Could Trend-Following Be A Successful Trading Strategy? (Part III)

Part I and Part II of our trend-following series illustrated the value of diversification and how it can be used to reduce portfolio drawdowns. The challenge is finding uncorrelated instruments as an Indian-domiciled trader. Irrespective of how you slice it, Indian equity indices are correlated to each other, we only have a handful of commodity contracts that trade with sufficient volumes, interest rate derivatives are still waiting for liftoff and the RBI has banned speculative activities in currencies.

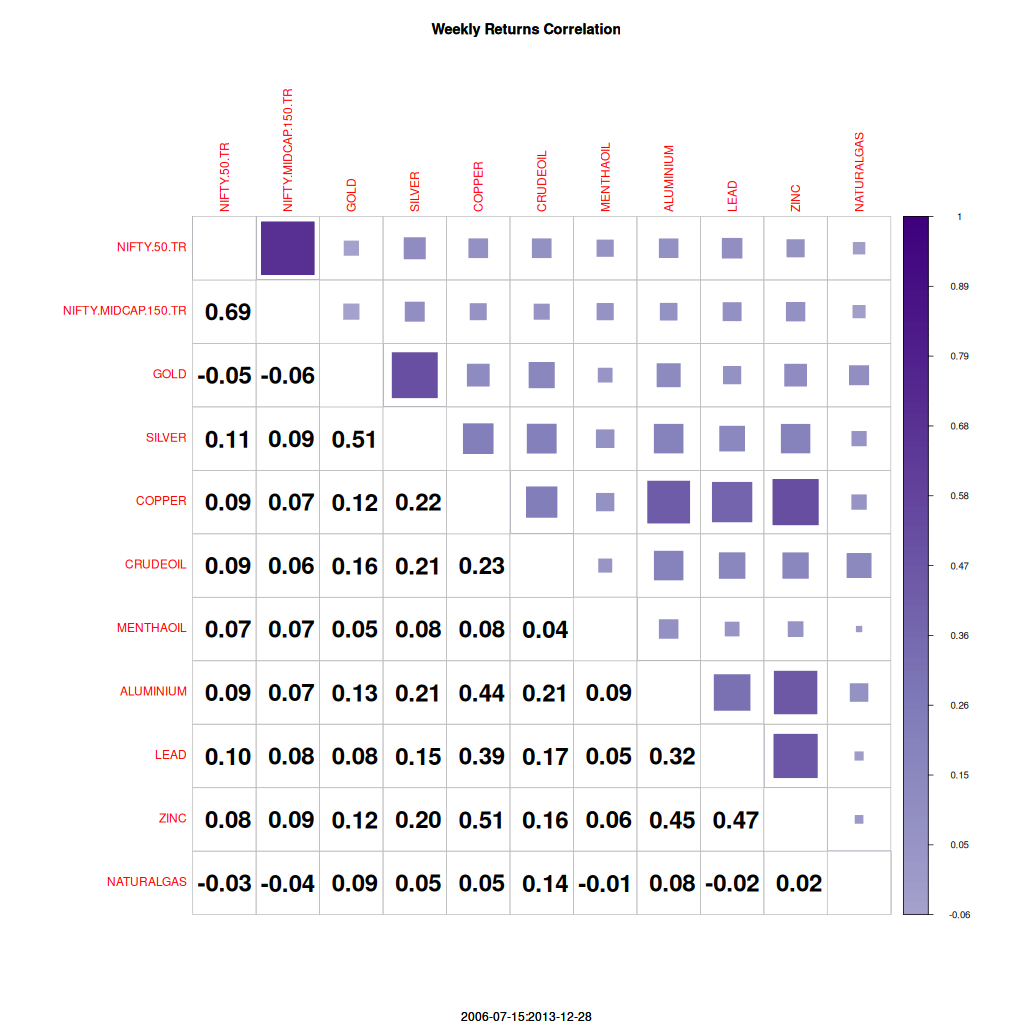

Working with what we have, let’s begin by looking at correlations between different assets from 2006 through 2013.

If you pick NIFTY 50, then you’ll have to drop MIDCAP 150. Add Gold and drop Silver. Copper is highly correlated with Aluminium, Lead, and Zinc. Dropping the assets with patchy liquidity, you are left with only four assets: NIFTY 50, Gold, Copper, and CrudeOil.

Now, the second most important question while building a trend-following system is about the lookback period. How we figure this out depends on how much exposure you can take at any given point in time. For example, if you can only afford to trade one contract of each asset, then you’ll have to go with a binary on/off approach. However, if you can trade a larger number of contracts per asset, then you can take a continuous approach. The higher your exposure/bankroll, the higher your Sharpe, up to a certain point.

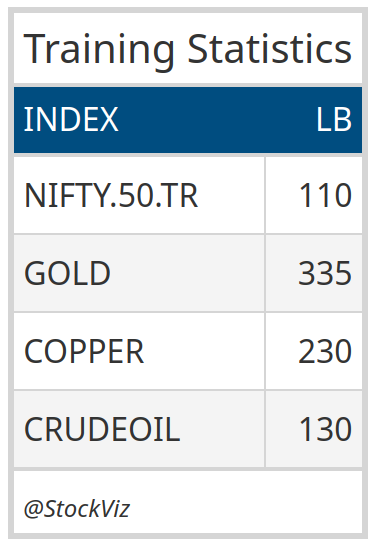

To keep things simple, let’s assume that you can trade only a single contract per asset. We can split the data into pre-COVID (Train) and post-COVID (Test). With the Training set, we iterate through each year, looking back 4 years (roughly 2 market cycles), and rank the performance of a simple crossover strategy across a large number of moving averages. We then take the median of the top 5 lookbacks by year as our final lookback (LB).

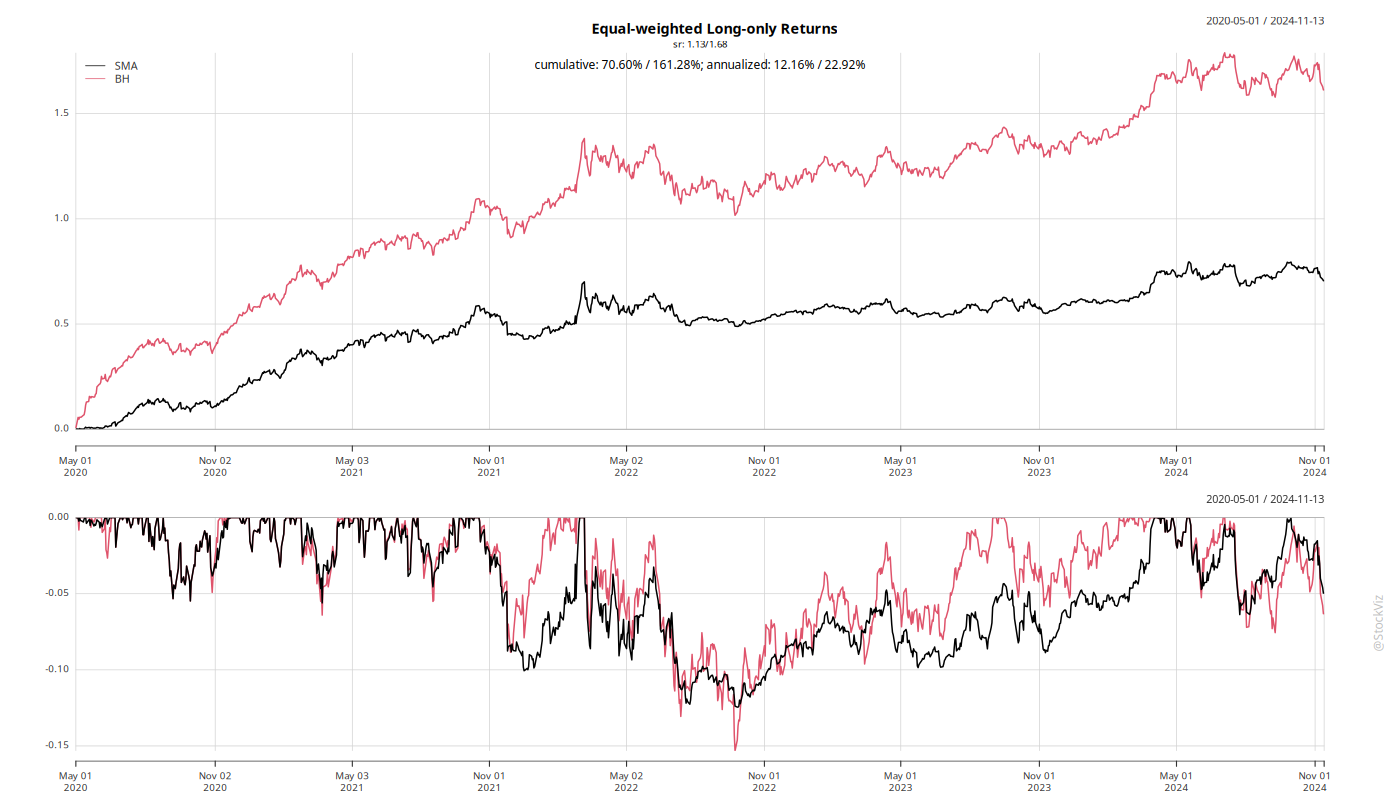

We run a 5xLB crossover strategy for each of those assets in our Test set. Here’s how it fared.

The black line is an equal-weighted crossover SMA strategy, and the red line is an equal-weighted portfolio of all four assets. A transaction cost of 25bps on the notional trade was assumed.

With a max drawdown of ~10%, you could apply 2x leverage and get to a mid-20s return. However, the equity curve is a tad disappointing.

The biggest culprit for the underperformance turned out to be Crude Oil.

A flat market is kryptonite for trend-following strategies. You’ll watch your bankroll wither away in transaction costs as the system bounces around zero. That’s diversification for you.

If you are capital-constrained, then perhaps a diversified basket of futures with a prudent amount of leverage would be better than trying to find the “best” trend signal.

Lesson: There’s a big difference between theory and practice. In theory, a diversified trend-following strategy should beat the market. However, in practice, you are constrained by the number of instruments you can trade, your bankroll, and transaction costs.

* Sir what If we Use Super trend Indicator(10,3) in SmallCap 100 Index in Daily Time Frame From its inception.

* We use SmallCap Index because catching Trend in SmallCap is bit easier than Large Cap.

* As SmallCap is more Volatile as well as more Directional also.

* Use Slightly big time frame like Daily, because in small time frame it get difficult to predict direction So use Daily time frame to capture big trend.

– I would eager to use Super trend Indicator in SmallCap 100 Index for Trend Following Trading Strategy.