnover using that method.But I will in any case have this checked. *** Ajay just checked your account, I took the tradewise turnover report, did a sell value – buy value for all the trades, I got the value 463167.5 which matches what your P&L shows to the dot.

hello Team,

Thanks , I was Incorrect, perhaps there was a miscalculation.

all praise to your efforts

Hi,

This question is not related to This topic. This morning i read about abt BSE Brokers forum trying to Lobby with SEBI to fix minimum brokerage. Is this is a cause for concern??. If it does happen lot of trades will become unviable.

Charan, SEBI/Exchanges are pro-investor/retail. Don’t think it will happen, if we sense that something like that is going to happen, we will let all of you know.

hello team,

Now tradewise turnover report is available on Q. but when i download it for DP1528. for turnover we take sum of profit & loss both positive as 22,52,726.25. but for gross profit when we take sum of them with sign

it reduces to just -54,001.25. though actual gross profit for dp1528 is 4,63,167.50

a lot of difference is there.

so pls check the same . thanks

Hello team,

All praises to your efforts to make our life simple through q.

But I feel n FIFO Basis future turnover calculation is not correct in Tax P& L report .

My Id is RA2486.

My notional Turnover is around 78 crore for 2014-15.

And 45200 nifty futures are bought and 43800 nifty futures are sold. And report says my future turnover is 489319. It should be more than 20 lacs.

Pls check the same and if I am wrong pls tell us , with example how to calculate. Because turnover is key factor to determine whether books should be audited or not.

Ajay, for now the turnover calculation that we are following is basically an absolute sum of scrip wise profitability. So if Nifty July future you were up 1lks, and Sept future you were down 2lks, the total turnover is 3lks.

There is another school of thought which says that this should be an absolute sum of trade wise profitability and not scrip wise. So an absolute sum of profits and losses on each trade that you have undertaken. We are adding this report on tax p&L in the next few days.

Best.

hello Nithin,

thanks to address issue.

Today i checked q and got tradewise turnover report is there , you have added this option in tax P&L .

but when i tried to get tradewise report for 2 ids ra2486 & dp1528 on mozilla firefox & google chrome respectively. it did not show up.

pls check the same.

thanks for your efforts.

Ajay, some issue with this, give it a couple of hours.

nitin

my id is tndn0359 your tax report for options turnover shows me more than one and half crore .if you add profit and loss of option it will not even cross 15 lakhs . i do not how you calculate this.

please do reply.

regards

nandakumar

3 years losses I have not filed ,can I file this financial year back years loses.

Yes you can file, but you won’t get the benefit of carry forwarding the losses. Only for FY14/15, if you file on time you can carry forward the losses.

Can someone suggest good CA in Bangalore with specialization in stock market and who charges reasonable fees?.

Check taxiq.in

Hello Nithin,

i am a F&O trader and sum of F&O contacts is more than seventy crore , but on FIFO basis, sum of loss & profit is less than 35 lacs.

1. what should be taken as turnover, 70 crores or 35 lacs,

2. do i need to file a CA audited return .

For the sake of IT:

1) You’ve to consider your turnover as Rs.35 lacs which you’ve mentioned as the sum of all your profits & losses. Note that netting off isn’t allowed in order to compute settlement turnover.

Eg: If you’ve made a profit of Rs.1 lac on one contract and a loss of 1 lac on another contract, your turnover is Rs.2 lacs and not 0. I’m hoping you’ve arrived at 35 lacs by considering the sum of all obligations contractwise.

2) About Audit of books:

If you’ve made a profit: If profit 8% no audit required.

If you’ve made a loss: If you have any other source of income on which you’ve to pay Income tax, then you’ve to get your books audited if you wish to carry forward losses. If you have no other source of income/income is below taxable income, then you can carry forward loss without getting your books audited.

pls tell me 8% of what ? whether it is turnover or working capital ?

Read this post.

1. Sum of profit and losses, and not contract turnover. So yeah 35lks

2. You need audit if your profit is less than 8% of 35lks, otherwise no audit required.

also sir my 2nd question….how to know whether i am classified as trader or investor for filing IT return…???(i did not do intraday trading)…..kindly reply.

Regards

devendra

Devd, there is no simple answer to this. Do read this blogpost and some Q&A at the bottom of the page. Since you are saying that you have traded F&O, you have to declare yourself as a trader to file your ITR

thnx sir,

i believe i got the answer. I will file as an trader as in do F &O.

also my profits from equity i will clubbed with losses from F &O.hope i am right.

also sir 4 days back i opened the account with zerodha. hope to remain in touch with you.

thnx again.

Best of luck,

hello Nitin Kamath Sir,

I have 1 question, this fiscal i am having a short term gain in equity is 5,0000/-…and loss in F&O is 50,000…can these 2 be clubbed for tax harvesting..or loss is F&O will not be considered….!!!and i have to pay tax on 50,000 gain on equity…!!!pl. guide…..thnx

Dev, if you consider yourself as a trader (use ITR4) and show equity trading also as your business. Then yes, you can adjust your gain from equity trading against loss in F&O. But if you don’t, then no you can’t.

I looked at the tax loss harvesting and found that all my profits are listed as Short term captal gains. But I checked the period of holding and I found that I have held the stocks for more than one year. Then why is it categorized as Short term capital gain?

Having this checked.

Hello sir,

Could you please clarify the below doubt. The following are tax details

EQUITY REALIZED PROFITS ₹118.40 Details

F/O REALIZED PROFITS ₹8,233.75 Details

TOTAL REALIZED PROFITS ₹8,352.15

Details :

INTRADAY/SPECULATIVE PROFIT ₹ -8,125.60

SHORT-TERM PROFIT ₹118.40

TOTAL FUTURES PROFIT ₹13,658.75

TOTAL OPTIONS PROFIT ₹-5,425.00

Question:

1. For EQUITY REALIZED PROFITS why the INTRADAY loss is not considered in tax calculation.

2. Where should we consider the brokerage and other charges incurred.

3. If i sum up including the intraday loss, the total profit would be in negative.

Could you please clarify the below doubts.My Id is HORM1738

Thanks.

I got answers from http://zerodha.com/z-connect/traders-zone/taxation-for-traders/taxation-simplified#comment-35803

Manoranjan, if you open your normal TaxP&L intraday/speculative profit is also considered. But Speculative can’t be setoff against other profits/losses, so it is not shown in the tax loss harvesting report. Brokerage and other charges are a cost, so it should be considered under your expenses on the ITR.

Hi Nithin

1.

Can presumptive income be offset using Tax loss harvesting.

Suppose my salary is 300k. I made <8% on TO of 300k. So as per presumptive- i will declare 8%=24k as profits.

Can i reduce it using tax loss harvesting?

2. As someone mentioned earlier, whether 44AB and tax loss harvesting be analysed from different perspective or seen as combined ?

SAY I made 10k on TO of 100k. More than 8%, hence no audit. But i offset it against ST capital loss of 6k, will i be required to do audit as 10k-6k=4k is less than 8% ?

1. You can’t setoff any STCG/business losses against your salary income. If you have a business income of 3lks, and assuming you made business losses(i.e you show your trading as a business), you can setoff the business income using business losses to reduce your tax outgo.

2. Even if you are using tax loss harvesting as an active trader, you can do it only to the extent of 8% of your turnover in case you are trying to avoid audit. (assuming your turnover for the year is less than 1cr, if it is more than 1 cr you will need an audit in any case, so you can harvest your losses to full extent).

3. Yes, if it is 6K you will need an audit, but if it is 8k, you will not need.

Hi Nithin, Thanks for providing a valuable information on Tax harvesting. I ran the Tax harvesting my account and surprisingly it takes the profit made in long term gains. I would expect the Tax harvesting to show only short term gains which are taxable.

Kindly help ?

Karthikeyan, we are showing long term gains also on that list because if you classify yourself as a trader, you can offset this gain by selling stocks which are making losses. If you are an investor, disregard that long term gain bit.

What is the definition of an active trader? How many trades a week/month/year?

How many maximum trades should I do per week/month/year to remain classified as an investor and not as a trader?

I understand, that even if I do one trade in Futures, I will be classified as a trader. Is this true?

If I do intraday delivery of stocks a few times(buy and sell the same day) will I still be classified as a trader?

I have foreign(USA) stock long term capital gains? Will that be considered as trader income or investor income? It is foreign USA stock that I held for more than 2 years.

If I stop trading futures next year and only stick to equities, can I change my status to investor next year?

It can be considered as your investment itself, but you need to hold it for more than 3 years for it to be considered as long term capital gain. Tax on LTCG for unlisted stocks is 20% after indexation. If you sell it before that STCG for short term is as per the income tax slab you fall in.

You can show your futures trading separately and keep your investment separately.

I am IT professional and as per my salary I have to pay 30000 as TAX , which is already deducted for current financial year.

Now my question is I am having 60000 loss in my account in Zerodha for current year.

is there any chance I can save tax here by showing my 60k loss ?

Vikas, your salary income can’t be adjusted against your business/trading loss. You can set it off against any other business income you make. Declare this business loss, you can carry forward this loss for 8 years and set it off against any profit that you make in the next 8 years (remember any business profit and not just trading profit)

Losses from trading business cannot be settled against salary heads……..

Income form heads under salary is always taxable u can’t save it by any means

Income from business or loss from business can be settled from heads income from business only…

E.g. If u suffered a loss of 1lakh from fno this loss u can settled for next 5years from any profit which u will get in coming 5years..

How to declare this business loss? I file IT return for my salary, where should this loss be declared?

You will need to use ITR 4 and not ITR1 or 2 that you might be using now. Check this module.

Dear Zerodha,

This is the first time I am going to file and pay taxes. I have few doubts, Please clarify them

>>If we nullify our profits with the loss making stocks then we miss >8% profitability criteria which requires CA audit.

>>I am working in a private company. so do I need to file my stock income while filling ”C” form in my company website. or can I upload C form and stock returns separately in Income tax website.

>>I am trading on only in equity segment and make 4000/- Loss( missing >8% profitability and turnover 1Cr. criteria). Do I need to audit my books.

Chandu, if you are trading only equity segment, you can file your returns using ITR 2 and there is no Section 44AD applicable (8% thing). But yes, if you are trading very actively like a business you need to use ITR4 or ITR4S.

IF you are filing using ITR4/ITR4S, then it makes sense to reduce your profits only to the extent where you are making 8% of your turnover as profits. Because like you said correctly, below this audit would be required.

Form C that you give to the company is separate, you have to file your ITR separately.

Thanks a lot for this. Never knew that there was a way to save money this way.

You can use all the Back office Report available in the Back office to come to a Conclusion on Profit & Loss account or Income and Expenditure Account. They can be again correlated with Contract Notes if required to be done to get Satisfaction so that it helps in preparing the IT Returns.

Hi sir

my CA said ager apko stock market transection (profit & loss) show karna hai to uska alge se ledger banana padega jiska alge se wo charge karenge.

Mujhe aap se yea janana hai ki back office main ledger ke sath available hai all transactions.

Ledger report also is available in the Q https://q.zerodha.com/ledger/display/

Yes, Ledger, all transactions, and P&L report available.

Thanx nithin sir 🙂

Nitin

Hi,

One query , what is the tax treatment of unsettled contracts , for e.g a futures contract with expiry of Apr15 , bought in March15 and outstanding as on 31Mar15.

is it excluded from income tax calculation or the income / loss in form of MTM needs to be considered for income tax calculation.

Thanks & Regards

Neeraj

Neeraj, it is upto you. But I think it is best to MTM all open positions to 31th march for tax calculations.