Zerodha – Margin Policies

Traders,

Margin Policy can change at any point of time based on market volatility.

The following post will give you our standard margin policies while trading equity intraday & delivery, f&o, currency and commodity. You can trade equity either intraday or delivery on NSE, BSE and MCX-SX. If you are not enabled on the latter 2 exchanges, print the segment addition form and courier back to us if you wish to.

1. Stocks or Equity or Shares Trading

Intraday equity:

When you take a trade in equity and square the position off before the end of day, it is called as intraday equity trading. Since you don’t carry the position overnight, we provide you a margin or leverage of between 3 to 20 times on around 150 liquid stocks to trade for intraday. You can trade intraday at Zerodha with leverage by using these 2 product types while taking a trade.

MIS (Margin Intraday Square off)

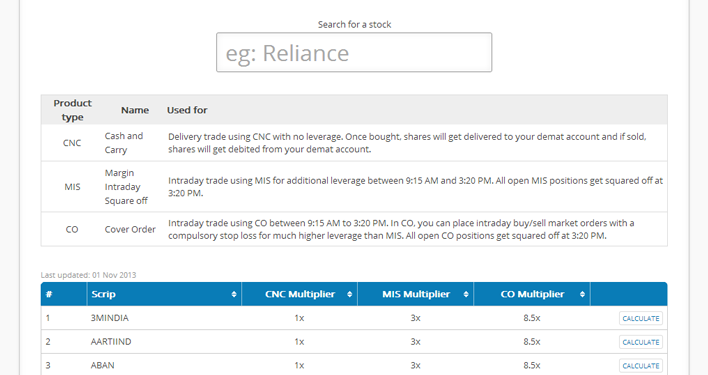

When you use this product type, you commit on keeping the trade intraday and hence we give you a leverage between 3 to 14 times based on the risk and volatility of the stock. Our margin calculator tool has a list of all stocks and the MIS leverage you get.

CO (Cover Orders) & BO (Bracket Orders)

Cover orders and Bracket orders are unique orders at Zerodha where you can trade intraday with a definite and compulsory stop loss. Since the risk with such a position is low, the margin required is less and hence the leverage higher. When you trade intraday using cover orders, the leverage you get vary from 6 to 20 times(twice as much as MIS). . Read this to know more on Cover orders and this for Bracket orders.

Our Margin calculator tool has a list of all stocks with MIS and CO/BO margin/leverage.

Imporant

Even though we square off all intraday positions automatically around 3.20 pm, the onus of squaring off all intraday MIS/BO/CO positions lies with you. If any intraday position or a MIS/BO/CO trade is not squared off on the same day for any reason, it shall get converted as a Cash and Carry (“CNC”) or NRML position and carried forward to the next trading day. Our RMS desk shall square off any such position the next trading day without the requirement of a margin call, if the necessary cash is not available in the Client’s account.

Delivery Equity:

When you buy stock and hold it overnight, it is called a delivery trade. At Zerodha, you need to use product type as CNC while placing a trade to take delivery of equity stock. The product type CNC will show up on your order window only if you have a demat account mapped to your trading account since you would require a demat to take delivery of the equity that you purchase.

At Zerodha we provide no leverage when you are executing delivery trades which mean that you if you want to buy Rs 1lk of stock as CNC, you will need this Rs 1lk in your trading account and similarly if you want to sell Rs 1lk of shares with product type as CNC, you will need these shares in your demat account mapped to your trading account.

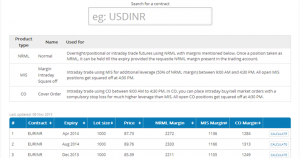

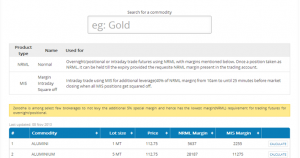

2. Futures Trading – Equity (Stock & Index), Currency & Commodity

Futures as such are inherently leveraged which means that to buy X amount of futures you need only a small portion of it called as margin in your account. This margin to buy futures is stipulated by the various exchanges.

For NSE, Zerodha settles with exchange on T+0 and hence has the lowest futures margin requirement.

While trading futures at Zerodha you can use 3 product types:

NRML (Normal)

To take position as NRML you will need the complete exchange stipulated margin, but once you take a position as NRML you can hold the position till expiry, provided you’re maintaining such stipulated Exchange margins until expiry.

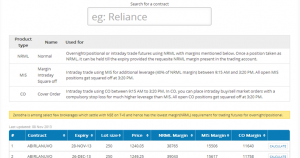

MIS (Margin Intraday Squareoff)

MIS is used by intraday traders as all open positions get squared off before the end of day. But since no position is carried forward overnight the margin required is also lesser than the exchange stipulated margins.

- For equity & Index futures, MIS margin: 45% & 35% of NRML margin respectively, all MIS positions squared off around 3.20pm.

- For Commodity futures, MIS margin: 50% of NRML margin, all MIS positions squared off about 25 minutes before market closing

- For Currency futures, MIS margin: 50% of NRML margin, all MIS positions squared of around 4.30pm.

CO (Cover orders) & BO (Bracket orders)

Cover and Brackets are unique orders at Zerodha where you can trade intraday but with a definite and compulsory stop loss. Since there is a stop loss placed, the risk of the position reduces and hence the margin required to take it reduces as well. Read this to know more on cover orders. Read this for Bracket orders.

Using Cover and Bracket orders, you can trade futures with lesser margins than NRML and MIS. Presently Cover order facility is available for equity, commodity and currency futures.

All the required NRML, MIS and CO/BO margins are updated on our Equity futures margin calculator, Currency Futures Margin calculator and Commodity futures margin calculator daily.

Imporant

Even though we square off all intraday positions automatically around 3.20 pm, the onus of squaring off all intraday MIS/BO/CO positions lies with you. If any intraday position or a MIS/BO/CO trade is not squared off on the same day for any reason, it shall get converted as a Cash and Carry (“CNC”) or NRML position and carried forward to the next trading day. Our RMS desk shall square off any such position the next trading day without the requirement of a margin call, if the necessary cash is not available in the Client’s account.

3. Options Trading – Equity (Stock & Index) & Currency

Option buying:

When you buy options, either equity or currency there is no additional leverage we provide. So if you are buying calls or puts of any contract, the premium required to buy them has to be present in your trading account. You can trade options either with product type as NRML or MIS, but since there is no additional leverage provided if you use product type as MIS, it is advisable not to use MIS while buying options since all MIS positions would get squared off before the close of markets.

But note that when placing market orders on options on an illiquid contract where the ask price is more than the last traded price, you will be able to purchase at the ask price even if the money in your account is just enough to buy at the last traded price. Make sure to transfer additional funds immediately into your trading accounts if you buy for more options than the money in your account.

Option Writing/Shorting:

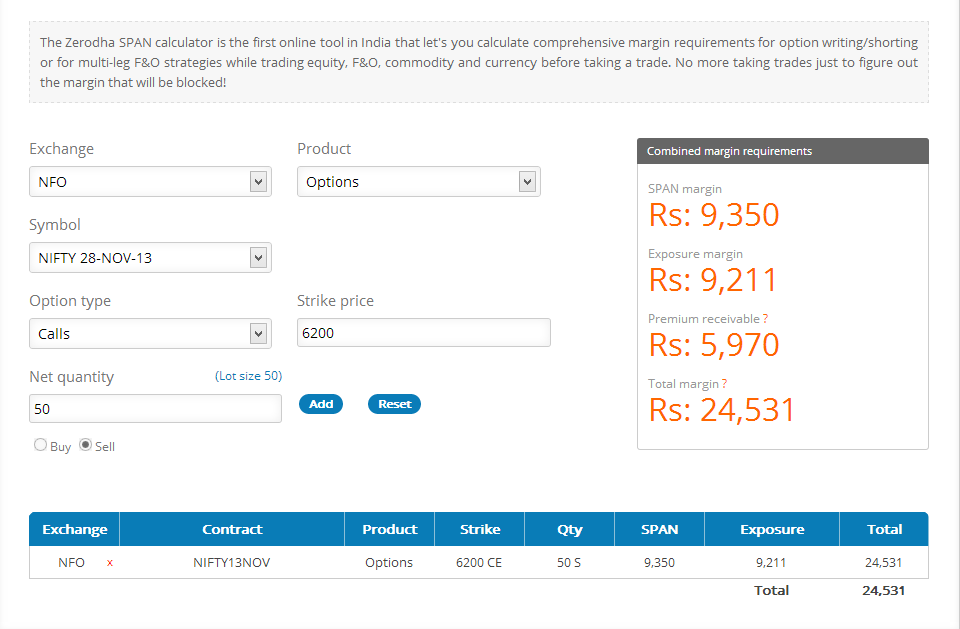

When you short an option, the margin required depends on various aspects like underlying, expiry, volatility and more. We are the first brokers in India to have an online SPAN calculator tool which lets you calculate the margin requirement for shorting an option by mocking the position in the tool.

You can short option either using the product type as NRML or MIS. The SPAN calculator tool lets you know the margin required to hold overnight or NRML margin, if you trade using MIS you will need only 50% of that margin.

Important

- The settlement cycle in India is T+1 day in case of F&O (Equity, commodity, currency) and T+2 day for Equity delivery. What this means is that credit from sale of option contracts & any profits from F&O positions gets credited only the next day, and any sale credits from equity delivery trades happen on T+2 day. This credit is available for you to trade intraday, but there might be a short margin penalty applicable if you carry forward positions using this unrealized credit.

- When you send Market Orders in Options for multiple lots, our system checks only for the margin of the first lot and validates your order. For example, if you see the price of a Nifty option at Rs. 100 and you have Rs. 75000 in your account and you send a market order it validates only for the first lot and sends your order through. During execution if the price of the option goes higher, your order still gets completed although you will end up with a debit balance. This debit balance has to be cleared by you by end of day failing which you will be charged interest as per our policies until you clear the debit balance.

- Because of illiquidity of stock option contracts, market orders have been disabled on stock options. Only limit orders are allowed. Place a limit buying order higher than the current price or selling order below the current price, this will act as good as market order but will also protect from any impact cost due to illiquidity. You can place market orders on index options.

- For all intraday positions (MIS, CO, BO), even though we run square offs automatically, the onus is on you the client to ensure all MIS,CO,BO positions are squared before market closing.

The SPAN tool can also be used for calculating margin requirement for multi-leg trading strategies.

Happy Trading,

* this post was last edited on 8th Nov 2015

For better risk management, can i choose to not use the margins on MIS intraday equity orders and only buy stocks worth what is there in my zerodha trading account?

Or will i compulsorily get margins assigned?

Hi Varun, if you want to buy stocks only for the amount available in your Zerodha account without using margins, you can use the CNC product type even for intraday trades. This ensures you are not assigned any additional margin.

Hi Shruthi,

Choosing CNC product type and selling the same day would still lead to higher STT and other charges correct?

Is there a way we can go for intraday trading but without using margins and using my own money paying the full amount upfront.

Hi Paramjeet, for equity trades, the system displays charges associated with equity delivery trades regardless of whether you used MIS or CNC product types. Intraday charges appear only after you square off positions on the same day, whether through CNC or MIS.

i have a doubt, I know that m2m is charged on the daily basis but what if u use 2 leg spread option strategies and lets say it went against your view, will i have to pay the margin on the daily basis.

I’m regular user Zeroda app. Like trading with Zeroda.

Want to trade in futures but does not need margin at all, is it possible that my order shall be accepted only if I had total contact value amount in cash in my account, this is for avoiding over exposure.

Thanks

Hello,

Why collateral margin cannot be used for option buying in zerodha? Option buying facility is available through collateral margin by other brokers. Just wanted to know why zerodha has restricted this to option writing only.

Hi Aman, we’ve explained this here. We’ve also noted this as feedback and will check into the possibilities.

Hi, please correct me if I am wrong, Gold Fut are around 5Lakhs, each tick size is 100Rs., so I observe that there is not much margin available for us.

(Physical Gold 100gms=5.9Lakhs, if one Re increased, 100Rs. profit)

If i want to trade in options with capital of 5crore and let premium price is 100, so that quantity is 500000, so how can i execute the order with single click? Please reply in details, thanks.

Hi Shubham, exchanges have quantity freeze limits, which limit the maximum quantities one can buy or sell in a single order. To get over this, you can use Iceberg orders, or Basker orders.

I am trading using demo account and l have trained a little bit now I want to trade real time so i have one major question . in kite if I am depositing 50,000 with a margin I get in intraday for 5 and I can trade till 2,50,000 . now my question is now I am making trade at a price of 1000 and I am buying 200 shares worth of 2,00,000 And I am taking a trade and can I take a another trade at the same time with the same amount . like buying two stocks at the same time worth . Can you clear this for me

In case of sell from demat balance, what’s the cutoff time by which one should purchase the sold quantity for it to be considered as intraday? Is it 3.20 or 3.30 ? It’s important for tax calculation.

Hi Paddu, open intraday positions are to be squared off by 3:20 PM for equity. We’ve explained this here.

Is there any interest on margin in intraday.

Hey Zeeshan, there is no interest charged for using intraday leverage.

Does my intraday profit gets shared with broker if I use 5X leverage?

Hey Simon, no, you don’t have to share any profit you make. You only have to pay brokerage. You can check out all the charges here.

Would the margin blocked also be released after T+1 day after squaring off option writing positions before expiry. I know that the profits earned would be released after T+1 day; just wondering if the margins that was blocked especially for option writing positions, would they be also released after T+1 day after squaring of positions on T day. Should I wait for T+1 day to use those margins that was unblocked

Example:

Yesterday If I sell NIFTY options and my margins (span+exposure) get blocked say Rs 1 L .

Today I exit (i.e. buyback) the same NIFTY options with profit of Rs 1000.

I know I should wait for T+1 day to get Rs 1000 in my account for me to use it without having to face penalty charges.

My question for the Rs 1 L (unblocked margin) as well should I wait for T+1 day ? Can I use the unblocked margin on same T day to write new options without facing penalty charges ?

HAI ,

if sold 2 options ( ce/pe ) to built straddle

then i need to adjust the straddle …. i exit PE OR CE …then can i take next order to built straddle with same premium amount on same day ?

i mean if exit or square of option selling strik …can i take new position with same amount or i have to wait for T +1

Hey Srikanth, the margin released after squaring-off the short option position can be used immediately for taking other trades. You don’t have to wait until T+1 day.

thank you so much

What is the charges on margin used for Commodity trading on delivery basis?

Sir, I am very happy with Zerodha and investing in Shares and Mutual funds. Recently doing Swing trading also. I have read your chapters relating to Margin requirements. Still, I need clarification for the following issues :

1. Margin requirement is applicable to swing trading equity delivery?

2. The sale proceeds of sale today can be used to purchase the share today?

3. How to avoid the margin penalty in Wing trading?

539243

For Intraday Options Buying and Selling (MIS), why am I not getting the GTT Stoploss & Target Percentage which I am getting for Overnight (NRML) mode?

I would like to place an Intraday Order, set the Buy/Sell Limit Price, set the GTT Stoploss & Target and focus on my desk job. The algorithm would do it’s thing whether I am Live at KITE or not!!

Call and Trade charges : around 5thousand deducted on this name over 4 years .. whats this and why is it being deducted from my account

Hi. Today i purchased Lot 25 4th Feb CE Bank Nifty @ Rs.469 units. I sold the same at Rs.406 with loss.

I again purchased Lot 25 @Rs.424 and now my average margin came to Rs.446.

However, when i tried to sell them @ Rs.430, I got an error stating insufficient fund your account.

I had 30k in my account. But why i was getting error Insufficient funds (i.e. 25 * 469 = 11725)

Also i observed, the stock price went to Rs.480 and my average price was Rs.446. but still it was showing loss in P&L balance.

Please assist.

why you charged above rs.20 ?

as per your rule rs.20 maximum for intraday trading, i was trade on 8th jan

i bought rs.930 (share price) & sold rs.950 (share price)

total share quantity: 100

at that time i paid brokerage rs.40

i purchased stock 1050 of Subex company past 18 days i invested 34000 today is 28000 ie 6000rs loss i sold but it deducts 12000 why plz justify

Hello,

i want to know if i short nifty future 1 lot how much money do need to have in my account. Do i only need margin money which is around 1.5 lakh per lot or do i have to have around 9.75 lakh (75*13000) rupee to hold that short position for a month or long

You will only need the margin amount.

hie, can you explain margin process for intraday trading?

what happens to margin when a trade is square off in intraday trading?

Nothing. If you square-off the trade the same day, the margin blocked is simply released.

I am holding XXXXX stock in my portfolio for years. Now i am thinking to book profit on the same. Do i need to have any margin for the same?? if yes, where can i see margin requirements.

Would the margin blocked also be released after T+1 day after squaring off option writing positions before expiry. I know that the profits earned would be released after T+1 day; just wondering if the margins that was blocked especially for option writing positions, would they be also released after T+1 day after squaring of positions on T day. Should I wait for T+1 day to use those margins that was unblocked

Example:

Yesterday If I sell NIFTY options and my margins (span+exposure) get blocked say Rs 1 L .

Today I exit (i.e. buyback) the same NIFTY options with profit of Rs 1000.

I know I should wait for T+1 day to get Rs 1000 in my account for me to use it without having to face penalty charges.

My question for the Rs 1 L (unblocked margin) as well should I wait for T+1 day ? Can I use the unblocked margin on same T day to write new options without facing penalty charges ?

Is there any update on providing limit for CNC trades, which was announced long back. Any insight on this would be really helpful. TIA

Dear Sir,

today i did a intraday Short Selling and i put a request for buying of Shares before 3.20PM but its not executed and Still Showing On Positions with Quantity .how this will be resolved.and at what time money will be credited in my account.

Hi I want info about NRML. I brought x amount of shares as NRML. After how many days do i need to pay the remaining amount ? Can i sell the shares before if i want without paying full amount ?

Sir

What is the method to place a target price in a Normal order for Crude oil Futures.,keeping in mind sufficient margin is kept in my account.

Place a Limit order at the target price.

OK.Thank you sir,

Regards

Suresh Nair

Hello Sir, (1) suppose in market hours if ihave two positions sell call in 10k loss and buycall in 10k profit with zero available cash balance,then will my sellcall loss adjusted with the buycall profit as my net profit and loss is zero OR ineed to bring extra funds to the account for the sellcall loss at that point of time with holding both positions…

(2) suppose if my sellcall position is in 10k loss and available cash is 10k in market hours and position running then will my loss 10k deduct from the available cash balance(10k) OR the exposure margin which was blocked before taking position at that moment…can you please elaborate how margins work

i had 30 shares of herohonda and by selling one share in equity(CNC) and bought 3 natco pharma shares on May 14th 3.28 PM IST, but there is haircut charge debited Rs.251? i have not pledged any shares and then why zerodha charged unnecesarily?

Best create a ticket on our Support Portal for such account specific queries.

Mr. Nitin Kamath

Horrible experience yesterday. Refer Ticket No. 20200422189899

Spoke to somebody around 10 am today too.

When I could not buy 9900 call of 30APR yesterday as order was repeatedly cancelled, Margin page showed that trading could be done between 9000 to 9350 strikes only.

On phone today I was told that

1. Zerodha had to restrict trade range yesterday due to Brokers (Zerodha’s) market wise limit

Were your customers notified at all ??

YET order for 9500 CE had gone through.

Perhaps 9500 falls between 9000 and 9350 !!!

2. I must have placed IOC order for Apr Fut order today as it was rejected . On Pi platform, there is no option of IOC order in LIMIT ORDER box !!

Of course decent burial has been given to the whole thing by closing the Ticket stating, issue is closed after our conversation.

IS NO explanation necessary ??

I don’t think Covid is the reason …….. This benign anarchy shows some of your group doen’t give two hoots if things go well or how a problem is explained / addressed.

Wonder which way things are headed at ZERODHA

May I have saner explanation ???? ( Please see attachments to my complaint )

A K Kaul

How to calculate Margin for Niftybank in futures.

Assuming 1 lot ( 20 ) for Bank Nifty April futures is trading at 20830 INR.

How much margin is required to buy 2 lots of Bank Nifty April futures in MIS( intraday )

hii sir,

i have 4000 rs. in my account . but i cant use intraday leaverage amount .

sir please help me how i can use leaverage or margin .

thank you

Why are MIS Margins now more than CO/BO Margin? I thought CO/BO margin was higher as it required mandatory SL’s

The margin requirements for BO/CO are dependent on the SL you enter.

Why are Buy Option positions on Date of Expiry is Auto-executed.?

At What time. ?

Sorry, can you be a little clearer?

If client use margin in intraday trading then is the zerodha apply any charges for providing leaverage ?

If yes then what are the charges ?

No, there are no additional charges.

Hi

I want to know if i use margin in equity trades and i make some profit, will i receive the full profit amount or will zerodha be keeping a percentage of that amoount with themselves.

also, as the MIS trades are squared off at the end of the day do you guys charge a small percentage over the margin or some sort of penalty if we lose the money when using margins.

There is no charge for the MIS margin, however, if you lose more money than what you have in your account and the account goes into negative balance, an interest of 0.05% per day is charged on the negative amount.

How do I hold MIS position overnight for equities? Is there additional margin required for that? Is it also possible to hold short position overnight.

No, you cannot hold an MIS position overnight. You can only use CNC for that, paying full cash. Also, you cannot short equity overnight directly. You can only short the future, write a call option, or buy a put option.

In my equity contract note, I cannot see one of my stock entries being squared off. I can see only the sell entry because I sold it in the MIS section, but there is no buy entry for the same. I can also see the stock quantity being negative, obviously because the stock was sold first but not bought subsequently yesterday. I also owe certain amount (exactly the amount for which I sold the stock) to Zerodha for this sell-only transaction. Does this mean the transaction is still pending and will be auto squared off in some time or may be in a couple of T days? Please guide.

Regards,

Yogi

Dear Team,

Using Stock Collateral margin can do the trade in Index(Nifty, BankNifty) options.

You can use collateral from pledging stocks to write options only.

Today is 12-Dec-2019. As per the Zerodha margin calculator, the NRML margin required to hold the overnight position on TORNTPOWER expiring on 26-DEC-19 is Rs.1,44,311/- and I had around Rs.1,90,000/- in my trading account. When I converted the MIS position I held in TORNTPOWER future contract to NRML position, I got a message saying that for NRML position the fund required is around Rs.2,10,000/- and I had to exit the position.

Is the Zerodha margin calculator showing the wrong information? Or is there any bug in the Zerodha trading platform? Please explain.

When are you guys providing delivery margin for stocks.

Working on this.

Hello Nitin,

I wanted to know that if I have a demat account with zerodha, are my stocks pledged only when I take a position or they are pledged irrespective because I understand that once I have stocks in my demat account, a limit is always available to me to trade. Or

Do I have to decide in advance if I want to trade, send an email asking for my shares to be pledged and only then will I be allowed to take a position the next day.

Regards,

Hi Alane, you don’t need to send an email. You simply need to go to your holdings on Console and place a pledge request. This is processed the next day and you can take positions.

Hi,

I want to know what is the amount that would require to trade in Nifty CE/PE option in intraday Trading.

Amount for

Nifty Nov 12000 CE – Intraday trade

Nifty Nov 11900 PE – Intraday PE

You can check out our margin calculator for margin requirements.

I am not able to trade in futures as it says ”this segment is not enabled on your acccount” . I tried purchasing NIFTY 50 future using both the options ”MIS ” and ”NRML”, please help.

You are required to submit your income proof to trade F&O.

i have calculated margin for the following strategy on zerodha margin calculator and the margin required is around 25000

the strategy is

crude long @ 3750

hedged crude by buying 3700pe & shorted 3800ce

will i get margin call as all my positions are hedged?

You’ll need to maintain the required margins, as per the margin calculator. Any short-fall in the margin will result in a margin call. Also, note that the margins shown on the margin calculator may be slightly different from the actual margin required, as the trading platform calculates margins realtime.

Can I sell share, Which I have Purchased on same day by using cash n carry(CNC)…if it’s there in POSITIONS..?

Yes, you can.

Is zerodha provide intraday margin on the basis of holding stocks value?

You can pledge stocks to avail margins. The process is explained here.

On regular basis I faced margin issue in case of 1:1 call spread or put spread , if I have 220k on my account I should get leverage on delivery at list with 600 share of Nifty 1:1 basis, I can’t even put butterfly neither for delivery please do something with hedge positions for delivery positions.Thank You

Team,

please explain the difference between MIS and CNC.

Are there any extra charges associated for trade with these options?

thanks

Banwari Sharma

if i incur a loss in intraday trade and i have negative realised profit will the charges be auto deducted from my trading account

Yes.

Hi , i’m John , Suppose I have Ten thousand rupees , suppose the desired stock provided 13 times leverage , and i made the trade with the full ten thousand , and also made profit or loss, can I Make the second trade with the same leverage that day without getting deducted , because I get mails that i have use more than 100 percent of the leverage , is it because i made the second trade, is it that i’m limited to 10000 x 13 = 130000 , that day or could i make more trades (triple the amount) without getting deducted ?

You can use the 10k only once to buy worth 1.3lk(10k x 13). However, if you close that position, you can take a fresh position with the entire 10k.

And the brokerage remains the same with no additional charges ?

Sir, Hope you are well!

I have recently open the A/c & it is showing me the margin (Cash Transfer from Bank A/c) available is 10,000/- So how to know the leverage amount I will be getting. It will show in the Fund Tool Bar or where I can see the margin available.

If I short for Idea (Vodafone) Example:- Qty 2,000 @ 7.00 = 14,000/-

But Margin I have is 10,000/-

Leverage showing in the Zerodha is 4X, this means 4X 10,000 = 40,000/-

So, Margin or called as cash balance available multiply by Leverage i.e. 4X so, 40,000/- worth value stock I can buy for Intraday.

Please advise.

what does this means,

your EQUITY margin utilization has reached 169.07% of your available balance. Add funds on http://kite.zerodha.com/funds immediately to avoid square off. Team Zerodha

I got this mail from Zerodha

This essentially means that your position is losing more money than what is available in your trading account and you need to bring in more money. A detailed explanation is available here.

Nithin,

One thing i don’t understand, suppose i have 200 stocks of HEROMOTOCO in my demat account and sell JUN FUT or JUN Call option, why i should maintain margin. If i dont close the position by expiry date, Zerodha can sell the stock at prevailing prices on expiry date right?

Shankar,

The broker runs a risk of short delivery if the client ends up selling the shares in his demat before expiry and the F&O is exercised.

You can pledge the holdings to get collateral margin to fulfill the increased margin requirement.

I am not able to search put options for index / stock in the buying screen. Pls help

What are you typing into the search bar?

Please provide Delivery margin facility for long term investing, many people are ready to pay interest for that but the interest rate should be reasonable.

Should be available in some time.

Hey Matti,

Define ”some time”?

Anytime in 2019? or the wait would be much longer?

Under Orders need information on tab called ”Disclosed Quantity” How this can be used.

Thanks

Bela Patel

Hey. It’s explained here.

Beside equities can we pledge MFs and avail margin for F&O trades.

Hey Mona,

Pledging Mutual funds is presently not available. We are working on it and we’ll keep you posted.

I have a question suppose i have twenty thousand and leverage on a particular stock was 15.2 times , and a i bought the stock on full leverage estimated value at 304000 which is 100%.

and i have sold it ,end of discussion .

Well here comes my question will I be able to buy another stock on leverage another 100% , or will they charge alot and if so , how do they calculate. This way i can estimate the profit i can make on another trade.

Thank you.

Your service counts.

Yes, once you sell the stocks, the margin is released(after adjusting the Profit/Loss). You can use the funds to place another order utilizing the provided leverage.

Suppose I make a short straddle on expiry day on nifty. If I use MIS order then will the margin required be 50% of what is required for normal order on the same day ?

Hello,

My account has debiited Rs.27 rupees on yesterday, Can you please let me clarify me on this.

You can find all debits and credits in your account statement on Console.

If you still have a query, you can raise a ticket on our Support Portal for all account specific clarifications.

I am having the margin to short the option strike and suppose I have shorted after a day if the price go bit higher …again zerodah will ask to add the amount for margin or it is done at the time of shorting itself???

Can I transfer my February options contract to march options contract.

i.e if I have one lot of options contract with expiry of feb can I extend the expiry of my contract to the next month of March.

You need to individually exit the Feb contract and take a position in the March contract.

If the scrip is in Ban period, you can call our dealing desk, who will help you rollover the contract.

dear sir,

i bye share in cnc order and sell on next day , but i cant see fund in my account why..??, what happen..??

kindly provide help.

thankyou

You should be able to see the margins updated as soon as you sell the stock. You can, however, withdraw this amount only on T+2 as that’s the settlement period for stocks in India.

Hi,

I went to the equity margin calculator and input the stock name – INFRATEL but it only showed me stocks I can buy under MIS and CNC. However, I want to short INFRATEL or any other stock in intra day then how much is the margin required to short a stock (NOT F&O) in intraday?

Can we hold options over night without POA ?

Yes, you can.

Sir I have cash of Rs. 10000. I have purchase stock of Rs. 100 per share i.e. 100shares . I have choose product of Mis intraday.if stock price increases to 105.and margin for that stock is 14x. So can I get profit of Rs.1400×5=7000

Does the status change automatically or I will be informed first? sir please let me know how can i use it there without opening NRI account.

Hi,

Do we have any means to know how much leverage/margin available for each scrip in mis type?

Presently margin for scrips for equity in BO is only 10%

Kumar, Margins for BO/CO are defined based on the Stoploss you choose to place and the stock. You can check the BO/CO Margin Calculator for the same

Faisal,

I did not pass a wild comment. You can go through Nifty 50 scrips and tell me how many scrips are eligible for 15%-20% margin, with 1 RE sl. I remarked after trying with .1 sl also. Previously every scrip had a convenient margin of 20.8. When we try to recover losses, then there is no margin available. Then you feel the difficulty.. CO had upto 37% for equity, now is also reduced to 10-15. Only futures are well supported by CO. When there is auto square off available, then why limit BO’s and CO’s? Trader works with a calculation. When an available margin is not there, then you need to rework on qty by which time price changes. Nowadays I am taking only 10 times, at least saves time on recalculation.

Secondly, why there is no target feature in CO? Is it NSE policy or Zerodha policy?

Thanks,

Kumar

You can check the Equity margin calculator to find the leverage we offer under MIS.

Hi,

I have opened demat account in zerodha and i have to go abroad for further studies. So i want to know,

can i trade in zerodha from there.

You can use the account there, but if your status changes to NRI, you’ll need to open an NRI account.

Does the status change automatically or I will be informed first? sir please let me know how can i use it there without opening NRI account.

This depends on how you file your income taxes. Best you contact a CA or Tax consultant who can help you with the same.

Hi,

I have 2 questions

1. why am i charged 20 rs brokerage even when it is 1% or 20rs which ever is less, so when i buy stockes of 100 rs for intraday i am charged 20 rupees for brokerage insted it should be 1 RS

2. what if if Buy CNC for a share and sell it the same day will i be charged brokerage as CNC has no charge

Thanks

1. You will be charged Rs. 20 or 0.01%, whichever is lower. If you think you’ve been overcharged, please create a ticket on support.zerodha.com.

2. This is still an intraday trade and the brokerage would be levied accordingly. 0 brokerage applies to delivery trades only.

my margin available is 1015 and in console it shows my account value 974.

How is unrealised profit calculated in funds tab. Since that doesn’t tally with the unrealised profit shown in position tab

Hey Chintan,

We are working on fixing this. The MTM shown in the positions tab will be accurate.

In Zerodha , you don’t provide any leverage for CNC orders. Full amount needs to be in client’s account even to place CNC order. It happens many a times for limit order that the order is not executed and the funds remain with Zerodha overnight or even more time. Even if the order is executed, it takes T+2 days for delivery of share which means that funds remain with Zerodha for at least two days. Similarly, the withdrawal of unused funds takes 2 days to get credited in client’s account.

There are following two options to the above :

1) Unused funds may be allowed to be withdrawn immediately after closure of trade hours thru’ UPI

2) One may use margin by pledging the shares for CNC and recoup the margin by T+2 days.

If you don’t agree to above options, pl. advise alternate solution to the problem.

Can i use bank guarantee or Letter of credit from bank to get limit for intraday trading.

I’m afraid that wouldn’t be possible.

Hi,

I searched on your kite manual but I am not able to find my answer on below query:

Suppose I have certain stocks in my account which was bought on delivery, now there is 0 Rs. cash in my account but stocks are available so can I make margin / intra-day trade by considering the margin limit of stock available with 0 cash ??

Because most of other stock brooking firm provides such limit.

You can do this by pledging your stock holdings, however, as per regulations, you will need to have 50% of the margin required as cash. This has been explained in more detail here.

Hi Zerodha Team,

Begging of the blog it has mentioned as ”If you are not enabled on the latter 2 exchanges, print the segment addition form and courier back to us if you wish to.”

i have recently created the account, How will I get to know about those segments have been added to my account or not? and mainly what are the benefits of adding those segments?

Kindly explain about this.

Thank you

Pramod Vasudev Bhat

Why can’t I buy a contract on the day of its expiry ?

Hi,

I bought options without stoploss

nifty 11400CE @ 108 sep expiry

auropharma 820CE @ 22 sep expiry

now i am going through a big loss (30k)

Should i hold till expiry or should i square off now

how much more loss will get if i hold till expiry ?

Any suggestions are welcome !

Thanks in advance

I am a beginner in Options trading.

1. If I bought a Put Option (RelianceSep18CE 1220 as an example) and a few days later (before expiry) I simply sell the PE at the same strike, is my position squared off automatically? The difference between premiums is my profit/loss? I do not have to pay any margins for the SELL leg, no matter where the Spot and Premiums go until expiry?

2. If I use a Bull Call Spread or other similar strategy (RelianceSep18CE as an example), instead of waiting till expiry, won’t it be prudent to track the premiums and square off one/both legs before expiry? Isn’t there some STT implication here that one benefits from?

3. Like charts of share prices, aren’t charts of premiums at various strikes worth tracking? Are they available anywhere, if yes?

4. Since NSEPaathshaala is closed down, is there any other mock trading platform for Options by any chance?

5. When I square off/ Close my Options Trade, will it still count in Open Interest?

Thanks

Hey Deepak.

1. No, you don’t have to pay any margins for the sell transaction(as it is a square-off order).

2. Yes, you can square-off the position(s) before expiry.

Yes, there is STT benefit if your square-off your long ITM options before expiry(Upon expiry, you will be paying 0.125% of the contract value as STT). Read more here.

3. Currently, charts for the strikes are available only for the period they’ve been trading for(maximum of 3 months). We plan to add continuous charts in the near future.

Can I do Intraday trade on a stock that is not in the margin list, if I have the cash?

If the stock is not in a trade to trade category, then yes, you can.

Zerodha Charge any fee if we earn profit using margin ??

No charges for intraday margins, Saurabh.

Suppose 10000 rupees cash amount available in kite zerodha account. So can i trade upto 50000 ruppes or somewhere near to that for intraday?

Because some trading companies giving such facility to there clients.

Can I open Zerodha demat(and trading) account without a margin account?

At Zerodha, there’s no concept of a ’margin account’ as such. You open a trading and demat account and add money to the trading account whenever you wish to trade. Margins offered are basically the funds available in your trading account.

Hi, If i buy current month nifty futures and Sell next month futures what is the total margin required for NRML.

Hey Fazil,

You can find this out using the margin calculator.

IN EQUITY TRADING FOR INTRA DAY IT IS TERMED AS MIS AND FOR DELIVERY IT IS TERMED AS CNC ,WHAT TERMS ARE USED FOR POSITIONAL BUY FOR FUTURES & OPTIONS, SINCE IT IS NOT SQUARE OFF ON THE SAME DAY. PLEASE LET ME KNOW BEING A BEGINER,

i am new to this discount broking & need to know about the procedures to trade online , what is the exposure you offer against cash deposit in f&o segment, need to have a clear idea…..please guide

Sir can we use stock as a margin for derivative positional trades and if yes then any interest you charge or not

Hi,

How to place stoploss order in Options.

I have tried in NRML options, but it is not getting triggered.

with regards,

K. Prabhu

Hey Prabhu, the SL would only get triggered if there’s a counter trade available in the market.

Hypothetically, if Nifty 11000 Call Option LTP is 56, and if i have to buy this call option, the only amount i would require is 56*75(1 lot)=Rs. 4200/- right?? No margin to be kept and also no margin required if i square it off right?? Thanks for your help

That’s right, Alok.

Is margin required if i have to square off a bought option. Also, when is the amount credited to my account after square off?? Thanks

No margin required to square off a position. The margin for the position is released as soon as the position is squared off and this can be used to take trades. The funds can be withdrawn from the next day.

Hi Sir,

I cant see my shares pledged in the collateral of my Kite app nor in my Q holding at the end of friday after market closed. What is the reason of so as I didnt enter into any position on this day nor I placed the request for unpledging?

Hey Yaman, can you create a ticket here https://support.zerodha.com/.

Order Not Placed and getting the following error. Can you explain what it means?

RMS:Rule: Option Strike price based on Ltp percentage for entity account-ZXXXXX across exchange across segment across product

Today i did Intraday trade by taking Leverage Ex Bought Union Bank 1000 shares at 94.5 and Sold it at 96.4 and i earned Rs 845 by deducting all taxes, Aparat from all the taxes is der any extra charges apply for this by Zerodha???????

All charges that will be levied are listed here. Nothing more.

As per the latest SEBI circular, additional margin collection (exposure margin) for index options has been deferred until July 1st 2018. Will Zerodha auto sq off in case account balance drops below exposure margin for June Series?

We’ll wait for clarity from the exchanges and SEBI. Until then, the current RMS measures stand.

is zerodha change his Leverage plan ?

when i open my a/c that time i get 20.7* time Leverage but today i get only 10.3* time Leverage.

why ??????

reply soon.

Hey Madhvesh, the leverage offered is dynamic and changes based on various factors. You can check the margin required here. In case of BO/CO, the leverage is dependent on your stoploss as well.

you increase the margin from 33x to 25x .pls if u further increase the margin then inform the trader before

your page says – Even though we square off all intraday positions automatically at 3.20 pm, the onus of squaring off all intraday MIS/BO/CO positions lies with you.

i have following question –

1. if i want to sell between 3.20 to 3.30 pm what are the steps to be followed.

To keep the position open beyond 3:20, you’ll have to use CNC/NRML.

so we dont get any margins for that? even if its intraday.

Intraday trades have to be in MIS/BO/CO. The leverage is offered considering the fact that these positions will be squared off by the user before 3:20 else we have the time to square them off on our end. When any of our clients trade with leverage, the risk of the remaining amount is taken by Zerodha and this is a means of mitigating that risk. If you want to hold the positions beyond 3:20, you’ll need to use the NRML/CNC product and bring in the full margin.

Thank you

what is Formula to Calculate Margin/Leverage in Intraday MIS in Bracket Order ??? Because With Variation In Price of Share Leverage Change. I have to Update Daily for every Stock Which is Very time Consuming.

It has been 2 years since you are talking about the margin lending to start soon. You have got nbfc licence too. What is pending now? Is it ever going to start ?

Wanted to understand how can i convert my MIS future order to NRML and use the margin provided by zerodha .

Please explain me the process.

Hello Sir,

I have one query , I’m doing intraday trading on leverage by zerodha account, I used 11x to 14x leverage by zerodha in intraday trade

I have question that is it any charges applicable to this leverage i used ?

Hi,

If you have traded a strategy comprising for stock future & call/put options, in case of closing the strategy by simultaneously selecting the trades, only future gets traded. To execute the options, you have place separate limit orders. You miss opportunity book profits or limit your losses due to this.

Why don’t Zerodha places a limit orders with CMP as trigger price for stock options?

Hope you understand the problem & do the necessary changes.

Rgds

You can do that on your end. Doing this selectively for stock options isn’t a feasible option, neither is changing the order type after confirmation a correct practice.

matti,

there is query i raised on April 25th, can you reply on the same

sir zerodha proviede margin in CNC and BO & CO(Bracket order and Cover order ) sir

1) Zerodha can using margin market Pre-open session can use that sir Time 9.00 to 9.07 time of preopening can buy stock sir

2)please tell can i buy or weight market open

Yes, you can place MIS orders in the pre-open session.

HI Nikhil,

How can I set a bracket order for breakouts in kite. I mean placing the order(say buy) before the breakout in the upward direction. Currently bracket orders buy should be less than market price. When price reaches that level it gets triggered. But if I place buy greater than market price then it is executed immediately which i don’t want to happen . Please help

You can use the SL order type while entering the bracket order to achieve this.

Hi Mr Kamath,

I need one information, Zerodha sends EOD margin statement and contract notes at the end of the day. if on any given day Margin statement says that all the margin requirements are met and there is no margin requirement then on that day can your back office team levy penalty stating that there was margin shortfall.

some currency margin penalty charges were levied in my case but on that respective days, EOD margin statement says that there was sufficient margin and no additional margin required.

can you please clarify?

thanks

satvinder

this is awaiting your reply since 25th April. is this the service you provide to our customers?

I want to know if I can auto sell shares on certain price like if I buy 10 share at 105 per share and want to auto sell at 107.

Hi Nitin

I am a zerodha customer and mostly deal in option trading .I recently transferred some stocks from india bulls to my existing zerodha account to get some extra margin while trading.However,I am not getting the benefit of stock margin while buying any call or put options.Kindly let me know the reason behind it .

Regards

Kanishk

Hi Matti,

thanks for your earlier replies.

just one more question, if I am carrying positions in currency segment which has a settlement of T+1 day. for example, if have 100 short 65.5 ce option, the ledger balance is Rs10,000 only on day 1. next day that is on day 2 I bought 100, 65.5 ce option and sold 100, 65.25 ce option then will there be any penalty.

i am assuming since both the transaction has T+1 settlement then there should not be any penalty. can u please guide.

thanks for your help

Satvinder

Hi,

Yesterday, I sell the 6 shares 180rs by MIS.. that time I had fund 110rs in my account. The end of the day, 6 shares completed the position by 179.25. So I got the profit of around 4rs. The fund value showed as 115rs something. But today I saw my fund value,it is decrease to 90. I was wondering why 25 rs deducted from fund again even I got profit?

Taxes and charges would have been deducted at the end of the day. Check the contract note and ledger for details.

Mr Kamath, Can you please update me on Margin penalty on currency options and futures. As far as my knowledge goes short margin penalty is levied if the clear balance is below SPAN margin and not below SPAN+Exposure.

I believe this is true for both NSE fut+options and Currency Fut+options.

can you throw some light?

thanks

Satvinder

ZO6352

For currencies, you’ll need to maintain both SPAN and exposure to avoid margin penalties.

Again you didn’t reply to my specific question. Does exchange levy penalty on clear balance below SPAN or below SPAN+Exposure. Can you please confirm this for Currency fut+ options and NSE eq fut+ options?

are there different rules for NSE FO and currency FO for margin penalties and margin requirements?

thanks

That is exactly what I am saying. For currency futures & options, exchange levies penalties if the margin maintained is below SPAN + Exposure, while for Equity F&O, maintaining SPAN should be enough to not attract penalties.

BankNifty is presently trading at 24400. Margin requirement for 23000 April Put options is 82500 while for 24000 April Put options it is 65000. WHy would margin requirement for a more OTM option be significantly higher?

Regards,

Apoorv Sood

What happens if i loose a some amount while trading using BO……if i loose 670 rs….what will be my total lose…is it 1000….if not …..mine is 1000 loose and also call and trade charges….while i dont use to call and trade…..

Since u have mentioned u luv playing poker.. Any tips on poker?? or any info on where I can play 3 patti lyk a pro :):)

I have Commodity MCX Crude oil mega lot (19 March 2018 expiry) in NRML mode by at 4095 when it was on top, suppose till 19 March it’s expiry date I didn’t get my buying price so what will happen?

1- Do you convert into April lot or cut my position?

2- If it will convert in April lot expiry, then what is the procedure and charges should I bear?

Please suggest! I am very confuse.

Regards,

Gaurav

9911215292

WHAT IS THE MARGIN REQUIRED IN NRML, CNC IN DIFFERENT STOCKS AND WHERE WE GET THE MARGIN TABLE FOR DIFFERENT STOCKS.

Hi, Would like to say a great product and Idea of Zerodha. Though as an investor i see few missing points.

1. There is no choice for user to chose from NSDL/CDSL for Demat and all are forced CDSL accounts. (which in a way is bad as i personally prefer NSDL based account and I have my personal reasons for same)

2. Despite of huge margin(Portfolio) of mines to buy a share of 1/100 of that value also i do not get credit and have to first transfer money to account which is the most pathetic thing I can see. Looking at market fluctuations I might buy or sell things. I have no pre-thought how much money should I keep in Zerodha before that. I anticipate that atleast since the trade is T+2 you should allow at least 2 days of credit to user and if person does not pay in those 2 days you can levy heavy interest or can pledge the existing shares in his/her portfolio.

Hope to see you overcome both the above problems soon.

This is the one of the point I am thinking twice to switch to Zerodha. Currently I am using Indiabulls , I can buy shares without parking my money with them.This is great advantage.

I put many orders without money at low price and if executed , I will pay if not no need of money.

Hi Team

I would like to calculate the total margin requirement programatically, could you share how exactly the margin tool works, or any links or information ?

Thanks

Hi Nithin

I have an open NRML F&O Order and its expiring tomorrow. Can i roll it over for the next month? I am not able to see this option. I am maintaining the required margin.

Hello,

I have a question about swing trading. If I want to carry forward my futures position (NRML) overnight, then i am exposed to overnight trading risk. In case of Long position, if on the next day market opens much lower then is my Stop Loss order going to be executed even if the next day’s opening price far below the my SL (Limit) price?

For example, if I took Long position in Nifty Futures (NRML) at 10,200 and the Stop Loss(limit) order is at 10100, suppose the market opens next day at 9500 (Hypothetically), then is my stop loss order going to be executed?

If not, then how do i overcome this overnight trading risk, as situtations like these can wipe away one’s trading account.

Regards,

Ritvik

Hello,

I have query about option spread margin leverage. For executing sunpharama short strangle of FEB2018 expiry strike price 540 put & 630 call. How much fund require for executing order?

You can check out the margin requirements on our margin calculator.

How to add margin in zerodha and how to check minimum margin and available margin.

Hi,

Can i trade in options using CO. Also please clarify whether I can trade only Nifty and Bank Nifty or Stock options also. Would also like to know the Margin leverage that I will get under CO.

Thanks,

Darshan

Dear Support,

Please take note of serious concerns over margin calculator. please inform clients time to time about changes in Margin in whichever the case may be, margin leavrages are getting drastically changed (on budget day, even after budget day) no information in provided through SMS, mails, notfication over Kite platform, on margin calculator tool & not even published in Your Bulletins page. in such scenario as trader it was extremely diffucult on my part to take or exit current positions on MIS intraday Equity products. losses are part and parcel of the business, still it was pure negligence on your part in providing informations to your clients. Expecting better support in future.

If I have forgot to exit the NRML currency future positions, will it automatically square off on the expiry date ? and at what time ?

I think there’s an issue with your margin statements. I’d logged an issue (#168320) in this regard. The ones that get emailed don’t seem to account for shares purchased on the BSE or Mutual funds (through Coin). This makes me feel a lot richer than I actually am, but has left a very unpleasant feeling as far as your support goes.

It’s taken over a week for an explanation as to why the numbers are different on Kite, Q and the statements I get by mail – and the advice is to ”read the mail carefully”. The mail incidentally details none of the reasons I’d have more funds in my account than I actually do.

It’s obvious that your support staff (Anish A) is working hard, but not smart. Assuming a customer is mentally deficient rather than checking on an issue isn’t really what I’d expect from a young, forward thinking org.

The margin for MIS Nifty Futures is mentioned as 40%. So does it mean if I have money for 10 lots of Nifty future index, in intraday I can buy 14 lots (40% more)?

Please tell me how many nifty index future lots I can buy in intraday if I have the money to buy 1 lot in positional?

Nitin ,

settlement is T+1 for FNO.

1. Is that if i buy an option today at a X premium using regular order then i cannot sell today. Ill be getting it only tomo ?

2. If i square off a regular option buy before expiry then when will the amount get credited ? Is that tomo or onky on the expiry ?.

Pls clarify . Thanks in advance

1. You can sell the contract at any time. The settlement is just when the money actually hits your account. You can only withdraw the funds after settlement.

2. You receive the credit on T+1, no need to wait for expiry.

Sir,

Is there any hidden charges for leverage given by zerodha for intraday trading ??

Hello Nithin,

Do we have GTC or GTD order options on Kite platform ?

Hi Nithin,

I found Zerodha is great tool for trading. I am loving it. Thanks for simplicity and openness. can we have inclusive & deep learning video about tool? Also good to see if you share your knowledge across board on trading insight & best practices.

I am proud to see that Bangalore start up is taking great shape.

Wish you a great success &

Hi, why there is no leverage for executing delivery trades, if I you want to buy Rs 1lk of stock as CNC, why would i need to keep such full in cash. Why do not you give margin against my holding? Thanks

For delivery trades, the exchange requires us to present cash at the end of the T+2 day. If you’ve pledged your stocks to buy these stocks, where would we get the cash from?

Sir,

When exchange requires you to pay in T+2 days why do you block funds on the same day of placing order if that is the case you should allow your clients to withdraw amount on same day when sale order is executed why do you take T+2 days to release our fund.

In a way I strongly believe that based on portfolio you should provide margin and allow your client to take position and make payment before T+2 day failing which you can liquidate the shares for the amount due to you, anyways we all have executed Power of Attorney in your favour so nobody can raise any grievances for their stocks being liquidated and/or the other option left is charge interest on delayed payment.

Hi,

I place CNC orders on a daily basis. At the beginning of the day, it is very difficult for to estimate the total volume of these orders. Hence, managing margins is a bit of issue unless I leave a lot of cash lying underutilized in account.

How do you check available margin for CNC trades, do you look at cash available in account, or total margin available after adding additional margin on account of pledged securities. During the trading hours, if there are multitude of Bracket Orders and CNC orders, will your system be intelligent enough to let all CNC orders through as long as margin for non CNC orders is being met through margin from pledge?

For example, Assume that i have Rs 50000 cash in account and Rs 50000 additional margin available from pledge, so total Rs 100000 margin. I want to know what happens when I do the following:

a. On a given day, I place an order to buy Rs 80000 worth of reliance securities in CNC. Essentially, I have enough margin available but cash available is short.

b. On a given day, I place an order in NIFTY Futures which consumes Rs 40000 margin. Then I place an order to buy Reliance in CNC for Rs 40000. So, I have enough margin to support both trades, but fno order is placed first. So will the first order in futures consume 40000 cash margin leaving only 10000 for subsequent CNC order or both the orders will go through.

c. Can we do something like that we maintain enough margin in form of liquidbees, pledge it you, and then place CNC orders as required during the day. Then closer to end of the day, we sell required no of Liquidbees to ensure that we have sufficient cash in account to cover for all executed trades in CNC orders.

d. Further, in stocks says I buy 100 shares of Reliance and after 10 days, I do intraday sell buy of 100 shares in Reliance, then there is no activity in my demat account for the share. Does the same apply to Liquidbees?

Regards

Saurav

Hi,

I’m new to online stock marketing & I’m a beginner. I have created trading account online thru aadhar in Zerodha for Equity. As i said, I’m a beginner I want to invest for long term. So, Having demat account is mandatory?

Yes, a demat account is where your shares are held.

Can we do short selling in cash segment also for intra day ? Almost all the brokers provide this facility and if yes how can I do it?

Hello,

I am new to stock world. I have places CNC order for SBI and then on next day i did exit on market rate still it is showing as open position

Can you help ?

Br

Samrat

sir my request is zerodha should start margin facility like kotak or icici where one can hold margin position for some days , paying some interest

Yes, coming up with a margin product soon.

Hi,

Where can i check what is the overdrawn amount incase of short put option contract.

You can check out the Kite dashboard and see if the margin used is more than your account value.

Hi , I request you to please don’t add extra amount as margin in my account from Zerodha side.

Hey Sahdeep, simply use the CNC/NRML product type while placing orders if you don’t wish to use any additional margins.

Hi,

I plan to open an LLP for doing FnO trading and want to use my currently owned shares and mutual funds holding for pledging and getting margin for FnO trading. Can I use the shares in my own demat account (being a partner/owner of the LLP firm) as collateral without transferring to demat account of LLP firm. The reason is that once I transfer the shares/MFs to the LLP demat account, it is change of ownership ( which I want to avoid) and also I will have to pay tax for whatever capital gains is calculated at the time of change of ownership.

I’m afraid that wouldn’t be possible Naveen. Margin from pledged shares is only available for the same account as where the stocks are held.

Zerodha,

How many times during the day do you change the margin requirement for a stock futures? My understanding is that NSE updates it 6 times a day, though I am not sure of the time-frame before and after the market hours if you can let everyone know about it in the interest of all.

Thanks

Need to open an a/c with Zerodha.

1. Can it be done thru Online. I have Aadhar Card with me. Is PAN card is mandatory ?

2. Since i am in Bangalore, can i open a/c OFFLINE also? if so, what are the documents required? whether your representative approach us to collect the documents.

3.How should i contact, Ph.no.pl….

need your support

Hi Zerodha,

While trying to trade on Equity margin for Goa Carbon, Rain Industries no margin providing. I remember until 1st week of November, you have provided the margin for Rain, but not. Is there any specific issue on this.

Thank you.

Hey Aravind. The margin requirement for any stock is defined by the RMS team based on the market conditions for the scrip.

Hi,

Please explain me the difference between ”squareoff at market price” and ”squareoff at LTP”.Yesterday I lost my profit and ended up in loss because of the confusion of ”squareoff type”.The price at which it was squaredoff(in market price) was too low,that I endedup in loss.I just want to know,whether ”squareoff at LTP”,will be just one LTP (LTP at the time of order execution )or series of LTP as per the fluctuation.If it is just the LTP at the order of execution,will I have to wait till the LTP bounce back.kindly please explain.Thanks.

How much shares we can buy from Zerodha platform ?

can we do bulk deal or block deal from our platform ?

if i want to buy 2.5million (25 lakhs) share of some ABC stock then how can i buy ?

or

is their any limitations for buying volume ?

or

is their any other sources from you ?

Thanks.

Regards,

Tejas.

After trading account is opened should i need to transfer fund to make it account active? OR i need to transfer fund when i want to start the trading? Kindly advice.

Tejas, your choice. You can transfer the funds anytime you choose to.

will i have to pay aditinaly for future contracts if i carry it overnight for some days?

Penalty will only be applicable if there is a margin shortfall in your account. As long as you have complete margins you are fine.

Dear Nitin

I have a question regarding CO.

Why the stop loss price has to be so close (20%) to LTP?

It becomes very difficult to trade during expiry when the option prices are very low.

for example: NIFTY 1 Rs LTP can easily touch 1.2 Rs.

Hi Nitin,

I had a question regarding the total margin required for trading futures.

Supposed I go long on 1 lot (1000 qty) of Tata steel, the cmp is 713. The total margin required for this is about 80 k that’s showing up on your calculator.

I hedge the position by buying 1 lot of 700 PE.

Now, the combined margin requirement is about 60 k on your calculator.

But, my max loss is if the price expires at 700.

Thus, I’m losing 713-700 = 13 x 1000 = 13 k on the futures long.

And 14 x 1000 = 14 k on the 700 PE as it will expire worthless.

My max loss is 14k + 13 k = 27 k.

Why is Zerodha blocking 60 k for this?

Hi,

Can you please let me know the brokerage charges for equity option that is 20 Rs is it for a single contract of option or for a whole lot size.

Thanks & Regards.

Ketan

Ketan, it is Rs 20 per transaction regardless of the number of lots. You can check out our brokerage calculator to calculate this yourself.

if we buy some stock today by cnc type on same can we sale if price is higher

Nares, yes you can. The transaction will count as intraday.

Hi,

I apologize if this covered above, but several searches could not lead me to an answer so the question below.

Is there any page on Kite/Zerodha to view margin blocked by each position? I often need to churn my positions based on best utilization of margin. Where can I see margin blocked by each position?

Best,

Rushabh

Hi Nithin Sir,

I am waiting for your answers/views patiently on below questions towards Risk perspective.

Assume; a client holds the hedged position & if there is a substantial Upward price movement in it, then;

1) Do Zerodha square-off positions without notifying to the client/s? If Yes, which leg/s in the below cases;

a) Debit/Credit Spread Options strategies

b) Long Future & Short Option strategy

c) Short Future & Long Call Option Strategy

2) If the Answer of Question 1 is ”NO”, then, do Zerodha ask for additional Cash? How much & When (time windows if any)?

3) As you aware that on 25th October; the gap-up opening for SBI was greater than 20-25% (Rs.320+ levels). So, in this situation how Zerodha deal/managed / would have managed, if I would have carry the Bull Call Spread for 255 & 260 strikes on 24th October & if I had only 10,000/- Cash left in my Margin Account after utilizing the required SPAN + Exposure margins earlier?

I need your help to understand the concept of LEVERAGE ?

how and when can i start using Leverage for intraday trading ?

Is there any specific criteria for getting 10 times Leverage ?

Pankaj, check this post which explains this nicely. The leverage on stocks/contracts is decided by our RMS team based on various criteria such as volatility, liquidity etc. You can use the margin calculator tool to calculate the margin requirements.

how many time i trade in intraday for equity?

You can trade as many times as you wish as long as you have enough funds in your account.

Hi,

Can I purchase on CNC and sell on the same day? Will this be considered as Intraday?

Hi Team,

I want to clarify on few things since i have just opened my account with Zerodha. At the start of day, I see an opportunity in some stock & take intraday position using MIS option but before 3.20 pm, my target return is not achieved & now I wish to convert this position into delivery so as to avoid any loss but my margin account is short of funds, is it possible to convert the position to CNC & NEFT is initiated immediately after market close to fund the account so that it settles the credit on same day. Can you please advise if its possible & does Zerodha provides margin for delivery trades atleast for a day or two basically before settlement(T+2).

Please reply kar do..

Hi, I am new on zerodha.. Yesterday I bought shares of around 8500 cnc, regular.. Now the balance should be 1500 but it is showing 1473.00. I credited my account with 10000. I want to know when zerodha is not charging anything for cnc then why they have cut 25 rs from my account.

Hi,

Is the margin calculator not updated on regular basis ? Ex, It says for ACC17OCT it says the margin required is 86,072.But when I try to buy one lot it got rejected with below message,

”rms:margin exceeds,required:100382.22, available:95845.58 for entity account-XXXXXX across exchange across segment across product”

can you explain how 100382.22 is being derived ?

Thanks and Regards,

Kiran

Kiran, the margin calculator is updated at the end of day, it doesn’t show you live margin requirements.

Sir

Any update on funding/margin for delivery positional trading in cash segment..As being a succesfull trader I think u understand the problem..

Hey Manju, will take more time.

Hello. I had a question:

If I invest an amount of Rs 10,000 and let’s say I get a margin 10 times that, i.e 1 Lakh to trade with, so what will be the charges on the 90,000 you provide as loan? Apart from the trading charge of Rs 20, will I have to pay any interest on it if the trade is not intra day? Secondly, can I trade on commodity without margins? Thanks.

Hi Syed. The leverage you receive from Zerodha is purely intraday. You’d have to use the MIS product type to place these orders. MIS positions are required to be squared off by you before 3:20 PM for equity and 10 minutes before trading stops for commodities. If this is not done, the positions are squared off by our team at the market price.

You can indeed trade commodities without additional margins. You simply need to use the NRML product code while placing an order.

Why are some securities (eg. Rcom, Rcapital, jsw energy etc.) under ban for trading in futures ?

Check this answer.

sir

99% stock companies(erosmedia..etc)for intraday equity trading recommended by ”epic research”,a top stock market advisary firm….

aren’t listed for margin/leverage….why?

while there is a option of bo&co orders…

We don’t give margin/leverage for intraday if stock is hitting circuits.

i got a mail that my margin has crossed beyond limit ..102.42% plz add funds to your account what should i do my account is funded properly …i further i had calculated my margin didn’t exceed that limit still it was showing that..

I’ve answered it here: https://tradingqna.com/t/margin-call-mail/21015

Hello Nithin,

Hope you are doing good.

I have few concerns like :

If i invest 100k, upto what credit limit am i eligible for in Zerodha ?

How many intraday transactions are allowed per day on a single stock ?

If i keep a margin of 0.5 for every sell on a penny stock, will the intraday transaction go through ?

Thanks,

Nazeeb

Nazeeb, depends on the stock. Check this list: https://zerodha.com/margin-calculator/Equity/. It is higher if you use Bracket or cover orders. Most penny stocks are in T2T category, so intraday won’t be allowed by exchange on them.

Is POA required for intraday equity trading ? If no , will i get margin amount for intraday ? (Equity )

Not required for intraday. Yes u will get margin.

Hi,

What is margin available?

What i get from your answer is i can trade in these bonds/debentures. Please correct if i am wrong.

Also how much margin is required for this debt market orders?

You could buy them as long as they’re trading on the secondary markets. There’s no leverage on this, so you’ll need the actual order value as margins.

Thanks for the inputs. I have submitted new account application with your ahmedabad office yesterday.

Can i trade in securities listed in retail debt market of BSE and NSE? Some of the scrip codes are as below

IDFC Bank N1

IDFC Bank N2

IDFC Bank NC

IFCI310312A

IFCI310111A

I am looking for the broker who offers trading in this above mention scrips.

You’ll have to add this on Kite and then you’ll be able to buy/sell. Just type the series (N2,N1,NC) on the Kite searchbox and you’ll see all corresponding scrips.

I added fund of 4.3 k and then purchased stock of 2.4 k. Initially it was showing t 1.9 k as margin available

now it s showing same 2.4 margin used but 6.11k margin available and account value as 4.28 k

Are margin provided by zerodha chargeable??

If yes then at what rate please explain.

Intraday margins are not chargeable.

Hi,

I am a new trader. I have a question.

Is there a limit on number of times you can buy and sell a stock or contract for ex Banknifty 14th Sep 25000 CE in a single day on NSE?

No limit as such.

Dear Sir,

What is margin used?? And can I withdraw it??

Margin used is what is blocked for your open positions. Can’t be withdrawn.

Hi Nitin,

I have been using your stock pledging facility for some time now in combination with liquid bees for complying with minimum 50% cash equivalent condition. My problem is when the stock prices go up over time the 50:50 balance get disturbed . I will know of this only when the interest charges start showing up in Q. Calculating this on a daily basis is quite cumbersome since i need to calculate value of initial cash available +/- MTM , change in collateral value etc for arriving at the final proportion. I was wondering if it would be possible to have a pie chart or indicator in Q or in trading software to indicate the real time situation so that we do not unnecessarily incur interest charges. It would also be a great help if Q dash board can indicate net overnight cash levels in the account.

With best regards and congratulating you on a great job done with various customer friendly initiatives.

Makes sense. Adding it to our list of things to do.

Hi Nitin,

Any update on this initiative. It would be useful to have such a tool

Hey Nilay, nothing yet. We are fully focussed on moving to our new backoffice. Will keep you posted about this.

Dear Zerodha Team

I want to know do you have E-margin products for Equity stocks (can carry forward the positions to the next few days) for Intraday traders. Thanks.

Raju, we will be introducing soon.

Hi Nithin, any ETA? Please?

Hi Nitin,

I saw F&O obligation amount is debited in ledger when there are no futures holdings

Why some amount is debited still if there are no future holdings?

Are they penality charges?

This is both futures and options. Also if you have exited it yesterday, there might be obilgations on it for yesterday. Best to send account specific queries to [email protected]

Hotkeys for buy / sell equity are not working on macbook. Any solution?

This is for Kite is it?

What does a broker do with exposure margin or any margin (based on their risk assumption) charged more than SPAN. Are they allowed to utilize these funds for their business, loan them out, or use these funds to provide margin funding for other clients, or earn nominal interest?

SPAN + Exposure is blocked by exchange. Anything over this a broker blocks as per his risk again stays in the exchange client bank account. No client funds can be used for any other purpose.

Can a broker ask for more margin than the exchange stipulated max SPAN and max EXPOSURE margin guidelines when selling options?

Yes he can.

Could you please provide some time frame for getting Margin delivery for equity (CNC). I heard from CEO says that you have got licensed for NBFC(If i am not wrong).

Really great if you can provide some lights

We will start off with loan against securities first.

If my margin is low and im trading with leverage. will you deduct 20 rupees for each trade as call n trade services ?

As long as a dealer is placing an order for you, call and trade charges will be charged.

When will the zerodha provide margin lending for delivery based equity in CNC type. You had mention this earlier in site, it would soon start this provision?

Above, two of my same posts are ignored by you…..Is there any specific reason as you are perfectly answering all other queries ????

We’re working on setting up the systems, we’ll announce about it soon.

Hello,

it has been many months since you have got your NBFC license and also, setting up the systems should not have taken that much time. Please be true and inform that whether it is going to launch or not. I have a serious doubt on it now.

Dear Nithin,

I have a question regarding overnight position in banknifty futures.

Suppose I had bought 1 lot banknifty futures and maintained enough margin (say Rs 60000) as specified on a daily basis.

Now what would have happened on the demonetisation day, Banknifty opened roughly 1300 down.

What would have been the margin requirement at open?

Would the position be squared off at open?

Yeah, any point of time if you lose more than 50% of the margin to hold a position, it gets squared off automatically.

Just a question, what would be the safe margin requirement in that case? 1300 points on banknifty would be 52000.

Would i still have the position squared off if I had more than 52000?

As per historic statistics and your personal view, what would be the utmost safe margin that needs to be maintained to cater to such unexpected events?

The best way to trade F&O is using the least leverage as possible. Most professional traders don’t look at margins, but the actual contract value. So if the contract value is 5lks and margin is 1lk, keep 5lks in some form in your account. I know it sounds extreme, but I’d suggest keep atleast 40 to 50% money in trading account as margin.

The 7th anniversary is next week. Are we going to start the margin lending serice from next week. It is readily available with mostly all other firms.

If this is not going to be launched in next week, please provide actual start date if possible?

We already had conversation in this regard in past and you said that 15 aug is approx date of launching the service.