A quick guide to cash management for startups

A recurring theme about financial crises is that people keep learning the same old lessons. The collapse of Silicon Valley Bank (SVB) highlighted the lessons of proper cash management. To recap, Silicon Valley Bank was a favorite among startups due to its focus on providing banking for them. As venture funding exploded after the pandemic, the bank saw a flood of deposits from VC-backed companies. SVB invested these funds in a mix of short-duration bonds available for sale on short notice and longer-duration bonds to be held till maturity.

Usually, this isn’t an issue; this is how banks work—they borrow short and lend long. The problem started when the interest rate cycle turned. As the US Federal Reserve began to hike rates, venture funding slowed. Startups couldn’t easily raise funds and started drawing down on their deposits. SVB was hit with a double whammy.

On the one hand, deposits were fleeing because the bank had a narrow and volatile deposit base of VC-backed firms. On the other hand, long-duration bonds were losing value as rates rose. The bank had to start selling assets to meet the withdrawals. The losses from bond sales wiped out its equity, making it insolvent.

Startups that couldn’t withdraw their funds were left in the lurch. Luckily, the US Treasury announced that depositors would be made whole. This episode highlighted the same old lessons many company treasuries learned during the IL&FS, DHFL, Franklin Templeton, and Yes Bank crises. It was the same story in each of these episodes. Company treasuries sought higher returns, assumed unwanted risks, and got stuck or lost money.

Cash is the lifeblood of your business, and it’s not something you should take for granted. Ensuring you don’t lose money is paramount, and you should be paranoid about the safety of your company cash. This is all the more important if you have raised funds from external investors because you have a fiduciary duty toward them.

In our interactions with startups, one recurring question has been how to manage cash safely while earning a positive yield. In this post, I’ll explain the options you have and some dos and don’ts. This post isn’t meant to be a comprehensive guide to cash management; the goal is to highlight some basics to help you avoid potential disasters. By cash management, I mean how to park the cash of your startup safely.

The principles of managing cash are the same, be it for individuals or companies:

- Safety: Ensuring that your cash is safe is paramount. You can only make money if you don’t lose money.

- Liquidity: Funds should be readily accessible without any penalties.

- Risk: higher the returns, the higher the risk and probability of loss is a good heuristic when thinking about risk. But there are various types of risks at an instrument level and entity level. You need to have a good sense of all these risks.

Regardless of the debt instrument you choose to park your cash in, you must understand three key risks.

Credit risk

Credit risk, or default risk, is the risk of permanent loss of your capital. Except for government bonds, all other instruments have various degrees of credit risk.

Liquidity risk

The risk of you being unable to exit an instrument. For example, if you invest in corporate bonds, it’s not always easy to sell them at any time. Indian corporate bond markets are notoriously illiquid.

Interest rate risk

All fixed income (debt) instruments have an inverse relationship with interest rates. As interest rates rise, prices fall, and vice versa. As rates rise, new debt instruments will be issued at higher rates, making the older debt instruments unattractive. So if someone has to buy the old debt instruments, they demand a discount to get returns similar to the current market rates. So as prices fall, the yields on debt instruments rise.

Not all instruments have the same interest rate sensitivity. To know the interest rate sensitivity of an instrument, you need to understand a concept called “duration.” Duration is a measure of the interest rate sensitivity of a bond, and it’s denoted in years. The longer the duration of a bond or a debt mutual fund, the higher the interest rate sensitivity.

Cash management is as much an art as it is a science. It involves certain assumptions and requires planning and forecasting. You can never be 100% correct, but at the very least, you need to be directionally right. Ultimately, cash management boils down to choosing the right instrument for the right reason. Here is a list of instruments and their pros and cons.

Current accounts

Ideal for day-to-day operational requirements. Current accounts don’t pay any interest. We see a lot of startups keep all the cash in current accounts, this is a mistake.

Safety

In short, the larger the bank, the safer it is. Make sure you have multiple bank accounts and spread the cash around.

Note: Even if you are diversified across banks, it’s still a good idea to track the health of the banks in which you have money. Tracking the stock price of the banks and their bond yields will give you a good idea of their health.

- If a bank’s stock price relative to a bank index or other banks falls dramatically, like Yes Bank or SVB, that’s a red flag. Stock prices are also noisy, so you don’t have to react to all changes.

- If a bank’s bond yield rises dramatically compared to other bonds of similar maturities or government bonds of similar maturities, that’s a red flag. A bond yield is a measure of return and risk as well.

You can check stock prices on any financial news website or from your broking account. Tracking bond yields is a bit tricky since most bond trading happens over the counter (OTC). You can check out these websites:

Bank fixed deposits (FD)

Fixed deposits are available in tenures ranging from 7 days to 10 years. They are simple instruments to understand. You put in X, and you get Y at maturity. You can choose between periodic interest payments and cumulative payments in FDs with longer tenors.

Safety

The government guarantees FDs in scheduled banks up to Rs 5 lakh. But so far, depositors haven’t lost money in India. Bank failures have been resolved through restructuring and mergers safeguarding depositors. Having said that, it’s a good idea to stick to the largest banks to avoid headaches. You will earn a lesser return, but that’s worth the peace of mind. If you use FDs, make sure you spread them across 3–4 banks. Smaller banks offer higher returns on FDs, which comes with higher risk.

Should you use fixed deposits for cash management?

Fixed deposits are simple instruments and easy to understand. The one consideration you should know about is post-tax returns. Certain debt mutual funds offer similar or higher returns with higher tax efficiency. You can factor this in when choosing between an FD and a mutual debt fund.

Corporate fixed deposits

Corporate FDs are similar to bonds, and they are offered by non-bank financial companies (NBFCs). All corporate FDs are rated by credit rating agencies. They are rated on a scale of AAA and A1 to D and A4. The higher the credit rating, the safer the entity accepting deposits.

Here’s the rating scale of CRISIL for corporate fixed deposits

Safety

Unlike bank FDs, there’s no deposit guarantee for corporate deposits. Their safety depends on the financial strength of the company issuing them.

Should you use corporate fixed deposits for cash management?

Corporate fixed deposits are similar to corporate bonds and carry credit risk (the risk of losing your money). Picking corporate FDs based only on returns is a recipe for disaster. Higher returns come with a higher risk of default. This has to be factored into your analysis.

Corporate bonds

Corporate bonds are issued by companies. These bonds are issued in various maturities and are rated by credit rating agencies like corporate deposits.

Safety

Safety depends on the financial stability of the issuer. Broadly, AAA-rated bonds from PSUs are the safest, and so on. But remember that credit ratings are not a perfect indicator of safety. Though rare, they can change rapidly. In 2018, IL&FS was downgraded by nine notches in a single day. In the case of Silicon Valley Bank, Moody’s downgraded it just a few days before the bank went into receivership.

Should you use corporate bonds for cash management?

Unless you have an experienced person with a deep understanding of Indian bond markets, I wouldn’t recommend corporate bonds for cash management. Mutual funds are a much better alternative.

Government bonds

G-Secs: Government bonds, or G-Secs, are bonds issued by the RBI on behalf of the central government with maturities ranging from 1 to 50 years. G-Secs have a fixed interest rate that is paid out semi-annually.

T-bills: These are short-term bonds issued by the RBI on behalf of the central government with maturities of 91 days, 182 days, and 364 days.

State Development Loans (SDL): These are long-term bonds with maturities above one year issued by the RBI on behalf of state governments. SDLs have a fixed interest rate that is paid out semi-annually.

Safety

- G-secs and T-bills carry an explicit guarantee by the government of India.

- SDLs aren’t explicitly guaranteed, but it’s assumed there’s an implicit guarantee. This is one reason SDLs have a higher interest rate than G-secs of similar maturities.

Should you use government bonds for cash management?

- Compare the yield of treasury bills to bank FDs. If the yields are higher, as they currently are, they are a much better alternative to bank deposits. You can see the historical yields and rates here.

- Long-duration G-Secs aren’t suitable for short-term cash management.

Debt mutual funds

Think of a debt mutual fund as a fixed deposit that trades. Debt mutual funds invest in various types and maturities of bonds and fixed-income securities. There are 16 categories of funds that are categorized based on the duration and type of bonds they can hold.

I think debt mutual funds are the ideal instruments for cash management for startups. Not all 16 categories are useful. You can safely ignore all categories except:

- Overnight funds

- Liquid funds

- Ultra short duration funds

- Low duration funds

- Money market funds

Overnight funds

These funds invest in a security called tri-party repo (TREPS) with a 1-day maturity. TREPS is fully collateralized, so there’s no credit risk in these funds. The portfolio of the fund matures every day, and the fund reinvests the proceeds every day, so the interest rate risk is almost nothing.

Credit risk: Nil

Interest rate risk: Almost zero

Liquidity risk: Low

Liquid funds

These funds invest in securities such as commercial papers, treasury bills, and certificates of deposits that mature within 91 days.

Credit risk: Depends on the rating of the bonds in the fund portfolio. Low if the fund invests in A1 and AAA-rated and sovereign-rated securities (SOV) like government bonds and treasury bills. Government bonds and treasury bills are sovereign-rated since they have no credit risk.

Interest rate risk: Very low

Liquidity risk: Low

Note: There have been cases where liquid funds have defaulted because they invested in risky bonds with low credit ratings.

Ultra short duration funds

These funds invest in securities such as commercial papers, treasury bills, and certificates of deposits that mature within 3–6 months.

Credit risk: Depends on the rating of the bonds in the fund portfolio. Low if the fund invests in A1 and AAA-rated and sovereign-rated securities (SOV) like government bonds and treasury bills.

Interest rate risk: Very low

Liquidity risk: Low

Note: There have been cases where ultra short funds have defaulted because they invested in risky bonds with low credit ratings. Franklin Templeton’s ultra-short fund was a notable example.

Low duration funds

These funds invest in securities such as commercial papers, treasury bills, and certificates of deposits that mature within 6–12 months.

Credit risk: Depends on the rating of the bonds in the fund portfolio. Low if the fund invests in A1 and AAA-rated and sovereign-rated securities (SOV) like government bonds and treasury bills.

Interest rate risk: Low

Liquidity risk: Low

All these five fund categories have a maximum duration of under one year, which makes them suitable for cash management. An important caveat is that I’ve generalized liquidy risk. The liquidity depends on the underlying bonds, which tend to have idiosyncratic risks specific to the issuers, which is reduced if a fund is well diversified.

If you observe closely, the excluded list includes gilt funds that only invest in government bonds. Does that mean they are not safe?

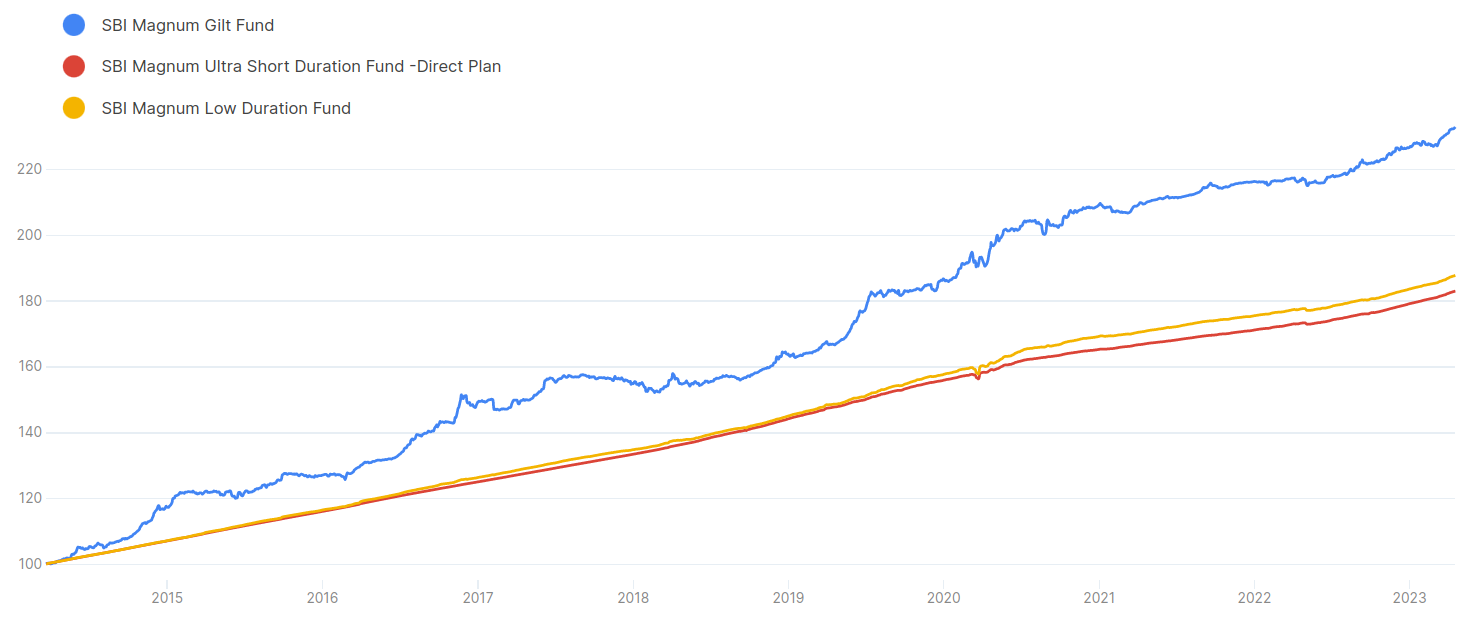

Gilt mutual funds hold long-duration government bonds. Higher duration = higher interest rate sensitivity and volatility. This makes them unsuitable for cash management.

To give you a sense, I’ve compared short-duration funds with a gilt fund. As you can see, the volatility is much higher.

If you are a startup, uncertainty is your default state. You won’t have visibility into the future beyond a year or a few years. So it makes sense to manage your cash using short-term instruments that still give you returns higher than savings bank accounts and bank fixed deposits. Also, with long-term funds, you need to understand interest cycles and how to manage them—it’s not easy to predict interest rates and make money from that.

Safety

Debt mutual funds are just a wrapper. Their safety depends on the underlying debt instruments they invest in. For example, a debt fund that only invests in government bonds is much safer than a debt fund that holds AA and A-rated corporate bonds.

A rating scale for bonds

A few tips when investing in debt mutual funds:

- Always choose direct plans of mutual funds.

- Things will be uncertain when you are a startup and growing. There’s no point in taking credit risk and interest rate risk with your cash.

- Don’t invest in funds based on high past returns. Stick to the top 5 AMCs and funds with the highest AUM. The returns differential between the best-performing debt funds and the worst-performing funds isn’t that high.

- Gilt funds are safe from credit risk but not interest rate risk. They aren’t suitable for short-term cash management.

- Monitor the monthly AUM of debt funds. If there’s a rapid drop in AUM of the debt funds or across the AMC, that’s a red flag. You can check the AUM in the monthly fact sheets or on any mutual fund website.

- Hybrid funds are risky and unsuitable for cash management.

- You may encounter people who will recommend or sell you credit risk funds. These funds should be at the top of the list of things to avoid.

- You can check the fund details on Coin or other finance portals like Moneycontrol and ValueResearch.

The NO list

- Avoid ALL high-yield instruments by high yield, I mean, any debt instrument that promises 2-3% extra returns over safer alternatives like government bonds or fixed deposits.

- Avoid all structured and securitized high-yield products. These may be structured products that are backed by gold, loans, invoice discounting cash flows, etc. These are extremely risky and unsuitable for safety parking cash.

Additional resources

This post is meant to be a quick guide to give you a sense of your options. There’s more context to each of these investment options. Here are a few additional resources that will help you:

The idea of this post was to give you a sense of how to think about cash management. If you have any questions, you can post them here, and I’d be happy to answer them.

Hey Bhuvan,

Very insightful content dude.

Can you also create a blog explaining how the taxes will be levied on startups for investing in the above explained instruments

I have question ?. Above all is it important who is the key person, who is managing or insights of all the transactions.