It’s the economy, stupid: Fixed lines soar, money flies, people don’t

We love India Data Hub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macroeconomic data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to India Data Hub. All mistakes, of course, are our own.

Quick! What’s the first thing that comes to mind when you hear “India” and “telecom” in the same sentence?

I’ll bet good money it has something to do with India’s mobile revolution.

Of course not! It was… er… MTNL. That’s a thing, right?

Right. I totally believe you.

Buzz off. What’s your point?

Glad you asked!

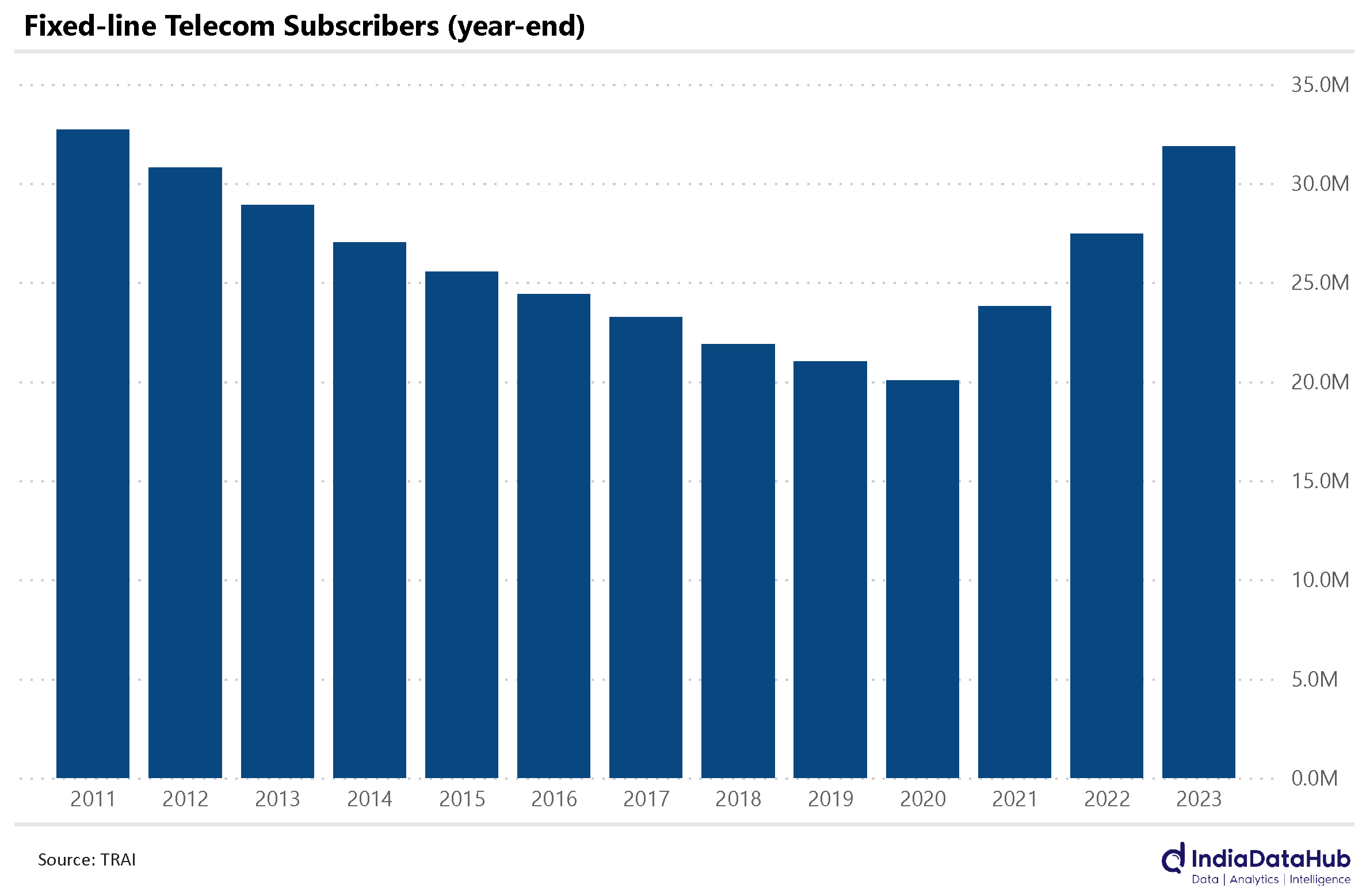

There’s a curious bit of data from last week, at least if you think the future of telecom is a move towards everything becoming wireless. And that is: after a protracted decline, fixed-line connections are now growing rapidly.

Oh please. You mean, like, landlines? You’re not serious.

Yep, landlines. But also, things like fixed broadband connections. Here’s a quick snippet:

- Telecom operators added 300,000 fixed-line connections in December. With that, they’ve added a total of 4.4 million connections in all of 2023: the highest in over a decade.

- This is part of a wider upsurge in the last three years, where they added a total of 12 million connections. There are now over 30 million fixed-line connections in the country: the highest there have been since 2012.

Oh. So who’s still buying fixed connections? People in some rural corner of nowhere?

Hehe. Nope. People in Delhi and Mumbai.

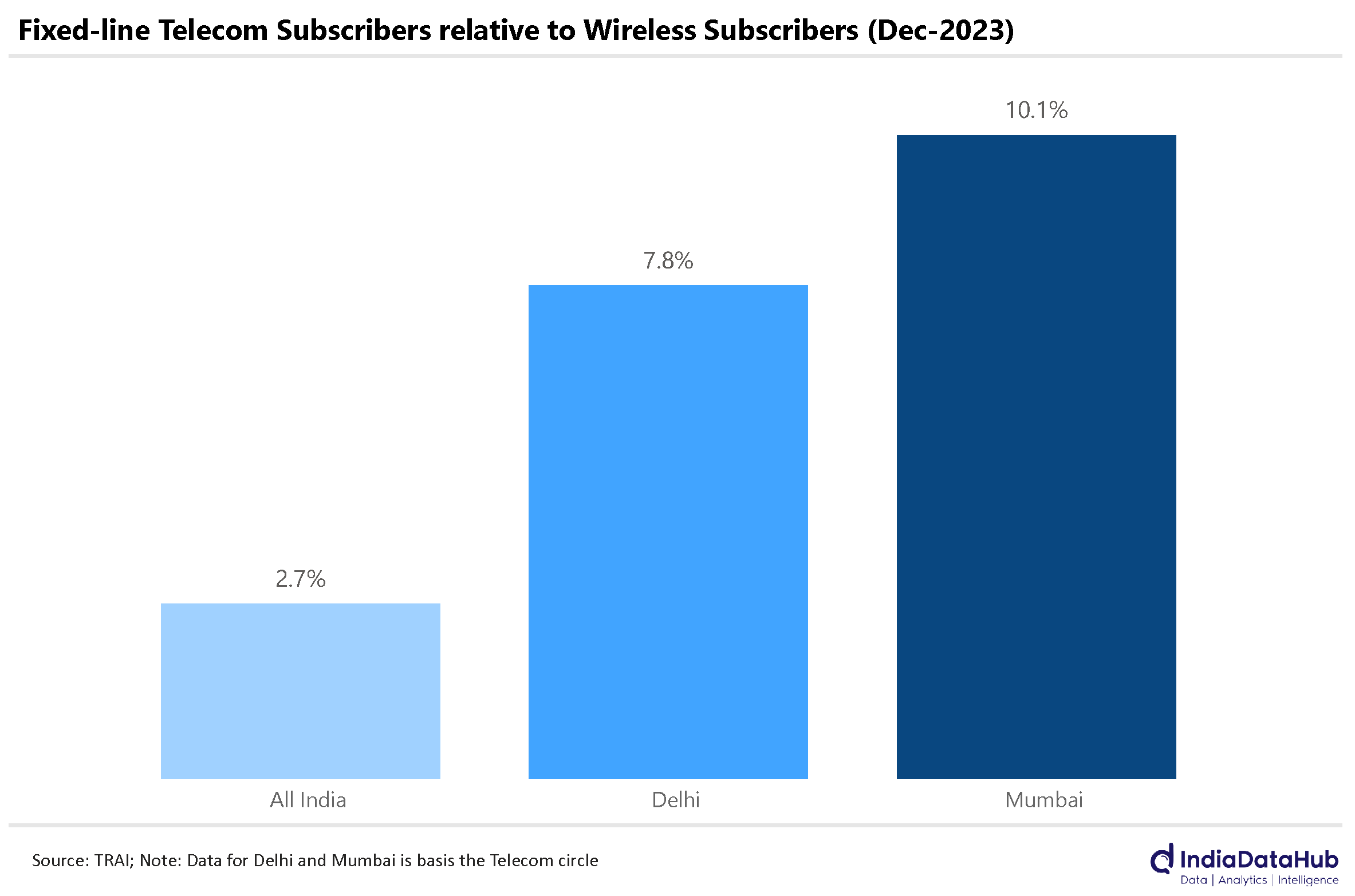

Look, I don’t want to overstate the point. Mobile connections are still overwhelmingly popular. The number of fixed-line connections in the country is ~3% of the number of mobile connections.

In places like Mumbai and Delhi, though, it’s much closer to the 8-10% mark. Maybe they need broadband connections for all the Netflix they’re watching.

That number probably looks lower than it is, by the way. Think about it: how many mobile connections do you have at home? Three? Four? Five, even? Chances are you don’t have more than one broadband, or landline. That’s probably the case with every home. Those 8-10% fixed connections probably connect 20-30% of the populations of these cities.

And they’re growing. Fast.

What’s next? People are taking bullock carts instead of flying?

I don’t know about bullock carts, but they sure aren’t flying.

Come again?

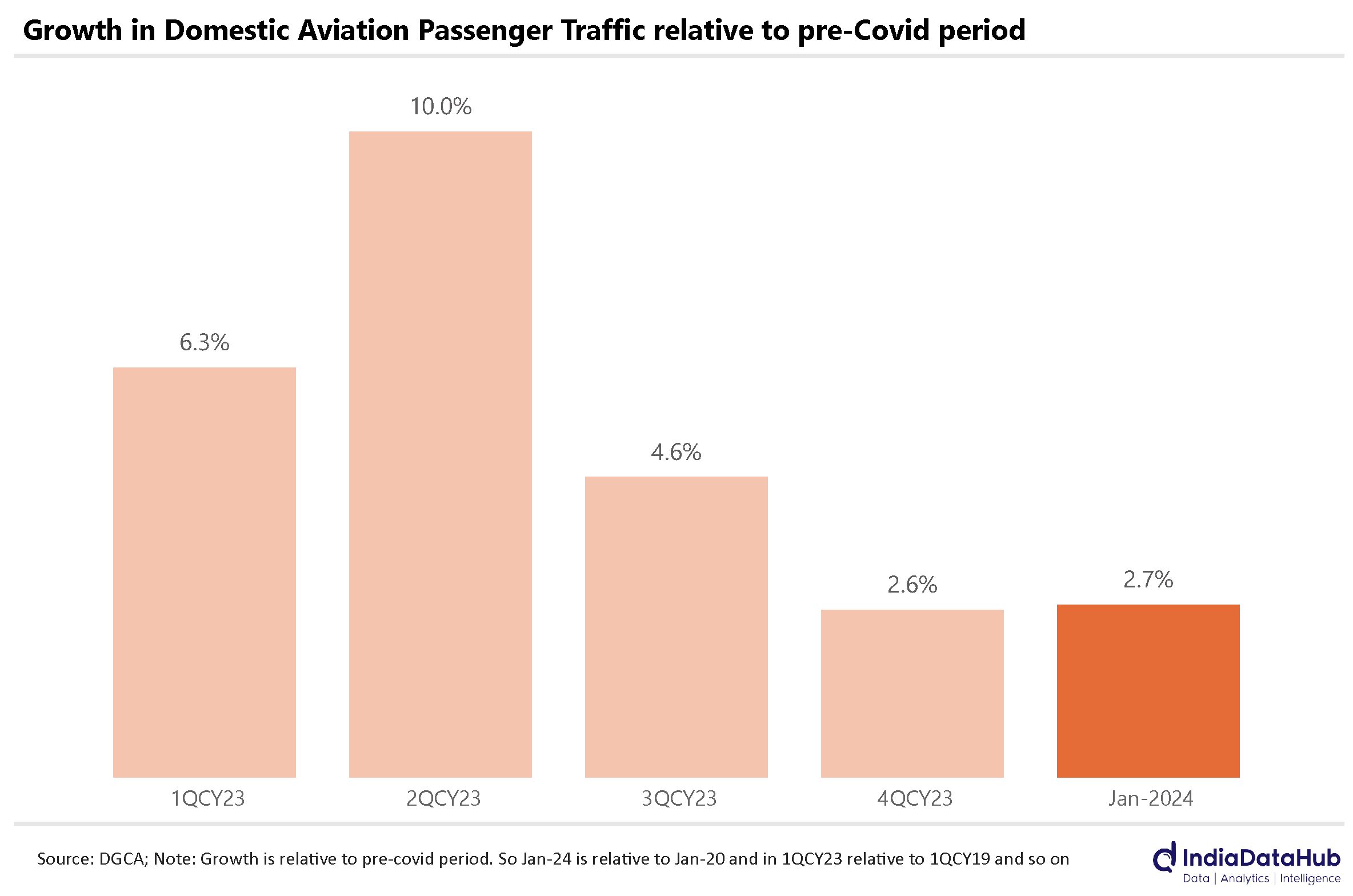

Yeah. The aviation sector’s seeing some turbulence right now. In fact, it isn’t soaring much higher than it was before the pandemic.

Puns? Disgusting.

Haha, yeah. Couldn’t help myself.

Anyhow. Here’s the news:

- Domestic airlines haven’t added too many flyers this January, with just 4% more passenger traffic than January 2023. And it’s not like too many people were flying last January either – the aviation sector was still trying to regroup after passenger traffic crashed (sorry, sorry, I swear I’ll stop now) during the COVID-19 pandemic.

- This is a sharp drop from December, when passengers were 8% higher than they were in December 2022.

If you want a better sense of things, look at how little the industry has grown since the pandemic. The chart above should give you a snapshot. It compares the last year or so against 2019 and early 2020. Even though four years have passed in between, there’s been very little difference.

If you want a better sense of things, look at how little the industry has grown since the pandemic. The chart above should give you a snapshot. It compares the last year or so against 2019 and early 2020. Even though four years have passed in between, there’s been very little difference.

Moreover, the difference is dropping. Midway through 2023, passengers were still a respectable ~10% higher than in 2019. This January, in contrast, passenger traffic barely budged from where it was in January 2020, inching upwards by less than 3%.

Foreign money is leaving the country!

What!? Should I feel happy? Scared? Angry?

Hey, I’m just trying to tell you what happened. This isn’t a news channel, after all.

But here’s what you should know:

There are two ways you can invest in a country. There’s a simple way: you take a punt on its capital markets. You buy stocks, bonds, or something similar, and see where they go. You aren’t trying to get your hands dirty or make something – you’re just along for the ride. Much like you might be in the capital markets of your own country. This is called ‘foreign portfolio investment’ (FPI).

There’s also a hard way. You put in serious money for the long haul. You see a country as a good place to do business, and so, you roll up your sleeves and dive in. You buy up a big piece of a company, or if you’re very brave, you start a business from scratch, and then get involved in running it. This is ‘foreign direct investment’ (FDI).

It’s the latter that’s come down massively.

Yeah, I forgot that you’re boring. Anyway, what’s going on?

Two things:

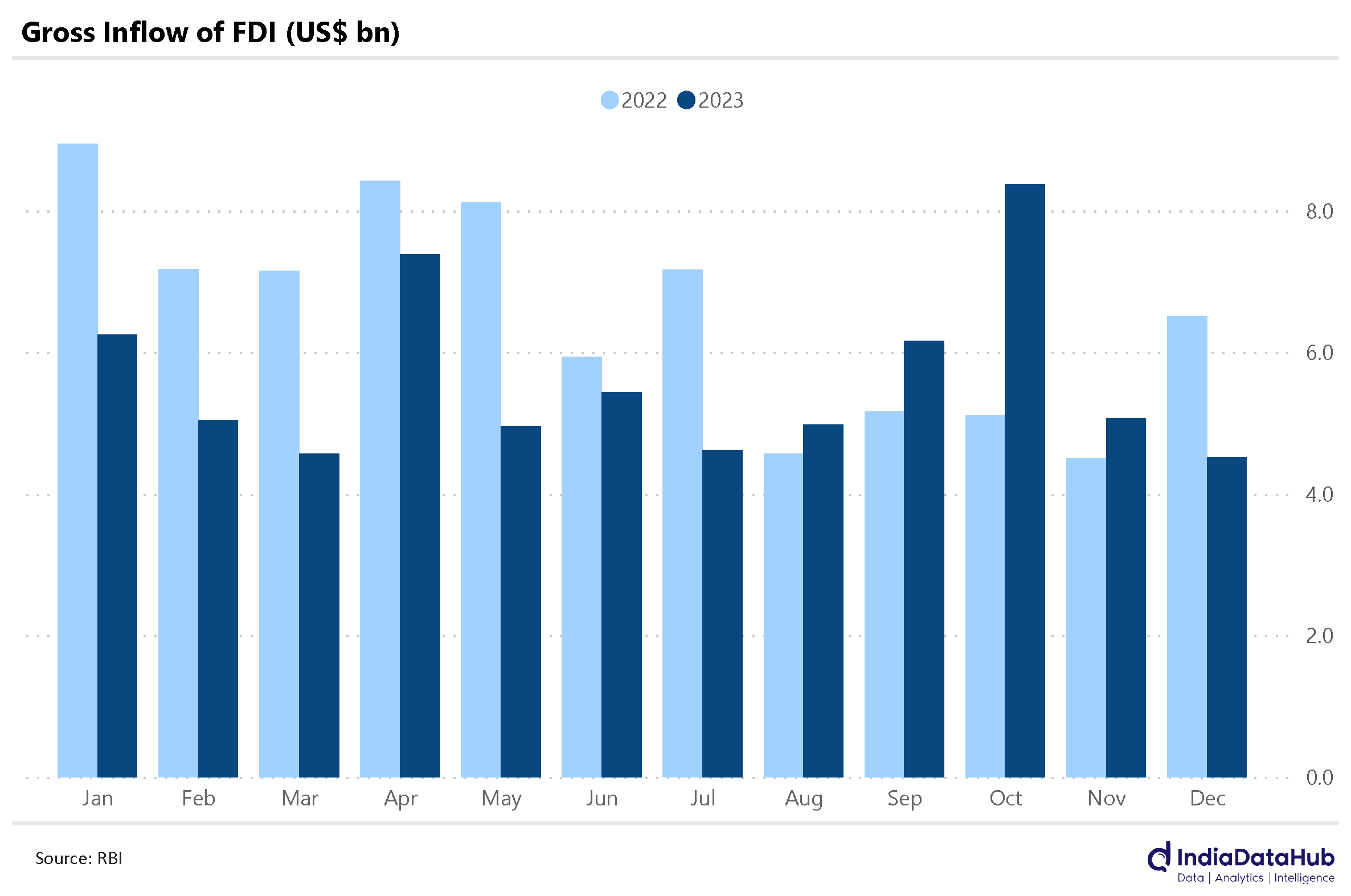

- One, there’s less FDI coming in. After going up for five straight months, the total FDI coming into the country in December – at US$ 4.5 billion – was 30% less than in December 2022. See the graph below for a clearer picture.

- Two, a lot of FDI from before is leaving the country. A total of US$ 6 billion left the country in December.

In all, more FDI money has left the country than has entered it in the month. This is the very first time this has happened since the RBI started keeping track back in 2011.

Very first time? Ok, I’m scared now.

Hey, don’t be. This is just a single month. Fluctuations like this can happen for many reasons: including that people are just put off by the idea of investing, these days. After all, the global economy has taken some bad hits off late.

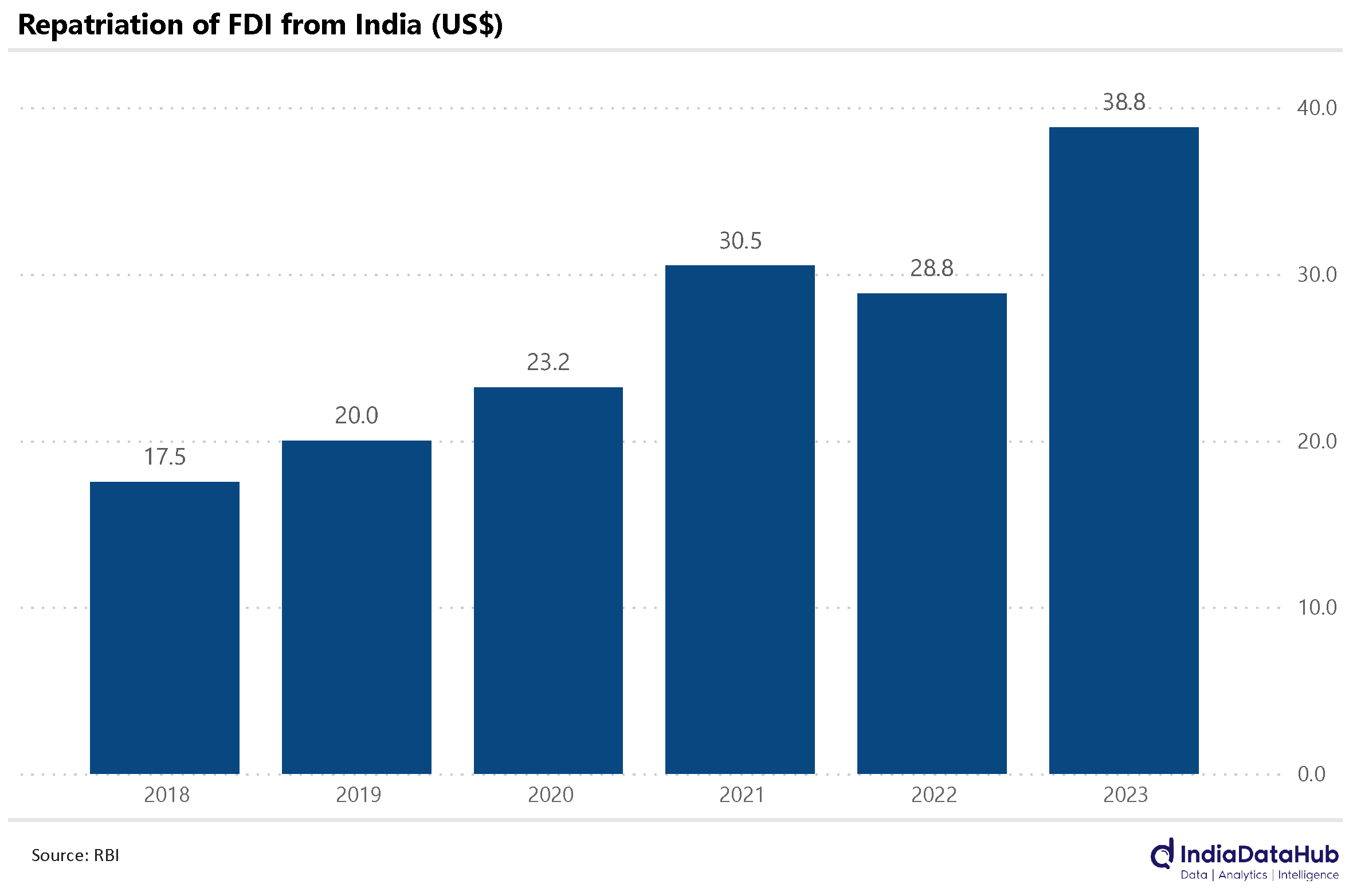

There’s a trend you should think about, though: a lot of FDI has generally been leaving the country.

In 2019, an average of US$ 1.7 billion in FDI was exiting India every month. In 2023, that’s jumped up to US$ 3 billion. Although December saw a massive spike in outflows, even in the long term, FDI is leaving India at a faster rate.

As more FDI leaves the country, we’ll need to find ways to get more FDI simply to stay where we are. Or, we give investors a reason to stick around. Whichever.

It’s not just foreign capital, though. Indian money is leaving the country too.

Let’s rewind. What does that even mean?

Sure. Here’s what you need to know.

The Indian Rupee is not fully ‘convertible’. That is, you can’t simply convert your Rupees into foreign currencies, or use them up for foreign transactions. At least not beyond a strict limit.

That’s part of India’s attempts at keeping the Rupee strong. We briefly touched on this last week, but here’s a quick recap: the more that Rupees are spent internationally – whether to buy foreign products or just other currencies – the more Rupees are supplied to international markets. And when they’re easily available, they lose value.

The RBI doesn’t want the Rupee to lose value, because that makes it harder for us to buy the things we really need. This is why it limits how many Rupees an Indian resident can spend abroad. It’s put together a ‘Liberalised Remittance Scheme,’ (LRS) which allows you to send out Rupees worth US$ 2.5 lakh in a year without running into hassles. Need to send more? Well, now you have to fill forms and deal with bureaucratic hurdles, which makes the whole thing a lot more painful.

That’s not all. When you send out any more than ₹ 7 lakh under the LRS, your bank cuts some of it as ‘Tax Collected at Source’ (TCS). That’s counted as part of your income tax payment for the year. This cut used to be 5%, but with last year’s budget, it’s jumped up to 20%.

So it’s become rather difficult for ordinary people to send Rupees abroad. And yet, they’re doing so more than ever.

That sounds unusual…

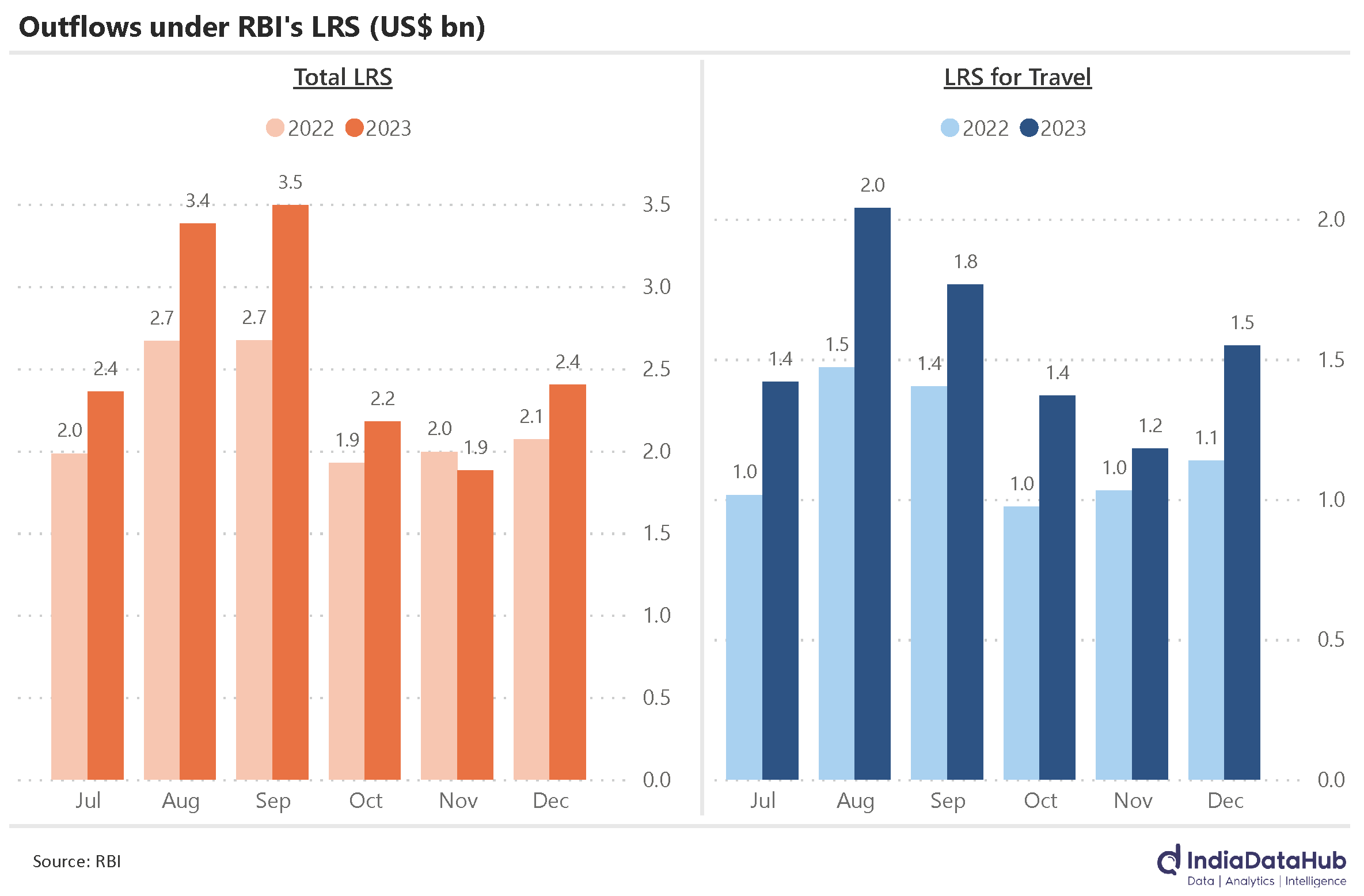

It is. Most people thought less money would go out this year. That simply didn’t happen. Get this: last December, 16% more Rupees left the country under the LRS than in December 2022.

Where’s all this money going, though?

Well, foreign trips!

People are pulling out far more money for foreign trips than before. Last December, the amount of money sent out under the LRS grew by 36% against December 2022. That’s a total of US$ 1.5 billion. At this rate, we’ll be spending something like US$ 20 billion on just foreign trips this year.

It’s not like the TCS hike hasn’t worked at all.

It’s worked where you actually need to shell out more than ₹ 7 lakh. You need that sort of money when you’re investing abroad, for instance. The LRS going into foreign investments has dropped over the last year.

But our wanderlust is making us spend smaller amounts more often, and that’s why a lot of Indian money is leaving the country.

That’s all for the week, folks. Thanks for reading.

There’ll be plenty more next week, with a whole lot of GDP data coming in.