4.1 – Quick recap

In continuation of the previous chapter: Classifying your market activity

The income tax department allows you to decide whether to show your stock investments as capital gains or a business income (trading), irrespective of the period of holding the listed shares and securities. Whatever stance you take, you will have to continue with the same in the subsequent years. Check this circular.

Simply put,

- Stocks that you hold for more than 1 year can be considered investments as you would have most likely received some dividends and also held for a longish time

- Shorter-term equity delivery buy/sells can be considered investments as long as the frequency of such buy/sell is low.

- If you wish, you can also show your equity delivery trades as a business income, but whatever stance you take, you should continue with it in the future years as well.

This chapter focuses on investing; hence, we will keep the discussion limited to points 1 and 2. In the next chapter, we will discuss taxation when trading/business income.

4.2 – Long term capital gains (LTCG)

Firstly, you need to know that when you buy & sell (long trades) or sell & buy (short trades) stocks within a single trading day, then such transactions are called intraday equity/stock trades. Alternatively, if you buy stocks/equity and wait till it gets delivered to your DEMAT account before selling it, then it is called ‘equity delivery-based’ transactions.

Any gain or profit earned through equity delivery-based trades or mutual funds can be categorized under capital gains, which can be subdivided into:

- Long-term capital gain (LTCG): equity delivery-based investments where the holding period is more than 1 year

- Short-term capital gain (STCG): equity delivery-based investments where the holding period is less than 1 year

Taxes on long-term capital gains for equity and mutual funds are discussed below –

For stocks/equity – 0% for first Rs 1.25 lakhs and long-term gains exceeding Rs 1.25 Lakhs will be taxed as follows:

- If the sale occurred before July 23rd, 2024, the tax rate is 10%

- If the sale occurs after July 23rd, 2024, the tax rate is 12.5%

The threshold of Rs 1,25,000 applies to the total long term capital gains for both periods (before and after July 23, 2024).

The above taxation rate is only if the transactions (buy/sells) are executed on recognized stock exchanges where STT (Security transaction tax) is paid. As discussed above, LTCG is a holding period of more than 1 year.

If the transactions (buy/sells) are executed through off-market transfer where shares are transferred from one person to another via delivery instruction booklet and not via a recognized exchange by paying STT, then LTCG is 20% in case of both listed and non-listed stocks (Listed are those which trade on recognized exchanges). Do note that when you carry an off-market transaction Security Transaction Tax (STT) is not paid, but you end up paying higher capital gains tax.

Note that a gift from a relative through DIS slip is not considered as a transaction and hence not capital gain. It is important that gift not be treated as transfer, and relative could be (i) spouse of the individual (ii) brother or sister of the individual (iii) brother or sister of the spouse of the individual(iv) brother or sister of either of the parents of the individual (v) any lineal ascendant or descendant of the individual(vi) any lineal ascendant or descendant of the spouse of the individual (vii) spouse of the person referred to in clauses (ii) to (vi).

For equity mutual funds (MF) – 0% for first Rs 1.25 lakhs and long-term gains exceeding Rs 1.25 Lakhs will be taxed as follows:

- If the sale occurred before July 23rd, 2024, the tax rate is 10%

- If the sale occurs after July 23rd, 2024, the tax rate is 12.5%

Similar to equity delivery-based trades, any gain in investment in equity-oriented mutual funds for more than 1 year is considered LTCG and exempt from taxes up to Rs 1.25lk per year. A mutual fund is considered equity-oriented if at least 65% of the investible funds are deployed into equity or shares of domestic companies.

For non-equity oriented/Debt MF – taxed as per slab rates.

Union budget 2014 brought in a major change to non-equity mutual funds. As opposed to 1 year in equity-based funds, you have to stay invested for 3 years in non-equity/debt funds for the investment to be considered as long-term capital gain. If you sell the funds within 3 years to realize profits, then that gain is considered as STCG.

Note: The government, in the Finance Bill 2023, made certain amendments that apply to debt funds that invest not more than 35% in equity shares in Indian companies. As per the new rules, these mutual funds will be taxed at applicable slab rates, irrespective of the holding period, without any indexation benefits for investments made on or after April 1, 2023.

For Cryptocurrencies/Virtual Digital Assets – flat 30% on the gains.

Budget 2022 introduced taxation on Cryptocurrencies (VDA). Gains from Cryptocurrencies are taxed at a flat rate of 30%. No deduction is allowed except for the cost of acquisition. The tax rate is the same for both long-term capital gains and short-term capital gains.

4.3 – Indexation

Indexation helps adjust the effect of inflation on your purchase price.

If you are wondering what inflation is, here is a simple example to help you understand –

All else equal, if a box of sweets was priced at Rs.100 last year, chances are the same could cost Rs.110 this year. The price differential is attributable to inflation, which in this example is 10%. Inflation is the percentage by which the purchasing value of your money diminishes.

Indexation determines the true net gains on the sale of an asset after considering the effect of inflation.

Until FY2023-24, you could get an indexation benefit to determine your net capital gains on non-equity-oriented mutual funds, property, gold, and others where you are taxed on LTCG. The Union Budget 2024 eliminated the need for indexation on all investments except for the real estate investments made before 23 July 2024, the day the budget was announced. So, if you are making long-term capital gains on a property bought before the budget day, you have the option to pay an LTCG tax of either 20% with indexation (old regime) or 12.5% (new regime) without indexation.

How can you apply indexation to the purchase price of your real estate asset? Or how can you find the indexed purchase price of your asset? You can use the Cost inflation index (CII), which can be found on the income tax website.

Let’s understand indexation and evaluate the old and new regimes using the purchase/sale of an apartment as an example.

Purchase value: Rs.10,00,000/-

Year of purchase: 2015

Sale value: Rs 30,00,000

Year of sale: 2025

Long-term capital gain: Rs 20,00,000/-

Without indexation in the new regime, I will have to pay an LTCG tax of 12.5% on the capital gains of Rs 20,00,000/-, which works out to Rs 2,50,000/-.

Under the old regime, the 20% LTCG tax on an asset’s indexed purchase value can be computed as follows.

Firstly, calculate the indexed purchase value. We need to use the cost inflation index (CII) for that. Find below the cost inflation index from the income tax website until 2024/25. Refer to this for CII data before 2001/02.

| Financial Year | CII |

|---|---|

| 2001-02 | 100 |

| 2002-03 | 105 |

| 2003-04 | 109 |

| 2004-05 | 113 |

| 2005-06 | 117 |

| 2006-07 | 122 |

| 2007-08 | 129 |

| 2008-09 | 137 |

| 2009-10 | 148 |

| 2010-11 | 167 |

| 2011-12 | 184 |

| 2012-13 | 200 |

| 2013-14 | 220 |

| 2014-15 | 240 |

| 2015-16 | 254 |

| 2016-17 | 264 |

| 2017-18 | 272 |

| 2018-19 | 280 |

| 2019-20 | 289 |

| 2020-21 | 301 |

| 2021-22 | 317 |

| 2022-23 | 331 |

| 2023-24 | 348 |

| 2024-25 | 363 |

Going back to the above example,

CII in the year of purchase (2015): 240

CII in the year of sale (2025): 363

Indexed purchase value = Purchase value * (CII for the year of sale/ CII for the year of purchase)

So –

Indexed purchase value = Rs 10,00,000 * (363/240)

= Rs 15,12,500

Long term capital gain = Sale value – Indexed purchase value

Therefore, in our example

LTCG = Rs 30,00,000 – Rs 15,12,500

= Rs 14,87,500/-

So the tax now would be 20% of Rs 14,87,500 = Rs 2,97,500, which is more than the Rs 2,50,000/- that you will pay under the new regime. In this example, you would most likely choose to pay the LTCG tax under the new regime. However, there can be instances when the old regime might result in a lower tax outgo for you.

You don’t have to calculate the indexed purchase value of your real estate manually. You could use the IT department’s Cost inflation index utility for that.

4.4 – Short term capital gain (STCG)

Tax on short term capital gains for equity and mutual funds are discussed below –

For stocks/equity – 20% of the gain for shares sold after 23 July 2024.

It is 20% of the gain if the transactions (buy/sells) are executed after 23rd July 24 and 15% if executed before 23rd July 24 on recognized stock exchanges where STT (Security transaction tax) is paid. STCG is applicable for holding period over 1 day and not more than 12 months.

If the transactions (buy/sells) are executed via off-market transfer (where shares are transferred from one person to another via delivery instruction booklet and not on the exchange) where STT is not paid, STCG will be taxable as per your applicable tax slab rate. For example, if you are earning over Rs.15,00,000/- per year in salary, you will fall in the 30% slab, and hence STCG will also be taxed at 30%. Also, STCG is applicable only when the income exceeds a minimum tax slab of Rs 2.5lks/year if you have opted for the old regime and a minimum tax slab of Rs. 3lks/year if you have opted for the new regime. So if there is no other income for the year and assuming there was Rs 1lk STCG, it would not entail the flat 20% tax.

For equity mutual funds (MF) – 20% of the gain if sold after 23rd July 24 and 15% if sold before 23rd July 24

Similar to STCG for equity delivery-based trades, any gain in investment in equity-oriented mutual funds held for less than 1 year is considered STCG and taxed at 15% of the gain. Do note that a fund is considered equity-based if 65% of the funds are invested in domestic companies.

For non-equity oriented/Debt MF – As per your individual tax slab

For Cryptocurrencies/Virtual Digital Assets – flat 30% on the gains.

4.5 – Days of holding

For an investor, the taxation difference between LTCG and STCG is quite huge. If you sold stocks 360 days from when you had bought, you would have to pay 15% of all gains as taxes on STCG. The same stock if held for 5 days more (1 year or 365 days), the entire gain would be exempt from taxation as it would be LTCG now.

It becomes imperative that you as an investor keep a tab on the number of days since you purchased your stock holdings. If you have purchased the same stock multiple times during the holding period, then the period will be determined using FIFO (First in First out) method.

Let me explain –

Assume on 10th April 2014, you bought 100 shares of Reliance at Rs.800 per share, and on June 1st, 2014 another 100 shares were bought at Rs.820 per share.

A year later, on May 1st, 2015, you sold 150 shares at 920.

Following FIFO guidelines, 100 shares bought on 10th April 2014 and 50 shares from the 100 bought on June 1st, 2014 should be considered as being sold.

Hence, for shares bought on 10th April 2014 gains = Rs 120 (920-800) x 100 = Rs 12,000/- (LTCG and hence 0 tax).

For shares bought on June 1st, Gain = Rs 100 (920-820) x 50 = Rs 5,000/- (STCG and hence 15% tax).

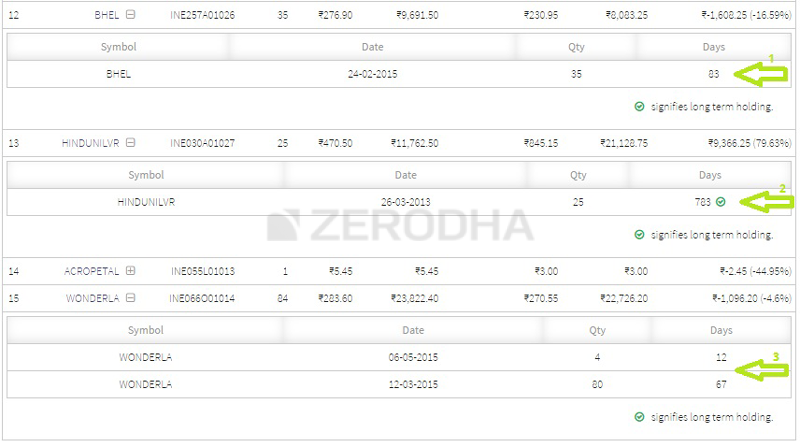

Small little sales pitch here 🙂 – if you are trading at Zerodha the holdings page in our back office platform called Console will keep a tab for you on a number of days since your holdings were purchased, and even a breakdown if bought in multiple trades.

Here is a snapshot of the same –

The highlights show –

- Day counter

- A green arrow signifying holdings more than 365 days, selling which won’t attract any taxes.

- If you have bought the same holdings in multiple trades, the split up showing the same.

Besides Zerodha Q, equity tax P&L is probably the only report offered by an Indian brokerage which gives you a complete breakdown of speculative income, STCG, and LTCG.

4.6 – Quick note on STT, Advance Tax, and more

STT (Securities Transaction Tax) is a tax payable to the government of India on trades executed on recognized stock exchanges. The tax is not applicable to off-market transactions which are when shares are transferred from one DEMAT to another through delivery instruction slips instead of routing the trades via exchange. But off-market transactions attract higher capital gains tax as explained previously. The current rate of STT for equity delivery based trades is 0.1% of the trade value.

When calculating taxes on capital gains, STT can’t be added to the cost of acquisition or sale of shares/stocks/equity. Whereas brokerage and all other charges (which include exchange charges, SEBI charges, stamp duty, service tax) that you pay when buying/selling shares on the exchange can be added to the cost of share, hence indirectly taking benefit of these expenses that you incur.

Advance tax when you have realized capital gains (STCG)

Every taxpayer with business income or with realized (profit booked) short term capital gains is required to pay advance tax on 15th June, 15th Sept, 15th December, and 15th March. Advance tax is paid keeping in mind an approximate income and taxes that you would have to pay on your business and capital gain income by the end of the year. You as an individual are required to pay 15% of the expected annual tax that you are likely to pay for that financial year by 15th June, 45% by 15th Sept, 75% by 15th Dec, and 100% by 15th March. Not paying would entail a penalty of annualized interest of around 12% for the period by which it was delayed.

When you are investing in the stock markets, it is very tough to extrapolate the capital gain (STCG) or profit that will be earned by selling shares for an entire year just based on STCG earned for a small period of time. So if you have sold shares and are sitting on profits (STCG), it is best to pay advance tax only on that profit which is booked until now. Even if you eventually end up making a profit for the entire year which is lesser than for what you had paid advance tax, you can claim for a tax refund. Tax refunds are processed in quick time by the IT department now.

You can make your advance tax payments online by clicking on Challan No./ITNS 280 on https://incometaxindiaefiling.gov.in/.

Which ITR form to use

You can declare capital gains either on ITR 2 or ITR3

ITR3 (ITR 4 until 2017): When you have business income and capital gains

ITR 2: When you have a salary and capital gains or just capital gains

4.7 – Short and long-term capital losses

We pay 15% tax on short term capital gains and 0% on long term capital gains, what if these were not gains but net losses for the year.

Short-term capital losses, if filed within time, can be carried forward for 8 consecutive years and set off against any gains made in those years. For example, if the net short-term capital loss for this year is Rs.100,000/-, this can be carried forward to next year, and if the net short-term capital gain next year is Rs.50,000/- then 15% of this gain need not be paid as taxes because this gain can be set off against the loss which was carried forward. We will still be left with Rs Rs.50,000 (Rs.100,000 – Rs.50,000) loss which is carried forward for another 7 years.

Long-term capital losses can now (post introduction of LTCG tax@10%) also be set off against long-term gains.

Long-term capital loss can be set off only against long-term capital gain. Short-term capital loss can be set off against both long-term gains and short-term gains.

Losses incurred in crypto cannot be offset against any income, including gains from cryptocurrency and such loss shall not be allowed to be carried forward to subsequent assessment years.

Key takeaways:

- LTCG : Equity, Equity MF – 0% for first Rs 1lk, 10% on exceeding Rs 1lk, Debt MF: 20% after indexation benefit

- STCG: Equity: 15%, Equity MF: 15%, Debt MF: as per individual tax slab

- You can use the cost inflation index to determine and get the benefit from the indexed purchase value

- Index purchase price = Indexed purchase value = Purchase value * (CII for the year of sale/ CII for the year of purchase)

- If you have bought and sold the same shares multiple times then use FIFO methodology to calculate the holding period and Capital gains

- STT is payable to the Govt and cannot be claimed as expense when investing

Interesting reads:

Livemint: If you pay STT STCG is 15% otherwise as per tax slab

Income tax India website – Cost inflation index utility

Taxguru – Taxation of income & capital gains for mutual funds

HDFC- Debt mutual funds scenario post finance bill (no2), 2014

Disclaimer – Do consult a chartered accountant (CA) before filing your returns. The content above is in the context of taxation for retail individual investors/traders only.

Loved how you broke things down. 馃檪 The step-by-step guide was excellent.

I sold some long term holdings for buying a property and got an LTCG of 8.5 lacs, though it was a once in a lifitime like transactions. do I have to maintain BOA ? I can\’t file it in 44ADi as I have a commission income in current FY, so i won\’t be able to file the next year return in 44 AD. what should I do ? If I show it as LTCG, then rest of my income does not cross 2.5 lac, can i do it this way ?

You can still use 44AD even if you have commission income. The only thing is you can\’t use ITR4(Sugam), when you have commission income. But you can\’t switch back and forth from capital gain to business income.

However, I don\’t think you may need to do any of that. You\’re transaction is probably already exempt under Section 54F.

Not a CA. Consult your tax advisor.

Hi,

Suppose I have no income except interest from bank savings. e.g Rs 20,000

and i have LTCG from sale of Equity MFs e.g Rs 5,00,000 held for 10 years

and i have LTCG from sale of Debt MFs e.g Rs 5,00,000 held for 10 years

Total 10.2L

How will i be taxed?

Suppose if the income is 6 lakhs, and STCG are 60k, then how much tax to pay?

Hi, I had a particular stock (equity) that I was holding for more than 1 year. To capitalize on the tax benefit of 1.25 L, I sold the stock on a particular day and purchased the same stock (same quantity as well) on the same day after selling. First sold my existing stock and then purchased on the same day. Will this be treated as long term capital gain or this would be considered as intra day for tax treatment. Please clarify

Hi Duraibbabu,

Selling shares and buying back on the same day will be considered an intraday trade. For tax harvesting, the shares have to move out of the demat account through a delivery sell transaction.

When there is no delivery, it will be considered speculative business income and will be levied tax at the slab rate.

However, if its a T2T trade on a delivery-basis, the benefit of tax harvesting may be available. Please consult your tax advisor.

Does we have to pay tax on STT also ?? STT is allready deducted. Then while STCG again we have to pay tax on STT ??

Suppose ek shares 16000 @ 100 buy Kiya and sell Kiya 16000 @ 105 . Ispe zerodha per realise profit hua 80 k lekin saare charges aur stt total 3660 kat ke haath mein aata 76340 rs , aur net realised profit hua 76340 . Then on which pay STCG ???

I have one doubt, I have gained 72 Lakhs as profit.For STCG 20% Do I have to pay directly to the government portal or to the brokerage trading app.I used one trading which is not normal,we can\’t Topup or withdraw ourselves.My question is Is the STCG should be paid before withdrawing the profits to my bank account because I couldn\’t withdraw my profits now. They are asking me to pay tax to their individual bank account first.

Hi, If I just want to build my corpus for long term (10 to 15 years) but I am buying, selling stocks and then reinvesting with in a year or more than a year depending on the market movements. Do I still have to pay STCG or LTCG tax even though I did not withdraw any money to my bank account?

LTCG loss carry forward how much consecutive

Year ?

8 years

i had a profit in short term through share and also had some loss in mutual fund that adjusted vise versa?

Sir if I purchased some share of a company after 3 months I sell it on loss rs 10000/ again same day or next day I purchased it again what happened to loss I booked rs 10000/ on sale of my share, please explain

Suppose investments made in Money Market funds(Debt Mutual Funds)before 1st April,2023 were redeemed after 23rd July,2024, after a period of 2 years but before expiry of 3 years. What will be the capital gains taxation rate on this, @ 12.5% LTCG rate or at personal income tax rate ? and the reason for the same.

Dear sir

1. is reabte ubder 87A available for STCG equity

2. I gift share worth 4 lacs to my relative (Bhabhi). And she earn 2 lacs as STCG. what will be tax calculation(she has no other source of income).

Will she bear tax on 6 lacs income or only 2 lacs STCG.

3 Also related to qn no 2 will STCG will be clubbed with my income or bhabhi have to pay for it

4 Is gift deed mandatory for gifting shares to relatives (for ITR purpose)

Hi !

If I invest in Bharat Bond ETF (Listed Debt Fund) as on today, what will be my Capital Gains Tax Implications considering the changes made in the last 2 Budgets. Few places its mentioned that it will have no implication of the holding period and so it will be taxed as per the Slab. Few places it is mentioned that since it is a \”Listed Debt Fund\” it will be treated for Long Term in 12 Months and taxed at 12.5%. Please Clarify if possibe.

My short term gain for the year is Rs.376500.I am a homemaker without any other income. Then what is the tax liability Sir.

zero tax liability till 4lakh for STCG + if u also sell Long term stock in that case 125000 more will be exempt

total income 525000 exempt hoga… ZERO tax dena hoga….

Thanks for clarifying, that unutilsed basic exemption limit is available after exemption of 125000, in case of ltcg from selling equities, meaning thaereby maximum 525000 is tax free provided there is ltcg of rs 125000.

The LTGC tax need to be paid on the sale of stocks even if the money is in the Zerodha account(or reinvested in stocks) OR tax needs to be paid only when the money hits the bank account?

for LTCG 125000 exempt apko show karna hoga

agar koi or income nh hai tho 525000 tak exempt hoga

HI Brij Kishore Gupta,

Is there any Exemption of Income tax for the current year in equity non speculative Income. Please reply

Yes, basic exemption limit is available for non speculative income only if you are a resident.

Is there any Exemption of Income tax for the current year in equity non speculative Income. Please reply

yes IF LTCG 125000 will be exempt.

Sir ,

My zerodha account was closed earlier by me . How can I gate pnl statement for currunt financial year and previous years .

Dear Sir

Suppose I earn STCG 2.2Lacs and LTCG Zero rupee and I don\’t have other source of Income.Do I have to file ITR or have to Pay tax

No

Hi, Anybody please confirm whether we can offset DP charges, STT and AMC charges from STCG and pay tax for balance

For Ex:

STCG 30000/-

DP Charges 583/-

AMC 78/-

STT & Others 516/-

Here shall i need to pay tax on rs. 30,000/- or for 28,823/-

if u have no other income then 30000 will be tax free….

if u have other income like salary more than 400000 than you have to pay tax

DP charge less hoga

AMC Less hogi

STT less hoga on purchase only

STT on sale less nh hoga

I have day traded thrice in a day on the same script and made a profit of Rs 383. The next day I see that my principal amount has been reduced by Rs 27

I am unable to understand if I consider Rs 60 as brokerage charges for 3 rounds and considering STT, stamp duty and other statutory charges it will not be more that Rs 70 overall. Please explain and share me the break up of this deal made on 19th Sept 2024.

purchase 20 sale 20 is one round 40*2=120 brokerage

else will be other charge

have to confirm with your broker

Hi there,

In console, where can i find the option to see the number of days i have hold the stock for?

Lets say, I bought 10xBEL share on 1st May-2024. Later, i buy the same share on 1st Sep-2024. I would like to keep tab on number of days my holdings were purchased?

Thanks

Please clarify on the Advance Tax payment requirements in case there is LTCG realized on the first quarter ( say July sometime I sold equity/shares that was held 1yr+, and say there are some 2L profit ) do I have to pay the Advance tax based on this Gains ?

Clarifying this because in the article above says/mentions only STCG when talking about the Advance Tax. Isn\’t this Advance Tax applicable for all the gains ( both the LTCG & STCG ) ?

15th June 15%

15th September 45% (cumulative)

15th December 75% (cumulative)

15th March 100%

ek bar ITR fill karo tho confirm kar lena kisi CA se

How much tax has to be paid if only equity shares and mutual funds have profit of Rs 3 lakh and above?

STCG 400000

LTCG 125000

TOTAL 525000 EXEMPT

(if no other income)

Hi Nitin Chadha,

Can I show STCG and LTCG as Business income going forward, as I only do trading and there is no other source of income for me apart from some minor bank interest – Yes, you can do that. Whatever stance you take, you will have to continue with the same in the subsequent years as well.

STCG 400000

LTCG 125000

TOTAL 525000 EXEMPT

(if no other income)

if isse jada income hai tho

STCG ko Business income show kar sakte ho

but LTCG 125000 tak exemtp hoga

means

STCG Ko business income show par 12lakh tak

or LTCG 125000 exempt hai hi

total income is 13,25,000 exempt kar sakte ho…but

STCG ko ek bar Business income show kar di tho future mai bhi Business income hi show karoge…

Hi

Can I show STCG and LTCG as Business income going forward, as I only do trading and there is no other source of income for me apart from some minor bank interest

Sir,

Kindly explain-

If my annual salary is 3 lakhs and my STCG is 2 lakh annually, in which calculation and how much I have to pay tax?

salary 300000

s/d 75000

total 225000 taxable hui

STCG 200000

total hua 425000

less 400000 (400000 tak koi tax nh lagta)

tho STCG bacha only 25000 * 20% tax lagega 5000 tax dena hoga

agar tax bachana hai tha 175000 tak ka profit book karo only baki sahe Demat mai rehnedo

next year sell karna

Hi sir for example I have invested 12 lakhs in equity and now it became 70 lakhs after 1 year and I am holding for 1 year how much tax I have to pay sir

suppose apki or koi income nh hai

purchase 1200000

sale 7000000

profit 5800000 LTCG hua 1year se upar

less 125000

taxable 5675000

Tax rate 12.5%

taxable Amt 709375 + 4% cess

709375 + 28375

Total Tax 737750

tax bachana hai tho or bhi option hai

contact

[email protected]

Hi Nithin,

Are you going to update this module as per the new tax regulation ?

Infact, that would be much appreciated.

Please update the whole taxation chapter as per the latest regulations so that it can be helpful to new investors and traders.

Tax treatment in my hands for \”I purchased Securities in a company for Rs.30,000/- after 3 years the company gets closed and no money received from that company securites\”

agar company listed thi tho apko

DIS from broker se lena hai wo share demat mai show ho rahe honge

unko apni family member ko 1rs mai sell kar do broker se baat karo kese

tho apko loss hogaya uss loss ko ap setoff kar sakte ho profit se

Post 2024 budget of 23rd July 24 what will be the tax rate for shares purchased in June24 and sold in August24.

Will STCG for such a trade be taxed at 15% or at 20%

Please clarify.

Thanks

15% uspar jo phele sell kiya

20% uspar jo baad mai se kiya hai

agra 400000 se jada income hai tho

other koi tax nh

for more info [email protected]

hi sir,

i want to know that what expenditure will be show in ltcg & stcg for itr 2. brokerage charge, annual charge is also in expenditure.

What will be the percentage of tax on the selling of inherited shares?

Sir,

I bought one number of ICICI Money Multiplier Bond (deep discount) through Zerodha for 79,500/- in October 2020.

On maturity in May 2023, received 90,400 after TDS of 9,600/-; Thus the net gain is 20,500.

This gain of the bond – bought in the secondary market and held till maturity is to be treated as Capital Gains or Interest income. Pl clarify.

Dear sir,i am a house maker .my husband transfer some shares to my demat account,after that i learn ivesting in stock market mean time i sold some shares ( my husband transfered shares) got gains 25000 approx and dividend also,now i would to pay tax.please give your suggestion which itr (1 or 2) i want to fill.

apke husband ne apko share transfer kiye as a gift

us case mai income apke Husband ki hogi apki nh

chahe ap sale apne Demat se hi ku na karo

clubing of income rule lagega

agar ye chahate ho ki income akpi wife mai lage

tho contact kijiye [email protected]

I AM CONFUSED I have low income i have 1)short term capital gain 350000,2)speculative loss of 127000 i do trading in share market by mortgage loan and lic loan intrest for the same is around 240000 per year

pl tell me how tax will be calculated

genuine reply pl help me

I have transferred yes bank shares from kotak securities to zerodha. AIS says off market debit transactions of 33000. how this transaction will be covered in Income tax return. please advice

What will happens when I sell my share/stock at a rising price right after 2/3 weeks of investment

If you are selling above the price you bought, then you profit 🙂

Hi Nithin,

For instance,say I have realized a ltcg: 10 lakhs and stcg: 1lakh before 15june24 while my stcg BFLoss : -1 lakh, ltcg BFLoss: -5 lakh(from 2023-24).

So do I need to pay advance tax already by june15 for ltcg after offset?

Or can I pay tax at year end without penalty?

Please advise.

Hello,

My query is regarding taxation of Options in Foreign Stock (In Zerodha Tax PnL the options trading is shown in currency Sheet). How does this work? Is it the same way as how it is taxed in India or is there any other Rule?

Dear Sir

which is better and simple ?, to report share income under business income or capitalgains. I am a retired Canara Bank Officer and can not afford to perplexive mental exercises. Please advise

with regards

sivasubramaniam

I am unemployed, I make STCG profits of 3.5 lakhs in a year. how much I will be taxed?

Assume unemployed

STCG 400000

LTCG 125000

total 525000 exempt koi tax nh dena

any other question contact [email protected]

Hi Vivek Metta,

My wife is not a salaried person (no other income) and has made 20 lakhs STTG what would be the net tax payable? – You need to pay 15% Tax on STCG of 20 Lacs.

My wife is not a salaried person (no other income) and has made 20 lakhs STTG what would be the net tax payable?

I got allotment of share through IPO ( no STT paid) and I sold through exchange (STT Paid) after allotment within a year . Profit will come under STCG and Tax shall be @15% on profit ? pl clarify .

Hi, Can LTCG or STCG be offset fully or partially against underutilized balance of basic exemption limit while filing IT return??

HI Mumtaz Doongerwala,

How to calculate Tax on sale of Liquid Bees?

Tax for Debt ETFs (Bought on or after 01.04.2023) – Irrespective of holding period: Taxable at slab rates.

Tax for Debt ETFs (Bought before 01.04.2023) –

STCG: Taxable at slab rate (Held up to 36 months)

LTCG: Taxed at 20% after indexation benefit. (Held more than 36 months)

How to calculate Tax on sale of Liquid Bees?

Hi Yuvaraj,

1. I have carried forward short term capital Loss Of Rs. 1,29,110 and short term capital loss of Rs. 2,27,631 during FY 2023-24. As such, Total short term capital loss as on 31/03/2024 works out to Rs. 3,56,741/-. I have long term capital profit of Rs. 21,93,712 during the year. Can I adjust short term capital loss of Rs. 3,56,741 against the long term capital gain of Rs. 21,93,712? – Yes, you can set off Short Term Capital Losses are allowed to be set off against both Long Term Gains and Short Term Gains.

2. I had purchased the following bonds at the premium during the FY year 2019-20:

Date of Purchase Maturity Date

9.05% L&T Finance Ltd. 2027 INE027E07AL1 09-May-19 15-Apr-27

9.45% State Bank of India Perpetual INE062A08199 08-May-19 22-Mar-24 ( date of call option)

8.97% Rural Electrification Corporation 2029 INE020B08BP90 08-May-19 28-Mar-29

Now SBI has exercised its call option on 22/03/24. Can I treat the premium paid on purchase of the above three bonds as expenditure during the FY 2023-24? – You cannot claim as expenditure against Interest Income.

Dear Shri Nithin ji,

I need clarification on the following two points:

1. I have carried forward short term capital Loss Of Rs. 1,29,110 and short term capital loss of Rs. 2,27,631 during FY 2023-24. As such, Total short term capital loss as on 31/03/2024 works out to Rs. 3,56,741/-. I have long term capital profit of Rs. 21,93,712 during the year. Can I adjust short term capital loss of Rs. 3,56,741 against the long term capital gain of Rs. 21,93,712?

2. I had purchased the following bonds at the premium during the FY year 2019-20:

Date of Purchase Maturity Date

9.05% L&T Finance Ltd. 2027 INE027E07AL1 09-May-19 15-Apr-27

9.45% State Bank of India Perpetual INE062A08199 08-May-19 22-Mar-24 ( date of call option)

8.97% Rural Electrification Corporation 2029 INE020B08BP90 08-May-19 28-Mar-29

Now SBI has exercised its call option on 22/03/24. Can I treat the premium paid on purchase of the above three bonds as expenditure during the FY 2023-24?

Regards

Yuvaraj Patil

Can we deduct interest charged by a broker on a marginal trading facility while computing my capital gains? What if I disclose my trading activity as my business income? In that case, will I be able to deduct the same? Kindly provide solutions for both scenarios.

If not deductible, why? Please provide appropriate reasons and rules. Additionally, is there any case or judgment on the disallowance of interest expense for capital gains since it is purely used for acquiring shares?

Also find the refer to the case of Tishul Investments ltd where the madras high court has given the judgement in the favor of the assessee where the interest can be part of the cost of acquisition while computing capital gains.

I wanted to know if we can still rely on these judgements and consider interest expense to be part of cost of acquisition while computing capital gains?

[Trishul investments Ltd]

(Commissioner Of Income-Tax vs M/S.Trishul Investments Ltd on 12 July, 2007)

(https://taxguru.in/wp-content/uploads/2016/04/Fritz-d.-silva.pdf)

Nithesh, its best if you consult a qualified CA. But here is the thing – All Cost which you have Incurred to acquire Capital Asset is allowed as Cost of Aquisition. It will be part of Purchase itself. Not only Interest for example if you take Subscription of Some Equity Advisor as well.

Only thing is allocation towards each Stock need to accounted Properly.

Sir If am a salaried person and belong to 30% tax slab. I have LTCG is 1.2Lakh. Is this 30% tax slab will implemented to my whole LTCG or 1 lakh LTCG is lax free and remaining 20 k will be taxed to 10%.

Hi There!

Under P&L report asan example,

Realised P&L

+26.63L

Charges & taxes

3.14L

Other credits & debits

-6.2k

Net realised P&L

+23.42L

Does this 3.14L includes STCG and LTCG already or I will have to pay those on Net realised P&L 23.42L?

Thanks.

Where to show the expenses or brokerage charges, stamp duty charges paid etc for selling of equity shares in ITR 2 ?

Stock I sell 1st march for the purpose of tax harvesting, can I buying it after 2 days.

Hi Sir,

please advise if i have both short term & long term capital gains of rs 80,000-/ each in the same year. what is the process to calculate the tax.

Hi Sir,

I would like to know if i have short term capital gain of Rs 90,000-/ & Long term capital gain of Rs 90,000-/. do i have to calculate separately tax for both heads or i have to sumup both gains? what is the proceedure . pls advise

Taxation For STCG/LTCG Equity SHARE

capital gain altogether with other income-

1. not exceeds 2.5L For old regime and 3L For new regime is not taxable.

2. exceeds 2.5L or 3L- taxable as per existing tax rate.

Post your views on this.

For capital gain of 19.5 lakhs from stocks, how much tax should I have paid before 15th December 2023?

Thanks.

I have short term capital gain of 2.83 lakhs and long term gain of 1.5 lakhs. No other income or deduction.how much tax I have to pay

Hi, I want to know what are credits and other charges in tax profit and loss report and why it is showing a negative value in my case like (-2888) and the realised profit shown in the website is including all the taxes and charges or do I have to minus the taxes and charges from that amount to see my actual profit.

My question is related to LTCG on gifted mutual fund units, such that if

Year 2020

MF bought by father for INR 50,000

Year 2022

MF transferred to me when price is INR 1,50,000

Year 2023

I sell MF for INR 2,00,000

Will my LTCG be considered to be 2L, 50k or 1.5L? Also will my father incur any tax at all from this transaction?

I want to invest in a foreign index ETF and wondering if the Zerodha (kite) tax PNL report includes the indexation benefits for the returns?

Sir i am student but not residential and my total earned income 2 lakh earned through stcg In a financial year. So,I will need to pay any tax

I have a doubt here so i have earned 10 lakh ruppees and invested 8 lakh in equity mutual fund now i have 2 lakh so my question here is do i need to pay the tax for earned money even if i invested 8lakh rupees in mutual or not.plz answer

Hello,

I hold 200 HDFC shares in my Zerodha account. (Long term since 3 years now).

Now if i GIFT this to my father\’s ZERODHA account and he books profit then do i pay 20 % LTCG on this? or it will be considered under normal rate of LTCG 10 %?

Moreover, can you throw some more light on GIFTING stock how the taxation works? will it have more STT or brokerage charges on both sides?

For listed share, if I do the transfer off-market, this will qualify for indexation benefit, correct?

Hi

Does zerodha deduct STCG from profits ?

Hi sir,

If salary income 4.9L (after all deduction and exemption) and short term capital gain Rs. 30k so i will paid 15% on short term gain. So 87A rsbate is applicable in this case or not.

Hi,

Suppose i am in higher tax slab means 30% so for STCG(Equity fund like parag parikh flexi cap) do i need to pay 15% or 30%?

Tax benefits while dealing in stocks as firm or as an individual

Why long-term and short-term capital gains losses are not cleared off in the current year, and why they are carried forward to next years?

This is very helpful blog articles I have ever read. Continue your great work. Thanks for blog commenting opportunity. I really like this post and republish from my website. Please link to my websites and publish your another articles on my websites. Thank you again.

Financial Advisor in India

In section days of holding, you have written that by holding the stock for five days more you will be exempt from paying tax but my question is it will still count for long term so it means we have to pay tax 10%. so the benefit we get is 5%. Am i right?

Hi Navin,

I got some stocks which are no more traded. Can I show total value as loss and reduce it from my income.

You cannot do that because you will be having your rights in those shares.

Do a off market transfer and book loss and then adjust it against your incomes.

I got some stocks which are no more traded.can I show total value as loss and reduce it from my income.

Hi, Mr Kamath. I came across this informative article and read the comments too. Glad to.note that you are pErsonally replying.

Me and my wife have accounts with Zerodha. Last year I gifted shares online tomy wife. I have been requesting for statement of gifts made as per requirement of IT but the same has not happened till now. Also I had to literally bang the customer care team to change the buy cost of gifted shares to that 9f original date(which wasput as transfer date). Had very hard time getting it done. I would Like your help in having a statement on gifted shares for the sake of IT.

Thanks 8n anticipation…

why does zerodha not show the charges in tax pl while showing details of short term and long term txn details. Only amount appeared in purchase,sale and profit column. How can we calculate exp which can be shown in itr

Hi,

I have a salaried income and fall in 30% tax bracket. If I make a stcg of 200000 please confirm

1)how much i need to pay .

A) 30k

B) 60K

2)By when I need to pay

Hi Prateek Bansal,

What will be the capital gain tax treatment on private limited and llp company. I mean will they be considered as same STCG AND LTCG?

For Private Limited Company – It will be unlisted shares.

STCG

Period of Holding will be less than 24 months unlike Listed Company shares where it is less than 12 months.

STCG will be taxed as per slab rates unlike Listed Company shares where it is taxed @ 15%

LTCG

Period of Holding will be more than 24 months unlike Listed Company shares where it is more than 12 months.

LTCG will be taxed @ 20% after indexation unlike Listed Company shares where it is taxed @ 10% without indexation.

Hello Folks,

What will be the capital gain tax treatment on private limited and llp company. I mean will they be considered as same STCG AND LTCG? please clear

For taxation, can I:

(1) show short-term gains as business income &

(2) show long-term gains as capital gains,

in the same AY?

Hi HM,

If the LTCG is less than 1 lakh, am I forced to offset the loss from previous year or do I have the option to carryover or carry forward the old loss (for 8 years) to a year when the gain is more than 1 lakh and hence taxable? – LTCG first gets set off with carry forward loss irrespective of the amount and then exemption of 1 Lacs gets applied.

Hi Nithin Kamath

If the LTCG is less than 1 lakh, am I forced to offset the loss from previous year or do I have the option to carryover or carry forward the old loss (for 8 years) to a year when the gain is more than 1 lakh and hence taxable?

Hi Harsh,

If I have income from stocks only and profit earned by selling the stock is t less than slab limit of income tax. Do I need to pay tax as it comes under capital gains?

No need to pay tax if the capital gains is under the basic threshold limit of 2.5 Lacs.

If I have income from stocks only and profit earned by selling the stock is t less than slab limit of income tax. Do I need to pay tax as it comes under capital gains?

Hi Sanjay,

STCG tax which is 15%, is this applicable same to all irrespective of gender? – Yes, it is 15% irrespective of gender.

STCG tax which is 15%, is this applicable same to all irrespective of gender?

Hi Praneeth,

I was trying to file that loss (ITR-2) through Quicko, I went all through the steps until last step i.e “e-file”, where could not download Json file.

Please help me how to download Json file and proceed further in filing for AY 2023-24.

Haven\’t used Quicko.

As on today, only ITR Forms/Schema have been notified; Income Tax department is yet to release Utility.

https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns

Hey San

I am sorry please ignore my previous question, while consider the below question.

I was trying to file that loss (ITR-2) through Quicko, I went all through the steps until last step i.e “e-file”, where could not download Json file.

Please help me how to download Json file and proceed further in filing for AY 2023-24.

Thanks

Namaskar

Thanks San, your response was quite helpful !!

So, I was trying to file that loss (ITR-2) through Quicko, I went al through the steps untill last step i.e \”e-file\”, where I had downloaded the Json file, but may I know what is the next step?

Thanks

Praneeth

HI Praneeth,

I had a short term capital loss of 2,00,000 between 01-04-2022 to 31-03-23.

The questions:

1) Should I have to file that loss before 31-03-2023 or can it be filed after 31-03-2023 for it to be carried forward for further years? – You need to file before 31st July 2023 to carry forward the losses for future years.

2) Actually under which filing year does that loss fall, under AY 2022-23 or AY 2023-24 ? – Loss falls under AY 2023-24 (FY 2022-23)

Namaskar

I had a short term capital loss of 2,00,000 between 01-04-2022 to 31-03-23.

The questions:

1) Should I have to file that loss before 31-03-2023 or can it be filed after 31-03-2023 for it to be carried forward for further years?

2) Actually under which filing year does that loss fall, under AY 2022-23 or AY 2023-24 ?

Thanks

Praneeth

Hi Dhananjeyan,

I have made a STCG of 1.6L , so I should pay 15% for tax – Yes, you should pay 15% tax on STCG

Same time I have holdings in my account which are losses . Is there any way that I could book the losses and do something ? – You can go for Tax Loss Harvesting

Same time I’ve got dividend of 50000 in this financial year that got reflected in my bank account . Should I show this as an income and pay tax for this also ? – Yes, Dividend Income is also taxable.

Hello

I have made a STCG of 1.6L , so I should pay 15% for tax

Same time I have holdings in my account which are losses . Is there any way that I could book the losses and do something ?

Same time I\’ve got dividend of 50000 in this financial year that got reflected in my bank account . Should I show this as an income and pay tax for this also ?

Hi Raghunandan,

You can claim both side expenses except STT.

Hi,

I need help in understanding the taxation for investors. When we buy and sell shares there are few addition costs that we incur such as brokerage, exchanges charges, etc and I have added all the possible charges below.

While Buying a share

Brokerage

Exchange transaction charges

CGST

SGST

IGST

STT

SEBI Turnover fees

Stamp Duty

While selling a share

Brokerage

Exchange transaction charges

CGST

SGST

IGST

STT

SEBI Turnover fees

Stamp Duty

DP charges

I understand that we cannot claim STT as an expenditure in capital gain. However can we claim other charges as an expenditure. I would appreciate if you could specify the list of charges that we can add as an expenditure.

Also, can we claim these expenditure for both buying and selling of a share. For ex: If my buy brokerage is Rs. 10 and sell brokerage is Rs. 15, can I add expenditure as Rs 25 or just Rs. 15.

Thank you

HI Roktimjit kakoty,

My friend is a broker. Trades from zerodha and pays taxes as per profit earned from options trading.

I am a salaried person. Suppose i gave him X lakhs rupees on my behalf to invest in stock market. And he returns me y amount per month in my bank account through online transaction. Will that y amount per month of mine be taxable?

No, it will not be taxable in your hands. But you should be give justification for the credits received in Bank Statement.

If your broker friend is treating as \”Y\” transfers are expense – then you should declare it as Income.

My friend is a broker. Trades from zerodah any pays taxes as per profit earned from options trading.

I am a salaried person. Suppose i have him X lakhs rupees on my behalf to invest in stock market. And he returns me y amount per month in my bank account through online transaction. Will that y amount per month of mine be taxable?

Note: friend already pays taxes for all kind of profit earns.

The interesting thing to note in regards to 20% after indexation for non-equity oriented or debt funds: Most of these funds return between 8 to 10% and typically inflation in India has been around that for the last many years. So with the indexation benefit, you typically won’t have to pay any tax on LTCG of non-equity-oriented funds.

Does this indirectly mean, We shouldn\’t expect good returns on Debt Funds?

Hi I have an account in Zerodha, wanted to known

1. If Loss of LTCG can be set off against profit of STCG while calculating Advance tax for the Qtr gone by and

2 If Total Charges and other credits and debits have to be minus from STCG profit and then that amount is to be taken for calculating advance tax. Is this right ?

Is it complusory to pay advance tax or can we pay the tax at the year end

Nithin,

I have 35 lic shares @904 and current price is 680 after 90 days, now I\’m in loss of around 25%

Suppose I gift those 35 stocks to my spouse.

1) can i show this 25% loss in my ITR ?

2) If my spouse sells the stocks within 365 days of gifting, will it be considered LTCG or STCG because I came to know that 904 will be considered the buying price even if the stocks are gifted?

Can dividend income be set off against short term capital loss

Suppose I purchase 100 shares of company A @Rs.50 in year 2018 in demat account D1. Again I purchase 50 shares of same company A @Rs 70 in year 2022, but in different demat Account – D2. Now if I sell 50 shares of company A @Rs60 today from demat account D2, will it be \”short term capital loss\” or \”LTCG\”??

For Suppose am without leverage in a day A stock buy @156 and sold it 159 at end of the day 3:25 . quantity 1000 .

Wt will be the taxation?..

What will be the LTCG and STCG, if i buy and sell through my private limited company or llp?

I have some profits in options.. Trading bank nifty

Does zerodha is deducting any income taxes for profits on daily base..

Please reply…

My account is resident normal account

Sir, My father in law had been purchased some shares of a company in before 2000. Last year , with devidend it\’s quantity is increased 4 times of shares. He is retired persons and have agriculture land.

Last year, he needs some funds on his health issue so he sold some quantity of shares .( Last year to last month)three times and got some amount( Approximately amount of Rs.1 lac x 3= 3 lac) and now , he wants to paid advance tax then kindly suggest me that how many advance tax should be paid before 15 th Sep 22.

Sir,

I am.new in stock market and recently i have gained 1.2 lack by selling different shares from my portfolio..my question is that will my broker directly cut the tax from my available funds or the tax will get cut once i transfer that 1.2 lack in my saving bank account…plz ellaborate

will the tax amount on STCG deducts during the withdrawal of the money?

Hi Sankalp rao,

I am a NRI PIS customer. I already pay huge brokerage and other reporting charges per transaction. I don’t have any income in India. Why is STT charged @15% though my earnings in India is less than 2.5 lakhs? Any way to avoid it?? Please advise.

The deduction is not STT, it is Tax deducted @ source (TDS) as per Income Tax Act. You can claim refund by filing the Income Tax return in India if your income is less than 2.5 Lacs.

Hello Nithin,

I am a NRI PIS customer. I already pay huge brokerage and other reporting charges per transaction. I don\’t have any income in India. Why is STT charged @15% though my earnings in India is less than 2.5 lakhs? Any way to avoid it?? Please advise.

Sir the pdf button to this module is still downloading the old file please please can you update that I downloaded and printed the old version

Would like to know the total income in ITR is the income after adjusting all exemptions and previous losses or is it the total income earned during the year?

For applying for the credit cards, they will ask us the total income as per the ITR filed. What are we supposed to do?

Acknowledgement on ITR portal shows the total income as the net income after adjusting all the exemptions and the previous capital losses. Is it not supposed to be what is earned during the year? Is it not the sum that credit card providers will be interested into? For credit card, the proof of income is ITR and ITR ack shows the total income as the net after all adjustments towards exemptions and previous years\’ losses.

What would be LTCG calculation for holding sold after more than 2-3 years with profit? How tax should be calculated? On flat net profit or on average profit per annum?

In tax P&L report, the taxable profit is shown to be just the difference of sale and purchase value. It does not account for other charges. Does it mean that taxable capital gain is just the realized gain and not the \’net\’ realized gain??

Also please elaborate on the turnover in the tax P&L report. I am asking from capital gains perspective.

This regarding below section.

4.5 – Days of holding

For an investor, the taxation difference between LTCG and STCG is quite huge. If you sold stocks 360 days from when you had bought, you would have to pay 15% of all gains as taxes on STCG. The same stock if held for 5 days more (1 year or 365 days), the entire gain would be exempt from taxation as it would be LTCG now.

** Instead of 5 days, we need to hold 6 days to fall on LTCG, recent income tax AIS statement is treating like this, be careful **

Capital gain in excel sheet

I made profit in short term (less than 1 lakh) should i have to pay tax if the profit made is less than 1 lakh? and my annual income is less than 2 lakh?

What if a person makes short term share profit of more than one lakh and he is not tax assesse. I mean doesn\’t pay tax for past decade and is new in stock market say 6 months but made profit more than one lakh.

When income tax will catch him

I mean immediately next financial year or after 5 years

Iam new to stock market plus not tax assesse

Hi Kalsum,

Currently, I am an employee at a family business and getting a salary from the business.

I have some agricultural land from which I get some other income.

I also trade options regularly and have income from that. I do not trade equity and If I buy a stock I usually sell it after 1-2 years or very rarely.

So my options income gets classified as business income and is taxed at 30%. How do I tackle my options income? I know it is taxed at 30%. But what else can I do about it? Can I claim expenses on this? If I subscribe to sensibull and get laptop repairs etc can I claim that expense ?

Yes your options income gets classified as Business Income. It is taxed as per the slabs rates applicable. It the net profit from options trading is more than 10 Lacs and 15 Lacs in old and new regime of taxation – then it is taxed @ 30% of profit exceeding 10 Lacs and 15 lacs.

You can claim all the expenses relating to options trading like subscriptions/laptop expenses/STT charged/SEBI turnover fees etc.,

Dear Sir,

Currently, I am an employee at a family business and getting a salary from the business.

I have some agricultural land from which I get some other income.

I also trade options regularly and have income from that. I do not trade equity and If I buy a stock I usually sell it after 1-2 years or very rarely.

So my options income gets classified as business income and is taxed at 30%. How do I tackle my options income? I know it is taxed at 30%. But what else can I do about it? Can I claim expenses on this? If I subscribe to sensibull and get laptop repairs etc can I claim that expense ?

Hi Girish,

If I add 3 lakhs to my zerodha account now and use it for trading in futures & after a month I decide to withdraw that 3 lakhs from my demat account. Will it be taxable ?

If you have earned any profit, then it is taxable.

Can I lend my shares in vinati organics ltd to my friend with out any monetary gain

If I add 3 lakhs to my zerodha account now and use it for trading in futures & after a month I decide to withdraw that 3 lakhs from my demate account. Will it be taxable ?

HI Sudhakar,

(1) where the profit in gold EFT has to be shown – If it is short term, you need to enter the details under Item #6 under Schedule CG and if it is long term, you need to enter under item# 10 under Schedule CG

(2) in STCG, where expenses like STT, SD,DP charges are to be shown – you need to enter item # 1 b iii(Expenditure wholly and exclusively in connection with transfer) . Further you cannot claim STT as deduction.

(3) whether we have upload the zerodha tax p& l file in ITR3 – you cannot upload Zerodha Tax PL in ITR 3

Hi, what all charged can be claimed under tax exemption? STT/Exchange transaction/DP charges? How to show in ITR, pls guide

Hi Vyas,

Is advance tax applicable only on business income and STCG? Is it not applicable on LTCG realized during the year?

Advance Tax is applicable on LTCG as well.

I trade using zerodha account. In ITR-3,

(1) where the profit in gold EFT has to be shown

(2) in STCG, where expenses like STT, SD,DP charges are to be shown

(3) whether we have upload the zerodha tax p& l file in ITR3

Is advance tax applicable only on business income and STCG? Is it not applicable on LTCG realized during the year?

Taxation makes sense if you invest in the best short-term stocks. You can see the best short-term stocks on our website- https://investhub.agency/blog/short-term-stocks/

Sir

I have LTCG of 10Lakhs on Mutual funds In April 2022 in my Zerodha account. I do not have any other income. I may or may not have additional Capital gains in the remaining Financial Year.

How much Advance Tax I shall pay by June 2022. Should I pay 15% on 90k (Tax on 10L capital gain) or shall I pay the whole amount now itself.

Suppose if I book another 10 Lakhs Capital gain in August, should I pay entire 1.9lakhs tax by Sept 15th or only 45% of it.

Can you update us on intra day trading taxation slabs for both profits & losses.

Thanks

Hello sir.

Are brokerage charges and other charges (other than STT) deductible as allowed expenditure whether in Capital Gain or in Business Income for Intraday Trading and Short Term Trading..

Please help sir.

Thank you.

Hi,

I am a student, I am not falling under any tax slab I have some capital which I use to buy and sell shares in short term. Do I need to pay STCG on my profits?

Sir i am new to market suppose I made stcg of 50000 and I have to pay tax on 15% , so my question is does the tax is taken directly by brokerage company or I have to file itr

If I keep my money in zerodha wallet as a saving purpose ( not to buy or sell of stocks and shares) , do i have to pay tax at the time of withdrawal ?

Hi,

In my Zerodha P&L report, Realized P&L is 3 lakhs and Net realized is 50K with 2.5Lakhs as charges&taxes. When I file for taxes, should I pay taxes on 3lakhs which is realized profit or pay taxes on net realized profit which js 50K..Appreciate your help.

Thanks!

Sir, In itr2 one condition is to be fulfilled,i.e. the total all quarters of respective CG must be equal to the final figure of BFLA. But negative value is not allowed in any of the quarter. Suppose I have a short term gain of Rs. 1000 with a quarterly break up of 500,1000,300,200,(-1000). Where to fill this (-1000) in the quarterly break up table of CG?

will the Trading platform automatically deduct the STT charges or does the person has to pay it separately to govt.?

Sir STCG is 26000 in current year 2021-22. No other income. Can fill the ITR compulsory. and paid the 15% Tax.

I am Zerodha member.RH1390.

My total income for the FY 2021 22 is given below :

I am a Sr Citizen.

1.Co Divided 106000

2.Rent income 90000

3.Other income 31000

4.STCG 885300

I want to know my tax liability.

I have made investment Rs 150000

Whether STCG will be charged at 15%flat. Or I will get benefit of slab rate ?

If I buy Sovereign gold bonds (SGB\’s) via secondary market (Zerodha in my instance) on 31.3.22 (trade date) & it\’s get settled on T+2 days i.e 2.4.22, my queries are

1. From income tax point of view which date is considered \”Trading date\” or \”Settlement date\” for report in ITR purpose & tax calculation purpose

2. From RBI 4kg maximum allowance of SGB\’s per FY per PAN user point of view which date is relevant \” Trading date\” or \”Settlement date\”.

Thanks

Hi,

Where I have to pay tax on selling shares and also process of paying tax on selling of shares in demat account ? Please guide me

Suppose if I make long term capital gain of Rs1,50,000 on equity mutual fund and a long term capital loss (indexed) of Rs60,000 in liquid/income (any debt) mutual fund. Can the amount of Rs60,000 be offset against Rs1,50,000 thus paying no long term capital gain?

Hi

I have 2 questions viz:

(1) As per the tax loss harvesting report, i have a Realized STCG of 1.06L but an unrealized STCL of 2.34L. Will i still need to pay STCG tax of 15% tax on 1.06L?

(2) As per the tax loss harvesting report, i have a realized LTCG of 3.1L but an unrealized LTCL of 2.06L. Since 1L is tax free for LTCG, do i still have to pay any tax (3.1L loss – 2.06L = 1.04L) since the Console for my account is showing 2.06L as the Long term tax-loss harvesting opportunity.

Please advise asap. Thanks in advance.

~ Abhishek

hi nitin sir

can i get set off of future lot loss against equity STCG.

can a person change his decision of paying tax on bussiness income & capital gains year on year?

or doesn\’t he have chance of changing decision as he pays bussiness income in previous FY & now(i.e present FY) he wishes to convert it to capital gains?

Reiterating again that if investing/trading on the markets is the only source of income, and even if you are trading with moderate frequency, it is best to classify income from all your equity trades as a business income instead of capital gains.

here in yes investing/trading is the only income i get..

why we should consider delivery based trades as bussiness income instead of capital gains.

asuume, a person is in 10% tax slab,then he gets 1 lakh of deduction under capital gains right?

While calculating tax from tax p&l statement in console, should I deduct the total charges and other credit/debit from short term capital gains? Suppose my Short term capital gains is 20k, other charges is 1k, and other credit/debit is 1.5k. How much tax should I pay?

Query:

1. Have a profit of ₹25,000 as short term capital gains (15% of profit amount) in the current financial year.

2. Have sold a scrip at the loss of ₹25,000 in the same financial year.

3. What would be my Capital Gains tax in this scenario?

a) No tax since I can net off my losses incurred against the 15% of the profit accrued

b) Is there any cap on the amount should I need to consider the loss amount

c Short term capital losses can be set off only on Long term capital Gains

d) Short term capital losses can be set off on Short term capital Gains

Whether TDS applicable on brokerage income..

suppose, i have a loss of 70000 in future and option intraday trading in financial year 2019-2020 and loss of 20000 in commodity intraday trading in the same financial year. Now i have profit of 300000 in intraday commodity trading in the financial year of 2020-21, then what will be my taxable amount (If i am a sallaried person)

I have STCG, lets say of 1 lakhs but have not transferred this amount from my zerodha wallet to my bank account. I continue investing this amount into more stocks. Will I still be liable to pay the tax and declare it in my ITR or should it only be after i transfer the gains into my bank account?

Hi Nithin,

In section 4.4, it is mentioned that STCG is applicable only if annual income exceeds 2.5 LPA. Kindly please help me understand what to do in each of the following cases:

1. Suppose I have a business and no salary income, and my combined income from my business and delivery based equity trading (and all other income sources) doesn\’t exceed 2.5 LPA, am I exempted from paying any STCG? (Assuming I am going to show my income from delivery based equity trading as STCG and not non-speculative business income.) Also, which ITR from do I use?

2. Suppose I have only business income and no other salary income and it doesn\’t exceed 2.5 LPA, and I have losses in the current FY from delivery based equity trading, which exceeds the income from my business, is it beneficial to show my trading losses as STCG losses or business income losses? Also, which ITR from do I use?

3. Suppose I have only losses from my business and also from delivery based equity trading, and I have no other salary income, is it beneficial to show all my losses as non-speculative business losses or separate them into business losses and STCG losses? Also, which ITR from do I use?

4. A general question, does business income also get taxed as per income tax slabs for salaried employees? Or there\’s a separate taxing system for business income? (I have a partnership firm)

If the above questions are too specific and needs more information as to how the income tax was filed in the previous years, I had a corporate job in 2017 and 2018, that\’s when I started earning and paying income tax. I quit my job in the ending of 2018 and started a partnership firm in the middle of 2019. I have no business income or other salaried income since then (and had only losses each year which I didn\’t show or carry forward due to being unaware) and I started stock trading in only delivery based equity segment after April 2021 and all I have are losses. Hoping to get a response to all my questions above. Thanking you from the bottom of my heavy heart in advance. Please help :\’)

Hi BSN,

When is your capital gain becomes taxable?

As soon as you sell the stock with gains

Or until you bring that profit out in your bank account?

It is taxable as your as you have earned it.

Irrespective of whether you withdraw or not – it is taxable as soon as you book it.

When is your capital gain becomes taxable?

As soon as you sell the stock with gains

Or until you bring that profit out in your bank account?

HI Sayyed Mehmood,

HOW DID THE SHORT TERM GAIN APPLY AFTER TRANSFERRING THE PROFIT TO MY BANK ACCOUNT OR IT WILL BE APPLICABLE EVEN IF I KEEP THE PROFIT IN MY TRADING ACCOUNT AND BUY ANOTHER SHARE AGAIN?

Irrespective of whether you withdraw profit or not (once realized) – you need to pay tax on capital gains.

HOW DID THE SHORT TERM GAIN APPLY AFTER TRANSFERRING THE PROFIT TO MY BANK ACCOUNT OR IT WILL BE APPLICABLE EVEN IF I KEEP THE PROFIT IN MY TRADING ACCOUNT AND BUY ANOTHER SHARE AGAIN?

All these rules rules are they valid even now in FY 20- -21? If I sell off market transferred shares from my joint account where my wife is the first owner will I get the benefit of LTCG if sold within one month after transfer? The share were being held more than 5 years in joint account and she is not a tax payee.

Hi Mohit Ashwani,

I have bought share of different companies and sold them in 3-4 month time and made 15.20 k as realized profit ( +14.23 K as net realized profit)

But in Future and Option had loss of -6.35K (Net realized Loss is -12.32K)

What will be my net profit and on what amount will I have to pay taxes??

You can set off the current FNO Loss of 12.32K with Short Term Capital Gains and pay the balance tax on 1.91K.

Tax will 15%(+4% Cess) on 1.91K

I have bought share of different companies and told them in 3-4 month time and made 15.20 k as realised profit ( +14.23 K as net realised profit)

But in Future and Option had loss of -6.35K (Net realised Loss is -12.32K)

What will be my net profit and on what amout will I have to pay taxes. ??

Hi Chaithanyan,

Sir if I got 4.5 lakhs profit by selling shares within one year. I don’t have any other income source. So my total income for the financial year is 4.5 lakhs only. Can I claim the 2.5 lakh deduction while filling tax and also as income less than 5 lakhs can i file zero tax or should I pay 15percentage flat tax on whole 4.5 lakh.

Yes, you can claim the benefit of 2.5Lacs. You cannot file Zero tax return because tax applicable on the balance 2 Lacs is 30K.

However; you can claim rebate u/s 87A upto 12.5K. You need to pay tax of Rs 17.5K + Cess applicable.

Hi

Hi, I have made some STCG in a few stock in FY22. I have also made some STCG in Paytm.

I want to hold onto Paytm shares for long term.

Will I be able to book capital loss in Paytm if I sell and buy on the same day, to offset againt the STCG I made else where? – or do I have to wait for T+2 to buy the shares back?

If you sell the existing shares and buy the same in the same day – it amounts to Intraday and you cannot set off with STCG made elsewhere.

Sir if I got 4.5 lakhs profit by selling shares within one year. I don\’t have any other income source. So my total income for the financial year is 4.5 lakhs only. Can I claim the 2.5 lakh deduction while filling tax and also as income less than 5 lakhs can i file zero tax or should I pay 15percentage flat tax on whole 4.5 lakh.

Hi, I have made some STCG in a few stock in FY22. I have also made some STCG in Paytm. I want to hold onto Paytm shares for long term. Will I be able to book capital loss in Paytm if I sell and buy on the same day, to offset againt the STCG I made else where? – or do I have to wait for T+2 to buy the shares back?

Hi Divya,

If I have earned profit of Rs 100000 and after brokerage and everything my net realized profit is 50000. I have to pay tax on 50000 or 100000?

For STCG, you can claim all the expenses relating to sale except STT.

You need to pay tax on net STCG. In your case 50K.

If I have earned profit of rs. 100000 and after brokerage and everything my net realized profit is 50000. I have to pay tax on 50000 or 100000?

Hi Ram,

I am salaried employee with 5LPA and this year I got LTCG of 6L by selling TATA Elxsi stocks.

So i need to pay LTCG tax as 10%of (6-1)L. Correct?

Yes; you need to pay 10% tax on 5 Lacs. Rs 1 Lac is exempted.

Suppose if I paid the LTCG as per the above logic as 50k, then do I need to add the profit 4.5L to my total income?

So that my total income for this year will become 9.5L(5L+4.5L) and tax slab will change ?

Yes; 6 Lacs will be added to your total income and your tax slab will change.

If there is any income like Income from Other Sources – then it will be taxed @ 10%; 15% and 20% depending on your regime.

Hi ,

I am salaried employee with 5LPA and this year I got LTCG of 6L by selling TATA Elexsi stocks.

So i need to pay LTCG tax as 10%of (6-1)L. Correct ?

Suppose if I paid the LTCG as per the above logic as 50k, then do I need to add the profit 4.5L to my total income ?

So that my total income for this year will become 9.5L(5L+4.5L) and tax slab will change ?

Please advise me.

Sir i want to know that if my STCG is less then 2.5 lakh and i have no other income. Means in entire financial year i have only this income. Do i need to pay any tax on that gains. And if my income from STCG EXCEED above 2.5 lakh but below 5 lakh then do i have to pay 5% of 2.5 lakh. One more question can a trader also save under 80C

How is capital gain calculated on shares transferred off market? Which Date is taken as date of acquisition?

Hi Nitin,

I have a zerodha demat account for almost an year. I have one question in my mind from several day a no one clear my doubt in this.

Suppose I purchase a 1 lac of stock and every year that stock increase with a 50 percent of profit but I do not book profit. After 5 yrs I sold them so 1lac principle and 2.5lac profit(50k each yr). So would I be applicable for tax or not as I have yearly gained 50K.

Hi Nitin,

As I am finding it difficult to gather information related to scrips of Mutual Fund and I don\’t wish to avail the benefit of Grandfathering provision for the Stocks/MF bought on/before 31 January, 2021. Therefore, is it possible to file the LTCG of such equity (i.e., bought on/before 31.01.2018) in the place available for equity bought after 31 January, 2021 in a consolidated form. Please assist.

Thanks and regards

In the advance tax part you say that it\’s best to pay that is made up till now but what if suppose I paid tax on stcg made up till 15 June then I book more profits .. then how much am I suppose to pay on 15 sept … 45% of total stcg booked or 45% on the stcg booked after 15 June and before 15 sept

I am looking at structuring my Long term trades as LTCG but the short term equity delivery based trades as Business Income. I don\’t have any intraday trades or F&O trades.

I do have other business income and I was wondering if I Can I use the losses from short term trade to offset other business income??

Response to Baharul – Yes, the 15% STCG tax will be applicable. Remember, LTCG/STCG taxes are applicable on all \’realized\’ profits. Realized profits are the ones that have been booked. It does not matter if the gain has subsequently been withdrawn to the bank account or reinvested.

Response to Venkata – Ideally, the filing of returns is not mandatory if one does not fall in the tax bracket. However, as Karthik mentioned, filing of returns is our way of declaring to the government our income. In such a scenario (especially when capital gains are involved), I would advise one to still go ahead and file the returns if possible. Do remember, in order to claim any refunds, you will need to file the returns first.

I have questions related to 15% short term capital gains tax

Suppose I buy a stock \’A\’ at 1000 and sell it at 1100, so I have profit of 100 rupees, now using that 1100 rupee I buy a stock \’B\’ and I am holding that stock.

Do I still have to pay the tax on 100 rupees

Hi, one follow-up question, if answer to above it NO, do I still need to do Tax filing?

Response to Venkata – If you don\’t fall in any tax bracket (less than 2.5 lacs), then the STCG tax will not be applicable. If STCG was already paid in the form of advance tax, while filing your returns you can claim a refund.

Hi,

You mentioned STCG of 15% is levied if the transactions (buy/sells) are executed on recognized stock exchanges. Is it applicable even if the total income doesn\’t exceed the minimum tax slab of Rs 2.5lks/year ?

Response to Ronak\’s question – Hi team,

I have a quick doubt regarding taxation

Do we have to pay IT (LTCG or STCG) on the profit booked on a trade or on the amount that is withdrawn to your bank account?

Answer: Booking of profits attract capital gains tax. Booking of profits means you exit/sell the position. You may or may not choose to then transfer the money to your bank account but this does not deny the fact that you have booked the profits. Short answer: All gains are applicable to STCG/LTCG when it is realized, i.e, you have sold the position and does not matter if the cash has then been transferred to your account.

Response to Laxman Kandalgaonkar: LTCG is considered on a gross basis for taxation basis, i.e, LTCG from both equity oriented mutual funds and stocks will be considered together. Hence, in your case, out of the total 2lac gain, tax of 10% will be on 1,00,000 (Gain upto 1lac is exempt from LTCG tax).

If I have 1,00,000/- profit in stocks and 1,00,000/- in MFs. If I sell both for LTCG. Do I get benefit of 0% tax upto 1 Lac in both?

Hi Nithin,

Could you please help me with tax implications (STCG/LTCG) for the stocks that went through a corporate action (spinoff/merger/demerger) eg Guj. Borosil?

If I do a OFF MARKET DEBIT TRANSACTION from one demat account to another DEMAT ACCOUNT of mine, then should I have to pay LTCG or any kind of tax for this transaction?

If I do a OFF MARKET DEBIT TRANSACTION from one demat account to another DEMAT ACCOUNT of mine, then should I have to pay LTCG or any kind of tax ?

Thank You So Much Sir, For Fast Reply

Hi Anvar,

If a Person makes 5 Crores per Annum in Trading(Short term),

Which is only one income source he have, what is the tax slab applicable to that person.