Business updates, increased disclosures and improving transparency

Hindi: इस पोस्ट को हिंदी में पढ़ने के लिए यहाँ क्लिक करें।

I have been reading and listening to quite a bit of Charlie Munger over the last few days. Every time I go down this rabbit hole, I tend to discover more about myself and what I think Zerodha should be. If I had to summarise, I could use some of his quotes from this extensive list.

- One of the greatest ways to avoid trouble is to keep it simple… the system often goes out of control.

- I would argue that passion is more important than brainpower.

- Remember that reputation and integrity are your most valuable assets and can be lost in a heartbeat.

- To get what you want, you have to deserve what you want. The world is not yet a crazy enough place to reward a whole bunch of undeserving people.

- Is there such a thing as a cheerful pessimist? That’s what I am.

- The best thing a human can do is to help another human being know more.

- Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you’ve won.

Since we started, we have used every opportunity to bring transparency, disclose risks, and share knowledge that can be useful to Indian retail investors and traders. But given the success of our business thanks to customer trust, we believe that we have an obligation to do even more. For instance, we have made regulatory technical glitch reports public for better transparency. These reports are bound by strict regulations for documenting and reporting technical issues in a broker’s systems and are meant to be shared by brokers with regulators internally whenever an issue happens. We have made this reporting publicly accessible.

Also, from now on, every six months, we will publish updates on our business performance and financials, the various risks that we face (and the broking industry in general), the overall customer performance when trading higher-risk products, any technical issue reports, our internal metrics on our customer support performance and quality, and more.

The business

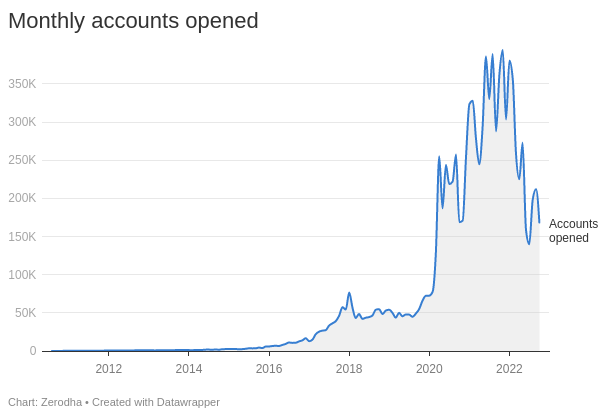

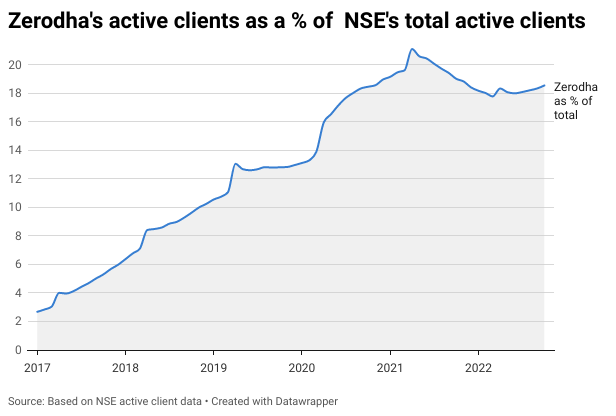

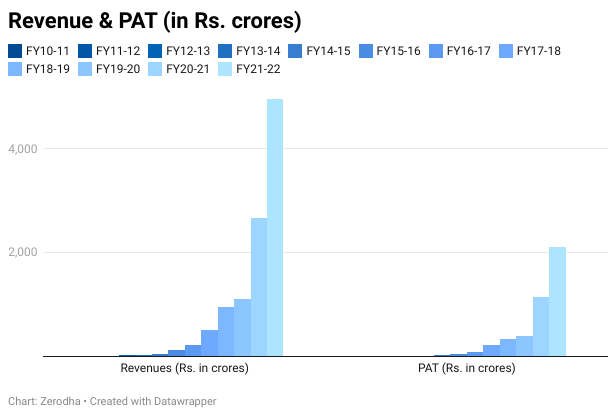

Back in March 2020, when COVID-19 hit, I sent an email to our team, telling them that we were getting into a period where the business would get tested and that it was time to get into monk mode. As shown in the graphs above, I couldn’t have been more wrong in my prediction. Since then, we have grown 5X in customers, revenue, and profits.

In our revenues, ~25% are pass-through exchange transaction charges, which we collect from customers and pass on to the exchanges. Technically, this isn’t our revenue; if we excluded it, our margins (PBT/Revenue) would be ~70%. The net worth of the business today is ~30% of all funds that clients park with us at any given time. At 30% of our own capital as a percentage of total client funds being handled, we are probably among the safest brokers around the world in terms of capitalisation. We have also been a zero-debt business from the very beginning. Like the many times in our journey when we were at the right place and right time, we were lucky to have had a phenomenal couple of years in terms of profits, helping us increase our net worth just in time when the new regulations require brokers to have much higher working capital requirements.

While our products and philosophies on how we run the business have been the key to our success, certain factors have helped our growth, and the industry in general, tremendously. One is obviously the phenomenal bull market in India. Developments such as eKYC, online digital signatures, and UPI turned the largely offline industry into a truly online, paper-less one, enabling mass participation. And for us specifically, adoption via word-of-mouth from our customers.

Our higher gross margins are a result of several conscious decisions and approaches.

- We don’t spend any money on marketing or advertising.

- We have a lean tech infrastructure built on top of high quality Free and open source software (FOSS) that we adopt and maintain in-house.

- We avoid external SaaS/vendor dependencies and lock-ins and self-host systems as much as possible.

- We have grown our teams slowly and organically, regardless of industry trends.

- We have been extremely conscious of avoiding the build up of bloat in the business in any form even when times are good, knowing full well that short term booms always end in mean reversions and corrections.

What are we doing with our success?

As a business, we have been lucky to enjoy steady growth over the last decade. From the early days, we have supported a wide range of social causes with the resources available to us. However, the last two years have brought us unprecedented financial success. Maybe with some irony, we are of the belief that extreme concentration of wealth is one of the biggest social issues today. Then there is climate change, the single biggest issue that looms over not just us, but all species on the planet.

In 2020, we set up the Rainmatter Foundation, a non-profit organisation to focus on exactly this, the single biggest threat that humanity faces. The foundation focuses on climate change, ecological restoration, and the one thing that is generally not talked about in the context of these problems—livelihoods. Of the ₹750 crores we originally pledged to the foundation to invest in these causes, about ₹300 crores have already been disbursed. Climate change is not a problem that one entity or any technology can ever solve, but it is our conviction that the resources we have been lucky to accumulate are best utilised when invested in the society in these areas. This is not only about our conscience but also common sense. There will be no business if there is no society! Here is a list of some of the organisations and causes the Rainmatter Foundation is helping.

Apart from supporting non-profit organisations and causes, we also support entrepreneurship in these areas. We have structured the for-profit investments in this space in such a way that any potential returns go back 100% to the foundation. In addition, we continue to allocate at least 15% of Zerodha’s annual profits to the foundation.

The idea of investing with a thesis for a whole ecosystem started with Rainmatter Fintech in 2016, where we try to support startups that help grow the capital market ecosystem and help Indians do better with their money. Here is a list of all startups that the fintech fund has helped.

As a side note, our success in building a profitable business has also meant that we are also contributing to nation building through payment of income taxes. Since March 2019, we have paid corporate tax of over ₹1800 crores.

The risks

High beta business

At or near the top of every bull market, brokerage firms seem like businesses that can do well and generate cash forever. But this isn’t true. Our business performance is highly correlated to the markets (high beta) and volatility. The financials turn around as soon as the bull market plateaus or markets trend down. Be it the early 2000s, the 2008 global financial crisis, or even now in the US (2022). The revenue of brokerage firms falls off the cliff as soon as the bull stops.

As you can see from the first graph, we have already seen an almost 50% fall in monthly new account openings from January this year, and this trend has been similar across the industry. While the account openings have dropped, the revenues across the industry still haven’t. This is mainly because we are at all-time highs. If the underlying markets were not performing well, the revenues would have also dropped significantly. Also, a drop in new account openings leading to a revenue drop works with a lag.

While we are on track to do as much revenue and profits as last year, even this year, we think we will be unable to match the current revenues and profitability from the next financial year for a few more years. This is not just because we see a dip in new account openings and a drop in the bull market momentum, but also because we think we have temporarily hit a plateau in terms of the target market, customers who have sufficient savings to invest in the markets and an ability to generate revenue for the brokerage firm. The business will also most likely get impacted due to the changing regulatory landscape, where, among many things, the working capital requirements are going up quickly.

Dependency on day trading and F&O community for revenue

We continue to charge no brokerage fees from investors, which means that we depend on intraday equity and F&O traders for revenue. This comes with a few risks.

Powering leveraged trades as a broker comes with a risk; it is almost like running an insurance business. You charge a small fee and allow a customer to trade with leverage, but every once in a while, there will be a black swan event when a group of customers can lose more than their capital, which can become a liability if the customer doesn’t bring in funds. For example, in April 2020, when crude oil prices settled at -$37, a negative value, which no risk management system worldwide had planned. We lost ~₹30 crores that day, and many international brokers lost tens of millions of dollars. Quite a bit of brokerage we had generated from Crude oil since the start of our business was lost that day. There have been many such events on individual scrips, the most recent being GBPINR moving ~4% in a day when margin requirement was ~2%. There is no way around this risk, and we could wake up any day with a large event that moves the entire market or individual scrips by more than 20% lower or higher, leading to liability on the broker if the client defaults. We have been allocating 10% of our profits to a war chest from the start of our business as a contingency to cover for whenever there is a black swan.

Any regulatory change, be it a product suitability framework for F&O trading, higher margins, an increase in STT, or even a drop in market volatility, can cause a significant dip in active trading volumes and our revenue. I keep telling our team that we are always just one circular away from a 30% dip in revenue. But thanks to our frugal operations and profitability from the start of our business, we have over 15 years of runway today. So even if we were forced to pivot our business model, we would have sufficient time to figure it out.

Associated risks

With our own funds, we invest in bank FDs, Government bonds, and have a long-term stock portfolio. We neither leverage (borrow to trade more) nor trade any leveraged products like F&O, which can lose more money than the capital at stake. This is to ensure there is no risk due to our treasury operations to the business. Our portfolio currently has exposure of 33 percent to bank FDs, 32% to stocks, 13% to Government Securities, 9% to tax-free bonds, and 13% to Gold bonds.

Through Zerodha Capital, our NBFC arm, we have started a Loan against securities (LAS) operation with a loan book of approximately ₹70 crores. The minimum haircut or maximum loan against any security is 50% per NBFC guidelines. We lend only against a curated list of stocks and mutual funds, and currently only amounts less than ₹50 lakhs. Hence, this is an extremely low-risk business. The idea for starting LAS was to help customers with stock holdings reduce their interest outgo on high-interest-rate loans. Since LAS is secured, we currently lend at 10.5%.

We haven’t started margin funding on our platform since we believe it isn’t the right product for retail customers. For a retail customer buying stocks thinking the price will go up, It is easy to get lured in by greed and take leverage by borrowing when investing, even if the idea wasn’t to do the same. Leverage carries huge risks and should be avoided by most, especially retail investors. But given the competitive pressure, we will potentially have to launch MTF in the future. Even if we did, it would be a hidden feature (like LAS) that would not try to tempt people into borrowing when there is no need to.

The entire team at Zerodha holds a significant stake in the business through ESOPs. For most, this would be a significant portion of their individual net worth. This also means that everyone on the team has a vested interest in ensuring that the interests of the customers are never compromised on.

Disclosure – Technical issues

No tech platform can guarantee 100% up-time and 0% technical issues, even if they’re the world’s biggest tech companies. A stock brokerage in particular is an incredibly complex series of real-time systems that interact with each other, carrying immense risk. The tiniest problem can cascade and cause unexpected issues. We have, and continue to, invest huge amounts of effort into making our systems as resilient to technical issues as possible. The way we have architected our systems is that customer activity is distributed across completely independent “silos,” so that problems do not cascade to the entire client base.

Whenever there is a technical issue (that affects trading for more than 15 mins), we are mandated to report it to the exchanges within 2 hours, followed by a preliminary report the next day and a root cause analysis within 21 working days. We have now started publishing these internal regulatory reports on our website as a part of our commitment to transparency. We will, through these disclosures, also share the approximate number of customers affected by any technical issues. These disclosures will help you better understand what goes behind the scenes at a brokerage firm and better anticipate technological risks associated with trading the markets.

Overall profitability of customers

Many customers decide to trade risky products with leverage with the wrong expectations that money can be earned easily and quickly. This problem has been accentuated by many claiming to generate large amounts of trading profits on social media. We have used every opportunity to create awareness that in the long run (3-year period), less than 1% of those who actively trade equity futures and options generate returns higher than bank fixed deposits or 7% annually. We will start sharing more granular information in the next few weeks. Generating profits from active trading is as hard as generating profits while running a business, if not harder, given that anyone can start trading and not everyone can start a business. The odds of succeeding when actively trading are very low, similar to any other walk of life, which requires skill, hard work, and some luck to succeed. From running a business to playing sports or music for a living.

Across our customers over the last many years, we have seen that higher the leverage the lower the chances of profitability. The profitability numbers are much lower in case of equity F&O as most trading happens in options, especially buying options which is the riskiest and the most leveraged product. We had shared this post last year on things to keep in mind while buying options.

While it might sound counterintuitive to hear this from the CEO of a brokerage firm which relies on active trading for revenue, I think a customer who remains active for many years by doing well in trading, even if not generating revenue in the short term, is a lot more valuable to a brokerage firm than customers who trade aggressively with wrong expectations and then become inactive. So when we look at our business, we think we should do whatever it takes to help the customer do well in the long run, even if it means a reduction in revenue in the shorter term. By helping set the expectation that stock markets aren’t a place to make quick and easy money, we can help the customer be risk averse, leading to better decisions with money.

Disclosure – Customer ratings

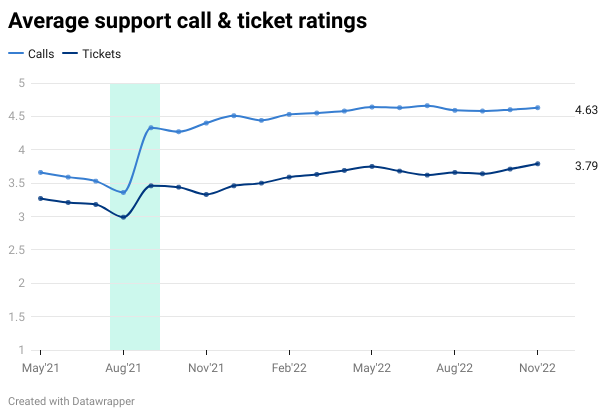

The dramatic improvement in ratings around Aug 2021 was when we transitioned our inbound sales team to support.

We take your ratings for both calls and tickets seriously and use them to help improve the overall quality of our interactions. We are continuously working to improve, and your ratings will help us significantly.

Thank you once again for your continued appreciation and support. If you have any queries, you can visit tradingqna.com where we answer queries ranging from everything at Zerodha to markets in general.

Best,

I’d

Password

Give me

Hi Tushar, could you please create a ticket at support.zerodha.com so our team can check and assist? We’ve explained the process of creating a ticket without logging in here.

You can track the ticket via email updates in your registered email ID.

I completed my my documentation process at Thursday 19/01/23 but till now I didn’t receive welcome Mail for use I’d ..

It’s saying only 48 hours but taking more than 100 hours.. why it’s happening like that. if any one knows about this please let me know…

Thanks.

Hi Hari, we’re having this checked, you should receive the login credentials within 48 working hours at your registered email address. More information here: https://support.zerodha.com/category/account-opening/online-account-opening/articles/how-do-i-know-when-my-account-is-open-how-long-does-it-take

Sar Maine 200 rupaye kar diya hai but abhi login nahin kar Paya hai

IDP04-3028302-1761979

Hi Ibrar, looks like you’ve only registered your details. Your application process is not complete yet. Click here to complete the same. Please refer to this article to know more about how to complete your application form.

Very good app

Easy buy and sell order

Hi, Nitin sir, Hearty congratulation for successful journey. I am happy to see you such a wonderful firm developed in India. Nitin sir I started/ applied IPO in December 1989 and will be complete 33 years’ experience during this month. I witnessed so many up & downs in the market, the then time we went nearly 100 KMs for buying or selling now just one click sir, during my entire service attended couple of trading centers but Zerodha is a very good platform for all category traders. I attended two times to zerodha Bangalore office you team has given good response. Now I am doing only from one platform ZERODHA just because of transparence & commitment. Thanks to entire your team and GOD BLESS YOU sir.

I m still waiting for my login and password

Hi Sanjay, sorry to hear this. Please create a ticket at support.zerodha.com so that our team can check and assist.

Zeroda is very transparent

But i am confused in sale the shares by your platform i do not get proper

Mechanism please provide me a knowledge so I can use your platform please do need full

Hi Nitinvkumar, please crate a ticket at support.zerodha.com with more details on the issue you seem to be facing. Our team will assist you with this.

Congratulations on your past success and numbers.

Also, kudos to your transparency and hope to hear more from you continuously

Hearty congratulations on your successful journey! On this occasion I request you to kindly provide more Tradingview chart standard features in Zerodha Tradingview charts.

Just a few of them are –

1. Countdown to bar close

2. After customizing chart appearance (background color, candle colors etc.) it should get saved as a default chart layout to automatically load at the start. Even when the user save a chart layout (which never loads automatically by default), it disappears after a few days!

3. Bar replay feature

4. Multiple alerts based on chart indicators with sound alarm

5. Customization of colors based on hex values or RGB values

6. Facility to make chart timeframes favorite (by marking star against their name)

7. Saving of chart templates on Zerodha server for each user, so they can be used on any computer by that user. Currently although user can make & save many chart templates and save in his local computer, but only 6 are visible for use in the Templates menu.

……. and many more…….

In short, I wish to make Zerodha Tradingview chart as my only chart and stop using Tradingview site’s chart completely.

Kindly consider this request to make us a part of your success.

Many thanks!

Zerodha team has been doing excellent service. Thanks to the entire team of Zerodha. Continue to do more service and be customer friendly.

Well done Zerodha team and especially to the CEO and his team! This is how you build the trust of clients in your business. And as he always says in his interviews trust is key when people are to park money with you.

Really appreciate the level of transparency you keep. You are setting an example for others as well. Best Wishes.

You are a role model of how a company should be run and function with the best interests of customers and community at large. Im happy and proud to be your customer and I wish more success to you. I wish you to start manybmore companies and have a great impact on the country, the world and the world of business!

Best,

Pavan

Really appreciate this transparency and no doubt zerodha is the most honest and transparent business. I have more confidency than other brokers.

Only 1 request is to not charge for API access , which you do 2K per month which is quite high. Most competitors give free.

when a retail customer is using API, they are not using the App 90% of time ANYWAY and both App and API in backend, go through same API,

so why charge so high for API Access. when in my view its same for Zerodha in terms of compute resources

As a trader We are worried out technical issues . It is appreciated that you care so much for that but if you show some signal or warning sign that will warn traders to play safely or get out of deep water . sometimes we make internet responsible for such behavior of slow charting , slow up dation of rates , orders shown pending even if LTP crosses ordered rate etc. So pl evolve a warning system to warn traders .

Thanks

Best platform for specially beginers. Wish you and your team Merry Christmas and New year.

HI,

Thanks for sharing the success story and congrats for the same. Wishing you and all your family members and the staff a merry Christmas and a prosperous New Year ahead !

आप एक अच्छे डिस्काउंट ब्रोकर हैं, लेकिन आपको एक अलग सेवा प्रदान करनी चाहिए और आप इसके साथ शुल्क ले सकते हो।

Zerodha is wonderful app and it helps a lot 😊.

Best app for India. Thanks zerodha.

Zerodha is no 1 brokers in India becoz their kite app very easy use for trading it so fast and chart IQ new features BETA it is very usefull for intraday i sugest new begginer pl open ac in zerodha I have last 3 years use of kite app no mistake for technically so i am satisfied with zerodha thanks

No Society ,No Business.This is the TRUTH. This also reminds us the attitude of The TATAS & The Wipro while doing business in India. Thanks for your approach.Zerodha is the BEST , Therefore.

Thanks

Heartening to note of Zerodha’s efforts from every perspective to keep us fed with inputs of significance.

Keep up the good work….’SKY IS THE LIMIT’.

Thanks Zerodha for updates and useful informations.

The amount of maturity and trust that zerodha has can just be unmatched to any other broker or founders in general. Every time I think this is the best humanly possible, nithin or nikhil comes up with something new forcing me to question my integrity and ethics and invoking learnings about life in general

If all your operations run on FOSS solutions than this is a monumental achievement. I’m still shying away from Linux and FOSS software on my PC due to its unpredictable nature while handling specific tasks.

Great achievements in very short span. Congratulations!

Nicely presented your growth story with data.

Zerodha give me a second income chance as its trading platform is very easy and secure.

Thank you Nithin ji for writing this.

Superbly articulated thoughts. I feel your writing has a calming effect on its readers, it is like a written meditation.

Festive greetings to you, your family and Team Zerodha!!

Hi, I have been associated with Zerodha since much early stage in 2016, and have helped get other family members under the fold. While zero brokerage is definitely an attraction, what has kept me hooked to Zerodha is its product innovation, simple UI, customer centricity and transparency (read honesty) across various touchpoints – essentially, I am not just a Zerodha client, but an advocate of the business.

All I wish is – May your tribe grow, not just in capital markets space, but in every walk of life and business!! My best wishes Nitin and team. Wish you pure bliss and nothing else!!

wish you all the best for the upcoming year and God Bless you.

Kindly remove the range issue in option buying except this remaining all are super.Due to this range issue we need to take 10 to 15(first selling option and then buying ) trade in a week.Remaining all broker this range issue is not there.Your platform is very good.

Hi Jitesh, we allow buying options of any strike for hedging purposes if you hold a short option position. The restriction is for naked long options due to the member-level OI limit. We’ve explained this here.

If you want to trade without strike price restrictions, we have an alternative solution for this. More details here.

Dear,

Nitinji,

Super one update by day to day requirements of investers & traders

I also like eco friendly trading platform…..👌

Hi Nitin.

You are remarkable. 0dha Kite is such a great platform to trade. I, after reading you time and again get to understand that the greatness of Zerodha comes straight from the core, its CEO.

You needed not, no one demanded, no requirement not any compulsion. But you come with all the disclosures and clarity.

Kudos to you and your team. You have made our (traders’) life so comfortable. The ease of trading has never been so much in any platform, before & after.

And the mind & heart are matchless.

You are one of the greatest contributors to society and India.

HI ZERODHA and it’s team,

All the very best to the team of zerodha to make our trading community more dependable with zerodha in terms of more advanced and transparent operations.

Some times might have bit of issues, but overall . Zerodha rocking it’s level best 🙏💐👍

@Nitin kamat if u can do something for frofitable trader.can u manage to invite 1cr profits in finance year.and do some trader community. Let’s some do it. Thanks

Some times undoubtedly your system is hanging mostly when market moves traders side

we think we have temporarily hit a plateau in terms of the target market, customers who have sufficient savings to invest in the markets and an ability to generate revenue for the brokerage firm.

if the client defaults, what action broker would take on client?

Hi,

I have purchased 548 shares of Brightcom Group Ltd(BCG) on 6th of December 2022, till to date i. e 16th December 2022 i haven’t received the shares in my account neither my amount is refunded. What type of service is this? Customer support also doesn’t help.

Why does a customer / investor have to suffer for any fault of the broker or seller whatsoever. Isnt it the duty of the broker to take responsibility and do the needful.

Hi Sweety, due to orders from law enforcement agencies to the stock exchange, shares of BCG purchased on the 5th and 6th of December are withheld and are unavailable for selling. Please check your email for more details.

Neither BCG share bought on 6th dec 22 or money has been returned, Zerodha is only repeating same thing that law enforcement has stopped…

I am facing the same issue. BCG shares bought by me on 6th Dec are not showing. when will it get resolved?Is this issue faced only on zerodha or on other other trading platforms as well?

I wish you all success

I am a trader with Zerodha since Feb 21. Earlier I was with another broker but was never satisfied. The business transparency and principles of Zerodha pulled me towards you like a magnet. I am an active trader and an investor (using Coin) and the consistency of your platform and care for customers is outstanding. There was never an alternative for me once I started using your services. I truly appreciate the difference you have made to the broking industry. Wish all the success to you that you fully deserve!

Anything you are doing for algo trading….Nowdays every brokerage free up the ALGO KPIs but since you are charging hefty amount as algo api many players are not giving solution based on zerodha.They are integrating with other brokers.What is view on this? Also is there a possibility to make zerodha really zero brokerage firm for traders also?

That’s really a wonderful journey and I am happy to be part of this as a retail investor.

Wish you guys more success in the coming years with business and CSR stuff.

Nag

Start US trading also & make less time for withdraw

Hi Rahul, we’re in the process of getting our NSE IFSC membership. However, cannot provide any timeline at this moment.

We’re also working on instant withdrawals. We’ll keep you posted on them.

I think whenever you go public you should offer Some quota and discount to long term active traders for their contribution to the business

Please introduce auto slicing of orders also and give customers both options of auto slicing and iceberg orders. Also, kindly introduce both iceberg as well as auto slicing in Basket orders.

This is called Industry Leadership!, believe it or not, you guys have inspired and forced your competitors to offer better service every day!, to name a few – Tech, UX, ease of use, back-office, Pricing, transparency and integration of tools. I can’t imagine the industry without your legacy and you guys are setting global benchmark in various aspects – this is new India!

All of this is happening in Namma Bengaluru, this is really cool! congratulations to you and your team.

Congratulations Zerodha &Team for a great success story.

I really appreciate the ease of operation using Zerodha, keep up the good customer friendly work.

Transition to Zerodha from traditional brokerage house was due to the difficulty faced in covid times in offline methods used.

As you have mentioned adopting online means of verification and fund transfer made investments much easier and simple to common investors like us.

When will auto deduct from bank for SIP will start ? We still have to manually purchase units on our SIP date. I guess it is almost a year now. You guys still haven’t fixed this ?

Hi Nitin, you can now create mandates for your SIPs. Check out this thread for more details.

Hi

During Covid time, I prompted my two daughters to start their investment innings in stocks thanks to Zerodha. It’s going great. Only hiccup is adding funds every now and then. Isn’t it time Zerodha think of an alternative where funds requirement is met directly through a linked bank

Congratulations on your success and Best wishes for it to continue. ”There is nothing so good that it can not be improved” is a dictum , many may be aware of it. As a newcomer to your portal, I have put up to you the problems I encountered, so that they can be eliminated. Opening an account – my experience was ’very difficult’ took a long time, (possibly due to covid related disruptions). A case study of ETH 658 and UQT 995 would give leads on areas needing attention. The ”support ’ system, has enabled me to talk to about 50 executives – so far so good; but being unable to call back for a missed call is tortuous. Even getting at an executive is time consuming and more often, leads to ’call drops’. Why not have a system of a dedicated extension for such calls, instead of the round robin of 1 for,2, for etc. (A nice short story by ”Sujatha” (Rangarajan) would make good and funny reading). Today I find the options of ADD WITHDRAW funds options missing in the FUNDS tag, and I am at a loss to know how to add funds. Please make access for help a little less cumbersome. Thank you

Hi Janakiraman, we’re getting this checked. You’ll have an update on your ticket.

Firstly, congratulations on your achievement. I heard about Zerodha through several financial influencers and later became a user. All since the first day of using, I never had any complaints – so I can am a happy zerodha customer.

After watching multiple interviews of yours and feeling your thought process, reading such a candid sharing of information today makes me feel more engaged with Zerodha. Your monk-sort of attitude towards success and proactiveness about the possible future brings people like me back to reality, and this helps in checking my journey as well.

Thanks for everything you are doing, and I wish you all the success.

If every thing good with your company than why you are misleading your clients on POA and DDPI process, you do get revanue from the invester by pledge there shares by miss use of POA. Why Zerodha not letting me submit DDPI without POA, that’s to i must select all the option in DDPI which include pledging / re-pledging of shares.

Dear Sir

Hearty congratulations to you and your team, for creating acceptable ambiance of trading platform for all type traders, investors and sub brokers. The platform is very good and user friendly, appreciable part is that, quick response from you and your team while resolving the issues. I am proud to spread this information to few of my friends and they have started

May god bless you and your team

Just started my investment journey. I feel safe and secured with my investments at Zerodha. Hoping and praying for an IPO and i get the allotment. Best wishes and continued success for Zerodha.

VYJAYANTHI

Congratulations to you and the team!!

When are planning to provide CAGR calculations for individual stock wise or if possible then portfolio wise too. I see other broking houses (at least one I have seen) do provide stockwise CAGR calculations. This is very critical metric. Request you to please look into this. Thanks.

Hi Vivek, we plan on implementing CAGR on Console for the Portfolio, this is on our list of things to do. Will keep you posted.

Congratulations on the progress. You have made many services better from the day I joined Zerodha as a customer and recommended it to many. Only thing that deteriorate in these years is Support. You should surely work towards improving your support quality better (very long waiting time in the queue ) . You can leverage the educated youth power of India in small towns who speaks different languages. You have just scratch the surface. You know the potential of this country better.

Neatly written . tTll Now Zerodha is keeping things straight and Open. As you have mentioned, This shows your commitment . The following points mentioned is testimony to your growth story, Never compromise on the following. In the age of Information spreading your updation towards better is welcome and stay afoot with Investors /Clients

Remember that reputation and integrity are your most valuable assets and can be lost in a heartbeat.

Wish you all the best Zerodha team. Since its teamwork

Thanks

Hi Nithin & Team, Thank you for the transparency. I was completely away from stock market for about 10 long years (may be because of my brokers dealer/sales team, who were one of the biggest in India those days) my son suggested Zerodha around year 2020, I was new to placing order online, thanks for the kite which may be the most user friendly compared with any other trading terminal out there.

All of my money invested/traded through Zerodha also I am standing amongst the 1% of your customers, who are profitable ! since the time I started with Zerodha, thanks for nudge and smallcase !

Request you to offer subscription of small case to all your retail customer at a nominal fee so that the profitable customer base may increase, of course you were provided many with free access !

When I took the decision to start with zerodha almost 5 years ago, I was not sure if it was the right idea, but I did it anyway. Down the line I boast/advertise(word of mouth) about zerodha saying I started with them long back and I keep showing my friends about your platform. I’m really proud to be your customer and hope you have great success going forward.

Quote:

I think a customer who remains active for many years by doing well in trading, even if not generating revenue in the short term, is a lot more valuable to a brokerage firm than customers who trade aggressively with wrong expectations and then become inactive. So when we look at our business, we think we should do whatever it takes to help the customer do well in the long run, even if it means a reduction in revenue in the shorter term. By helping set the expectation that stock markets aren’t a place to make quick and easy money, we can help the customer be risk averse, leading to better decisions with money.

You continue to deserve respect from larger audience irrespective of whether or not they are an active trader.

Realy informative details provided in this article. I appreciate your effort for providing all required tools which will be helpful for us.

Thank you for sharing your success with customers.

I am hearing from my friends and circle who r trading …….regarding future and options …..shortly in Jan 2023 will u increase brokerage from Rs 20/- to Rs.30./-…….is it real….kindly clarify…….Venkat

YOU ARE BEST.I LOVE YOUR APP INTERFACE.CONGRATS FOR YOUR SUCCESS.THANK FOR SUCH GREAT PLATEFORM

I am a new trader so, for me chart is very usefull,

Great success story! very inspiring, a lesson or two to learn.

I have to admin, Zerodha gave me the confidence to start investing in Stocks and MFs.

The application itself is very easy to use, providing good insights about the organization and their business. What I like the most is the warning about the risk involved in investing a specific stock.

Appreciate the transparency in running the business which is hard to find in most of the business.

Wish many more success!!

Charts on Zerodha are not adjusted for corporate actions like bonus / rights need to attend to it on priority, as the whole purpose gets defeated

Hi Karun, all the charts are adjusted for corporate actions. Could you please let us know which scrip you are referring to?

I am indeed happy reading this. It is quite heartening to note that you want do business with ethics, irrespective of cost involved. Please keep it up. Zerodha will achieve success in all its business and CSR activities. By the way, any plan to Zerodha going public?

Hi Nithin,

The way you & Mr. Karthik Rangappa have been the flagbearer of retail investors interests by giving them a transparent product in Zerodha and knowledge treasure in Varsity; people like me can’t thank you enough.

The articles like these, time and again put things in perspective and let us re-think about what we are dealing with. Negative Crude prices and 20% fall in index, can surely bankrupt many on us.

Though I am sure I will be with Zerodha till the day I am an active trader but would like to give some feedback. I am an active F&O trader and spend approx 5-10K per month on brokerage charges on Zerodha. Off late I have been using platforms like Shoonya/Tradeplus/MStock, though all these platforms have some shortcomings, but they surely are improving. I have started doing all my active trades on Shoonya and I am not disappointed. The lure to save 5K-10K per month is taking my there. I am sure you will just take this as feedback from an admirer.

My heartfelt thanks to you and entire Zerodha team and wishing more success in future.

Nithin,

Thanks for Sharing. Full respect to team zerodha and you in particular for being ethical and transparent in all your operations.

Kudos and much respect.

Cheers from a Happy customer.

Very assuring and useful article. Your initiatives will help us a lot. Thank you.

great going zerodha

You deserve appreciation for this kind of transparency and ethical business. I would request you to provide some more technical tools simple and straight to access data and help analyze the same.. Thanks once again.

I appreciate your transparency, I’m always with you congratulation sir

Thank you for sharing, wish you all good luck

सुदर वछानसेवा मीळते

अभीनदन

Good to see how our favourite broker and platform has evolved.

Does Zerodha has any international expansion plans??

Would like to see an Indian company serve globally.

I’m a software developer, would you be ok sharing Zerodha’s tech-stack? Thanks!

Check out our tech team’s blog: https://zerodha.tech/

Dear Sir,

First of all congratulations on the success of Zerodha and I hope Zerodha will grow more in the coming future as well. Also, we are thankful to Zerodha for providing us with such a wonderful platform to participate in financial markets.

But I would like to request you to kindly provide Zerodha’s API for free as a gift to the community. As a result, a lot of budding entrepreneurs (not registered entities) may try to build a FinTech product to serve a larger market and thus make our country more robust in the financial sector.

I appreciate your transparency, I have been Zerodha customer for about 7 years and what I like most is the simplicity of Apps apart from the clear vision and ethical traits that you have shown. I do believe that being too much greedy in share market doesn’t work well in longer term for most of the people and hence it becomes even greater responsibility of brokers to make their customer consciously aware and protect them as much as possible.

Superb…!!!

What a way to disclose… I always look forward to a post from you Nikhil. Informative as always.

Thank you.

Regards,

Arun

Sir,

Please do something about the bank mandate for mutual funds. I have stopped investing in SIPs due to this issue and I want to invest

Hi Ritesh, you can now set up mandates and automate your SIPs. Please check this post for more details.

Dear Mr. Nithin, I am really impressed the way you have done the discloser. You have made me your Fan for life time. Wishing you lots of success and be the catalist for success of your clients.

Warm Regards

Jagat Yagnik

Sir, every thing ok. But one more facility is needed in the trades. Show different set of trades in different trade-baskets ( eg. one straddle set trades , strangle set trades, iron-condor set, butterfly set etc should be shown as different trade-sets, so that we can easily identify in which trade set we are in profit or loss and can take decision by closing the required trade-set at a time. ) Now, in the present scenario, all executed trades are shown in the ”positions” in ascending order (getting mixed up). Please try to implement it . I already raised a ticket on this issue. Regards.

Thank you nitin sir. I love zerodha. I listen every potcoast / interviews of yours on youtube. You are inspration to many. Thank you and god bless you.

Love and respect from Ajmer,Rajasthan 🙂

Its tremendous that within a span of 12 years you have become one of the top broking firms in India. Your transparency is highly appreciated when the bureaucracy is not transparent in its dealings. Keep it up. As a senior citizen who is in trading for over 18 years i am quite comfortable with your kite platform. I am trading with you for the past one year. Your brokerages are reasonable. I have only one suggestion to make.

For Senior citizens who trade with a cap of Rs 50000/=to 100000/=(for eg.) may be given lesser commission. Since nearly 30% of the profits are eaten by brokerage/commision.

greart transperency zerodha .my trading journey started in zerodha from 2017. so i have all kind of trading memories (good,bad and ugly). i can trust you zerodha thank you.

why is there a dramatic decrease in account opening in 2018 is it due to capital gain tax?

Hi Nithin & Team

How do you define the term ”active trader”?

What is the base considered for calculating 1% traders making more than bank FD’s in long term?

Appreciate your approach of sharing all relevent information and apprising gullible investors of tempting pitfalls.Failure to create a ticket at suuport service is a frequent issue I face as I am a senior citizen who is not very tech savy.Your initiative through Foundation is praiseworthy specially ensuring continued annual contribution of 15% of net profits.Best wishes to your team .

Thanks & Proud to be a zerodha kite user.

I have 3 Family account with ZERAODH..

Excellent Expierance..

Thanks a Lot..Keep It Up….

Hi Nitin

Many congratulations for rapid growth in your business in last few years.

Hope you continue to do so in coming years too.

I have one small request cum suggestion, since majority of your income come from trading community, it will be huge favour to them if Zerodha could reduce its brokerage for intraday traders.

Request you, please, make it INR 10/- per trade instead of 20, since many brokerage houses are already doing this, it will be huge benefit for intraday trading community. It will be like giving a small gift to trading community, who is contributing primarily in your growth.

Huge chunk of our trading expenses go in brokerage.

So please, please think over it.

Thank you so much.

Kudos to Nitin and team zerodha.

Things like these are what make a business survive for decades.

Keep going like this and for long !

The risk disclosure and customer performance section of the article is very informative and useful, continue doing this forever it is much appreciated.

I have been making a decent consistent profit for past 18 months, testing myself in different market trends before i make enough money to quit my main job, i loved these lines especially.

”Generating profits from active trading is as hard as generating profits while running a business, if not harder, given that anyone can start trading and not everyone can start a business. The odds of succeeding when actively trading are very low, similar to any other walk of life, which requires skill, hard work, and some luck to succeed. From running a business to playing sports or music for a living.”

also waiting for this data ”We will start sharing more granular information in the next few weeks”

Sir

When in 2014, my son told me about a discount brokerage in India, zerodha, I was skeptical because by that time i had an account with SHCIL. But he assured me that it’s reliable and than I opened my account with you. After having some experience all my family members also opened their account with zerodha.

Till today we are enjoying world class services at zero cost because we invest only in CNC mode.

Thank you so much.

God bless you.

Regards

Dr G S Singh

zerodha customer care solving problems even layman also understands. This is first priority their humanity. last two months i am very much appreciated to Zerodha. in future pl suggest which shares to buy/sell to my mail.

zerodha customer care solving problems even layman also understands. This is first priority their humanity. last two months i am very much appreciated to Zerodha. in future pl suggest which shares to buy/sell to my mail.

This is the reason, I am with the Zerodha Last 7 years, your commitment, your truthfulness, and your hard work. Although I am not in Overall profit, I learned a lot from Zerodha Varsity and self-study. I neither attended any seminar nor followed anyone except useful thoughts from CEO Nithin Kamath. For the last two years I am in profit and hopefully, This January I will cross my breakeven of 7 years.

Thanks Nithin for sharing Charlie’s wisdom and zerodha’s story. Your storytelling skills are quite good. Keep doing the good work. Please do keep being ethical,transparent and truthful in your deeds(which i know would you surely would) even if there are external pressures from any other players to play the short term game and do not let dopamine be a factor in decision making in any thing you wish to pursue.I wish you all the best for your future ventures.

Hi Zerodha family!

Kudos on the successful journey so far…. carry on the good work.

Cheers!

Good disclosures, genuine suggestions about F&O and the profitability expectations rightly explained. Kudos…a long way to go. Let us all grow together our wealth not greed.

Thanks a lot for true disclosure, it helps to build up confidence and removes fear from minds. I hope you will keep it up onwards.

One of the most informative and honest review .please start giving us some option to trade and invest in foreign market too.

Hi Saikat, we’re in the process of getting our NSE IFSC membership. We’ll keep you posted on it. However, cannot provide any timeline at this moment.

Hi Saikat, we’re in the process of getting our NSE IFSC membership. We’ll keep you posted on it. However, cannot provide any timeline at this moment.

Hi Nitin,

Thanks for the comprehensive article and the inspiring quotes in the beginning. I have been a Zerodha customer for more than a year now and I’m pretty much impressed with the way you are heading Zerodha towards success and also enlightening people through your consistent knowledge share initiatives. Appreciate your actions towards addressing the global warming and other socio economic issues the world is going through at this point in time. I wish you a greater success in the coming years and also your relentless contributions to the society as a whole. Good luck.

Base on your graphical data customer keep on increasing this is good for Zerodha growth..

Same way can you reduce the brokerage rate, this will increase further more customers..

Sir, very nice to read the findings. Now logging into kite web has become a little cumbersome. Firstly we are required to login into the app which requires the OTP. Then we have to login to kite web which again requires OTP CODE from the app which is lasting for few seconds. All other security firms made login into web trading plat forms with one mobile OTP. They are not enforcing the app. Pl make it simple where login requires just mobile OTP which will be helpful to zerodha customers. Thanq

Hi Ram, if you don’t want to use the App code, you can also log in to the web with the SMS/email OTP by clicking on ”Problem with Mobile App Code”.

Thanq very much. I will do like that

Please allow same funds using in comodity and equity and also option brokage should be 10 to15 if possible….

Hi Aritra, we’re working on merging both equity and commodity so that our clients can use one single ledger for their trades. Will keep you posted. More here: https://support.zerodha.com/category/funds/adding-funds/other-fund-related-queries/articles/can-i-use-the-same-funds-for-trading-on-equity-as-well-as-commodity

Transparency is the piller of any kind of online business. We are blindly believed in you for your transparency and faithfull communication. Thanks for doing this. Keep up the good work continues.

Thanks for sharing this. It is very helpful for understanding the fact and not the artificial news

I must say this is a fantastic initiative and sharing of thoughts, you have slowly turned into the Narayan Murthy of Broking Industry . Have been associated with you since 2016 and have never ventured with any other broker as I just dont trust them.

Keep up the Good work and my Best wishes always with you !

I started investing in Stocks only after my retirement as a hobby. A friend of mine recommended Zerodha. It has been an amazing journey of learning. Thanks for sharing your thoughts and for the information about your operations. Being a development consultant appreciate your foundation work. All the best to the zerodha team.

As I am not among those one percentage of F&O traders who make money, I am thankful to you for disclosing the truth, so that I will not continue to lose my hard-earned money

I am so happy to see Zerodha disclosing these details to customers (though you are a private company). May be these details are available with your published data with ROC’s and is accessible, Zerodha disclosing these details is simply awesome. Wish Zerodha more success in the years to come. One request to you is to allow pledging of shares as margin money and making this available free of interest (like some other firms do).

Informative and very transparent read. Thanks for your honest report Wishing you all continued success .

Appreciate

the business can be further enhanced by incorporating following suggestions

1. There is need to incorporate security pledging part of application.

2. No fee should be charged for pledging

Congratulation on the great success and on making this trading environment safe and easy!!

Wondering if Zerodha planning to create a platform for investing in stocks listed on foreign stock exchanges?

Hi Kiran, we’re in the process of getting our NSE IFSC membership. We’ll keep you posted on it. However, cannot provide any timeline at this moment.

intrested towork with you on foriegn land i am a yoga teacher

U guys deserve it!

LAS and funds from pledged securities should include Intraday options as part of the investment universe. Currently, this feature seems to be applicable only for intraday stocks and hence, it is very limiting in nature.

Thanks you so much for the nice service you are providing

Very Good. Keep going. I hope the Zero Brokerage policy on CNC Delivery trades, which is the main magic of Zerodha, remains in force forever. This invaluable policy of Zero Brokerage is a savior for us small CNC traders. Furthermore include new indicator like Adoptive Moving Average in Kite…..

This is awesome and helps in maintaining the trust we have in Zerodha!

Thanks for the transparency and sharing all the possible details.

In India there was a time. Entrepreneurship was inspirational. Current era of mushrooming Startups, Ethical Practices and High value systems driven entrepreneurs like Nithin is inspirational. Now the new age entrepreneurs will not only aspire to start business, they will also aspire to become like Zerodha who is like Infosys of broking industry.

Very Good. Keep going. I hope the Zero Brokerage policy on CNC Delivery trades, which is the main magic of Zerodha, remains in force forever. This invaluable policy of Zero Brokerage is a savior for us small CNC traders. Furthermore include new indicator like Adoptive Moving Average in Kite.

Built a great product and quite clearly the market leadership is proving that. However, I do notice that support for opening account is quite challenged, especially corporate accounts. The so called offices across other cities are virtually non functional and the whole process of documentation going up and down is quite frankly a nightmare. Same is true for NRIs also. I would imagine that if this is streamlined, the downtick in the curve of market share should get reversed pretty fast

Sir,,

We need to add one feature that is we can put stop loss after booking the stocks…so that we can minimise the losses and book the atleast minimum profit.

Hi Binod, you can use GTT order to place Stoploss for stocks in your holdings. GTT remains valid for one year from the date of creation or until triggered, whichever is earlier. You can learn more about GTT orders here.

Great if you follow mr munger, you are good.

Its a great news to read about how Zerodha is performing over the years but more than this is the vision of you and your team to be transparent to all stakeholders. kudos keep it up.

warm regards

Congrats Nitin Kamat and team!

Thanks for sharing the risks of trading so openly. Wishing you ten -fold success in all your endevears and a happy and healthy life for you and your family.

Dear sir,

I am member of zerodha since last three months and since them I have not felt inconvenient so for. I think this is one of the best brokers. I hope this will continue.

i look forward to receive your business some time.

Thanks

Zerodha is the best Brokering Firm , but need improvement in Chart Section

I love the transparency here. It really shows the true sense of ’lead by example’. Wish to see more businesses of India do this and share with their direct customer base.

Very Good News for all Zerodha investors. Mutually Trusted will Growth together.

Thank you soMuch for such a transparency in our investment.

Excellent service . Keep going……

This is great to see how ZD is moving step & step and taking a giant leap with strong fundamentals. Great going Kamath & Co.

Other than product and earning from the market… what is the global improvements you guys have contributed the community and mankind??? I trust every growth and technology is to assist mankind have a better living. What is your contribution towards such human touch??

Team Zeroda is doing wonderful job. Its not so easy to handle such large quantum of trades and trading community with such ease and transparency. I have not experienced even a single obstacle in trading in my last five years of trading with Zeroda.

Nikhil,

It’s good to hear everything in details. But tell me one thing, when are you planning to implement XIRR information in ZERODHA platform so that users can track their portfolio growth in efficient manner? It’s been almost 3 years and people are still demanding this feature. Care to explain?

I would like to second this as well. It would be really nice to see XIRR feature, especially for long-term retail holders.

Hi Aavi, there are some complexities involved with edge cases which is why this has taken time. Having said that we’re close, please bear with us.

Shubham, this is the same reply you’ve given to couple of users three years back. And surprisingly @Nithin and team Nithin deletes the logical criticism and questions. You or your team deleted my last comment/criticism just like that. It seems Mr. CEO and his team do not love to hear criticism. They do not entertain logical questions, all they wanted it praises and cheer-ups.

Thank you for sharing, wish you all good luck and hope to see zerodha going public

Thank you 🙏

Brilliant ! just Brilliant !

Good to hear in details about the company where i have kept most of my investing money.

I liked the rainmatter initiative.

I also liked to word of caution on trading expectations.

regards to the whole team of Zerodha.

Thanks Zerodha and @Nithin sir, @Karthik sir and support crew especially. Congrats for your grand success and pray that it prospers even more in future. Its due to your great platform (kite) and educational content (zerodha varsity), successful traders and investors alike have been able to take calculated and informed decisions, thus keep oneself aloof from extreme greed and fear. Paired with Sensibull, we feel it’s nearly a complete one stop package and expect that the high standards set by your team will continue to be delivered along with continual improvements and added features. Thanks once again. 😃

why is there a dramatic decrease in account opening in 2018 is it due to capital gain tax?

Hi sir, we happy to see you such wonderful person/firm developed in India rather than US . MY 70% of money/ my wealth lying in ZERODHA just because of TRUST.

Thanks for Providing Clarity Nithin, atleast we as investors are assured to some extent that our cash is safe in zerodha demat, good to know you’ve provided clarity on profitable percentage of traders, these days people are going berserk in social media.

Wow! This is so detailed including the risk disclosures. This when even listed companies shy away from sharing details. These are definitely best practices which every company should look to emulate. I hope more brokers take a page from you. You & Zerodha deserve all the success & more. best wishes always.

Nice to see your maturity N as business grows…

Hope you continue same ..rare to see nowadays…

Just one request as most of your revenue is from Day Trading income ( Please build some new age Trading Analytic platform ..which is not available in marketplace…

All the best ….

Thanks for the updates. This is quite informative, haven’t seen anything even close in the Indian broking industry. Looking forward to all the future updates.

I had been updated mail from rediff to gmail as per your instruction oh sorry SEBI instruction,if I still get informative webin of this article on redid should I rise concern of so called compromised state of hacker prone zeroth or double standard of purity of zerodha

#INACCEPTABLE

Hi Ranjan, please create a ticket at support.zerodha.com with more details on the issue you seem to be facing. Our team will have this checked and assist.

aa

Thanks for sharing this and congrats on all the success. I hope there are more businesses, especially the listed ones with public money learn from this and disclose all the risks.

After reading the above it is evident that at a young age you have achieved your primary business goals at Zerodha,but following buzzwords always go along at pinnacles of success,Excellence &innovation, Scale, CSR & customers,Iam sure all are always at top of your mind ,which are also probably reasons of success.

Wishing you your staff & families a merry christmas,Seasons Greets and a happy and prosperous New Year ahead.

Information is enlightening, empowering the investors

Zerodha’s Trading platform is the best platform available in the indian market. Kite has simplified the trading ideas through its excellent charts. so easy to get in to the reports. You don’t need to do marketing because your customers will do it. Keep the quality…. business and profit will follow.

Impressive story.

I was hoping for information on when retail customers can start investing in US stocks through Zerodha’s platform. Your NSE IFSC tie up is 8 months in the waiting. Your customer support has no clue on the matter and customers are looking left and right to find brokers who can provide the service.

Grateful if you can kindly close the gap on this.

Thanks

Hi Sachit, we’re in the process of getting our NSE IFSC membership. We’ll keep you posted on it. However, cannot provide any timeline at this moment.

Learned investing in shares from Zerodha is a continuous journey. Wishes for your continusous growth and support.