Coin newsletter #1: Bull market mistakes

In the past year or so, we’ve seen a huge spike in new investors. While, in general, this new breed of investors are more informed than the previous generation, some of them continue to make the same old mistakes.

At Zerodha, we spend quite a bit of time educating investors. We constantly share things and answer queries from investors on Varsity, Z-Connect, Tradingqna and the Zerodha YouTube channel & podcasts.

So every month, we’ll publish an update with the most important things you should know as an investor. We’ll also include links to all the important things we share across Varsity, Z-Connect etc so that you don’t miss out on anything important.

Oh, and just one more thing. If you’re new to the markets and thinking of investing in mutual funds, here’s one important thing you should know. All mutual funds come in two plans: Regular and Direct. When you invest in a regular plan, you pay up to 1% as commission every year for as long as you’re investing. But when you invest in a direct plan of a mutual fund, there are zero commissions. On Coin, we offer zero commission direct mutual funds.

The thing about commissions is that they compound over time. So, if you’re a DIY investor, it makes no sense to invest in regular plans of mutual funds. Oh, and regular plans are also sometimes mis-sold as free, they aren’t. Always remember, costs are a big drag on returns in the long run. So, read this Varsity chapter before you start investing in mutual funds.

NFOs

It’s still raining NFOs. In 2020, there were about 50 odd NFOs as fund houses rushed to capitalise on the market rebound. But just 7 months into 2021, we’ve already crossed 50 NFOs and counting. What’s surprising is that these NFOs have collected over Rs 30,000 crores. And it looks this isn’t stopping anytime soon, given that AMCs continue to file for new fund launches. The last time we saw so many NFOs was probably in 2008.

Even to this day, quite a few investors confuse NFOs for IPOs and expect listing gains. But NFOs and IPOs are two different things. In very simplistic terms:

IPO: When a private company wants to raise capital, it sells shares to the general public.

NFO: When an asset management company (AMC) wants to launch a new scheme, it launches a New Fund Offering (NFO) and sells units to investors. It uses the money it raises to buy the underlying securities (stocks, bonds, commodities) in the new fund.

NFOs are heavily marketed, especially in bull markets like the current one. They can be tempting, but not all NFOs are worth investing in. Even today, NFOs are mis-sold with a pitch that the units are available for cheap at just Rs 10, particularly by banks & wealth managers. Investors fall for the pitch without realising that Rs 10 is just a number and doesn’t mean anything.

A few things to keep in mind about NFOs:

- Most NFOs have existing alternatives with performance track records.

- Except for unique funds, not all NFOs are worth investing in. For example, up until the last 2-3 years, we didn’t have too many international funds if you wanted to diversify globally.

- It’s better to see how a new fund performs than invest right away.

Markets near lifetime highs

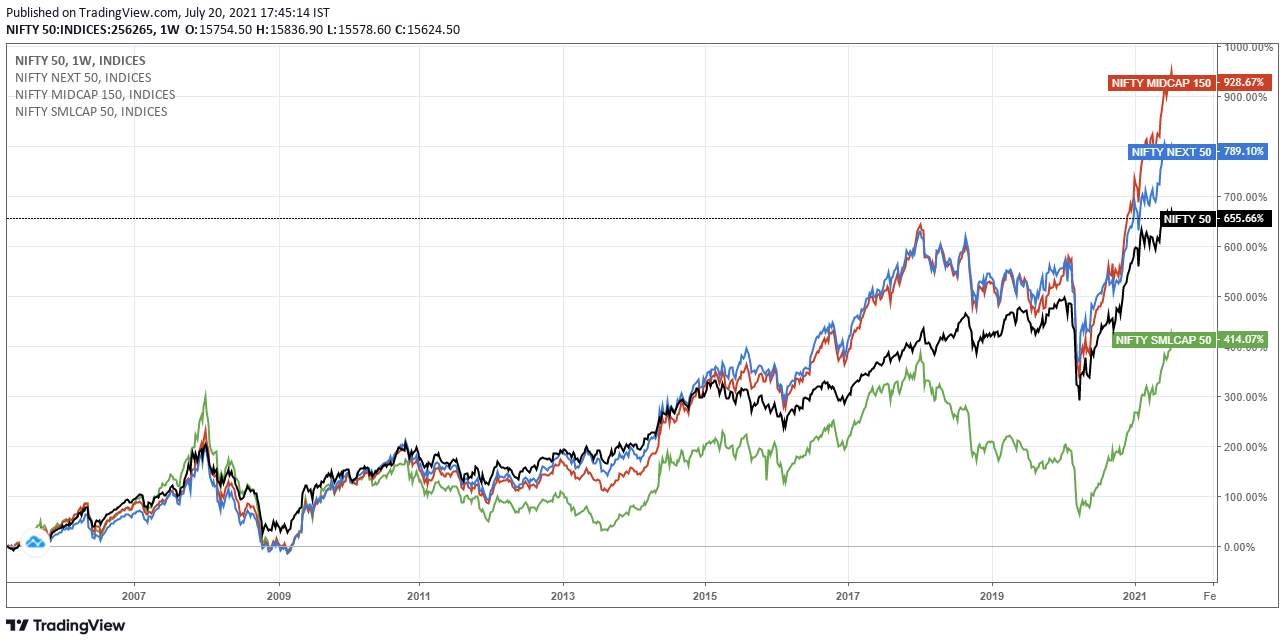

The large, mid, and smallcap indices are all trading at or near their lifetime highs.

Major indices

And this is the time when some investors start getting nervous and start tinkering with their investments or stop their SIPs. But that would be a huge mistake.

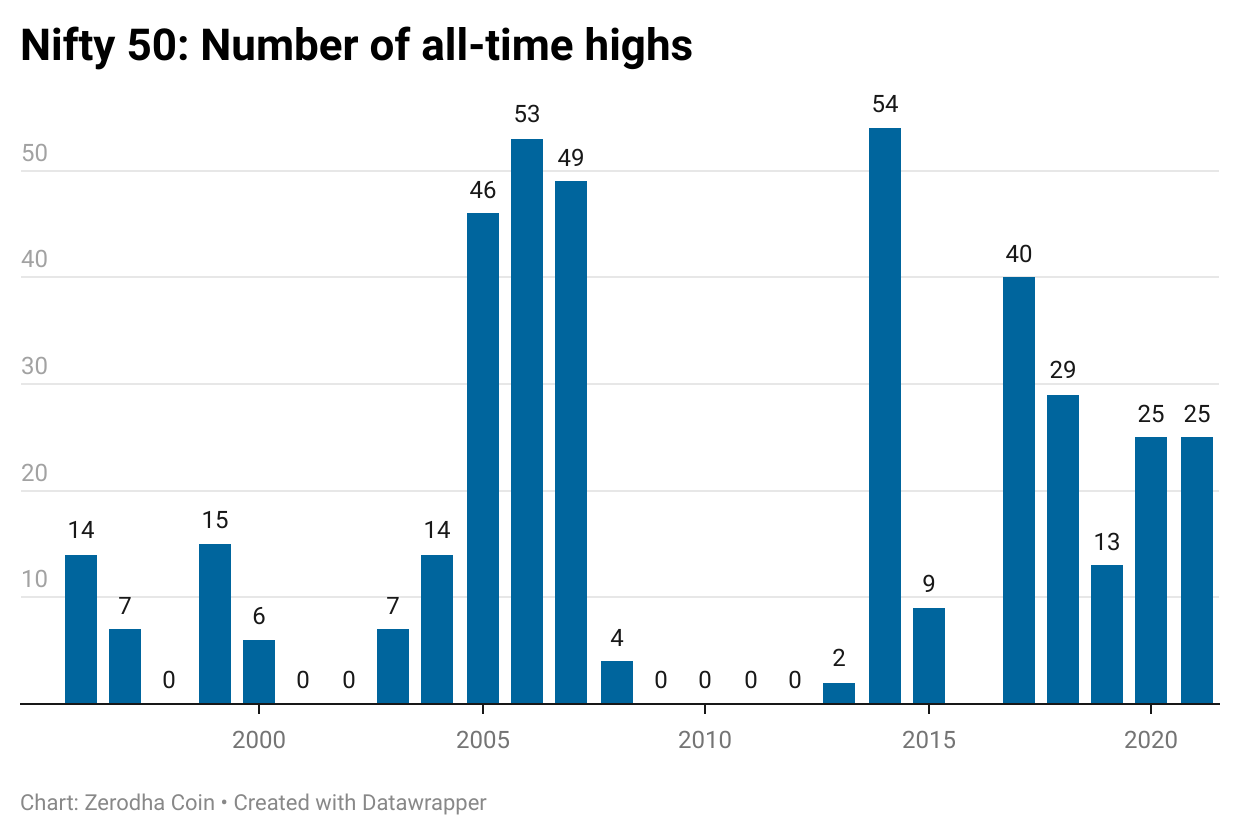

The thing is, markets keep making fresh highs all the time. This image shows the number of times Nifty made new highs each year. So, just because the markets hit new highs doesn’t mean they have to fall. In fact, strong momentum tends to persist if you observe the image.

Nifty 50 all-time high instances

But in any case, even if you were to time the market, i.e., sell at the peak and buy at the bottom, you need to be right twice. As much as we humans like to think we’re good at predicting things, we aren’t. And even if you time the market perfectly, you aren’t guaranteed to beat a simple SIP.

Most of us will be saving for our long term goals like retirement, which are decades away. Reacting to short term movements is a sure way of hurting your odds of reaching those goals.

The best thing you as an investor should do is:

- Get your asset allocation right. It sounds complex, but it need not be. We even have a simple guide to help you figure out your asset allocation.

- Rebalance periodically to keep your desired allocation.

- Ignore all the noise.

On Zerodha Educate

Last month we caught up with Rishad Manekia of Kairos Capital. In part 1, Rishad speaks about how a new investor should think about personal finance and shares some dos and don’ts. In part 2, Rishad talks about how to manage your personal finances in these challenging times.

https://open.spotify.com/episode/2SawdycQ2lxLBPQtRvcIH6?si=jKmzTMDUQiOMWltLOJiE0Q&dl_branch=1

https://open.spotify.com/episode/4YfWYZscjUqhNqiefCj3Na?si=2e3ZHoRQRWCIhoAjNYoT_g&dl_branch=1

Varsity updates

Speaking of personal finance, there are a lot of misconceptions around it. Personal finance is uniquely personal, and there are no easy answers. What works for someone might not work for you. Most people assume personal finance is all about investing; it’s not. Investing is just a small part of it.

We now have a dedicated module for personal finance right from the basics. With about 30 chapters, it’s also the biggest module on Varsity. It has pretty much everything you need to know to start your personal finance journey, starting with the fundamental question of why you should save.

We’d love to hear your thoughts. Please leave a comment if you have any feedback, suggestions or ideas for us; we’re listening.

hello

Recently CO order are blocked for F&O segment. Is there any technical dependency due to new margin rule or Authority has given such new rule?

CO order is till safe if trader want to pay 100% margin and allowed to choose CO for intraday trade in F&O.

I have direct mutual funds for more than last 6-7 years. Can I bring the existing funds and SIPs under Zerodha Coin?

This for single window tracking and registering all SIPs in same place. Thanks.

Thanks a lot for starting the new letter Coin news letter #1: Bull market mistake. Definitely Zerodha platform user will be benefitted immensely. Continue with this program.

Can I suggest an addition to this news letter. Why not to add zerodha research related to stock.

Great job @ FOC.

Reader of varsity books. Completed 1st, 2nd, 4th modules.

Going through 11th module now.

Teaching with example makes reading fun. God bless and

Good luck Team Varsity.

Good Initiative… Keep rocking…

Glad to read it. Great initiative. keep it up.

Great

I came to know about this newsletter yesterday when it appeared in my holding tab at the top. I found it useful and informative. While reading below I realised that Zerodha is educating investor since long

”At Zerodha, we spend quite a bit of time educating investors. We constantly share things and answer queries from investors on Varsity, Z-Connect, Tradingqna and the Zerodha YouTube channel & podcasts.”

However, I never heard about these platforms. Never got any email related to these newsletters/podcasts. If these are free then can you send emails for the same.

Wealth of right information. Continue to do the good job.

Really awesome newsletter and information provided

I have few of the MF schemes invested with other portals since last few years. Can I transfer these to zerodha along with the accumulated units? What is the procedure for doing so?

Please advise…

Thanks

Good Publication. Keep us update like this.

Nice

Good to know info….Eye Opener…..Keep sharing in bits

1. Such newsletters are very helpful and can prevent wrong investment decisions. Thank you for it.

2. As experienced stock investors repeatedly remind us we enter the stock market with no training whatsoever not realizing we are playing around with our hard earned money – and 95% of the time losing it!

3. One suggestion ; please make the type darker as senior citizens like me find it hard to read.

4. Another suggestion is to make the watchlist on Zerodha Kite alphabetical. Now we have to scroll through all the pages to find a script. This will be very helpful.

5. Why not have Portfolio management for not so HNI investors – like 50 lakhs?

Thanks and keep up the good work

Excellent information. Thanks

good information. Please highlight the important points.

What means Same company has June NFO, July NFO, August NFO so on and how we can expect returns of that company. Please reply

Kindly create a different section on page for comments so that new ones don’t make the page look huge and incite the reader to ”read it later at some free time.”

Is it not available for mail subscription?

Superbbb👌👌👌👌

very informative.

Superb

Awesome Zerodha Team! Great going. Appreciate this initiative to make new investors aware of key points and bringing transparency in the market do’s and dont’s. It will great be if you can mention the duration of read on top of the article (eg., Medium portal). Keeping a 2 min read articles will attract more readers and helps us to remember the key message. Best wishes!!

Hi,

I have already invested in Mututal Funds individually filling the data in AMC website. Now its difficult to track all of them. If I subscribe to Coine, it will automatically show all my holdings ?

Good going Zerodha ,always at best .Best wishes for more informative launches .It will be good if you give daily tips too in Equity,Currency and commodities by your experts

Great initiative.. It’s really very happy to an investor who is new to the market and also for the loser. Tnx and appreciated

Great initiative.. It’s really very happy to an investor who is new to the market and also for the loser. Tnx

Nicely defined personal finance

Quite Informative

very happy to read this.

keep moving….. & take us along.

PLEASE SEND ALL INFORMATION REGARDING IT IN OUR INDIAN COUNTRY LANGUAGE HINDI

Yes

I shall be grateful if you can assist Senior Citizens in managing their funds. Most are not versed with new investment opportunities and pool their resources with Banks earning barely 6% on which 33% tax is paid, resulting in net gain of just 4%, which doesn’t beat the inflation. Specific videos & knowledge may be shared, specifically designed for Sr. Citizens wrt better and safe avenues open for investment other than Bank FDs.

Great initiative. University has been a great.source of information on investment for beginners. Who be great if the.charing functions in Zerodha can be made more reliable and loss-proof to have a long therm use of these charts

Basics of finance nicely simplified

I’m very much interested to get this regularly.

please make script in smaller to read in short time. beginners can understand if it is simple and sweet. thank you for this new add-on.

I’m interested to get this regularly.

How to subscribe the news latter

Very good concept n things to adere.

Dear sir, If it is a free service, then ok. AND if it is as value added service (VAS) from Zerodha then I am not interested please. Thanks

Thank you!

You keep surprising us!

Nice initiative. Appreciate efforts & deep understanding.

Keep it up.

Dear zerodha, 🙂you are so great.

I wish you always grow in higher sky.

Thanks you ❤

It’s very useful for bigginer…

Good Information, it is always nice to get updates from your broker.

There has been a drastic increase in numbers where people have started to do trading and making extra income, even college students are able to do with an minimum investment, thanks to Zerodha.

dear sir,

thank you for your valued guidance.

as an investor , i want IPO guidance.

the best thing of Zerodha is its simplicity an yet very effective and useful.

thanks again

-b.k.vaghela

It is very useful information/ Keep it going on.

Hello Team

Plz add me to the contact list and subscribe my email to your newsletter

Gr8 initiative…

THANKS FOR THE INFORMATION

HELP INVESTORS ALSO WITH BUY & SELL RECOMMENDATION

new investors.. young earning people.. new to markets .. need to earn/save for future.

what about 58 + ( will live maybe till 85+), worked all life, retired, cannot get new proper jobs, hence at home, mentally agile,

saved money now used for retirement (till death do us apart) , we need to earn, we too are new investors, .. new to markets .. need to earn , to spend balance years a better life.

58+ crowd will keep on growing, have funds, need to earn.

Pandemic kept me indoors, Zerodha got me occupied, gave job to earn on own , staying indoors at home.

we need more guidance, and funds will start get diverted from other saved instruments to Market

Thank you Zerodha, your are doing a good thing by taking care of your clients. Please keep us updated with day to day information.

Typo… The best thing for you as an investor should do is… You can please rephrase it to correct the grammar. The article is very good by the way.

On another note, I would like to share my own experience as I sailed through 3 major crashes and market tops. It is always better to cash out 50 percent of our investment when we feel the market is at the top (like today). We may be wrong. In fact most of the time we WILL BE wrong. But liquidating 50 percent and keeping rest 50 percent is the most defensive play. If the market still climbs up, we can still get benefited by the rise. If the market falls, we have surplus funds to invest in fundamentally good stocks (never invest in mediocre stocks however lucrative they might look). I have 15 yrs of experience in trading and I quit my day-time job 4 yrs ago. I am doing good and enjoying the other sides of life. You can take this advice if you want.

By the way, SIP is a good way to invest for long term. I personally never did it, as I find it more interesting to directly play with the stocks in short term. Money is not everything, the passion and the thrill of an adventure are also part of the parcel that makes our life meaningful 🙂 But I seldom do day trading. 3-6 months investment get us the best return, with a few selected stocks kept in the long term portfolio for regular dividend income.

I fully agree with you sir

Thanks for sharing your thoughts…Sir.

Thank you for this

Great information, Thank you Zerodha. Please keep us updated.

Thanks for this.

Great stuff. Keep this coming. New investors definitely need to learn.

Plse Improve your services first

1.IPOS issues I applied Zomato ipo zerodha plat form but payment link not send my mail plse solve problems first otherwise second

Happy guru purnima

A true and practical knowledge in a holistic manner. 👌👌👍👍👏

Very engaging piece of information

This is an awesome initiative. Full of insights and recommendations from the experts.

Will look forward to many more coming our way.

Investment lessons are to be best learnt from the experts and who better than thought leaders from Zerodha itself.

Sadhana Nitro chemical share given bonus 2:5 but not show my a/c record date 21/7/2021

Sub kind of information given me

it will be supplementary informative

Great work.

Very brief but still very informative.

Good initiative.

Also please see the possibility to post free intraday / long term stock suggestions.

Excellent information for beginners like me. Thanks to Zerodha.

A good one to start. Audio quality is very bad. Content should be reviewed thoroughly before posting.

Informative. Some advice for 50+ new entrant age group wil be appreciated.

DEBT AND GILT MUTUAL FUNDS ARE GOOD AND BETTER FOR 50+ .

ENQUIRE AND KNOW MORE TO GET HANDSOME INCOME FROM IT.

The Direct mutual funds are not free… It has expenses… don’t give misinformation to investors, of course direct funds are less expense ratio. But not zero expenses. Dear investors pls aware Direct funds has the expenses….!

Zerodha will get remunerations from AMCs for selling Mutual Funds.

No comments

Zerodha भैया, जरा zerodha varsity का Hindi Pdf थोड़ा समय निकालकर बना दो,🙏🙏🙏

Really it is a nice thing that you are going to start for helping new traders. thanks.

Varsity is a true GURU for us.

Thanks Zerodha.

Happy Guru Purnima….

GREAT TO EDUCATE US WITH THIS NEWSLETTERS.

CAN YOU SEND US THE NOTIFICATION ON MAIL AS WELL TO UPDATE AND SAVE FOR FUTURE.?

ALSO MAKE A SEPERATE APP FOR THIS TYPE OF NEWSLETTERS AND PODCASTS SO THAT WE CAN MAKE A LIBRARY FOR SAVED/LISTEN/NEWER ONES IN YOUR APP. THIS WILL BE DEDICATE TO YOUR EXCLUSIVE CONTENT MADE BY YOU FOR US TO EDUCATE AND GROW MORE. THANKS FOR THIS INITIATIVE. LOOKING FORWARD TO GROW US MORE LIKE THIS AHEAD IN OUR WEALTHY JOURNEY.

Information to acchi hai pan Hindi mein hai kya

Looks very promising. Contents very informative

It’s great you started this service, it will help/teach people to stay knowledged about ups and downs in the market

Thanks

Zerodha has become my friend for a lifetime 🙂

Hiii

Good. Keep it short in bits. And let there be a place we can always go back to read the newsletters in case we missed them. Thanks.

Good work….keep going

Great information thanks for sharing 👍

WHAT ARE THE CHARGESFOR THIS .

I have direct mutual funds for more than last 6-7 years. Can I bring the existing funds and SIPs under Zerodha Coin?

This for single window tracking and registering all SIPs in same place. Thanks.

Hindi m bhi

news letter upload kre

I always wonder if services like you mentioned ”coin” are free , how are you making money then?

Zerodha is gag of lutere…..cheeter etc

How it works.

grt info keep up the good work

Awesome thing with so much great information for genuine readers….keep posting and rocking!

Great,

Information is useful to educate the retail investors.

Can you post in malayalam?coz l couldn’t understand many things

Nice Informative and keep introducing new things Zerodha.

great keep updating us

can we have a subscription service for this newsletter so that we don’t miss the further one’s 🥺

¶

Reply

How should i subscribe to this newsletter?

Hope this will help the investor in guiding them about market trends.

great efforts; Zeerodha revolutionist among brokers. keep going

Wonderful. Keep it crisp and simple, no story writing. Whichever message is to be conveyed, let it be clearly mentioned with important points underlined, have seen many newsletters which go like ”fine print” until the end of the letter none knows what the actual focus is about.

I hope it helps retail investors as most of them are highly mistaken about the one way route of the mkt..

Great!!

Great information in esay way.

Very good initiative.

how it works

Very informative

can we have a subscription service for this newsletter so that we don’t miss the further one’s 🥺

Very informative content…keep going

Purane coin

The audio quality of the first part of podcast is hard to understand, is it possible for you to fix the noise and echos and reupload it?

can we have a subscription service for this newsletter so that we don’t miss the further one’s 🥺

The link behind this line needs WordPress admin login:

> So, read this Varsity chapter before you start investing in mutual funds.

Great information in esay way.

Cool thing, keep this in bits so it’s attentive to grab us.